In this article, I have compared RollWorks vs. ZenABM based on their features, pricing, and ideal uses to help B2B marketing and sales teams decide which one fits their account-based marketing strategy (or if they might need both).

Read on…

In case you’re short on time, here’s a summary:

1. RollWorks Overview: Multi-channel ABM (display, LinkedIn, email, web personalization), enterprise-ready, integrates third-party intent (Bombora, G2), supports account scoring and journey stages, multi-touch attribution, advanced analytics. Steeper learning curve, higher cost (~$1,000+/month). Best for mid-market to enterprise teams with large account lists and resources to manage complexity.

2. ZenABM Overview: LinkedIn-focused ABM, uses first-party intent from LinkedIn ad engagement, tracks account-level activity in real time, integrates with CRM, assigns BDRs automatically, simple dashboards, affordable ($59–$479/month). Ideal for SMBs or lean teams running LinkedIn campaigns, testing ABM, or wanting fast, actionable insights.

3. Key Differences:

4. Use Cases:

RollWorks is the ABM division of NextRoll (the company behind AdRoll), designed to bridge digital advertising with account-based marketing.

It’s often considered an entry-level enterprise ABM platform for scaling programs.

RollWorks combines NextRoll’s expertise in programmatic advertising with an ABM lens: identifying target accounts, engaging them with coordinated ads, and measuring impact across the funnel.

Let’s have a closer look at its key features:

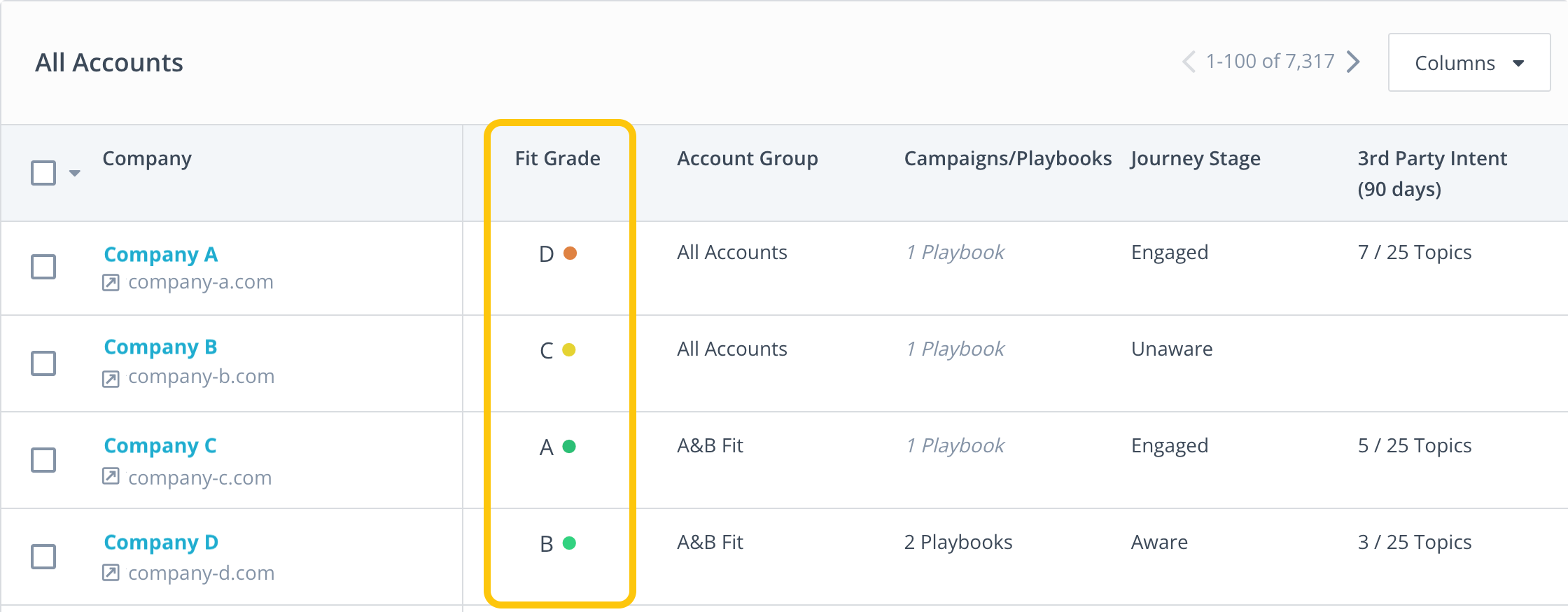

You can import or build target account lists (TALs) and score them based on fit and intent.

RollWorks provides an “ICP Fit” grading (A–D) using firmographics, technographics, and your CRM data.

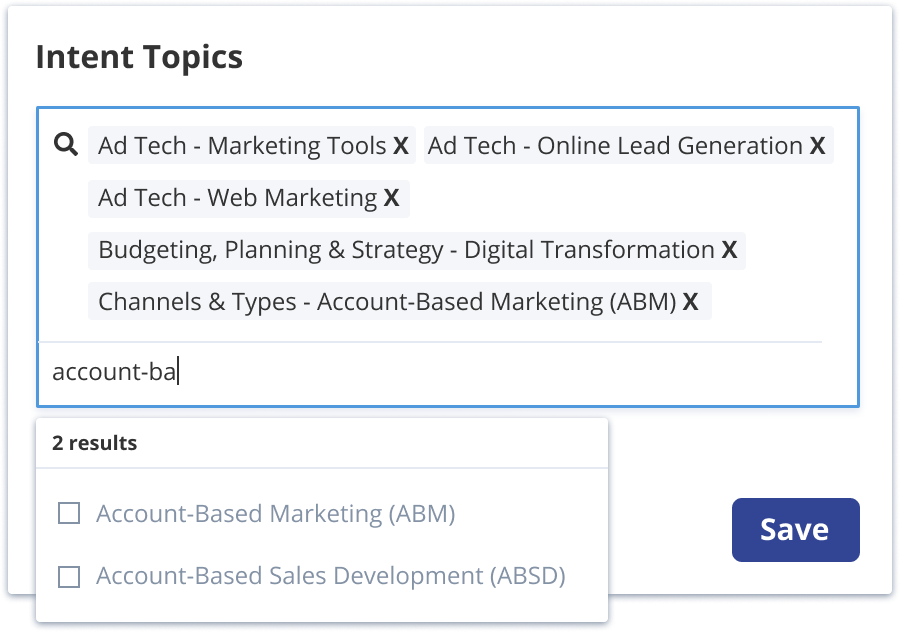

Additionally, it monitors accounts for in-market behavior via keyword tracking: you select relevant keywords/topics, and RollWorks flags accounts researching those terms across the web.

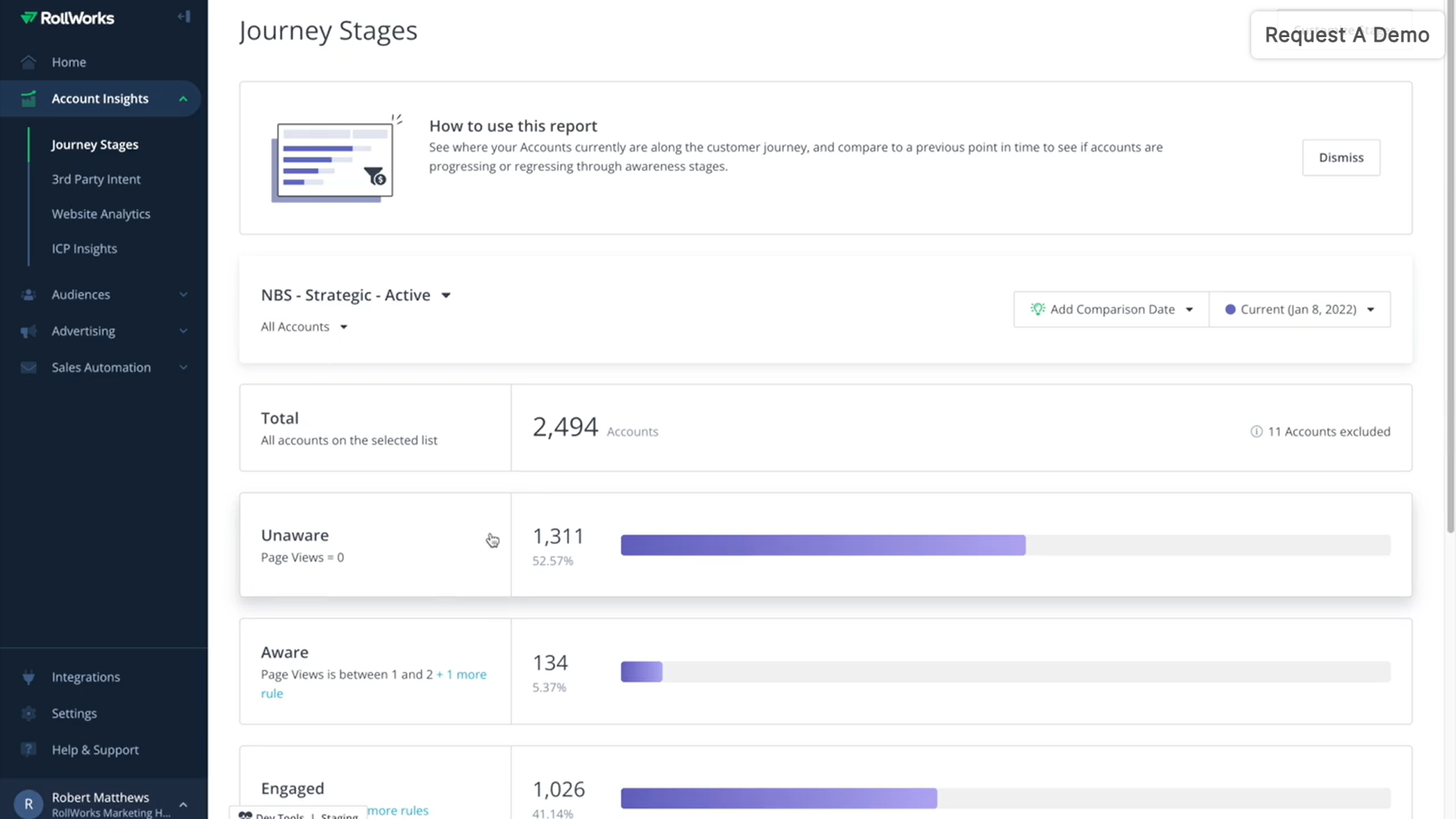

These intent signals (from RollWorks’ own data pool and partners like Bombora) feed into a Journey Stages model that categorizes accounts as “Unknown,” “Aware,” “Engaged,” “Open Opportunity,” etc., depending on their engagement level.

Pro Tip: Ditch third-party keyword intent surges and embrace first-party sources.

ZenABM, for instance, captures first-party qualitative intent by tracking which LinkedIn ads a company actually interacts with, giving precise, actionable signals.

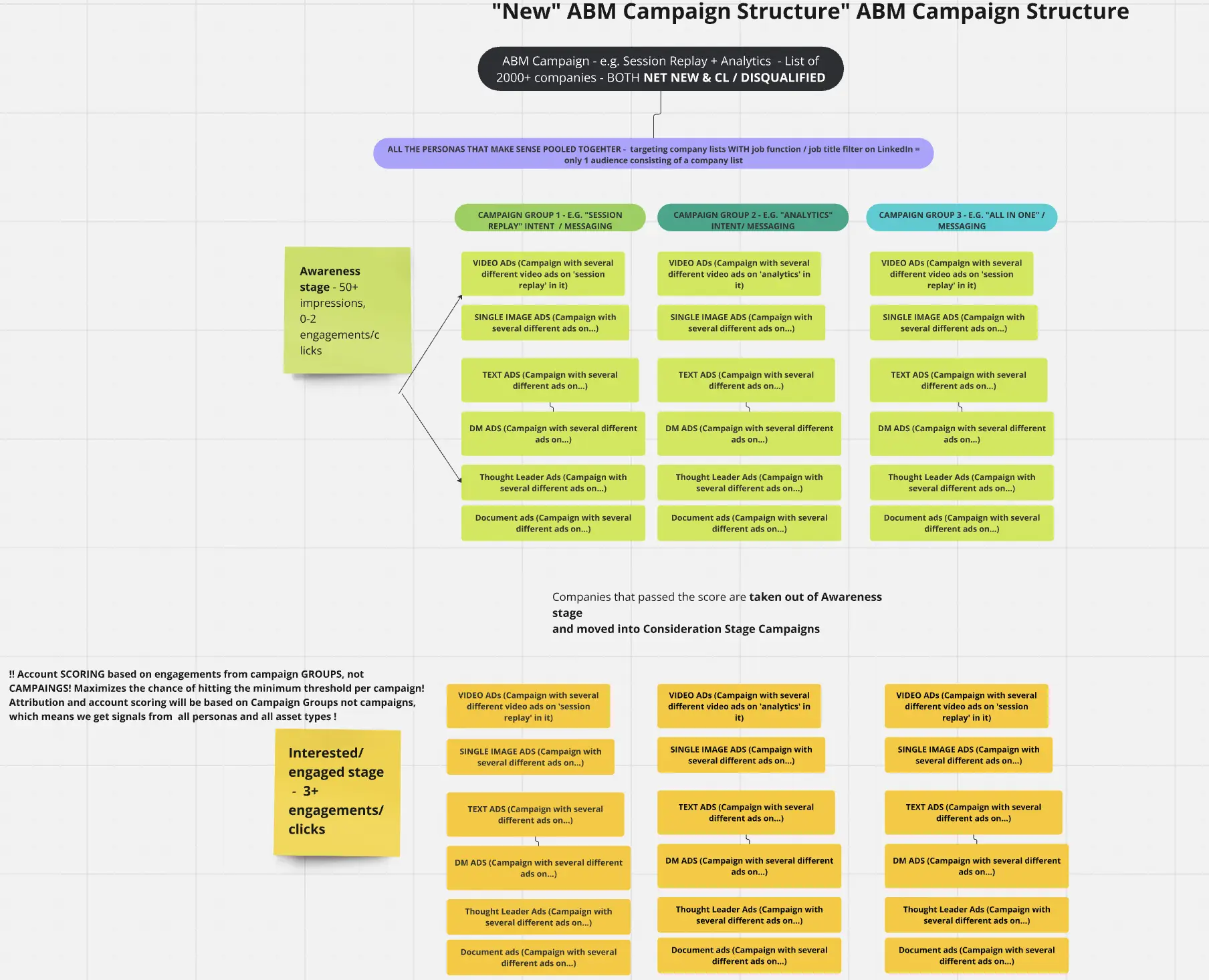

In fact, folks at Userpilot (our customer) had built entire ABM motions around this approach, tagging campaigns by pain point and then doubling down on specific BOFU ads based on what the account is engaging with.

Their campaign structure:

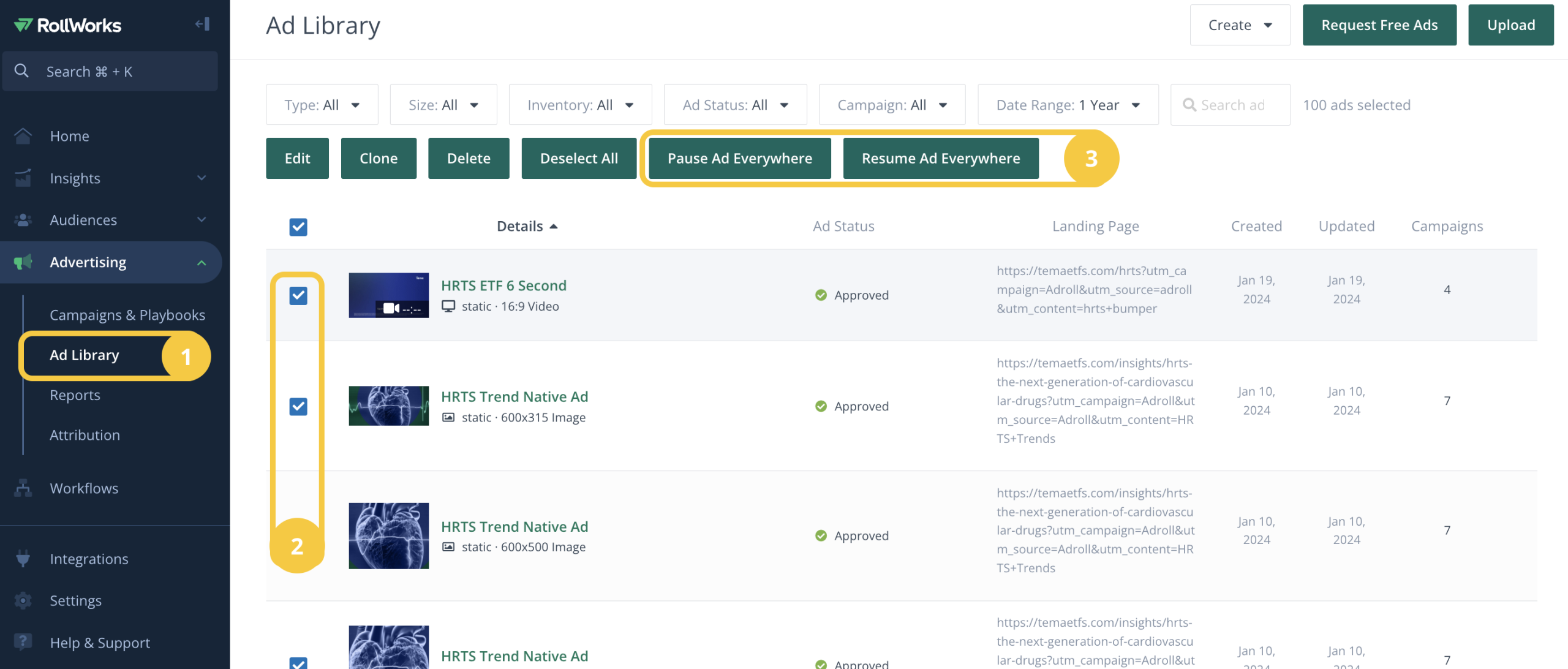

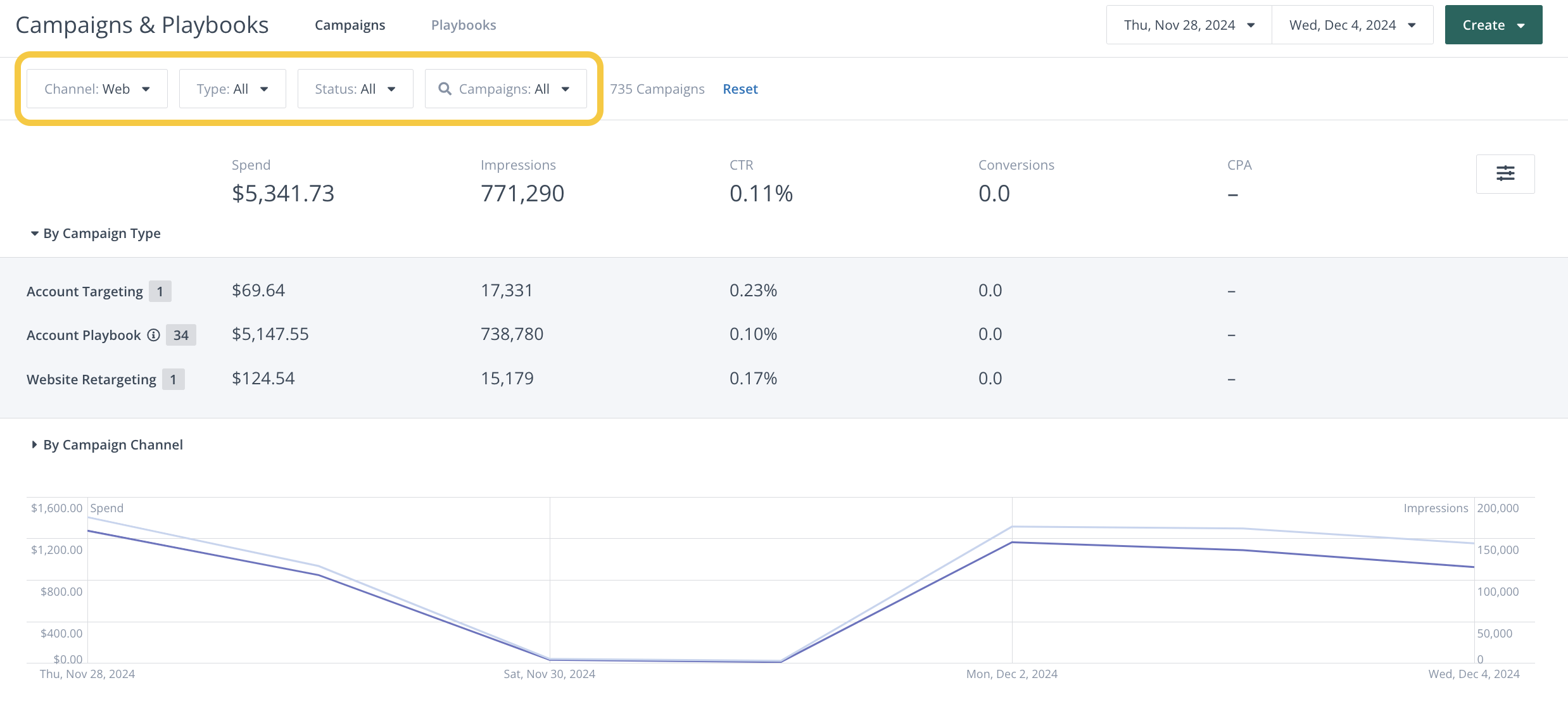

RollWorks has a native display ad network (leveraging AdRoll’s DSP) and supports ad delivery across web display, retargeting, and social channels.

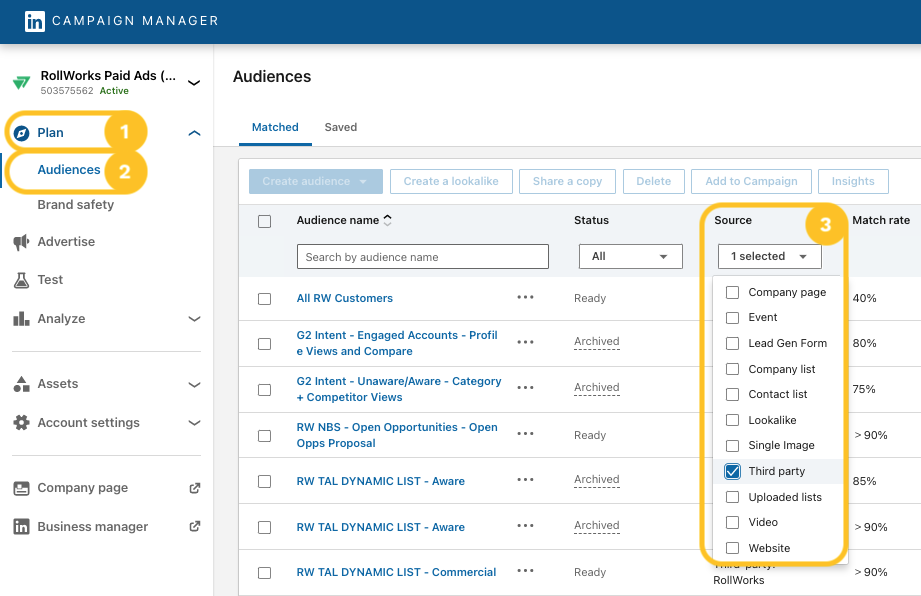

For example, you can run programmatic display ads to your target accounts, and also integrate LinkedIn ads through RollWorks’ interface (RollWorks uses LinkedIn’s Marketing API to sync audiences or campaigns).

It offers persona-based targeting too, allowing you to tailor ads by job role or seniority to hit specific decision-makers.

Dynamic ads and a creative library are also included to manage ad creatives at scale.

To connect advertising to the pipeline, RollWorks provides a website tracking pixel that de-anonymizes site visitors by matching their IP or cookies to company data.

When someone from a target account visits your site, RollWorks tries to identify the company and can even suggest contacts from that account.

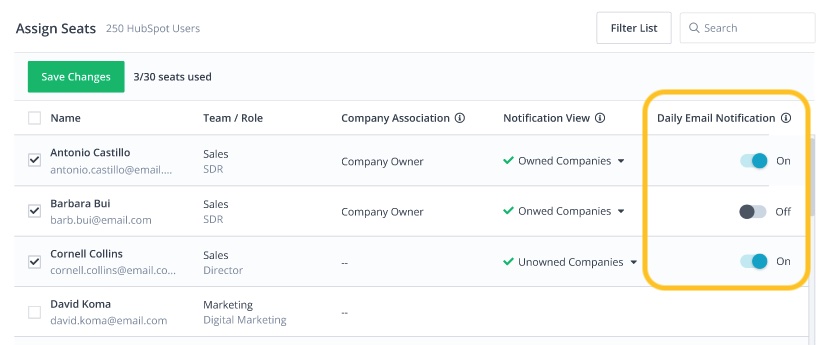

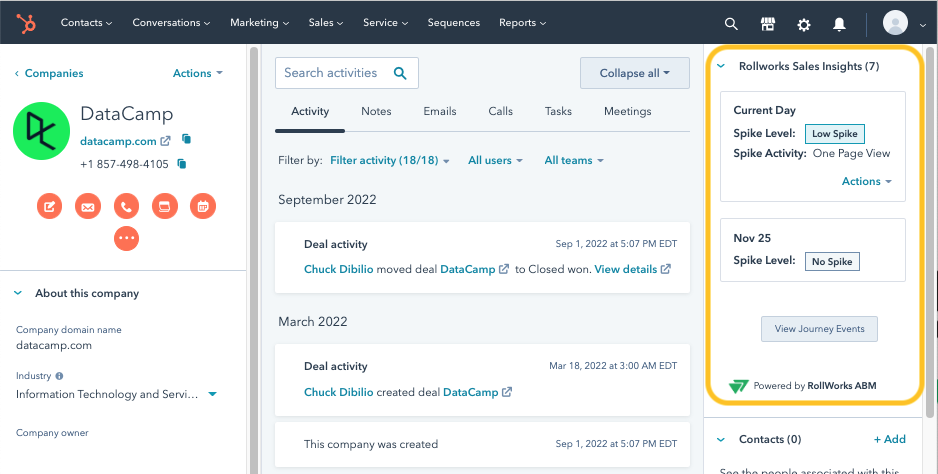

RollWorks continuously monitors account engagement across touchpoints (ad impressions/clicks, site visits, email engagement if connected) and sends “Account Spike Alerts” to notify teams of surges.

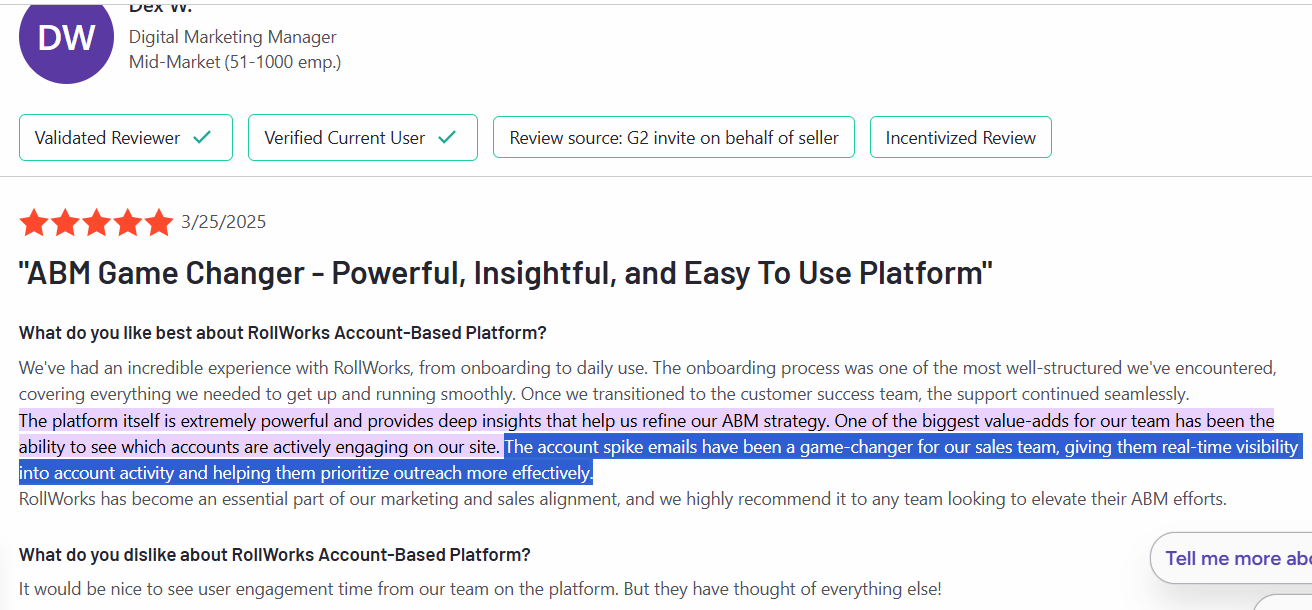

One G2 reviewer called the account spike emails “a game-changer for our sales team, giving them real-time visibility into account activity and helping them prioritize outreach more effectively.”

RollWorks also offers Sales Insights widgets inside CRM – e.g. a Salesforce window that shows recent account engagement and suggests next steps, aligning sales with the ABM data.

The platform supports workflow automation such as moving accounts between audience segments, creating CRM tasks, or adjusting ad bids based on behavior.

For example, if an account moves to “Opportunity” stage, RollWorks can automatically reduce ad frequency or switch the content. Or if Bombora intent shows an account surging on a topic, RollWorks can auto-add that account to a campaign and increase bid spend for them.

RollWorks’ “Journey Stages” feature also comes with recommended actions: the system might suggest increasing the budget for high-fit accounts that haven’t engaged yet.

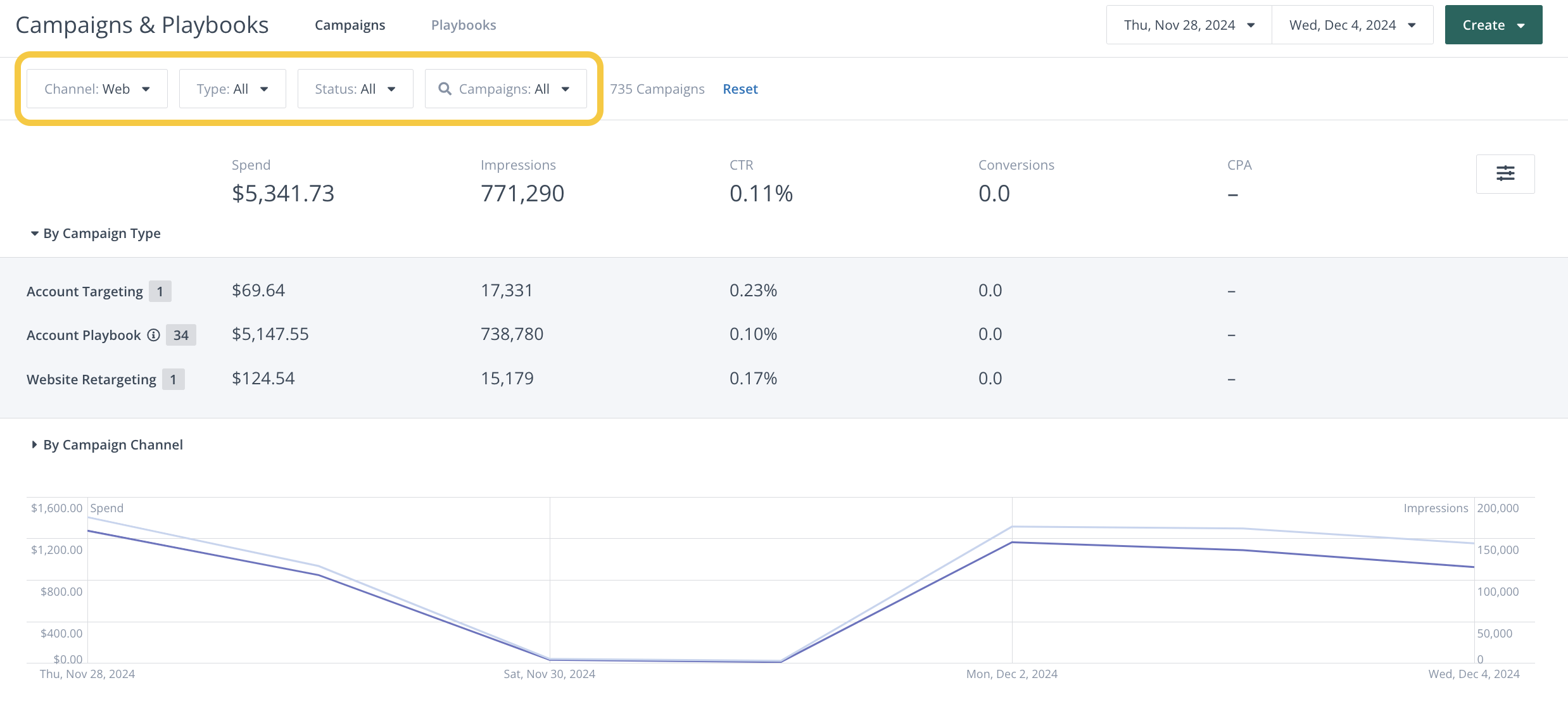

On the analytics side, RollWorks provides unified dashboards that tie ad performance to pipeline: you can see impressions, clicks, and attributed opportunities or revenue in one place.

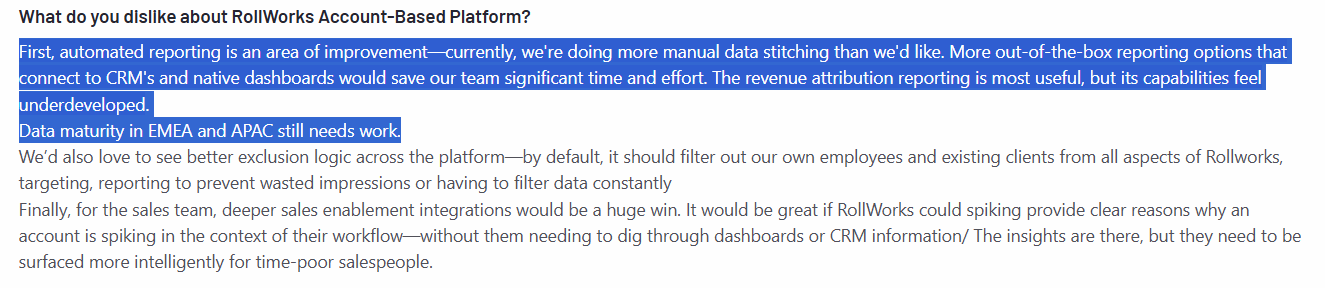

However, some users have noted that attribution reporting in RollWorks is simplistic.

RollWorks integrates with major CRMs (Salesforce, HubSpot) for bi-directional data sync.

It also connects to marketing automation systems (e.g. Marketo, Pardot) and sales engagement tools like Outreach/Salesloft via API or native connectors.

For intent enrichment, it partners with Bombora and G2, and for data with providers like ZoomInfo.

You can explore the full list in our RollWorks for ABM guide.

RollWorks uses a tiered/usage-based pricing model rather than a simple self-serve subscription (note: as of 2025, it has rebranded under the AdRoll ABM umbrella).

There is a limited Free or self-service tier, which basically lets you run retargeting ads and basic account targeting by paying only for ad spend.

Serious ABM functionality, however, comes in paid plans that require speaking with sales to get a quote.

But the price tag ain’t that crazy, unlike other ABM enterprise tools.

For small to mid-sized teams, RollWorks often starts just under $1,000 per month.

In fact, RollWorks touts that it was the first ABM platform to offer a sub-$1k/month plan to lower the “intimidation tax” of ABM tools.

ZenABM is a modern, lightweight ABM solution designed specifically for running LinkedIn-based account campaigns.

Key offerings in ZenABM include:

ZenABM integrates directly with the LinkedIn Ads API to pull account-specific data from all campaigns.

This allows you to identify precisely which target accounts are interacting with your LinkedIn ads (impressions, clicks, etc.), all mapped to individual companies.

Since this data is sourced directly from LinkedIn users, it is extremely accurate. Many larger ABM platforms, such as RollWorks, depend on probabilistic approaches like IP matching or cookie tracking to estimate visitor identities.

Such estimates often fail. Research from Syft shows IP-based tools correctly identify companies only about 42% of the time.

ZenABM’s first-party method provides more reliable, intent-driven signals from ad engagement. When multiple employees from a single company interact with your LinkedIn ads, you can be confident the account is genuinely interested. No external data feed required.

Pro Tip: ZenABM can also reveal anonymous website visitors for free. Retarget them with inexpensive LinkedIn text ads, and ZenABM will identify the companies that saw your impressions.

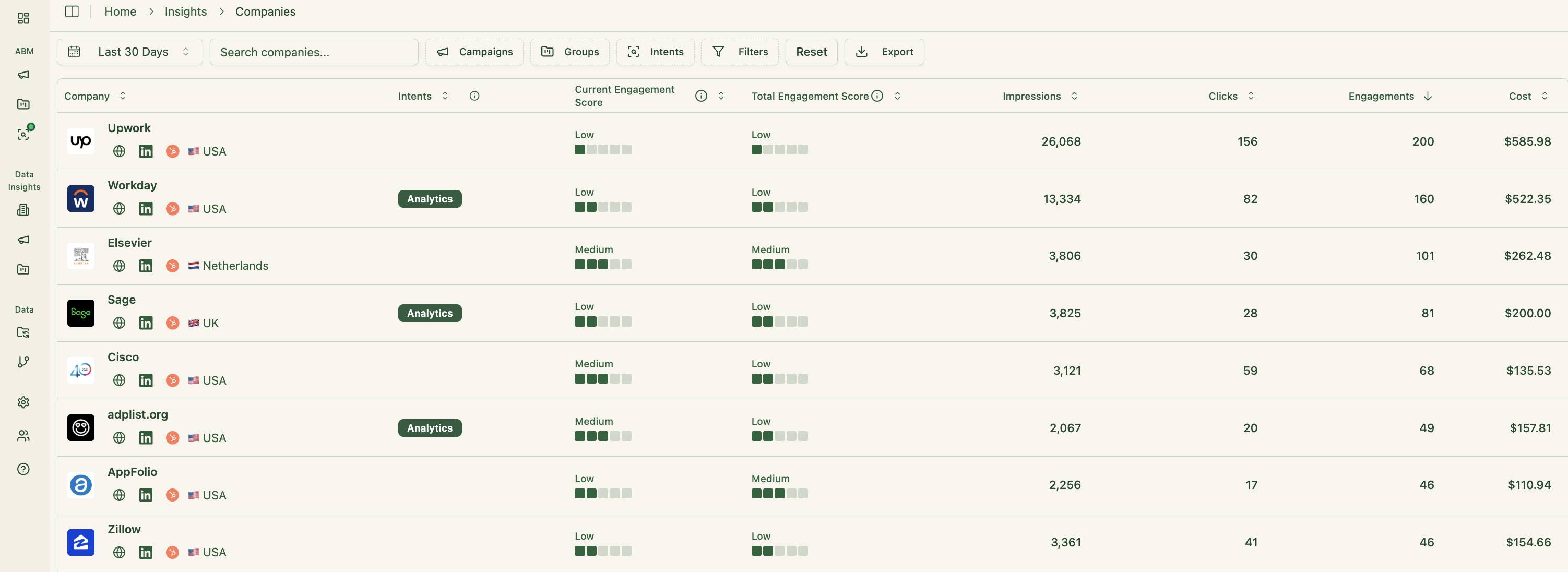

ZenABM continuously updates engagement scores from ad interactions. You can monitor recent trends (like the past week) or historical patterns to identify accounts heating up.

These scores help marketing and sales prioritize high-value accounts for follow-up.

ZenABM enables you to define your ABM funnel stages (e.g., Identified → Aware → Engaged → Interested → Opportunity) and automatically classifies accounts using engagement and CRM information.

You can set your own thresholds for “Engaged” or “Interested,” and ZenABM will track stage transitions automatically.

This delivers full-funnel visibility like enterprise ABM platforms, highlighting where accounts stall and where progress accelerates.

ZenABM integrates bidirectionally with CRMs such as HubSpot (Salesforce available on higher plans).

LinkedIn engagement data feeds directly into your CRM as company-level properties, keeping sales teams informed:

ZenABM can auto-update account stages to “Interested” when engagement passes a set threshold and assign accounts to specific BDRs for follow-up.

ZenABM allows you to tag campaigns by theme (like “Feature A” vs. “Feature B”) and shows which accounts engage with which themes, revealing their priorities.

This is genuine first-party intent. Instead of paying RollWorks or another platform for inferred keyword interest, you get direct proof like Account Z clicking “Feature A” ads, demonstrating actual buying interest.

These insights also sync to your CRM, supporting highly targeted outreach and relevant messaging.

Your sales reps can instantly see which topics or pain points each account reacts to most.

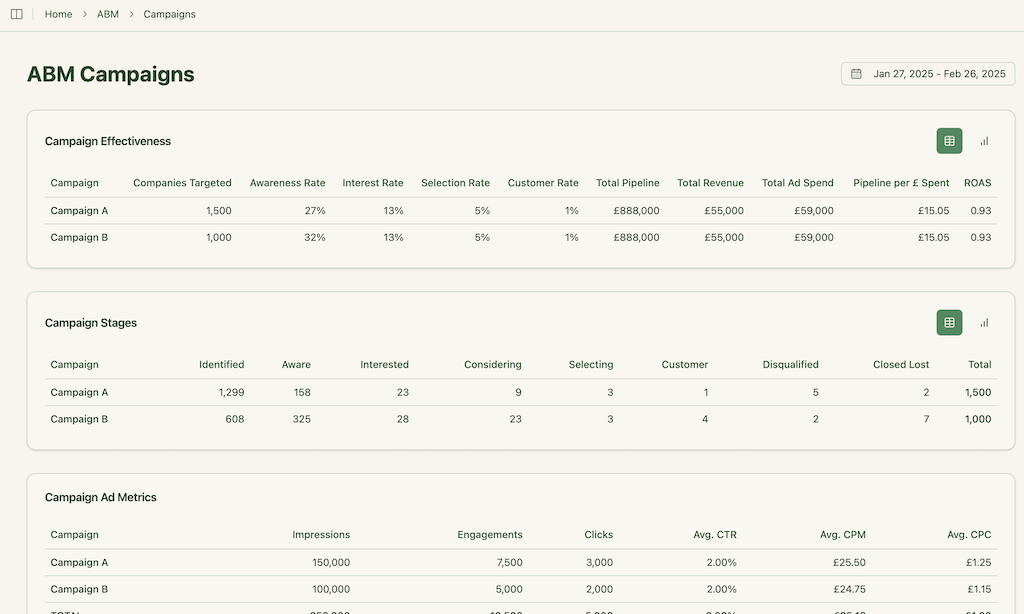

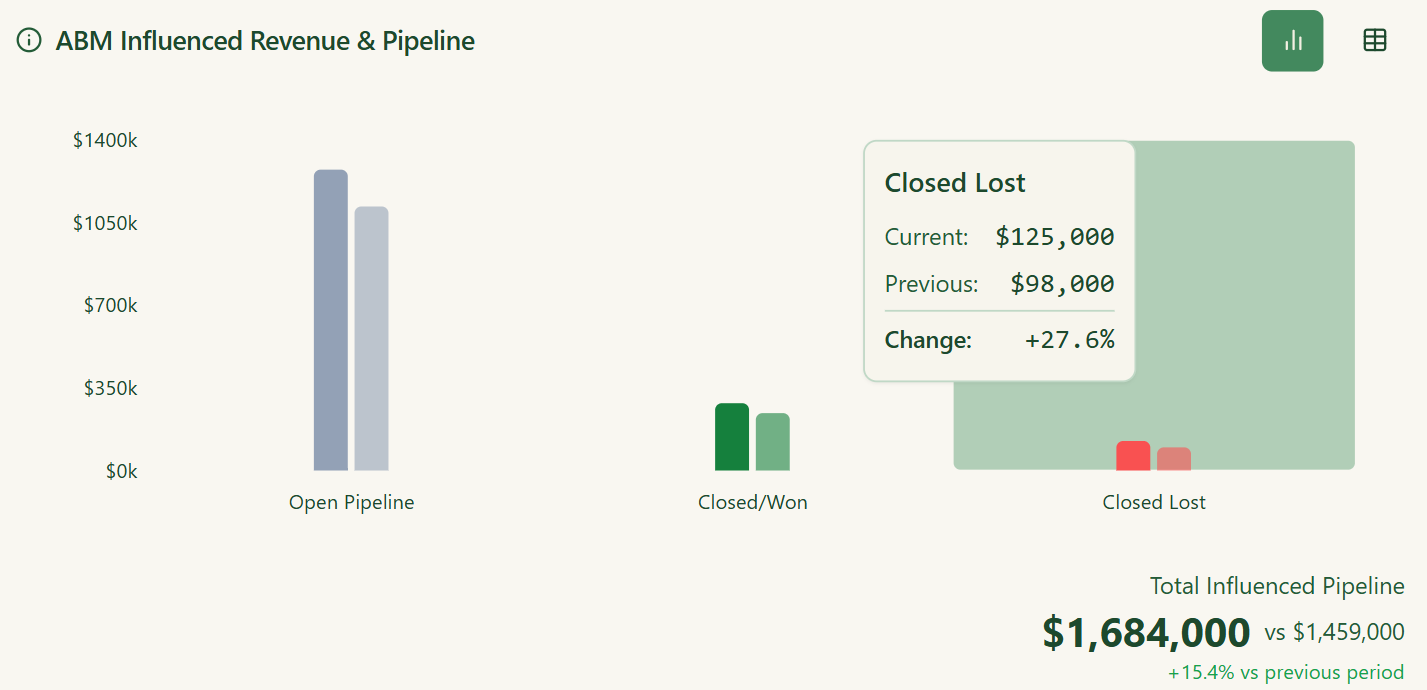

ZenABM includes pre-built ABM dashboards linking ad exposure, engagement, funnel stages, and pipeline metrics.

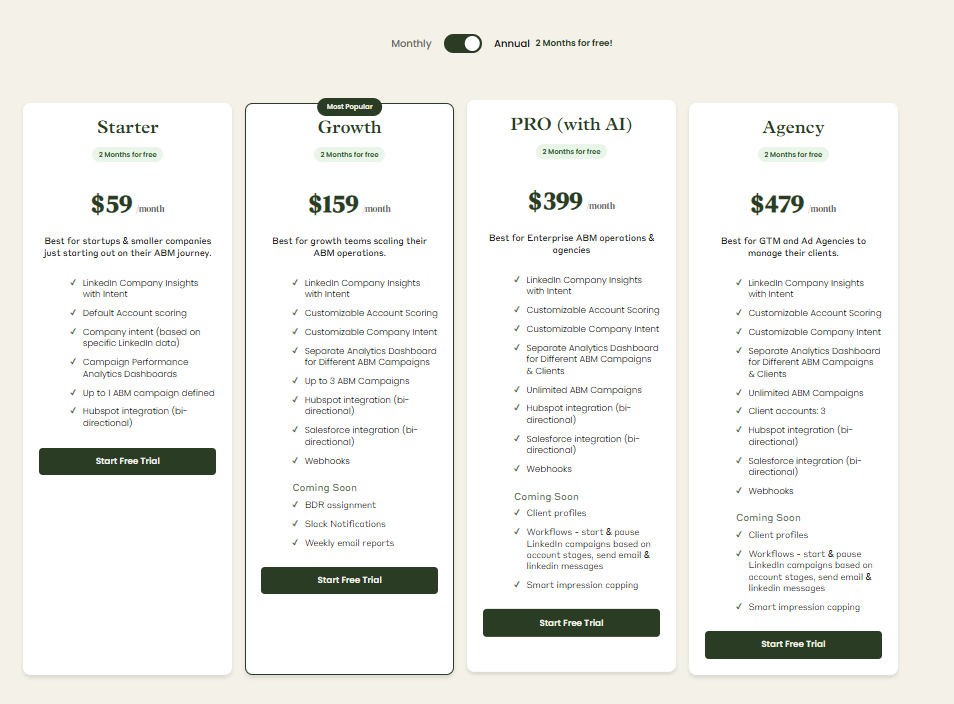

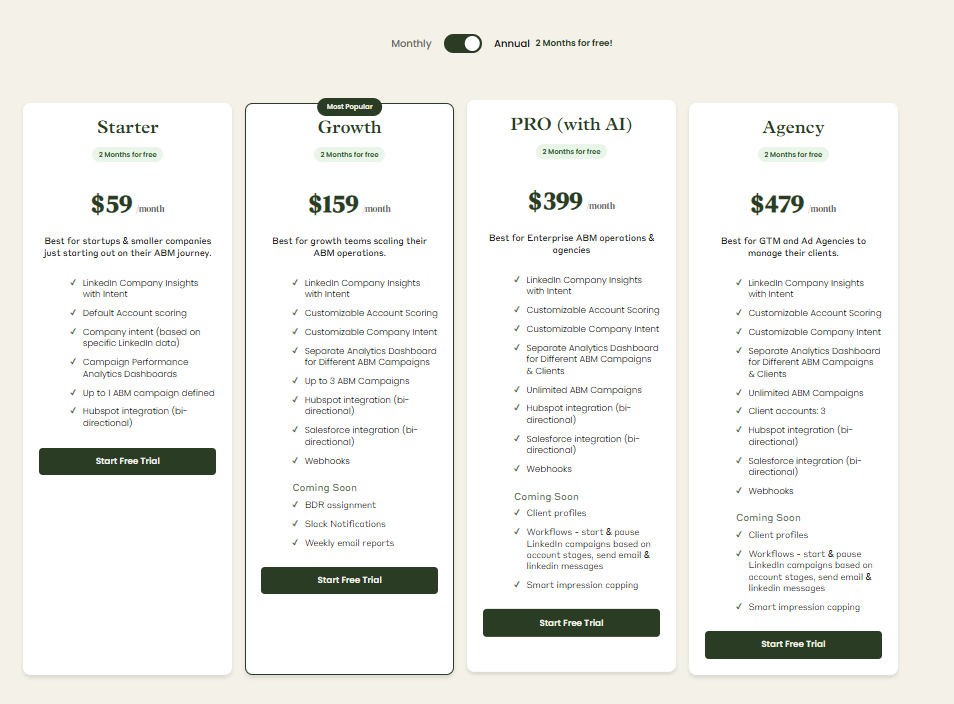

Plans start at $59/month for Starter, $159/month for Growth, $399/month for the Pro (AI) tier, and $479/month for the agency tier.

Even the highest tier costs under $7,000/year, far less than RollWorks.

All plans cover essential LinkedIn ABM functions, with higher tiers mostly expanding limits or adding Salesforce integration.

Pricing is flexible (monthly or annual with two months free), and a 37-day free trial allows teams to try before buying.

Each platform offers distinct ABM strategies to identify and engage target accounts, enabling personalized outreach and better conversion.

Key differences to consider:

RollWorks uses predictive intent modeling.

It aggregates signals from across the web (search behavior, third-party data sources like Bombora, review sites, etc.) and applies AI to predict which accounts are actively researching solutions, capturing hidden buyer intent from multiple sources.

This provides a broad, holistic view of interest, including anonymous research activity.

ZenABM relies on first-party, qualitative intent from ad engagement. It focuses on how target accounts interact with your LinkedIn ads to gauge intent.

In other words, RollWorks might indicate an account is showing interest in “CRM software” searches broadly, while ZenABM tells you this specific account clicked your product webinar ad twice. ZenABM’s intent signals are direct and campaign-specific, whereas RollWorks’ approach is inferential and based on aggregated third-party data.

RollWorks is multi-channel, covering display, social, search ads, email campaigns, website personalization, and sales outreach.

ZenABM is single-channel focused (LinkedIn), prioritizing simplicity and direct first-party engagement signals.

Some core ABM features overlap, but execution varies.

RollWorks provides advanced analytics and multi-channel attribution, forecasting revenue impact and attributing pipeline to ads, emails, and events.

It’s comprehensive but can be complex to set up and may be overkill for smaller teams.

ZenABM focuses on clear, deal-specific LinkedIn attribution.

It directly maps ad-engaged accounts to CRM opportunities, showing influenced pipeline and revenue per campaign in a simple, actionable format.

RollWorks has a steeper learning curve, often requiring onboarding, enablement, and configuration.

ZenABM is simpler, focused on one channel, and comes with ready dashboards. Teams can get started quickly by connecting LinkedIn and CRM and setting a few thresholds.

ZenABM is orders of magnitude cheaper for a given number of accounts (tens or hundreds of dollars a month vs. thousands). It’s also self-service with no commitment. You can start or stop at will.

RollWorks is a bigger investment, likely justified when you need the multi-channel reach and advanced features at scale.

An organization with a large sales team, multiple marketing channels, and thousands of target accounts might outgrow ZenABM’s limited scope and need RollWorks (or a similar platform) to coordinate everything.

Conversely, a startup or small marketing team would find RollWorks’ typical contract size and complexity hard to swallow; ZenABM would let them dip a toe into ABM without the heavy cost.

There’s no one-size-fits-all.

“Better” depends on goals, channels, budget, and team.

Choose the platform based on your scale, channel focus, and budget.

RollWorks is the heavyweight for enterprise multi-channel ABM, while ZenABM is lean, fast, and ideal for LinkedIn-first campaigns or smaller teams.

Many organizations benefit from a hybrid approach, getting broad coverage plus precise, first-party LinkedIn insights.

For more details about ZenABM, you can book a demo now or try the tool for free!

RollWorks is the ABM division of NextRoll, the company behind AdRoll. While AdRoll historically focused on e-commerce retargeting, RollWorks was built for B2B ABM use cases. They share a platform, but RollWorks retains its ABM-specific features and distinct pricing, making it the ABM solution within the NextRoll family.

RollWorks can sync audiences to LinkedIn and report high-level engagement metrics, but it does not provide detailed, account-level ad analytics. ZenABM, by contrast, pulls granular engagement data for each account and campaign. RollWorks is best for running LinkedIn campaigns as part of a broader multi-channel ABM strategy, whereas ZenABM excels at detailed LinkedIn insights.

Both RollWorks and ZenABM integrate with Salesforce and HubSpot. RollWorks syncs account and lead data such as fit scores, journey stages, and intent flags, though Salesforce integration may carry additional costs. ZenABM pushes detailed engagement metrics and intent tags to the CRM, can auto-update account stages, and assign BDRs for follow-up. Setup is simpler and included with all paid plans, giving sales teams more actionable data.

Results depend on your ABM strategy rather than the tools alone. RollWorks can improve pipeline contribution, target account engagement, and help discover previously unknown interested accounts. ZenABM can accelerate sales cycles, improve BDR conversion, and clearly demonstrate LinkedIn ROI. Both tools require proper targeting, relevant ad creatives, and alignment with sales to translate their capabilities into revenue impact.