In this guide, I compare N.Rich and Terminus on features, pricing, and where they sit in an ABM stack, so marketing and sales can quickly see which one matches their motion.

I also cover how ZenABM can work as a lean, LinkedIn-first alternative or sit alongside them as a lighter ABM analytics layer.

N.Rich vs. Terminus: Quick Summary

In case you’re short on time, here is the snapshot:

- N.Rich is an ABM execution layer built on a B2B DSP with ICP modeling, intent scoring and programmatic campaigns.

- Terminus is a broader ABM platform that centralizes multi-channel ads, engagement data and account analytics in one Engagement Hub.

- N.Rich leans into programmatic display and native/video formats, with optional LinkedIn alignment.

- Terminus runs display, retargeting, LinkedIn, CTV and audio ads from a single platform for multi-channel coverage.

- N.Rich combines first-party web and ad signals with third-party intent topics and pushes account scores into your CRM.

- Terminus relies on partners like Bombora, plus Visitor ID and engagement, to surface in market accounts.

- N.Rich gives account-level analytics, opportunity attribution and an ICP Sales Velocity Score to connect media to pipeline.

- Terminus adds Account Hub views, multi touch attribution and ABM dashboards focused on account journeys and influenced revenue.

- N.Rich includes website visitor identification and firmographic or technographic enrichment based on IP data.

- Terminus de anonymizes website visits using reverse IP, cookies and CRM matching, then ties them back to accounts.

- Both integrate with Salesforce, HubSpot, LinkedIn and MAPs, but Terminus spans more of the classic B2B stack and partner ecosystem.

- N.Rich pricing starts a little above ten thousand dollars per year and scales with usage; Terminus usually lands in mid five figures and can climb to low six figures for larger rollouts.

- Pick N.Rich if you want intent-driven programmatic ABM and can live with a focused execution layer.

- Pick Terminus if you want a full ABM platform for multi-channel advertising, engagement and attribution, and your budget supports it.

- A third option: ZenABM gives account-level LinkedIn ad engagement, pipeline dashboards, account scoring, ABM stages, CRM sync, first-party qualitative intent, automated BDR assignment, custom webhooks, an AI chatbot and job title analytics starting at $59 per month.

N.Rich Overview: Key Features, Pricing, and Reviews

N.Rich positions itself as an agile ABM execution layer for mid market and enterprise teams, built on a B2B DSP with intent, ICP and ABM workflows.

Key Features of N.Rich

Core N.Rich capabilities include ICP building, intent scoring, programmatic campaigns and account-level analytics.

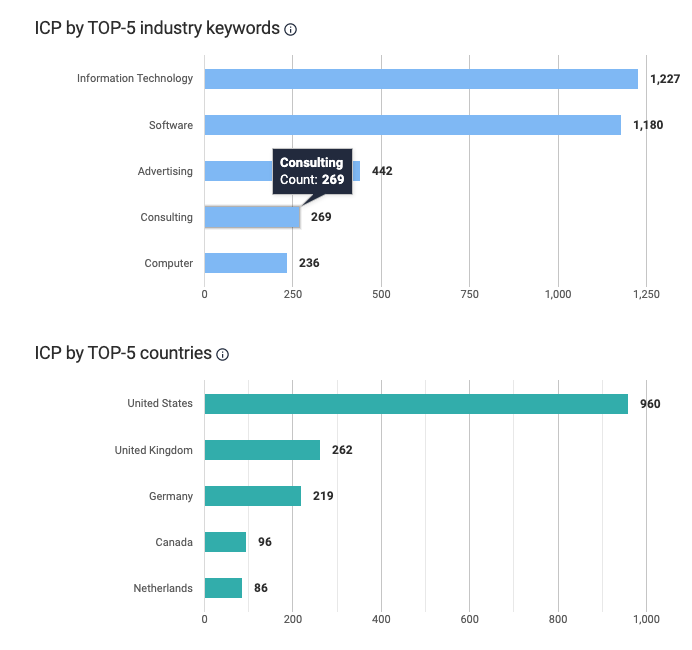

Dynamic ICP & Target Account Lists

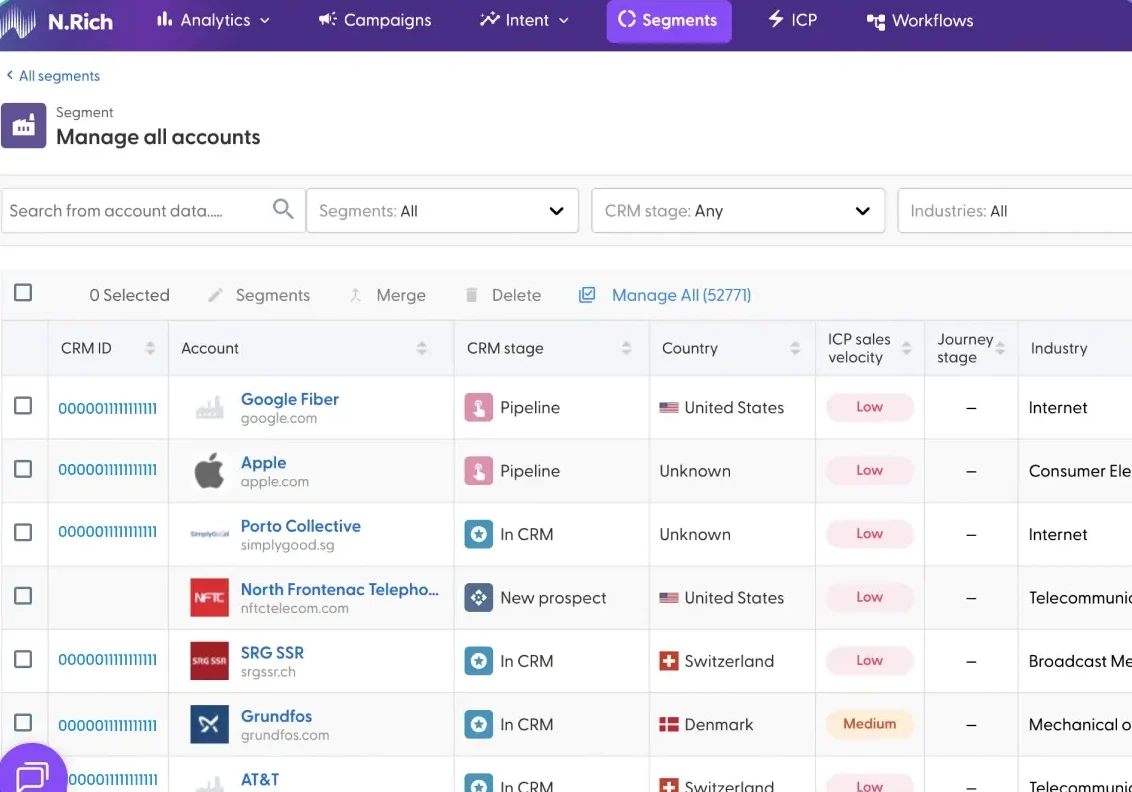

N.Rich ingests CRM opportunity data to understand your best customers and then scores new accounts against that pattern.

You can spin up target lists with filters like industry, employee count and tech stack, moving away from pure gut feel selection while still depending on CRM data quality.

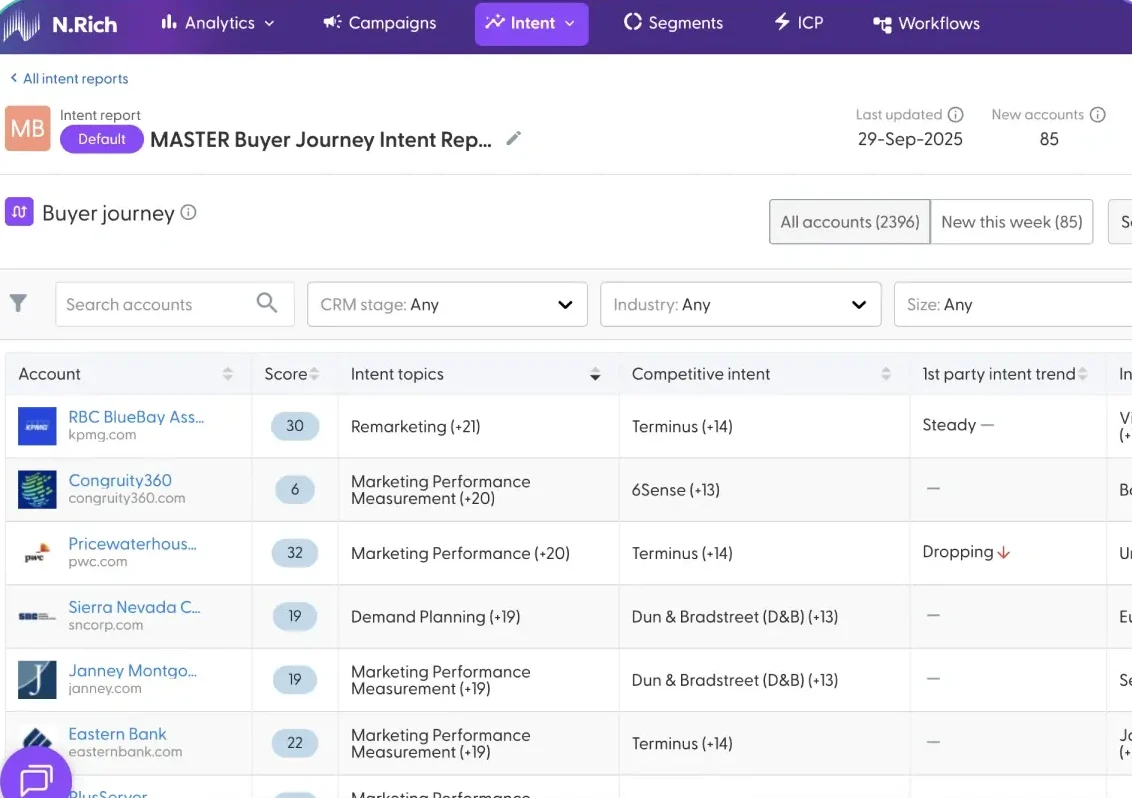

Intent Data & Account Scoring

N.Rich fuses first-party behavior (site visits, ad engagement) with third-party intent feeds to highlight accounts researching key topics.

Accounts receive intent scores so marketing and sales can focus on the warmest, consent-based interest, while topic data syncs into your CRM for follow-up.

Account-Based Advertising

N.Rich ships with a built in DSP to run programmatic display to target accounts, with support for native and video formats.

You can connect LinkedIn Ads so that display and LinkedIn campaigns stay aligned, and reviewers point out a straightforward campaign builder with bulk creative uploads and A/B tests.

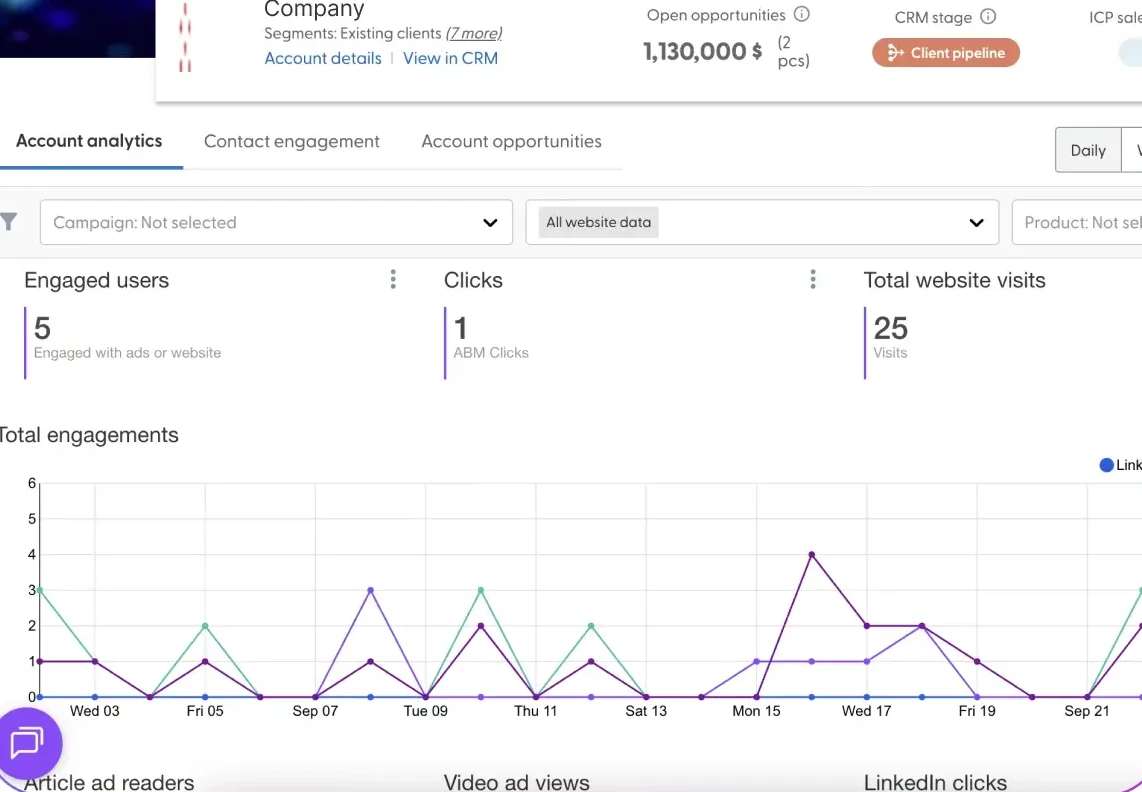

Analytics & Opportunity Attribution

N.Rich gives account-level analytics that tie engagement to pipeline and revenue. The Opportunity Attribution dashboard links impressions, clicks and visits to opportunities and closed deals.

It also calculates an ICP Sales Velocity Score per account and can sync those metrics back to your CRM on higher tiers.

Integrations & Data Enrichment

N.Rich connects to the main CRMs and marketing tools. Native integrations include Salesforce, HubSpot (Marketing and Sales Hub) and LinkedIn (Marketing Solutions and Sales Navigator), so you can pull CRM data for segmentation and push back engagement, topics and scores.

Upper tiers add firmographic and technographic enrichment to improve targeting.

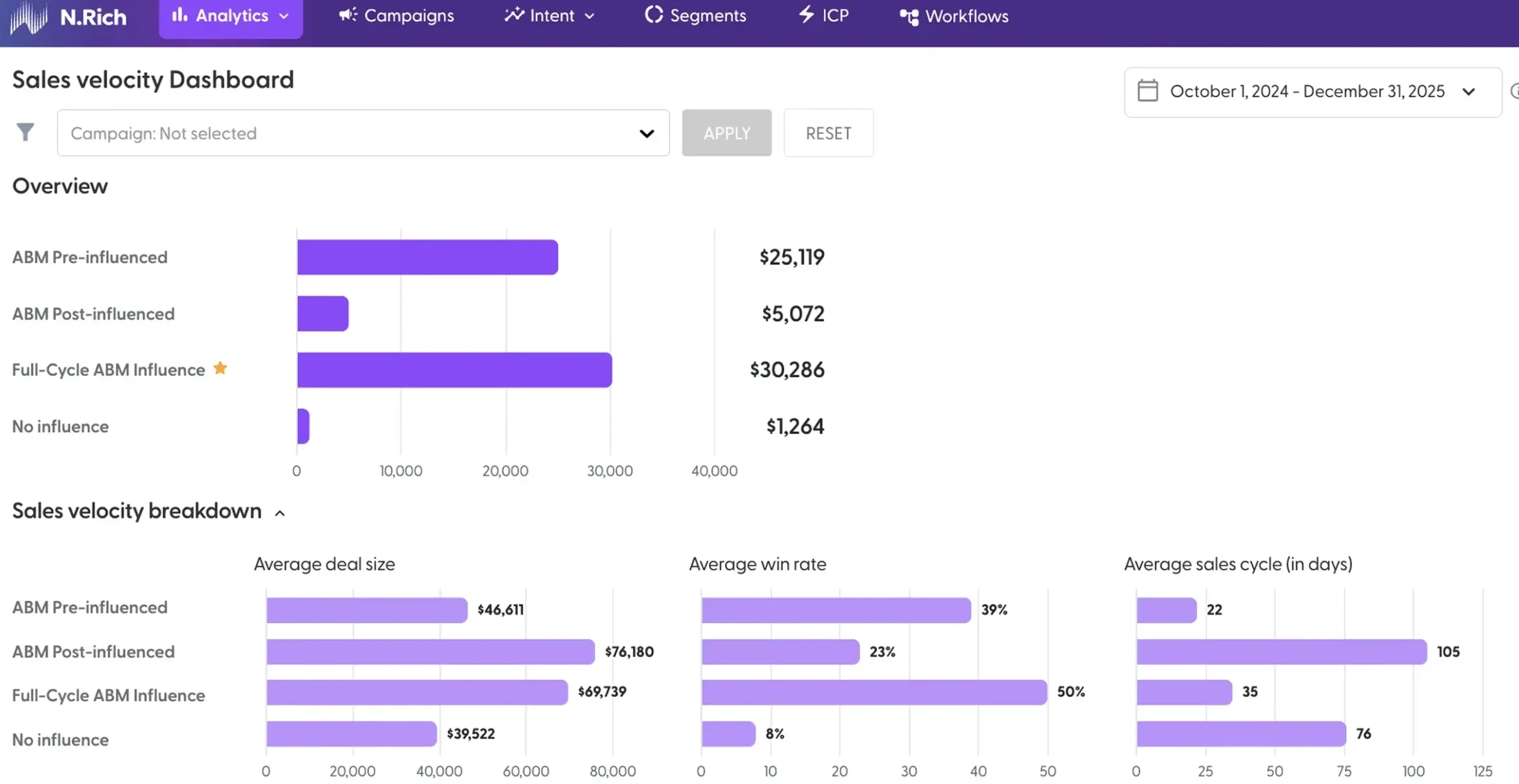

N.Rich Pricing: How Much Does It Cost?

N.Rich uses tiered pricing tied to team size and ABM maturity, with all plans focused on turning intent data into revenue.

LITE: Starting at $10,320/year + $1,050 One-Time Onboarding Fee

For smaller teams testing intent-driven ABM.

Includes 1 intent report, 10 topics, 1 marketing seat, 3 sales seats, 1 N.Rich account, 1 ABM campaign, chat support, plus:

- Intent scoring

- Unlimited firmographic and technographic data

- Website visitor identification

- Basic account analytics and alerts

GROWTH: Starting at $23,800/year

For teams scaling ABM and tightening sales and marketing alignment.

Includes everything in LITE, plus:

- More intent reports and topics

- Additional marketing seats and unlimited sales seats

- CRM and MAP integrations

- Richer attribution and more ABM campaigns

- Dedicated Customer Success Manager

ENTERPRISE: Custom Pricing

For global, mature ABM programs with complex orchestration needs.

Includes everything in GROWTH, plus:

- Unlimited intent reports and higher topic limits

- Unlimited users and multiple N.Rich accounts

- Dynamic ICP Builder and open API

- Automated workflows and strategic consulting

All plans benefit from N.Rich data depth and native ABM orchestration, but you still need to speak with sales for a precise quote.

Note: because N.Rich starts above $10K per year, ZenABM often looks leaner for LinkedIn first teams, starting at ~$59/month with the top tier still under $6K per year. You still get core LinkedIn ABM essentials: account-level ad engagement tracking, account scoring, ABM stage tracking, hot account routing, bi-directional CRM sync, custom webhooks, qualitative intent and plug and play ROI dashboards.

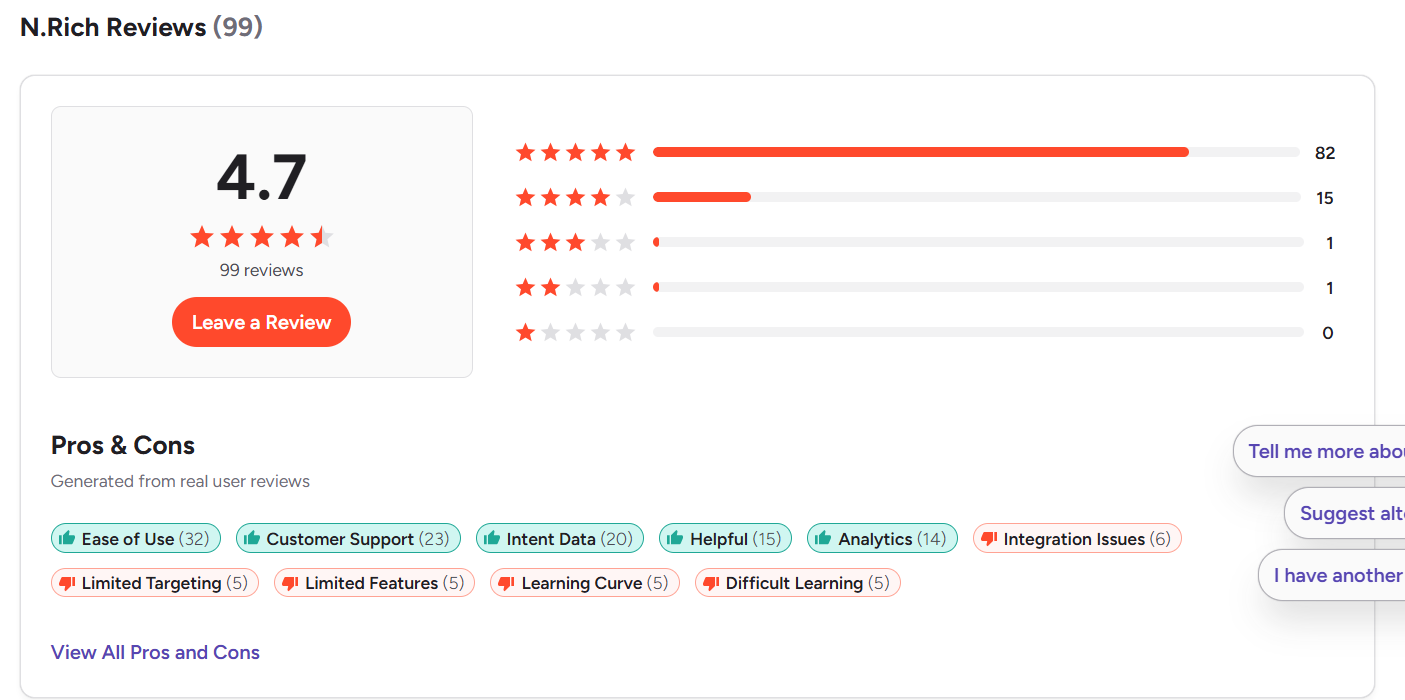

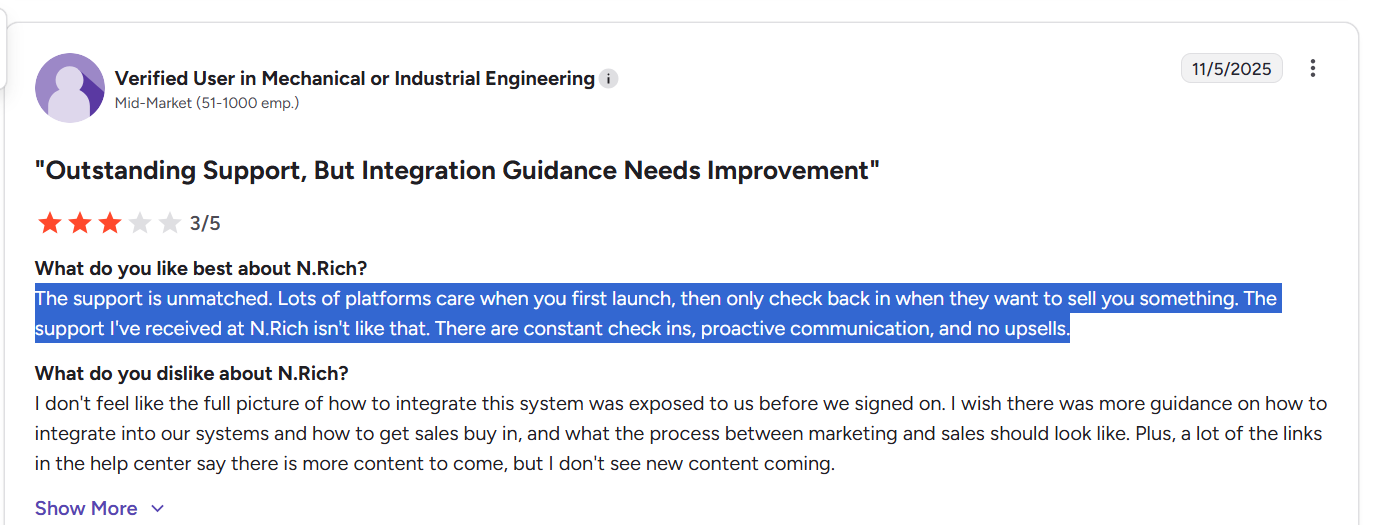

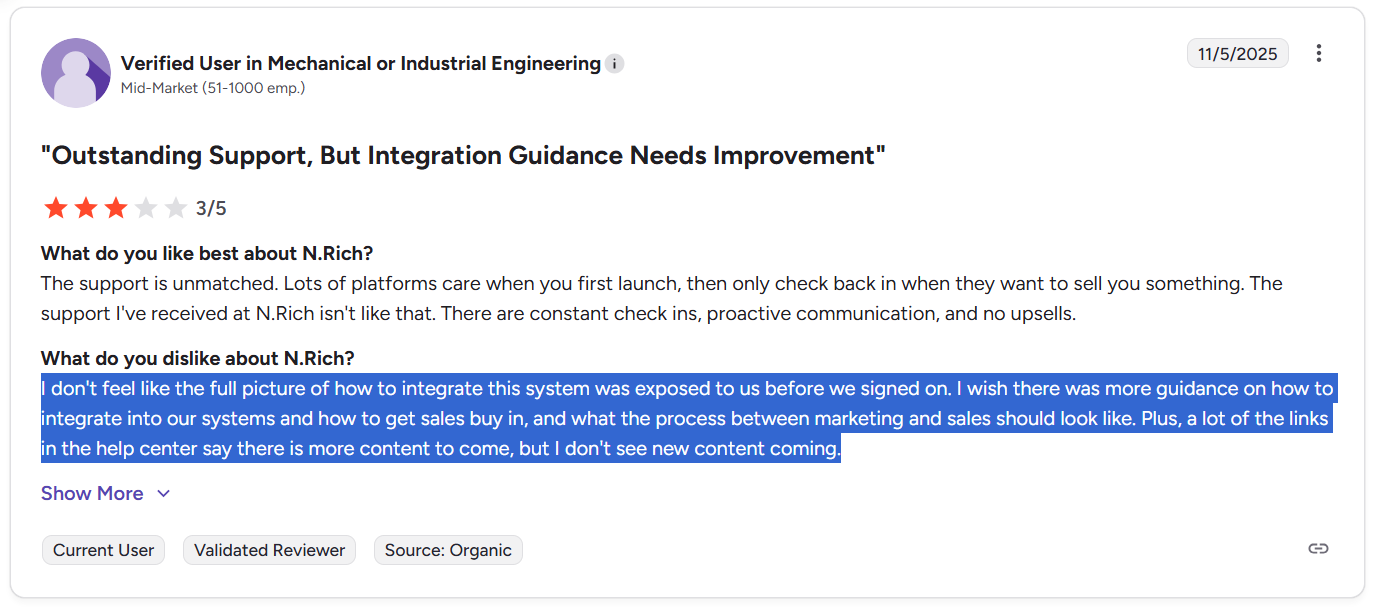

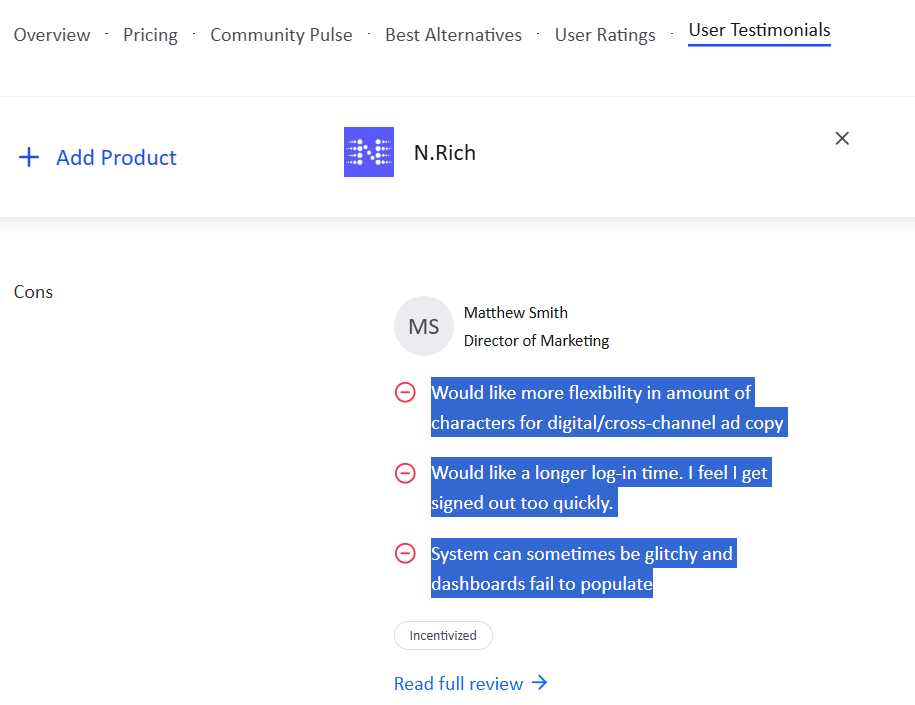

User Impressions and Reviews

N.Rich scores 4.7 out of 5 on G2 (around 99 reviews), which signals strong overall satisfaction.

Across G2, TrustRadius, Reddit and similar sites, a few clear themes show up.

Pros (According to Users)

- Support that shows up: Reviewers describe N.Rich support as responsive and proactive, with check-ins that are actually helpful, not pure upsell.

- Usable once configured: Many say it becomes straightforward and even enjoyable once ICPs, lists and campaigns are in place.

- Strong intent and targeting: Users like the quality of intent signals and account selection for focusing spend on high value accounts.

Cons (According to Users)

- Setup takes work: Onboarding, data mapping and reporting usually need ops help and a bit of patience.

- Integrations need clearer guidance: Some users report surprises during integration and wish the end state had been explained better upfront.

- Feature gaps: A few reviewers point to limits around ad copy, session timeouts or occasional glitches.

Terminus Overview: Key Features, Pricing, and Reviews

Terminus is widely described as an end-to-end ABM platform.

It is popular with B2B marketers who want a unified ABM “Engagement Hub” that spans ads, web activity and sales touchpoints.

Here are the key pieces.

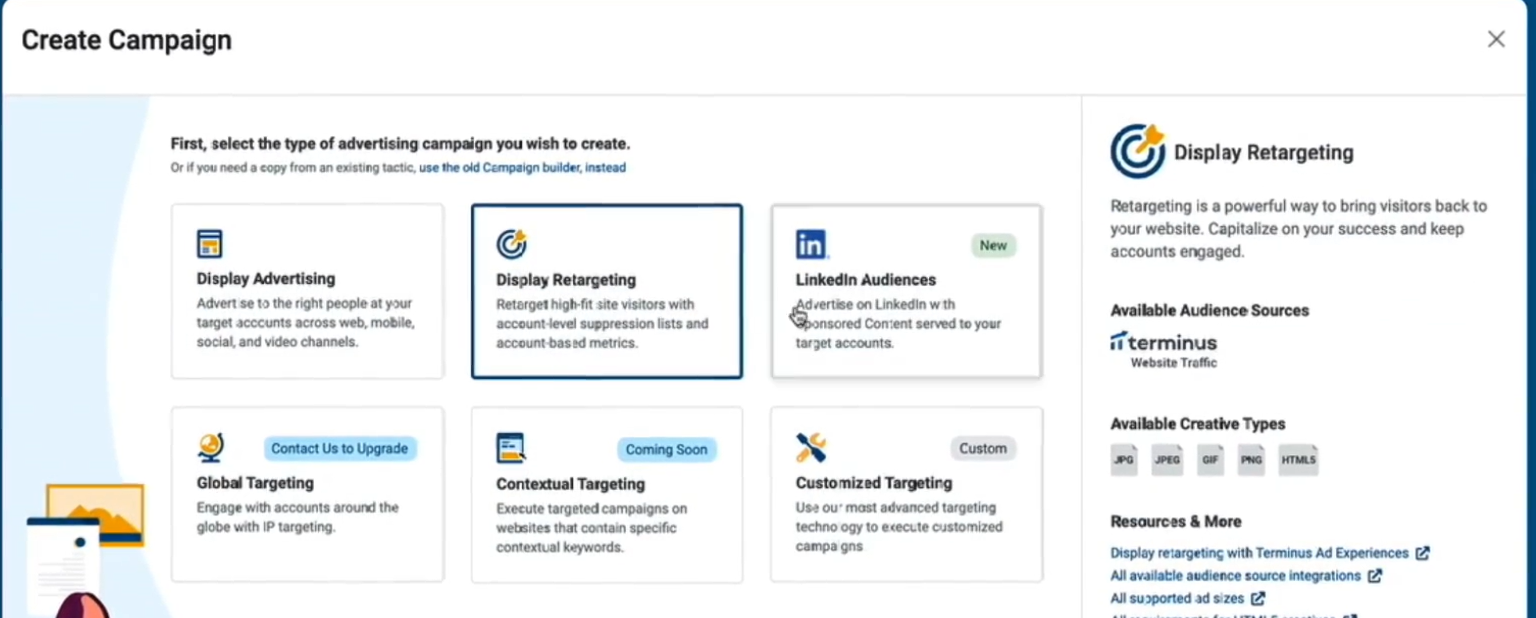

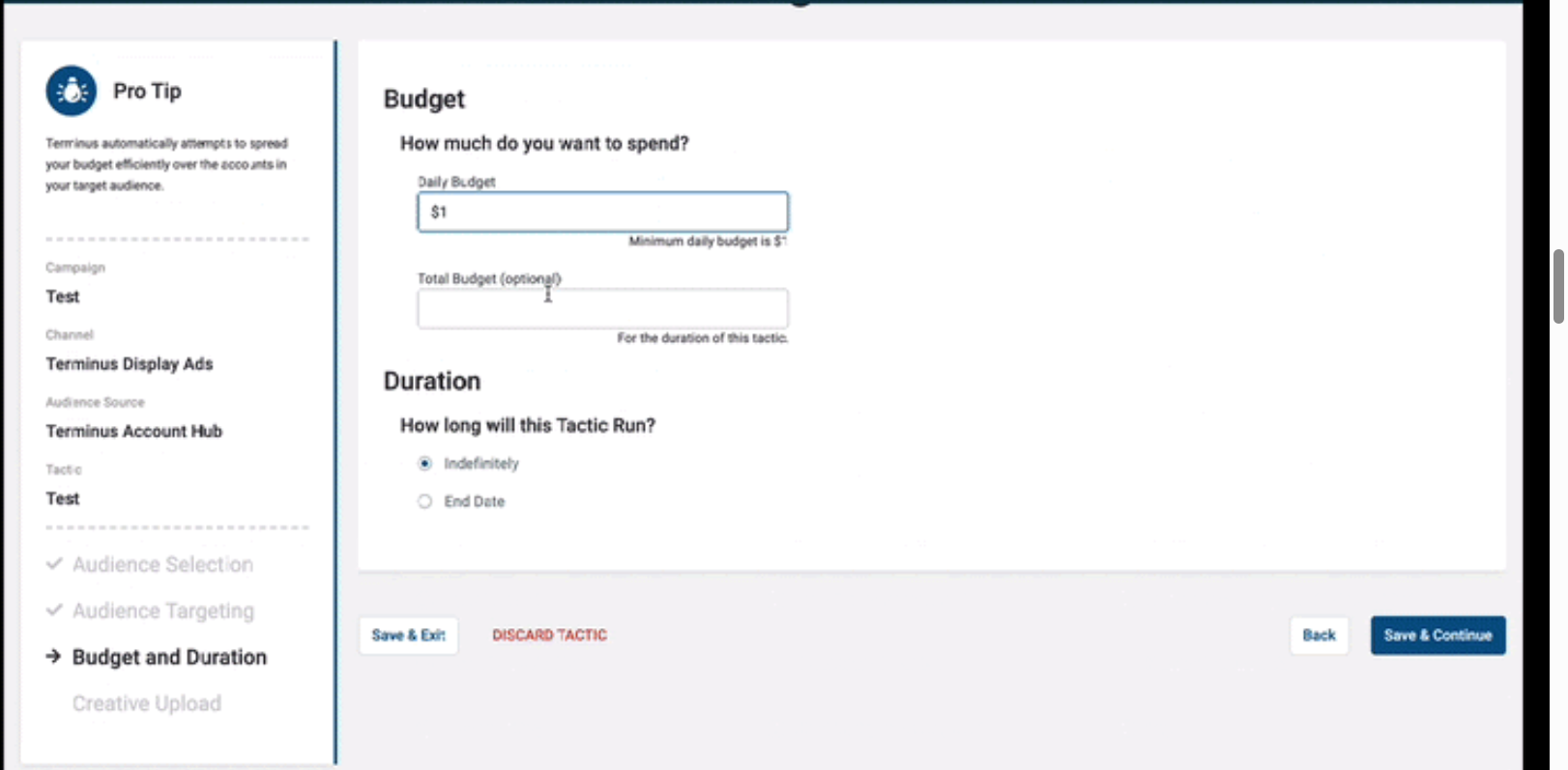

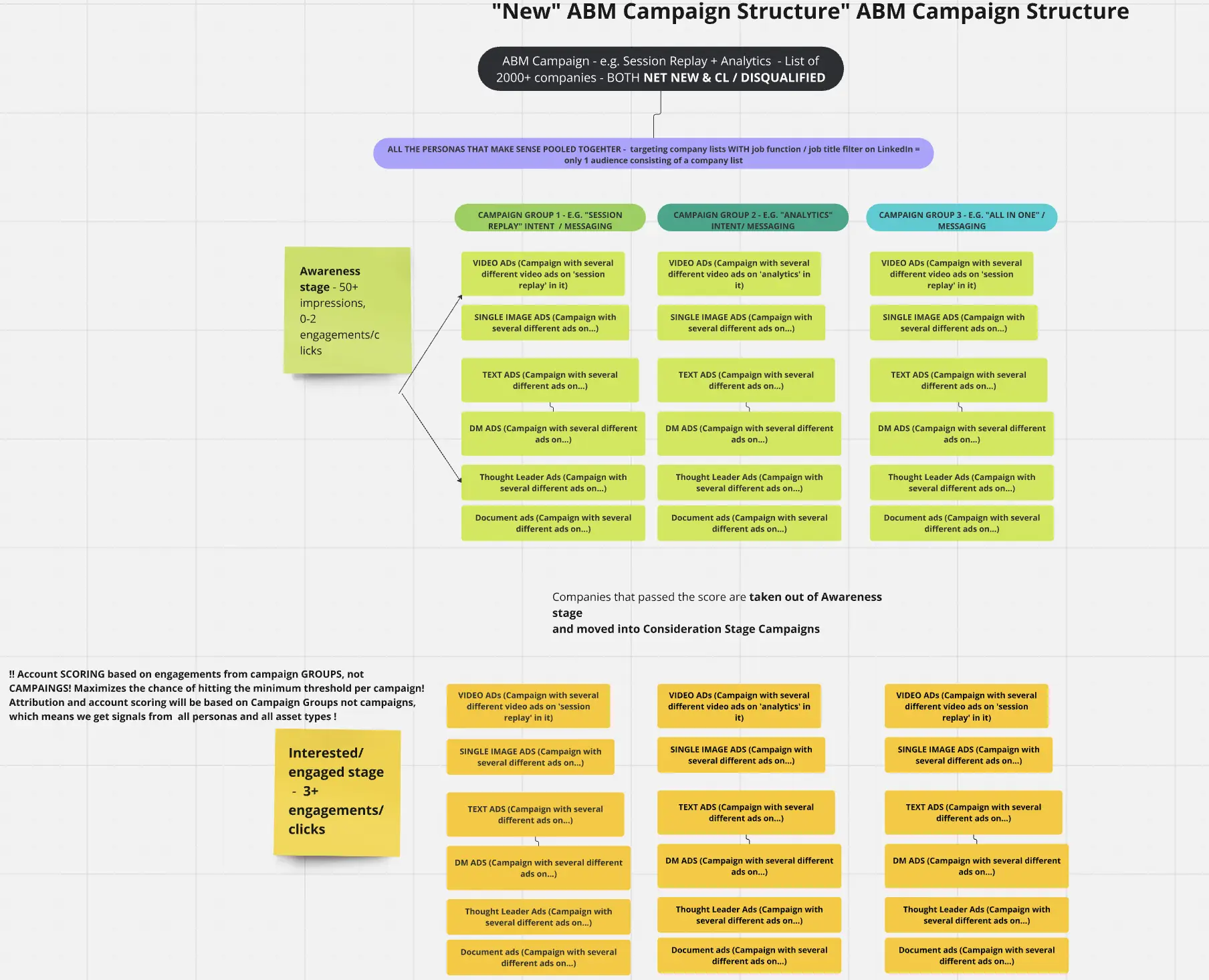

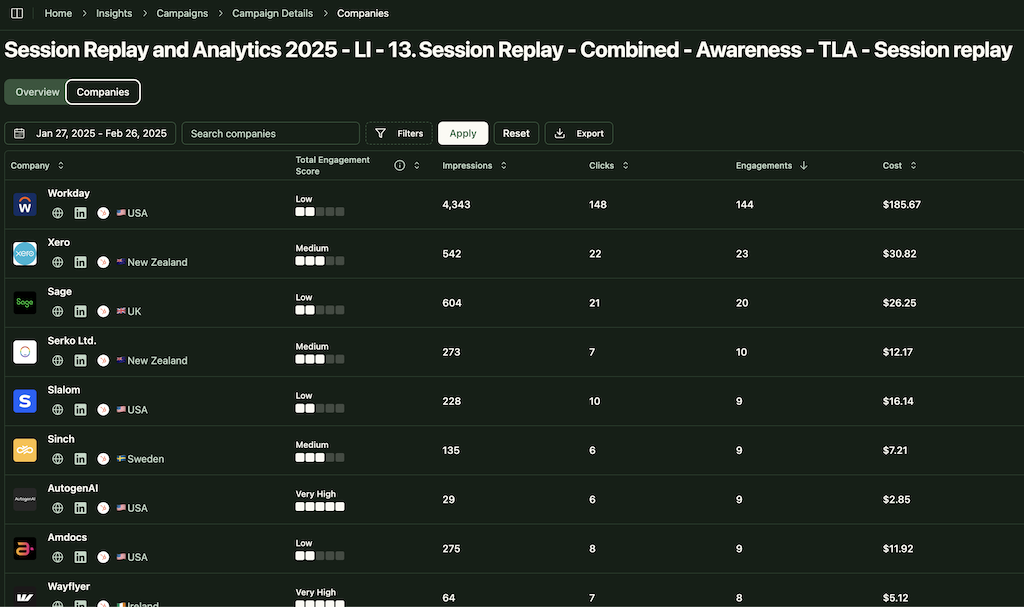

Multi-Channel Ad Support

Terminus lets you plan and manage ads across multiple channels inside one platform.

This includes traditional display ads via an account-based DSP, retargeting, LinkedIn Ads and newer formats like connected TV and audio.

By centralizing media, Terminus helps you hit target accounts across web, social and other inventory from one place, while automatically balancing impressions so a few accounts do not eat all the budget.

For teams that need centralized multi-channel orchestration, Terminus can simplify how you run ABM campaigns.

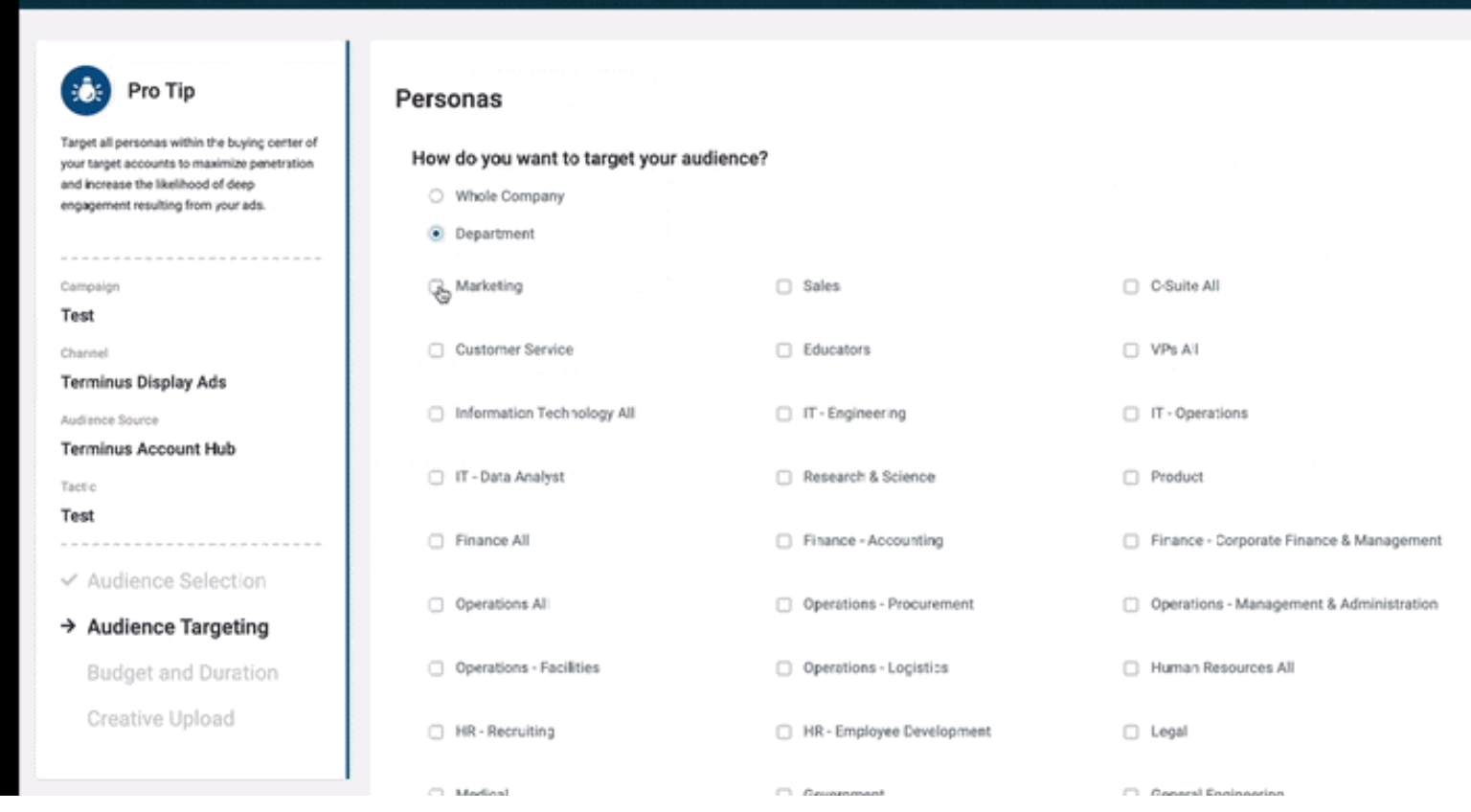

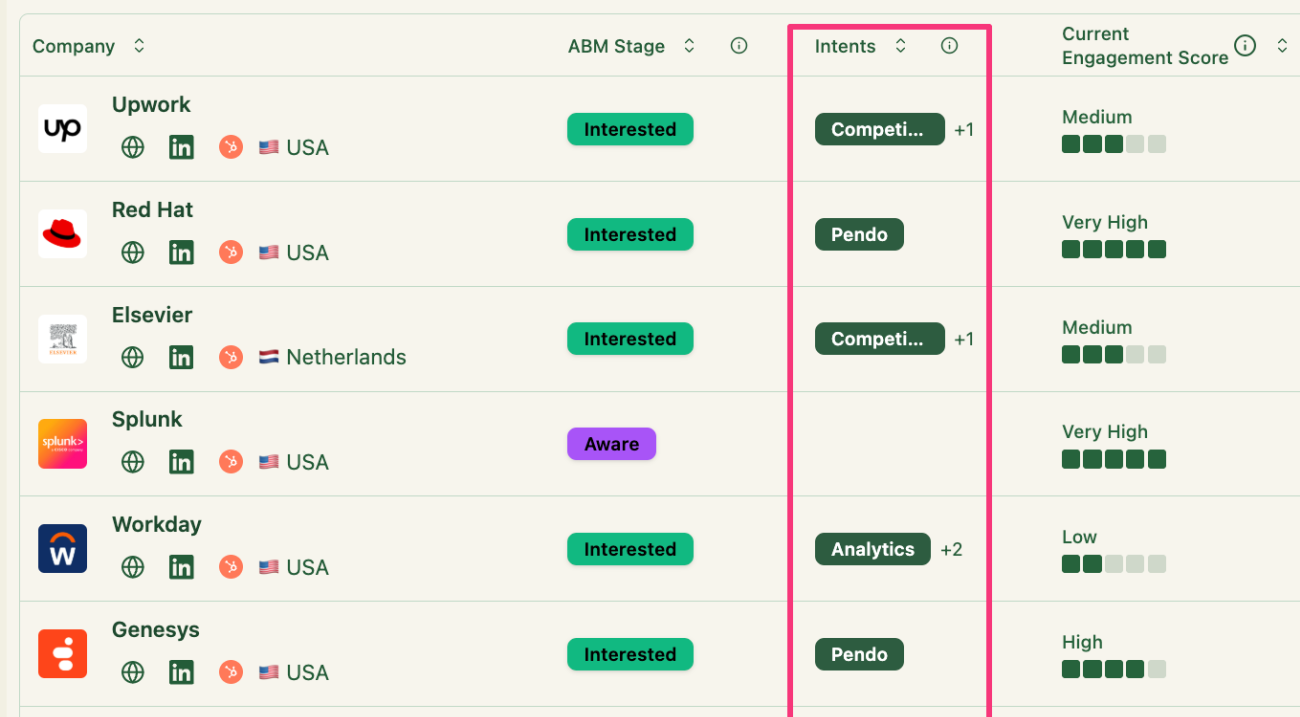

Account & Persona Targeting

You can upload or sync target account lists from your CRM and refine audiences by persona attributes such as department, seniority or function.

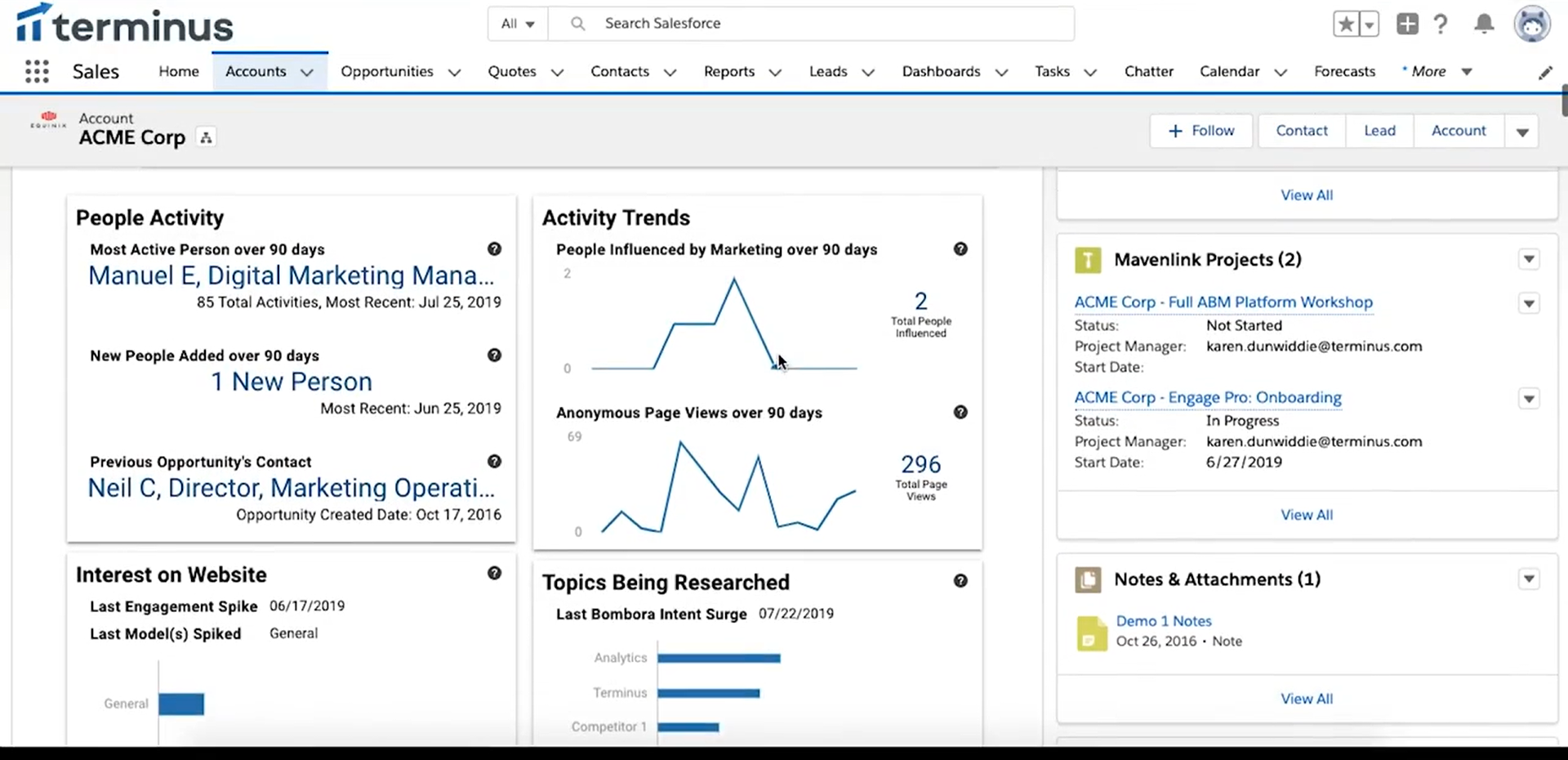

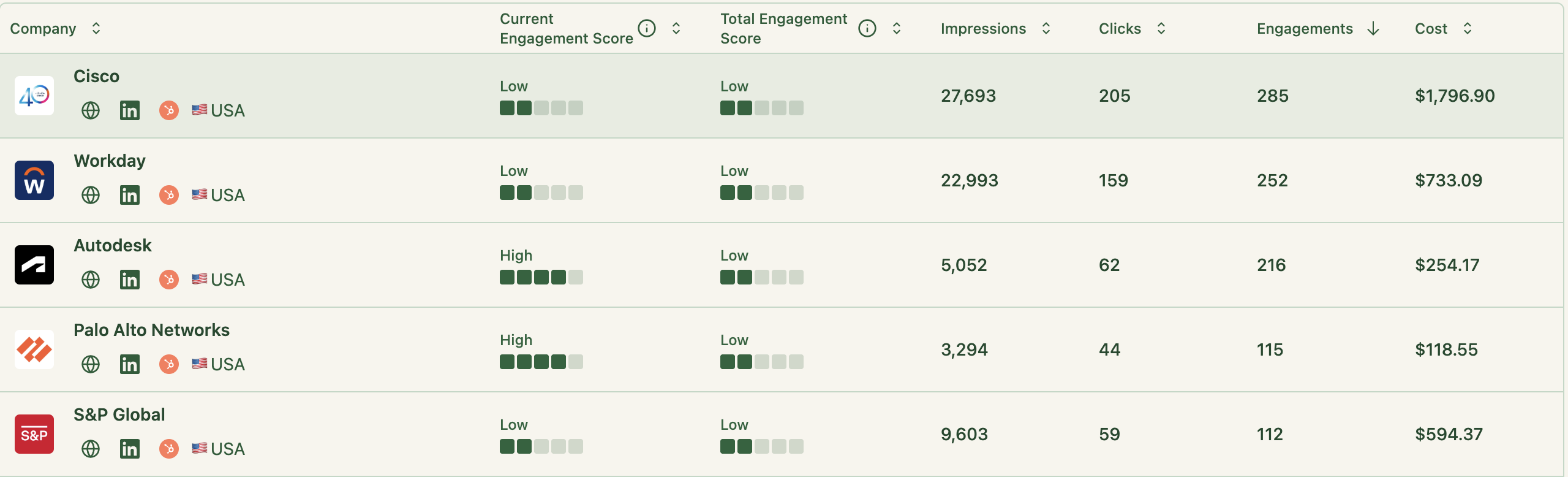

Account-Level Engagement Tracking

The platform tracks impressions as well as clicks at the account level.

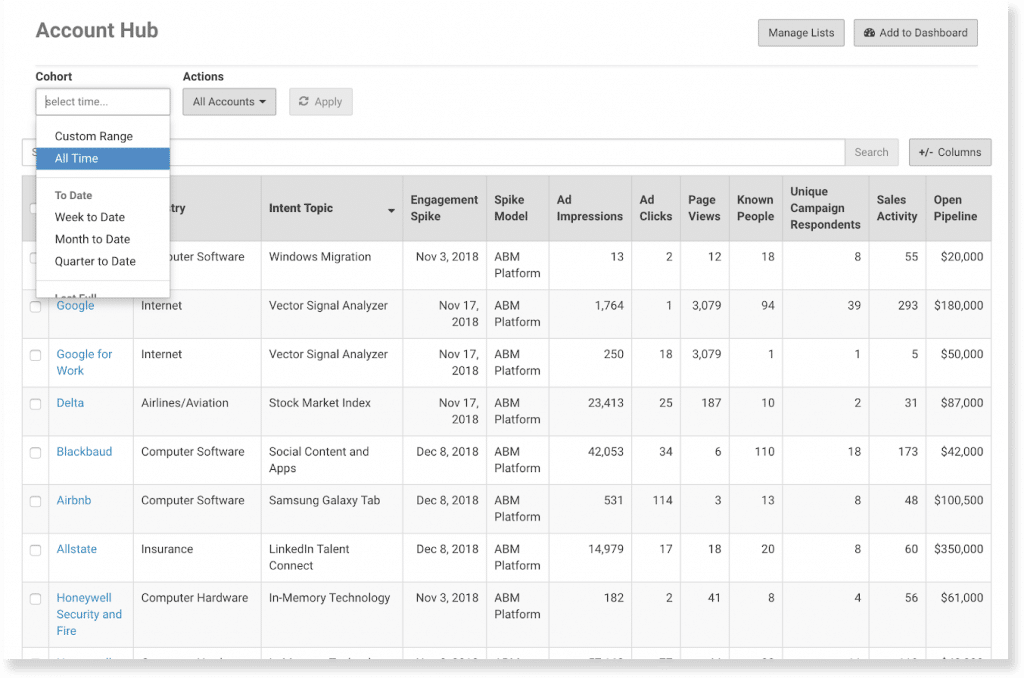

In ABM, simply knowing that a target account repeatedly saw your ads is useful. Account Hub surfaces impressions, clicks, site visits and other engagement per account so you can see how your programs land and support account-based attribution.

Website Visitor Identification

Terminus includes Visitor ID to de-anonymise website traffic.

It uses reverse IP lookup, cookies and CRM matching to figure out which companies (and sometimes which known contacts) are on your site.

If an anonymous visitor later fills a form, Terminus can connect that history back to the account. It also maps CRM leads to sessions by email domain, so you know, for example, when a director from Acme Corp visited the pricing page.

Intent Data

Terminus integrates intent data from providers such as Bombora to highlight in-market accounts so you can prioritize spend on companies that show strong research behavior.

Pro Tip: Third-party intent spikes can be noisy; first-party signals are usually more reliable.

ZenABM captures first-party qualitative intent by tracking which LinkedIn ads a company actually engages with, giving you clear buying themes instead of abstract keyword spikes.

The Userpilot team (a ZenABM customer) built their ABM playbooks around this idea, tagging campaigns by pain point and increasing BOFU spend where accounts interacted most.

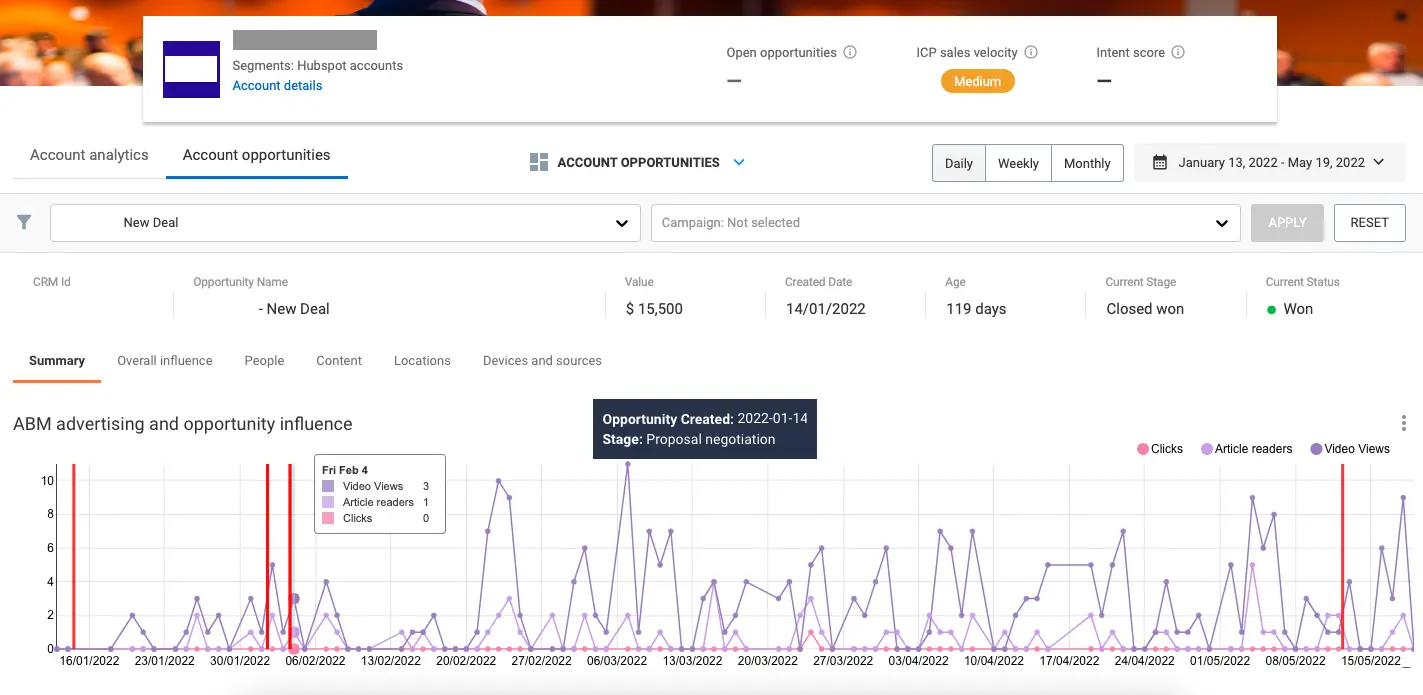

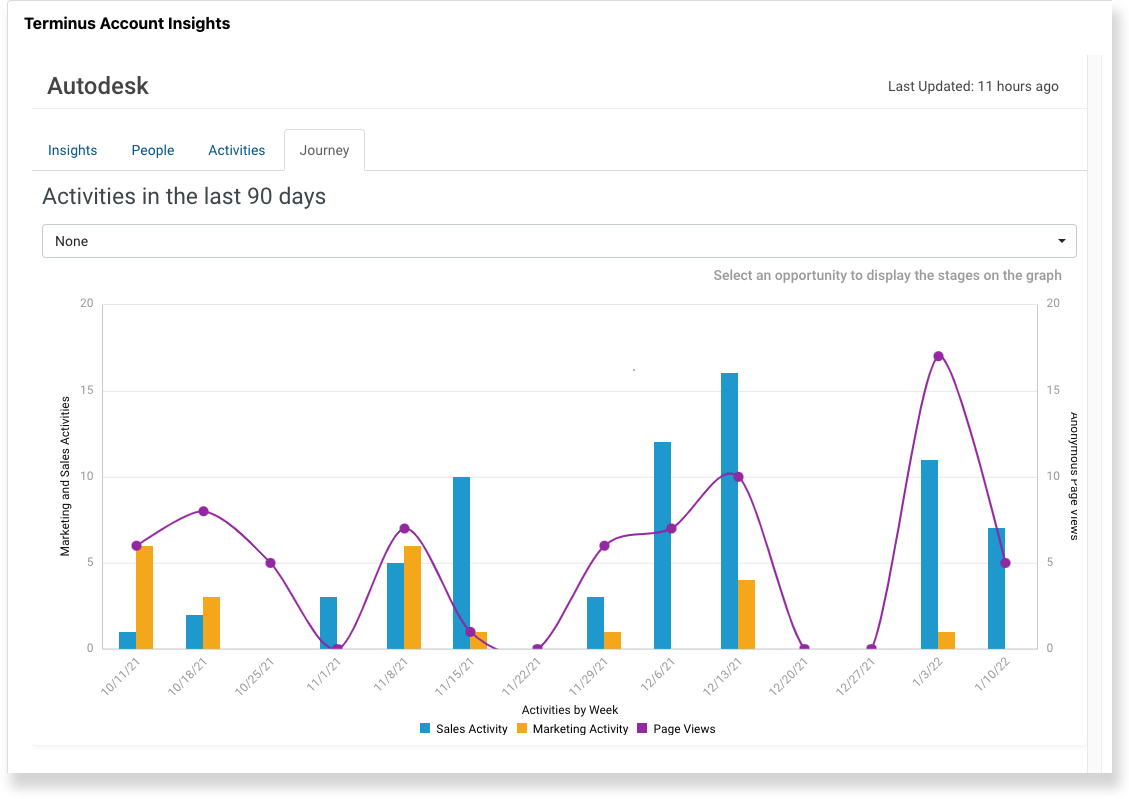

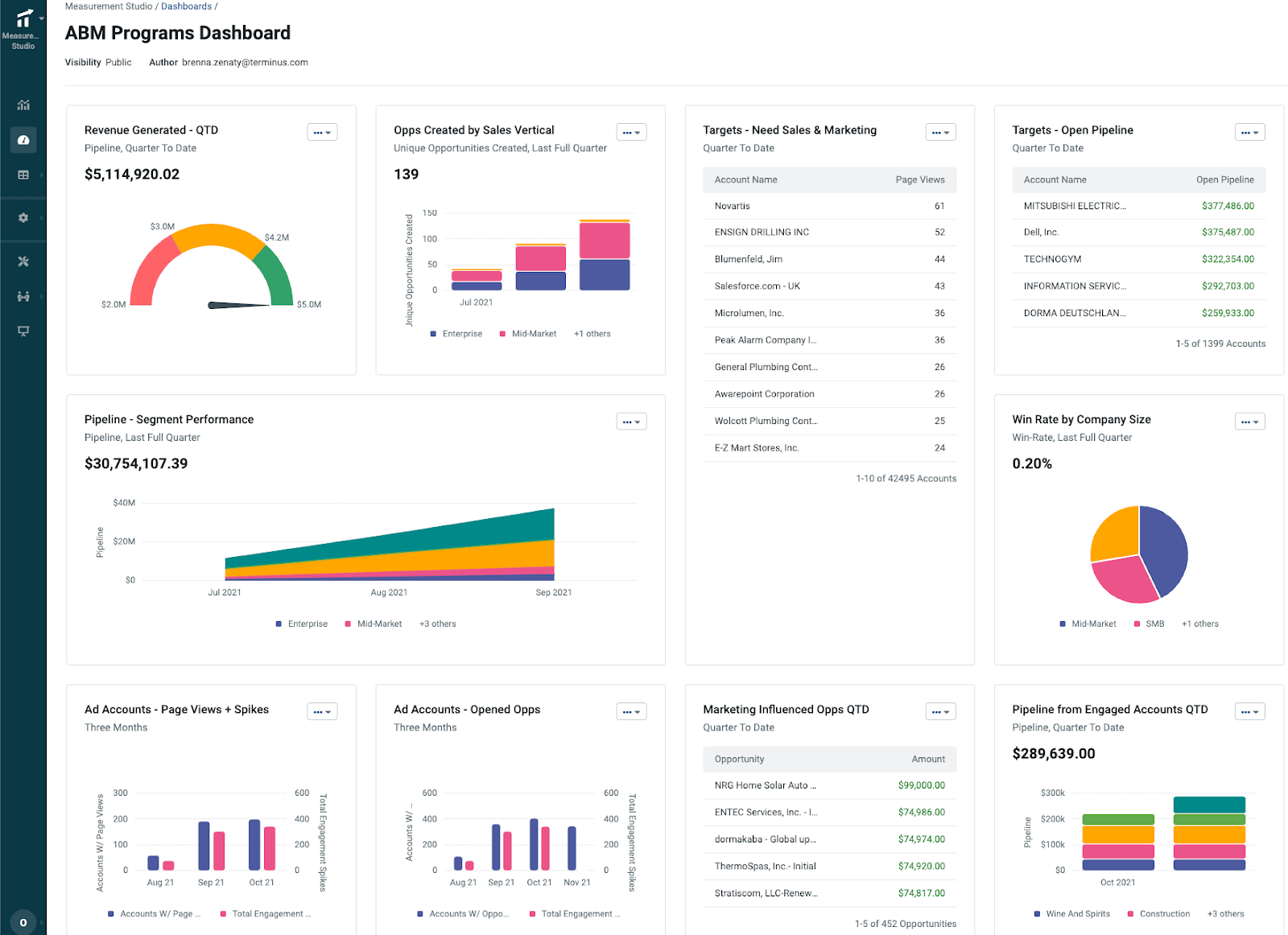

ABM Analytics and Attribution

Measurement Studio in Terminus (supported by the BrightFunnel acquisition) handles multi touch attribution at the account level.

It lets marketers see how ads, emails, website sessions, events and other touches influence pipeline and revenue using first touch, last touch and custom models.

All of this rolls into an account journey view so you can see how an opportunity moved from early engagement to closed won.

Terminus also provides ready-made ABM dashboards that show revenue, opportunities, pipeline influence, top engaged accounts and similar metrics, plus topic-based views for discovering new opportunities.

Integrations

Terminus plugs into a wide range of B2B tools.

There are built-in connectors for major CRMs (Salesforce, HubSpot, Microsoft Dynamics), marketing automation platforms (Marketo, Pardot, HubSpot Marketing Hub, Eloqua), ad channels (LinkedIn Ads, Google Ads), sales tools (Outreach, Salesloft and others), analytics (Google Analytics, Adobe Analytics, PathFactory), data providers (Bombora, G2 intent, Clearbit or DemandScience) and more.

You can dig through the full list in the Terminus docs.

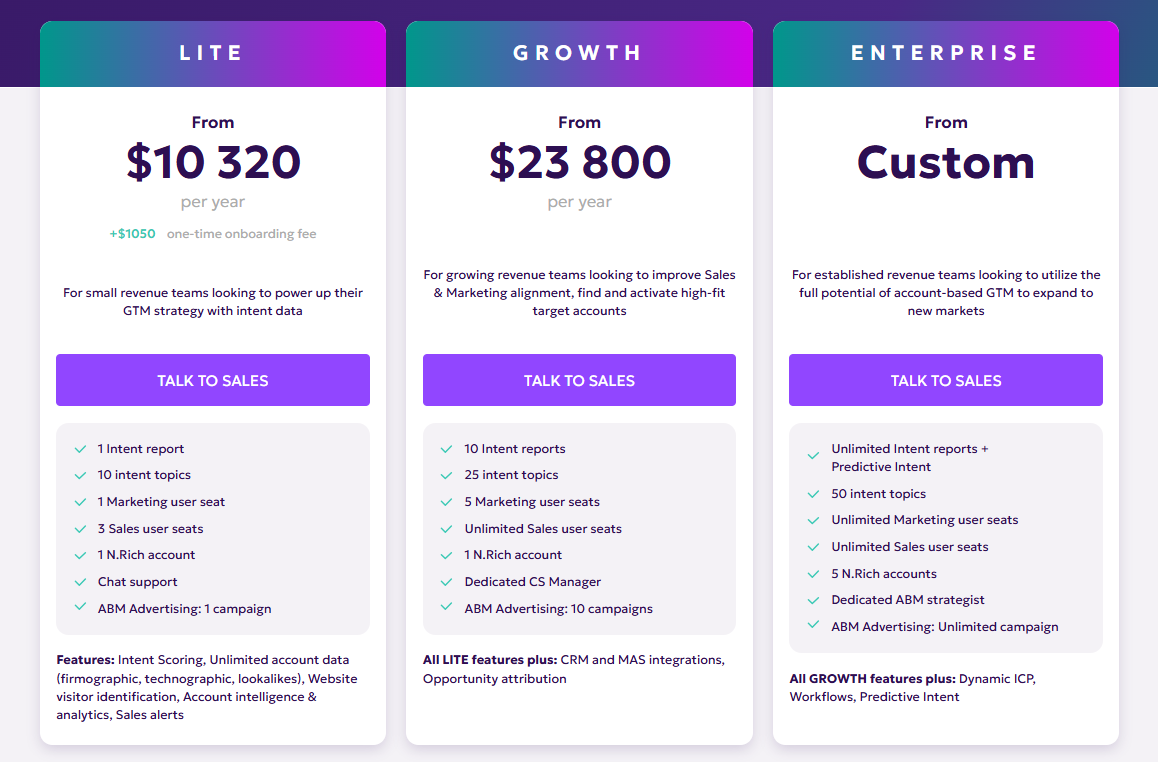

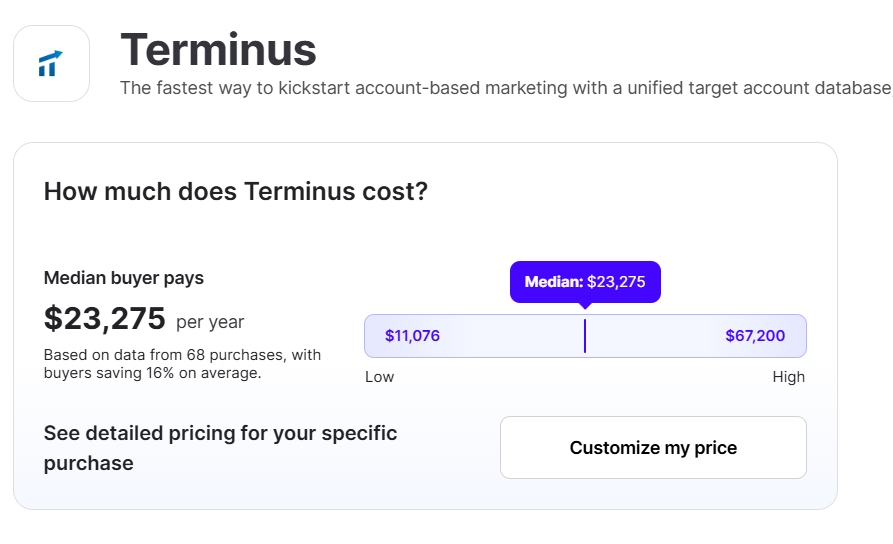

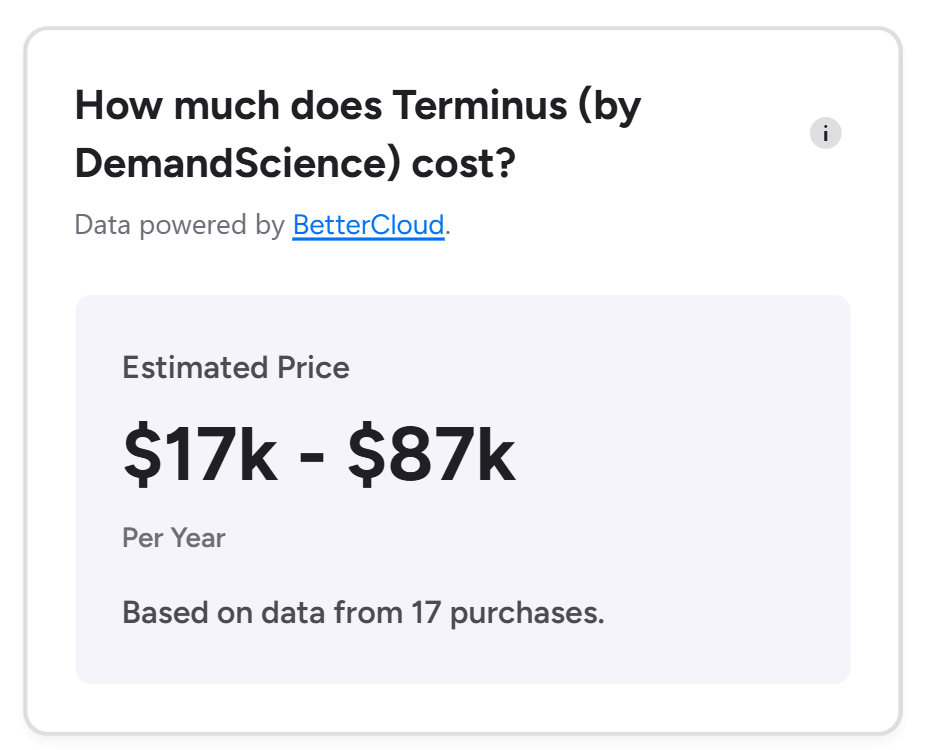

Terminus Pricing

Terminus runs on premium, custom-quoted pricing.

There is no public price card; you have to speak with sales.

Most research suggests deals land in the mid five figures per year and can climb into six figures for large enterprises.

Vendr puts the median Terminus price at about $23,000 per year, with some large customers paying $100K to $250K or more annually.

CMO.com suggests starting costs around $57,500 per year, with contracts up to $266,000, and G2 reviews point to a broad range between $18,000 and $87,000. Overall, pricing is not friendly to very small teams with tight budgets.

Terminus Reviews

On sites like Trustradius, Infotech.com and Software Finder, users praise Terminus for a solid UX and broad ABM coverage.

Common complaints include cost, limits on accounts per campaign, some reporting gaps and occasional integration friction with HubSpot.

N.Rich vs. Terminus: Key Differences

The key differences between N.Rich vs. Terminus are tabulated here.

| Aspect | N.Rich | Terminus | Best suited for |

|---|---|---|---|

| Core positioning | ABM execution layer built on a B2B DSP with ICP, intent and programmatic workflows | End-to-end ABM platform and Engagement Hub for ads, web and sales touchpoints | Teams picking between a focused media engine and a broad ABM suite |

| Primary channel focus | Programmatic display with native and video formats plus LinkedIn alignment | Display, retargeting, LinkedIn, CTV and audio ads from one platform | Whether you mainly need DSP-heavy ABM or full multi-channel coverage |

| Intent model | Combines first-party signals with third-party intent topics and scores accounts | Uses partner intent data, such as Bombora, plus Visitor ID and engagement metrics | Teams choosing between topic-based intent and a broader partner-driven intent stack |

| ICP and targeting | Dynamic ICP builder driven by CRM opportunities to shape lists and scoring | Target account lists from CRM with persona filters, such as department or seniority | Orgs that want automated ICP modeling vs classic TAL plus persona filters |

| Website visitor identification | Website visitor identification with firmographic and technographic enrichment | Visitor ID that de-anonymises traffic using reverse IP, cookies and CRM matching | Teams deciding between a lighter reveal vs deeper identity stitching |

| Engagement and journeys | Account-level analytics and ICP Sales Velocity Score per account | Account Hub views of impressions, clicks, visits and cross-channel journeys | Whether you need high-level metrics or full journey timelines |

| Attribution and analytics | Opportunity attribution linking impressions and clicks to opportunities and deals | Measurement Studio with multi-touch attribution and ABM dashboards for pipeline and revenue | ABM teams picking between focused campaign analytics and richer revenue reporting |

| Integrations | Salesforce, HubSpot, LinkedIn and MAP integrations plus enrichment providers | Wide ecosystem of CRM, MAP, sales engagement, analytics and intent integrations | Stacks that need a few core connections vs a broad integration hub |

| Pricing level | Premium pricing from around 10,000 USD per year, with Growth near 23,800 USD and Enterprise custom | Custom pricing that often sits in mid-five figures and can reach low six figures | Budgets that can support premium vs true enterprise ABM spend |

| Complexity and adoption | Needs onboarding and ops support, but keeps focus on media and intent execution | A broader surface area that demands more configuration and process change | Teams wanting a lighter execution layer vs orgs ready for a platform-level shift |

| ABM breadth | Covers ICP definition, intent, DSP campaigns and account analytics | Covers ads, visitor identification, intent, sales activation and ABM analytics | Companies choosing between an ABM media engine and a full engagement hub |

N.Rich vs. Terminus: So Which Is Better for ABM?

If your ABM plan is mainly about turning intent data into targeted media and you care most about programmatic display plus some LinkedIn alignment, N.Rich works well as a specialist execution layer.

It takes ICP models and topics, turns them into DSP campaigns and gives you account-level analytics and velocity scores so you can see which accounts are actually moving.

Terminus behaves more like an ABM control center.

It pulls multi-channel ads, website behavior, intent and account journeys into one place so marketing and sales can work from a shared view of engagement.

For teams that want a single pane of glass for ads, site activity and attribution, and have the budget, Terminus is more comprehensive.

But if most of your serious ABM work runs on LinkedIn, both can start to feel heavier than necessary.

In that case, ZenABM is a more pragmatic choice. It gives you first-party company-level LinkedIn engagement, account scoring, ABM stages and CRM synced revenue attribution without forcing a total platform replacement.

ZenABM as a LinkedIn First, First Party Lean ABM Alternative

If your main need is first-party accuracy on LinkedIn, account scoring, ABM stages, CRM sync and revenue attribution, a lighter platform is easier to adopt.

This is where ZenABM comes in.

Even for teams running multi-channel ABM, ZenABM adds value through the following features.

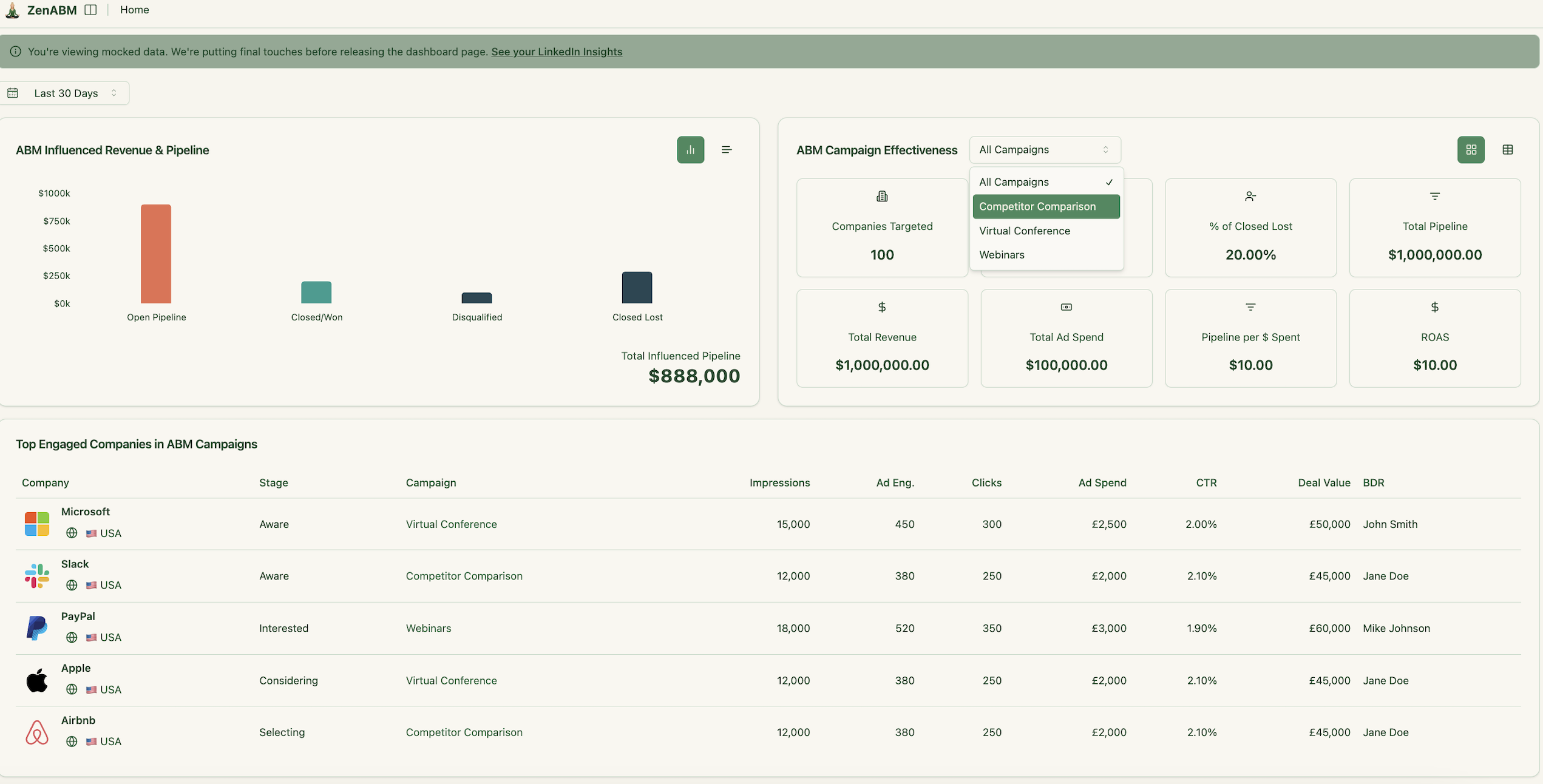

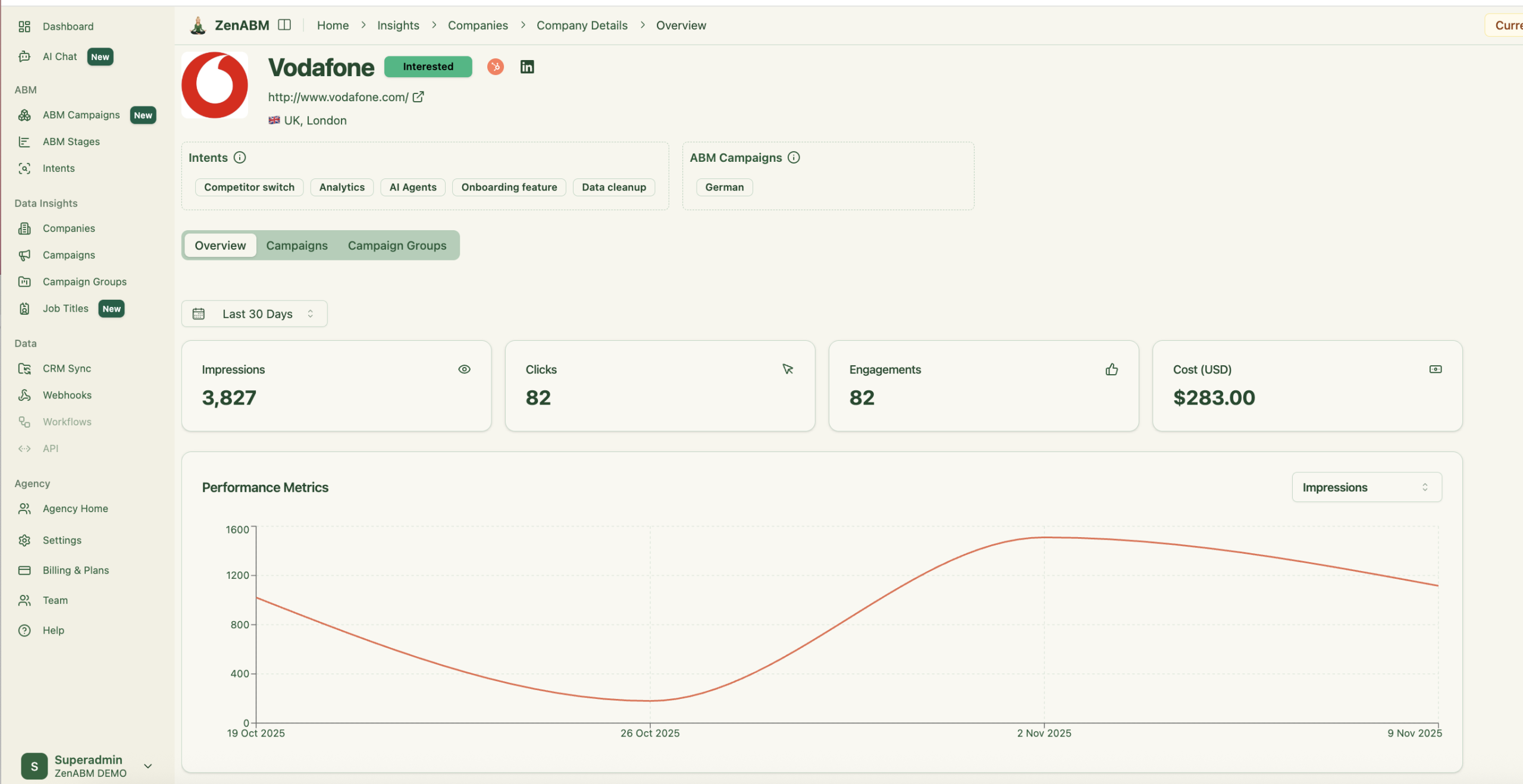

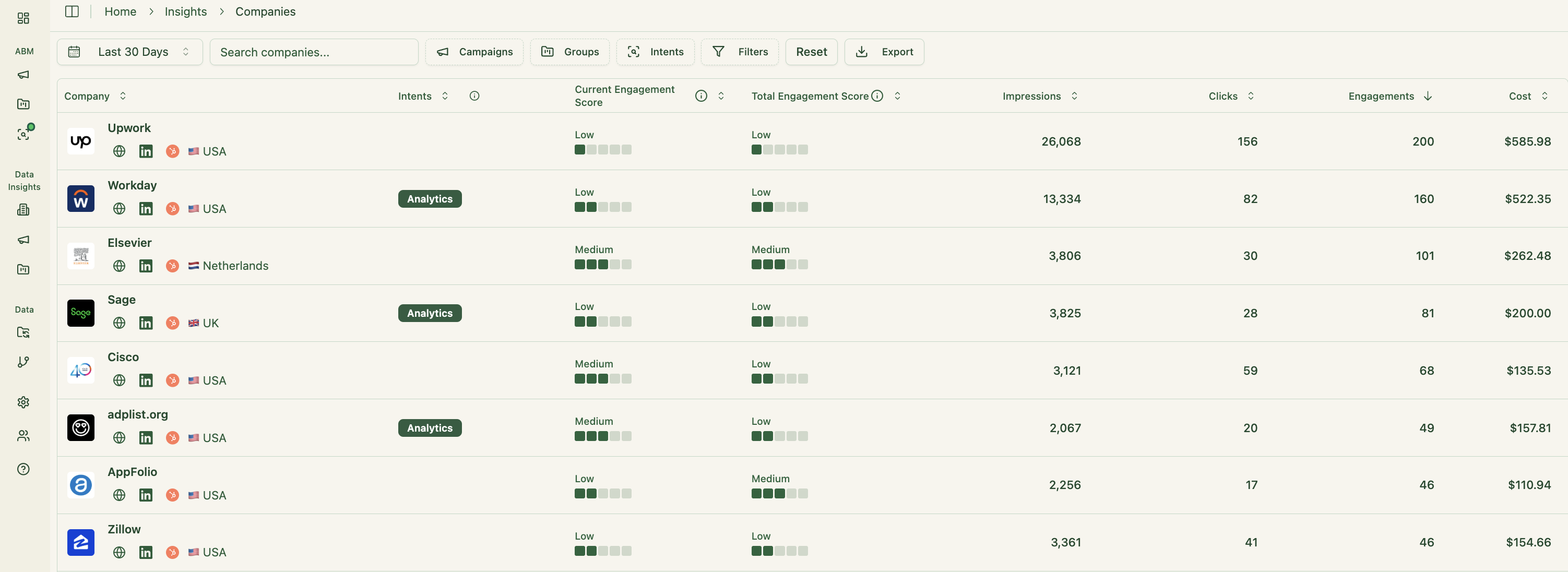

Account-Level LinkedIn Engagement Tracking

ZenABM connects directly to the official LinkedIn Ads API and records account-level data per campaign.

You see which companies view and engage with your ads from first-party LinkedIn data instead of noisy IP or cookie matching. A Syft study shows IP identification accuracy often peaks around 42 percent, so ZenABM treats ad engagement as the stronger intent signal.

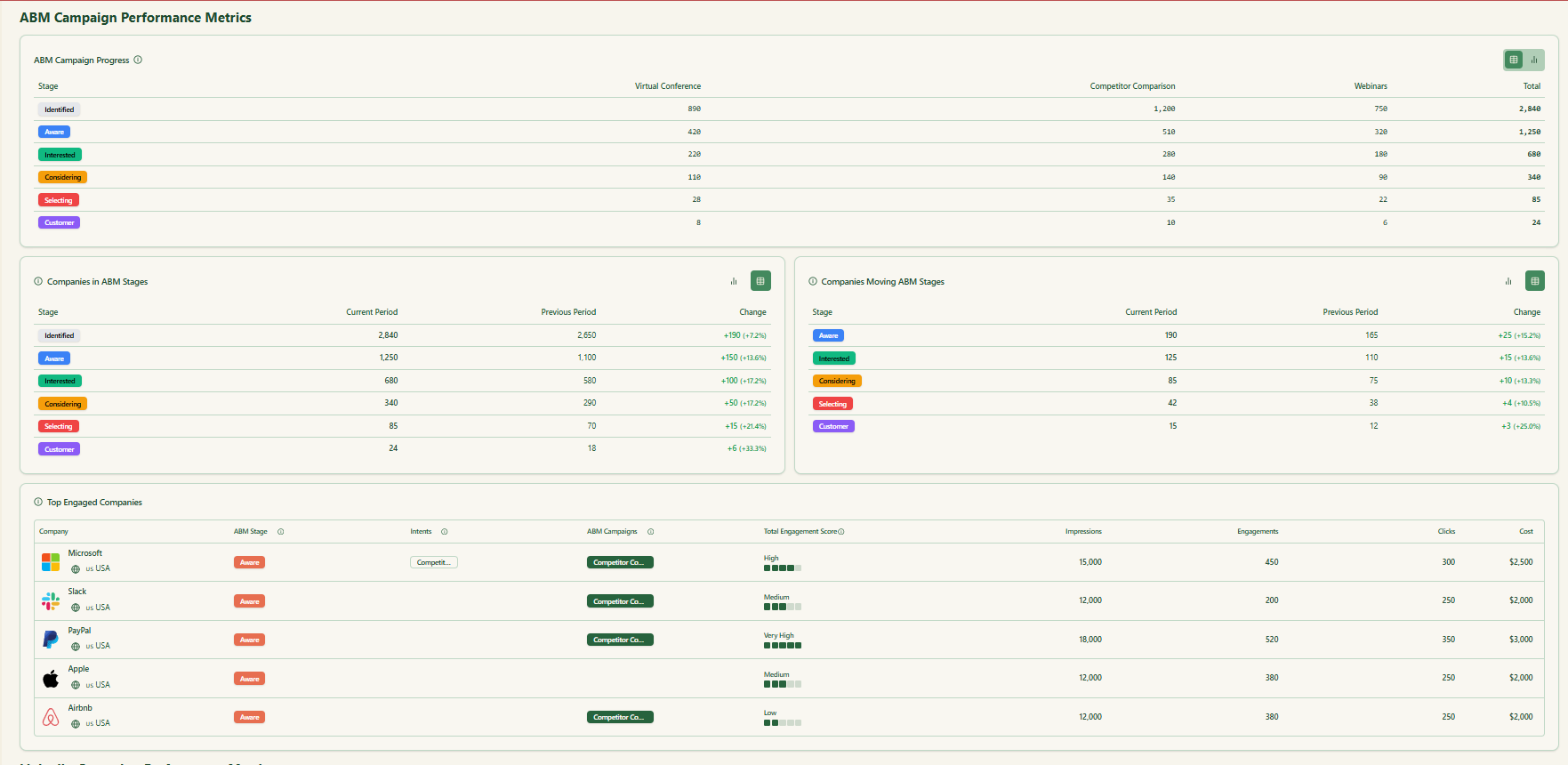

Real Time Engagement Scoring & ABM Stages

ZenABM updates engagement scores continuously as accounts interact with your ads. You get a full touchpoint history and can define stages such as Identified, Aware, Engaged, Interested and Opportunity.

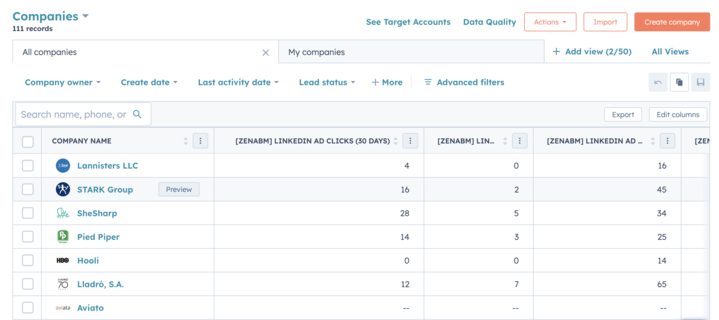

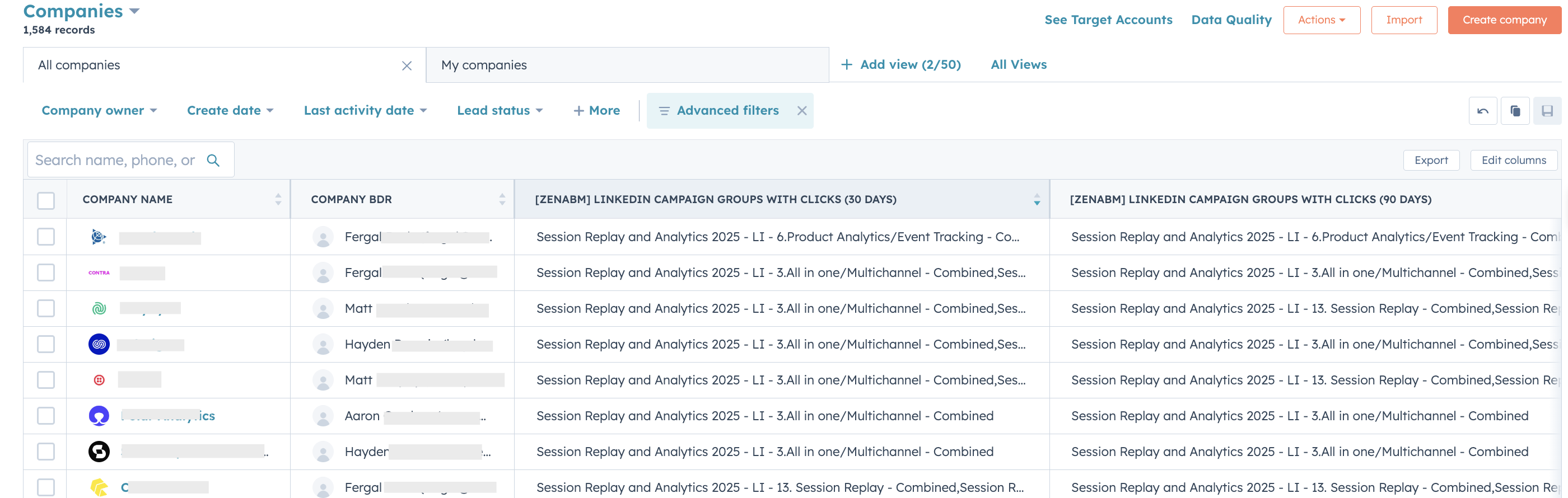

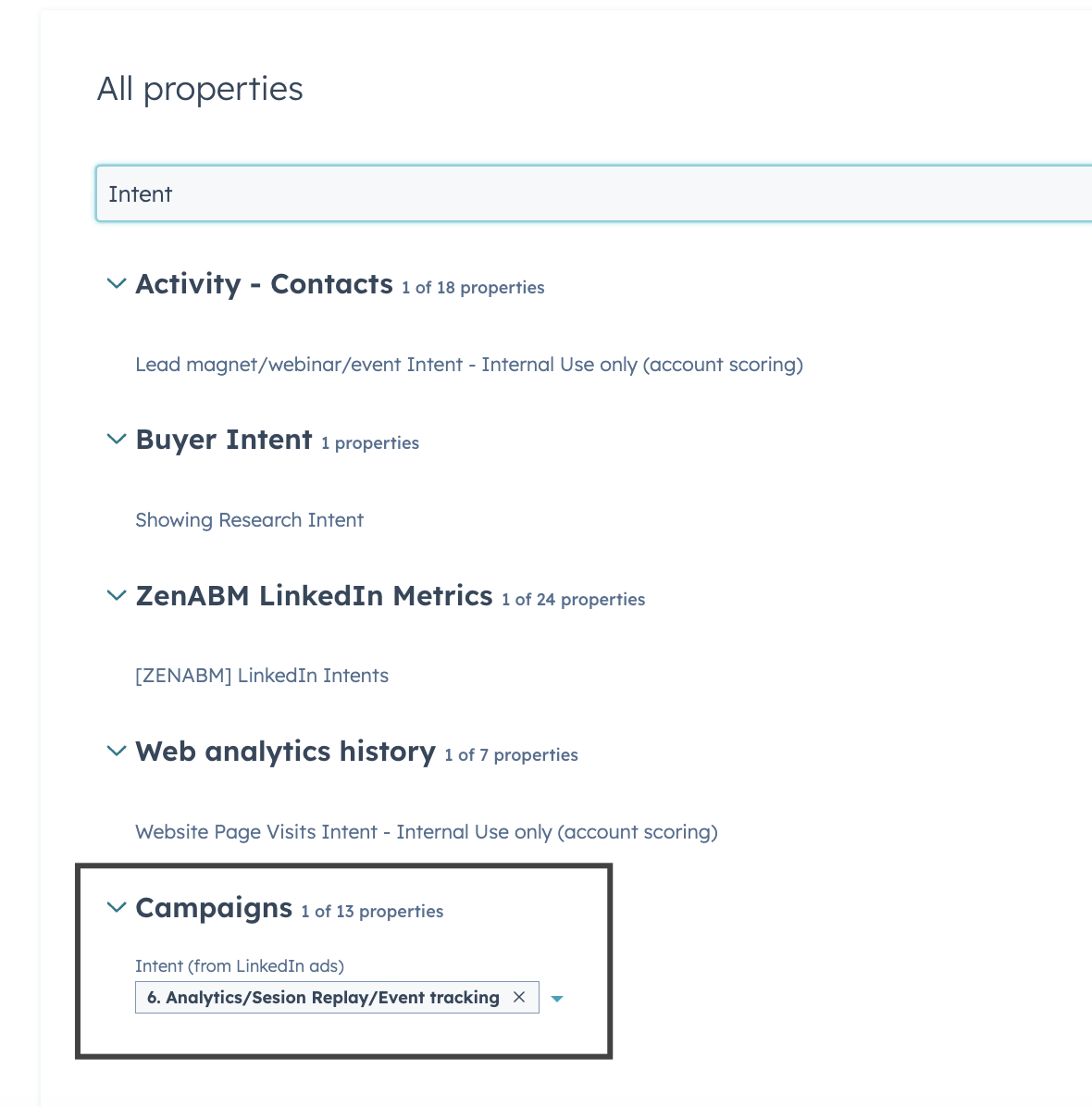

CRM Integration and Workflows

ZenABM syncs bi-directionally with HubSpot and supports Salesforce on higher plans. All LinkedIn metrics can be written as company properties in your CRM.

When an account crosses your scoring threshold, ZenABM can update its stage and auto-assign a BDR for timely outreach.

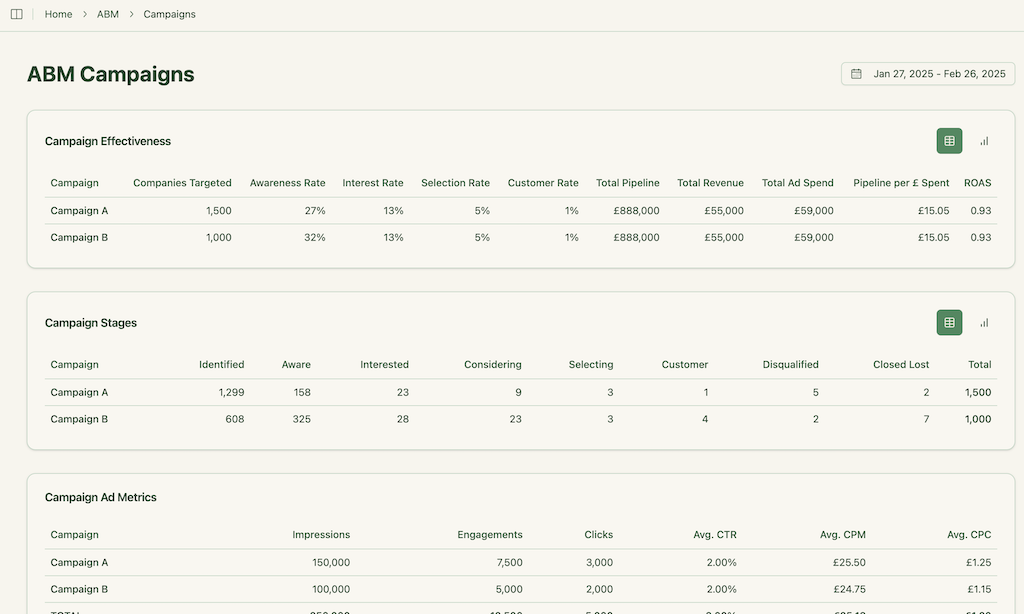

Intent Tagging and ABM Analytics

ZenABM lets you pull intent topics from LinkedIn campaigns and tag each campaign by feature, use case or offer.

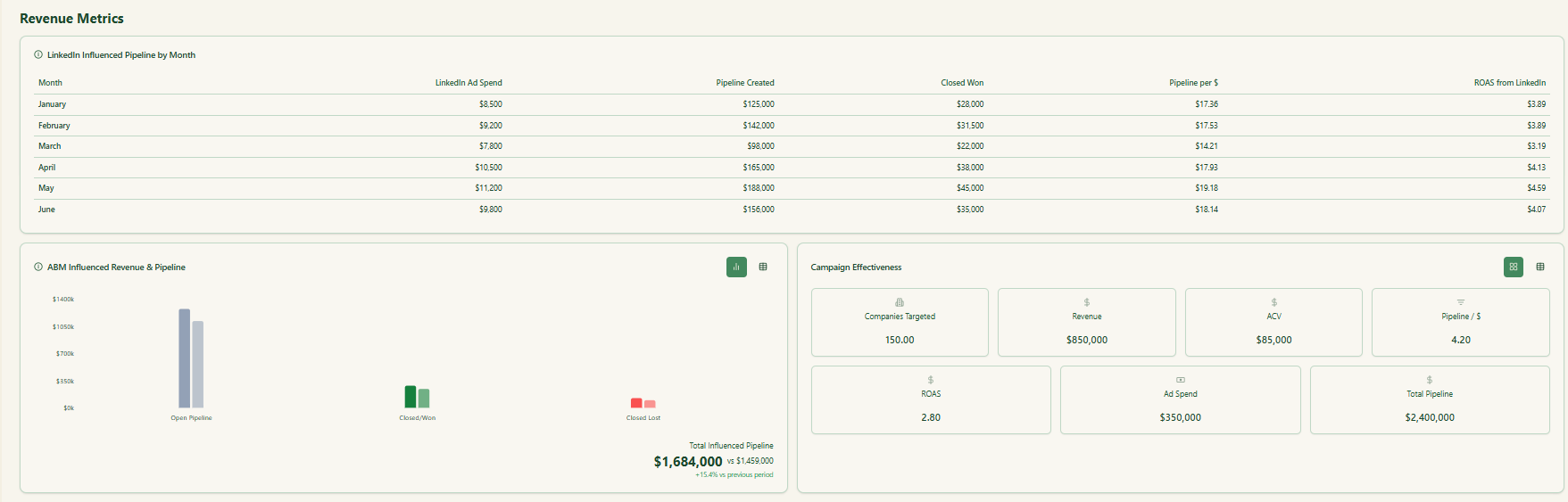

Its ABM dashboards tie LinkedIn ads to account engagement, stages and revenue. Because ZenABM tracks deal value and ad spend per company and campaign, it calculates ROAS and pipeline per dollar automatically.

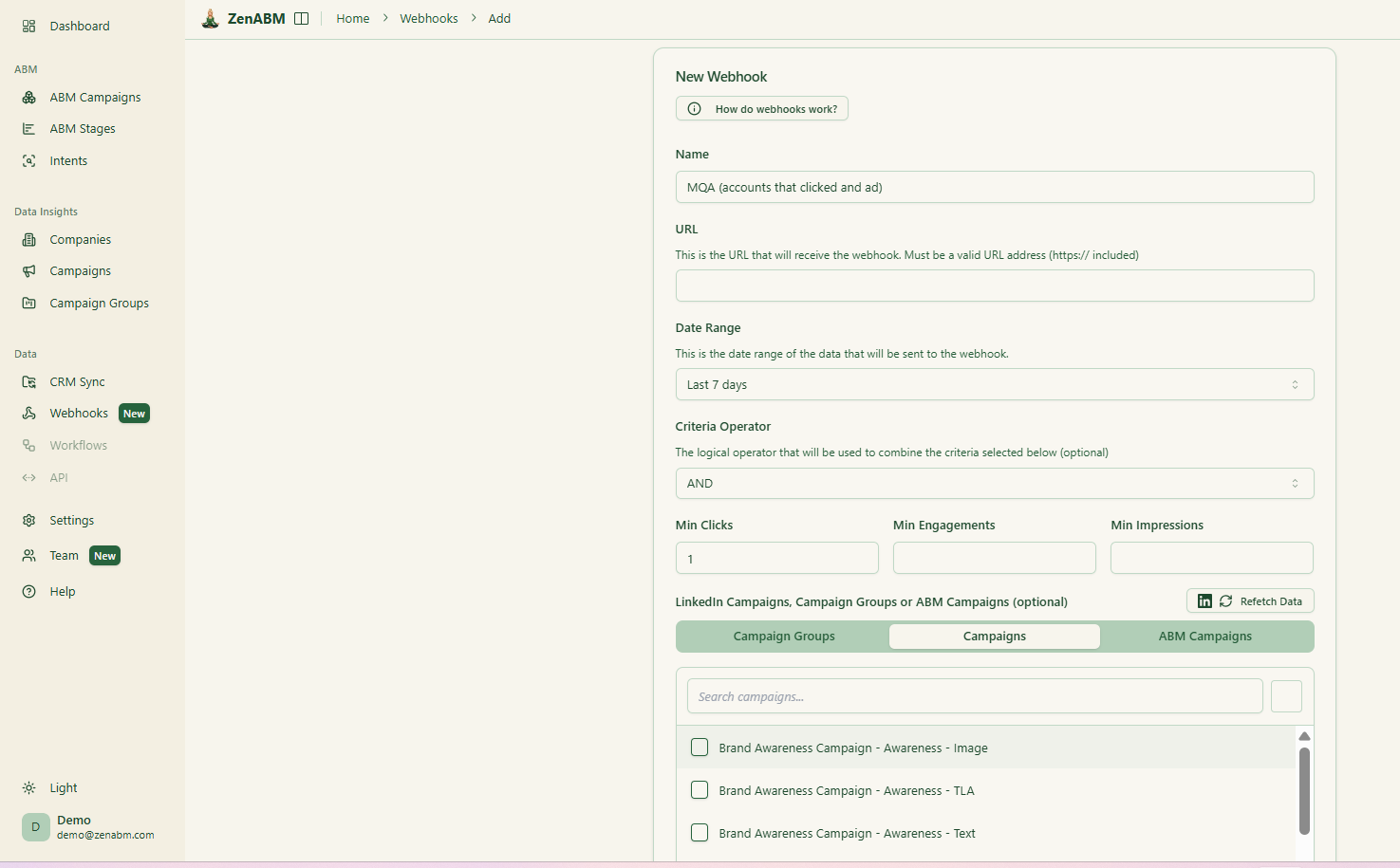

Webhooks, Job Title Analytics & Campaign Objects

ZenABM webhooks send events into your stack for Slack alerts, enrichment flows and other automation.

You can also group LinkedIn campaigns into ABM campaign objects and view performance across markets, personas or creative clusters instead of juggling isolated reports.

AI Chatbot & Multi-Client Workspace

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model so you can ask questions like “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting campaigns?”

Agencies can use the multi-client workspace to manage several ad accounts and clients with their own ABM campaigns, dashboards and reporting without constant switching in Campaign Manager.

ZenABM Pricing

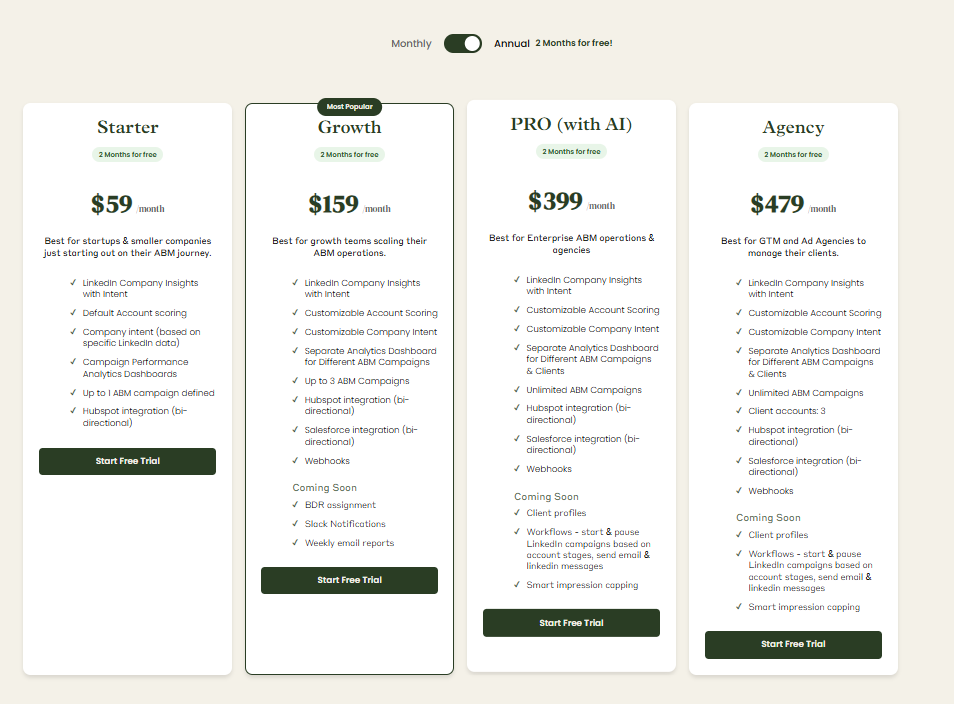

Plans start at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI) and $479/month for Agency.

Even the Agency plan stays under $6,000 per year, and all tiers include core LinkedIn ABM capabilities. Higher tiers mainly increase limits and add Salesforce sync.

Every plan comes with a 37-day trial.

Conclusion

N.Rich and Terminus both sit in the serious budget category, but solve slightly different problems in an ABM stack.

N.Rich is best when you want to turn ICP models and topic intent into DSP campaigns and understand their impact on the pipeline without rebuilding the entire GTM engine.

Terminus makes more sense when you want a broad ABM platform to unify multi-channel ads, website behavior, account journeys and attribution, and are ready for the cost and complexity.

If your main obsession is seeing which companies engage with your LinkedIn ads, how that changes scores and stages and which campaigns actually drive pipeline, ZenABM will usually get you there faster and cheaper.

It plugs into your CRM, pulls from the LinkedIn API and focuses on the first-party signals that actually move deals, instead of forcing you into a heavy ABM operating system.