©2026 ZenABM - All Rights Reserved.

Accurate LinkedIn Ad Funnel Attribution is the dream for every ABM manager, because without it, reporting the value of your programs and explaining LinkedIn spend to leadership becomes guesswork. If you want to know how to measure the full-funnel impact of LinkedIn ads, you need visibility that traditional tools do not offer.

The painful truth is that most CRMs and LinkedIn’s Campaign Manager or the Business Manager attribution views do not solve this.

So, I will outline what is broken in CRMs, LinkedIn’s native options, and IP matching tools, then show how ZenABM fixes those gaps.

Let’s break down where conventional methods fail when you attempt to measure the full-funnel impact of LinkedIn ads.

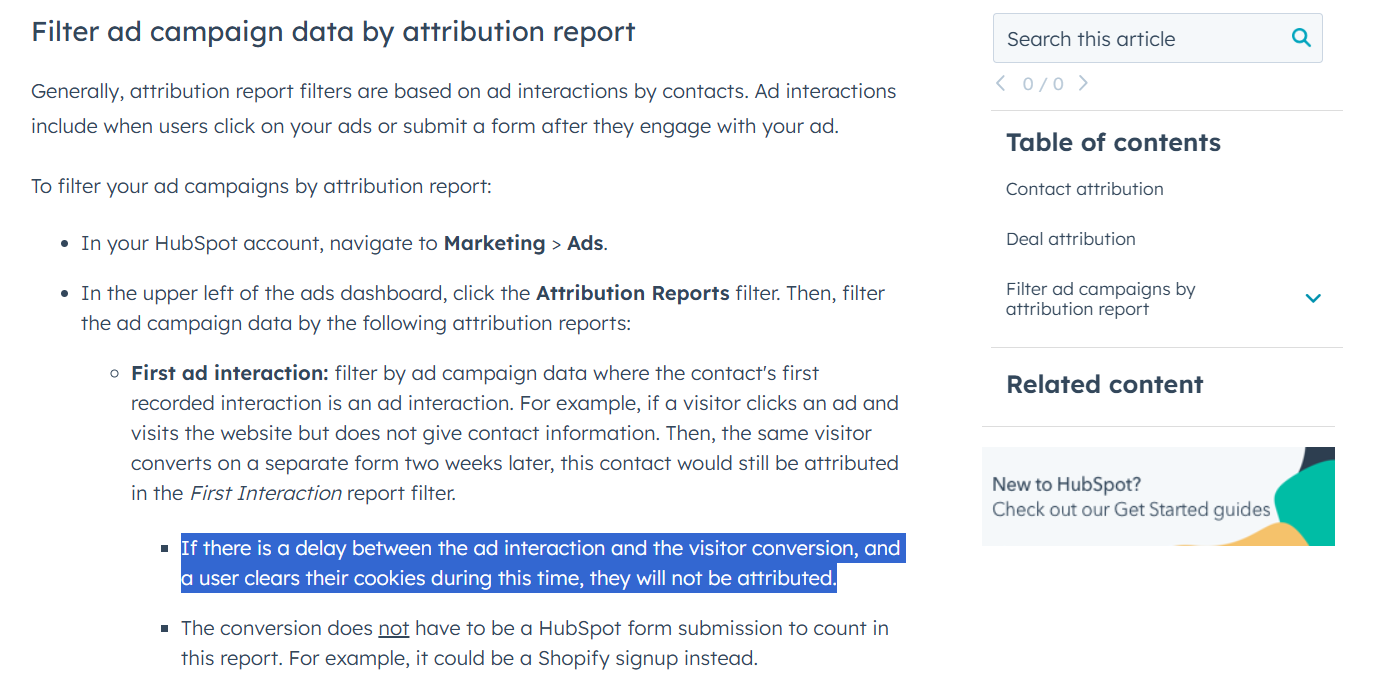

Top CRMs like HubSpot can connect a contact to a company, yet they typically register LinkedIn impact only when all of the following are true:

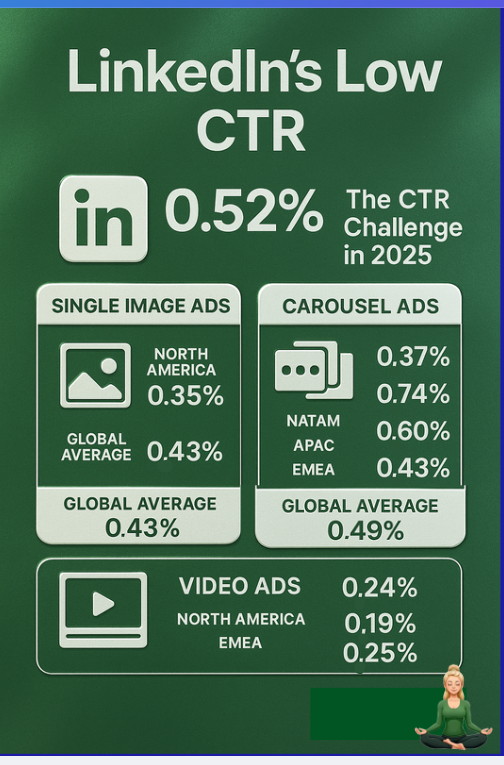

On LinkedIn, clicks are scarce. CTR often sits around 0.4 to 0.5%:

View, later search, then convert via another channel is common on LinkedIn, which means your attribution reports drift away from reality.

Even among clickers, many will not convert in the same session.

Yes, HubSpot can sometimes connect a later form to an earlier ad click, but that depends on cookies. If you still rely on cookies in 2025 and consider the job done, I admire your optimism 🙂

Direct LinkedIn integrations in CRMs, for example, HubSpot’s ads tool, do not fix this either.

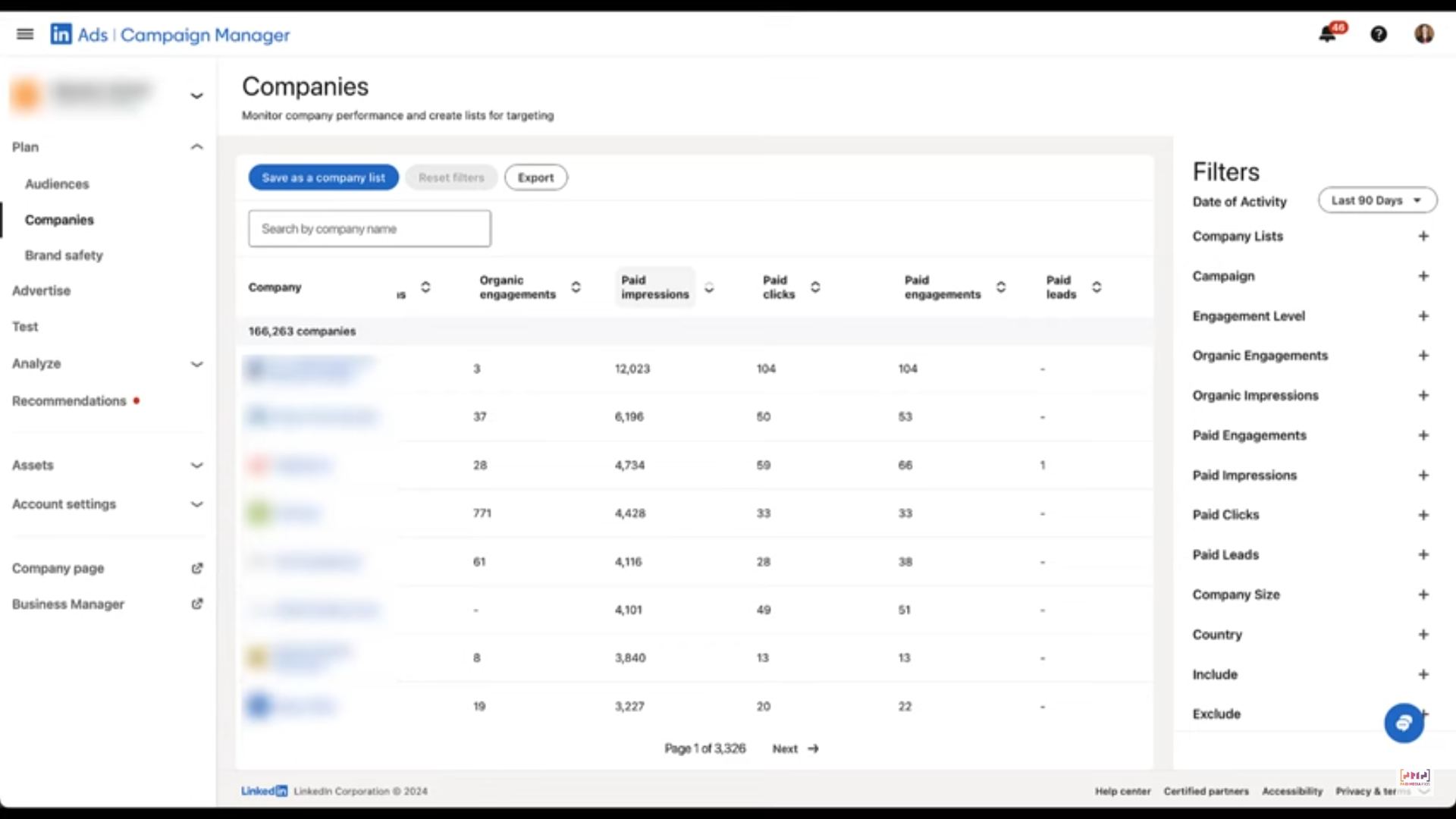

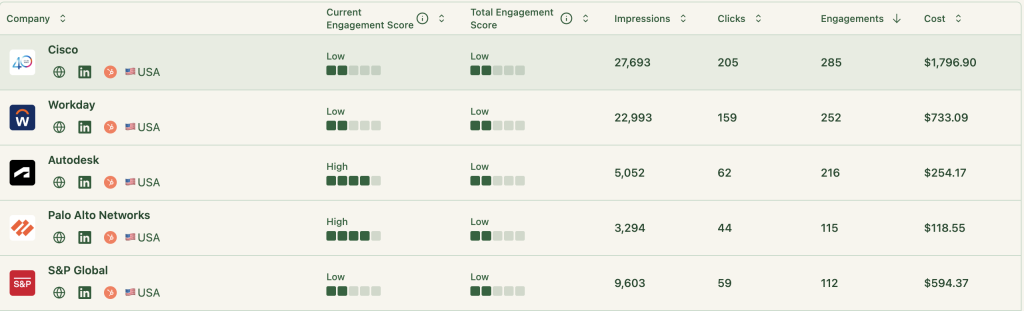

They surface CTR, impressions, and similar metrics, but you do not get a company-level breakdown:

Since view-through is invisible, even the ROI presented in the top right of that interface will mislead you.

For LinkedIn ad funnel attribution, LinkedIn provides:

In 2024, Campaign Manager added the Companies tab:

You can now see company-level impressions along with clicks, which is a step toward view-through measurement.

The catch is that you still do not get a campaign-level split. You cannot see which campaign or campaign group created that exposure.

As a result, ad creative testing and message strategy are hard to optimize, because you cannot tell which offer or asset is winning.

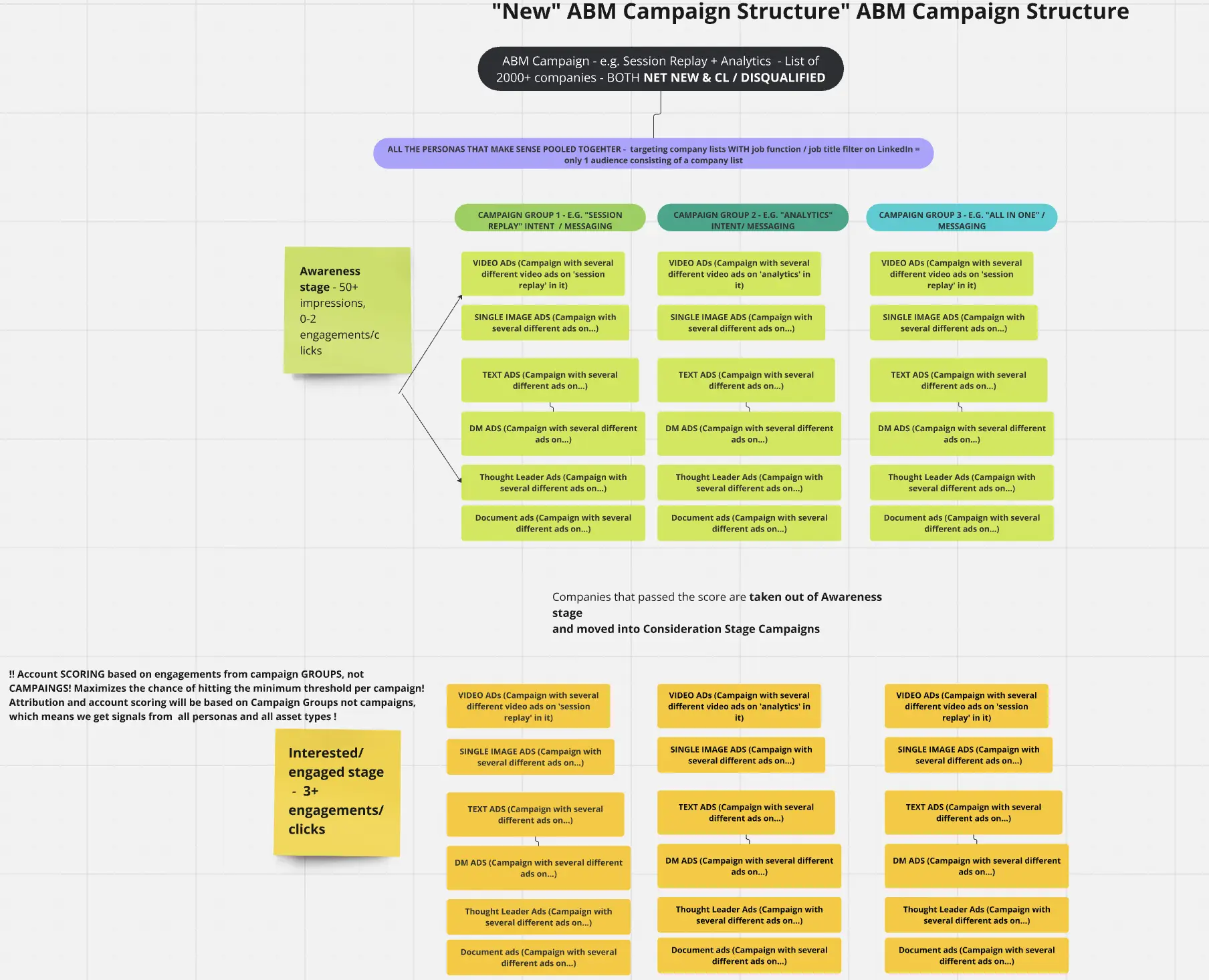

If you structure ads by different features or offers, like this:

You will not know what piqued the company’s interest. BDRs lose context, and accounts keep seeing generic creatives even late in the journey.

Business Manager’s Revenue Attribution Report does not rescue you either.

RAR relies on the Insight Tag and CAPI.

The Insight Tag only fires when someone clicks and lands. If they do not click, then later arrive organically and convert, there is no attribution.

If they click but convert in a later session, or block cookies, the Insight Tag cannot connect the dots, so RAR remains blank.

Some teams try the offline conversions API. They upload hashed emails and timestamps. LinkedIn matches those to viewer emails. When the same person viewed and later converted, you get credit.

In B2B, someone views, and a teammate converts. That is normal. In that case, RAR does not credit the account. There is no company-level matching. You would need to manually correlate the customer’s company with the Companies tab exposure.

Even then, you still lack ad-level clarity, so ad or campaign group credit remains guesswork.

In short: Lead-level attribution is brittle in LinkedIn’s native stack because cookies can be blocked, and the viewer and the converter can be two different people from the same company. If you choose company-level engagement for attribution, which is ideal for ABM, Campaign Manager still does not reveal the specific campaigns or groups that drove the conversion.

Teams that attempt company-level attribution often turn to IP matching to deanonymize visitors. These tools still depend on clicks, which means no view-through measurement.

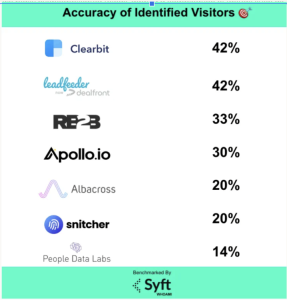

Even for click-through, accuracy is weak. Reported peaks are near 42 percent, per Syft:

In a real Userpilot test, only 1 company ID appeared out of roughly 300 visitors.

“We created a no-index domain for our ABM ads to ensure all traffic came from target accounts. Over about 90 days and roughly 300 visitors, our IP tool identified just one company, our own.”

– Emilia Korczynska, VP Marketing, Userpilot

In practice, the Companies tab in LinkedIn Campaign Manager, while not sufficient for ad-level attribution, beats most IP matching strategies.

First, in ABM, focus on company-level attribution. It reduces operational complexity and aligns with how buying groups make decisions.

Next, to truly learn how to measure the full-funnel impact of LinkedIn ads, you need company-level engagement that includes impressions for view-through and a campaign-level split for creative attribution.

This is exactly what ZenABM provides.

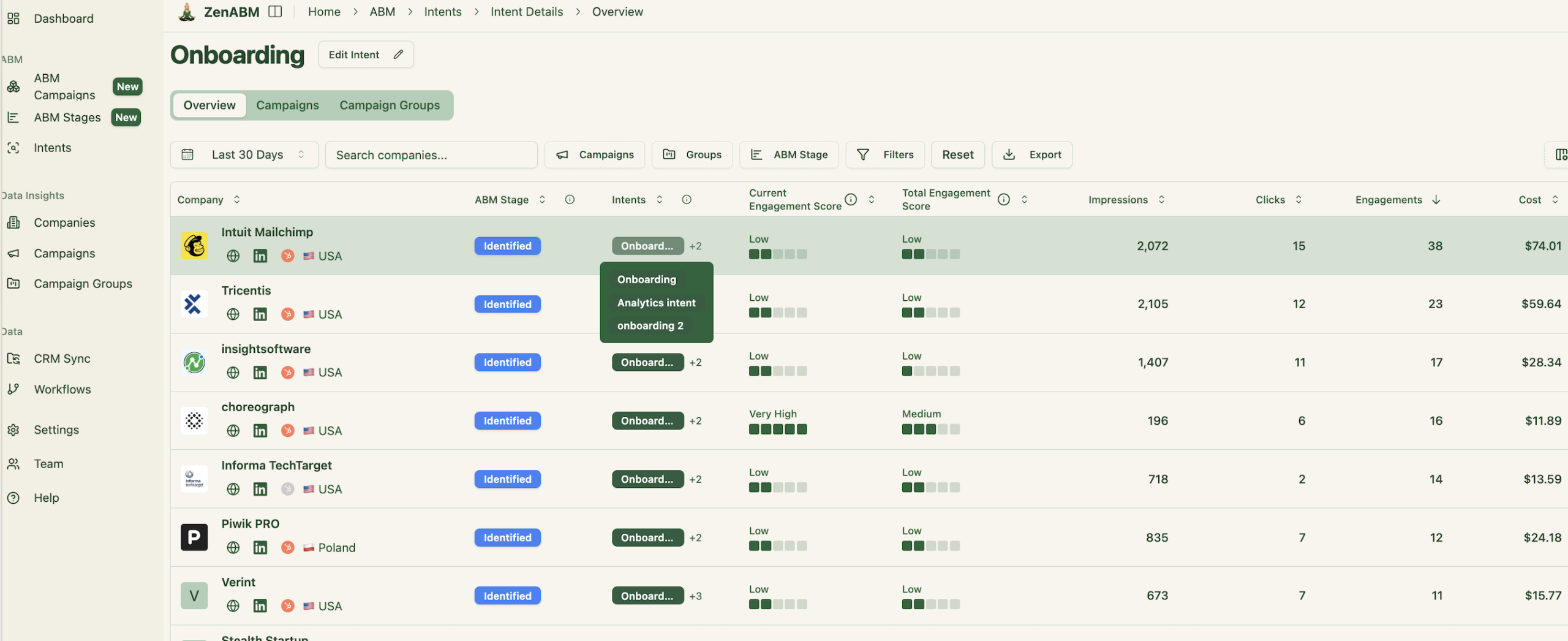

ZenABM ingests company-level ad engagements, including impressions, from LinkedIn’s official API:

It then matches engaged companies to deals in your CRM to reveal pipeline and revenue influence:

You can also set the minimum impression threshold that counts a deal as ad-influenced, which keeps analysis consistent with your thresholds.

Here are additional capabilities that strengthen ABM performance:

ZenABM calculates a “Current Engagement Score” for each company based on recent ad touches. When a company crosses your threshold, ZenABM updates its ABM stage in CRM and alerts sales.

Buyer Intent Insights

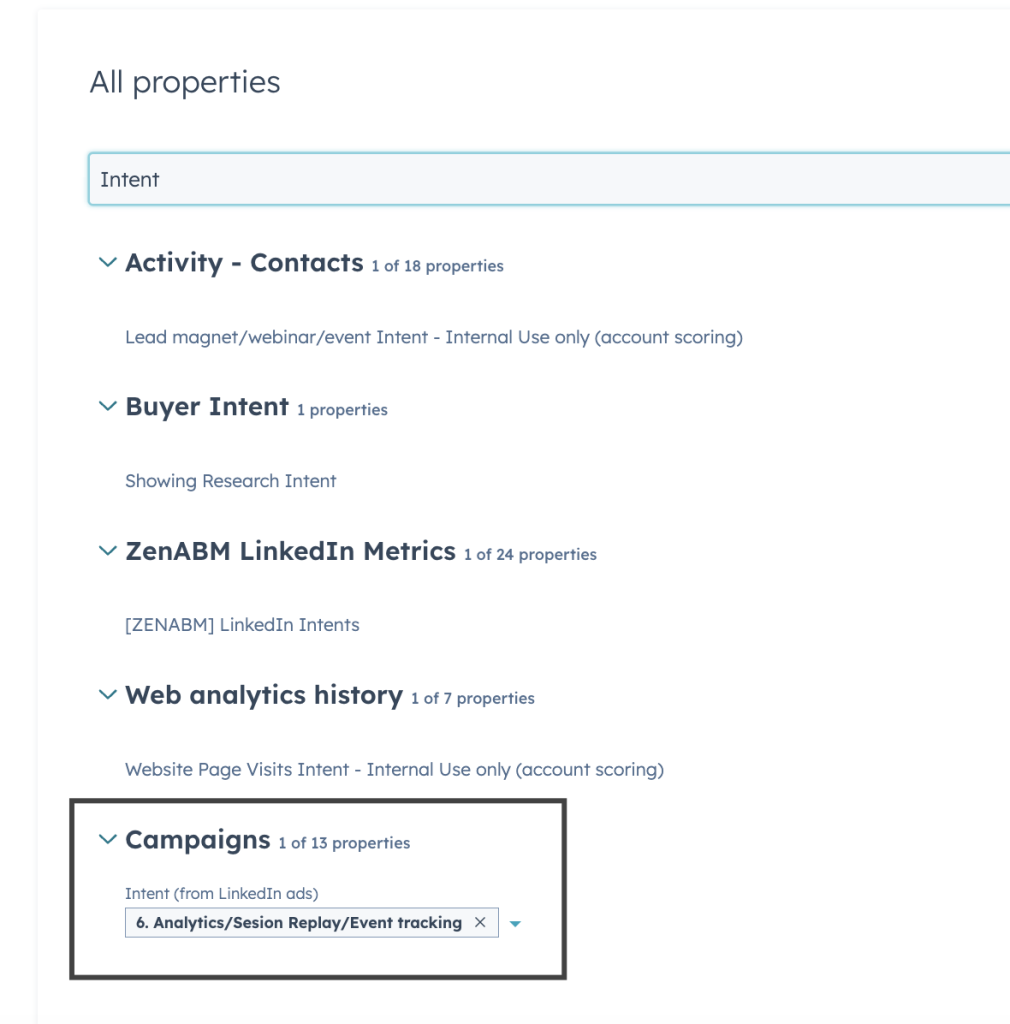

When you run multiple use case campaigns, ZenABM highlights which companies engage with which themes. Reps get a crisp conversation starter without complex workflows:

It also writes the intent to CRM as a company property:

Stage tracking is built in, and you can define your minimum thresholds for each stage:

Use ZenABM to export lists of companies that engaged with each campaign or use case. Then retarget those accounts with follow-up ads or personalized outreach.

You need LinkedIn ad funnel attribution to quantify the pipeline and revenue that ads influence. If you want to learn how to measure the full-funnel impact of LinkedIn ads and improve future campaigns, you also need ad-level clarity, which means knowing which specific ad or campaign group contributed to each conversion and how much value it created overall.

Since most users do not click, you must capture company-level impressions, not only clicks.

In practice, the essentials are company-level impressions per ad campaign and engaged companies matched to deals in your CRM.

Most CRMs and LinkedIn’s native tools still do not provide this view in one place.

Try ZenABM now for free or book a demo to see how to measure the full-funnel impact of LinkedIn ads with confidence.