B2B buyers treat most display banners like wallpaper. I do too. Banner blindness is a thing, and more of us ask AI for answers instead of wading through blogs. Add bots, malware, and murky attribution, and display ads start to look like the wrong horse for account-based marketing.

Here is a data-backed comparison of LinkedIn ads vs. display ads for pipeline growth, plus how ZenABM helps convert LinkedIn engagement into a measurable pipeline.

Read on…

In a hurry? Start here.

ABM focuses on a high-value account list with relevant, timely touches. On paper, display ads seem helpful because you can target companies and crank up awareness. In practice, display is often the soft spot in an ABM plan.

Audiences have filtered out banners for years. Many users no longer notice header and sidebar ads at all. CTRs sit at a fraction of a percent. Even when noticed, banners often trigger distrust and get ignored. Platforms keep adding ways to hide them, which says plenty about the user experience.

For ABM, that is fatal. You have a short list of target accounts and a small buying committee. If they do not see or trust your ads, the channel will not move pipeline.

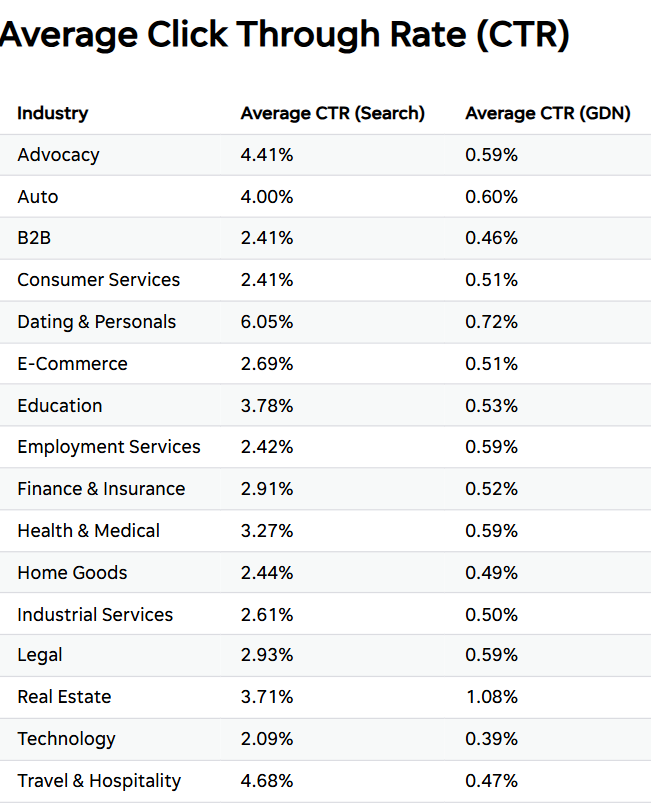

Average display CTR in B2B sits around 0.3 to 0.5%.

That means more than 99% of impressions go nowhere. Clicks can be accidental or curiosity only, not intent. By contrast, LinkedIn or email clicks tend to be rarer but richer, and LinkedIn engagement outperforms display on quality. It is not surprising that 43% of marketers rank display among the least effective channels.

Programmatic display leans on cookies, device IDs, and IPs. With remote work and mobile access, IP-based account targeting can be shaky, so you reach the wrong people and miss the ones who matter. A Syft study puts deanonymization accuracy around 42%.

Data also decays. Gartner estimates account data accuracy drops by 20% each year as roles change. ABM needs named personas inside named accounts. Display struggles to deliver that level of certainty.

ABM cares about meetings, opportunities, and revenue at the account level.

If you are only tracking vanity metrics, you will misread success and spend more where it does not matter.

LinkedIn gives you the right stage, the right audience, and the right controls for ABM.

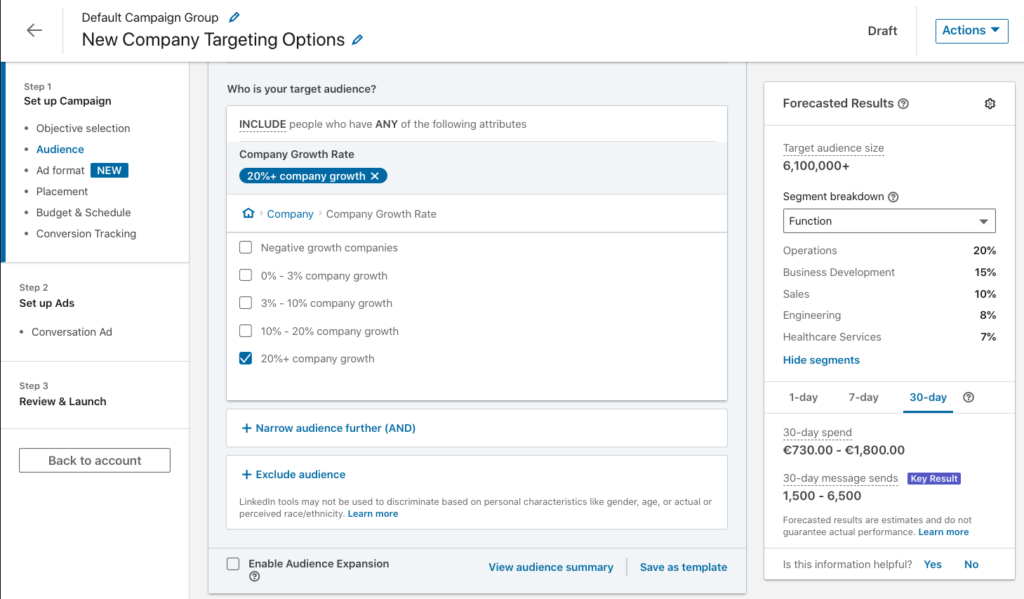

Filter by company, size, industry, title, seniority, skills, and groups. You can even segment by company growth rates.

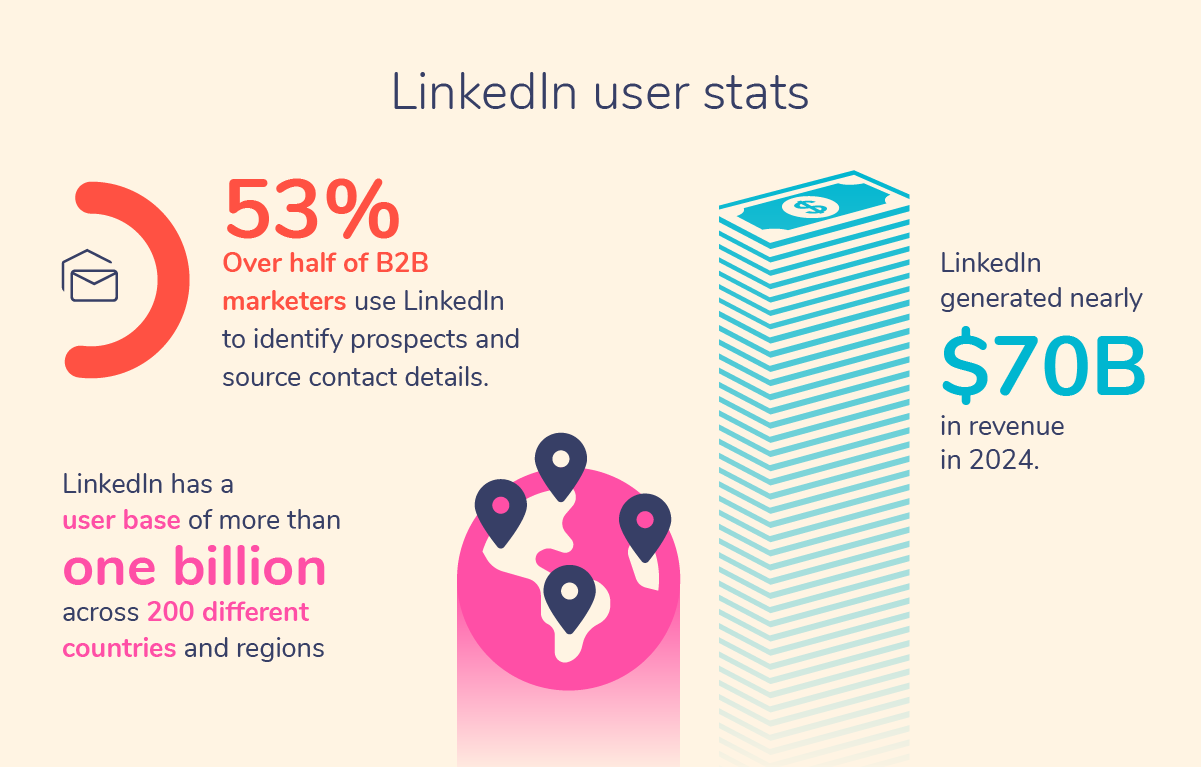

That lets you target specific companies and roles inside them using profile data, not guesswork. No more hoping an IP lines up. It is why over half of B2B marketers rely on LinkedIn for prospecting.

And 33% of B2B decision makers research upcoming purchases on LinkedIn. That context matters.

Sponsored Content, Sponsored Messages, and Conversation Ads live inside the feed and inbox where work happens. They feel native. Display often limps at 0.3 to 0.5% CTR, while even conservative LinkedIn benchmarks start around 0.5%. The bigger win is quality of interaction and recall in a professional setting.

Personalized LinkedIn ABM correlates with 30 to 40% faster cycles, and many programs see 3 to 4X ROI. When ABM is executed on LinkedIn, the path from ad view to meeting is shorter because the right people are already in the right headspace.

In short, spend on LinkedIn ABM tends to come back as revenue, not just reach.

Here is how ZenABM helps you capture, measure, and act on LinkedIn engagement so marketing and sales move together.

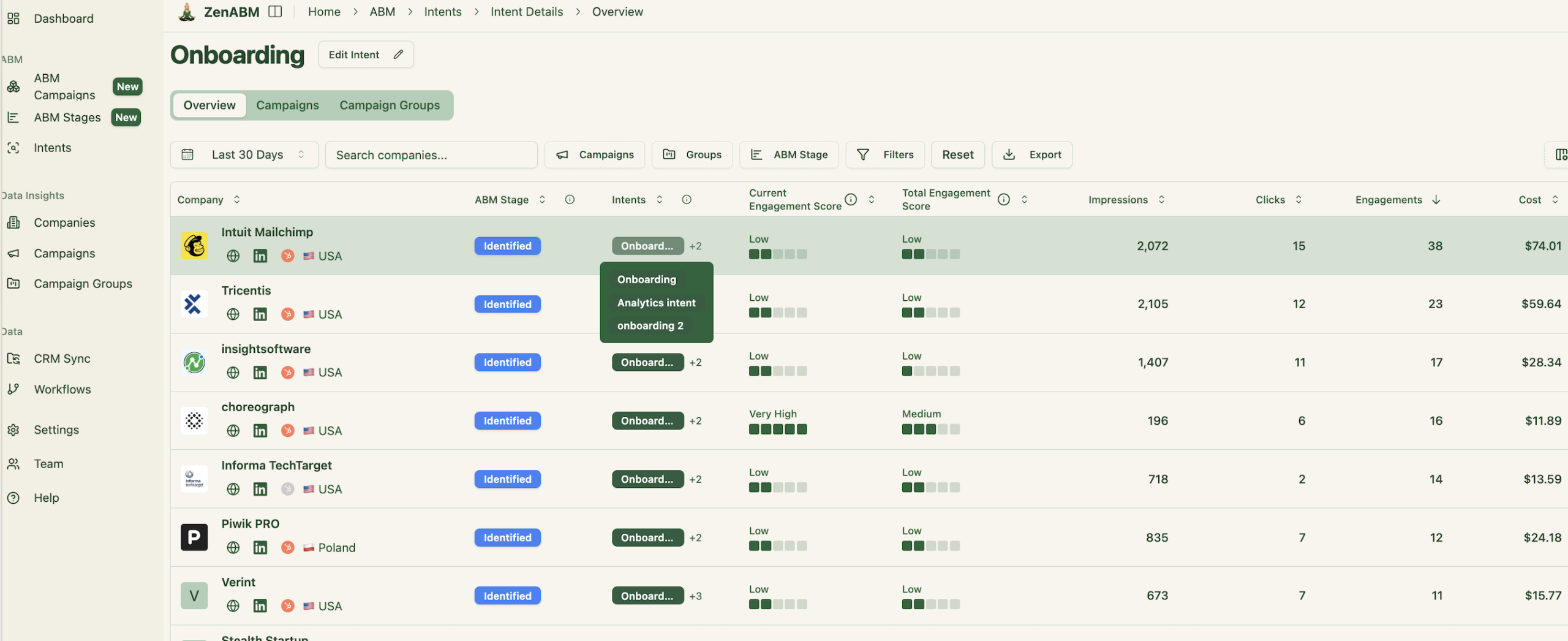

ZenABM pulls company-level LinkedIn ad metrics for every campaign, including impressions, clicks, engagements, and spend.

Beyond raw company-by-campaign metrics, ZenABM rolls up historic and recent engagement to score accounts and map them to ABM stages that reflect true buying readiness.

You can customize the thresholds that define each stage.

ZenABM tracks the ABM stage for each account and auto assigns hot accounts to BDRs when they hit the interested stage, directly inside your CRM.

Your BDR outreach triggers immediately, without manual checks or Slack reminders.

Run ABM on LinkedIn while marketing works in ZenABM and MAPs, and sales stays in CRM. ZenABM pushes engagement as company properties to your CRM, and also matches accounts to deals to pull in revenue context.

For the other way of this two-way CRM integration, ZenABM maps engaged companies to open opportunities and pulls deal values.

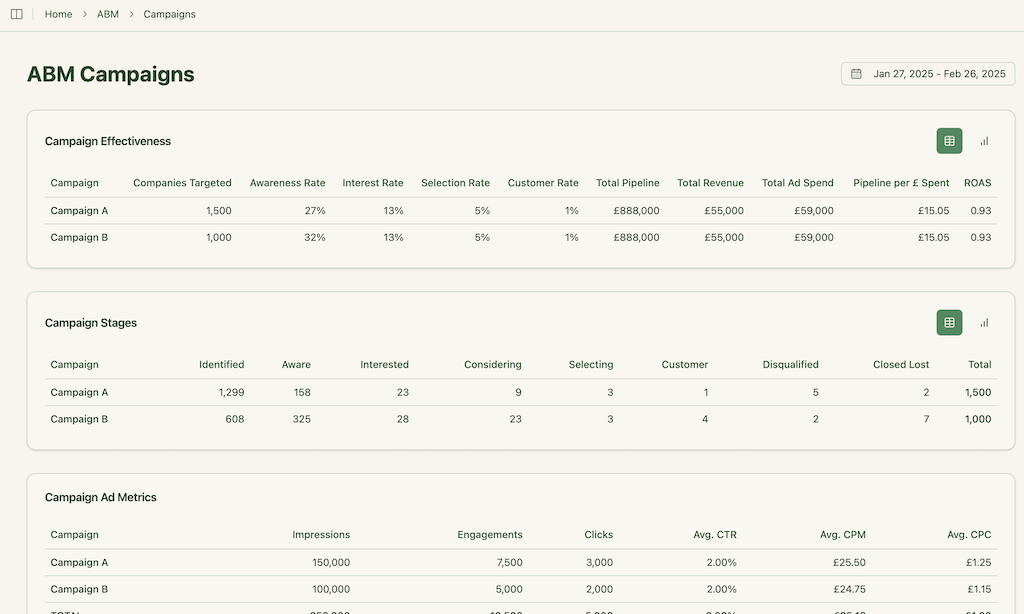

Out of the box, you get dashboards that show performance at every layer, from your ABM campaign rollups to LinkedIn campaign groups and individual campaigns.

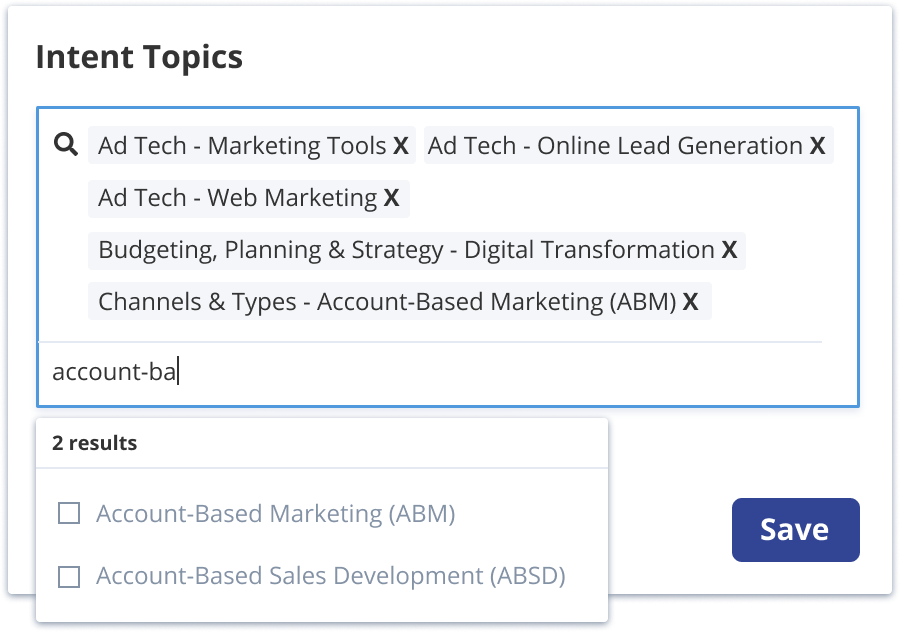

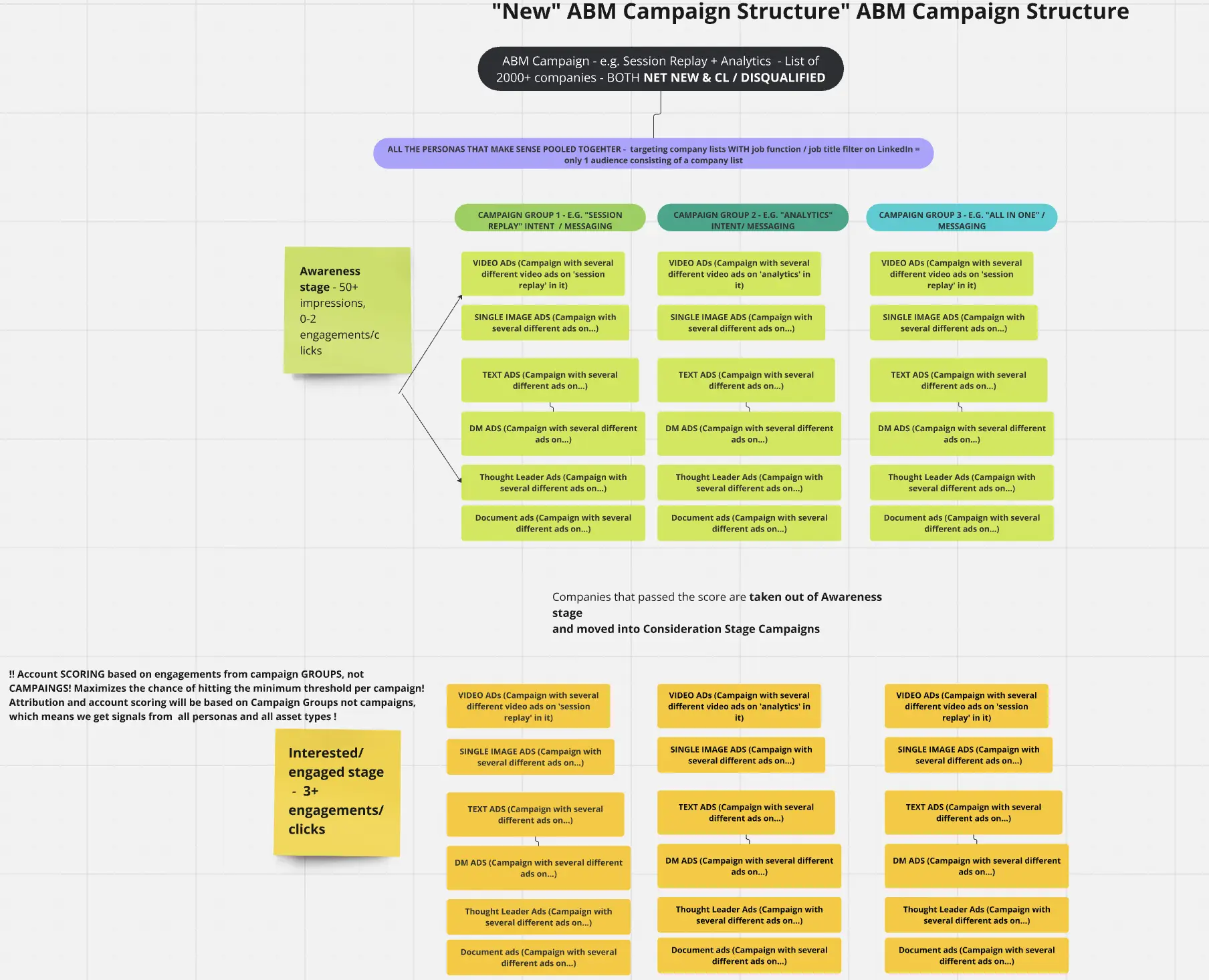

Many teams buy third-party intent from suites like Demandbase or RollWorks. You can also embed qualitative intent into your own ad structure and let ZenABM read it.

If you sell product management software, run separate campaigns for different intents like product analytics, onboarding, session recording, and all in one.

Tag each campaign with intent in ZenABM to surface company level themes and group accounts by shared interests.

ZenABM also writes intent as a property to your CRM so BDRs know what to lead with.

See how many companies sit in each stage and how they move. If accounts jump from aware to interested but stall there, you can find the friction and fix it quickly.

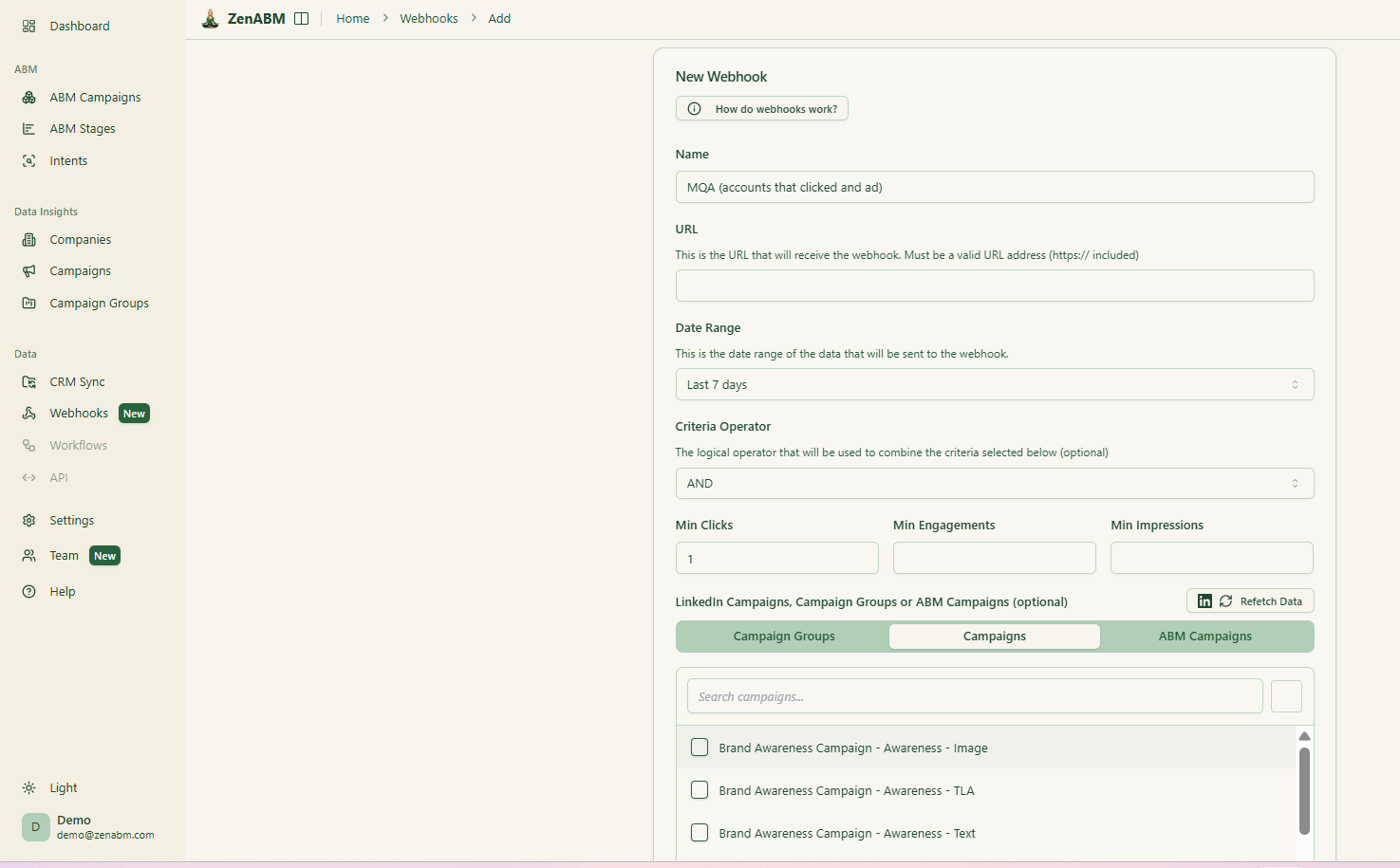

Use ZenABM webhooks to exchange data with tools across your GTM stack, such as Clay and Apollo.io.

Display had a run, but for ABM, it burns budget without moving buying committees. LinkedIn-first ABM gives you precision, context, and better signals. With ZenABM you can prove engagement, prioritize accounts, and attribute revenue. Stop paying for disappearing impressions. Invest in campaigns that move accounts forward.