LinkedIn ad ROI monitoring isn’t simple, especially in the nuanced world of B2B with its intricate buyer journeys.

Identifying how individual LinkedIn ads contribute to revenue is challenging, particularly when traditional ROI monitoring tools, such as LinkedIn’s built-in analytics or standard CRM solutions, aren’t effective enough.

In this article, we’ll explore why typical ROI monitoring approaches don’t quite measure up on LinkedIn and present a better alternative.

What makes monitoring LinkedIn ad ROI such a challenge?

Primarily, LinkedIn functions mainly as an awareness-building platform.

Users typically don’t click on ads here.

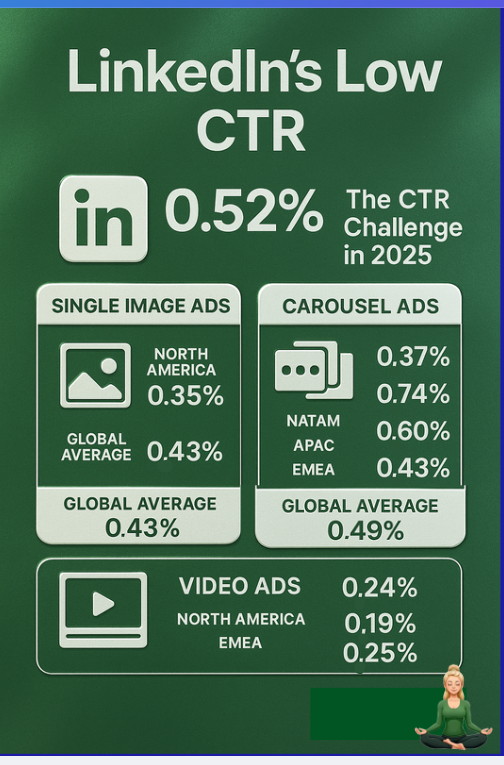

Just consider the click-through rates (CTR):

Unlike Google Search, where users actively search and click ads with clear intent, LinkedIn audiences are mostly passively scrolling.

A potential buyer might see your ad, gain interest, but later directly visit your website or search for you via Google. You’d attribute such a visit or conversion to direct traffic or SEO, entirely missing LinkedIn’s role.

The solution?

You shouldn’t depend only on click-based monitoring models. Effective ROI monitoring requires capturing view-through interactions—tracking account-level impressions and engagement rather than clicks alone.

Although many B2B marketers grasp this theoretically, practical implementation remains elusive, largely due to limitations of conventional tools:

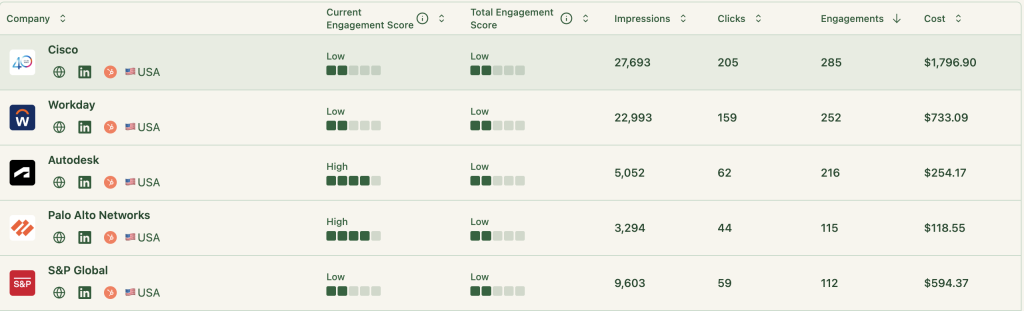

LinkedIn’s Campaign Manager historically provided minimal account-specific engagement insights. Only in 2020 did LinkedIn introduce the “Company Engagement Report,” which evolved in late 2024 into the “Companies” tab:

This feature provides detailed company-level engagement data like paid clicks and impressions, surpassing mere click-through monitoring.

However, engagement isn’t linked to specific ads or campaigns. All metrics are aggregated at the ad account level.

While you see overall company engagement, you won’t know precisely which ads those companies viewed.

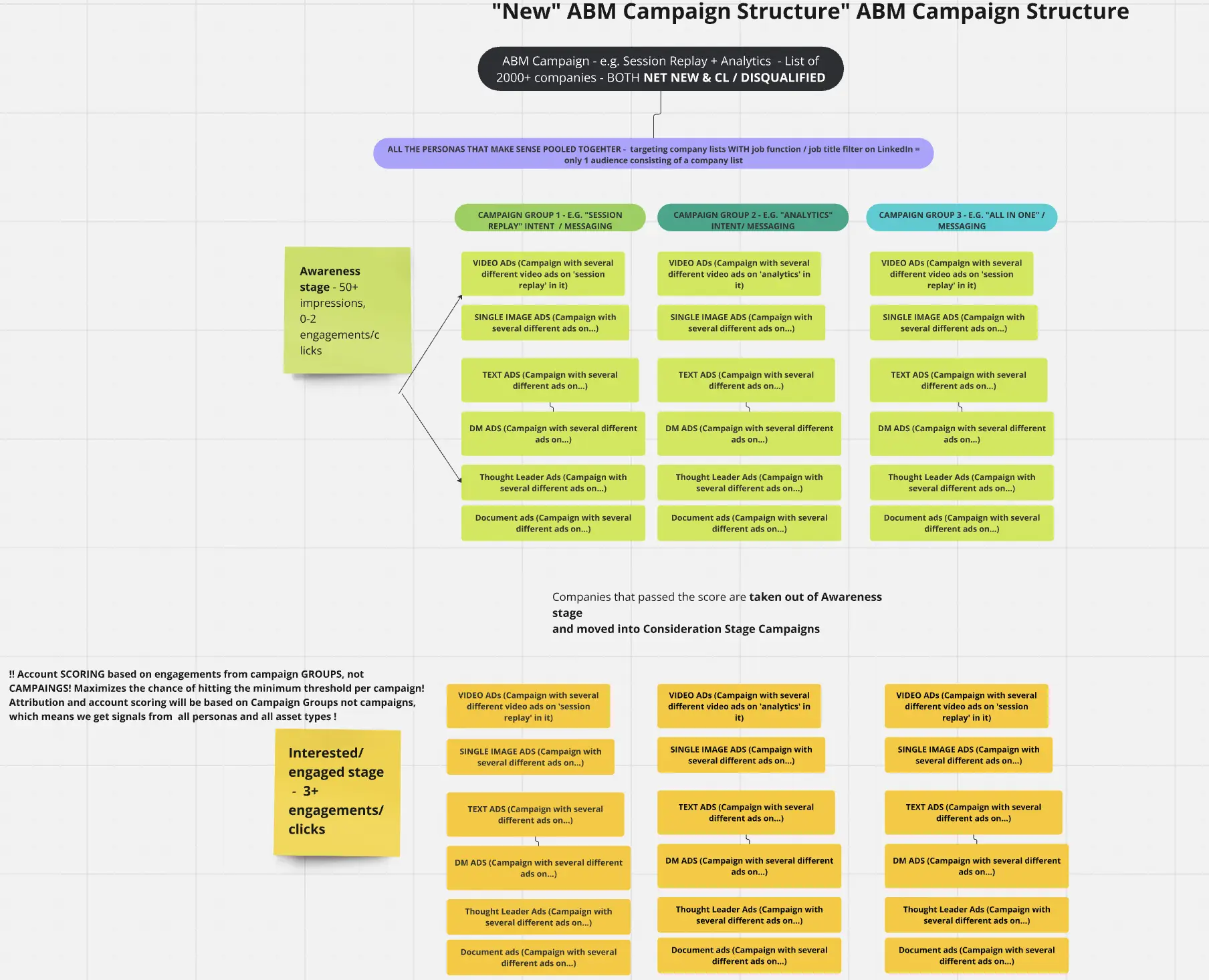

Most marketers run multiple simultaneous ABM campaigns, each branching into various groups containing several individual ads. Campaign differences include:

Without granular, campaign-level company data, attributing revenue or accurately mapping buyer intent becomes impossible.

Consider Userpilot’s intricate campaign structure:

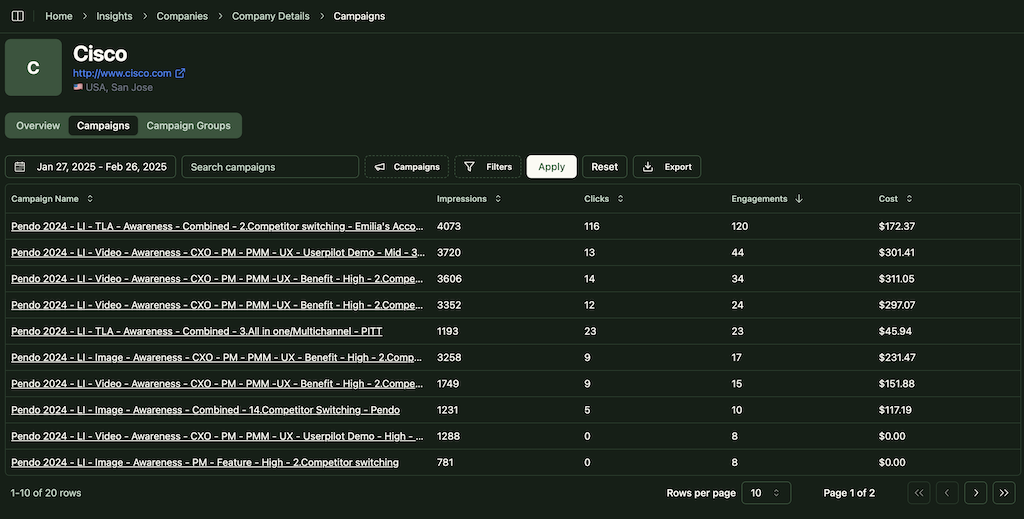

Aggregated account-level data isn’t sufficiently actionable. You need impressions, clicks, and engagement detailed by company for every individual campaign and group.

Without campaign-specific data, monitoring ad ROI accurately and conducting meaningful A/B tests is unfeasible.

What about external tools claiming to identify companies visiting your site?

These deanonymization solutions (reverse IP lookup services) can occasionally match visitors to companies through IP addresses.

However, they only function effectively when someone clicks an ad. This completely neglects those who merely viewed the ad without clicking. an enormous gap for LinkedIn monitoring.

Even for visitors who do click, accuracy is disappointing—typically about 40%, as shown by a Syft study:

Why?

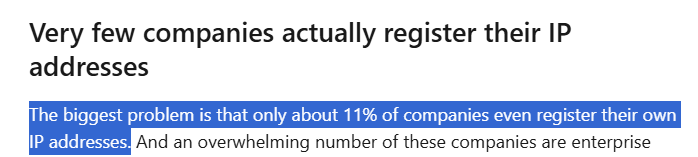

IP-based matching is unreliable due to VPN usage and shared networks (e.g., coffee shops). Moreover, many companies haven’t registered their IP addresses, leaving nothing to match against:

For instance, a B2B firm (Userpilot) employed Clearbit, a tool reputedly more accurate for IP matching. The result?

Only one company identified—their own:

Thus, traditional deanonymization offers negligible insights for LinkedIn ad ROI monitoring.

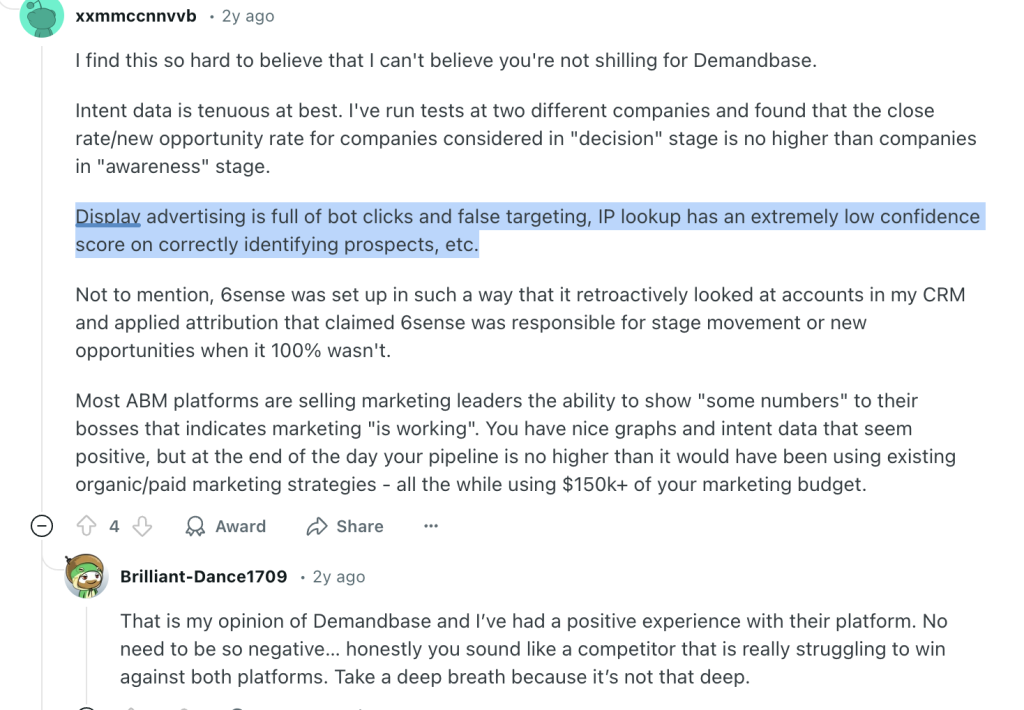

Some marketers use display ad networks (e.g., AdRoll, Criteo) for audience retargeting and matching. These networks depend on third-party cookies and device fingerprinting to track user behaviors and infer associated companies or industries. Unfortunately, this method doesn’t effectively solve LinkedIn ROI monitoring issues either:

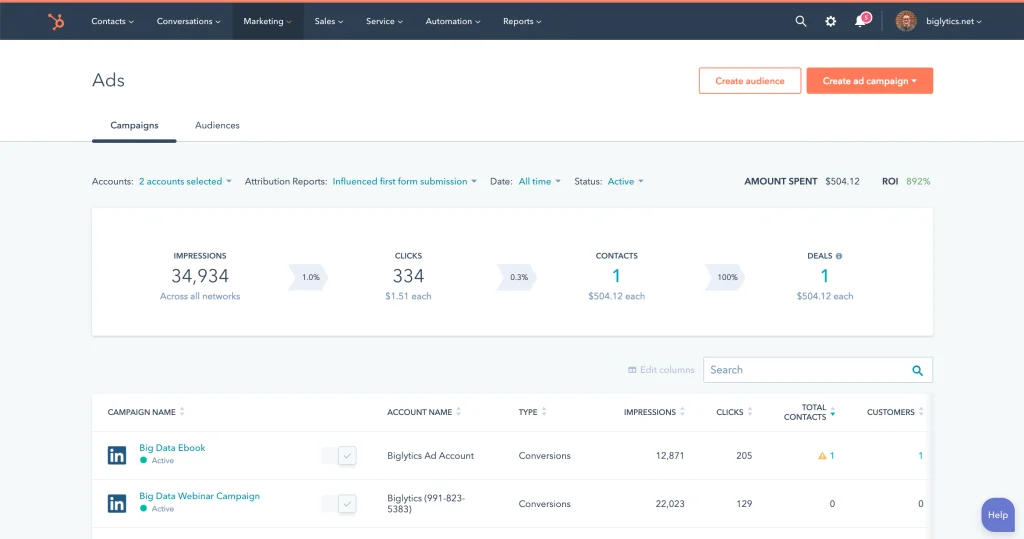

Another frequently used strategy involves leveraging ad integrations from your marketing automation or CRM platform—for instance, HubSpot’s LinkedIn Ads integration.

HubSpot’s ads feature allows syncing your LinkedIn Ads account, importing lead form data, and even managing LinkedIn campaigns directly from within HubSpot. However, regarding precise ROI monitoring, it falls short by not providing insights into:

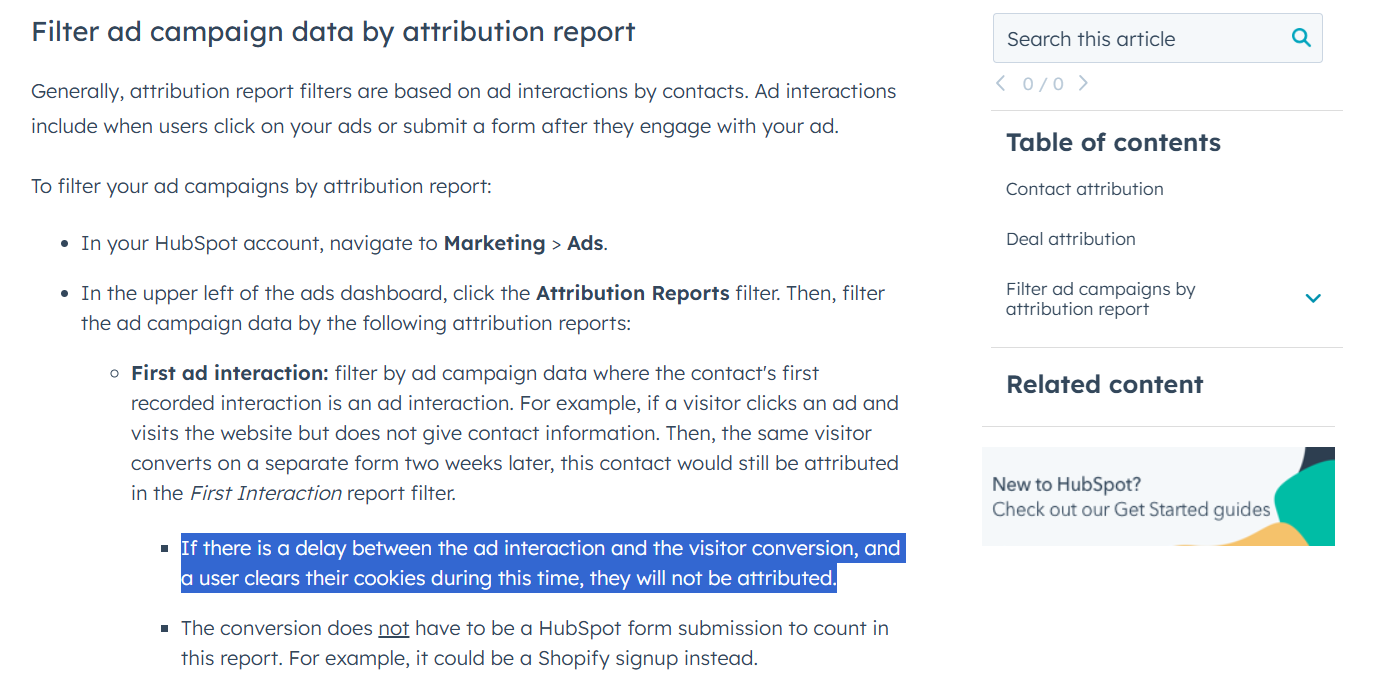

You might wonder, “Doesn’t HubSpot’s tracking script or LinkedIn Insight Tag capture this?” Unfortunately, significant limitations persist:

Key takeaways:

What’s essential for robust LinkedIn ad ROI monitoring is a solution capable of tracking detailed company-level engagement (impressions included, not just clicks) across every campaign and campaign group.

ZenABM leverages LinkedIn’s official APIs to gather detailed, company-level engagement insights from your campaigns, without relying on guesswork, cookies, or IP-based tracking.

This first-party methodology accurately captures genuine interactions with your LinkedIn ads. Here’s how ZenABM simplifies and enhances LinkedIn ad ROI monitoring and attribution:

Regardless of whether target accounts click or simply view your ads, ZenABM systematically captures their interactions, recording each company that:

This comprehensive monitoring enables attribution of influence beyond immediate clicks or form submissions. For instance, if Company X views your ad repeatedly but doesn’t initially interact, yet later visits your site and requests a demo through another channel, ZenABM connects these engagements clearly.

ZenABM demonstrates precisely how these repeated ad impressions contributed to shaping interest, accurately attributing each interaction along the buyer journey. In essence, ZenABM provides true “view-through” attribution for LinkedIn campaigns, extending well beyond basic last-click methods.

Marketers often lean on last-click attribution, crediting the final ad interaction before conversion. Alternatively, some over-prioritise the campaign with the highest click volume.

ZenABM corrects this imbalance by showing every LinkedIn campaign that an account engaged with throughout its buyer journey. This allows you to fairly distribute ROI credit across all meaningful touchpoints.

For instance, a lead might first respond to a thought-leadership post, later engage with a product-specific ad, and finally convert through a demo offer. ZenABM surfaces the full engagement journey, ensuring early-stage or lower-volume campaigns also receive due credit for their influence.

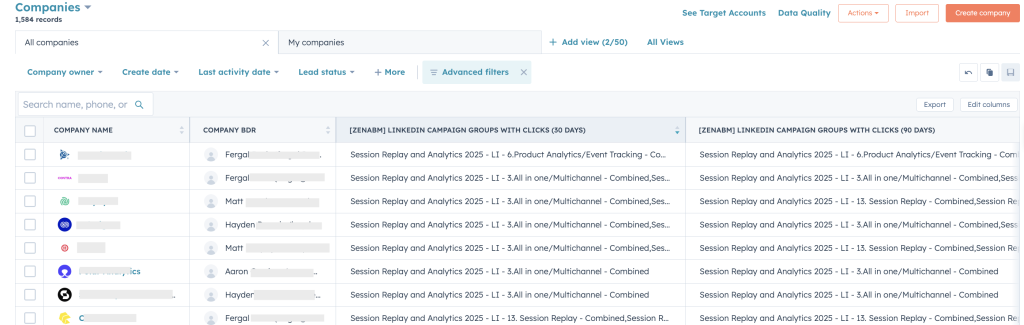

No more manually updating spreadsheets or aggregating data by hand.

ZenABM automates the process, pushing LinkedIn ad engagement stats straight into your CRM, such as HubSpot, as dynamic company-level properties. You’ll receive automatically updated fields like “LinkedIn Ad Impressions – Last 7 Days” or “LinkedIn Ad Clicks – Last 7 Days” per account.

This seamless data flow lets you generate reports and trigger CRM-based workflows in real time, based on up-to-date ad engagement activity.

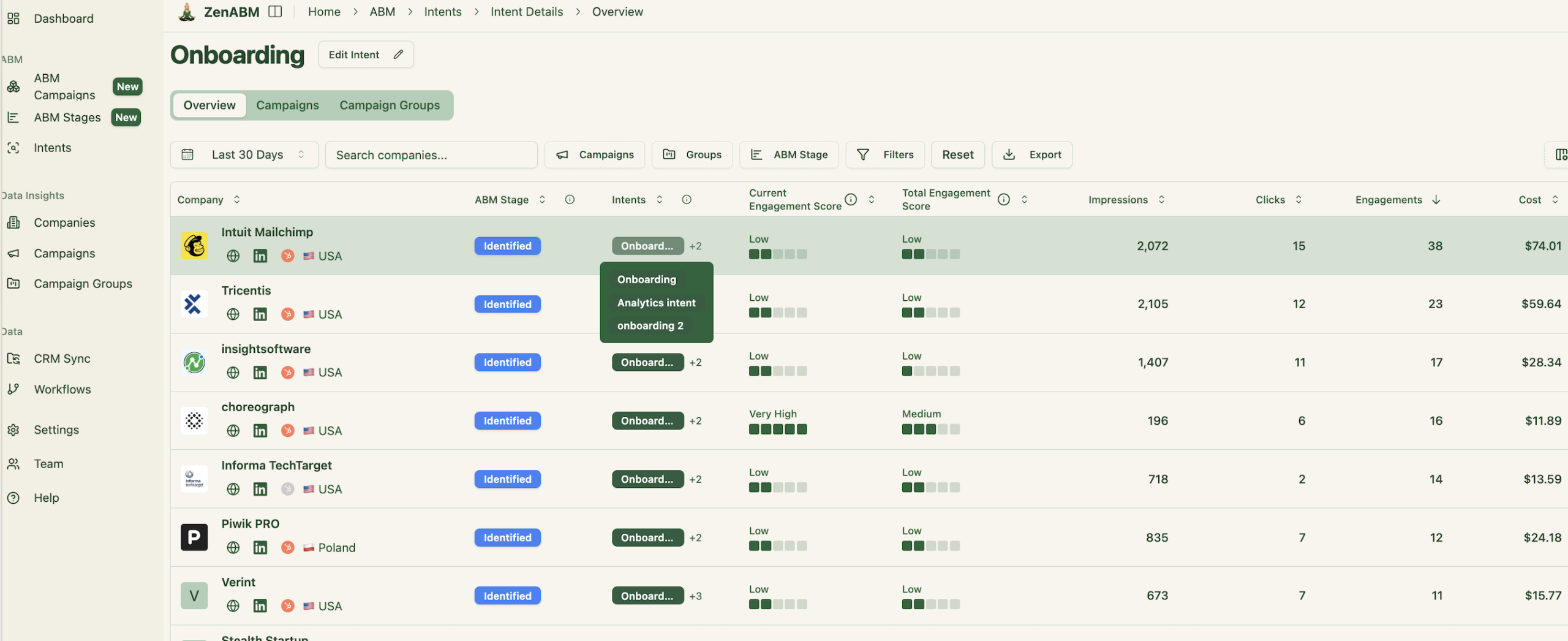

Another powerful feature of ZenABM is built-in lead scoring.

The platform calculates a real-time engagement score for each account based on factors like how many ads they’ve seen, how many times they clicked or interacted, and how recently these interactions happened. This “LinkedIn Engagement Score” acts as a proxy for intent – if an account is surging in engagement, it could be showing buying signals.

ALso, ZenABM can automatically use these scores to flag hot accounts to your sales team.

For instance, when an account’s score crosses a certain threshold, ZenABM can assign that company to a BDR in your CRM:

In ZenABM, you can tag every campaign or group with its underlying intent (feature, use-case, pain-point).

Then ZenABM will cluster engaged companies with that intent, so BDRs can talk about what prospects actually care about.

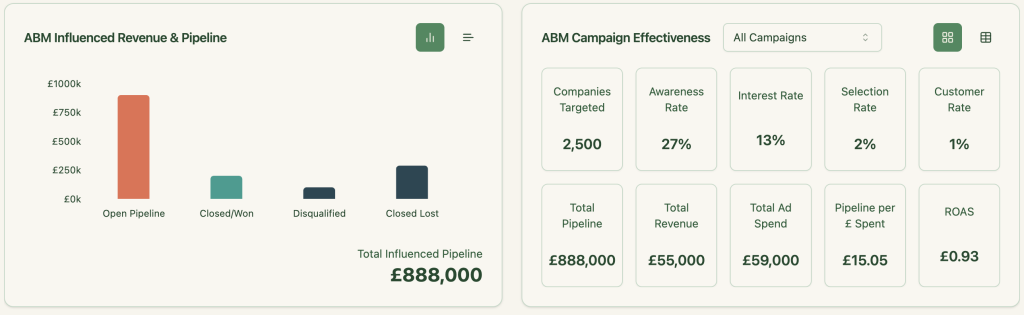

Ultimately, ROI monitoring is about connecting advertising costs with tangible business outcomes.

ZenABM closes this gap by mapping engagement from LinkedIn ads directly to your CRM pipeline. It correlates account-level activity and even specific opportunities with pipeline stages and closed deals. You get an end-to-end view from ad exposure to actual revenue.

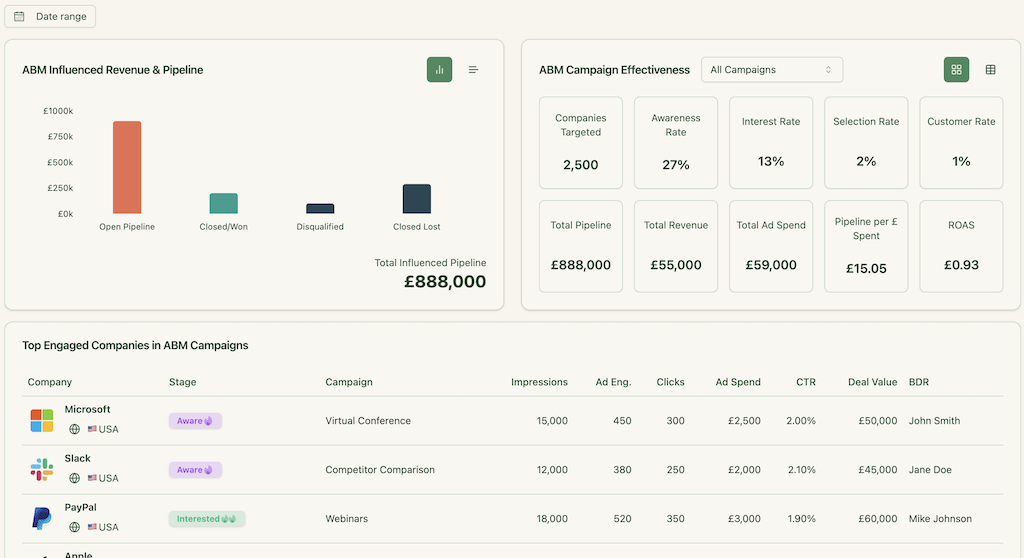

ZenABM is purpose-built for account-based marketing and includes pre-built dashboards that visualise all your key metrics. No need for technical setup or custom reporting.

These dashboards highlight exactly what matters for ROI monitoring, impressions vs. engagement, pipeline attribution, ROAS, high-intent accounts, and more.

With ZenABM, you move beyond a click-focused approach and shift to a complete, account-centric ROI analysis.

ZenABM’s data practices are 100% LinkedIn-compliant. As LinkedIn cracks down on scraping and unauthorized automation tools:

![]()

ZenABM stays fully above board by using LinkedIn’s official APIs. That means you’re getting verified first-party engagement data—accurate, reliable, and safe. No risk to your compliance or LinkedIn account.

LinkedIn ad ROI monitoring goes far beyond counting clicks or leads—it’s about mapping the full customer journey, from first exposure to final deal closure.

This is especially true in B2B environments, where long sales cycles and multiple decision-makers are the norm. Traditional last-click attribution doesn’t cut it. It ignores the early engagement that warms up an account.

By adopting an account-level monitoring strategy, you uncover the hidden influences that actually drive revenue. ZenABM makes this not only possible but seamless, revealing which campaigns truly generate awareness, build intent, and convert high-value prospects.

When you can identify which ads move the needle (not just those that get clicks), you can refine your entire LinkedIn strategy based on real outcomes.

Ready to stop guessing and start measuring what works?

Try ZenABM and finally gain complete clarity into your LinkedIn ad ROI.