LinkedIn ad analytics in B2B marketing is messy. Buying committees are large. Journeys are long. Clicks are rare.

Most native reports and many CRMs focus on click-throughs and last-touch views. That view hides how LinkedIn actually shapes demand across accounts.

In this post, I have discussed the problem and the fix (ZenABM). You will see what breaks LinkedIn ad analytics in B2B marketing and how to build analytics that reflect real account engagement and pipeline impact.

Why is LinkedIn ad analytics hard for B2B teams?

LinkedIn is great for awareness and consideration.

People do not click often.

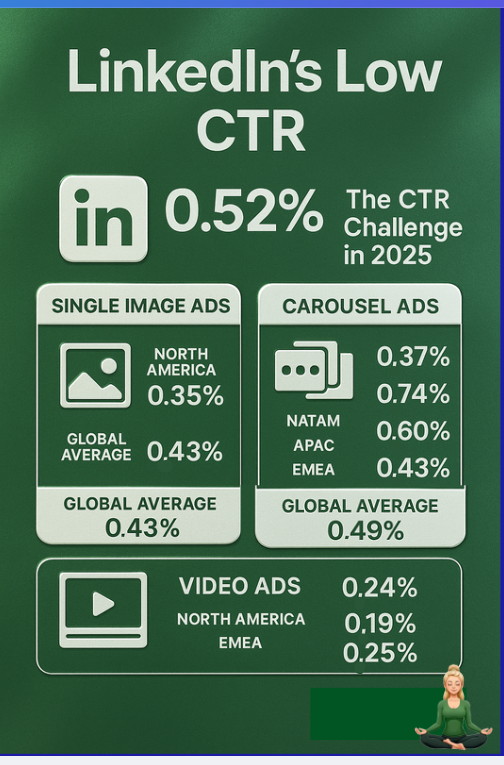

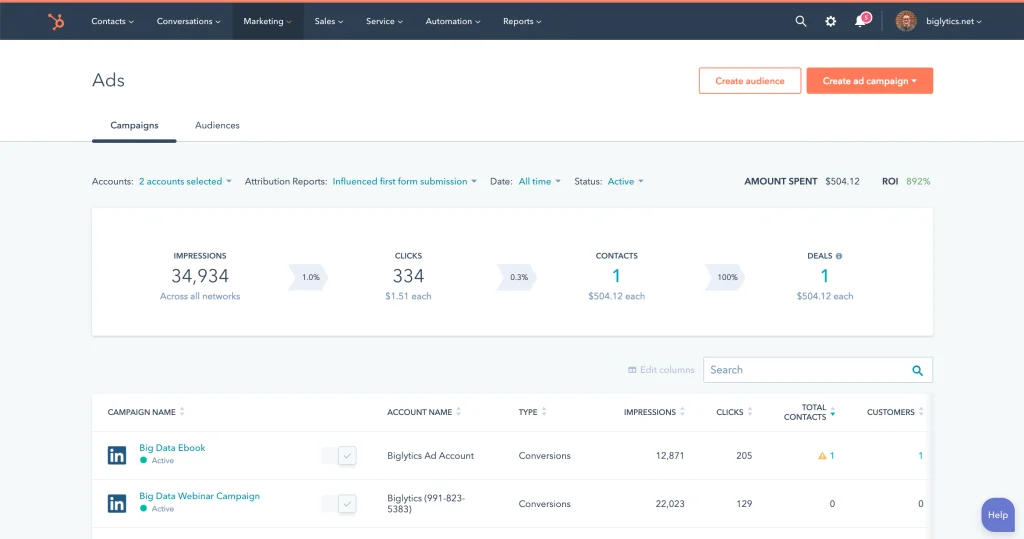

Look at the CTR:

Search ads capture explicit intent. LinkedIn captures attention while buyers scroll.

They may see your ad and later Google your brand or go direct. Your analytics credits SEO or direct. LinkedIn’s role disappears.

The fix is simple to say and harder to do.

Do not anchor on clicks. Build analytics that capture view-through signals at the account level. That means impressions and engagements tied to companies, not just to individuals who submit forms.

Conventional tools fall short for several reasons.

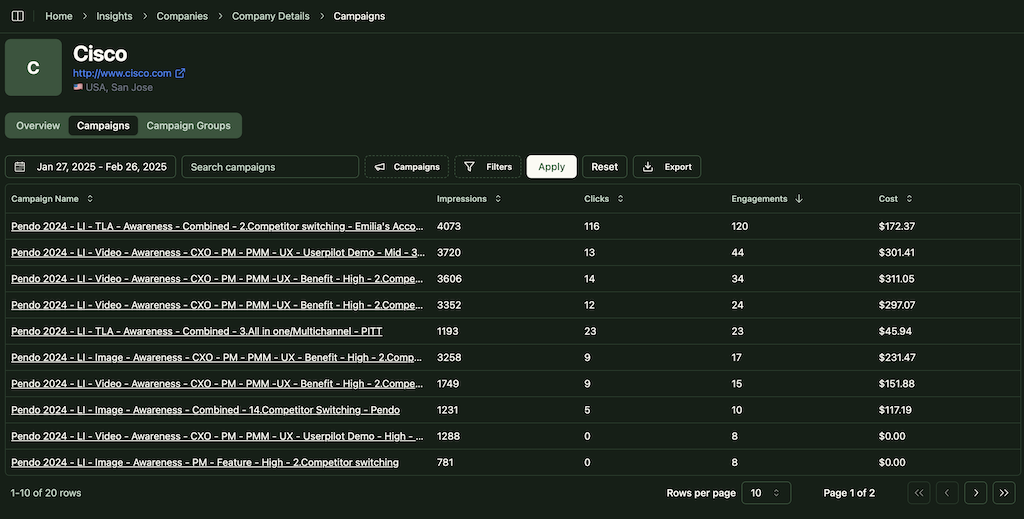

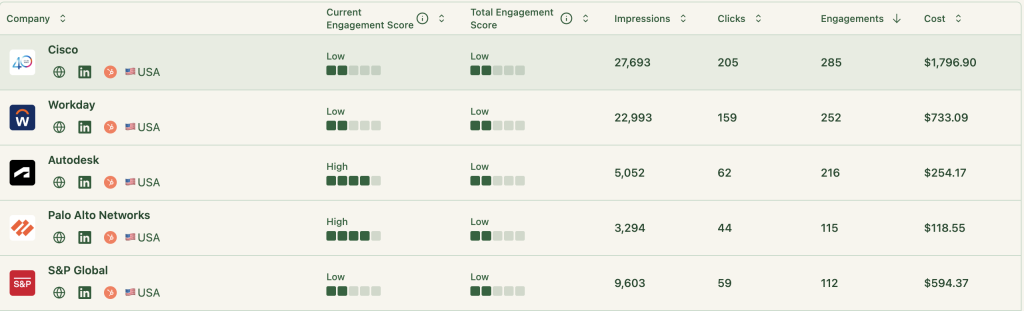

LinkedIn’s Campaign Manager long offered limited account-level depth. In 2020, LinkedIn launched the “Company Engagement Report”. In late 2024, it evolved into the “Companies” tab:

You can see company metrics like paid impressions and paid clicks. That goes beyond basic click tracking.

The problem. Engagement is rolled up at the ad account level. You still cannot bind which campaigns or ads a specific company saw.

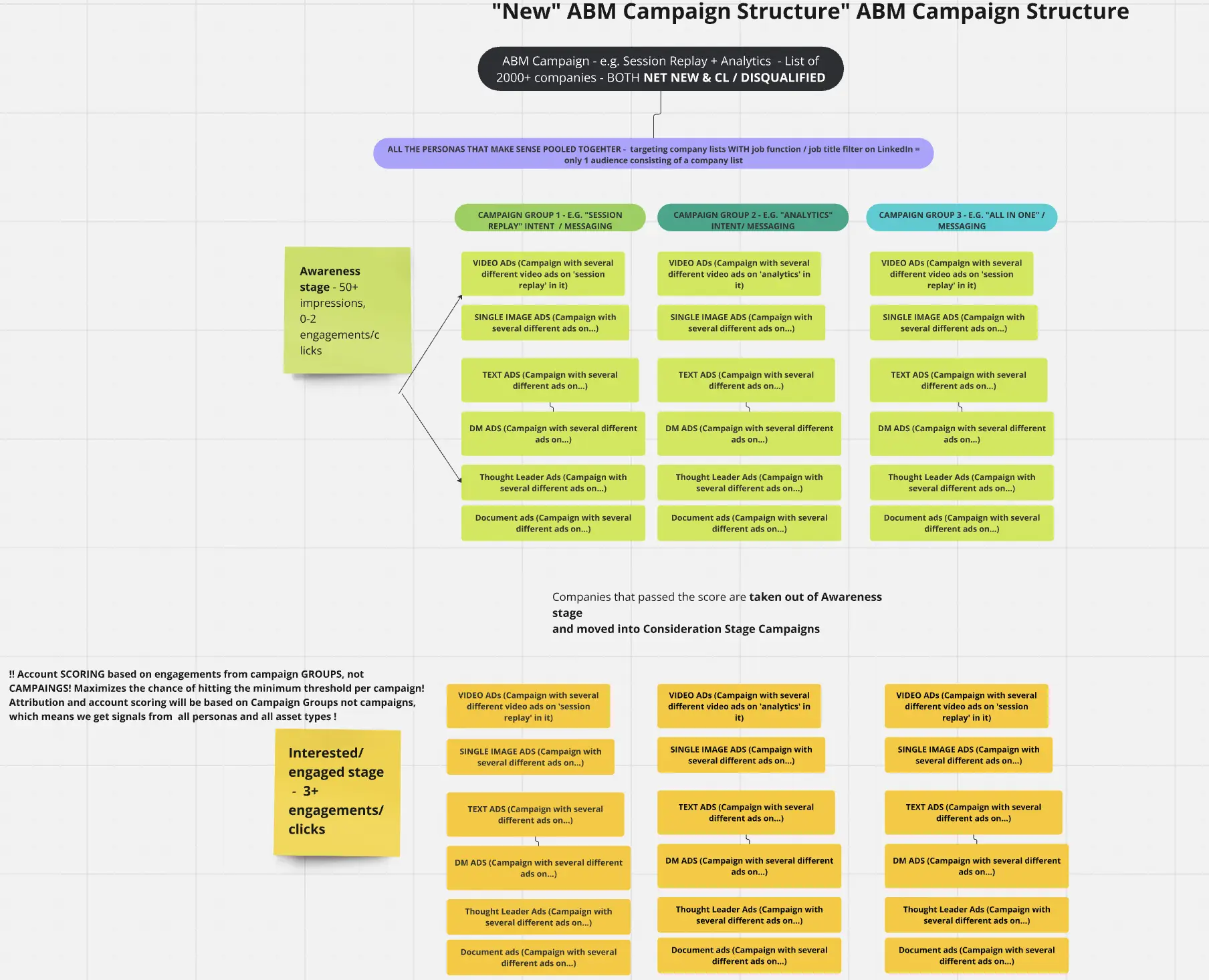

Most ABM teams run many campaigns across groups and themes.

These differ by:

Without campaign-level company data, you cannot map intent or run clean analytics.

See how layered structures look at Userpilot:

Account-level rollups are too blunt. You need impressions, clicks, and engagements by company for each campaign, campaign group, and ABM program.

Without that, you cannot compare campaigns, stop waste, or run real A/B tests.

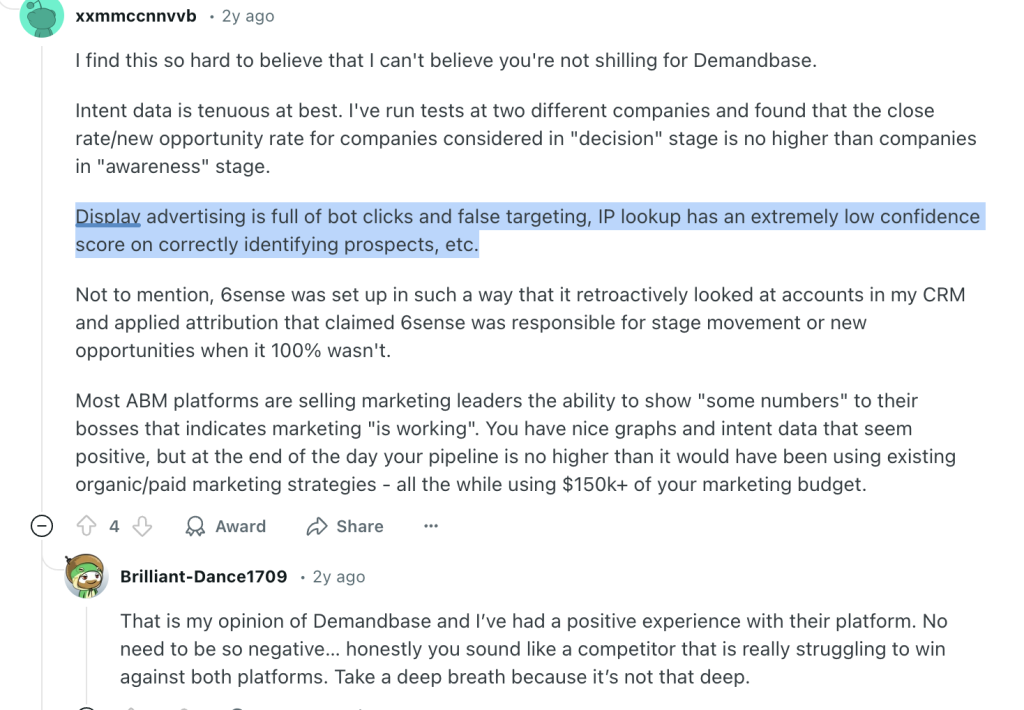

What about reverse IP tools that claim to reveal companies on your site?

They only work after a click. View-through influence is invisible. That leaves a major gap in LinkedIn ad analytics for B2B marketing.

Even for click-through traffic, accuracy is shaky (often near 40%, per a Syft study):

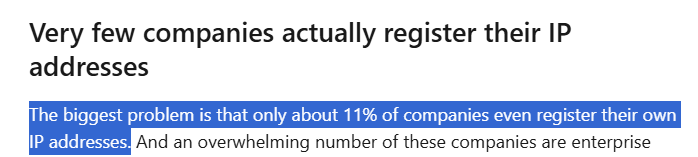

Why does it fail?

IP mapping is brittle. VPNs and shared networks break it.

Many companies never register their IP blocks. There is nothing to match:

A real case. A B2B team at Userpilot tried Clearbit to identify companies from LinkedIn ad traffic.

The output.

One company revealed. Their own:

Classic deanonymization barely moves the needle for LinkedIn ad analytics.

Some teams lean on display networks such as AdRoll or Criteo for retargeting and audience matches. These systems often rely on third-party cookies and device fingerprinting. That does not solve LinkedIn analytics.

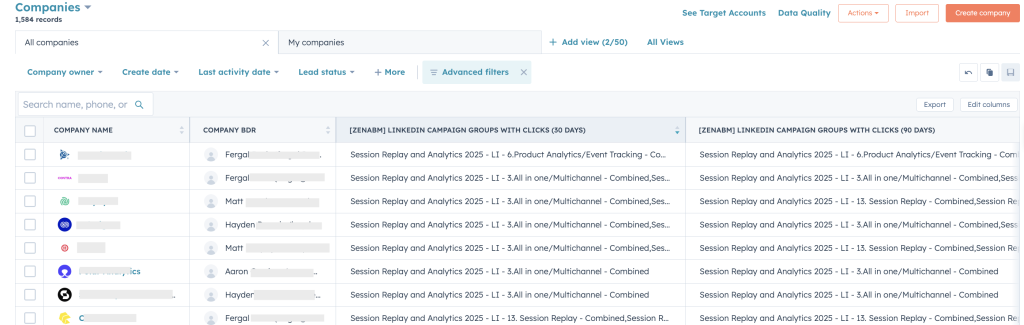

You can connect LinkedIn Ads inside your marketing automation or CRM. For example, HubSpot’s LinkedIn Ads integration.

Useful for management and lead forms. Limited for analytics:

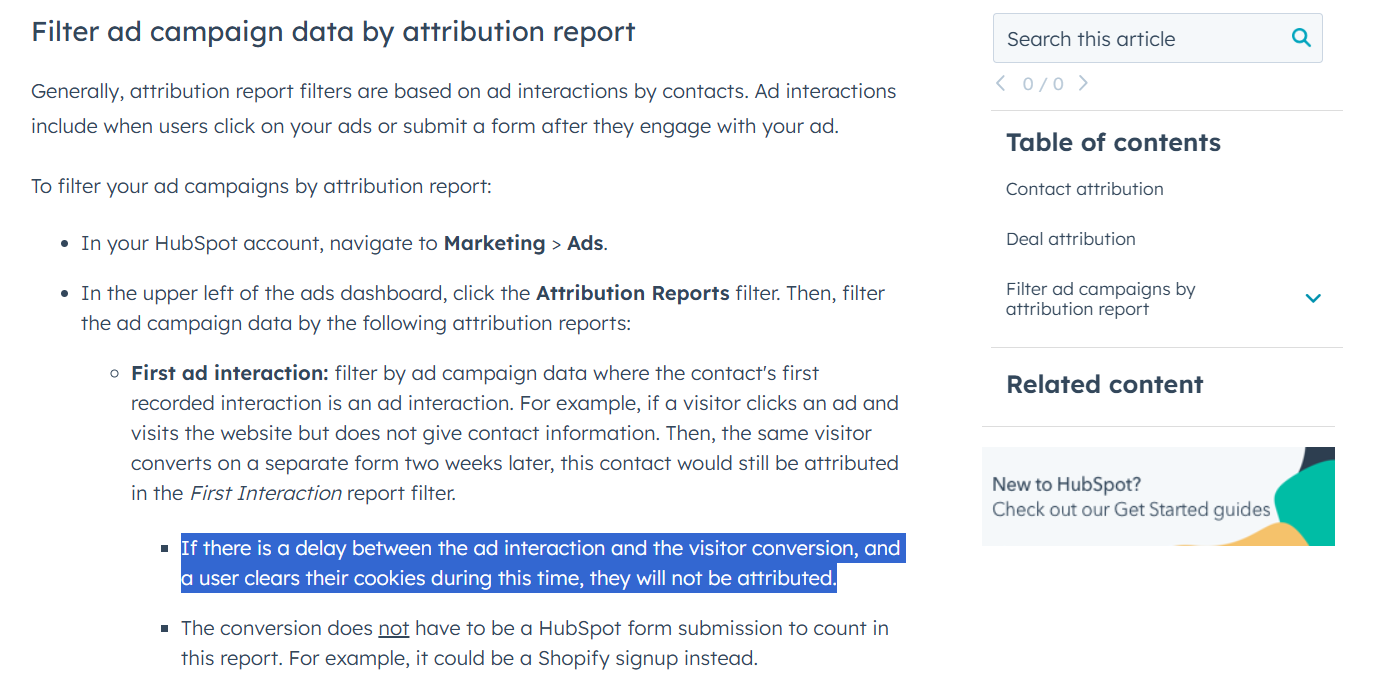

Does HubSpot tracking or the LinkedIn Insight Tag close these gaps? There are constraints.

Bottom lines.

To get accurate LinkedIn ad analytics in B2B marketing, you need campaign-level and company-level engagement captured, even on impressions and synced into your systems.

Here’s how ZenABM fixes LinkedIn ad analytics for B2B teams:

ZenABM records companies that:

You can give credit when there is no form fill. If Company X saw your ads repeatedly, then requested a demo via search or direct, you will still see the influence. If several ads warmed that account over time, each touch is visible.

Last click distorts the story. Click volume does too.

ZenABM shows all campaigns an account has interacted with on the way to the pipeline. Early thought leadership gets its share. Mid-funnel product ads get theirs. Your analytics reflect the real sequence.

Manual spreadsheets go away.

ZenABM writes live engagement into CRM company properties such as “LinkedIn Ad Impressions – Last 7 Days” and “LinkedIn Ad Clicks – Last 7 Days”. Reports, scores, and workflows stay current.

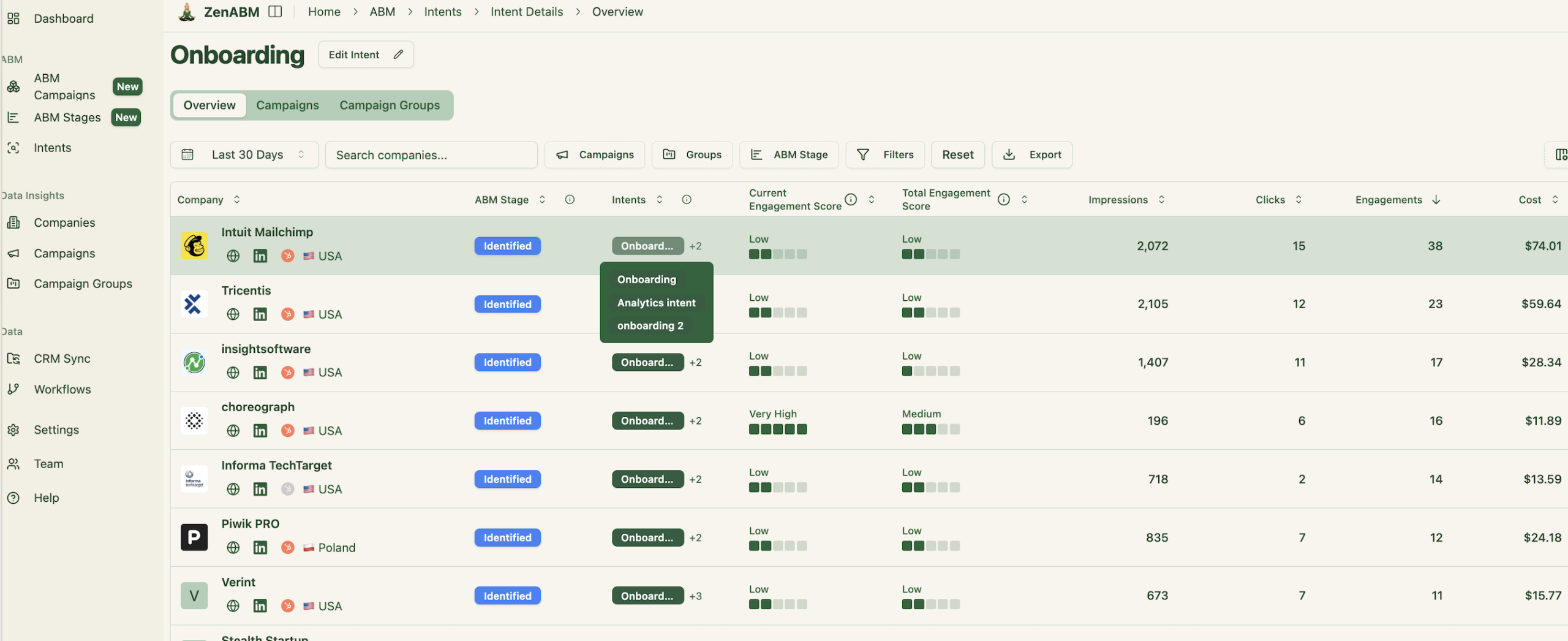

ZenABM scores engagement in real time.

It weights recency, frequency, and interaction type. When a company’s score crosses a threshold, the account can be routed to a BDR automatically:

Each campaign or group can be tagged by intent such as feature, use case, or pain.

ZenABM clusters companies by that intent so reps speak to what buyers care about.

Real analytics ends at revenue.

ZenABM maps campaign engagement at the company level to opportunities and deals in your CRM. You see how LinkedIn ads shape pipeline and closed-won outcomes.

Because ZenABM is built for ABM, it includes dashboards that highlight what matters. Impressions versus engagement. Pipeline influenced. ROI or ROAS. Top engaged accounts. Everything updates on schedule. No custom SQL required.

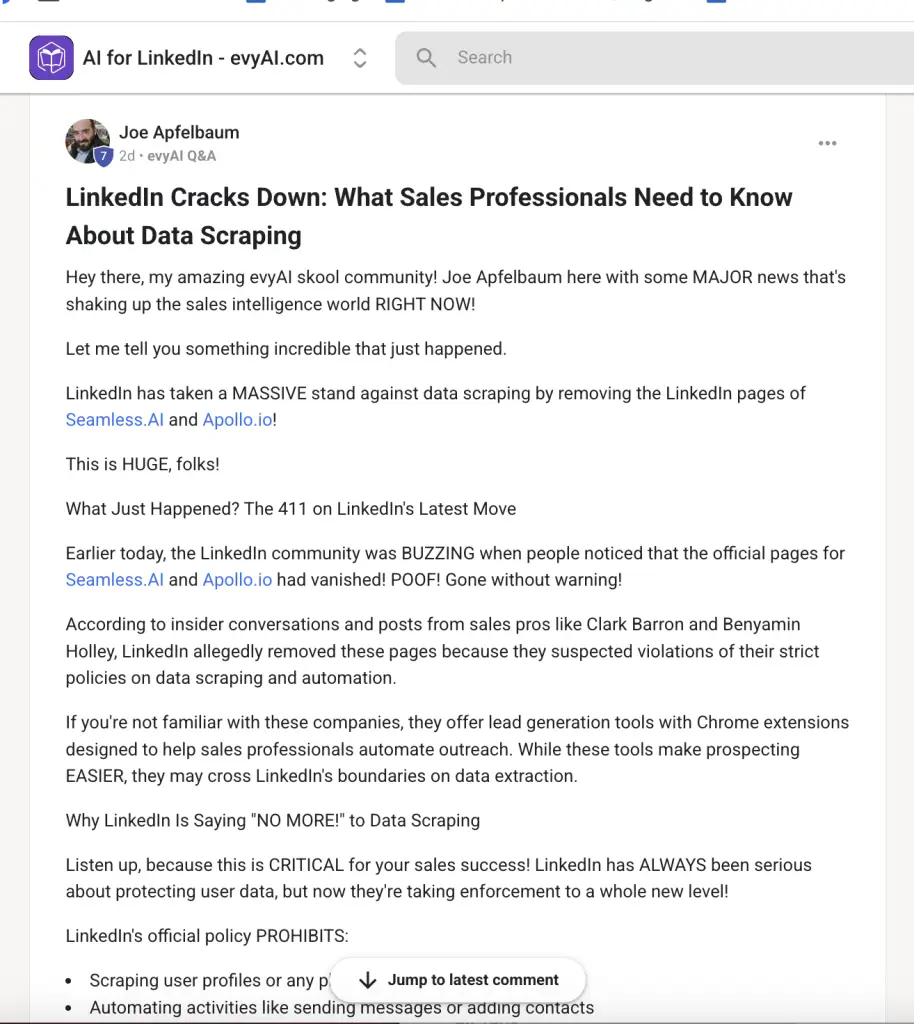

LinkedIn continues to crack down on scraping:

And on automation bots:

![]()

ZenABM uses LinkedIn’s official API. You stay within platform rules and data privacy norms. Signals are reliable and safe.

Good LinkedIn ad analytics in B2B marketing does not stop at clicks. It maps impressions, engagements, and clicks to the account. It follows the path to pipeline and revenue. Last-click models miss early assists and shared influence across a buying group.

Shift to company-level and campaign-level analytics that capture view-through and click-through. Sync those signals to your CRM and dashboards. ZenABM makes this practical with first-party data, fair attribution, scoring, intent tags, and ready-made ABM views. When you can see which ads move accounts forward, you can invest with confidence and scale what works.

Ready to level up your reporting and insight?

Try ZenABM now and bring LinkedIn ad analytics in B2B marketing into one reliable, account-centric view.