LinkedIn Account-Based Marketing (ABM) has emerged as the most effective strategy for B2B companies facing diminishing returns from traditional demand generation. When executed properly, companies are achieving $10+ in pipeline per dollar spent and 2x ROAS within 16 months (I have personally done it as the VP of marketing at Userpilot). These aren’t aspirational numbers—they’re real results from mid-market B2B SaaS companies that followed a systematic, data-driven approach. The problem? Most LinkedIn ABM programs fail within the first 6 months. Not because ABM doesn’t work, but because teams lack a tactical, step-by-step playbook. This guide fills that gap with the exact framework that’s generated over $5 million in influenced pipeline from $490k in ad spend (based on 16 months of real campaign data). If you feel “lost at sea” with how to start your LinkedIn ABM program, this post will be the answer. Most ABM resources are too high-level and strategic – this guide is tactical and actionable, built from real mistakes and wins so you can avoid the costly errors most teams make in their first year.

For the past 5 years, Userpilot growth has come 100% from inbound – with the majority from organic SEO traffic. At our peak in early 2024, we would publish up to 150 content pieces per month, driving 235,000 monthly visitors. But at some point – SEO content started to bring diminishing returns – for both internal and external reasons. Nobody who works in marketing needs explaining that since AI overviews started rolling out, it’s been “quite the ride” in SEO – with relentless Google updates throwing many website’s content efforts against the wall, and extreme SERP volatility. After a year of ups and downs, our traffic finally settled, but didn’t really increase. And even after hiring a really *stellar* head of SEO – the pipeline from organic hasn’t really grown. So without ABM – we would have been in a dark place (and esp myself, as the VP of marketing who makes these decisions). But we also noticed something more tricky – as our product became more robust and our prices increased (in 2024, we almost doubled our ACV!) – our conversion rate from SEO started slowly decreasing. It seemed like while organic SEO traffic really worked for cheaper, transactional B2B sales – it started to limp when our ACV grew and the sales cycles became more enterprise-oriented – and longer. At some point our CEO called me out for having built a ‘siloed marketing department’ – with every function paddling independently towards their own goals, without collaborating much, and definitely without creating the much-wanted ‘flywheel effect’ – where the team’s effort contributes to more than the sum of its parts. It was time for me to act – and ABM or die trying…

Before we dive deep, here’s the quick overview of the 8 steps you’ll need to build a winning LinkedIn ABM strategy:

Let’s break down each step with the actual playbook I use.

Before diving into the tactical playbook, let’s clarify what ABM actually is – because there’s a lot of confusion.

The fundamental difference between ABM and demand generation comes down to targeting strategy:

In practical terms:

| Demand Gen | ABM |

|---|---|

| Target: Broad ICP (anyone who fits) | Target: Specific account list (handpicked companies) |

| Metric: MQLs, Cost per Lead | Metric: Pipeline per $, Account Stage Progression |

| Content: Generic to ICP | Content: Personalized to account characteristics |

| Success: High lead volume | Success: High account engagement → deals |

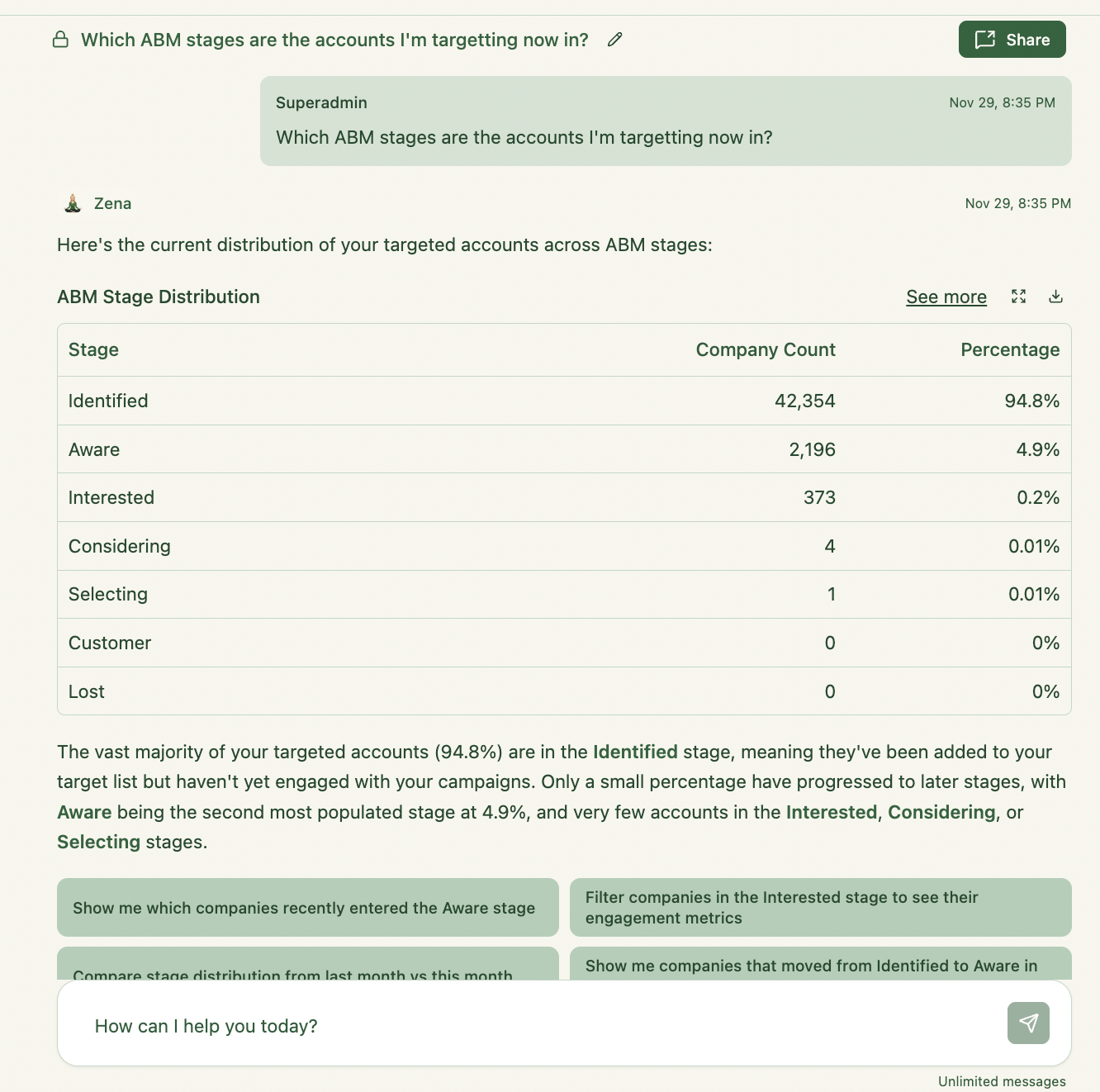

ABM works by moving target accounts through progressive stages of engagement. Here’s the framework we use (based on Kyle Poyar’s ABX benchmarks):

| Stage | Definition | Typical Conversion % (Kyle Poyar’s ABX benchmarks) |

|---|---|---|

| 1. Identified | All targeted accounts (your TAL) | 100% |

| 2. Aware | 50+ ad impressions | ~55% |

| 3. Interested/Engaged | 5+ clicks or 10+ engagements | ~32% |

| 4. Considering | Demo bookings, trial signups | ~18% |

| 5. Selecting | Accounts with open deals | Varies |

The key insight: ABM isn’t just advertising. It’s a full-funnel approach that combines paid ads, intent signals, and personalized outreach to move specific accounts from “never heard of you” to “ready to buy.

This is also exactly what we designed in ZenABM – easy to adjust account scoring in the form of “ABM Campaign Stages”, that update automatically in your CRM and can get sent to any other platform of your choice (e.g. Clay for prospecting into these companies or Smartlead for follow up outreach):

When we started, we tried to build account scores using both LinkedIn ad engagement AND website visitor data. This proved impossible – for one simple reason: website visitor deanonymization is too unreliable. We’ve actually set up a separate no-index domain for our ABM ad campaigns to be sure 100% of the traffic landing there is our ‘target accounts’. And sadly, from the ~300 visitors to a certain page path on that website – in 90 days, Breeze Intelligence (based on Clearbit’s API) identified only 1 company…ourselves!

And according to a study by Syft – Clearbit is actually the most accurate from many popular deanonymization services:

So we decided to simplify the account scoring – and use only quantitative ad engagement data from LinkedIn in our CRM and use the qualitative aspect (which ad campaign groups – organized by intent – the accounts engaged in) for personalizing the follow-up email & LinkedIn outreach.

Here’s where most teams go wrong: they start with a completely cold list of companies that “fit their ICP” and wonder why ABM isn’t working. Don’t start cold. The best LinkedIn ABM target account lists start from low-hanging fruits – accounts that already have some relationship with your brand:

Only after you’ve exhausted these warm sources should you go after completely cold accounts from your ICP.

For our first campaign, we “recycled” the account list we used for cold outbound in H1. That list was based on the “win-loss” analysis we did on our growth and enterprise deals, and used various targeting filters like company size, location etc. We only enrolled the companies that didn’t convert before.

We also targeted accounts using specific technologies (where relevant for a specific ABM campaign). The second campaign was based on this, and targeted a specific segment of accounts in our SAM that were using a specific technology. For this we used Clay and BuiltWith’s API to build the list:

Clay is the secret weapon for ABM list building. Here’s how the experts use it (based on insights from this deep dive with Clay experts):

Depending on the focus of each ABM campaign, we use different additional selection criteria for the companies we want to target. For example, for a campaign focusing on our new “Session Replay + Analytics” features, we would target lookalike companies to our enterprise customers, that also match the following: Firmographic Fit:

Technographic Indicators (from BuiltWith or similar tools):

We also tap into our CRM data to uncover the right-sized accounts that we previously lost to competitors because of missing features:

Expert Insight from Ali Yildirim (Understory): “Ads should never exist in a silo. It’s our duty as good advertisers to make sure every dollar matters. Using Fibbler’s webhook, you can import all of the companies engaging with your ads into Clay. Then we basically copy and paste the job titles we’re targeting on LinkedIn and use a Find People lookup function in Clay to find the LinkedIn profile URLs of the relevant titles at those companies.”

Pro tip: Export your CRM’s closed-lost deals from the past 18 months. Upload to Clay. Enrich with current company signals (funding, hiring, tech stack changes). Score. You now have a warm ABM list that’s infinitely more likely to convert than a cold ICP list.

Answering this question before launching your ads is super-important – so you can avoid budget dilution. We made this mistake quite a few times – launching too many ads per campaign.

To calculate a realistic ABM budget you need to have ABM revenue goals set first. Then you need to work your way backwards from your revenue target – knowing your deal close rate, qualification rate etc. – to how many Target Accounts you really need to target. And then – looking at your historical LinkedIn ad performance benchmarks – CTRs, CPCs and CPMs – or industry benchmarks – you can see what budget you need to realistically set to reach enough of these accounts:

How did we know how many accounts we should target, or what budget to set? After we decided to use Kyle’s ABX benchmarks, we then set a revenue goal for this initiative and ACV – and worked our way backwards (knowing our close rate and qualification rate). So let’s assume you want to close $1 million in revenue from ABM in 2025. Your ACV is $50k. Your close rate is 25% and your qualification rate is 75%.

How did we know how many accounts we should target, or what budget to set? After we decided to use Kyle’s ABX benchmarks, we then set a revenue goal for this initiative and ACV – and worked our way backwards (knowing our close rate and qualification rate). So let’s assume you want to close $1 million in revenue from ABM in 2025. Your ACV is $50k. Your close rate is 25% and your qualification rate is 75%.

$1,000,000 in ARR / $50k in ACV = 20 deals So we’re looking at: 20 / 0.25 / 0.75 / 0.18* / 0.32 / 0.55 = 3,367 accounts that you need to target to hit your revenue target. How much budget will you need for that? That depends on your CPMs and Cost per Conversion from the channels you pick. Knowing 55% of your target accounts will become aware, and then – 32% of those will be interested, and 18% will be considering (will have booked a demo) – you will need approximately 107 accounts to convert into demos. If your cost per conversion is $1,100, you’re looking at a $117,700 LinkedIn ad budget. You can also try to calculate it (more accurately) based on your average CPMs, CTRs and landing page conversion rates. The average CTRs are ~0.35% – 0.45%. So for every 1,000 impressions – you get only 3-4 clicks. Let’s say your great landing pages convert at 1% rate. So to generate 107 demos with a 1% landing page conversion rate and a 0.4% CTR, you would need approximately 2,675,000 impressions. Let’s say your CPM is $55. You’ll need to spend $55 x 2,675 = $147,125. LinkedIn doesn’t distribute impressions equally between accounts though – use tools with impressions cap like Factors.ai to cap impressions per account.

Why is budget allocation so important? As Ali Yildirim wrote – allocating budget to campaign is “simple math”. Let’s say you want to run a LinkedIn Image ads campaign consisting of 5 ads – how much budget would you need to allocate to this campaign to get a meaningful number of clicks?

This is an example of a LinkedIn ad campaign that didn’t have a chance to succeed:

Most underperforming LinkedIn campaigns don’t fail because of bad targeting or weak creatives – they fail because each ad never gets enough budget (doesn’t get served enough) to generate any useful data to inform you how it’s performing. Once you look at your total budget first (instead of ideas first), then the campaign structure you can actually afford becomes obvious. When you divide your monthly budget by 30, you get your real daily spend limit. That number determines how many ads you’re allowed to run – not how many you want to run. Based on this (and which campaign types – single image ads, carousel ads, video ads) – you want to run – you can then determine how many personas/intents you can target.

Most underperforming LinkedIn campaigns don’t fail because of bad targeting or weak creatives – they fail because each ad never gets enough budget (doesn’t get served enough) to generate any useful data to inform you how it’s performing. Once you look at your total budget first (instead of ideas first), then the campaign structure you can actually afford becomes obvious. When you divide your monthly budget by 30, you get your real daily spend limit. That number determines how many ads you’re allowed to run – not how many you want to run. Based on this (and which campaign types – single image ads, carousel ads, video ads) – you want to run – you can then determine how many personas/intents you can target.

Based on this campaign outline and the math above – how many ads can you run with a $10,000 monthly budget and $8 cost per click? How many different personas can you realistically target?

$4,800 + $4,800 + $1,900 + $2,880 + $250 = $14,630 So in fact, with a $10k budget you don’t even have enough to run one “full on” campaign – I’d do maybe just one video ad, and 1 carousel to stay within the $10k budget. Also – as you can see – with a $10k budget and $8 CPC you can’t really experiment with splitting your campaigns by persona or by intent. You need to mix all the personas or intents in, or just focus on one persona/intent at a time. I’d strongly recommend you follow this math to avoid the mistakes I made, and make sure that:

Here’s how you can calculate how many ads (in total) you can “afford” to run per month:

Monthly budget ÷ 30 ÷ (cost per click x 4 clicks) = maximum number of effective adsNow divide it by the number of ads required per each campaign format – and you’ll know how many campaigns you can run.

This is where most ABM programs fail: generic, corporate ads that look like every other B2B company’s feed. Let me share what actually works based on our analysis of 10,000+ LinkedIn ads. For detailed benchmarks and best practices, check our full LinkedIn ABM Benchmarks Report 2026.

TLAs are the best performing ad format by far:

| What Works | What Doesn’t |

|---|---|

| 1st person “I” voice (65% of top performers) | Corporate “we” voice |

| Link placement at bottom (75% position link in final 25%) | Link interruptions mid-content |

| 1,000-1,500 characters optimal length | Too short or too long |

| Pain-point hooks: “I’ve seen so many…” | Generic opening statements |

| FREE trials or ungated resources | Webinar CTAs (0% in top 20!) |

Based on our analysis of extremely high CTR ads (2%+):

Here’s an example of a “winning” ad template:

And here’s an actual Linkedin image ad that performed really well for us (> 0.70% CTR):

Based on our LinkedIn ABM Benchmarks Report 2026, here’s the optimal ad mix:

| Ad Format | Quantity | Why |

|---|---|---|

| Thought Leader Ads (TLAs) | 5 ads | Best value: 77% cheaper CPC ($3.06 vs $13.23), 2.68% CTR |

| Single Image Ads | 5 ads | Good reach, reliable performers |

| Carousel Ads | 1 ad | Balanced engagement, good for explaining complex products |

| Video Ads | 2-3 ads | Awareness building (keep spend low – video underperforms on CTR) |

| Text Ads | 5 ads | Cheap impressions, brand reinforcement |

Linkedin ABM ad mistakes are so scary (costly!) that I turned them into a Halloween costume last year 😉 You’ve spent a ton of time building your lists, planning your campaigns, creating your perfect ads…Now don’t blow it at launch. 😉

Use the Classic Ad Editor. The new Accelerate features give you less control over targeting and bidding. For ABM, you need precision.

Use “Website Visits” objective. Not “Brand Awareness”, not “Engagement”, not “Lead Generation” (unless you’re using Lead Gen Forms, which I don’t recommend for ABM). Website Visits lets you:

Turn OFF audience expansion. For ABM, you want to hit your specific target accounts, not LinkedIn’s “similar audiences.”

LinkedIn will happily show your ads 50+ times to the same person. Set frequency caps to avoid annoying your prospects and wasting budget.

Expert Insight from Ali Yildirim (Understory): “One of the frequent issues we see when reviewing LinkedIn ad accounts is the consolidation of spend and impressions on top accounts, usually the ones with more employees. We have a workaround to make sure that the smaller accounts still receive an equal proportion of spend.”

Once we have a list of accounts we want to target, we add them to the right ABM campaign list on HubSpot. Initially, we used contact lists on LinkedIn ads to target our accounts by relevant personas (e.g., PM, UI/UX, PMM, CXO) and we had to find their specific email addresses in Clay. This quickly became *very expensive* – finding email addresses on Clay even through cheap APIs like e.g. Leadmagic costs money, let alone Clay credits, but the worst was Marketing Contacts on HubSpot. So what we started doing instead is just pushing Company Lists from HubSpot to LinkedIn Ad Campaigns – and filtering those by LinkedIn Campaign Manager’s native ad filters:  FYI – it usually takes around 48 hours for your audience to get ready on LinkedIn after being synced. Once available, you can use these lists with LinkedIn targeting options and add additional filters to further narrow down your audience:

FYI – it usually takes around 48 hours for your audience to get ready on LinkedIn after being synced. Once available, you can use these lists with LinkedIn targeting options and add additional filters to further narrow down your audience:

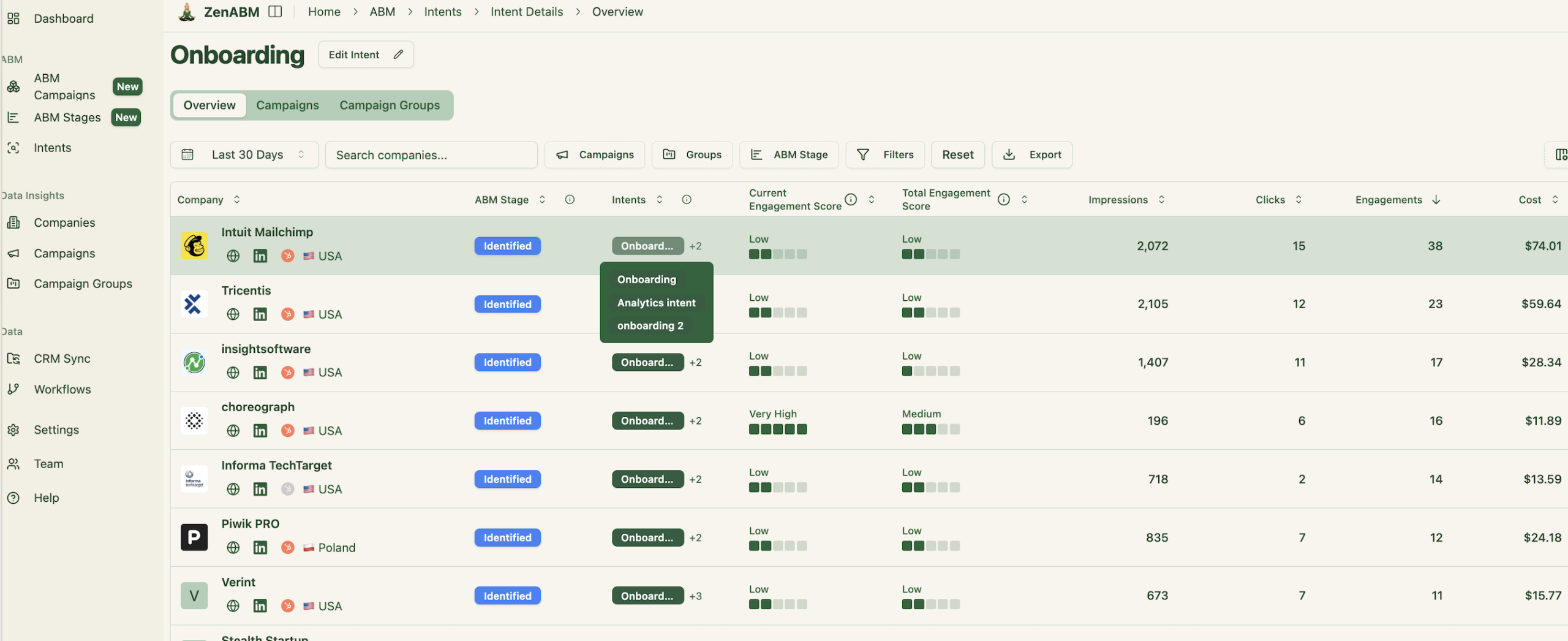

All our accounts start in the “identified” stage. However, as soon as an account meets the ABM stage benchmarks (e.g., when an account receives more than 5 clicks, it moves to the “interested” stage – and the “awareness” ads are paused for them, and they are automatically enrolled in the “interested” stage ads). You can make your stages more sophisticated in ZenABM by combining different company properties from your CRM:

This segmentation allowed us to craft highly targeted messaging tailored to each persona’s pain points and their position in the ABM funnel.

This segmentation allowed us to craft highly targeted messaging tailored to each persona’s pain points and their position in the ABM funnel.

For example, in the screenshot above, the first ad is targeted at accounts in the awareness stage for PM personas and introduces our product by highlighting various jobs to be done by the PM persona. The second ad, targeted at PMs in the consideration stage, showcases a case study of a similar persona and the value they derived from using our solution.

This segmented and personalized approach to ads significantly boosted engagement by ensuring the messaging resonated with the specific needs and challenges of each persona at their respective ABM stages.

This is where ABM gets real. You’re not measuring clicks and impressions – you’re measuring account progression through buying stages.

First – we’re pushing the company-level engagement data from LinkedIn Campaign Manager to HubSpot. As of January 2025 – you can’t do this natively. So at first – we found a cool and cheap (we were paying $69 per month) tool that acts as a LinkedIn API data connector for HubSpot. Then – when we realized the tool pushed only quantitative engagement data into the CRM, not qualitative ones (which campaigns the company engaged with – we use that information for personalizing BDR outreach) and didn’t have any of the ABM stages features or analytics – so we decided to build our own API solution (and this is where my husband came into the picture) – ZenABM. That way, we can push both quantitative campaign engagements and qualitative ones into company properties on HubSpot:

Since the campaigns are already segmented by intent, 12 in our case, we can then create a workflow to assign the respective intent(s) in a custom multiple checkboxes company property on the company level based on the campaign names/intent coming in from ZenABM. Then when the BDRs do the prospecting themselves and create leads, the associated company’s intent(s), from the custom property, gets copied to the lead level as tags. This helps the BDRs reach out with very relevant, targeted messages – based on what the company members are already engaged with:  So – to sum up – using ZenABM we push the ad engagements and clicks on a weekly basis into custom HubSpot company properties – “LinkedIn Ad Engagements – 7/30/90 days” and “LinkedIn Ad Clicks – 7/30/90 days”. ZenABM also pushes and automatically updates the account ABM Stage into HubSpot (“Aware”, “Interested”, “Considering” etc.) – which we then use for follow-up LinkedIn and email outreach.

So – to sum up – using ZenABM we push the ad engagements and clicks on a weekly basis into custom HubSpot company properties – “LinkedIn Ad Engagements – 7/30/90 days” and “LinkedIn Ad Clicks – 7/30/90 days”. ZenABM also pushes and automatically updates the account ABM Stage into HubSpot (“Aware”, “Interested”, “Considering” etc.) – which we then use for follow-up LinkedIn and email outreach.

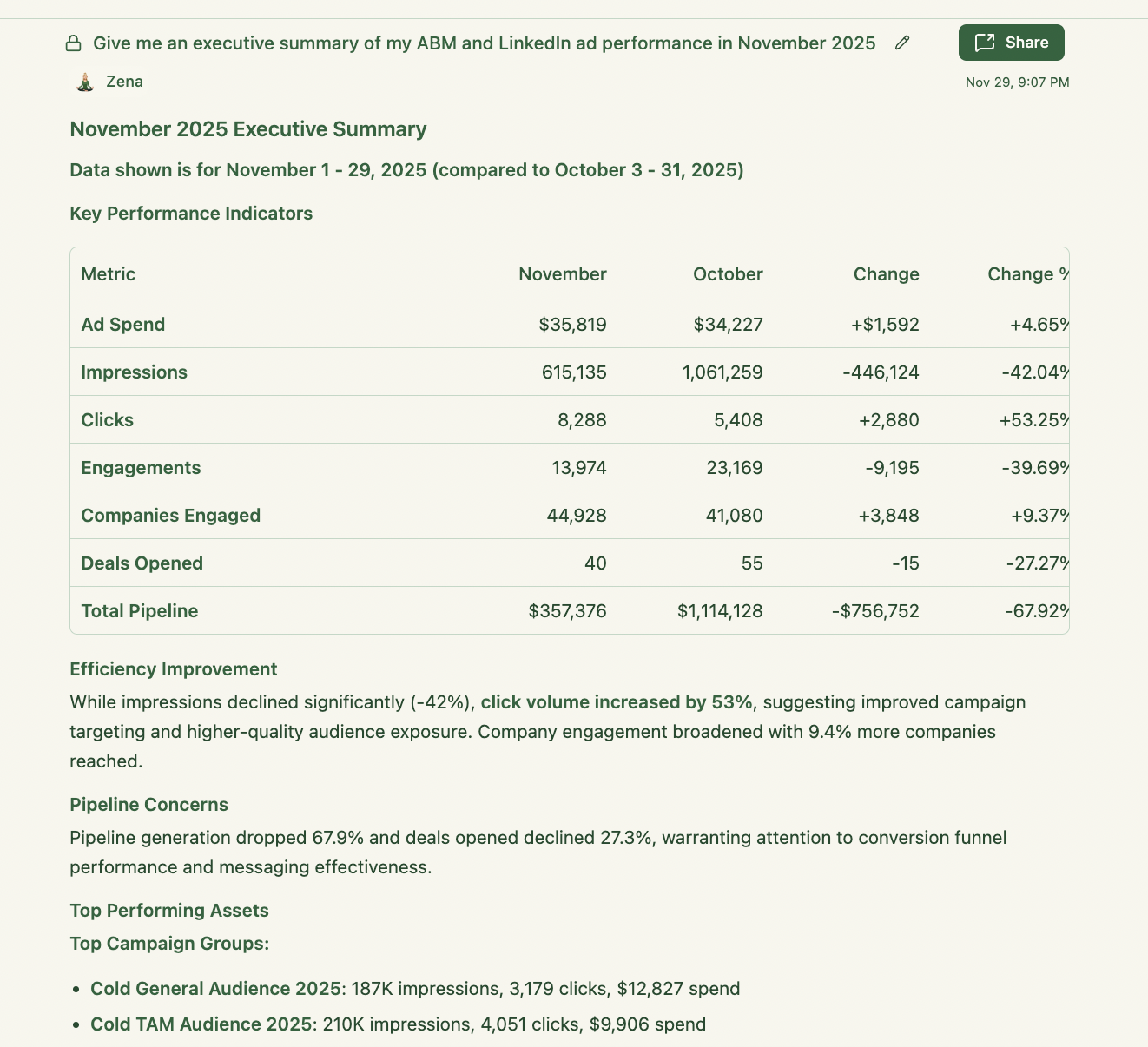

Forget vanity metrics. Here’s what actually matters for LinkedIn ABM.

Traditional lead gen measures MQLs. ABM measures influenced pipeline – the total value of deals where your target accounts engaged with your LinkedIn ads before entering the sales process. This is a fundamental mindset shift:

| Metric | Definition | Benchmark (Top 25%) |

|---|---|---|

| Pipeline per $ Spent | Total influenced pipeline / ad spend | $15.20 per $1 (median: $5.21) |

| Deal Open Rate | % of engaged accounts that opened deals | Varies by ACV |

| Stage Progression Rate | % moving from Aware → Interested → Considering | See framework above |

| Account Coverage | % of target accounts reached with 50+ impressions | >55% |

| De-duplicated Revenue Attribution | Revenue attributed without double-counting across campaigns | Use ZenABM |

Not all personas convert equally. Track pipeline per $ spent by persona to know where to allocate budget:

Action: Shift budget to RevOps. Test new messaging for Sales Leaders.  ZenABM gives you these dashboards out of the box, with ABM campaign objects that group your LinkedIn campaigns by initiative for proper attribution.

ZenABM gives you these dashboards out of the box, with ABM campaign objects that group your LinkedIn campaigns by initiative for proper attribution.

Here’s where ABM turns into pipeline. Accounts in your “Interested” stage (5+ clicks, 10+ engagements) are showing buying signals. They’re warm. Don’t let them go cold. This is the core of intent-based outbound – using intent signals to trigger personalized outreach instead of cold blasting.

Don’t pitch slap. Even though they’re engaging with your ads, they haven’t raised their hand. The goal is to start a conversation, not close a deal.

Expert Insight from Alex Fine (Understory): “I’m generating one opportunity for Understory for every 44 people I reach out to via cold email. That is elite efficiency. Every contact runs through ICP screening at both the contact and company level automatically in Clay. The messaging is funny, but also very specific to how they were found in the first place.”

Sample LinkedIn connection message:

“Hey [Name], noticed [Company] has been exploring [topic from ad engagement]. We work with a lot of [similar companies] on exactly this. Would love to connect and share what’s working for them if it’s useful.”

Sample email:

“Hi [Name], I saw [Company] has been researching [intent topic]. We recently helped [similar company] achieve [specific result]. Thought you might find this [relevant resource] useful. Worth a quick chat?”

ABM isn’t set-and-forget. Here’s how to continuously improve your campaigns.

This seems obvious, but most teams let underperforming ads run for months. Review weekly:

Reallocate budget to your winners.

Ad fatigue is real on LinkedIn. Your target accounts will see the same ads repeatedly. Introduce 2-3 new creatives per month per campaign. What to test:

Review pipeline per $ monthly by:

Shift budget toward what’s working. Cut what isn’t.

As you see which account characteristics correlate with pipeline, use that to build lookalike lists:

My approach: Every month I review which ads are in the bottom 20% by CTR and pipeline influence. Those get paused. Top 20% get more budget. The middle 60% stays as-is until they move into top or bottom.

Look, I know this post is long. But here’s the truth: LinkedIn ABM doesn’t have to be complicated. The simple version:

That’s it. 16 months into our ABM program, we’ve generated over $5 million in pipeline with $10+ pipeline per $1 spent and 2x ROAS. And we made plenty of mistakes along the way (which I’ve shared above so you can avoid them). The key is starting. You’ll learn more from running one ABM campaign than from reading 10 more blog posts about ABM strategy.

| Purpose | Tool | Why |

|---|---|---|

| ABM Analytics & Attribution | ZenABM | Account stages, scoring, intent, pipeline attribution, AI chatbot (Zena) |

| List Building & Enrichment | Clay | Data waterfall, account scoring, contact discovery |

| LinkedIn Outreach | HeyReach | Automated connection requests and follow-ups |

| Email Outreach | Instantly / Smartlead | Sequences for engaged accounts |

| CRM | HubSpot / Salesforce | Pipeline tracking, deal management |

I learned most of what I know from these people. Give them a follow:

Ready to stop guessing and start running ABM that actually generates pipeline? Start your free ZenABM trial and see which accounts are engaging with your LinkedIn ads today.

Based on the budget math above: minimum $10-15K/month per persona to get meaningful data (3-4 clicks per ad per day). With a $10k budget and $8 CPC, you can run about 10 effective ads. If your budget is lower, reduce the number of ads but maintain click volume per ad – better to run 5 ads well than 15 ads with budget dilution.

Expect 3-6 months to see pipeline impact. Month 1-2 is awareness building. Month 3+ is when accounts start progressing to demo/trial stage. Don’t judge ABM on 30-day results. We hit our stride around month 5-6, and have now been running for 16 months with compounding results.

For ABM, drive to website. Lead Gen Forms capture contact info but don’t tell you account-level engagement. Use Website Visits objective for better ABM analytics.

Depends on budget and goals. Use the reverse-engineering formula: if you need 20 deals and have typical conversion rates (55% aware, 32% interested, 18% considering), you need ~3,400 target accounts. Adjust based on your specific numbers.

Demand gen casts a wide net and optimizes for lead volume. ABM focuses on specific high-value accounts and optimizes for pipeline influence and account progression. ABM is about depth (engaging the right accounts deeply), demand gen is about breadth (reaching as many potential buyers as possible).

No. ZenABM starts at $59/month and gives you account stages, scoring, intent, and pipeline attribution. You don’t need $50K enterprise platforms to run effective LinkedIn ABM. Start lean, prove results, then evaluate if you need more.

As we learned the hard way – even the best deanonymization tools (like Clearbit) only identified 1 company from 300 website visitors to our ABM landing pages. That’s why we rely on LinkedIn ad engagement data for account scoring instead – it’s much more reliable.