©2026 ZenABM - All Rights Reserved.

In this article, I compare Factors.ai vs. Terminus across features, pricing, and practical fit so marketing and sales teams can choose the platform that best supports their account-based marketing program.

I also explain where ZenABM fits in as a lightweight, budget-friendly alternative or a complementary layer to these enterprise ABM suites because its approach is different.

Read on…

Factors.ai presents itself as an “all-in-one” ABM intelligence and analytics platform for B2B marketers.

Its core proposition is to bring web, advertising, and CRM data together so you can view the full account journey end to end and turn those insights into action.

Below are the standout capabilities, pricing posture, and typical use cases.

Factors.ai can capture and attribute touchpoints across channels such as site, ads, email, and CRM activities, then apply multiple attribution models.

It supports roughly nine models, including first-touch, last-touch, linear, time-decay, U-shaped, and W-shaped, and lets you compare two models side by side.

This gives marketers a defensible read on which campaigns and assets influenced pipeline and revenue instead of relying on single-touch views.

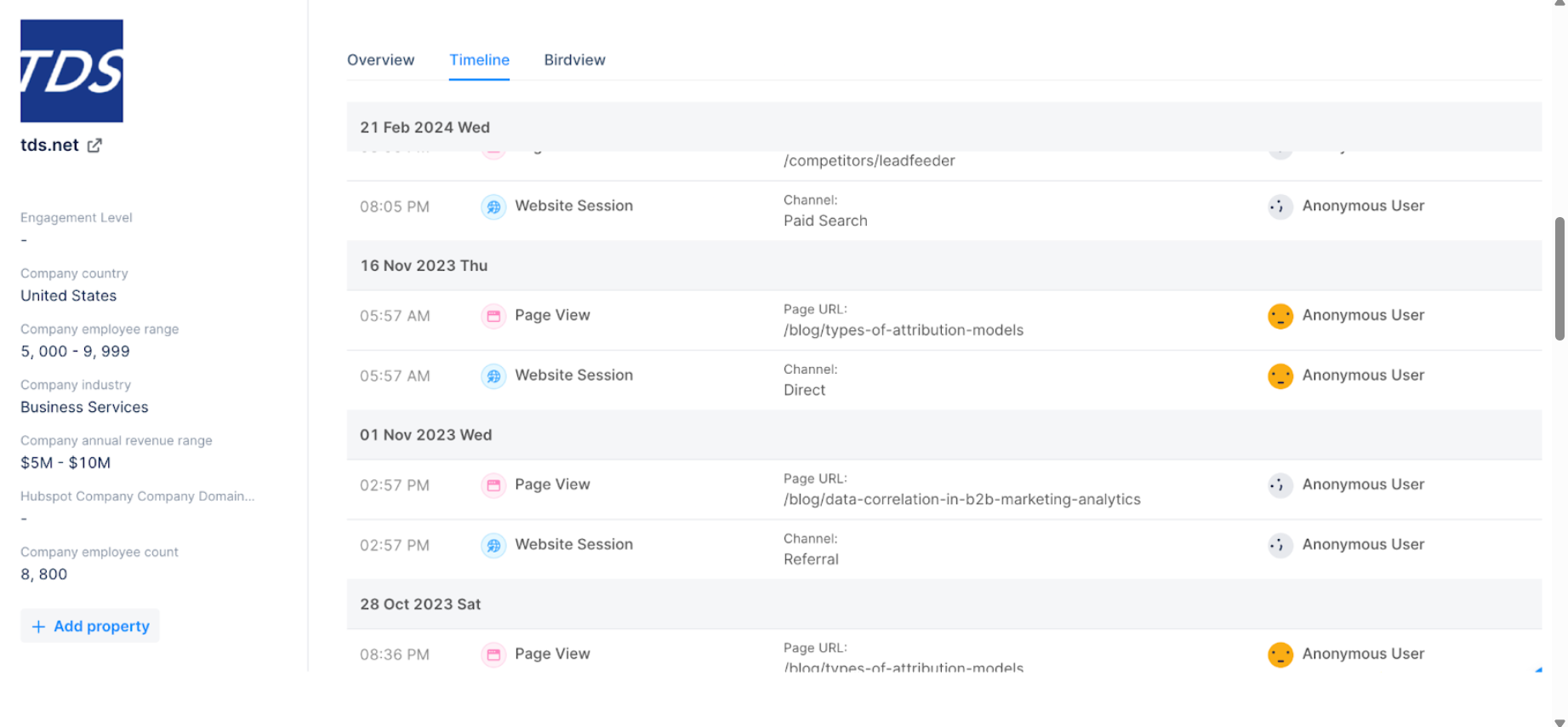

All activity flows into an Account Timeline that maps each company’s chronological path across anonymous sessions, ad interactions, and sales engagement.

A key capability in Factors.ai is linking anonymous visitors to the companies browsing your site.

By using IP data and partners like Clearbit Reveal and 6sense, Factors.ai notes it can deanonymize up to roughly 64 percent of traffic by matching IPs to corporate domains.

In practice, if a visitor from Acme Corp lands on your site, Factors.ai may identify the company and display “Acme Corp” in your dashboard with firmographics such as industry and company size.

This site-to-account resolution fuels an “Account Intelligence” area so you can see which target accounts are active across your properties.

Factors.ai augments accounts with firmographics and intent data.

Using Clearbit, it can enrich industry, headcount, revenue band, location, and similar attributes.

Through 6sense or other providers, it can reflect buying stages or topic-level intent.

All account engagement, including pageviews, ad impressions or clicks, and form fills rolls into an engagement score.

Scoring is configurable, blending fit with observed engagement to surface warm accounts.

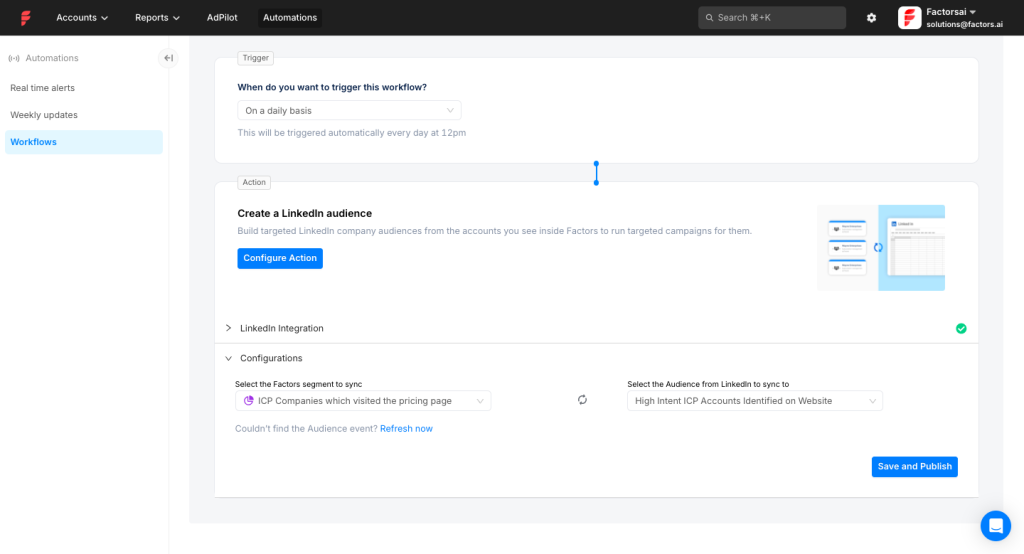

Factors.ai connects with major ad platforms like LinkedIn, Google Ads, Meta, and Microsoft Ads to ingest performance and sync audiences.

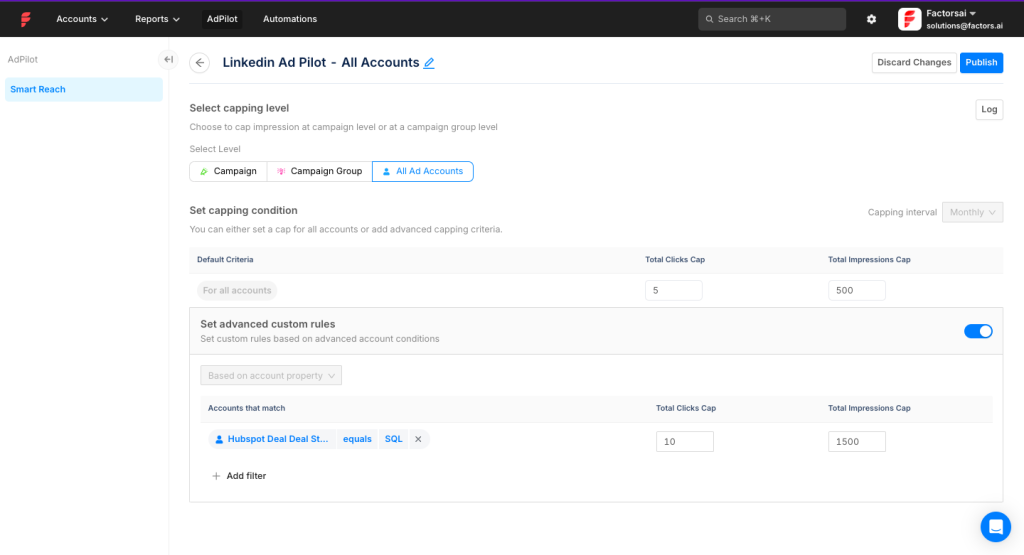

It also provides an AI-assisted LinkedIn AdPilot that helps streamline LinkedIn ABM operations.

AdPilot can auto-build audiences from Factors segments and set impression limits per account, so you avoid over-serving the same companies.

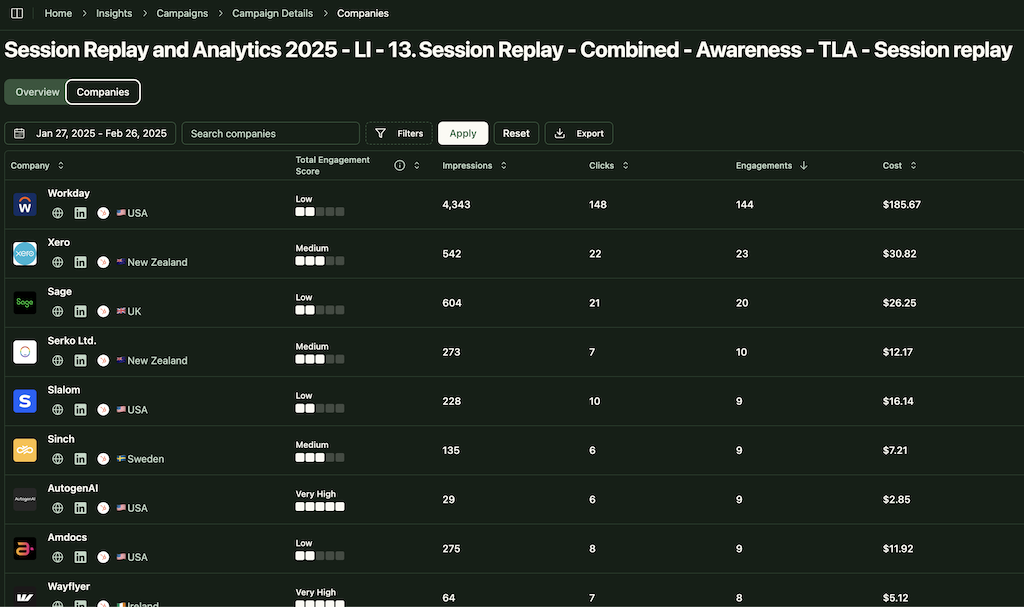

Factors.ai also captures impression-level LinkedIn data, not just clicks, enabling view-through attribution so you can credit influence without a click.

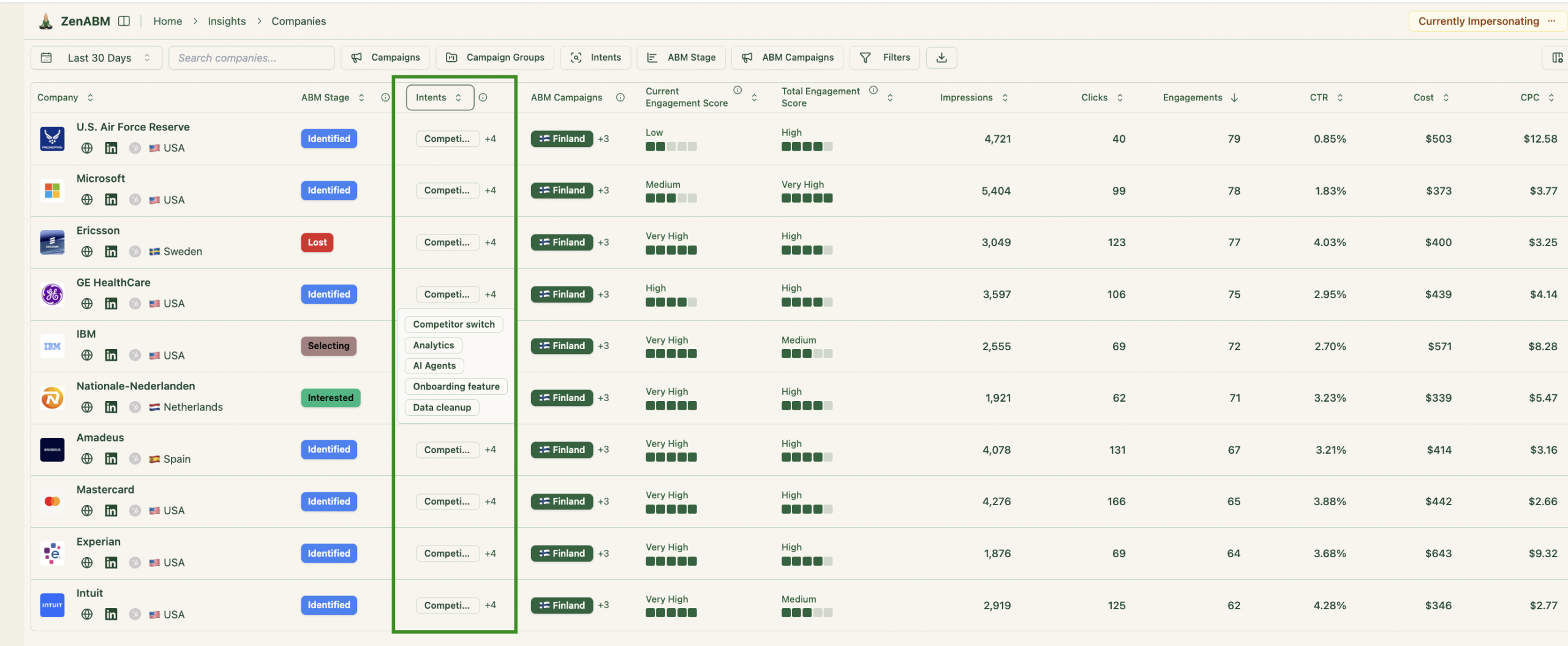

Pro Tip: Like Factors.ai, ZenABM records company-level LinkedIn engagement down to impressions, and goes further by showing which ads a given account interacted with, so you get real interests, not just raw activity.

Tag campaigns by theme or feature, and ZenABM will surface each account’s intent and sync both qualitative and quantitative insights to your CRM.

This gives BDRs immediate context on who is heating up and which topics to lead with during outreach.

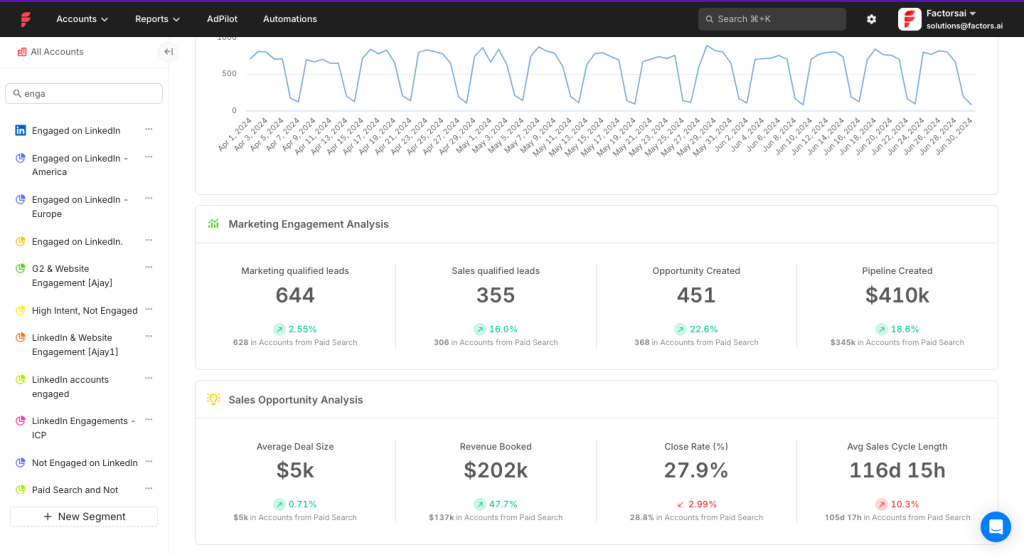

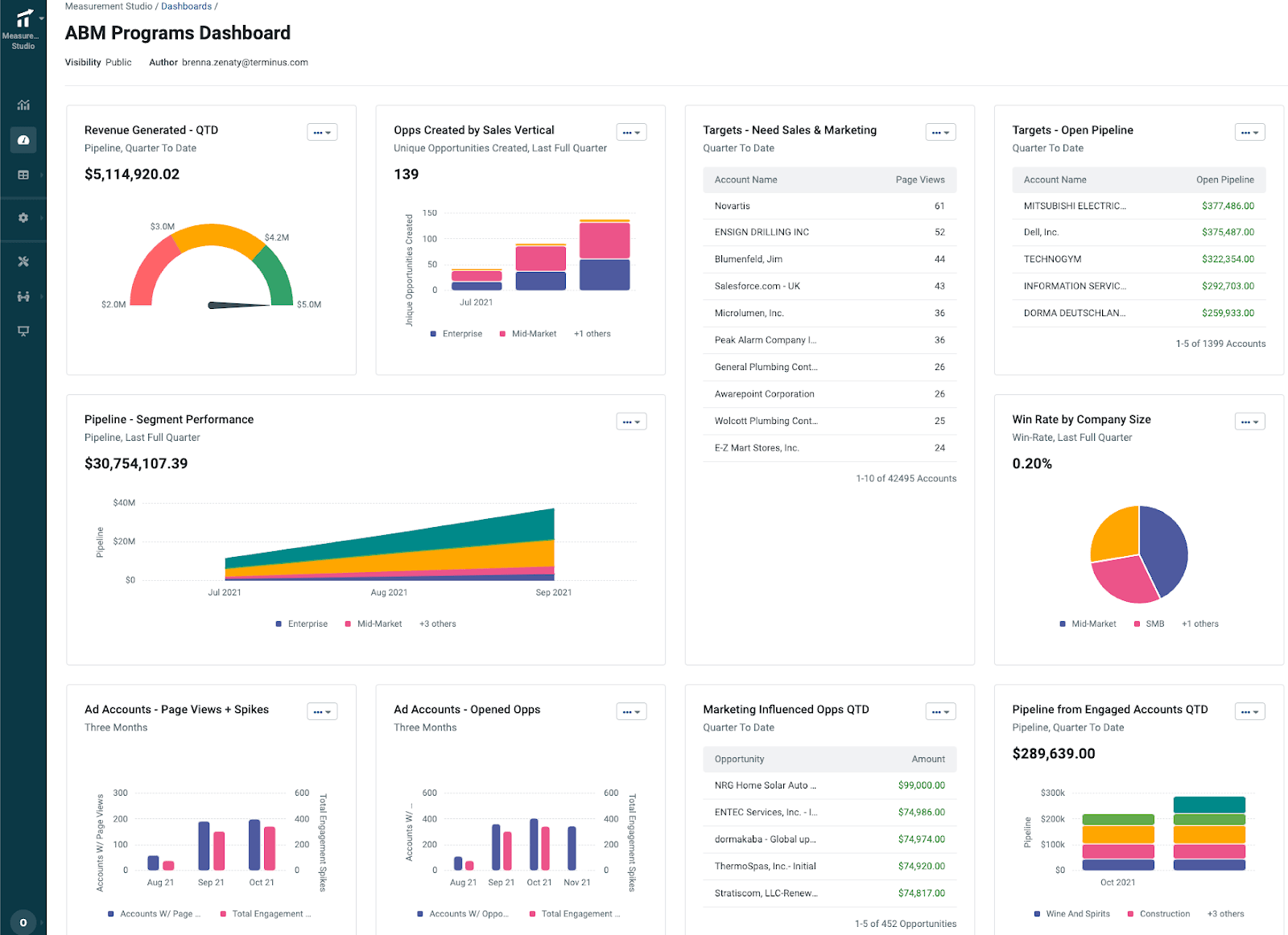

Beyond attribution, Factors.ai offers ABM analytics dashboards.

You can monitor metrics like Visits by target account, Pages per account, and Ad impressions per account to gauge engagement across the site and ads.

Higher tiers unlock prebuilt ABM dashboards showing which campaigns lift account engagement, how targets distribute by funnel stage, and which opportunities marketing influenced.

You can also build custom reports, with limits that increase by plan, for example, Basic includes roughly ten custom reports.

Some G2 reviewers note that custom reporting can feel constrained.

Other commonly mentioned friction points include:

Factors.ai follows a multi-tier approach with a free plan plus paid packages.

Exact pricing is not public. The site stresses “custom pricing built for your needs” and directs teams to book a demo for quotes.

Officially, the four tiers are:

All plans include the foundational account identification and analytics layer.

A free trial is available so you can validate outcomes before purchasing.

As a directional benchmark, Factors.ai often falls in the $10k to $25k annual band.

Terminus is often described as an end-to-end ABM platform.

It gained prominence for its breadth of features and integrations, appealing to B2B marketers who want a unified ABM “Engagement Hub” covering advertising, web, and sales touchpoints.

Let’s have a look at its key features:

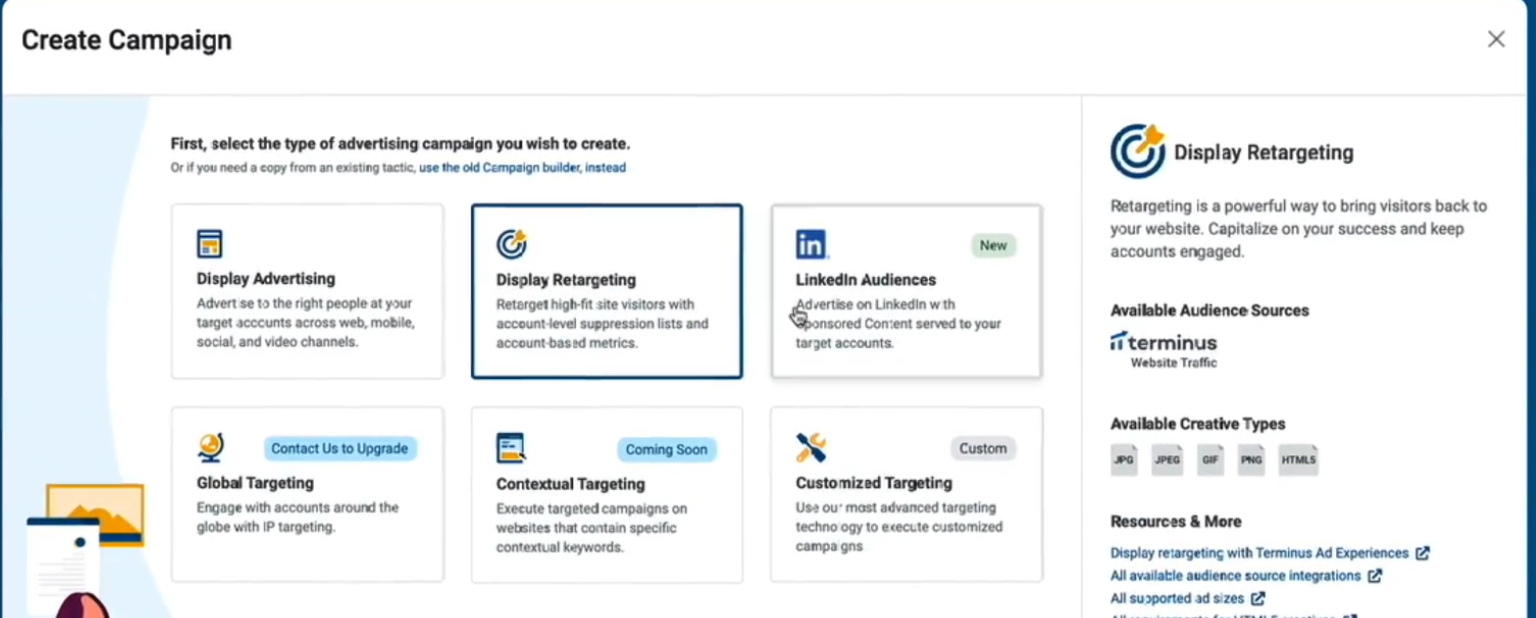

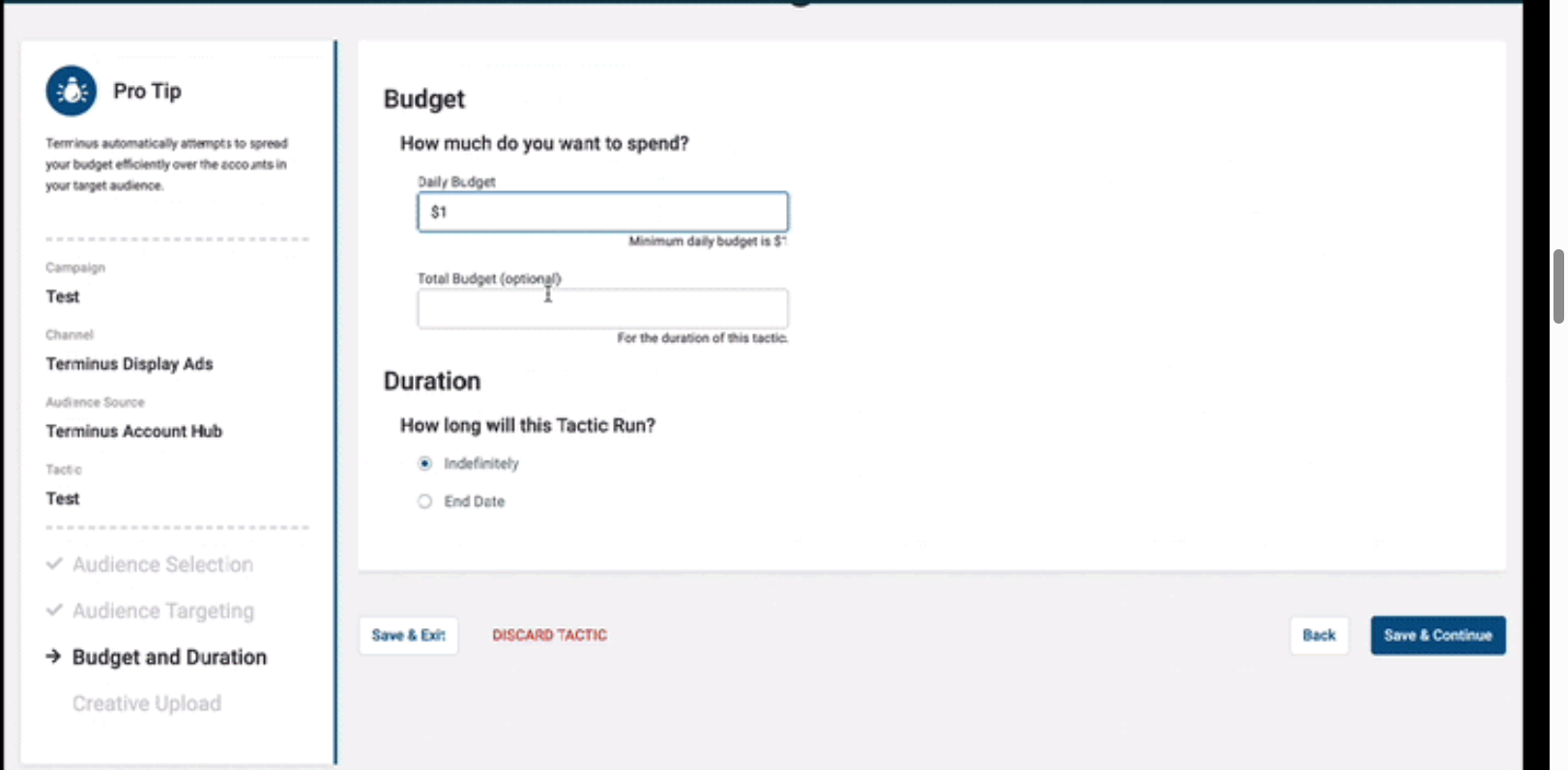

Terminus allows you to run and manage ads across a wide range of channels natively.

This includes traditional display ads (across thousands of websites via an account-based DSP), retargeting ads, LinkedIn Ads, and even newer formats like connected TV and audio ads.

By consolidating ad channels, Terminus helps you reach target accounts on the web, social (LinkedIn), and other avenues from one platform.

It also inherently balances impressions across your target account list so that no single account consumes your entire budget.

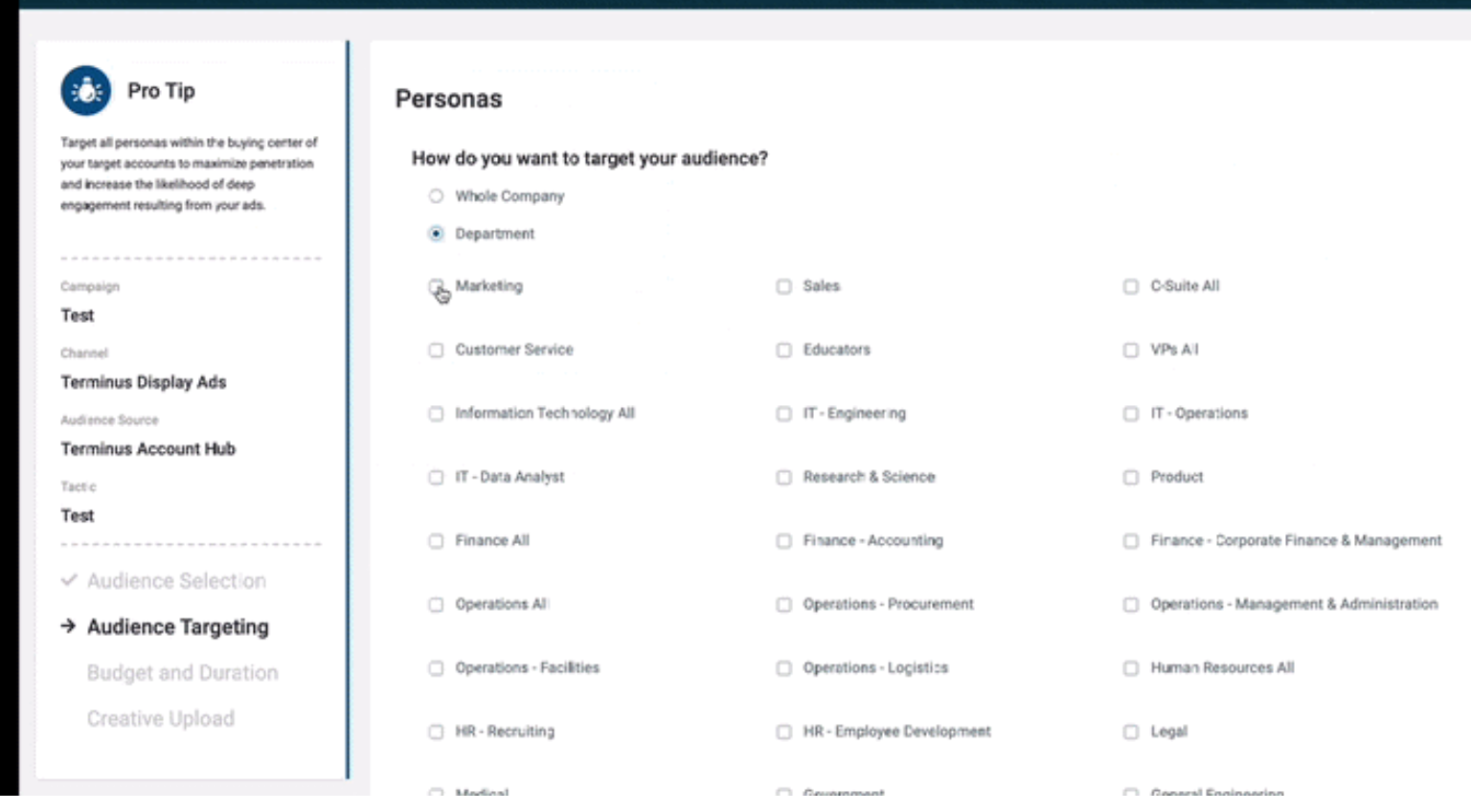

You can upload or sync target account lists (TALs) from your CRM into Terminus and refine audiences by persona attributes like department, seniority, or role.

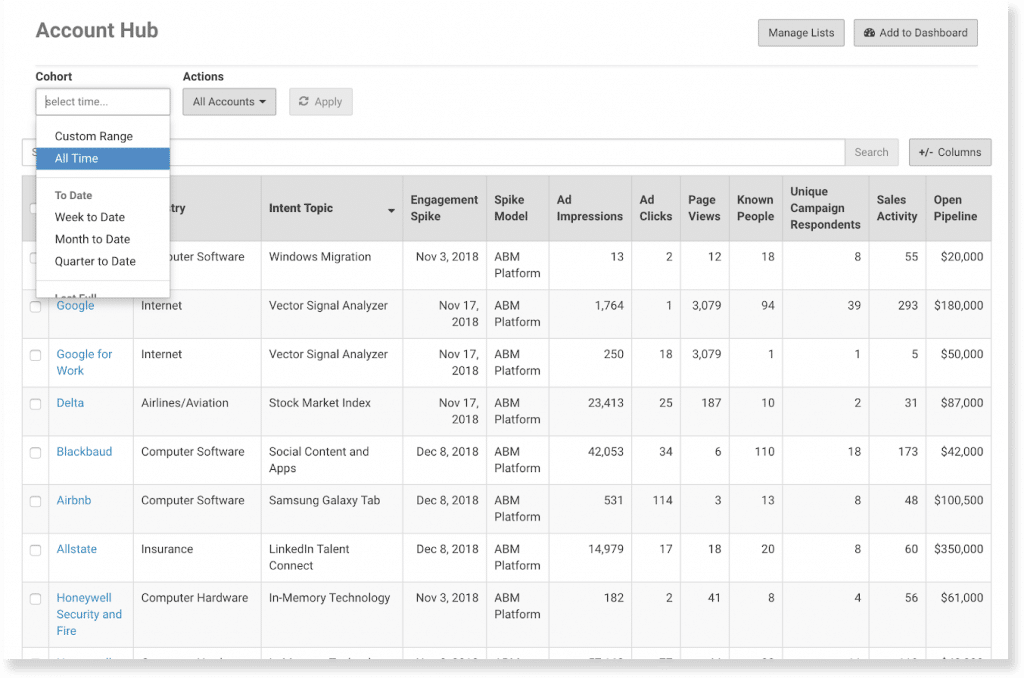

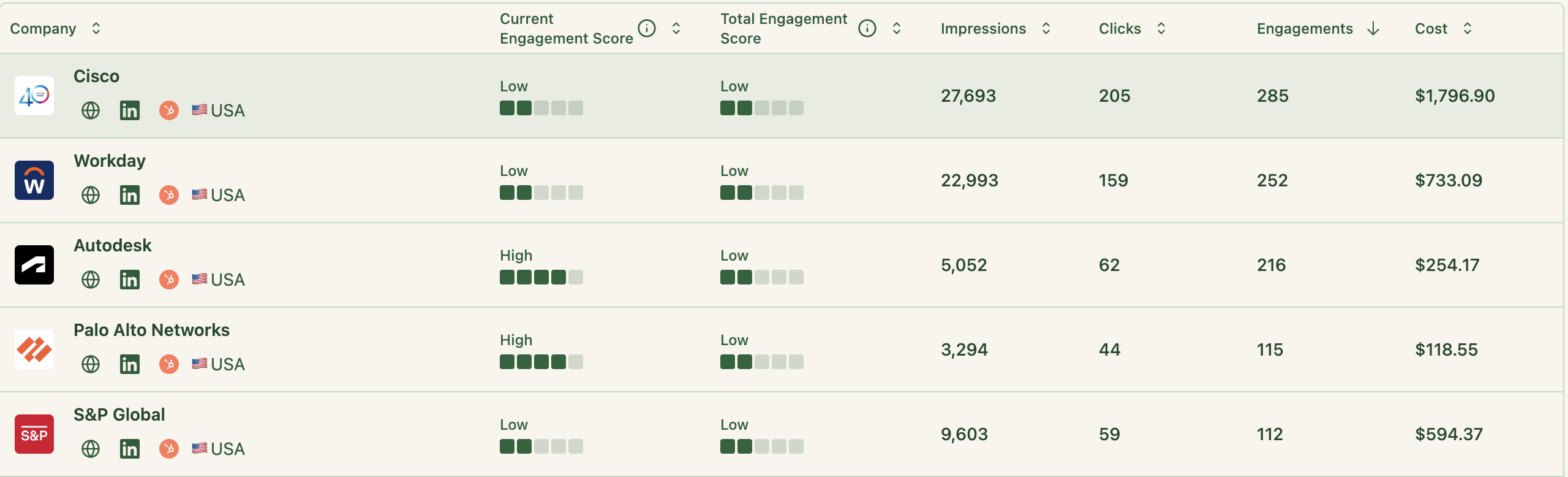

The platform tracks not just clicks but also impressions at the account level.

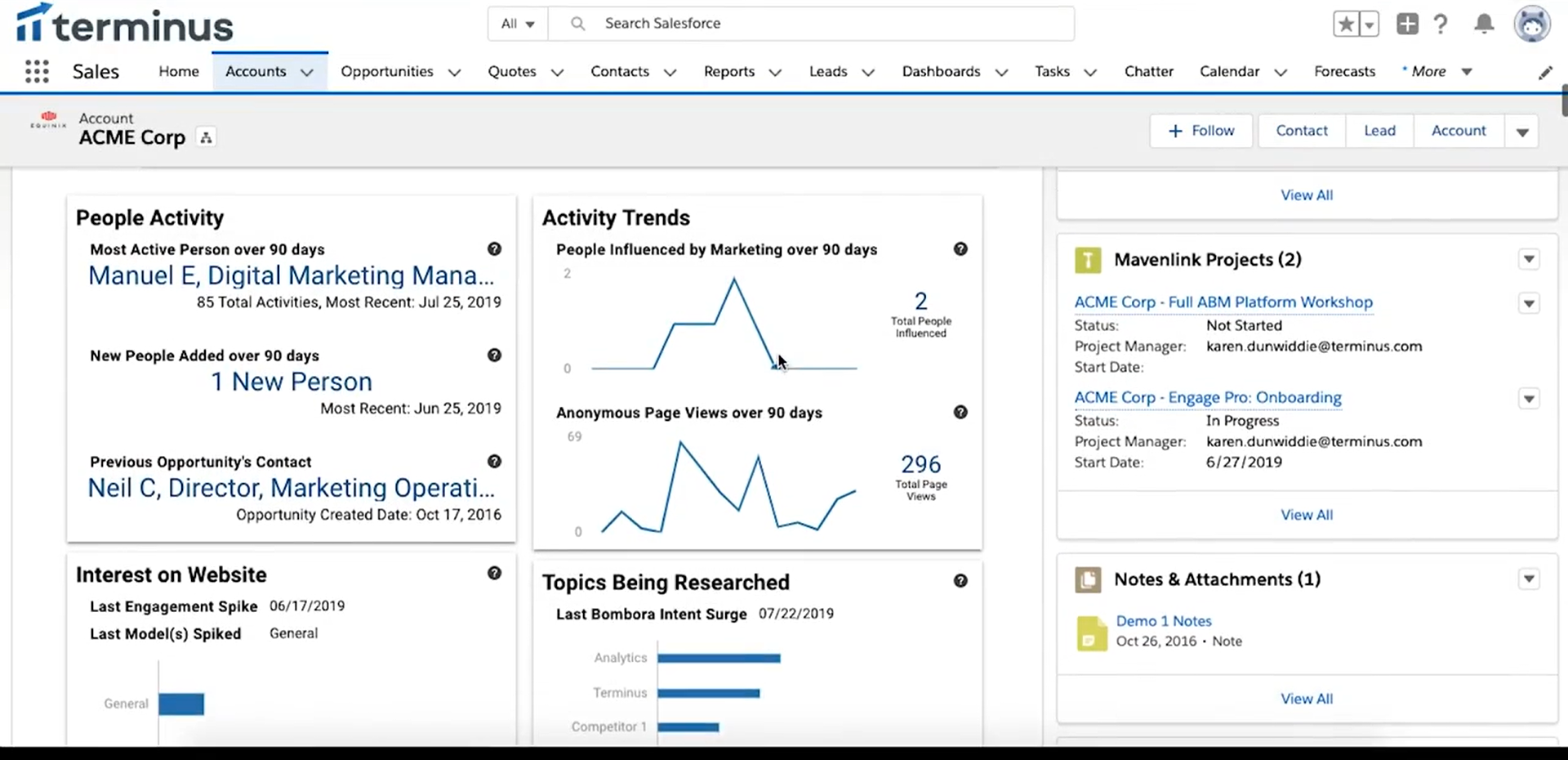

This is critical in ABM, where seeing that target account X saw an ad (even without clicking) is valuable. Terminus’s Account Hub compiles these engagement metrics for each account, showing impressions, clicks, site visits, and more tied to your campaigns.

Terminus includes a Visitor ID feature to de-anonymize website traffic.

It uses techniques like reverse IP lookup, cookies, and CRM matching to recognize which companies (and sometimes which known contacts) are visiting your site.

For instance, Terminus can drop cookies so that if an anonymous visitor later fills out a form, their past visits are attributed to that account.

It also matches known CRM leads to visits (by email domain), telling you if, say, a director from Acme Corp in your CRM visited the pricing page.

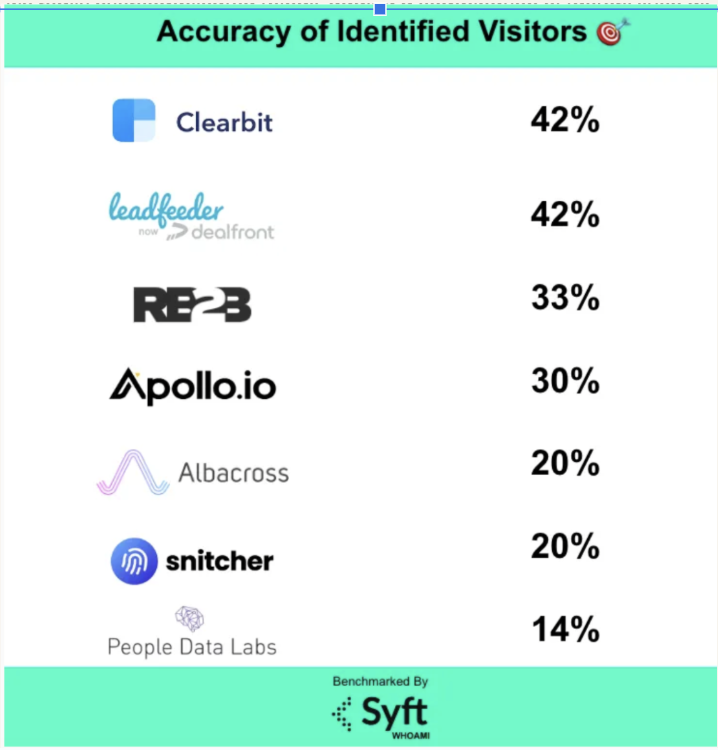

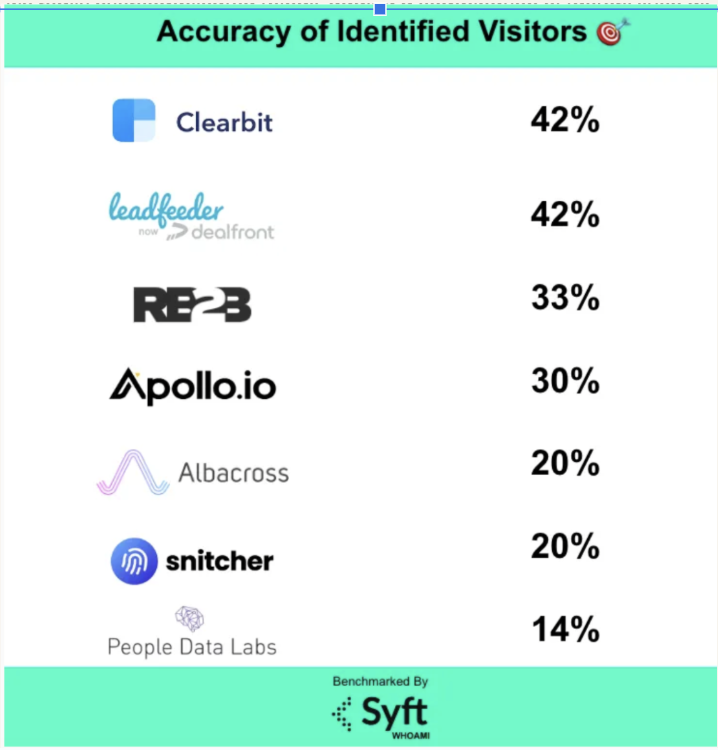

This visitor intel helps sales prioritize outreach, though it relies on third-party methods (IP, cookies) that have accuracy limits (often only ~40–50% accurate for identifying anonymous visitors, as reported by various studies, including one from Syft).

Pro Tip: ZenABM can reveal anonymous website visitors for free. Retarget them with inexpensive LinkedIn text ads, and ZenABM will identify the companies that saw your impressions.

Terminus integrates intent data from partners (e.g., Bombora) to identify in-market accounts, so you can prioritize ad spend on companies showing buying signals.

Pro Tip: Skip unreliable third-party intent surges and focus on first-party insights instead.

ZenABM captures authentic, first-party qualitative intent by tracking which LinkedIn ads a company actually engages with, offering clear, actionable buying signals.

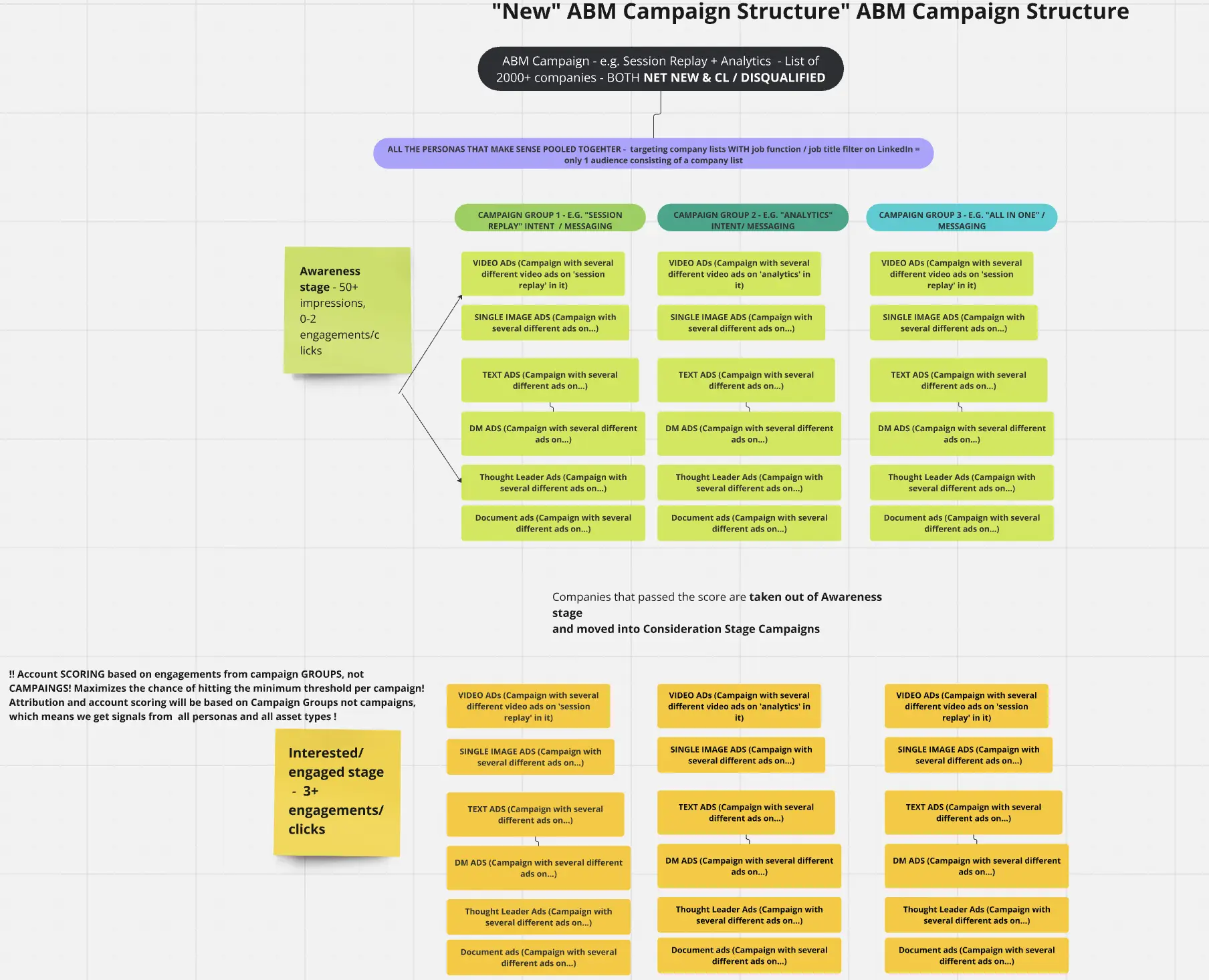

For example, the team at Userpilot (a ZenABM customer) built their ABM playbooks entirely around this method, tagging campaigns by pain points and doubling down on bottom-of-funnel ads that specific accounts were interacting with.

Their campaign structure looked like this:

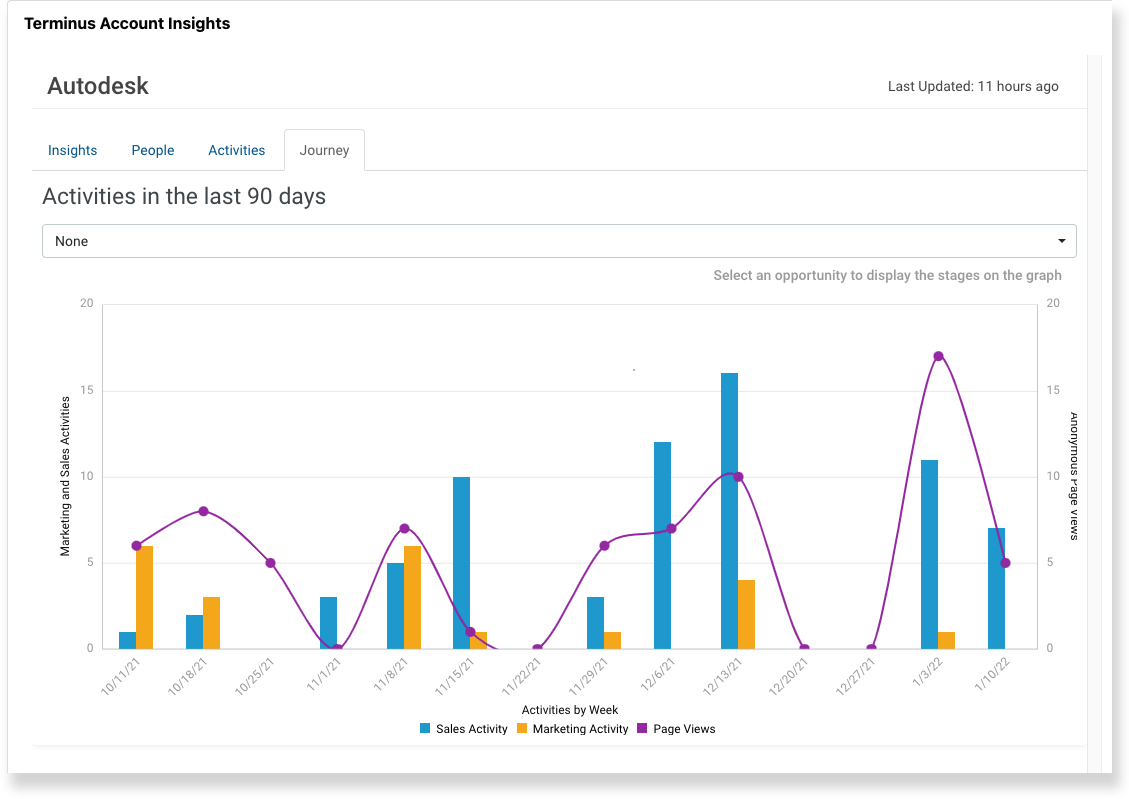

Measurement Studio in Terminus (bolstered by Terminus’s acquisition of BrightFunnel) provides multi-touch attribution across accounts.

Marketers can track how different touchpoints (ads, emails, website visits, events, etc.) influence pipeline and revenue, with support for first-touch, last-touch, and custom multi-touch models.

Importantly, all attribution is account-centric by default: activities roll up into an “Account Journey” view to see how an account progressed from engagement to pipeline to deal.

Terminus also offers out-of-the-box dashboards for ABM programs, showing metrics like revenue generated, opportunities created, pipeline influenced, top engaged accounts, and more.

Terminus integrates with many systems in the B2B marketing stack.

Out-of-the-box connectors include major CRMs (Salesforce, HubSpot, Microsoft Dynamics), marketing automation platforms (Marketo, Pardot, HubSpot Marketing Hub, Eloqua), advertising channels (LinkedIn Ads, Google Ads), sales enablement tools (Outreach, Salesloft, etc.), analytics tools (Google Analytics, Adobe Analytics, PathFactory), data providers (Bombora, G2 intent, Clearbit/DemandScience), and more.

You can explore each integration in detail in the Terminus docs.

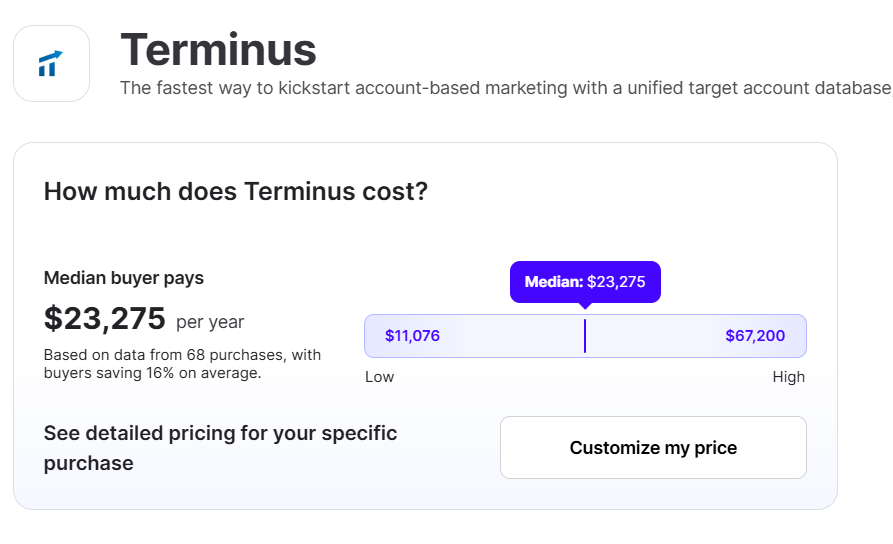

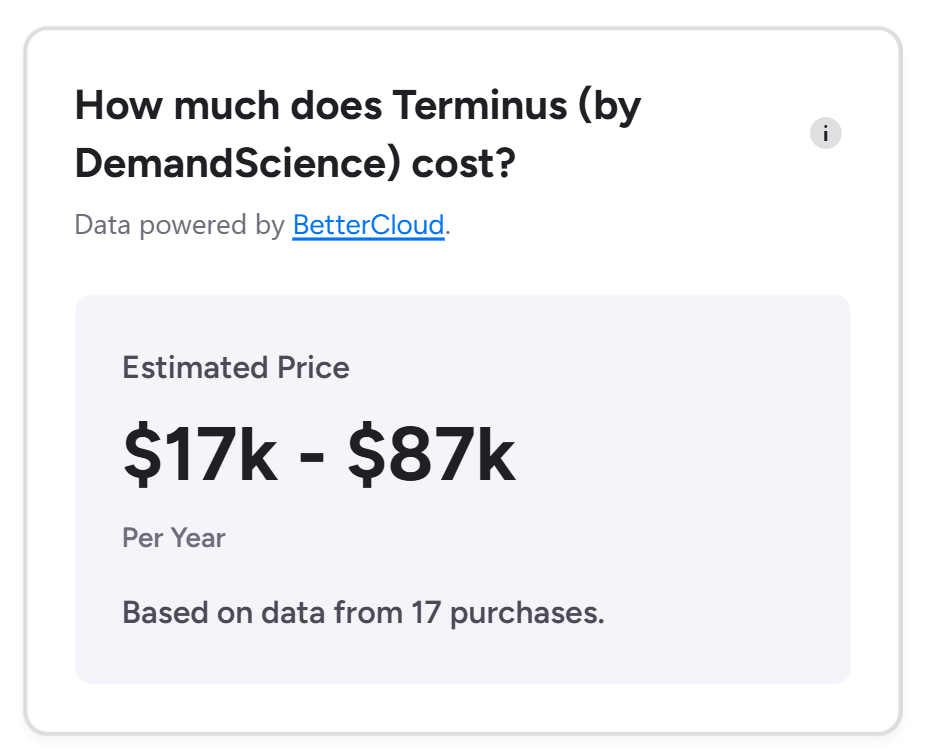

Terminus is known for its premium, custom-quoted pricing.

There are no public price tiers on their site; you need to go through sales for a quote.

Research indicates typical Terminus deals are in the mid-five figures annually, scaling up to six figures for large enterprise deployments.

Vendr, for example, says median Terminus pricing is about $23,000 per year, while large enterprises might pay $100K–250K+ annually.

CMO.com, on the other hand, claims the cost to start from $57,500 per year, with large enterprise contracts reaching $266,000, and G2 (based on 17 reviews) gives a broad range of $18-87,000.

Major differences between Factors.ai vs. Terminus that you should review:

| Category | Factors.ai | Terminus (DemandScience) |

|---|---|---|

| Positioning and scope | AI-powered demand generation and ABM analytics platform built to identify accounts, run ABM programs, and measure ROI, with AI agents that automate GTM tasks. | Now part of DemandScience, positioning a unified ABX platform that blends ABM and demand generation with multi-channel engagement across ads, chat, email signatures, web, and sales. |

| Signals and intent | Focuses on first-party and ad signals, deanonymized visits, and account journey analytics. | Tracks account-level engagement and intent, applying that context across channels, including email signature marketing targeted by recipient address. |

| Activation and channels | Centers on campaign analytics, ABM workflows, and attribution, including visibility for LinkedIn and Google programs, plus recommendations across the buyer journey. | Emphasizes coordinated engagement across advertising, chat, email signatures, website experiences, and sales, now packaged under the DemandScience brand. |

| Sales workflow depth | Pushes account insights into CRM for marketing and sales to action budgets and outreach. | Offers sales experiences and partner integrations for account-based chat and handoffs, routing conversations by account. |

| Pricing posture | Shows plan names with a Free tier and paid editions, but exact pricing is gated behind a demo. Third-party sources say it’s pricing starts at $12K/month. | Quote-based pricing. Since the November 2024 merger, packaging and contracting run under the DemandScience umbrella.

Research indicates typical Terminus deals are in the mid-five figures annually, scaling up to six figures for large enterprise deployments. Vendr, for example, says median Terminus pricing is about $23,000 per year, while large enterprises might pay $100K–250K+ annually. CMO.com, on the other hand, claims the cost to start from $57,500 per year, with large enterprise contracts reaching $266,000, and G2 (based on 17 reviews) gives a broad range of $18-87,000. |

| Complexity and time to value | Lands fast for campaign teams by clarifying ad-to-pipeline attribution and ABM analytics without requiring a full engagement suite. | Broader in scope. Delivers maximum value when multiple engagement channels are adopted, requiring higher process and ops maturity. |

Choose Factors.ai if

Choose Terminus if

ZenABM is a modern, lightweight ABM solution built for LinkedIn-based account campaigns.

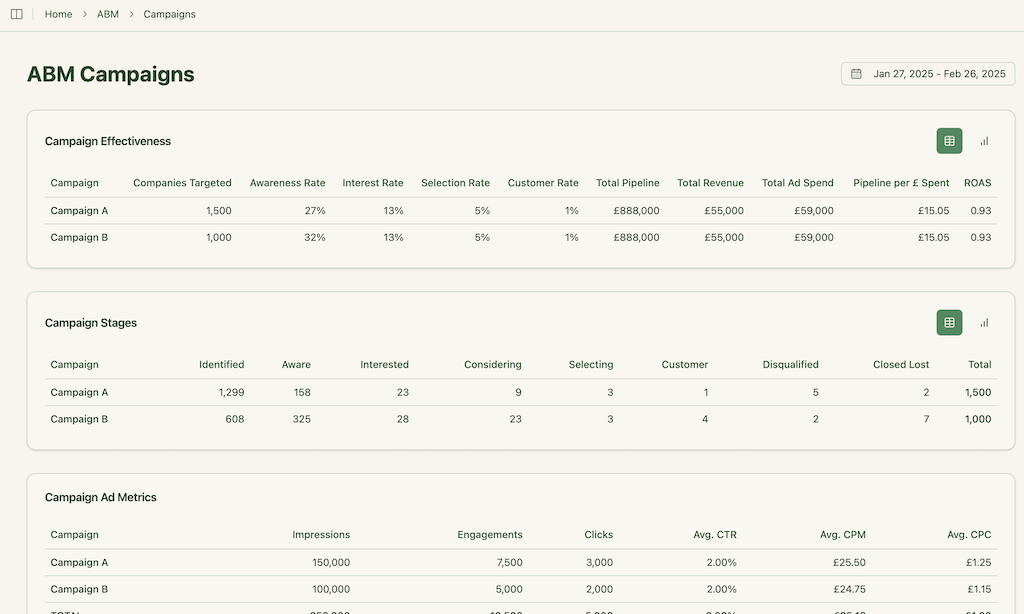

Key offerings in ZenABM include:

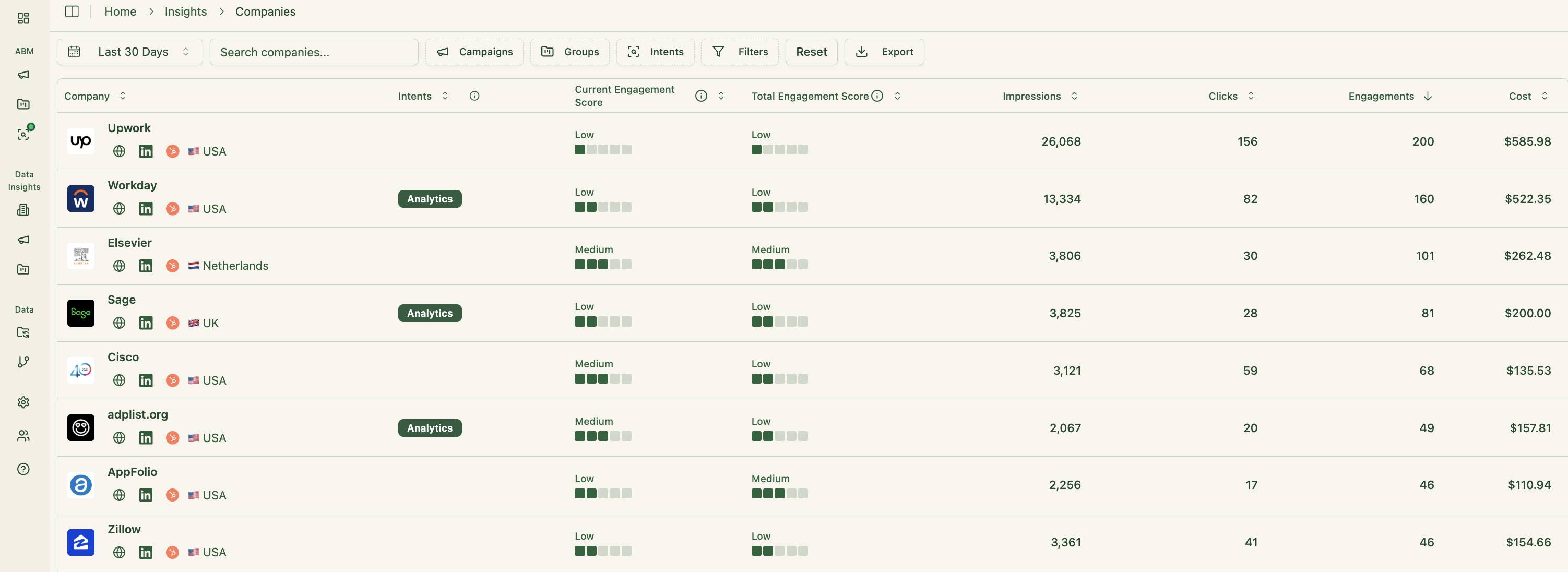

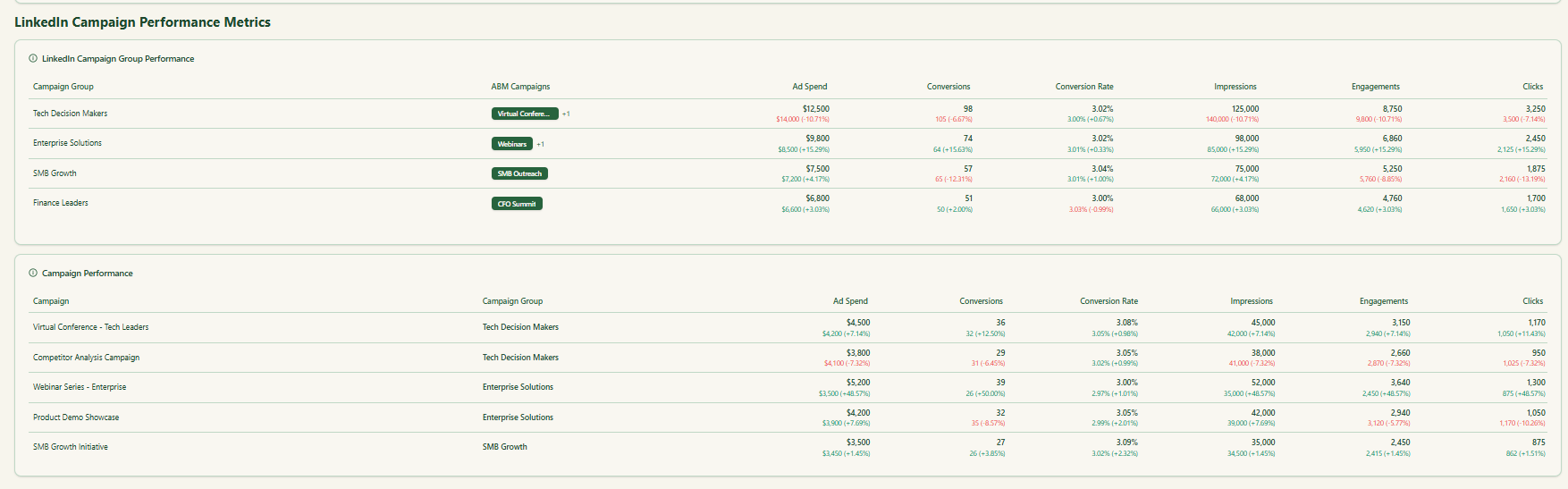

ZenABM connects directly to the LinkedIn Ads API to pull account-specific data from every campaign.

You can pinpoint exactly which target accounts are responding to your ads, including impressions and clicks, tied to company names.

Because the feed is first-party from LinkedIn, quality is high. Many legacy ABM suites still rely on probabilistic IP or cookie methods to guess visitor identity.

Those guesses are shaky. Research from Syft found IP-based identification only matches companies correctly about 42 percent of the time.

ZenABM’s first-party design yields cleaner, intent-rich signals from real ad engagement. When multiple employees from one company interact with your ads, you can be confident the account is warming.

Pro Tip: ZenABM can also help reveal anonymous visitors with no extra tooling. Retarget them with inexpensive LinkedIn text ads, and ZenABM will list the companies that were served those ads.

ZenABM refreshes engagement scores continuously from ad interactions.

Monitor recent momentum or longer trends to spot accounts heating up.

These scores help marketing and sales prioritize the right companies.

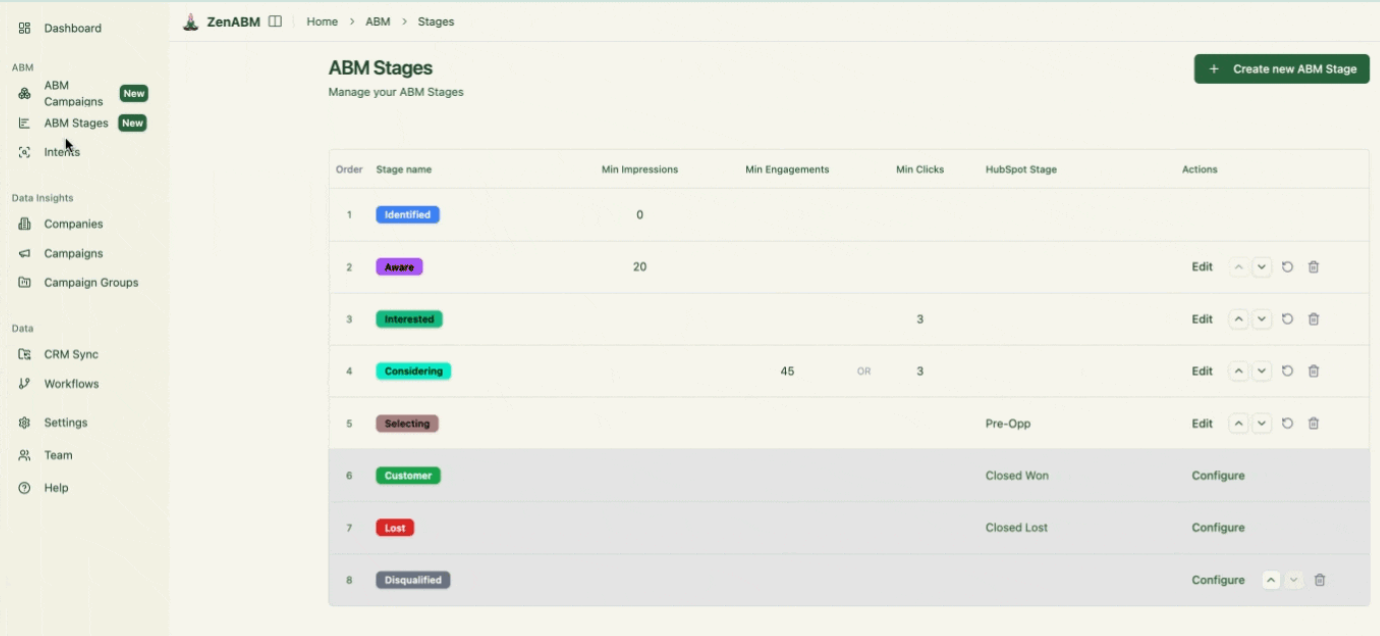

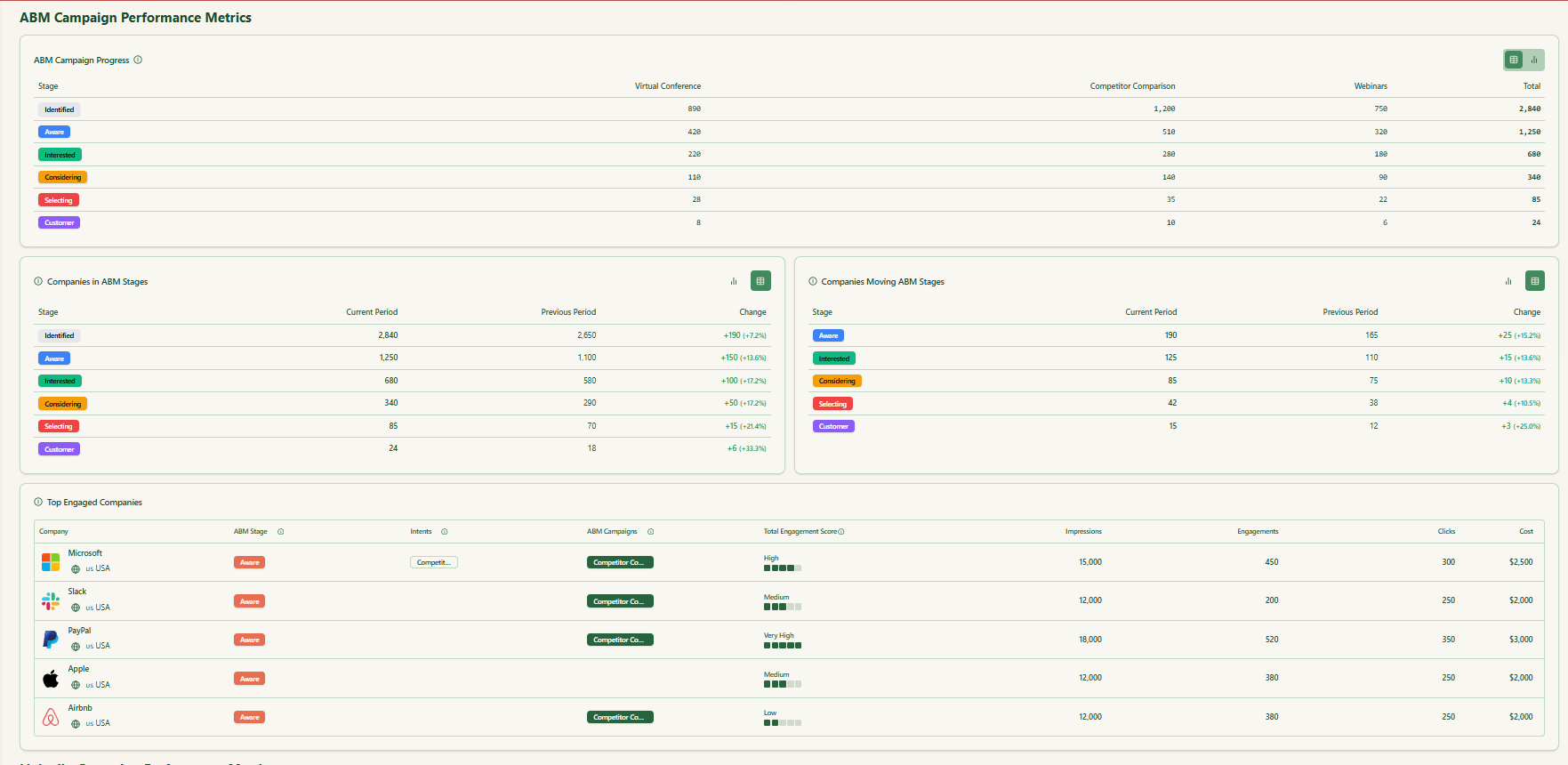

ZenABM lets you define funnel stages like Identified, Aware, Engaged, Interested, and Opportunity, then auto-classifies accounts based on engagement plus CRM data.

Thresholds are configurable, and ZenABM tracks stage movement for you.

This delivers end-to-end visibility similar to large ABM suites, so you can diagnose where accounts stall or advance.

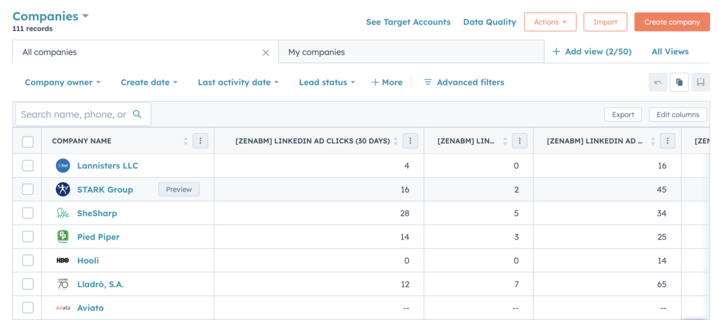

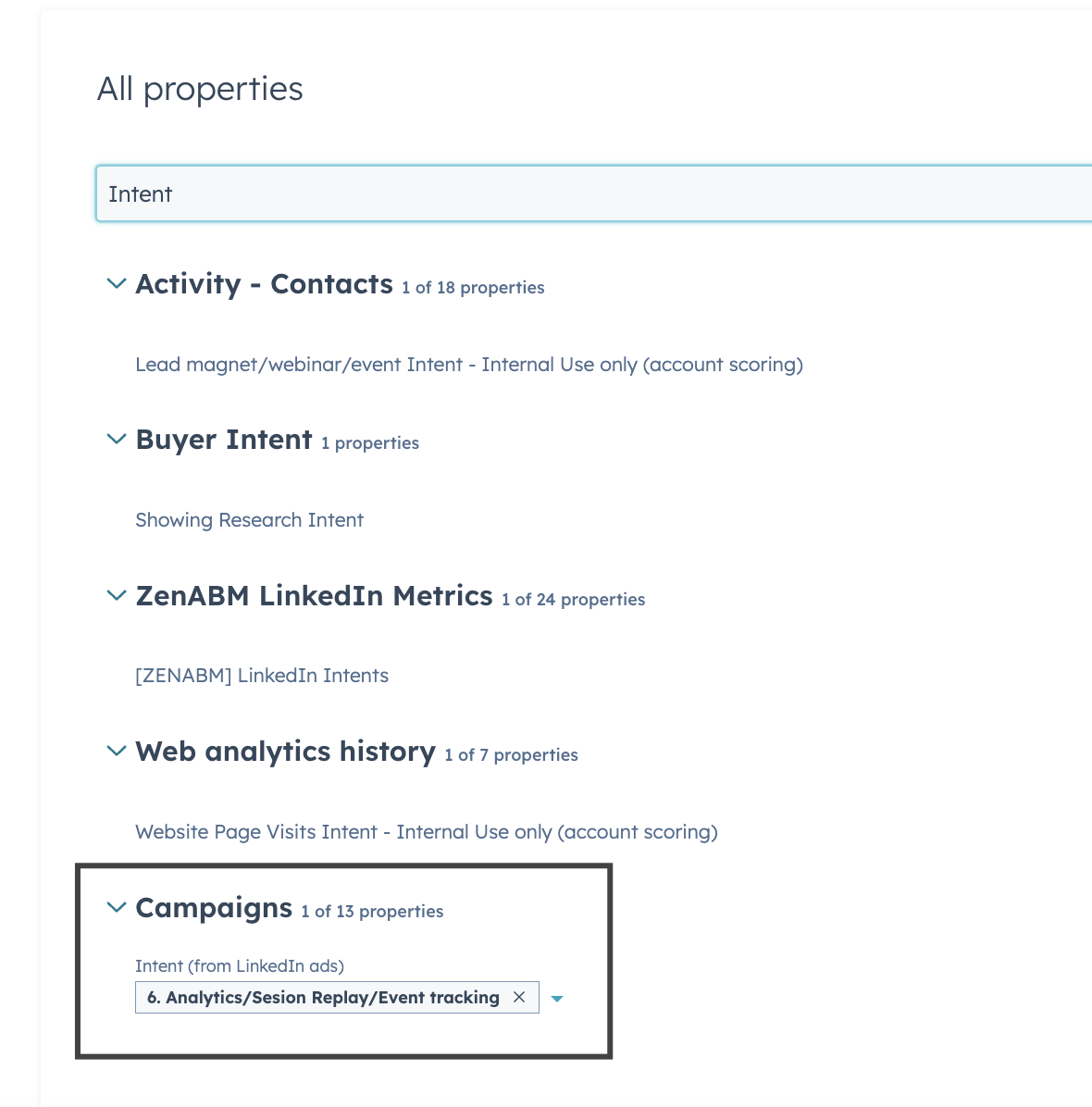

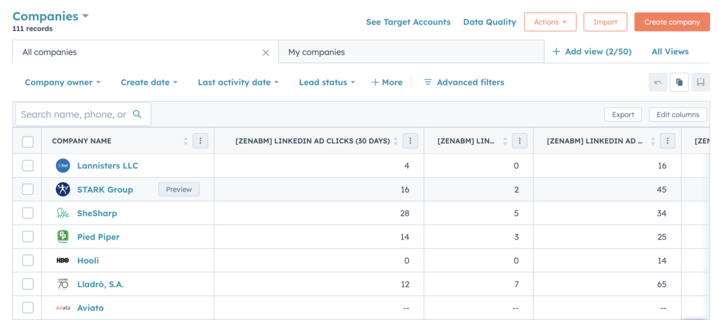

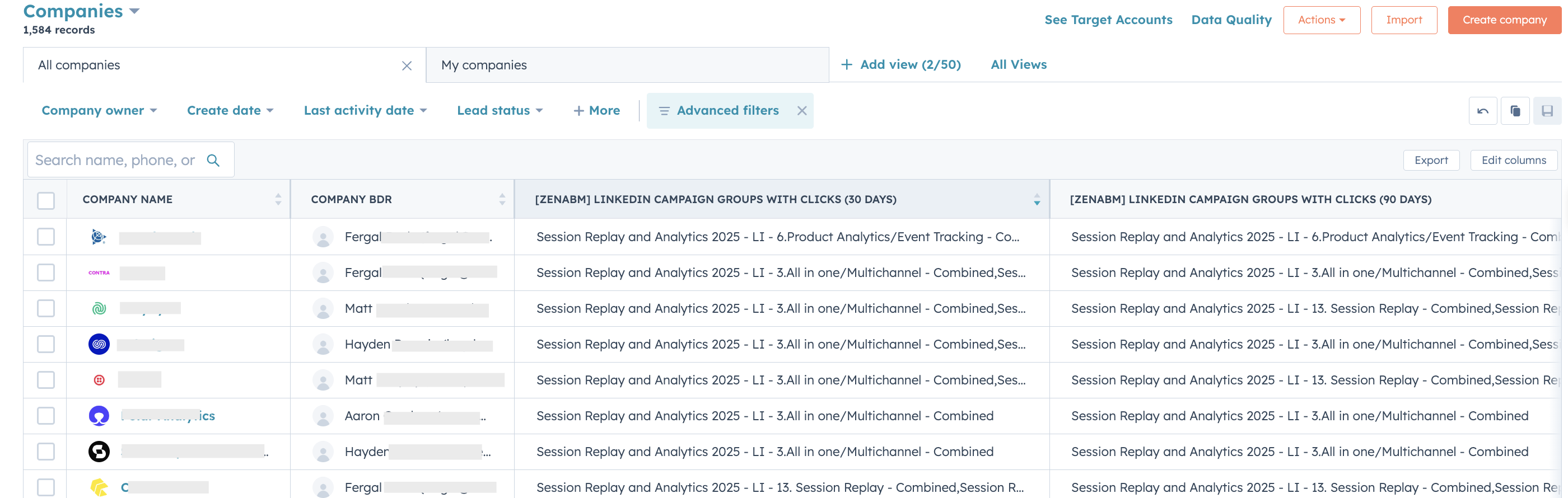

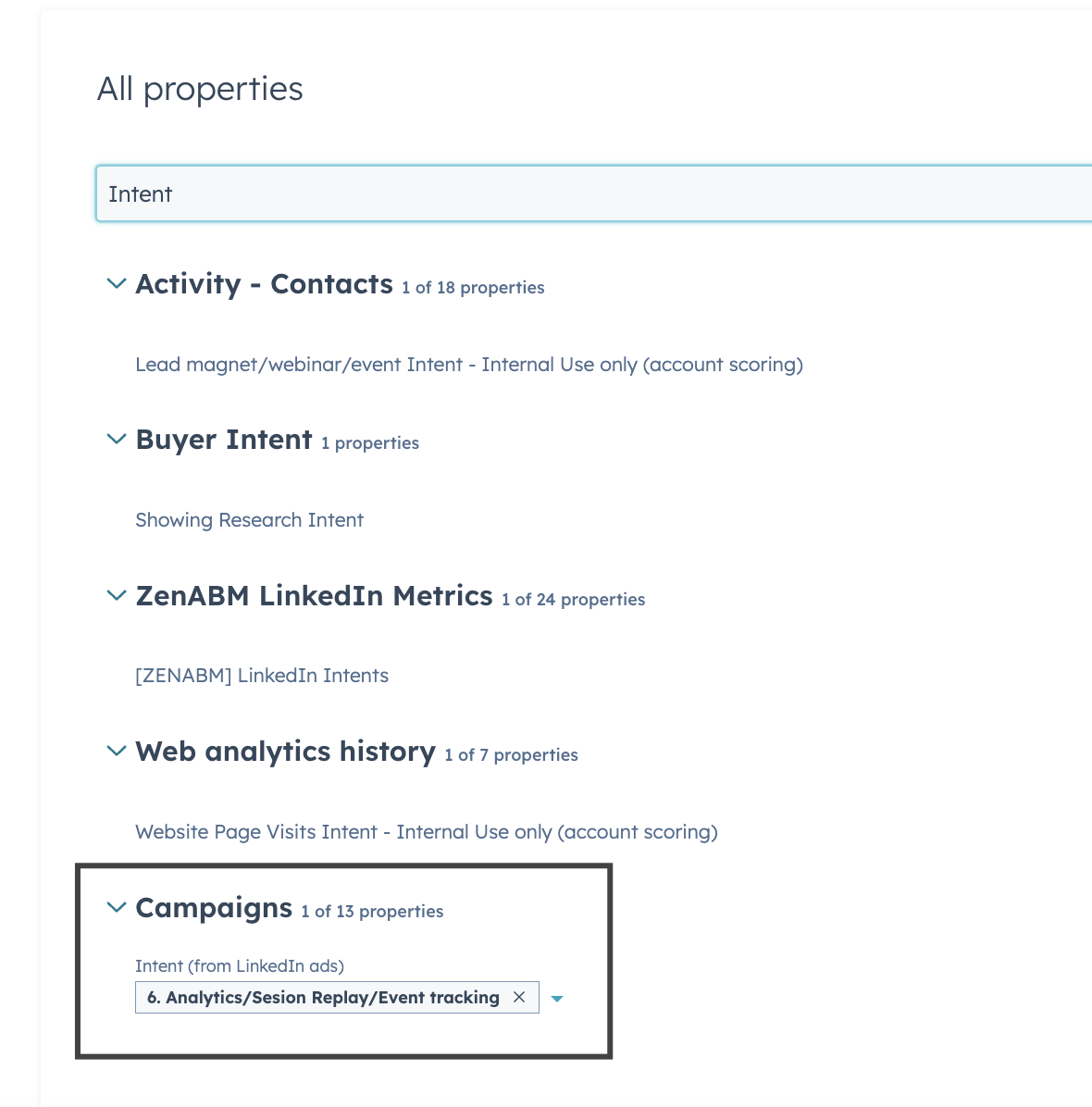

ZenABM syncs two-way with CRMs like HubSpot and supports Salesforce on higher plans.

LinkedIn engagement is written as company properties, so sales team has full context:

ZenABM can mark an account as “Interested” once thresholds are crossed and auto-assign a BDR.

ZenABM lets you tag campaigns by theme, for example Feature A vs. Feature B, then shows which accounts engage with which topics so you see priorities.

This is genuine first-party intent. Rather than pay for inferred keyword interest, you get proof that Account Z engaged with “Feature A,” a strong buy signal.

Those insights sync to your CRM for targeted messages and outreach.

Sales can immediately see which pain points and themes resonate for each account.

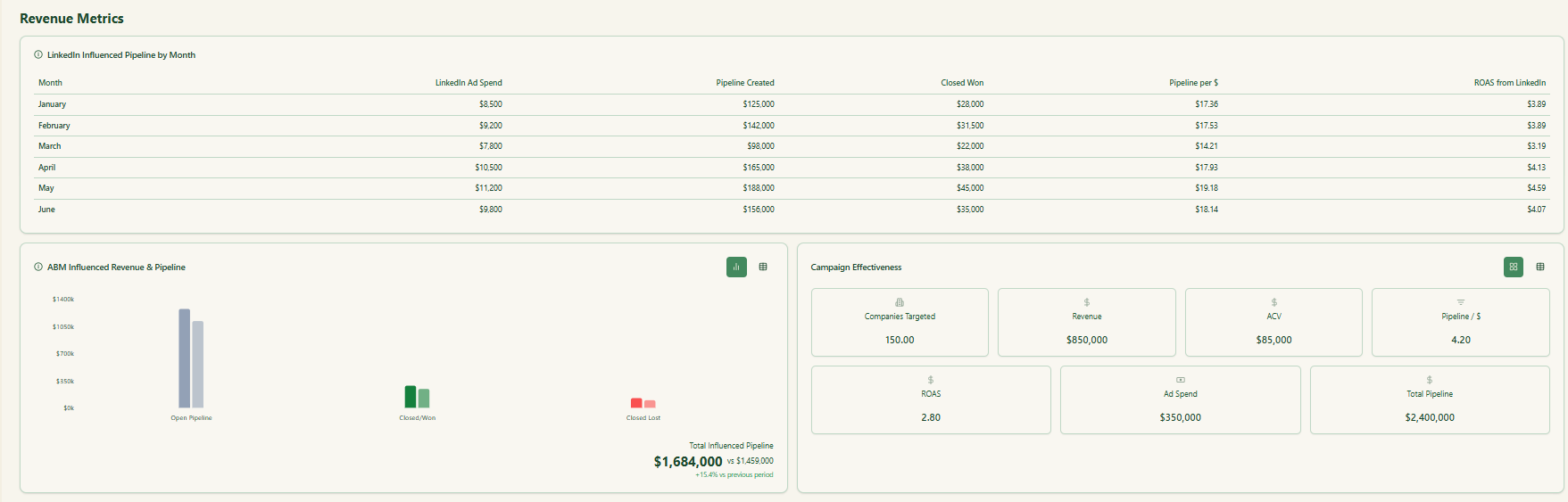

ZenABM ships with dashboards tying ad exposure, engagement, funnel stages, and pipeline.

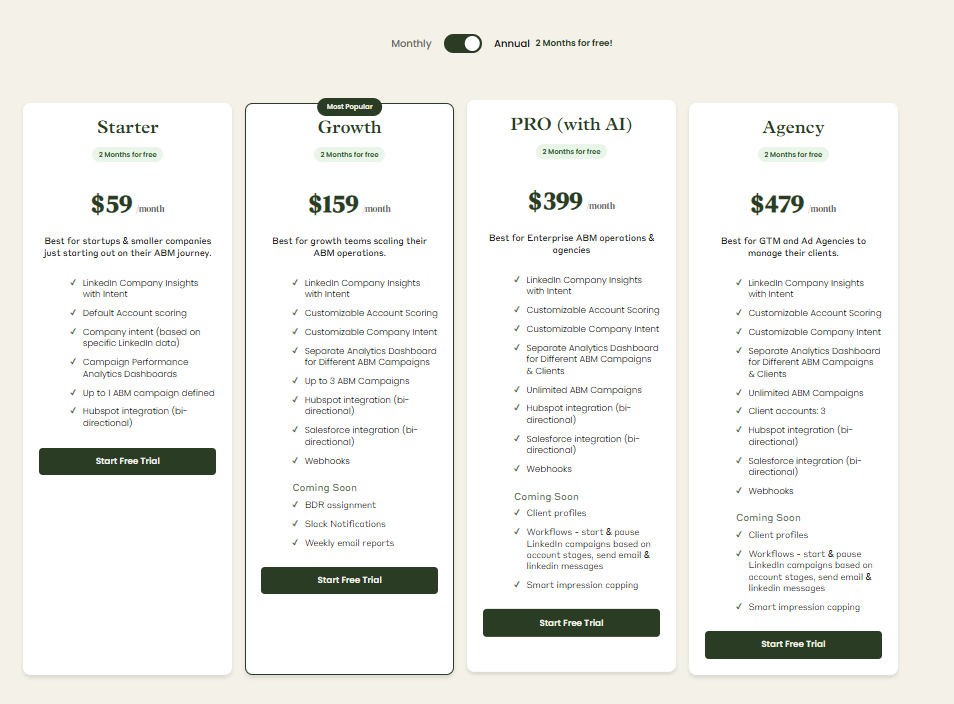

Plans begin at $59 per month for Starter, $159 for Growth, $399 for Pro (AI), and $479 for the agency plan.

Even the highest tier stays under $6,000 annually, which is far below Factors.ai or Terminus.

All plans include core LinkedIn ABM features.

Upper tiers raise limits or add Salesforce support.

Billing can be monthly or annual, with two months free, and there is a 37-day free trial so you can validate fit before buying.

Both Factors.ai and Terminus deliver strong ABM capabilities, but cater to different stages of marketing maturity.

Factors.ai shines when you need clear attribution, campaign analytics, and faster time-to-value without enterprise overhead. Terminus fits organizations ready for full-scale, multi-channel engagement and higher operational complexity.

If you want a lean, first-party, LinkedIn-native ABM system that syncs seamlessly with your CRM and shows real buying intent without inflated pricing, ZenABM bridges the gap.

It gives you the essentials of ABM intelligence, engagement, and ROI clarity, minus the enterprise cost and setup drag.