If you’re running ABM on LinkedIn, having ad reports that drill down to the company level for every single campaign is the absolute baseline.

Yet, despite juggling countless platforms, many marketers still struggle to collect this data.

In this guide, I’ll unpack why native CRM integrations, LinkedIn Campaign Manager, and even web-visitor deanonymization tools fall short and how ZenABM bridges the gaps.

Here’s why, even when combined, these traditional approaches still fall short of delivering precise company-level LinkedIn ad reporting:

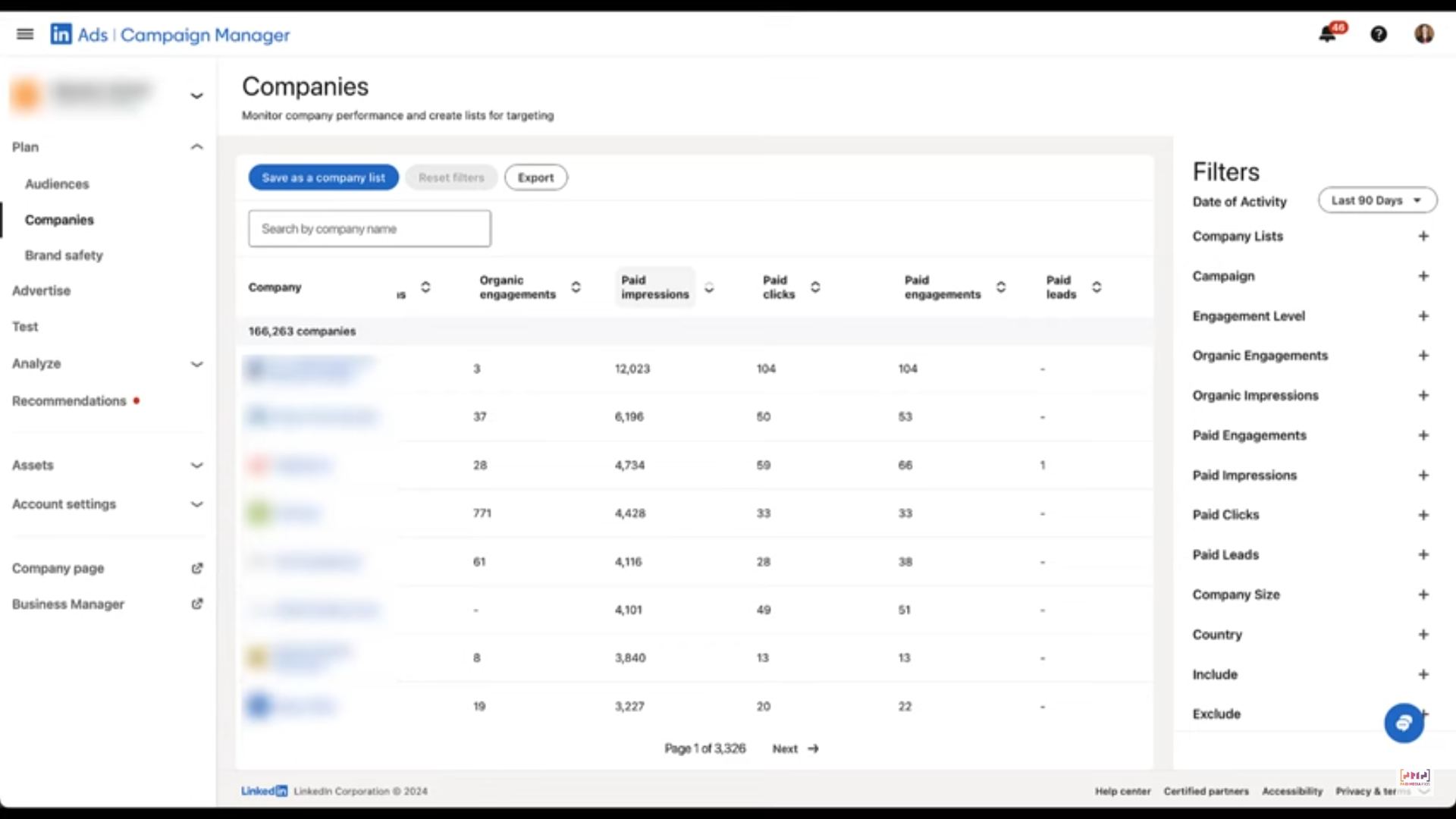

LinkedIn Campaign Manager wasn’t ABM-friendly until the ‘Companies’ tab arrived in 2024:

The tab now exposes paid clicks, impressions, engagements, and leads, plus their organic counterparts and an overall engagement score, at the company level.

Progress, yes, but still incomplete.

Although you finally see company-specific impressions and engagements, those numbers are aggregated across the entire ad account. You still can’t identify which exact ads resonated with each company.

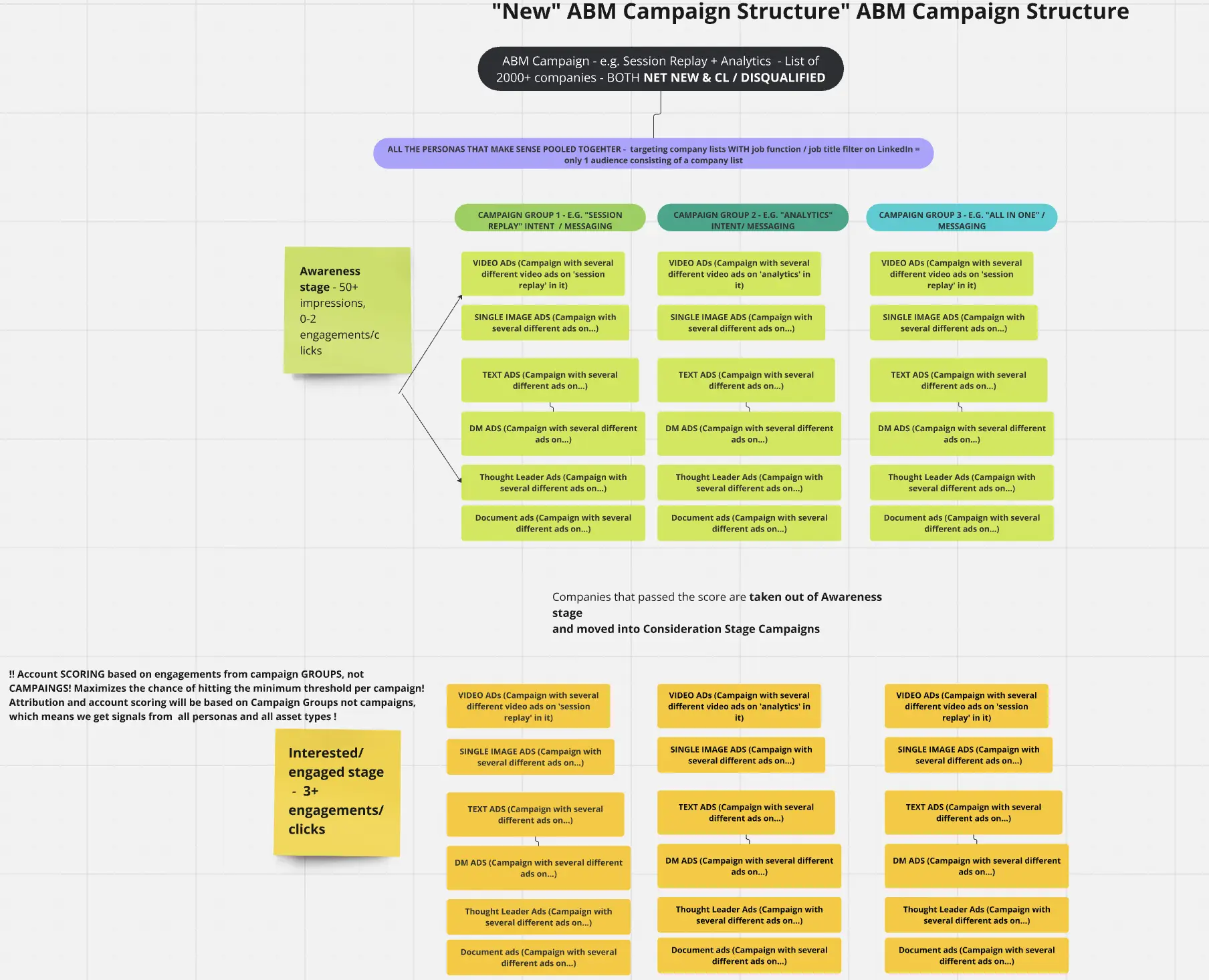

For ABM teams, that is a deal-breaker. Most run multiple initiatives simultaneously, each splitting into several campaign groups, with every group hosting multiple ad campaigns.

Those campaigns vary by:

Without campaign-level, company-specific data, you can’t map buyer intent or attribute pipeline correctly—just look at the layered structure Userpilot employs, for example:

With engagement rolled up to the ad-account level, the data is nearly useless. You need impressions, clicks, and engagement per company for every campaign, group, and overarching ABM program.

Why?

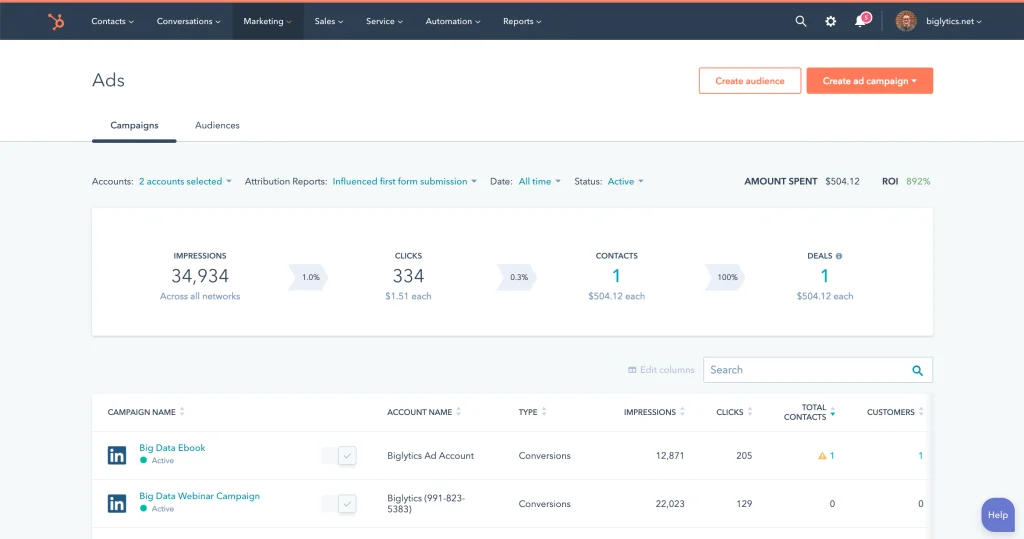

CRMs such as HubSpot can connect to your LinkedIn Ads account. For instance, the LinkedIn Ads–HubSpot integration lets you view ad-engagement metrics in HubSpot’s Ads tool:

Surprisingly, this view is even more restrictive than LinkedIn Campaign Manager.

You do see campaign-level impressions and clicks, yet there is zero visibility into the companies behind them. The firmographic detail disappears entirely.

Marketers often try one of these workarounds:

They then deploy web-visitor deanonymization software to reveal company identities.

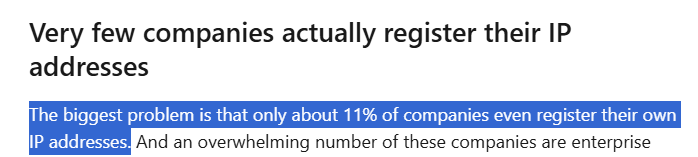

Behind the curtain, these platforms mostly rely on IP-address matching against a database—an approach that fails frequently because of:

The result? These tools correctly identify the visiting company roughly 42% of the time:

One more anecdote captures why paying for IP-matching tools rarely pays off:

“The accounts we targeted never appeared in our website analytics, even though we knew they landed on the bespoke landing pages for our ABM ads.

How do we know? We built a no-index domain solely for the campaigns, ensuring 100 % of visits came from target accounts. Over 90 days, Breeze Intelligence (using Clearbit’s API) spotted just one company… our own!”

– Emilia Korczynska, VP Marketing, Userpilot

This strategy also depends on clicks. If a company only views your ad and later arrives via organic search, the attribution is lost entirely (more on that next).

Bottom line: LinkedIn Campaign Manager aggregates by account, CRMs drop company details, and IP-matching tools are unreliable. You need a platform that shows company-level LinkedIn metrics for every campaign, group, and ABM initiative.

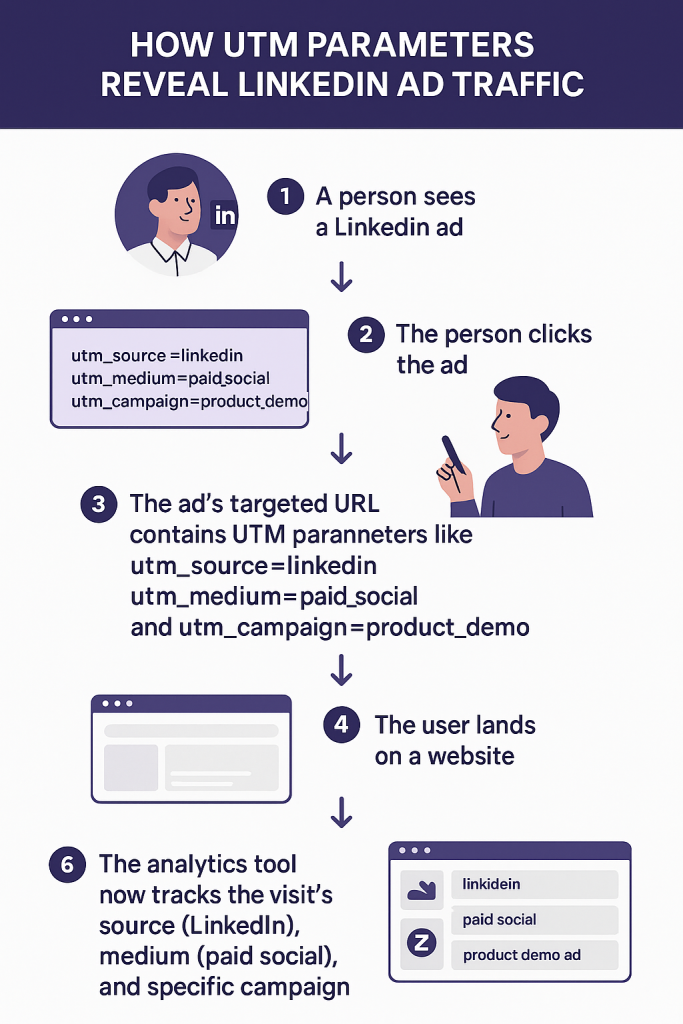

Sure, you can combine LinkedIn CAPI, the Insight Tag, or a CRM pixel with UTM parameters to catch visitors from ads—but the visibility is limited.

If someone clicks an ad but doesn’t submit a form in the same session, LinkedIn CAPI and the Insight Tag cannot reveal their company.

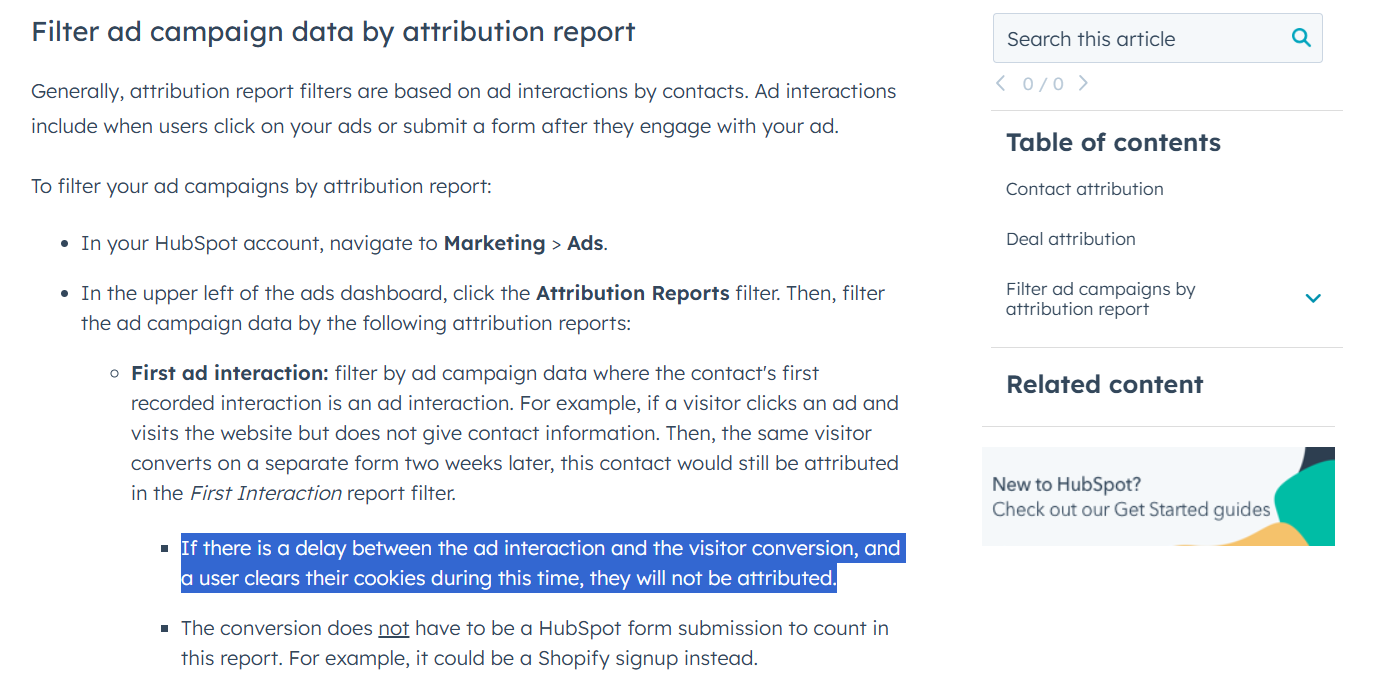

HubSpot can theoretically attribute a returning visitor to the original ad click even without a form fill, yet it relies on cookies, hardly reliable as cookies fade out.

Even if cookies behaved perfectly, two challenges remain:

Many viewers never click, later Google your brand, and arrive via another channel.

Many viewers never click, later Google your brand, and arrive via another channel.Bottom line: Even with flawless cookies and perfect form fills, you’d still miss companies that viewed your ad but converted through a different path. A click-through approach is simply inadequate on LinkedIn. View-through attribution via company-level impression and engagement reporting is mandatory for effective ABM.

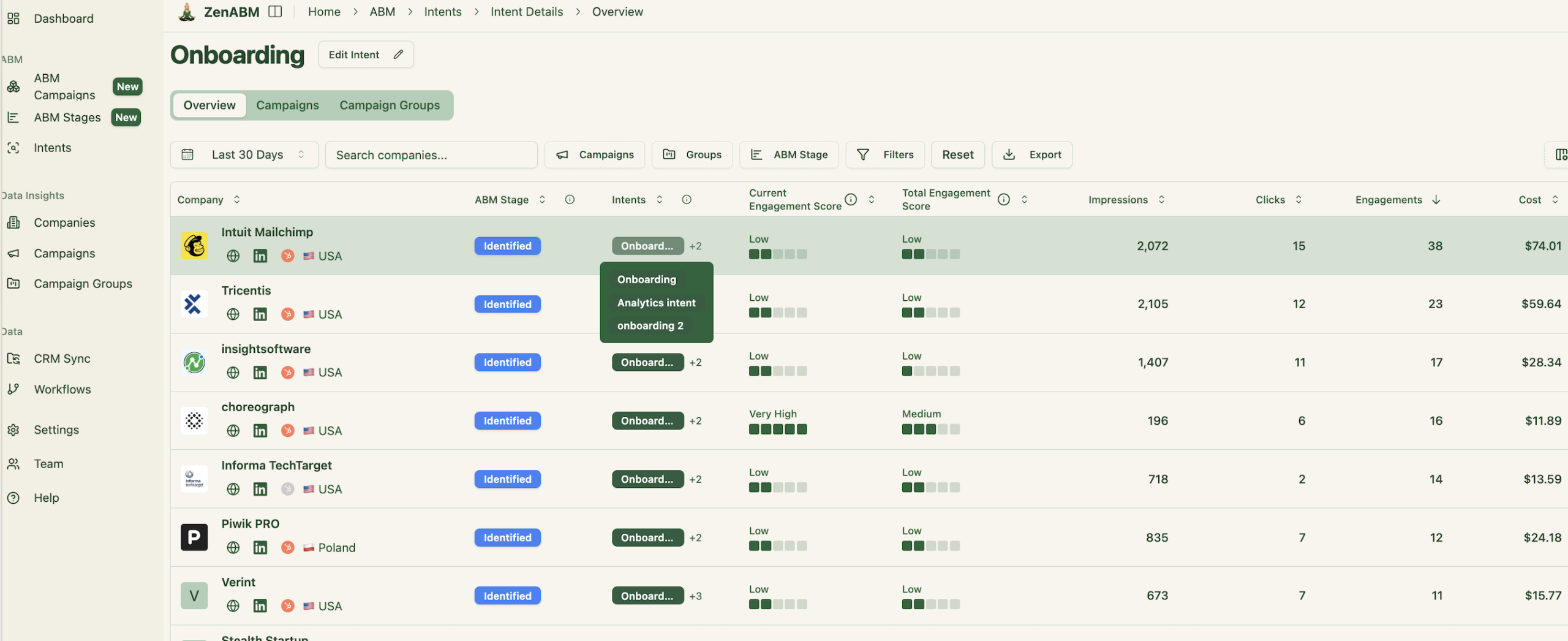

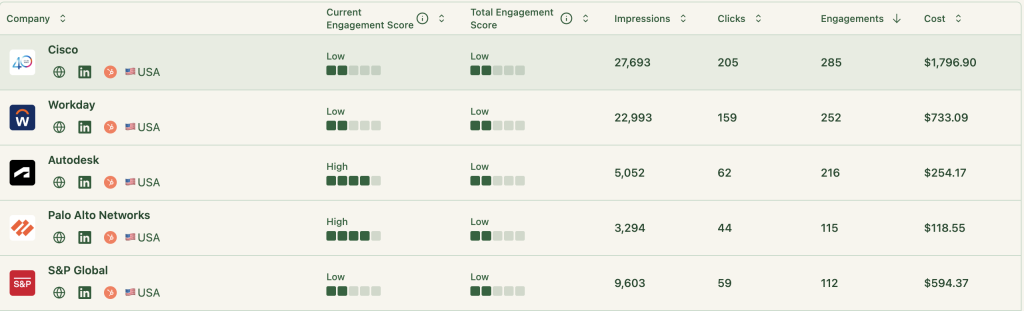

ZenABM pulls first-party data straight from the LinkedIn Ads API, breaking it down by company and revealing impressions, clicks, CTR, spend, and total engagements for each campaign and campaign group.

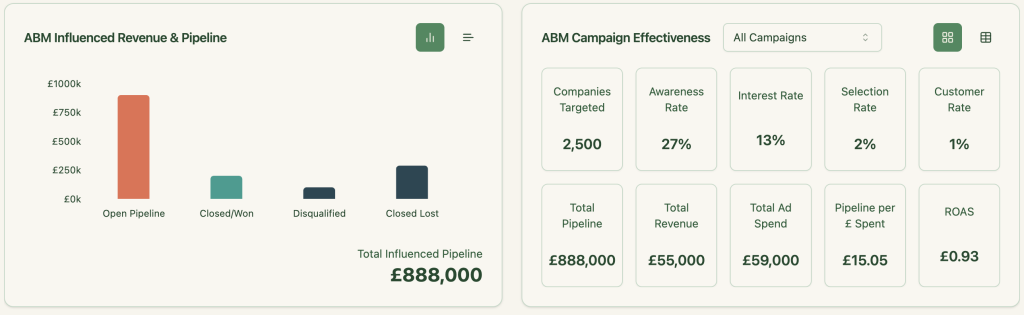

Connect ZenABM to HubSpot or Salesforce and it instantly maps ad-engaged companies to your deals, pulls deal values, and surfaces a complete ABM scorecard:

Core metrics ZenABM calculates:

Tag each campaign or group with its underlying intent (feature, use-case, pain-point). ZenABM clusters engaged companies by that intent so BDRs can speak to what prospects actually care about.

ZenABM assigns every company to an ABM stage—Awareness, Interest, Selection, Customer—using ad signals plus CRM activity, and lets you fine-tune the thresholds.

Two score types keep teams informed:

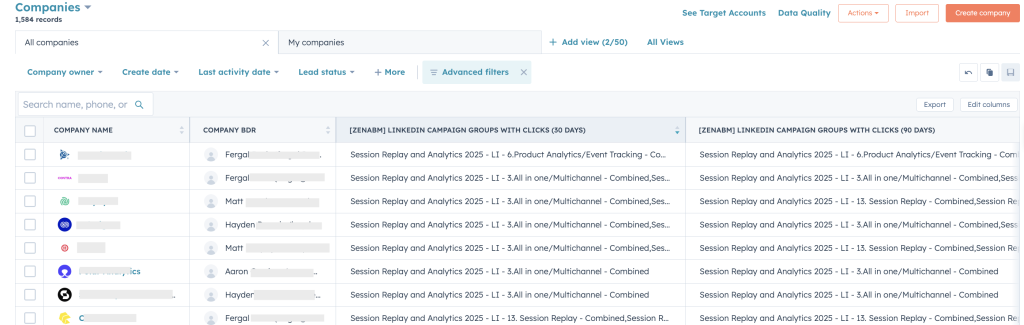

Impressions, clicks, intent, stage, and scores—all fields sync back to HubSpot or Salesforce as company properties. ZenABM even assigns a BDR once an account passes the engagement threshold.

LinkedIn Campaign Manager lumps data together; CRMs omit firm-level detail.

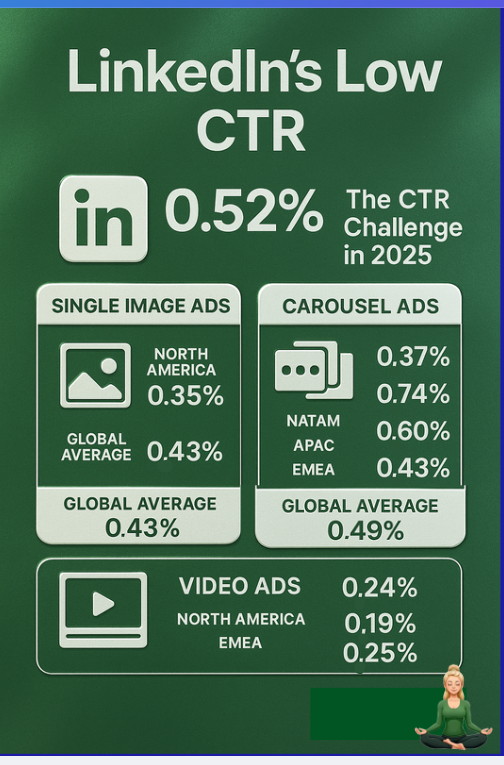

Relying solely on click-through approaches such as CAPI, the Insight Tag, or CRM pixels blinds you to companies that view ads without clicking.

True ABM success depends on knowing exactly which companies engaged with which ads, and what that means for outreach, scoring, and revenue.

ZenABM supplies company-level insights for each campaign, automatic BDR assignment, real-time scoring, intent tagging, and a frictionless CRM sync.