©2026 ZenABM - All Rights Reserved.

![7 Great ABM Marketing Tools [2026]](/_next/image?url=https%3A%2F%2Fwp.zenabm.com%2Fwp-content%2Fuploads%2F2026%2F02%2F7-Great-ABM-Marketing-Tools.jpg&w=3840&q=75)

Choosing ABM marketing tools can feel tougher than running ABM itself.

Plenty of marketers admit they jumped into shiny platforms without a clear needs map, ending up with either bloated overkill or a tool that falls short.

So, I wrote this breakdown to fix that: a head-to-head of the 7 great ABM marketing tools, with fit by business size (enterprise, mid-market, SMB).

Read on to find your match

| ABM Tool | LinkedIn Ads Integration | Direct API Integration | Real-Time Engagement | Multi-Channel Ads | Intent Data (3rd-party) | CRM Integration | AI Predictive Analytics | Community/Organic Tracking | Pricing (Entry-level) | Best for |

|---|---|---|---|---|---|---|---|---|---|---|

| Demandbase One | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | High | Enterprise ABM |

| ZenABM | ✅ | ✅ | ✅ | ❌ | ❌ | ✅ | ❌ | ❌ | Low | LinkedIn-centric ABM |

| 6sense | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | High | AI-driven ABM |

| Terminus | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | ❌ | ❌ | High | Sales & Marketing alignment |

| RollWorks | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | Medium | Ad-focused ABM |

| Common Room | ❌ | ❌ | ✅ | ❌ | ❌ | ✅ | ✅ | ✅ | Medium | Community-led ABM |

| Factors.ai | ✅ | ❌ | ✅ | ❌ | ✅ | ✅ | ✅ | ❌ | Flexible | Analytics-focused ABM |

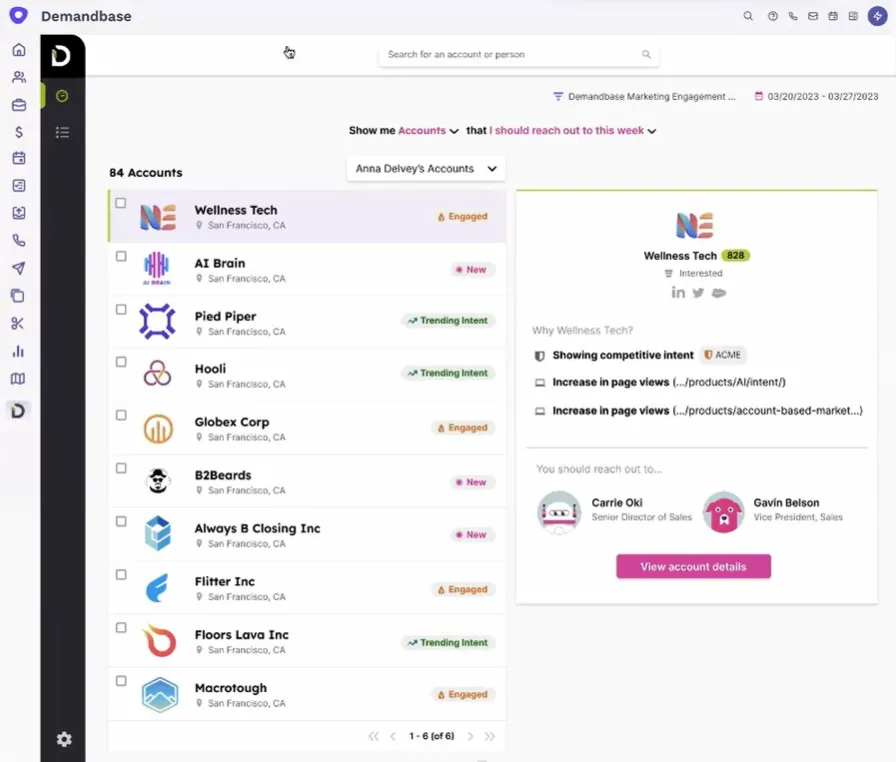

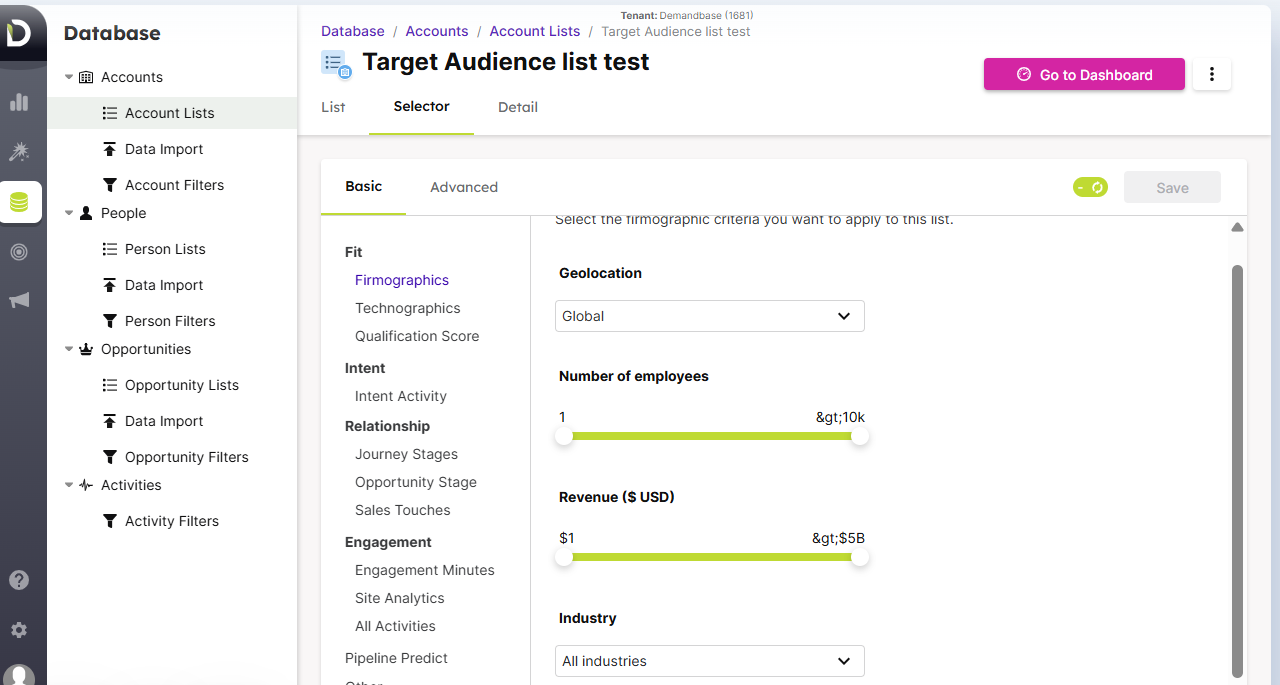

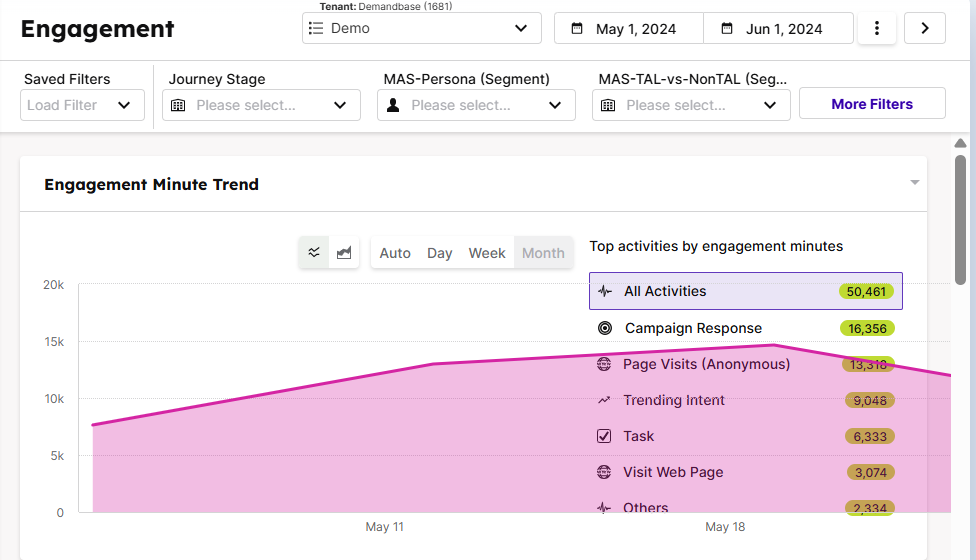

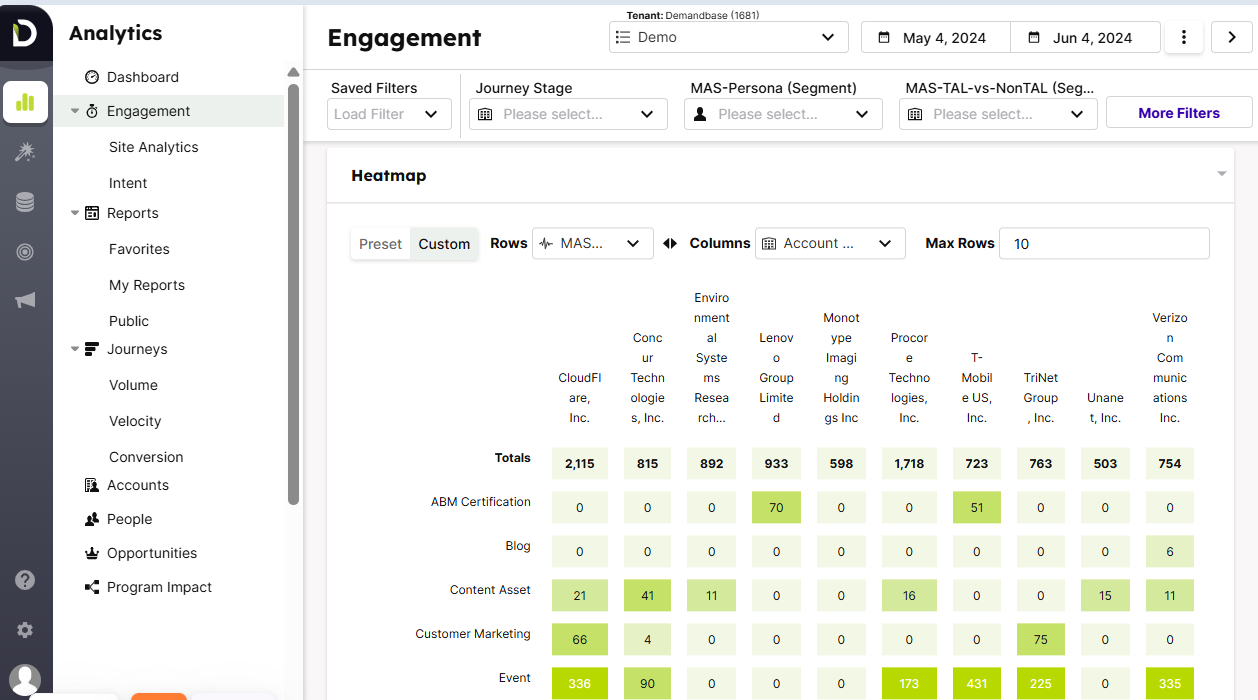

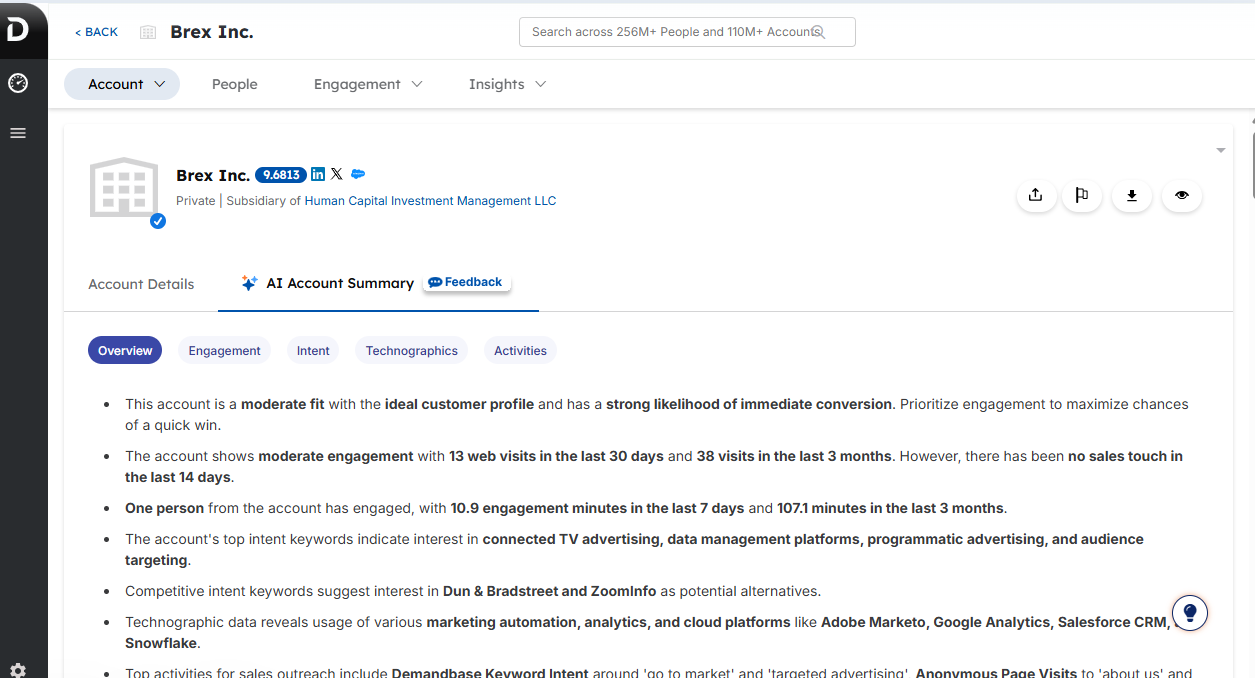

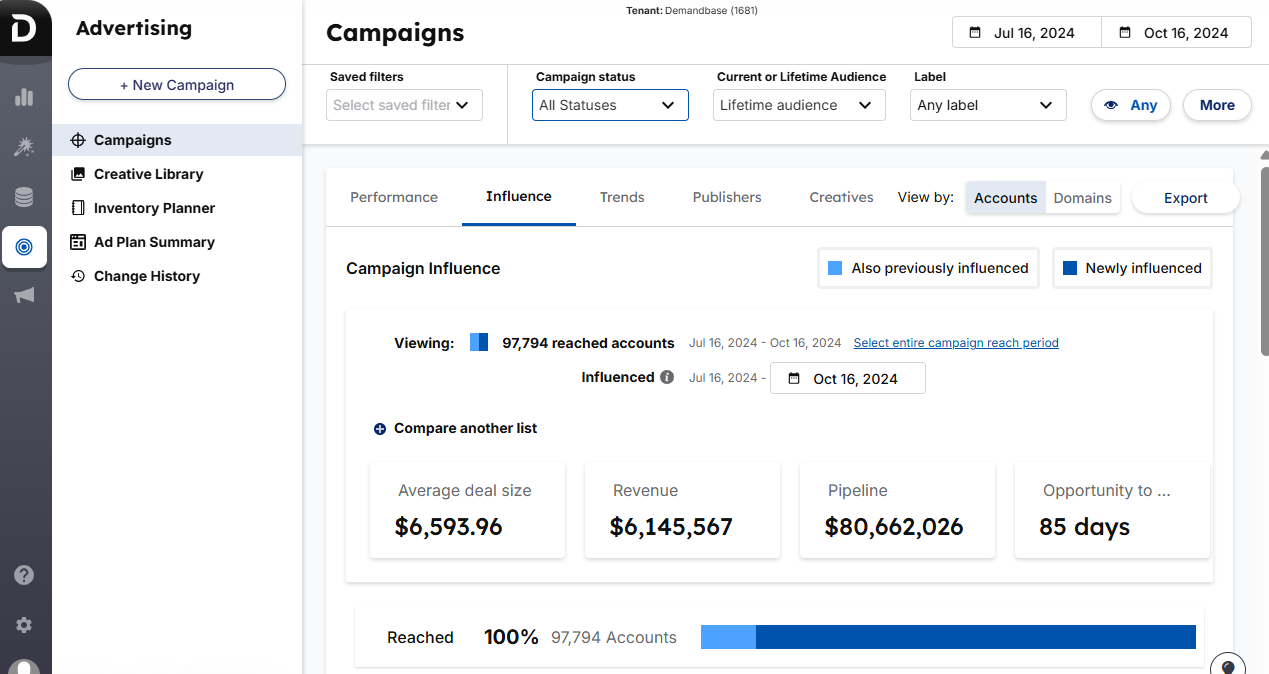

Demandbase One is an end-to-end, enterprise-class ABM suite; TAL building, multi-channel campaigns, website personalization, analytics, and sales enablement in one place. Among enterprise ABM marketing tools, it’s a perennial leader.

Here’s the highlight reel:

Build/refine TALs using your data + Demandbase’s graph and AI (firmographics, technographics, intent, even hiring signals).

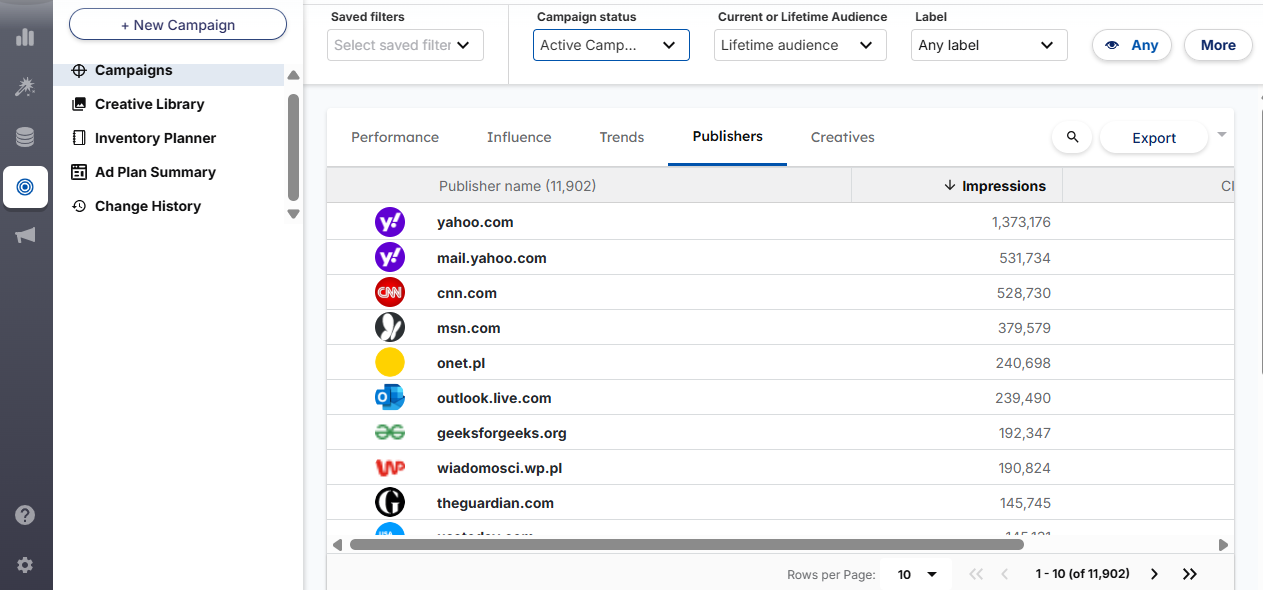

Run programmatic display, retargeting, native, CTV via its DSP; manage LinkedIn, Google, and more with account-level frequency capping and AI spend optimization. Few ABM marketing tools match this DSP breadth.

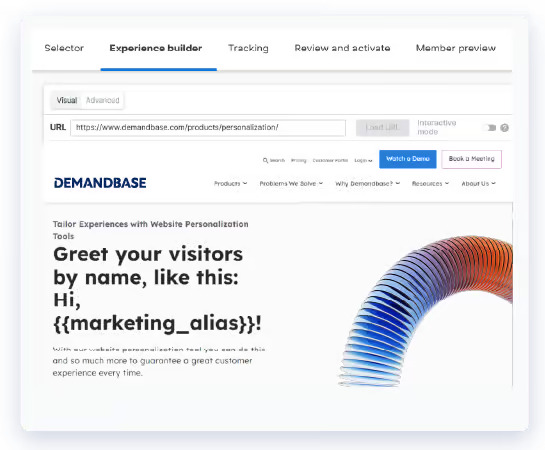

Serve account-specific messages, pages, and microsites based on IP/cookie recognition—handy for Tier-1 experiences.

Unify firmographics, technographics, third-party intent, and on-site behavior into a 360° account view for smarter prioritization.

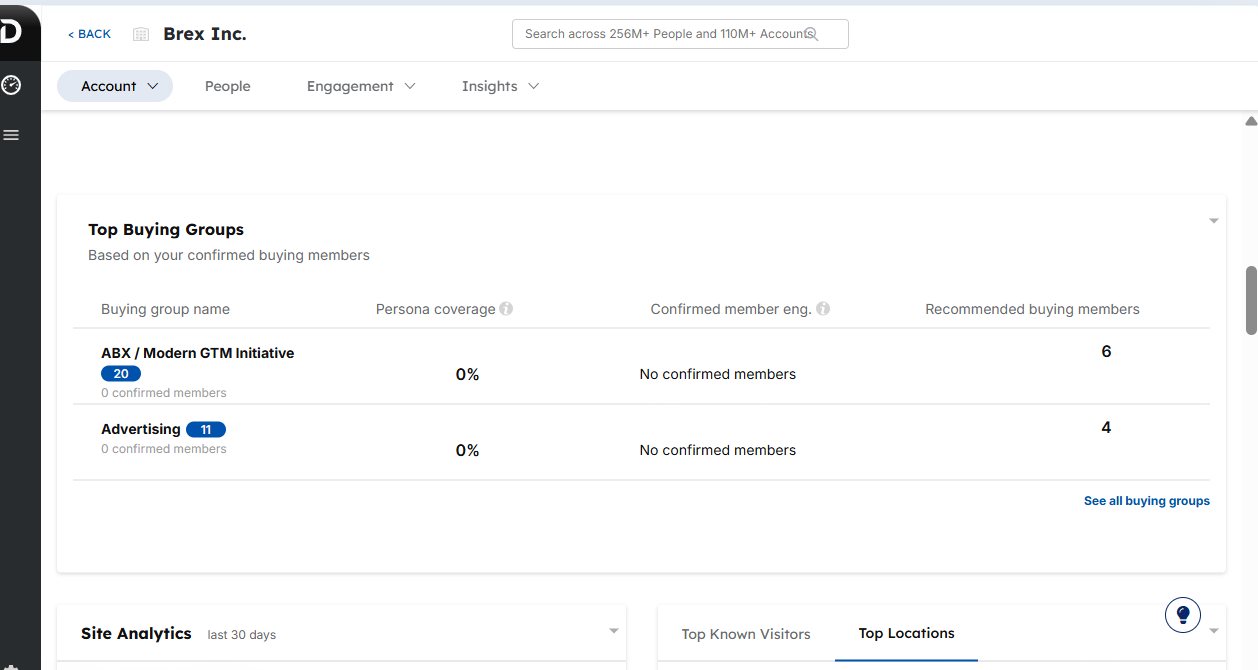

Map buying committees and target the right roles inside each account.

Track engagement, stage progress, influenced pipeline/revenue, and AI-driven pipeline predict scores.

Works with major CRMs, MAPs, sales engagement, and more including a streamlined “for Sales” view so reps know where to focus. See the official docs.

Demandbase One suits mature teams wanting ads, personalization, intent, analytics, and sales enablement under one roof. That’s great for big account lists and tight marketing–sales alignment.

Three biggies: steep learning curve, premium pricing, and easy to overbuy for simpler motions.

Large B2B orgs with established ABM, big budgets, and multi-channel plays, especially if you want to consolidate point solutions.

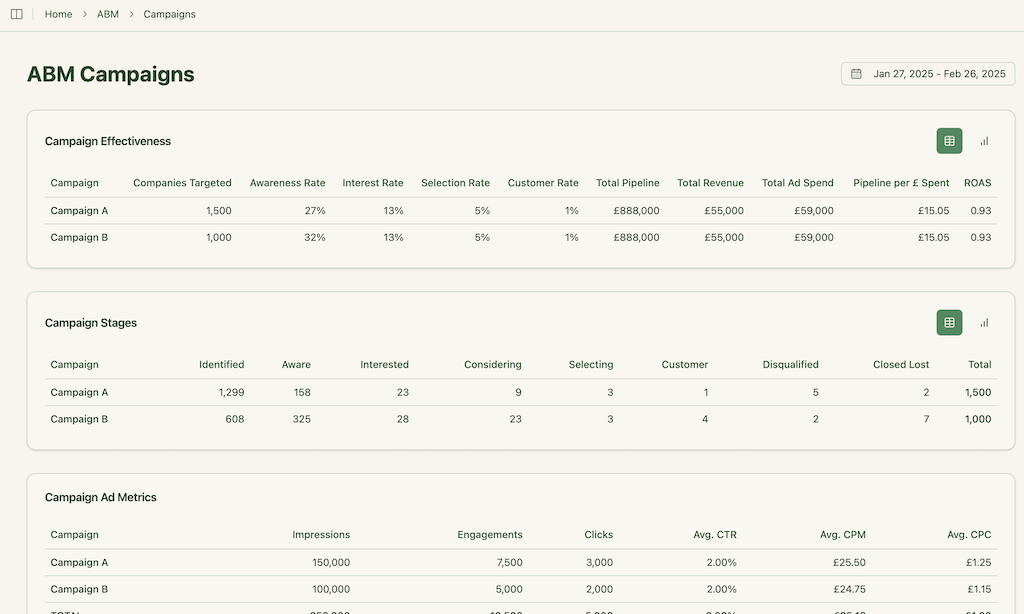

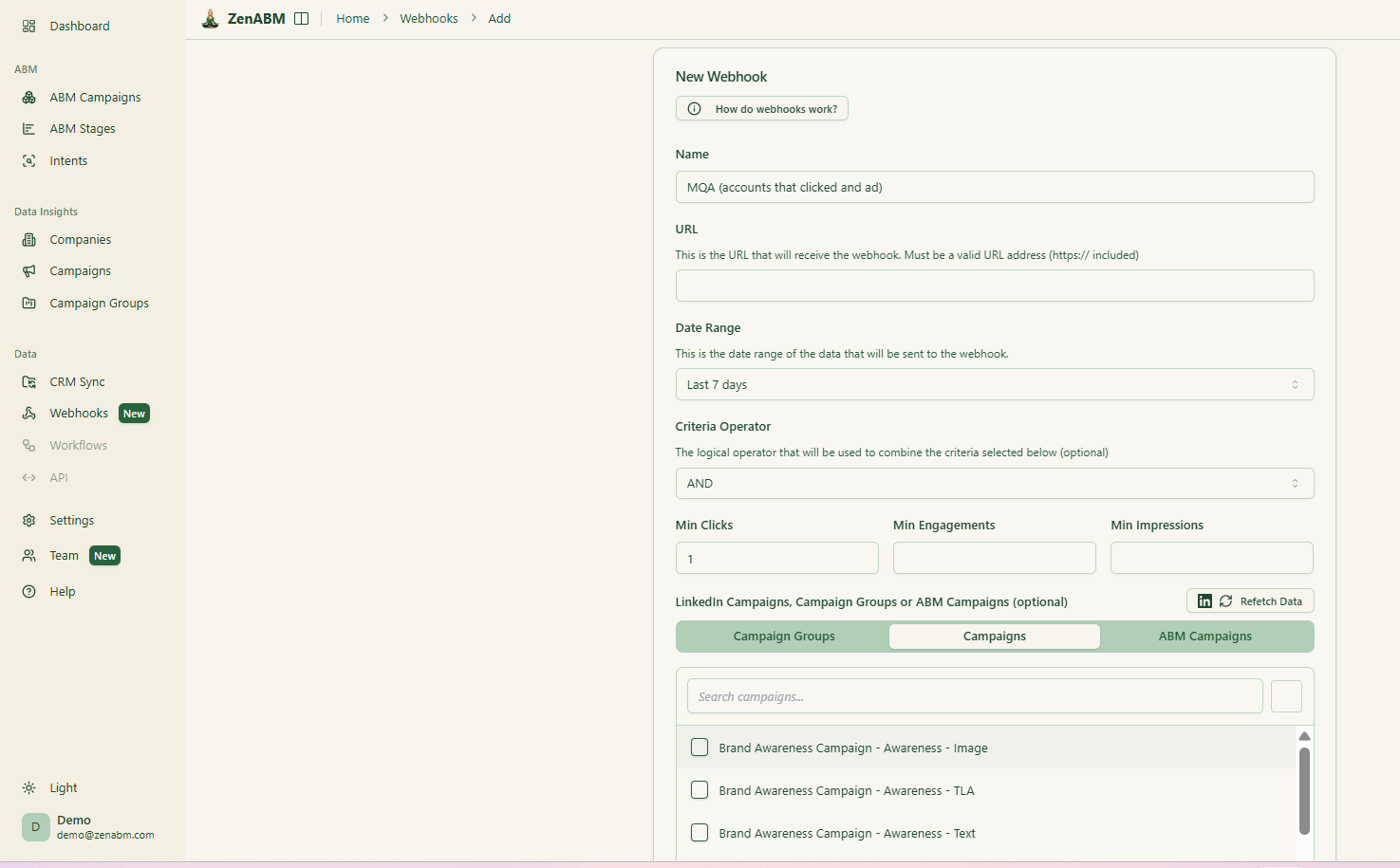

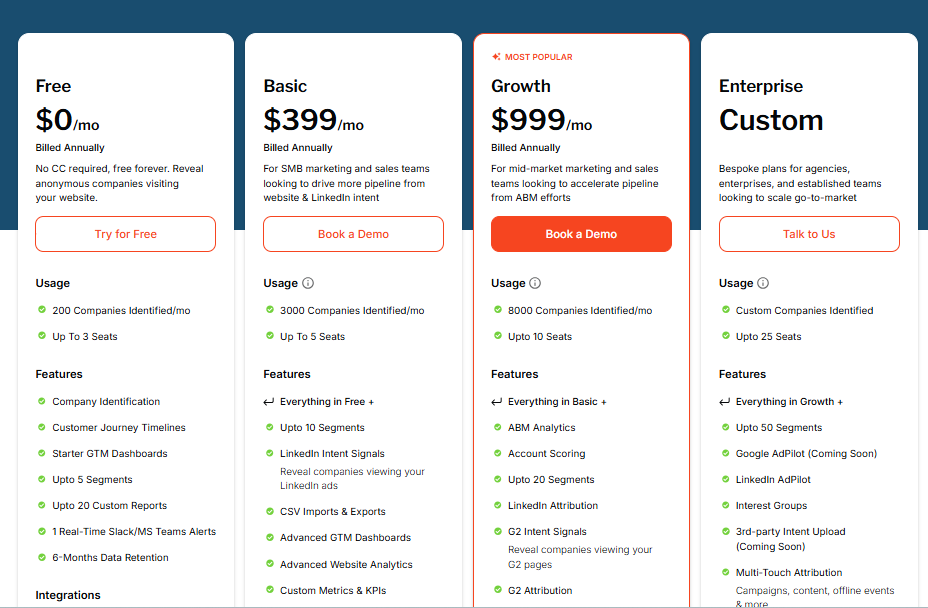

ZenABM is a plug-and-play ABM analytics platform built for LinkedIn-first programs.

From LinkedIn engagement tracking to pipeline tie-back, it covers the essentials for LinkedIn-heavy ABM marketing tool stacks. If you are comparing ABM marketing tools just for LinkedIn, start here.

Here’s what you get:

ZenABM pulls first-party, account-level LinkedIn ad data directly via LinkedIn’s official API. Few ABM marketing tools offer true API-level precision here.

It auto-scores each account’s LinkedIn engagement in your chosen window (e.g., last 7 days), updating constantly, so sales sees who’s heating up right now, not just historically. A lifetime score is included, too.

ZenABM combines its score + CRM data to track each account’s ABM stage.

You control the thresholds for every stage:

And you can visualize stage movement to spot leaks:

ZenABM writes LinkedIn engagement as a single company property in your CRM (HubSpot/Salesforce; plus webhooks for others) and auto-assigns a BDR when an account crosses your “Interested” threshold.

Running multiple campaigns by feature/value?

Tag campaigns by intent, see which accounts engage with which theme, and push that to CRM for personalized pitches. Many ABM marketing tools claim intent, but this one ties it directly to LinkedIn campaigns you actually run.

Full-funnel dashboards show engagement, influenced pipeline/revenue, win-rate, and ROAS by matching ad-engaged companies to CRM deals.

Drop ZenABM into any GTM workflow through custom webhooks:

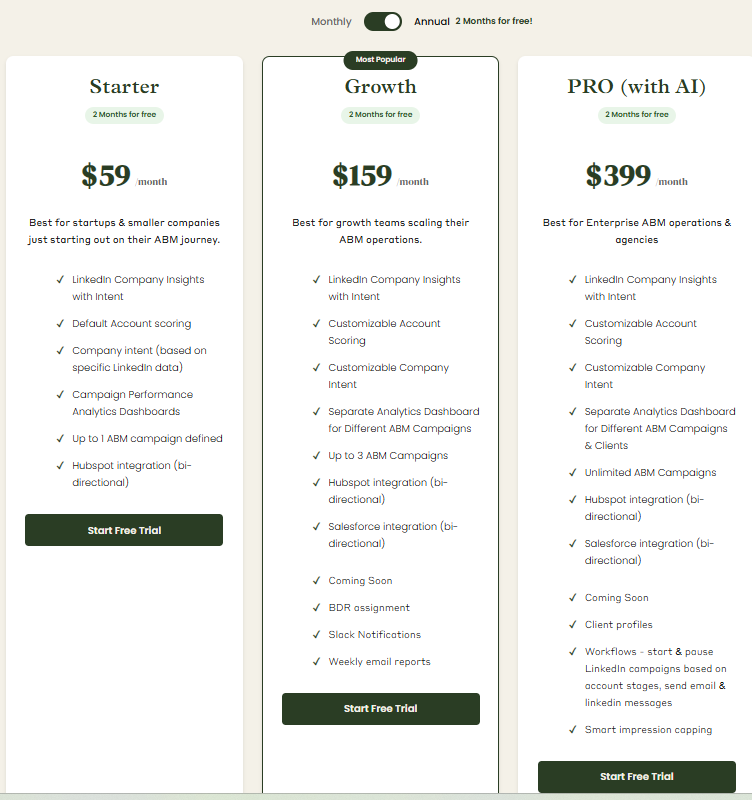

Plans start at $59/month with tracking, scoring, CRM sync, and dashboards included.

By design, ZenABM is LinkedIn-specialized. It’s elite for LinkedIn analytics and attribution, but not a multi-channel do-everything suite.

If your ABM motion revolves around LinkedIn Ads, ZenABM is a layup: enterprise-grade clarity without enterprise lift.

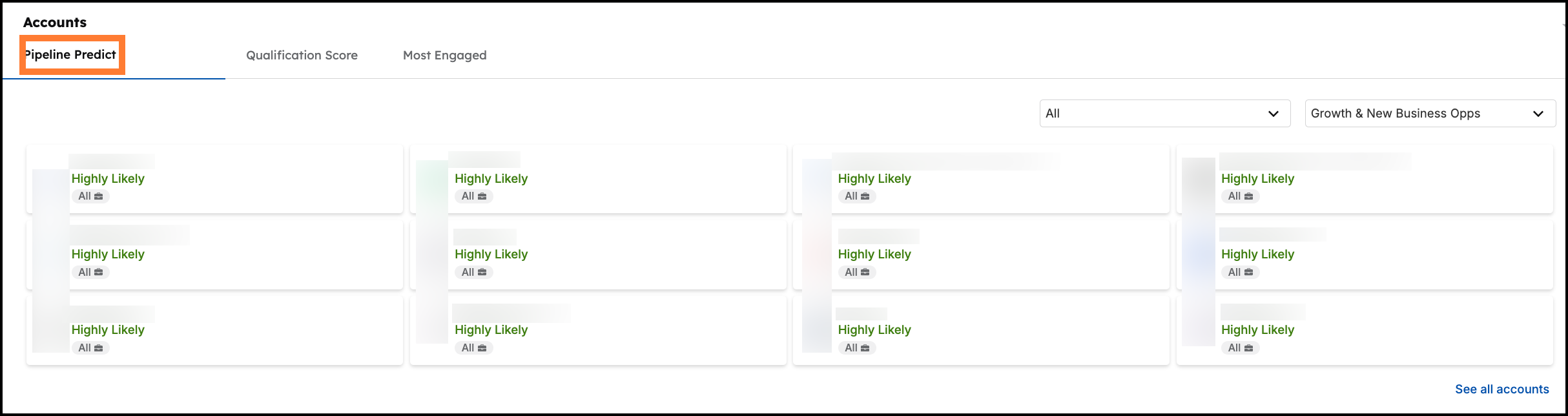

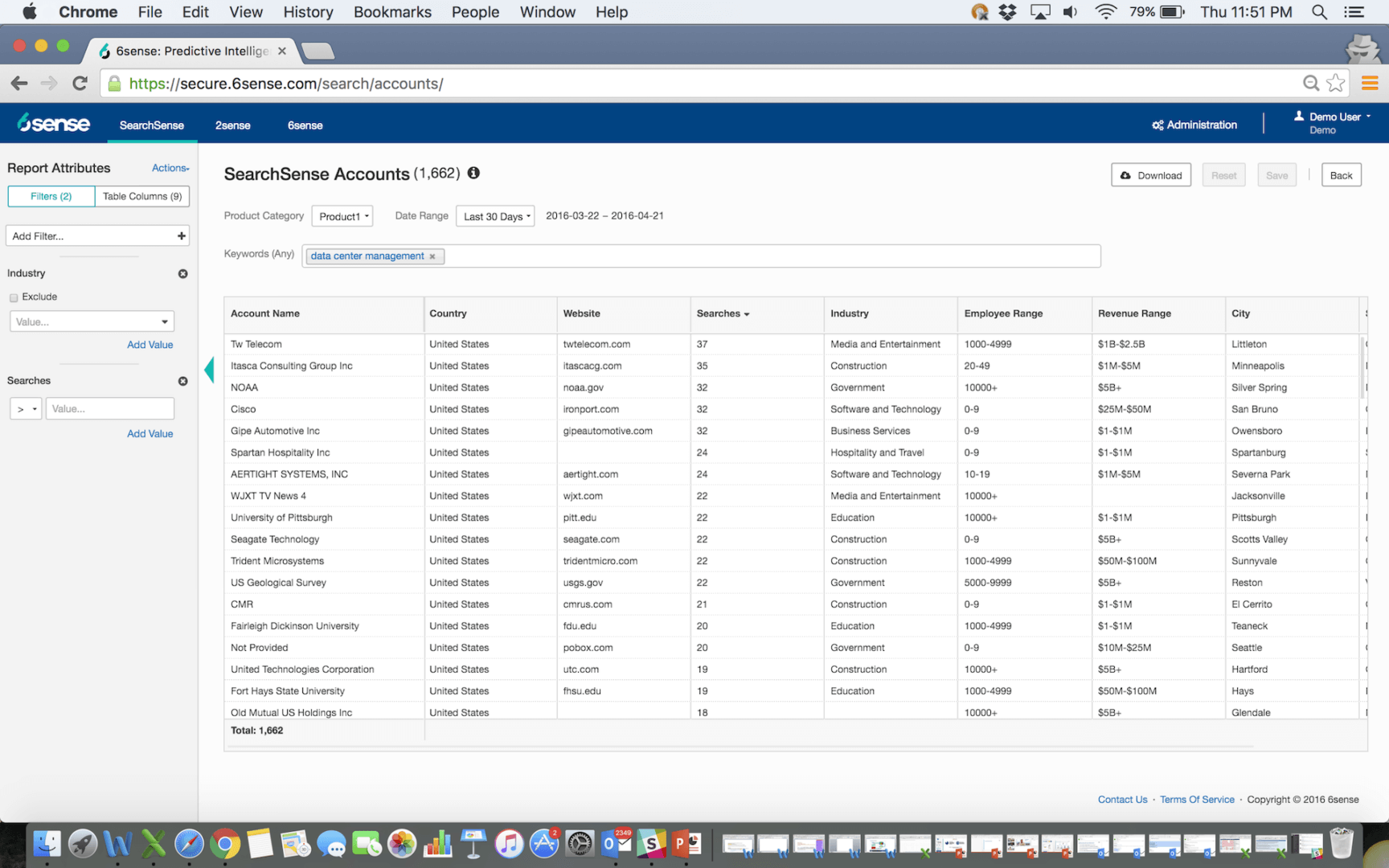

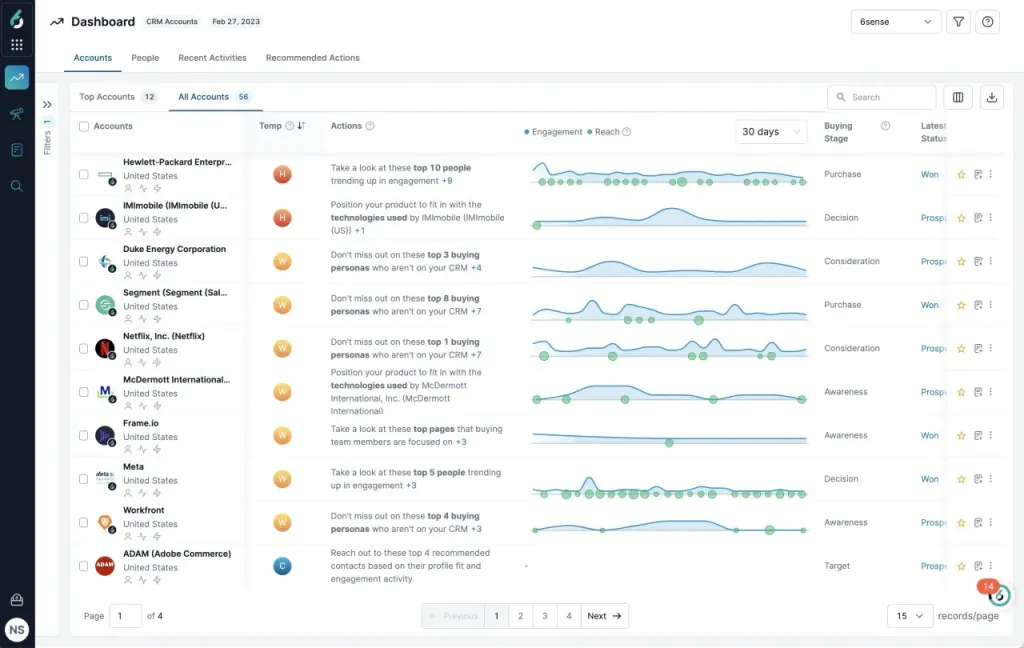

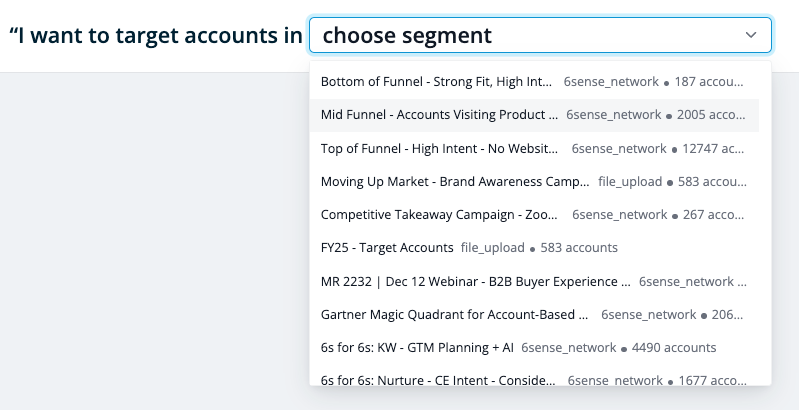

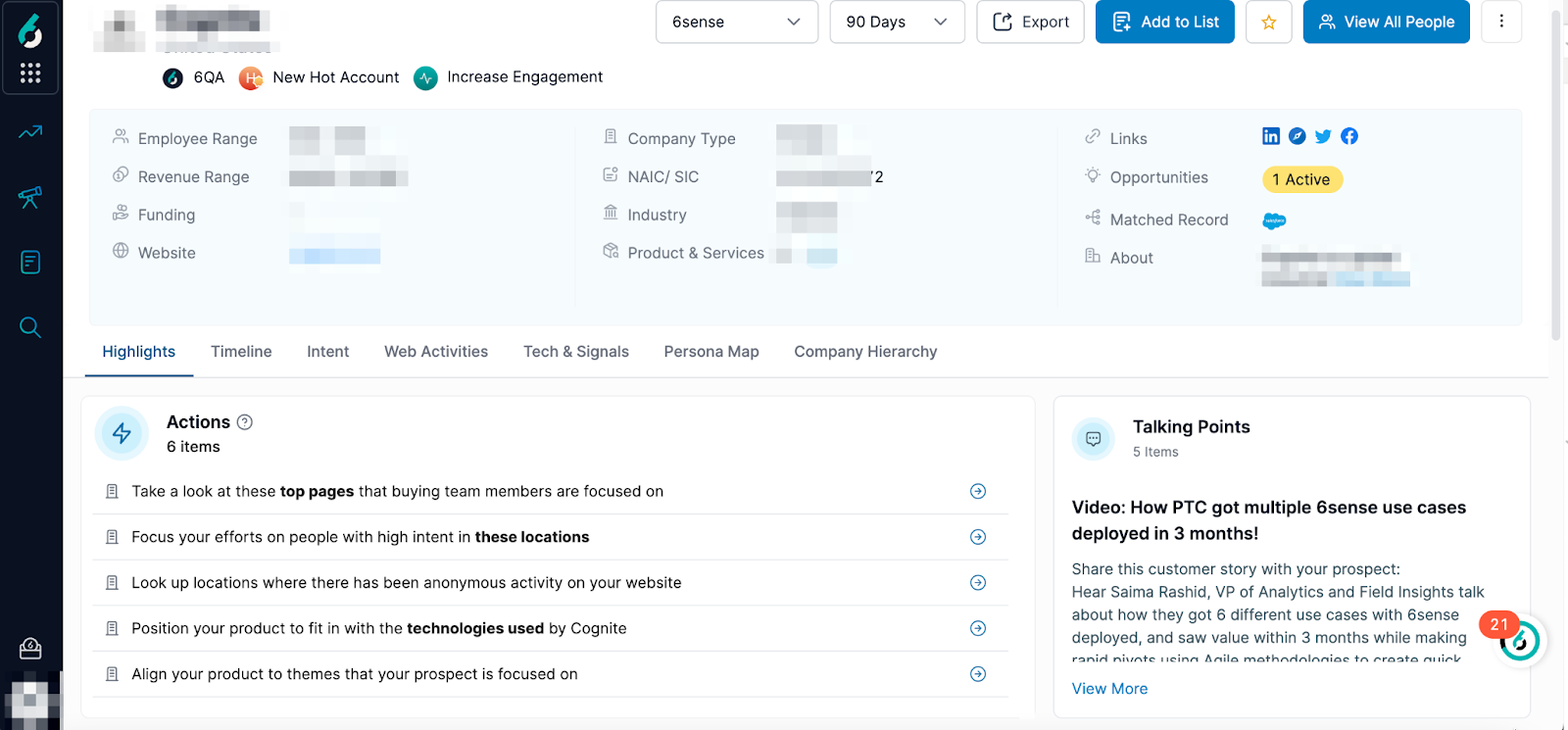

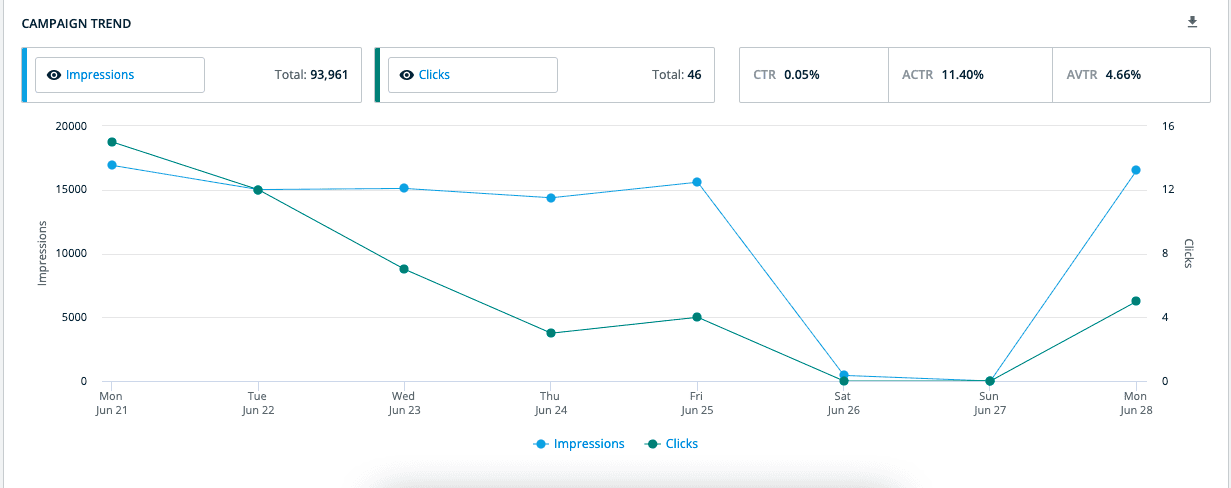

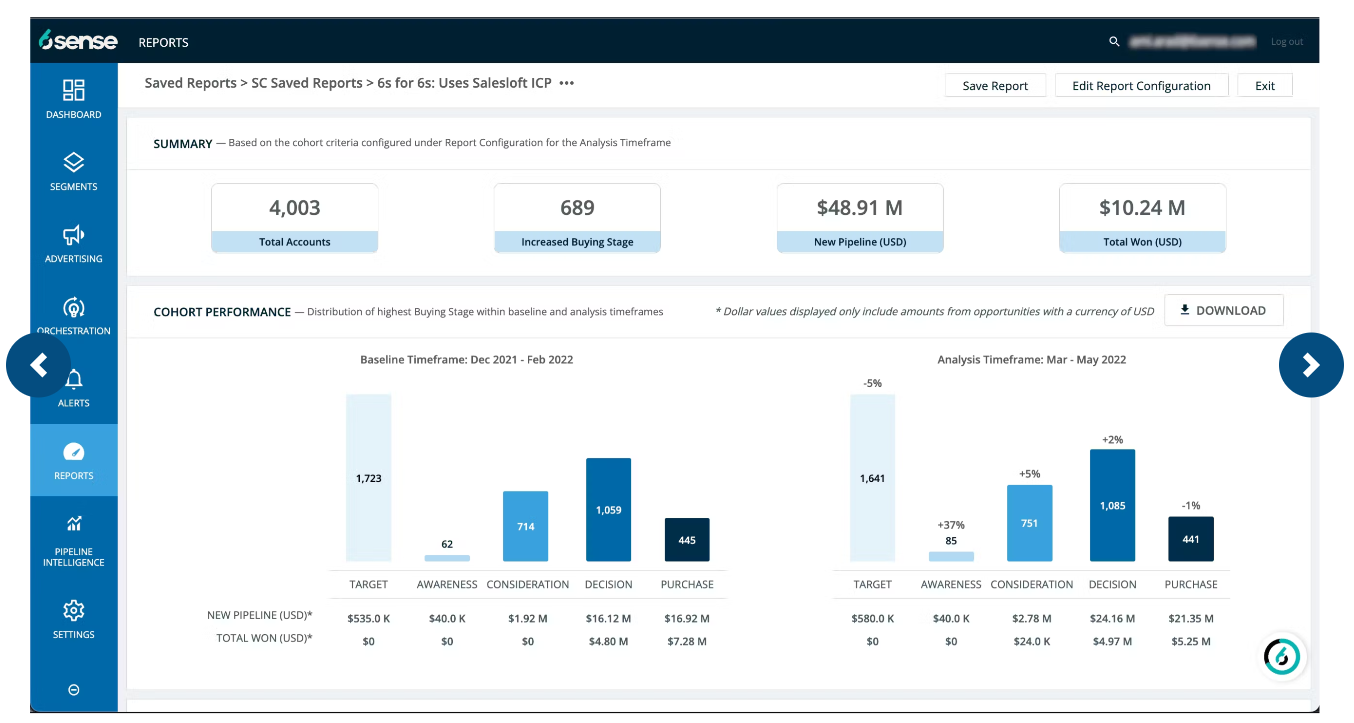

6sense is known for predictive intelligence that answers: who’s researching you, who to call next, and which campaigns will convert. In lists of ABM marketing tools, 6sense often stands out for intent depth.

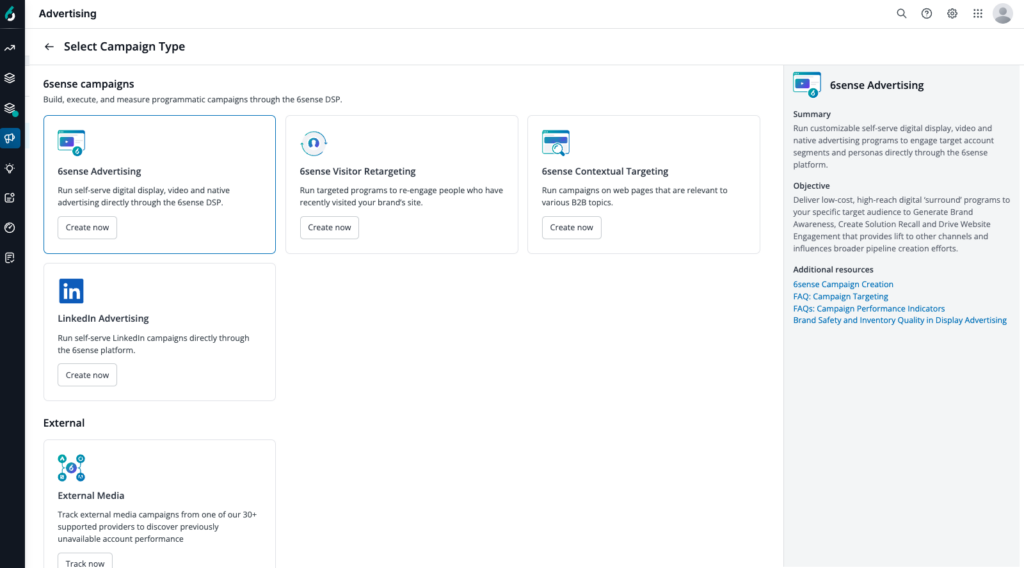

Standouts include:

De-anonymize traffic using its Company Graph (IPs, cookies, device IDs, etc.) to infer likely visiting companies.

Run programmatic + integrate LinkedIn/Google; trigger sales emails, web personalization, and chat via partners.

Crunch firmographics, visits, third-party intent (e.g., Bombora/G2),

and engagement to predict buying stages and likelihood to win. Then surface top accounts for reps daily.

Combines first-, second-, and third-party intent for a fuller signal picture.

360° profiles with firmographics, technographics, key contacts, and more—segment precisely and launch tightly targeted plays.

Give reps stage/status intel and suggested next moves.

Prove sourced vs influenced pipeline, run MTA, and forecast revenue from target accounts.

Loved for intent accuracy and predictive chops, great for larger teams wanting AI to prioritize and orchestrate across channels.

High cost, complexity, and a need for clean data. Overkill if you only care about LinkedIn.

6sense is best for mid-to-large B2B firms with long cycles, big lists, and sales capacity to act, especially if you already invest in intent + ads.

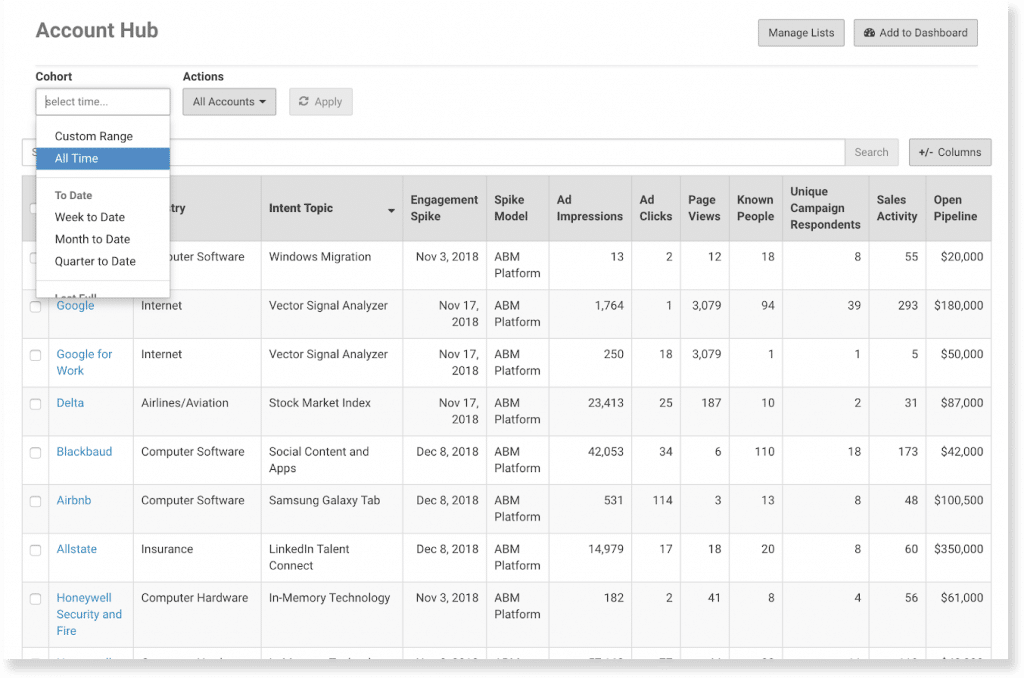

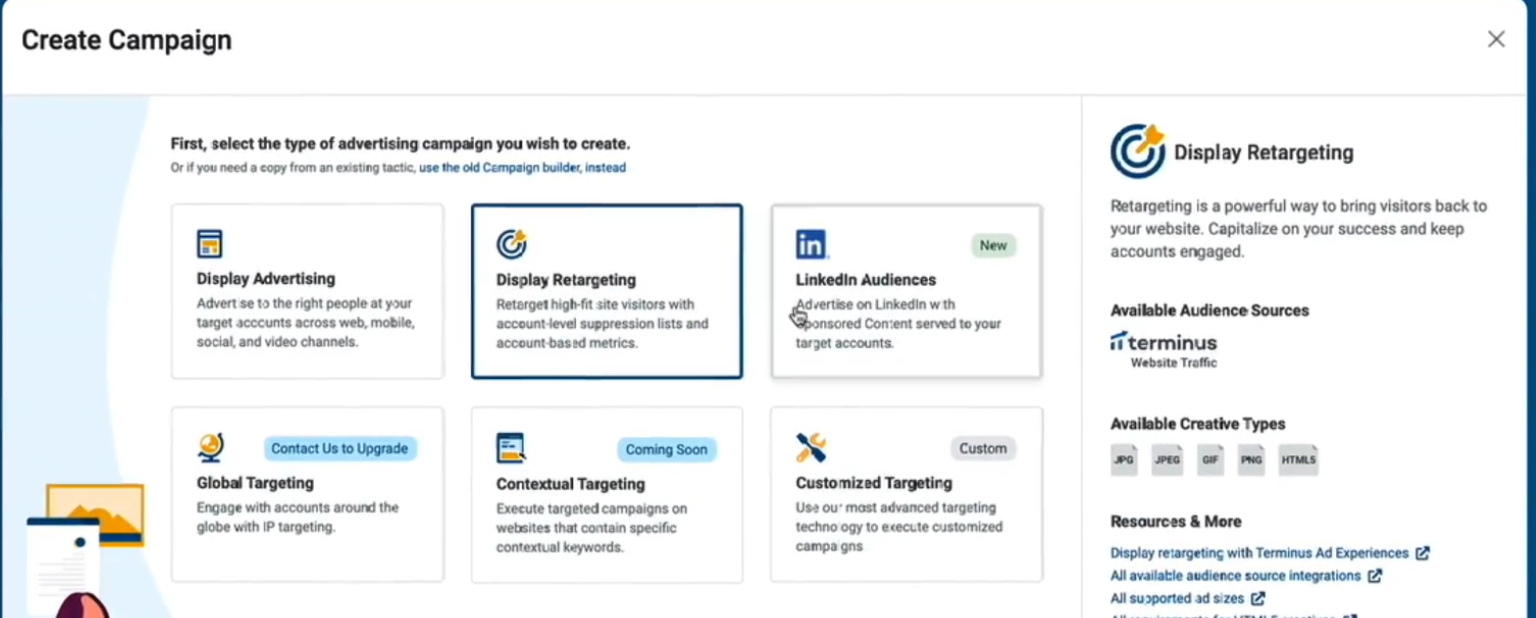

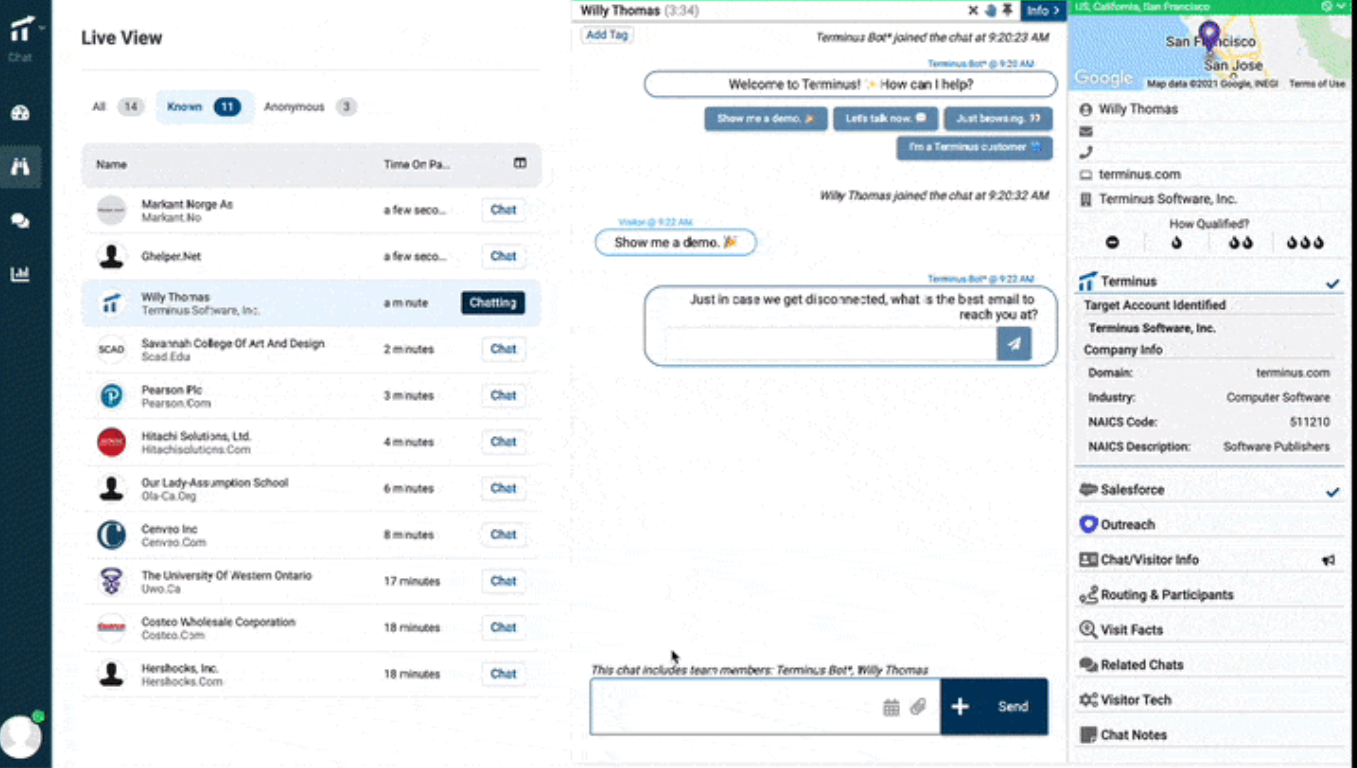

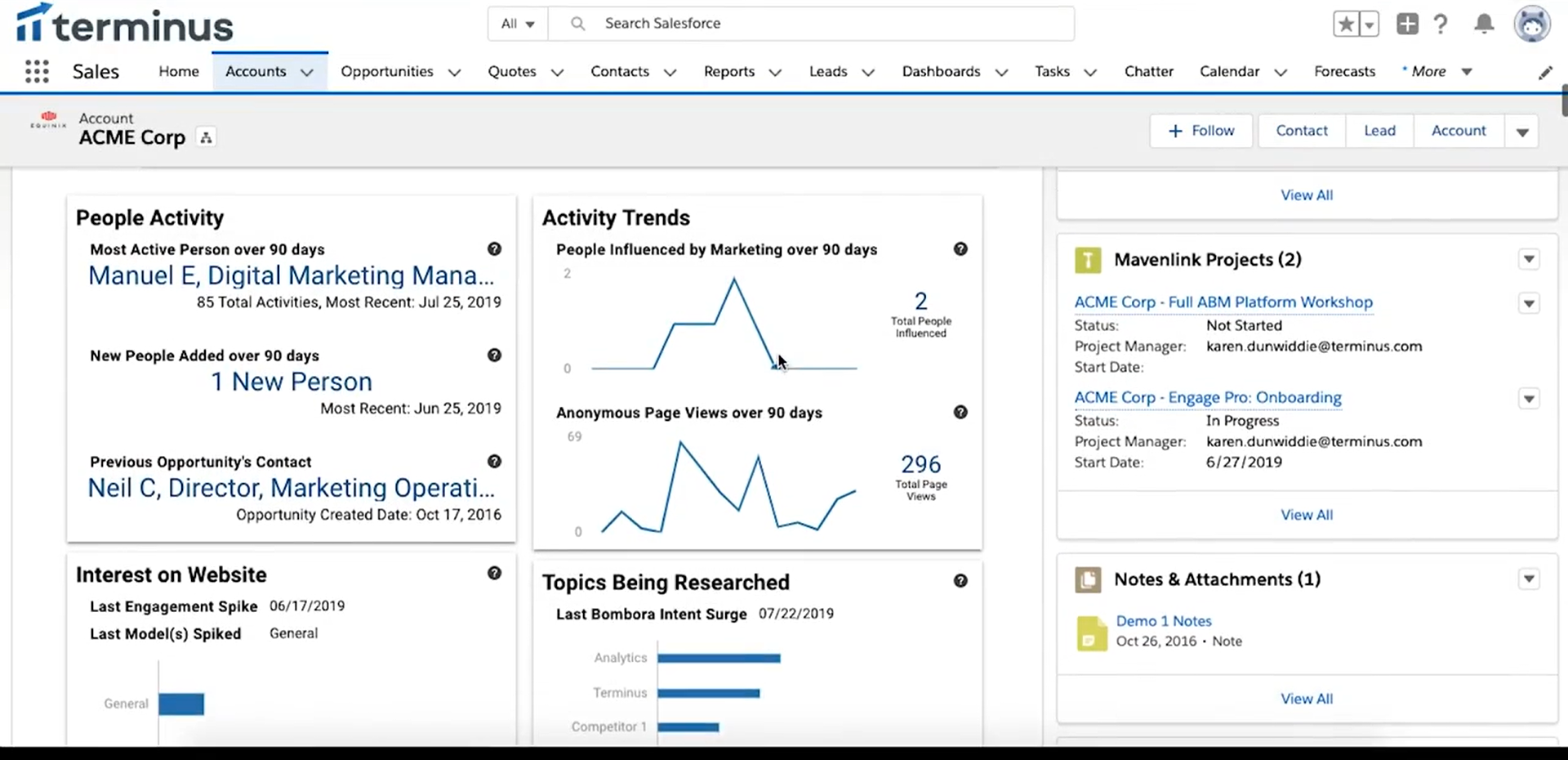

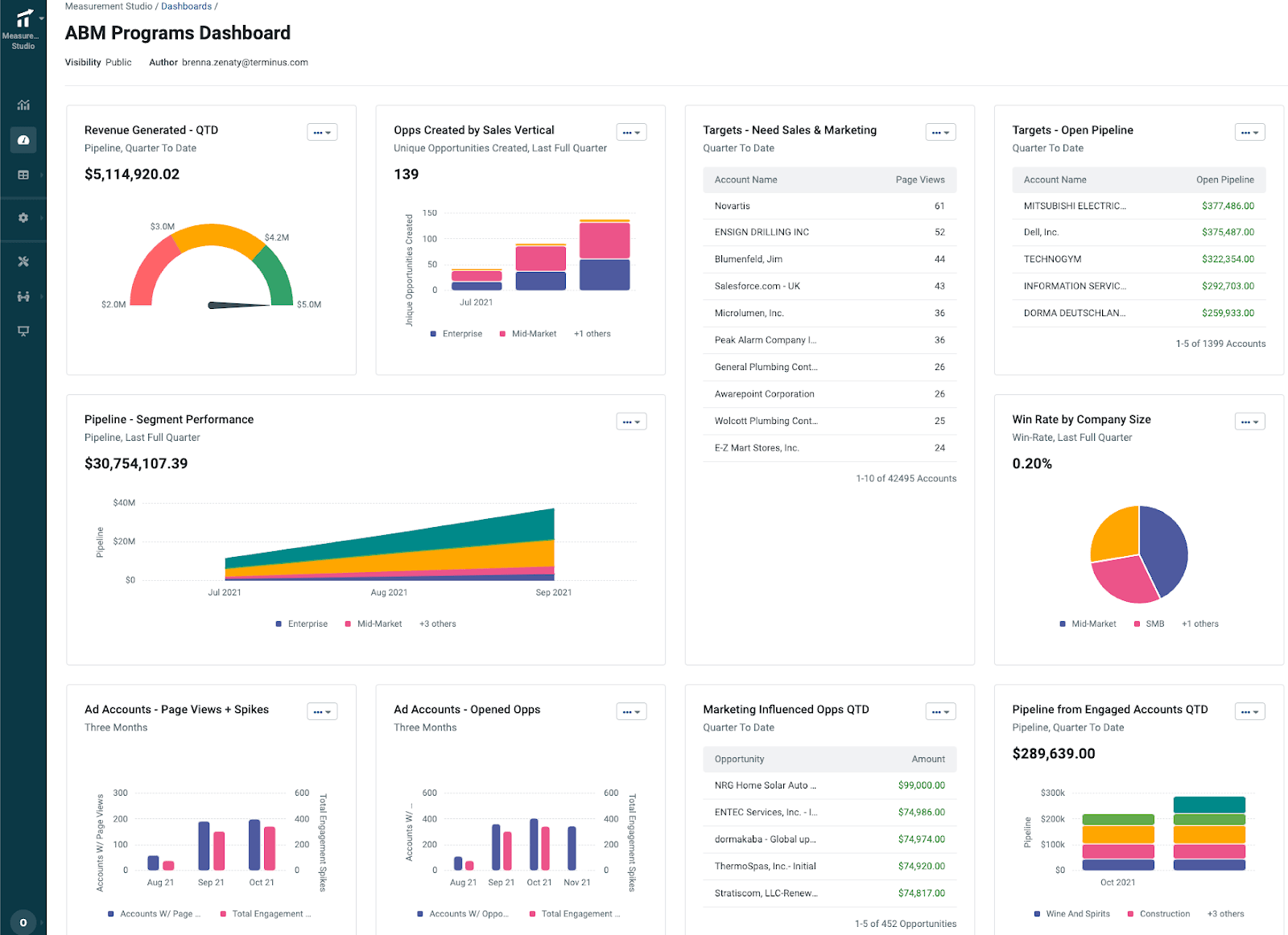

Terminus evolved from ad tech into a broader suite (ads, email signatures, chat, orchestration).

What stands out:

Run targeted ads on Google, LinkedIn, and display networks directly inside Terminus.

Turn employee email signatures into an ABM channel; add chat/personalization for target visitors.

Tie into Outreach/Salesloft so high-intent accounts trigger sales sequences.

Plug into CRM/MAP plus Bombora, G2, Slack, and more (see the docs).

Attribution dashboards connect ABM programs to pipeline and revenue lift.

A well-rounded toolkit that keeps ads, signatures, chat, and analytics in sync and also has a nice UI with scalable adoption.

Premium pricing; occasional limits/quirks reported by users; can be overkill for simple, ads-only motions.

Best for multi-channel ABM with 5+ marketers and a comparable sales team; excellent in mature industries with large ACVs.

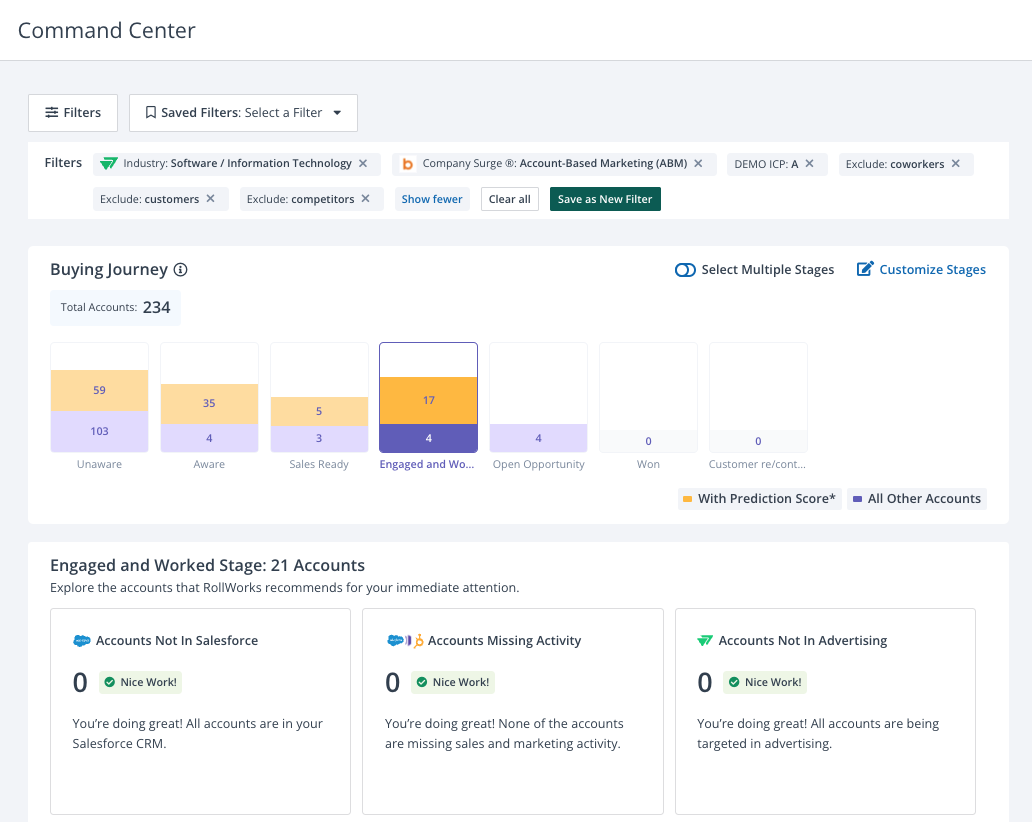

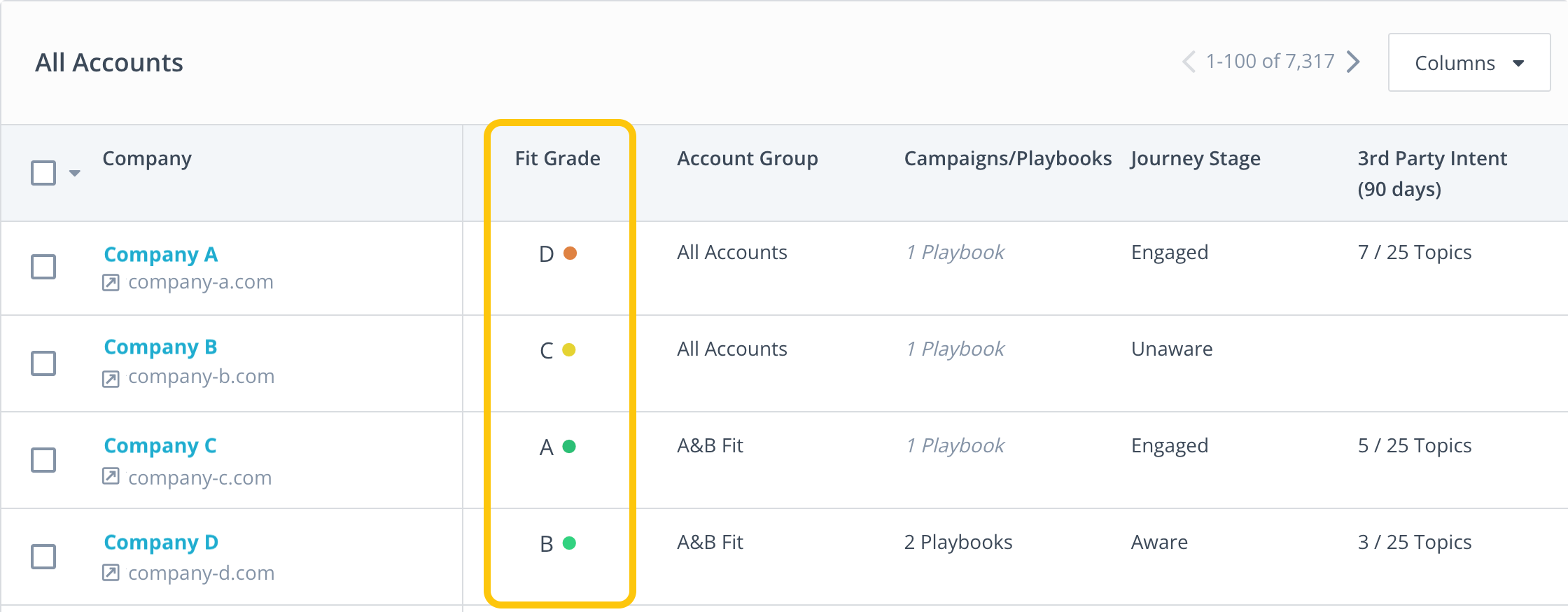

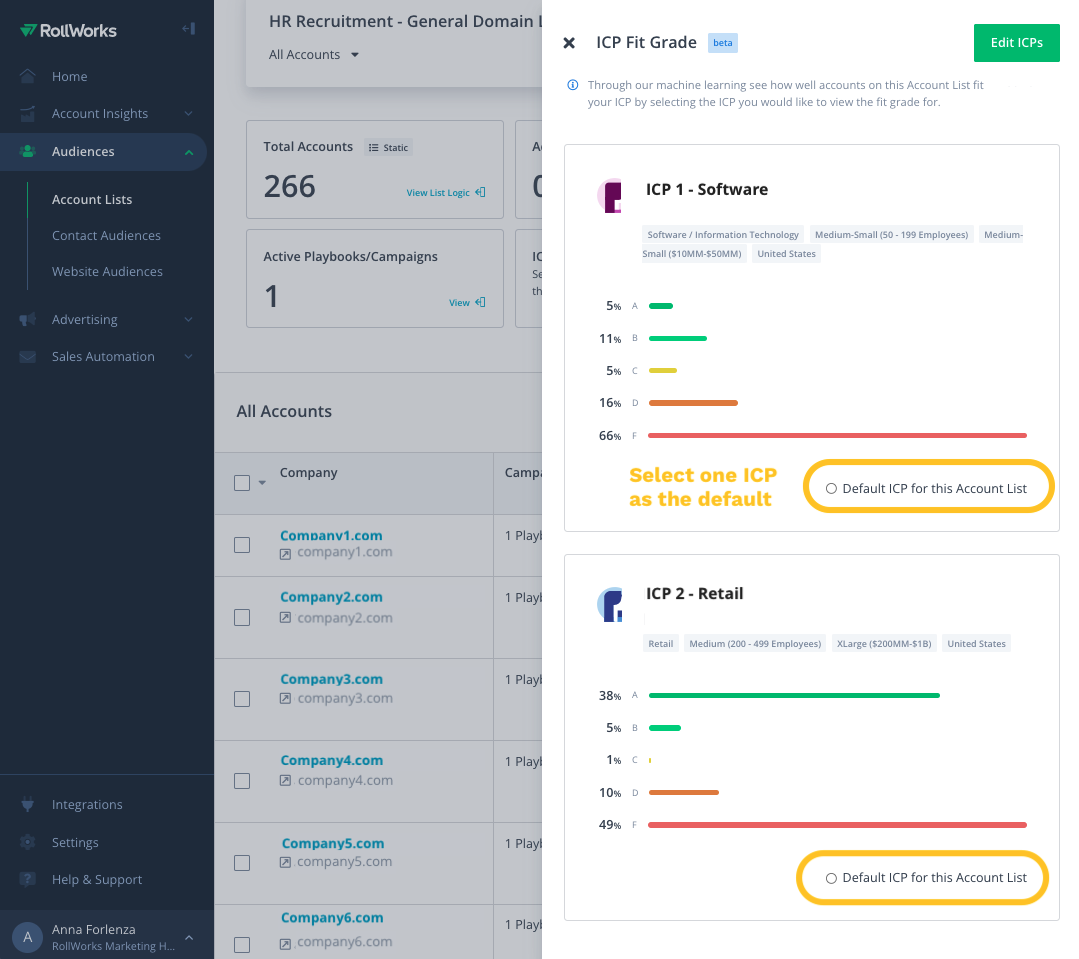

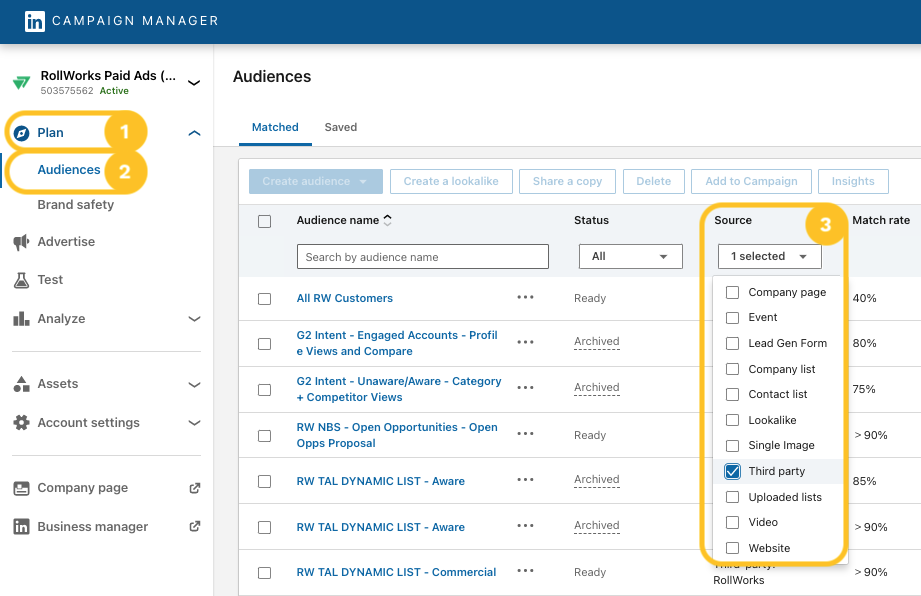

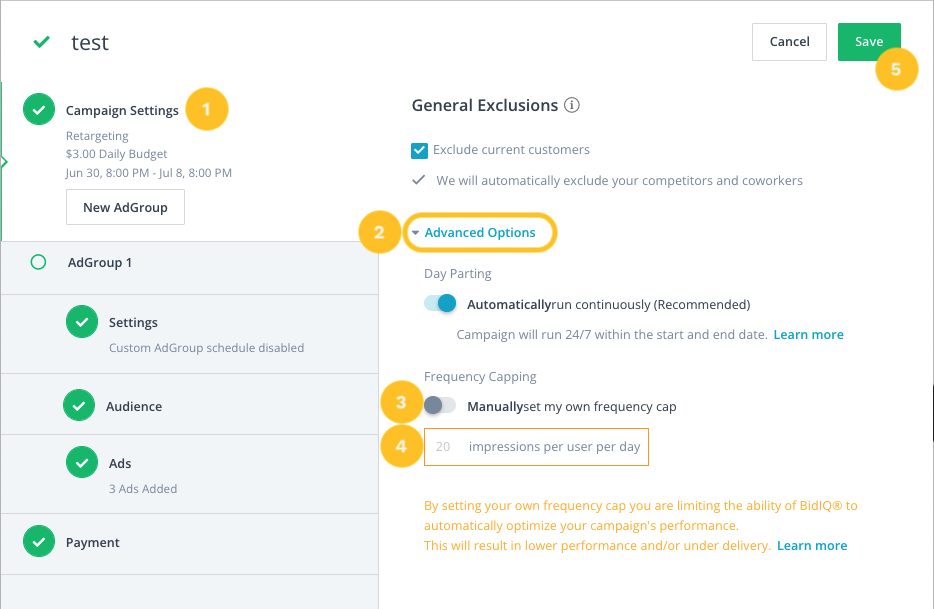

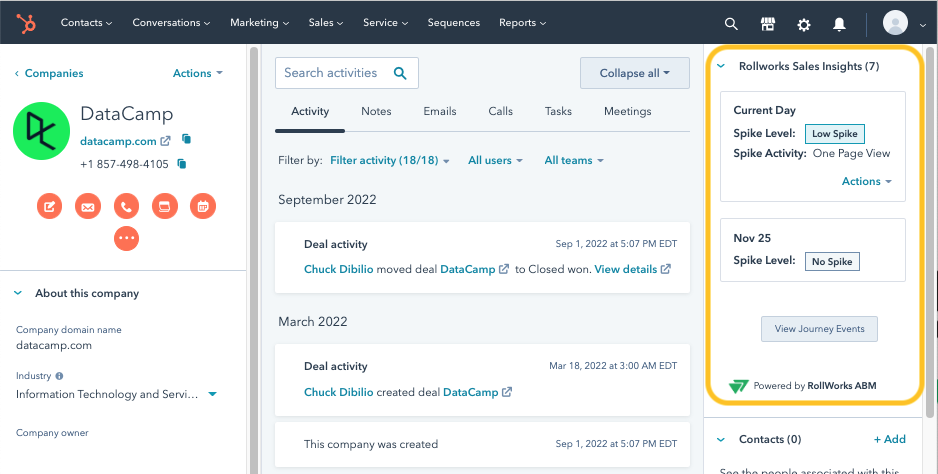

RollWorks is the approachable path into enterprise-grade, ad-centric ABM. As far as ABM marketing tools go, it’s a strong “ads-first” choice.

Highlights:

Import from your CRM/MAP or use RollWorks data to generate lists with ICP Fit scoring (A–D).

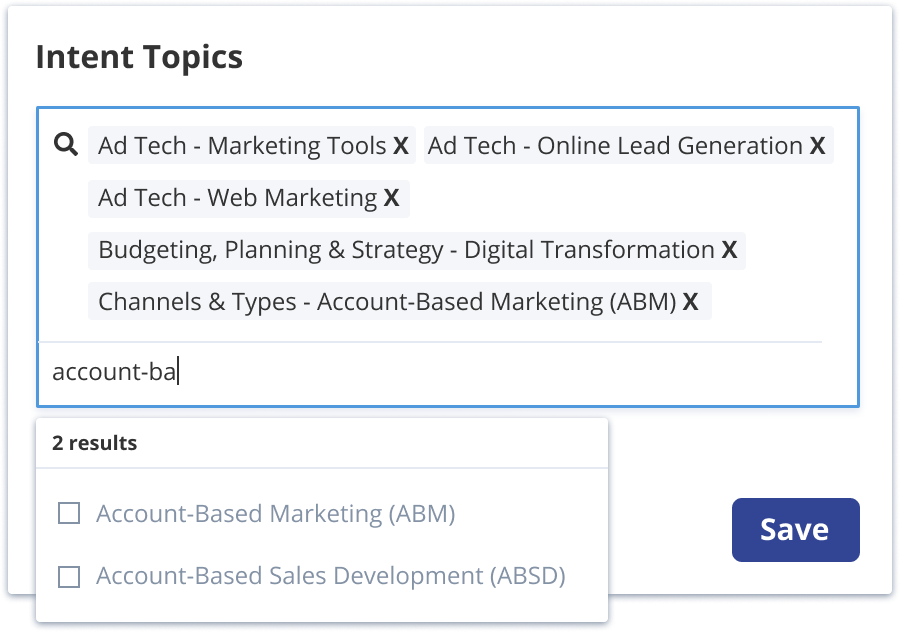

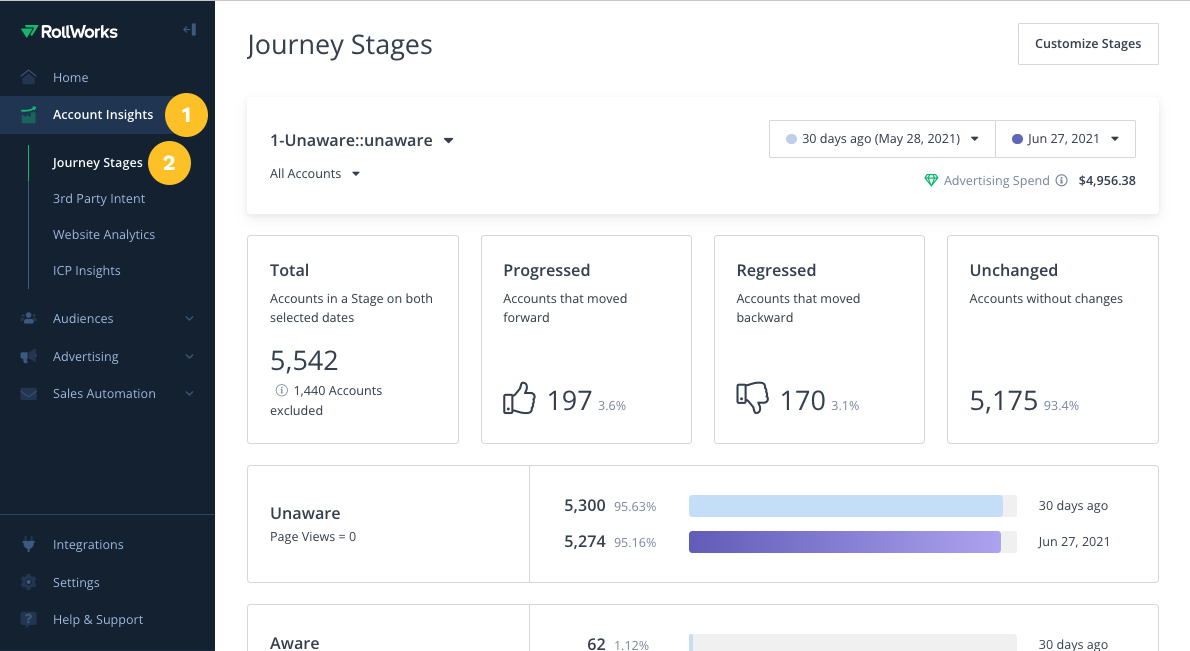

Track topic interest and journey stages to spot in-market accounts.

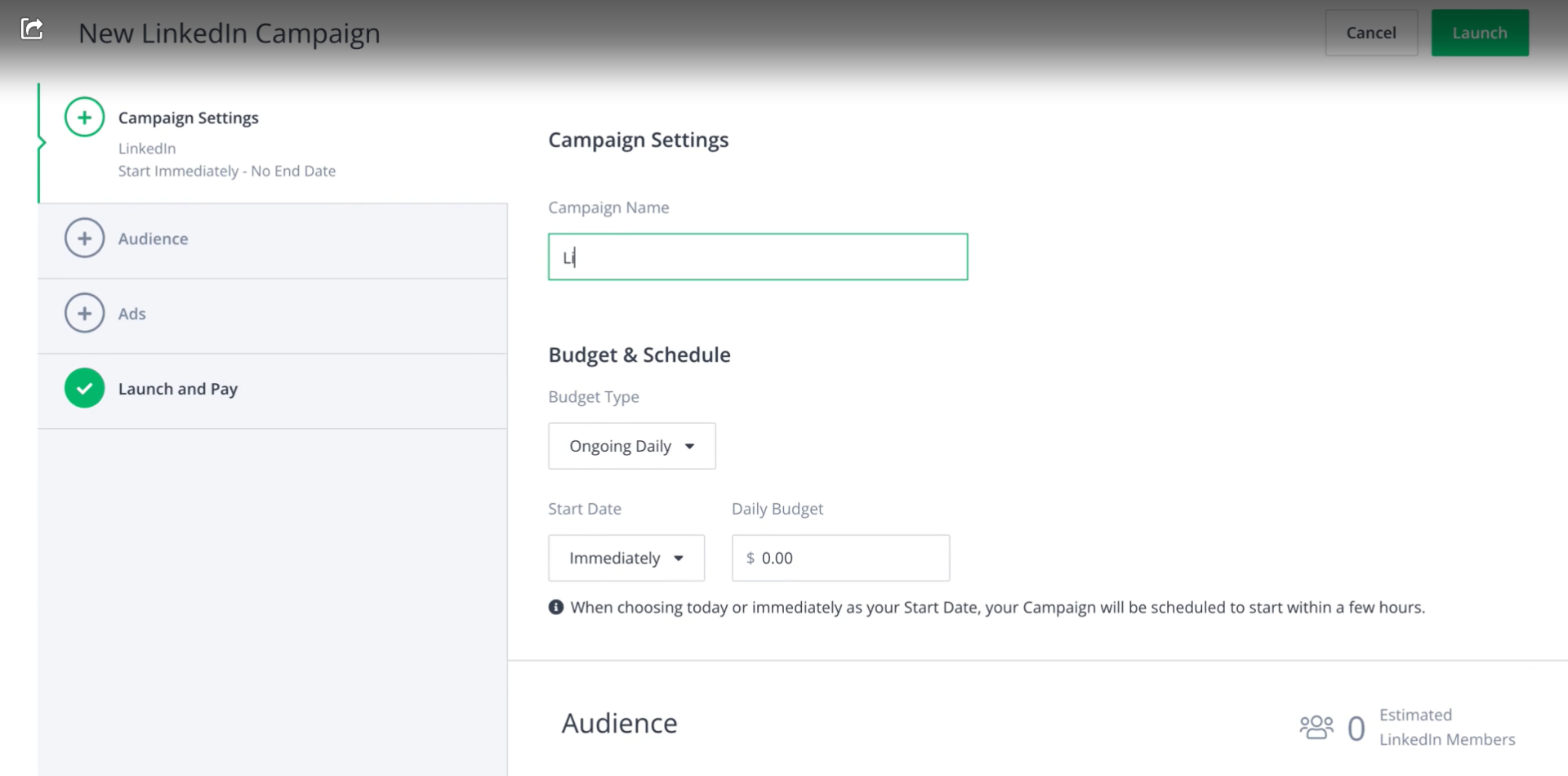

DSP for display/retargeting plus LinkedIn integrations with granular account/audience targeting, budget optimization, and frequency caps.

Two-way CRM sync, alerts for hot accounts, and widgets for rep workflows, plus Outreach/Slack connectivity.

Plays well with HubSpot, Marketo, and more. Deep dive in this RollWorks guide.

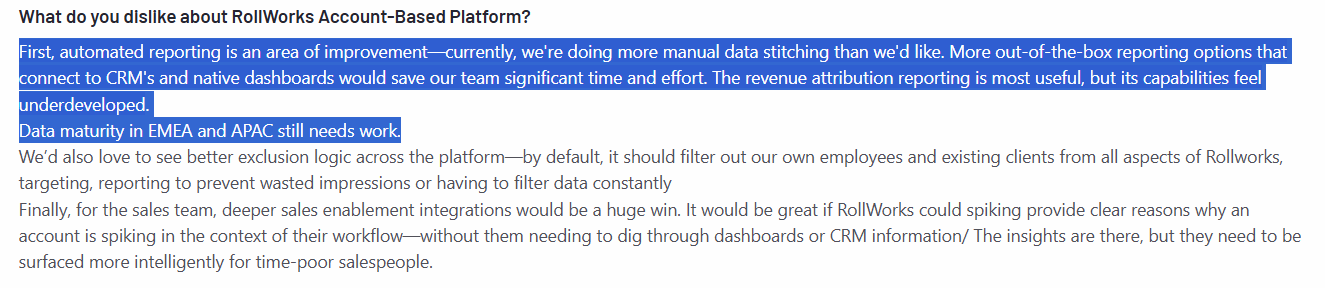

Ad DNA shines: strong audience management, intuitive setup, and solid account-level ad analytics. Compared to heavier ABM marketing tools, setup is friendlier for ad-led teams.

Requires meaningful spend ($2K–$5K/month in ad budget + fees). Focuses on digital ads/CRM outreach (no native direct mail or heavy web personalization). Less predictive than 6sense; some limits/integration gaps reported.

Great for mid-market teams leveling up from manual ABM to scalable, ad-led programs, especially LinkedIn + display blends.

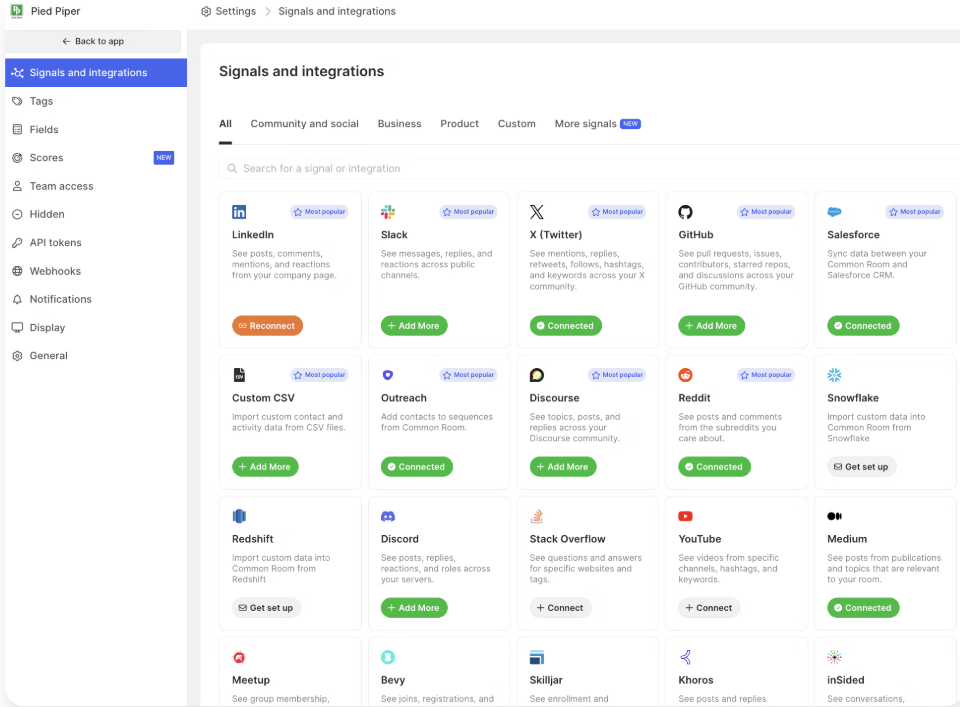

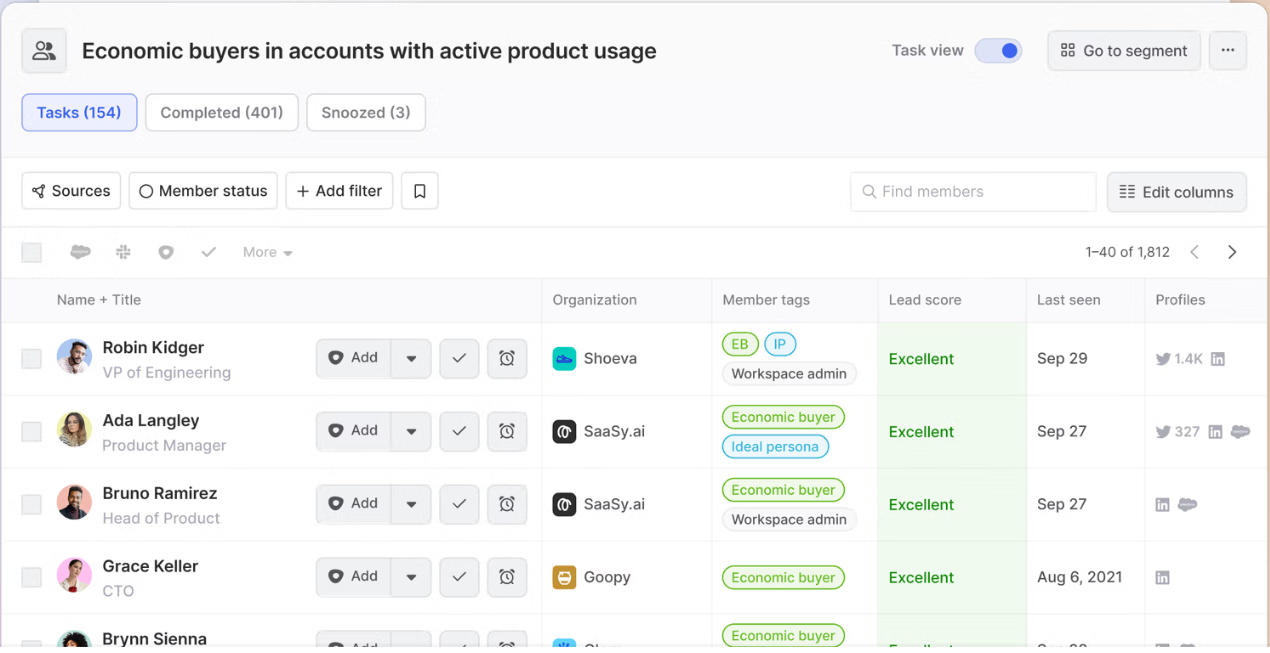

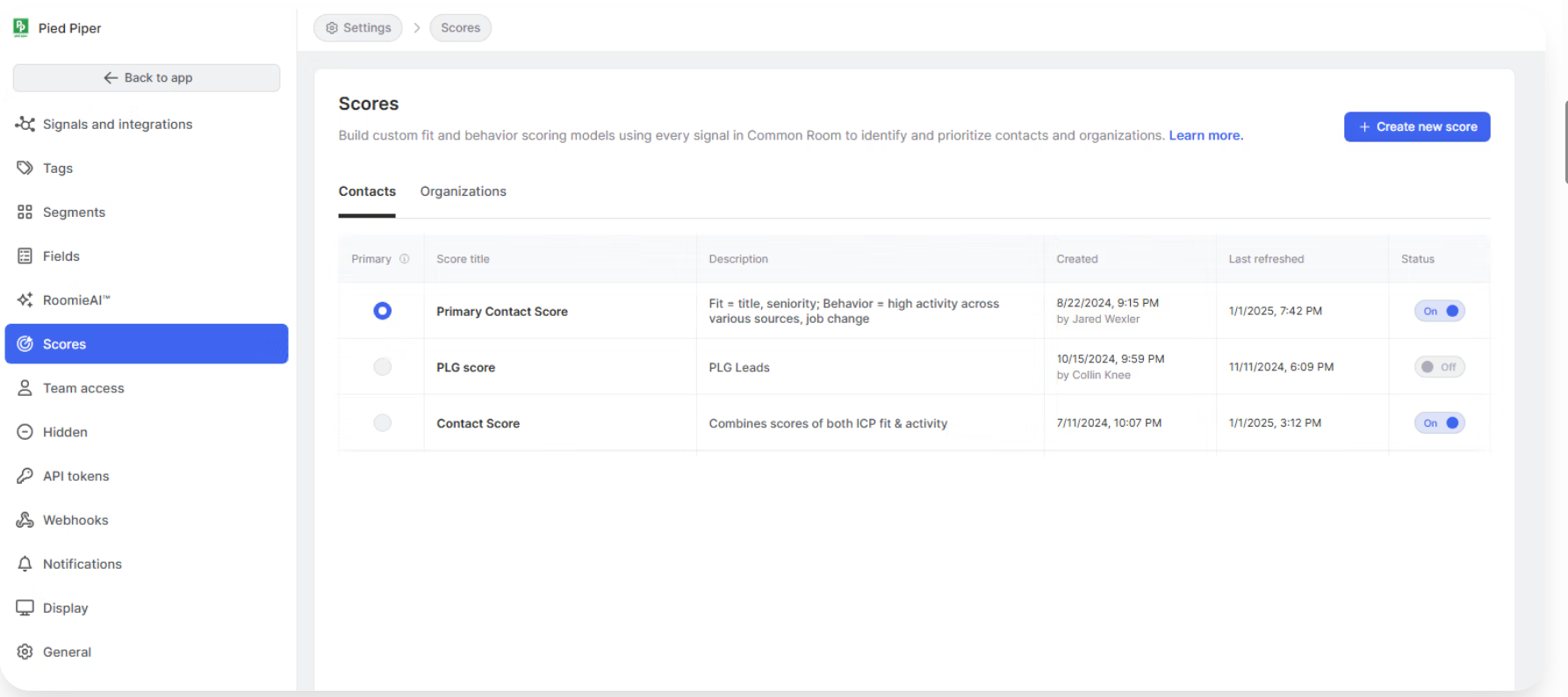

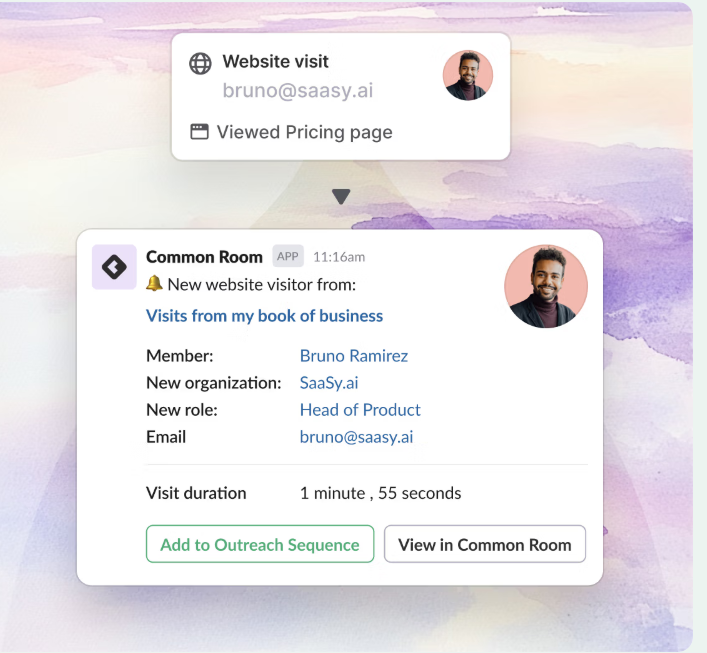

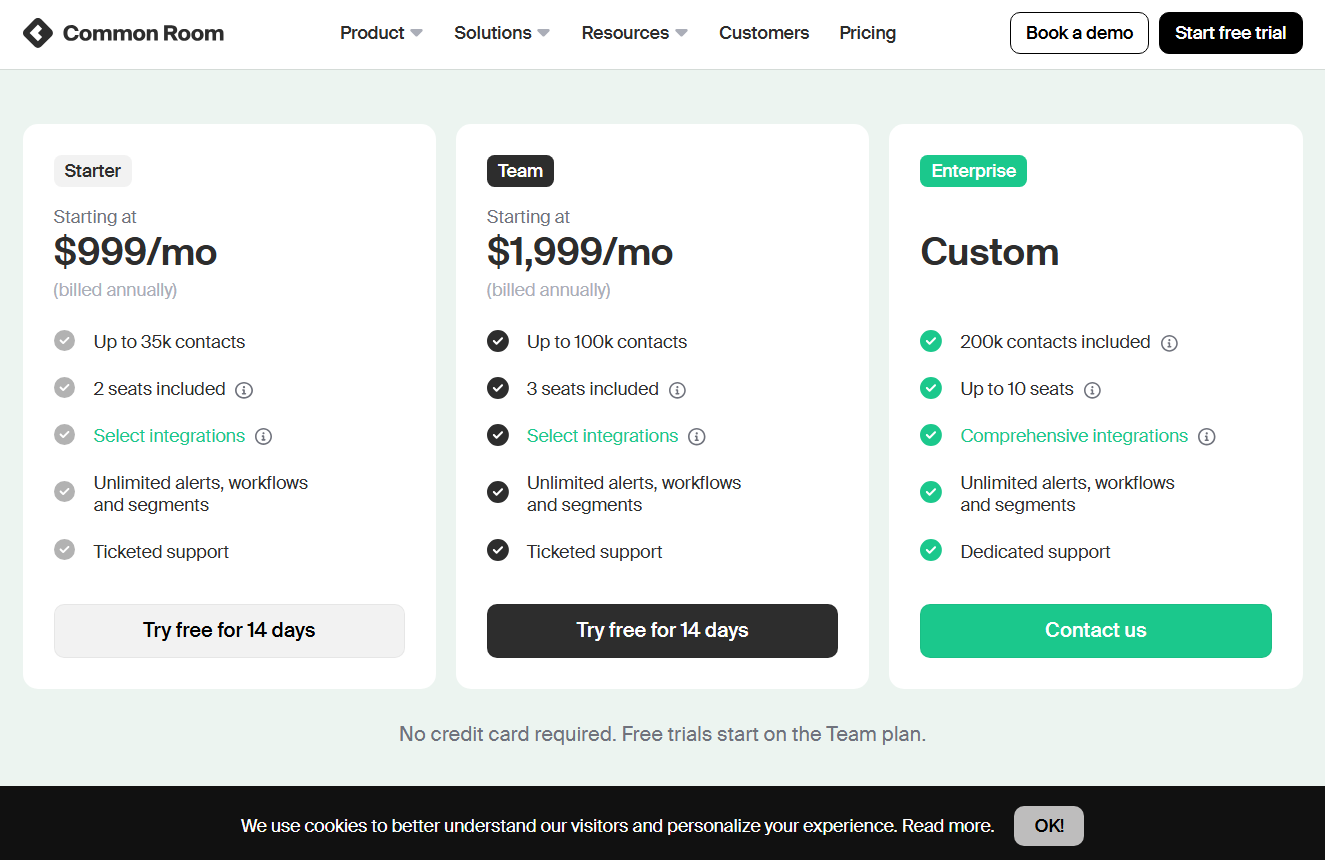

Leverage communities and organic signals instead of just paid ads to fuel ABM. Unlike ad-first ABM marketing tools, Common Room centers people and accounts from your community.

Core value:

Aggregate Slack/Discord/forums, social, GitHub/Stack, CRM, CS tools, and product analytics into unified people + account views.

Customizable models bubble up the most engaged contacts and companies.

Trigger alerts and tasks when priority people from target accounts engage.

Enrich people + account context, and sync hot lists to Outreach or into product analytics via Segment/warehouse.

Prove community influence on pipeline and show engagement trends across target accounts (not an ad attribution tool; complements one). If you already use other ABM marketing tools, this fills the organic-signal gap.

Ideal for community/PLG motions. Surfaces the right people and accounts fast, capturing early signals ad-first tools miss.

No native ad management, anonymous web tracking, or deep MTA; best paired with ad/MAP tools. Needs an active community to shine. Pricing starts ~ $1K/month and can grow; AI outreach is hit-or-miss; setup/scoring takes effort.

Perfect for companies with active dev/user communities. Pair with ZenABM to see organic + paid engagement together.

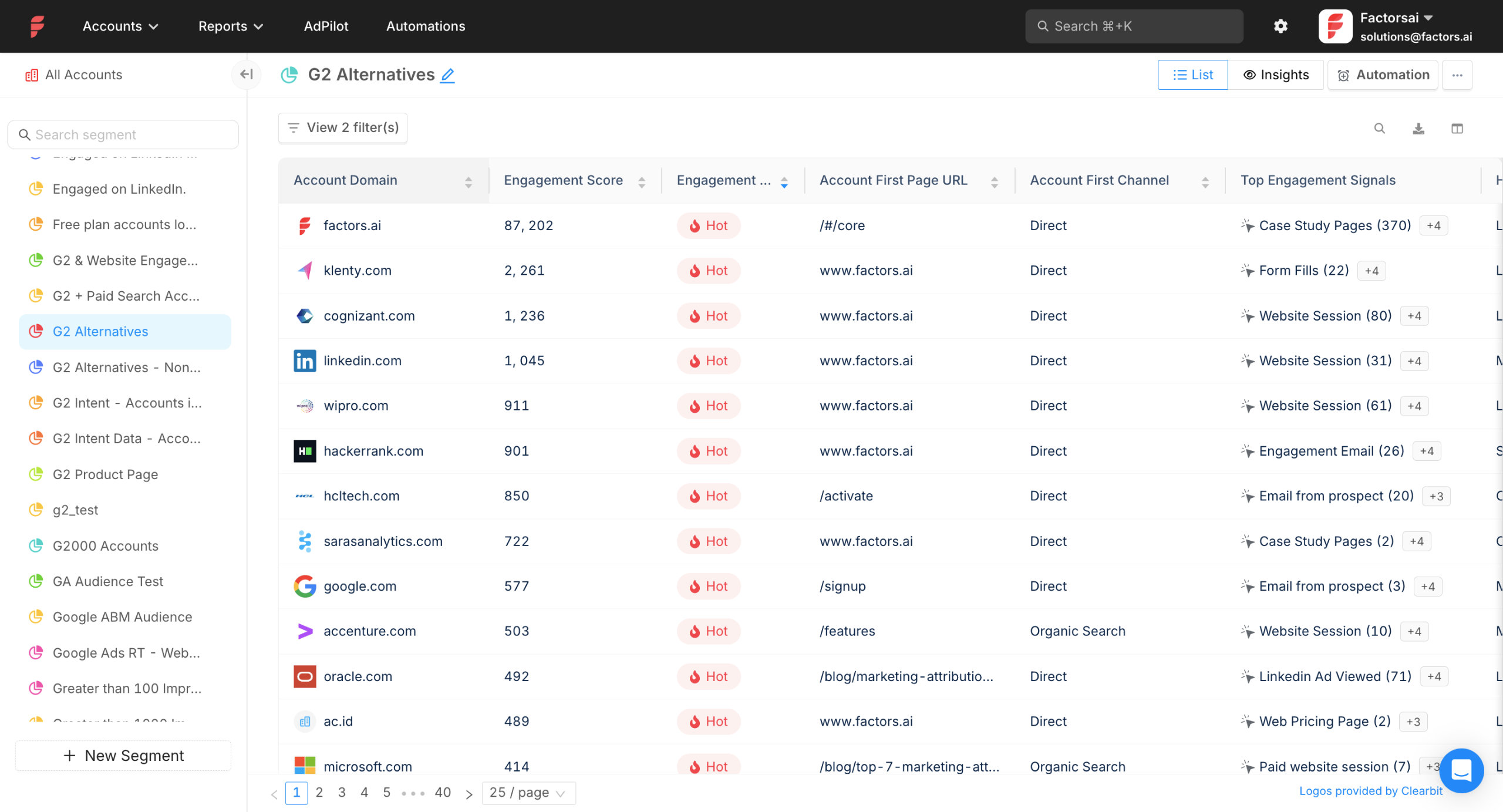

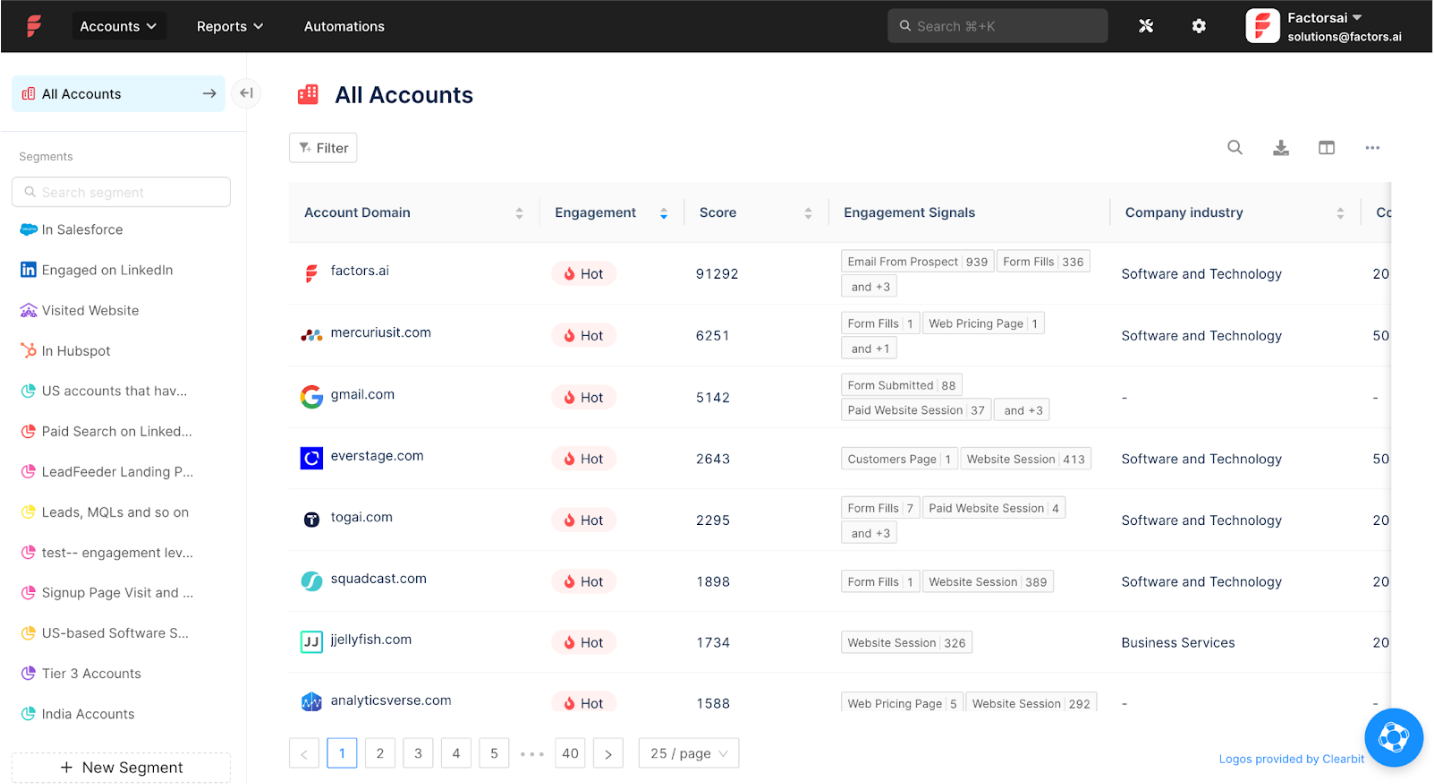

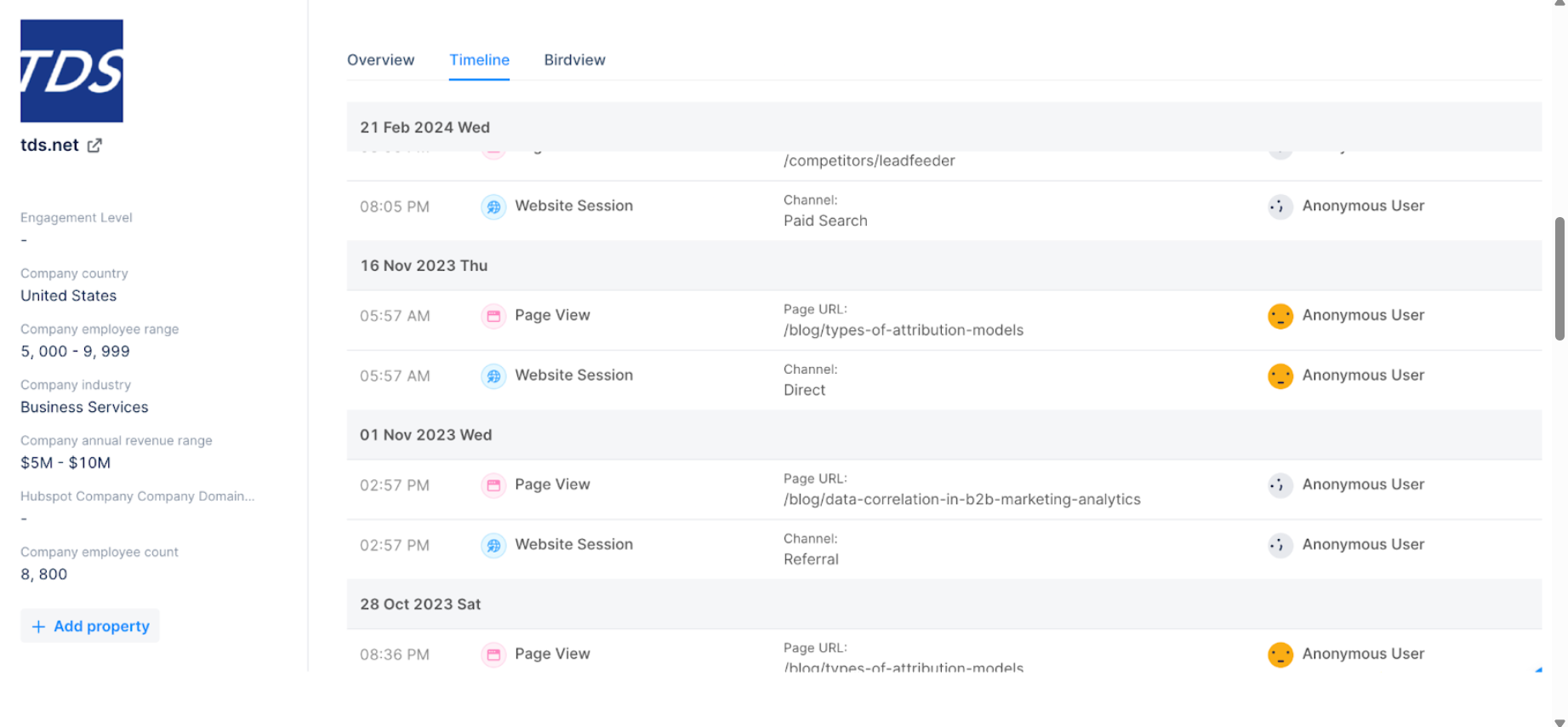

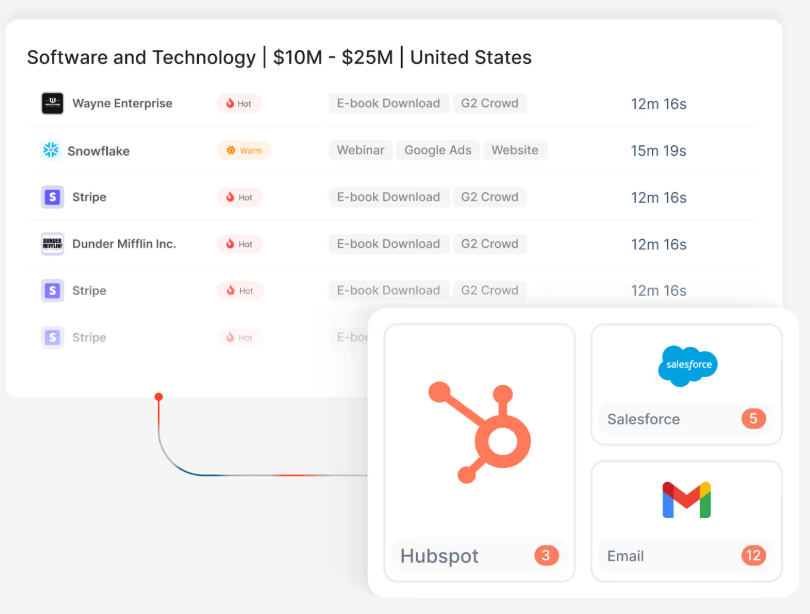

Factors.ai connects ABM touchpoints to revenue and answers which campaigns/channels moved target accounts. As an analytics-first entry in ABM marketing tools, it layers onto your stack.

Key pieces:

Out-of-the-box ABM/MTA reporting without building custom BI.

Identify some visiting companies via IP matching and attribute content influence.

Transparent pricing with free tier + modular add-ons; great for starting small, but costs can ramp with traffic/users.

Interest Groups and LinkedIn AdPilot bring intent segmentation and ads control (both premium add-ons).

Pull deal data and push insights back to your stack for clearer attribution.

Strong analytics layer without forcing a suite swap; low entry pricing and free trial help teams validate impact quickly.

Factors.ai’s usage pricing can spike at scale; IP match rates (~42%) mean you’ll still pay amid “unknowns.” Premium features add up, and it’s analytics-first, so you’ll still run campaigns elsewhere.

Factors.ai fits teams with ABM already in motion that want clearer ROI/attribution without buying a full suite; great for startups to test/learn, but fast-scalers may prefer fixed-cost platforms.

Winning with ABM marketing tools isn’t about the flashiest AI.

It’s about fit: stage, channels, and budget. When shortlisting ABM marketing tools, match the product to your motion and resources.

Need an enterprise all-in-one? Demandbase or 6sense.

Community-driven? Common Room.

LinkedIn-heavy? ZenABM is the obvious pick.

Buy for your real GTM, not the vendor deck.

Ready to try the LinkedIn-first path?