©2026 ZenABM - All Rights Reserved.

In this article, I compare 6sense and Terminus on features, pricing, and real-world fit so marketing and sales teams can pick the platform that best supports their account-based marketing strategy.

I also outline how ZenABM can act as a lean, affordable alternative or a complementary layer to these enterprise ABM suites because of what it does differently.

Read on…

In case you’re short on time, here’s a quick overview:

1. 6sense:

2. Terminus (DemandScience):

3. ZenABM:

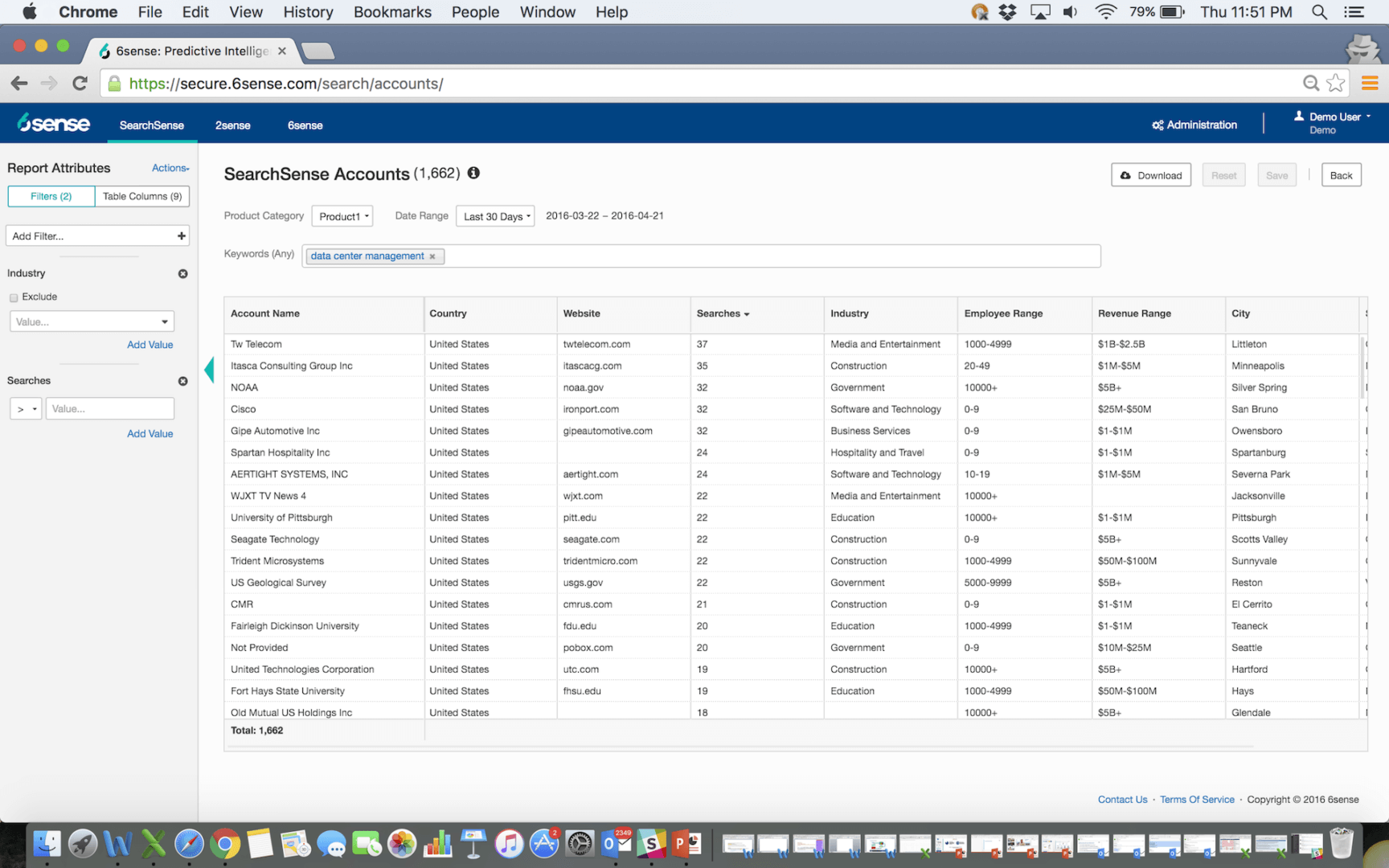

6sense is an AI-powered B2B ABM platform recognized for revenue and sales intelligence capabilities.

It helps revenue teams answer questions like “Who is showing intent” and “Which accounts deserve priority now” by combining large-scale data with machine learning.

The feature set is extensive for marketing and sales teams and is aimed at mid-sized and enterprise organizations.

Here are the highlights:

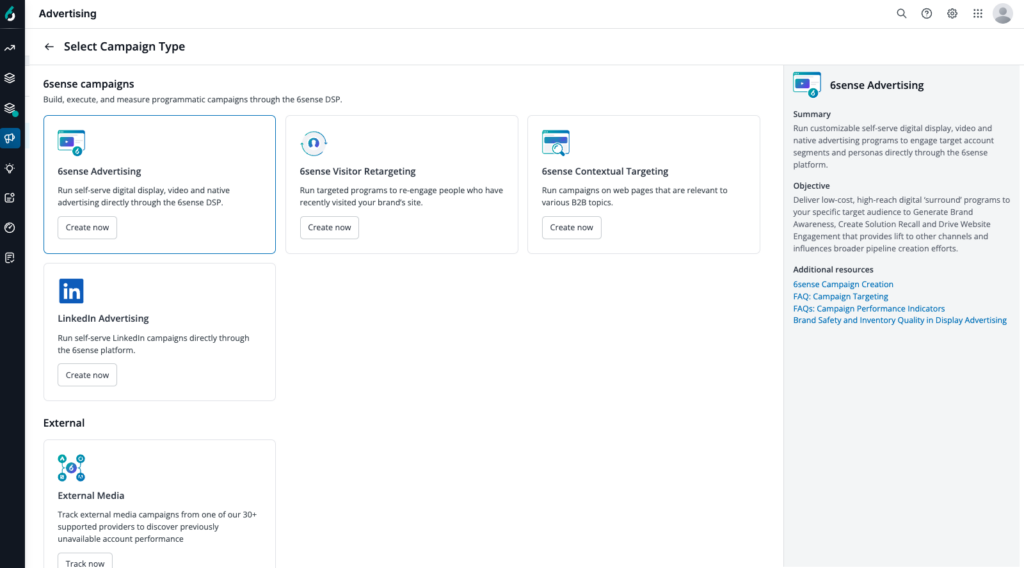

6sense provides a B2B DSP and integrations to activate ads across display, video, CTV, LinkedIn, Facebook, Google Ads, and more.

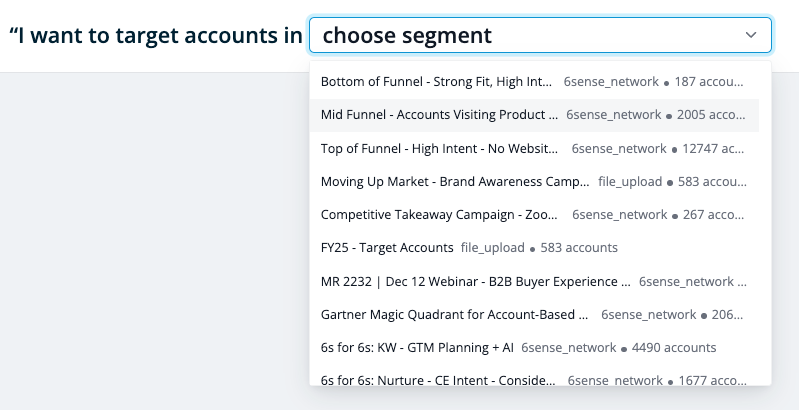

Teams can build dynamic audiences using firmographics, technographics, intent keywords, CRM data, and similar inputs to tighten targeting.

Orchestration allows ads, email, and sales outreach to coordinate based on account behavior.

6sense’s signature capability is its AI-driven intent and predictive scoring.

It blends first-party signals such as website visits, second-party data from review sites, and third-party intent around B2B search and content to produce a 0 to 100 score.

Those scores map to buying stages and conversion likelihood.

For instance, 6sense’s predictive analytics can notify sales when an account spikes on certain research topics or hits key pages, indicating potential in market status.

This gives sales a proactive way to focus on high-intent accounts.

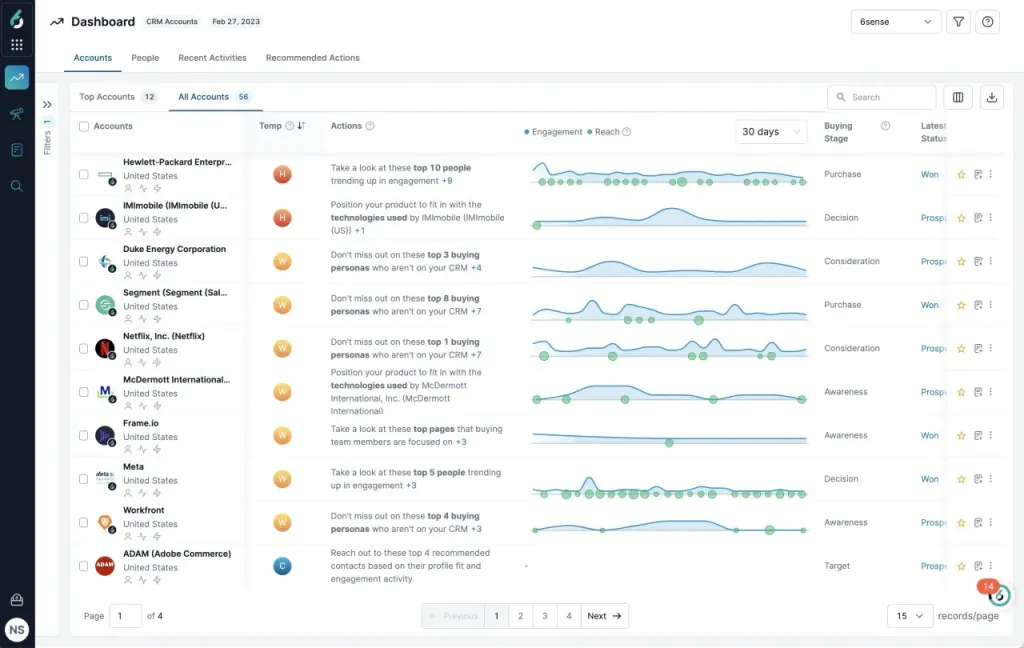

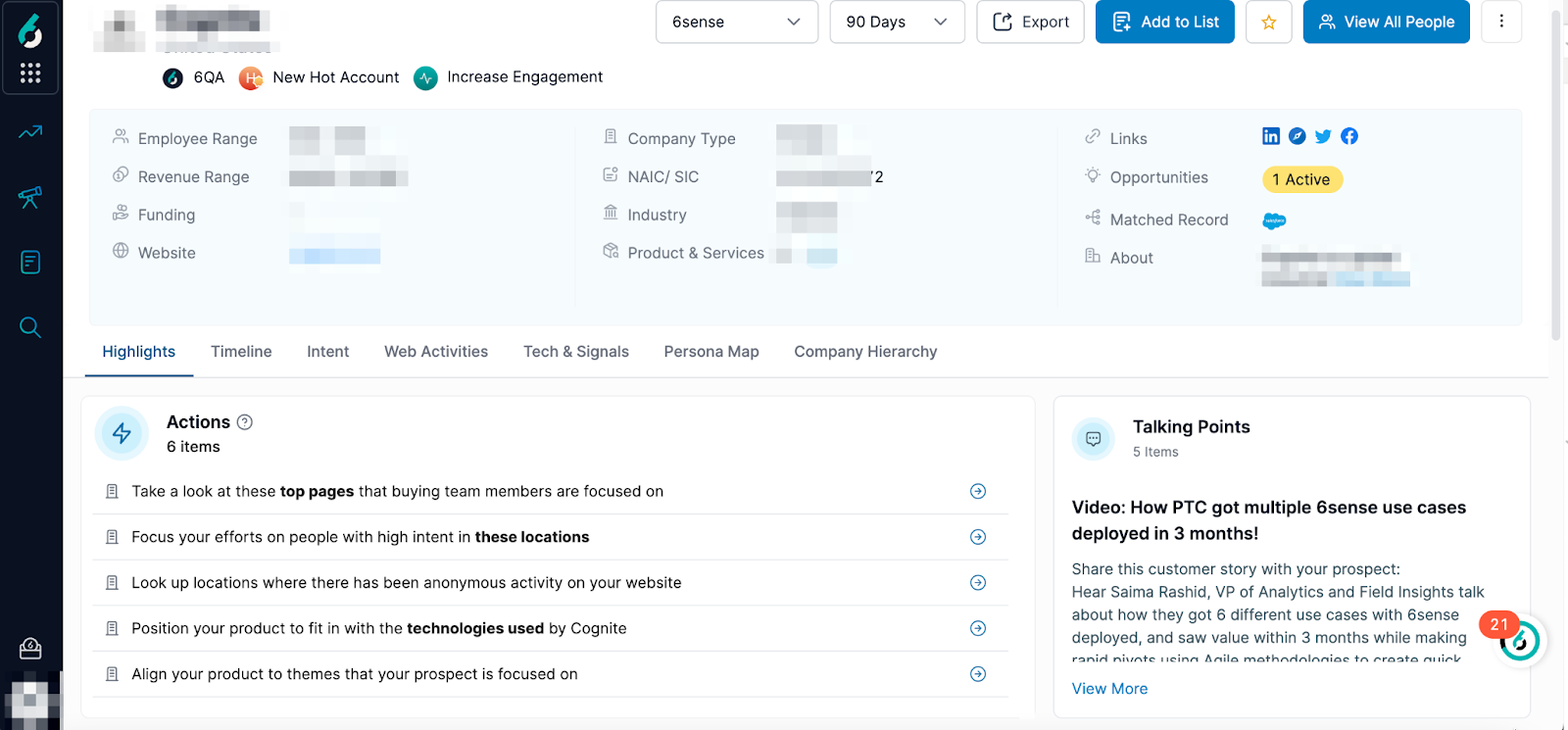

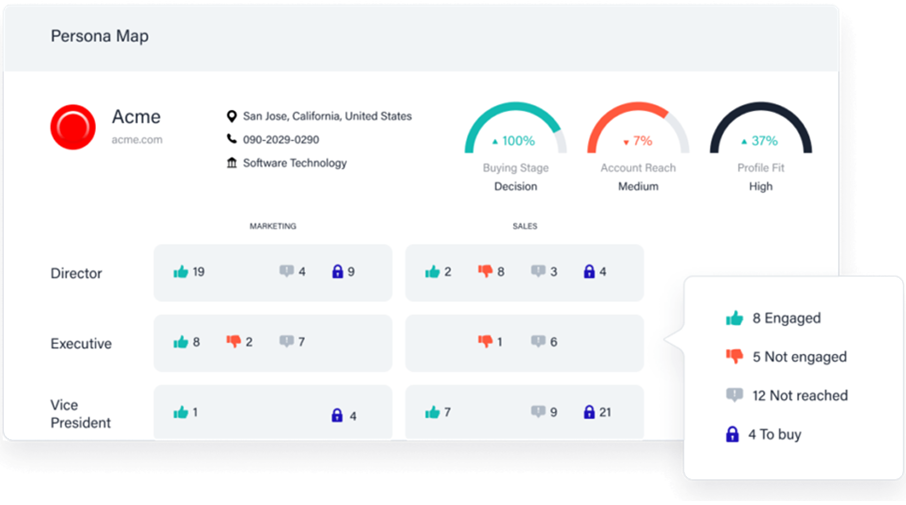

6sense builds comprehensive account profiles with firmographics, technographics, key contacts, and behavioral context.

It often supplements with third-party enrichment for contact data. Some users note international coverage can vary.

The sales intelligence features, such as buying committee mapping and next best action guidance, give reps the context they need.

![]()

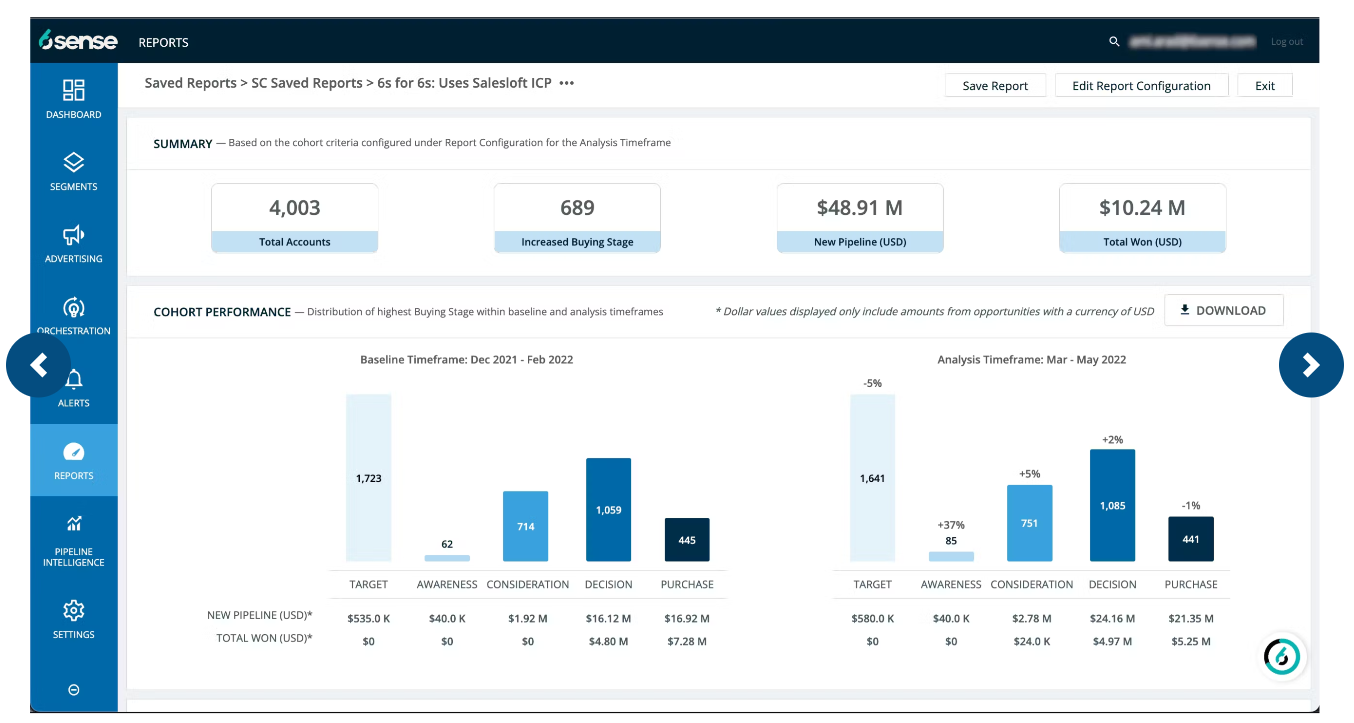

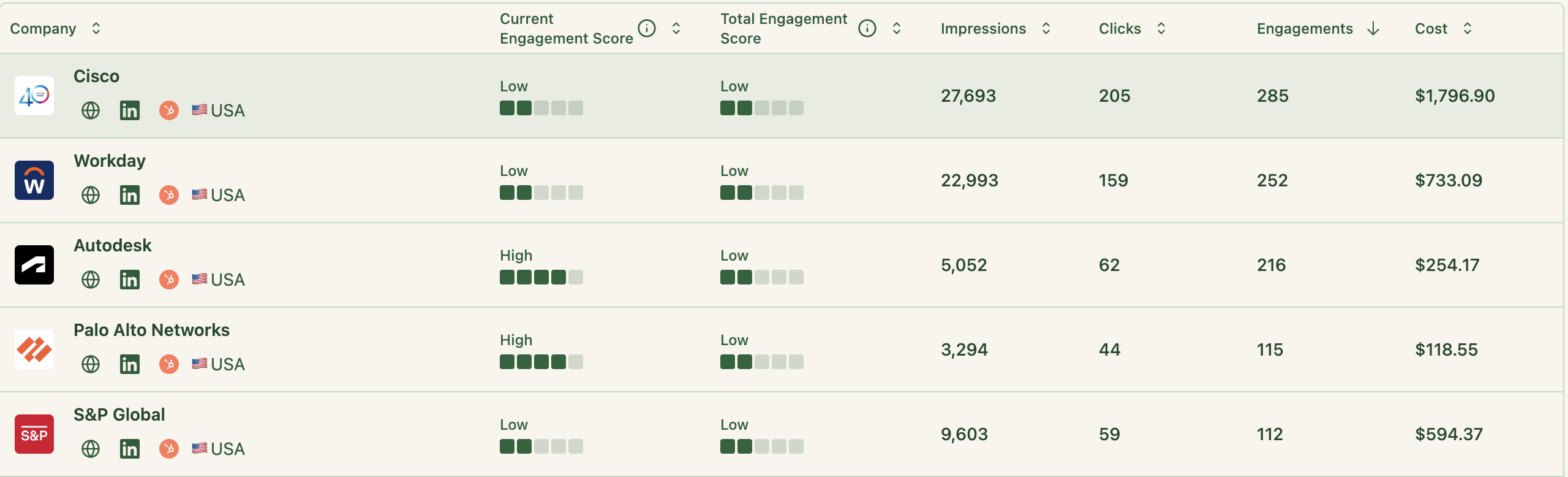

6sense provides robust dashboards for both marketing and sales outcomes.

It supports multi-touch attribution that ties pipeline to campaigns, shows influenced versus sourced revenue, and can forecast pipeline with AI.

Users can track how accounts progress across buying stages and how engagements correlate with wins.

6sense also integrates with tools like Mutiny for personalization and Drift for chat to extend the experience.

As an enterprise platform, 6sense connects with major CRM and marketing automation systems such as Salesforce, HubSpot, and Marketo, plus sales engagement tools like Salesloft and Outreach, and enrichment providers.

It aims to act as the intelligence layer for your GTM stack, improving collaboration across marketing and sales.

For example, segments from 6sense can sync to LinkedIn Campaign Manager or kick off sales sequences.

This helps both teams stay aligned on the same list of in-market accounts.

For more information, see 6sense’s integrations page.

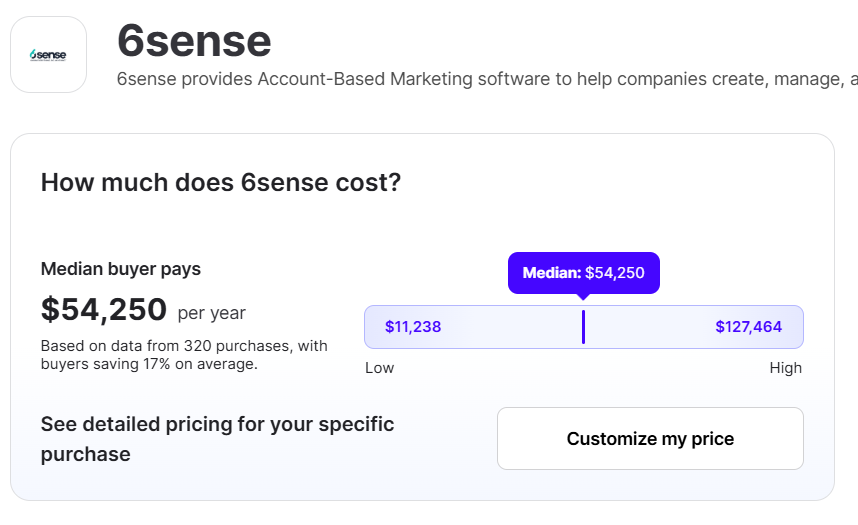

6sense is a premium product without public pricing. You will need to speak with sales for a custom quote.

Typical contracts are annual or multi-year and may include services or media components based on usage.

What should you expect to pay?

Although exact numbers depend on scope, most buyers should budget from the mid-five figures to six figures per year for a complete deployment.

Vendr cites a median 6sense price of $54,250 per year.

In short, a 6sense subscription often ranges from tens of thousands to several hundred thousand dollars annually across platform and add-ons.

Given the investment and the ramp required, 6sense suits organizations that will fully leverage advanced features.

Smaller teams that stay on one or two channels can find the price and complexity hard to justify.

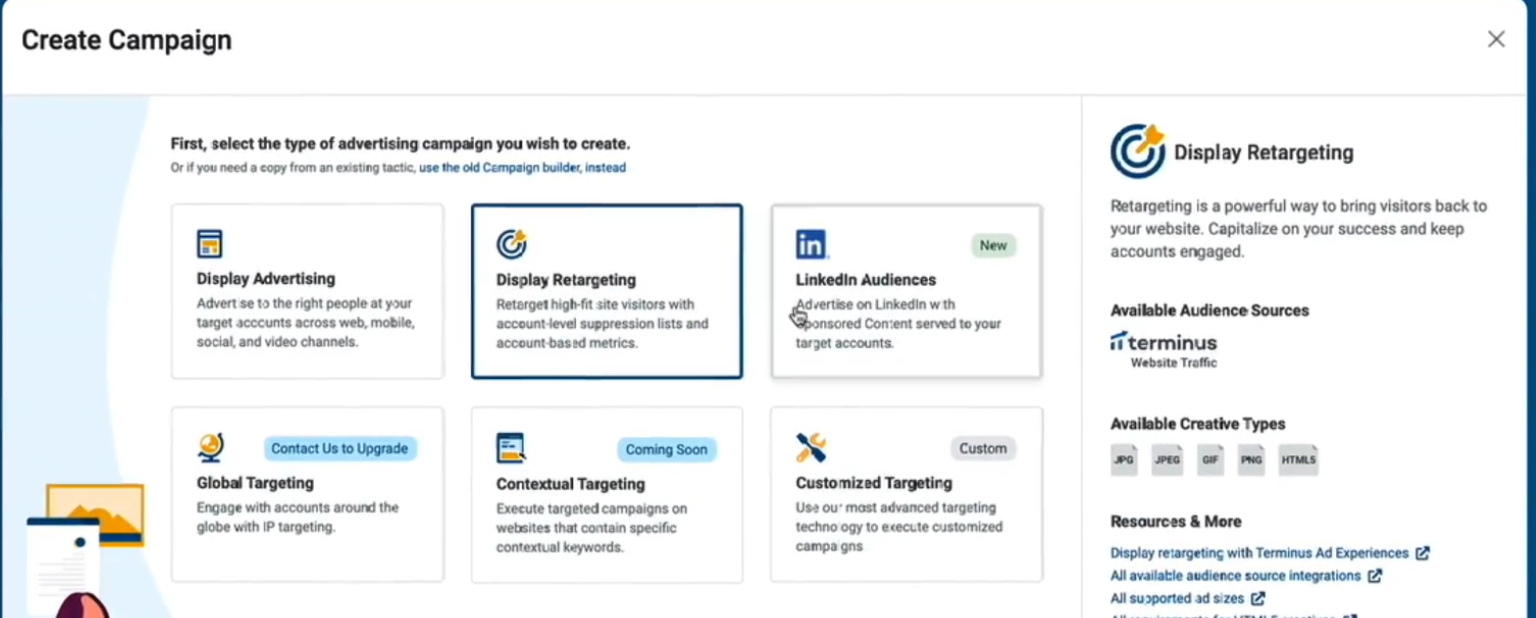

Terminus is often described as an end-to-end ABM platform known for its wide feature set and integrations. It appeals to B2B marketers seeking a unified ABM hub across ads, web, and sales touchpoints.

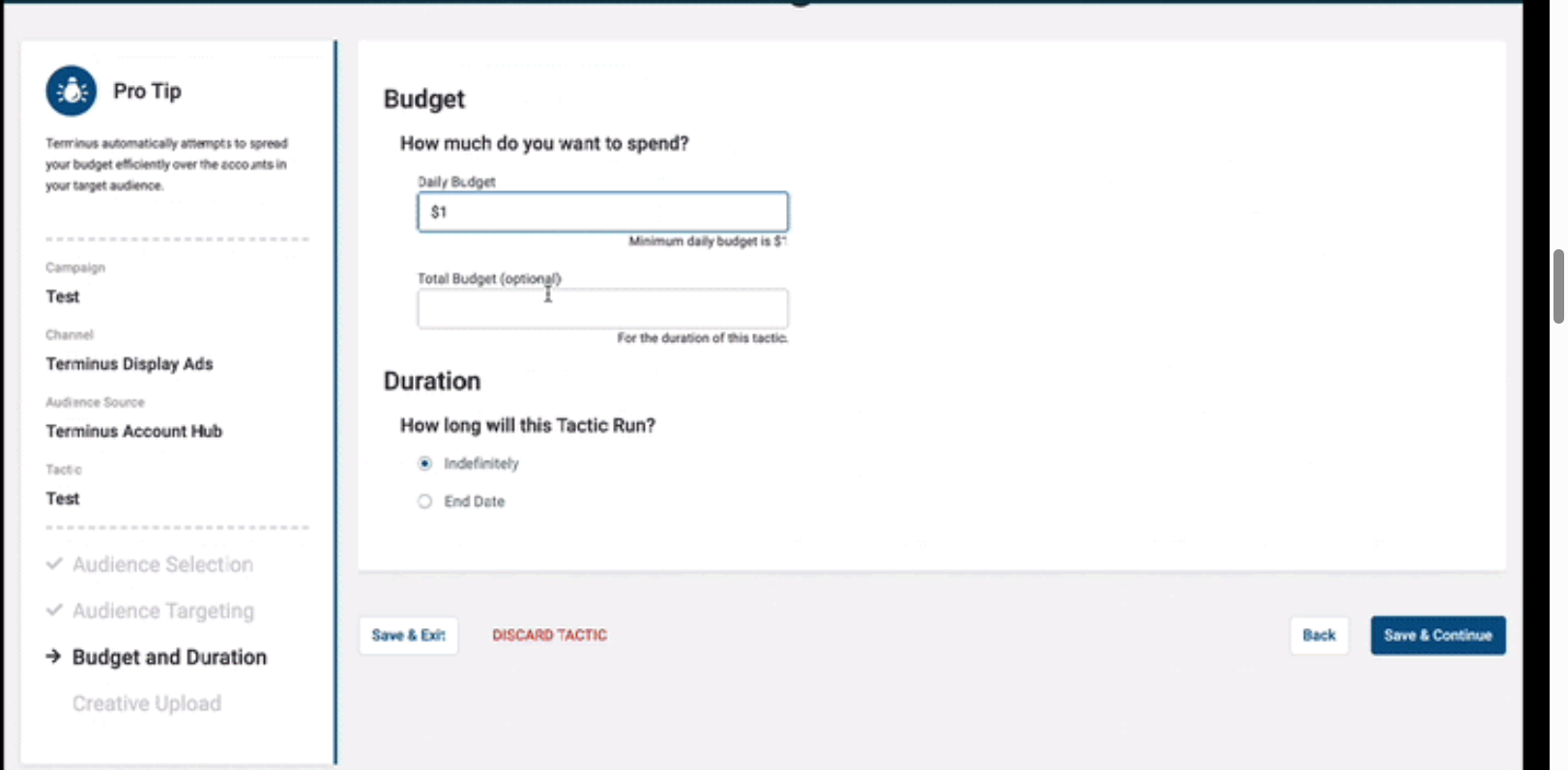

Run and manage ads across multiple channels natively: display, retargeting, LinkedIn, connected TV, and audio. By consolidating ad channels, Terminus helps reach target accounts on the web and social from one platform, balancing impressions across your target account list.

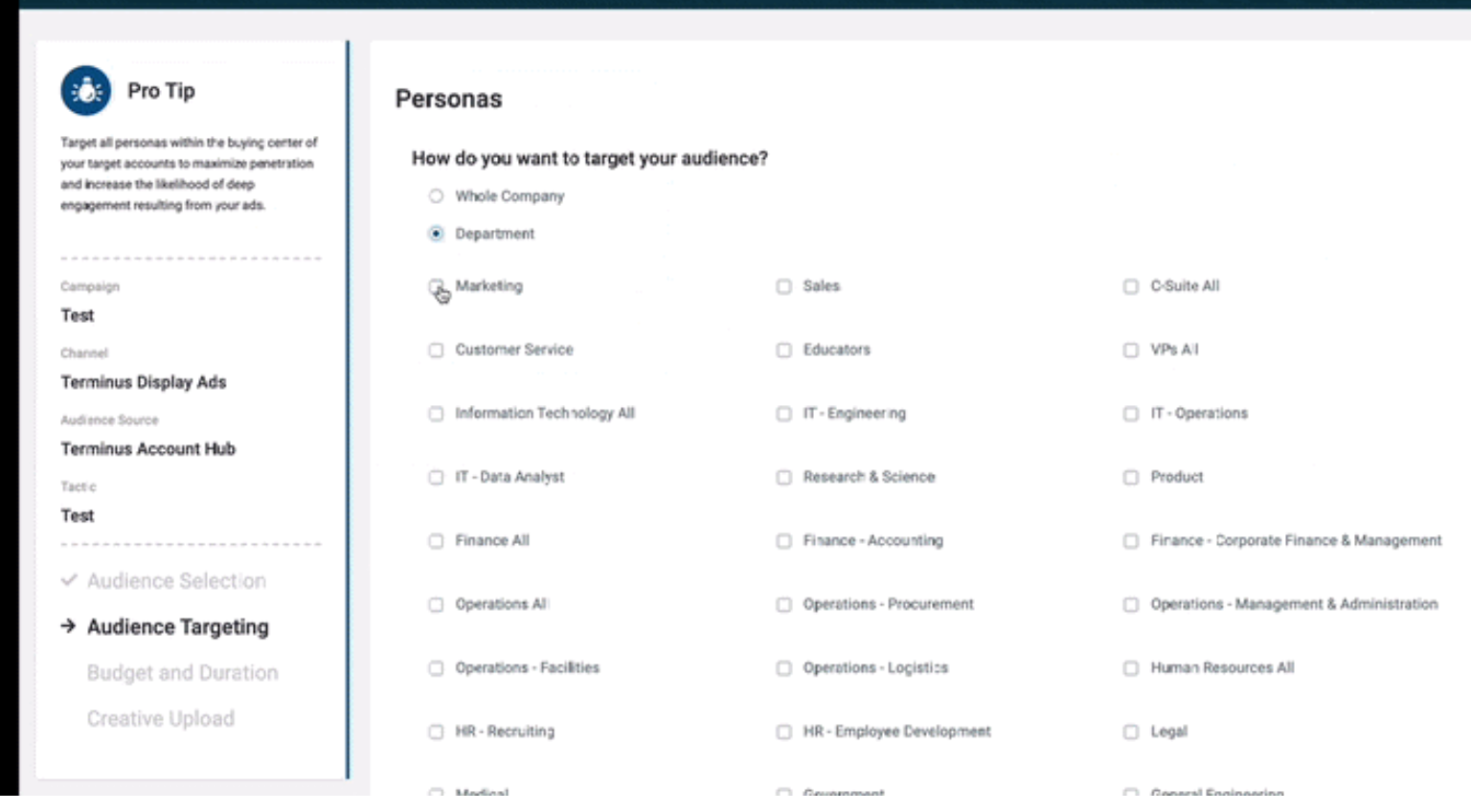

Upload or sync target account lists (TALs) from your CRM and refine audiences by persona attributes like department, seniority, or role.

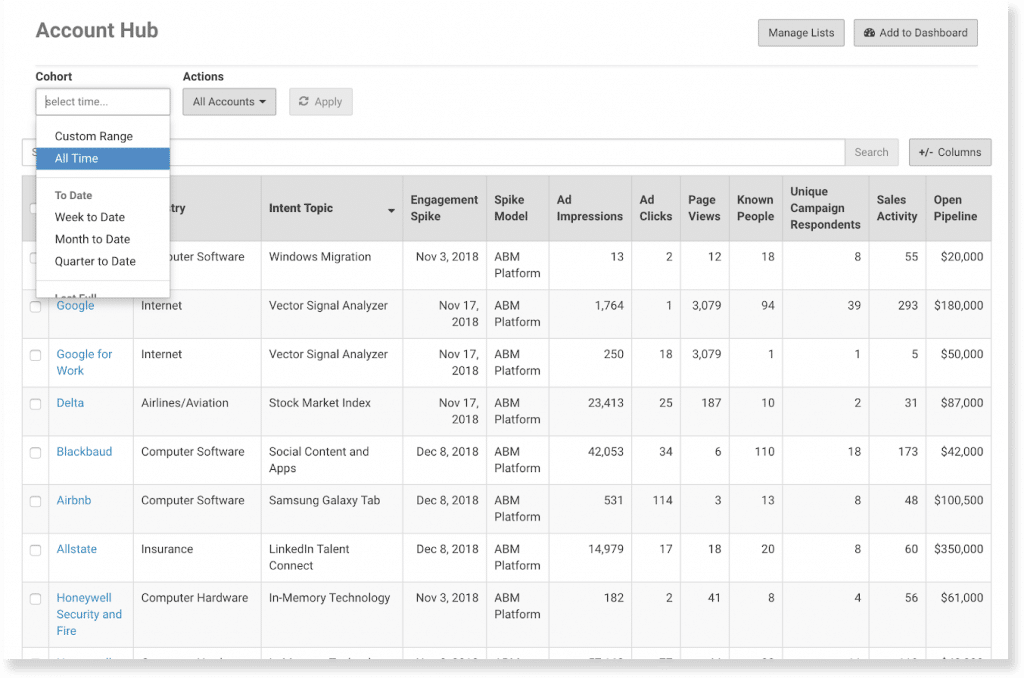

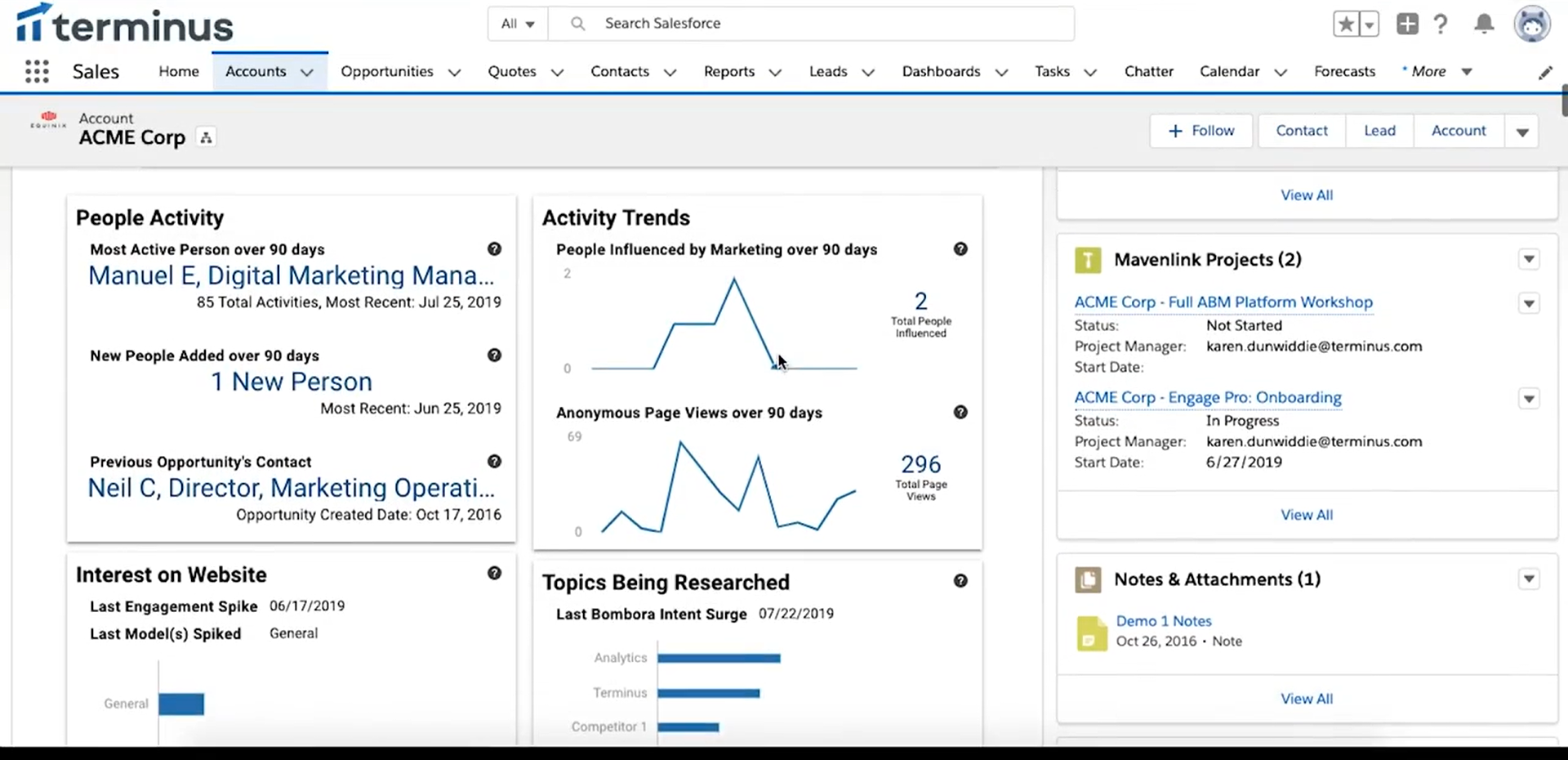

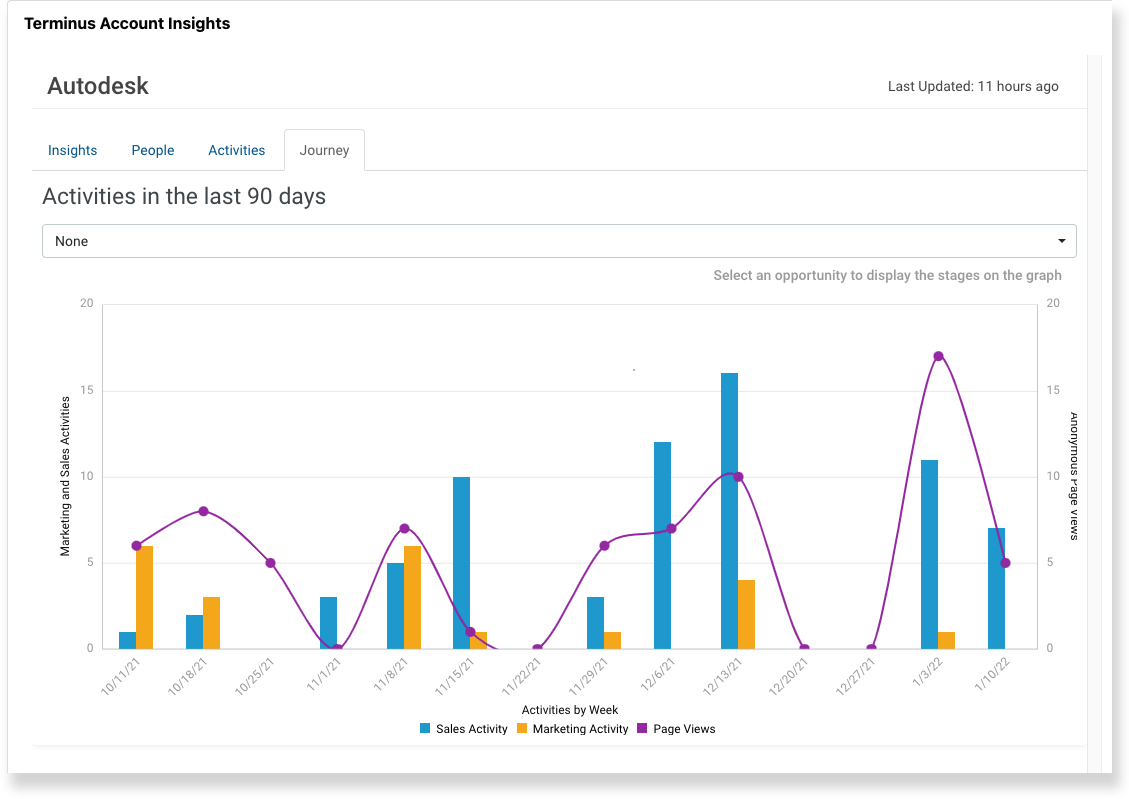

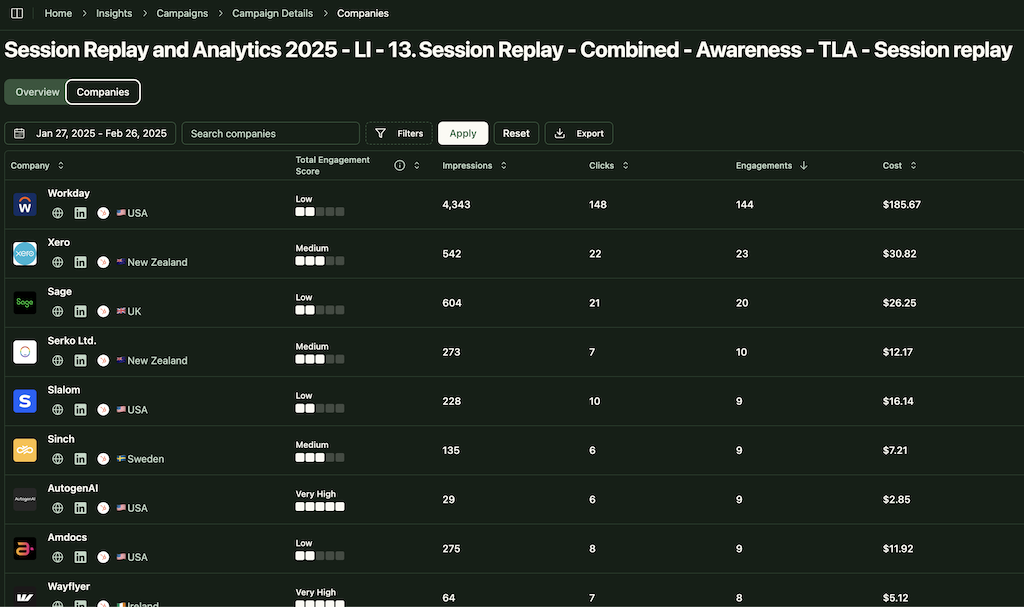

Terminus tracks impressions and clicks at the account level, helping marketers see which accounts are engaging even without direct clicks. The Account Hub compiles engagement metrics like impressions, site visits, and campaign interactions.

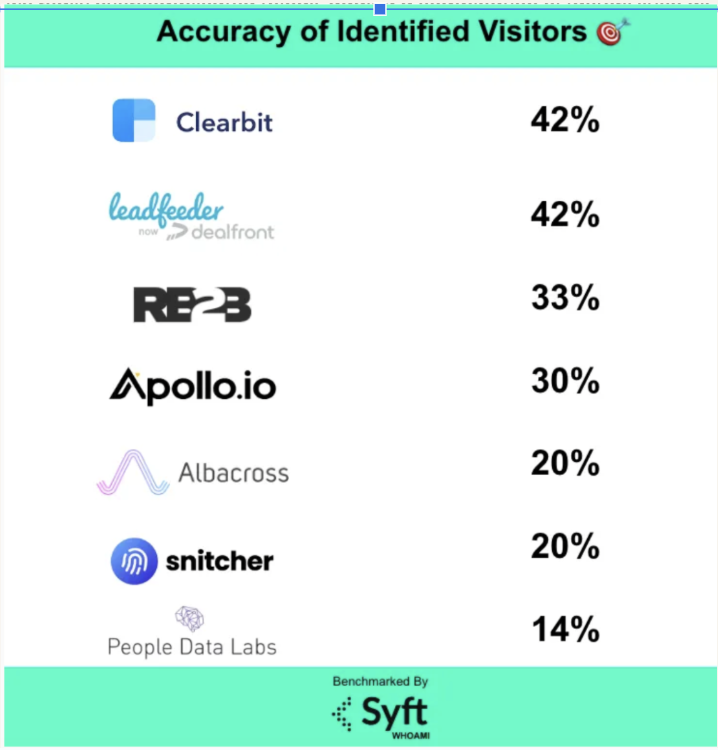

Terminus’s Visitor ID de-anonymizes website traffic using reverse IP lookup, cookies, and CRM matching. It connects anonymous visits to known accounts, though accuracy is often limited (~40–50%).

Pro Tip: ZenABM reveals anonymous visitors for free. You just have to retarget site visitors with LinkedIn text ads that are dirt-cheap anyway.

Terminus integrates with third-party intent providers like Bombora to identify in-market accounts.

Pro Tip: Favor first-party intent over third-party keyword spikes.

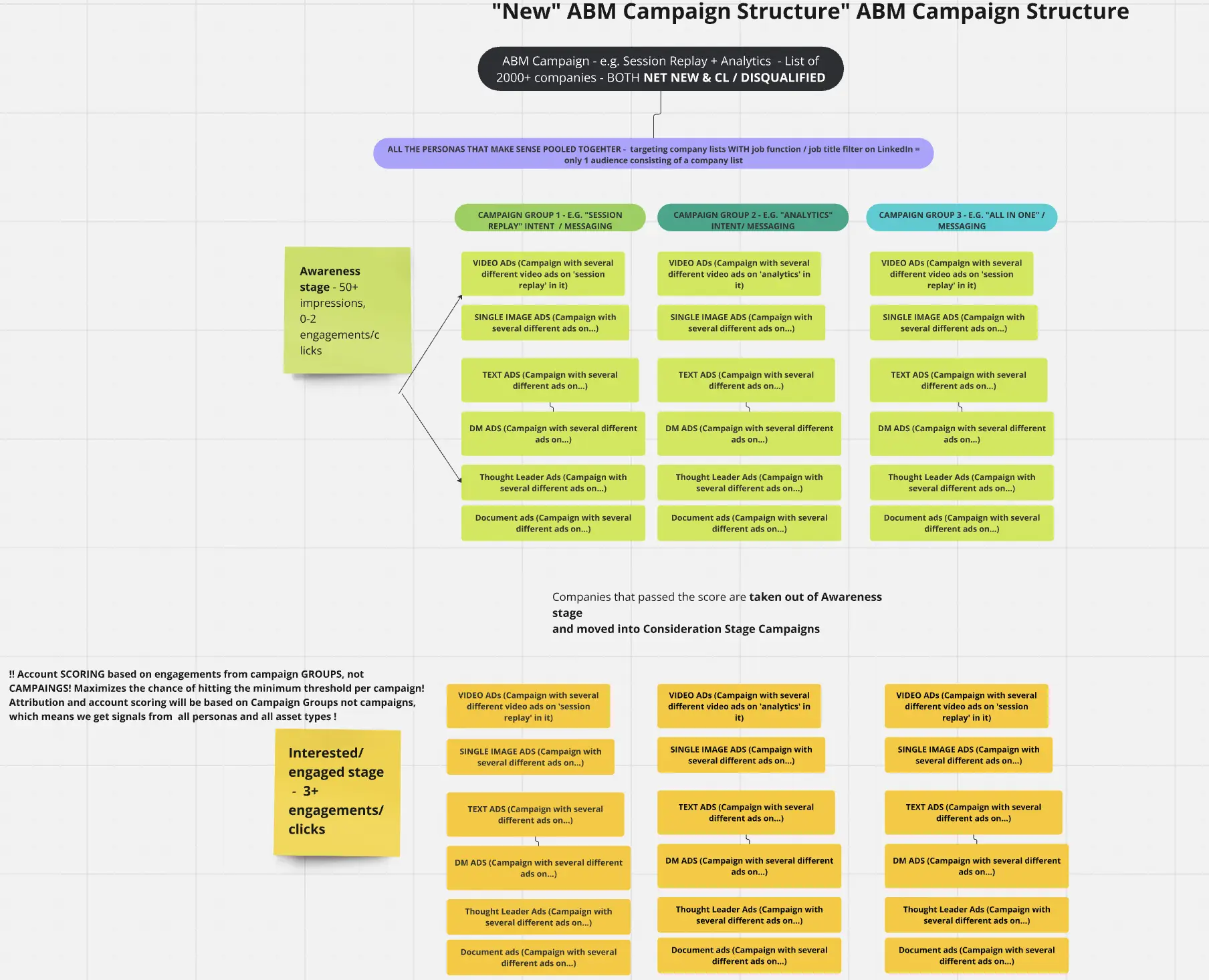

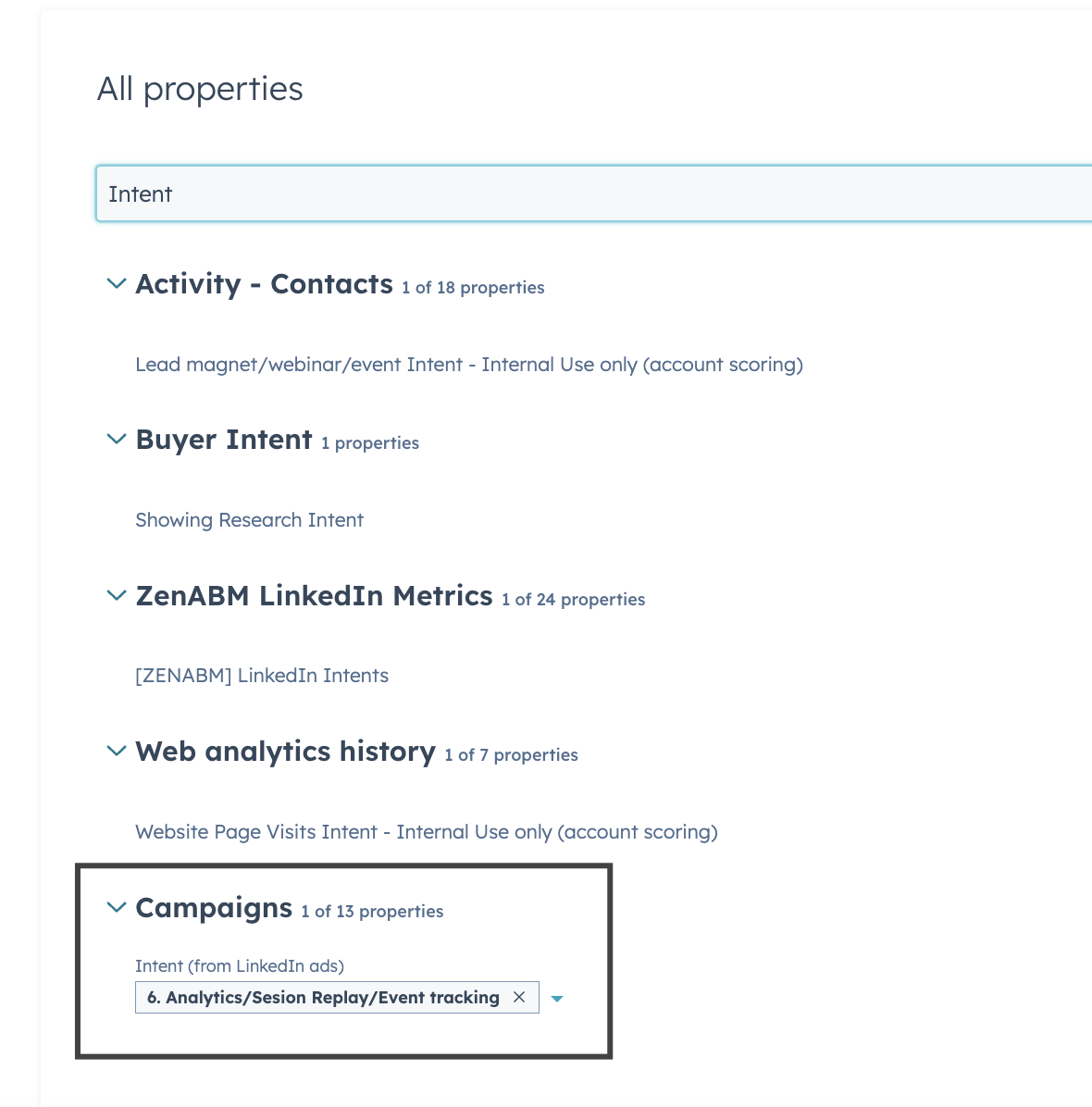

ZenABM captures qualitative intent by tracking which LinkedIn ads a company interacts with, so you get clear, actionable signals.

Userpilot and others have built ABM programs around this approach by tagging campaigns by pain point and increasing BOFU spend on themes that accounts engage with.

Their campaign structure:

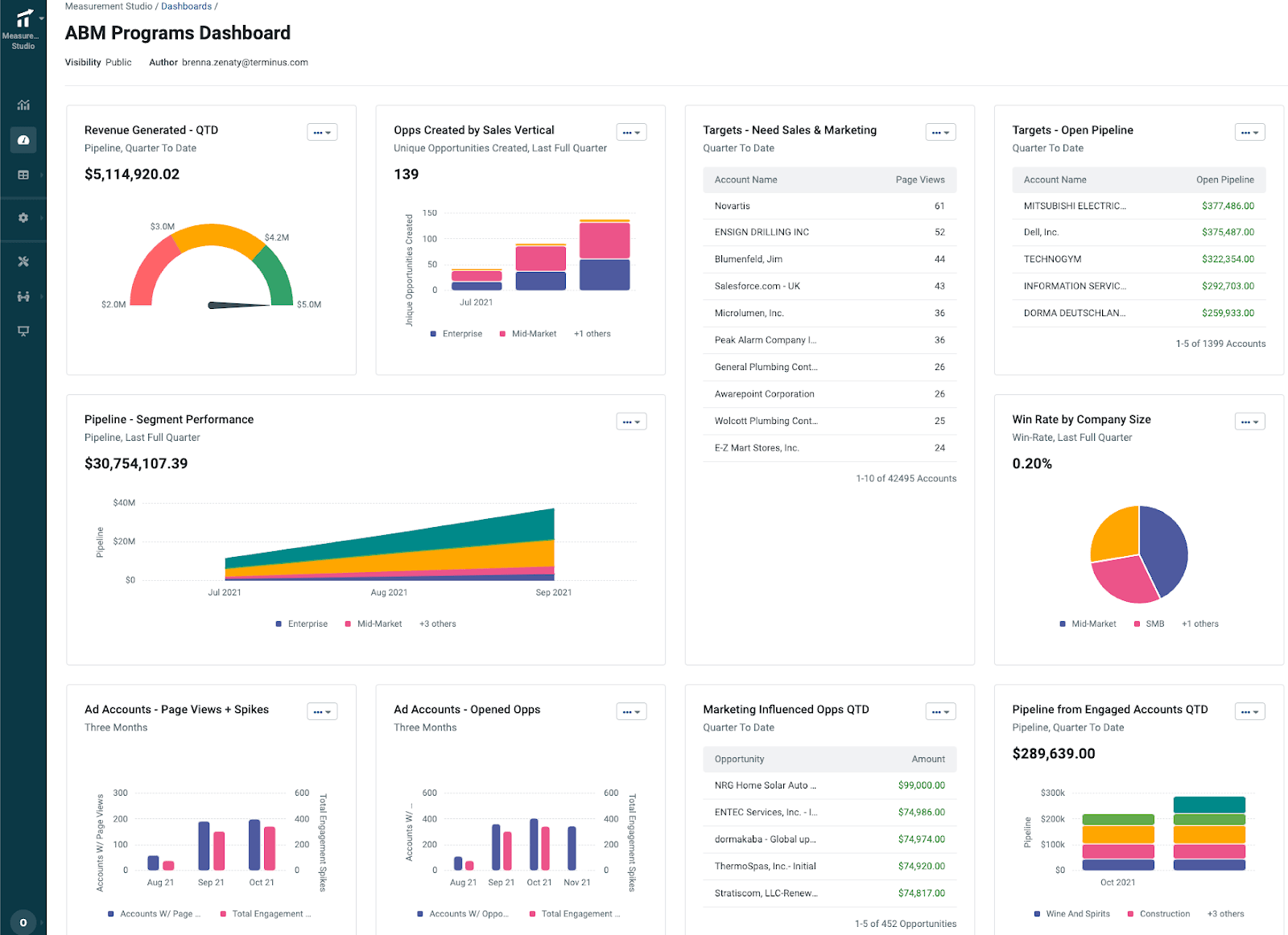

Measurement Studio offers multi-touch attribution and account-level analytics. Activities roll up into an “Account Journey,” showing progression from engagement to revenue. Dashboards cover metrics like revenue influenced, opportunities created, and top engaged accounts.

Terminus connects with CRMs (Salesforce, HubSpot, Microsoft Dynamics), MAPs (Marketo, Pardot, Eloqua), ad platforms (LinkedIn, Google), sales tools (Outreach, Salesloft), analytics (Google Analytics, PathFactory), and data providers (Bombora, G2, Clearbit).

Explore all connectors in the Terminus docs.

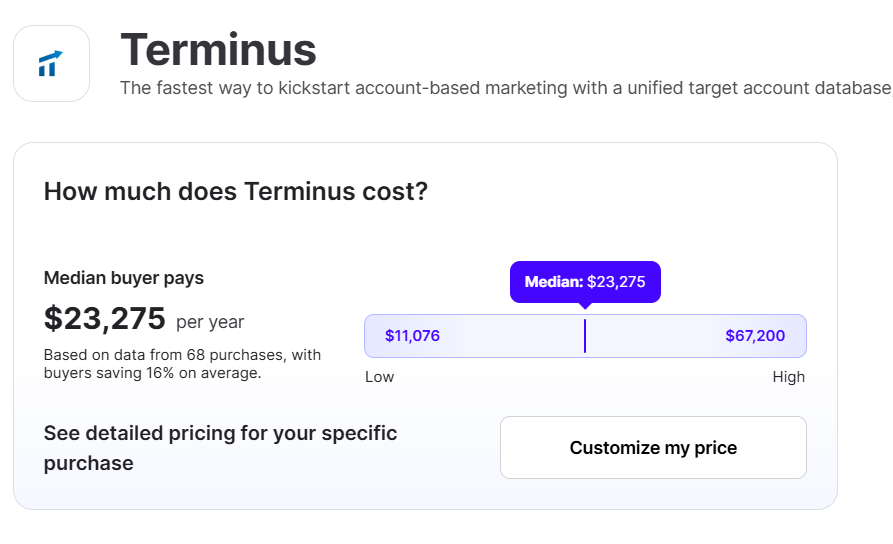

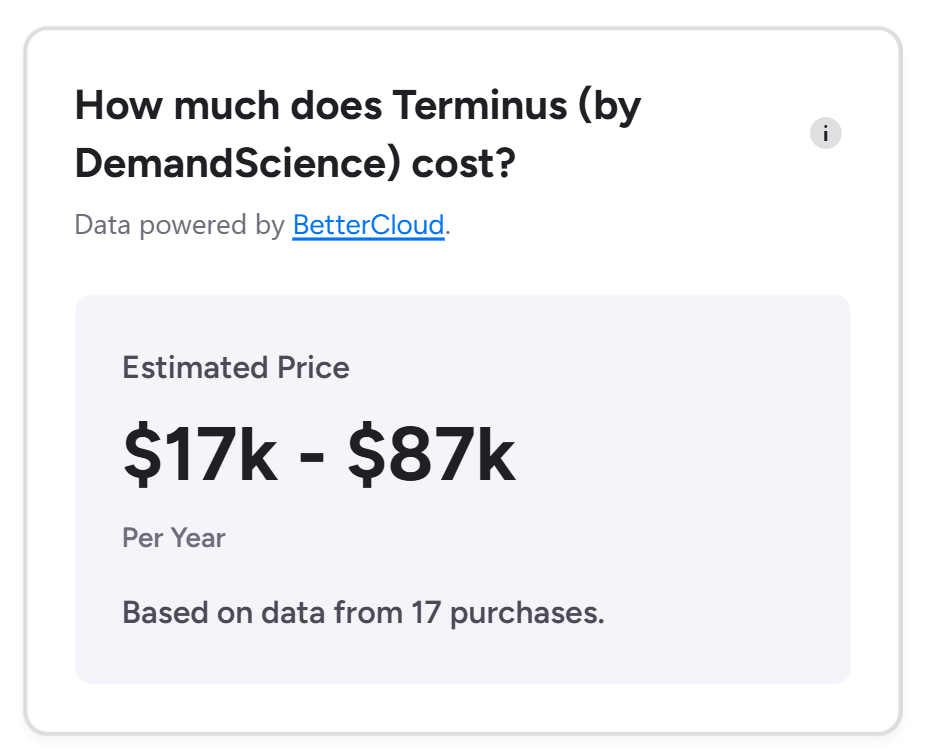

Pricing is quote-based and typically mid-five figures annually, reaching $100K–250K+ for large enterprises.

Vendr reports a $23K median cost, while CMO.com lists starting costs around $57,500/year.

Some notable differences between 6sense and Terminus that you must consider:

| Category | 6sense | Terminus (DemandScience) |

|---|---|---|

| Positioning and scope | 6sense is a Revenue AI platform that uses predictive modeling and a unified signal graph to place accounts in buying stages and drive cross-channel prioritization for sales and marketing. | Terminus, now merged into DemandScience and presented as an ABM and account-centric engagement stack, emphasizes advertising, email signature experiences, chat, web experiences, and account hubs. |

| Signals and intent | 6sense’s predictive layer classifies accounts by stage and surfaces in-market activity to trigger alerts, lists, and plays. | Terminus grades accounts on ICP fit, monitors topic intent, and moves accounts through Journey Stages for ad and outreach decisions. |

| Activation and channels | 6sense focuses on orchestration that spans inbound and outbound motions, then feeds sellers through Sales Intelligence and extensions. | Terminus centers on account-based advertising and engagement across display, social, email signatures, chat, and web, with guided playbooks tied to Journey Stages. |

| Sales workflow depth | 6sense offers a permanent Free tier of Sales Intelligence with 50 monthly data credits, company and people search, alerts, list builder, and a Chrome extension. | Terminus provides CRM widgets and sales handoffs, but its deepest strengths sit in ad and engagement programs. |

| Packaging and price posture | 6sense runs on custom quotes for the core platform, with public free pricing only for Sales Intelligence. Vendr’s marketplace currently lists a 2025 median ACV around $57K/year, with wide variation by scope. | Terminus pricing is also quote-based and, post-merger, is routed under the DemandScience umbrella. Vendr’s 2025 marketplace shows a median around $23K/year for Terminus packages. |

| Company changes you should know about | N/A | Terminus merged into DemandScience in November 2024. The combined company now positions an ABX platform blending ABM and demand generation. If you purchase “Terminus,” you will likely contract and onboard through DemandScience. |

| What users and reviewers tend to say | 6sense: Praised for predictive buying-stage visibility and alignment across SDR and AE teams. Critiques focus on cost and setup time, which are tradeoffs for its breadth. | Terminus: Valued for pragmatic, advertising-led ABM with Journey Stages and ICP Fit that marketers can operationalize quickly. Some reviews note that advanced reporting and multi-module deployments require process and budget discipline. |

Well, it depends:

ZenABM is a lean ABM platform built for running LinkedIn led ABM programs.

Key capabilities include:

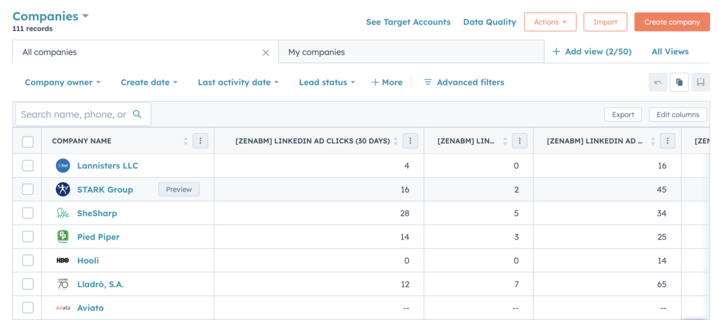

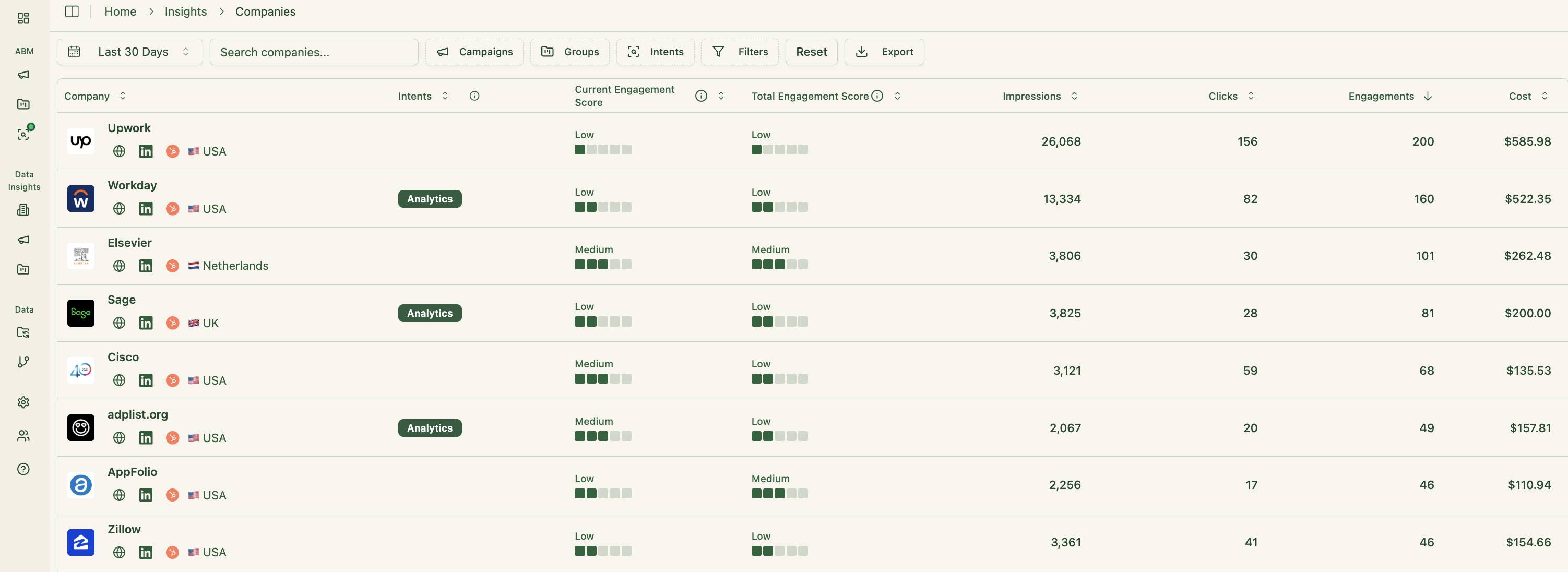

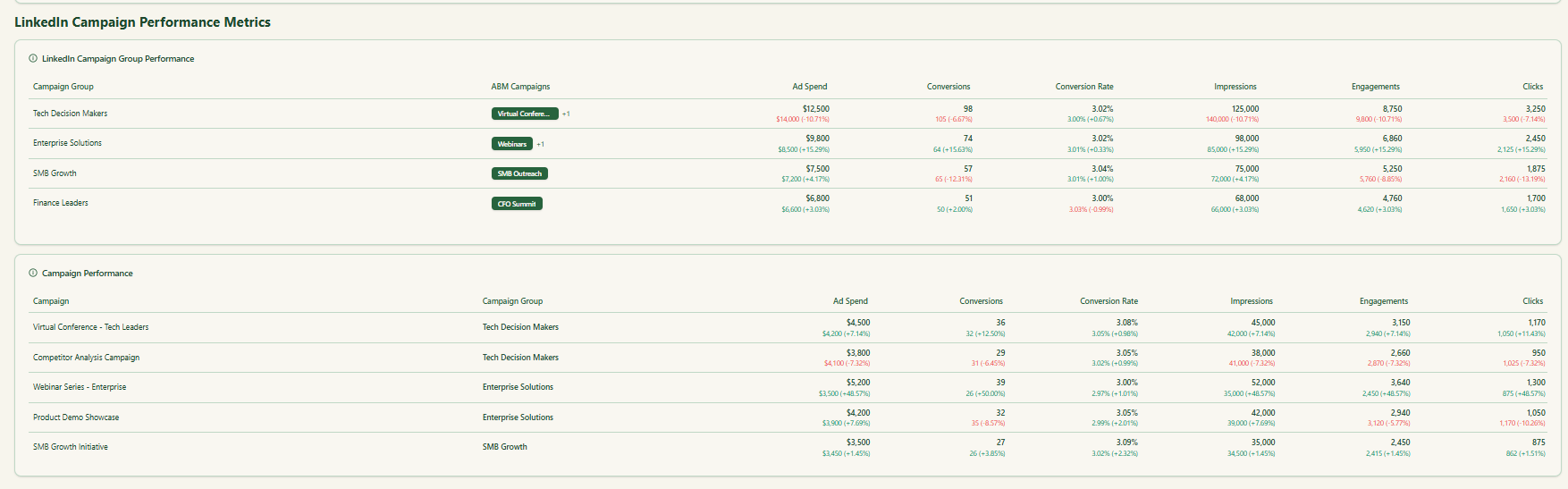

ZenABM connects directly to the LinkedIn Ads API to bring in account level data from every campaign.

You can see which target companies engage with your LinkedIn ads, including impressions and clicks, mapped at the account level.

Because this is first party data from logged in users, accuracy is high. Many ABM suites still depend on probabilistic IP or cookie methods to infer identity.

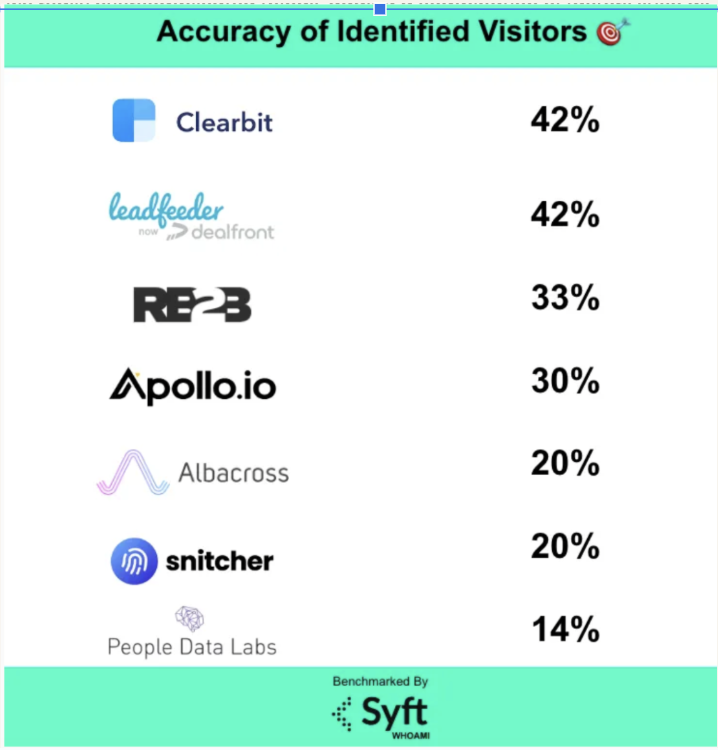

That guesswork can be unreliable. A Syft study found IP matching tools correctly identify companies about 42 percent of the time.

ZenABM’s first party approach yields cleaner intent signals from ad engagement. If several people at the same company interact with your ads, you know the account is warming up without buying third party data.

Pro Tip: You can also deanonymize many website visitors for free by retargeting them with low cost LinkedIn text ads. ZenABM will then reveal the companies that were served impressions.

ZenABM continuously updates engagement scores based on ad interactions. You can view recent or historical trends to spot warming accounts.

These scores help teams prioritize outreach to the right companies at the right time.

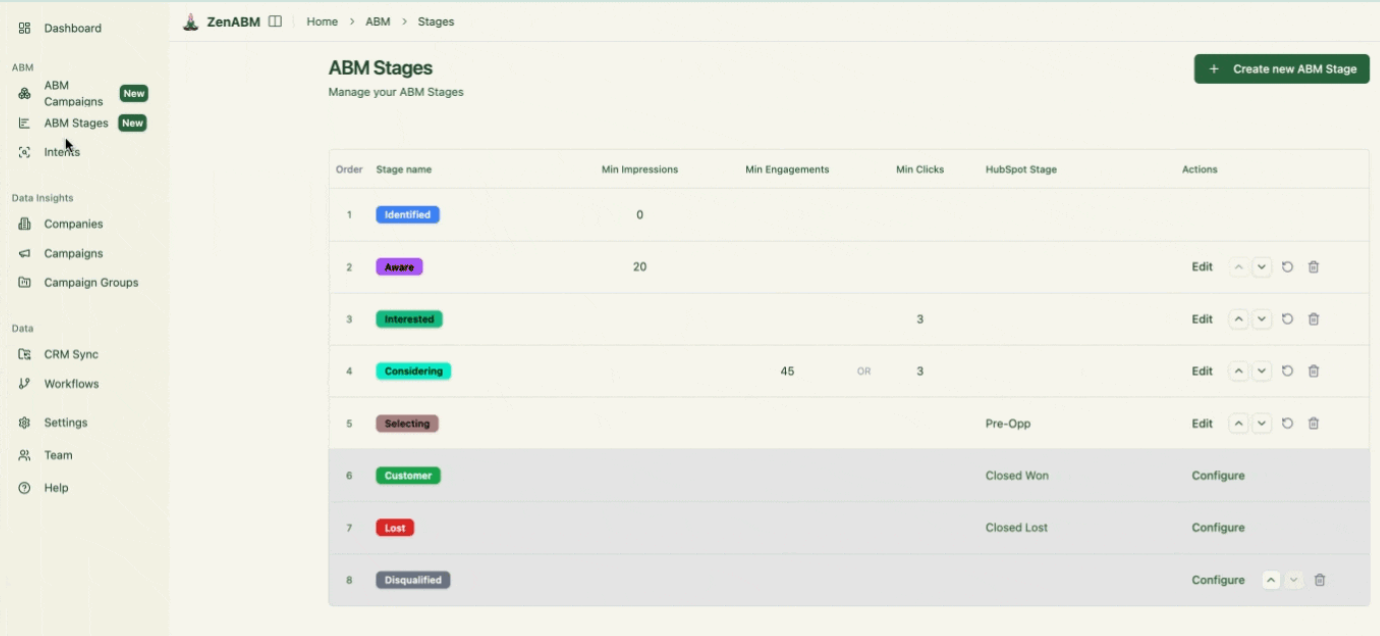

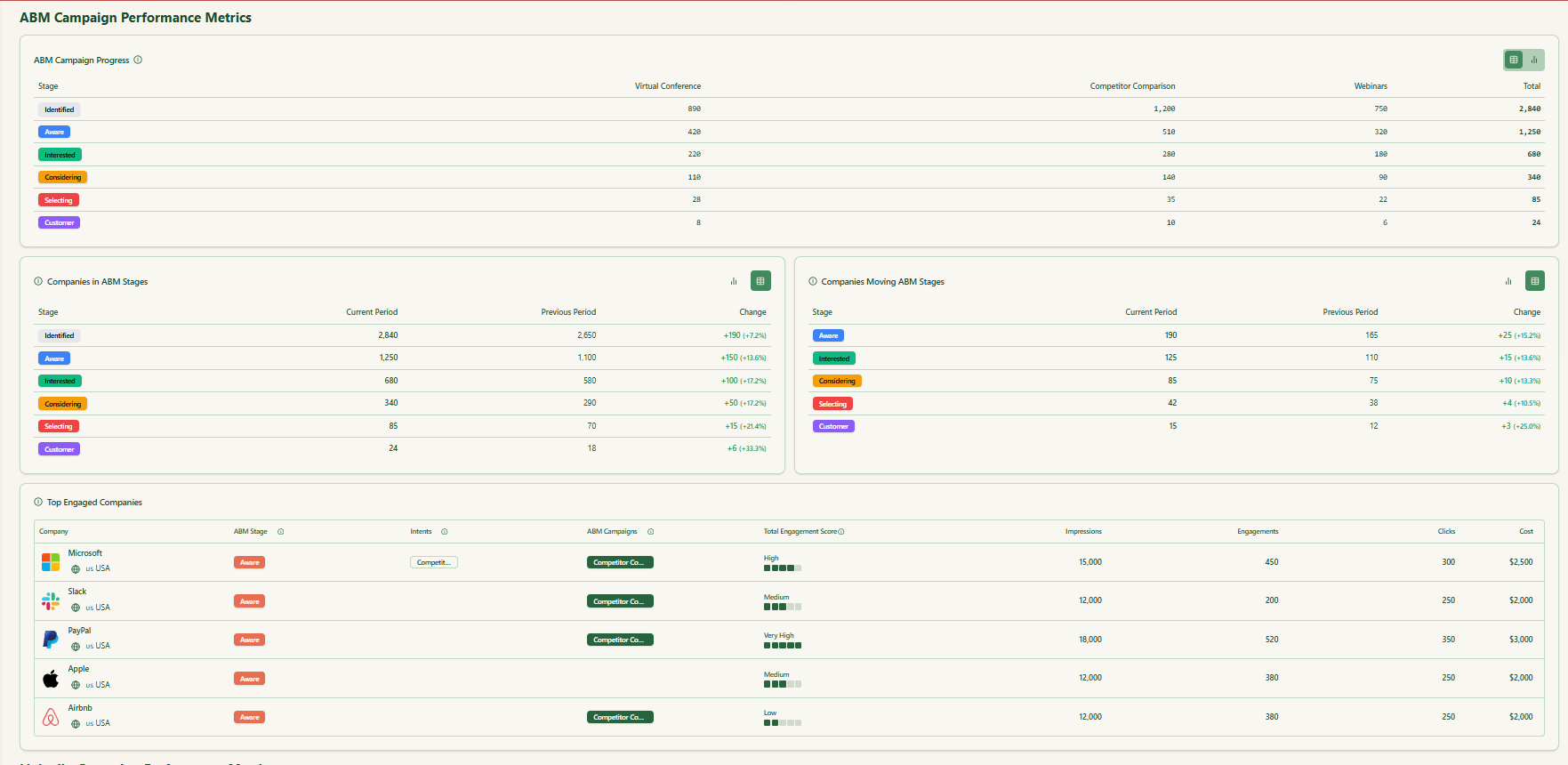

ZenABM lets you define ABM stages such as Identified, Aware, Engaged, Interested, and Opportunity. It then categorizes each account using engagement and CRM data.

You can adjust thresholds for each stage and ZenABM will track movement across the funnel automatically.

This delivers full funnel visibility similar to enterprise ABM suites and helps you find friction points.

ZenABM syncs bi directionally with CRMs such as HubSpot and Salesforce on higher plans.

LinkedIn engagement is written into your CRM as company properties so sales can react quickly:

ZenABM can also auto move accounts to Interested when engagement crosses your threshold and assign them to BDRs for immediate follow up.

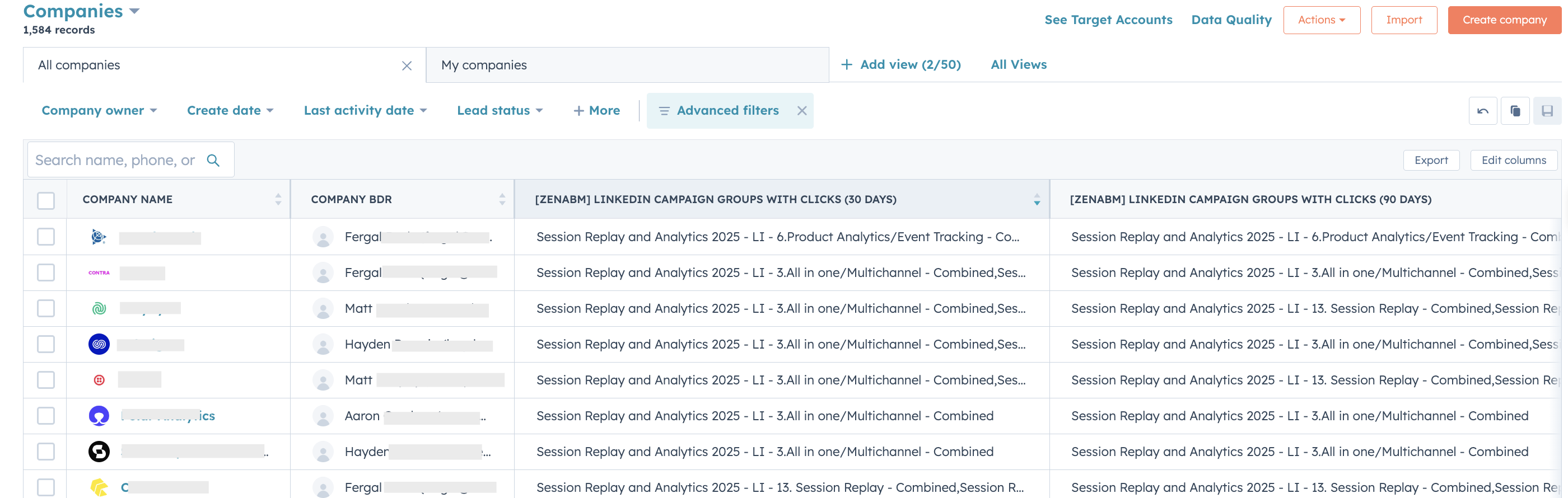

ZenABM lets you tag each LinkedIn campaign by theme or problem area. It then shows which accounts interacted with which themes so you know what each company cares about.

This is true first party intent. Instead of paying for inferred interest, you get direct evidence. If Account Z clicks a “Feature A” ad, you know the interest is real.

These insights sync to CRM, which enables highly relevant outreach and messaging.

Your reps always know the topic that resonates with each account.

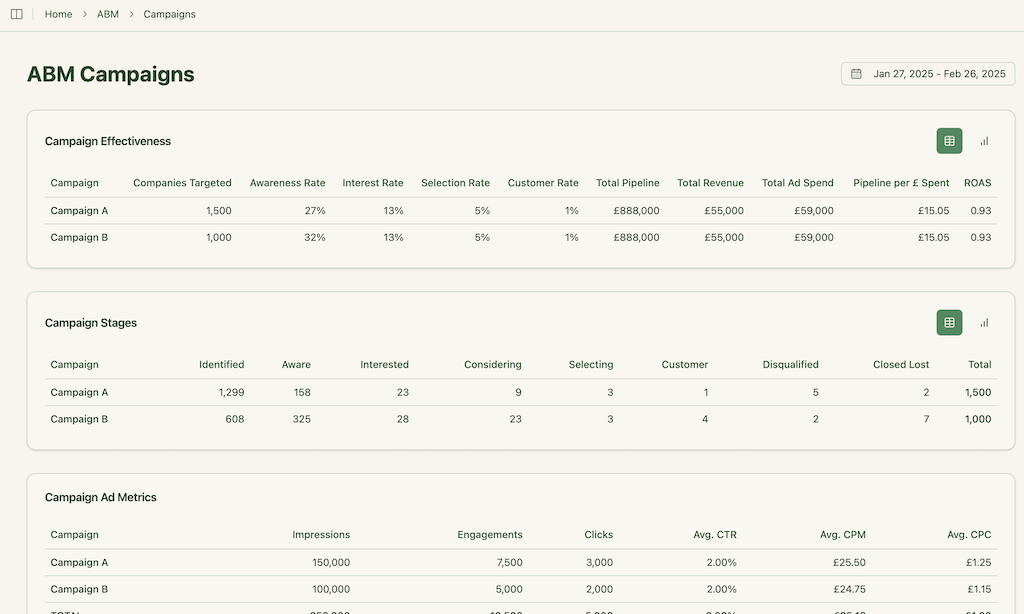

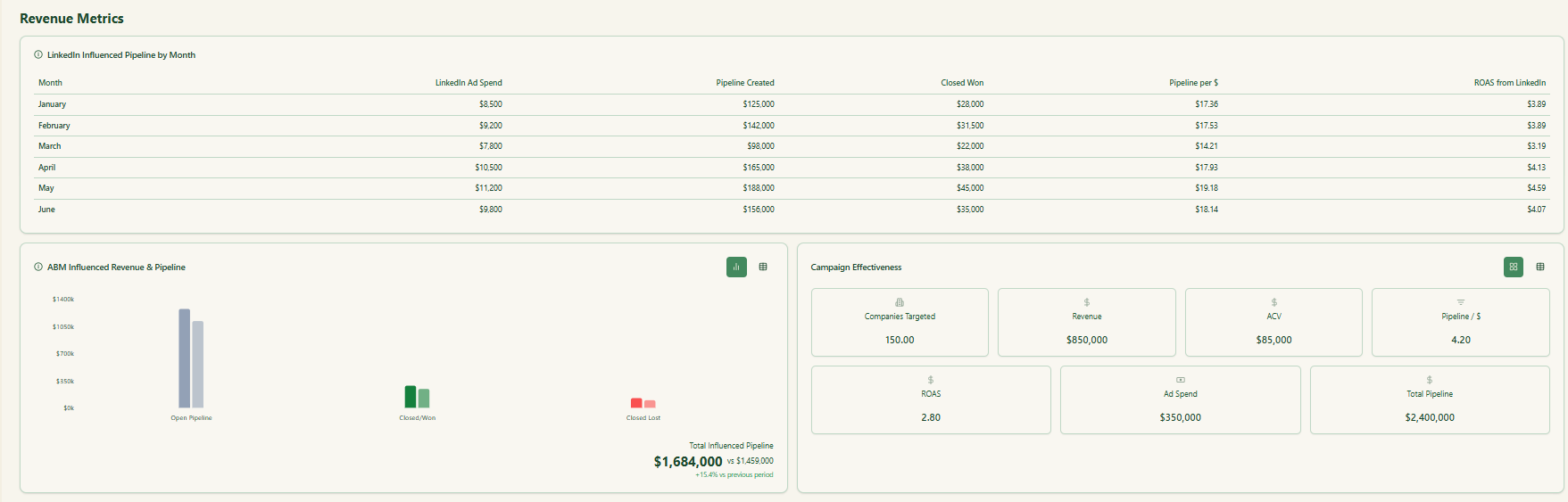

ZenABM ships with ready made dashboards that connect ad exposure, engagement, funnel stages, and pipeline.

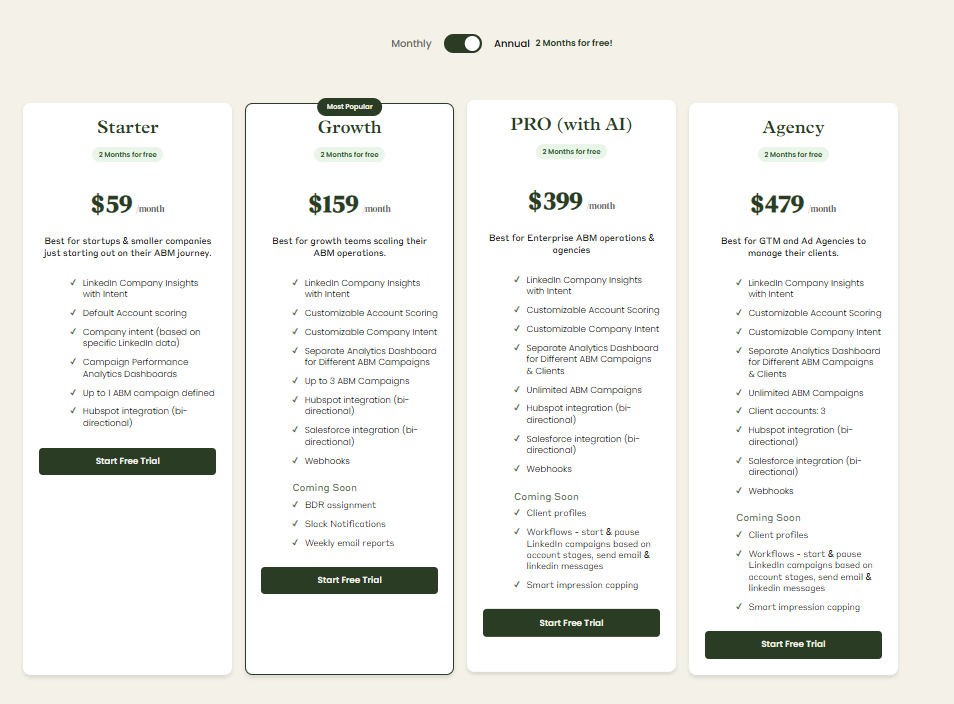

ZenABM starts at $59 per month for Starter, $159 per month for Growth, $399 per month for Pro (AI), and $470 per month for the agency tier.

Even the top plan stays under $7,000 per year, which is a fraction of typical 6sense or Terminus quotes.

All plans include core LinkedIn ABM features. Higher tiers mostly lift limits or add Salesforce integration.

You can pay monthly or annually with two months free, and there is a 37-day free trial to test before you commit.

Both 6sense and Terminus (DemandScience) remain leading ABM contenders, but their strengths differ sharply.

6sense is ideal for data-rich teams ready to orchestrate multi-channel GTM plays powered by predictive AI and unified intent data.

It’s complex, costly, and powerful when fully adopted across sales and marketing.

Terminus, on the other hand, serves marketers who prioritize ad-led engagement, account visibility, and faster deployment.

It’s more straightforward to operationalize and fits better for teams that live inside paid media and want clear Journey Stages to guide action.

But for leaner teams or those focused on LinkedIn-led ABM, ZenABM emerges as the pragmatic middle path.

It cuts through the complexity by delivering first-party intent data directly from LinkedIn, real-time ad engagement scoring, and CRM automation – all at a fraction of enterprise ABM pricing.

If your goal is to build predictable pipeline without burning six figures, ZenABM offers a credible, cost-efficient way to scale account-based marketing on LinkedIn.