©2026 ZenABM - All Rights Reserved.

In this article, I have compared Terminus vs. ZenABM based on their features, pricing, and ideal uses to help B2B marketing and sales teams decide which one fits their account-based marketing strategy (or if they might need both).

Read on…

In case you’re short on time, here’s a quick summary of the comparison:

Terminus is often described as an end-to-end ABM platform.

It gained prominence for its breadth of features and integrations, appealing to B2B marketers who want a unified ABM “Engagement Hub” covering advertising, web, and sales touchpoints.

Let’s have a look at its key features:

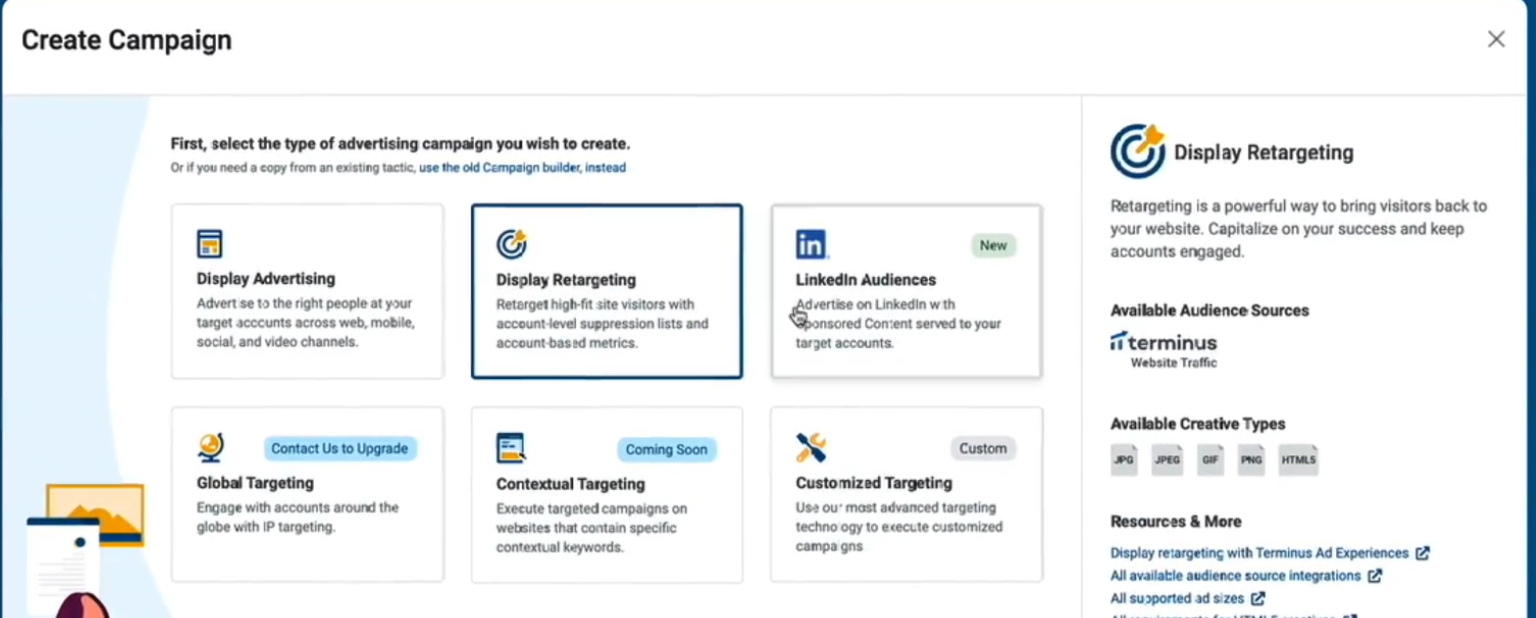

Terminus allows you to run and manage ads across a wide range of channels natively.

This includes traditional display ads (across thousands of websites via an account-based DSP), retargeting ads, LinkedIn Ads, and even newer formats like connected TV and audio ads.

By consolidating ad channels, Terminus helps you reach target accounts on the web, social (LinkedIn), and other avenues from one platform.

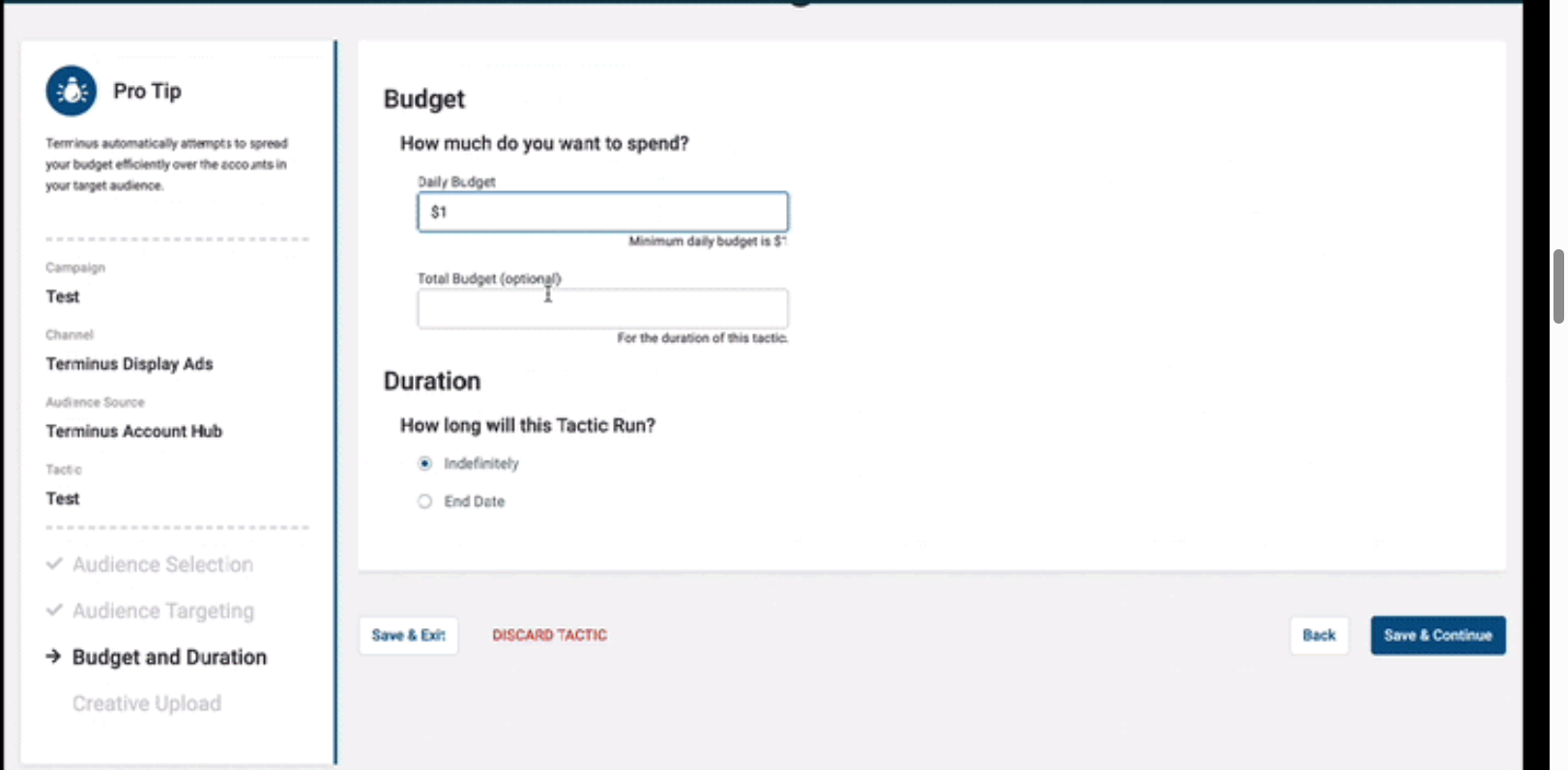

It also inherently balances impressions across your target account list so that no single account consumes your entire budget.

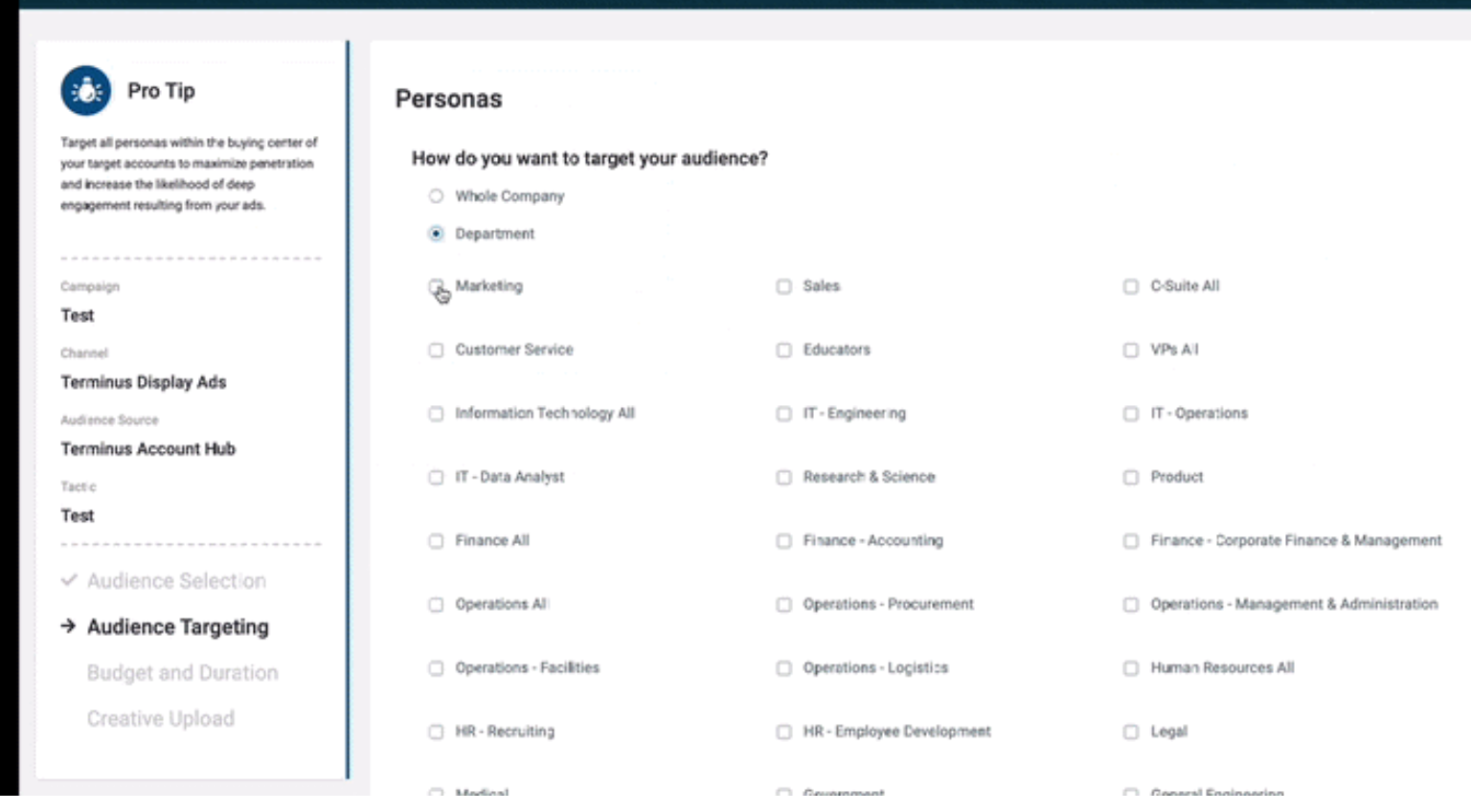

You can upload or sync target account lists (TALs) from your CRM into Terminus and refine audiences by persona attributes like department, seniority, or role.

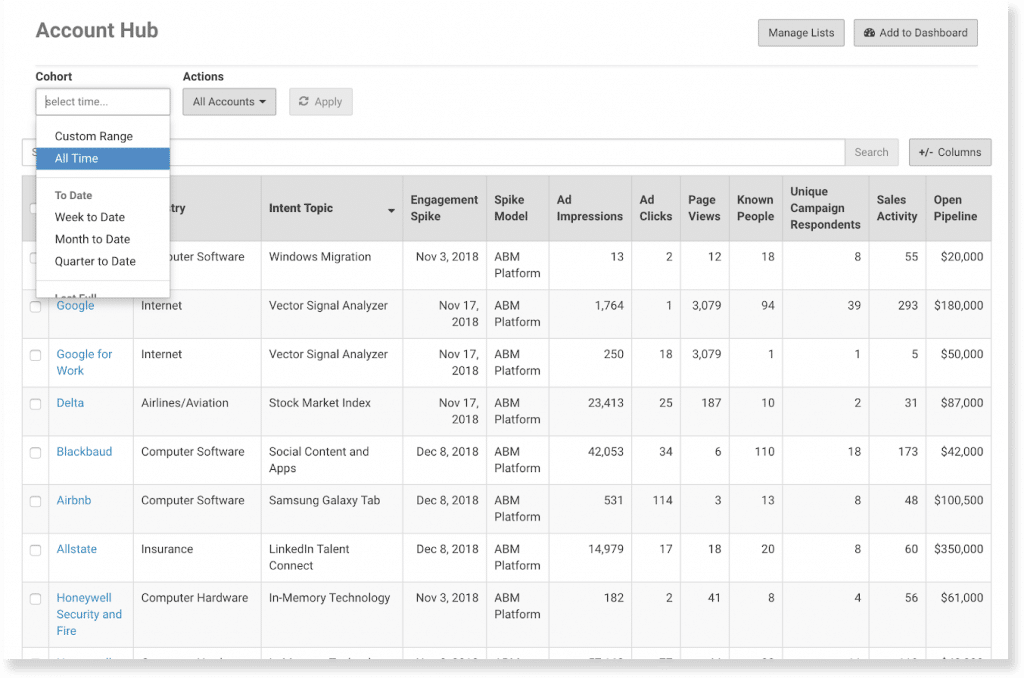

The platform tracks not just clicks but also impressions at the account level.

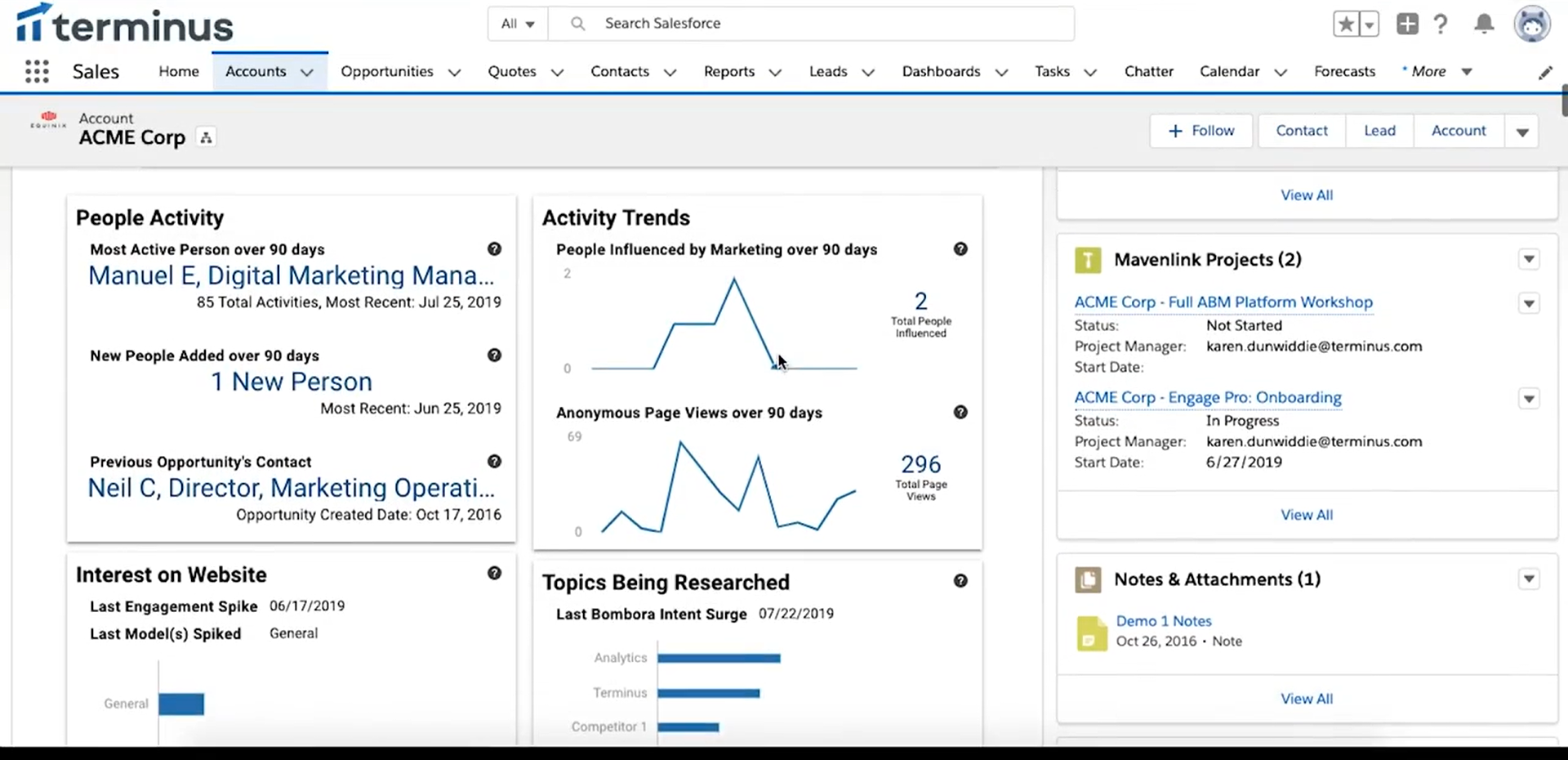

This is critical in ABM, where seeing that target account X saw an ad (even without clicking) is valuable. Terminus’s Account Hub compiles these engagement metrics for each account, showing impressions, clicks, site visits, and more tied to your campaigns.

Terminus includes a Visitor ID feature to de-anonymize website traffic.

It uses techniques like reverse IP lookup, cookies, and CRM matching to recognize which companies (and sometimes which known contacts) are visiting your site.

For instance, Terminus can drop cookies so that if an anonymous visitor later fills out a form, their past visits are attributed to that account.

It also matches known CRM leads to visits (by email domain), telling you if, say, a director from Acme Corp in your CRM visited the pricing page.

This visitor intel helps sales prioritize outreach, though it relies on third-party methods (IP, cookies) that have accuracy limits (often only ~40–50% accurate for identifying anonymous visitors, as reported by various studies including one from Syft).

Pro Tip: ZenABM can reveal anonymous website visitors for free. Retarget them with inexpensive LinkedIn text ads, and ZenABM will identify the companies that saw your impressions.

Terminus integrates intent data from partners (e.g., Bombora) to identify in-market accounts, so you can prioritize ad spend on companies showing buying signals.

Pro Tip: Skip unreliable third-party intent surges and focus on first-party insights instead.

ZenABM captures authentic, first-party qualitative intent by tracking which LinkedIn ads a company actually engages with, offering clear, actionable buying signals.

For example, the team at Userpilot (a ZenABM customer) built their ABM playbooks entirely around this method, tagging campaigns by pain points and doubling down on bottom-of-funnel ads that specific accounts were interacting with.

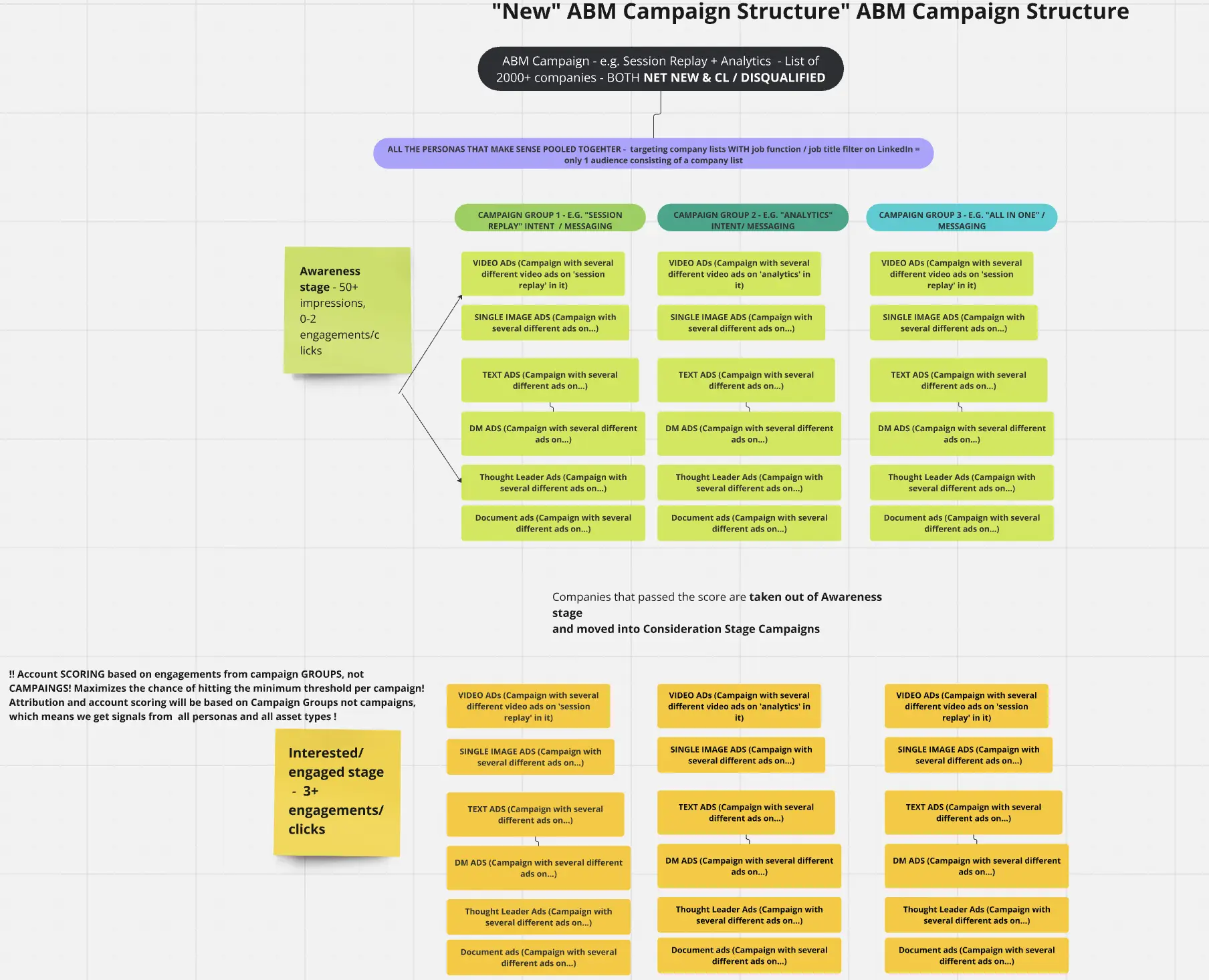

Their campaign structure looked like this:

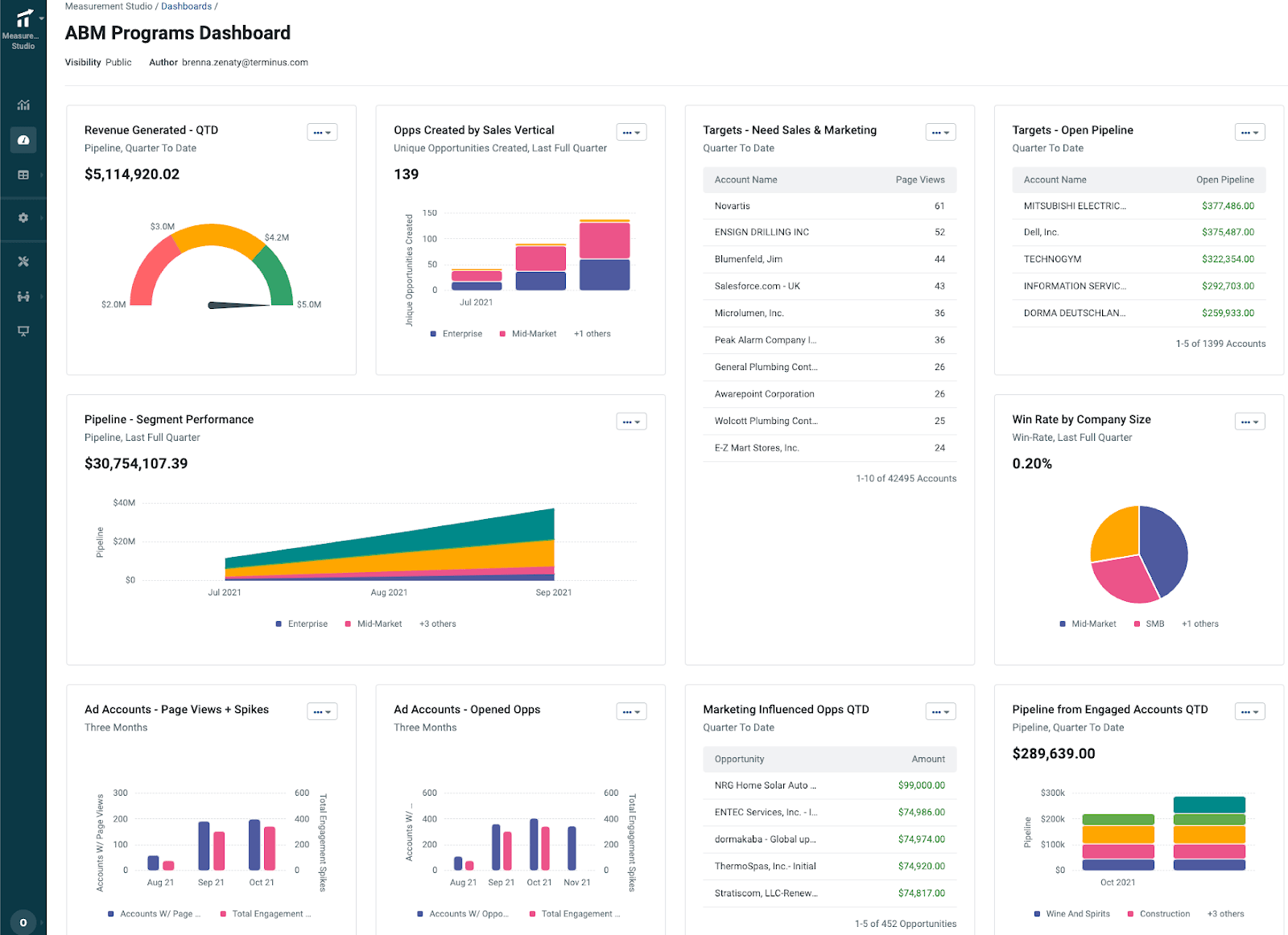

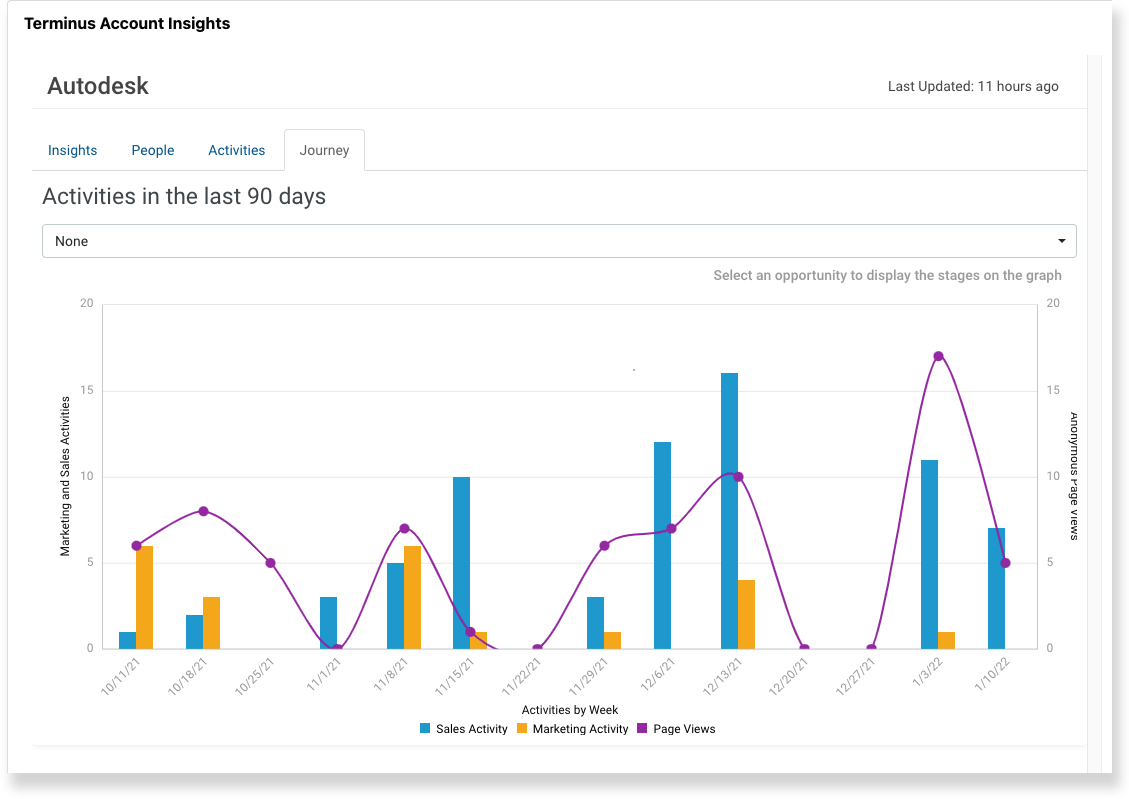

Measurement Studio in Terminus (bolstered by Terminus’s acquisition of BrightFunnel) provides multi-touch attribution across accounts.

Marketers can track how different touchpoints (ads, emails, website visits, events, etc.) influence pipeline and revenue, with support for first-touch, last-touch, and custom multi-touch models.

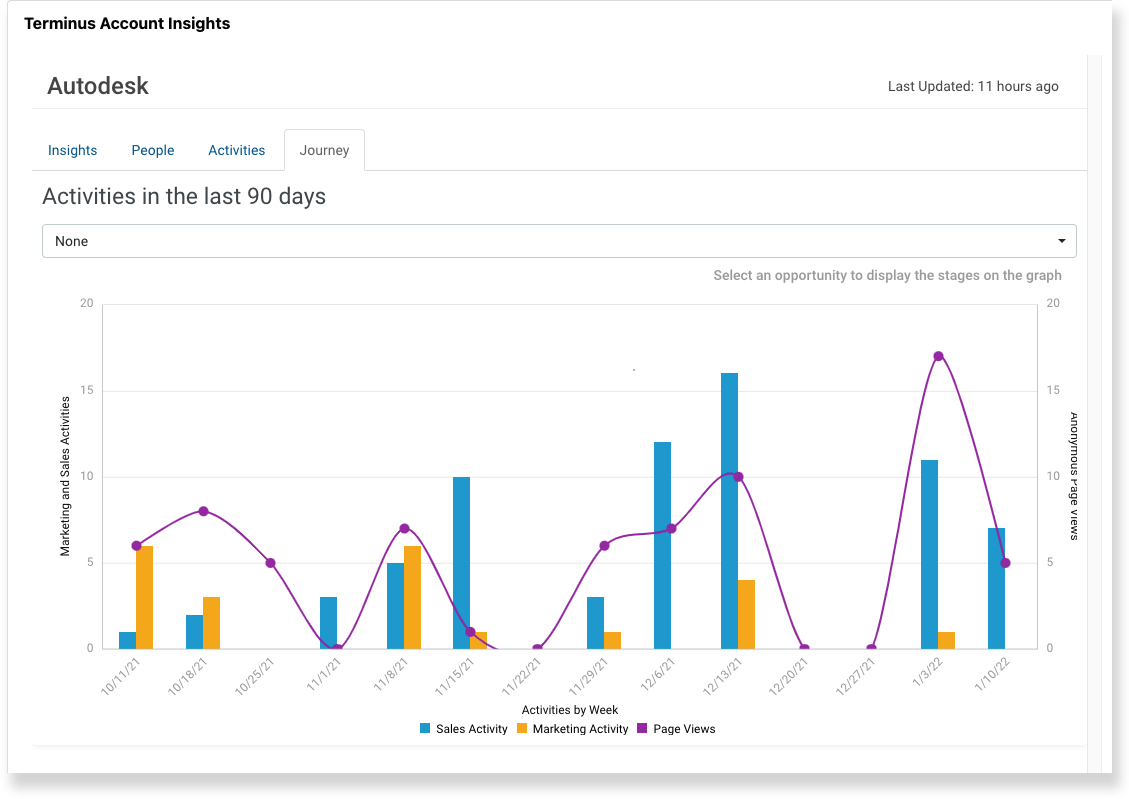

Importantly, all attribution is account-centric by default: activities roll up into an “Account Journey” view to see how an account progressed from engagement to pipeline to deal.

Terminus also offers out-of-the-box dashboards for ABM programs, showing metrics like revenue generated, opportunities created, pipeline influenced, top engaged accounts, and more.

Terminus integrates with many systems in the B2B marketing stack.

Out-of-the-box connectors include major CRMs (Salesforce, HubSpot, Microsoft Dynamics), marketing automation platforms (Marketo, Pardot, HubSpot Marketing Hub, Eloqua), advertising channels (LinkedIn Ads, Google Ads), sales enablement tools (Outreach, Salesloft, etc.), analytics tools (Google Analytics, Adobe Analytics, PathFactory), data providers (Bombora, G2 intent, Clearbit/DemandScience), and more.

You can explore each integration in detail in the Terminus docs.

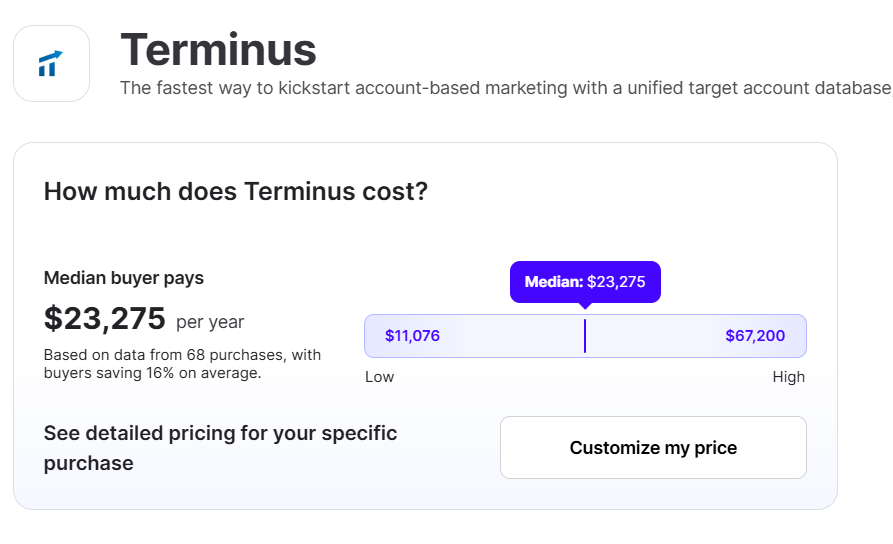

Terminus is known for its premium, custom-quoted pricing.

There are no public price tiers on their site; you need to go through sales for a quote.

Research indicates typical Terminus deals are in the mid-five figures annually, scaling up to six figures for large enterprise deployments.

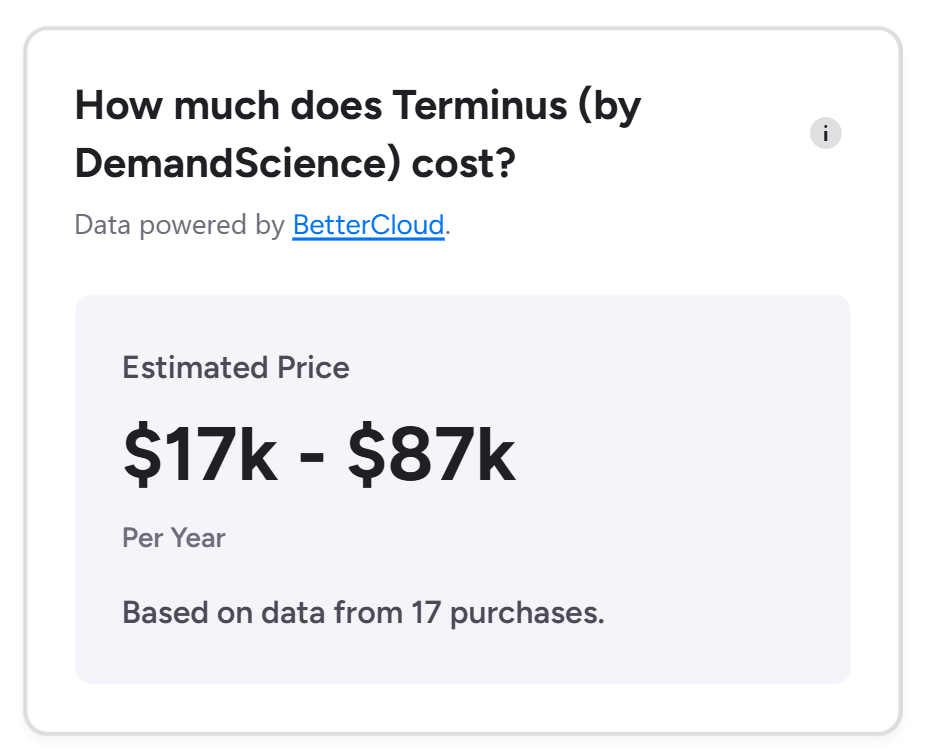

Vendr, for example, says median Terminus pricing is about $23,000 per year, while large enterprises might pay $100K–250K+ annually.

CMO.com, on the other hand, claims the cost to start from $57,500 per year, with large enterprise contracts reaching $266,000, and G2 (based on 17 reviews) gives a broad range of $18-87,000.

ZenABM is a lean, purpose-built ABM platform created for executing and analyzing LinkedIn-focused account campaigns.

Key functions offered by ZenABM include:

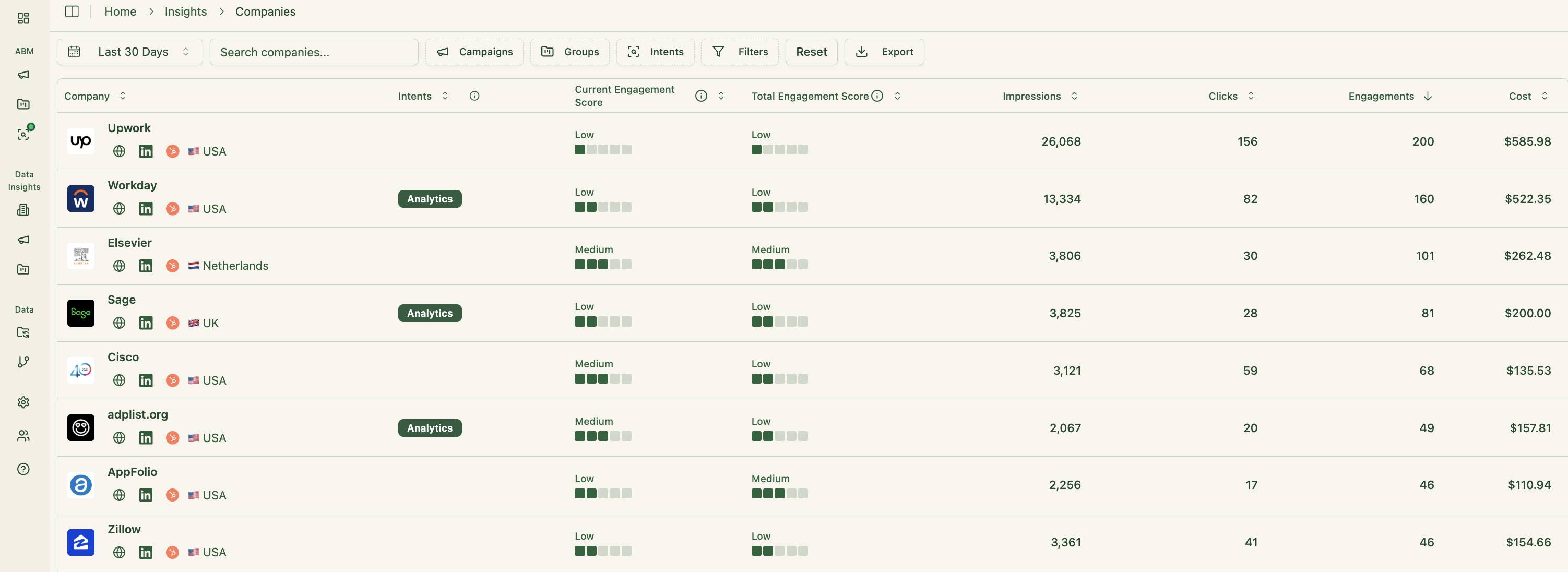

ZenABM connects directly with the LinkedIn Ads API to aggregate account-level performance data across all active campaigns.

This enables precise identification of which target accounts engage with your LinkedIn ads (clicks, impressions, interactions), mapped to their respective companies.

Because ZenABM uses authenticated LinkedIn data, accuracy remains exceptionally high. Larger ABM systems like Terminus typically depend on probabilistic tracking (IP or cookies), which often misidentifies visitors.

As i discussed even before, studies like one from Syft reveal that the best IP-based visitor identification tools only achieve around 42% accuracy.

ZenABM’s first-party approach ensures more dependable, intent-rich signals. When multiple individuals from the same organization engage with your LinkedIn ads, you can confidently attribute interest to that account—no external enrichment required.

Pro Tip: ZenABM can also uncover anonymous site visitors at no additional cost. Use low-cost LinkedIn text ads to retarget them, and ZenABM will identify which companies saw your ad impressions.

ZenABM automatically updates account engagement scores based on both recent and historical ad activity. You can analyze patterns over different timeframes to spot surging accounts.

These real-time insights help marketing and sales teams prioritize accounts that show meaningful engagement.

ZenABM supports customized ABM funnel stages (Identified → Aware → Engaged → Interested → Opportunity) and automatically moves accounts through stages using real-time engagement and CRM data.

You define thresholds for each stage, and ZenABM handles the tracking seamlessly.

This level of full-funnel visibility mirrors advanced enterprise ABM tools, showing where deals progress or stagnate.

ZenABM integrates two-way with CRMs like HubSpot (Salesforce available in upper tiers).

LinkedIn engagement metrics automatically sync to CRM company records so sales teams always have up-to-date visibility.

ZenABM can also auto-assign accounts to BDRs once engagement surpasses custom thresholds.

ZenABM lets you tag ad campaigns by theme (for instance, “Feature A” vs “Feature B”) and track which accounts engage most with each, revealing specific buying interests.

This represents verified first-party intent. Instead of relying on inferred keyword signals from Terminus or others, ZenABM gives tangible proof like “Account Z clicked Feature A ads,” showing clear interest.

These engagement signals sync with your CRM, enabling precise, topic-driven outreach.

Sales reps can instantly see which features or narratives resonate most with each target account.

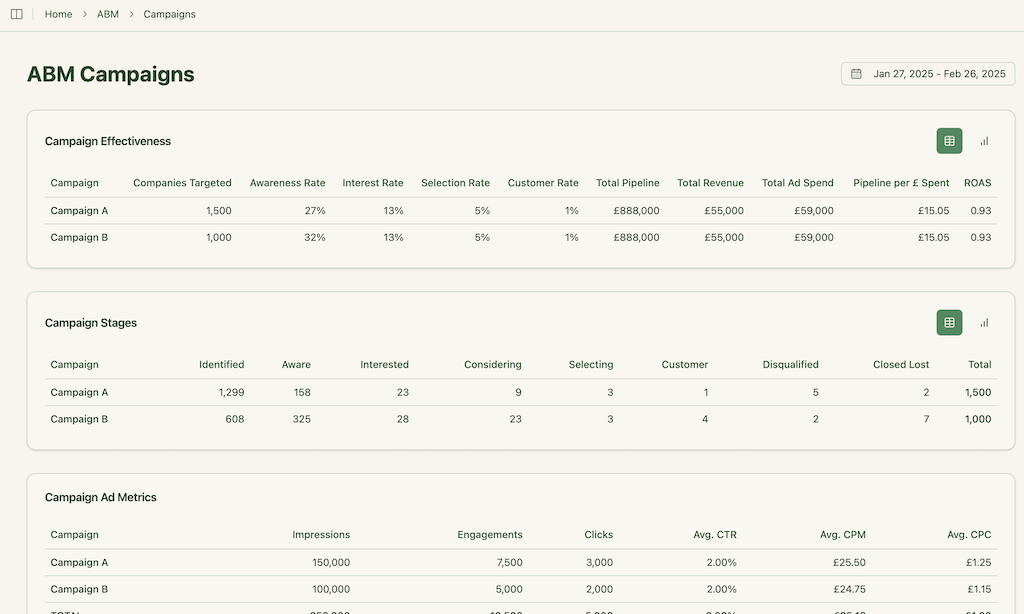

ZenABM offers built-in ABM dashboards that connect ad exposure, engagement, funnel movement, and pipeline metrics in one view.

These dashboards give revenue teams clarity into how campaigns translate to pipeline growth and ROI.

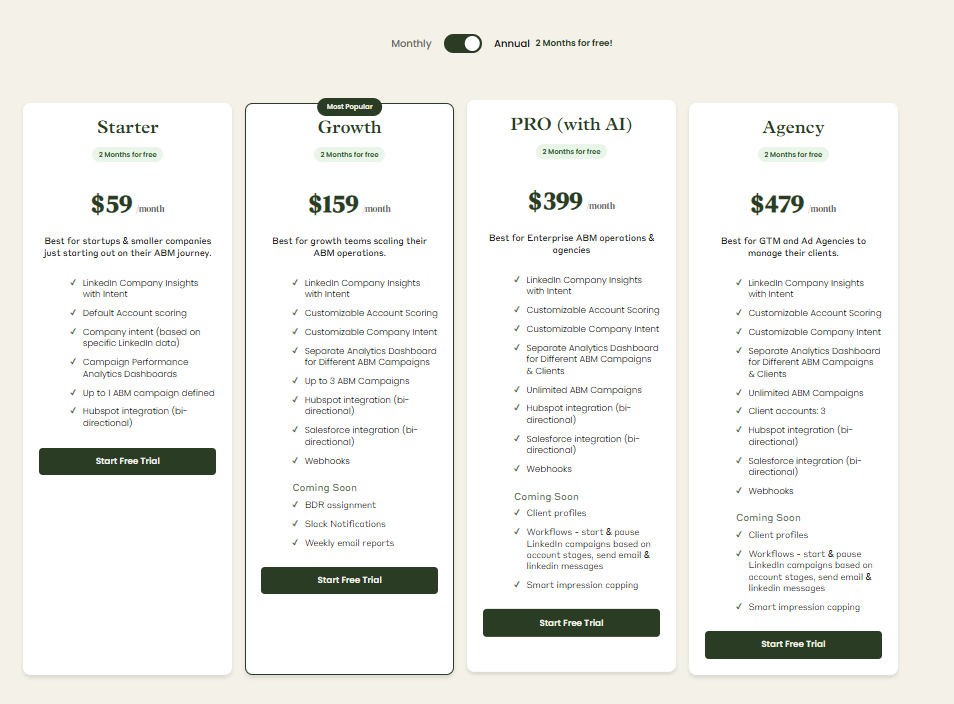

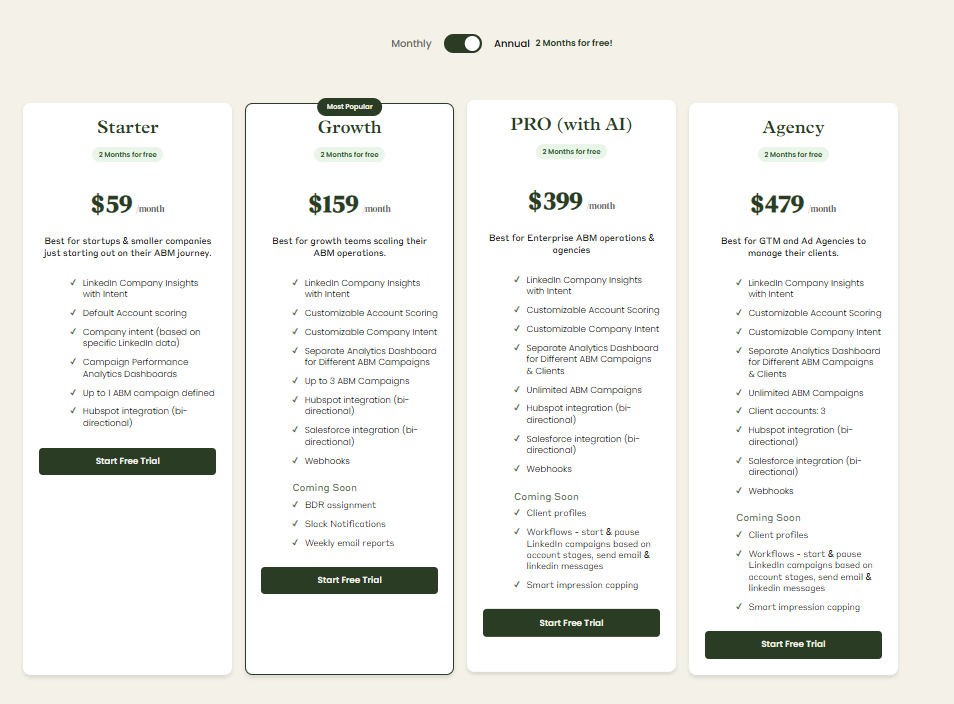

Plans begin at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI), and $479/month for the Agency plan.

Even the highest plan stays under $7,000 per year, substantially more affordable than Terminus.

All plans include key LinkedIn ABM features; higher tiers mainly extend limits and add Salesforce sync.

Flexible monthly and annual options are available, with a 37-day free trial to evaluate the platform risk-free.

Both tools bring unique ABM approaches to identifying and engaging key accounts, helping marketers deliver tailored experiences and improve conversions.

Key areas of distinction include:

Terminus relies on mostly third-party sources, especially for qualitative intent.

It combines signals from searches, third-party providers like Bombora, and review sites.

ZenABM, by contrast, captures direct qualitative and quantitative intent through ad engagement.

It interprets how target accounts interact with your LinkedIn ads to identify buying interest.

So, while Terminus might indicate that an account is researching “CRM software,” ZenABM pinpoints that the same account clicked on your product webinar ad multiple times.

Terminus spans multiple channels including display, search, social ads, email, and website personalization, along with sales integrations.

ZenABM keeps things lean, centering on LinkedIn to focus purely on high-signal, first-party engagement.

Both platforms offer core ABM functions, but execution differs.

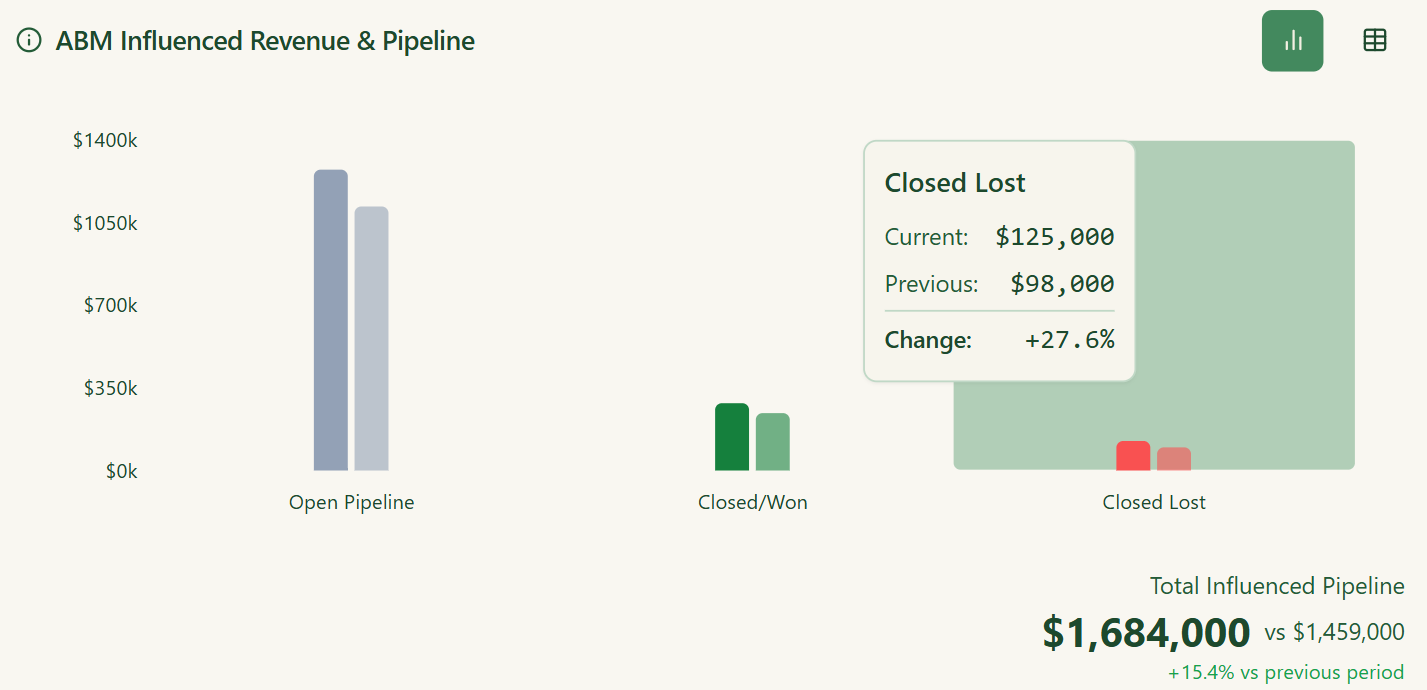

Terminus provides comprehensive multi-channel attribution, connecting ad spend to pipeline and revenue.

It’s robust but may feel heavy for smaller teams due to setup complexity.

ZenABM offers clear, LinkedIn-specific attribution reports, mapping ad-engaged accounts directly to CRM opportunities. This gives a transparent view of pipeline and influenced revenue per campaign.

Terminus takes longer to configure and often involves guided onboarding and training.

ZenABM is plug-and-play: Teams can start within hours by connecting LinkedIn and CRM and adjusting basic thresholds.

ZenABM costs significantly less.

Terminus, at a median price of about $26K annually (ZenABM’s highest tier is also less than $7k annually), demands a higher investment but scales better for enterprises running multi-channel programs with large account lists.

Startups or lean marketing teams would find ZenABM’s pricing and simplicity appealing, while enterprises needing a full ABM ecosystem would benefit more from Terminus’s extensive capabilities.

When it comes to “Terminus vs. ZenABM – which is better?”, the honest answer is “it depends” on your company’s ABM maturity, scale, channel focus, and budget.

Each platform has clear strengths for certain scenarios:

Hope the article was able to clear all your doubts regrading which tool is better for your ABM strategy.

If you have decided to focus on LinkedIn for ABM, let us help you ace it with ZenABM.

Book a demo now to see how ZenABM works or try it yourself for free!