Recotap presents itself as a LinkedIn-first ABM platform for B2B teams that want to identify, engage and convert high-value accounts with more precision, while Satlo positions itself as a LinkedIn Ads analytics and buyer intent platform.

In this guide, I compare Recotap vs. Satlo on features, pricing and ABM fit so marketing and sales teams can quickly see which platform lines up with their ABM motion.

I also cover how ZenABM can serve as a better alternative or a complementary layer, thanks to its unique feature set.

In case you’re short on time, here is a quick overview:

Recotap presents itself as a LinkedIn-first ABM platform for B2B teams that want to identify, engage and convert high-value accounts with more precision.

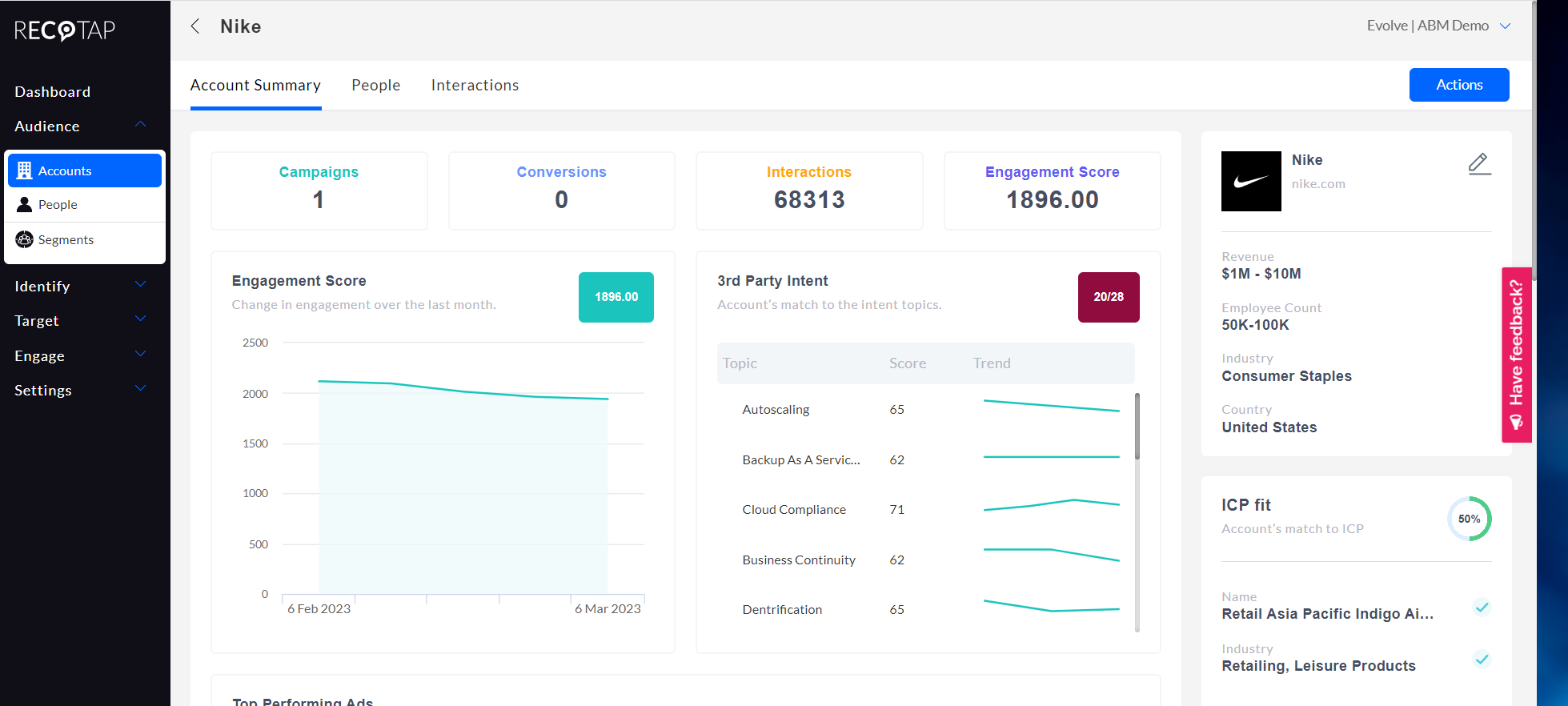

Recotap is an all-in-one ABM system that covers data, advertising, web experience and analytics.

Recotap pulls data from your CRM, marketing automation, website and third-party intent providers into a single account view.

In practice, it joins signals like site visits, ad clicks, external intent (Bombora, G2, TrustRadius) and CRM data so you can segment and score accounts by fit and activity.

The aim is to understand where each account is in its buying journey and point campaigns at those that match timing and fit.

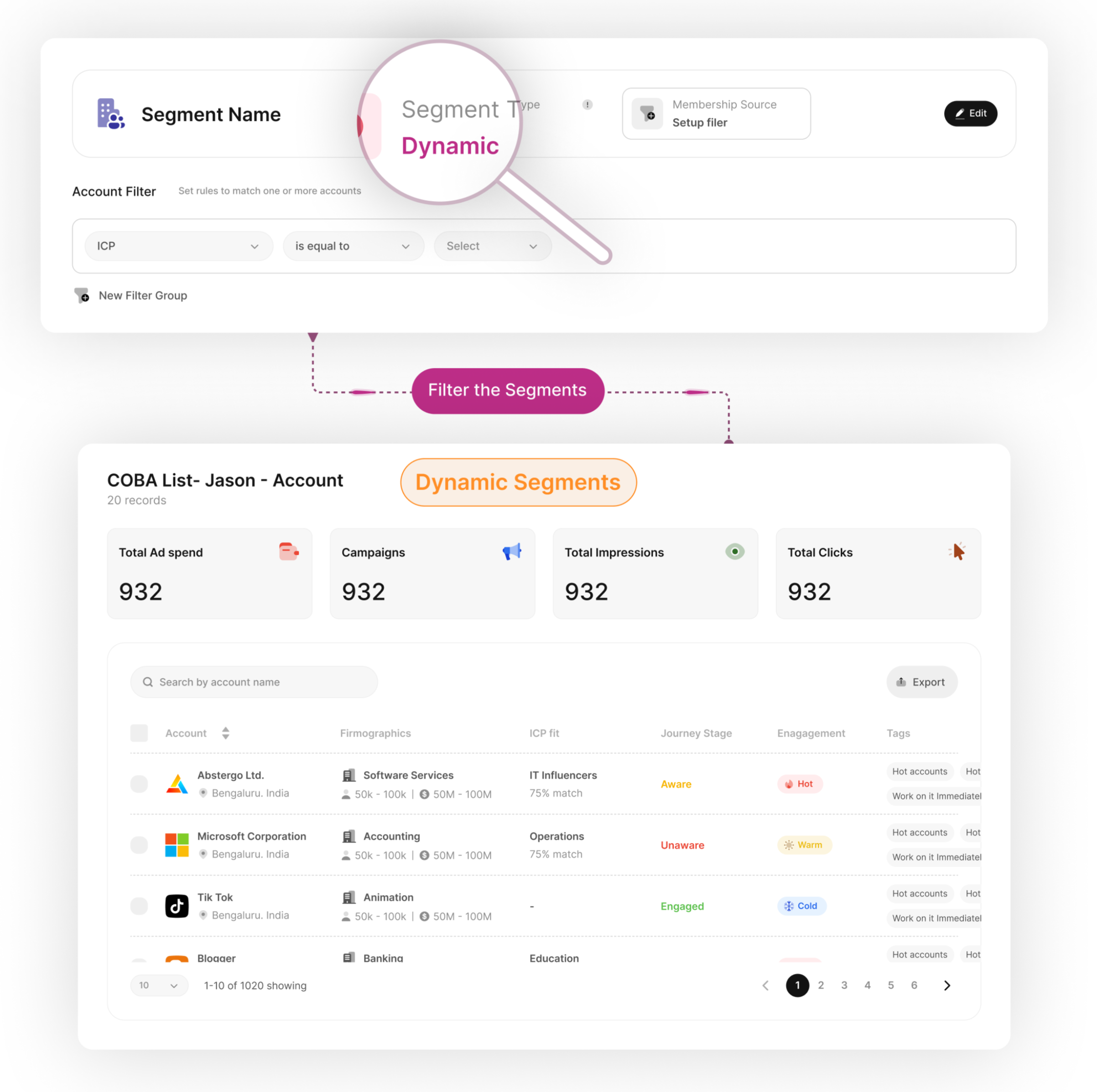

Recotap leans on dynamic segments and AI scoring. You define segments using firmographics, engagement, ICP fit and intent level, and the system keeps these lists refreshed automatically as data changes.

This cuts down manual work on target account lists. Recotap’s AI can also estimate journey stages so you know if an account is early research, actively engaged or close to sales.

As an official LinkedIn Marketing Partner, Recotap is built for advanced LinkedIn Ads management.

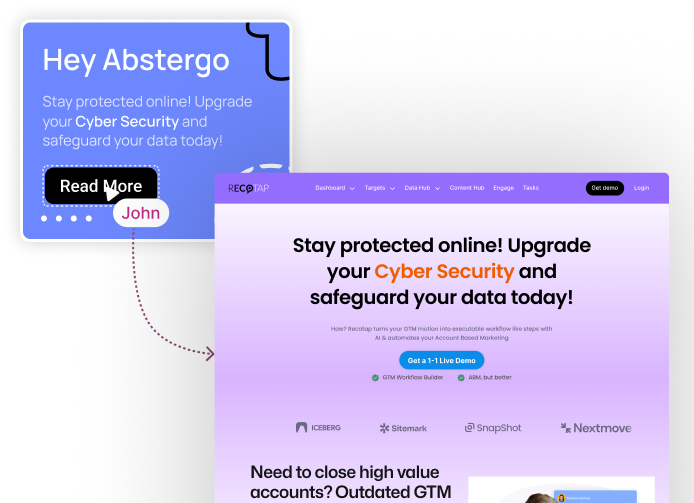

It supports account based LinkedIn campaigns and helps marketers roll out highly tailored LinkedIn ads for dozens or hundreds of accounts at once.

Recotap extends personalization to your website. You can set up 1:1 landing page experiences for target accounts without heavy engineering, putting it closer to web personalization modules in tools like Terminus or Demandbase.

Recotap integrates with major CRM and marketing automation platforms so sales and marketing can work from shared data.

Salesforce and HubSpot CRM are supported with bi-directional sync for accounts, contacts and deals, alongside Marketo and Pardot for marketing automation.

It also connects to sales tools like Outreach and Salesloft, plus Slack and Microsoft Teams, so BDRs get alerts when a target account crosses a threshold.

Recotap includes AI-powered analytics and revenue attribution dashboards.

Its Revenue Impact view links campaigns to pipeline and revenue so you can see which programs drive closed deals and how account journeys progress from first touch to conversion.

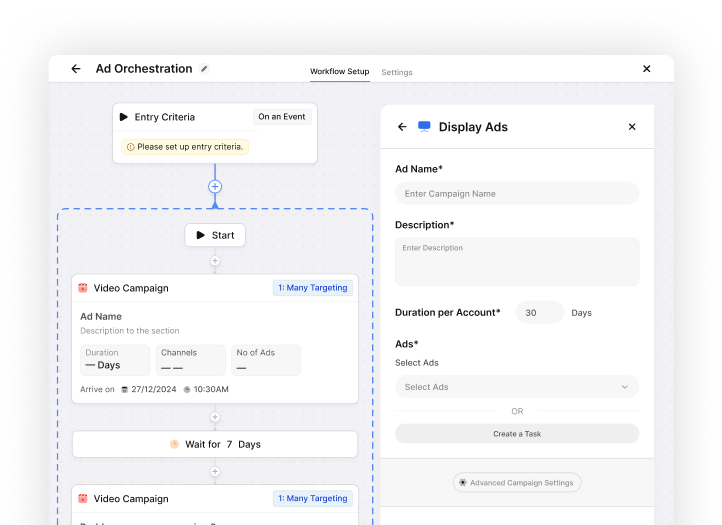

Recotap automates repetitive ABM tasks so lean teams can still run complex programs.

It tracks intent spikes, refreshes segments and triggers outreach when an account hits a hot score. One G2 reviewer notes that Recotap’s UX is built to simplify ABM without sacrificing outcomes.

Recotap’s main differentiator is how it merges and interprets intent data to run smarter ABM campaigns.

Its ABM Signal Hub blends first-party engagement data from CRM, website and marketing tools with third-party intent from G2, TrustRadius and Bombora, removing data silos and giving a more complete view of each account.

The intent scoring engine aggregates these signals, ranks accounts by readiness and pushes hot ones into campaigns or sales queues. Because sync is real-time, Recotap can trigger LinkedIn ad sequences as soon as an account shows buying behavior.

The upside is precise targeting with less manual monitoring, though the flexibility introduces some complexity. Reviewers say that once configured, intent orchestration feels close to what you get in tools like 6sense or Demandbase.

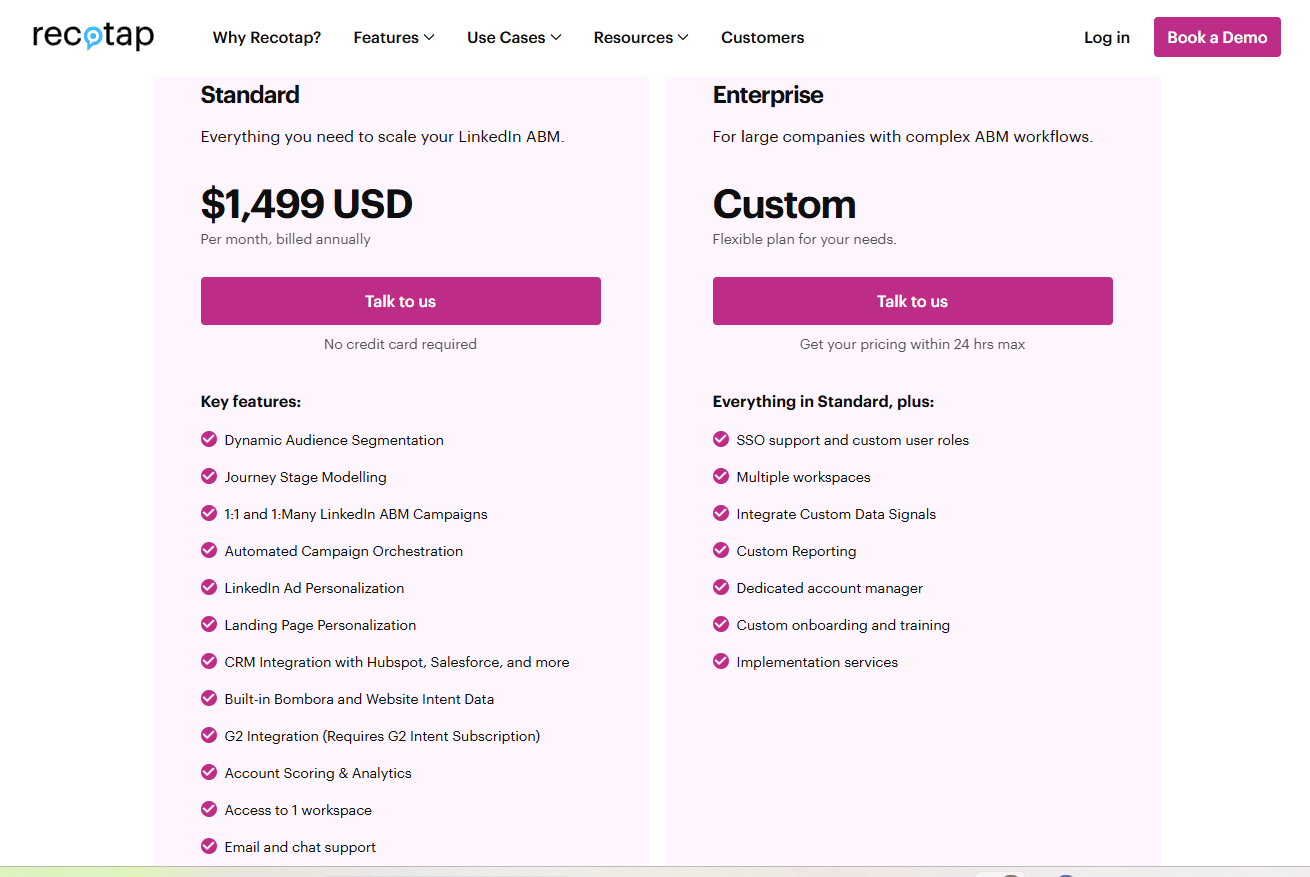

Recotap publishes pricing on its site, which makes budgeting easier.

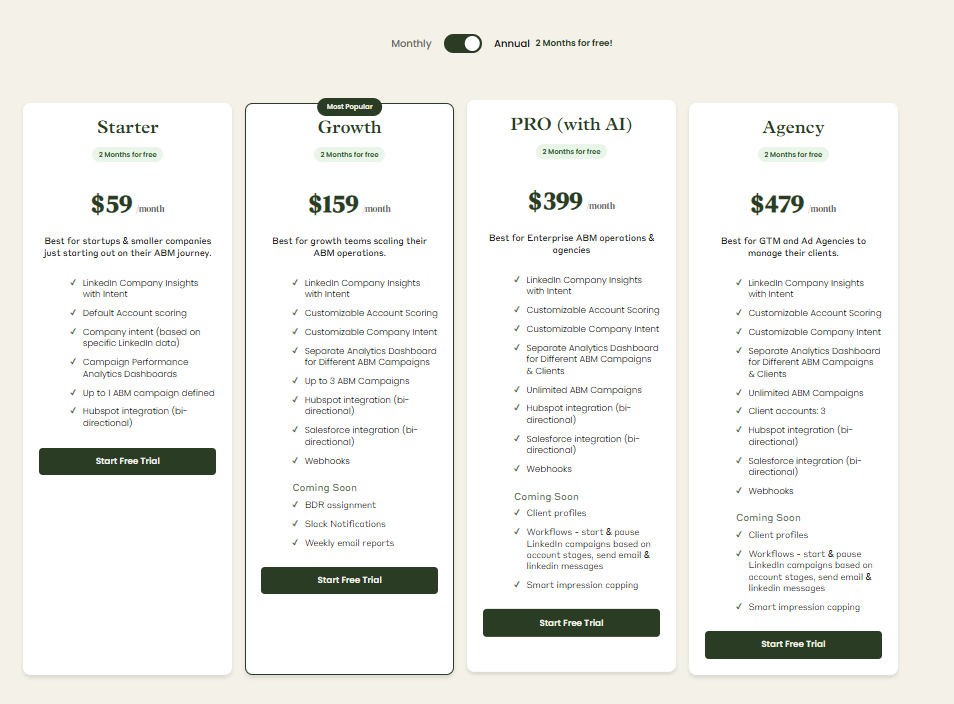

Given that Recotap’s entry plan already comes in above $10K per year, ZenABM stands out as a more budget-friendly option, starting at ~$59/month for the Starter plan, with the top tier still under $6K per year.

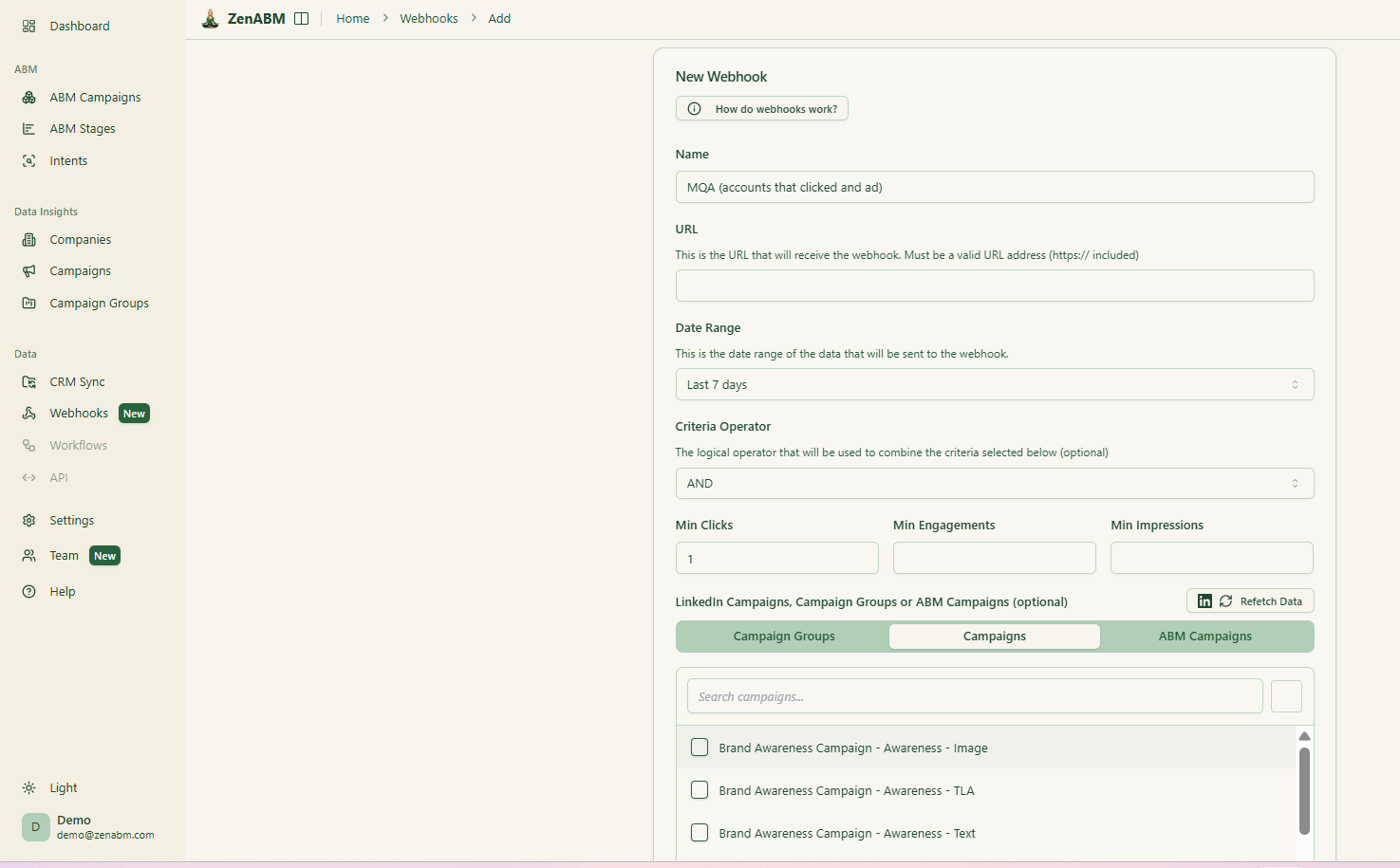

ZenABM still covers core LinkedIn ABM needs such as account-level ad engagement tracking, account scoring, ABM stage tracking, routing hot accounts to BDRs, bi-directional CRM sync, custom webhooks, qualitative company intent and plug and play ROI dashboards.

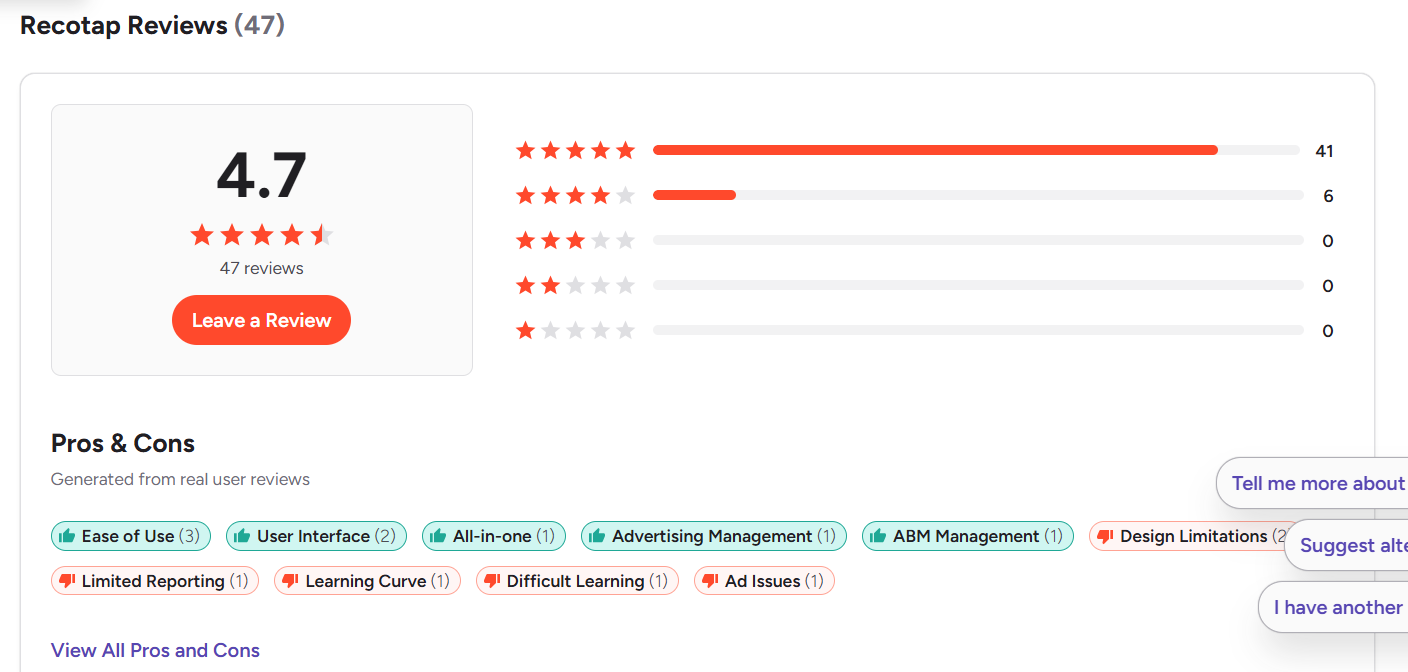

Recotap holds a 4.7 out of 5 rating on G2 from 47 reviews.

Most reviewers are based in Asia, which hints that Recotap’s GTM motion is currently APAC heavy.

Users often praise:

Common issues include:

TrustRadius and other review platforms are still relatively quiet on Recotap.

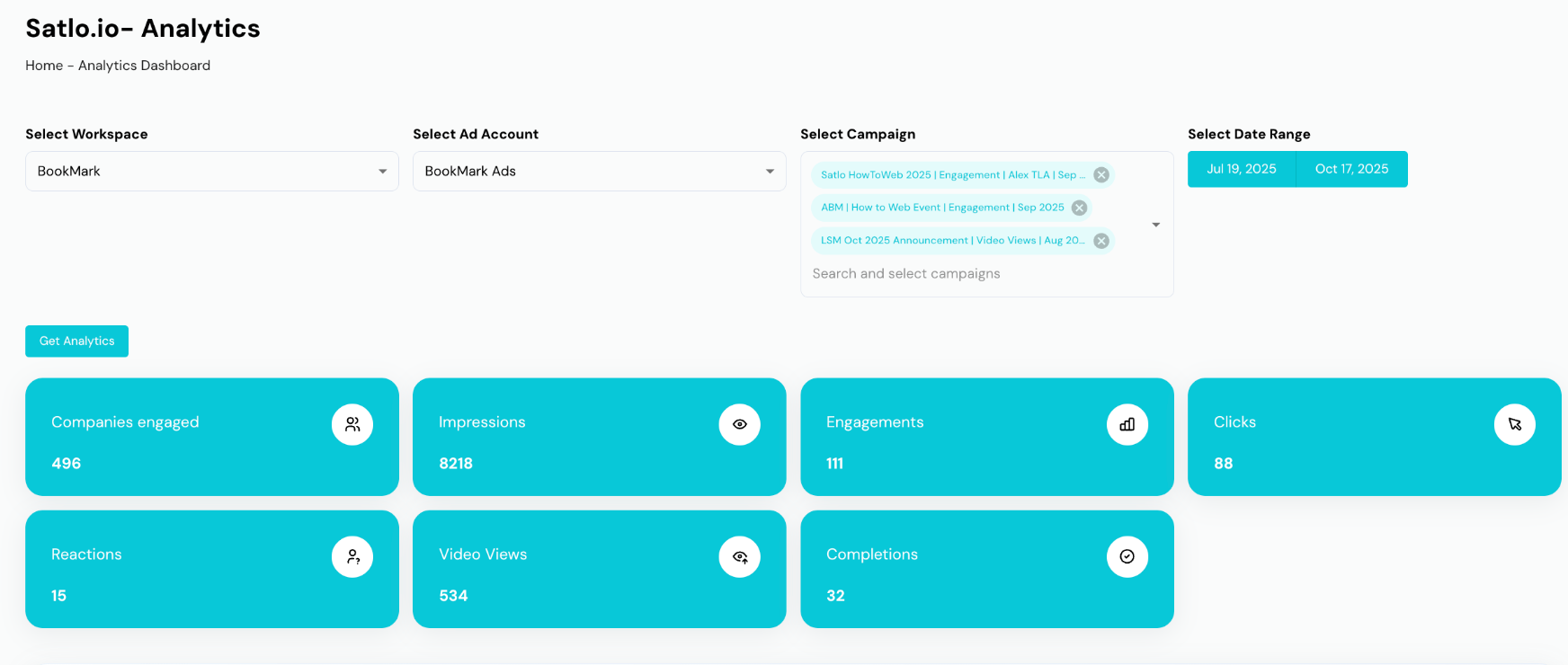

Satlo positions itself as a LinkedIn Ads analytics and buyer intent platform.

Here is how it works, what it costs and what users say.

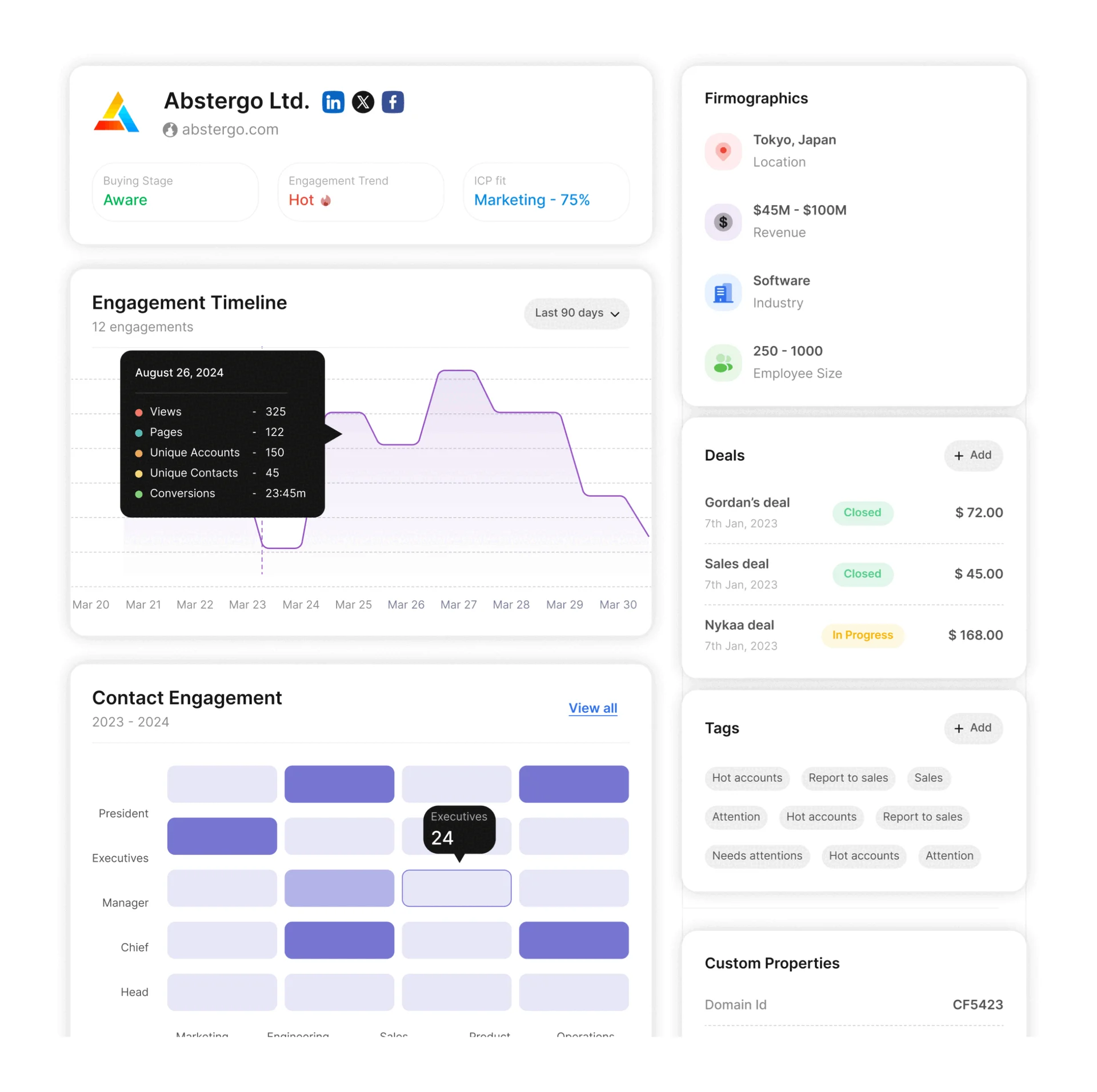

Satlo markets itself as an ABM platform that bridges ad performance and sales activation.

It aims to fill LinkedIn’s reporting gaps and help B2B marketers detect buyer intent and pass qualified opportunities to sales.

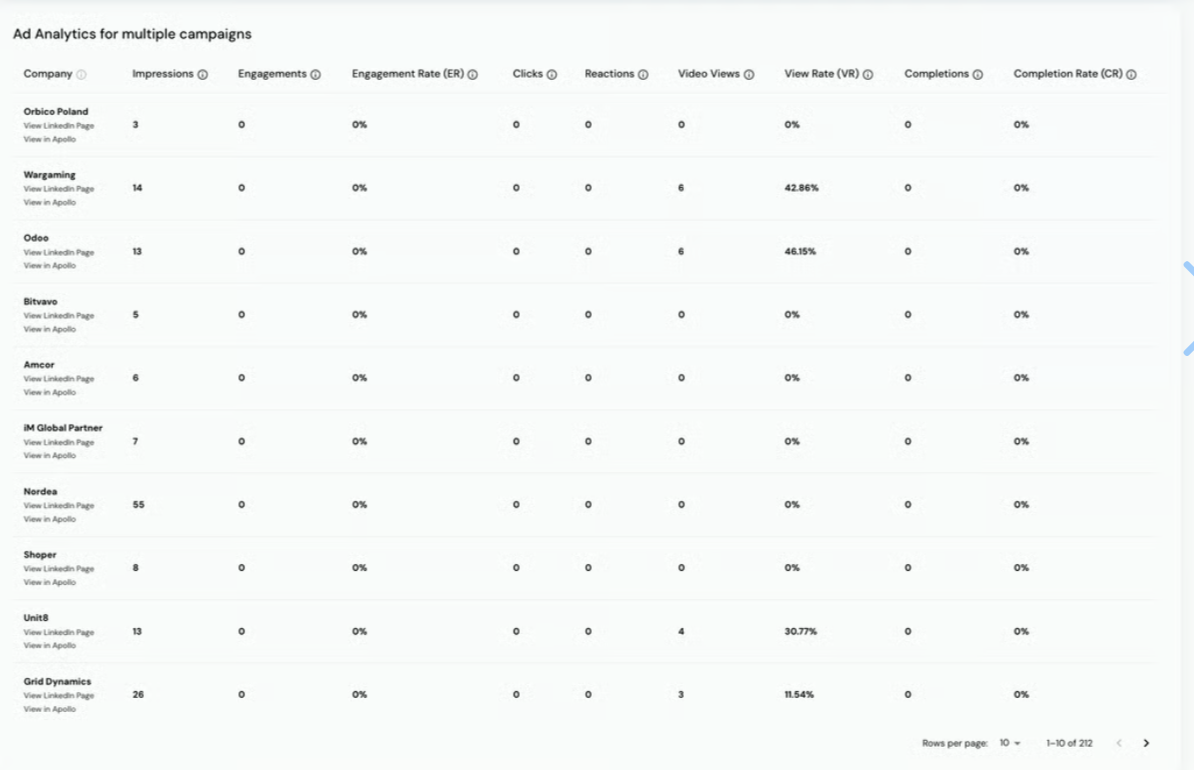

Satlo provides company-level LinkedIn engagement data (impressions, clicks and so on), which LinkedIn Campaign Manager does not expose directly.

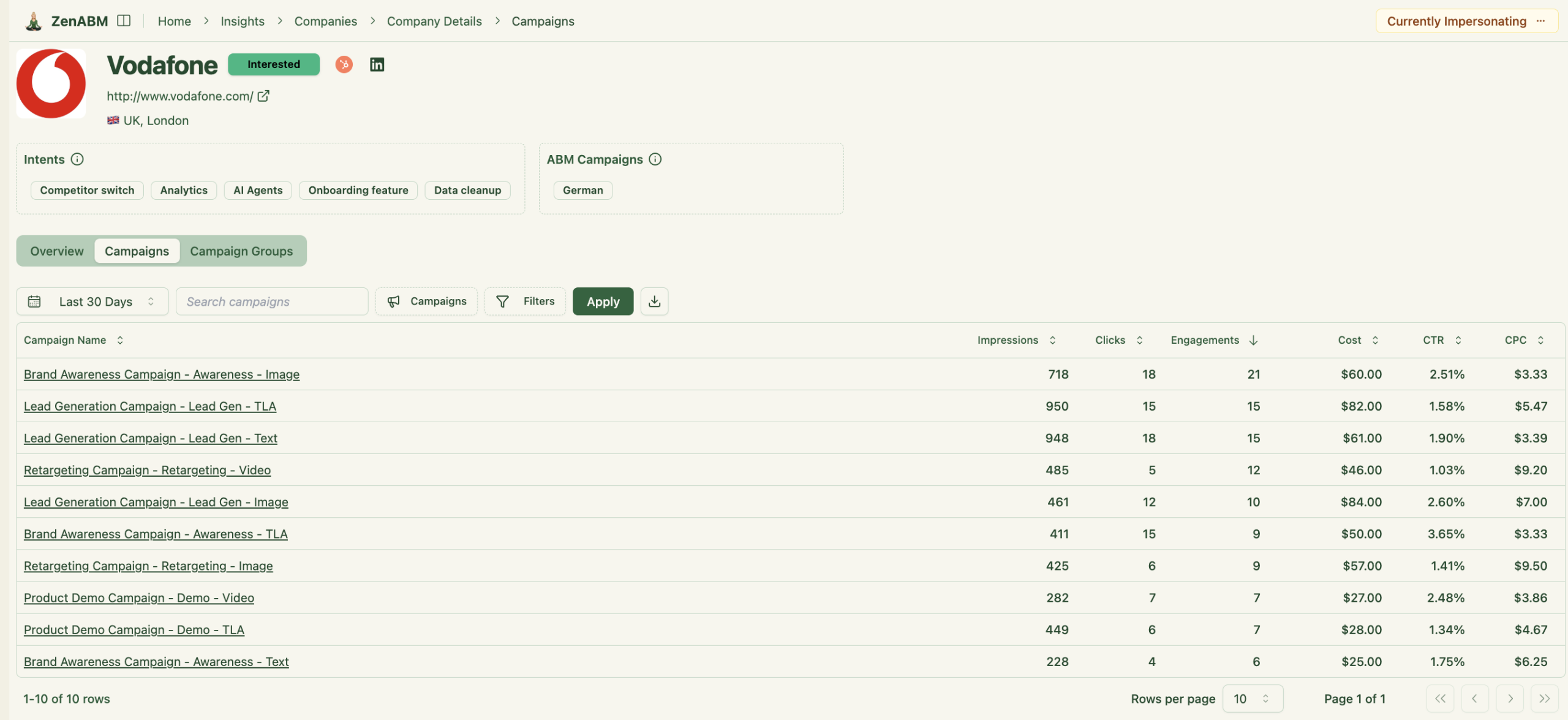

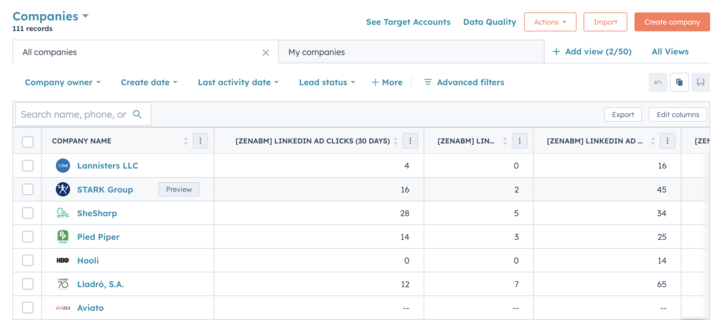

ZenABM offers similar company-level views:

Satlo integrates with tools like HubSpot and Apollo to push company lists into sales workflows.

It identifies which companies engaged with your ads and writes those accounts into your CRM.

Pro Tip: ZenABM also focuses on CRM sync (HubSpot and Salesforce) but goes deeper:

Satlo gives dashboards and exports that let marketers slice LinkedIn performance by account. Highlights include:

Satlo’s AI companion runs across all companies reached by your LinkedIn ads, surfaces sales actions and provides intent signals for key accounts.

It works across your ad accounts and unlimited data history and is available from the Pro tier onward.

The aim is to highlight accounts that shifted from passive exposure to active interest based on campaign interactions and company engagement, not just single clicks.

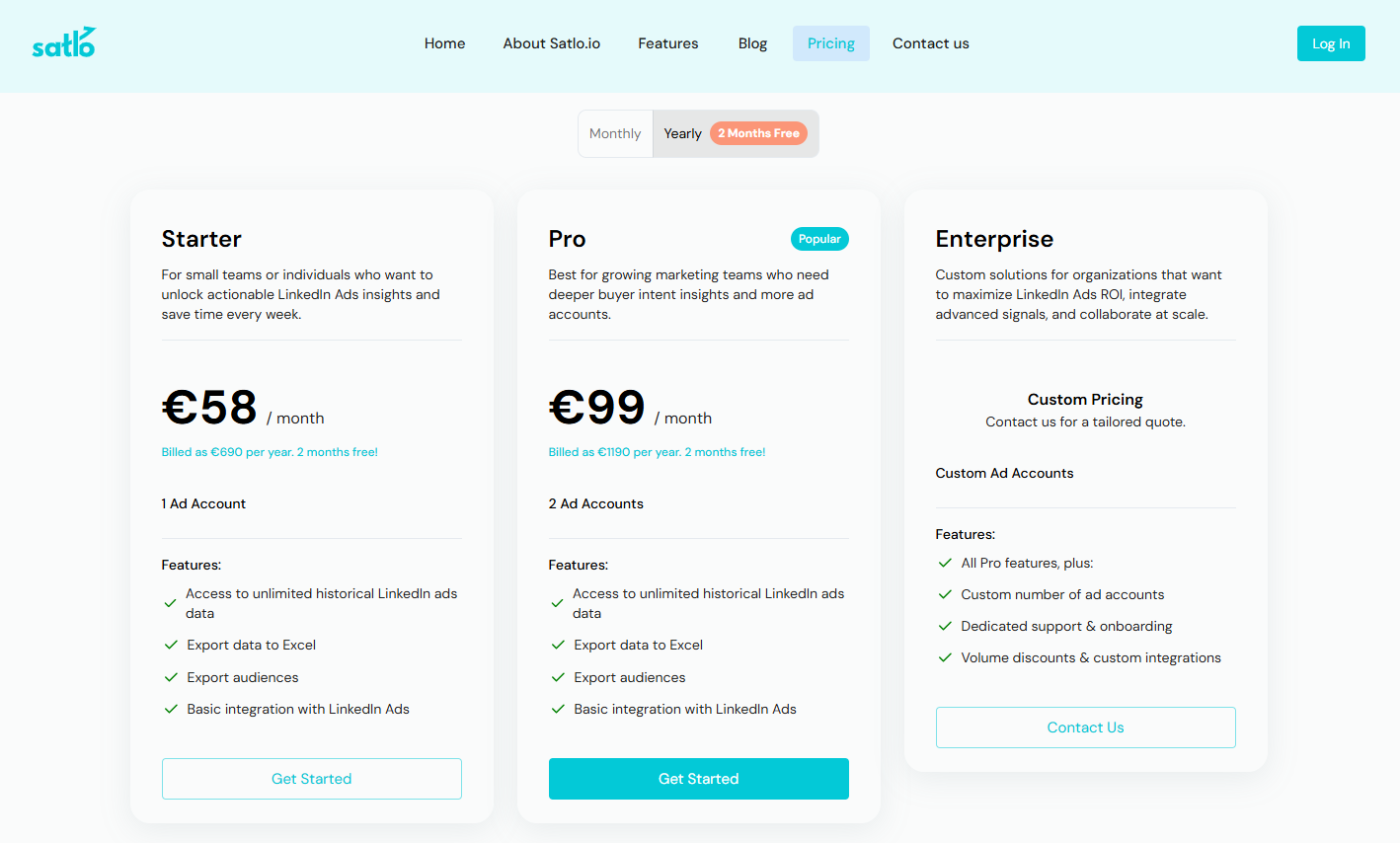

Satlo has three main plans, structured around the number of LinkedIn ad accounts and the depth of insight.

All plans include unlimited historical LinkedIn Ads data and the ability to export audiences and performance to Excel.

For individuals or small teams that want faster LinkedIn analysis without complexity.

Includes:

For growing teams that need broader coverage and deeper buyer insights.

Includes:

For larger organizations managing multiple accounts or needing custom integrations and support.

Includes:

Satlo also offers a 14-day free trial and uses Stripe for billing.

The key differences between Recotap and Satlo are summarized here.

| Aspect | Recotap | Satlo | Best suited for |

|---|---|---|---|

| Core positioning | LinkedIn first ABM platform for identifying, engaging and converting high value accounts | LinkedIn Ads analytics and buyer intent platform | Teams choosing between an ABM suite and a LinkedIn analytics layer |

| Main problem solved | Who to target, how to move accounts through ABM journeys and how to prove revenue impact | Which companies engage with LinkedIn ads and which should be passed to sales | ABM leaders vs performance and demand teams |

| Data and intent | ABM Signal Hub merges CRM, MAP, web data and Bombora or G2 or TrustRadius intent into account scores and stages | Company level LinkedIn engagement from the LinkedIn API plus simple intent scores and AI insights | Stacks that want multi source intent vs stacks happy with LinkedIn only signals |

| Execution scope | Runs LinkedIn ABM campaigns, dynamic segments, journeys and 1 to 1 landing pages | Analyses LinkedIn campaigns and surfaces hot accounts, no native campaign building | Teams designing ABM programs vs teams tightening reporting and handoffs |

| Website experience | Supports 1 to 1 landing pages and web personalization for key accounts | No web personalization features | Orgs that want coordinated ad plus web journeys vs ad only |

| CRM and sales integrations | Bi directional sync with Salesforce and HubSpot plus MAPs, Outreach, Salesloft, Slack and Teams | Integrates with HubSpot and Apollo to push engaged companies into sales workflows | Richer RevOps integrations vs lightweight sales activation |

| Analytics and attribution | Revenue Impact dashboards connect ABM campaigns to pipeline and revenue at account level | Company level reporting for LinkedIn engagement with exports and workspace overviews | Full ABM attribution vs LinkedIn centric analytics |

| Automation | Smart automations for intent spikes, segment refresh and triggered outreach | AI companion for recommendations, no orchestration engine | Teams wanting automated journeys vs guidance on where to focus |

| Pricing level | Standard at about 1,499 USD per month on annual, Enterprise custom | Starter at 58 EUR per month, Pro at 99 EUR per month, Enterprise custom | ABM budgets with 10k plus per year vs lean LinkedIn teams |

| ABM breadth | Covers data, LinkedIn ads, web personalization, segments, automations and ABM analytics | Narrow focus on LinkedIn Ads analytics and buyer intent | Companies choosing an ABM execution platform vs a LinkedIn insight companion |

You pick Recotap if you want an ABM platform that can actually run programs, not just report on them.

It makes more sense when:

In that setup, Recotap becomes the operating layer for campaigns, with LinkedIn as the main but not only surface.

You pick Satlo if you already run LinkedIn ads and your main problem is “who is actually engaging and who should sales talk to.”

It fits better when:

Satlo slots in cleanly beside an existing CRM and MAP, especially for teams that are not ready for a heavier ABM suite.

There is also a third option: ZenABM.

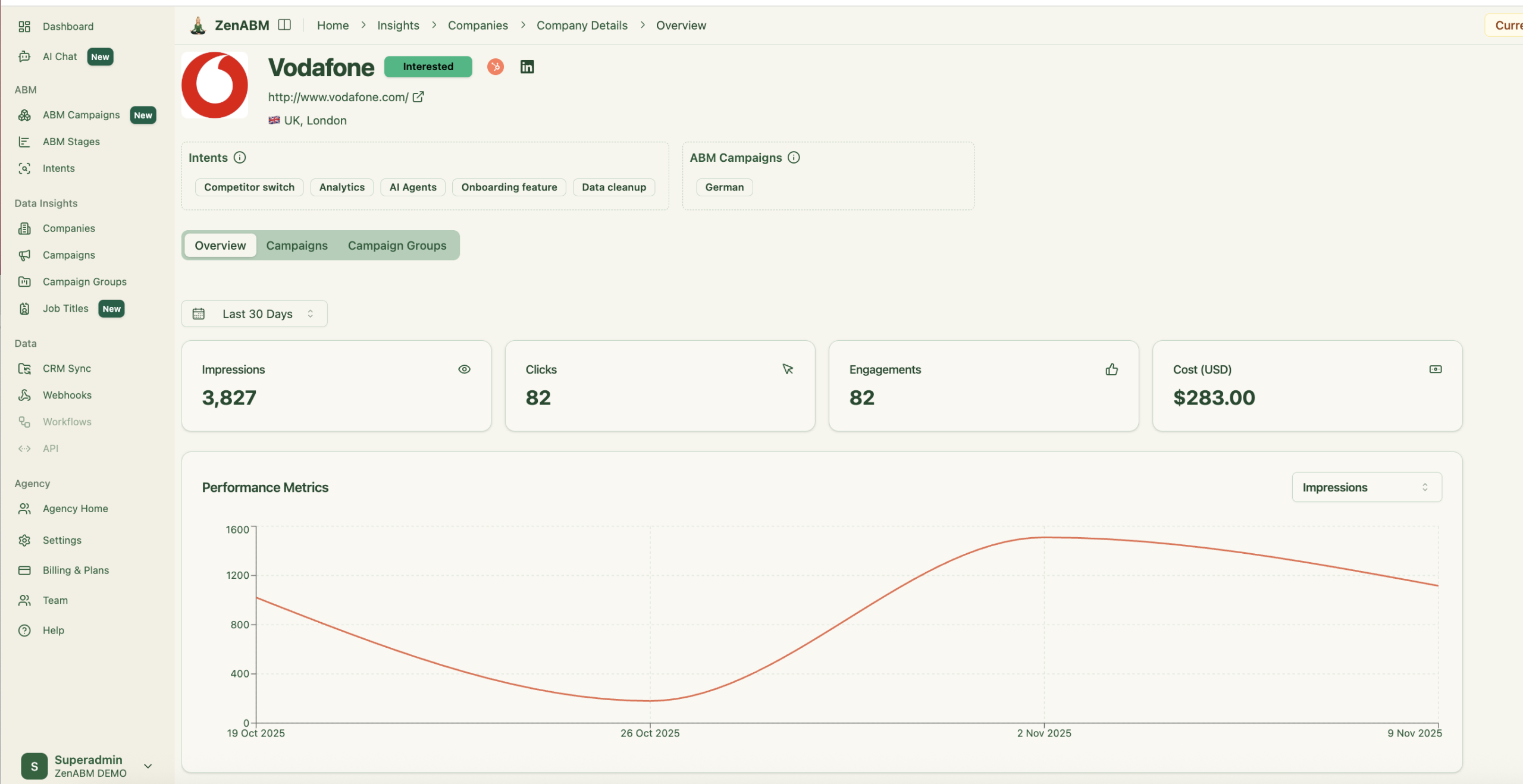

ZenABM is built for teams that rely on LinkedIn as the primary ABM channel and want first-party accuracy, automation, and revenue visibility without the price or complexity of multi-channel suites.

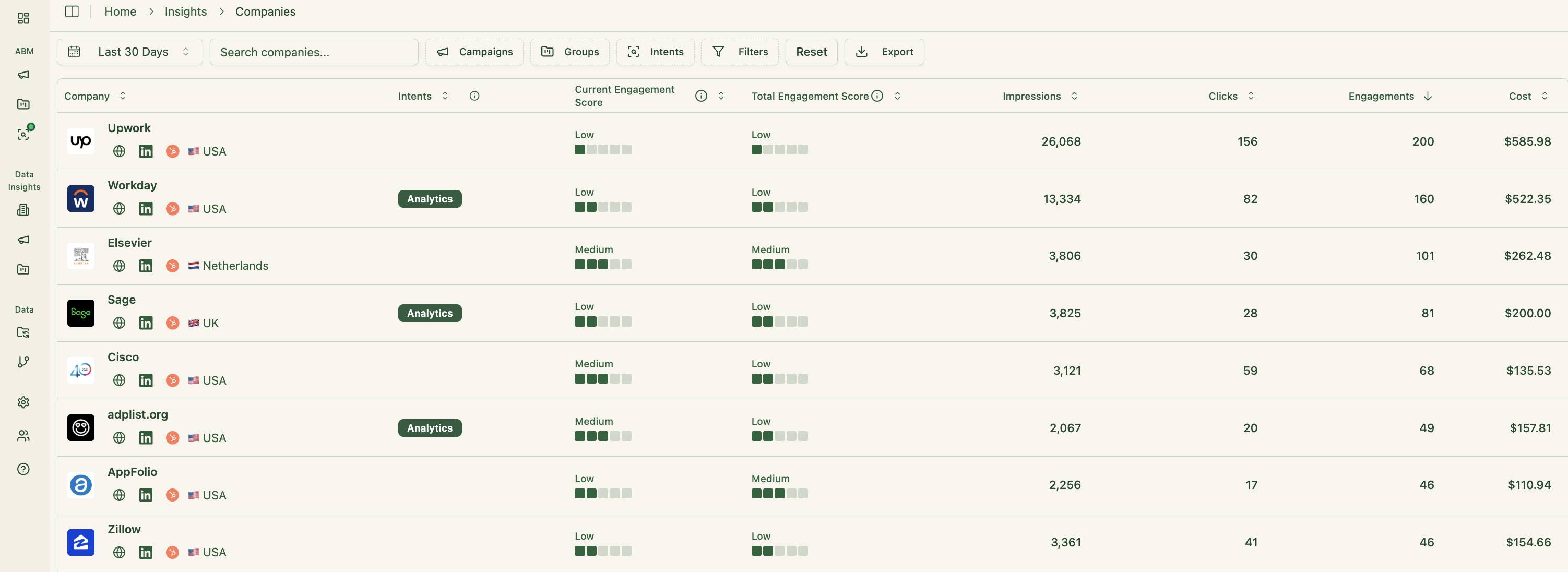

ZenABM connects to the official LinkedIn Ads API and captures account-level data for all campaigns so you can see which companies see, click, and engage with your ads.

Because this is first-party data from LinkedIn’s environment, it is more reliable than IP or cookie-based visitor ID.

A Syft study puts IP-based identification at around 42 percent accuracy.

ZenABM treats LinkedIn ad engagement itself as first-party intent. When several people in one company keep engaging with your ads, that is a strong buying signal without rented intent feeds.

ZenABM updates engagement scores as accounts interact with your ads across campaigns, so you can see who is heating up over short or long windows and let marketing and sales prioritize accounts that show real intent.

ZenABM also shows the full touchpoint timeline for each company:

ZenABM lets you define stages such as Identified, Aware, Engaged, Interested, and Opportunity and automatically places accounts in the right stage using scores and CRM data.

You control thresholds, and ZenABM tracks movement over time.

This gives you funnel visibility similar to larger suites, but powered by LinkedIn data.

ZenABM integrates bi-directionally with CRMs like HubSpot and adds Salesforce sync on higher tiers.

LinkedIn engagement data flows into the CRM as company-level properties:

Once an account crosses your score threshold, ZenABM updates the stage to Interested and automatically assigns a BDR.

ZenABM lets you derive intent topics from LinkedIn campaigns by tagging campaigns by feature, use case, or offer.

ZenABM then shows which accounts engage with which themes.

This is clean, first-party intent from owned interactions.

You can push these topics into your CRM so sales and marketing can tailor outreach to what each company has actually explored.

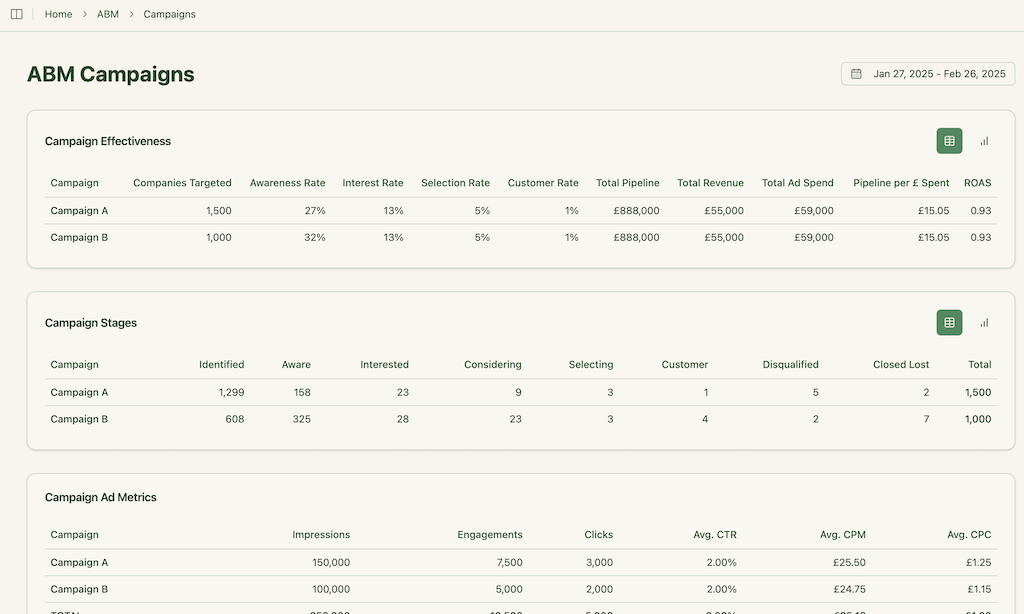

ZenABM ships with dashboards that connect LinkedIn ads to account engagement, stage movement, and revenue.

ZenABM’s custom webhooks let you push events into your stack, for example, Slack alerts, enrichment flows, or other ops automations.

ZenABM shows which job titles engage with your creatives and gives dwell time and video funnel analytics.

Most tools treat each LinkedIn campaign separately. ZenABM lets you group several into one ABM campaign object so you can see performance across regions, personas, or creative clusters.

Instead of juggling fragmented reports in Campaign Manager, you see spend, pipeline, account movement, and ROAS for the entire initiative.

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model.

You can ask questions such as “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting?” and get answers based on live data.

For agencies, ZenABM offers a multi-client workspace.

You can manage multiple ad accounts and clients in one environment, each with its own ABM strategy, dashboards, and reporting, instead of constantly switching accounts in Campaign Manager.

Plans start at $59 per month for Starter, $159 for Growth, $399 for Pro (with AI), and $479 for Agency.

The agency plan still stays under $6,000 per year.

All tiers include core LinkedIn ABM features. Higher tiers mostly increase limits and add Salesforce sync.

Plans are available monthly or annually, and every plan includes a 37-day free trial.

Recotap behaves like a full LinkedIn first ABM platform.

It unifies data, intent, LinkedIn campaigns and web personalization, then reports revenue impact at the account level, but it comes with a price tag in classic ABM territory.

Satlo is narrower and cheaper.

It gives you company-level LinkedIn Ads analytics, buyer intent scoring and an AI layer on top of your campaigns, without stepping into full journey orchestration.

If you want first-party LinkedIn company intent, ABM stages, CRM sync, job title analytics and ROAS per account at a lower and more transparent entry price, ZenABM sits neatly between the two and can act as either an alternative or a focused LinkedIn ABM layer in your stack.