©2026 ZenABM - All Rights Reserved.

In this guide, I break down how N.Rich vs. Influ2 differ on features, pricing, and where they fit in an ABM stack, so marketing and sales can see which one actually suits their ABM motion.

I also show how ZenABM can act as a lean, LinkedIn-first alternative or sit on top of either tool when you only need precise LinkedIn ABM analytics.

In case you’re short on time, here is the snapshot:

N.Rich presents itself as an agile ABM execution layer for mid-market and enterprise teams.

Under the hood, it is a B2B DSP with intent, ICP, and ABM workflows built on top.

Core N.Rich capabilities for ABM include ICP building, intent scoring, programmatic campaigns, and account-level analytics.

N.Rich pulls in CRM opportunity data to learn what your best customers look like and then scores new accounts against that pattern.

You can spin up target lists in minutes using filters such as industry, employee count, and tech stack.

The goal is to move beyond gut-feel account picks, although output still depends heavily on CRM data quality.

N.Rich blends first-party signals (site visits, ad engagement) with third-party intent feeds to highlight accounts researching key topics.

Accounts receive intent scores so sales and marketing can focus on those showing the strongest, consent-based interest.

The platform tracks thousands of topics and syncs them into your CRM for timely, theme-based outreach.

N.Rich ships with a built-in DSP to run programmatic display to target accounts and supports native and video formats.

You can connect LinkedIn Ads to keep display and LinkedIn campaigns aligned, and Capterra reviews note a simple campaign builder that supports bulk creatives and A/B tests.

N.Rich provides account-level analytics so you can see how engagement connects to pipeline and revenue.

The Opportunity Attribution dashboard links impressions, clicks, and visits with opportunities and closed deals so you can see which accounts actually moved.

The system also calculates an ICP Sales Velocity Score for each account and can sync all of this back to the CRM on higher tiers.

N.Rich integrates with the main CRMs and marketing tools.

Native connectors exist for Salesforce, HubSpot (Marketing and Sales Hub), and LinkedIn ads, letting you pull CRM data for segmentation and push back engagement, topics, and velocity scores.

Some connectors are reserved for higher plans, and N.Rich also offers firmographic and technographic enrichment so you can see what tools target accounts use.

N.Rich has simple tiered pricing tied to team size and ABM maturity. All plans aim to turn intent data into deals, with clear published ranges.

For smaller teams starting with intent-driven ABM.

Includes 1 Intent Report, 10 topics, 1 marketing seat, 3 sales seats, 1 N.Rich account, 1 ABM campaign, and chat support.

For teams scaling ABM and needing closer sales and marketing alignment.

Includes everything in LITE plus:

For global, mature ABM programs with advanced orchestration needs.

Includes everything in GROWTH plus:

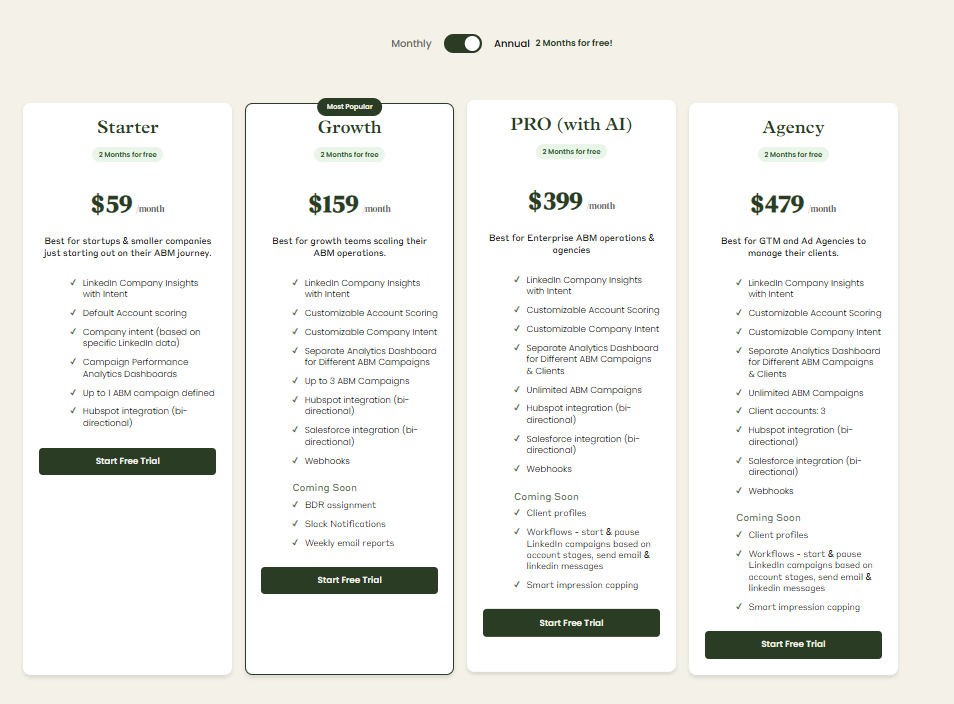

Note: because N.Rich starts above $10K per year, ZenABM often looks leaner for LinkedIn first teams, starting at ~$59/month, with the top tier still under $6K per year. You still get core LinkedIn ABM essentials: account-level ad engagement tracking, account scoring, ABM stage tracking, hot account routing, bi-directional CRM sync, custom webhooks, qualitative intent, and plug-and-play ROI dashboards.

N.Rich scores 4.7 out of 5 on G2 (around 99 reviews), which suggests customers are broadly satisfied.

Across G2, TrustRadius, Reddit, and similar sources, a few themes show up.

Influ2 is marketed as the first person-based account-based marketing platform.

It promises to target ads at specific individuals within your target accounts.

Let’s take a look at its features, pricing, and reviews.

Influ2 is about person-based advertising and ABM.

Let’s look at its core offerings:

Unlike many ABM platforms that stick to company-level audiences, Influ2 shows ads to specific individuals on major ad networks.

For example, you could target Jane Doe, CIO of Acme Corp, and have her see your ad on LinkedIn and later on a news site via Google Display.

No more wasting impressions on interns and random folks at the account who aren’t influencers in the deal.

How reliable is that matching?

Well, that is low 🙁

A study by Syft found that IP-matching accuracy for website visitor identification is a mere 42%.

The platform doesn’t just blast ads; it tells you exactly who saw or clicked them.

Influ2 will report impressions, clicks, and even website visits by individual name for each target on your list.

Your sales team can get real-time intel like “John Doe (Senior Director at Dream Account) saw 45 impressions and clicked 3 of them.”

Armed with these contact-level intent signals, sales knows who’s engaging and can tailor outreach accordingly.

Influ2 also tracks for third-party intent signals like keyword searches and the sites visited by your target contacts.

Pro Tip: Influ2 can surface third-party intent, like what keywords people may be searching or which sites they might be browsing, but that data is borrowed and often fuzzy. B2B buying decisions come from whole accounts, not a single contact’s browsing history, so these signals rarely map cleanly to real purchase momentum. ZenABM takes a cleaner route by giving you first-party company-level intent straight from your own LinkedIn ads. You see exactly which companies engaged with which feature-focused creative, which campaigns woke them up, and how their interest is shifting in real time.

Influ2 enables automated ad sequencing based on engagement triggers.

If Jane Doe clicked Ad A, you can automatically move her to see Ad B next, mirroring a personalized buyer’s journey.

The platform lets you set up rules so each contact’s ad experience evolves as they progress (or don’t) through the funnel.

It’s like marketing automation workflows, but for ads aiming to keep each person engaged with content relevant to their stage.

In theory this delivers the right message to the right person at the right time.

In practice, it’s only as good as the logic you set and your content variety.

Some users have noted the platform’s dynamic personalization could be stronger and more flexible, so it may not quite be the choose-your-own-adventure experience the marketing materials imply.

As a modern ABM tool, Influ2 plays nicely with the rest of your tech stack.

It offers integrations with major CRMs and marketing platforms like Salesforce, HubSpot, Marketo, Microsoft Dynamics, and marketing automation systems like Eloqua.

It also connects to sales engagement tools such as Outreach and Salesloft, and even collaboration hubs like Slack and Microsoft Teams.

The idea is to funnel those precious contact-level insights directly to where your sales and marketing teams live – e.g. pinging a Slack channel when a target account contact engages, or updating CRM lead records with ad engagement data.

Users generally praise these integration capabilities, though a few have struggled aligning Influ2 with certain existing workflows.

Implementation typically takes around one month on average, which is relatively speedy for an ABM platform (some competitors require a small army of consultants and several months to get rolling).

Influ2 platform provides dashboards to tie ad engagements to pipeline and revenue outcomes.

For example, you can see metrics like “982 buying groups influenced, 234 opportunities generated, 158 progressed, 17 won” – all attributed to people who saw or clicked ads. It offers revenue influence reports to show how ad campaigns contributed to deals.

Given the person-specific nature, data privacy is a big consideration.

Influ2 markets a “unique privacy-first technology” where their algorithm matches contacts in a GDPR/CCPA-compliant way.

They are SOC 2 Type II certified for data protection.

Essentially, they use hashed emails and first-party data rather than shady third-party cookies to target individuals.

This is meant to reassure your legal team that uploading a list of contacts is done securely and that ad targeting doesn’t violate ad network policies.

Plus, the tool has built-in ad creative storage too:

Influ 2 provides a list of hot accounts and the specific contacts within them that the sales team must attend to.

If you’re hoping to find clear pricing on Influ2’s website, sorry, you won’t.

Influ2 follows the enterprise software tradition of “Contact us for pricing”, with custom quotes based on your situation.

But here’s what’s available on third-party sources:

Let that sink in: $5 per contact who interacts (clicks or even just sees an ad). If you have 1,000 contacts on your target list, you could be looking at ~$5,000 for them to be reached and that’s on top of whatever internal cost to produce ads and manage the program. That user also noted their results were underwhelming for the price: the target contacts didn’t even recall the brand after clicking ads.

Let that sink in: $5 per contact who interacts (clicks or even just sees an ad). If you have 1,000 contacts on your target list, you could be looking at ~$5,000 for them to be reached and that’s on top of whatever internal cost to produce ads and manage the program. That user also noted their results were underwhelming for the price: the target contacts didn’t even recall the brand after clicking ads. That implies that for some, the deals influenced by Influ2 within a few quarters justify the cost. The critical view is that Influ2 probably makes the most sense financially if your deal sizes are large (enterprise B2B deals worth $50k, $100k+ each). Spending, say, $50k a year on Influ2 to help close $1M in new business could pencil out. This isn’t a tool for the scrappy startup with $5k total ad budget; it’s for teams willing to invest serious money to get in front of hard-to-reach decision makers.

That implies that for some, the deals influenced by Influ2 within a few quarters justify the cost. The critical view is that Influ2 probably makes the most sense financially if your deal sizes are large (enterprise B2B deals worth $50k, $100k+ each). Spending, say, $50k a year on Influ2 to help close $1M in new business could pencil out. This isn’t a tool for the scrappy startup with $5k total ad budget; it’s for teams willing to invest serious money to get in front of hard-to-reach decision makers.

Influ2 enjoys a 4.6/5 average rating on G2 across 150+ reviews, which sounds stellar, but let’s dig into what users actually say.

What users applaud about Influ2:

Where users see pain points or limitations:

Once you know both platforms, the N.Rich vs. Influ2 contrast becomes clearer.

Tabulated here:

| Category | N.Rich | Influ2 | Where ZenABM Fits |

|---|---|---|---|

| Core positioning | ABM and intent platform with its own DSP and CRM driven ICP builder for mid market and enterprise teams. | Person based ABM platform that targets and tracks ads at the individual contact level across channels. | LinkedIn first ABM analytics and activation layer focused on company level engagement and pipeline impact. |

| Main focus | Turn consent based intent and CRM data into targeted account based campaigns with account level attribution. | Reach specific decision makers and surface contact level engagement and buyer intent to sales. | Identify which companies are engaging with LinkedIn ads, score them, stage them, and sync into the CRM. |

| Target entity | Accounts and buying groups, scored and prioritized using ICP and topic based intent. | Named contacts inside target accounts, tracked individually for impressions, clicks, and visits. | Companies as the primary unit, with optional job title and role analytics on top. |

| Channels and activation | Programmatic display via native DSP plus coordination with LinkedIn Ads and other channels. | Person based delivery across networks such as LinkedIn and display inventory, tied to uploaded contact lists. | Deep coverage of LinkedIn Ads only, with ABM campaigns, retargeting logic, and engagement timelines. |

| Data and intent model | Blend of first party engagement and third party topic intent, tracked in a consent based framework. | Contact level engagement and third party browsing or keyword intent, aggregated into buying group signals. | First party intent from LinkedIn Ads API, based on how companies interact with specific campaigns and creatives. |

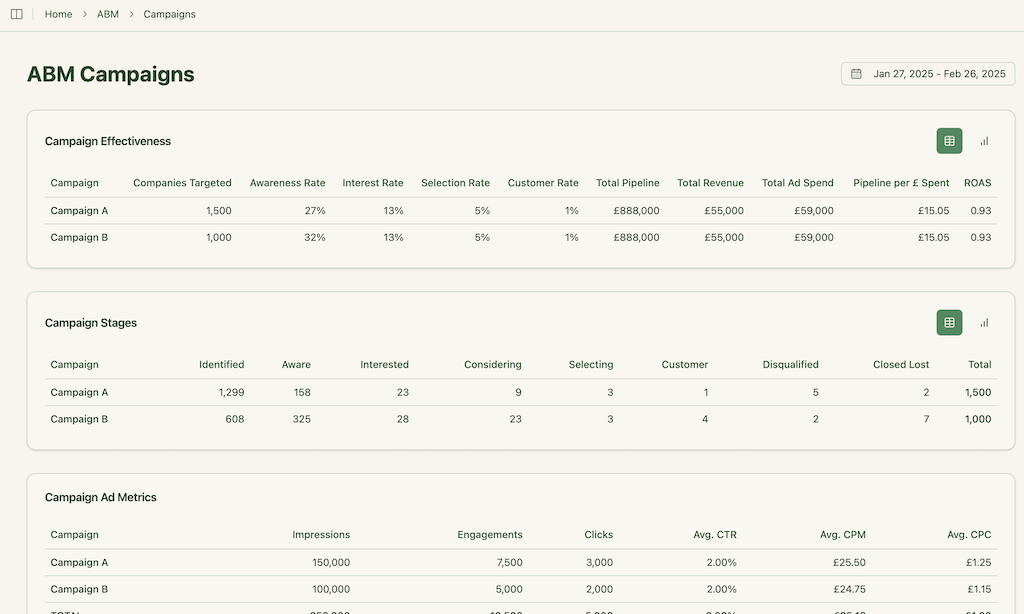

| Analytics and attribution | Account analytics, opportunity attribution, and ICP sales velocity scores tied back to CRM. | Reports that map contact and buying group engagement to influenced opportunities and revenue. | ABM dashboards that link LinkedIn spend to account engagement, stage movement, pipeline, and ROAS. |

| Pricing profile | Tiered annual plans starting above $10K per year plus onboarding, scaling with topics, users, and campaigns. | Per contact reach model that bundles media and platform, often perceived as high cost for broad coverage. | Flat tiered SaaS pricing from $59 per month to under $6K per year for agencies, no credits or media markups. |

| Ideal team profile | ABM teams with a defined ICP and intent program that want a DSP backed execution and analytics layer. | Revenue teams chasing large enterprise deals that justify paying to reach specific decision makers directly. | Teams whose main ABM motion runs on LinkedIn and who want accurate company level signals in their CRM. |

| Typical tradeoffs | Higher cost and setup effort, and reliance on strong CRM and intent data quality. | Premium per contact pricing and variable recall and impact from person based ad exposure. | Does not attempt to cover display or person based ads, instead focuses on depth for LinkedIn ABM. |

As I just said, if your main growth lever is LinkedIn and you mostly need first-party accuracy, account scoring, ABM stages, CRM sync, and revenue attribution, both can be overkills.

This is where ZenABM comes in.

In fact, even if you are using or decide to use N.Rich or Influ2, ZenABM has unique features that make it important for your ABM tech stack.

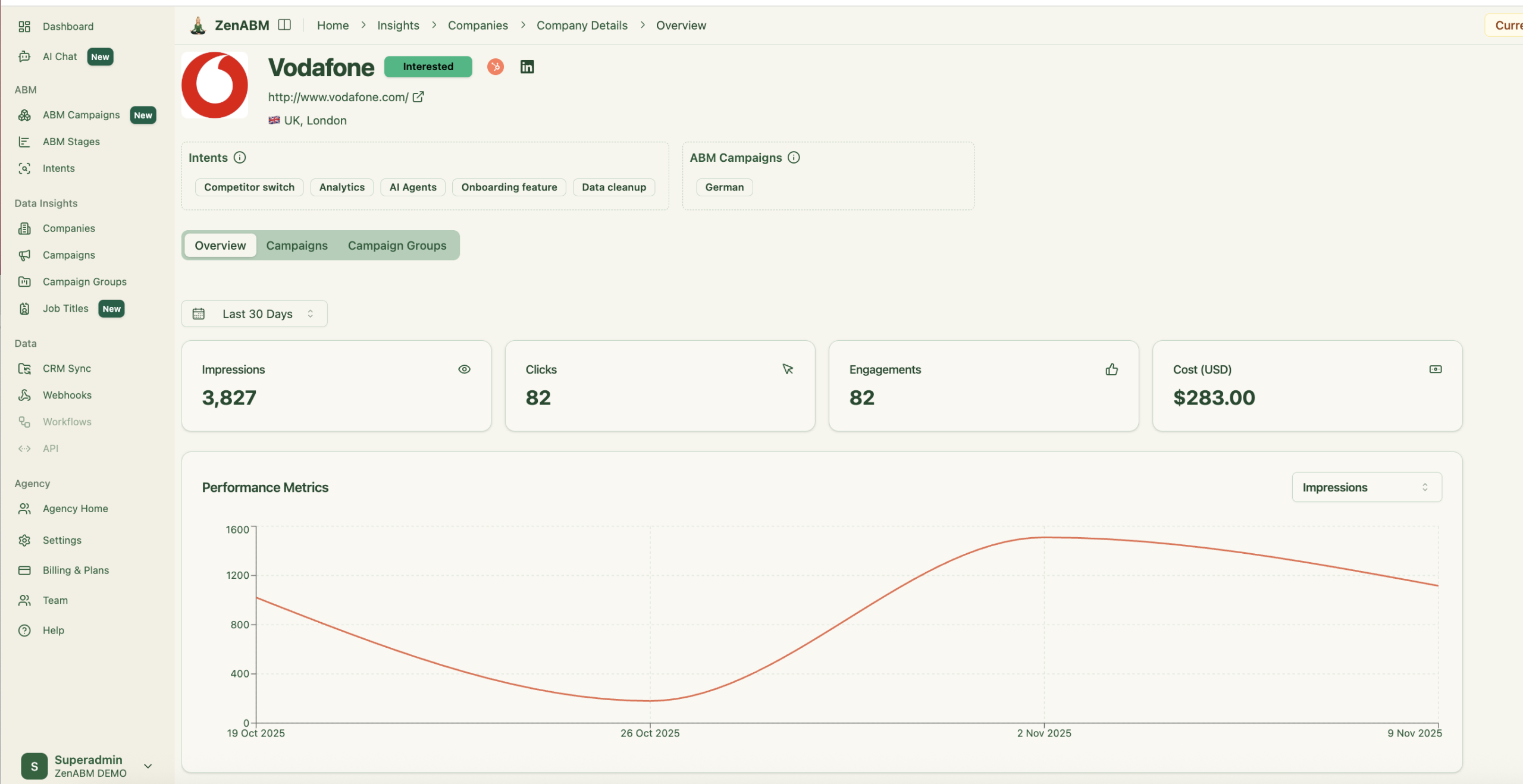

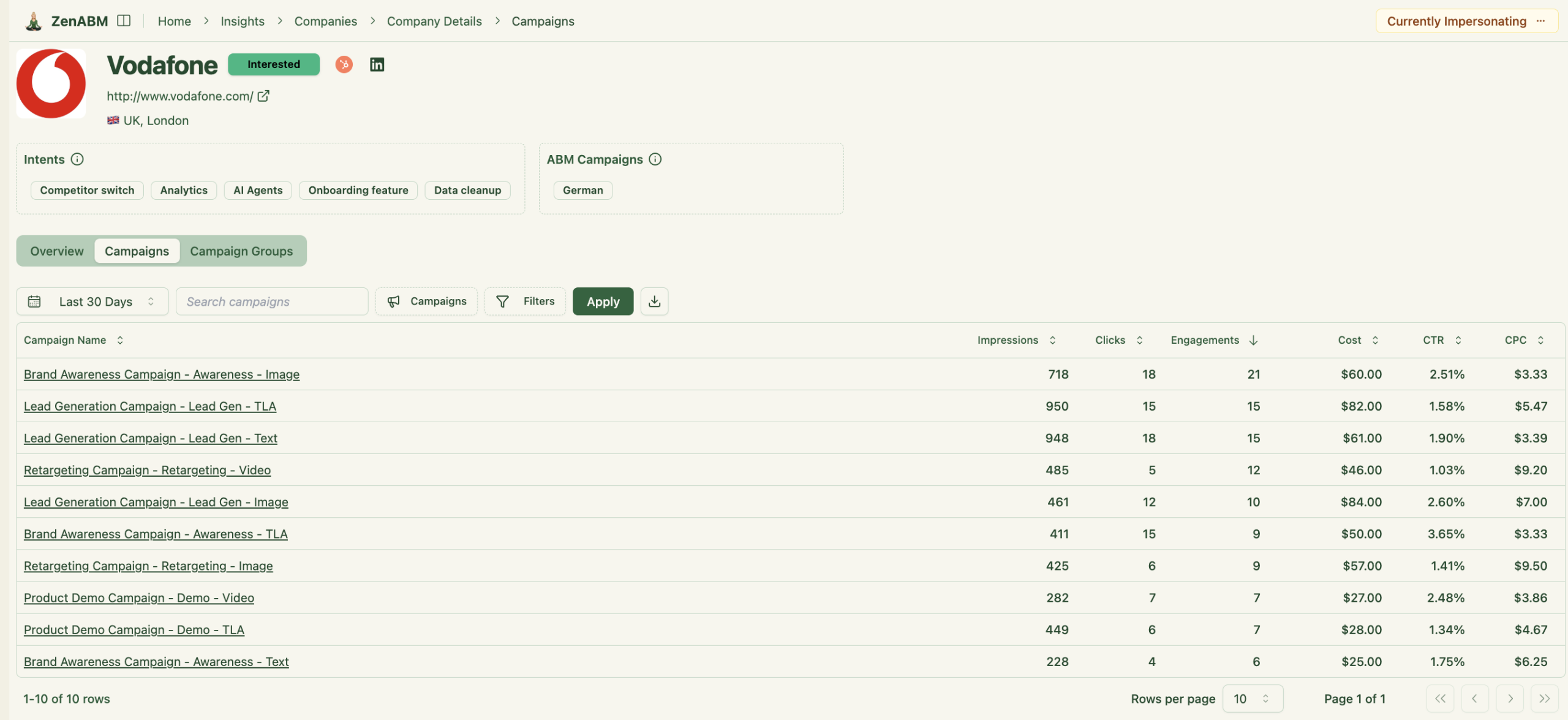

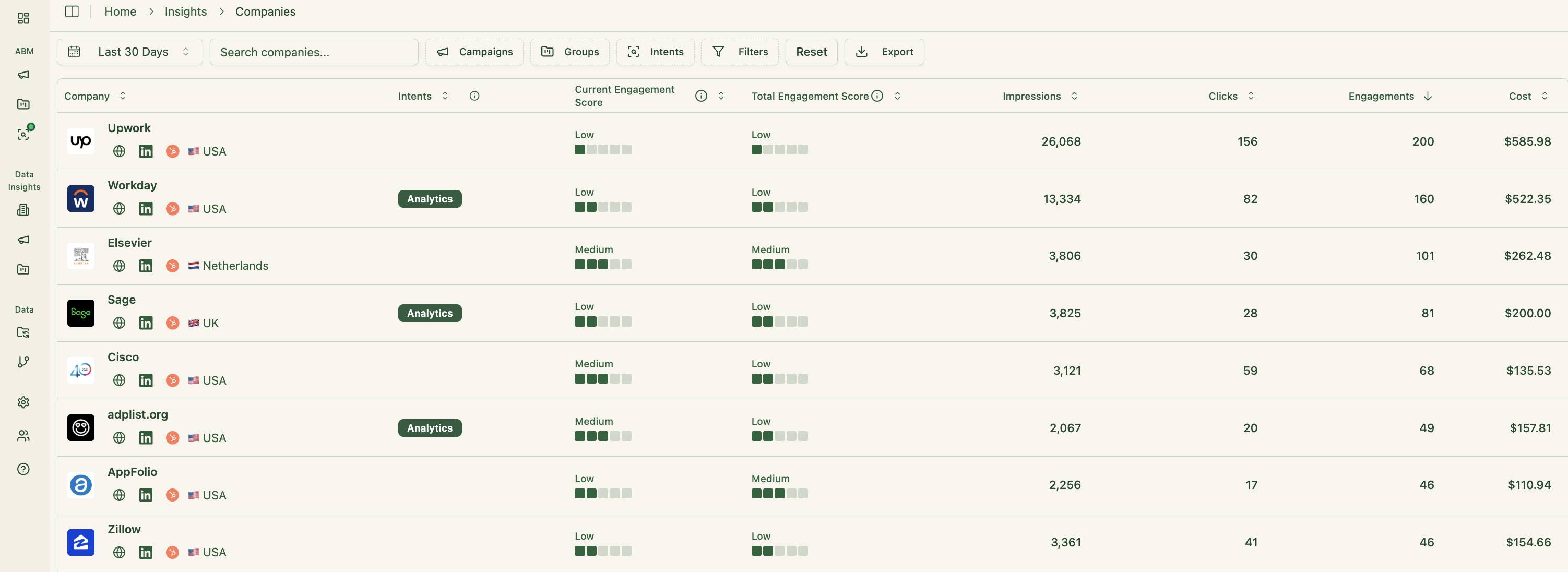

ZenABM connects directly to the official LinkedIn Ads API and records account-level data for every campaign.

You see which companies view and engage with your ads with account-level attribution, based on first-party LinkedIn data instead of noisy IP or cookie matching.

A Syft study suggests IP identification accuracy peaks around 42 percent, which is why ZenABM treats ad engagement as the primary intent signal.

ZenABM updates engagement scores continuously as accounts interact with your ads, across short and long windows.

Scores help prioritize accounts, and the interface shows a full touchpoint history for each company.

ZenABM lets you define custom stages such as Identified, Aware, Engaged, Interested, and Opportunity, then places accounts in the right stage based on scores and CRM signals.

This gives you funnel visibility close to large ABM suites, but concentrated on LinkedIn engagement.

ZenABM syncs bi directionally with HubSpot and adds Salesforce support on higher plans.

All LinkedIn metrics can be written as company properties in your CRM.

When an account crosses your score threshold, ZenABM updates the stage to “Interested” and assigns a BDR.

ZenABM lets you pull intent topics from LinkedIn campaigns. You can tag each campaign by feature, use case, or offer.

ZenABM then reports which accounts engage with which themes and lets you sync those topics into the CRM.

Reps can tailor outreach to what each account has actually explored instead of guessing.

ZenABM includes ABM dashboards that tie LinkedIn ads to account engagement, stages, and revenue.

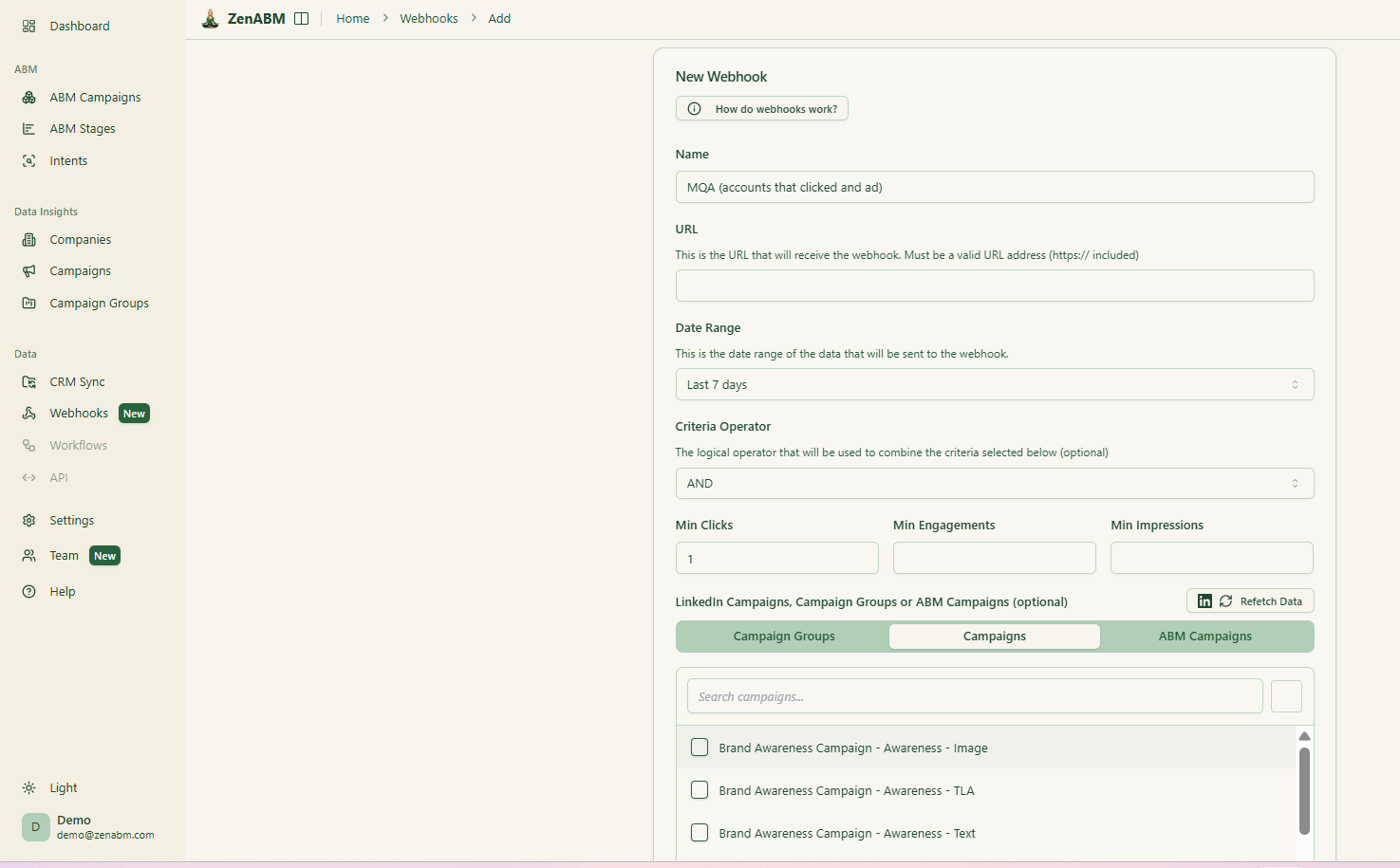

ZenABM’s webhooks send events into your stack for Slack alerts, enrichment flows, and other automation.

ZenABM shows which job titles interact with your creatives and how long they stay, plus video funnel analytics.

Instead of treating every LinkedIn campaign in isolation, ZenABM lets you group them into ABM campaign objects.

You can view performance across markets, personas, or creative clusters in a single place rather than juggling fragmented reports inside Campaign Manager.

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model.

You can ask questions such as “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting campaigns?” and get answers that reference live data instead of exports.

ZenABM supports agencies via a multi-client workspace so you can manage several ad accounts and clients in one environment with their own ABM campaigns, dashboards, and reporting without constant account switching in Campaign Manager.

Plans start at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI), and $479/month for Agency.

Even the agency plan stays under $6,000 per year, with all tiers including core LinkedIn ABM capabilities.

Higher tiers mainly raise limits and add Salesforce sync.

Monthly and annual billing are available, and every plan comes with a 37-day free trial period.

N.Rich is a solid choice if you want a structured ABM execution platform that converts CRM driven ICP and consent-based intent into coordinated programmatic and LinkedIn campaigns, with clear account level attribution. It aligns with teams that have the budget and data foundations to run a full ABM and intent program.

Influ2 makes more sense when your main goal is to reach and track specific people within target accounts and you are prepared to pay for that precision. The person based approach and contact level insights appeal most to teams selling high ticket deals where a handful of influenced buyers can justify the spend.

If your priority is to get more pipeline out of LinkedIn without taking on DSP complexity or per contact media economics, a LinkedIn first platform like ZenABM is often the cleaner route. You get company level LinkedIn engagement, first party intent, scoring, ABM stages, CRM sync, and revenue dashboards from pricing tiers that mid market teams and agencies can actually live with.