Madison Logic is an enterprise ABM suite, while Linklo bills itself as a LinkedIn Ads optimization platform built for account-based marketing-like precision.

In this guide, I have compared Madison Logic vs. Linklo on features, pricing and ABM fit so your marketing and sales teams can quickly see which platform aligns with their ABM motion.

I have also discussed how ZenABM can work as a lean LinkedIn-first alternative or serve as a complementary layer due to its unique features.

In case you want it short:

| Category | Madison Logic | Linklo |

|---|---|---|

| Core Purpose | Enterprise ABM suite for multi-channel activation, syndication and intent | LinkedIn Ads optimization tool for scheduling, pacing and delivery control |

| Main Strength | Large-scale reach across LinkedIn, display, CTV, audio and syndication | Precise LinkedIn ad scheduling and account-balanced delivery |

| Weakness | Expensive, complex onboarding, top of funnel heavy | No CRM sync, no attribution, no first-party intent, no multi-channel |

| Intent Data | Bombora surge plus engagement-based signals | No intent data included |

| Attribution | ML Measurement with pipeline influence | No attribution capabilities |

| Integrations | Salesforce, HubSpot, Marketo, Pardot, Adobe, Gong and more | No major CRM or MAP integrations |

| Advertising Channels | LinkedIn, display, syndication, CTV, audio | LinkedIn only |

| Pricing | Enterprise pricing, often multi-thousand per month | Starts at $199 per month |

| Best For | Enterprises running full-scale ABM across multiple channels | Teams optimizing LinkedIn Ads efficiency and delivery |

A third option: ZenABM gives account-level LinkedIn ad engagement, pipeline dashboards, account scoring, ABM stages, CRM sync, first-party qualitative intent, automated BDR assignment, custom webhooks, an AI chatbot (Zena) and job title analytics starting at $59 per month.

Madison Logic is an enterprise ABM platform that helps you reach named accounts across several paid channels from one place.

Here is a condensed look at what it does, what it costs and how users see it.

The Activate ABM platform combines content syndication, ads and intent data in a single system.

Madison Logic coordinates content syndication, display, LinkedIn ads, CTV and digital audio in one platform.

You can reach target accounts through whitepapers, webinars, LinkedIn Sponsored Posts and streaming TV or audio placements.

Madison Logic claims a large B2B intent graph built over many years and a broad set of accounts and contacts.

These signals feed ML Insights, which scores and prioritizes in market accounts so you know who to focus on.

Madison Logic can syndicate your content through its publisher network to generate MQLs from target accounts.

The vendor highlights tight filters, although some marketers view syndication as opaque and inconsistent on lead quality, with one Redditor calling it “a blind network with no way of filtering out of spec leads.”

Madison Logic runs programmatic display and LinkedIn campaigns against your account list.

As a LinkedIn Marketing Partner, it syncs segments into Campaign Manager and includes LinkedIn as part of multi-channel sequences.

The goal is sustained exposure across display, social and other channels, even though display networks still struggle with bots and banner blindness.

For teams with creative capacity and budget, Madison Logic can also activate CTV and digital audio campaigns as part of an ABM mix.

ML Measurement and the ML Intent Dashboard connect engagement to pipeline and revenue. The Intent Dashboard centralizes intent, engagement and benchmarks, then surfaces hot accounts and recommended next steps, with views for stage movement and cross-channel performance.

Madison Logic built its edge on deep intent data.

Its data arm later became Bombora, and the platform still blends first-party engagement with Bombora Company Surge, plus firmographic and technographic data inside the ML Data Cloud.

Targeting uses firmographics and job attributes, so you can reach the right roles and regions via syndication, display and LinkedIn.

Third-party keyword surge intent can skew toward curiosity rather than purchase intent, and some G2 reviews point out a strong top-of-funnel tilt.

Pro Tip: Third-party surge data can be noisy and expensive. ZenABM instead focuses on first-party qualitative intent by tracking how companies interact with each LinkedIn ad you run. You tag campaigns by theme, and ZenABM groups accounts by what they actually click, giving sales and marketing clearer signals.

Madison Logic connects to major CRM, MAP and sales tools, which suit complex B2B stacks, although setup and upkeep can require ops effort.

| Platform | Integration Details | User Notes |

|---|---|---|

| Salesforce (CRM) | Embeds account insights and engagement data and connects campaigns to the pipeline. | “The integration with Salesforce is everything when it comes to our reporting.” |

| HubSpot, Marketo, Pardot (MAP) | Pushes leads and engagement data into nurture flows that sync with CRM. | Some users mention early setup friction and occasional manual CSV fallback. |

| LinkedIn Marketing Solutions | Exports account segments into Campaign Manager for activation. | Reported to streamline activation and reduce launch time. |

| Gong | Feeds intent-backed insights into call prep and follow-ups. | Used to personalize conversations with AI-supported cues. |

| Convertr | Enriches leads in real time with intent scores and topics. | Helps route qualified leads faster into the right workflows. |

| Adobe Experience Platform | Feeds intent data into Adobe tools such as Journey Optimizer. | Supports full funnel personalization for enterprise programs. |

Madison Logic does not share list pricing publicly, so most buyers will see custom enterprise quotes.

Public benchmarks suggest:

User feedback reflects strong capabilities along with predictable tradeoffs.

Pros:

Cons:

Linklo bills itself as a LinkedIn Ads optimization platform built for account-based marketing-like precision.

It lets you schedule LinkedIn ads, balance ad reach across target accounts, integrate “intent” timing, and generally squeeze more efficiency from LinkedIn’s notoriously expensive ad channel.

Let’s take a deeper look at its key features and also discuss its pricing and reviews.

Linklo is laser-focused on LinkedIn Ads.

In fact, that’s the only advertising channel it manages.

The platform is essentially a power-user layer on top of LinkedIn Campaign Manager, addressing features LinkedIn itself lacks.

Its core offerings:

Perhaps Linklo’s flagship capability is automated scheduling of LinkedIn ads.

LinkedIn’s own ad platform infamously does not let you daypart or automatically pause campaigns on a schedule.

Linklo fills this gap by letting you set precise times for campaigns to run (e.g. only weekdays 8 am-8 pm).

The idea is to focus budget “where buyers actually engage” – e.g. during business hours, instead of frittering away spend at 2 am.

Linklo provides proprietary Company Flow™ feature to “balance reach/frequency and orchestrate ABM-style sequences” across your LinkedIn campaigns.

In plainer terms, this means Linklo tries to ensure your target accounts each see your ads in a balanced way.

Instead of LinkedIn’s algorithm dumping impressions into only a handful of accounts, Linklo’s Company Flow feature evens out the delivery so one company doesn’t gobble most of your impressions.

Company Flow also implies the ability to sequence ads, meaning you could show Ad A to an account first, then Ad B later as a follow-up.

However, let’s be clear: this is within LinkedIn only.

Linklo isn’t coordinating email touches or Sales Navigator InMails or any off-LinkedIn channels in those sequences.

It’s not a full orchestration platform like, say, Terminus (which coordinates ads, email, web personalization, etc.).

Linklo doesn’t provide any third-party intent data from sources like Bombora, etc.

It assumes you already know your target account list and focuses on delivering ads to them efficiently.

The closest thing to “intent” in Linklo’s toolkit is its use of engagement timing data.

By analyzing when your audience tends to engage on LinkedIn, Linklo can schedule ads during those intent-rich windows (e.g. if decision-makers engage more on Tuesday mornings, it will concentrate spend there).

This is useful, but it’s a far cry from the qualitative intent data that ABM platforms offer.

Pro Tip: Linklo provides no kind of intent data. Other ABM suites like 6sense, RollWorks, etc., provide intent data, but I don’t even prefer that. Third-party intent looks exciting until you realize it’s stitched together from mystery browsing data and hope. It tells you what a single contact might be googling, not what an entire buying committee actually cares about. ZenABM skips the guesswork by giving you first-party company-level intent straight from your own LinkedIn ads. You see which accounts engaged with which themes, which feature groups they reacted to, and how their interest changes over time.

Userpilot, using ZenABM, built their whole ABM campaign structure around this first-party company-buyer’s intent obtained from LinkedIn ads instead of third-party tools:

Linklo, being a lean LinkedIn-focused tool, currently has no native CRM or marketing automation integration.

The platform seems to operate mostly within its own dashboard on top of LinkedIn.

You use Linklo to adjust campaigns, and of course, your leads still flow into LinkedIn’s native lead gen forms or your CRM via LinkedIn’s connectors, but Linklo isn’t pushing account-level insights into your CRM.

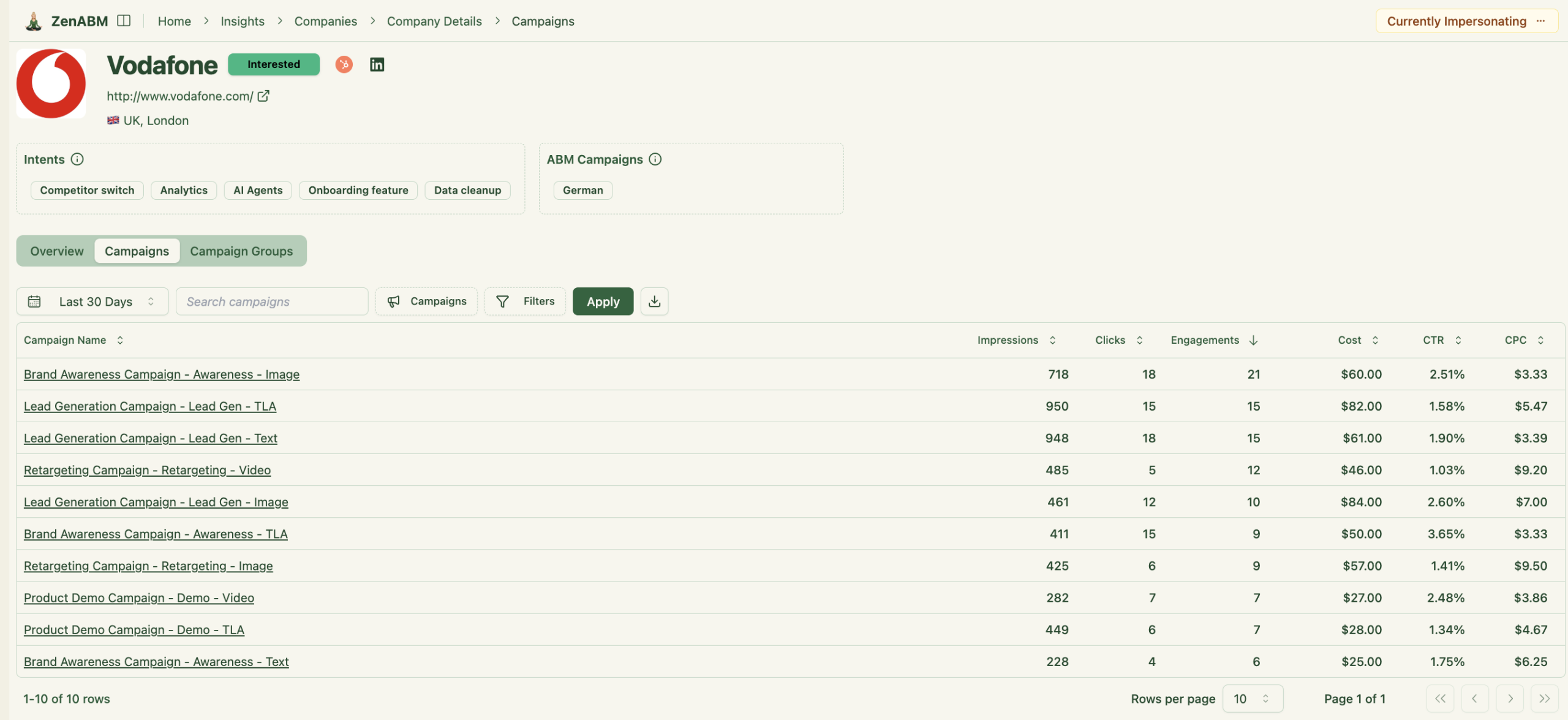

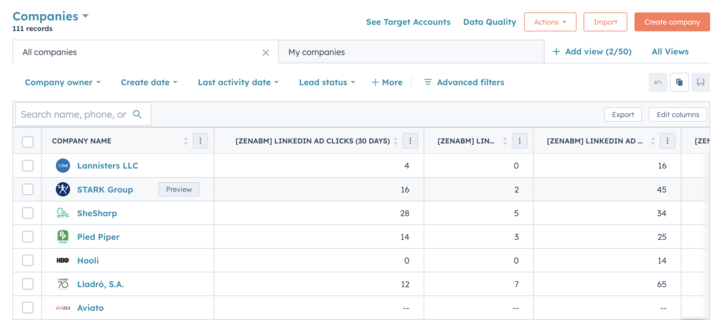

ZenABM, on the contrary, does provide bi-directional CRM sync:

Personalization in ABM usually means tailoring messaging or creatives to each account or segment.

Linklo itself doesn’t create personalized ad content for you.

You still have to design the ads.

However, by orchestrating sequences and controlling frequency per account (via Company Flow), Linklo enables a form of personalization: you could line up different ads for different stages or industries and use Linklo to ensure each account sees the right sequence.

Linklo publicly advertises that it “Starts at $199/mo.”

Nothing more.

Nothing less.

Not much is available on review sites either.

That suggests a flat monthly subscription (likely for a base package), which is refreshingly transparent compared to enterprise ABM platforms that require demos just to get a quote.

At $199 a month, Linklo is positioned as a relatively affordable tool – certainly modest next to the multi-thousand-dollar contracts of full-scale ABM suites.

What do you get for $199/mo?

The details aren’t fully spelt out on the website, but presumably the base plan includes core features (scheduling, budget management, A/B testing) for one LinkedIn Ads account or a limited number of users.

It’s possible that higher spending or multiple ad accounts could require higher tiers – e.g. agencies managing many accounts might pay more, but we haven’t seen a published tier breakdown.

The “starts at” phrasing implies there are higher levels, perhaps based on ad spend or team size.

One potential concern is feature bloat relative to cost.

Linklo packs in multiple capabilities (some might say it’s bloated for just managing LinkedIn): it combines functions of a bid rule engine, an ad scheduler, a budget pacing tool, and a lightweight analytics tool. If your team only needs one of those features (say, just dayparting), $199 might feel steep.

Conversely, if you’ll actively use all those features, then $199 is a great value.

Linklo’s pricing, being subscription-based, also means you can cancel if it’s not delivering value.

This is important because some ABM investments are hard to back out of (annual contracts, long implementation).

Again, if you are looking for a LinkedIn ABM tool with clearer pricing, I present ZenABM, starting at just $59/month.

ZenABM offers account-level LinkedIn ad engagement tracking, ad engagement-to-pipeline analytics with plug-and-play dashboards, account scoring, ABM stage tracking, CRM sync, first-party qualitative intent, automated assignment of BDRs to hot accounts, custom webhooks, and ad engagement tracking at the job-title level.

For a grounded view, what are actual users (or tire-kickers) saying about Linklo?

The truth is that public user sentiment is sparse.

Linklo launched in 2023 and hasn’t amassed many reviews on major platforms yet.

On G2, for example, Linklo is listed in the Social Media Advertising category but currently sits at 0 reviews.

TrustRadius and other review sites similarly have no substantial data on Linklo (a TrustRadius search turned up empty as of late 2025).

On social media and forums, the chatter I did find was a mix of curiosity and cautious optimism.

On Reddit, Linklo’s name has popped up in discussions among pay-per-click and LinkedIn Ads practitioners.

In one thread about scheduling LinkedIn ads (a question born out of frustration with LinkedIn’s limitations), a user mentioned Linklo as a known solution, though they admitted they hadn’t used it yet.

The key differences between Madison Logic and Linklo are summarized here.

| Feature | Madison Logic | Linklo |

|---|---|---|

| Platform Type | Enterprise ABM suite with multi-channel activation and large intent datasets | LinkedIn Ads control layer focused on scheduling, pacing and reach balancing |

| Channels Covered | LinkedIn, programmatic display, content syndication, CTV, digital audio | LinkedIn only |

| Intent Signals | Bombora surge data plus first-party engagement signals | No intent data |

| ABM Capabilities | Multi-channel ABM, account prioritization, syndication and enterprise segmentation | Light ABM style sequencing within LinkedIn via Company Flow |

| Attribution | ML Measurement ties engagement to pipeline and revenue | No attribution or revenue connection |

| Integrations | Salesforce, HubSpot, Marketo, Pardot, Adobe, Gong, Convertr and more | No CRM or MAP integrations |

| Use Case Fit | Large ABM teams needing broad reach, lead volume and enterprise intent intelligence | Teams focused on lowering LinkedIn CPMs and improving delivery efficiency |

| Pricing | Custom enterprise contracts often in the multi-thousand per month range | Starts at $199 per month with a simple subscription model |

| Complexity Level | High complexity, requires ops involvement and structured onboarding | Low complexity, quick to adopt for LinkedIn media teams |

| Ideal Buyer | Enterprise B2B with multi-channel budgets and strong marketing ops | Performance marketers, LinkedIn specialists, and small teams with a focused scope |

Madison Logic and Linklo solve completely different problems.

Madison Logic is for big ABM programs that need cross-channel reach, syndication, and enterprise intent layers. It works for large teams with the bandwidth and budget to run multi-channel ABM.

Linklo is for performance-focused teams who only care about making LinkedIn Ads cheaper, better paced and more controlled. It is not an ABM platform in a full sense.

ZenABM is built for teams that rely on LinkedIn as the primary ABM channel and want first-party accuracy, automation, and revenue visibility without the price or complexity of multi-channel suites.

Let’s look at its core features:

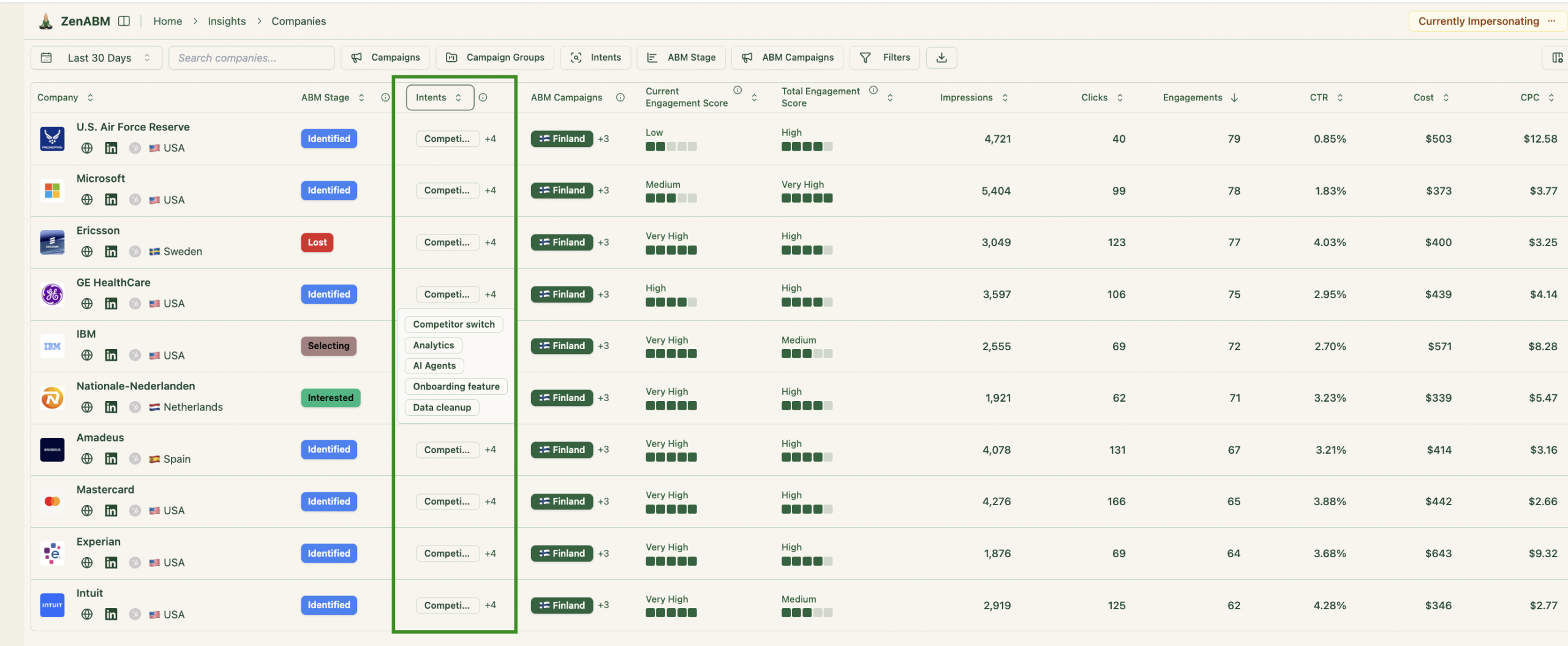

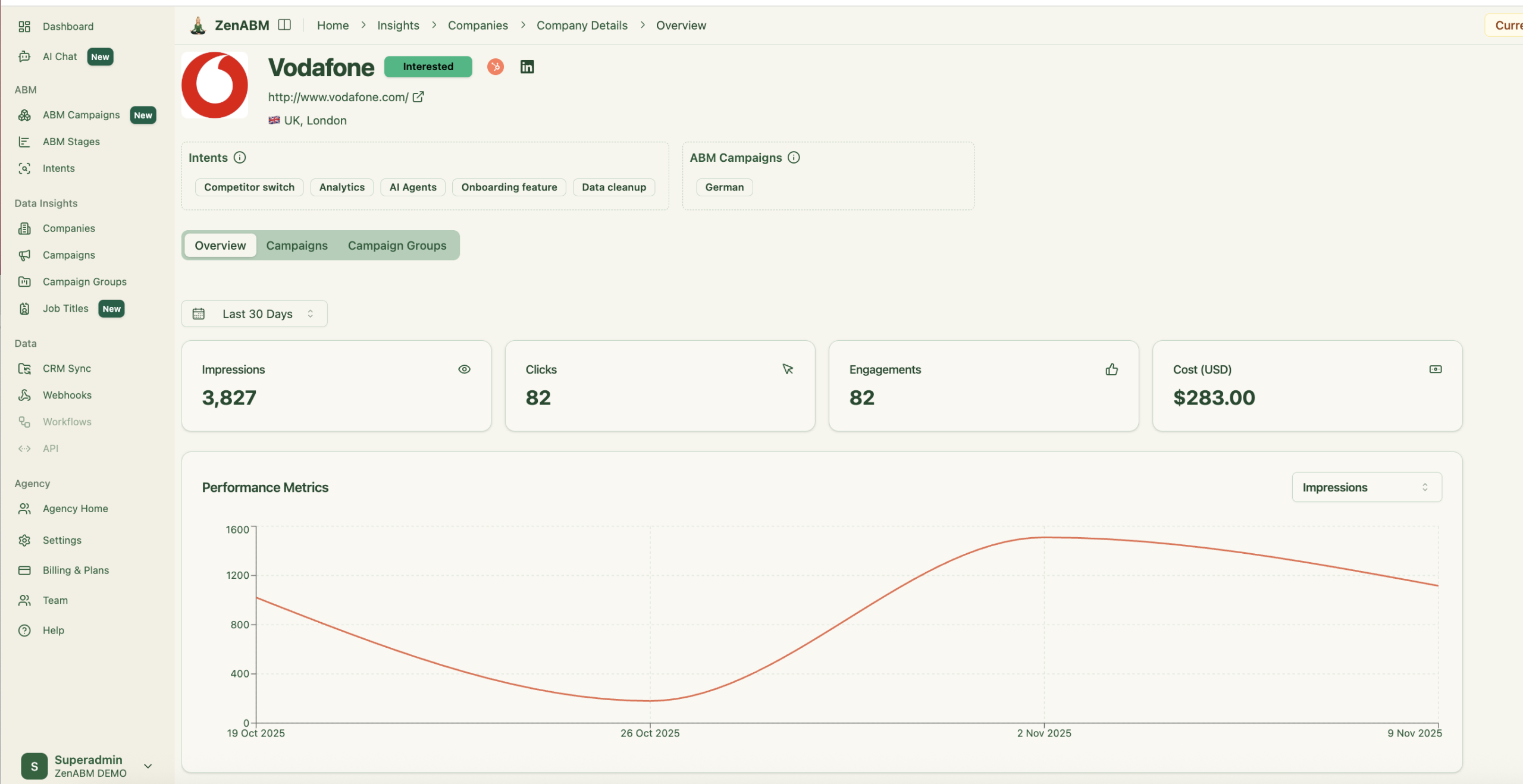

ZenABM connects to the official LinkedIn Ads API and captures account-level data for all campaigns so you can see which companies see, click, and engage with your ads.

Because this is first-party data from LinkedIn’s environment, it is more reliable than IP or cookie-based visitor ID.

A Syft study puts IP-based identification at around 42 percent accuracy.

ZenABM treats LinkedIn ad engagement itself as first-party intent. When several people in one company keep engaging with your ads, that is a strong buying signal without rented intent feeds.

ZenABM updates engagement scores as accounts interact with your ads across campaigns, so you can see who is heating up over short or long windows and let marketing and sales prioritize accounts that show real intent.

ZenABM also shows the full touchpoint timeline for each company:

ZenABM lets you define stages such as Identified, Aware, Engaged, Interested, and Opportunity and automatically places accounts in the right stage using scores and CRM data.

You control thresholds, and ZenABM tracks movement over time.

This gives you funnel visibility similar to larger suites, but powered by LinkedIn data.

ZenABM integrates bi-directionally with CRMs like HubSpot and adds Salesforce sync on higher tiers.

LinkedIn engagement data flows into the CRM as company-level properties:

Once an account crosses your score threshold, ZenABM updates the stage to Interested and automatically assigns a BDR.

ZenABM lets you derive intent topics from LinkedIn campaigns by tagging campaigns by feature, use case, or offer.

ZenABM then shows which accounts engage with which themes.

This is clean, first-party intent from owned interactions.

You can push these topics into your CRM, so sales and marketing can tailor outreach to what each company has actually explored.

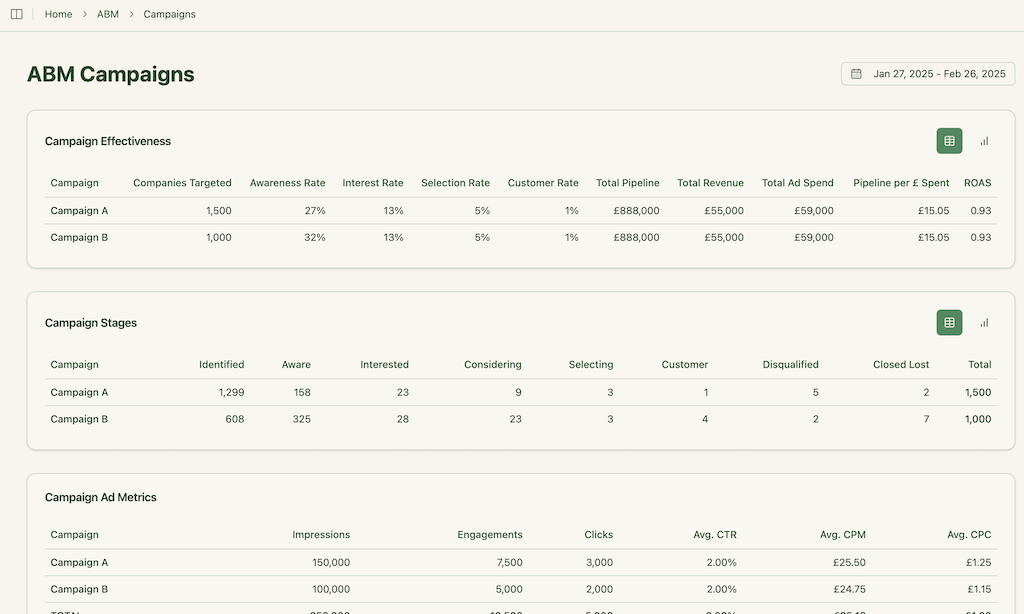

ZenABM ships with dashboards that connect LinkedIn ads to account engagement, stage movement, and revenue.

ZenABM shows which job titles engage with your creatives and gives dwell time and video funnel analytics.

ZenABM provides its AI chatbot called Zena that basically answers all you want from ZenABM in natural language.

You can ask Zena open-ended questions like you would a smart analyst and get company-level answers about:

Under the hood, Zena combines OpenAI with a library of carefully designed prompts and endpoints to join ad engagement, spend and CRM deals so it can explain which campaigns drove pipeline, which accounts turned into opportunities, which formats perform best and which companies are high intent but untouched by sales.

Instead of exporting spreadsheets and stitching pivot tables, you get plain language insights, ready to drop into strategy reviews, weekly sales standups or executive updates.

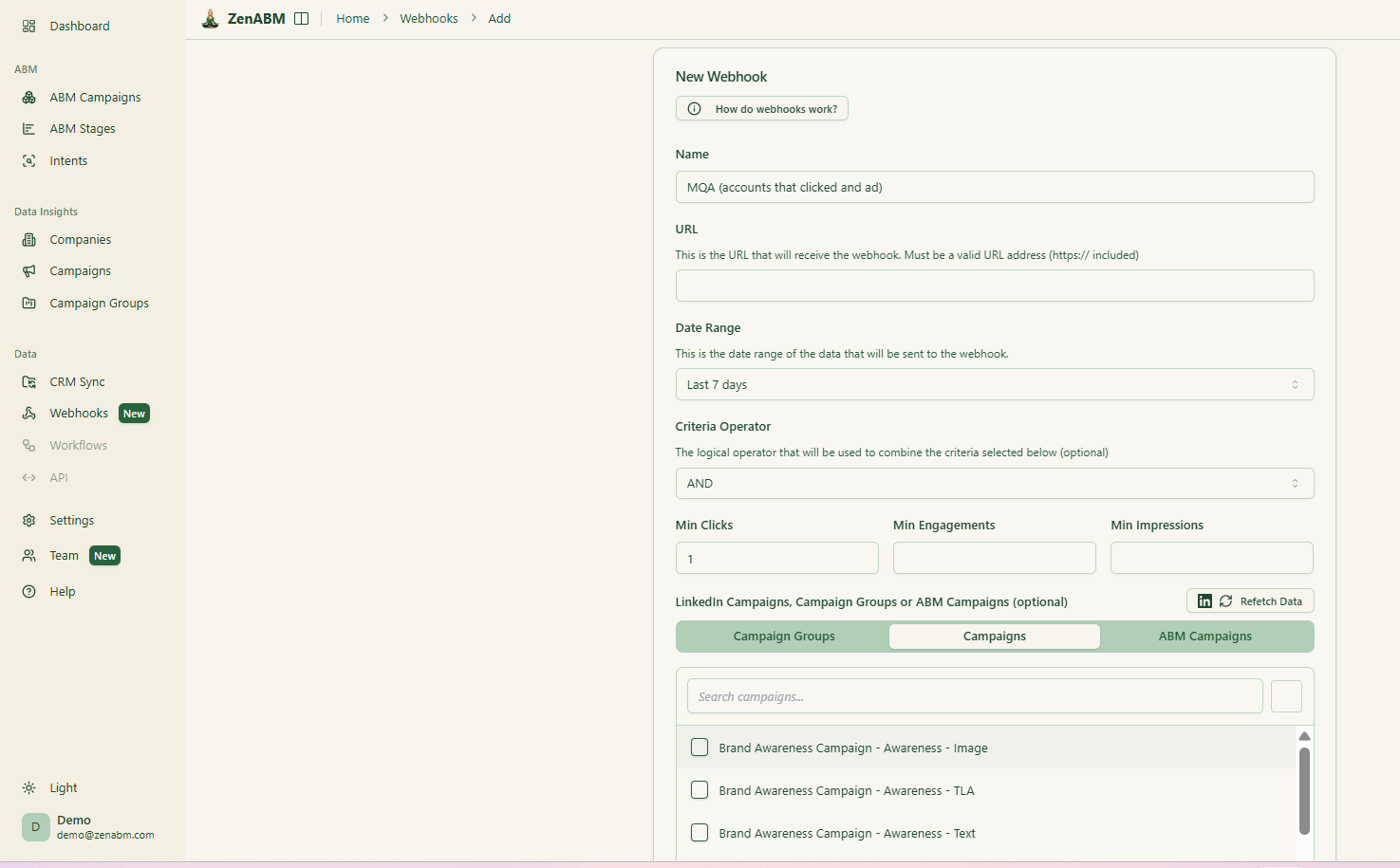

ZenABM’s custom webhooks let you push events into your stack, for example, Slack alerts, enrichment flows, or other ops automations.

Most tools treat each LinkedIn campaign separately. ZenABM lets you group several into one ABM campaign object so you can see performance across regions, personas, or creative clusters.

Instead of juggling fragmented reports in Campaign Manager, you see spend, pipeline, account movement, and ROAS for the entire initiative.

For agencies, ZenABM offers a multi-client workspace.

You can manage multiple ad accounts and clients in one environment, each with its own ABM strategy, dashboards, and reporting, instead of constantly switching accounts in Campaign Manager.

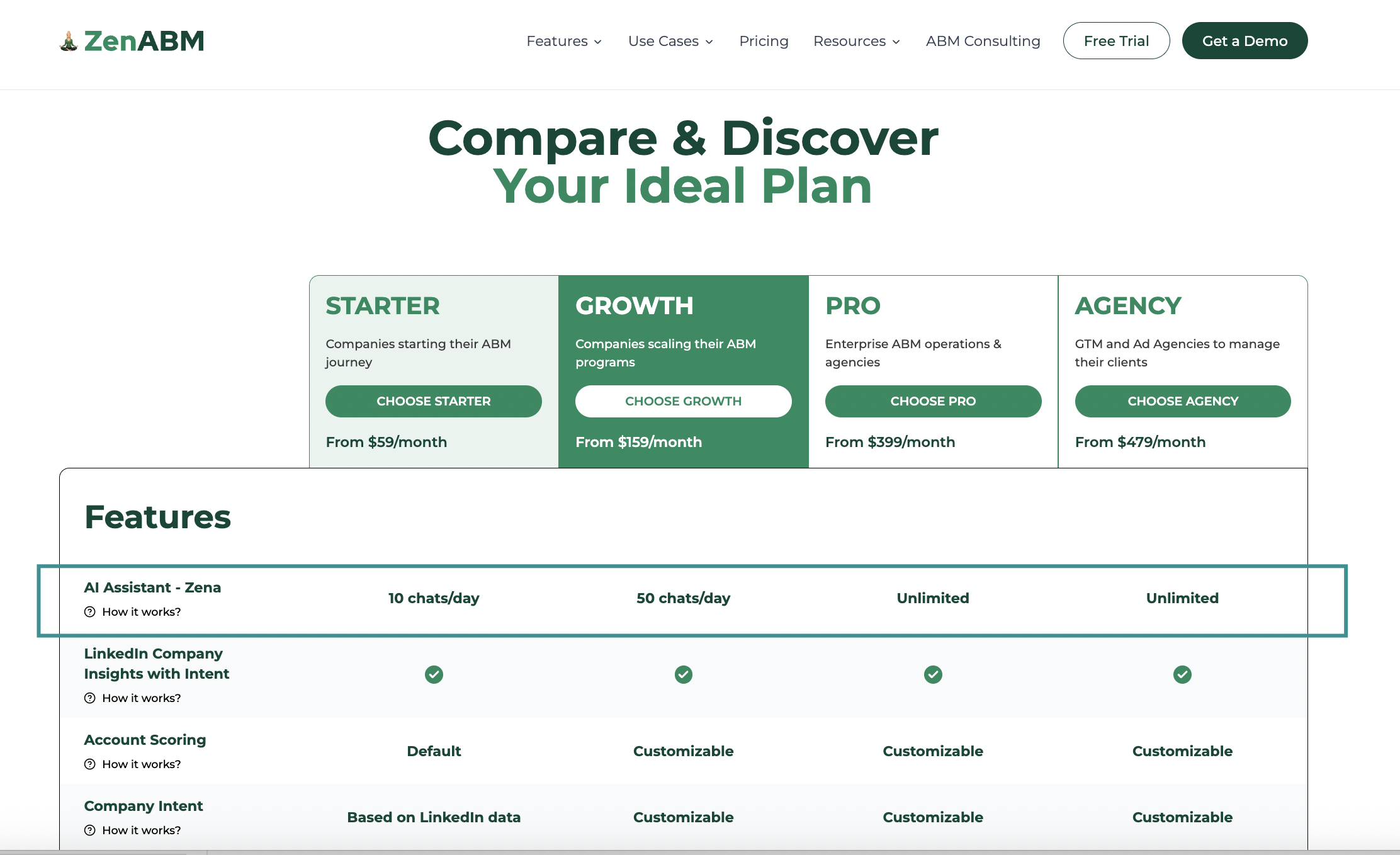

Plans start at $59 per month for Starter, $159 for Growth, $399 for Pro (with AI), and $479 for Agency.

The agency plan still stays under $6,000 per year.

All tiers include core LinkedIn ABM features. Higher tiers mostly increase limits and add Salesforce sync.

Plans are available monthly or annually, and every plan includes a 37-day free trial.

Madison Logic brings scale and multi-channel depth, while Linklo brings simplicity and LinkedIn optimization.

The gap between them is wide, and most teams do not need the full weight of Madison Logic or the narrow specialization of Linklo.

For LinkedIn-centric ABM teams that want clear first-party intent, account insights, attribution and CRM alignment without the enterprise budgets or complexity, ZenABM is the more balanced and effective choice.