In this article, I compare InsightSync vs. N.Rich on features, pricing, and ideal use cases so marketing and sales teams can see which one fits their account-based marketing setup.

I also show how ZenABM can work as a lean, lower-cost alternative or an additional layer on top of either tool, thanks to its unique LinkedIn-first ABM feature set.

InsightSync vs. N.Rich: Quick Summary

In case you’re short on time, here is the snapshot:

- InsightSync is a CI plus ABM analytics platform that centralizes competitor monitoring, target accounts, and engagement data.

- N.Rich is an execution first ABM and DSP platform that turns intent data into targeted display and LinkedIn campaigns.

- InsightSync does not run ads, but offers a CI hub, ABM hub, and engagement hub with account level scoring and alerts.

- N.Rich blends first and third party intent, dynamic ICP building, and opportunity attribution to show which campaigns drive revenue.

- InsightSync pricing starts around €699 per month, placing it in the upper mid market bracket.

- N.Rich pricing starts at more than $10K per year and climbs into the mid five figure range for GROWTH and ENTERPRISE.

- InsightSync suits teams that want strategic visibility across accounts and competitors without adopting a new DSP stack.

- N.Rich suits teams that want to activate intent into programmatic ABM and have the budget and ops muscle to support that motion.

- A third alternative: ZenABM offers account-level LinkedIn ad engagement tracking, ad engagement-to-pipeline analytics with plug-and-play dashboards, account scoring, ABM stage tracking, CRM sync, first-party qualitative intent, automated BDR routing, custom webhooks, an AI chatbot, and job-title-level ad engagement tracking, starting at just $59/month.

InsightSync Overview: Key Features, Pricing and Reviews

InsightSync is a newer player (as of late 2025) that positions itself as an all-in-one account-based marketing and competitive intelligence platform.

Its aim is to bring your target accounts, engagement data, and competitive research into a single workspace so GTM teams work from the same view.

Here is how it works in practice.

Key Features of InsightSync

InsightSync combines three main modules into one ABM platform.

1. Competitive Intelligence Hub

This is the main differentiator versus typical ABM only products.

The Competitive Intelligence (CI) Hub focuses on tracking competitors and overall market activity.

Key highlights:

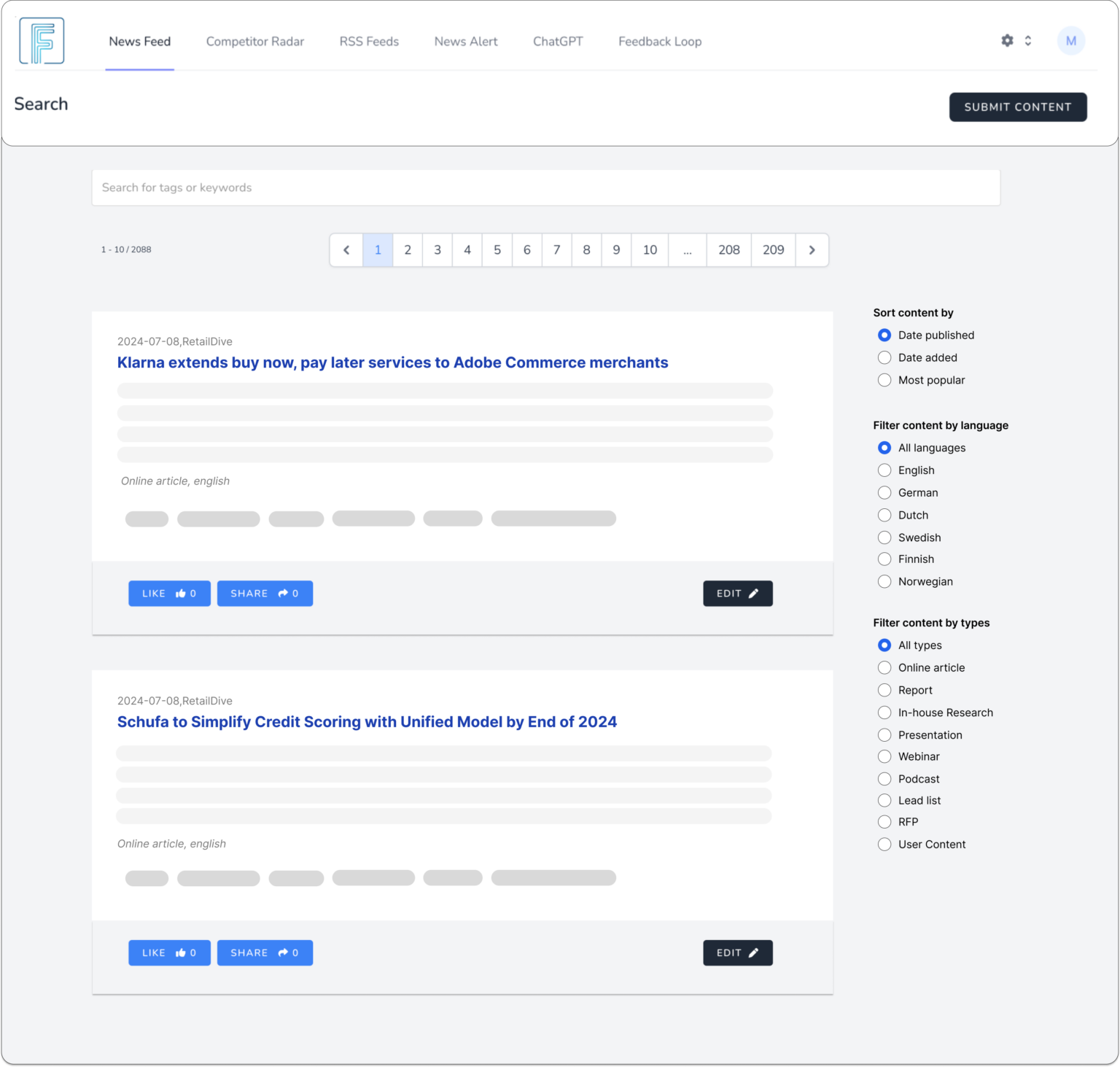

Unified News Feed

InsightSync pulls competitor content from news sites, press releases, and internal or external blog posts into one feed.

Instead of juggling multiple alerts and manual searches, you scroll a single consolidated stream.

You can tag and categorize entries to filter by topic or competitor, use the ‘like’ action to flag important items, and share key updates with colleagues.

You can also set custom alerts based on tags or keywords so you are notified when something big happens, for example when a rival announces an “Acquisition”.

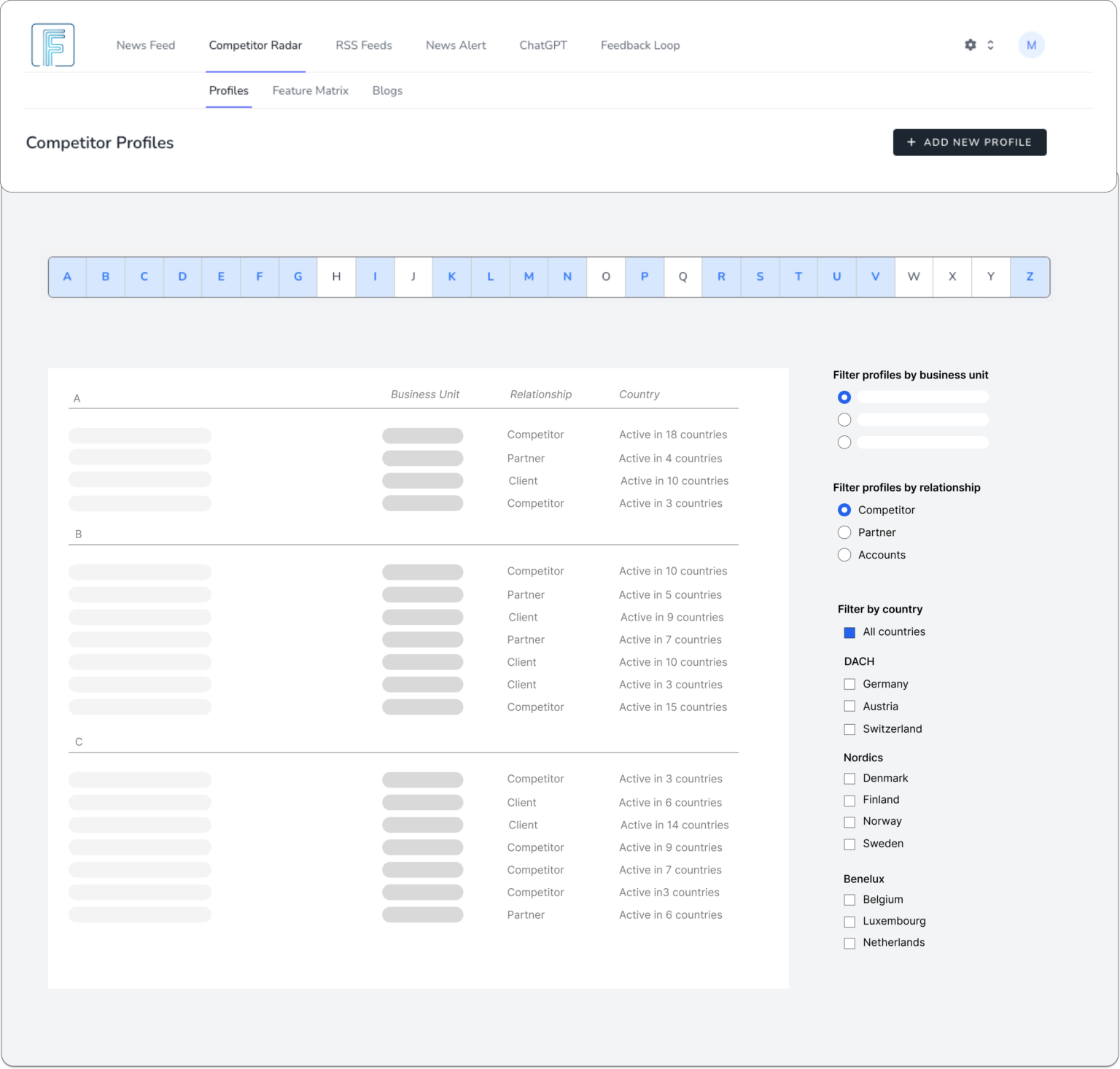

Competitor Radar & Profiling

The CI Hub lets you keep structured profiles for each competitor.

You can log customer logos, partnerships, pricing notes, and positioning angles so the team has a shared view of the landscape.

AI Document Search

Much competitive intel lives inside PDFs, decks, and long form docs.

InsightSync uses AI powered search to ingest these documents so you can query them, surface snippets, and extract summaries when you need them.

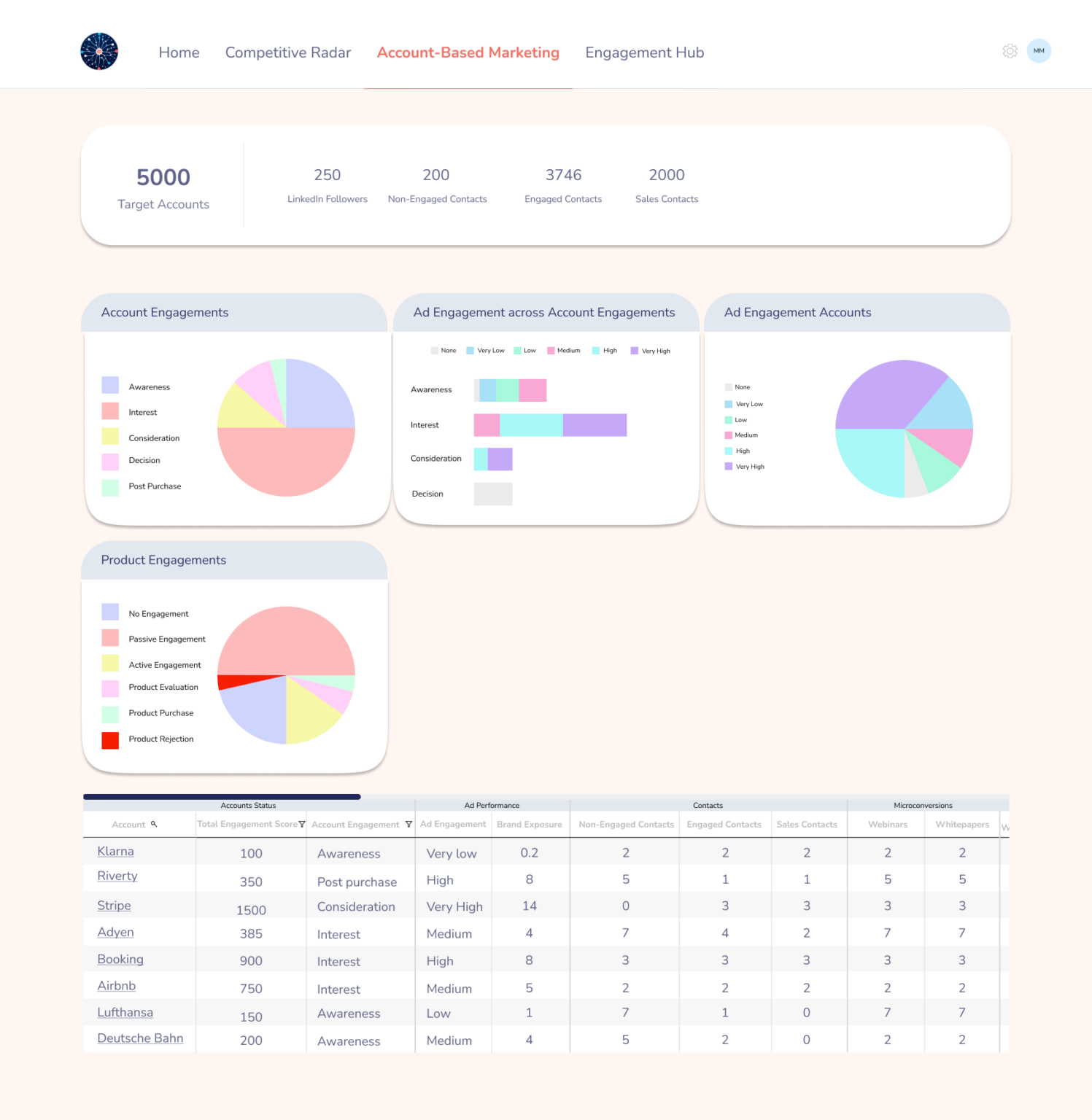

2. Account-Based Marketing Hub in InsightSync

The ABM Hub is the core of InsightSync. It helps you answer:

- Who are we targeting?

- What do we already know about them?

- How are we engaging them right now?

It becomes the center of your traditional account-based marketing workflows.

Key capabilities of the ABM Hub:

Target Account List Management

You can import or build your target account list (TAL) directly in InsightSync. Lists from your CRM or CSVs can be uploaded and maintained there.

Once imported, each account becomes a record you can track and enrich with firmographic fields such as industry, size, and tech stack, either via integrations or manual input.

Multi-channel Engagement Tracking

Once your TAL is set, InsightSync tracks engagement across ads, email, meetings and more in a single timeline.

You can score events to quantify interest, for example giving more points to a demo request than an email open, so high scoring accounts rise to the top as more sales ready.

Real-Time Alerts & Optimization

InsightSync surfaces accounts that are heating up or cooling down in near real time.

This helps your team focus on in market accounts and step in before key deals stall.

Account level visibility also lets you reallocate spend to engaged accounts and tweak messaging for segments that are lagging.

Scalability & Workflow Automation

InsightSync is built to grow with your ABM program.

It mentions automated workflows for scaling personalized outreach, although public docs do not go very deep into specifics.

One thing to note: InsightSync’s ABM Hub is channel agnostic (ads, email, meetings), but it does not ship its own ad network or marketing automation. It is not like Demandbase or RollWorks where you set live ads in the platform. You still run campaigns in LinkedIn, HubSpot, or other tools, while InsightSync ingests the performance data for attribution and analysis.

For teams that lean heavily on LinkedIn Ads as their main ABM channel, ZenABM is more direct because it connects to the official LinkedIn Ads API.

It pulls company-level impressions, clicks, engagement, and ad spend for each ad and campaign group, scores accounts, syncs this data into the CRM as company properties, and automatically routes hot accounts to BDRs.

Finally, ZenABM maps ad engaged accounts to deals in your CRM and provides revenue analytics and attribution dashboards so you can measure the real impact of your LinkedIn ads ABM strategy on pipeline and revenue.

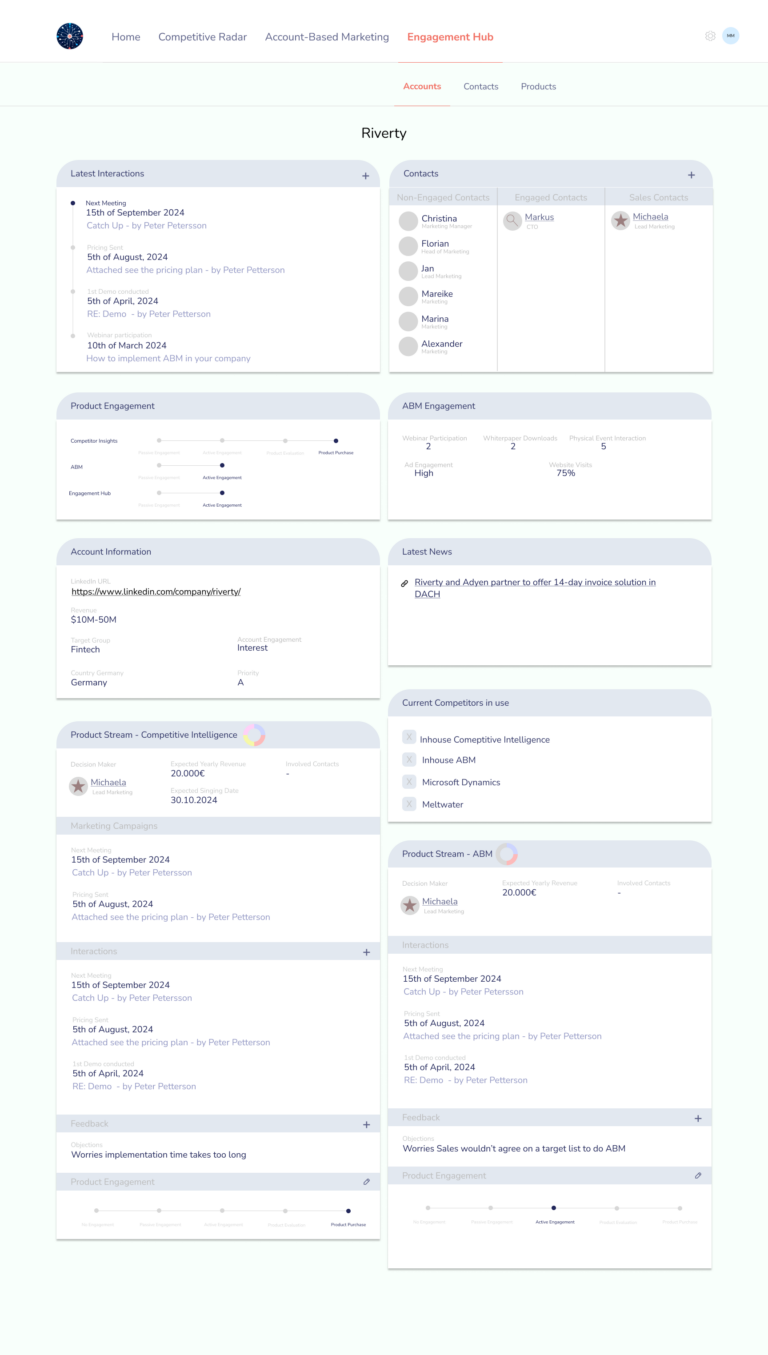

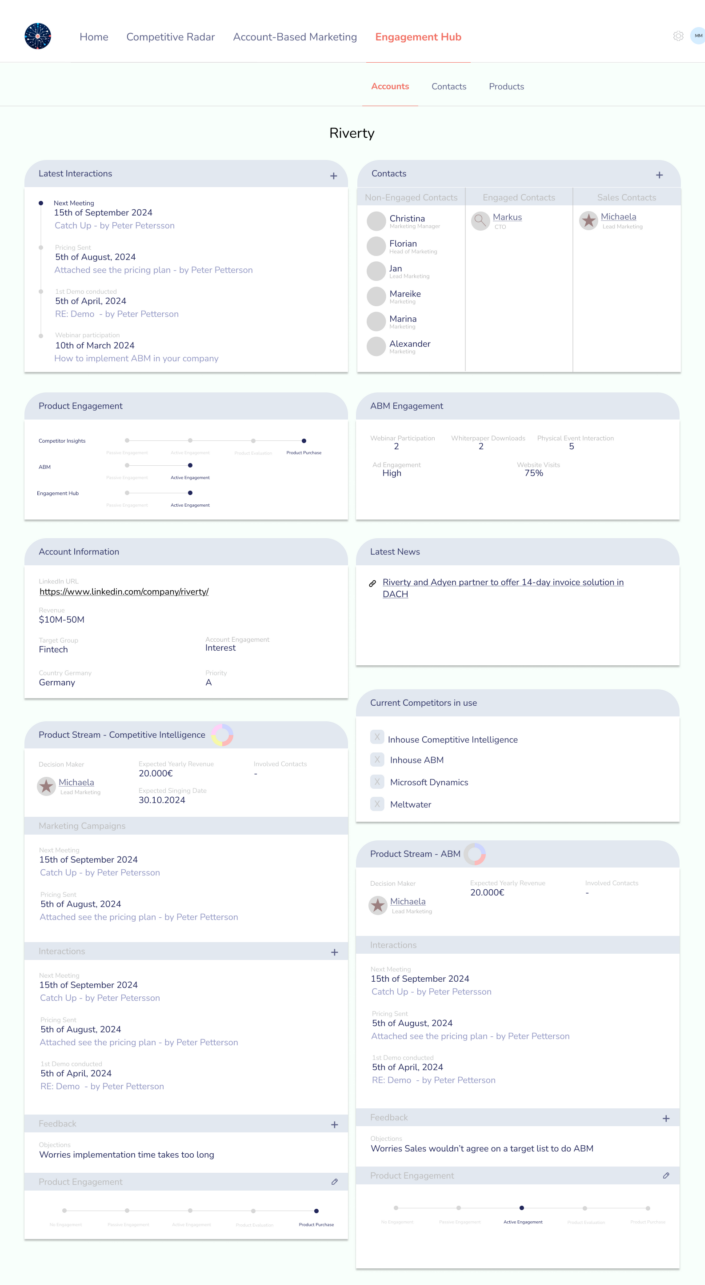

3. Engagement Hub

InsightSync’s Engagement Hub brings together account activity signals such as web visits, ad clicks, email opens, and event attendance into one view.

It highlights trends like rising interest or sudden silence, helping teams focus on high value accounts and reactivate those going cold.

At the contact level, you can see actions like who viewed pricing, who registered but skipped a webinar, and who interacts consistently, so sales can tailor outreach and marketing can refine content.

These insights help you map buyer roles and intent, infer funnel stage, and trigger timely follow-ups.

The Engagement Hub does not execute campaigns itself, but it aligns marketing and sales around a shared picture of account engagement and behavior data.

InsightSync Pricing: How Much Does It Cost?

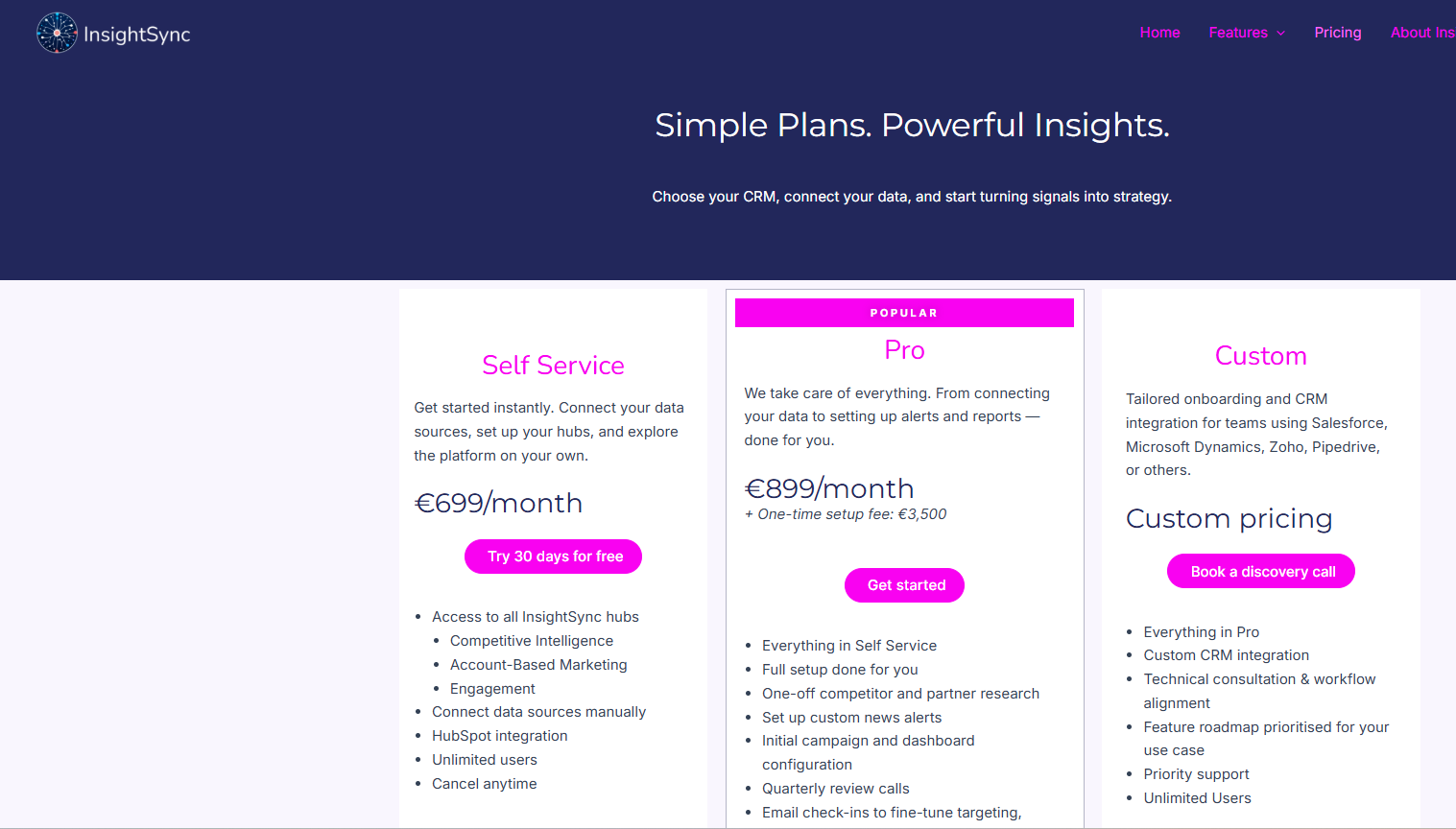

InsightSync sits in the premium bracket and targets teams ready to invest in a unified ABM plus CI platform.

Here is how the plans look (as of late 2025):

- Self Service – €699/month: Entry tier. Unlocks all three hubs (Competitive Intel, ABM, Engagement) and supports unlimited users. You manage your own setup and connect data sources manually or via their HubSpot integration (currently the only fully supported CRM). They show monthly pricing and allow cancel any time, plus a 30 day free trial.

- Pro – €899/month (+ €3,500 one-time setup fee): Aimed at teams that want white glove onboarding. InsightSync’s team connects data sources, configures alerts, and sets up dashboards. Pro includes a one-off competitor and partner research project, quarterly reviews, and periodic check ins. The monthly fee is only slightly higher than Self Service, but the setup fee is substantial.

- Custom – Contact for pricing: Built for organizations using CRMs beyond HubSpot, such as Salesforce, Microsoft Dynamics, Zoho, or Pipedrive. InsightSync notes these integrations are “currently building” and offers early access collaborations. Custom plans add bespoke CRM integrations, technical consulting, prioritized feature work, and priority support on top of Pro.

Overall, InsightSync lands in the upper mid market. It is cheaper than top enterprise ABM suites that run into high five or six figures, but far from an entry level $99 per month product.

If you treat it as your competitor monitoring hub, ABM analytics layer, and in some cases a lightweight CRM adjunct, the cost can be justified.

For early stage or lean ABM teams, a starting price of roughly €8K per year is a big leap, which is why tools like ZenABM lean into the “lean” positioning.

ZenABM starts at ~$59/month for the starter plan, which is a small fraction of InsightSync’s entry tier.

User Impressions and Reviews

Public feedback on InsightSync is still limited, but here is what shows up:

- Origin Story: Built by Practitioners: The platform was first created by a B2B marketing lead at fintech company Riverty who felt existing tools did not meet real needs. She built an internal product that took off and later spun it out as InsightSync. This mirrors ZenABM’s story: Michael Jackowski initially built ZenABM for Emilia Korczynska (VP Marketing at Userpilot) as a LinkedIn ABM solution. After strong results at Userpilot, ZenABM became its own LinkedIn ABM SaaS, with customers like Productive and Spear Growth reporting solid outcomes.

- Website Testimonial: The main testimonial on InsightSync’s site is from “John Doe, Riverty,” who says InsightSync has aligned marketing and sales and that the CI Hub alone “saved us hours each week.”

- No G2/TrustRadius Presence (Yet): As of November 2025, InsightSync does not appear on G2 or TrustRadius.

N.Rich Overview: Key Features, Pricing, and Reviews

N.Rich positions itself as an “agile, execution-first” ABM platform for mid market and enterprise teams.

In practice, it is a B2B demand side platform with ABM workflows on top.

Key Features of N.Rich

Here are the core components of N.Rich for ABM.

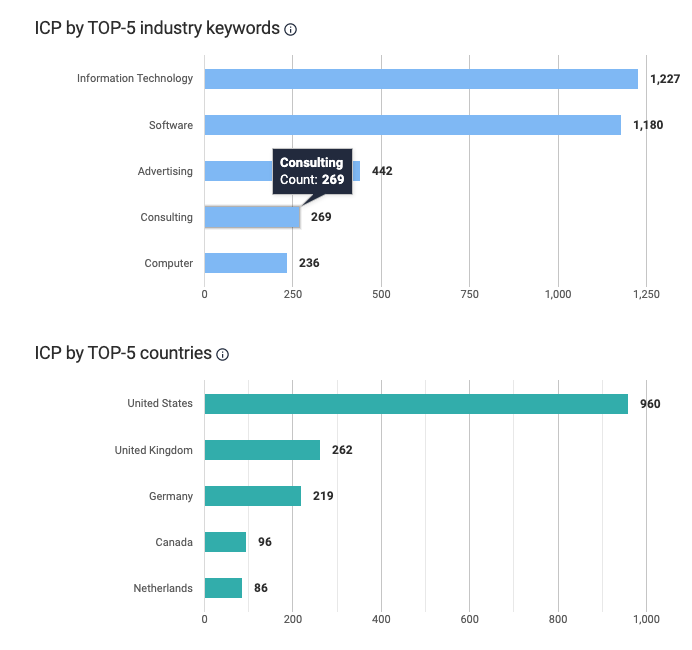

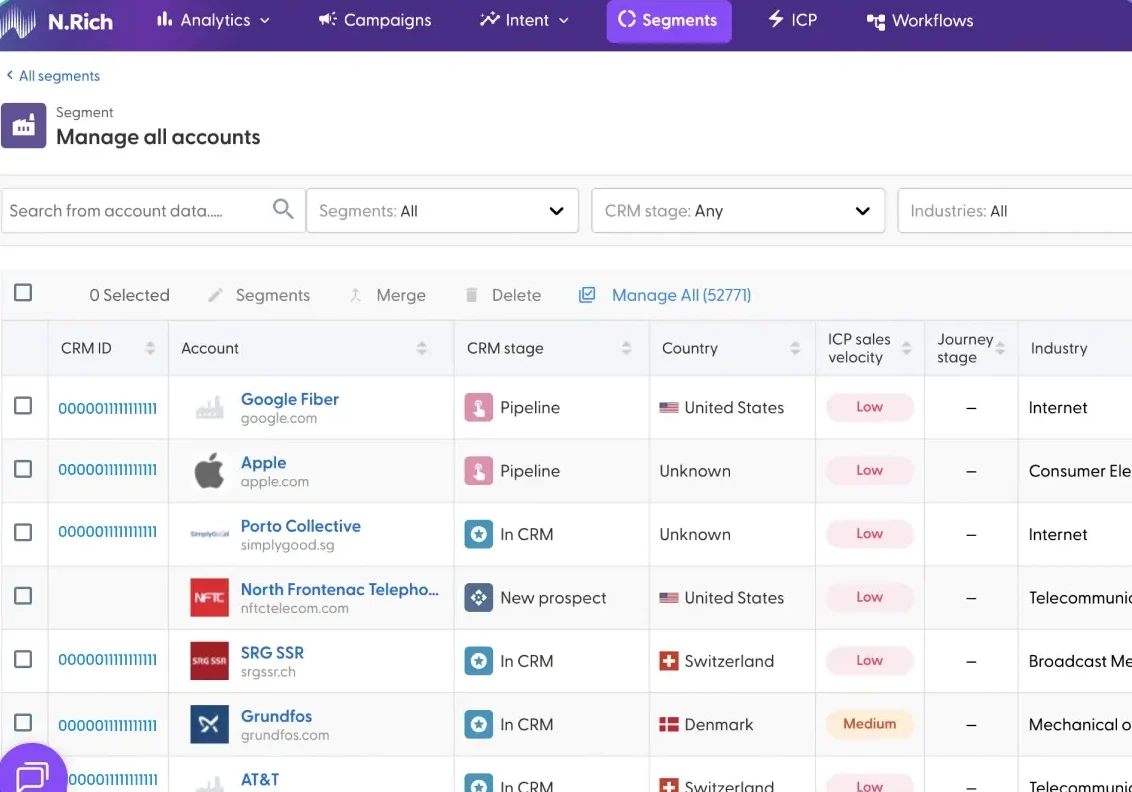

Dynamic ICP & Target Account Lists

N.Rich ingests your CRM opportunity data to help define your ideal customer profile and prioritize accounts.

The ICP builder uses past deals rather than pure guesswork to score which new accounts look most like your best customers.

You can build target lists in minutes with filters such as industry, size, and technographics.

The idea is to move away from pure “gut feel” account selection, although quality still depends on your underlying CRM data.

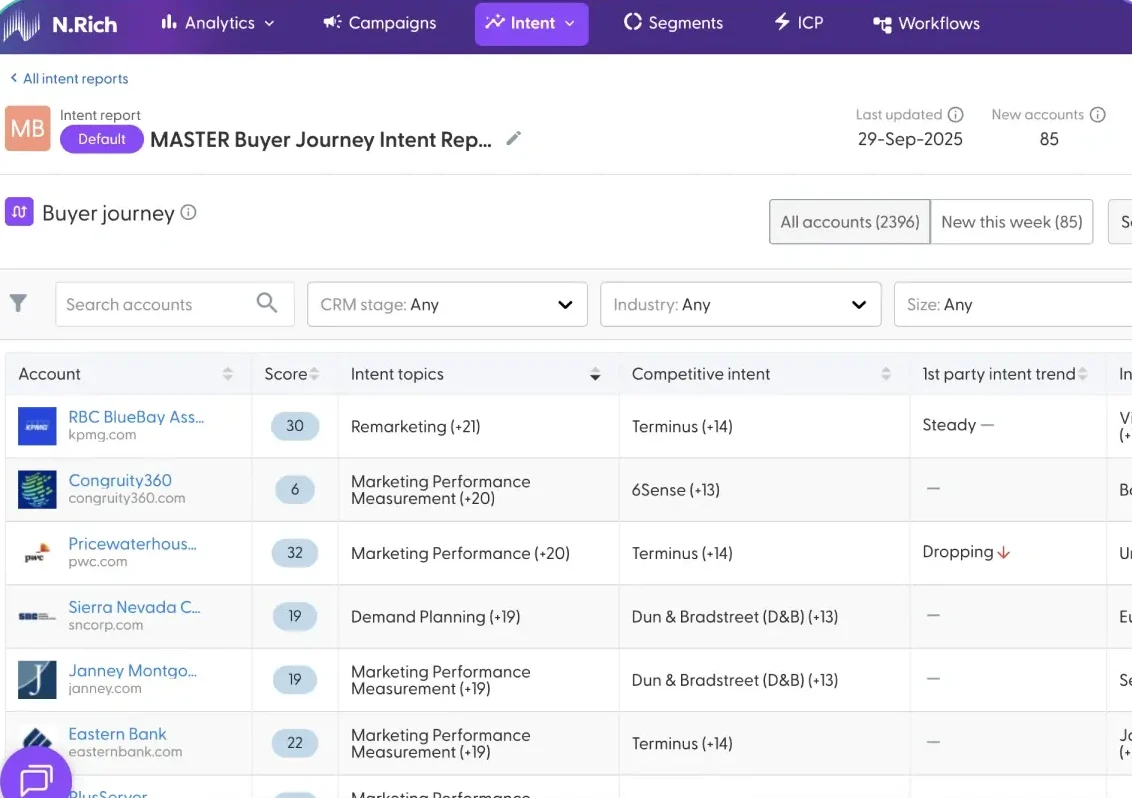

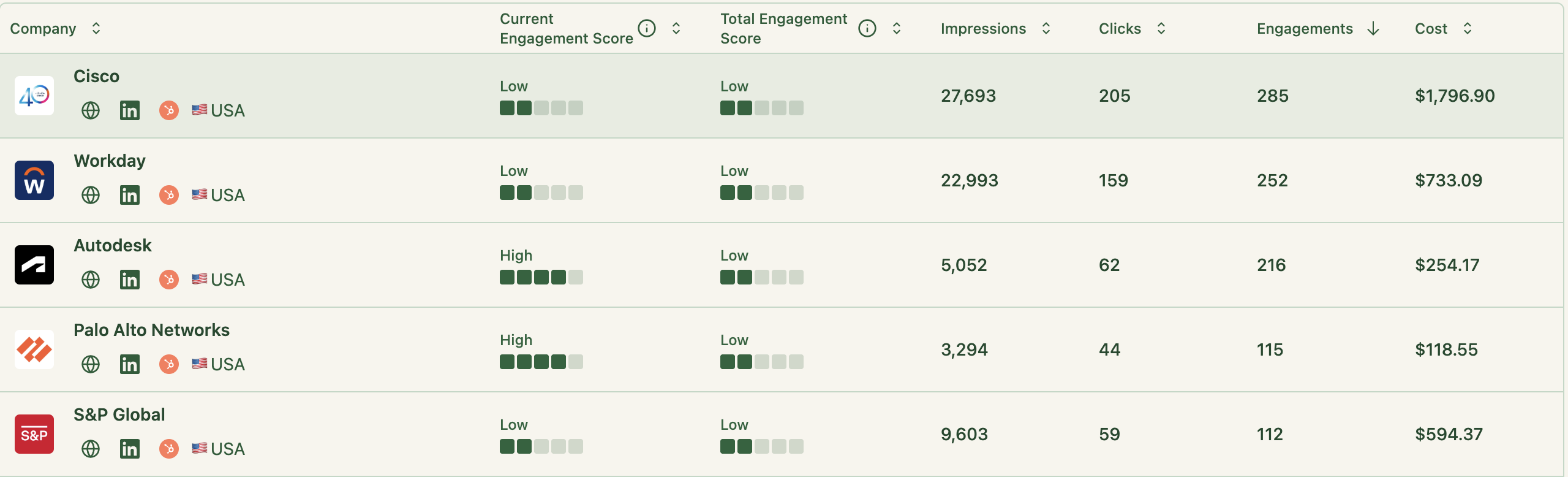

Intent Data & Account Scoring

N.Rich combines first-party intent (website visits, ad engagement) with third-party intent feeds to highlight accounts researching relevant topics.

Accounts receive intent scores so your teams can focus on the “hottest” ones.

A big selling point is that N.Rich collects intent in a fully GDPR compliant and consent based way.

The platform tracks thousands of topics and pushes these insights into your CRM, helping you plan timely and thematic outreach. For example, sales might get an alert when Acme surges on “cloud security” intent.

Account-Based Advertising

N.Rich includes a built in DSP so you can run programmatic display ads to target accounts and also supports native and video formats.

You can connect LinkedIn Ads to coordinate display and LinkedIn campaigns.

Reviews on Capterra mention a straightforward campaign interface, with an ad builder that can spin out many creatives and handle automatic A/B tests.

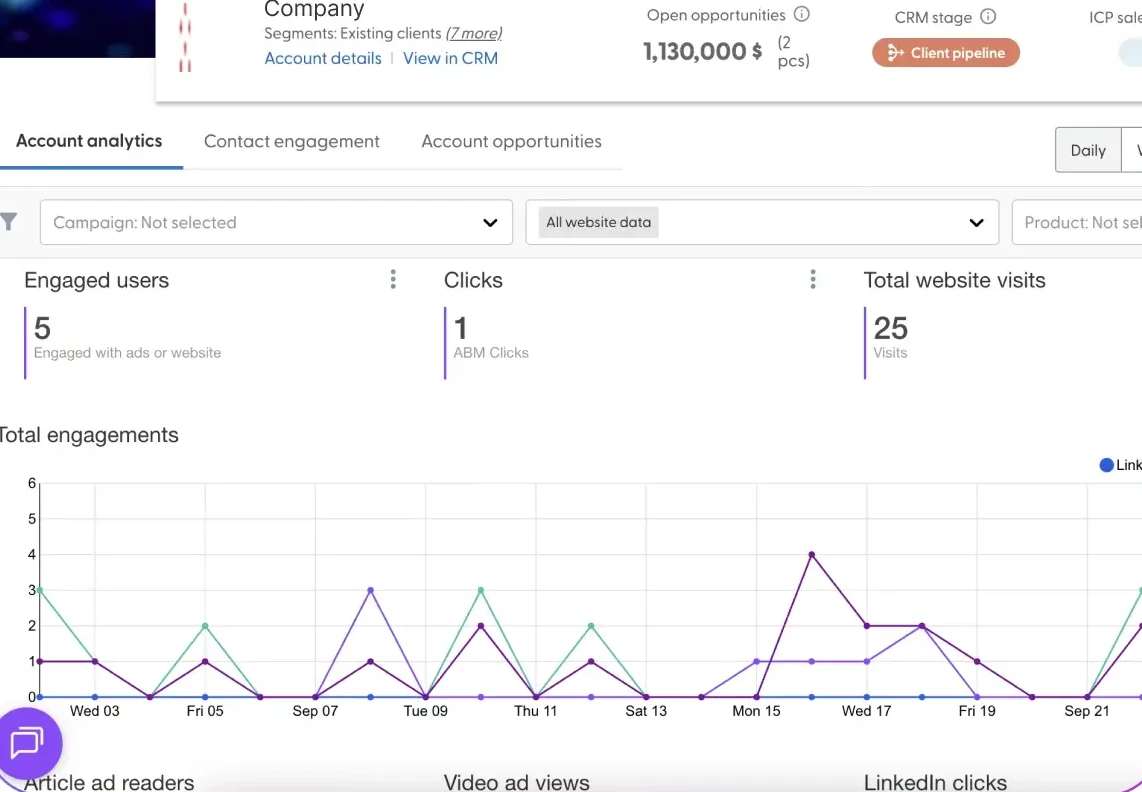

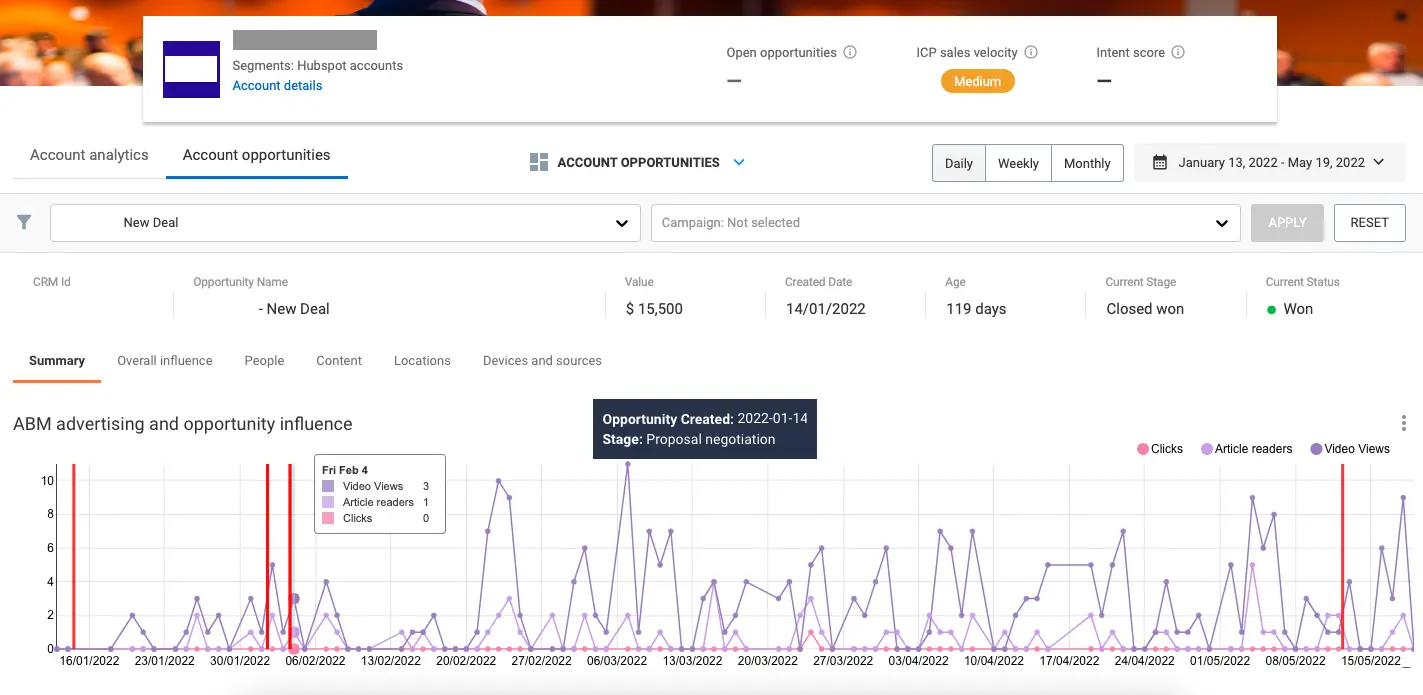

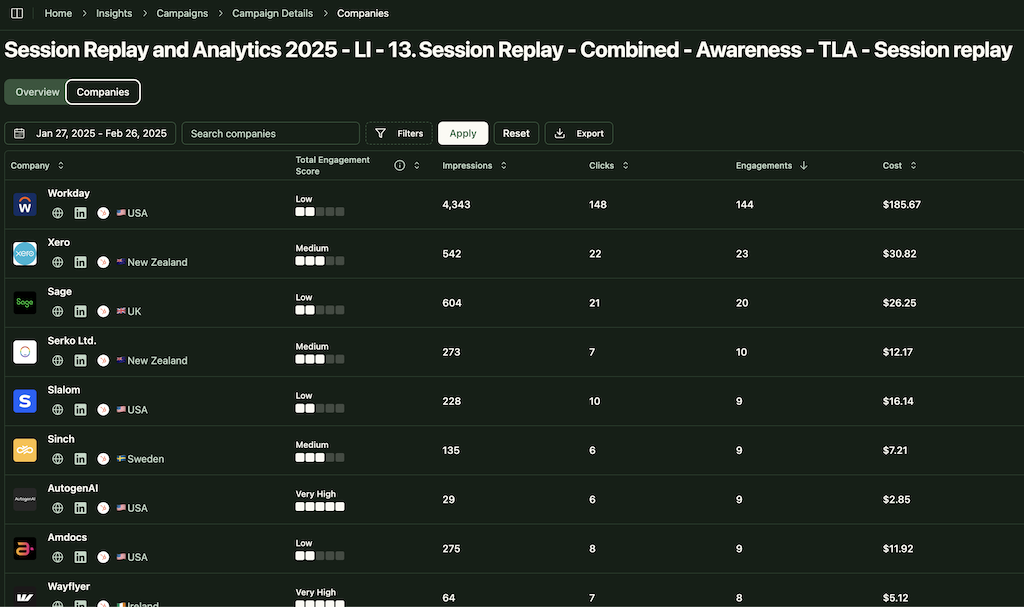

Analytics & Opportunity Attribution

N.Rich provides account level analytics so you can connect programs to revenue.

Its Opportunity Attribution dashboard links ad engagements and website activity with opportunities and closed revenue.

You can see, for example, whether a target account that saw 50 impressions and clicked twice later became an opportunity.

The platform also calculates an “ICP Sales Velocity Score” for each account to estimate how quickly it might convert based on your historical data.

These metrics can be synced to your CRM (on the right tier) so reps can see which pages or ads an account has engaged with.

Reporting is flexible but comes with a learning curve, especially if your team is new to ABM analytics.

Integrations & Data Enrichment

N.Rich integrates with the main CRMs and marketing tools.

It offers out-of-the-box integrations with Salesforce, HubSpot (Marketing & Sales Hub), and LinkedIn (Marketing Solutions and Sales Navigator).

These connections let N.Rich pull CRM data for segmentation and pipeline measurement, and push back engagement data such as intent scores and activities.

For example, via the HubSpot integration N.Rich can enrich company records with ad engagement, key topics, and velocity scores.

Some integrations are not available on the lowest tier.

N.Rich also ships firmographic and technographic enrichment so you can understand what tools your target accounts use.

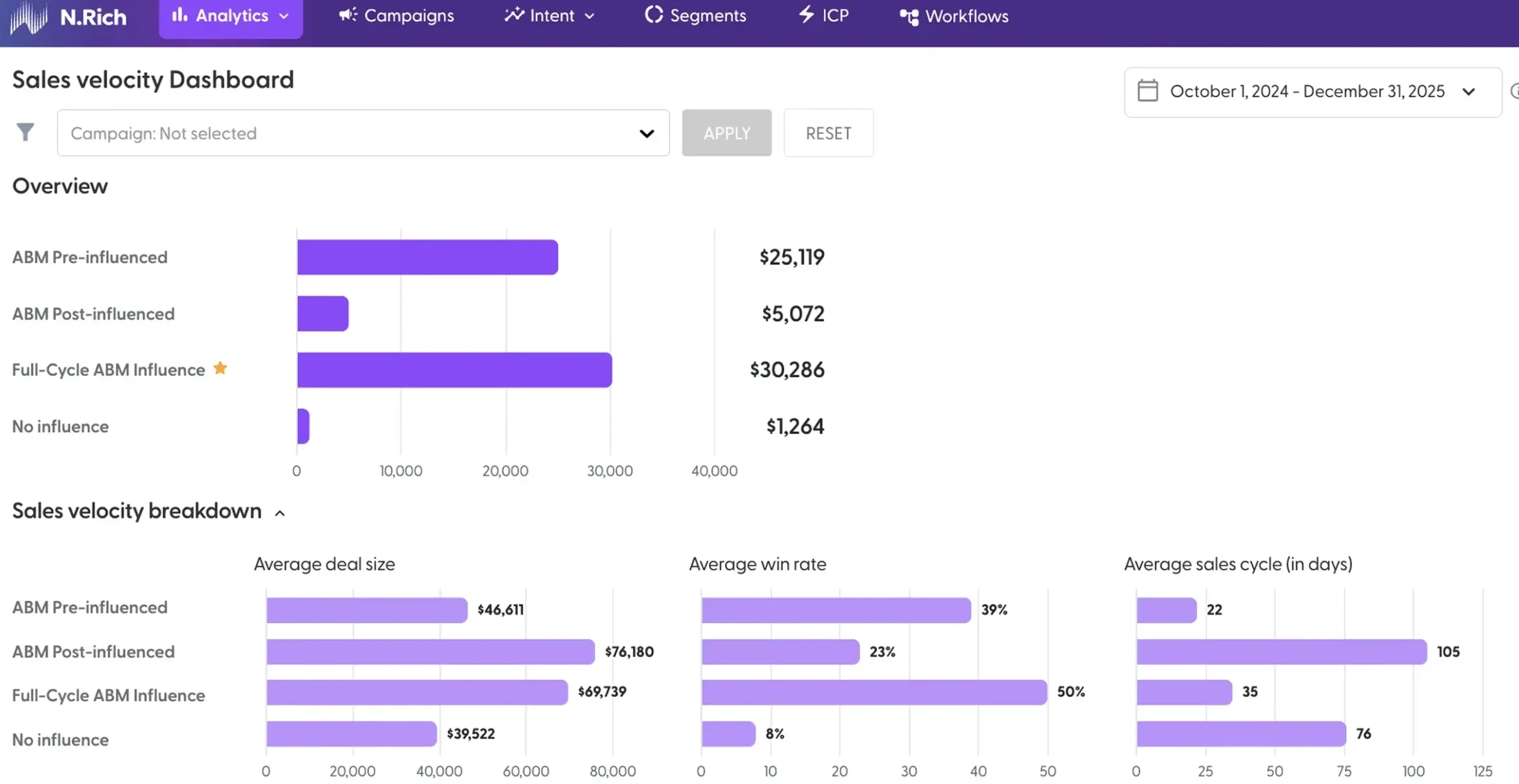

N.Rich Pricing: How Much Does It Cost?

N.Rich has clear, tiered pricing designed around team size and GTM maturity. All plans are centered on turning intent data into measurable outcomes, with transparent pricing.

LITE: Starting at $10,320/year + $1,050 One-Time Onboarding Fee

For smaller teams looking to kick off intent driven ABM.

Includes: 1 Intent Report and 10 Intent Topics, 1 Marketing seat and 3 Sales seats, 1 N.Rich account, 1 ABM campaign, and chat support.

Core features:

- Intent scoring

- Unlimited firmographic and technographic data

- Website visitor identification

- Account analytics and sales alerts

GROWTH: Starting at $23,800/year

Built for scaling GTM teams that want tighter sales marketing alignment.

Includes everything in LITE, plus:

- 10 Intent Reports and 25 Intent Topics

- 5 Marketing seats and unlimited Sales seats

- CRM and marketing automation integrations

- Opportunity attribution

- 10 ABM campaigns

- Dedicated Customer Success Manager

ENTERPRISE: Custom Pricing

For mature teams with global programs and advanced orchestration needs.

Includes everything in GROWTH, plus:

- Unlimited Intent Reports

- Predictive intent data

- 50 Intent Topics

- Unlimited user seats

- 5 N.Rich accounts

- Dynamic ICP Builder

- Open API access

- Automated workflows

- Dedicated ABM strategist

- Bi-weekly strategy consulting

All tiers benefit from N.Rich’s deep data, account intelligence, and native ABM orchestration. For detailed pricing, you still need to speak to sales.

Note: since N.Rich’s entry plan costs over $10K per year, ZenABM often looks like a smarter LinkedIn ABM alternative, starting at ~$59/month with the top tier still under $6K per year. You get everything essential for LinkedIn ABM: account level ad engagement tracking, account scoring, ABM stage tracking, hot account assignment to BDRs, bi-directional CRM sync, custom webhooks, qualitative buyer intent, and plug-and-play ROI dashboards.

User Impressions and Reviews

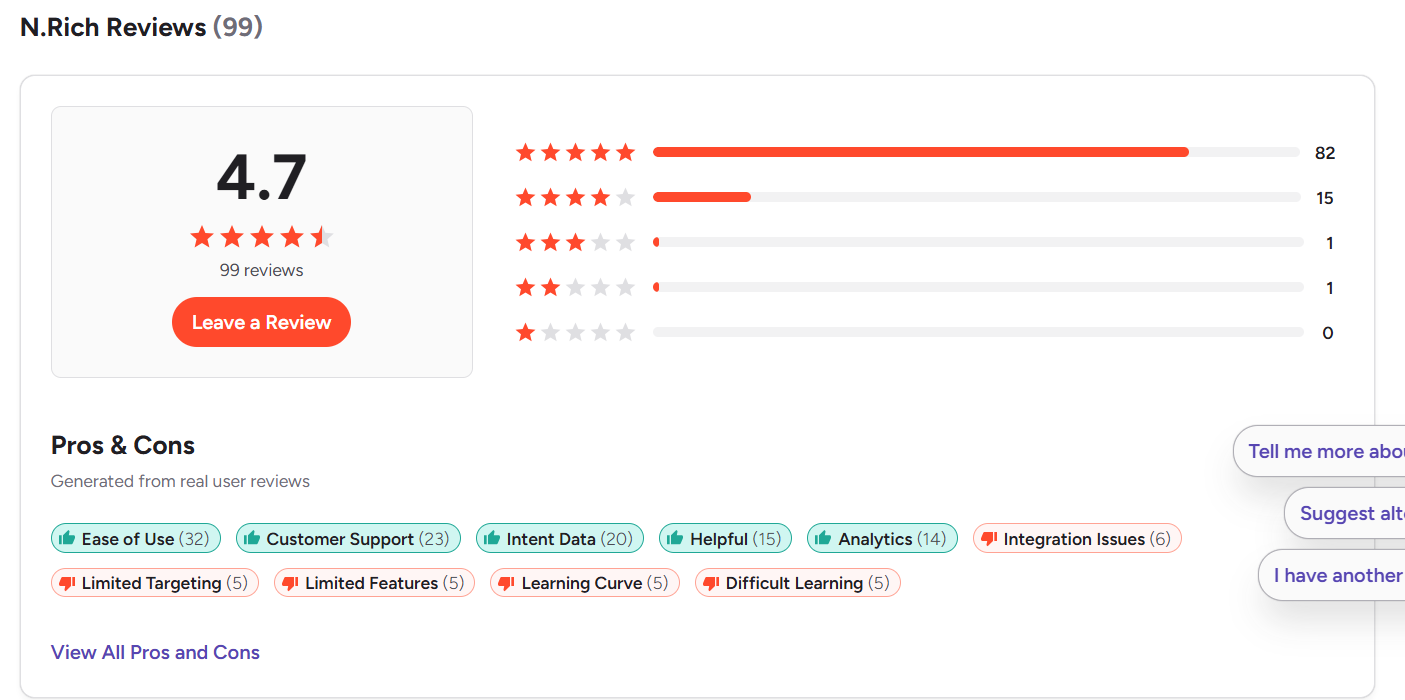

N.Rich scores 4.7 out of 5 on G2 (based on 99 reviews), which suggests customers are broadly happy.

Here is what users tend to say across G2, TrustRadius, Reddit, and other sources:

Pros (According to Users)

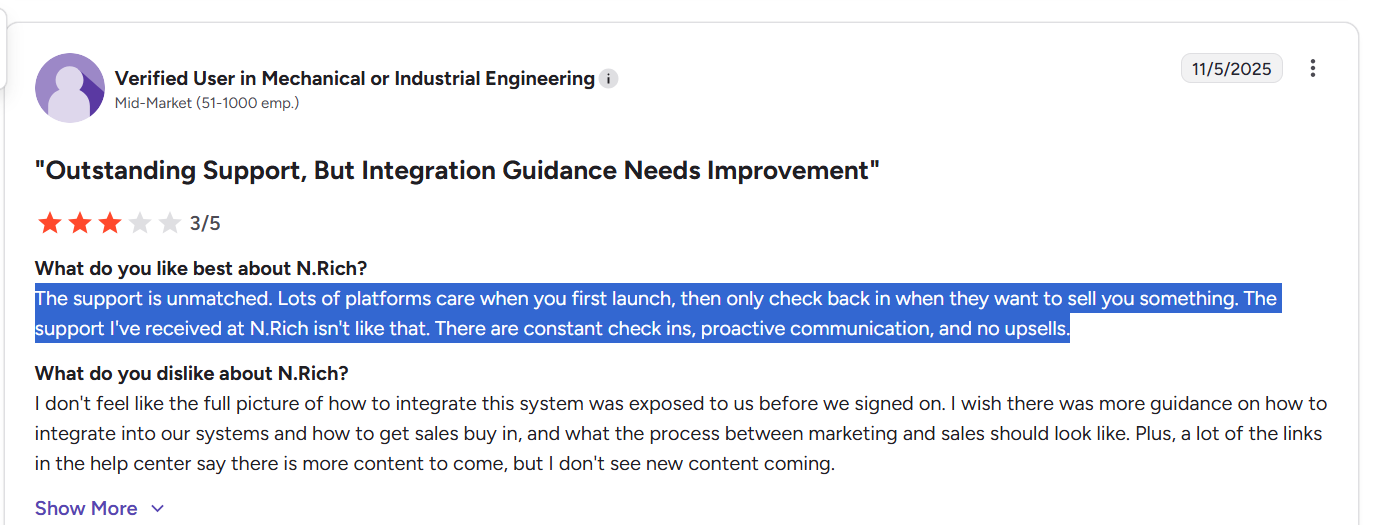

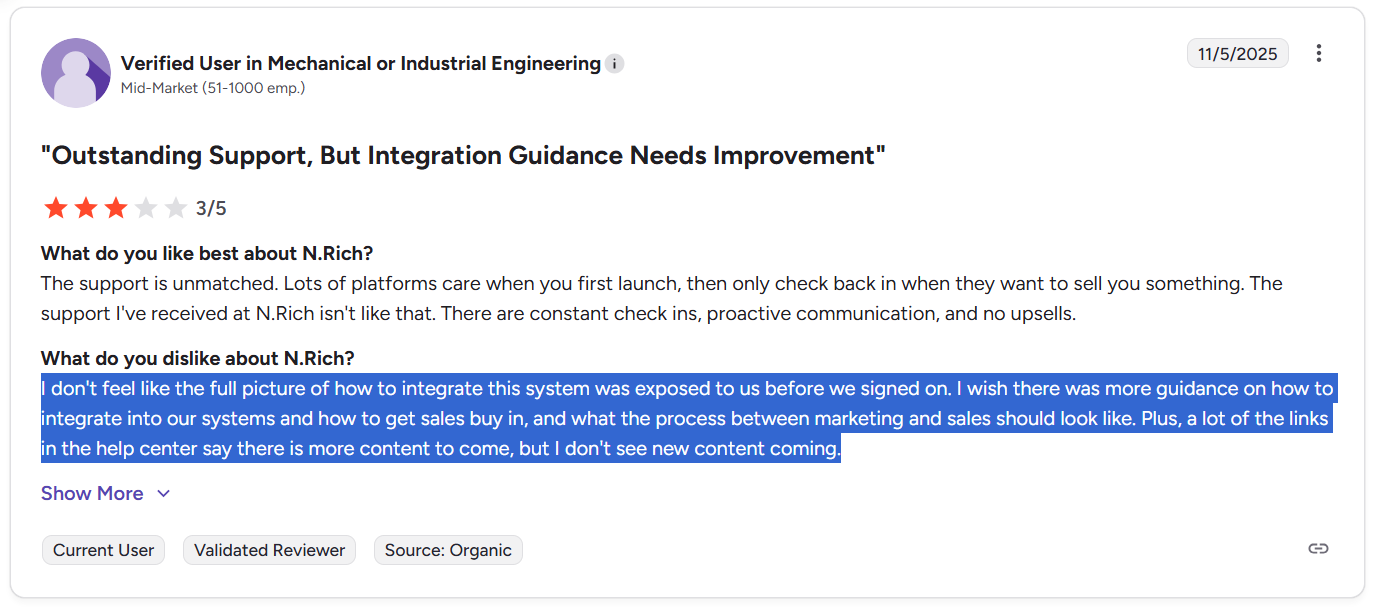

- Excellent Customer Support: Many G2 reviewers describe N.Rich support as “responsive,” “proactive,” and “invested in our success.” One user contrasted it with vendors that only show up to upsell, praising N.Rich for regular check ins without that pressure.

- Ease of Use (Once Set Up): “Ease of use” appears often, but with the caveat that you must put in the initial work. After lists, reports, and campaigns are configured, reviewers say the platform is intuitive and “enjoyable” to work with. One CMO noted it “made our work as marketers easier,” especially around automating lead progression and funnel stage tracking.

- Intent Data & Targeting Quality: Users appreciate the quality of intent and targeting. G2 reviews say N.Rich helps “identify and engage high-value accounts more efficiently” by combining rich intent with precise targeting.

- Analytics & Reporting: Users like the clarity of account engagement views and real time reporting on which accounts are engaging, which helps justify media spend.

Cons (According to Users)

- Initial Learning Curve & Setup Effort: Nearly every “easy to use” comment is paired with “after setup.” Onboarding and configuration take real effort. One reviewer wrote that N.Rich “can have a bit of a learning curve at first,” especially for advanced targeting and reporting. It is not that the software is confusing, but ABM is complex and N.Rich is full featured, so you should expect to involve your ops team.

- Integration Hiccups & Guidance: Some G2 users report integration challenges. One mid market reviewer gave N.Rich 3/5, saying “the full picture of how to integrate this system was not exposed to us before we signed on.” They wanted clearer guidance on integrating N.Rich with existing systems and securing sales buy in. They also mentioned many Help Center articles were “to be updated,” which made self service troubleshooting harder.

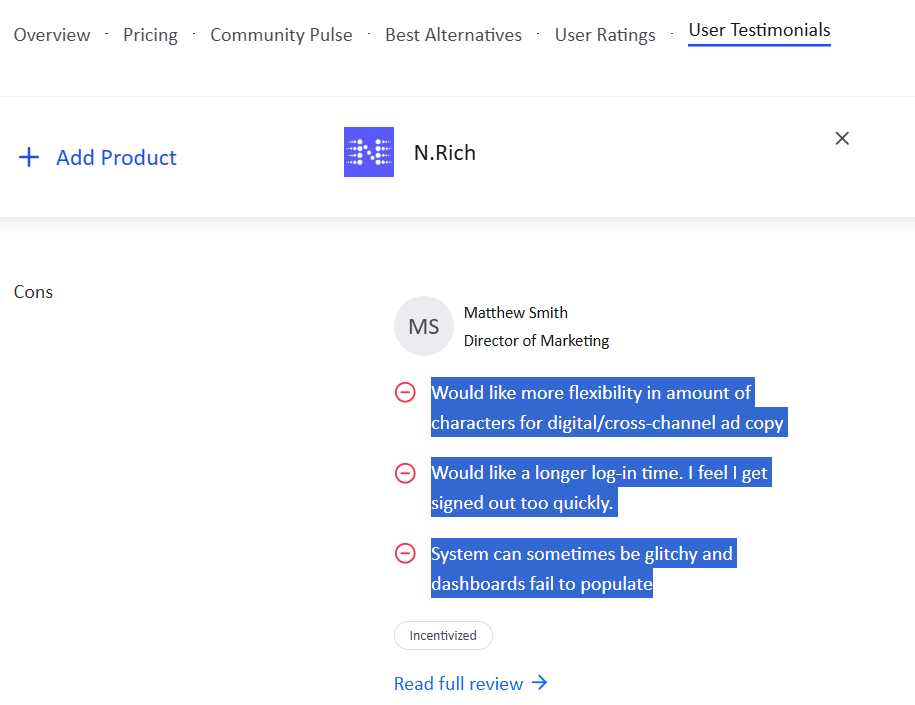

- Limited Features & Targeting Options (in Some Areas): A few users on G2 mention “limited targeting” or “limited features” in certain areas. One TrustRadius reviewer wanted more flexibility in ad copy character limits and longer login sessions, and noted the system “can sometimes be glitchy.”

InsightSync vs. N.Rich: Key Differences

Now that both platforms are covered, here is a direct comparison of InsightSync vs. N.Rich across key dimensions.

| Feature Category | InsightSync | N.Rich |

|---|---|---|

| Core Positioning | Competitive intelligence plus ABM analytics platform | Execution first ABM and B2B demand side platform with strong intent data focus |

| Primary Strength | CI hub with unified news feed, competitor profiles, AI document search, and multi channel engagement timelines | Intent driven account based advertising and DSP backed campaigns that turn intent topics into targeted media |

| ABM Focus | Target account list management, multi channel engagement tracking, account scoring, and alerts | Dynamic ICP and TAL building, intent based account scoring, and orchestrated ABM campaigns across display and LinkedIn |

| Intent Data | Relies mainly on first party engagement signals, no native third party intent feeds | Combines first party intent with third party intent topics, plus ICP sales velocity and predictive signals |

| Advertising Capabilities | No native ad execution, analytics and attribution only | Built in DSP for programmatic display, native and video, plus coordination with LinkedIn Ads |

| Website & Account Intelligence | Engagement Hub shows account and contact level activity across channels | Website visitor identification, account analytics, and velocity scoring for high intent accounts |

| CRM & MAP Integrations | Native HubSpot integration, other CRMs offered via custom tier and roadmap | Salesforce, HubSpot, LinkedIn Marketing Solutions and Sales Navigator, plus marketing automation integrations |

| Competitive Intelligence | Strong CI module with news monitoring, competitor profiling, and AI search | No dedicated competitive intelligence hub |

| AI Features | AI powered document search and account insight queries | Predictive intent and ICP sales velocity scoring, plus automation around hot accounts |

| Ideal Buyer Profile | Teams that need competitor monitoring plus ABM analytics without running ads inside the platform | Mid market and enterprise teams that want intent driven media activation and programmatic ABM at scale |

| Pricing | From €699 per month (Self Service) to €899 per month plus setup fee (Pro), with custom tiers for non HubSpot CRMs | From about $10,320 per year plus onboarding (LITE) to $23,800 per year (GROWTH), with custom Enterprise pricing |

| Review Footprint | Very limited public reviews, no presence yet on major review platforms | 4.7 out of 5 rating on G2 with around 100 reviews and broader community feedback |

| Learning Curve | Medium learning curve, relatively straightforward once configured | Noted onboarding and setup effort, simpler to use after lists, reports, and campaigns are in place |

| Best For | Strategy-focused ABM teams that want visibility into accounts and competitors across channels | Revenue teams that want to activate intent data directly into ads and prove impact with opportunity attribution |

InsightSync vs. N.Rich: So, Which Is Better for ABM?

InsightSync and N.Rich serve slightly different ABM motions, even though both handle account data and scoring.

InsightSync is a better fit if you want clarity more than built-in execution. If your priorities are knowing which accounts to chase, how they engage across channels, and what competitors are doing, InsightSync supports that strategic use case. It centralizes CI, engagement timelines, and scoring without forcing you into a new ad stack.

N.Rich fits teams that want to turn intent into media fast. It combines ICP models, topic level intent, and a DSP so you can launch and refine ABM campaigns across display and LinkedIn, backed by opportunity attribution and deeper analytics, as long as you invest time in onboarding.

If you already have execution covered and mainly need better visibility, InsightSync will feel lighter. If you want ads, intent, and attribution inside one ABM media platform, N.Rich will feel more complete.

ZenABM as a LinkedIn-First, First-Party Lean ABM Alternative

There is also a third path: ZenABM

Here are the key capabilities.

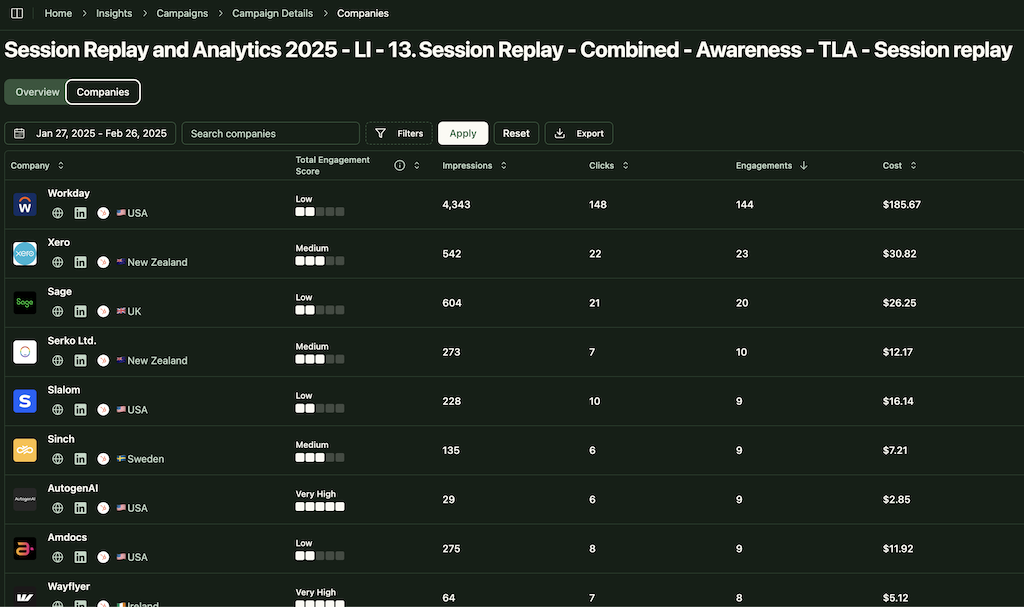

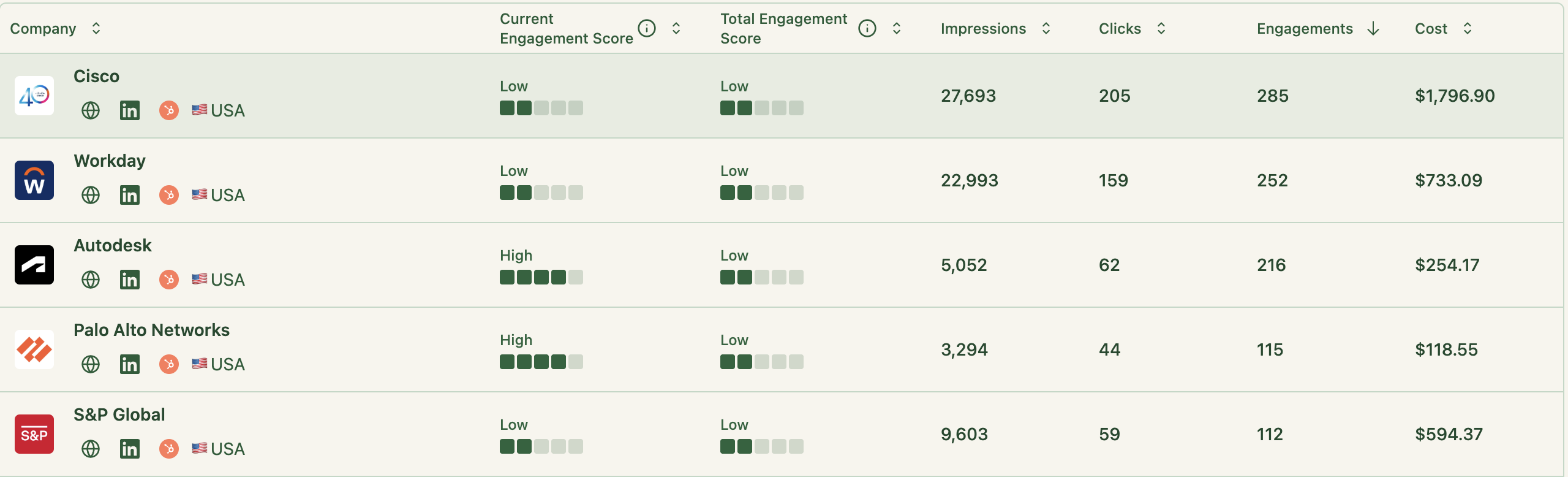

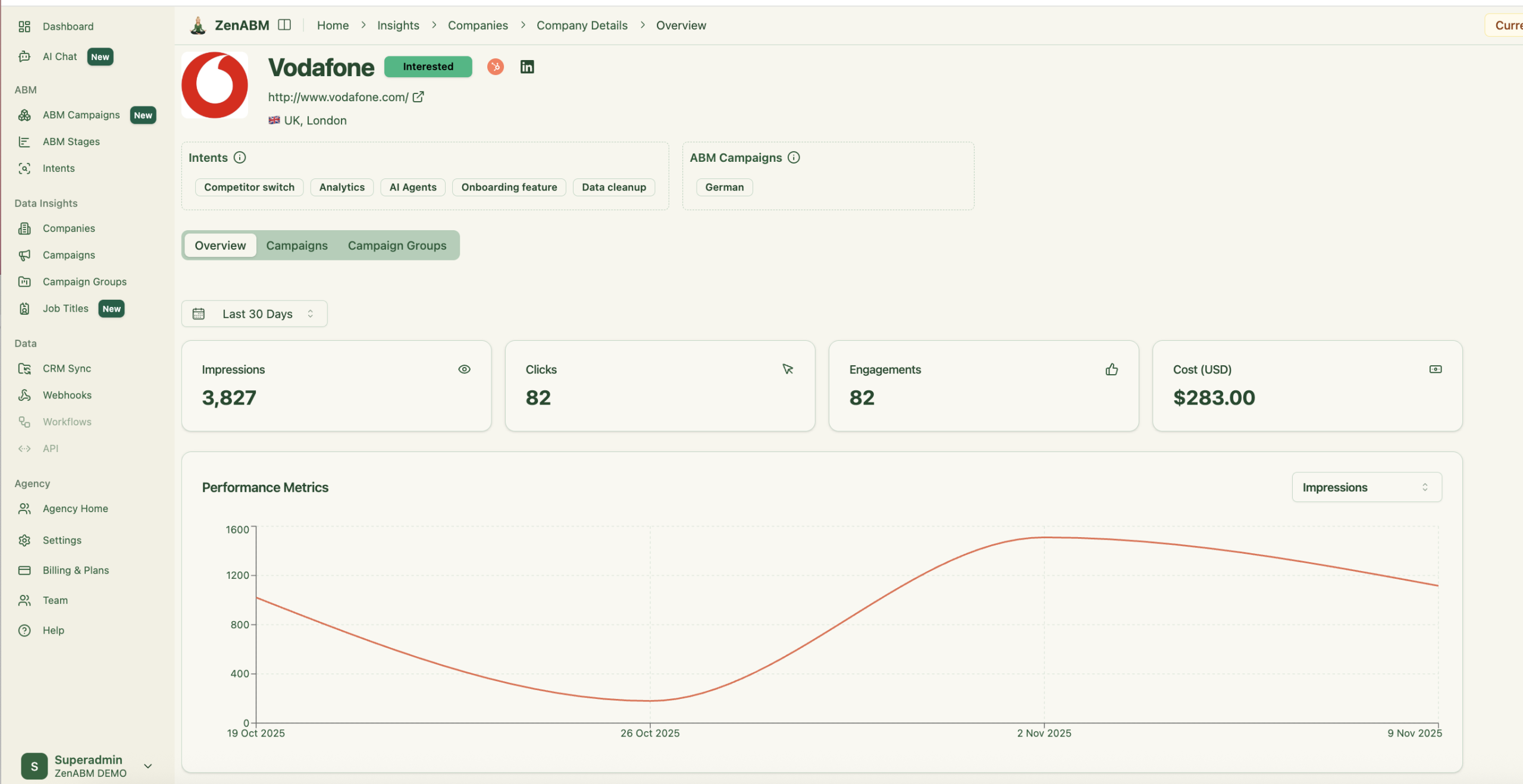

Account-Level LinkedIn Engagement Tracking

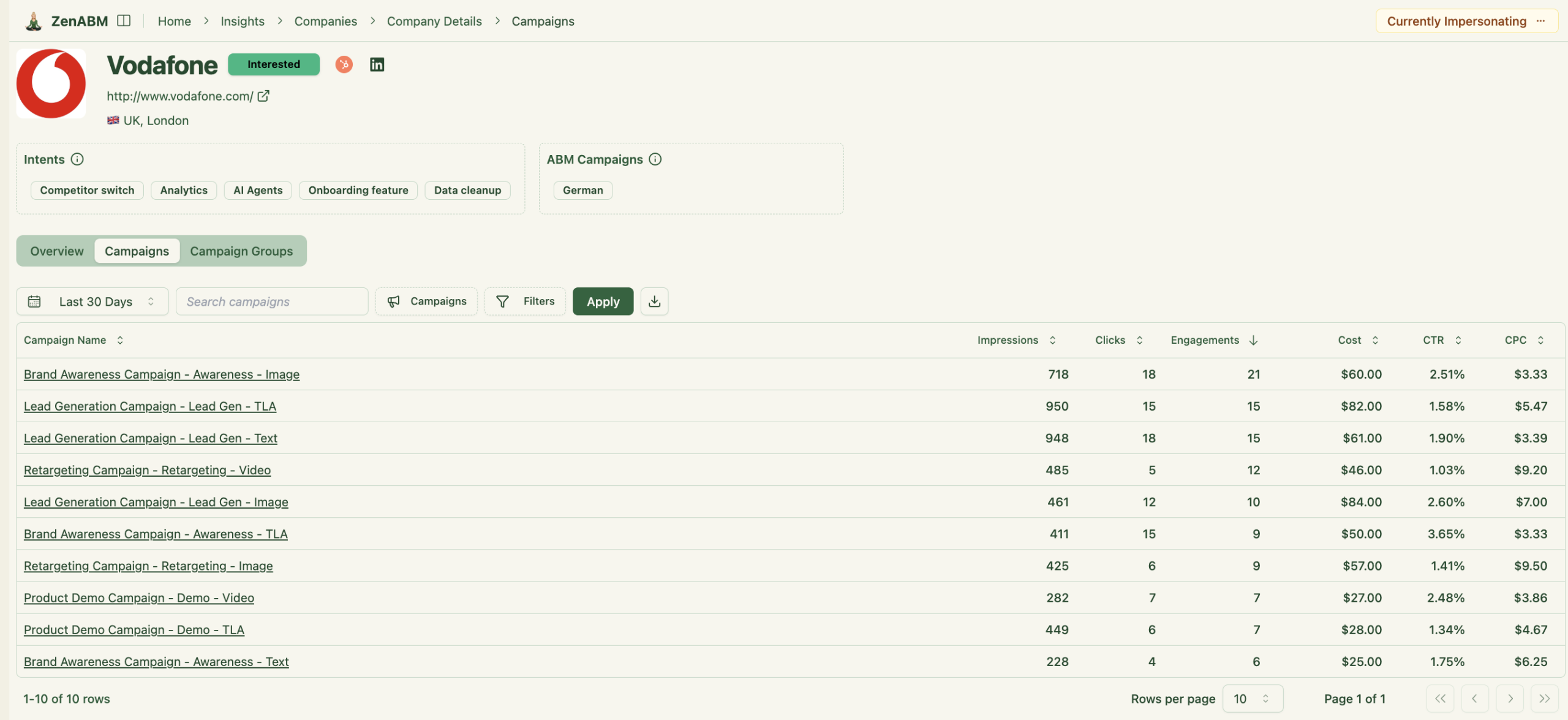

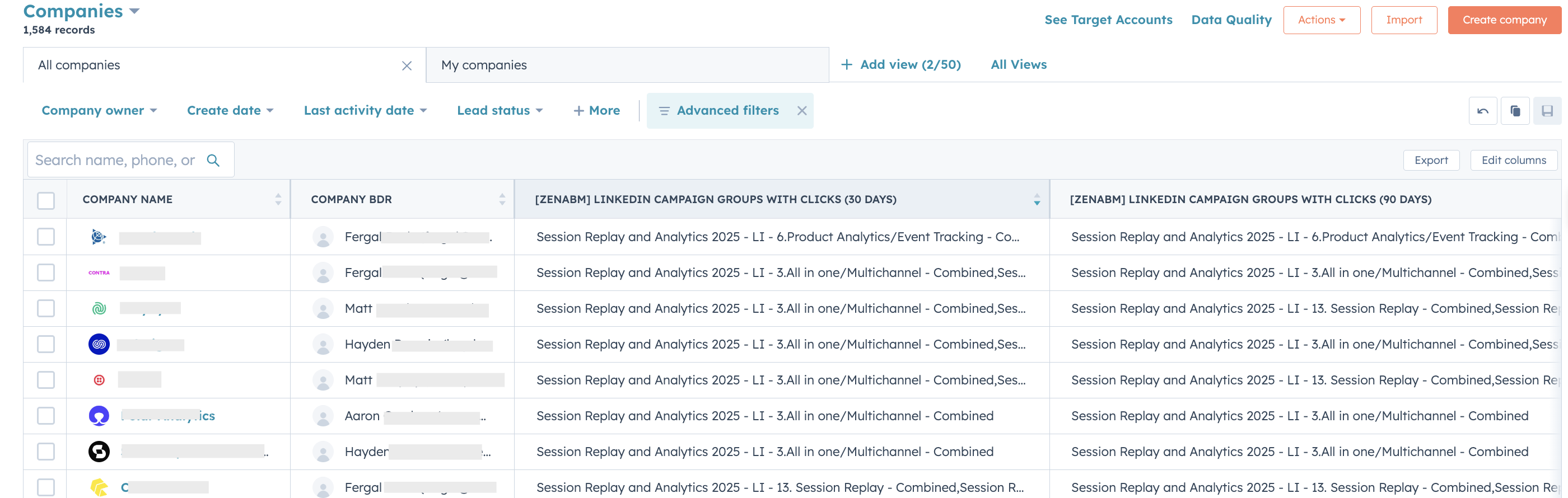

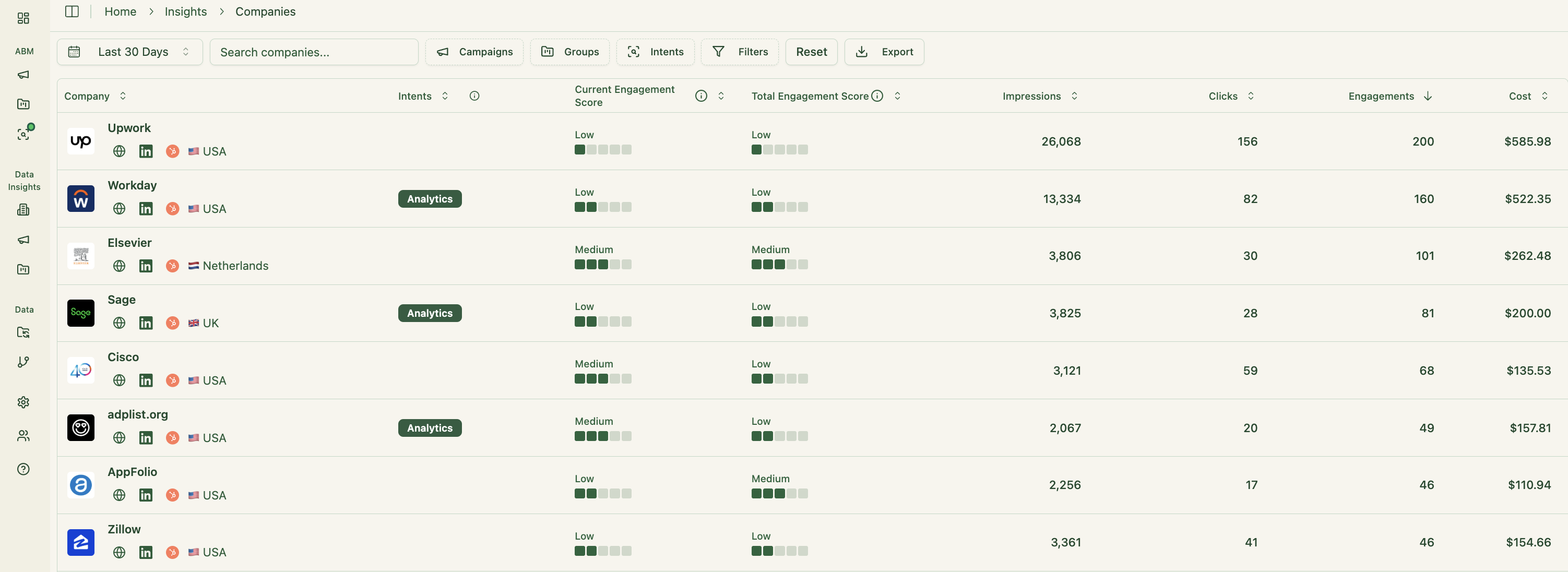

ZenABM connects directly to the official LinkedIn Ads API to capture account level data for every campaign.

You can see exactly which companies see and engage with your LinkedIn ads (impressions, clicks, etc.) with account level attribution.

Because this data comes from LinkedIn’s authenticated environment, it counts as first-party and is more reliable than tools that lean on cookies or IP matching, which are noisy.

A study by Syft found IP based visitor identification caps out at around 42 percent accuracy.

ZenABM treats ad engagement as first-party intent. When several people from Account X interact with your LinkedIn ads, you can treat it as a strong signal of interest without external intent feeds.

Real-Time Engagement Scoring + Full Touchpoint Timeline

ZenABM continuously updates engagement scores as accounts interact with your ads. You can inspect short windows (for example 7 days) or longer spans to see who is heating up.

These scores help marketing and sales prioritize accounts that actually show intent.

ZenABM also lays out the full touchpoint history for each account:

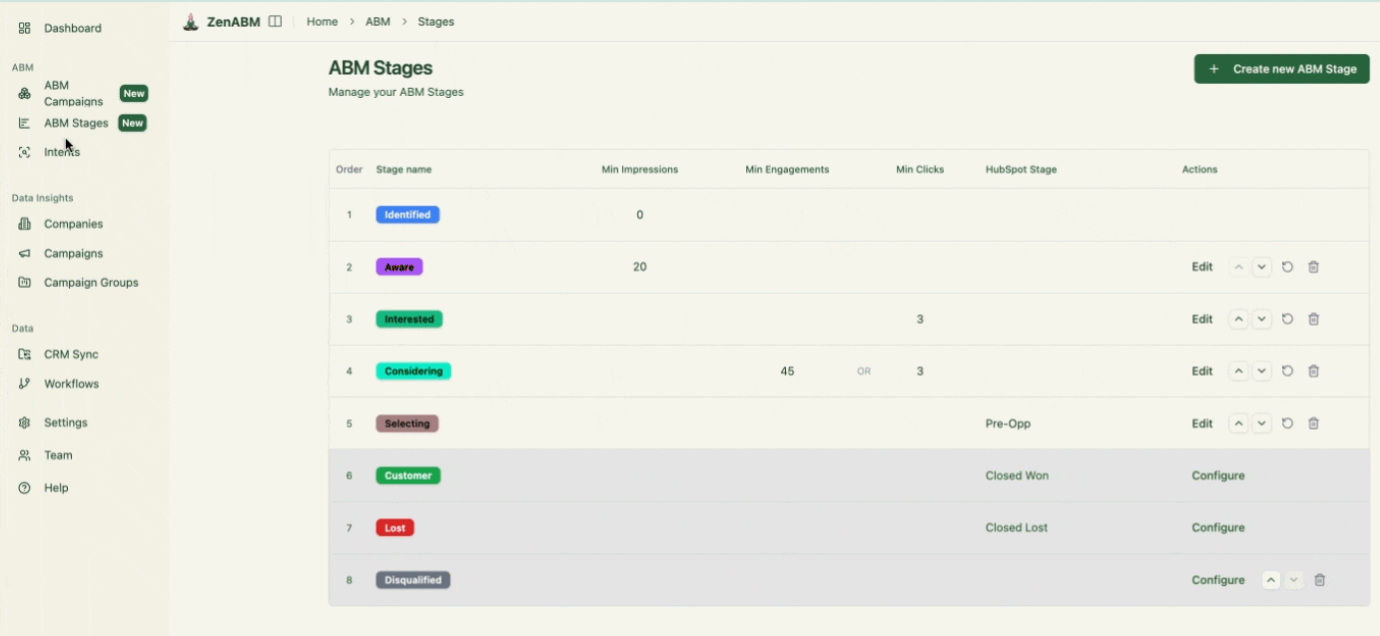

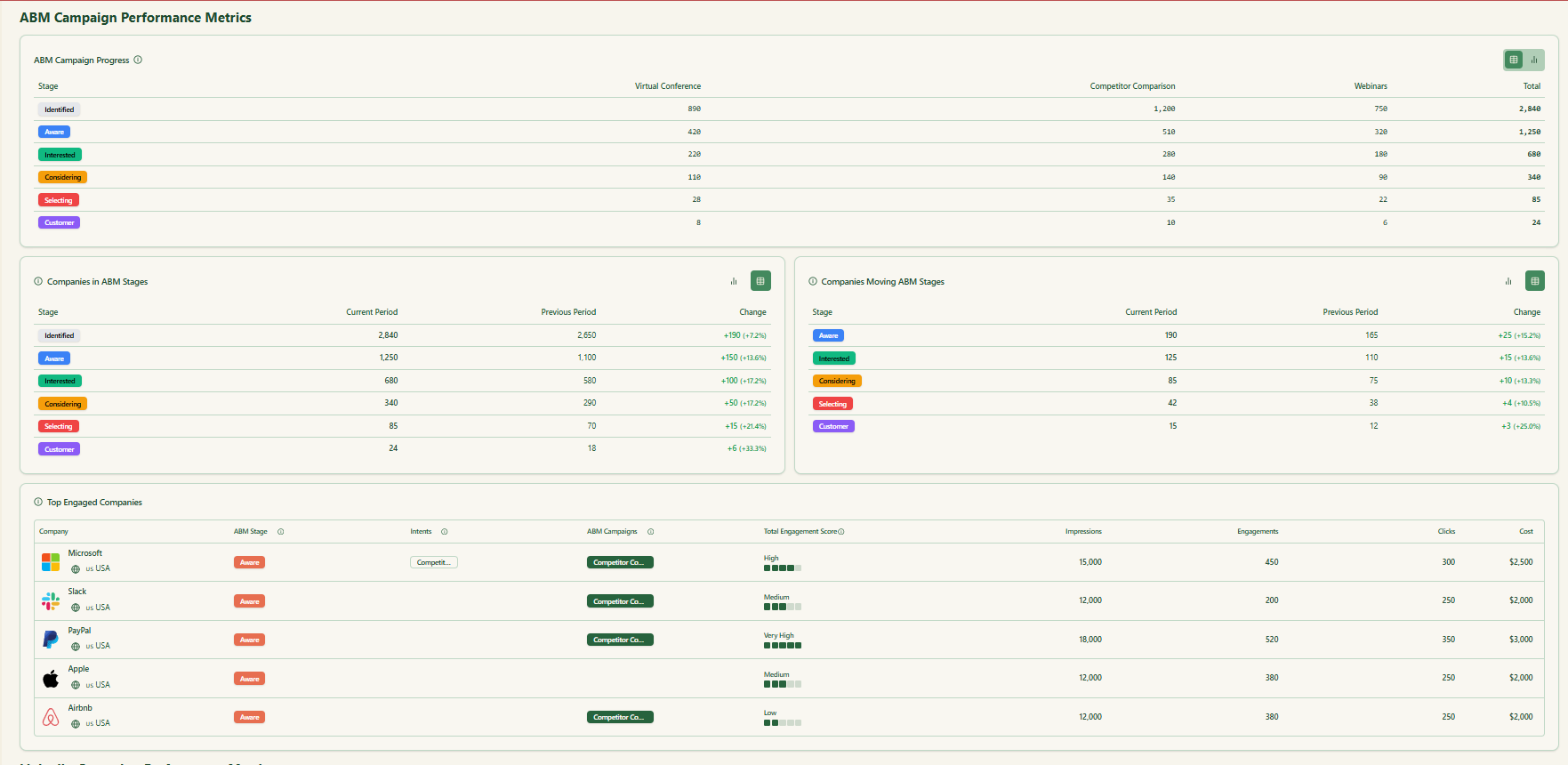

ABM Stage Tracking

ZenABM lets you define custom stages such as Identified, Aware, Engaged, Interested, and Opportunity.

It then uses engagement scores and CRM signals to automatically place each account in the right stage.

You control the thresholds for “Engaged” or “Interested,” and ZenABM tracks how accounts move or stall.

That gives you funnel visibility similar to large ABM suites, so you can see where accounts bunch up and fix leaks.

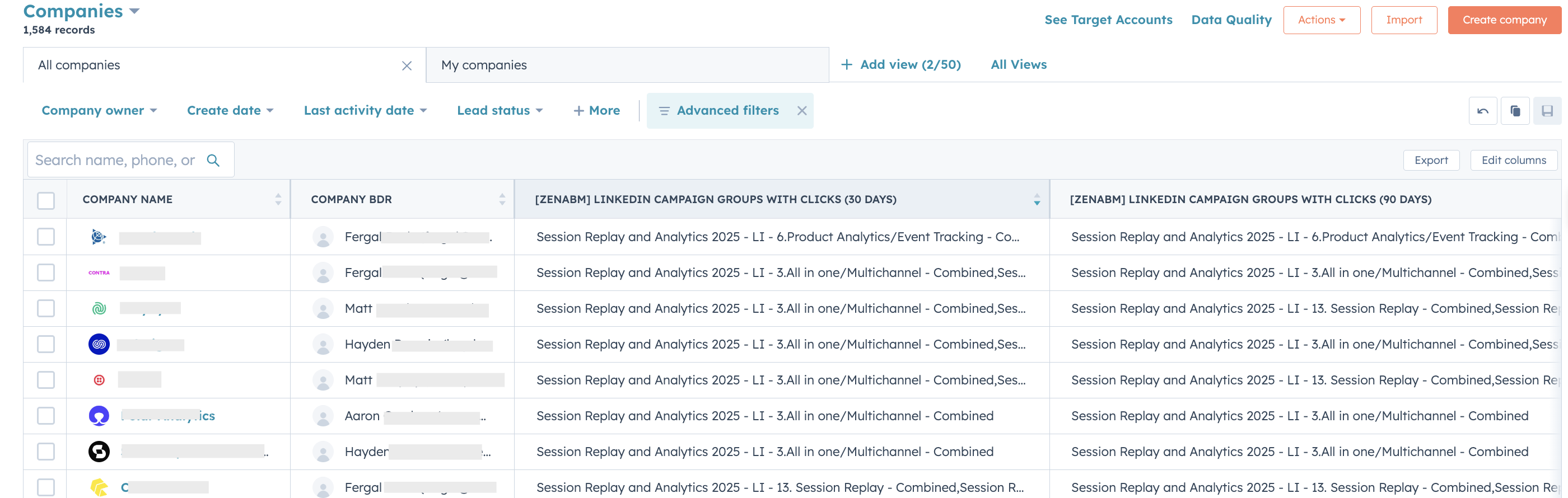

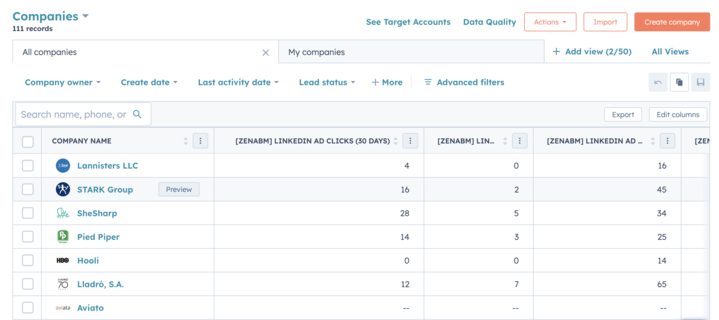

CRM Integration and Workflows

ZenABM integrates bi-directionally with CRMs like HubSpot and with Salesforce on higher plans.

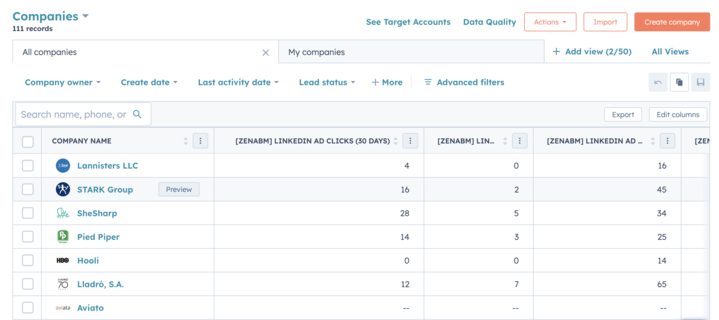

All the LinkedIn engagement data can be written as company-level properties in your CRM:

ZenABM also updates an account to “Interested” in your CRM once it crosses your score threshold and auto assigns a BDR.

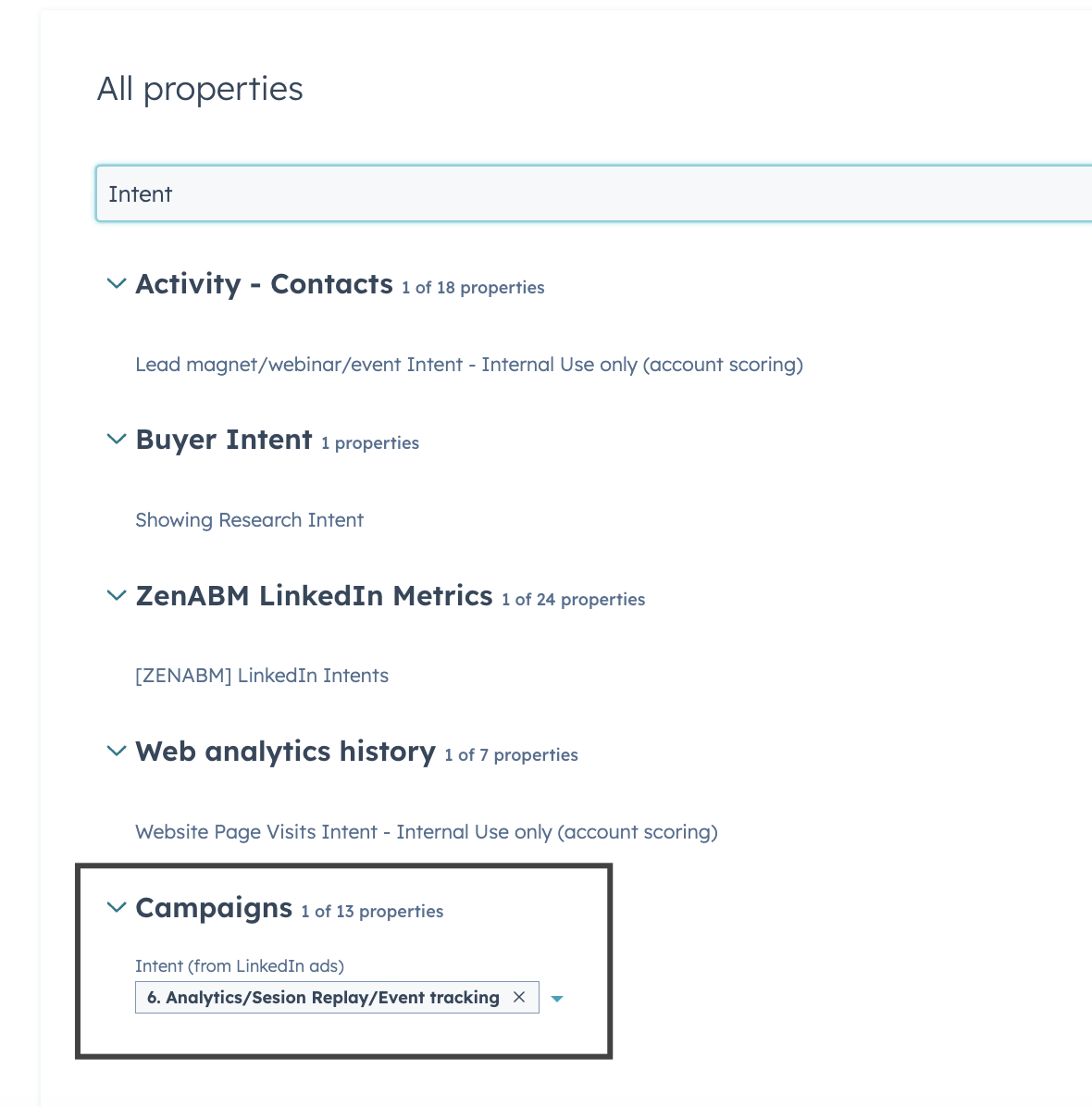

Intent Tagging from Ad Engagement

ZenABM lets you pull intent topics from your LinkedIn campaigns. You can tag each campaign by theme or offer such as “Feature A,” “Use Case B,” or “Pricing.”

ZenABM then reports which accounts interact with which themes so you know what each company cares about.

This is first party intent: instead of buying keyword intent, you see proof such as Account Z repeatedly clicking a “Feature A” creative.

You can also sync these intent topics into your CRM. This lets marketing and sales build sequences and messaging that match what each account is exploring.

Reps do not have to guess what to talk about. They can lean on the topics each account has already engaged with.

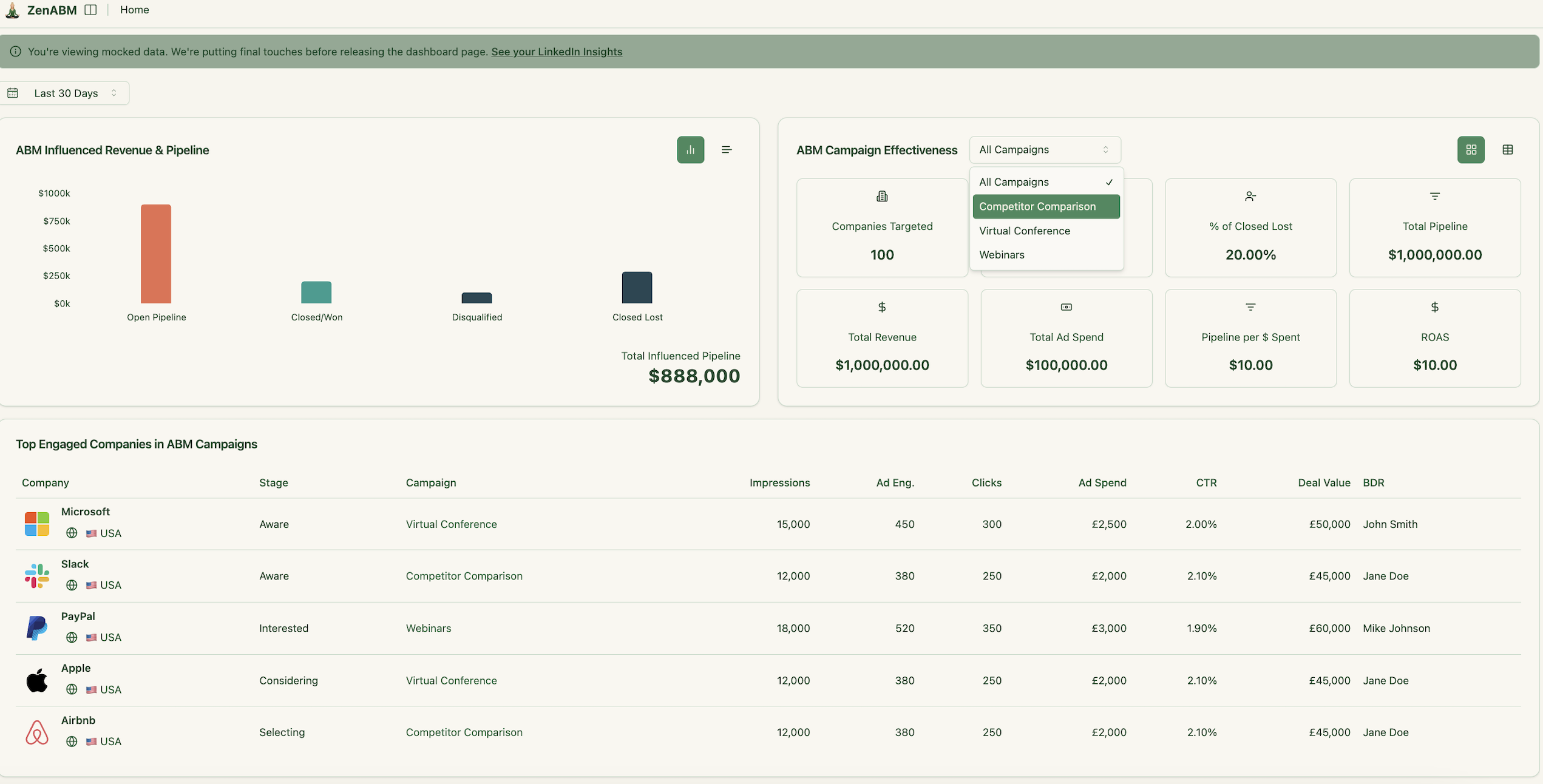

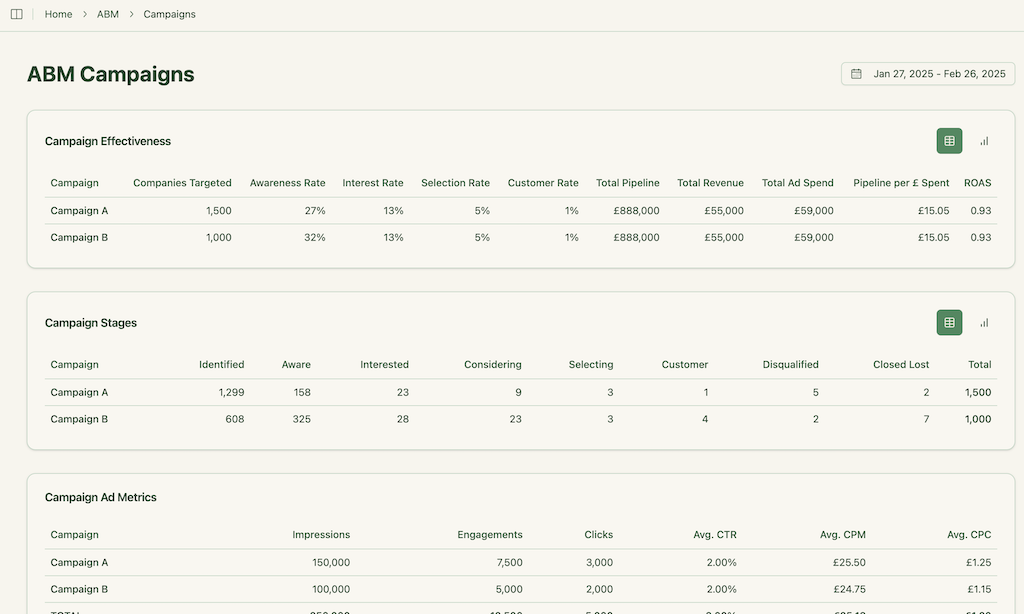

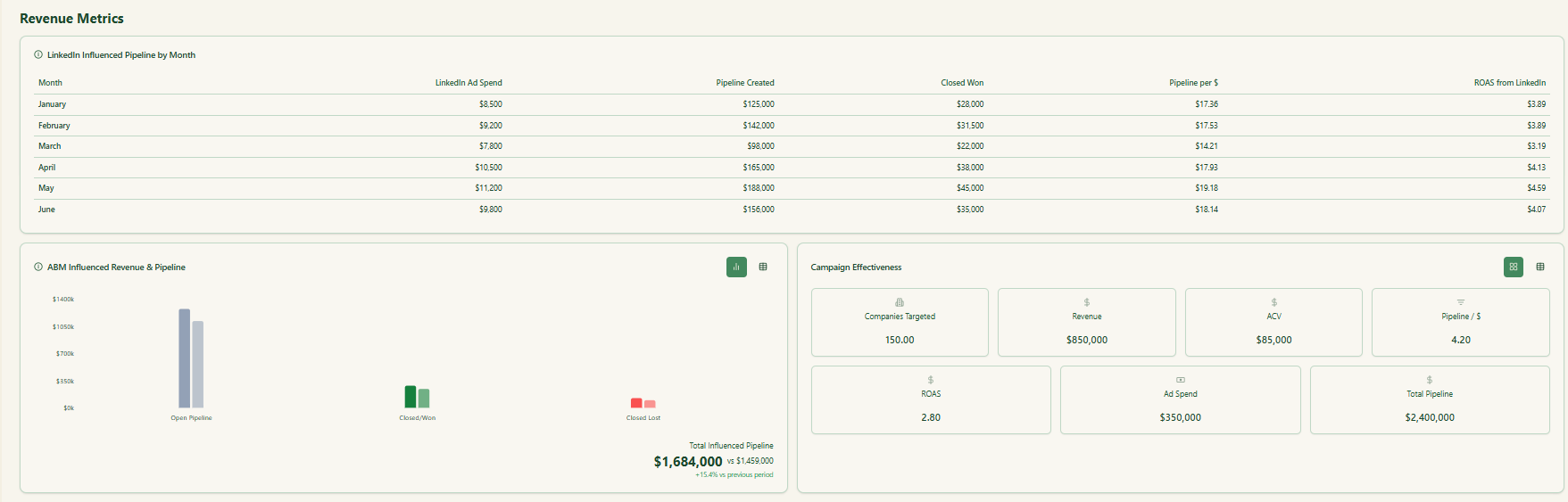

Built-in Dashboards and ABM Analytics

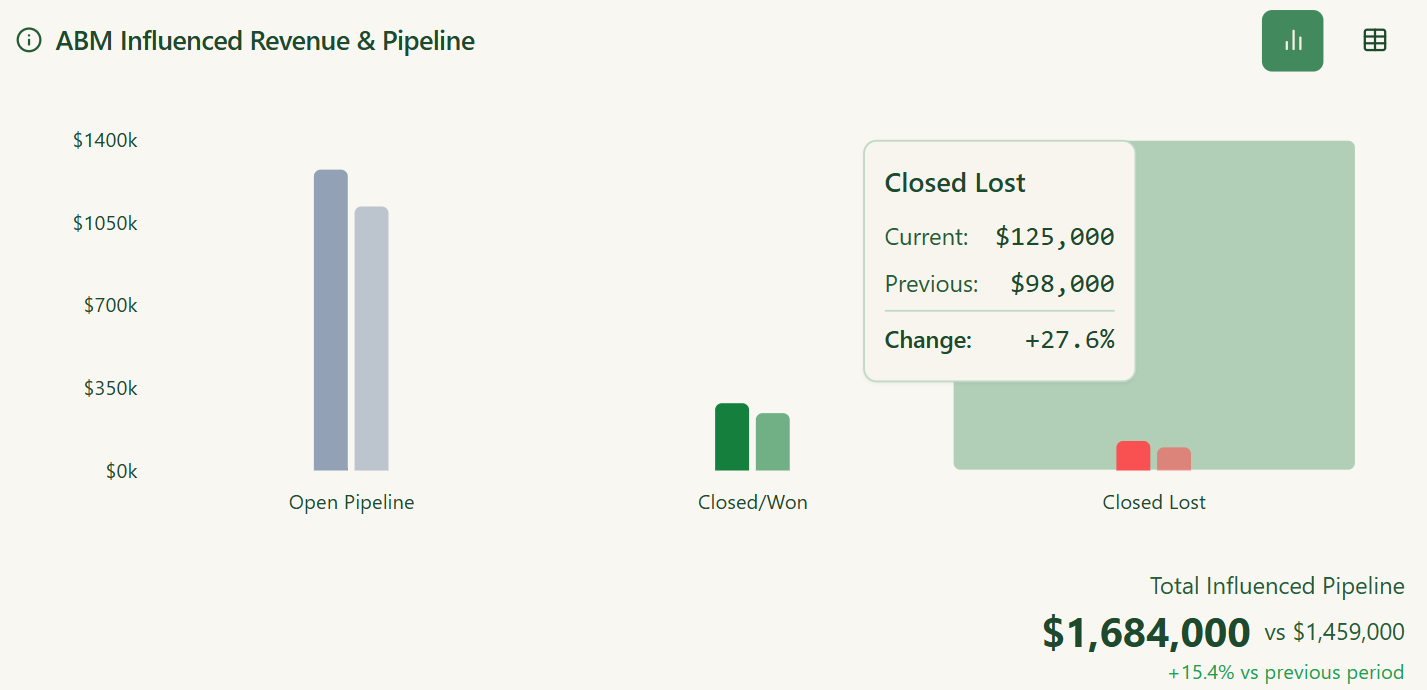

ZenABM ships with ABM dashboards that connect your LinkedIn ads to account engagement, funnel movement, and revenue.

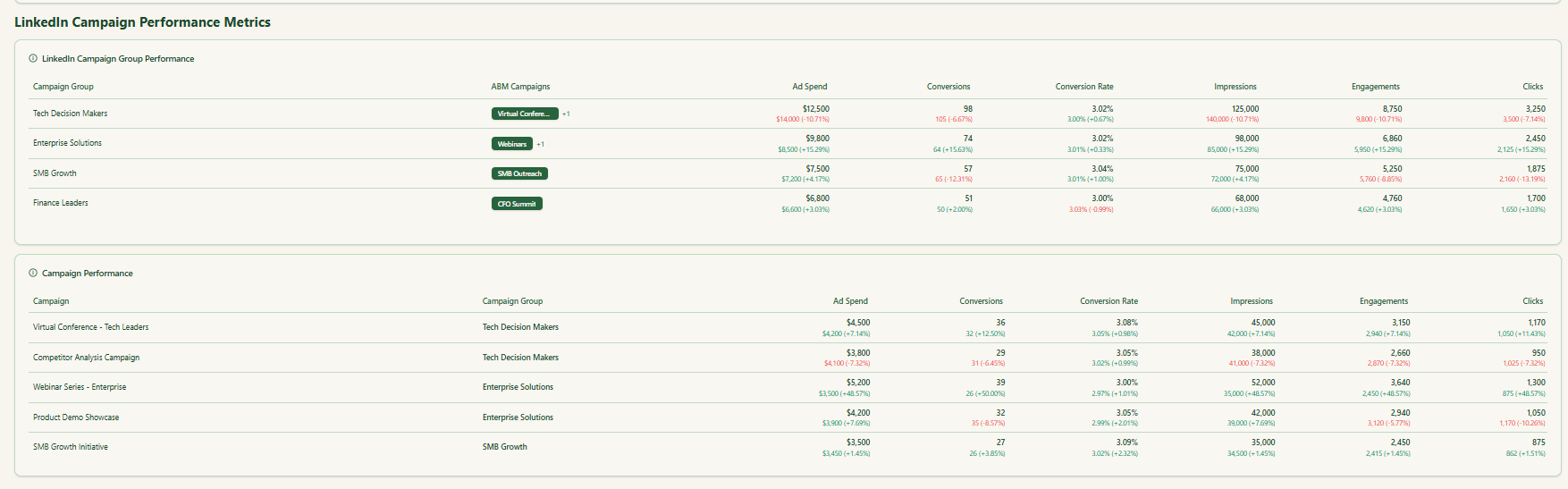

- You can track performance from high level ABM campaigns down to LinkedIn campaign groups and individual ads:

- Because ZenABM holds deal value and ad spend per company and campaign, it can calculate ROAS, pipeline per dollar, and other impact metrics, and visualize pipeline contribution. Instead of vanity metrics, it leans on those that connect to actual revenue.

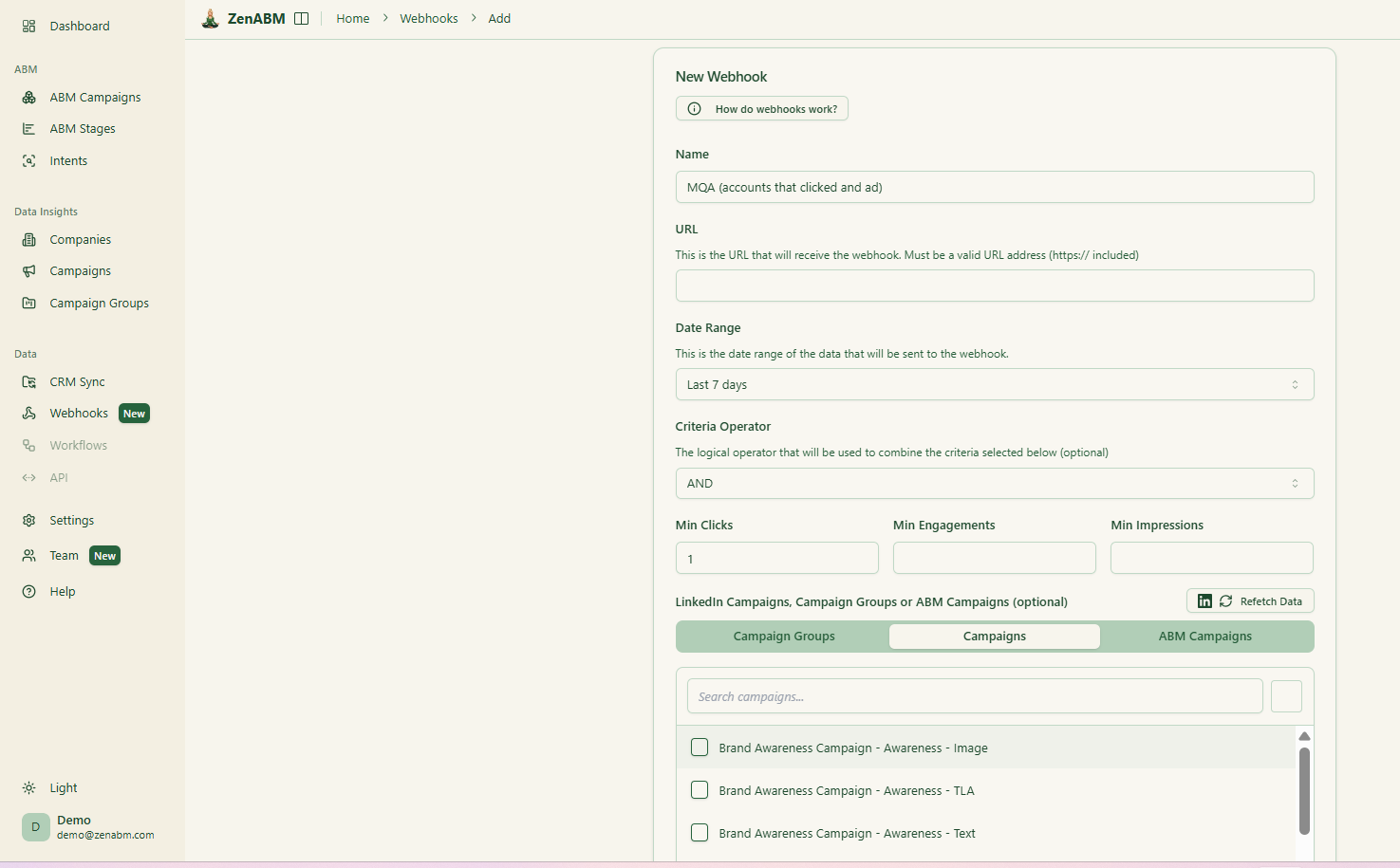

Custom Webhooks

ZenABM’s webhooks let you send events into your existing stack for ops workflows, Slack alerts, enrichment flows, and more.

Job-Title Analytics

ZenABM shows which job titles interact with your creatives and how.

You get raw stats, dwell time, and full video funnel analytics.

ABM Campaign Objects for True Multi-Campaign Attribution

Most tools treat each LinkedIn campaign as separate. ZenABM lets you group several into one ABM campaign object.

That way you can see performance across markets, personas, or creative clusters in one view.

Instead of juggling fragmented reports inside Campaign Manager, you see total spend, influenced pipeline, account movement, and ROAS for the full initiative.

AI Chatbot to Analyze Your LinkedIn and ABM Data

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model.

Instead of exports and spreadsheets, you can ask questions such as “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting campaigns?” in plain language.

The chatbot uses ad engagement, ABM stages, tagged intent, campaign groupings, and CRM values to answer with context.

Multi Client Workspace for Agencies

ZenABM supports agencies through a multi client workspace.

You can manage several ad accounts and clients in one environment, each with its own ABM campaigns, dashboards, and reporting, without constantly switching accounts in LinkedIn Campaign Manager.

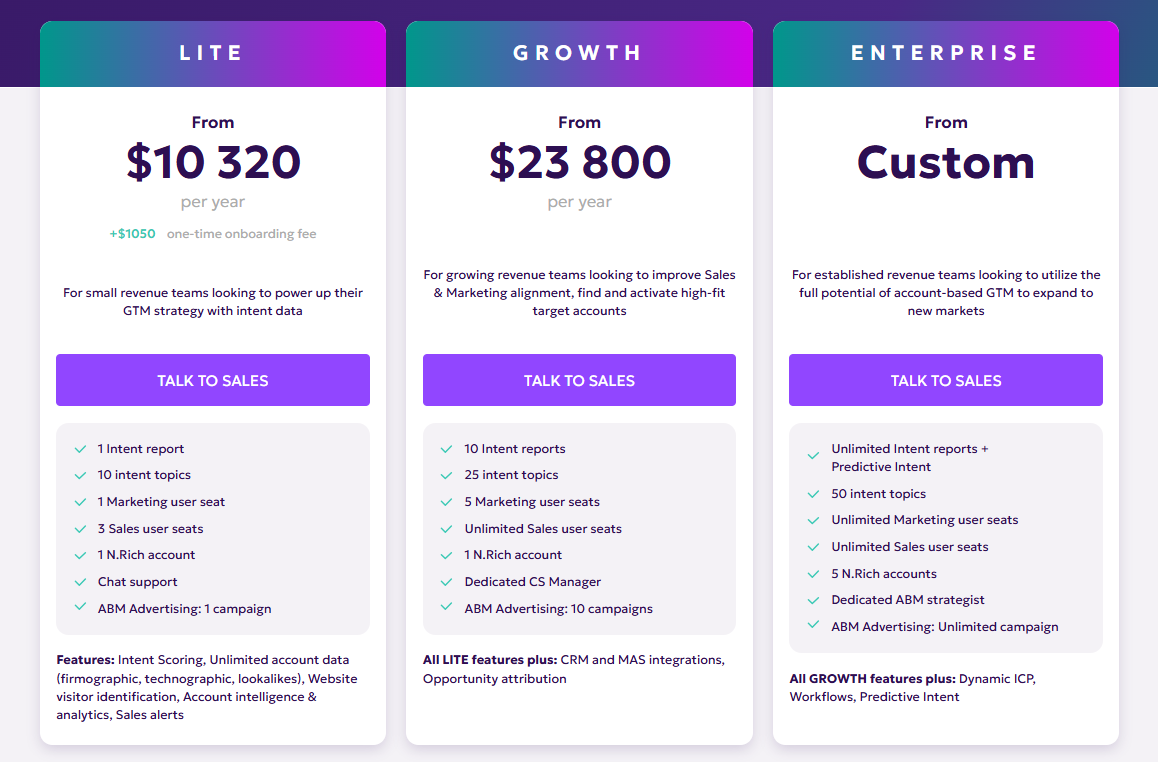

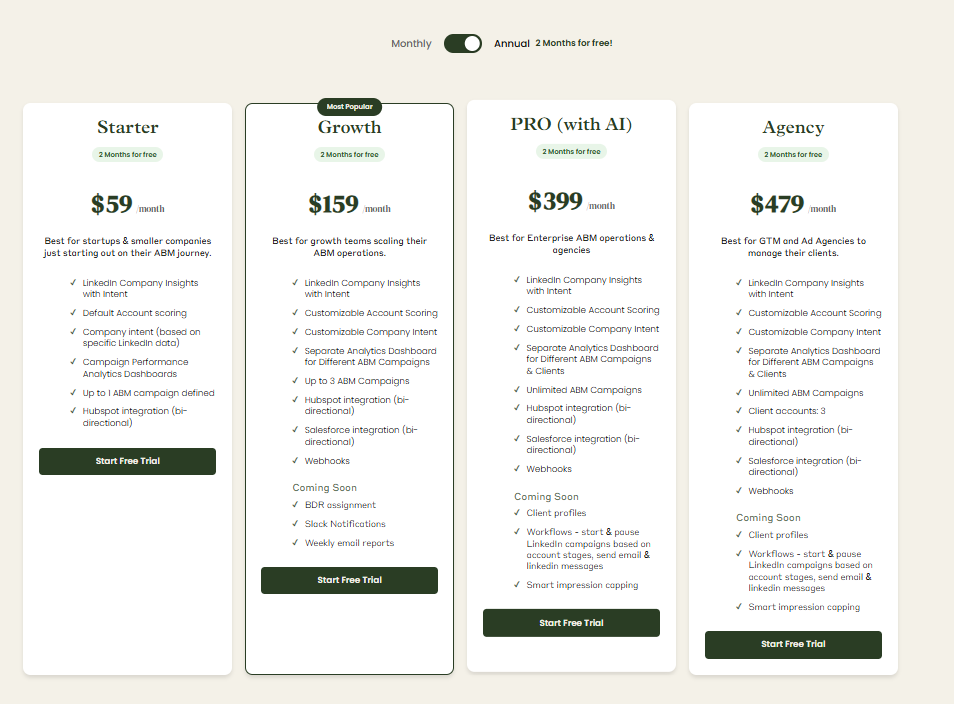

ZenABM Pricing

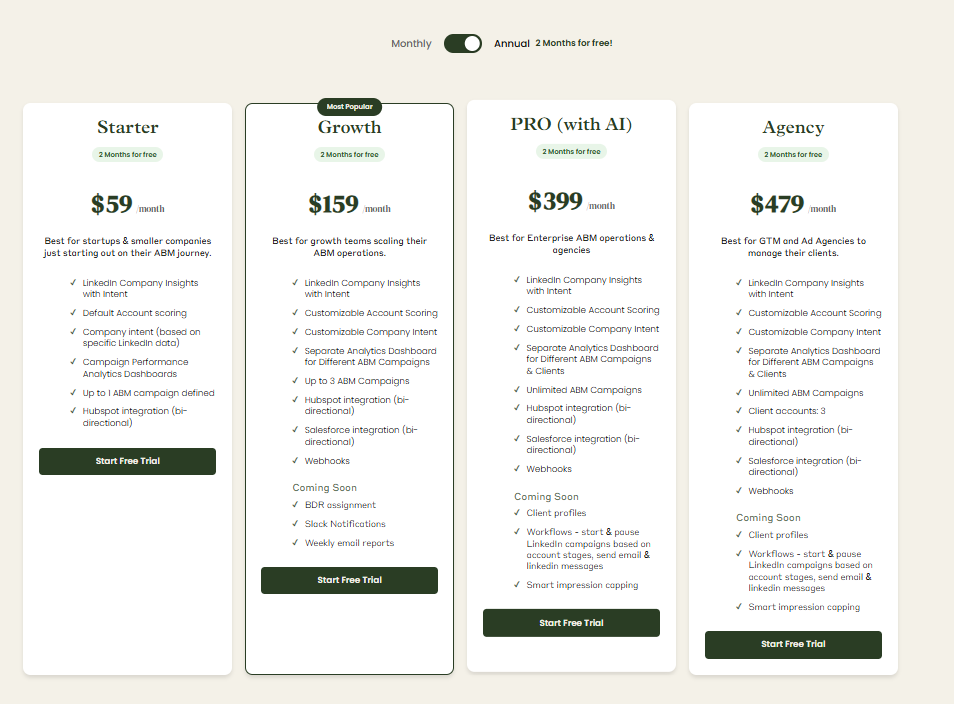

Plans start at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI), and $479/month for the Agency tier.

Even the agency plan stays under $6,000 per year.

All tiers include core LinkedIn ABM features. Higher plans mainly raise limits and add Salesforce sync.

You can choose monthly or annual billing, and every plan comes with a 37 day free trial so you can test it properly.

Conclusion

InsightSync is built to sharpen ABM strategy. It helps GTM teams align on target accounts, see how they are engaging, and keep an eye on competitors, without forcing a new media stack.

N.Rich is built to activate ABM. It turns ICP models and intent data into actual campaigns, with a DSP and opportunity attribution for teams ready to invest in always on media.

If your ABM program is still maturing and you primarily need shared visibility and prioritization, InsightSync will likely feel more approachable.

If your program is already in full swing and you want to pour intent into coordinated display and LinkedIn campaigns, N.Rich is the more logical choice.

And if your ABM motion is strongly centered on LinkedIn, ZenABM gives you first-party account-level engagement, intent from ad interactions, ABM stage tracking, CRM sync, and revenue dashboards in a lean and affordable package.