In this article, I have compared InsightSync and LinkedScope across features, pricing, reviews and ideal use cases so you can choose what fits your account-based marketing strategy.

I also show how ZenABM can act as a lean, affordable alternative or complementary layer due to its unique features.

InsightSync vs. LinkedScope: Quick Summary

In case you’re short on time, here’s the gist:

- InsightSync is a competitive intelligence plus ABM analytics platform that centralizes target accounts, engagement and competitor activity for GTM alignment.

- It works best when your main problem is getting marketing and sales to agree on which accounts to prioritize and why.

- LinkedScope is a LinkedIn Ads analytics and attribution layer that shows which companies saw and engaged with your ads and how that ties to the pipeline.

- It focuses on first-party LinkedIn API data, an intent-style score and CRM deal matching to move LinkedIn from vanity metrics to revenue insight.

- InsightSync is clearly premium, with euro pricing and paid onboarding, while LinkedScope keeps pricing opaque but pitched as month-to-month and contract-free.

- A third alternative: ZenABM gives account-level LinkedIn ad engagement, plug-and-play engagement to pipeline dashboards, account scoring, ABM stages, CRM sync, first-party qualitative intent, automated BDR assignment, custom webhooks, an AI chatbot, and job title level engagement tracking, starting at $59 per month.

InsightSync Overview: Key Features, Pricing and Reviews

InsightSync is a newer account-based marketing and competitive intelligence platform that puts target accounts, engagement data, and competitor research into one shared system.

The pitch is simple: tighter alignment across GTM teams without adding yet another media platform.

Key Features of InsightSync

InsightSync bundles three modules in one ABM platform.

1. Competitive Intelligence Hub

This is InsightSync’s main differentiator versus ABM-only tools.

The Competitive Intelligence Hub tracks competitors and market moves in one place.

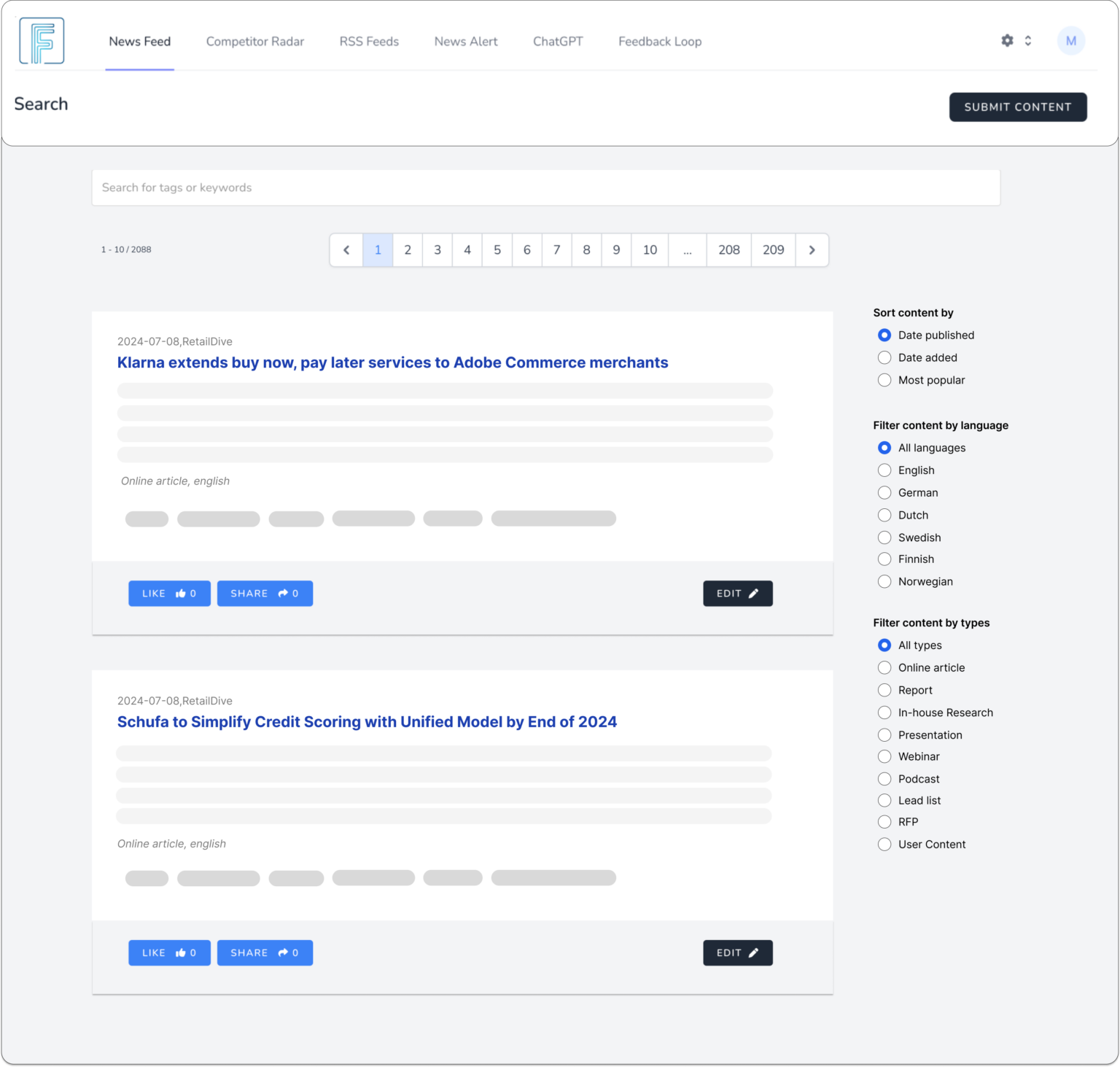

Unified News Feed

InsightSync pulls competitor content from news sites, press releases, and internal or external blog posts into a single feed, so you stop juggling multiple alerts.

You can tag items by competitor or topic, react to important updates, share them with colleagues, and set alerts for specific tags or keywords, for example, when a rival announces an acquisition.

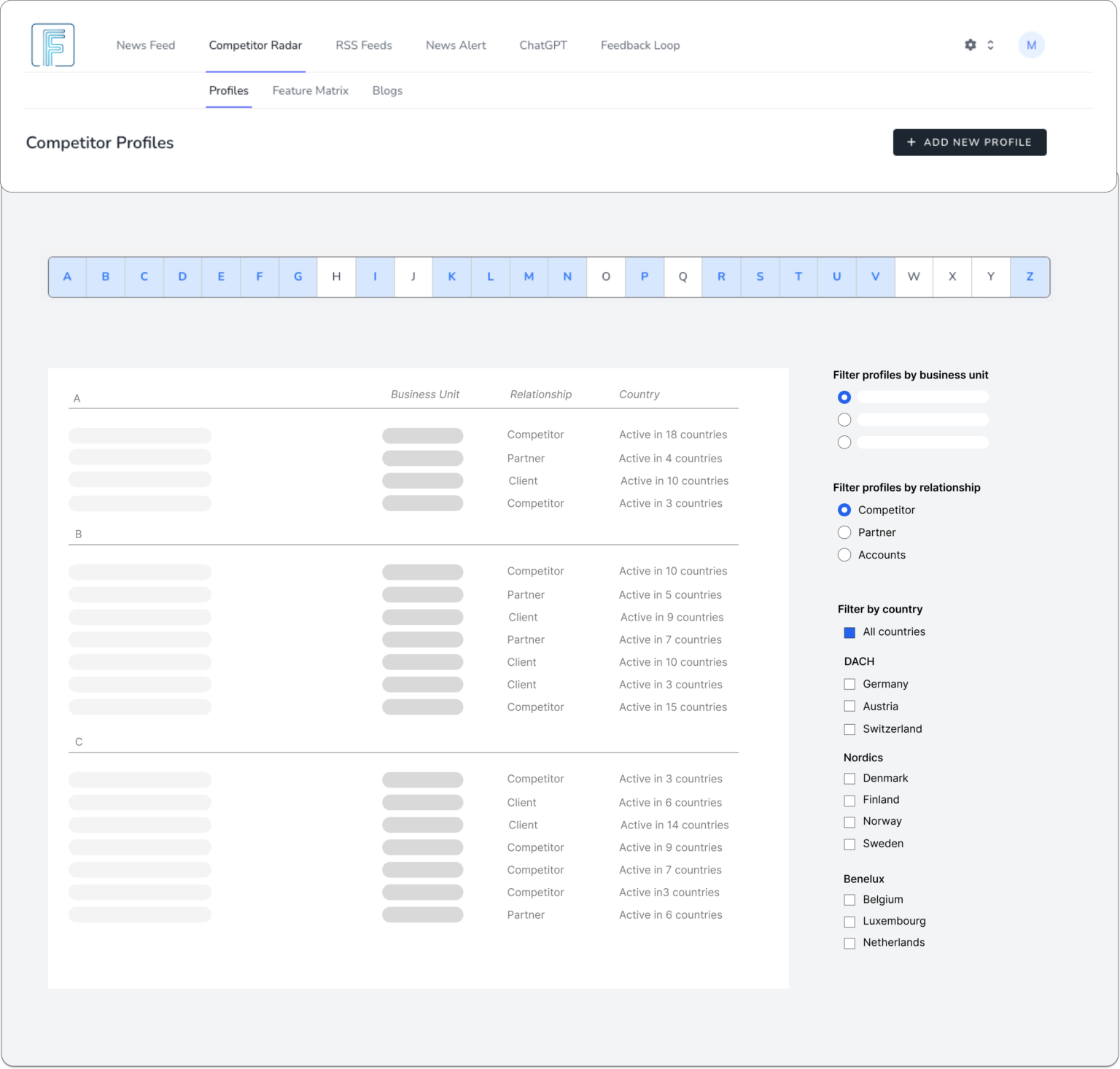

Competitor Radar & Profiling

The CI Hub lets you maintain structured profiles for each competitor, including customer logos, partners, alliances, pricing notes, and positioning, so the whole team uses the same picture.

AI Document Search

InsightSync ingests PDFs, whitepapers, and internal decks and lets you query them with AI search or pull concise summaries and key points.

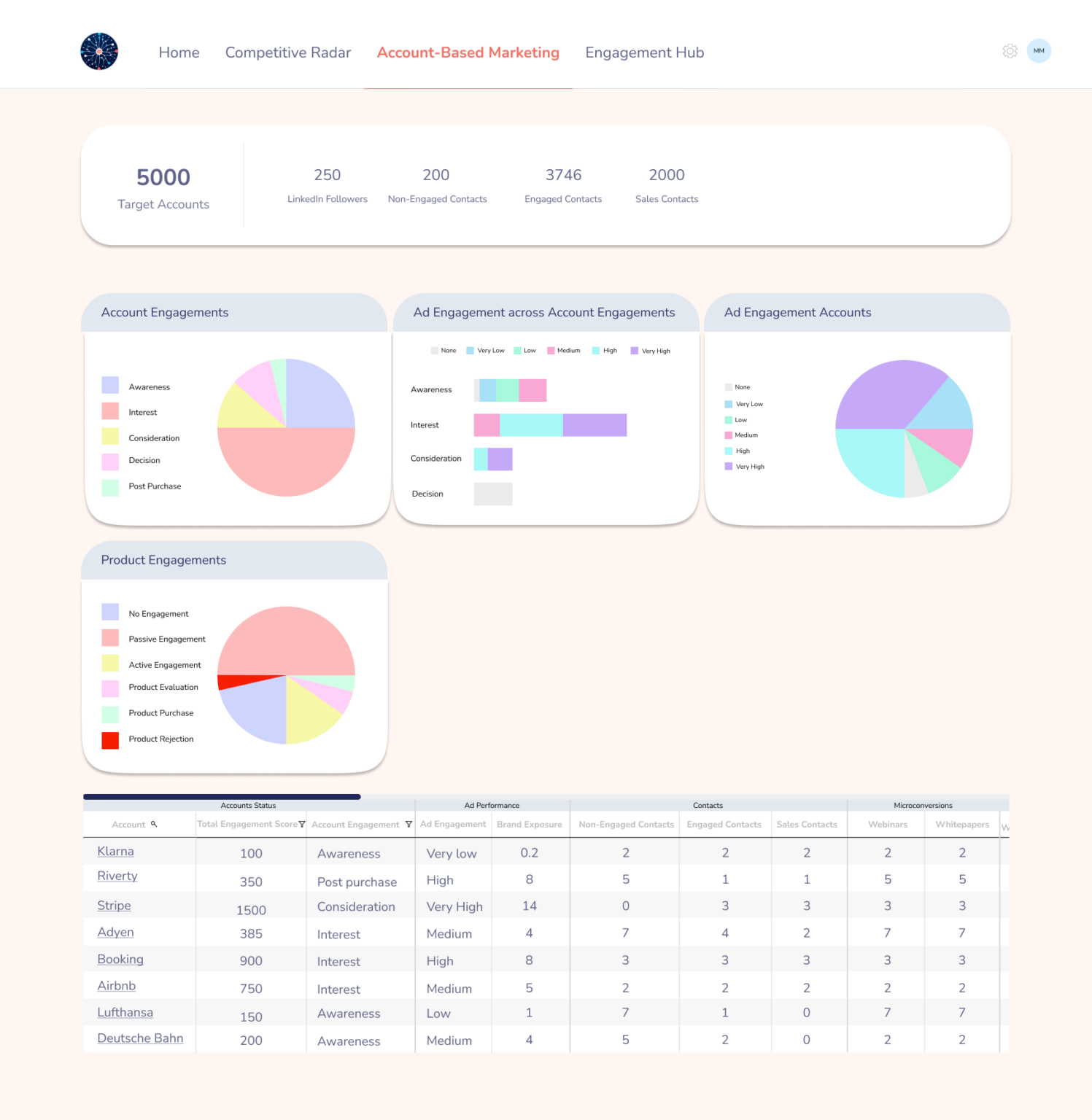

2. Account-Based Marketing Hub in InsightSync

The ABM Hub focuses on three questions:

- Who are we targeting?

- What do we know about them?

- How are we engaging them right now?

It is the home for your account-based marketing workflows.

Target Account List Management

You can import or build your target account list from your CRM or CSV files.

Each account becomes a record that you enrich over time with firmographics such as industry, size, and tech stack from other tools or manual input.

Multi-channel Engagement Tracking

Once your TAL is in place, InsightSync tracks engagement from ads, email, and meetings in one timeline.

You can score actions, so demo requests carry more weight than casual newsletter opens, and high-scoring accounts surface as more sales-ready.

Real-Time Alerts & Optimization

InsightSync flags accounts that heat up or cool down so teams can double down where momentum is growing and step in when important accounts go quiet.

Account-level visibility also supports budget shifts toward active accounts and messaging tweaks for segments that lag.

Scalability & Workflow Automation

InsightSync is positioned to grow with your ABM maturity. It references automated workflows for personalized outreach, although public details are still limited.

Important context: InsightSync’s ABM Hub is channel agnostic and analytics-focused. It is not an ad network or full marketing automation platform like Demandbase or RollWorks. You still run campaigns in LinkedIn, HubSpot, and other tools while InsightSync ingests data for attribution and analysis.

For LinkedIn-heavy teams, ZenABM offers a more direct path via the official LinkedIn Ads API.

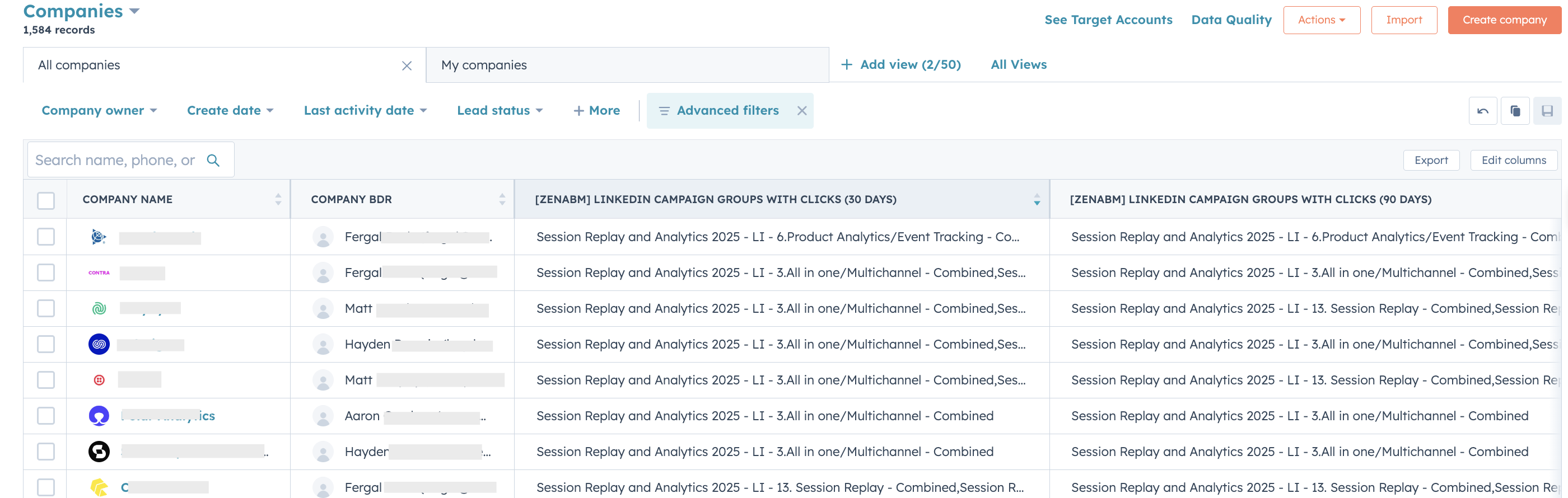

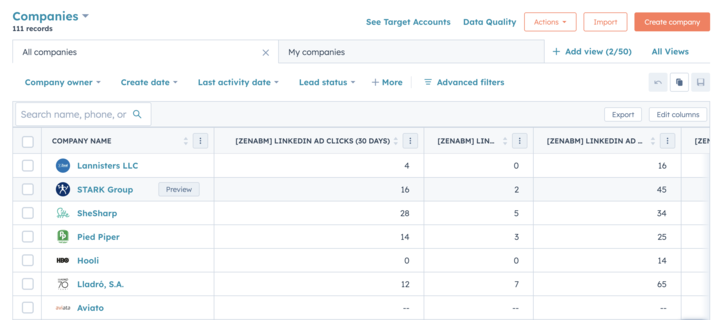

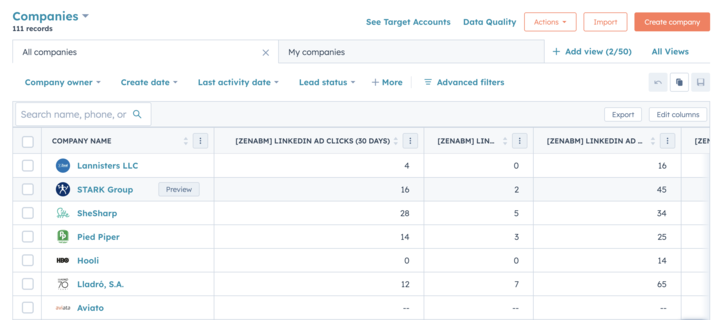

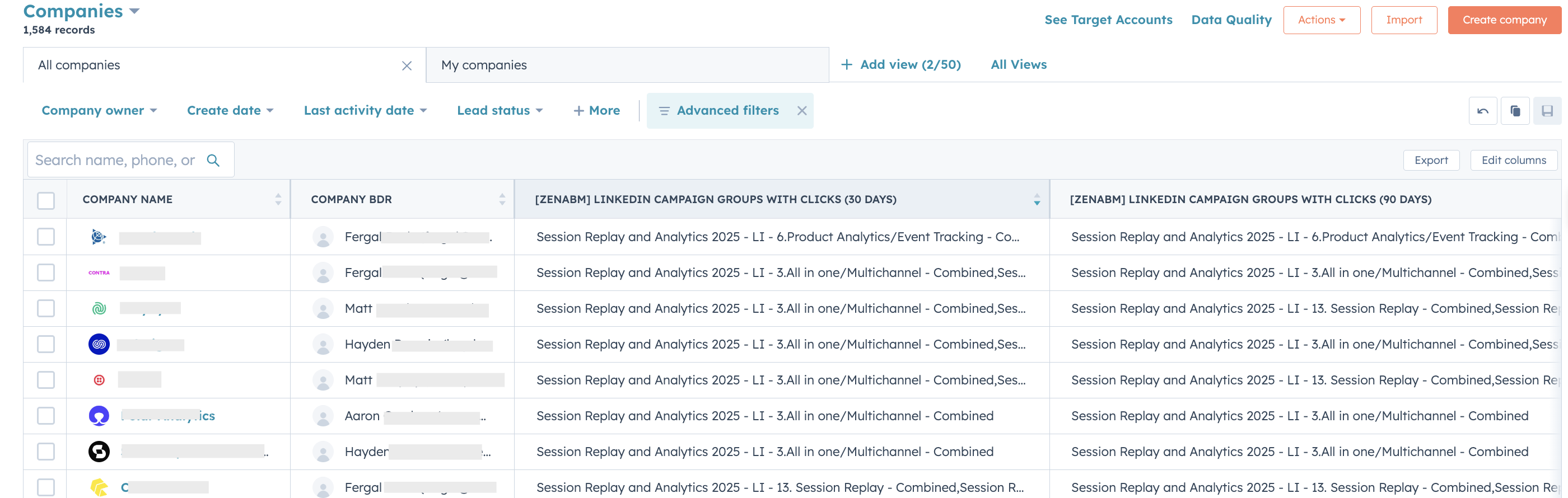

It pulls company-level impressions, clicks, engagement, and spend, scores accounts, syncs this data into the CRM as company properties, and routes hot accounts to BDRs automatically.

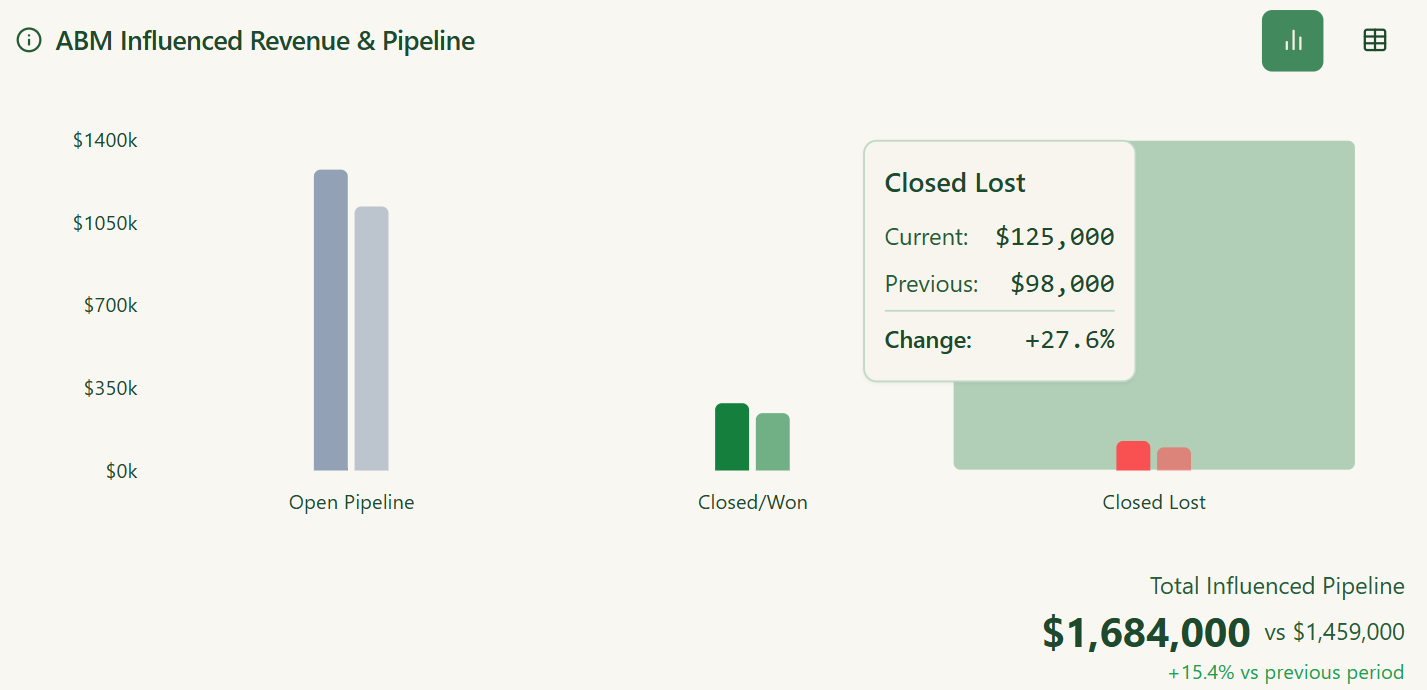

ZenABM then connects ad-engaged accounts with CRM deals and provides revenue and attribution dashboards so you can measure LinkedIn ABM impact on pipeline and closed revenue.

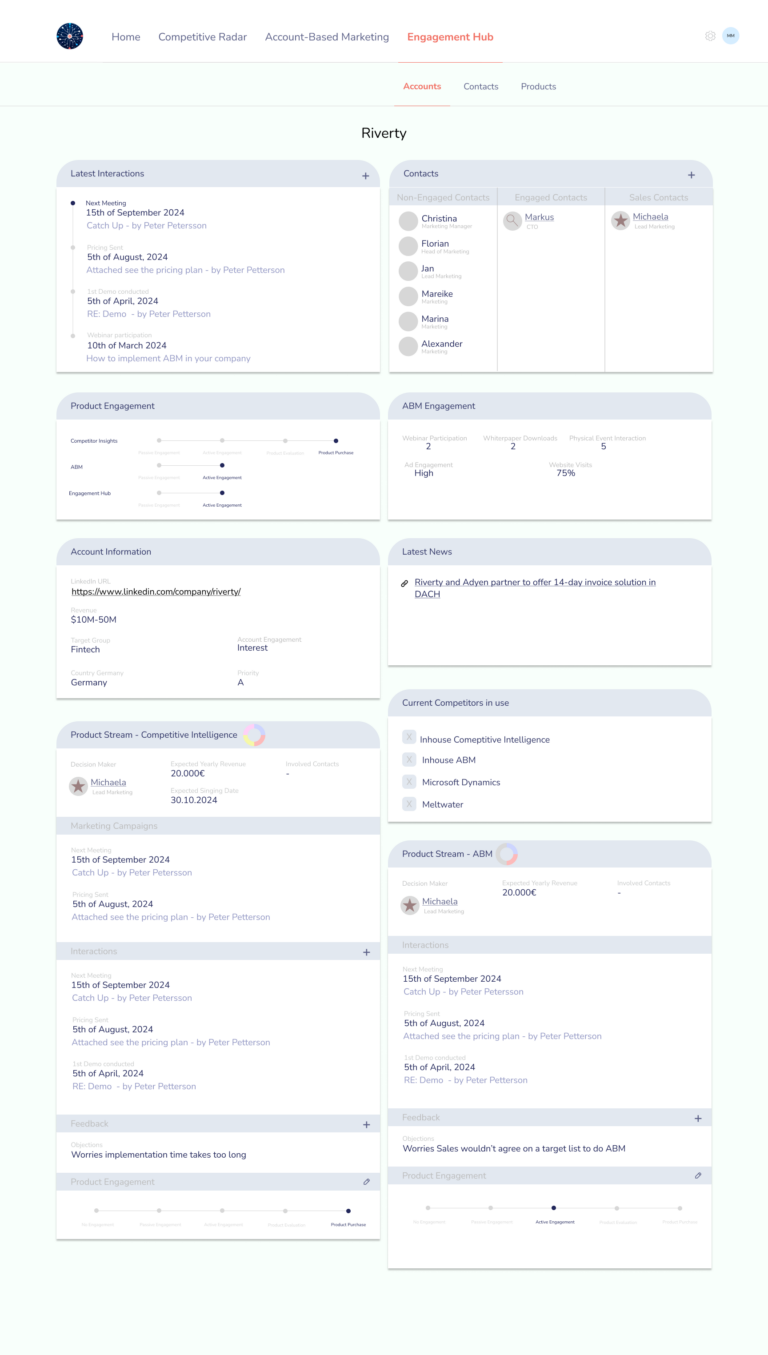

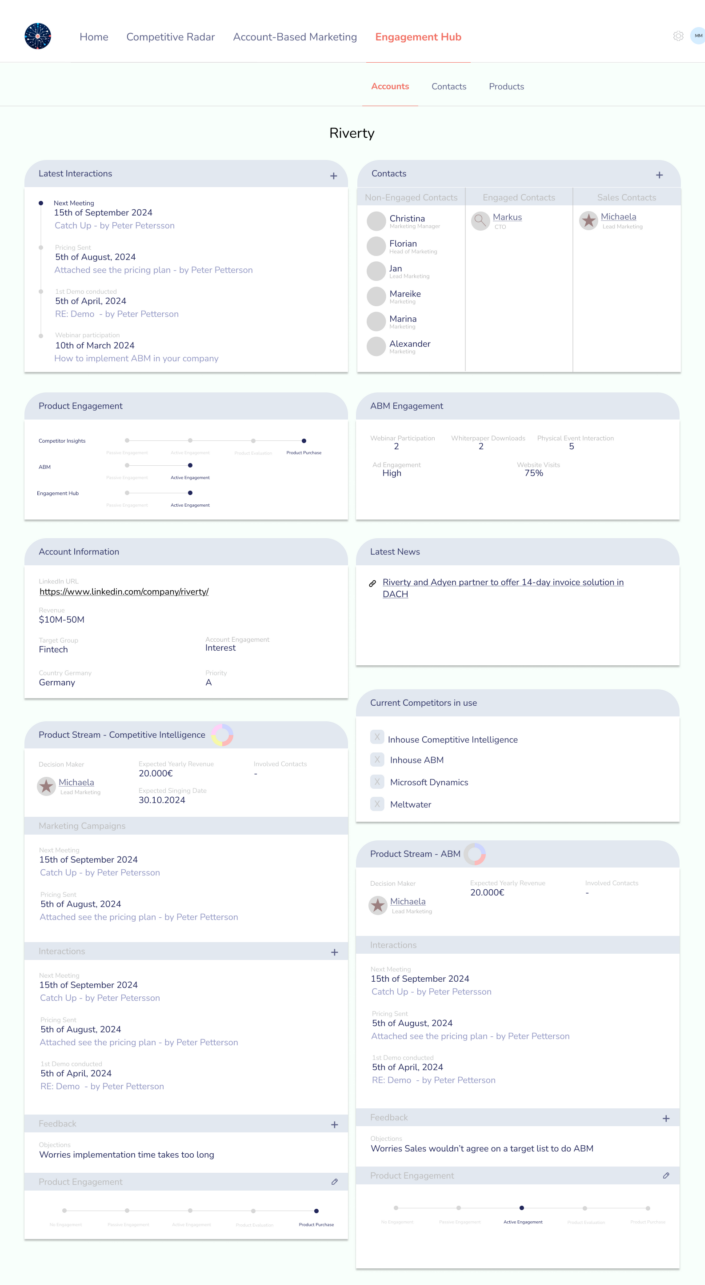

3. Engagement Hub

InsightSync’s Engagement Hub consolidates account activity such as web visits, ad clicks, email opens, and event attendance across contacts.

It highlights trends like rising interest or sudden silence so teams can focus on active accounts and re-engage those going quiet.

At the contact level, you can see who viewed pricing, who registered but skipped webinars, and who stays engaged, which helps sales tune outreach and marketers refine content.

These patterns help you map buyer roles and intent, infer funnel stage, and trigger timely follow-ups.

The Engagement Hub does not execute campaigns. Its job is to keep marketing and sales aligned around a shared view of account engagement and behavior.

InsightSync Pricing: How Much Does It Cost?

InsightSync sits in the premium bracket and targets teams that want a combined ABM plus CI backbone.

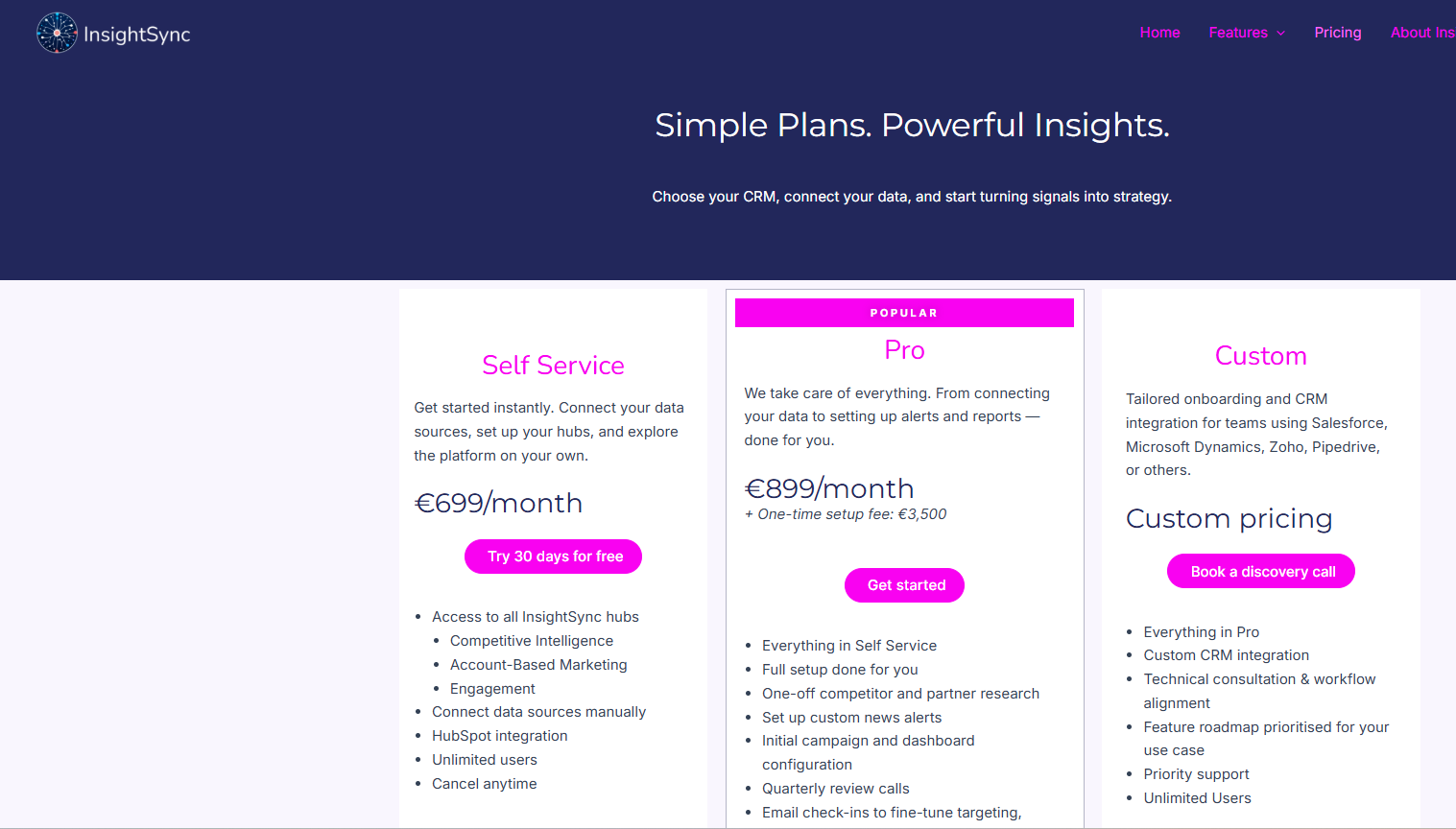

Here is the pricing as of late 2025:

- Self Service – €699/month: All three hubs with unlimited users. You handle setup and connect data manually or via the HubSpot integration, currently the only native CRM. Includes a 30-day free trial.

- Pro – €899/month (+ €3,500 one-time setup fee): Adds white glove onboarding. InsightSync’s team connects data, configures alerts and dashboards, and runs a one-off competitor and partner research project, plus quarterly reviews. The monthly step up from Self Service is modest, but the one-time service fee is sizeable.

- Custom – Contact for pricing: For teams on Salesforce, Microsoft Dynamics, Zoho, or Pipedrive. InsightSync is still building these integrations and offers early access. Custom plans add bespoke CRM work, technical consulting, prioritized features, and priority support.

InsightSync is cheaper than the biggest ABM suites, but still an upper mid-market spend. It works when you treat it as a CI system, ABM analytics layer, and light CRM adjunct in one.

Earlier stage or lean teams may still find the roughly €8K per year starting point heavy.

By contrast, ZenABM starts at about $59 per month for its starter plan, a small fraction of that.

User Impressions and Reviews

Public feedback on InsightSync is still limited, but a few patterns show up:

- Origin story – built by practitioners: InsightSync began as an internal tool from a B2B marketing lead at Riverty before spinning out. ZenABM has a similar origin: Michael Jackowski built it for Emilia Korczynska at Userpilot to fix LinkedIn ABM reporting, then turned it into a dedicated LinkedIn ABM SaaS. Customers like Productive and Spear Growth report strong results with ZenABM.

- Website testimonial: A testimonial from “John Doe, Riverty” says InsightSync has aligned marketing and sales and that the CI Hub alone saves hours each week.

- No G2 or TrustRadius footprint yet: As of November 2025, InsightSync does not have listings or reviews on G2 or TrustRadius.

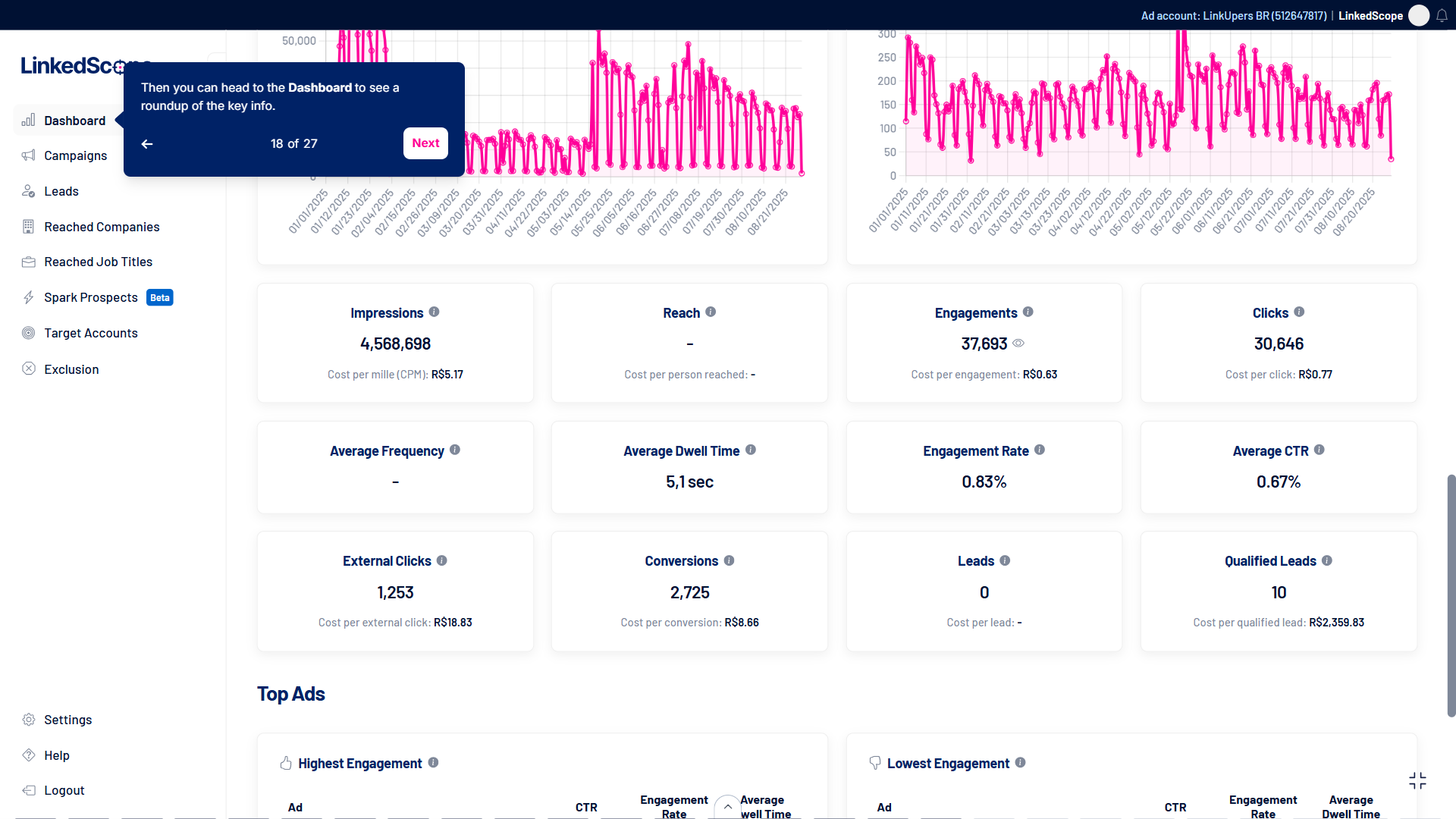

LinkedScope Overview: Key Features, Pricing, and Reviews

LinkedScope markets itself as a LinkedIn-centric account-based marketing attribution and optimization platform.

Let’s take a deeper look at its features, and see its pricing and user reviews.

Key Features of LinkedScope

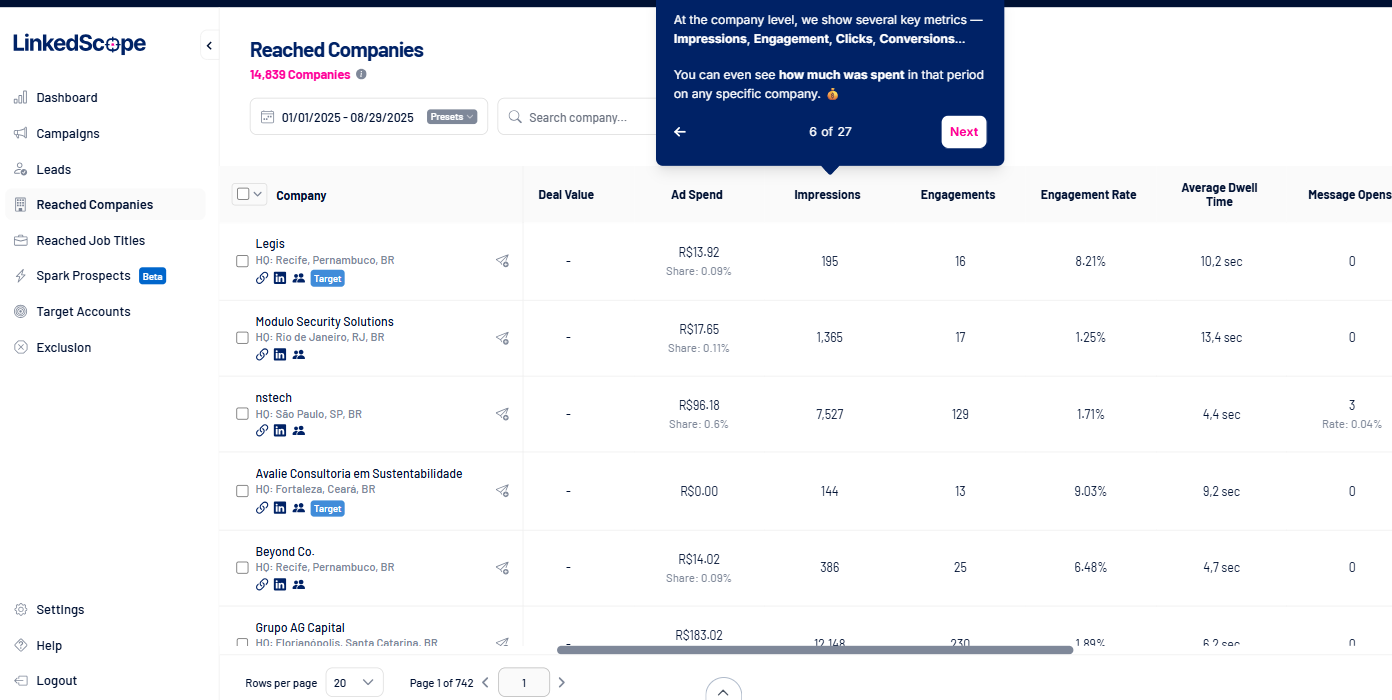

LinkedScope is essentially a LinkedIn Ads analytics layer + CRM connector with a sprinkling of intent scoring. I

It promises to tell you exactly which companies your LinkedIn ads reached, how they engaged, and whether they turned into pipeline or deals.

It even cooks up weekly prospect lists (accounts with high engagement metrics), so sales can pursue the most interested leads.

Let’s take a closer look at its core features:

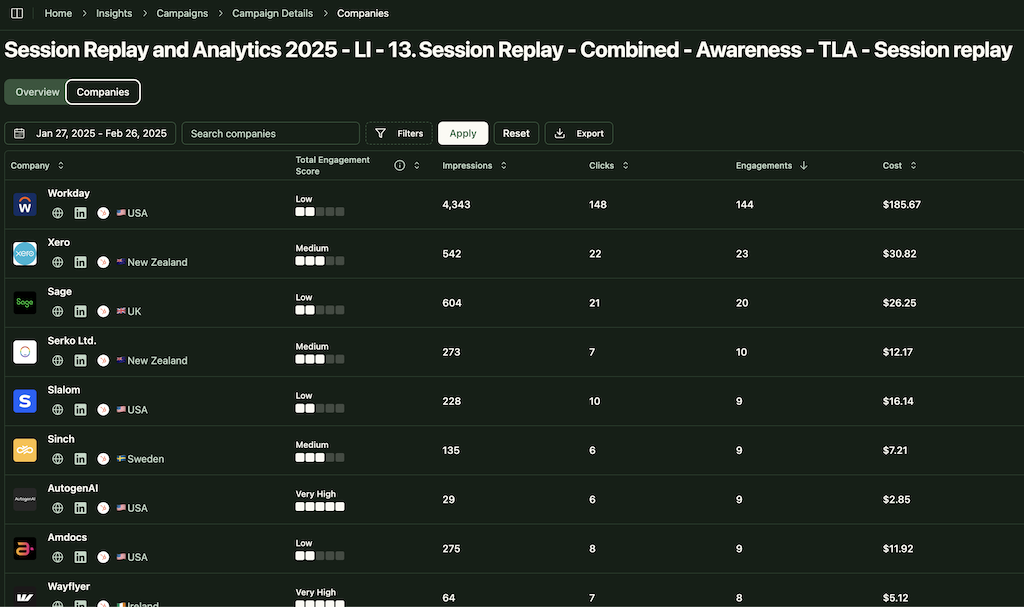

LinkedIn Ad Targeting & Reporting

It taps LinkedIn’s official API to pull all the company names and job titles exposed to your ads (no 25-title cap like Campaign Manager).

You can build target-account lists in LinkedScope and auto-sync them into LinkedIn campaigns in real time.

You also get dashboards for campaign reach, company penetration, and (via LinkedIn API) post-click engagement.

First-Party Data & Intent Scoring

All data comes straight from your LinkedIn ad campaigns via the official API.

LinkedScope does not invent third-party insights.

Because of LinkedIn’s rules, it only shows you analytics that LinkedIn itself has, just presented more fully.

On top of raw stats, it computes a proprietary Intent Index: basically an engagement score (clicks, conversions, comments, etc.) to highlight “Spark Prospects.”

Sales reps supposedly get a prioritized list of accounts already warmed up by ads.

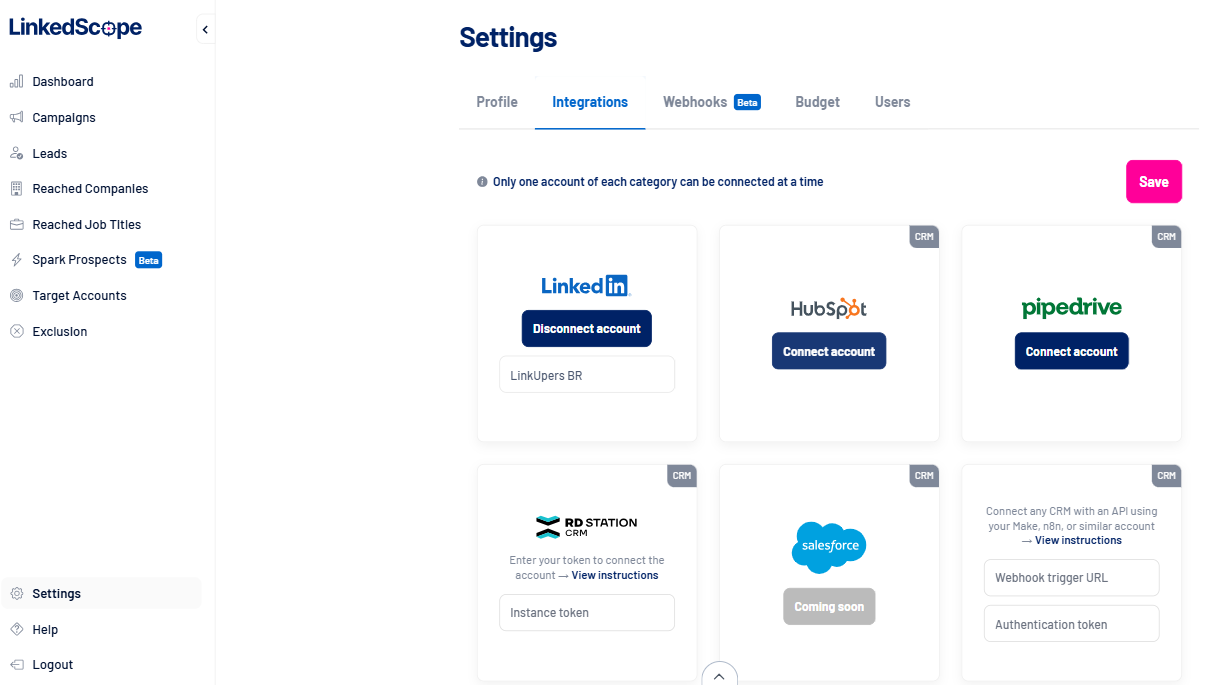

CRM Sync & Attribution

LinkedScope matches the companies hit by your ads to deals in any CRM (HubSpot, Pipedrive, RD Station, Salesforce, etc.).

It does this by matching website domains or exact company names.

This lets you attribute revenue to LinkedIn Ads: e.g. “$8M in closed deals came from accounts we had advertised to,” as their case study graphic brags.

Essentially, LinkedScope shifts LinkedIn Ads analytics from top-of-funnel vanity into supposed bottom-line visibility.

It also pushes the LinkedIn reach/intent data into tools like Slack or Zapier via webhooks, so you can automate alerts or import lists of engaged accounts into other systems.

By the way, ZenABM also provides detailed plug-and-play account-based LinkedIn ad revenue attribution dashboards for a starting price of just $59/month.

It does that by matching ad-engaged companies to the deals in your CRM, just like LinkedScope.

But there’s a difference: ZenABM doesn’t just match website domains to exact company names, but uses advanced algorithms to ensure minor spelling differences, etc., don’t leave companies unmatched.

LinkedScope Pricing: How Much Does It Cost?

LinkedScope’s site doesn’t mention anything except the fact that the subscription is month-to-month with no contract, and you get a 15-day free trial with no credit card.

Since many enterprise ABM tools (Demandbase, 6sense, Terminus, etc.) run into the tens of thousands per year, it’s fair to wonder where LinkedScope sits on the spectrum.

My guess: it’s probably priced for mid-market marketers or agencies who spend heavily on LinkedIn. If it were dirt-cheap or free, I doubt they’d omit it so pointedly.

In lieu of official rates, I checked the usual place: G2.

No luck there either.

LinkedScope has zero reviews on G2 and no user-submitted pricing.

Reddit and TrustRadius turned up nothing either.

In short, there’s no independent word on what it costs or whether any budget-conscious marketer ever questioned the bill.

If you are looking for a leaner yet effective tool, I present ZenABM, starting at just $59/month.

ZenABM offers account-level LinkedIn ad engagement tracking, ad engagement-to-pipeline analytics with plug-and-play dashboards, account scoring, ABM stage tracking, CRM sync, first-party qualitative intent data, automated assignment of BDRs to high-priority accounts, custom webhooks, an AI chatbot, impression capping, ABM objects, and ad engagement tracking at the job title level.

User Impressions and Reviews

It’s hard to analyze user sentiment when nobody’s talking.

As of now (late 2025), the only feedback I found on LinkedScope is marketing testimonials in Portuguese/Spanish on their site.

No one on Reddit or LinkedIn has posted a “I love/hate LinkedScope” rant that I could find.

G2 explicitly notes that there are not enough reviews to give any insight

InsightSync vs. LinkedScope: Key Differences

Here is a direct comparison of InsightSync and LinkedScope across core dimensions.

| Feature category | InsightSync | LinkedScope |

|---|---|---|

| Core positioning | Competitive intelligence plus ABM analytics platform for target accounts and competitors | LinkedIn Ads analytics, attribution and CRM connector with light intent scoring |

| Primary focus | Give GTM teams a shared view of who to target, how they engage and what competitors are doing | Show which companies LinkedIn ads reached, how they engaged and how that connects to pipeline and deals |

| Main modules or features | Competitive Intelligence Hub, ABM Hub, Engagement Hub | LinkedIn reach and engagement dashboards, intent index, weekly hot account lists, CRM and webhook sync |

| Channels covered | Channel agnostic analytics that ingest data from LinkedIn, email, meetings, web and other tools | LinkedIn Ads only, built on top of the official LinkedIn Ads API |

| Data and intent signals | First party engagement data plus competitor content, profiles and notes in one CI system | First party LinkedIn campaign data only, rolled into a proprietary intent index for Spark Prospects |

| CRM and integrations | Native HubSpot integration, custom work for Salesforce, Dynamics, Zoho and Pipedrive on higher tiers | Matches companies to deals in CRMs like HubSpot, Salesforce, Pipedrive and RD Station, with exports to Slack or Zapier |

| Execution capabilities | Does not buy media, focuses on analytics, scoring, alerts and CI to guide ABM execution elsewhere | Does not run ads itself, but optimizes and attributes LinkedIn campaigns using richer reporting and lists |

| Pricing profile | Premium euro priced platform starting around €699 per month plus a setup fee on some tiers | Month to month subscription with 15 day free trial, no public pricing numbers and no independent benchmarks |

| Review footprint | Early stage feedback, practitioner origin story and website testimonials, but no G2 or TrustRadius listings yet | No G2, TrustRadius or Reddit reviews, only vendor supplied testimonials in Portuguese or Spanish |

| Ideal team profile | B2B teams that want one CI plus ABM analytics backbone across channels and tools | Teams that invest heavily in LinkedIn Ads and want cleaner reach, intent style scoring and revenue attribution |

| Best use case | Aligning marketing and sales on which accounts to pursue, when to act and with what competitive context | Proving LinkedIn’s impact on pipeline and revenue, and feeding sales weekly lists of warmed-up accounts |

| Where ZenABM fits | Acts as a LinkedIn first companion when you need company-level ad engagement and first-party intent synced into the CRM | Offers a lean alternative when you want LinkedIn ABM, CRM sync, stages and attribution rather than only analytics and lists |

InsightSync vs. LinkedScope: So, Which Is Better for ABM?

InsightSync is the better fit if your main problem is alignment, not just ad reporting.

You get one system for target account lists, multi-channel engagement timelines and competitor moves, so marketing and sales can finally argue over strategy instead of spreadsheets.

If you already run campaigns in LinkedIn, HubSpot and other tools and want a CI plus ABM analytics backbone, InsightSync is the stronger candidate, provided the price tag fits your stage.

LinkedScope is the better fit if your world revolves around LinkedIn Ads and you are tired of guessing what they actually did.

It uses the official LinkedIn API to show which companies saw and engaged with your ads and then ties that to deals in your CRM.

That makes sense if your primary question is “what did our LinkedIn budget generate in pipeline”, rather than “how do we structure our whole ABM and CI motion.”

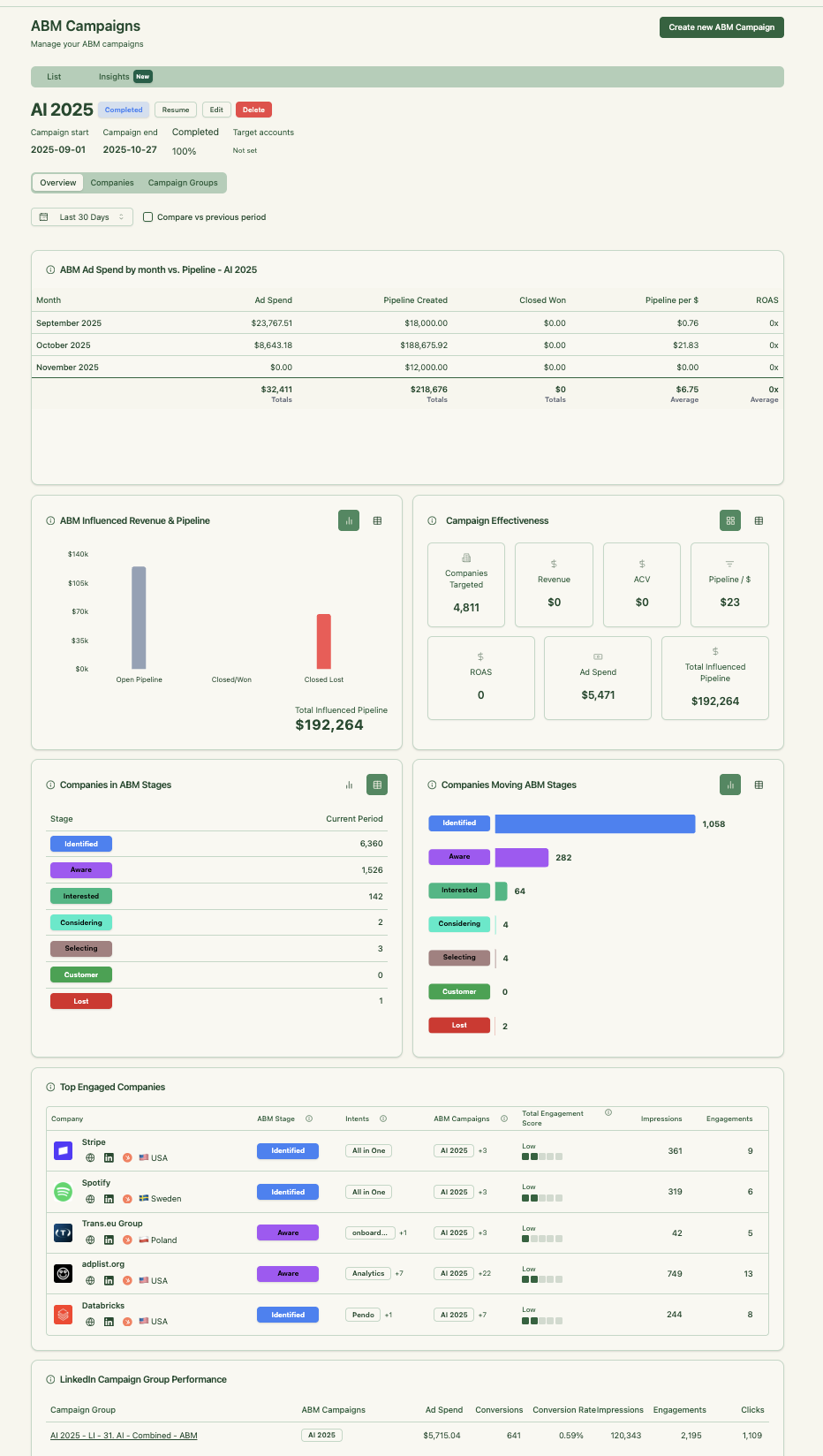

ZenABM as a LinkedIn-First, First-Party Lean ABM Alternative

There is also a third option: ZenABM.

ZenABM is built for teams that rely on LinkedIn as the primary ABM channel and want first-party accuracy, automation, and revenue visibility without the price or complexity of multi-channel suites.

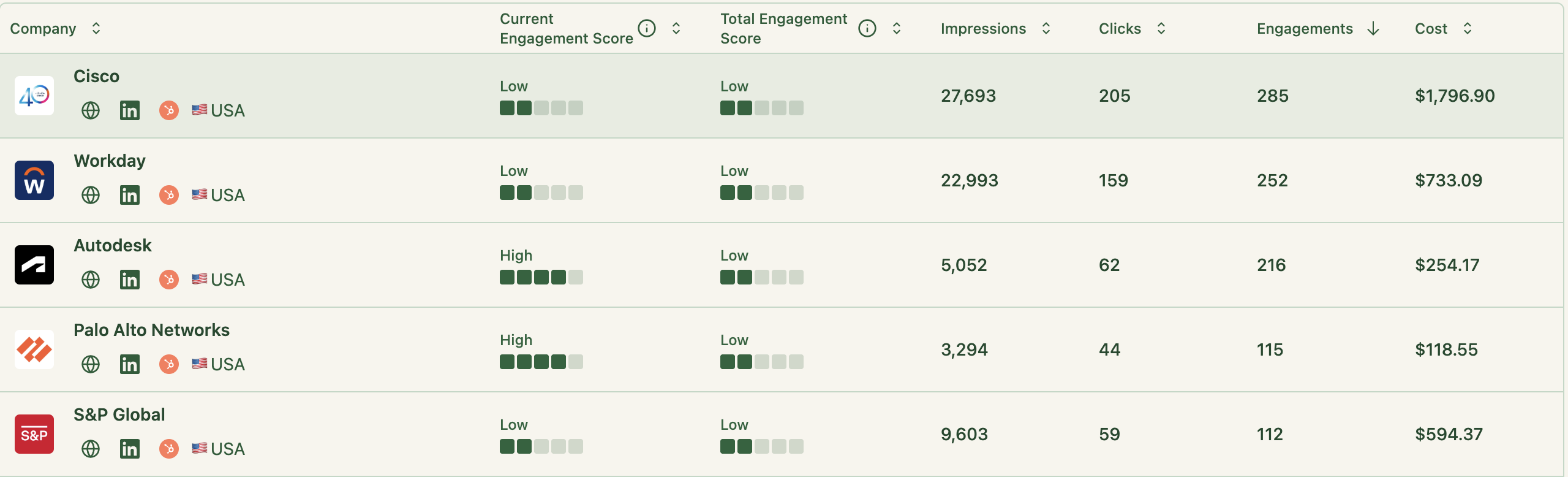

Account-Level LinkedIn Engagement Tracking

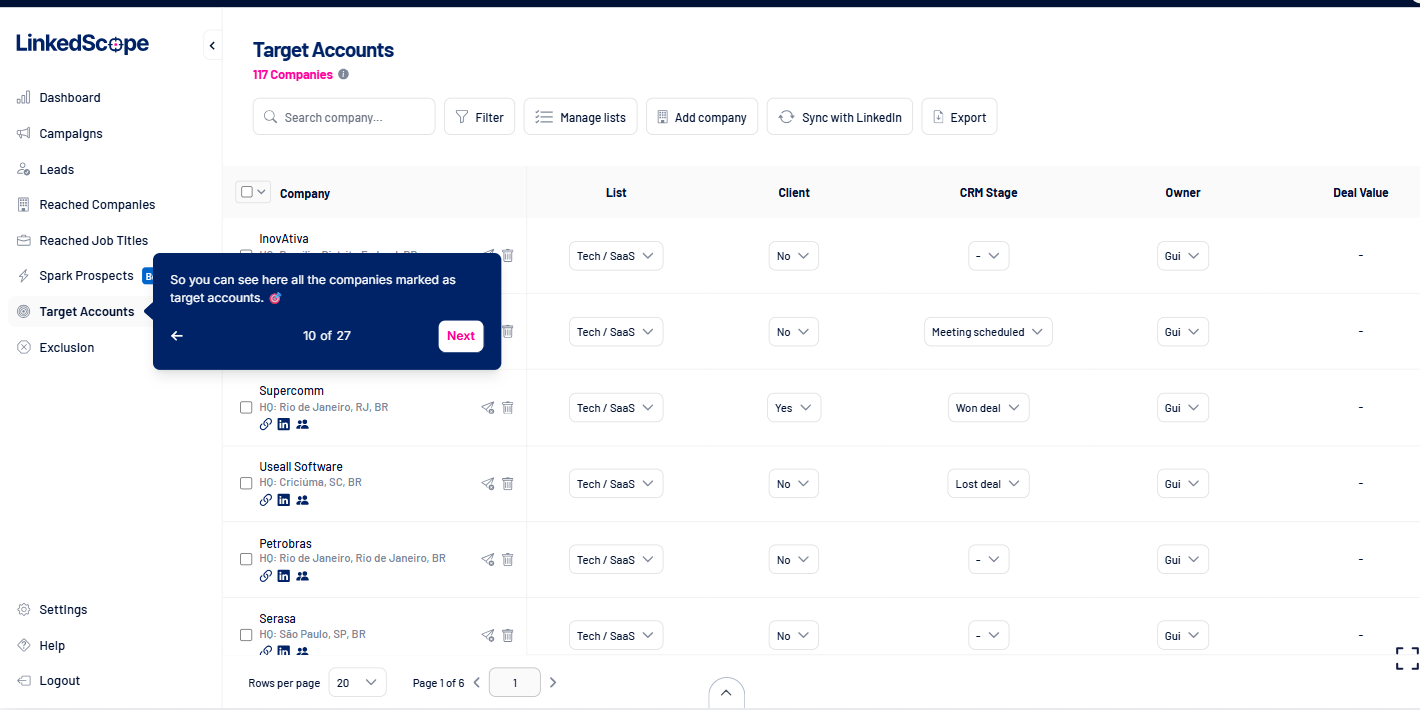

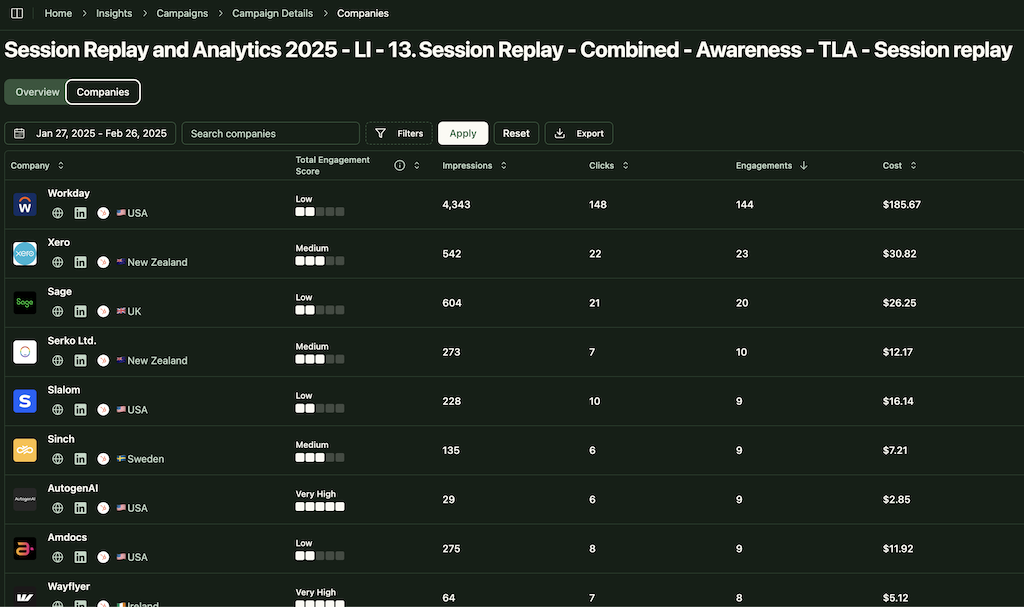

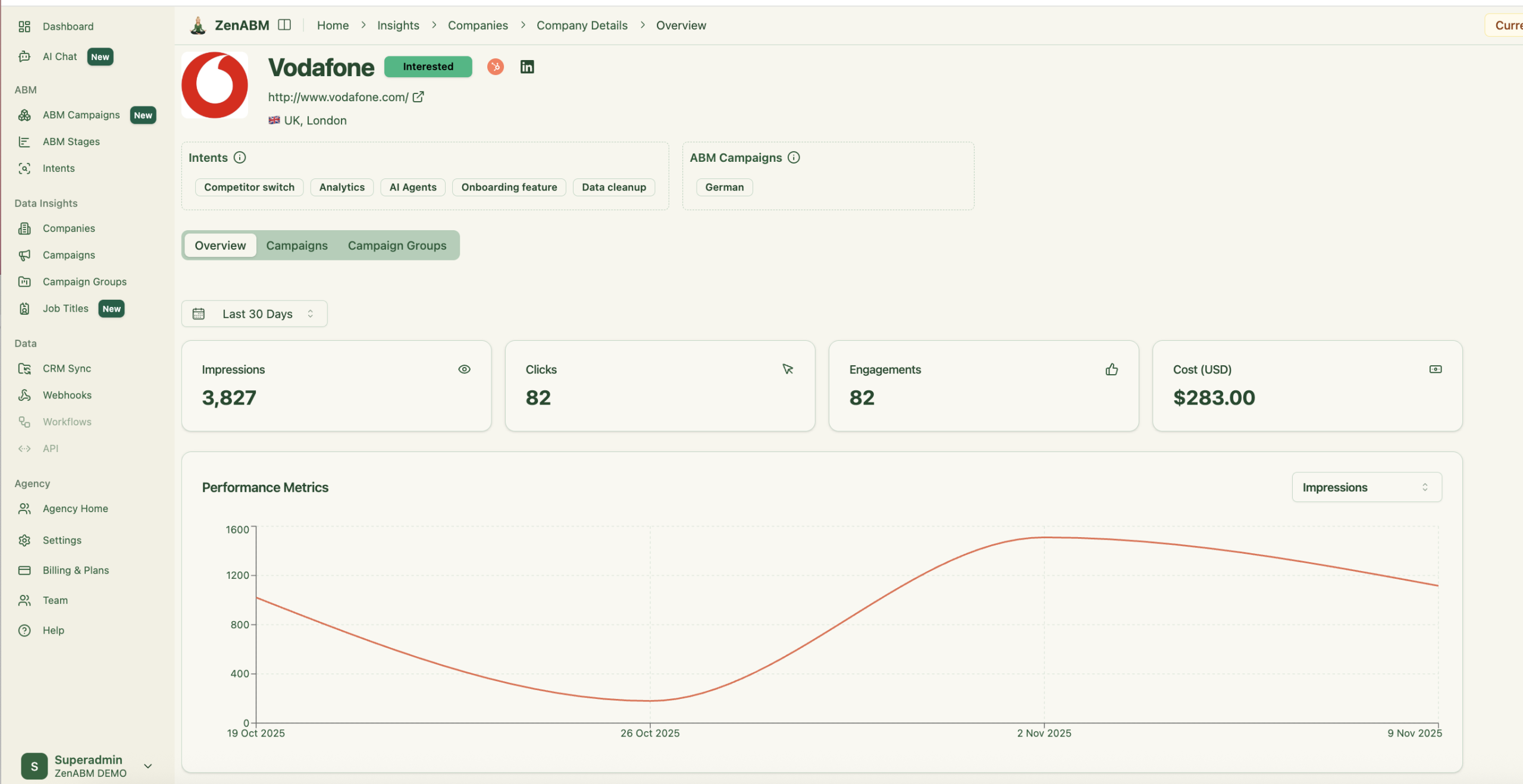

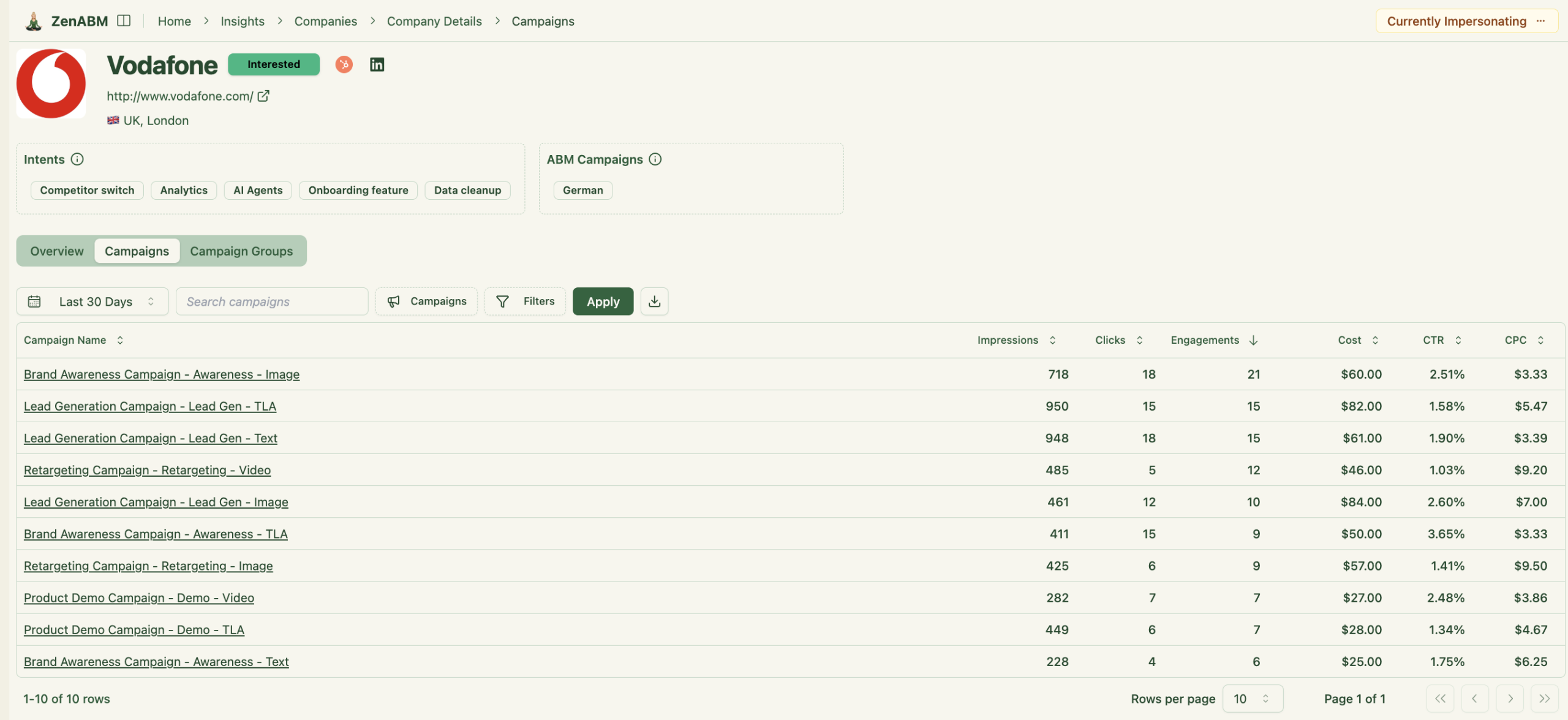

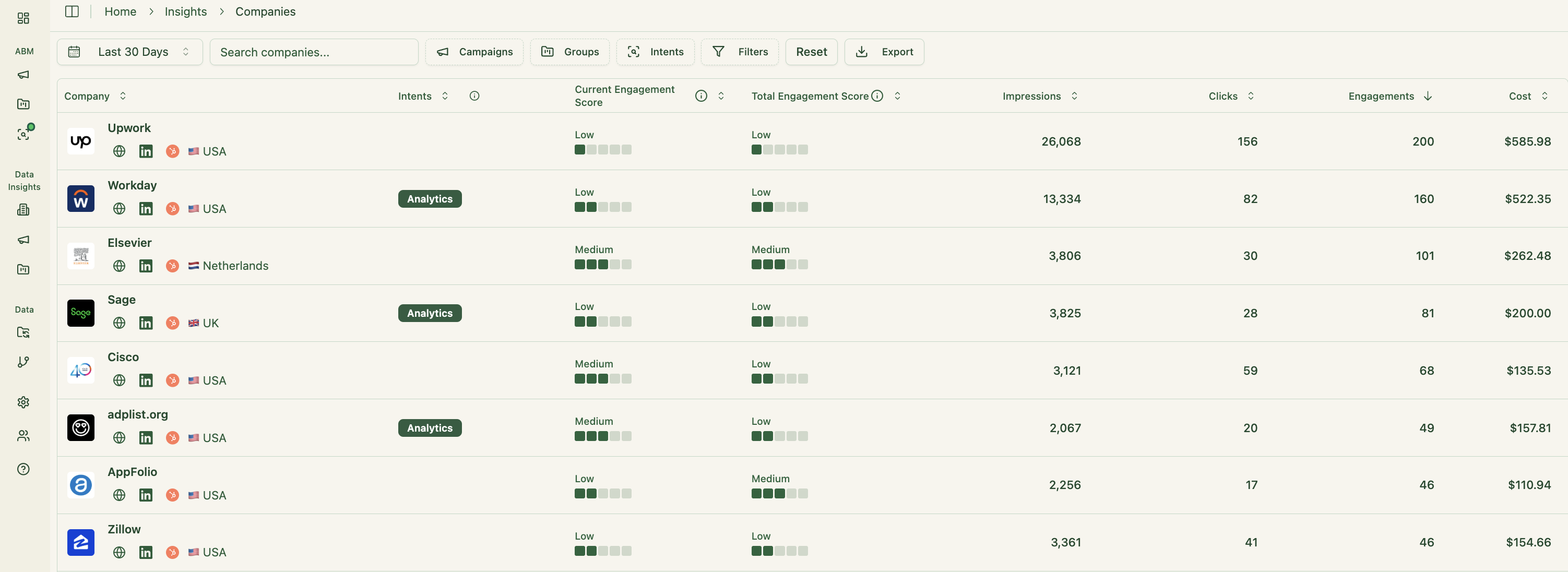

ZenABM connects to the official LinkedIn Ads API and captures account-level data for all campaigns so you can see which companies see, click, and engage with your ads.

Because this is first-party data from LinkedIn’s environment, it is more reliable than IP or cookie-based visitor ID.

A Syft study puts IP-based identification at around 42 percent accuracy.

ZenABM treats LinkedIn ad engagement itself as first-party intent. When several people in one company keep engaging with your ads, that is a strong buying signal without rented intent feeds.

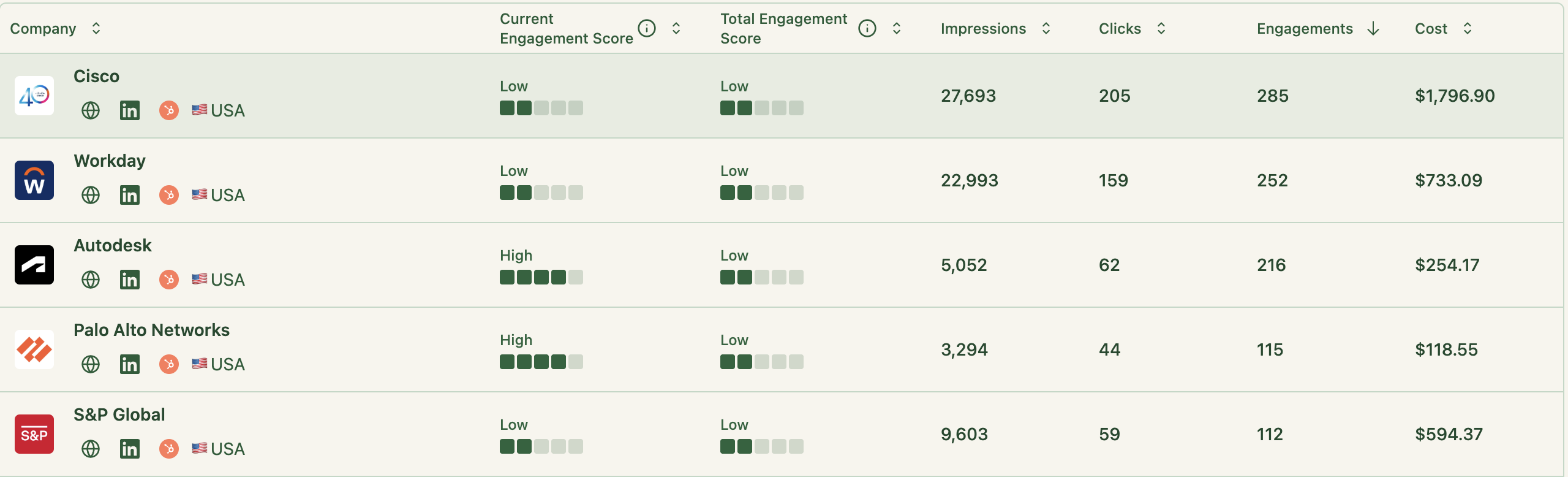

Real-Time Engagement Scoring + Full Touchpoint Timeline

ZenABM updates engagement scores as accounts interact with your ads across campaigns, so you can see who is heating up over short or long windows and let marketing and sales prioritize accounts that show real intent.

ZenABM also shows the full touchpoint timeline for each company:

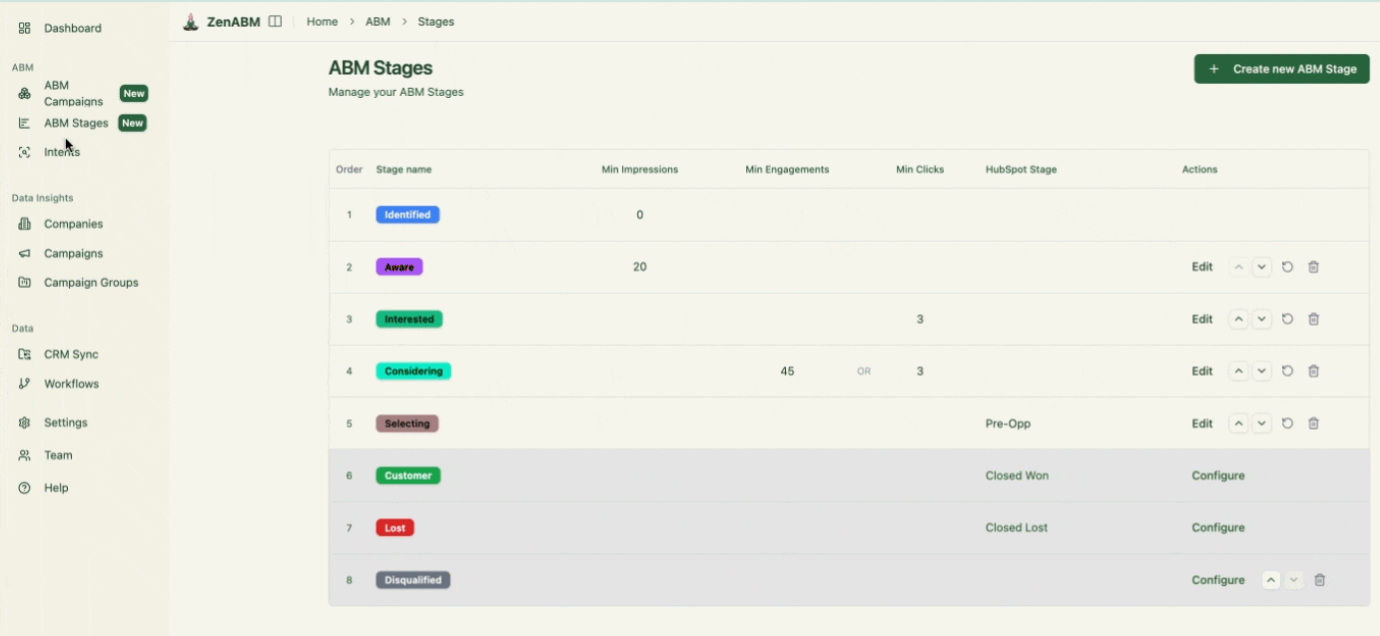

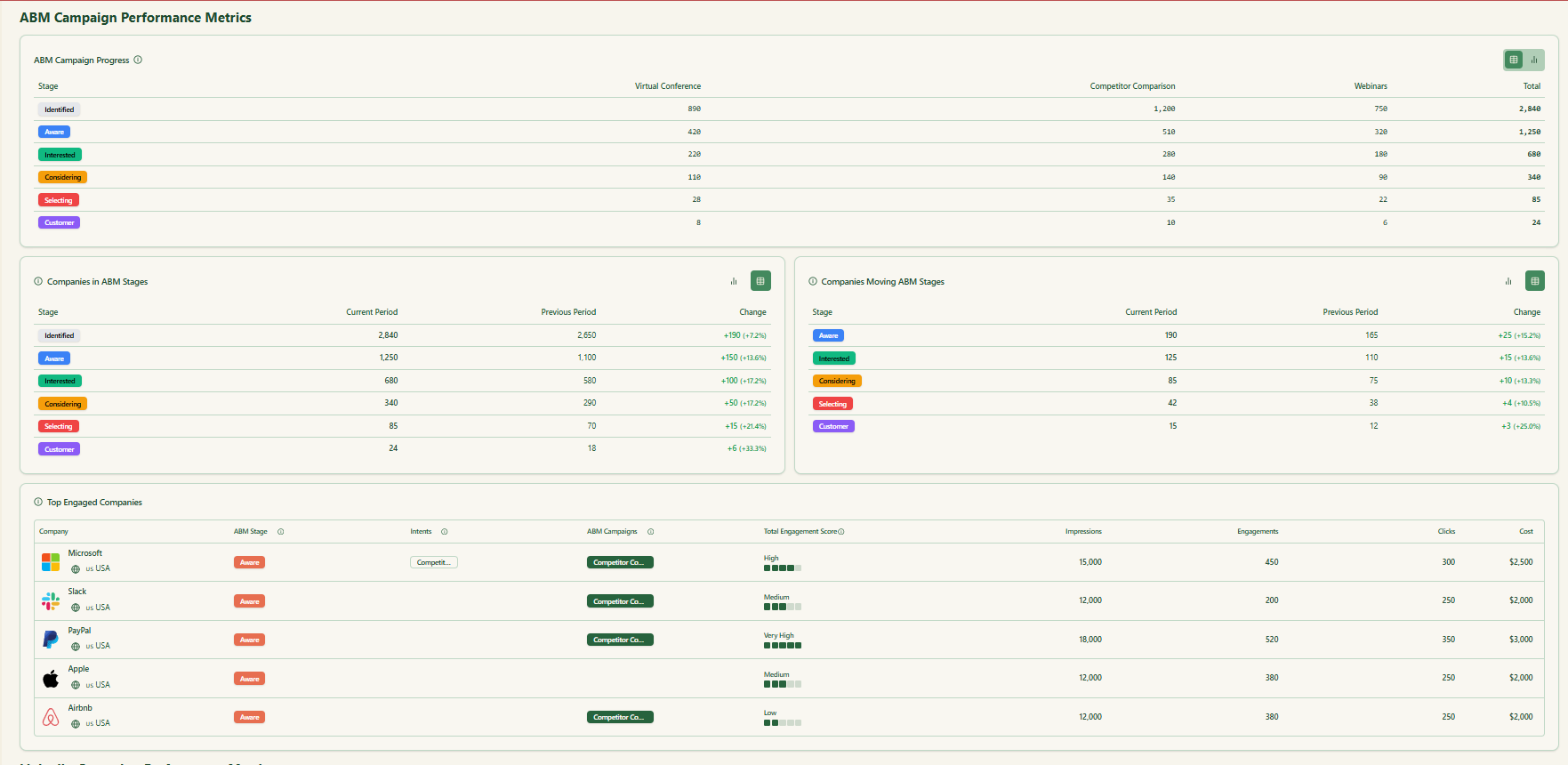

ABM Stage Tracking

ZenABM lets you define stages such as Identified, Aware, Engaged, Interested, and Opportunity and automatically places accounts in the right stage using scores and CRM data.

You control thresholds, and ZenABM tracks movement over time.

This gives you funnel visibility similar to larger suites, but powered by LinkedIn data.

CRM Integration and Workflows

ZenABM integrates bi-directionally with CRMs like HubSpot and adds Salesforce sync on higher tiers.

LinkedIn engagement data flows into the CRM as company-level properties:

Once an account crosses your score threshold, ZenABM updates the stage to Interested and automatically assigns a BDR.

Intent Tagging from Ad Engagement

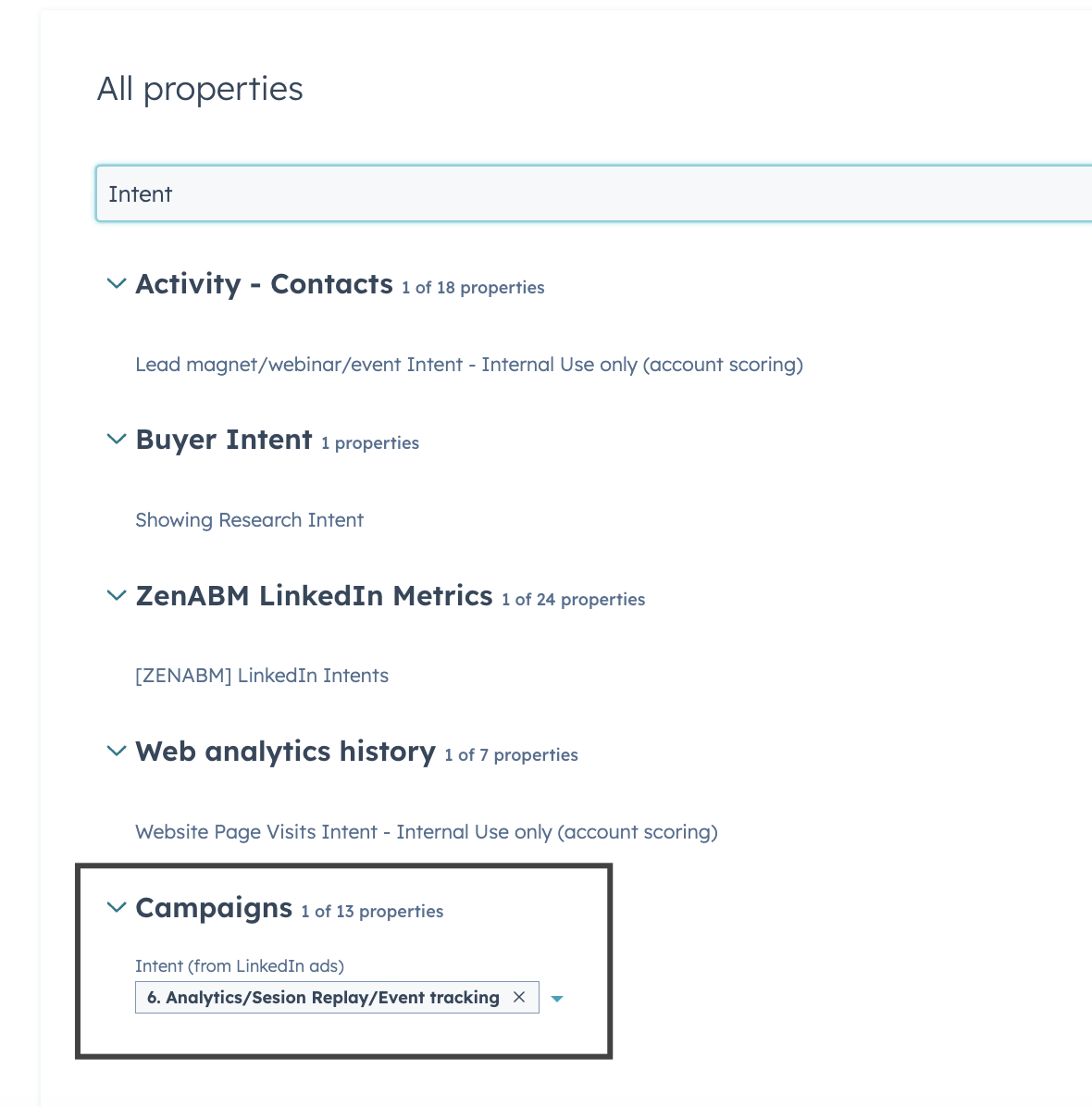

ZenABM lets you derive intent topics from LinkedIn campaigns by tagging campaigns by feature, use case, or offer.

ZenABM then shows which accounts engage with which themes.

This is clean, first-party intent from owned interactions.

You can push these topics into your CRM so sales and marketing can tailor outreach to what each company has actually explored.

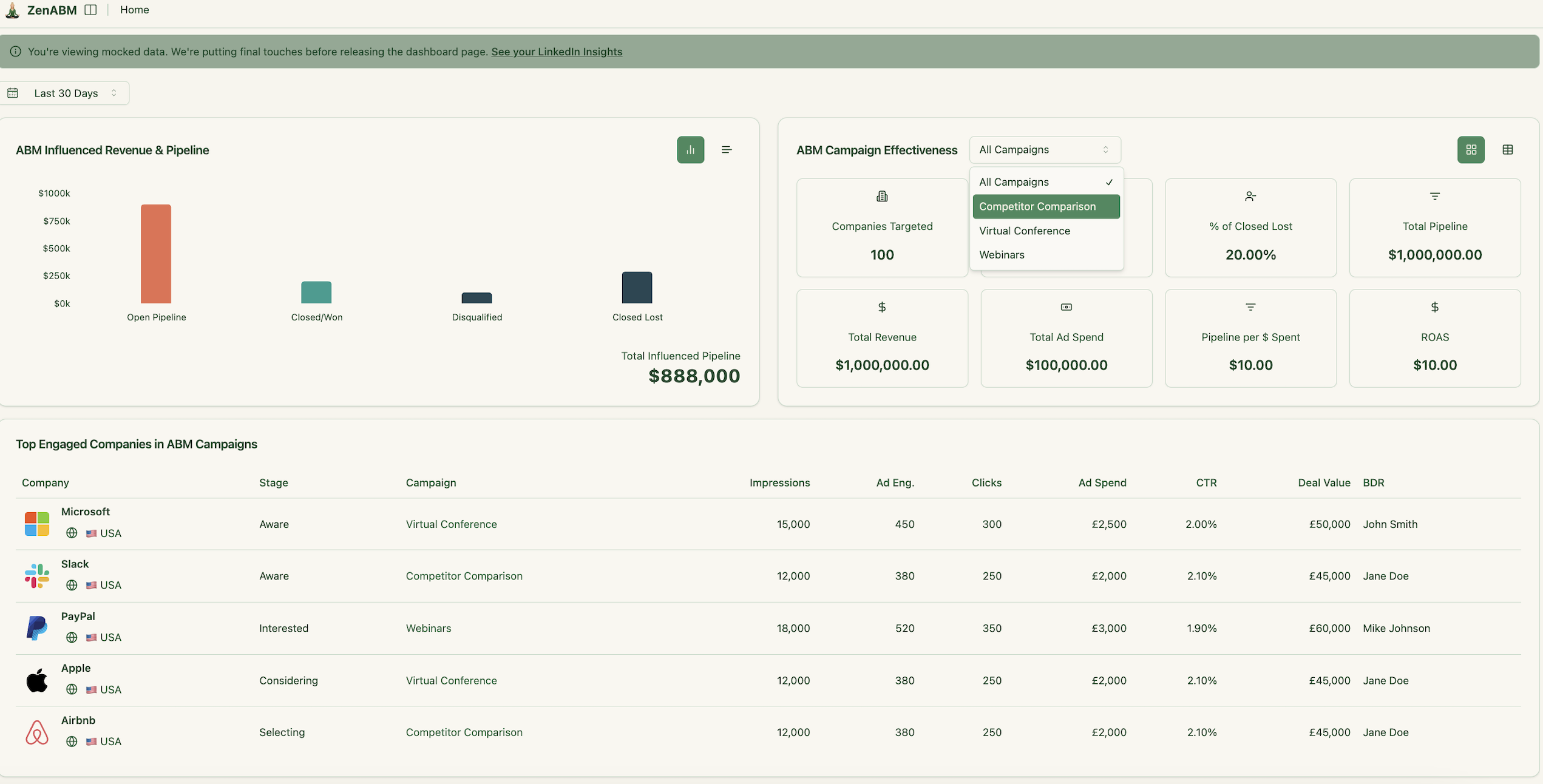

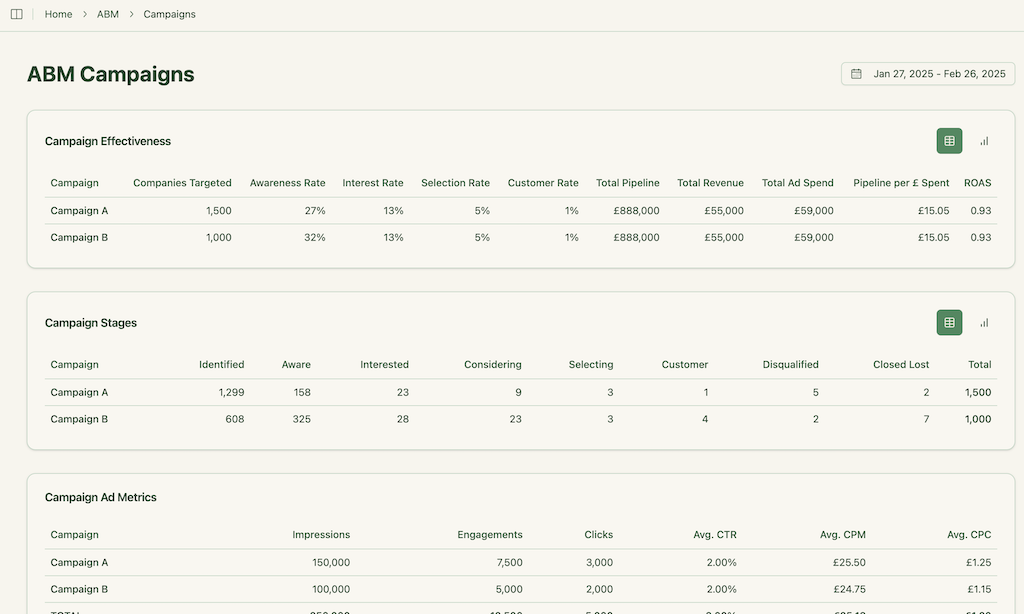

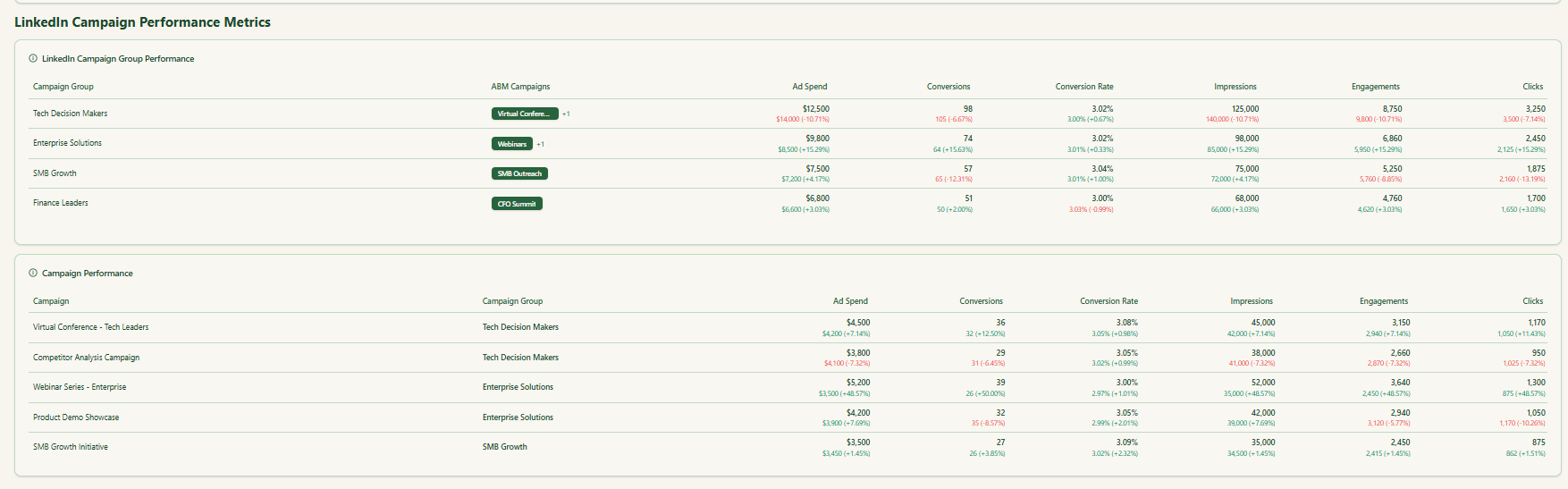

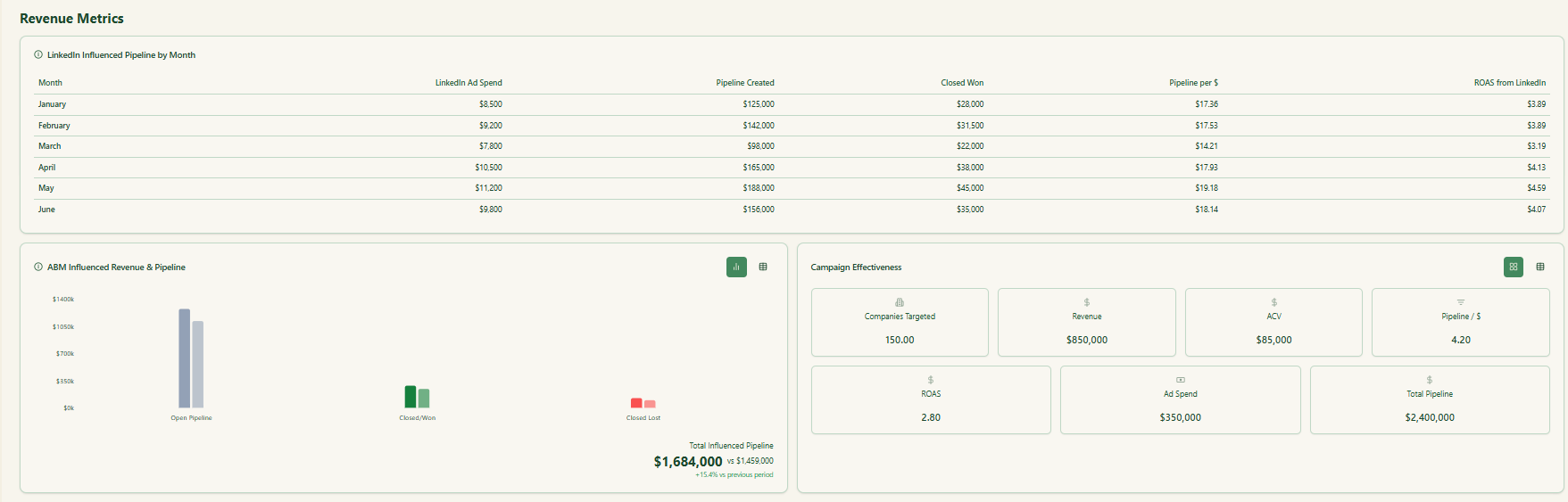

Built-in Dashboards and ABM Analytics

ZenABM ships with dashboards that connect LinkedIn ads to account engagement, stage movement, and revenue.

- You can monitor performance from high-level ABM campaigns down to LinkedIn campaign groups and individual ads:

- Because ZenABM stores deal value and ad spend per company and per campaign, it can calculate ROAS, pipeline per dollar, and other revenue metrics and show pipeline contribution.

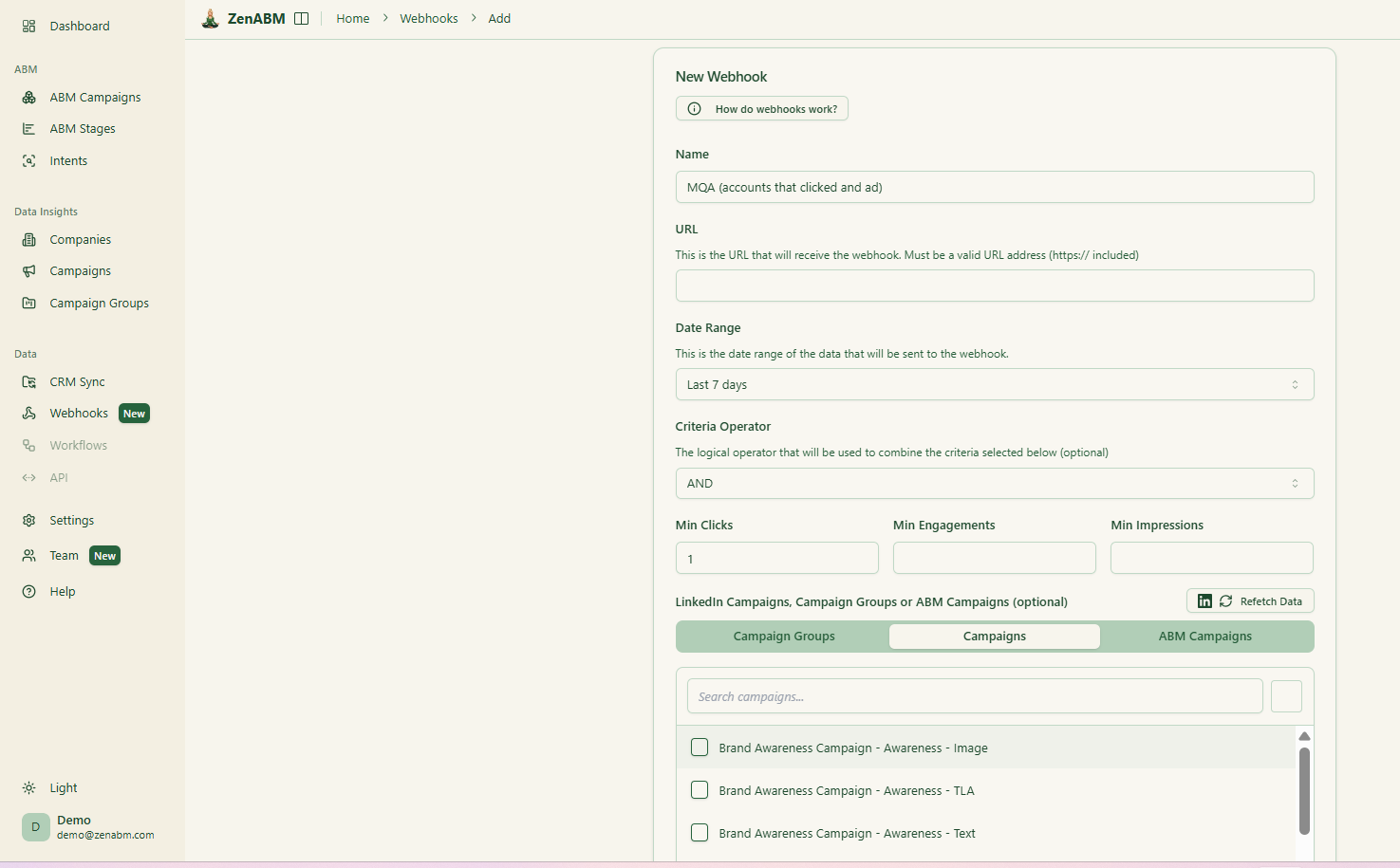

Custom Webhooks

ZenABM’s custom webhooks let you push events into your stack, for example, Slack alerts, enrichment flows, or other ops automations.

Job-Title Analytics

ZenABM shows which job titles engage with your creatives and gives dwell time and video funnel analytics.

ABM Campaign Objects for True Multi-Campaign Attribution

Most tools treat each LinkedIn campaign separately. ZenABM lets you group several into one ABM campaign object so you can see performance across regions, personas, or creative clusters.

Instead of juggling fragmented reports in Campaign Manager, you see spend, pipeline, account movement, and ROAS for the entire initiative.

AI Chatbot to Analyze Your LinkedIn and ABM Data

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model.

You can ask questions such as “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting?” and get answers based on live data.

Multi Client Workspace for Agencies

For agencies, ZenABM offers a multi-client workspace.

You can manage multiple ad accounts and clients in one environment, each with its own ABM strategy, dashboards, and reporting, instead of constantly switching accounts in Campaign Manager.

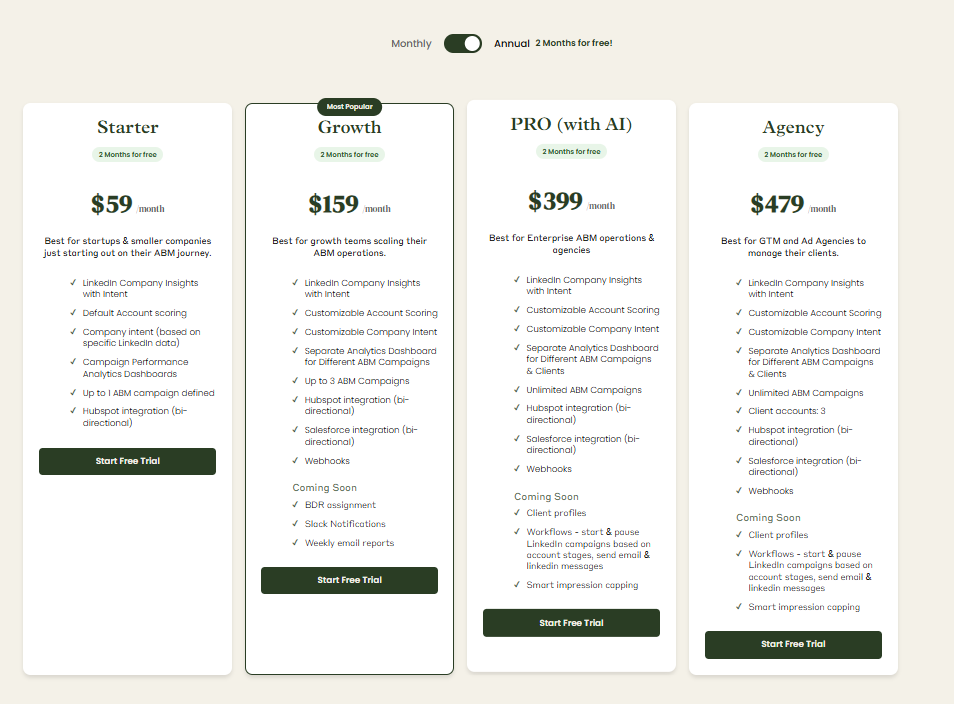

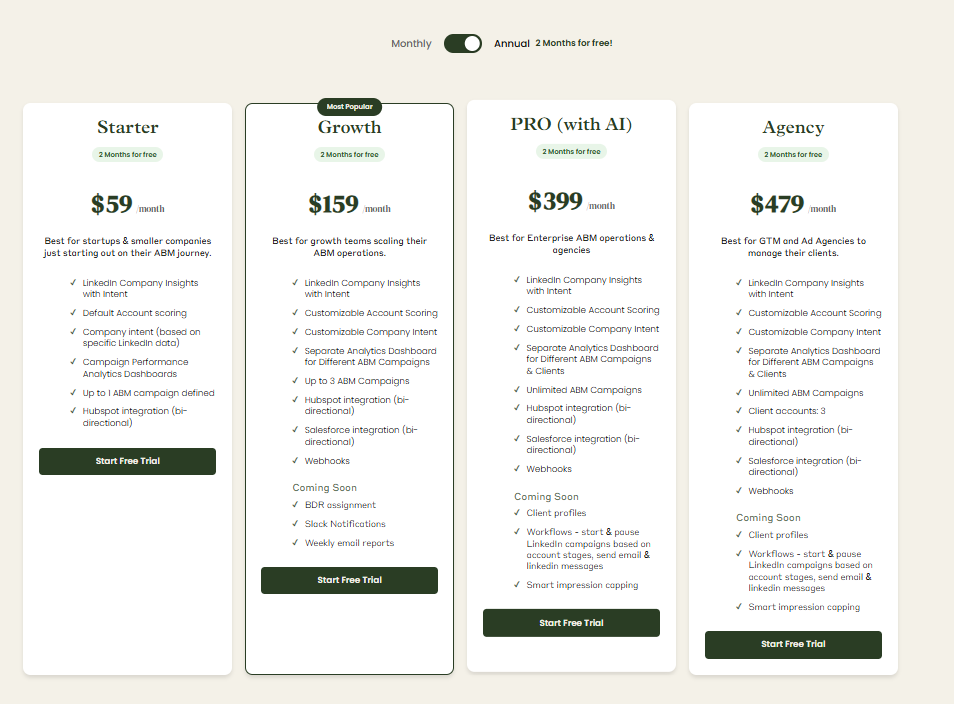

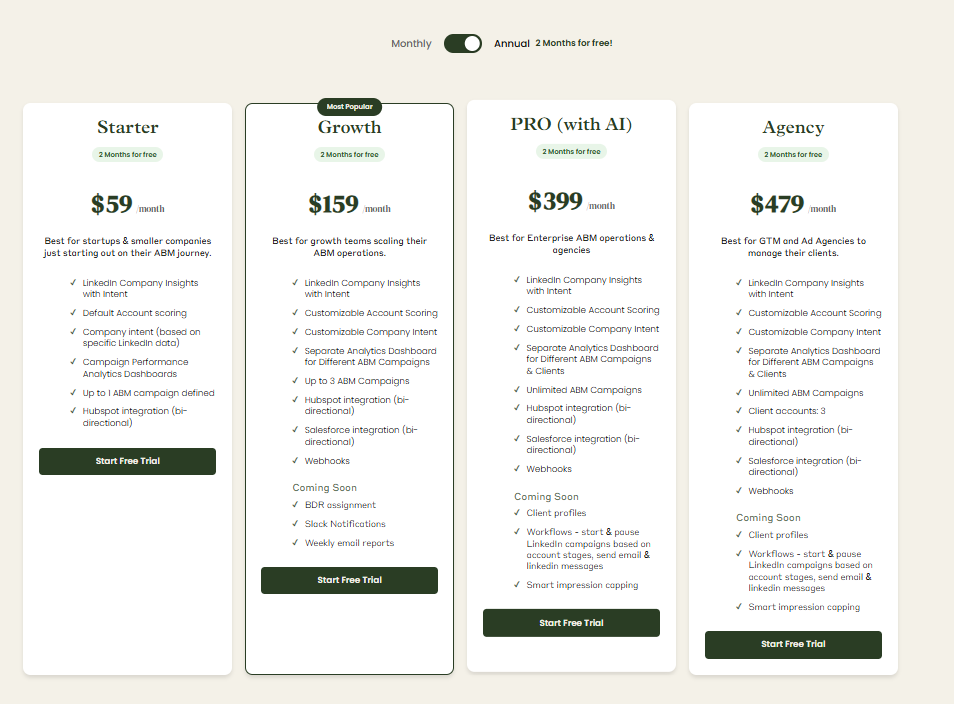

ZenABM Pricing

Plans start at $59 per month for Starter, $159 for Growth, $399 for Pro (with AI), and $479 for Agency.

The agency plan still stays under $6,000 per year.

All tiers include core LinkedIn ABM features. Higher tiers mostly increase limits and add Salesforce sync.

Plans are available monthly or annually, and every plan includes a 37-day free trial.

Conclusion

InsightSync makes the most sense if you want a single place to align marketing and sales around target accounts, engagement signals and competitor activity, and you are ready to pay for that combined CI plus ABM analytics stack.

LinkedScope is more attractive if your priority is proving and improving LinkedIn performance, with clearer visibility into which companies your ads reached and how that translated into pipeline and revenue.

For LinkedIn-heavy ABM teams that prioritise first-party intent, account scoring, ABM stages, CRM sync, and revenue dashboards without opaque pricing or long contracts, ZenABM offers a leaner path.

You can pair it with InsightSync or LinkedScope for broader coverage, or rely on it alone if LinkedIn is the backbone of your ABM program.

Try ZenABM now for free (37-day free trial) or book a demo to know more!