©2026 ZenABM - All Rights Reserved.

InsightSync is a competitive intelligence plus ABM analytics platform, while 6sense is a full-fledged enterprise ABM suite with predictive analytics being its most praised feature.

In this article, I have compared InsightSync vs. 6sense on features, pricing, reviews and best fit so you can pick what works for your account-based marketing setup.

I have also explained how ZenABM can be a lean, affordable alternative or a complementary layer to these enterprise ABM suites due to its unique features.

In case you’re short on time, here’s the gist:

InsightSync is a newer ABM and competitive intelligence platform that pulls target accounts, engagement and competitor research into one shared system.

The promise is simple: tighter GTM alignment without adding another media buying tool.

InsightSync combines three main modules in one ABM platform.

This is InsightSync’s main edge over ABM-only tools.

The Competitive Intelligence Hub tracks competitors and market moves in one place.

InsightSync aggregates competitor content from news sites, press releases and internal or external blogs into one feed so you are not juggling scattered alerts.

You can tag items by competitor or topic, react, share with colleagues and set alerts for chosen tags or keywords, such as when a rival announces a new funding round or acquisition.

The CI Hub stores structured profiles for each competitor, including logos, partners, alliances, pricing notes and positioning, so everyone works from the same reference.

InsightSync ingests PDFs, whitepapers and internal decks and lets you query or summarize them through AI search.

The ABM Hub revolves around three questions:

It becomes the home for your account-based marketing workflows.

You can import or build target account lists from your CRM or CSV files.

Each account becomes a record you enrich over time with firmographics such as industry, size and tech stack.

Once your TAL is set, InsightSync tracks engagement from ads, email and meetings in a single timeline.

You can weight actions so high intent steps like demo requests outrank casual newsletter opens and high scoring accounts bubble up as sales ready.

InsightSync flags accounts that heat up or cool down so teams double down where momentum grows and step in when important accounts go quiet.

Account level views also support shifting budget to active segments and adjusting messaging where engagement lags.

InsightSync is positioned to grow with ABM maturity and references automated outreach workflows, though public details are still limited.

Important context: InsightSync’s ABM Hub is channel agnostic and analytics-focused. It is not an ad network or full marketing automation tool like Demandbase or RollWorks. You still run campaigns in LinkedIn, HubSpot and other systems while InsightSync ingests data for reporting and attribution.

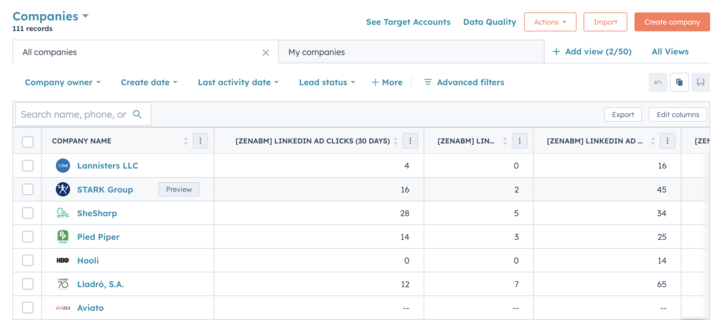

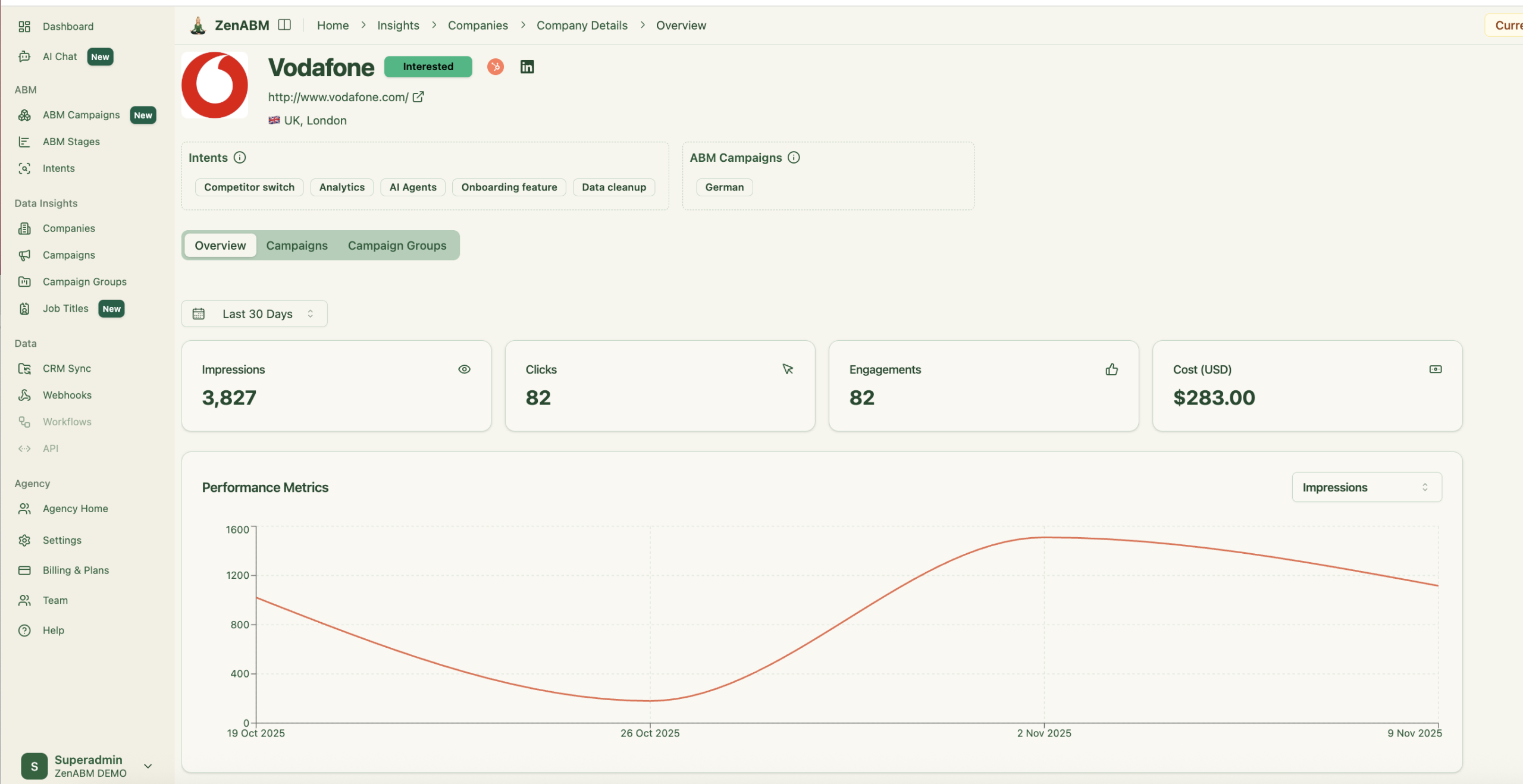

For LinkedIn-heavy teams, ZenABM connects directly to the LinkedIn Ads API.

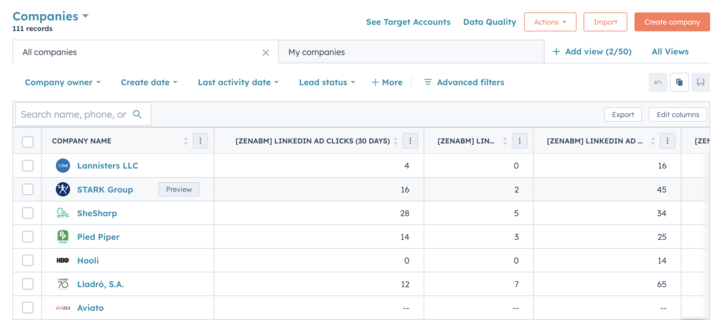

It pulls company-level impressions, clicks, engagement and spend, scores accounts, syncs this data into the CRM as company properties and routes hot accounts to BDRs automatically.

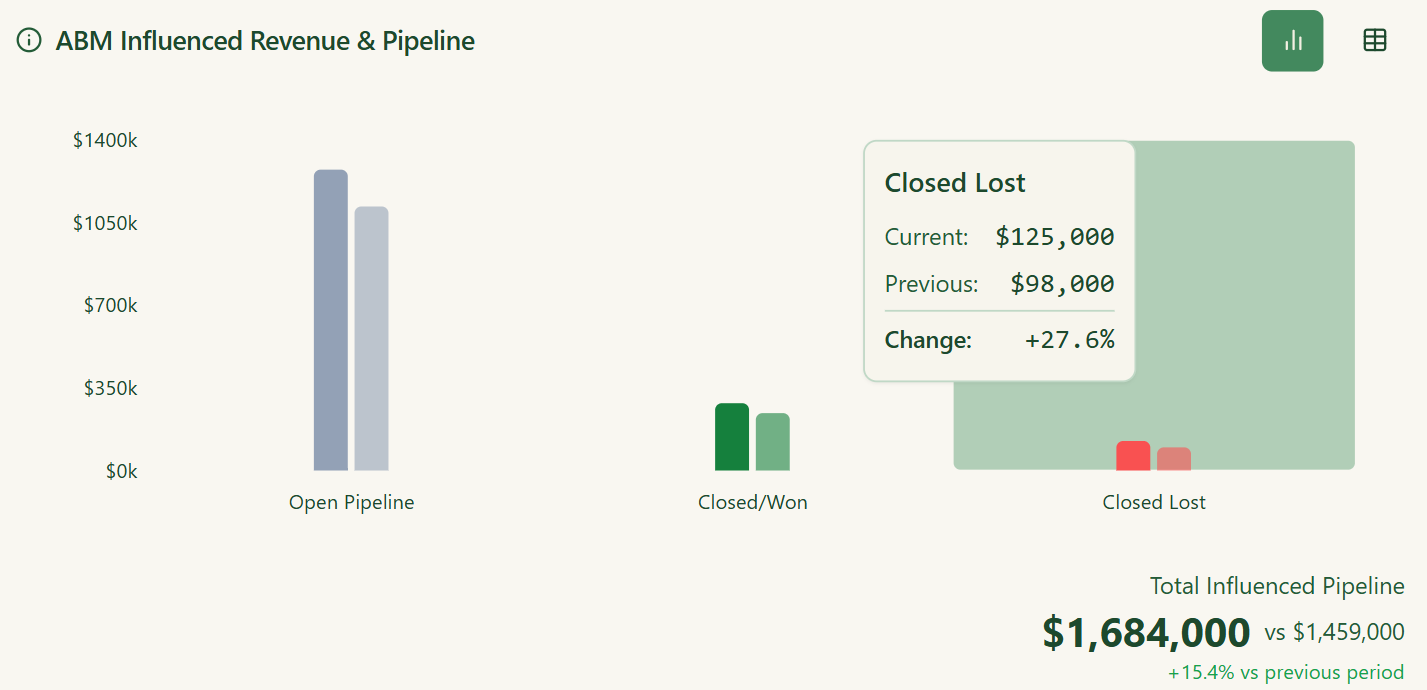

ZenABM then ties ad engaged accounts to CRM deals and provides revenue dashboards so you can measure LinkedIn ABM impact on pipeline and revenue.

InsightSync’s Engagement Hub consolidates account activity such as web visits, ad clicks, email opens and event attendance across contacts.

It surfaces trends like rising interest or sudden silence, so teams prioritize active accounts and re-engage those going quiet.

At the contact level, you can see who viewed pricing, who registered but skipped webinars and who stays engaged, helping sales refine outreach and marketers improve content.

These patterns help you map buyer roles and intent, estimate funnel stage and trigger timely follow-ups.

The Engagement Hub does not execute campaigns. Its role is to keep marketing and sales aligned on account engagement and behavior.

InsightSync targets teams that want a combined ABM and CI backbone and is priced in the premium band.

Here is the pricing as of late 2025:

InsightSync is cheaper than big ABM suites, but still a mid-market to upper mid-market spend. It works best when you treat it as a CI system, ABM analytics layer and light CRM adjunct combined.

Earlier stage or lean teams may find the roughly €8K per year entry point heavy.

By comparison, ZenABM starts at about $59 per month for its starter plan.

Public feedback on InsightSync is still light, but some themes show up:

6sense is an AI-driven B2B ABM platform known for revenue and sales intelligence strengths.

It enables revenue teams to answer “who is demonstrating intent” and “which accounts deserve attention right now” by combining large-scale data with machine learning.

The feature set is broad for marketing and sales teams and is designed for mid-market and enterprise organizations.

Here are the highlights:

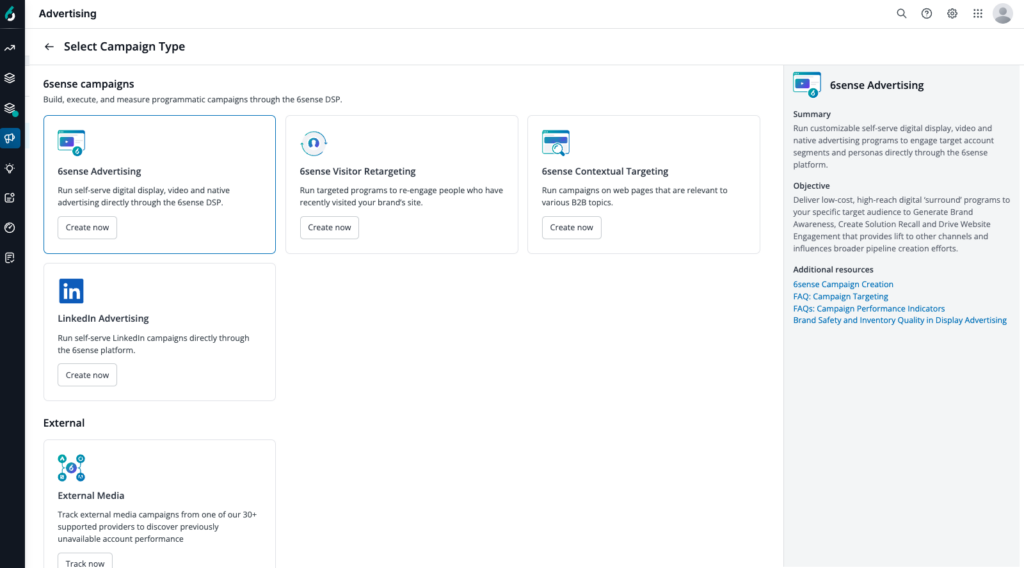

6sense includes a B2B DSP and integrations to run ads across display, video, CTV, LinkedIn, Facebook, Google Ads, and more.

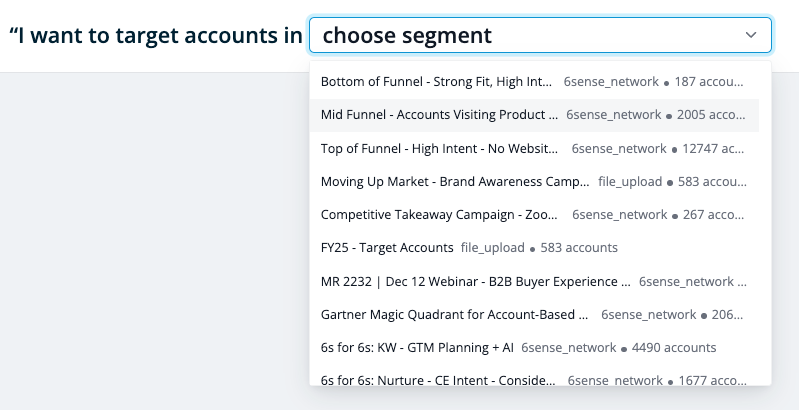

Teams can assemble dynamic audiences using firmographics, technographics, intent topics, CRM data, and similar inputs to sharpen targeting.

Its orchestration lets ads, email, and sales outreach coordinate based on real-time account behavior.

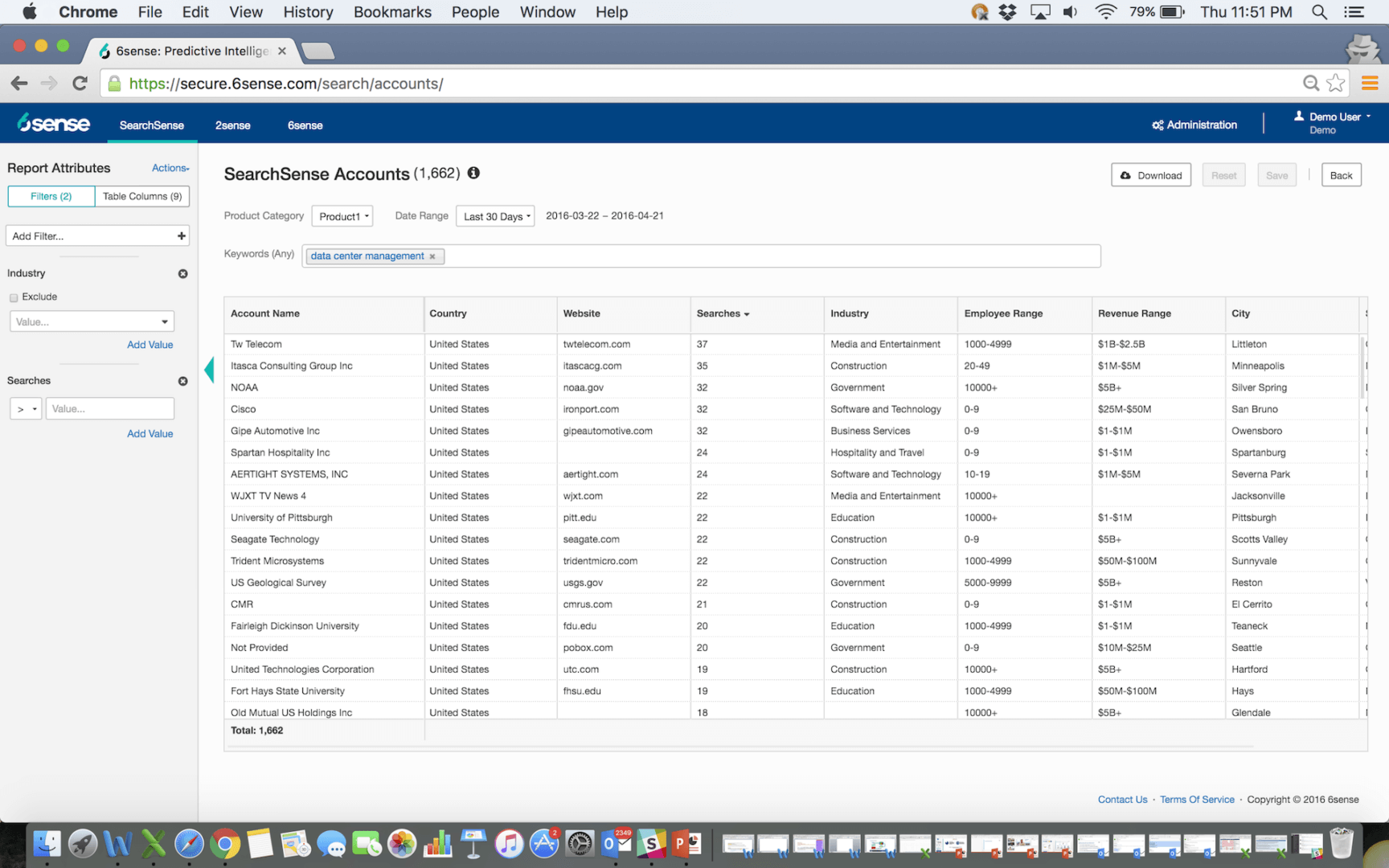

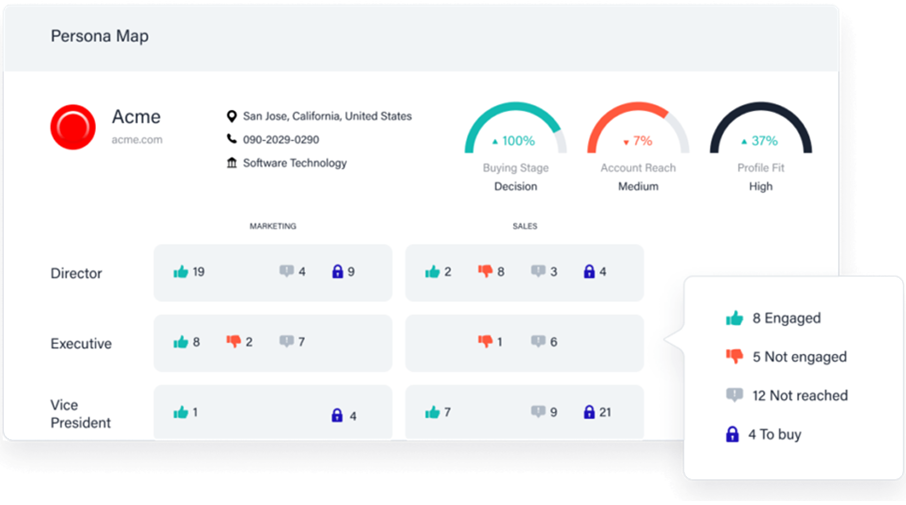

6sense’s signature capability is AI-powered intent and predictive scoring.

It blends first-party signals such as site visits, second-party review-site data, and third-party research patterns to produce a 0–100 score.

Those scores map to buying stages and likelihood to convert.

For example, 6sense’s predictive analytics can alert sales when an account surges on specific research themes or hits high-value pages, signaling possible in-market status.

This gives sales a proactive path to prioritize high-intent accounts.

Pro Tip: Favor first-party intent over third-party keyword spikes.

ZenABM captures qualitative intent by tracking which LinkedIn ads a company actually engages with, so signals are clearer and more actionable.

Teams like Userpilot have built ABM playbooks around this idea by tagging campaigns to pain points and increasing BOFU spend on the themes accounts interact with.

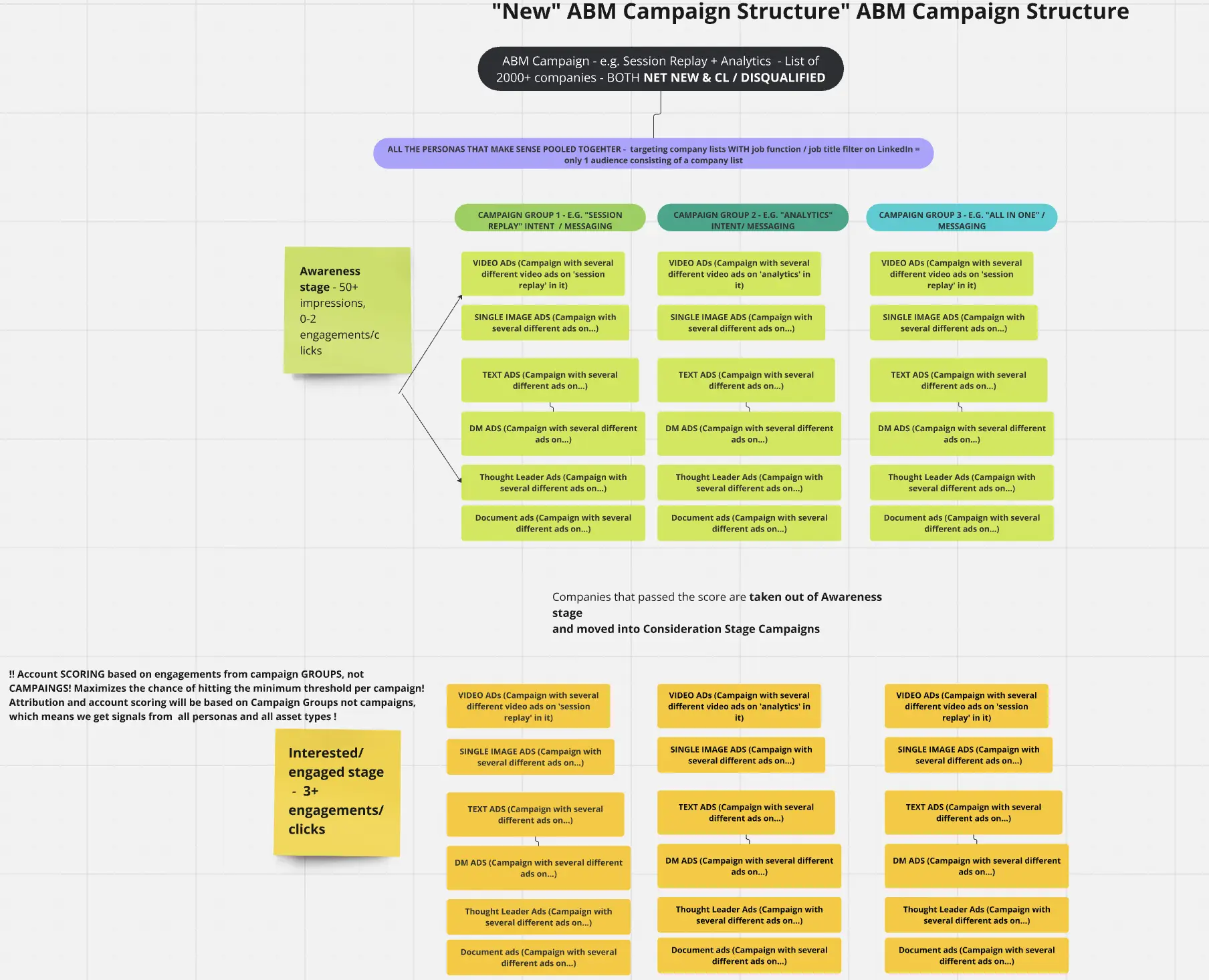

Their campaign blueprint:

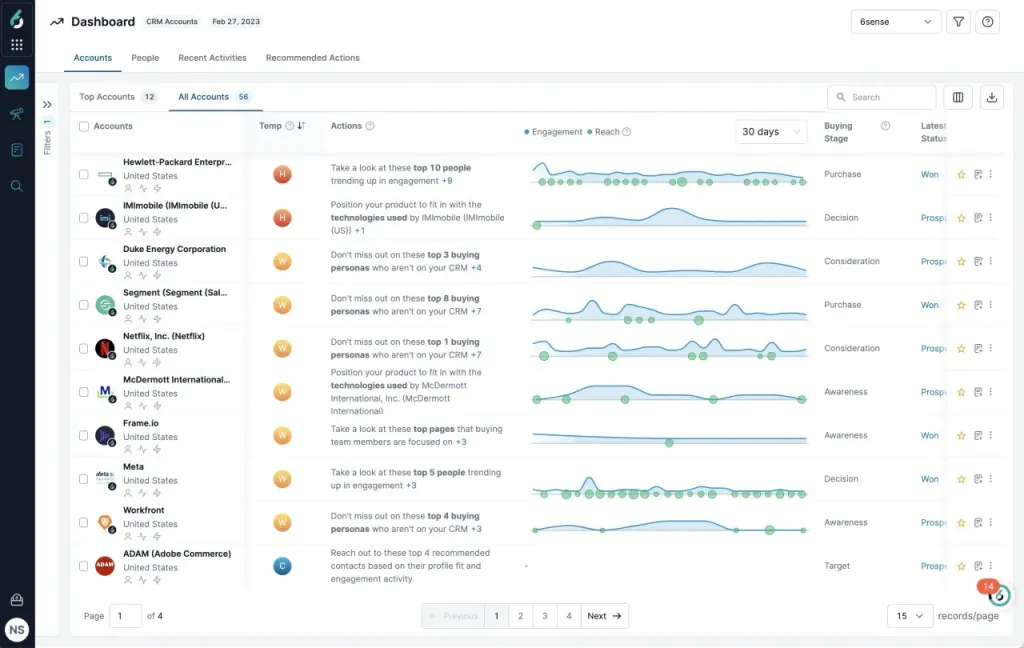

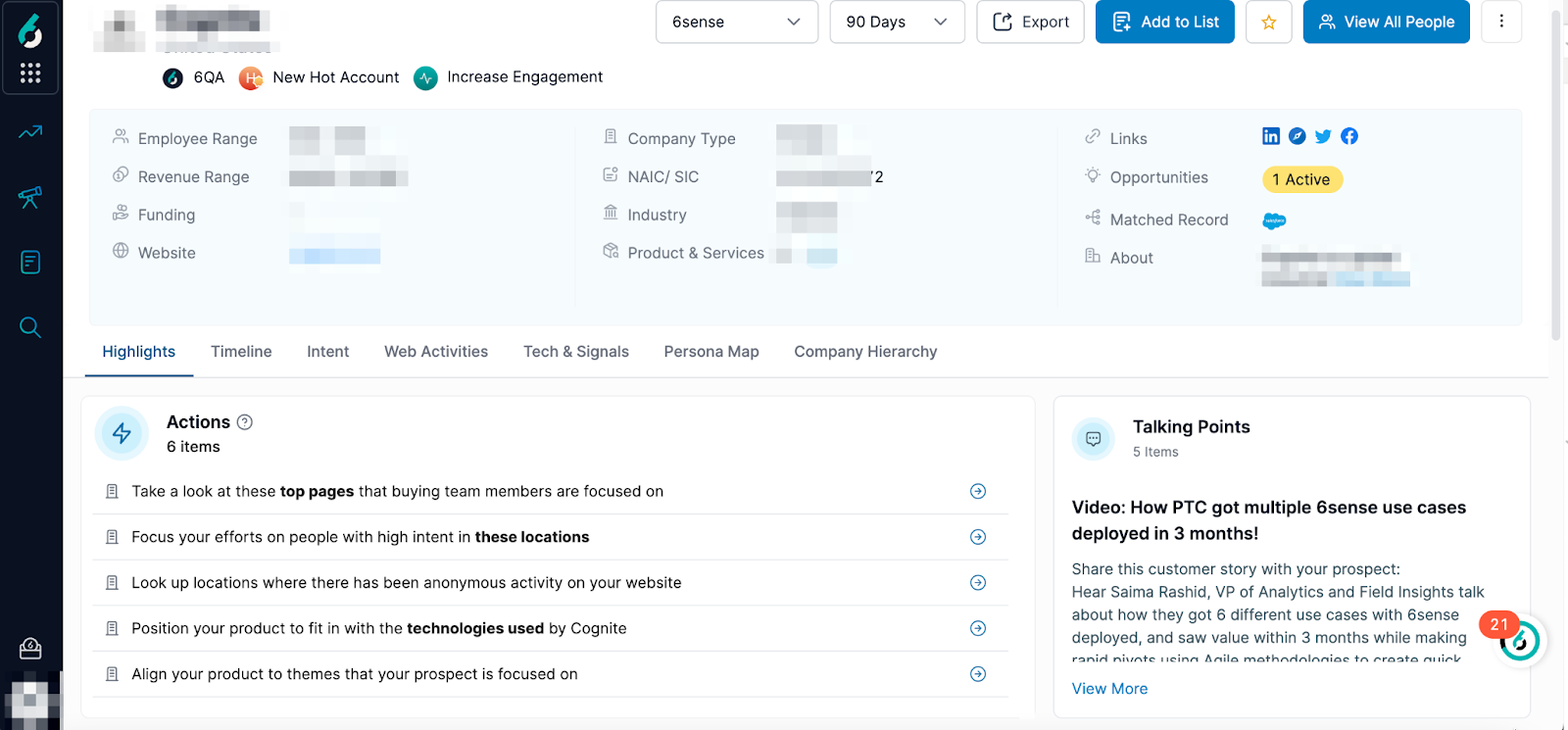

6sense compiles detailed account records with firmographics, technographics, key contacts, and behavioral context.

It often augments profiles with third-party enrichment for contact data. Some users note that international coverage can vary.

The sales intelligence features, including buying committee maps and next best actions, equip reps with useful context.

![]()

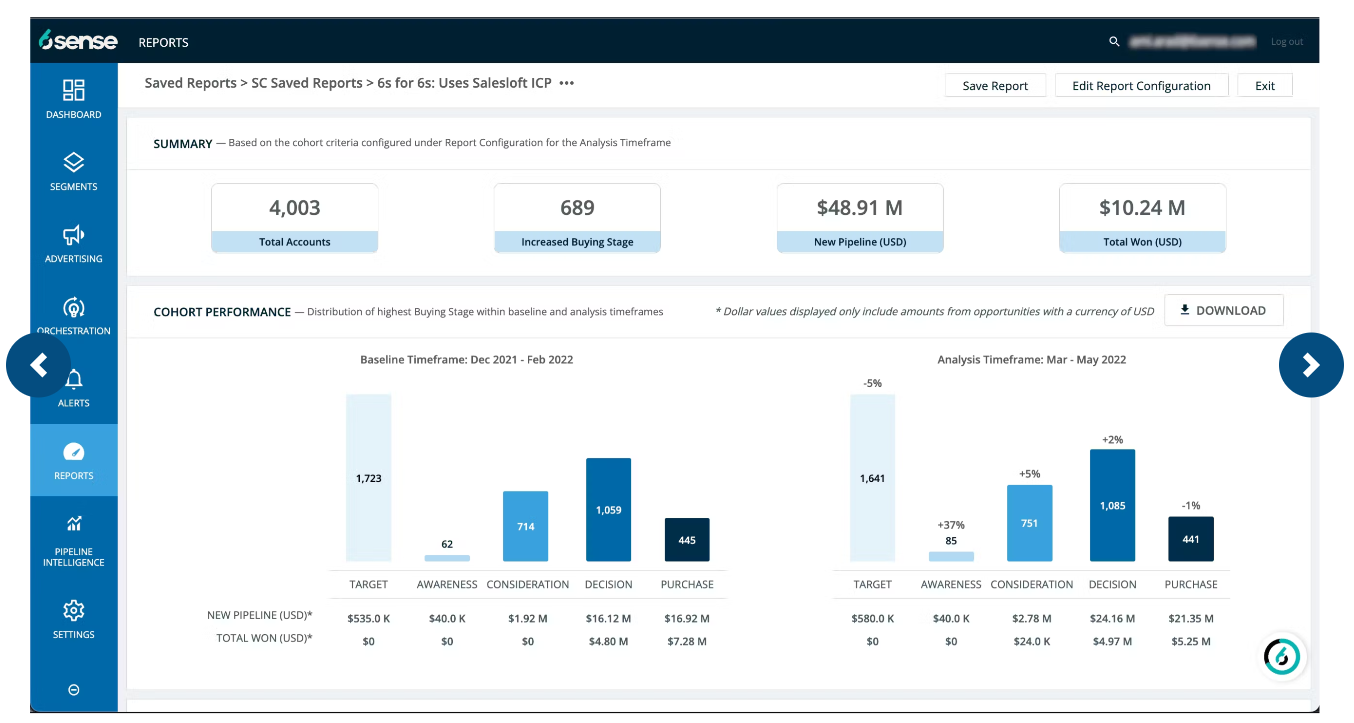

6sense offers extensive dashboards for both marketing and sales outcomes.

It supports multi-touch attribution that connects pipeline to programs, distinguishes influenced from sourced revenue, and can forecast the pipeline using AI.

You can monitor how accounts progress across buying stages and how engagement correlates with wins.

6sense also integrates with tools like Mutiny for web personalization and Drift for chat to extend experiences.

As an enterprise suite, 6sense connects with major CRM and marketing automation platforms such as Salesforce, HubSpot, and Marketo, plus sales engagement tools like Salesloft and Outreach, and enrichment vendors.

It aims to be the intelligence layer for your GTM stack, improving coordination between marketing and sales.

For instance, segments from 6sense can sync to LinkedIn Campaign Manager or trigger sales sequences.

This helps both teams operate from the same list of in-market accounts.

For details, see 6sense’s integrations page.

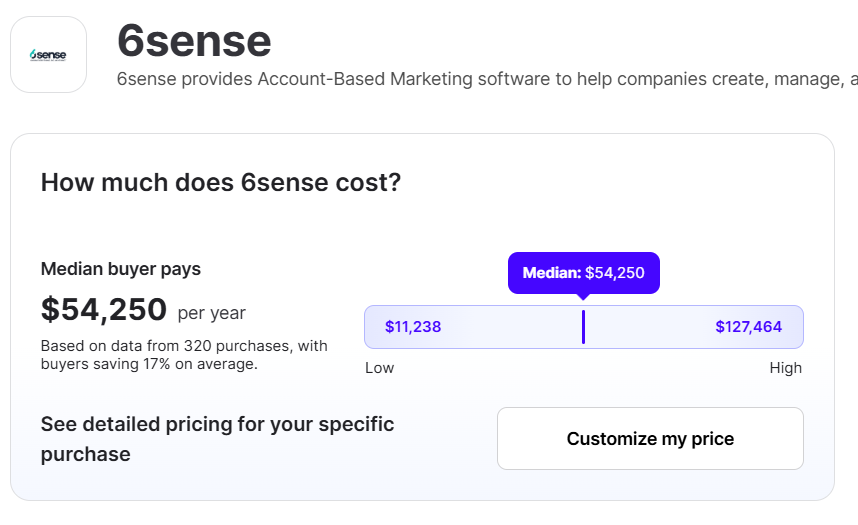

6sense is a premium platform with no public price card. You will need to engage sales for a tailored quote.

Contracts are typically annual or multi-year and may include services or media-related components depending on usage.

What should you budget?

While final numbers depend on scope, most buyers should expect mid-five figures to six figures per year for a complete rollout.

Vendr cites a median 6sense price of $54,250 per year.

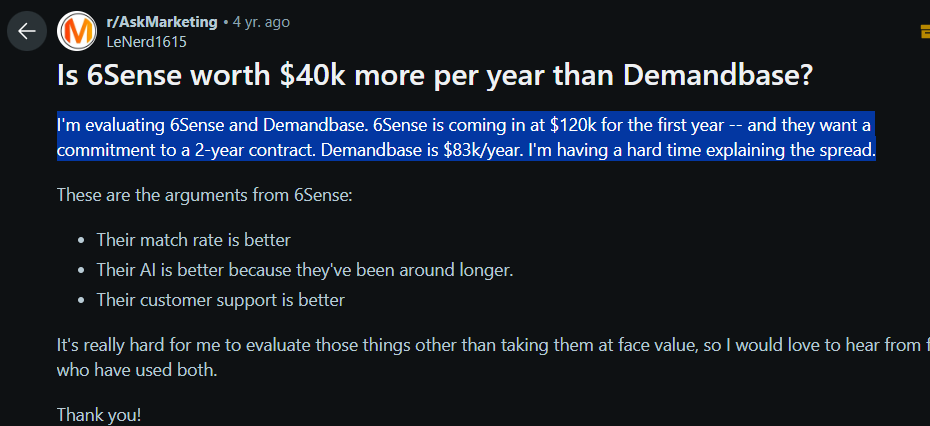

A user on Reddit shared a first-year quote of $120K from 6sense.

Given the investment and the ramp, 6sense fits organizations that will fully use its advanced features.

Smaller teams focused on one or two channels may find the cost and complexity tough to justify.

Users on review sites like G2, TrustRadius, and Capterra have praised 6sense for its accurate intent data, prediction insights, sales and marketing alignment, and improved lead prioritisation.

Cons expressed include a steep learning curve, performance lag, and high cost.

Here is a direct tabulated comparison of InsightSync and 6sense across their core features and positioning.

| Feature category | InsightSync | 6sense |

|---|---|---|

| Core positioning | Competitive intelligence plus ABM analytics platform for target accounts and competitors | Full-scale AI-driven ABM and revenue intelligence suite for marketing and sales teams |

| Primary focus | Give GTM teams a shared view of who to target, how they engage and what competitors are doing | Identify in market accounts, predict buying stages and orchestrate multi-channel engagement to drive pipeline |

| Main modules or features | Competitive Intelligence Hub, ABM Hub, Engagement Hub | B2B DSP and ad orchestration, predictive intent and scoring, account and contact intelligence, sales intelligence, analytics and attribution |

| Channels covered | Channel agnostic analytics that ingest data from LinkedIn, email, meetings, web and other GTM tools | Runs and orchestrates campaigns across display, video, CTV, search and social alongside email and sales engagement |

| Intent model | Account-level engagement from your own channels, plus competitor content and profiles | Blends first-party activity with third-party research and review site data into AI-powered predictive scores and buying stages |

| Execution capabilities | Does not buy media, focuses on analytics, scoring, alerts and CI to guide campaigns run elsewhere | Includes its own media buying and orchestration so you can plan, activate and optimize within the platform |

| CRM and MAP integrations | Native HubSpot integration and custom work for Salesforce, Dynamics, Zoho and Pipedrive | Deep integrations with Salesforce, HubSpot, Marketo and major sales engagement tools to sync segments, stages and activities |

| Analytics and attribution | Strong account-level engagement views and CI reporting to align GTM teams | Advanced multi-touch attribution, pipeline forecasting and stage progression analytics for marketing and sales |

| Pricing profile | Premium euro-priced platform starting around €699 per month, plus setup fees on some tiers | Custom enterprise pricing, often mid five figures to six figures per year, depending on scope and usage |

| Review footprint | Early website testimonials and practitioner origin story, limited third-party review coverage so far | Large presence on review sites and analyst reports, with a clear mix of strong outcomes and complaints around complexity and cost |

| Ideal team profile | B2B teams that want one CI plus ABM analytics backbone while keeping their existing media and automation stack | Mid-market and enterprise organizations that will fully adopt a heavy-duty ABM operating system and have the budget and resources to support it |

| Best use case | Aligning marketing and sales on which accounts to pursue, when to act and with what competitive context | Finding in market accounts at scale, prioritizing sales effort and orchestrating multi-channel ABM programs |

| Where ZenABM fits | Acts as a LinkedIn first companion when you need precise company-level ad engagement and first-party intent synced into the CRM | Acts as a lean LinkedIn ABM layer when you want account-level engagement, stages and attribution without the cost and complexity of a full suite |

InsightSync is the better fit if what you really need is shared context, not another media platform.

It centralizes target account lists, multi channel engagement and competitor intel so marketing and sales can finally operate from the same account view. If your main problems are alignment, clarity on which accounts matter and basic ABM analytics, InsightSync is the more focused and usually cheaper option, provided the roughly €8K plus per year price tag works for your stage.

6sense is the better fit if you want a full ABM operating system that runs across many channels and you are ready to commit serious budget and change management.

It gives you predictive intent, media buying, orchestration, deep revenue analytics and more, but with a steeper learning curve and contracts that often sit in the mid five figures or higher. It makes sense when you have a mature GTM engine, multiple channels to coordinate and a team that will actually use the breadth of features.

If you simply want to squeeze more pipeline out of LinkedIn and get reliable first party signals, both may be more than you need for the LinkedIn slice alone.

So, let me tell you about an alternative that makes more sense: ZenABM

There is also a third option: ZenABM.

ZenABM is designed for teams that rely on LinkedIn as the primary ABM channel and want first-party accuracy, automation and revenue visibility without multi-channel suite pricing or an overwhelming UX.

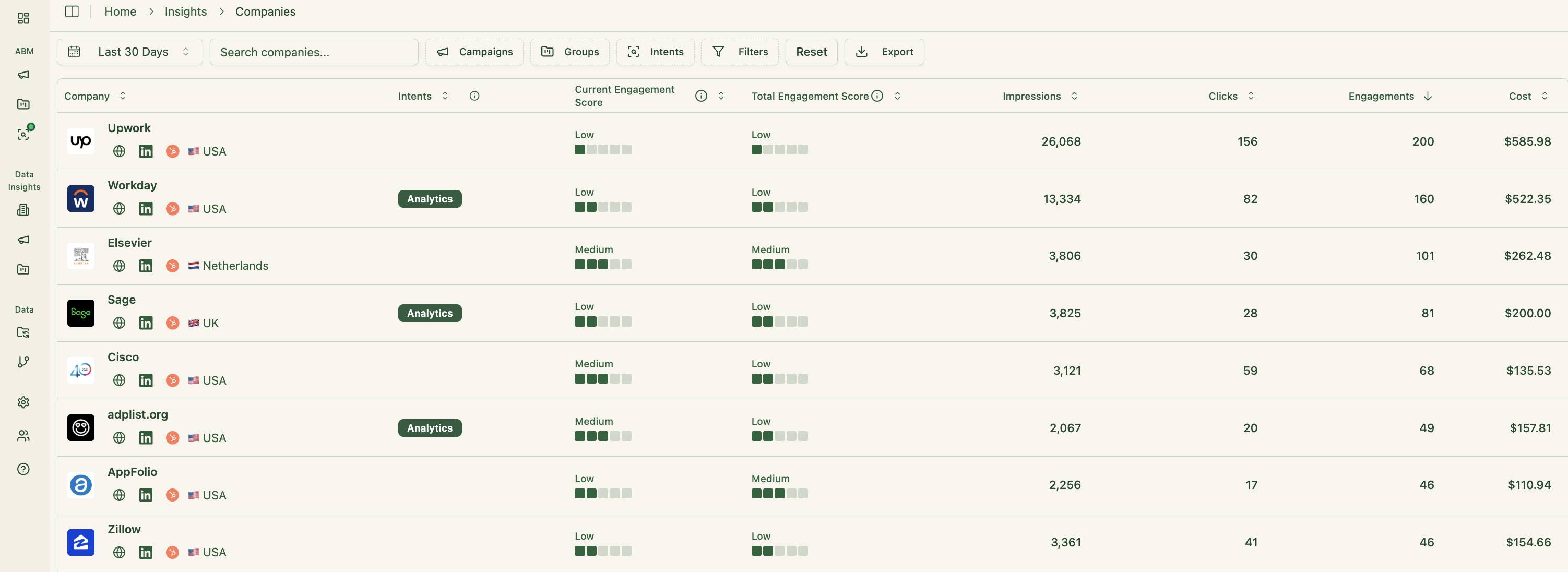

ZenABM connects to the official LinkedIn Ads API and captures account-level data across all campaigns so you can see which companies see, click and engage with your ads.

Because this is first-party data from LinkedIn, it is more reliable than IP or cookie-based visitor identification.

A Syft study puts IP-based identification at about 42 per cent accuracy.

ZenABM treats LinkedIn ad engagement as first-party intent. When several people in one company keep engaging, that is a strong buying signal without rented intent feeds.

ZenABM updates scores as accounts interact with your ads so you can see who is heating up and let marketing and sales prioritize accounts with real intent.

ZenABM also shows the full touchpoint timeline for each company:

ZenABM lets you define stages such as Identified, Aware, Engaged, Interested and Opportunity and automatically places accounts in the right stage using scores and CRM data.

You set thresholds, and ZenABM tracks movement over time.

This gives you funnel visibility similar to larger suites, powered mainly by LinkedIn data.

ZenABM integrates bi-directionally with HubSpot and adds Salesforce sync on higher tiers.

LinkedIn engagement data flows into the CRM as company properties:

Once an account crosses your score threshold, ZenABM updates the stage to Interested and assigns a BDR.

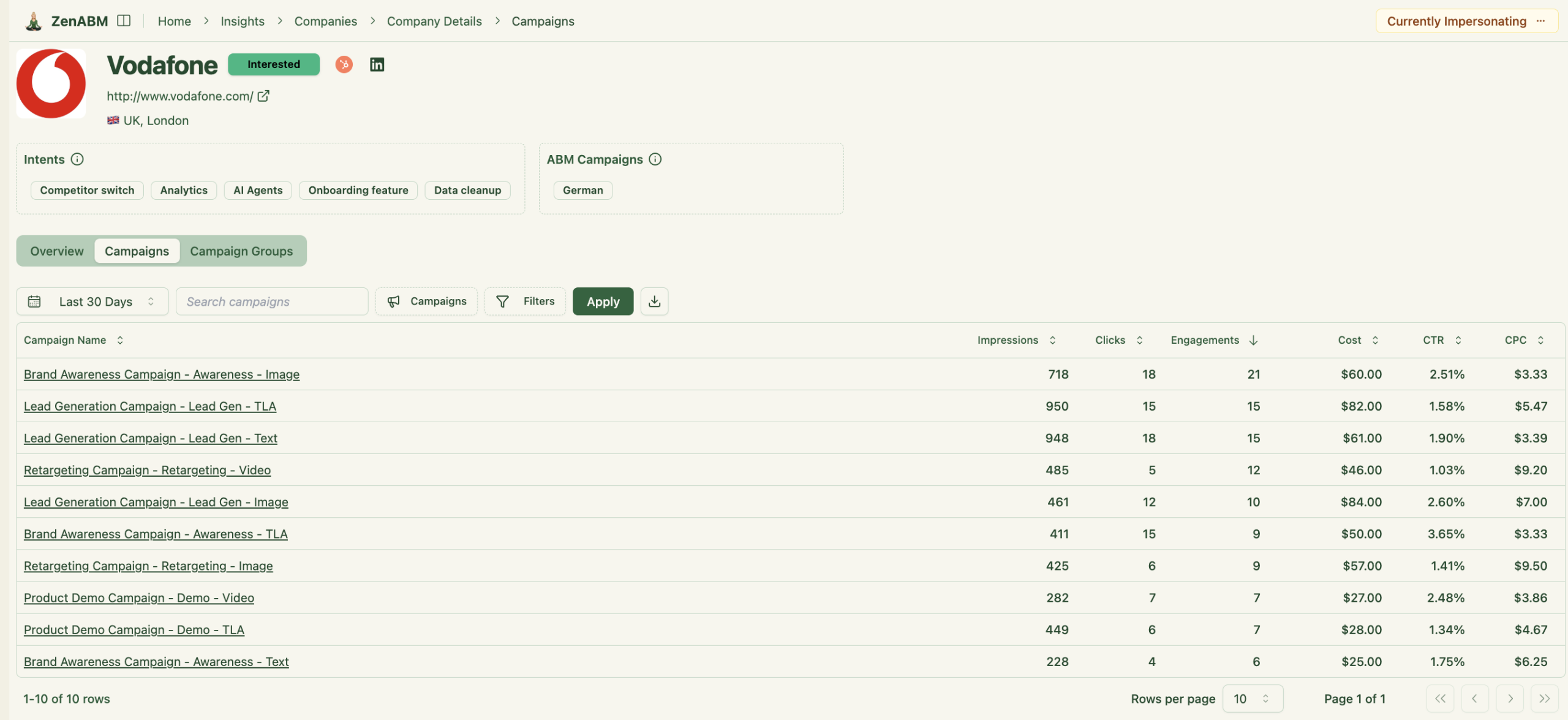

ZenABM lets you derive intent topics from LinkedIn campaigns by tagging campaigns by feature, use case or offer.

ZenABM then shows which accounts respond to which themes.

This is clean first-party intent from owned interactions.

You can push these topics into your CRM so sales and marketing can tailor outreach to what each company has explored.

ZenABM ships with dashboards that connect LinkedIn ads to account engagement, stage movement and revenue.

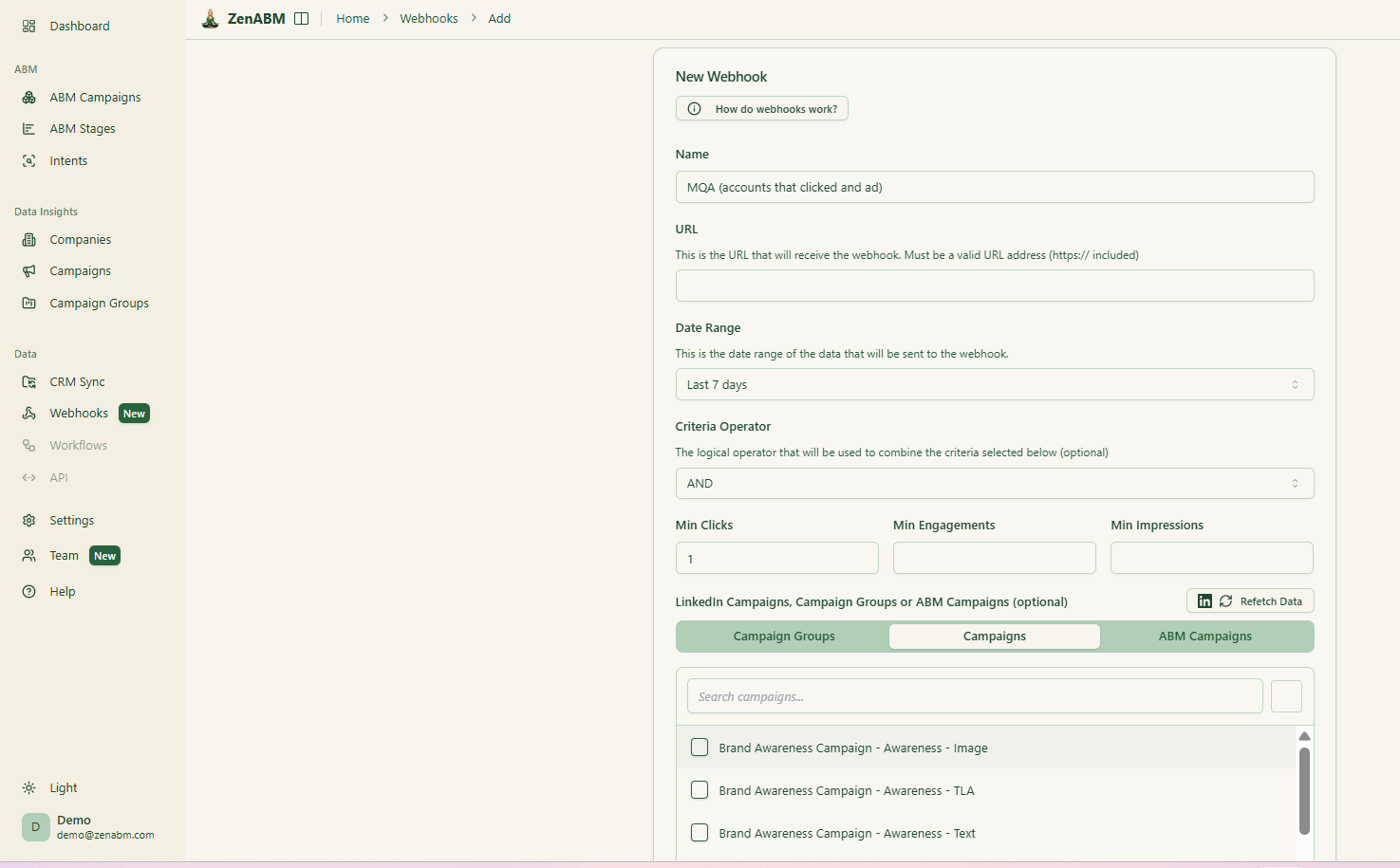

ZenABM’s webhooks let you push events into your stack, such as Slack alerts, enrichment flows or other automations.

ZenABM shows which job titles engage with your creatives and gives dwell time and video funnel analytics.

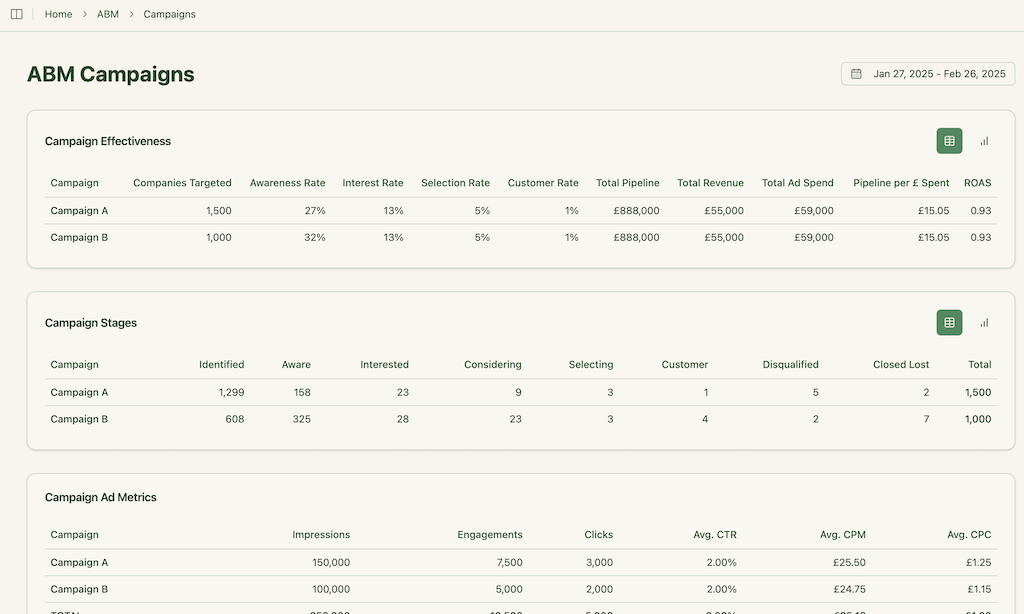

Most tools treat each LinkedIn campaign separately. ZenABM lets you group several into one ABM campaign object so you can see performance across regions, personas or creative clusters.

Instead of juggling fragmented reports in Campaign Manager, you see spend, pipeline, account movement and ROAS for the full initiative.

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model.

You can ask questions such as “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting?” and get answers based on live data.

For agencies, ZenABM offers a multi-client workspace.

You can manage multiple ad accounts and clients in one environment, each with its own ABM strategy, dashboards and reporting instead of switching accounts in Campaign Manager.

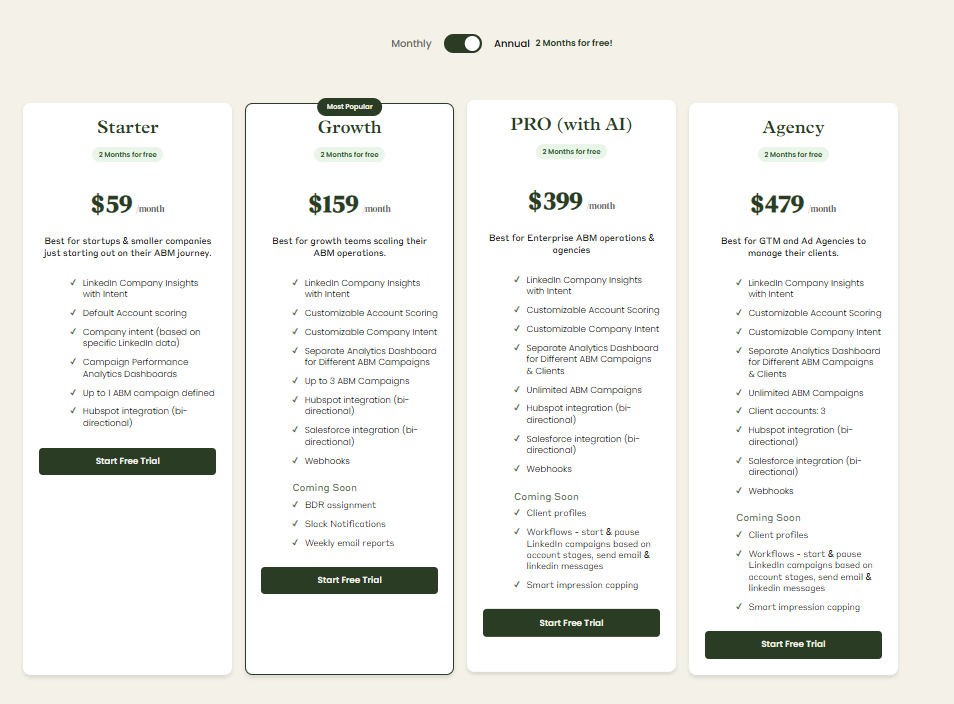

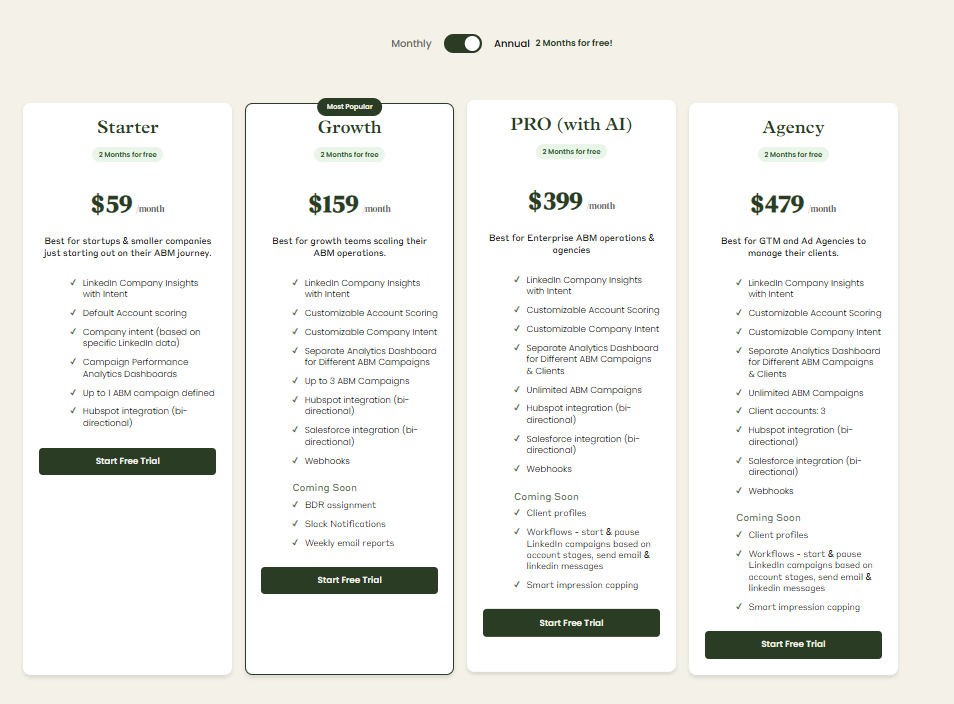

Plans start at $59 per month for Starter, $159 for Growth, $399 for Pro (with AI) and $479 for Agency.

The agency plan stays under $6,000 per year.

That’s far less than 6sense or InsightSync.

All tiers include core LinkedIn ABM features. Higher tiers mainly raise limits and add Salesforce sync.

Plans are offered monthly or annually, and each plan includes a 37-day free trial.

InsightSync makes sense if your priority is a shared, strategic view of accounts and competitors that keeps marketing and sales aligned while you keep running campaigns in tools like LinkedIn, HubSpot and your MAP.

6sense is compelling if you want an enterprise-grade ABM engine that finds in-market accounts, scores them with AI and orchestrates advertising and outreach across many channels, and you are prepared for higher prices and a heavier rollout.

For LinkedIn-heavy ABM teams that care more about first-party accuracy, account scoring, ABM stages, CRM sync and revenue attribution than about owning a massive ABM suite, ZenABM offers a leaner path.

You get company-level LinkedIn engagement, plug-and-play dashboards, clear intent signals and automated BDR routing starting at $59 per month.

You can even pair ZenABM with InsightSync or 6sense for added context, or else run it alone when LinkedIn is the core engine of your ABM strategy.

Try ZenABM now for free (37-day free trial) or book a demo to know more.