In this guide, I have compared Dreamdata vs. Terminus on features, pricing and ABM fit so your marketing and sales teams can quickly see which platform aligns with their ABM motion.

I have also discussed how ZenABM can work as a lean LinkedIn-first alternative or serve as a complementary layer due to its unique features.

In case you want a quick comparison:

| Category | Dreamdata | Terminus |

|---|---|---|

| Platform Type | B2B attribution and revenue analytics platform | Enterprise ABM orchestration platform |

| Primary Focus | Multi-touch attribution and revenue reporting | Multi-channel ABM execution and engagement |

| Main Strength | Clear attribution across long B2B journeys | End-to-end ABM execution at scale |

| ABM Capabilities | Account journeys and influence tracking | Native ABM workflows, targeting and orchestration |

| Ad Channels | Uses ad data, does not run ads | Display, LinkedIn, CTV, audio |

| Intent Signals | Engagement-based and inferred | Third-

party intent plus engagement |

| Attribution | Advanced multi-touch attribution models | Account-based multi-touch attribution |

| CRM Integrations | Salesforce, HubSpot, Dynamics | Salesforce, HubSpot, Marketo, Eloqua |

| Best For | Revenue teams focused on attribution clarity | Large ABM teams running multi-channel programs |

| Pricing | Starts around $750 per month | Custom enterprise pricing |

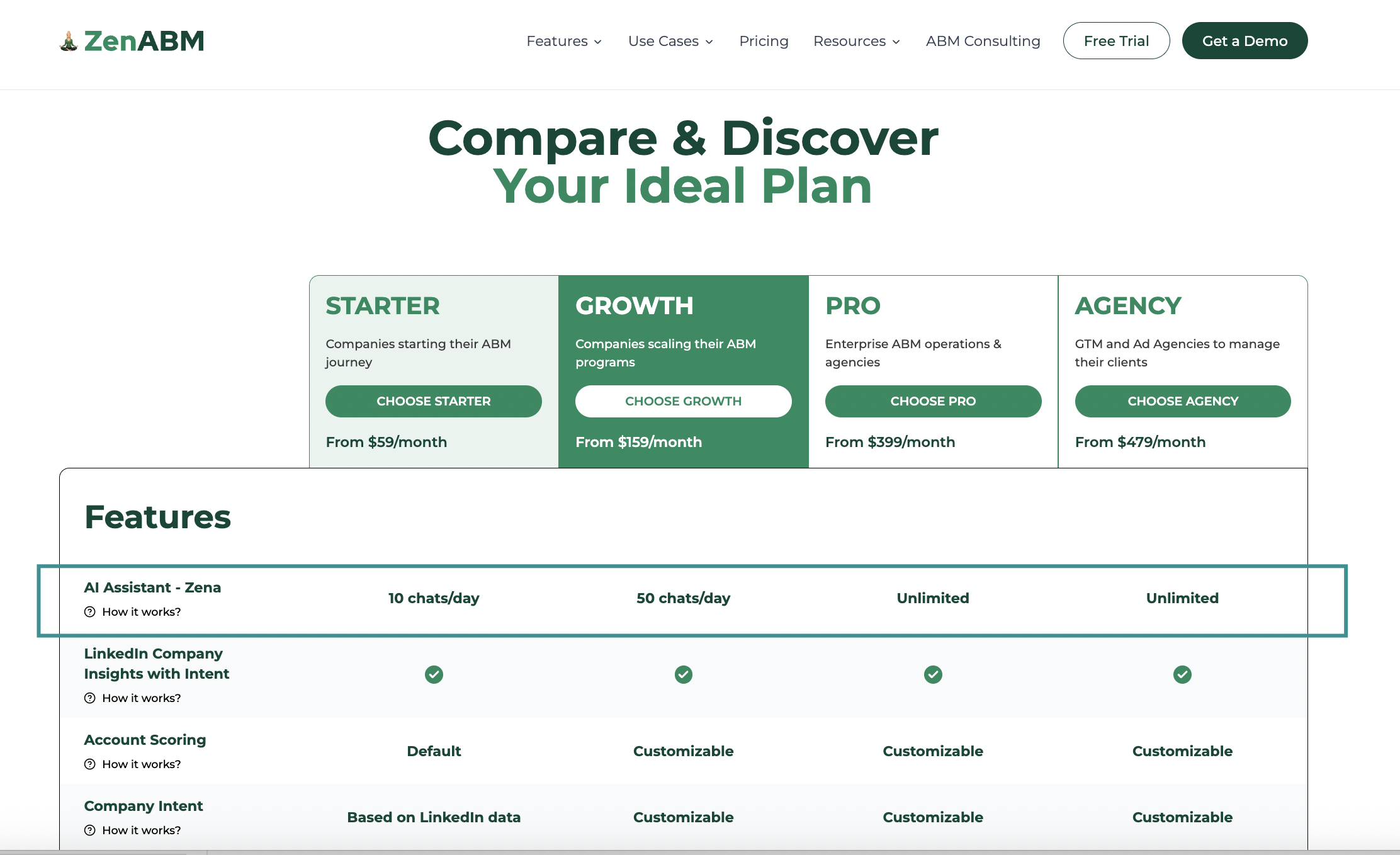

A third option: ZenABM gives account-level LinkedIn ad engagement, pipeline dashboards, account scoring, ABM stages, CRM sync, first-party qualitative intent, automated BDR assignment, custom webhooks, an AI chatbot Zena that gives deep LinkedIn ABM analytics in natural language, and job title analytics starting at $59 per month.

Dreamdata bills itself as a B2B “Activation and Attribution Platform” that maps buyer touchpoints and ties them to revenue.

Dreamdata aims to be a central place to connect marketing spend to revenue.

Dreamdata provides several attribution models, such as first touch, last touch, W-shaped, time decay, and data-driven options. It aggregates CRM, website, and ad data into a single timeline so you can see how content and campaigns contributed to a deal, not just the last click.

Dreamdata rolls data into revenue analytics dashboards, showing pipeline and ROI by channel, campaign, and content. You can track metrics like Time to Revenue and pipeline velocity by stage. Some users on G2 note that not all pre-built reports are useful, and the learning curve is real.

By the way, ZenABM also provides account-based LinkedIn ad revenue attribution dashboards starting at $59/month.

Dreamdata automatically organizes contact-level touchpoints into account journeys so you see how buying committees move from first touch to close. Its ABM view helps marketing show influence on deals and track account-level engagement.

The “Reveal” module identifies which companies are engaging most, scores their activity, and flags high fit visitors.

ZenABM also provides journey visualizations showing the impact of LinkedIn ads on a deal progression.

Dreamdata lets you build audiences using filters across all your data and sync them to ad platforms. For example, you can create a segment of accounts that visited your pricing page twice and retarget them on LinkedIn.

It also supports one-click conversion syncing, so events like SQLs or closed deals flow back into ad platforms for revenue-based optimization.

Dreamdata has 40+ integrations across CRMs, marketing automation, ads, analytics, and more.

Big ones:

ZenABM also has integrations covered:

Dreamdata pricing isn’t clear on the site.

Here is what is publicly available:

If you are looking for a leaner tool, ZenABM starts at $59/month. It offers account-level LinkedIn ad engagement tracking, plug-and-play dashboards, account scoring, ABM stage tracking, CRM sync, first-party qualitative intent, automated BDR assignment, custom webhooks, and job title-level engagement tracking.

Dreamdata reviews cluster around three themes:

Terminus is widely described as an end-to-end ABM platform.

It is popular with B2B marketers who want a unified ABM “Engagement Hub” that spans ads, web activity and sales touchpoints.

Here are the key pieces.

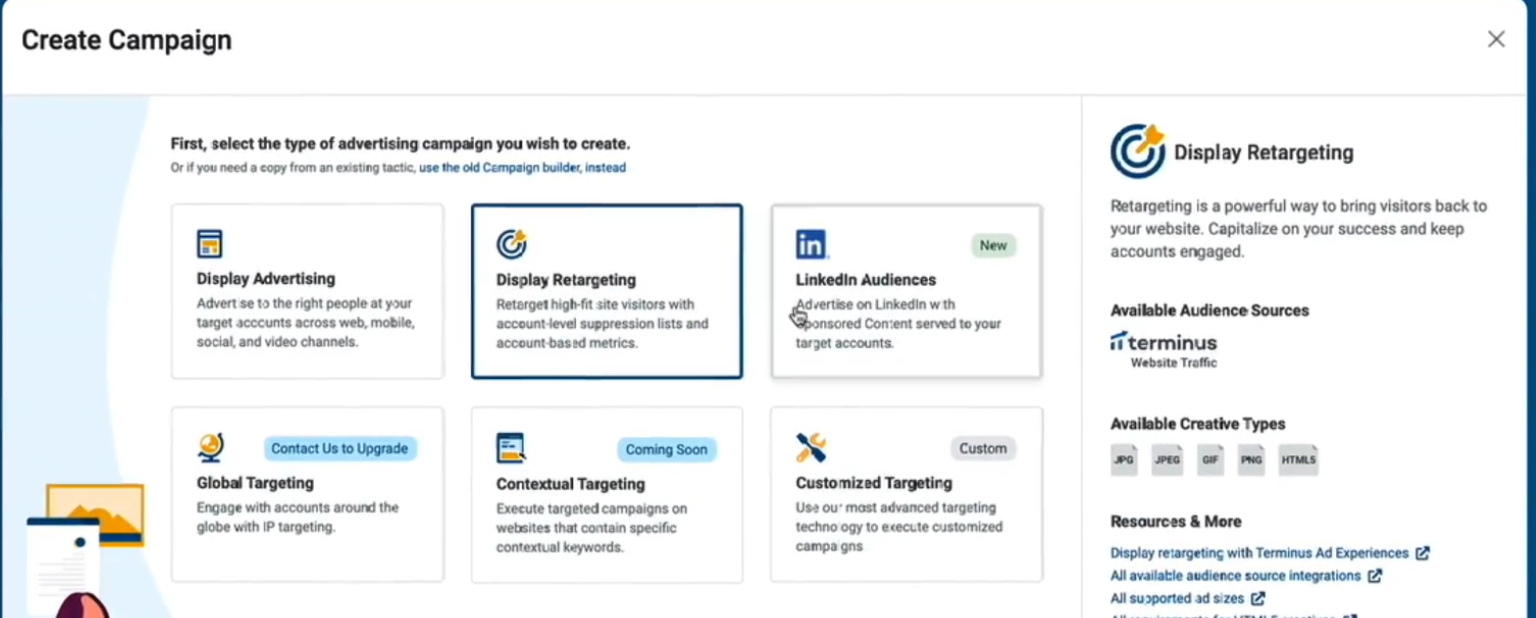

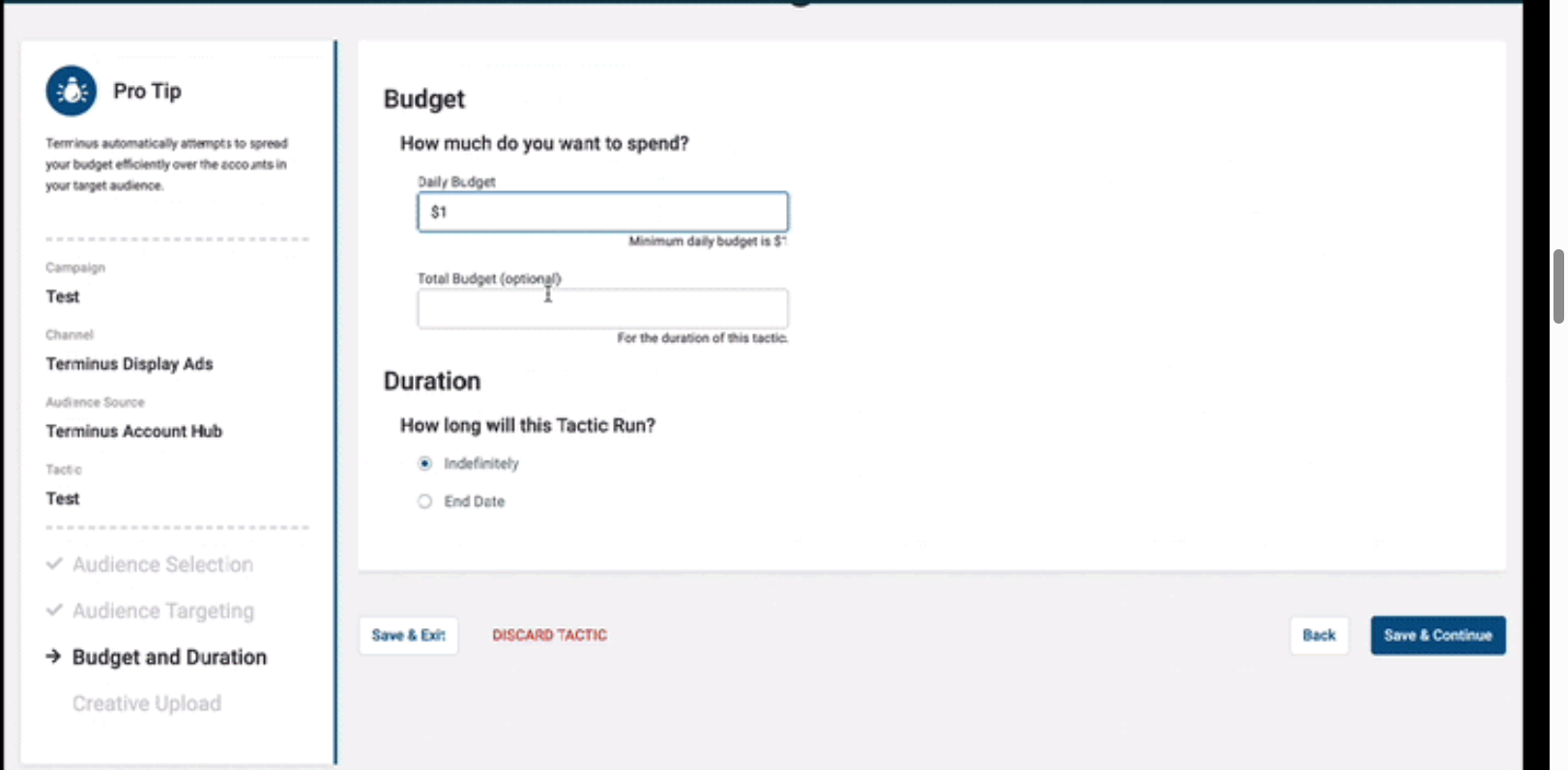

Terminus lets you plan and manage ads across multiple channels inside one platform.

This includes traditional display ads via an account-based DSP, retargeting, LinkedIn Ads and newer formats like connected TV and audio.

By centralizing media, Terminus helps you hit target accounts across web, social and other inventory from one place, while automatically balancing impressions so a few accounts do not eat all the budget.

For teams that need centralized multi-channel orchestration, Terminus can simplify how you run ABM campaigns.

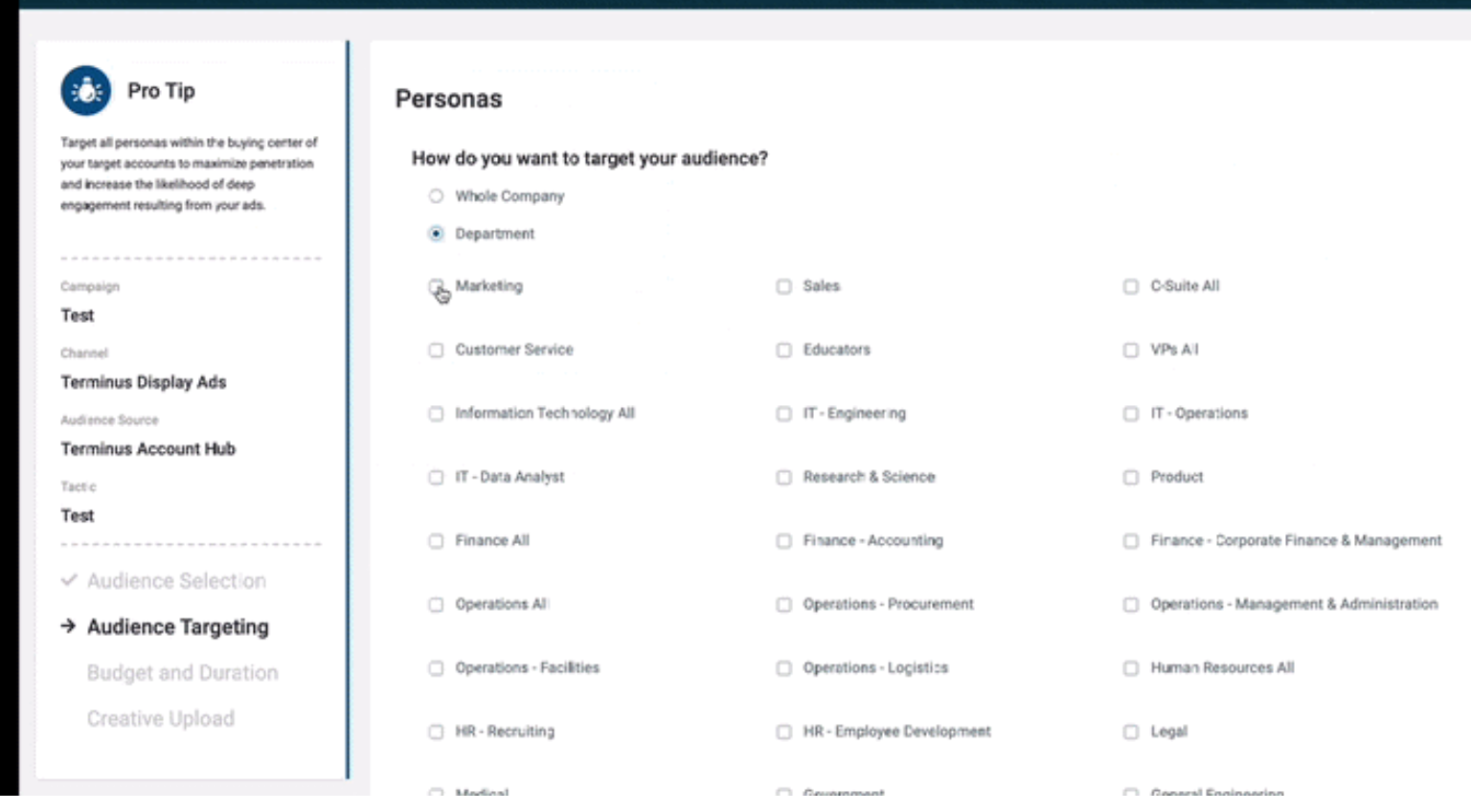

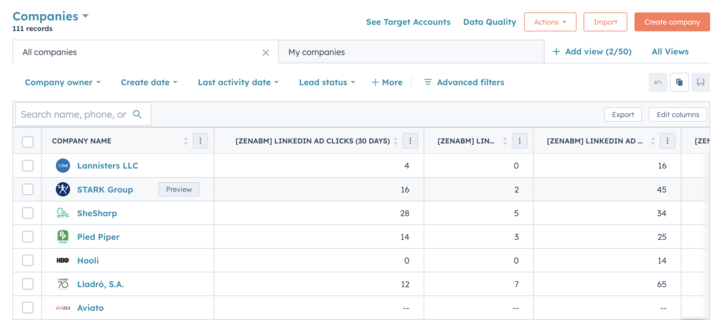

You can upload or sync target account lists from your CRM and refine audiences by persona attributes such as department, seniority or function.

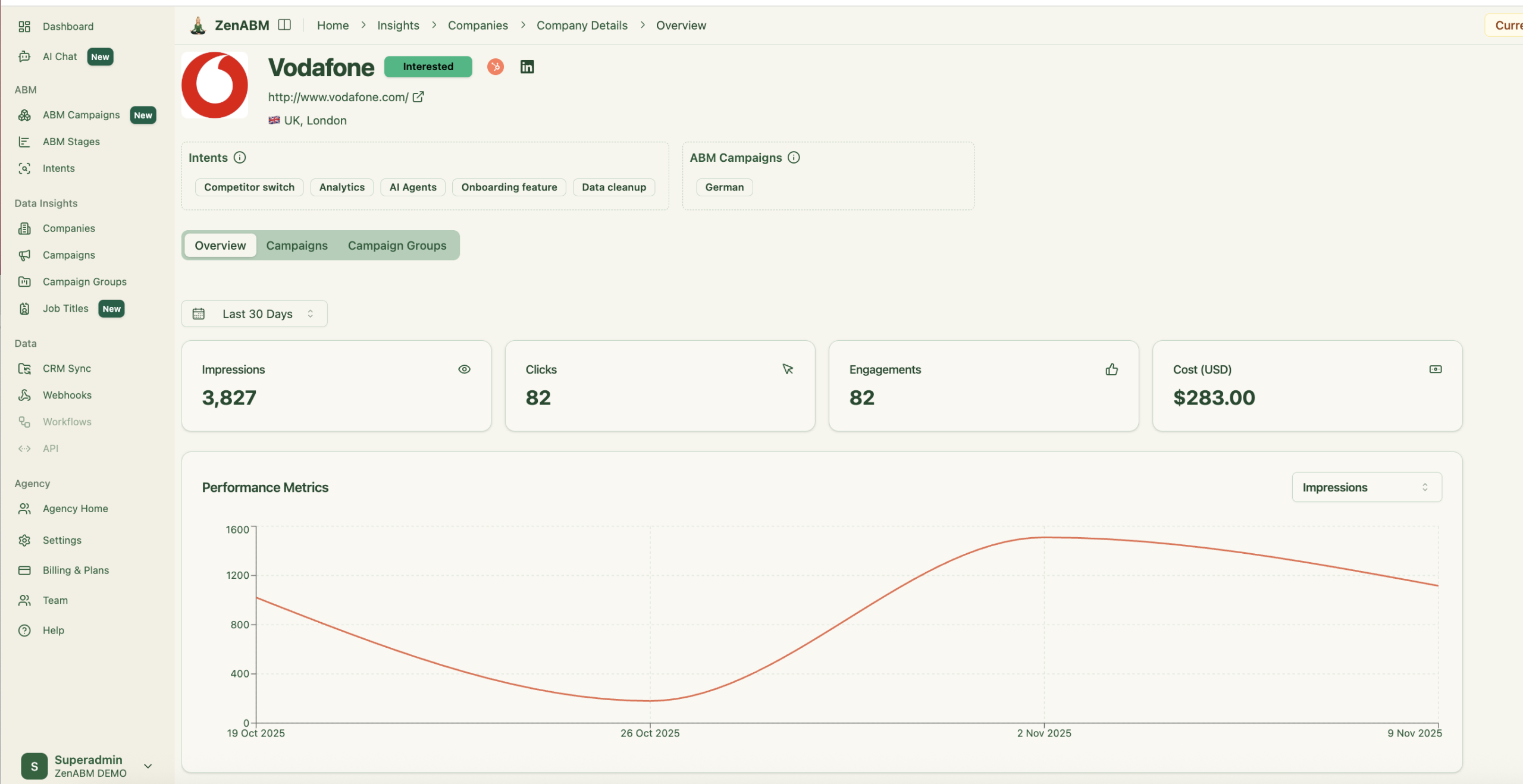

ZenABM also helps you track the personas/job titles of your LinkedIn ad viewers:

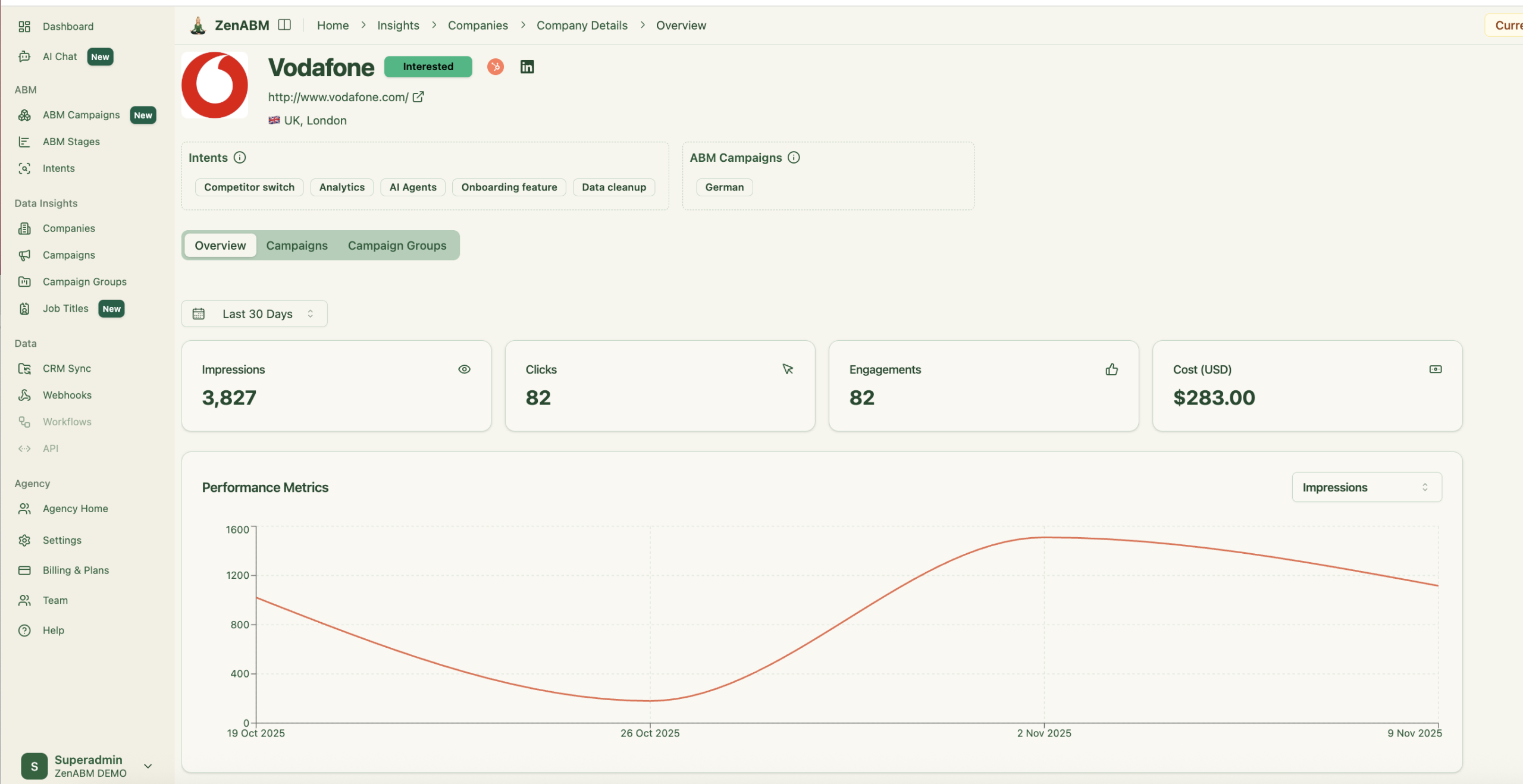

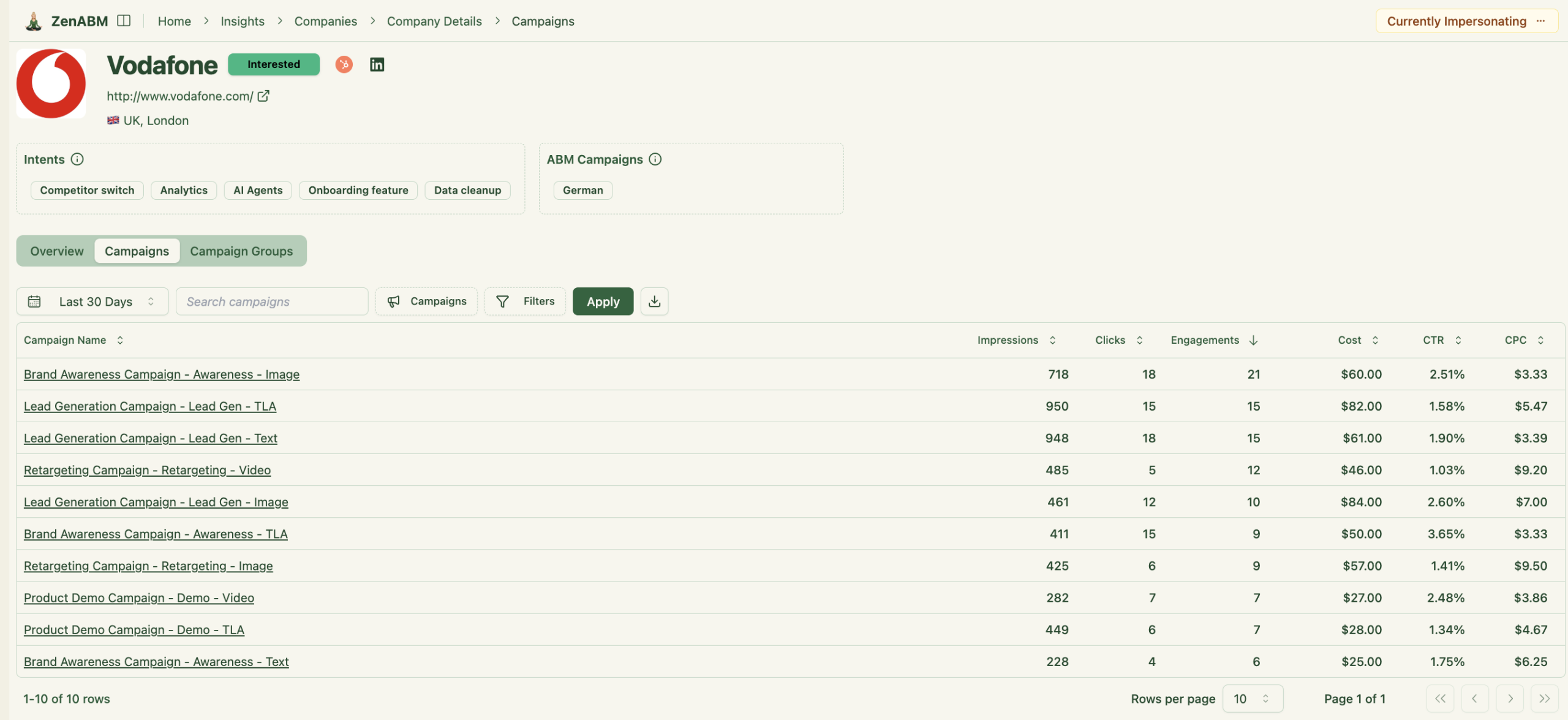

The platform tracks impressions as well as clicks at the account level.

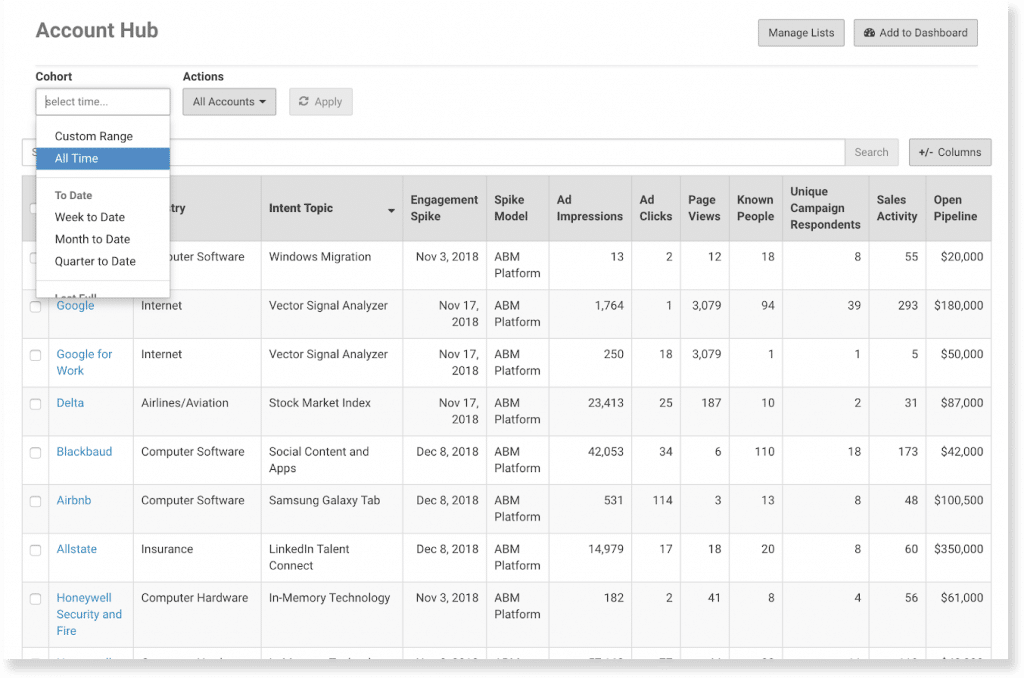

In ABM, simply knowing that a target account repeatedly saw your ads is useful. Account Hub surfaces impressions, clicks, site visits and other engagement per account so you can see how your programs land and support account-based attribution.

ZenABM also gives company-level engagement data for each LinkedIn ad campaign and campaign group.

You get:

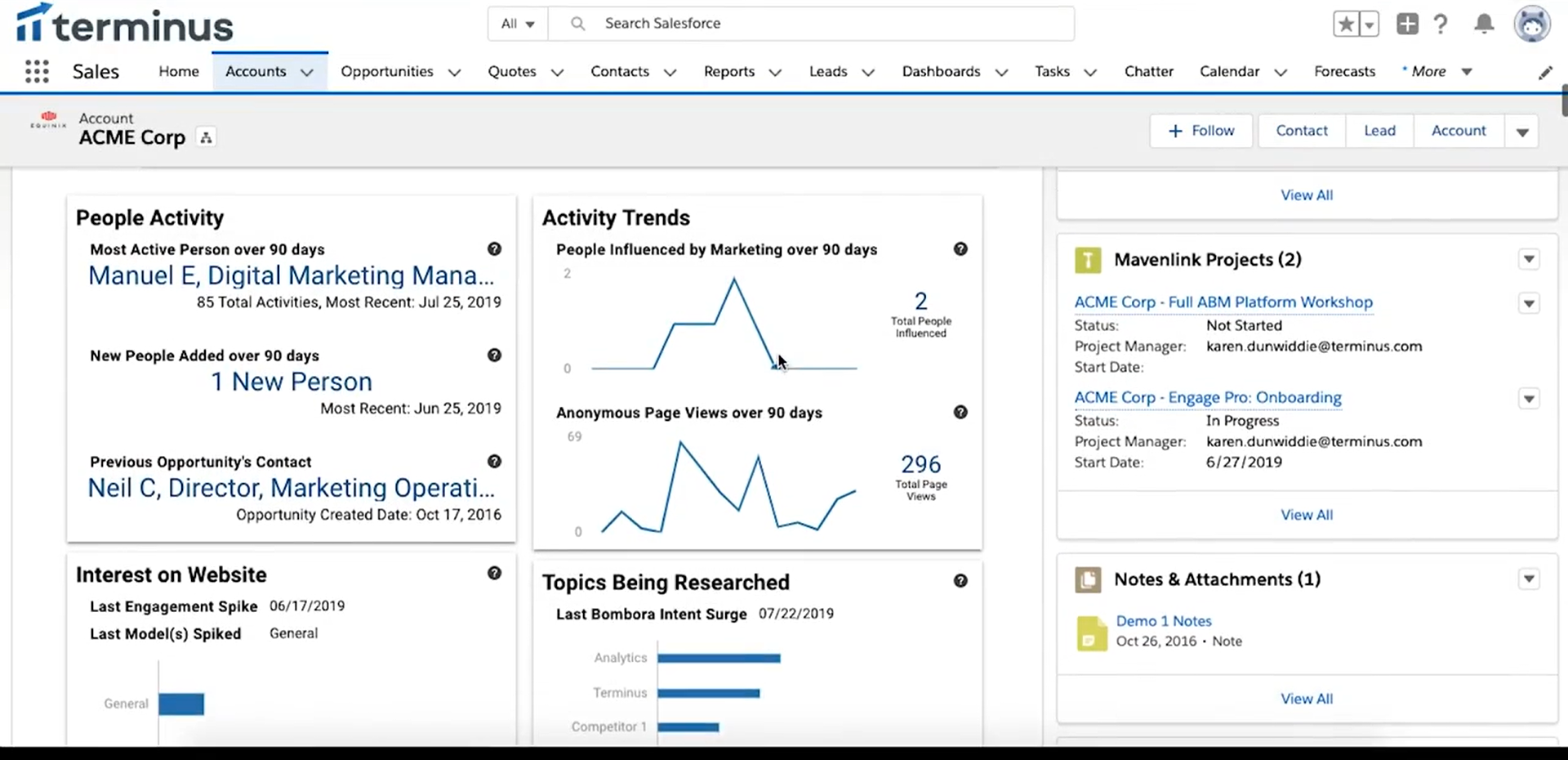

Terminus includes Visitor ID to de-anonymise website traffic.

It uses reverse IP lookup, cookies and CRM matching to figure out which companies (and sometimes which known contacts) are on your site.

If an anonymous visitor later fills a form, Terminus can connect that history back to the account. It also maps CRM leads to sessions by email domain, so you know, for example, when a director from Acme Corp visited the pricing page.

Terminus integrates intent data from providers such as Bombora to highlight in-market accounts so you can prioritize spend on companies that show strong research behavior.

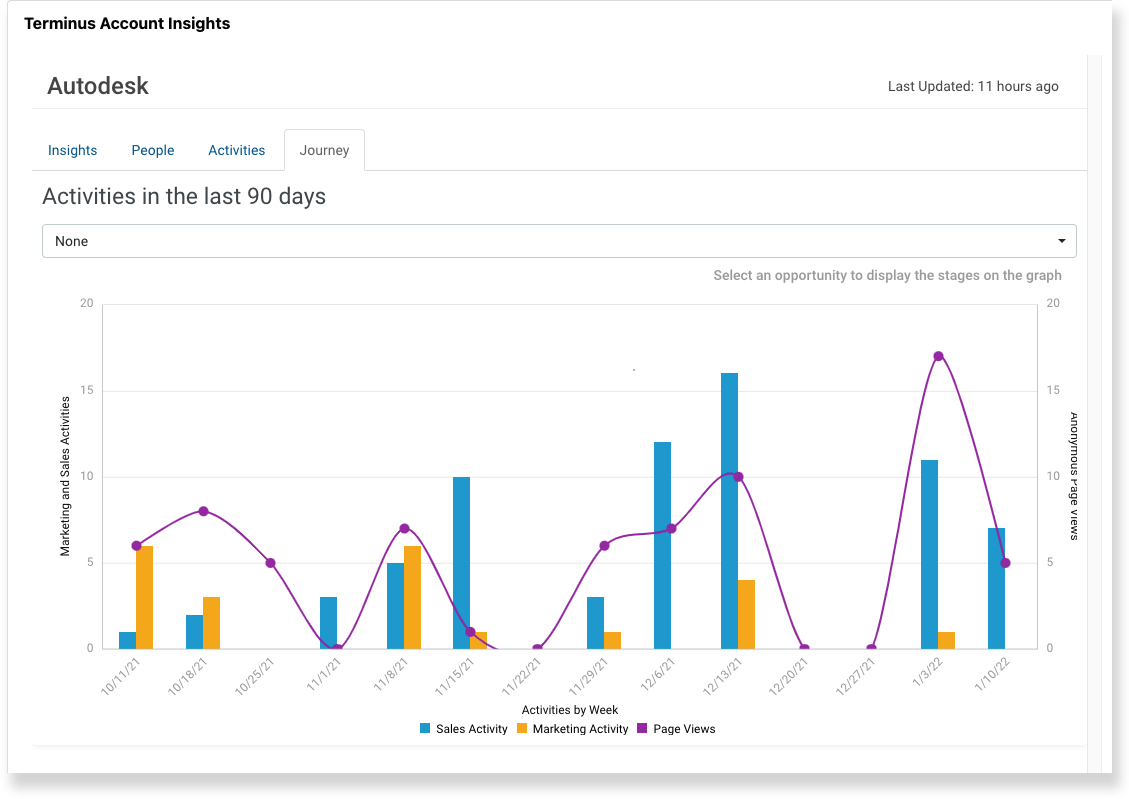

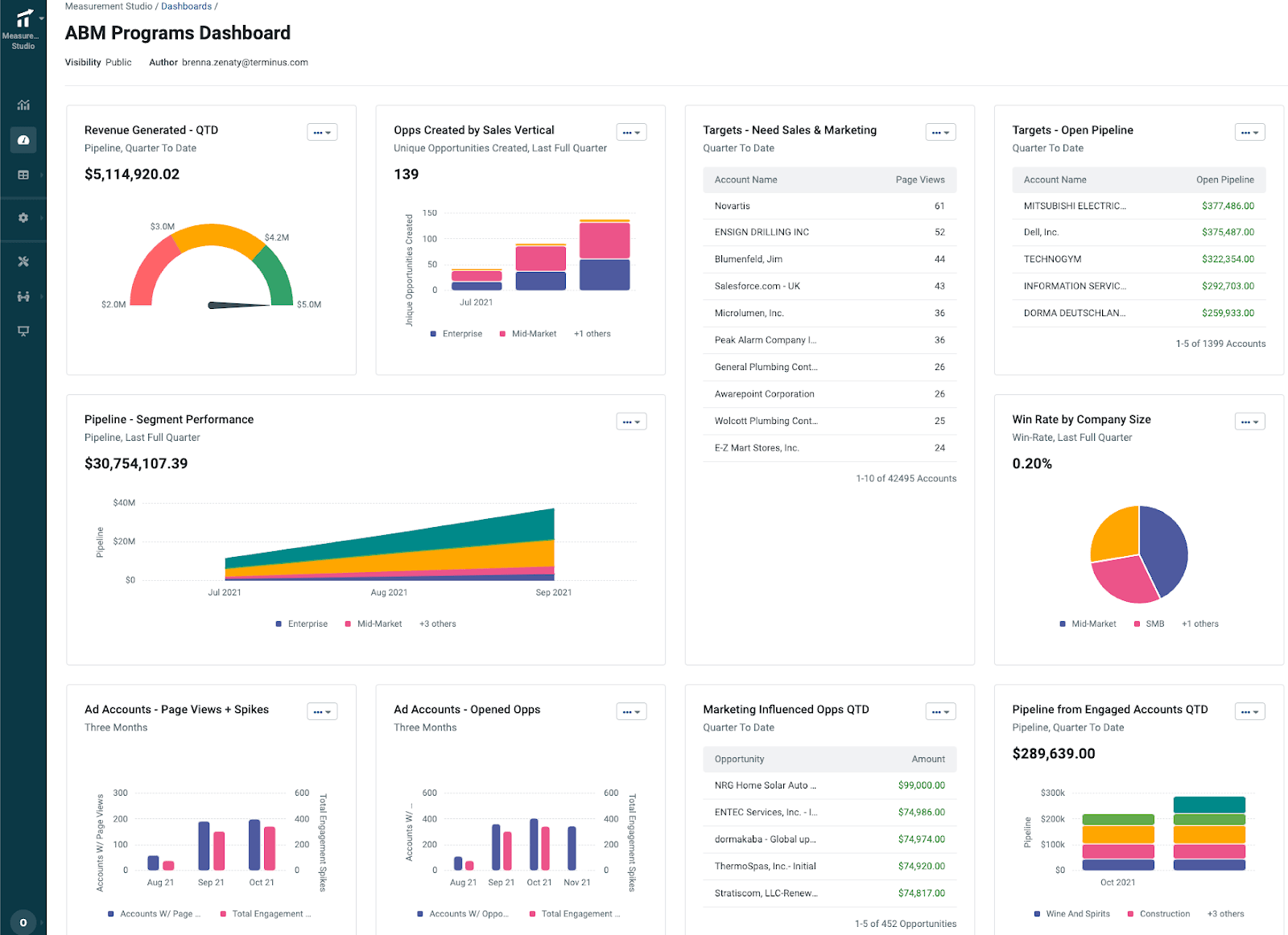

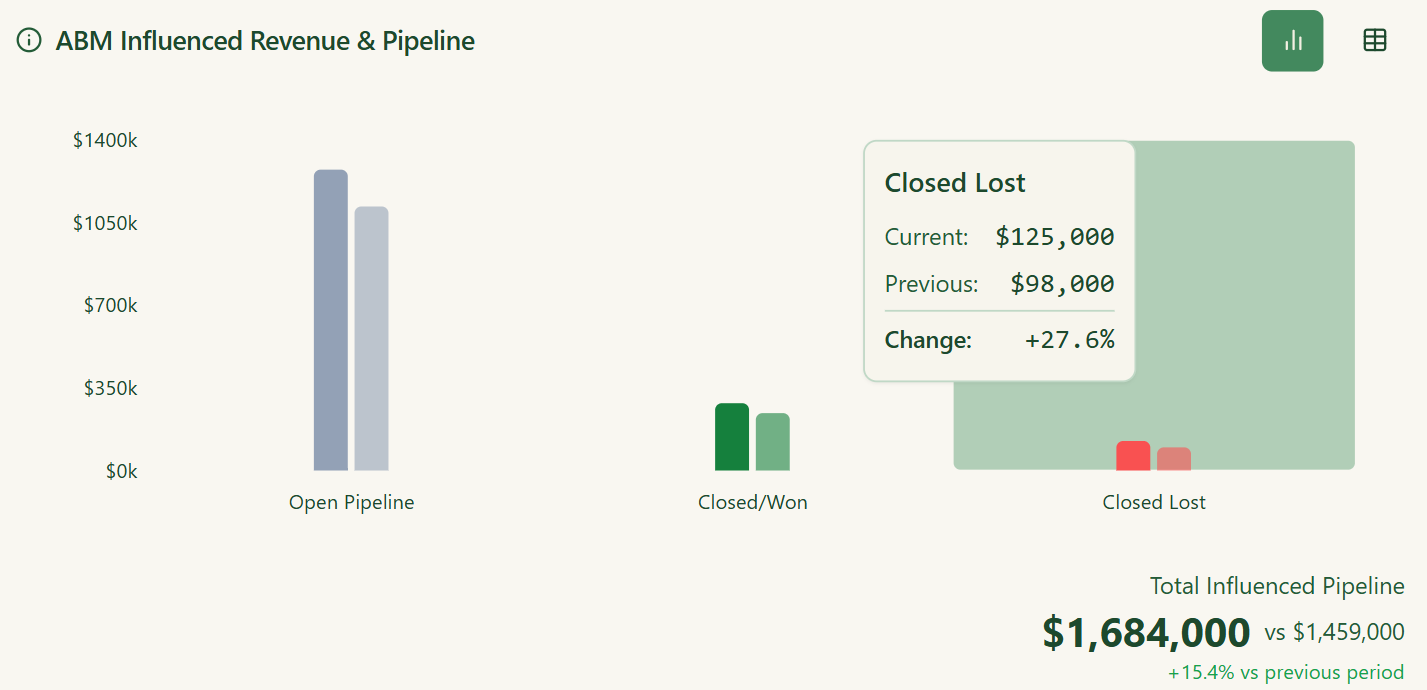

Measurement Studio in Terminus (supported by the BrightFunnel acquisition) handles multi touch attribution at the account level.

It lets marketers see how ads, emails, website sessions, events and other touches influence pipeline and revenue using first touch, last touch and custom models.

All of this rolls into an account journey view so you can see how an opportunity moved from early engagement to closed won.

Terminus also provides ready-made ABM dashboards that show revenue, opportunities, pipeline influence, top engaged accounts and similar metrics, plus topic-based views for discovering new opportunities.

Terminus plugs into a wide range of B2B tools.

There are built-in connectors for major CRMs (Salesforce, HubSpot, Microsoft Dynamics), marketing automation platforms (Marketo, Pardot, HubSpot Marketing Hub, Eloqua), ad channels (LinkedIn Ads, Google Ads), sales tools (Outreach, Salesloft and others), analytics (Google Analytics, Adobe Analytics, PathFactory), data providers (Bombora, G2 intent, Clearbit or DemandScience) and more.

You can dig through the full list in the Terminus docs.

ZenABM provides built-in integrations with CRMs like HubSpot and Salesforce.

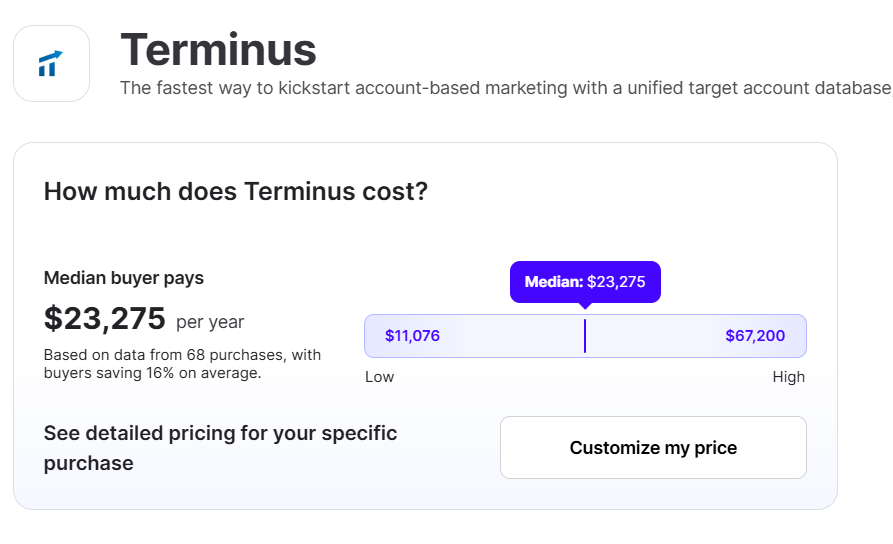

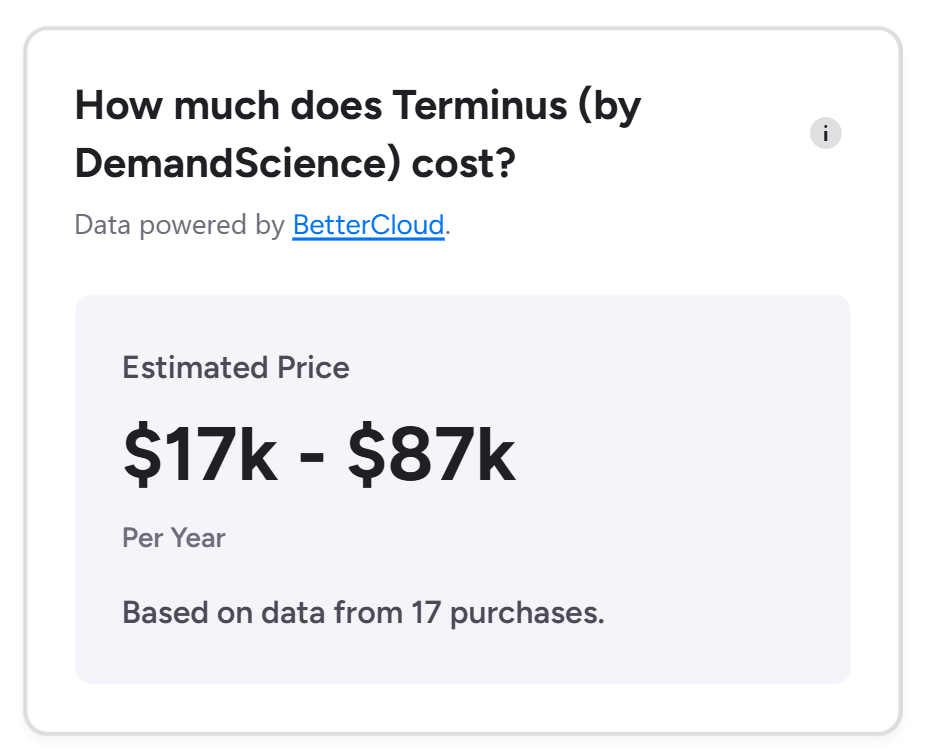

Terminus pricing is premium and custom-quoted.

There is no public price card; you have to speak with sales.

Most research suggests deals land in the mid five figures per year and can climb into six figures for large enterprises.

Vendr puts the median Terminus price at about $23,000 per year, with some large customers paying $100K to $250K or more annually.

CMO.com suggests starting costs around $57,500 per year, with contracts up to $266,000, and G2 reviews point to a broad range between $18,000 and $87,000. Overall, pricing is not friendly to very small teams with tight budgets.

ZenABM, on the contrary, starts at just $59/mo.

On sites like Trustradius, Infotech.com and Software Finder, users praise Terminus for a solid UX and broad ABM coverage.

Common complaints include cost, limits on accounts per campaign, some reporting gaps and occasional integration friction with HubSpot.

Dreamdata vs. Terminus differences are summarized here (along with ZenABM for perspective).

| Dimension | Dreamdata | Terminus | ZenABM |

|---|---|---|---|

| Primary Role | Attribution and revenue analytics | ABM execution and orchestration | LinkedIn-first ABM analytics and workflows |

| Core Data Signal | All-touch marketing data | Engagement plus third-party intent | First-party LinkedIn ad engagement |

| Intent Philosophy | Inferred from journeys | Predictive keyword-based intent | Observed engagement intent |

| Reliance on Third-Party Intent | Low to medium | High | None |

| LinkedIn Depth | Reporting only | One of many channels | Built entirely on LinkedIn Ads API |

| Ad Execution | No | Yes | No, analytics and activation layer |

| Account-Level Visibility | Journey-focused | Strong account engagement views | Native company-level dashboards |

| Contact-Level Context | Buying committee aggregation | Partial | Job-title and persona analytics |

| ABM Stage Tracking | Implicit | Yes | Fully configurable stages |

| Engagement Scoring | Activity-based | Predictive scores | Real-time engagement scoring |

| Revenue Attribution | Best-in-class multi-touch | Account-level attribution | Pipeline, revenue and ROAS per company |

| CRM Sync Depth | Analytics-focused | Deep but complex | Operational and bi-directional |

| Sales Automation | Limited | Dashboards and insights | Automatic BDR routing |

| AI Capabilities | Limited | Predictive modeling | Natural language analytics via Zena |

| Time to Value | Moderate | Slow | Fast |

| Operational Complexity | Medium | High | Low |

| Typical Annual Cost | $9K–$30K+ | $20K–$250K+ | $59–$6K |

| Best Fit | Attribution-heavy revenue teams | Enterprise ABM programs | LinkedIn-first ABM teams |

After we have discussed Dreamdata vs. Terminus for ABM, let’s visit the third option: ZenABM.

ZenABM is built for teams that rely on LinkedIn as the primary ABM channel and want first-party accuracy, automation, and revenue visibility without the price or complexity of multi-channel suites.

Let’s look at its core features:

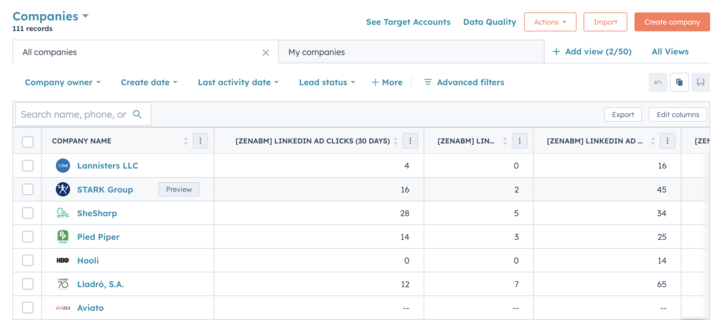

ZenABM connects to the official LinkedIn Ads API and captures account-level data for all campaigns so you can see which companies see, click, and engage with your ads.

Because this is first-party data from LinkedIn’s environment, it is more reliable than IP or cookie-based visitor ID.

A Syft study puts IP-based identification at around 42 percent accuracy.

ZenABM treats LinkedIn ad engagement itself as first-party intent. When several people in one company keep engaging with your ads, that is a strong buying signal without rented intent feeds.

ZenABM updates engagement scores as accounts interact with your ads across campaigns, so you can see who is heating up over short or long windows and let marketing and sales prioritize accounts that show real intent.

ZenABM also shows the full touchpoint timeline for each company:

ZenABM lets you define stages such as Identified, Aware, Engaged, Interested, and Opportunity and automatically places accounts in the right stage using scores and CRM data.

You control thresholds, and ZenABM tracks movement over time.

This gives you funnel visibility similar to larger suites, but powered by LinkedIn data.

ZenABM integrates bi-directionally with CRMs like HubSpot and adds Salesforce sync on higher tiers.

LinkedIn engagement data flows into the CRM as company-level properties:

Once an account crosses your score threshold, ZenABM updates the stage to Interested and automatically assigns a BDR.

ZenABM lets you derive intent topics from LinkedIn campaigns by tagging campaigns by feature, use case, or offer.

ZenABM then shows which accounts engage with which themes.

This is clean, first-party intent from owned interactions.

You can push these topics into your CRM, so sales and marketing can tailor outreach to what each company has actually explored.

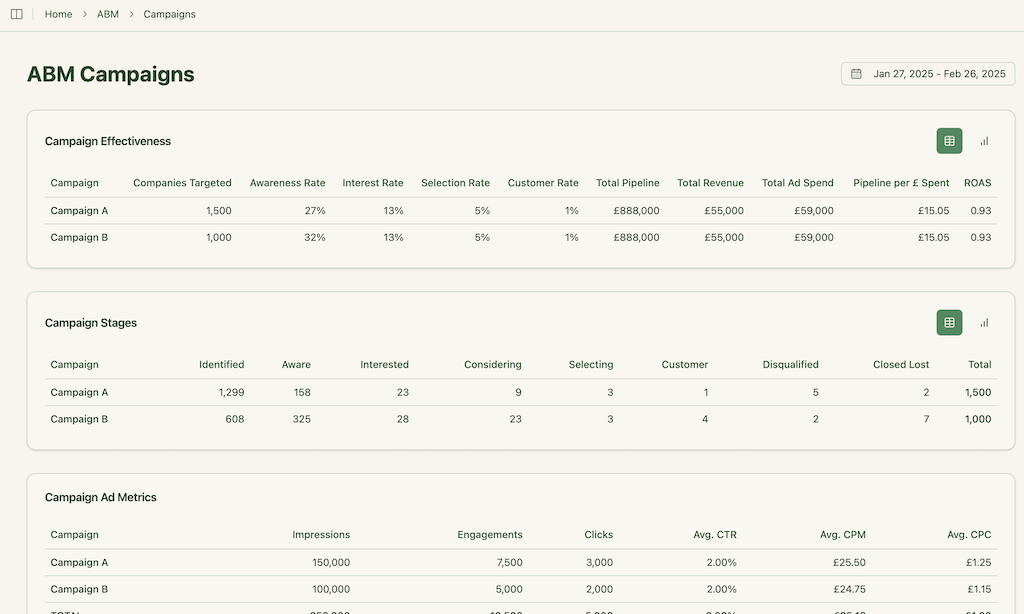

ZenABM ships with dashboards that connect LinkedIn ads to account engagement, stage movement, and revenue.

ZenABM shows which job titles engage with your creatives and gives dwell time and video funnel analytics.

ZenABM provides its AI chatbot called Zena that basically answers all you want from ZenABM in natural language.

You can ask Zena open-ended questions like you would a smart analyst and get company-level answers about:

Under the hood, Zena combines OpenAI with a library of carefully designed prompts and endpoints to join ad engagement, spend and CRM deals so it can explain which campaigns drove pipeline, which accounts turned into opportunities, which formats perform best and which companies are high intent but untouched by sales.

Instead of exporting spreadsheets and stitching pivot tables, you get plain language insights, ready to drop into strategy reviews, weekly sales standups or executive updates.

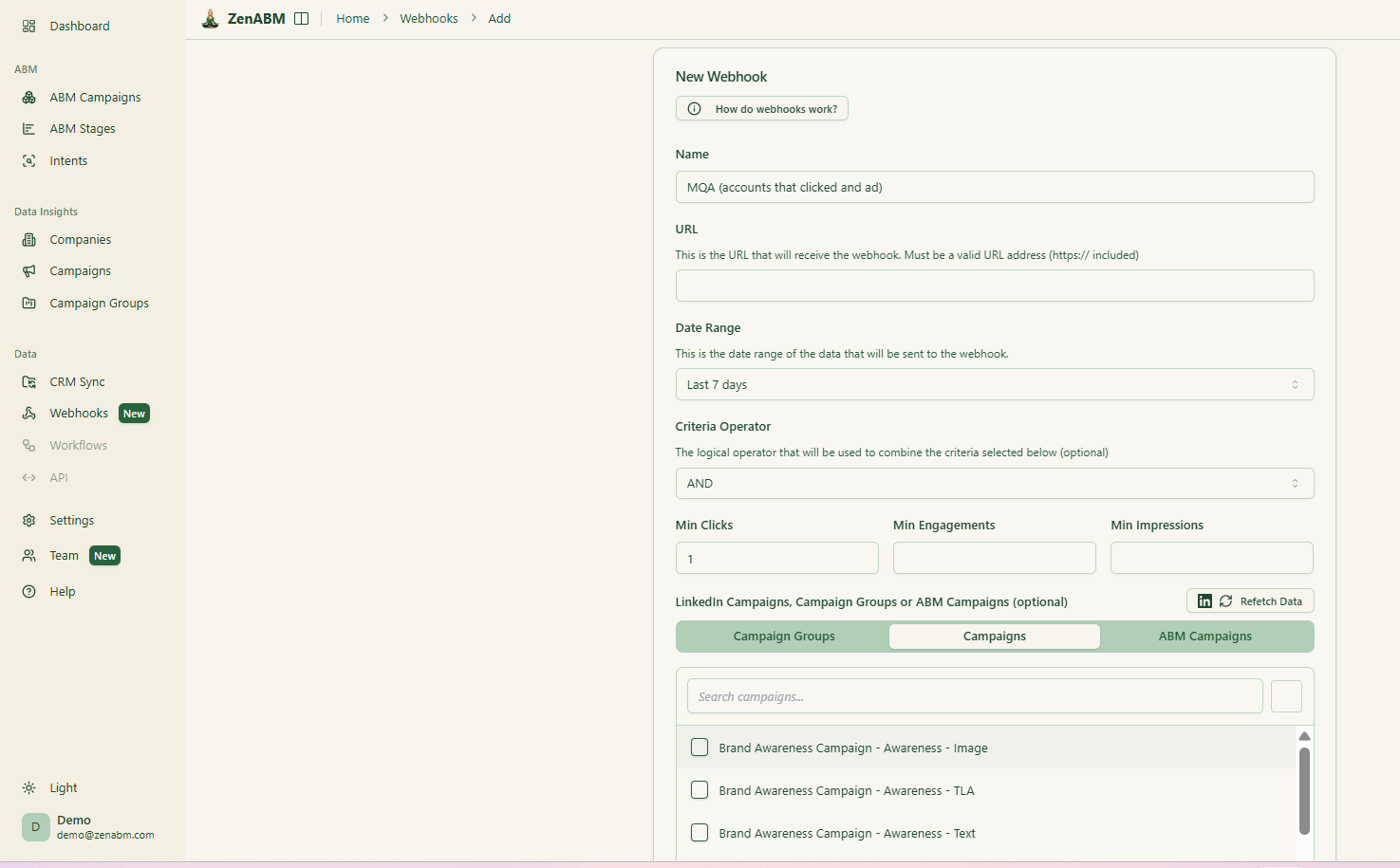

ZenABM’s custom webhooks let you push events into your stack, for example, Slack alerts, enrichment flows, or other ops automations.

Most tools treat each LinkedIn campaign separately. ZenABM lets you group several into one ABM campaign object so you can see performance across regions, personas, or creative clusters.

Instead of juggling fragmented reports in Campaign Manager, you see spend, pipeline, account movement, and ROAS for the entire initiative.

For agencies, ZenABM offers a multi-client workspace.

You can manage multiple ad accounts and clients in one environment, each with its own ABM strategy, dashboards, and reporting, instead of constantly switching accounts in Campaign Manager.

ZenABM pricing details:

Choose Dreamdata if your biggest pain is attribution. If leadership keeps asking which channels actually drive revenue and you need defensible multi-touch models across long sales cycles, Dreamdata is excellent at that job.

Choose Terminus if you are running a large, multi-channel ABM program and want one platform to coordinate ads, targeting, attribution and reporting, and you have the budget and team to support it.

Choose ZenABM if LinkedIn is your primary ABM channel and you want:

ZenABM does not try to be a data warehouse or a DSP.

It focuses on one thing and does it cleanly: turning LinkedIn ad engagement into actionable ABM intelligence.

It can replace complex enterprise layers for LinkedIn-centric teams, or sit alongside Dreamdata or Terminus to provide accurate, first-party LinkedIn attribution without inflating your contract.