Account-Based Marketing (ABM) success often hinges on choosing the right platform.

In this article, I have compared Demandbase vs. ZenABM, two prominent ABM solutions, to help B2B teams understand their features, strengths, and ideal use cases to further understand which one they should use or whether to go for both!

In case you’re short on time, here’s a quick comparison:

Demandbase is essentially a one-stop ABM suite that covers everything from building target account lists to running multi-channel ad campaigns and personalizing web experiences. Its key capabilities enable organizations to consolidate multiple tools into a single platform, streamlining workflows and reducing the complexity of managing separate solutions.

Demandbase also unifies account and contact data, enhancing sales intelligence, data enrichment, and outreach strategies for more effective ABM.

Key features of Demandbase in detail:

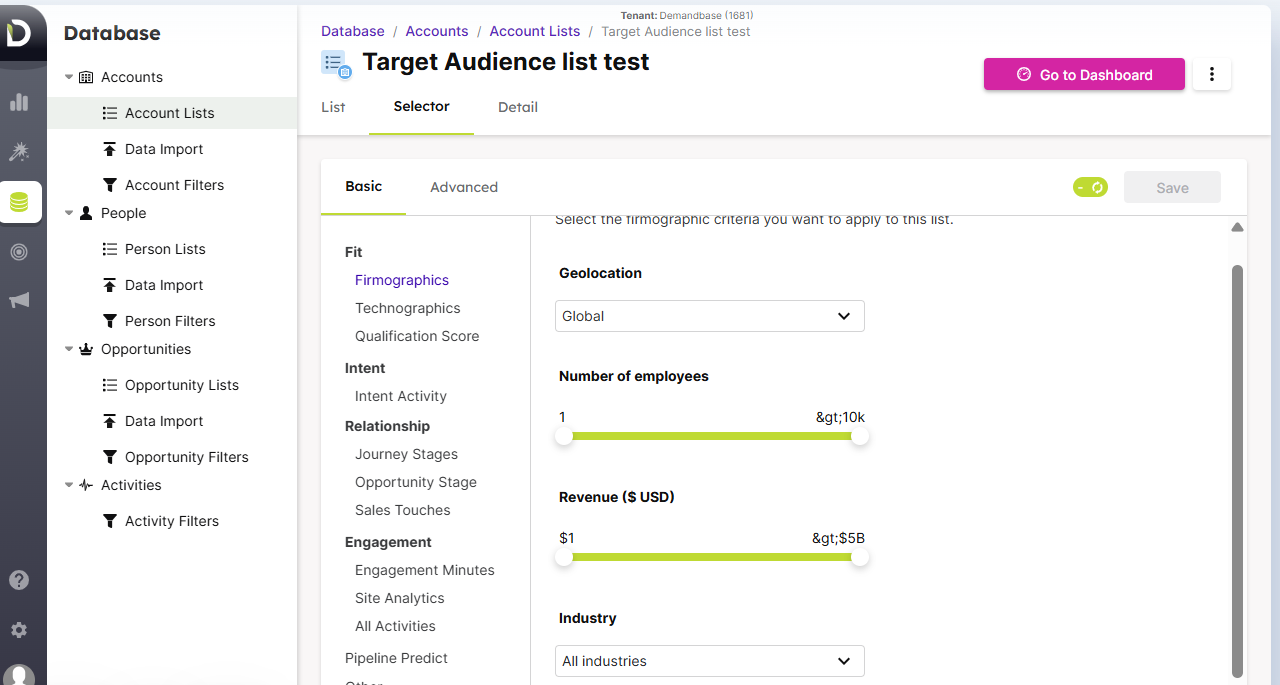

Demandbase helps build and refine target account lists using both first-party and third-party data, with AI suggestions based on firmographics, technographics, and intent signals.

This helps enterprises pick the right accounts to pursue.

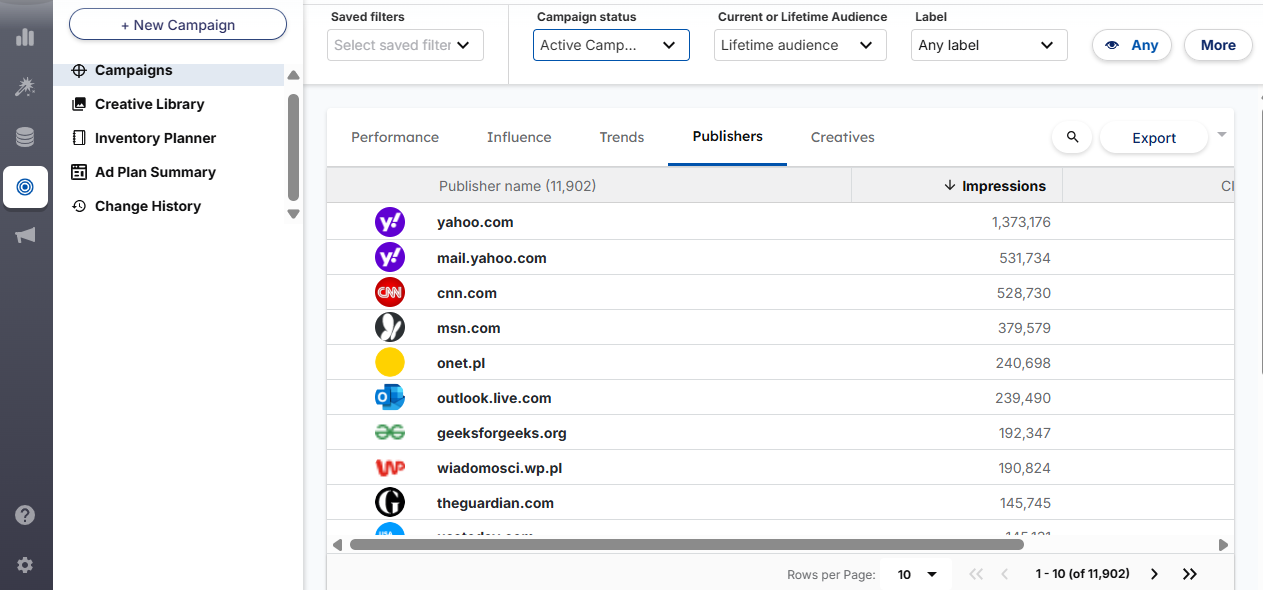

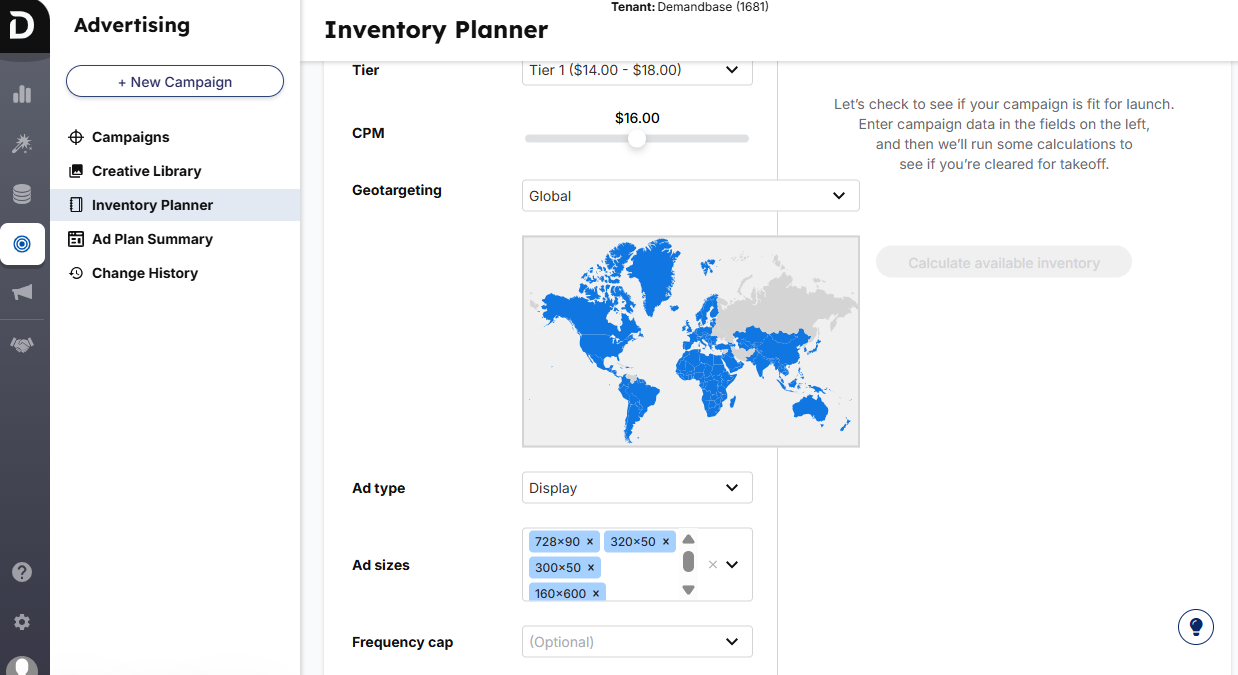

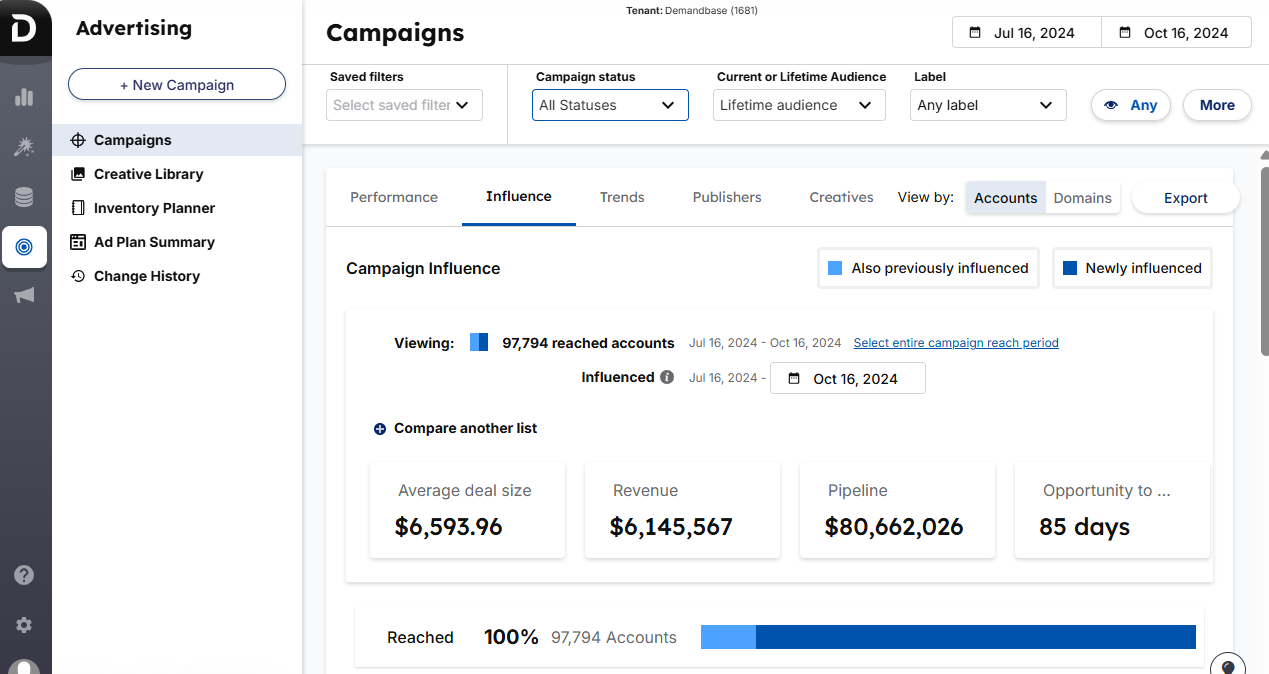

Demandbase has a native advertising capability that allows you to run programmatic display ads, retargeting, native ads, and even Connected TV, all within one platform. Demandbase’s native DSP enables highly targeted advertising across multiple channels, leveraging intent data to reach the right audience segments.

It also integrates major social platforms: you can manage LinkedIn, Facebook, Twitter, and YouTube campaigns inside Demandbase, with account-level frequency caps and AI-driven budget optimization.

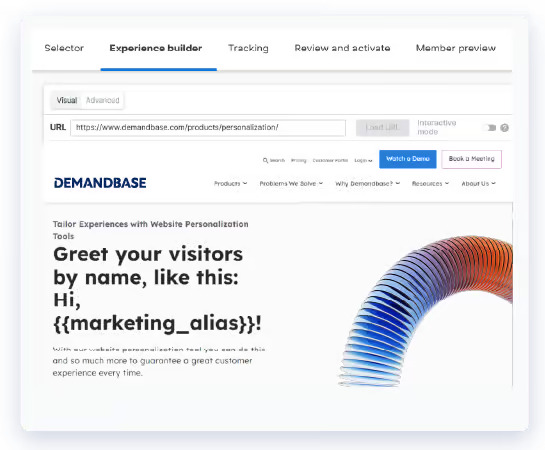

Demandbase enables personalized website content for target accounts.

You can create account-specific webpages or dynamic site content (greetings, offers, etc.) personalized to an account’s industry or funnel stage.

Demandbase integrates third-party intent data (tracking 62,500+ B2B keywords/topics) alongside your first-party engagement data.

This means Demandbase can show you which target accounts are “surging” on relevant topics across the web (through providers like Bombora) in addition to their interactions with your own content.

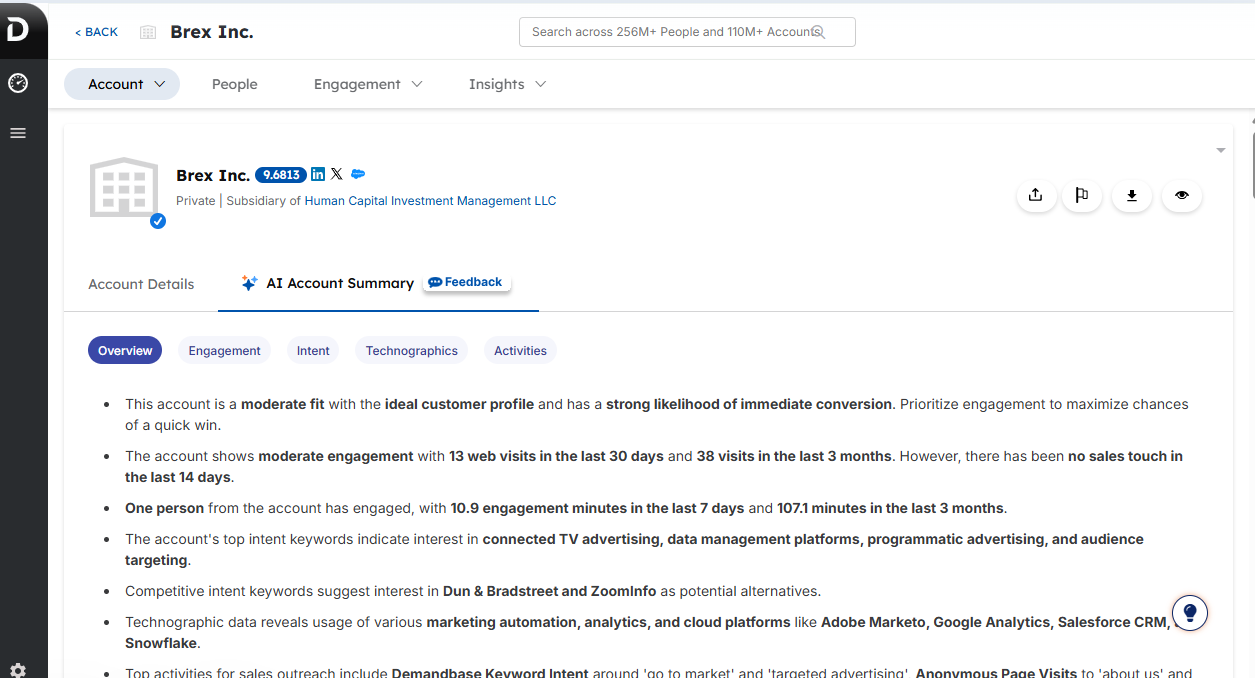

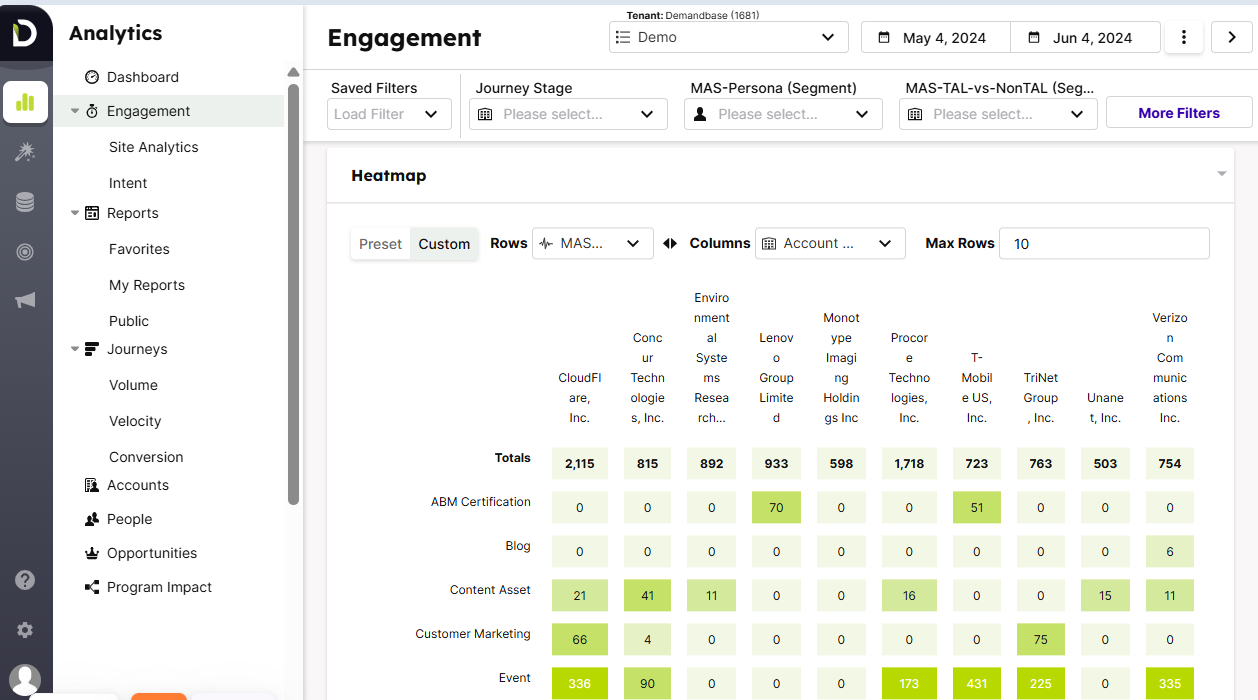

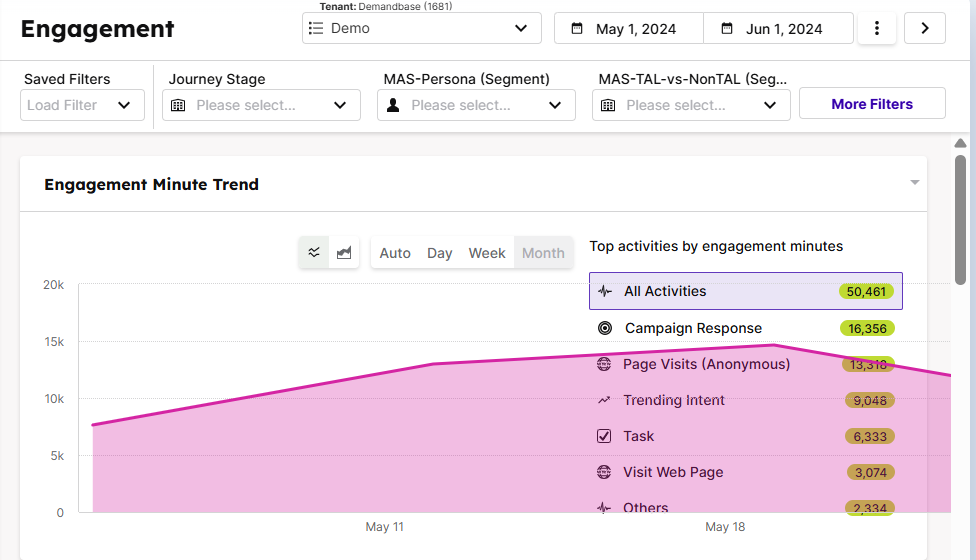

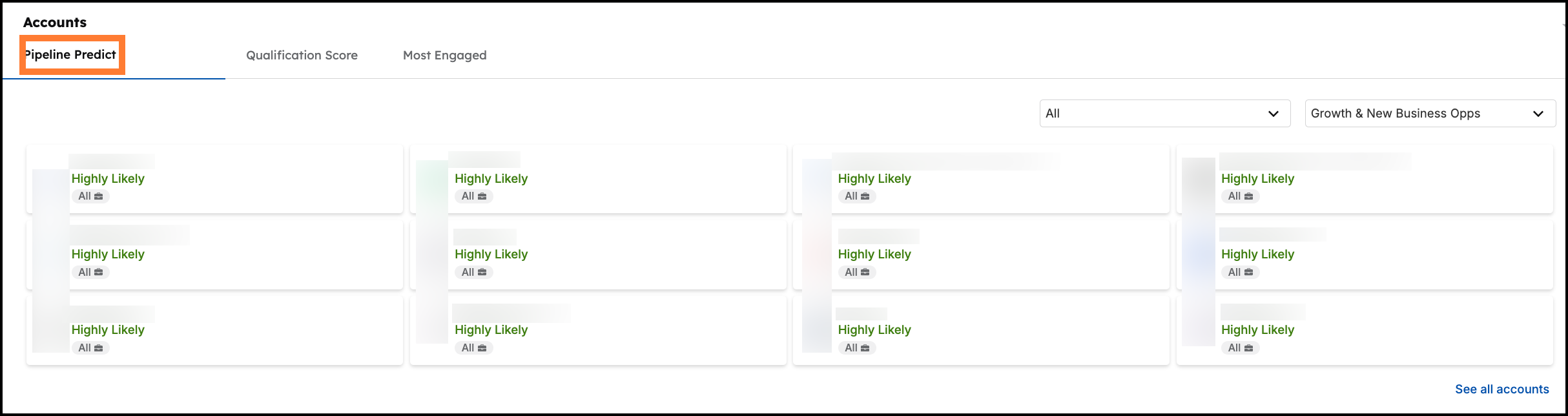

The platform also presents heatmaps and engagement scores that give a 360° view of account interest across various channels. In addition, Demandbase leverages predictive analytics and predictive marketing to identify in-market accounts and personalize outreach, helping optimize account targeting and improve sales and marketing effectiveness.

Pro Tip: Ditch third-party keyword intent surges and embrace first-party sources.

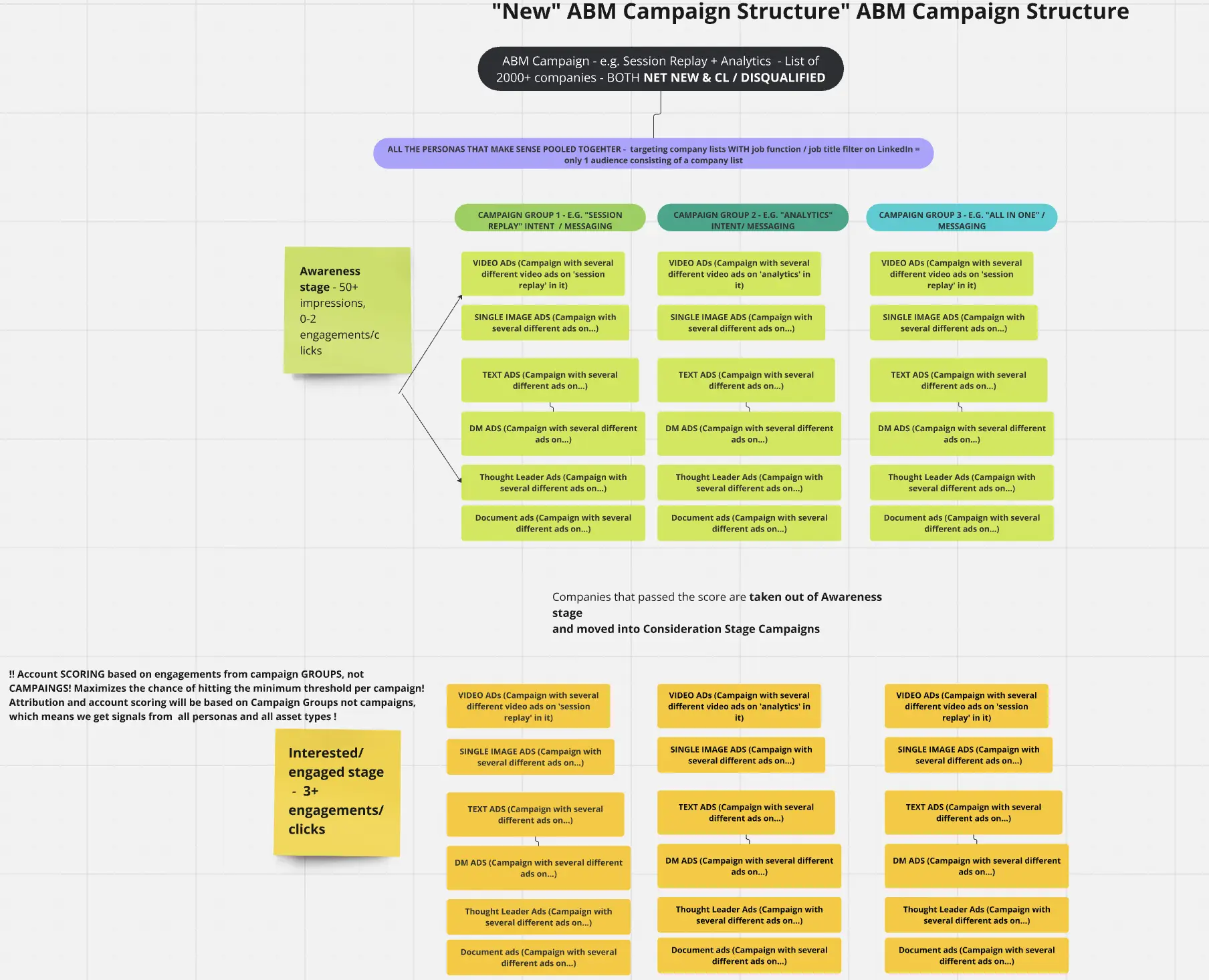

ZenABM, for instance, captures first-party qualitative intent by tracking which LinkedIn ads a company actually interacts with, giving precise, actionable signals.

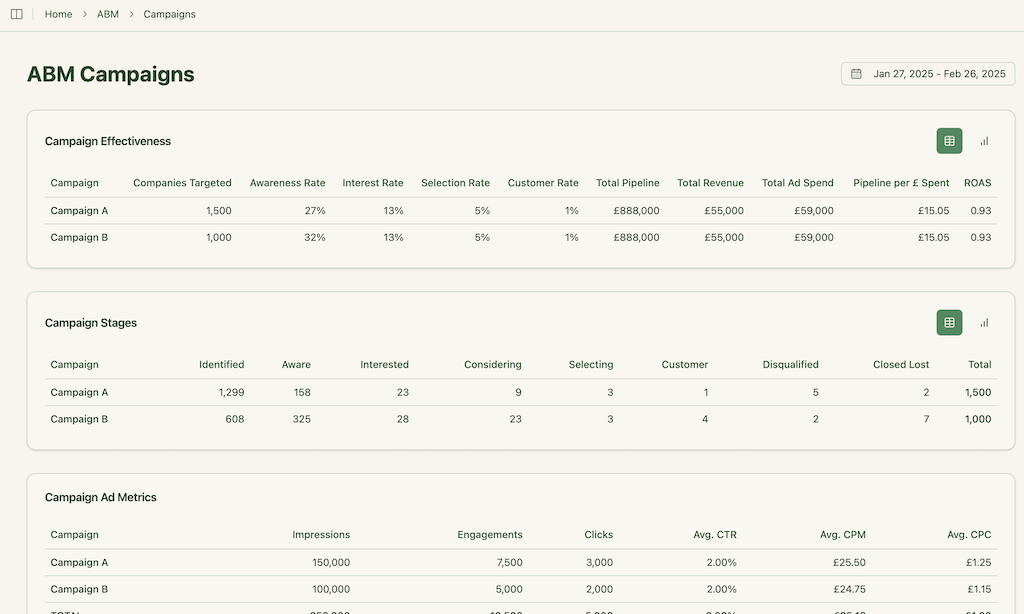

In fact, folks at Userpilot (our customer) had built entire ABM motions around this approach, tagging campaigns by pain point and then doubling down on specific BOFU ads based on what the account is engaging with.

Their campaign structure:

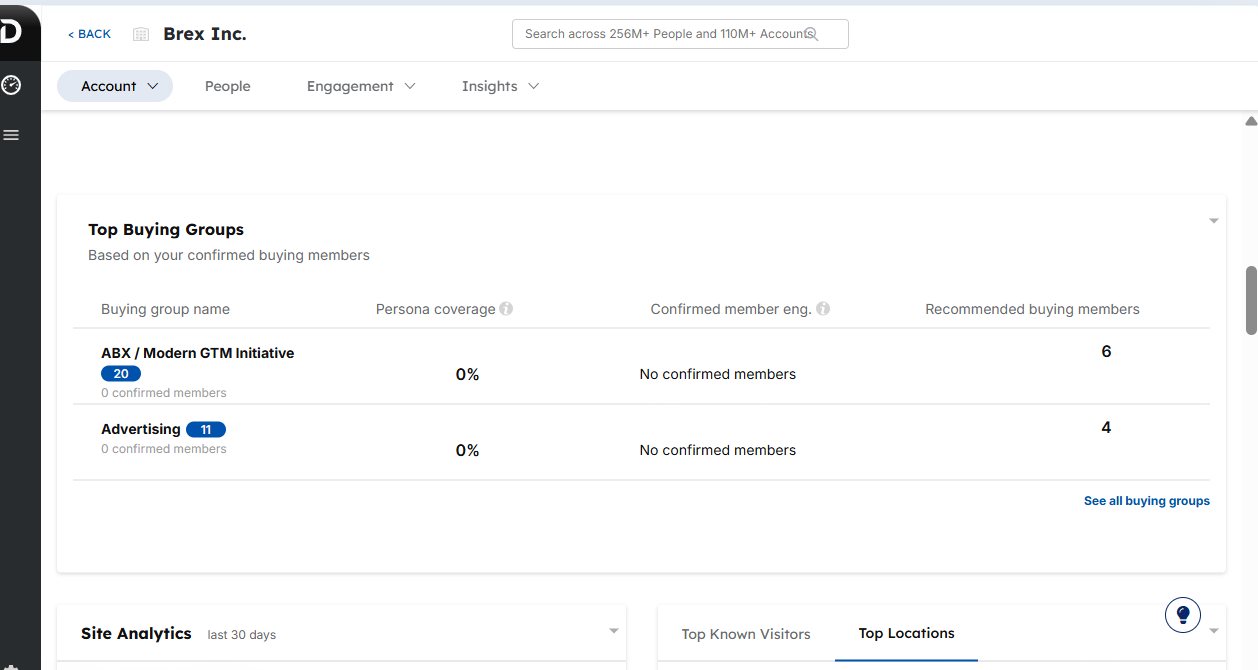

The platform helps build buying committees by identifying and targeting decision-makers within each account and also lets you target ad campaigns or sales outreach to specific job roles (e.g. all CMOs at your target accounts), ensuring you reach the right personas.

Demandbase provides rich analytics dashboards to track account engagement, campaign influence on pipeline, and revenue attribution. These analytics dashboards also provide deep insights into user engagement across the customer journey.

It even uses AI to predict pipeline outcomes, highlighting where sales reps should focus for the best win probability.

Remember: Ongoing management of these analytics is essential to maximize the platform’s value.

Demandbase connects with popular CRMs (like Salesforce), marketing automation platforms (MAPs), and sales tools to push account insights directly into sales’ workflow (e.g. a Salesforce widget showing account engagement). Demandbase offers seamless integrations with leading sales engagement tools like Outreach and Salesloft, making it easy to fit into your existing tech stack and streamline workflows.

This ensures marketing and sales are aligned on the same data.

You can explore all its integrations in the Demandbase official docs.

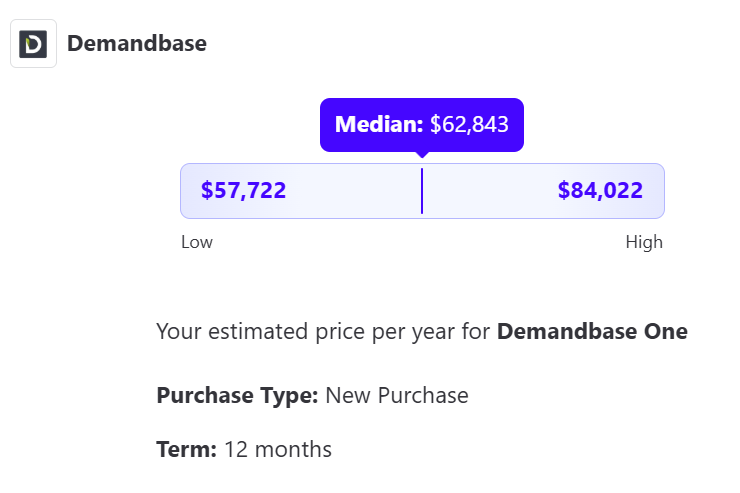

Demandbase’s pricing model is not publicly disclosed and typically requires direct contact with their sales team for a custom enterprise quote.

The pricing structure generally includes a clear platform fee plus per-user seat fees, and the total can scale up quickly with larger teams. Pricing can also be influenced by account behavior, such as the number of engaged accounts, platform usage, and the level of interaction from individual accounts.

According to industry data:

When evaluating costs, price benchmarks from industry sources can help buyers determine if they are getting a fair deal and avoid overpaying.

There are also add-on modules (like additional intent data feeds or sales intelligence databases) that can increase cost.

Because of its extensive capabilities, many smaller businesses find Demandbase to be overkill.

They might pay for features they won’t fully use.

So, yes, Demandbase is for companies with big ABM budgets and also an established ABM team.

ZenABM is a newer, lean ABM platform purpose-built for running ABM campaigns on LinkedIn. It empowers marketing teams to run effective LinkedIn ABM campaigns and track engagement with target accounts.

Key features of ZenABM include:

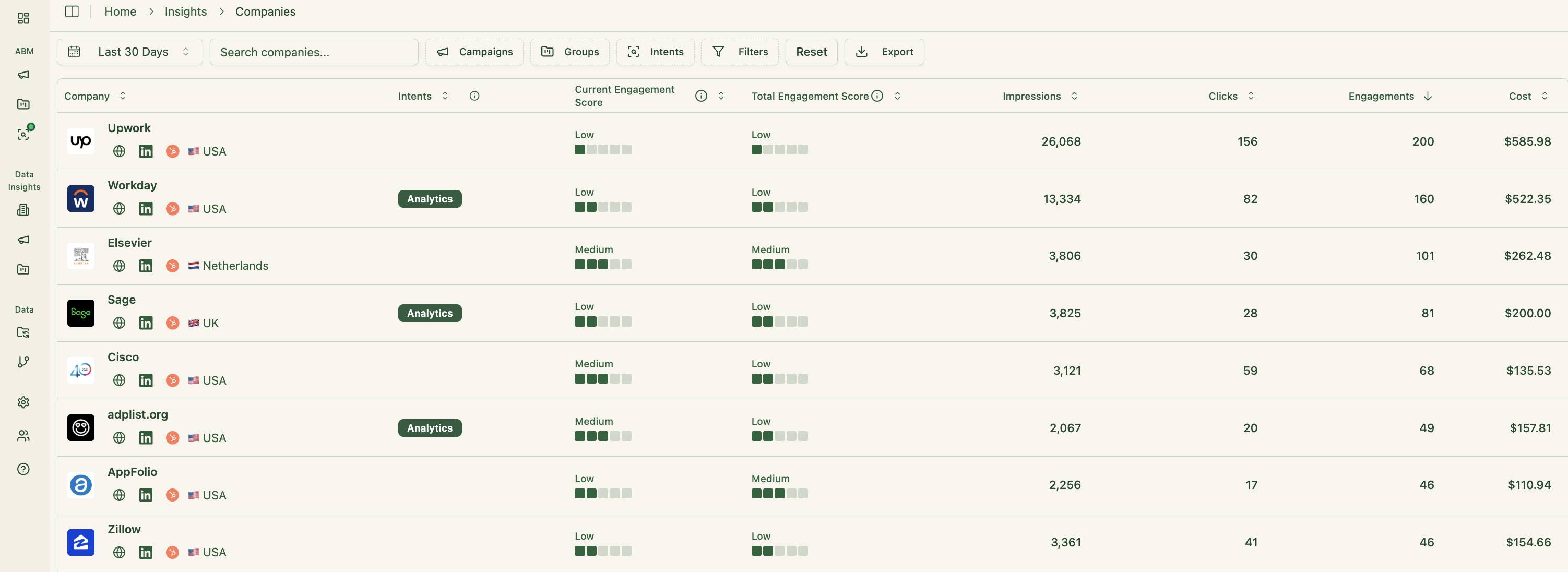

ZenABM connects directly to the official LinkedIn Ads API to pull in account-level data for each LinkedIn ad campaign.

So, you can see exactly which target accounts (companies) are engaging with your LinkedIn ads (impressions, clicks, etc.) – all attributed at the account level.

This first-party data is highly reliable because it originates directly from LinkedIn (user login-based). In contrast, many larger ABM tools, such as Demandbase, rely on less accurate methods, including browser cookies or IP matching, to estimate which company a visitor belongs to.

And by inaccurate, I mean very unreliable. A study by Syft, for instance, found that the accuracy of IP matching tools for web visitor deanonymization tops at a mere 42%.

ZenABM’s approach ensures qualitative intent signals directly from ad engagement, so if multiple people from Account X are clicking or reacting to your LinkedIn ads, you know that account is showing interest in your messaging without needing a third-party intent feed.

ZenABM calculates an engagement score for each account based on LinkedIn ad interactions, updating continuously.

You can view current engagement (e.g. in the past week) to identify which accounts are “heating up” right now, as well as historical engagement over time.

This real-time insight helps sales teams prioritize outreach.

ZenABM allows you to define stages in your account journey (for instance: Identified → Aware → Engaged → Interested → Opportunity).

It uses its engagement scores combined with CRM data to categorize each account into an ABM stage automatically.

The best part?

You can customize the thresholds for what constitutes “Engaged” or “Interested,” etc., and ZenABM will track movement of accounts through these stages.

This feature provides funnel visibility similar to big platforms. You can spot if many accounts are stuck in a stage (a funnel leak) or moving forward, and address gaps in your program.

ZenABM integrates bi-directionally with CRMs like HubSpot (and Salesforce in higher tiers).

All those LinkedIn engagement insights can be pushed into the CRM as company properties:

Also, ZenABM automatically updates an account’s status to “Interested” in CRM when they cross a score threshold, and even auto-assigns a BDR (sales rep) to follow up.

ZenABM provides a clever way to derive intent topics from your LinkedIn campaigns. You can tag each LinkedIn ad campaign with a theme or value proposition (for example, one campaign highlights “Feature A” and another highlights “Feature B”).

ZenABM then shows which accounts engaged with which campaign themes, effectively telling you what topic each account is interested in.

This is first-party intent data: rather than paying a third-party data vendor for intent signals about generic keywords, you’re seeing direct evidence of interest (e.g. Account Z clicked the “Feature A” ad, indicating they care about that use case).

Also, these intent signals can be automatically pushed to CRM. This enables marketing and sales teams to design targeted outreach campaigns and time their outreach perfectly to align with account interest.

Benefit?

Reps can personalize outreach, knowing what each account cares about most.

ZenABM offers out-of-the-box ABM dashboards that tie your LinkedIn ad exposure to account engagement, stage progression, and even pipeline contribution.

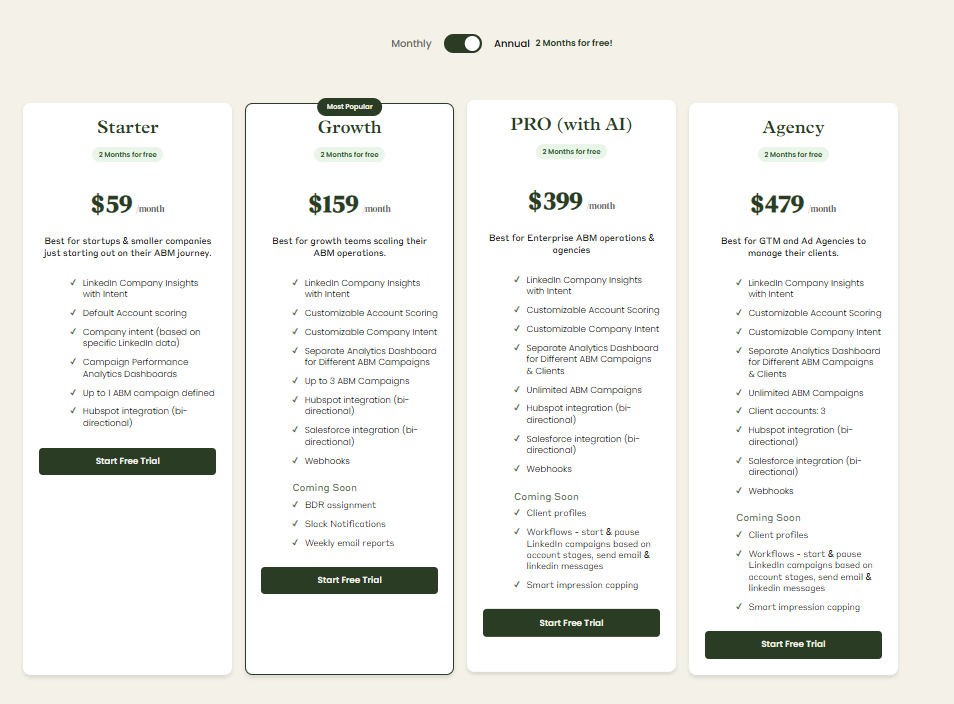

Plans begin at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI), and $479/month for the Agency plan.

Even the highest plan stays under $7,000 per year, substantially more affordable than Demandbase.

All plans include key LinkedIn ABM features; higher tiers mainly extend limits and add Salesforce sync.

Flexible monthly and annual options are available, with a 37-day free trial to evaluate the platform risk-free.

Here are the key differences to consider (These distinctions can help potential customers determine which platform best fits their needs):

Demandbase is a broad, all-in-one platform. It combines ad management, intent data aggregation, website personalization, sales intelligence, and analytics in one suite.

ZenABM has a narrower focus, concentrating on LinkedIn Ads analytics, account scoring, and CRM sync.

If you want one platform to replace several point solutions (ads, web personalization, etc.), Demandbase offers that breadth.

ZenABM, on the other hand, sticks to doing one thing well (LinkedIn-centric ABM) and does not attempt to cover channels like web or email.

A fundamental difference is in how each handles “intent” data.

Demandbase utilized third-party intent data: it can integrate data from providers like Bombora, which tracks 62k+ B2B web topics, to see if target accounts are researching relevant keywords. This gives a broad view of interest, but at an added cost and potential noise (since it’s based on external web activity).

ZenABM relies on first-party intent signals from ad engagement. You directly see which accounts engaged with your content and exactly what they engaged with. This qualitative intent from LinkedIn ads can be more actionable for sales (e.g. “Account A clicked our cloud-security ad, so they’re interested in that topic”) without paying for a third-party feed.

Demandbase supports a multi-channel advertising approach, while ZenABM, for now, focuses on LinkedIn.

Demandbase is powerful but complex. Users on G2 often mention a steep learning curve and that the platform can feel overwhelming due to its depth. It requires dedicated ops or enablement resources to fully implement and maintain.

In contrast, ZenABM is designed to be simple and plug-and-play. Its feature set is streamlined, and integration is straightforward (just connect LinkedIn and your CRM). This means even a small marketing team without a marketing ops specialist can use ZenABM effectively.

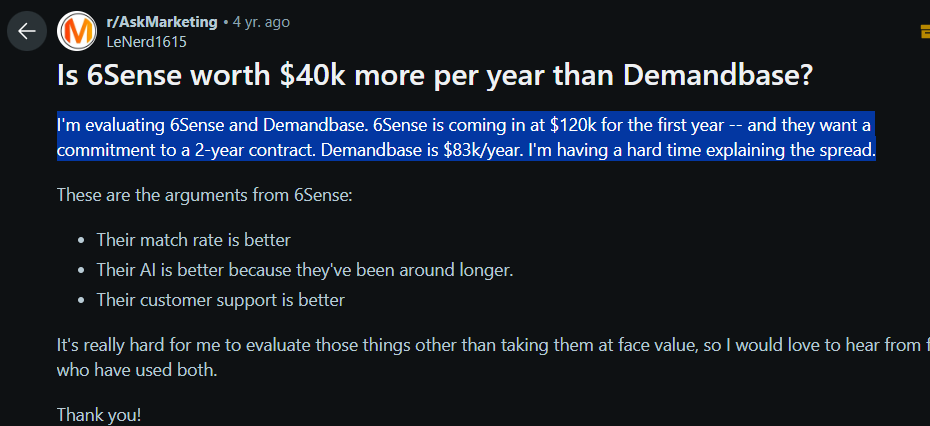

The pricing difference is dramatic.

ZenABM is a fraction of the cost of Demandbase with monthly plans in the low hundreds of dollars, it’s feasible even for startups and SMBs. Demandbase, with typical contracts in the tens of thousands per year, is a serious investment usually justified only for larger organizations. Moreover, Demandbase’s costs scale with number of users and add-ons, whereas ZenABM’s pricing is mostly flat per tier (unlimited users, up to certain campaign limits).

You can know more about this pricing comparison in our Demandbase pricing guide.

Demandbase suits large B2B enterprises with complex, multi-channel ABM programs that need an all-in-one platform at scale.

ZenABM, on the other hand, is built for small to mid-market teams or focused pods running LinkedIn-first ABM. It’s ideal for startups or mid-market firms wanting core ABM capabilities without enterprise bloat.

Enterprises may even pair the two using ZenABM for LinkedIn insights and Demandbase for broader intent and ad orchestration.

Both platforms supports deanonymizing target accounts visiting your website.

Demandbase approaches this with an IP identification pixel on your site for matching visitor IP addresses to its database of companies (and cookies) to guess the company.

However, this method is only accurate roughly 42% of the time (as one study found) due to VPNs and shared IPs.

ZenABM offers a creative alternative using LinkedIn. ZenABM suggests running low-cost LinkedIn text ads targeted at your website visitors as a way to reveal interested accounts.

Text ads on LinkedIn have very low click-through rates (so they’re inexpensive to serve), but ZenABM will show you which companies saw those ads frequently, meaning those companies’ employees likely visited your site’s key pages.

This first-party deanonymization tactic can identify engaged accounts more reliably than fuzzy IP matches.

The “better” ABM platform depends on your organization’s needs.

Here’s a balanced take:

ABM success depends on scale, budget, and intent strategy.

Demandbase suits large, multi-channel enterprises.

ZenABM offers lean, LinkedIn-first ABM with actionable first-party signals for smaller teams,

In fact, features like first-party qualitative intent from LinkedIn ads are pretty unique to ZenABM, so even bigger teams that want a LinkedIn-centric layer over their existing stack consider ZenABM as a complementary tool.