©2026 ZenABM - All Rights Reserved.

In this article, I have compared Demandbase vs. Terminus based on their features, pricing, and ideal uses to help marketing and sales teams decide which one fits their account-based marketing strategy.

I’ll also show you how ZenABM can be a lean, affordable alternative or a complementary layer to these enterprise ABM tools due to its unique features.

Read on…

In case you’re short on time, here’s a quick overview:

Demandbase functions as a comprehensive ABM platform designed to handle the entire spectrum from identifying target accounts to executing ads across multiple channels and tailoring website experiences.

Its core strength lies in bringing all these functions into one place, simplifying management and minimizing the hassle of using separate tools.

The platform also consolidates contact and account data to improve sales intelligence, data enrichment, and targeted outreach for stronger ABM execution.

Key highlights of Demandbase:

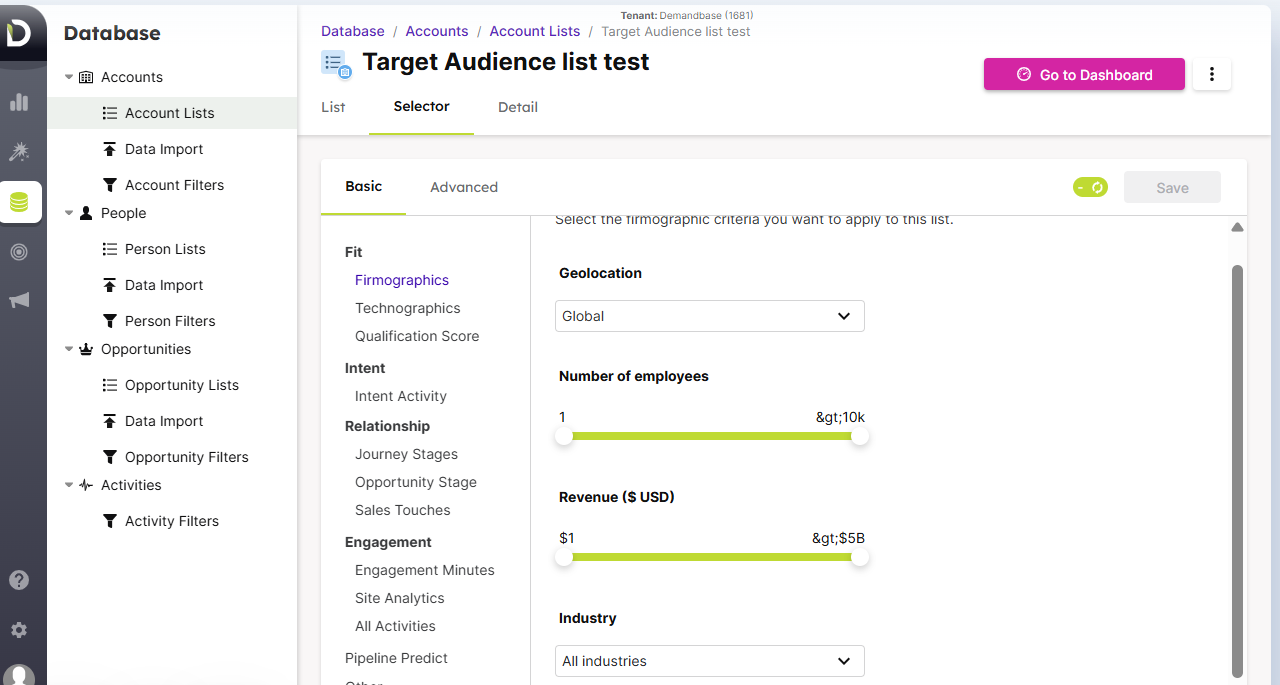

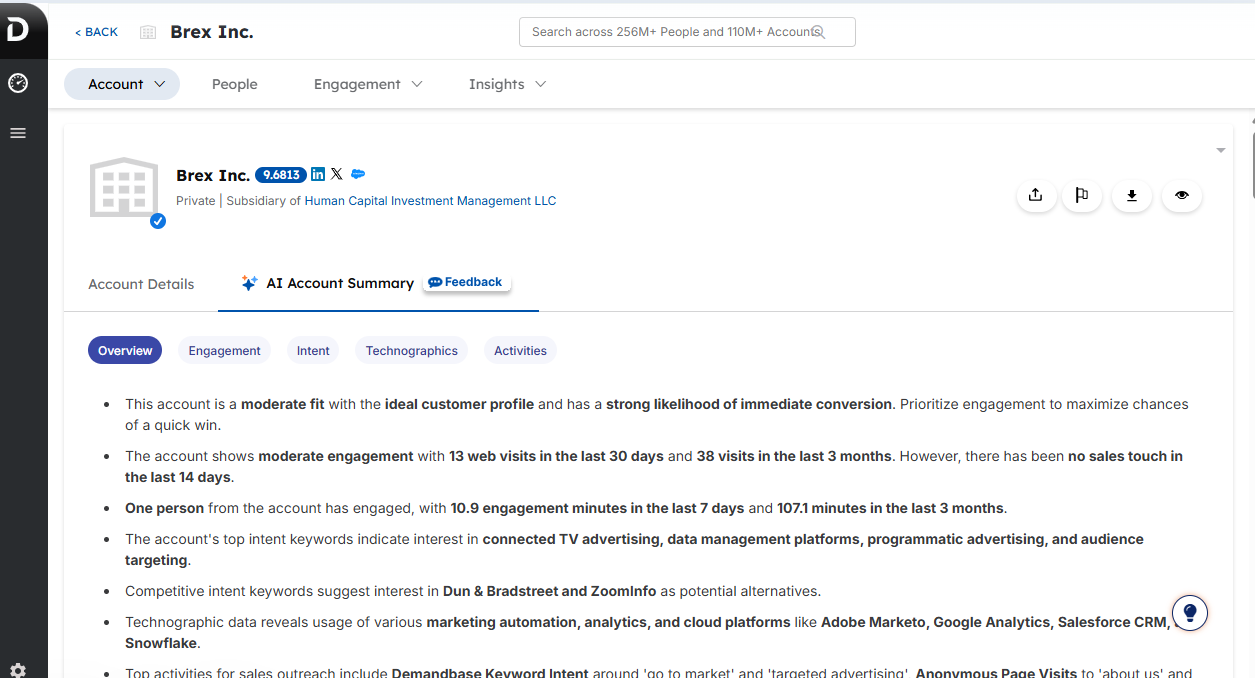

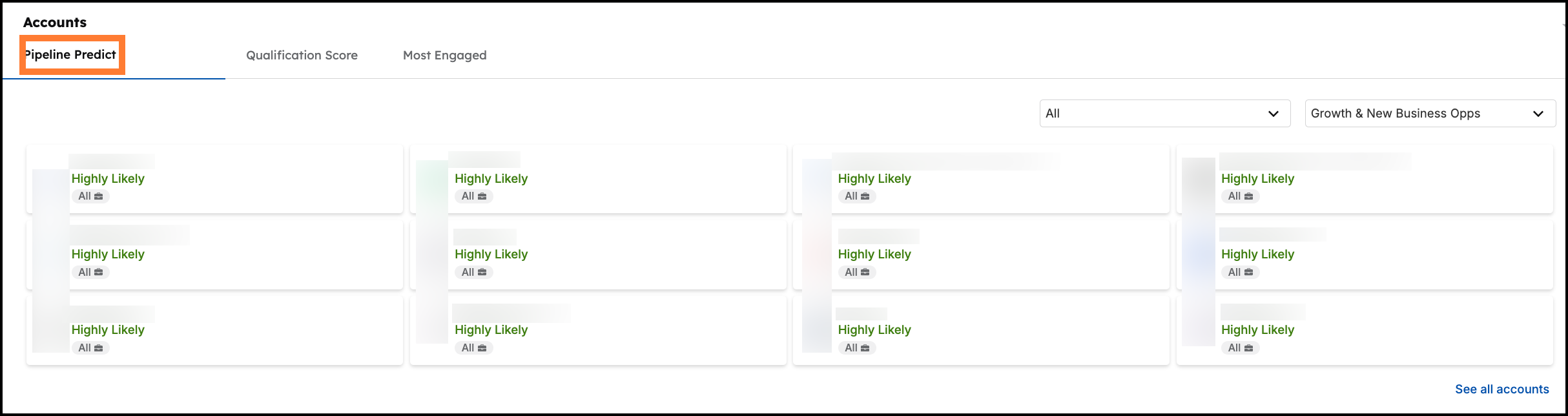

Demandbase enables marketers to create and refine target account lists using both internal and external data. Its AI-driven insights consider firmographic, technographic, and intent-based signals to recommend the most relevant accounts to pursue.

This helps organizations focus on the right prospects.

Btw, account intelligence and targeting are also what Demandbase is the most priased for.

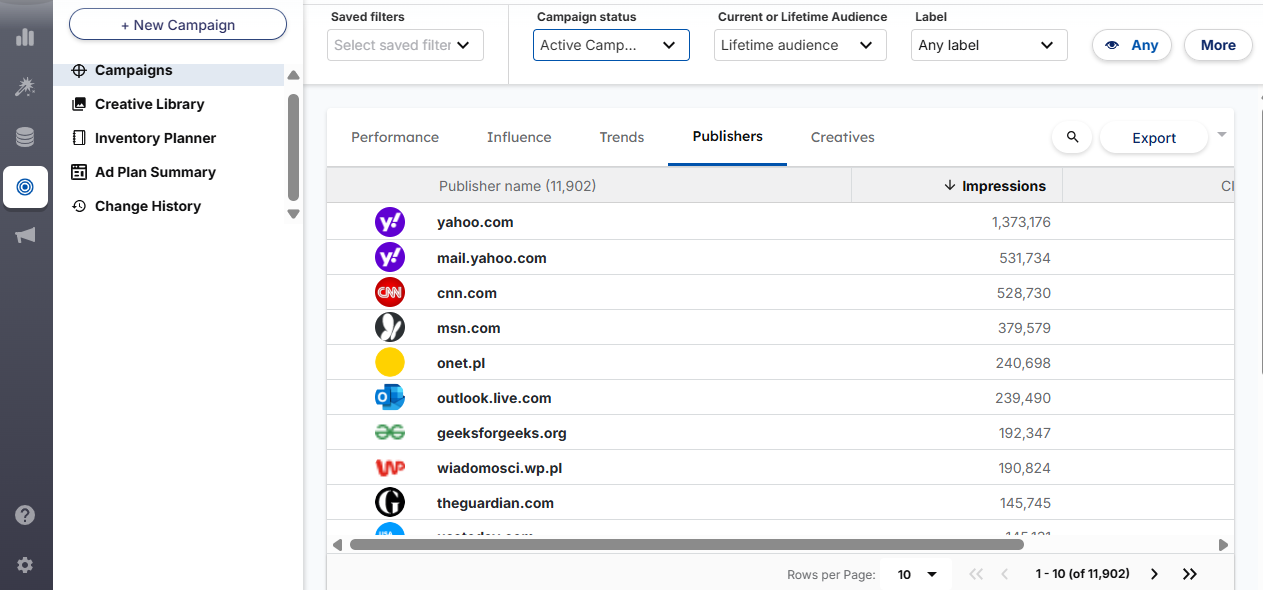

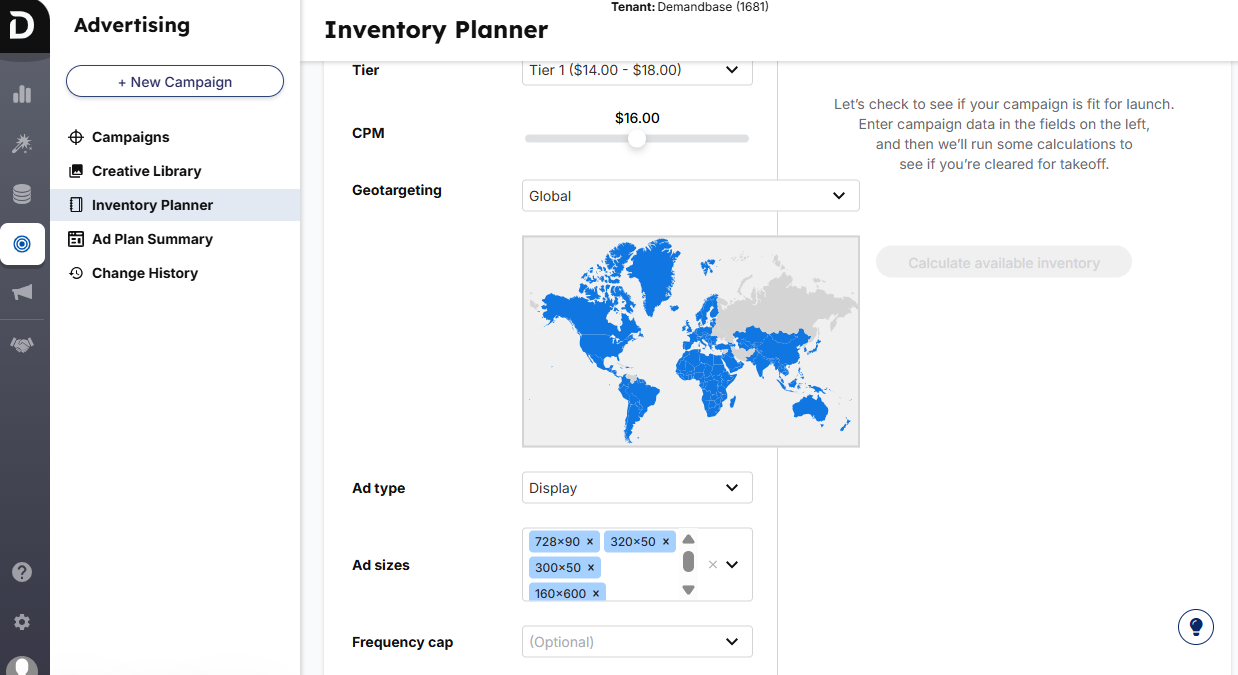

Demandbase’s built-in DSP allows marketers to manage display, retargeting, native, and Connected TV campaigns from one interface. Its intent-based targeting ensures ads reach the most relevant audience segments across multiple touchpoints.

It also connects with major social networks, so you can run LinkedIn, Facebook, Twitter, and YouTube campaigns directly within Demandbase, while maintaining account-level frequency caps and leveraging AI for budget optimization.

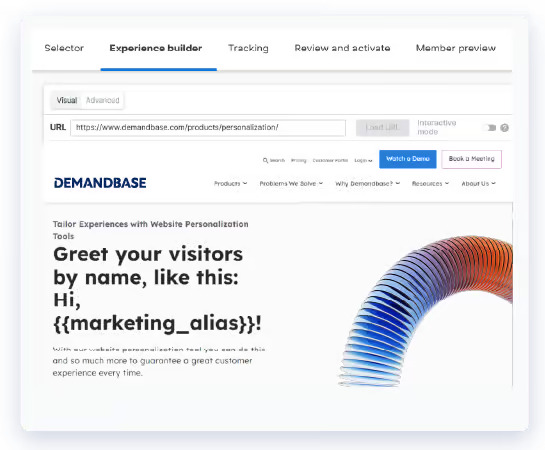

Demandbase lets marketers deliver personalized website experiences to target accounts.

You can display dynamic, account-specific content such as headlines, offers, or CTAs based on each visitor’s industry, intent, or funnel position.

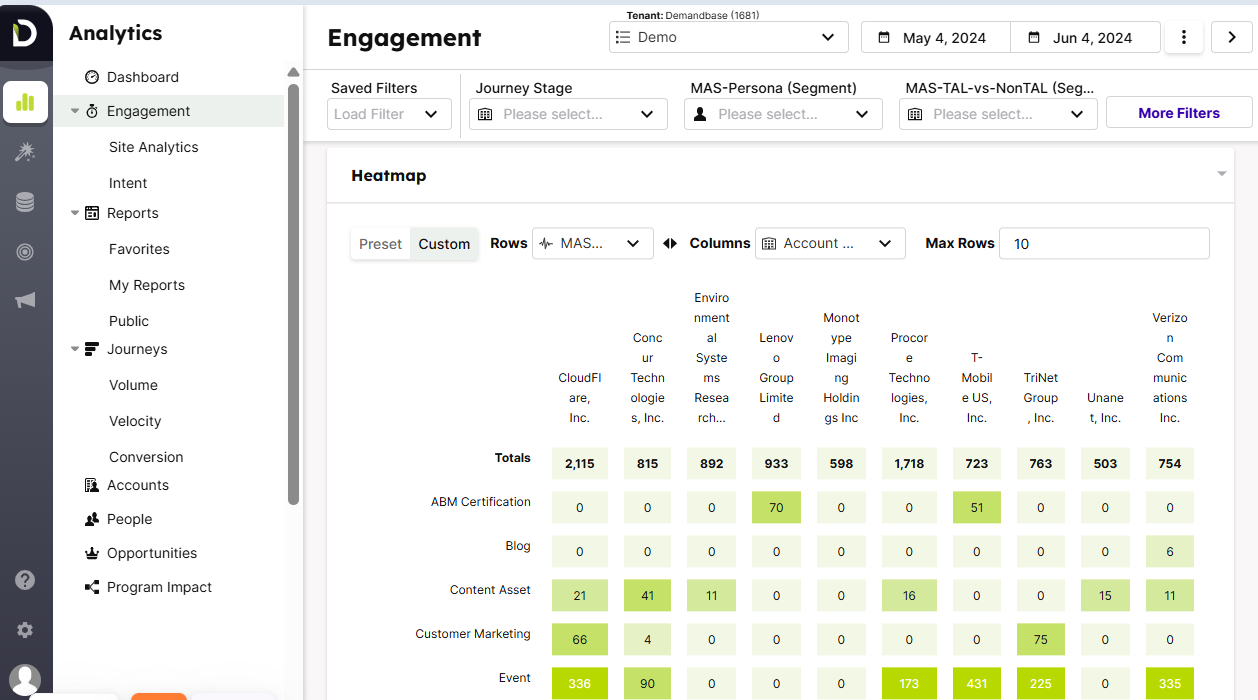

Demandbase merges third-party intent data from 62,500+ B2B topics with your own engagement data.

This helps you identify which target accounts are actively researching topics across the web (via providers like Bombora) and correlate that with how they interact with your campaigns.

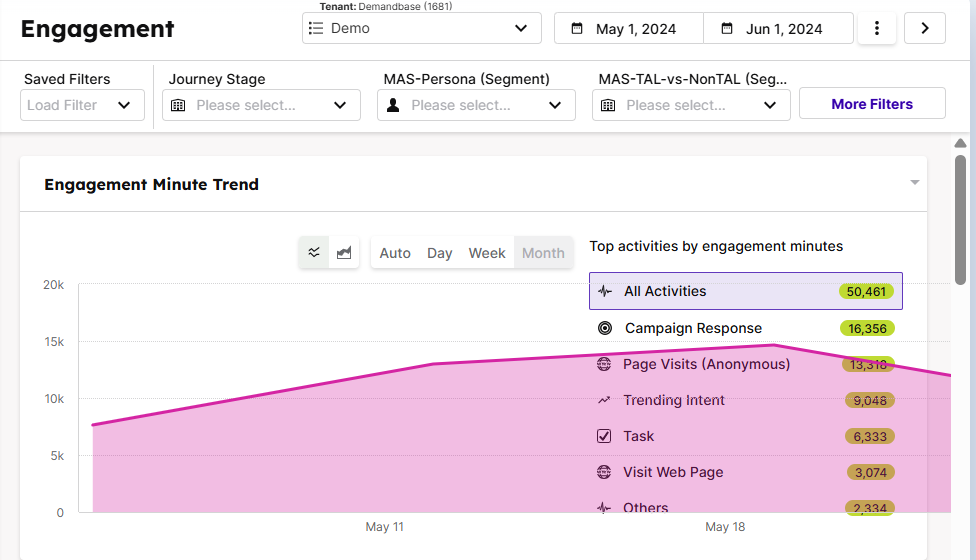

The platform visualizes this through engagement heatmaps and predictive scores, giving a complete view of each account’s buying intent. Its predictive analytics help marketers prioritize high-intent accounts and tailor outreach for maximum ROI.

Pro Tip: Instead of relying solely on external intent feeds, consider leveraging first-party engagement data.

ZenABM, for instance, captures direct qualitative intent by monitoring company interactions with your LinkedIn ads, providing sharper, more actionable insights.

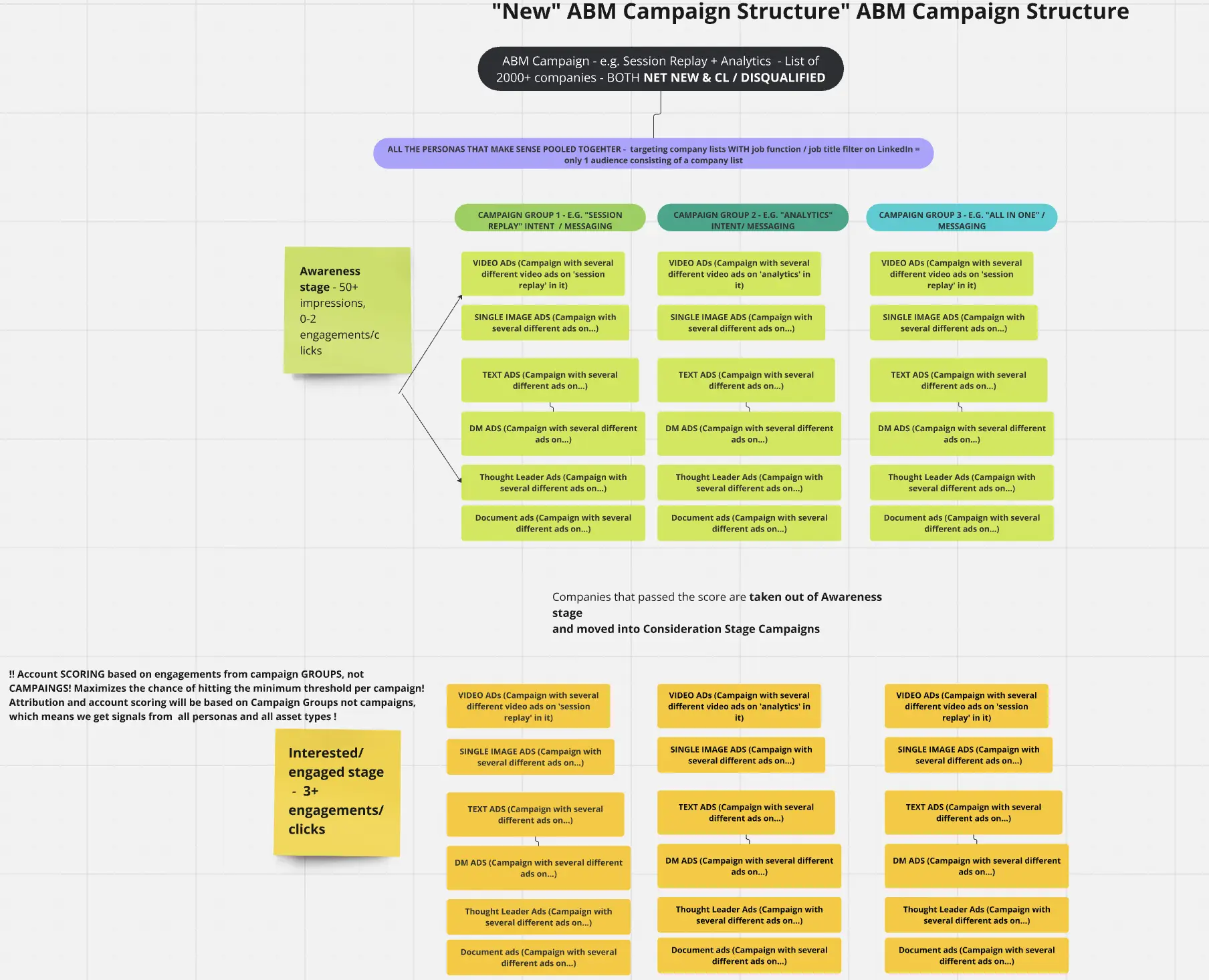

One of our customers, Userpilot, structured entire ABM plays using this model, categorizing ads by pain points and doubling down on BOFU campaigns based on engagement trends.

Their campaign structure:

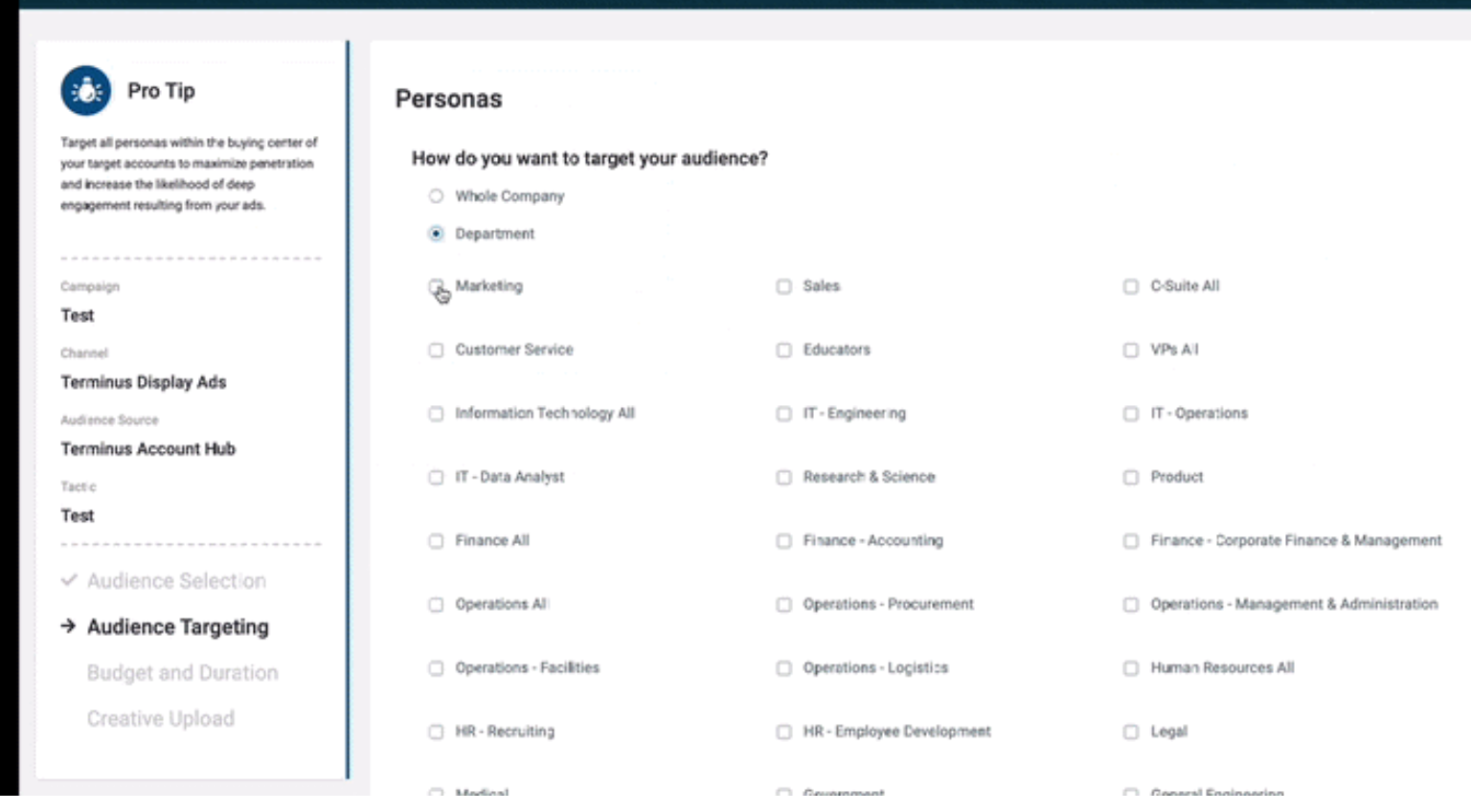

The platform identifies key decision-makers and builds buying committees within each account. You can target campaigns or outreach toward specific roles (like CMOs or CTOs), improving persona-level precision.

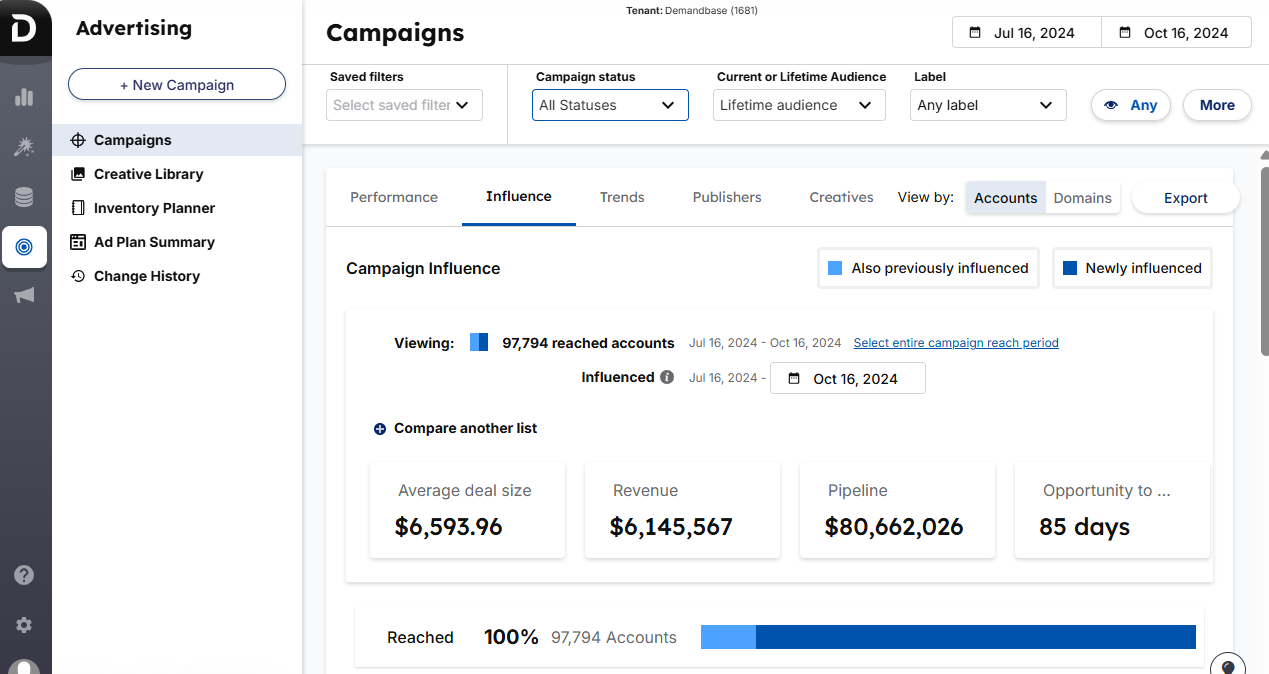

Demandbase delivers in-depth analytics and attribution dashboards that track engagement, pipeline influence, and ROI across campaigns.

AI-powered insights forecast potential pipeline outcomes and flag high-probability deals to guide sales focus.

Remember: Regularly updating and reviewing analytics is key to extracting full value from the tool.

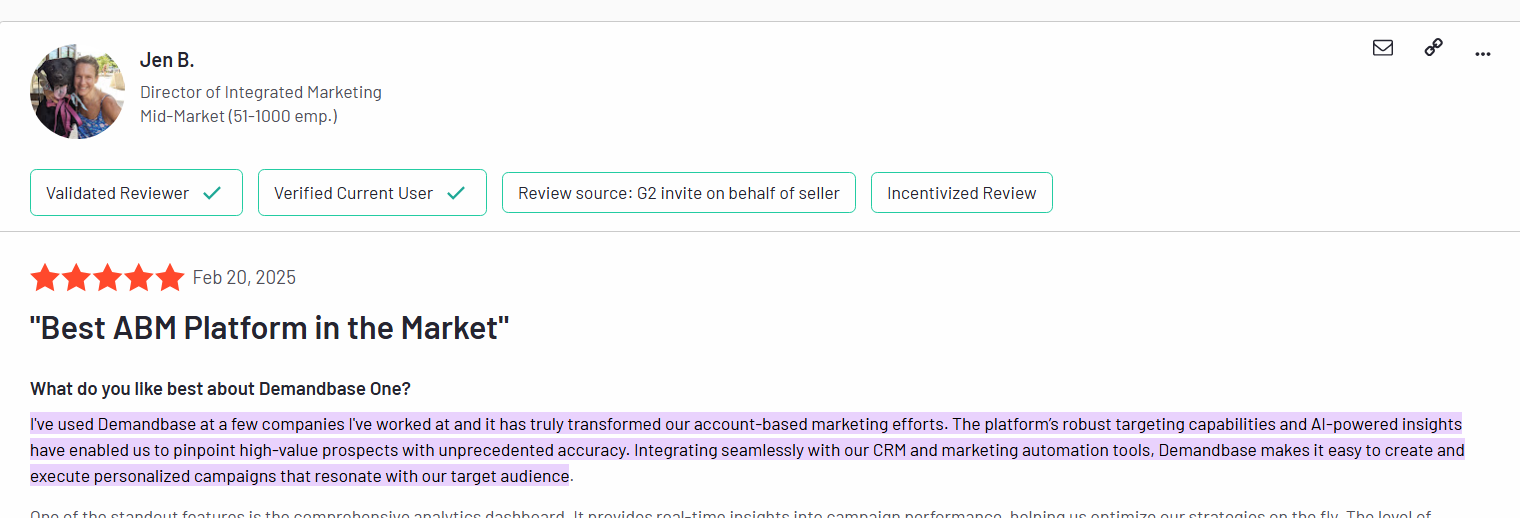

Demandbase integrates seamlessly with leading CRMs like Salesforce, marketing automation platforms, and sales tools. It also supports Outreach and Salesloft, allowing teams to sync engagement insights directly into their workflows.

This ensures sales and marketing operate from the same, unified dataset.

You can explore all its integrations on the Demandbase official docs.

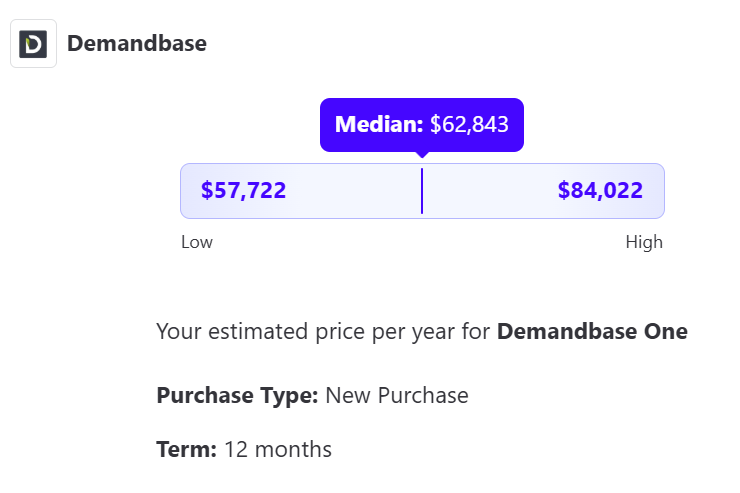

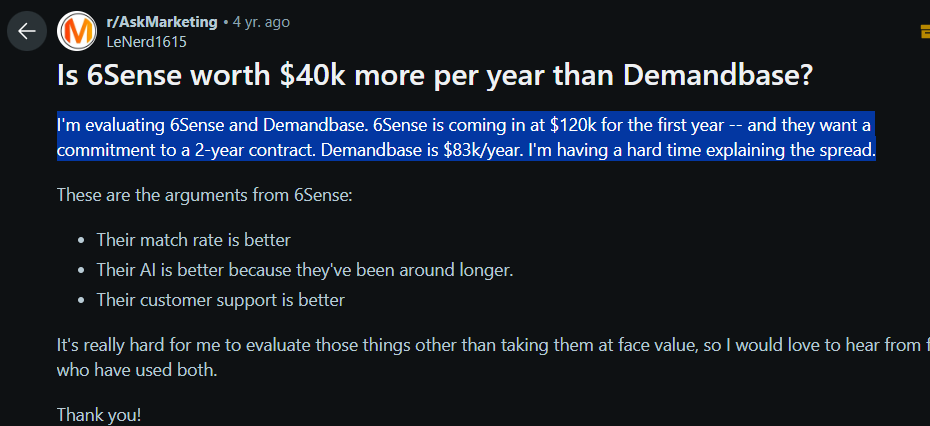

Demandbase doesn’t list its pricing publicly, and you’ll need to contact their team for a custom enterprise quote.

Typically, costs include a base platform fee and per-user charges, with overall pricing scaling by team size, number of accounts, and engagement volume.

According to available data:

When negotiating, it’s smart to benchmark against market averages to avoid overpaying.

Extra add-ons like enhanced intent feeds or data modules can further increase total costs.

Given its scale and complexity, Demandbase might feel excessive for smaller teams that may never use all its features.

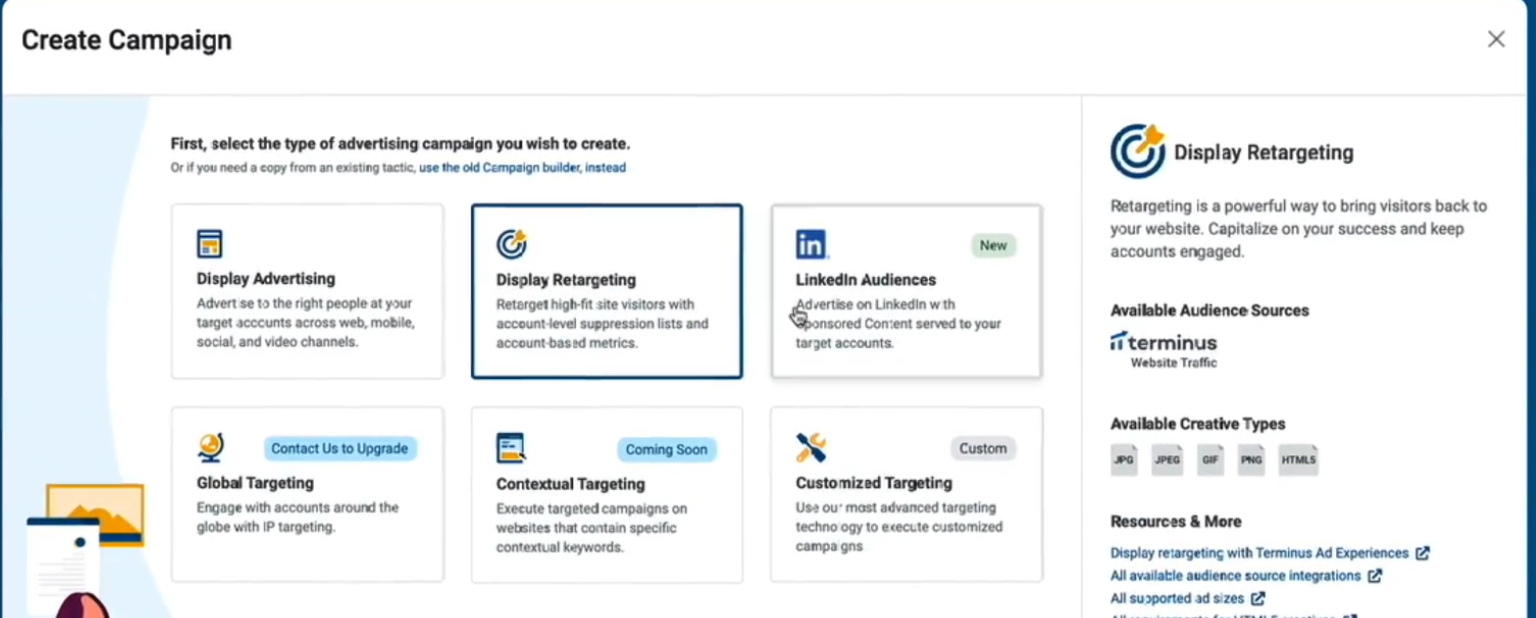

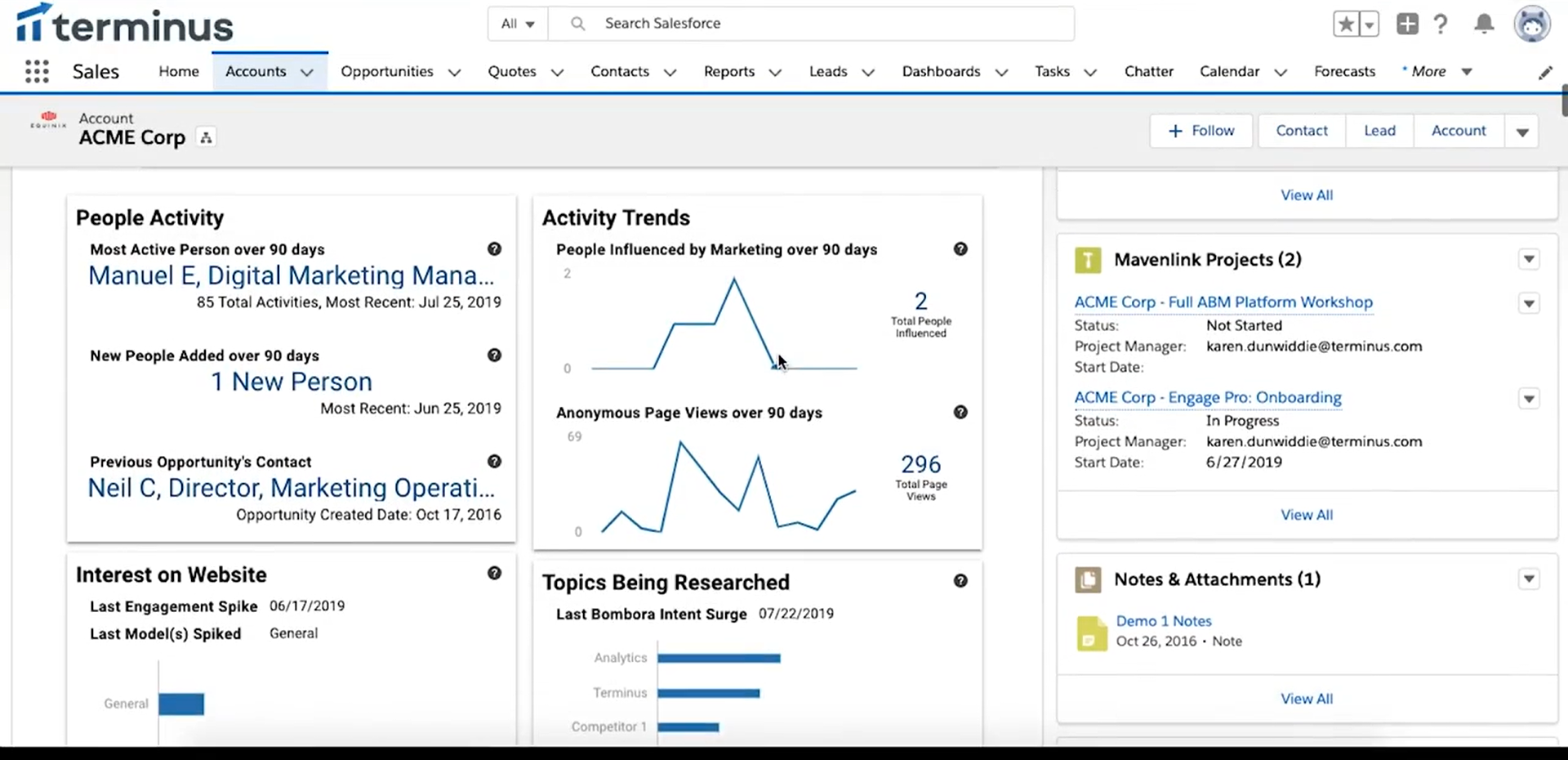

Terminus is often described as an end-to-end ABM platform known for its wide feature set and integrations. It appeals to B2B marketers seeking a unified ABM hub across ads, web, and sales touchpoints.

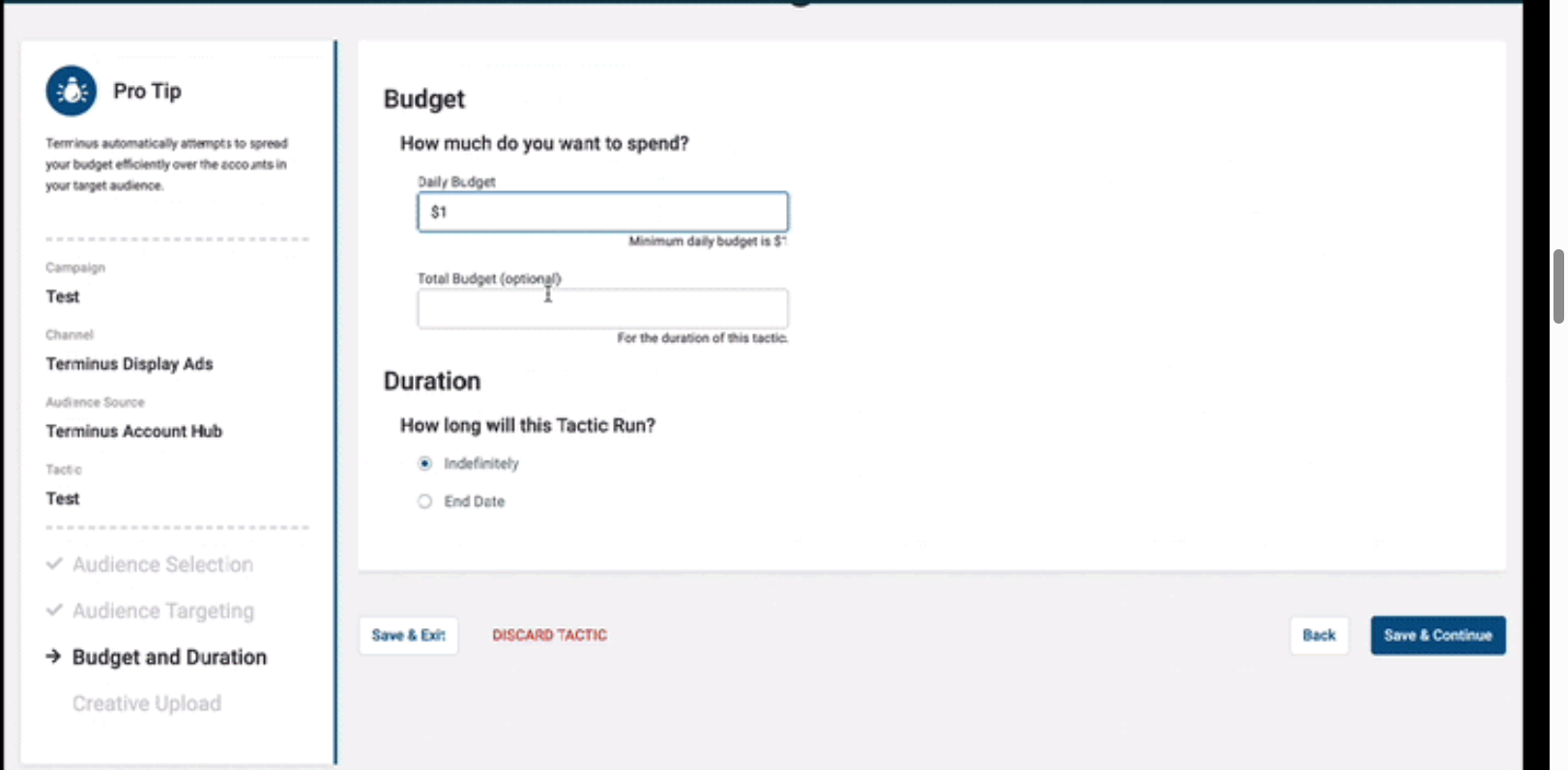

Run and manage ads across multiple channels natively—display, retargeting, LinkedIn, connected TV, and audio. By consolidating ad channels, Terminus helps reach target accounts on the web and social from one platform, balancing impressions across your target account list.

Upload or sync target account lists (TALs) from your CRM and refine audiences by persona attributes like department, seniority, or role.

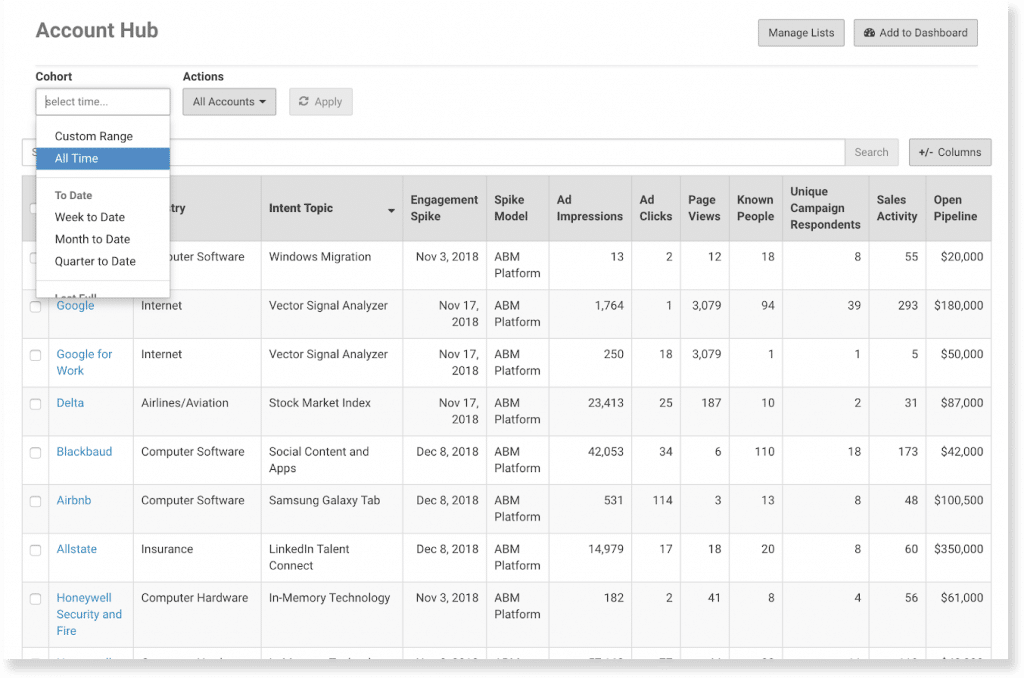

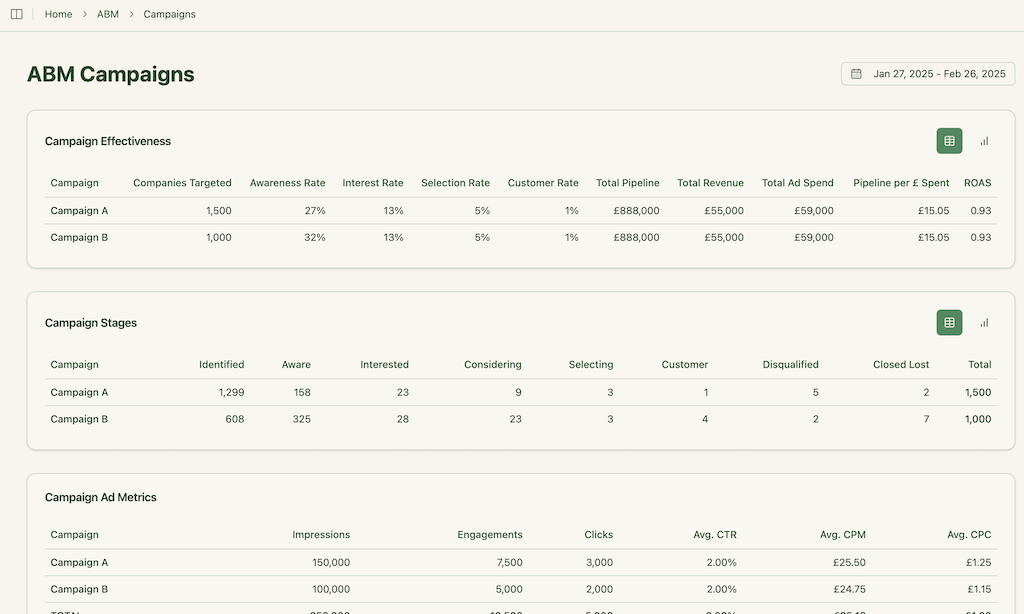

Terminus tracks impressions and clicks at the account level, helping marketers see which accounts are engaging even without direct clicks. The Account Hub compiles engagement metrics like impressions, site visits, and campaign interactions.

Terminus’s Visitor ID de-anonymizes website traffic using reverse IP lookup, cookies, and CRM matching. It connects anonymous visits to known accounts, though accuracy is often limited (~40–50%).

Pro Tip: ZenABM reveals anonymous visitors for free. You just have to retarget site visitors with LinkedIn text ads that are dirt-cheap anyway.

Terminus integrates with third-party intent providers like Bombora to identify in-market accounts.

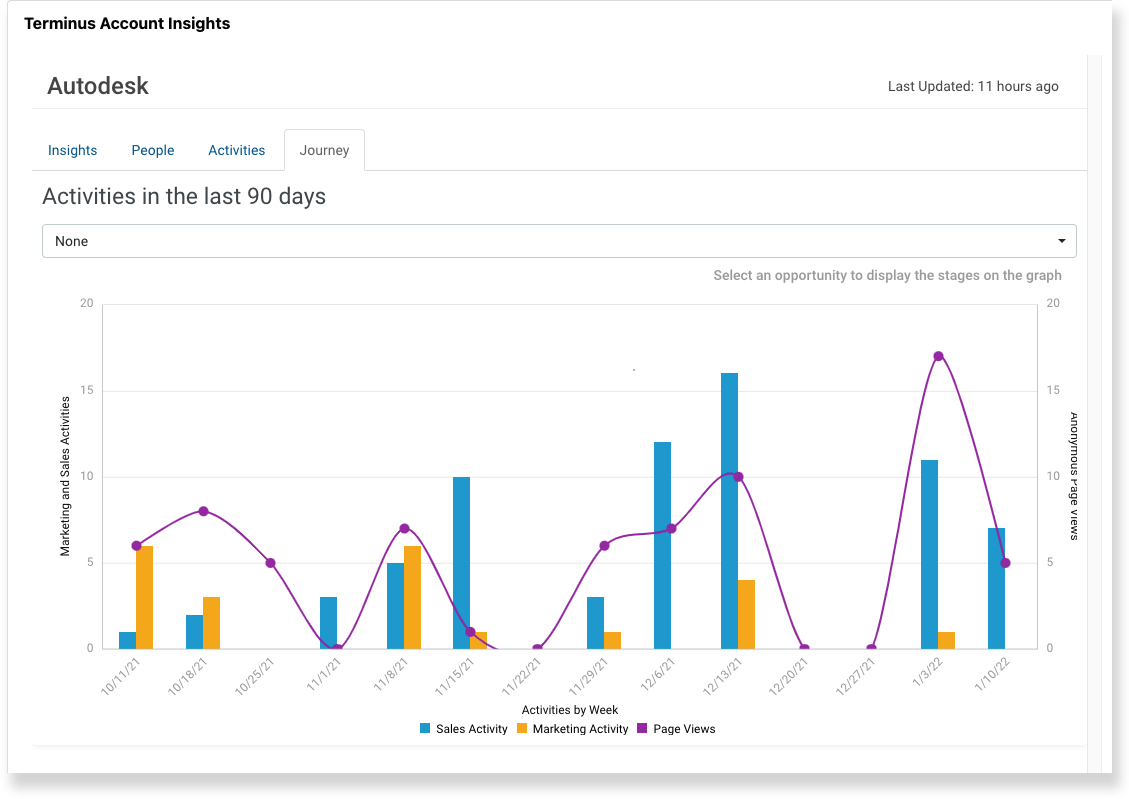

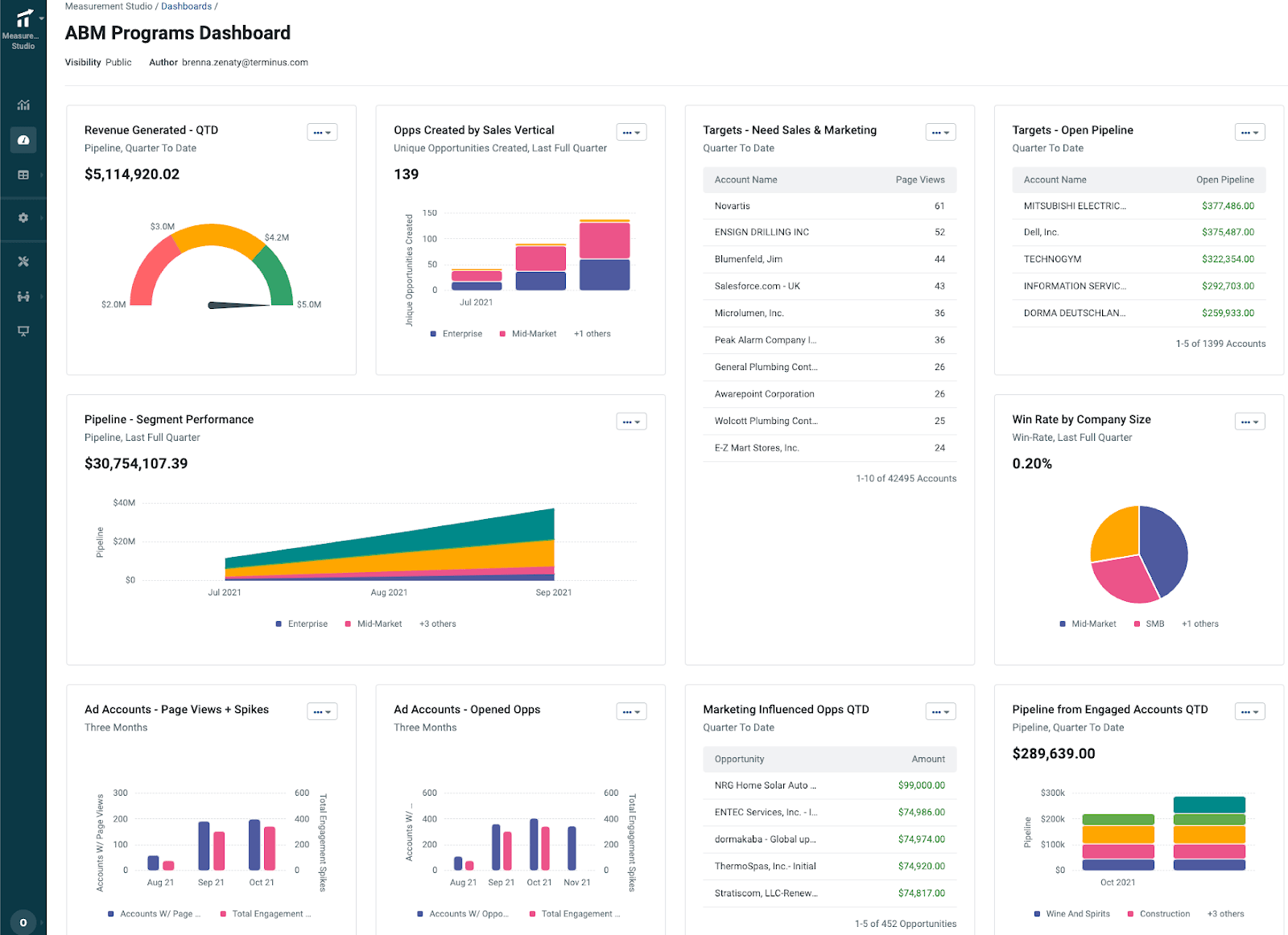

Measurement Studio offers multi-touch attribution and account-level analytics. Activities roll up into an “Account Journey,” showing progression from engagement to revenue. Dashboards cover metrics like revenue influenced, opportunities created, and top engaged accounts.

Terminus connects with CRMs (Salesforce, HubSpot, Microsoft Dynamics), MAPs (Marketo, Pardot, Eloqua), ad platforms (LinkedIn, Google), sales tools (Outreach, Salesloft), analytics (Google Analytics, PathFactory), and data providers (Bombora, G2, Clearbit). Explore all connectors in the Terminus docs.

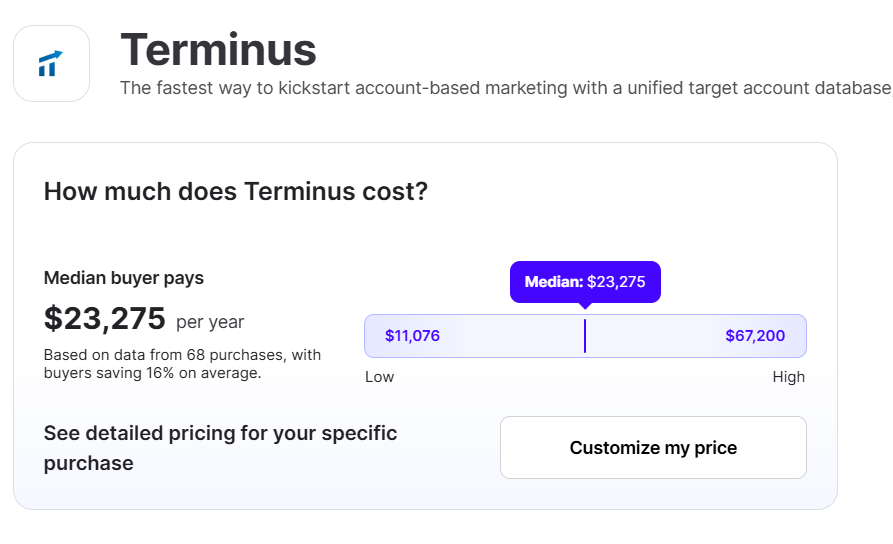

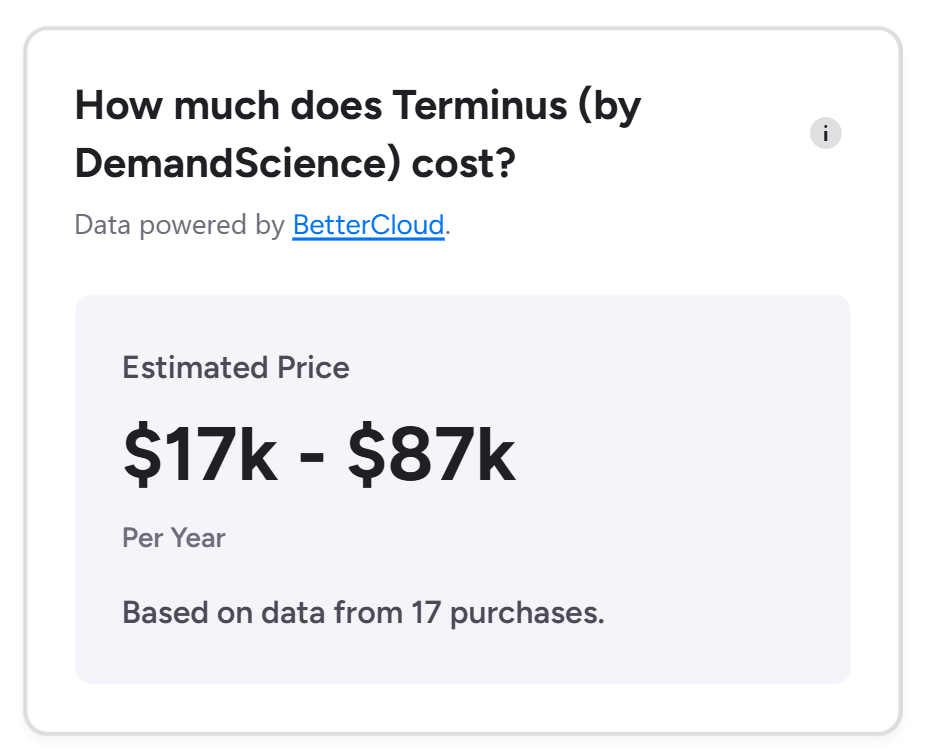

Pricing is quote-based and typically mid-five figures annually, reaching $100K–250K+ for large enterprises.

Vendr reports a $23K median cost, while CMO.com lists starting costs around $57,500/year.

G2 reviews show a wide range between $18K–87K.

Now that we’ve outlined both platforms, let’s compare Demandbase One vs. Terminus on their key differences.

While they overlap in many ABM features, there are some important distinctions tabulated here:

| Criteria | Demandbase One | Terminus |

|---|---|---|

| Scope of ABM Capabilities | Comprehensive, all-in-one ABM suite covering ads, intent, sales intelligence, analytics, personalization, and data management. Features proprietary AI for scoring and a vast native data cloud. | More ad-centric, originally built around LinkedIn and display ads. Covers core ABM functions but lacks Demandbase’s predictive analytics depth and native data infrastructure. |

| Advertising Channels | Runs campaigns across LinkedIn, Google, Facebook/Instagram, Twitter, YouTube, Bing, programmatic display, and connected TV via its DSP. Includes AI bid optimization and frequency capping. | Supports LinkedIn and Google Ads natively, plus display via network partners. Lacks direct Facebook or multi-social integrations but offers LinkedIn real-time sync and strong ad budgeting tools. |

| Unique Features | Extensive data enrichment through InsideView and Engagio, advanced web personalization, and 1:1 microsite creation for accounts. | Native email signature ads and chatbot integrations for ABM engagement, which Demandbase lacks out of the box. |

| Sales Alignment | AI alerts, intent spike notifications, and analytical summaries for sales. Deep CRM integration but requires sales teams to use its dashboards for full benefit. | Pushes engagement data directly into CRMs and Slack. Enables live chat with site visitors and keeps sales fully within their native tools. |

| Data Sources & Intent Signals | Owns first-party and proprietary intent data. Tracks site behavior through its own pixel and triangulates activity using multiple internal data sources. | Relies on partners like Bombora and DemandScience for third-party intent and enrichment. Uses IP and cookie matching (~42% average accuracy) for visitor ID. |

| Pricing Structure | Custom pricing based on platform fee, user seats, and add-ons. Typically higher cost, starting high-five to six figures annually. | Pricing based on modules and audience size, not users. Lower entry cost (mid-five figures) and more flexible for smaller teams. |

| Implementation & Ease of Use | Powerful but complex, with long setup times (months). May require external consulting and dedicated admin resources. | Faster setup (weeks), intuitive interface, and strong customer success support. Easier onboarding for lean teams. |

| Best For | Enterprises seeking a unified, deeply integrated, data-rich ABM ecosystem with advanced analytics and personalization. | Mid-market teams prioritizing ad performance, engagement, and speed to value without heavy implementation overhead. |

Demandbase One tends to be “better” if you:

Terminus tends to be “better” if you:

Both Demandbase and Terminus are substantial platforms catering to broad ABM needs.

ZenABM, by contrast, takes a “lean” and focused approach to ABM, designed primarily for LinkedIn advertising-driven strategies.

It’s positioned as a lighter, more affordable option, especially for teams that don’t require the full multi-channel suites of the big players, but do want better insight and automation around LinkedIn-centric ABM campaigns.

Its key features:

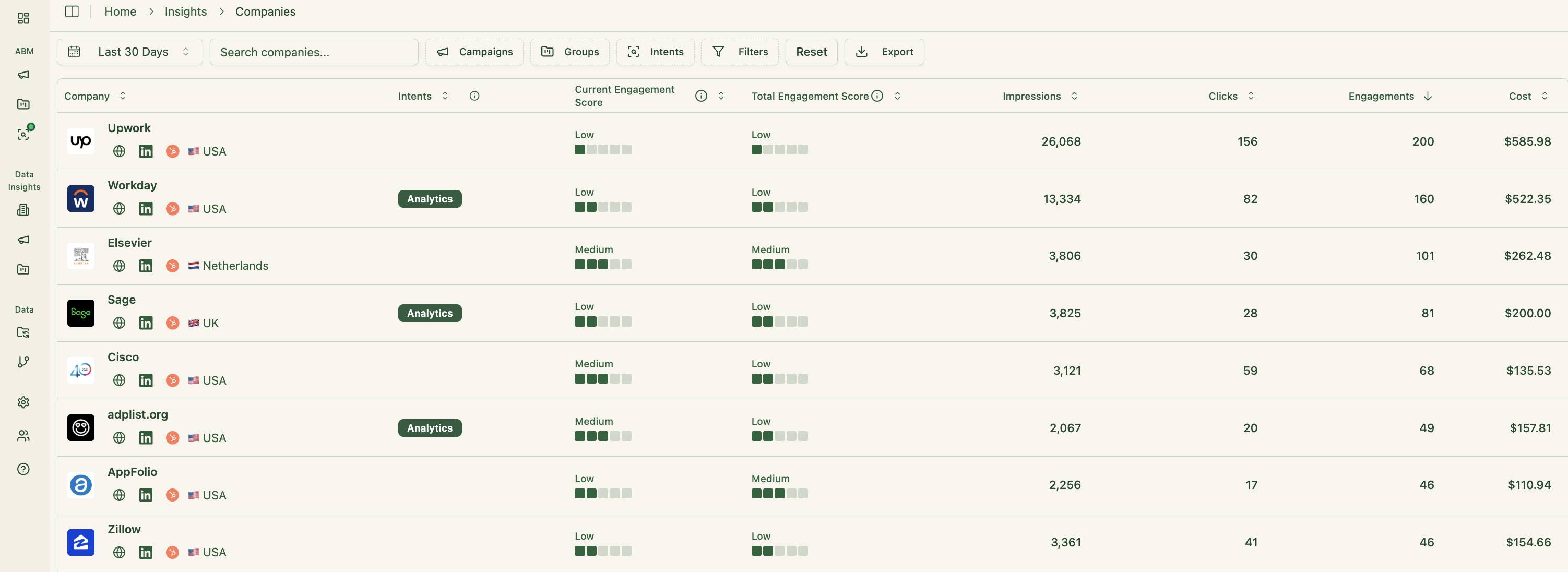

ZenABM connects directly to the official LinkedIn Ads API to pull in account-level data for each LinkedIn ad campaign.

So, you can see exactly which target accounts (companies) are engaging with your LinkedIn ads (impressions, clicks, etc.) – all attributed at the account level.

This first-party data is highly reliable because it originates directly from LinkedIn (user login-based). In contrast, many larger ABM tools, such as Demandbase or Terminus, rely on less accurate methods, including browser cookies or IP matching, to estimate which company a visitor belongs to.

And by inaccurate, I mean very unreliable. A study by Syft, for instance, found that the accuracy of IP matching tools for web visitor deanonymization tops at a mere 42%.

ZenABM’s approach ensures qualitative intent signals directly from ad engagement, so if multiple people from Account X are clicking or reacting to your LinkedIn ads, you know that account is showing interest in your messaging without needing a third-party intent feed.

ZenABM calculates an engagement score for each account based on LinkedIn ad interactions, updating continuously.

You can view current engagement (e.g. in the past week) to identify which accounts are “heating up” right now, as well as historical engagement over time.

This real-time insight helps sales teams prioritize outreach.

ZenABM allows you to define stages in your account journey (for instance: Identified → Aware → Engaged → Interested → Opportunity).

It uses its engagement scores combined with CRM data to categorize each account into an ABM stage automatically.

The best part?

You can customize the thresholds for what constitutes “Engaged” or “Interested,” etc., and ZenABM will track movement of accounts through these stages.

This feature provides funnel visibility similar to big platforms. You can spot if many accounts are stuck in a stage (a funnel leak) or moving forward, and address gaps in your program.

ZenABM integrates bi-directionally with CRMs like HubSpot (and Salesforce in higher tiers).

All those LinkedIn engagement insights can be pushed into the CRM as company properties:

Also, ZenABM automatically updates an account’s status to “Interested” in CRM when they cross a score threshold, and even auto-assigns a BDR (sales rep) to follow up.

ZenABM provides a clever way to derive intent topics from your LinkedIn campaigns. You can tag each LinkedIn ad campaign with a theme or value proposition (for example, one campaign highlights “Feature A” and another highlights “Feature B”).

ZenABM then shows which accounts engaged with which campaign themes, effectively telling you what topic each account is interested in.

This is first-party intent data: rather than paying a third-party data vendor for intent signals about generic keywords, you’re seeing direct evidence of interest (e.g. Account Z clicked the “Feature A” ad, indicating they care about that use case).

Also, these intent signals can be automatically pushed to CRM. This enables marketing and sales teams to design targeted outreach campaigns and time their outreach perfectly to align with account interest.

Benefit?

Reps can personalize outreach, knowing what each account cares about most.

ZenABM offers out-of-the-box ABM dashboards that tie your LinkedIn ad exposure to account engagement, stage progression, and even pipeline contribution.

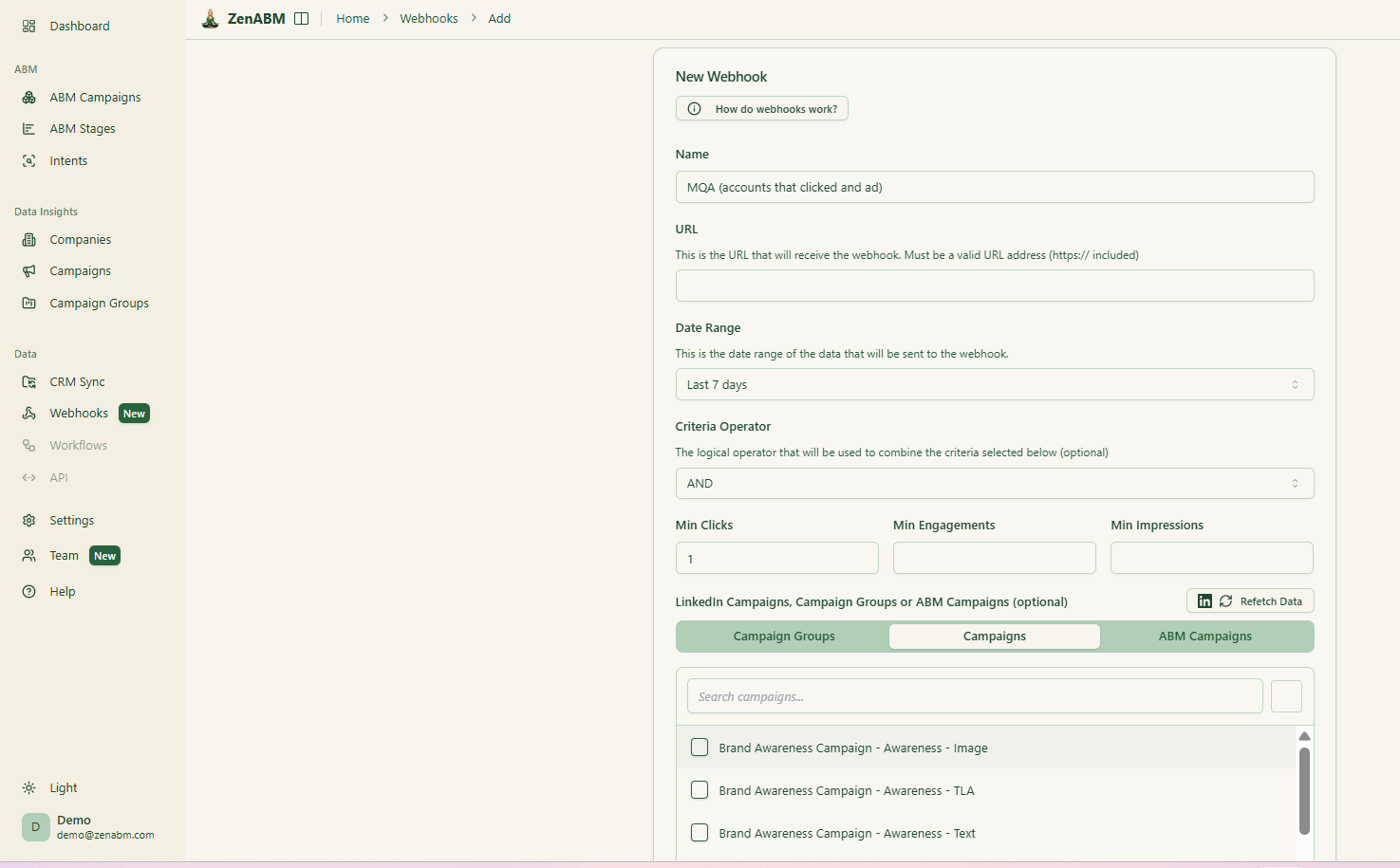

With ZenABM’s custom webhooks rolled-up, now you can put ZenABM wherever and however you want in your workflows.

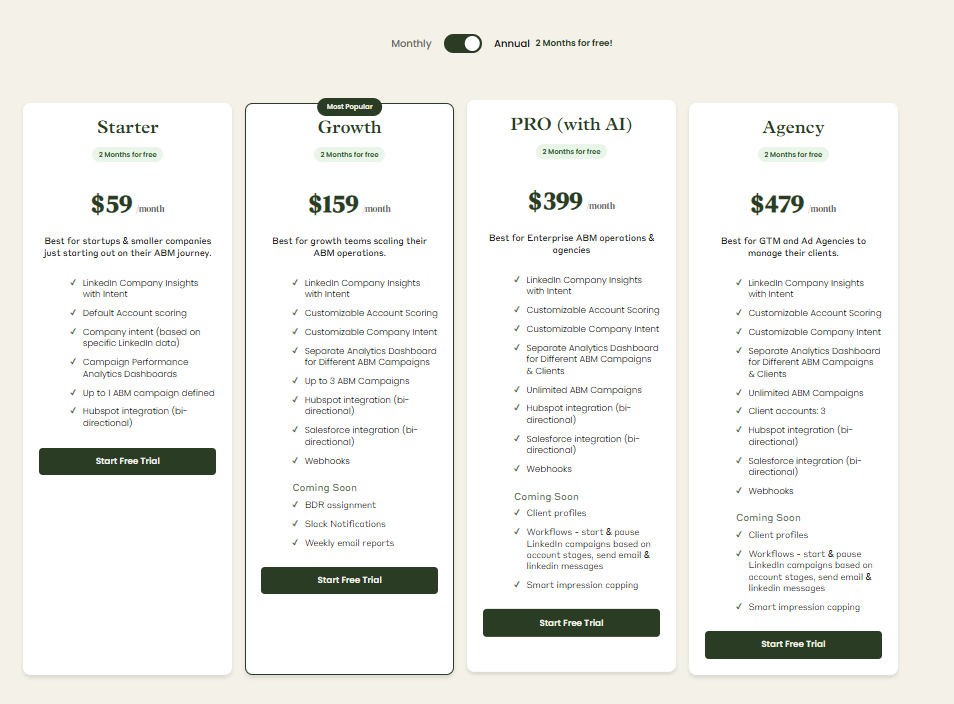

Plans begin at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI), and $479/month for the Agency plan.

Even the highest plan stays under $7,000 per year, substantially more affordable than Demandbase and Terminus.

All plans include key LinkedIn ABM features; higher tiers mainly extend limits and add Salesforce sync.

Flexible monthly and annual options are available, with a 37-day free trial to evaluate the platform risk-free.

Demandbase and Terminus both pack serious ABM muscle, but not every team needs to bench-press a six-figure tech stack.

Demandbase wins on depth and data sophistication, while Terminus shines with usability and faster setup for smaller GTM teams.

The truth?

Most B2B companies don’t need a sprawling enterprise suite to run effective ABM.

What they need is focus: first-party intent, sales visibility, and channel-level clarity.

That’s exactly where ZenABM fits in.

It delivers the core of ABM including real account engagement tracking, CRM sync, and stage visibility without the complexity tax.

If you’re serious about scaling ABM on LinkedIn but not a fan of bloated software and opaque pricing, ZenABM is your lean, first-party, LinkedIn-first alternative.