©2026 ZenABM - All Rights Reserved.

In this article, I have compared Demandbase vs. Factors.ai based on their features, pricing, and ideal uses to help marketing and sales teams decide which one fits their account-based marketing strategy.

I’ll also show you how ZenABM can be a lean, affordable alternative or a complementary layer to these enterprise ABM tools due to its unique features.

Read on…

Demandbase operates as an all-in-one ABM platform that spans the full workflow, from assembling ideal account lists to orchestrating multi-channel advertising and tailoring on-site experiences. Its breadth lets teams replace a patchwork of point tools with a unified system, which streamlines day-to-day work and limits the hassle of maintaining disconnected solutions.

Beyond campaigns, Demandbase consolidates account and contact records to strengthen sales intelligence, enrichment, and outreach so ABM motions land with more precision.

Key Demandbase capabilities explained:

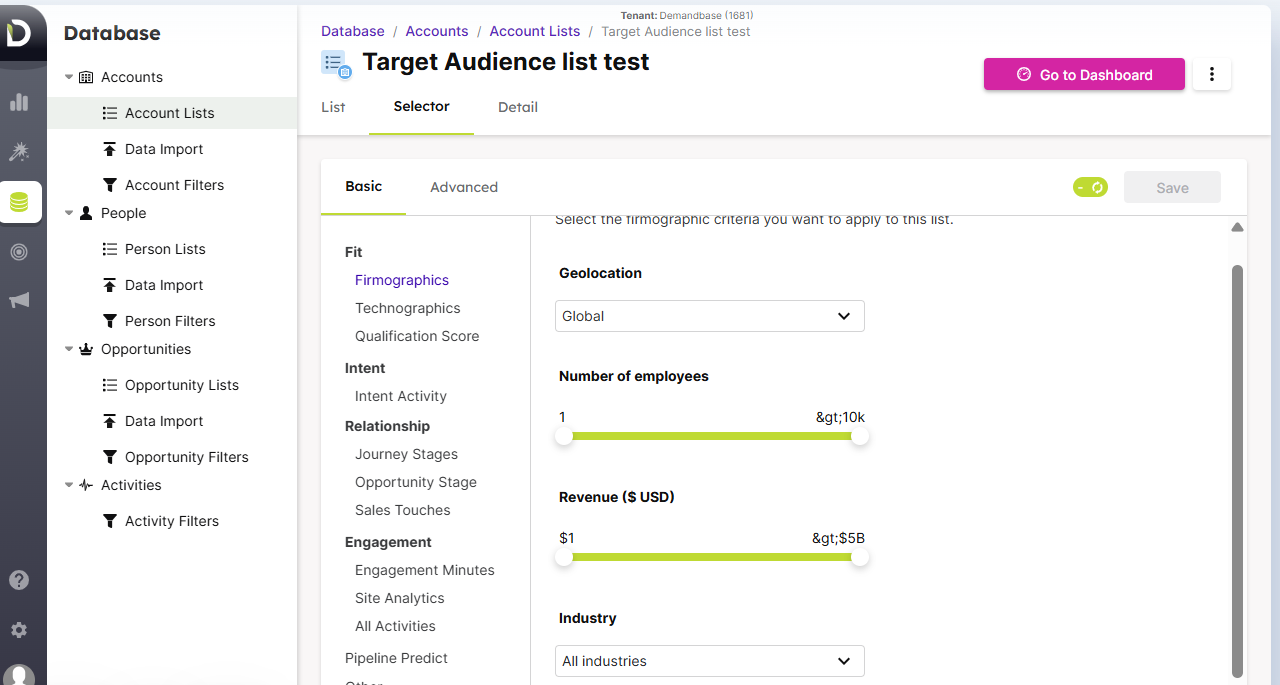

Demandbase helps you assemble and fine-tune target account lists by blending first-party and third-party data, then layering AI suggestions that consider firmographic, technographic, and intent signals.

This makes it easier for larger teams to prioritize the most promising accounts.

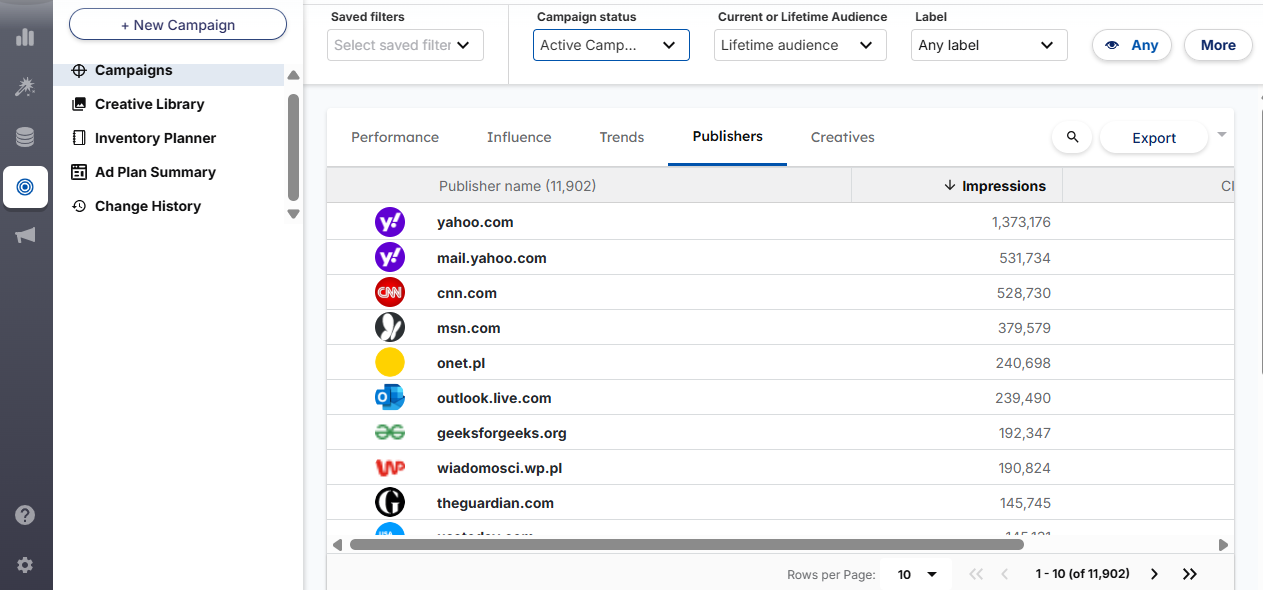

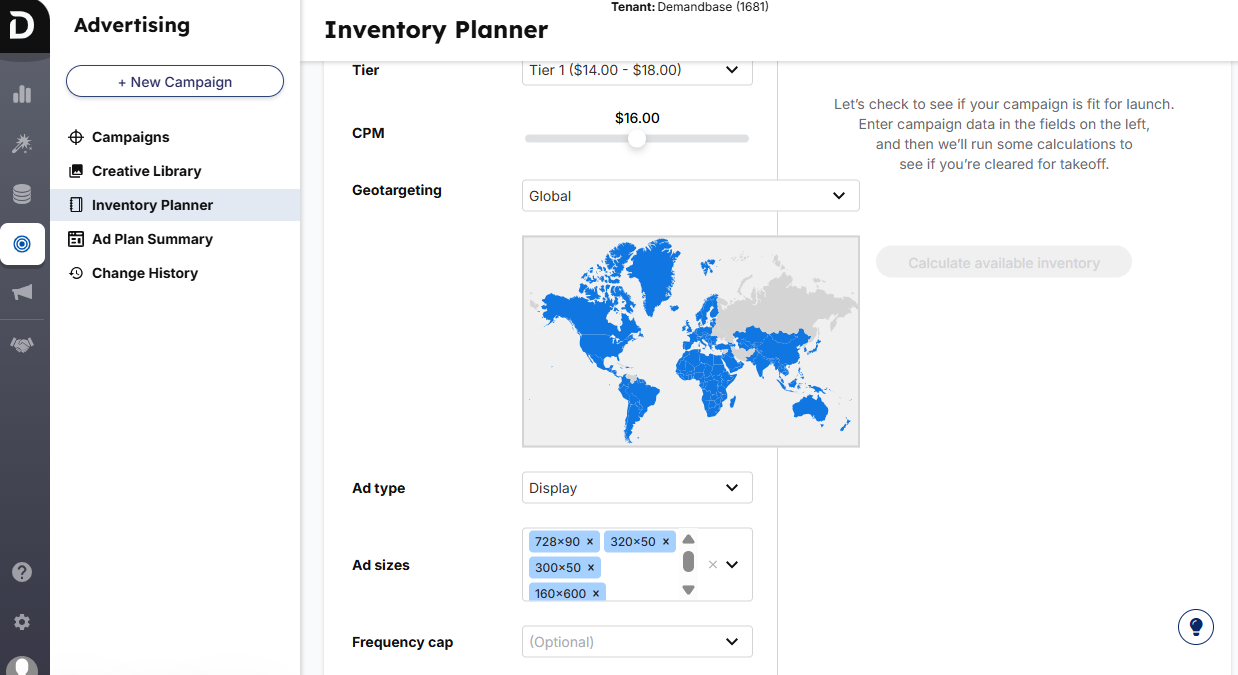

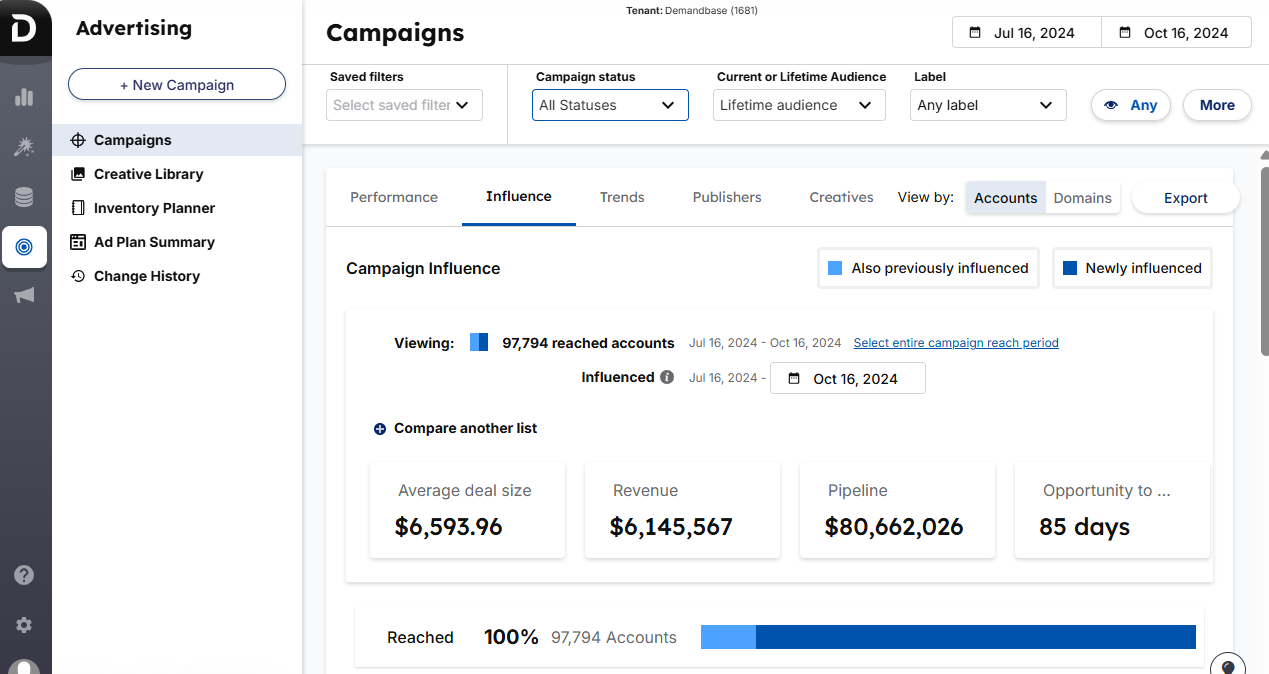

Demandbase ships with its own programmatic stack so you can execute display, retargeting, native, and Connected TV campaigns from one place. The native DSP supports precise account targeting across channels and uses intent data to reach the right audiences at the right time.

It also connects to leading social networks. You can manage LinkedIn, Facebook, Twitter, and YouTube from within Demandbase, apply account-level frequency controls, and lean on AI to optimize budgets.

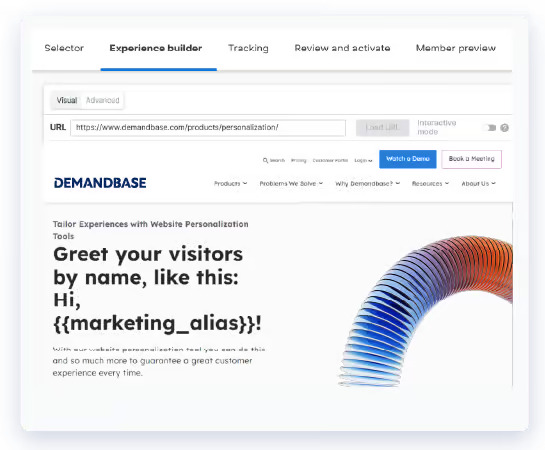

Demandbase supports tailored website experiences for target accounts.

You can deliver account-specific landing pages or dynamic modules such as greetings and offers tuned to a visitor’s industry or funnel stage.

Demandbase brings in third-party intent data that covers 62,500 plus B2B topics and merges it with your first-party engagement.

In practice, Demandbase flags target accounts that are “surging” on relevant topics across the open web via sources like Bombora, alongside how those accounts interact with your own content.

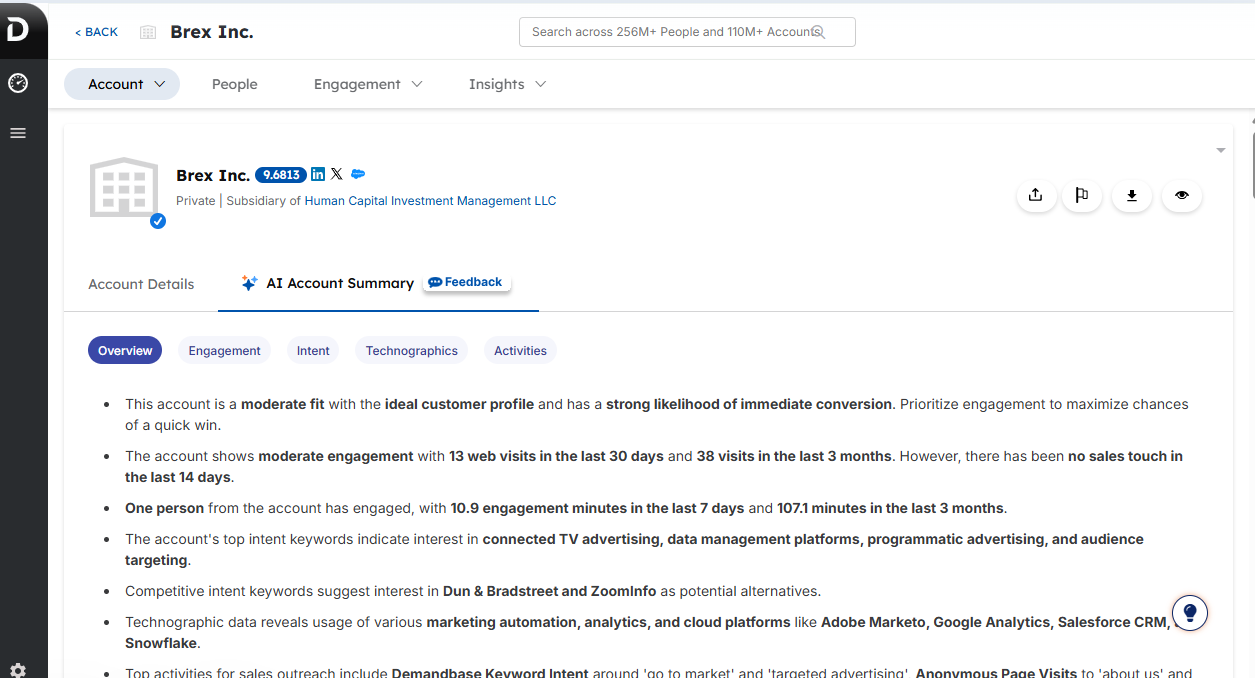

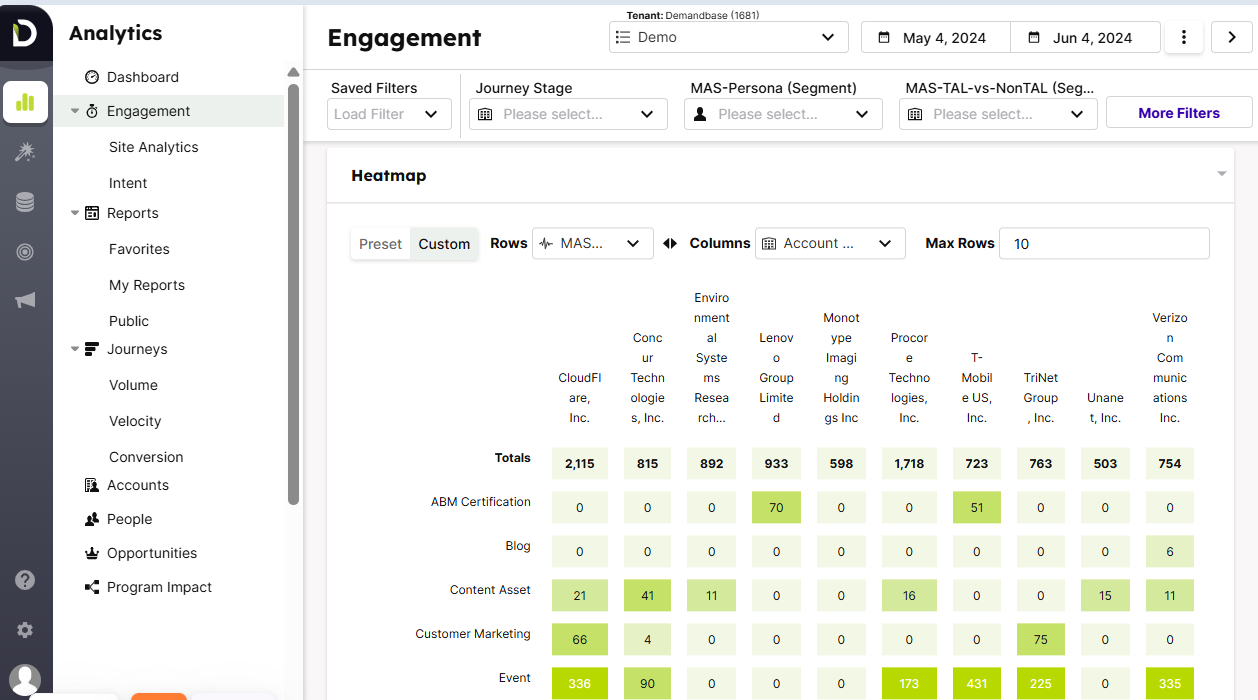

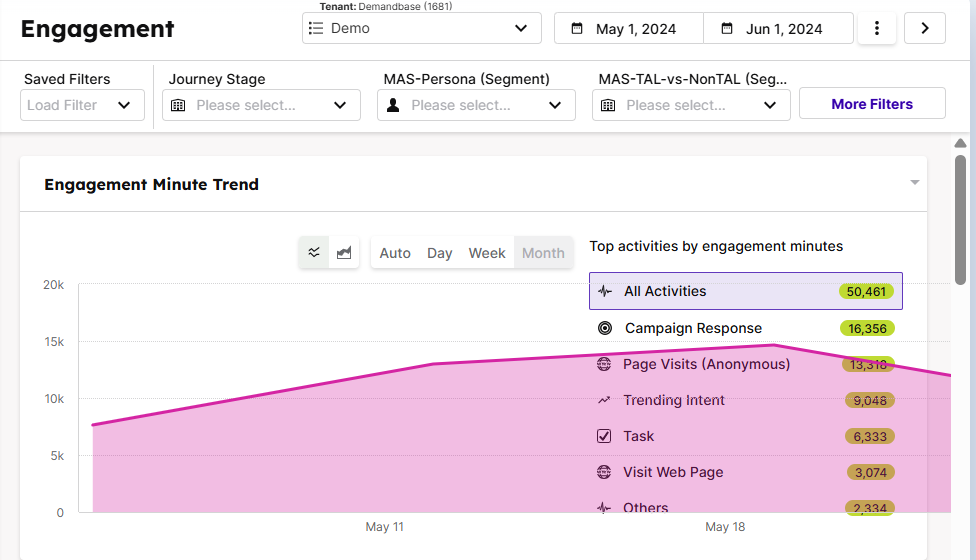

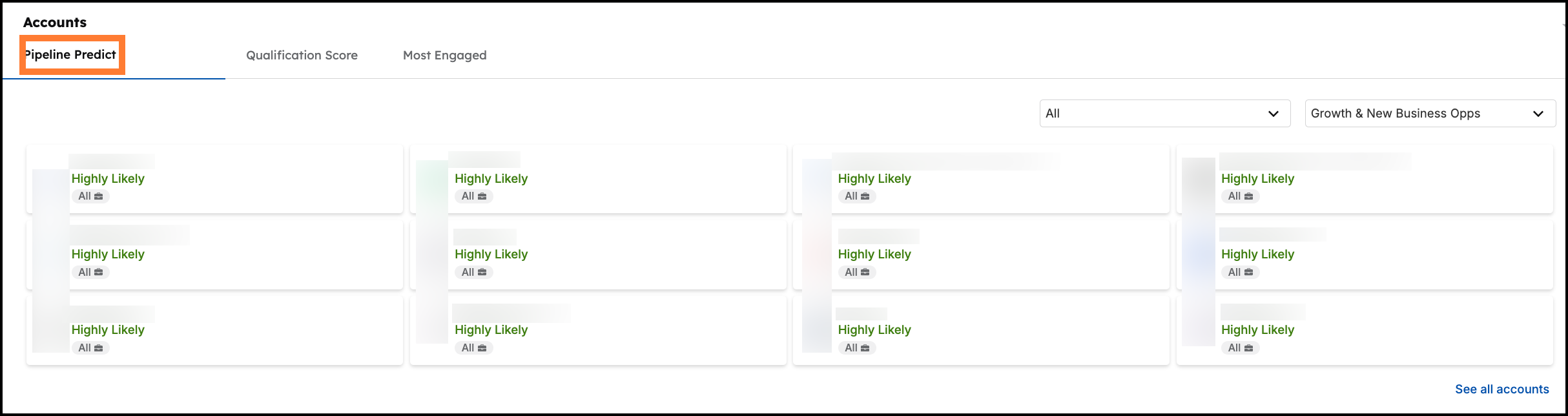

You also get heatmaps and engagement scores that provide a complete read on interest across channels. On top of that, Demandbase applies predictive analytics and predictive marketing to surface in-market accounts and tailor outreach so targeting and sales follow-up improve.

Pro Tip: Swap third-party keyword surges for stronger first-party intent.

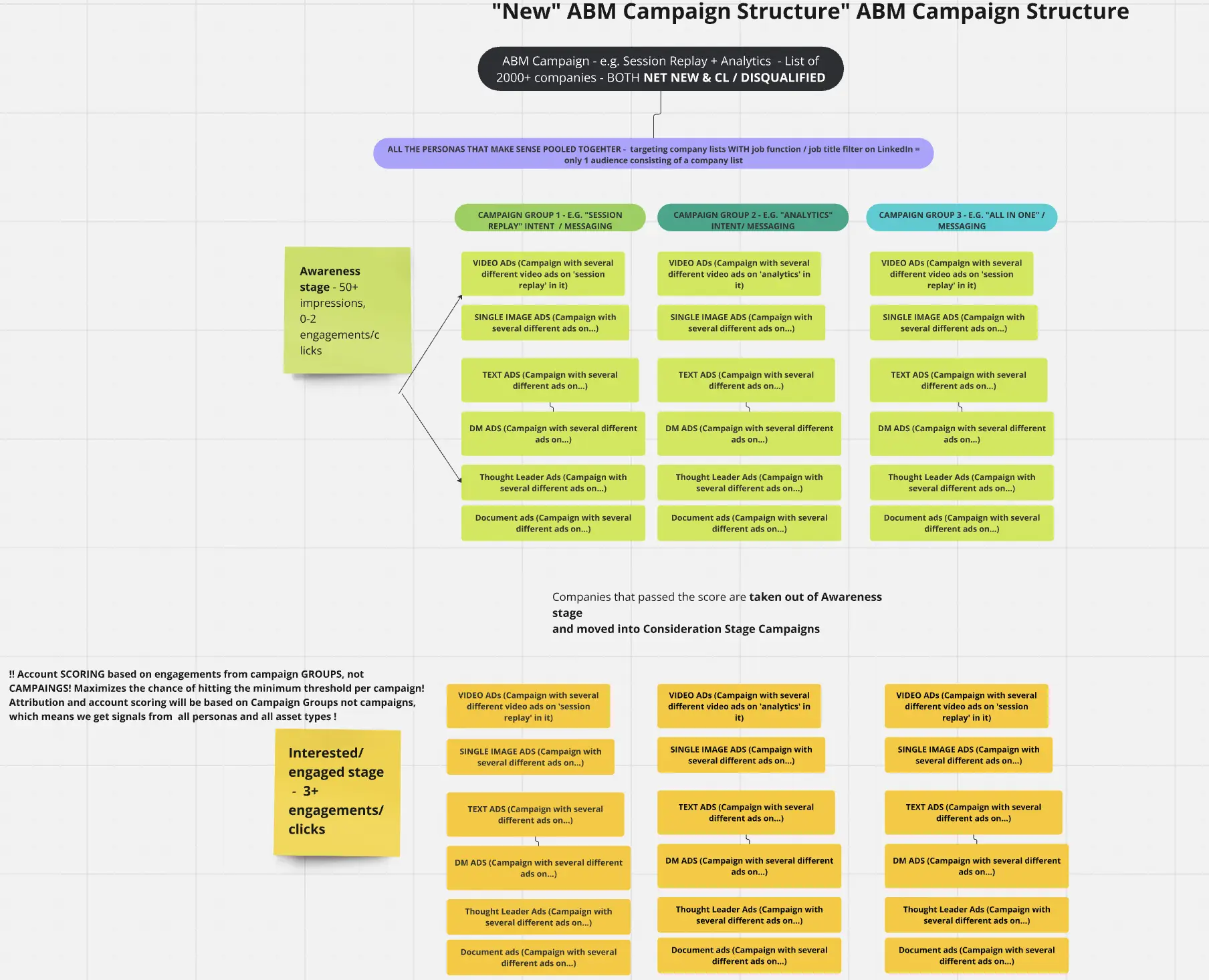

ZenABM captures qualitative first-party intent by recording which LinkedIn ads a company engages with, delivering specific signals teams can act on.

For example, the Userpilot team built full ABM plays around this method, tagging campaigns by pain point and then leaning into BOFU ads based on each account’s engagement pattern.

Their campaign structure:

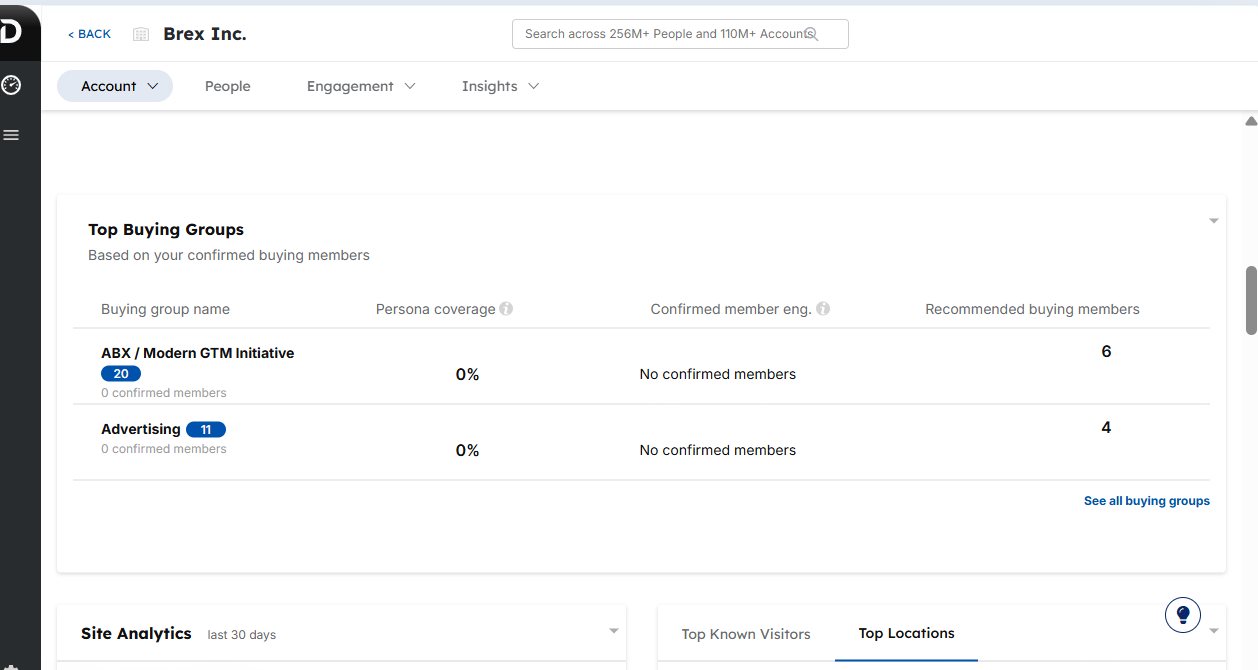

The platform helps you map buying committees by locating and targeting decision makers at each account, and it supports ads or sales outreach aimed at specific roles, such as CMOs across your TAL, so messages reach the right personas.

Demandbase includes extensive analytics to monitor account engagement, campaign influence on pipeline, and revenue attribution, with visibility across the full journey.

AI-driven scoring highlights likely pipeline outcomes and points reps toward the best opportunities to lift win rates.

Remember: To get the most value, plan for ongoing care and feeding of these dashboards.

Demandbase connects to major CRMs such as Salesforce, marketing automation platforms (MAPs), and sales tools so account insights surface directly in the seller’s workflow, for example via a Salesforce widget that exposes engagement. It also integrates with sales engagement platforms like Outreach and Salesloft, which helps it snap into existing stacks and reduce friction.

This alignment keeps sales and marketing working from one shared data set.

See the full list in the Demandbase official docs.

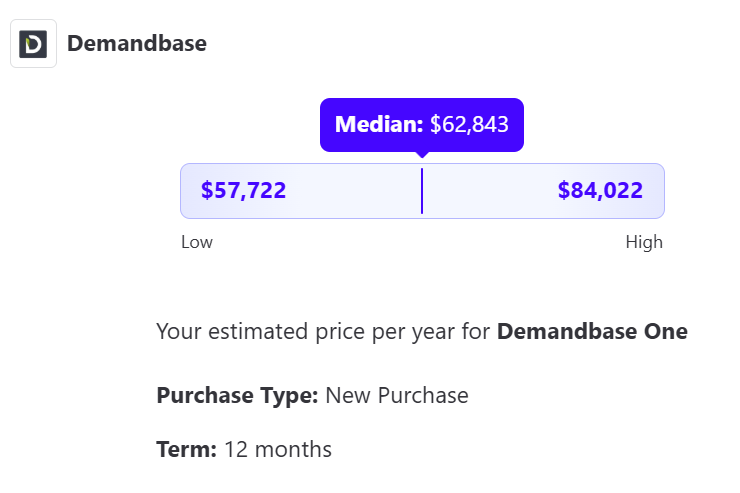

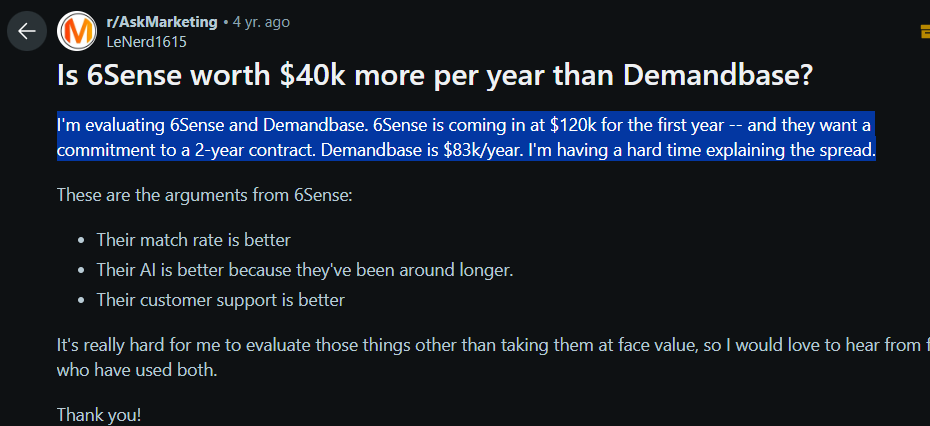

Demandbase does not publish list pricing and usually provides custom enterprise quotes after a call with sales.

Typical packages include a base platform fee plus per-seat charges, with totals climbing as teams grow. Pricing may also vary with usage, including how many accounts are actively engaged and how frequently the platform is used by individual users.

From market references:

Use third-party benchmarks while negotiating so you do not overpay for the package you need.

Keep in mind that optional modules, such as extra intent feeds or sales intelligence databases, can push costs upward.

Given how expansive the suite is, many smaller businesses consider Demandbase more than they require.

That leads to paying for capabilities that go underused.

Bottom line, Demandbase makes the most sense for teams with substantial ABM budgets and a mature program already in motion.

Factors.ai presents itself as an “all-in-one” ABM intelligence and analytics platform designed for B2B marketers.

Its core approach is to stitch together data from your website, advertising, and CRM to expose the account-level journey end to end, then help teams act on those findings.

Here is a breakdown of its primary capabilities, pricing motion, and common use cases.

Factors.ai can collect and attribute touches across channels like website activity, ad engagements, email, and CRM events, assigning credit via several models.

Out of the box, it supports roughly nine models, from first-touch and last-touch to linear, time-decay, and U- or W-shaped variations, and allows side-by-side comparisons.

Marketers get a clearer read on which programs and assets influenced pipeline and revenue, rather than relying on a single touch metric.

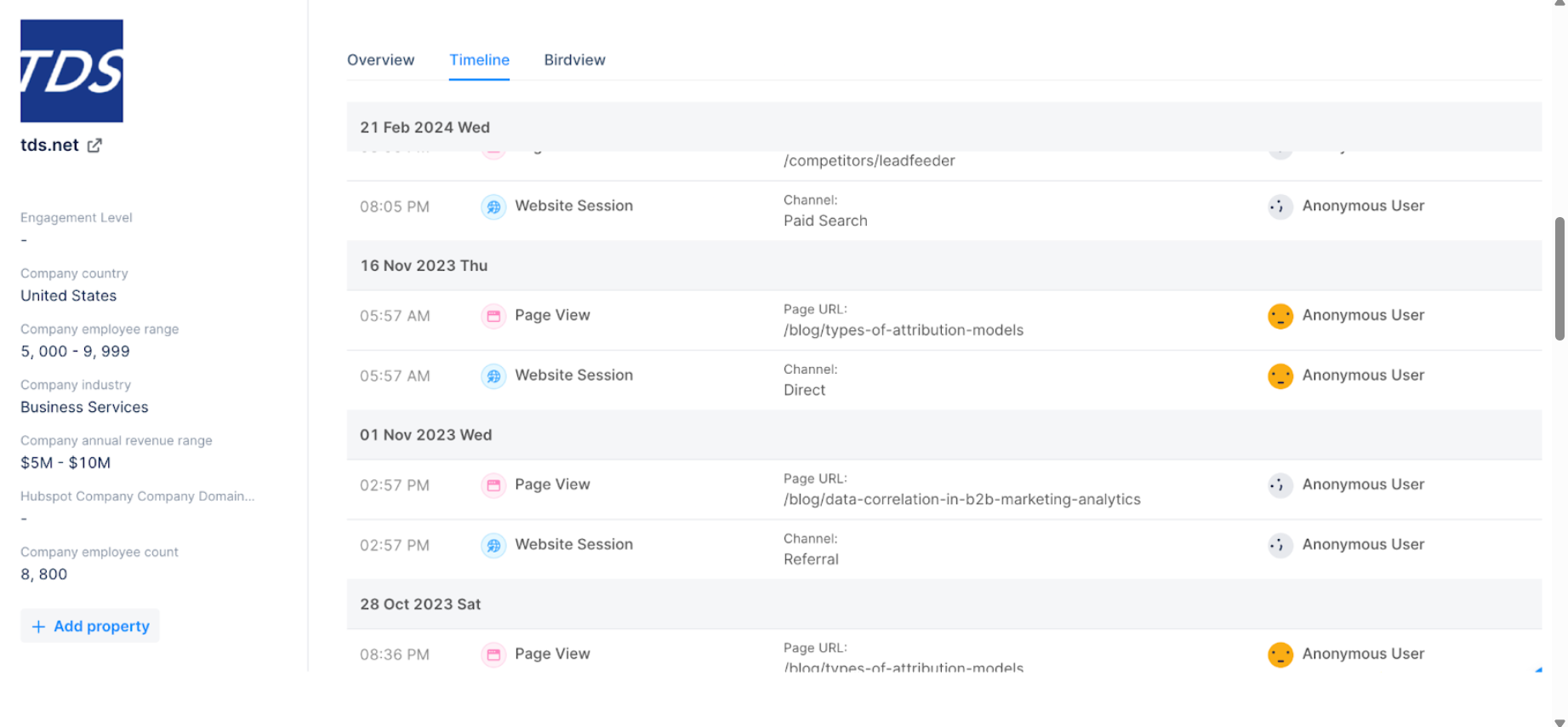

All interactions feed an Account Timeline that sequences every touch, from anonymous web sessions to ad engagement and sales activity.

A defining trait of Factors.ai is its ability to infer which companies are visiting your site even when visitors remain anonymous.

Through IP lookup and partners like Clearbit Reveal and 6sense, Factors.ai reports deanonymization rates near 64 percent by mapping IPs to corporate domains.

In practice, when a visitor from Acme Corp lands on your site, Factors.ai can surface “Acme Corp” in your reporting along with firmographic details such as industry and company size.

This site-to-account matching populates the Account Intelligence view so you can see which target accounts are interacting with your properties.

Important caveat: IP identification is imperfect. Studies such as the one from Syft peg accuracy at roughly 42 percent in the real world.

A clever workaround using ZenABM: retarget anonymous traffic with low-cost LinkedIn text ads, then let ZenABM identify the companies that were served those impressions.

Factors.ai enriches discovered accounts with firmographics and intent signals.

Using Clearbit, it can append attributes like industry, employee count, revenue bands, and location.

Via 6sense or similar sources, it can also infer buying stage or topic-level interest.

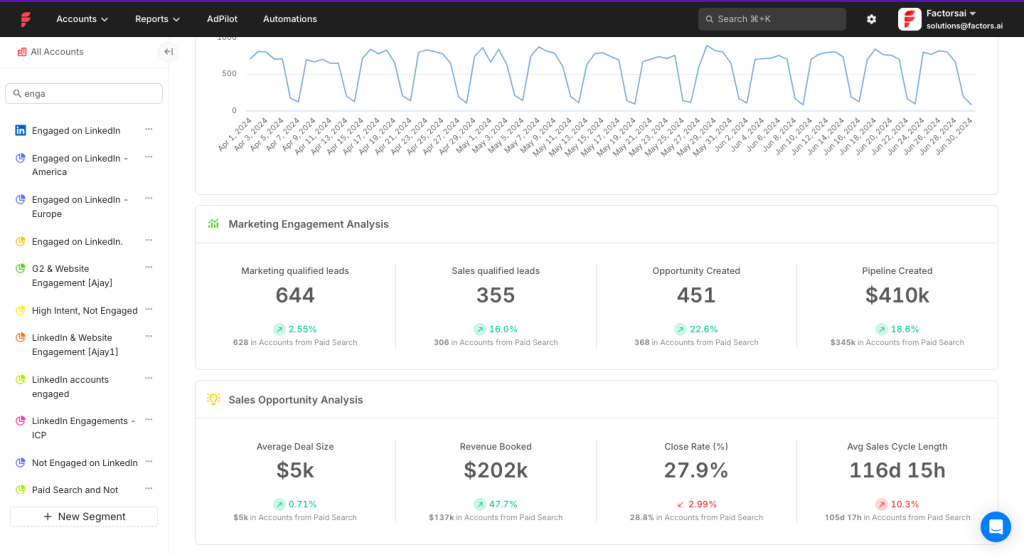

All of an account’s interactions across web views, ad clicks and impressions, and form fills are aggregated into a per-account engagement score.

Scoring models are configurable so you can combine fit criteria with engagement weightings to surface the warmest accounts.

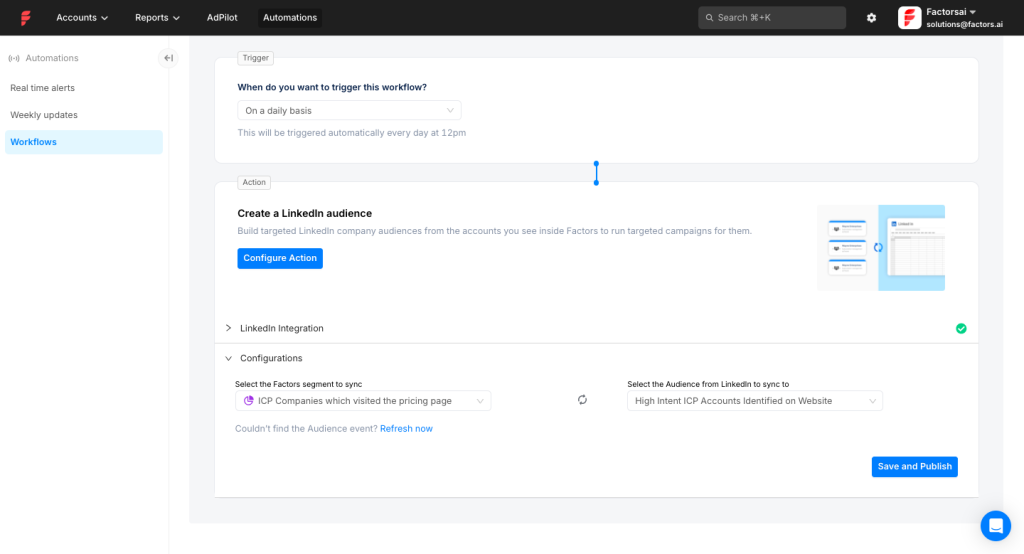

Factors.ai integrates with major ad platforms such as LinkedIn, Google Ads, Facebook or Meta, and Microsoft Ads to ingest campaign performance and push audiences.

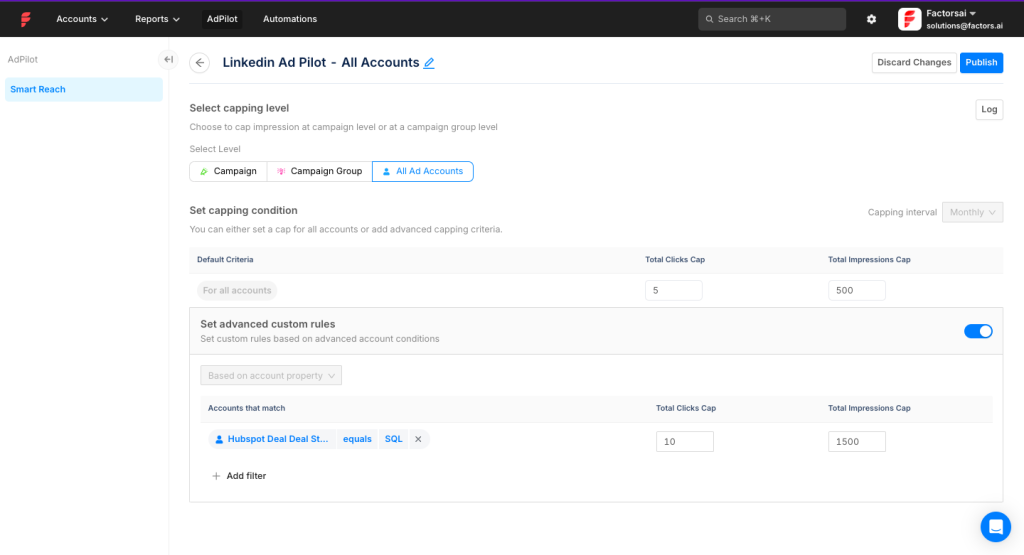

A distinctive capability is LinkedIn AdPilot, an AI-assisted tool that helps automate LinkedIn ABM operations.

AdPilot can dynamically manage targeting, for example by building LinkedIn audiences derived from account segments in Factors, and enforcing per-account impression caps so spend is distributed more evenly.

Factors.ai also records impression-level data for LinkedIn, not just clicks, which enables view-through attribution so influenced accounts get credit even when no click occurred.

Pro Tip: Like Factors.ai, ZenABM captures company-level LinkedIn impressions as well as clicks, and goes a step further by exposing which exact ads each account engaged with, which reveals what they care about rather than only that they interacted.

You can tag campaigns by theme or feature, and ZenABM will surface each account’s intent signals while syncing both qualitative and quantitative engagement into your CRM.

This gives BDRs context on which accounts are hot and which topics opened the door, making outreach more relevant.

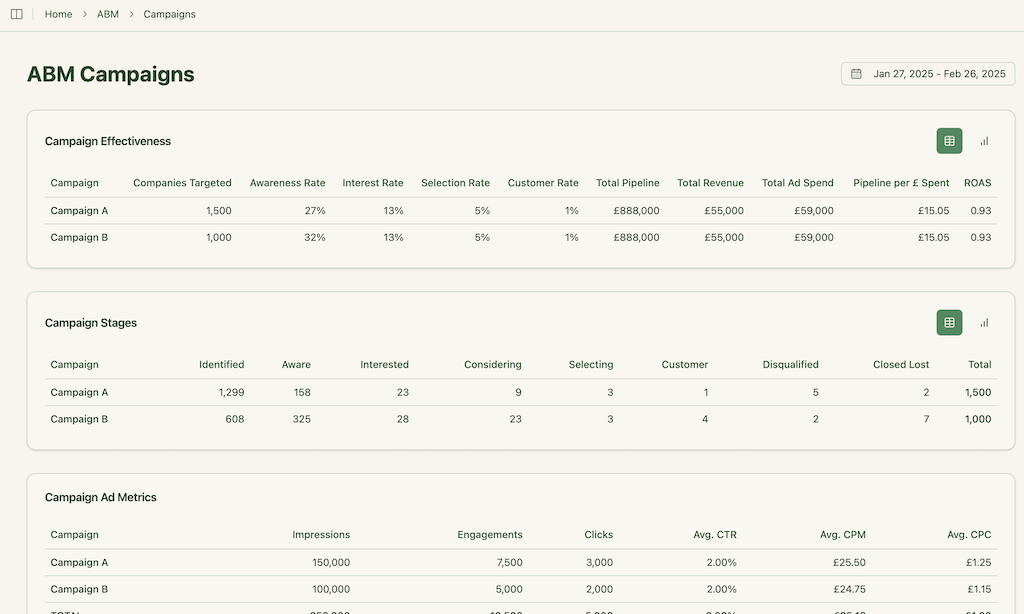

Beyond attribution, Factors.ai includes dashboards focused on ABM analytics.

You can monitor “Visits by target account,” “Pages per account,” “Ad impressions per account,” and similar views to gauge engagement from key companies.

Higher tiers unlock prebuilt ABM dashboards that highlight which programs generate the most account engagement, how accounts distribute across funnel stages, and what portion of pipeline marketing influenced.

Custom reporting is available too, with allowances that expand as you move up tiers. For instance, Basic may support around ten custom reports.

Some G2 reviews mention limits in customization.

Those same reviews call out a few pain points:

Factors.ai follows a multi-tier structure with a free entry plan and several paid options.

Specific prices for paid tiers are not listed publicly. The site leans on “custom pricing for your needs” and invites prospects to book a demo for an exact quote.

Officially, there are four tiers:

All packages include core account identification and analytics foundations.

A free trial is available so teams can validate value before purchasing.

When you put Demandbase and Factors.ai side by side, the biggest gaps show up in price, scope, and day-to-day usability.

Here’s a table discussing their differences, along with ZenABM for perspective:

| Category | Demandbase | Factors.ai | ZenABM |

|---|---|---|---|

| Target Market | Enterprise ABM programs with significant budgets and complex multi-channel plays | Mid-market teams centered on ad analytics and attribution | SMB to mid-market teams seeking lean intent plus CRM automation |

| Pricing Model | Custom enterprise quotes | Tiered: Free (basic ID) → Basic (~$5K/yr) → Growth (~$15K/yr) → Enterprise (~$25K/yr) | Self-serve starting at $59/mo |

| Typical Annual Cost (reported) | Median ≈ $65K and often higher for full suites |

≈ $5K–$25K based on tier |

Under $6K even at the highest self-serve tier |

| Core Focus | End-to-end ABM including intelligence, personalization, ads, and sales orchestration | Ad analytics, attribution, and impression-to-account mapping | LinkedIn-first account intent, scoring, and CRM write-back |

| Ad & Attribution | Native DSP plus multi-touch attribution across channels | Deep ad integrations, view-through attribution, per-company impression caps, LinkedIn AdPilot | LinkedIn ad engagement tracked to accounts and campaigns |

| Personalization | Advanced account and contact-level personalization with orchestration | No contact-level deanonymization or full site personalization | Personalization triggered via CRM workflows and engagement rules |

| Data & Integrations | Bi-directional CRM and ad platform sync across a wide ecosystem | CRM and ad integrations that primarily pull data, limited write-back | Native two-way HubSpot and Salesforce (in higher tiers) with automatic score and intent sync |

| Usability & Deployment | Powerful but complex, often needing dedicated ops and longer onboarding | Straightforward and more transparent, usually faster to stand up | Lightweight onboarding built for quick time to value |

| Unique Strengths | Orchestration depth, robust intent models, extensive personalization | Ad-level analytics, segmentation, impression controls, AdPilot automation | Affordable LinkedIn-first intent with tight CRM alignment |

There is no universal winner. Your best choice hinges on budget, team size, and the shape of your ABM strategy.

Both Demandbase and RollWorks cover a broad spectrum of ABM needs with comprehensive toolsets.

ZenABM takes a focused, purpose-built path that centers on LinkedIn-led strategies.

It is positioned as a lighter, more economical choice for teams that do not need the full multi-channel complexity of enterprise platforms but still want deep visibility and automation for LinkedIn-driven ABM.

Its notable capabilities:

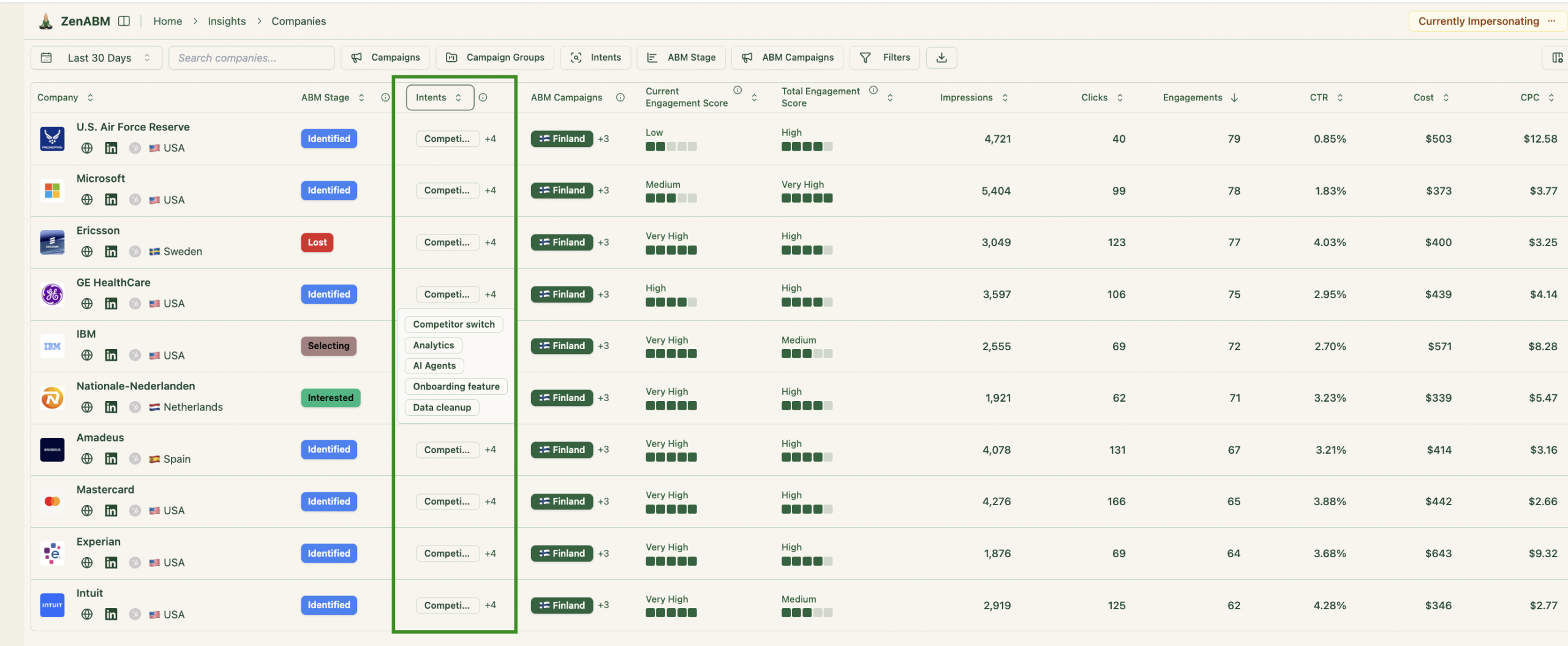

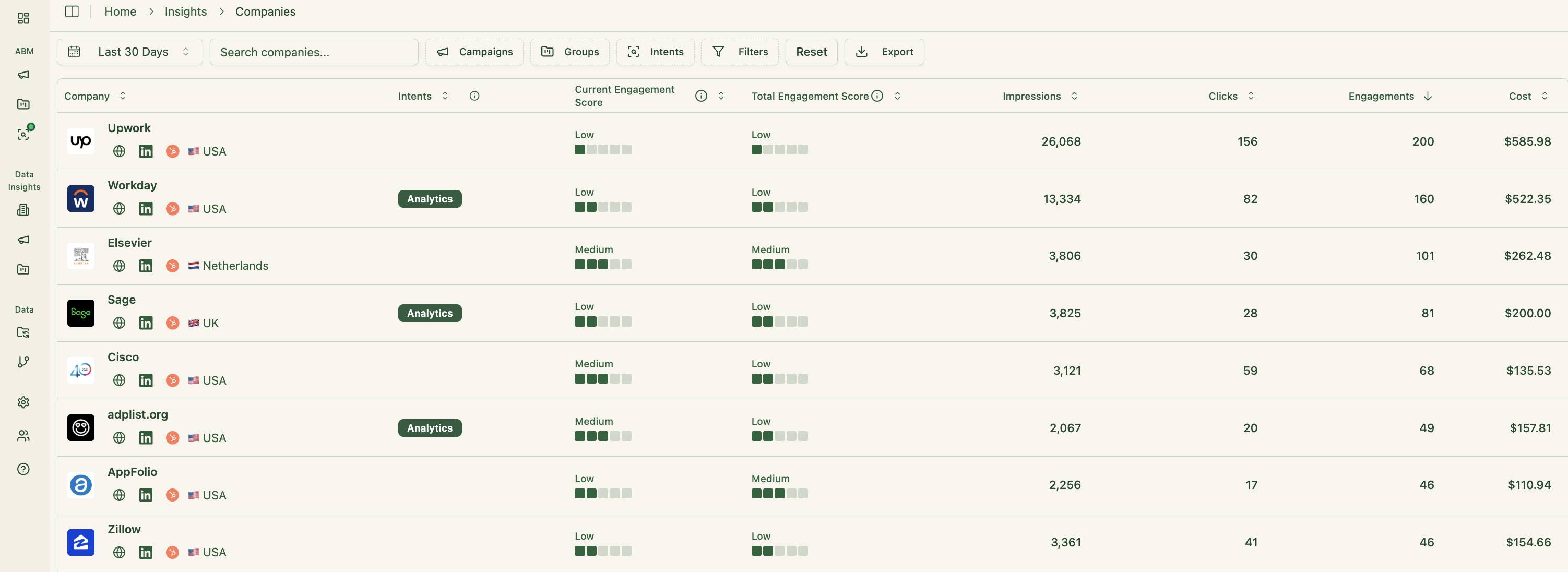

ZenABM connects to the official LinkedIn Ads API to ingest account-level engagement for every campaign.

You see exactly which target accounts interact with your LinkedIn ads, including impressions and clicks credited back to the company.

Because this is login-based, first-party data from LinkedIn, it is far more reliable than cookie or IP matching methods that larger ABM suites often rely on.

A Syft analysis found IP deanonymization accuracy hovers near 42 percent in practice.

ZenABM’s approach generates qualitative intent based on real ad engagement. When multiple people from the same company interact, you can treat that account as interested without leaning on third-party data.

ZenABM assigns an engagement score to each account using LinkedIn interactions and updates that score continuously.

You can track recency and all-time trends to spot warming accounts and sustained interest.

These insights help sales teams sequence outreach by likelihood to progress.

ZenABM lets you define custom stages such as Identified, Aware, Engaged, Interested, and Opportunity.

It blends engagement scores with CRM data to place each account into the right stage and continuously monitor movement.

You set thresholds for what counts as Engaged or Interested, and ZenABM maintains those stage assignments for you.

You get funnel-level visibility akin to heavier ABM tools, which makes diagnosing bottlenecks far easier.

ZenABM syncs bi-directionally with CRMs like HubSpot, with Salesforce available on higher plans.

All LinkedIn engagement flows into the CRM as company properties for easy reporting and automation.

ZenABM can mark accounts as “Interested” once they cross a defined score and automatically assign a BDR to follow up.

ZenABM derives intent directly from your ads. Tag each LinkedIn campaign with a value proposition or theme and the platform will show which accounts engaged with which message.

ZenABM then exposes which accounts interacted with each tag so you know which topics and features resonate.

This is true first-party intent, no third-party vendor required.

You can also sync these tags to your CRM, which lets sales and marketing coordinate timing and messaging.

Outcome: reps tailor outreach knowing which angle each account responded to.

ZenABM includes plug-and-play reporting that ties LinkedIn ad activity to account health, stage progression, and revenue impact.

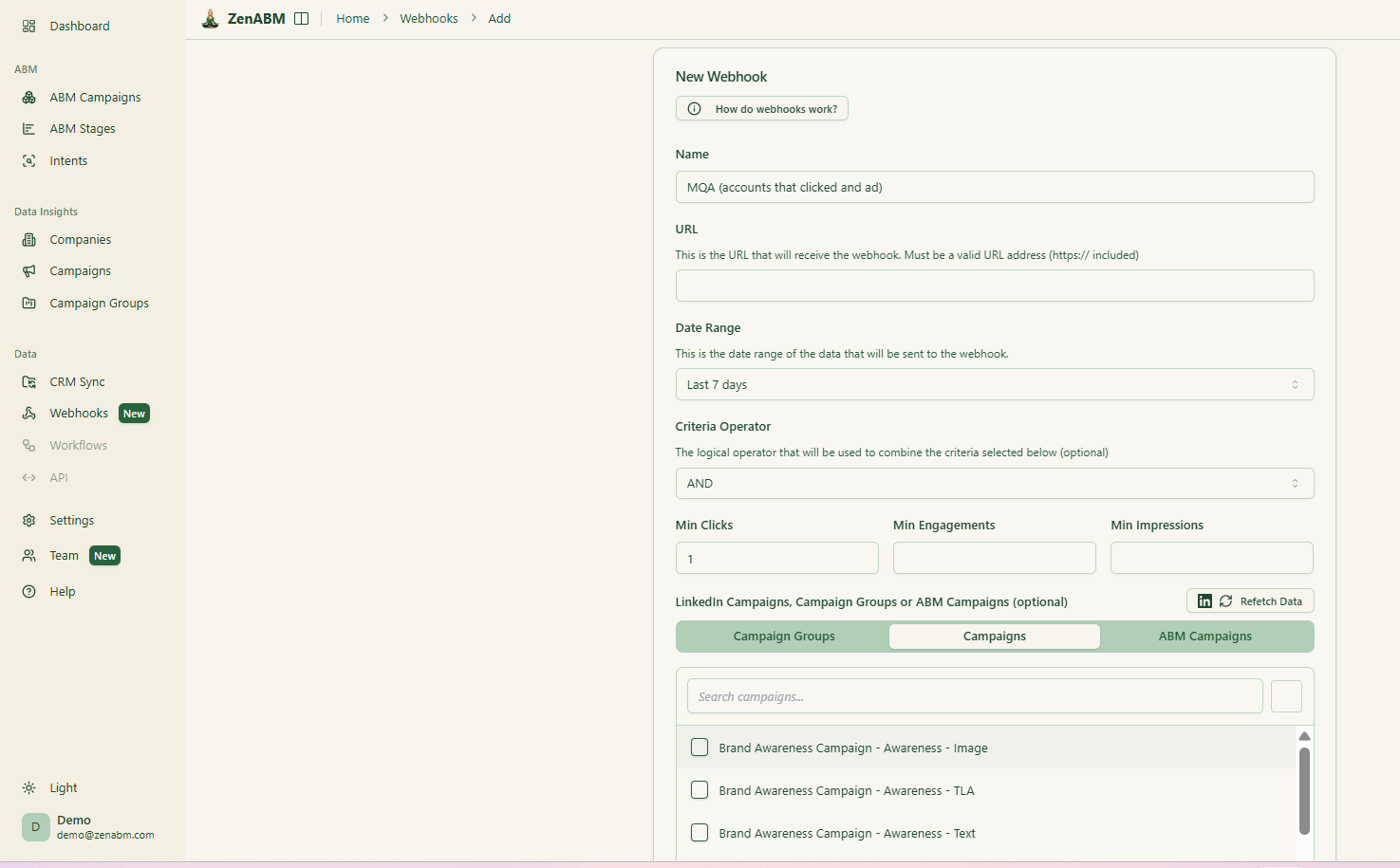

With ZenABM’s custom webhooks, you can wire it into virtually any external workflow or toolchain.

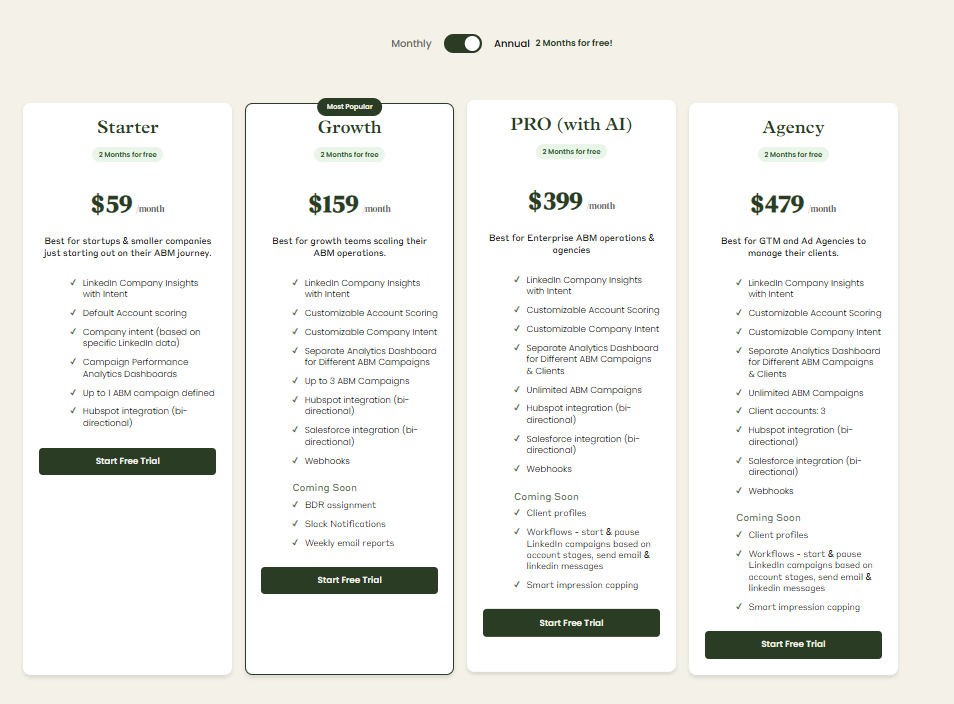

Plans start at $59 per month for Starter, $159 per month for Growth, $399 per month for Pro (AI), and $479 per month for Agency.

Even the highest plan remains well under $7,000 annually.

This is far below what most enterprise ABM suites charge for similar LinkedIn-centric outcomes.

Each plan includes core LinkedIn ABM functions, with higher tiers raising limits and adding Salesforce sync.

Monthly and annual options are available, and every plan includes a 37-day free trial so you can validate fit before committing.

Demandbase and Factors.ai both offer real ABM horsepower, yet they target different needs.

Demandbase belongs in the enterprise lane, serving teams with significant budgets, intricate data requirements, and the patience to implement and manage a broad suite.

Factors.ai is a nimble mid-market choice for marketers who care most about proving ad ROI and tightening attribution loops.

ZenABM takes a different route. It is a lean, first-party, LinkedIn-first ABM engine that delivers precision without bloat or six-figure price tags.

If your goal is to capture true LinkedIn engagement at the company level, sync it to your CRM, connect spend to revenue, and move quickly, ZenABM finds the balance between simplicity and sophistication.