Account-based marketing isn’t so niche-niche anymore.

Many businesses are doing it, so just ABM is no longer an edge.

You’re supposed to adopt advanced strategies now, and intent-based ABM is one of them.

Here, I’m going to compare the 5 best intent-based ABM tools based on their features, pricing, and even suitability for your business (most ABM giants are overkill, while some are just insufficient API wrappers).

Let’s go!

| Tool | Intent Data Type | Key Features | Best For | Pricing |

|---|---|---|---|---|

| Bombora | Third-party (4,000+ B2B content sites) | Company Surge scores, new TAL discovery, churn detection, ad targeting & journey mapping powered by third party data | Teams wanting broad-market intent coverage and target accounts discovery | Custom, avg. ~$25K/yr |

| ZenABM | First-party (LinkedIn Ads API) | Ad-level company engagement, qualitative intent tagging, CRM sync, ABM stage scoring, revenue dashboards with account engagement and high intent accounts for sales outreach | SMBs & mid-market teams focused on LinkedIn ABM and an account based marketing platform that aligns marketing and sales | Starter $59/mo, Growth $159/mo, Pro $399/mo |

| 6sense | Multi-source (first, second, third-party) | AI predictive scoring, journey stages, persona maps, advanced orchestration using predictive analytics for sales teams | Enterprises ($15M+ ARR) needing full-stack ABM | $60K–$100K+/yr (custom) |

| Demandbase | First + third-party (62,500+ keywords) | Heatmaps, account engagement score, unified 360° dashboards, alerts & personalization for marketing and sales teams | Mid-to-large enterprises with ops teams and key accounts at scale | $18K–$110K+/yr depending on scale |

| RollWorks | Keyword intent (own + Bombora) | Fit scoring, spike alerts, website visitor ID, multi-channel ads, stage triggers to reach high value accounts | Mid-market teams scaling ABM ads | Free tier; paid from ~$975/mo |

| ZoomInfo | Multi-source (web, ads, content, reviews) | Granular topics, real-time updates, persona-level mapping, CRM workflows that turn anonymous website visitors into account data for outreach efforts | Data-heavy teams needing deep contact + intent integration | $14,995–$45K+/yr (tiered, credit-based) |

Keeping it short and simple:

Your TAM (target addressable market) is your whole market.

Your ICP (ideal customer profile) is the slice that truly fits.

But even then, most ICP accounts aren’t “in market,” i.e, they aren’t looking to buy at that moment.

In fact, CMO Alliance and most B2B marketers claim that only about 5% of TAM is actively buying at any time.

That’s why intent-based ABM matters: it helps spot accounts actively searching for solutions like yours by leveraging intent data, behavioral data, and account engagement patterns across your target audience.

Example: if you sell an onboarding SaaS, track accounts whose employees search “onboarding tools” or “fix onboarding issues.” That’s a signal to marketing and sales that a sales outreach sequence and personalized messaging could move the sales cycle forward for high-value accounts.

Cross-check those with your ICP.

The overlap becomes your TAL because it will be made of accounts that are both fit and ready to buy.

That’s intent-based ABM for you 🙂

Note: Search behaviour is a type of third-party data packaged as intent data. First-party intent data, on the other hand, includes the account’s consumption of your content, whether paid (ads) or organic and whether on socials or your own site. Integrating intent data with marketing automation platforms helps marketing and sales teams orchestrate account-based advertising and route actionable sales leads to sales teams with better customer data quality and account data visibility.

Bombora is the OG of third-party intent data and a staple in account-based marketing tools.

Bombora pioneered the idea of a data co-op that monitors content consumption across 4,000+ B2B websites.

They compile all that activity into “Surge” scores, showing when a company is consuming content on a topic that you choose far above baseline – a strong buying signal.

Practically every ABM platform has integrated Bombora’s data at some point, which helps sales and marketing identify high intent accounts and shorten the sales cycle.

In fact, even the Forrester Wave Report has called it one of the most trusted B2B intent data providers.

Let’s look at Bombora’s offerings:

Bombora’s intent data is primarily the target account’s search behaviour, i.e. the queries they are searching for online, the sites they are visiting, etc.

This feature runs by you just putting in your desired keywords that you want to be tracked, and Bombora returns all those accounts that have been actively searching for them – especially the ones that have had a significant surge in those types of queries recently – it signals both recency and readiness to buy or being “in market.

The most noteworthy benefits?

Bombora helps judge the buying stage of a target account based on their B2B search behaviour.

It also tracks the content they are consuming.

So, it’s not just about what they are actively searching for, but also what different platforms’ algorithms are serving them, which improves personalized messaging and customer engagement.

The same intent data can be used to know when the accounts are hottest and for what, so you can time your ads accordingly.

Also, Bombora lets you build different audience segments for different topics that you can push to your ad platform, which strengthens account based advertising and sales engagement:

As I also mentioned in the case of ZenABM, intent data helps your BDRs talk about exactly what the prospect is looking for instead of shooting your entire brochure at the prospect.

The same goes for Bombora. Leveraging intent data here turns intent signals into actionable sales leads and better outreach efforts for sales teams.

Just like BDR outreach and ads, even events and the content that you build and share with the prospects also become more personalized with intent data.

This one was the most unexpected, but it makes sense.

I mean, if your loyal customers suddenly start actively searching for your competitors/alternatives, wouldn’t that signify a risk of churn?

Bombora, with its intent data, will be able to warn you before the churn actually happens based on competitors searched by the customer, so you can prevent losing the customer by giving proactive customer service and seeking feedback for potential churn. This helps retain existing customers and protect customer data-driven programs.

Some other ABM-related features of Bombora:

Bombora’s pricing for Intent Data (e.g. Company Surge) isn’t one-size-fits-all, and neither is it mentioned on their site.

Based on information on Vendr and HubSpot Marketplace, Bombora’s cost depends on three main levers:

As a benchmark, many users end up paying around $25,000/year for a solid, mid-sized deployment.

I have kept ZenABM in the first position here because I find it the most relevant one for an account based marketing platform.

Why?

ZenABM delivers first-party qualitative intent from ads, showing exactly what an engaged account cares about, while most others rely on third-party intent.

And even when they provide first-party signals, it’s usually quantitative (how much engagement), not qualitative (the specific interests driving that engagement).

And true intent-based ABM is all about the qualitative intent, right?

Ok, let me show you the intent-based features for sales and marketing teams working a coordinated account-based marketing strategy:

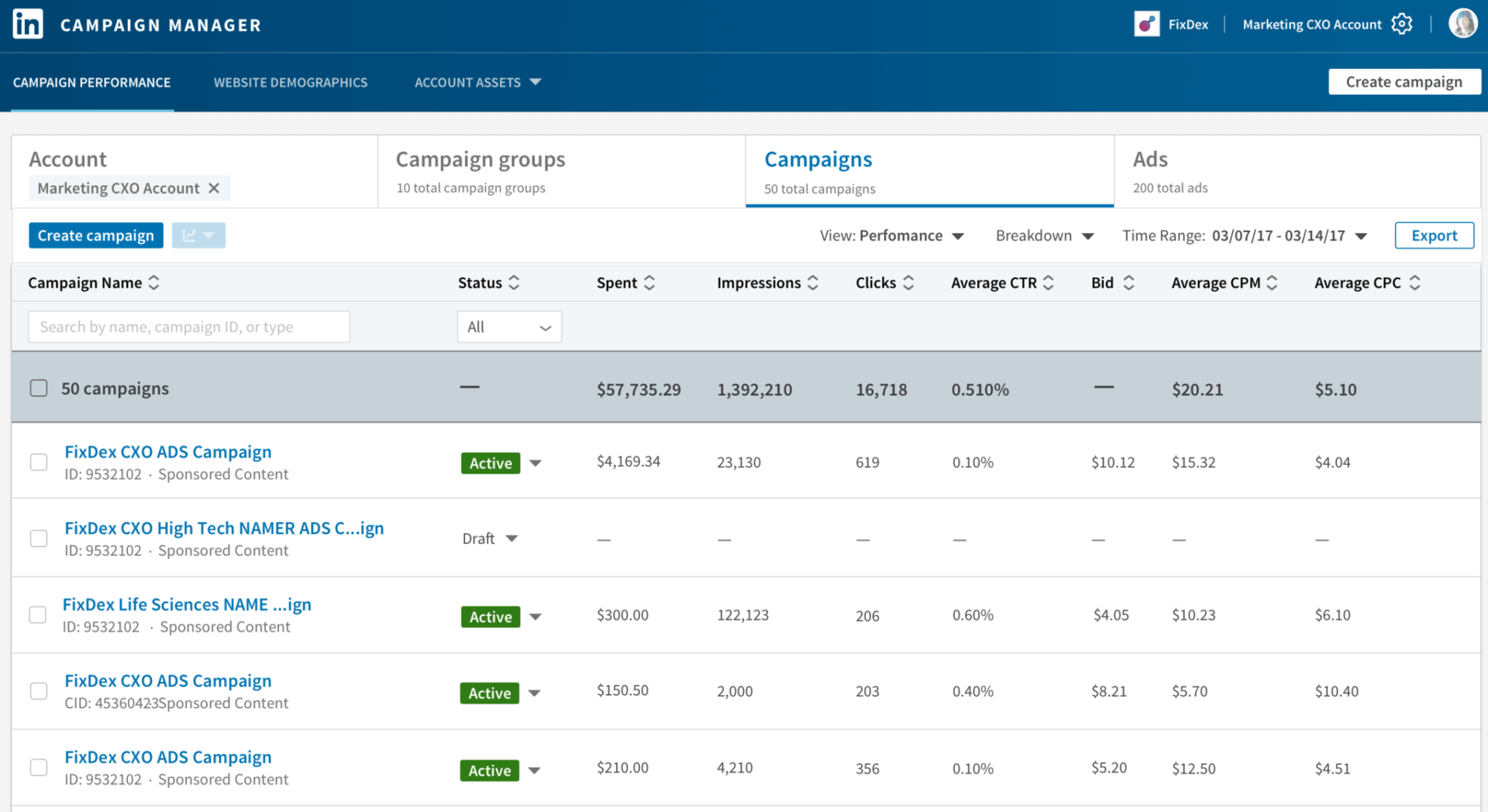

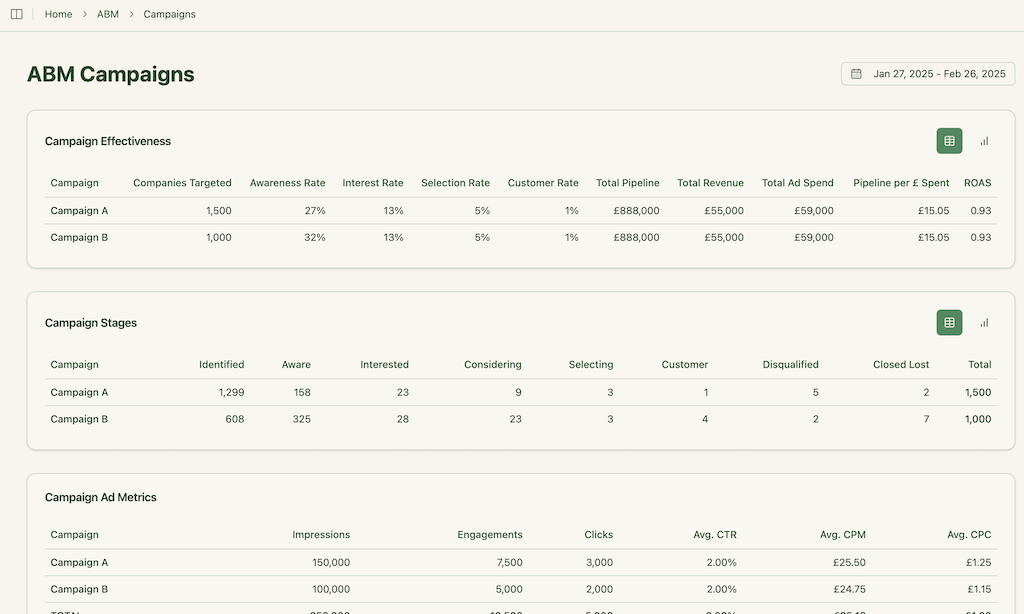

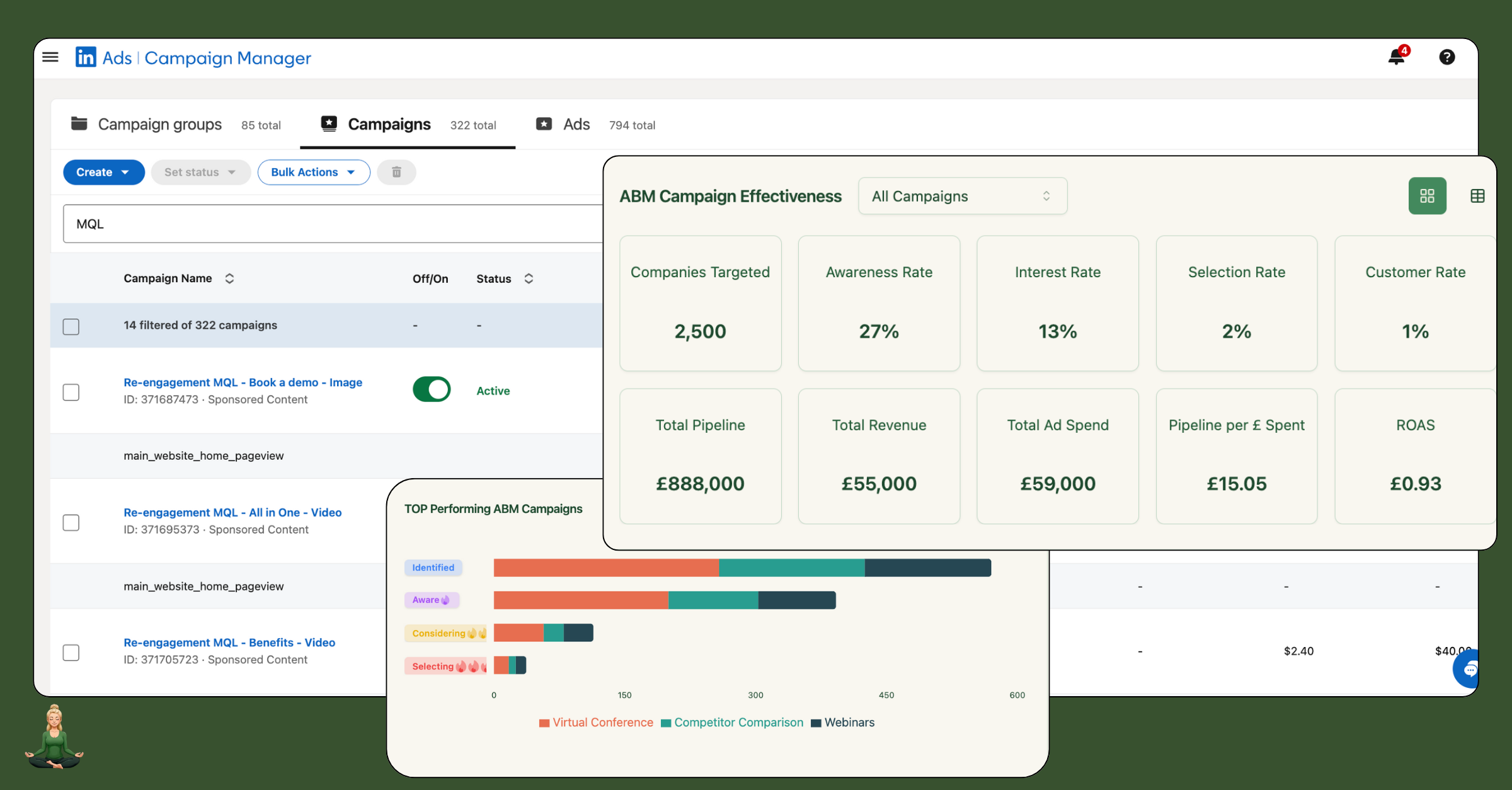

ZenABM tracks clicks, engagements, impressions, and ad spend for each company for each LinkedIn ad campaign and campaign group, which surfaces high intent accounts and improves sales engagement across the sales cycle:

So, you’ll know all the accounts that clicked, engaged with, or saw your ad in any period of time.

That’s first-party qualitative intent.

But wait, these metrics are shown for each ad campaign!

So, if you build different ads showing different features/offers, by knowing campaign-level engaged companies, you are essentially discovering what they are interested in.

So, yes, you also get qualitative intent that powers account-based advertising and more precise target audience selection for sales teams.

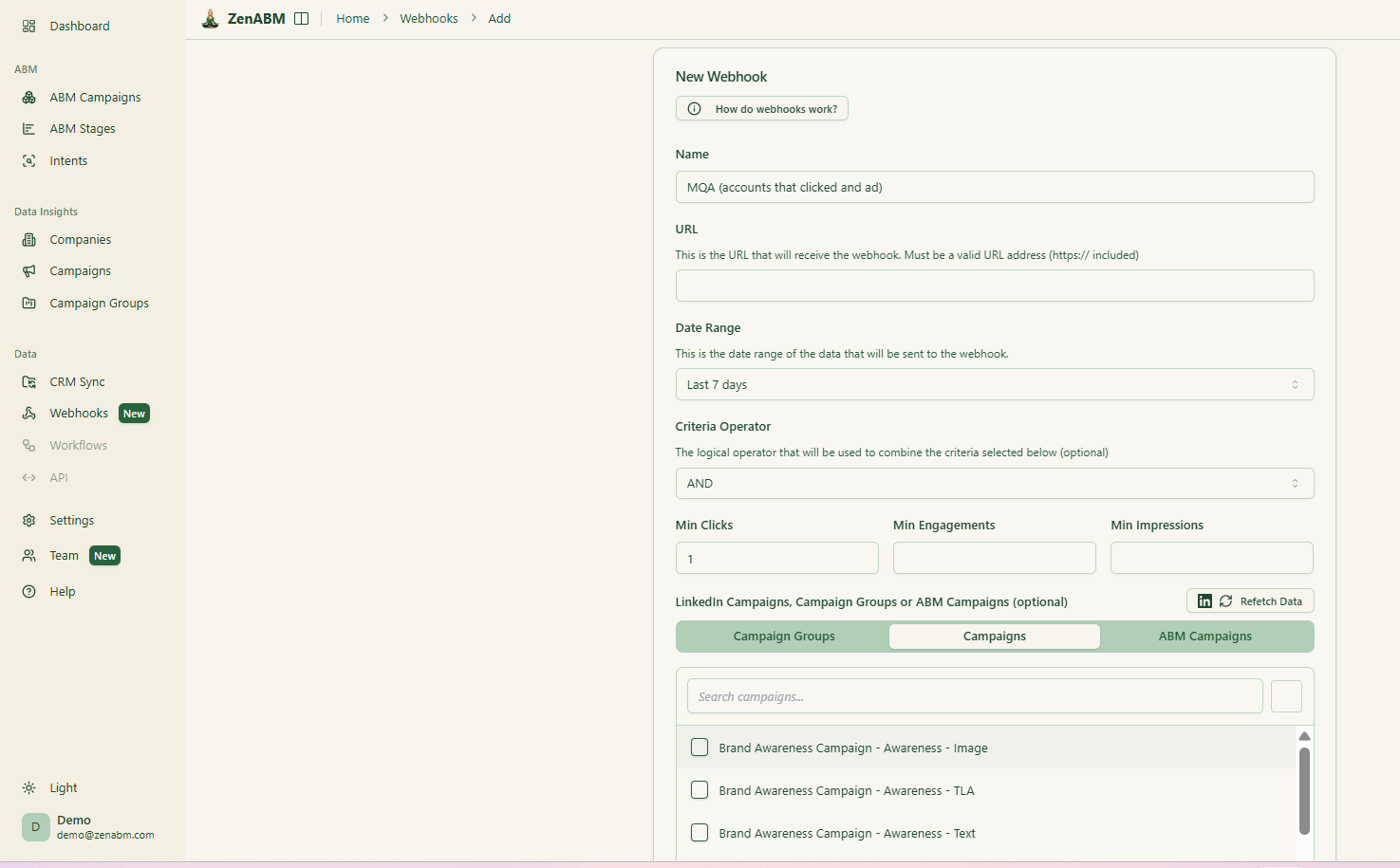

For further convenience, ZenABM lets you tag each ad campaign/campaign group with the intent within the UI.

Then, based on the company’s engagement metrics, it shows each company’s qualitative intent along with the quantitative metrics:

Also, it creates a specific tab for each intent where it groups all companies showing similar intents together (as you can see in the GIF above).

If this wasn’t enough, ZenABM also pushes each company’s intent to your CRM as a company property, so marketing automation platforms and marketing automation tools can trigger timely sales outreach and sales engagement handoffs.

So now, you can know if a target account is engaging with feature A ads the most and can double down on the opportunity by showing more BOFU and detailed feature A ads to the target account.

Also, you’ll know what kind of articles, case studies, or white-papers to share, and what to speak about during the BDR outreach instead of blabbering out all the features of your tool or shooting a generic message.

This alignment gives sales and marketing teams a consistent view of account data for key accounts and high-value accounts.

ZenABM uniquely provides this combination: qualitative intent tagging for ads + first-party data.

In fact, even LinkedIn’s own campaign manager rolls all the metrics at the ad account level:

So, there’s no scope for discovering what the prospect interacted with, anyway.

By the way, this also makes A/B testing different ad creatives impossible.

But ZenABM’s ad-level company-level engagement data is pulled straight from LinkedIn’s official API!

Talk about compliance 😉 and data quality for sales and marketing.

Apart from the intent-related features I discussed above, ZenABM also offers:

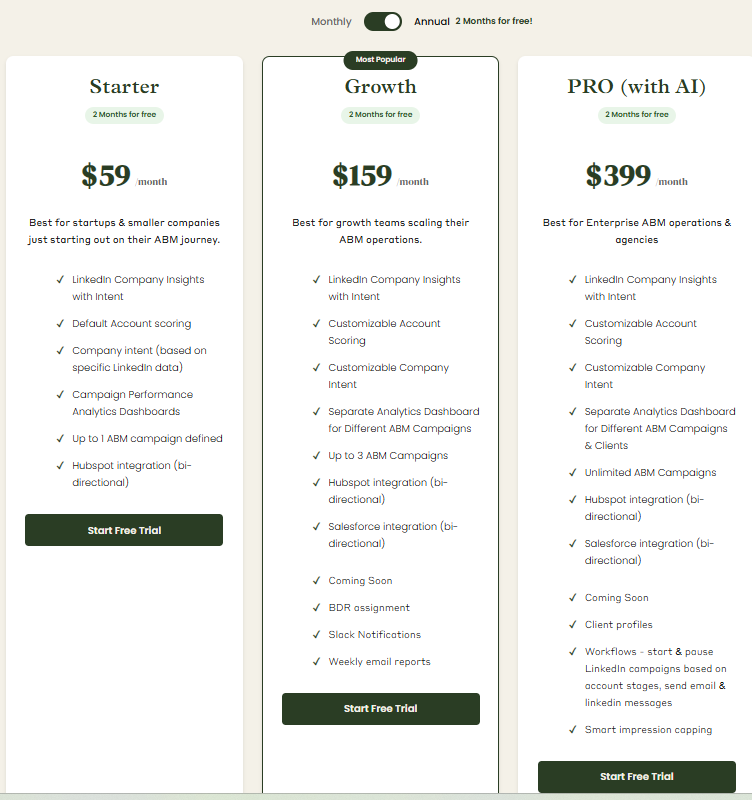

| Plan | Post-trial Price | Key Adds |

|---|---|---|

| Starter | $59 / mo | Everything discussed above; good for single-campaign pilots and marketing and sales teams testing account-based marketing software. |

| Growth | $159 / mo | Up to 3 campaigns, customizable scoring & intent logic, Salesforce sync, Slack alerts, weekly email reports for sales teams. |

| Pro + AI | $399 / mo | Unlimited campaigns/clients, AI workflows (pause LinkedIn ads when an account hits “Closed-Won”, auto-trigger BDR emails), impression capping, and client workspaces to support marketing and sales efforts at scale. |

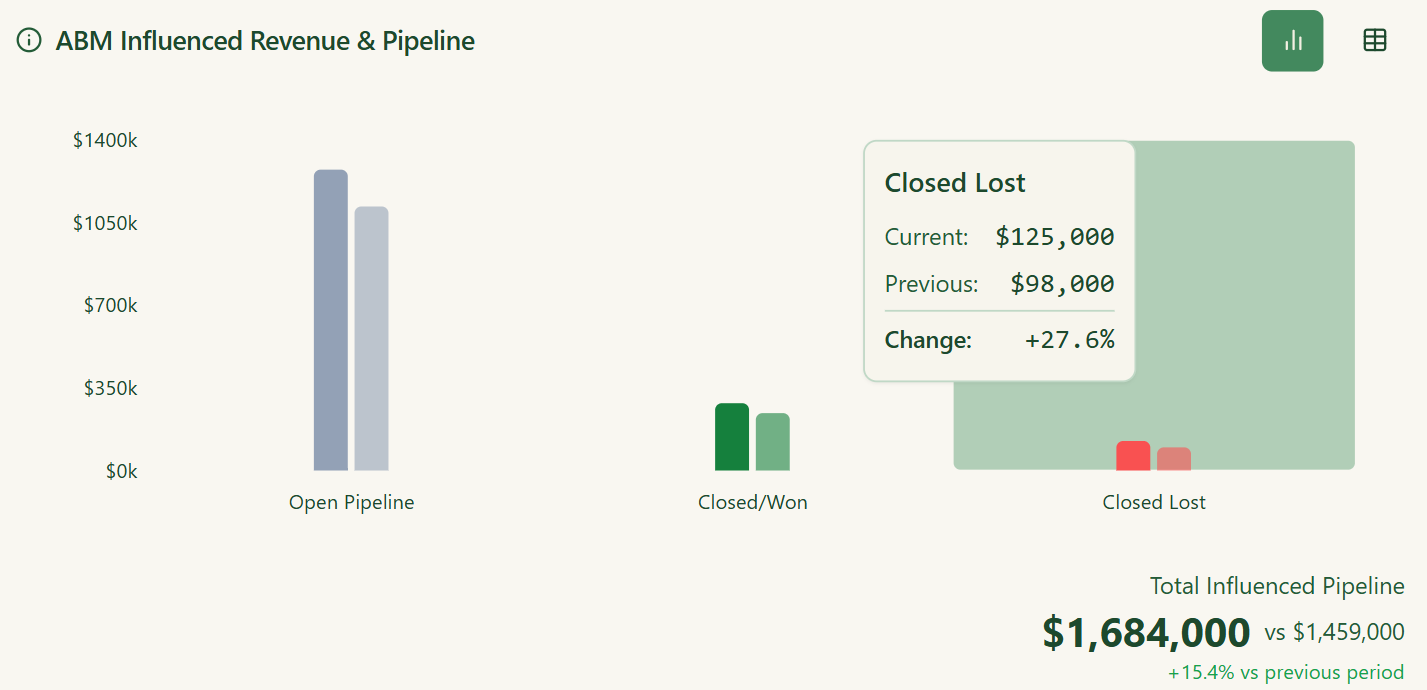

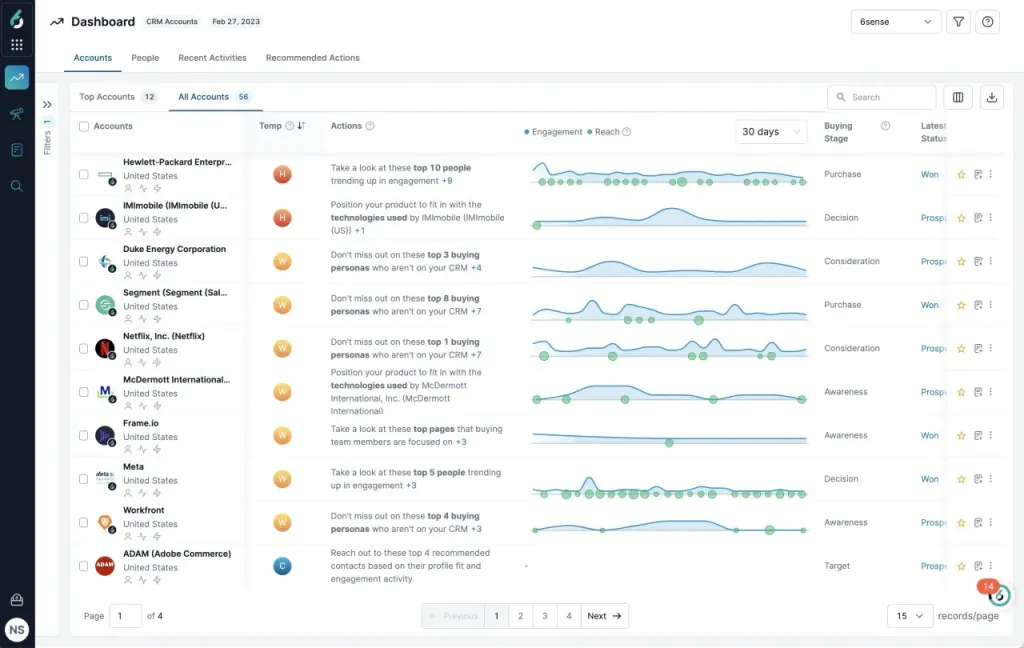

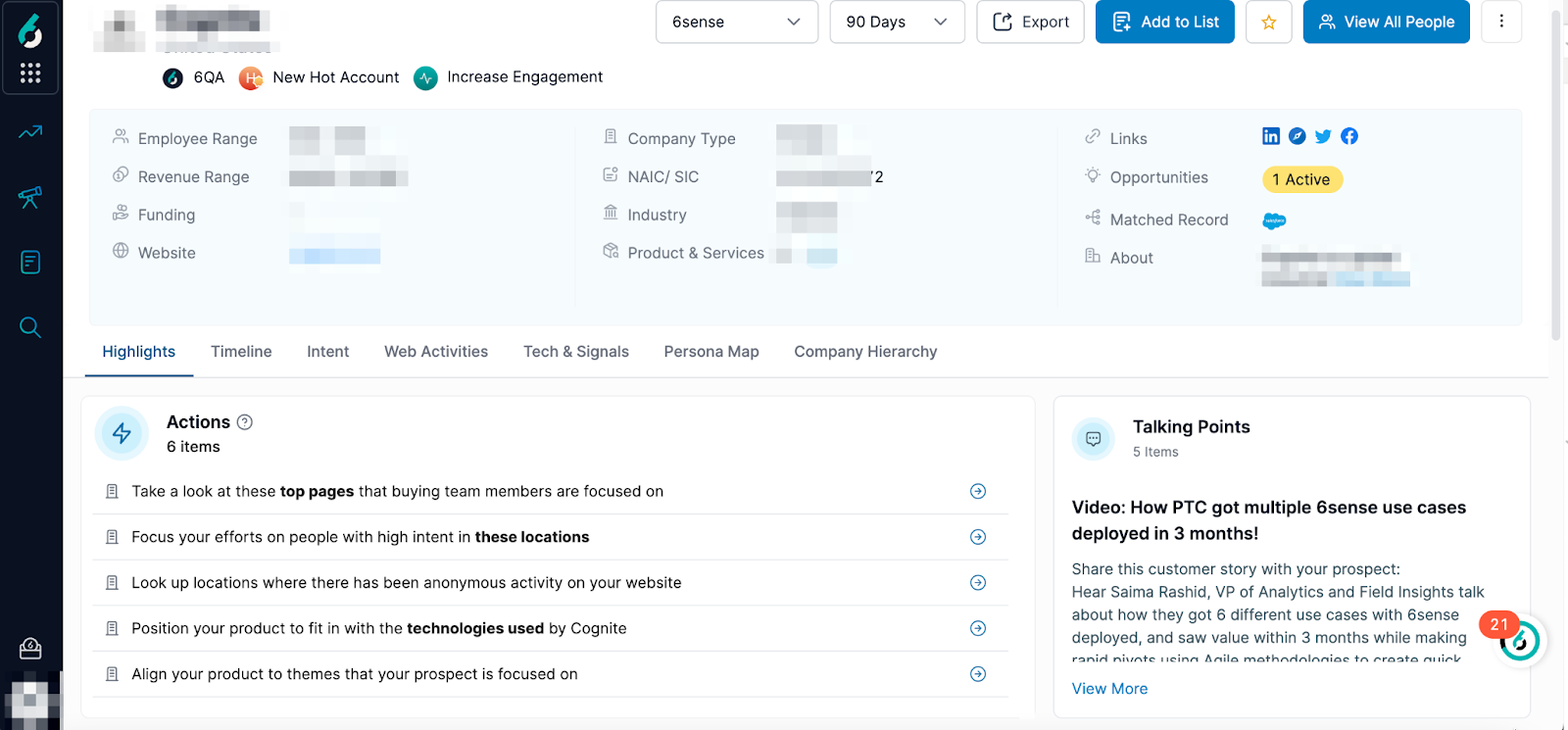

6sense is an account engagement platform that combines intent data (from multiple sources like Bombora, TrustRadius, G2, etc.) with your own website data, CRM data, and a dose of AI to predict where each account is in its buying journey.

It’s known for account scoring and for activating campaigns across channels (ads, sales outreach, etc.) based on intent.

Users love its “single pane of glass” where sales and marketing can see which accounts are hot and get recommended actions.

But make no mistake, this one’s not just an intent-based ABM tool but a whole enterprise stack (often $35K+ per year just for the software).

So, if you are a small company looking for only intent data, 6sense will definitely be overkill.

If you run a $15M ARR+ business, let me show you its intent-based features:

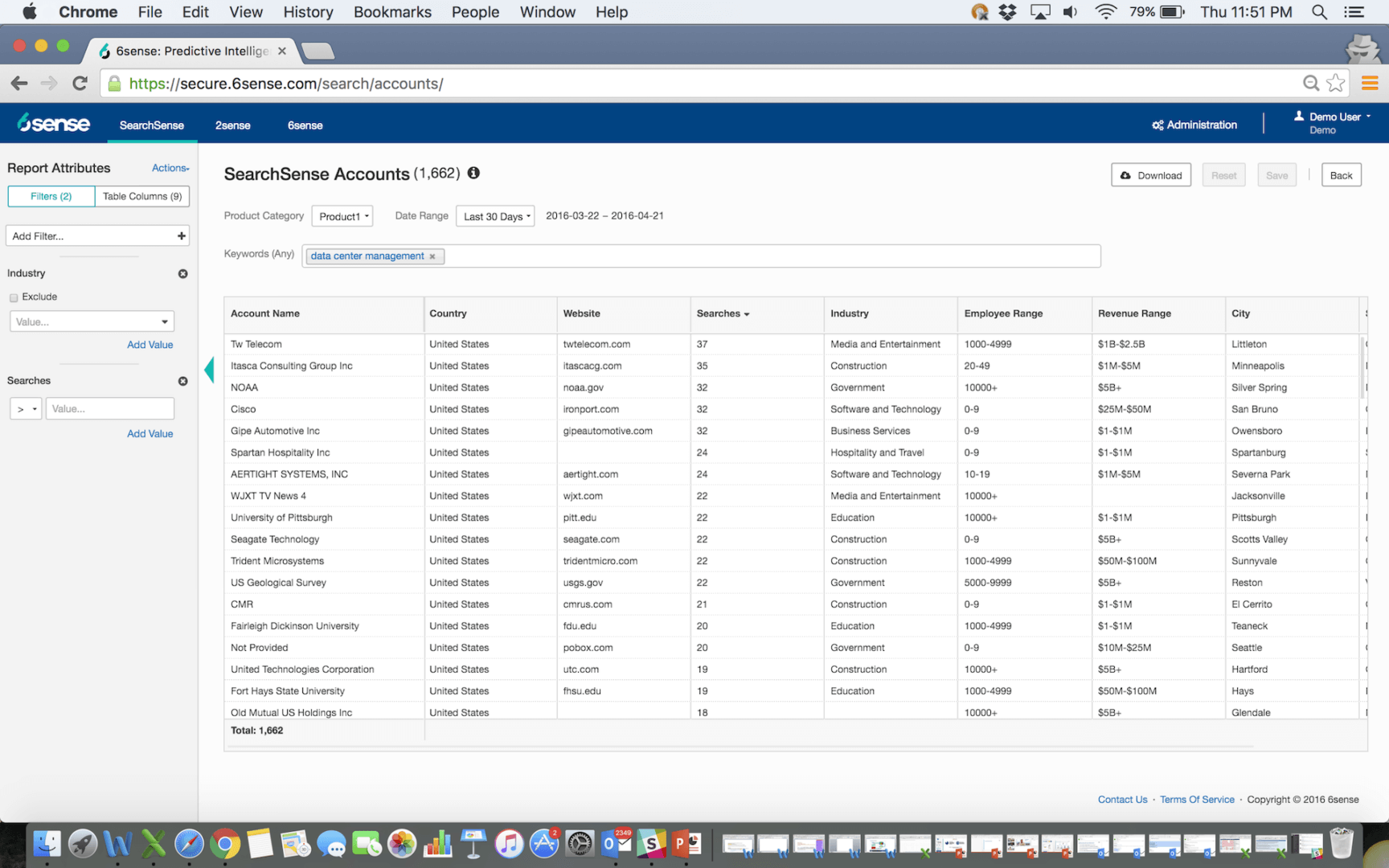

Among intent-based ABM tools, 6sense stands out for its AI-driven predictive engine and predictive analytics.

It automatically segments and scores accounts, then predicts their buying stage for sales teams and marketing teams.

Each account gets an Intent and Engagement Score (0–100), calculated from three intent-data layers:

The scoring itself is pre-defined, not customizable, but still powerful.

6sense’s predictive AI compares each account’s behavior against historical conversion patterns and assigns a likely buying stage.

This lets sales and marketing teams focus their ABM strategy on accounts that are not only a fit but also in-market, which helps marketing and sales teams align outreach efforts.

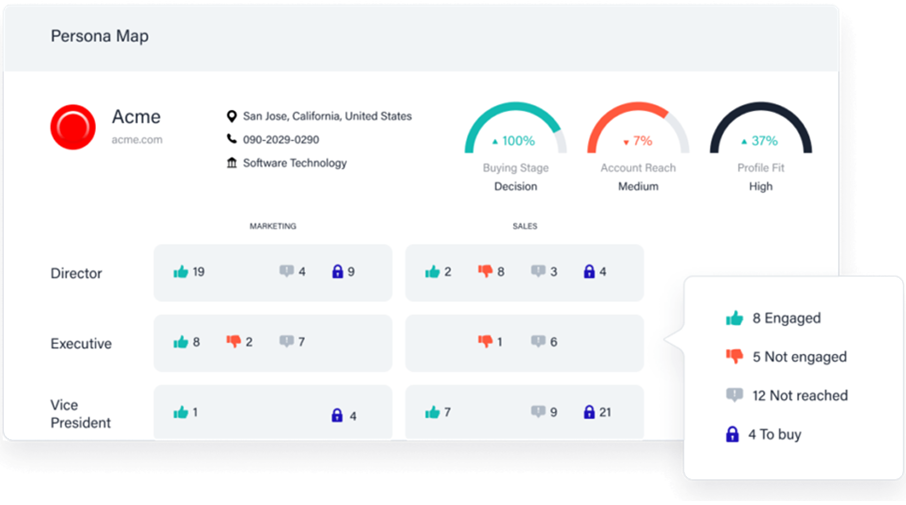

6sense goes beyond scoring to deliver a full account intelligence view.

You get firmographic, technographic, psychographic, behavioral, and CRM data in a single dashboard—plus AI-driven recommendations.

Its massive contact database (250M+ B2B records) enables Persona Maps that highlight buying teams and their engagement.

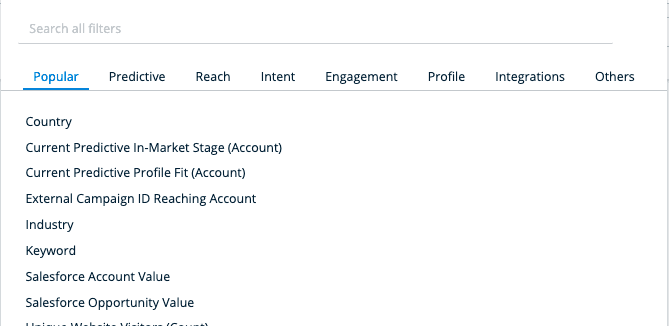

You can filter accounts with over 80 attributes (e.g., “all manufacturing accounts in consideration stage with 5+ visits this month”), making it both a prospecting tool and an ABM engine.

Its Company & People Search blends your CRM with 6sense’s global data, while the Chrome extension surfaces real-time account insights right inside LinkedIn or web browsing.

This helps you combine intent data with all other kinds of static data about the company and drill down to the persona level to improve sales engagement and personalized messaging.

Some other notable features of 6sense:

6sense does not publish fixed prices publicly, but here’ what I found from review sites:

Demandbase is a full-stack ABM platform similar to 6sense and is widely used as account based marketing software.

In fact, Demandbase is even more comprehensive than 6sense.

Third-party keyword-based intent data is just a part of it, among many other features, and so is its cost (goes upwards of $60,000 per year!).

So, it would also be an overkill for most businesses smaller than, say, $15M ARR.

Regarding intent data sources, Demandbase has its own data assets from past acquisitions (EverString, Spiderbook) and also partners with third-party intent providers.

One notable strength: Demandbase can directly integrate intent data into programmatic ad campaigns and website personalization.

For example, you can dynamically change your site content or ads shown based on an account’s intent topic – next-level stuff if you execute it.

The caveat: you’ll need a solid ops team to connect all the pieces and utilize the potential of the tool.

If you can afford the costs and have a dedicated team, here are its intent-based features:

Demandbase tracks buying signals from your target accounts across B2B content sites, search engines, and publisher networks, monitoring spikes against 62,500+ keywords.

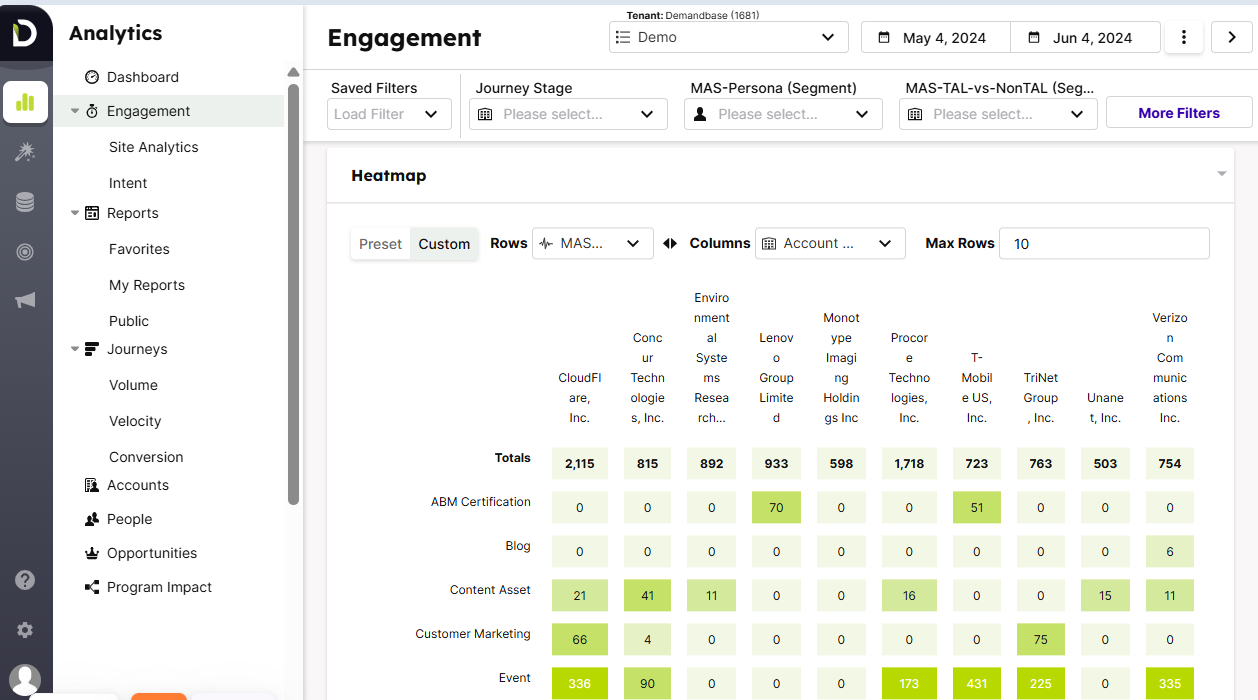

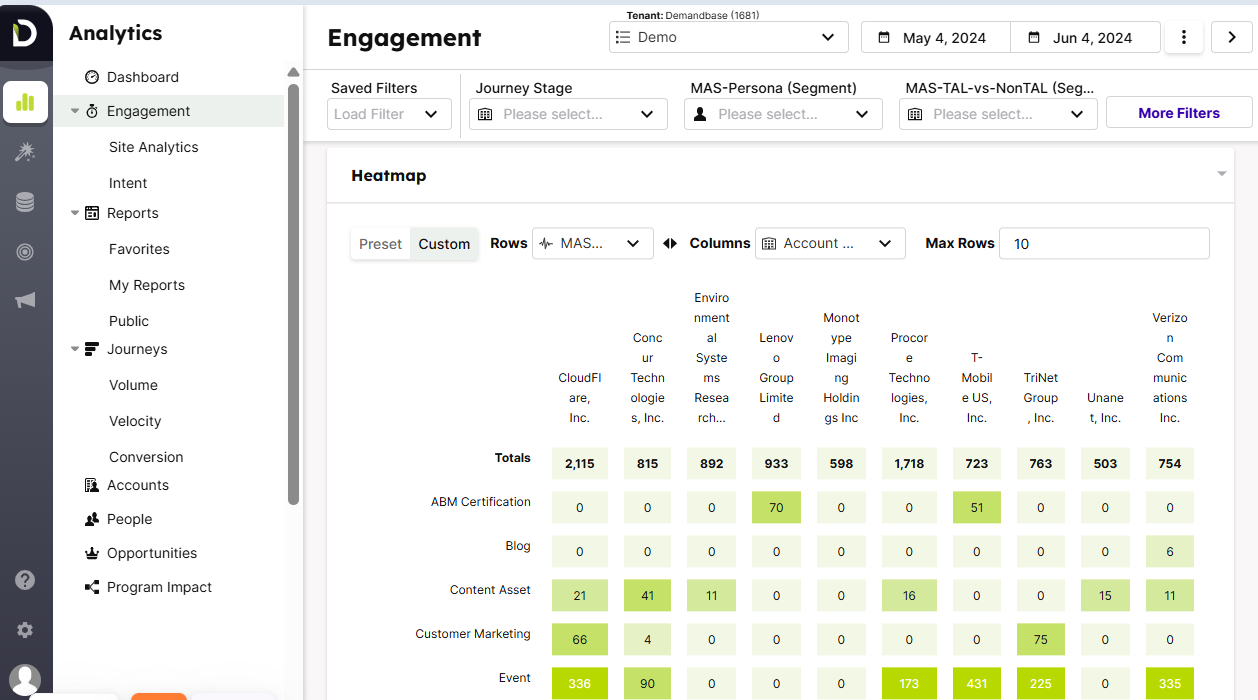

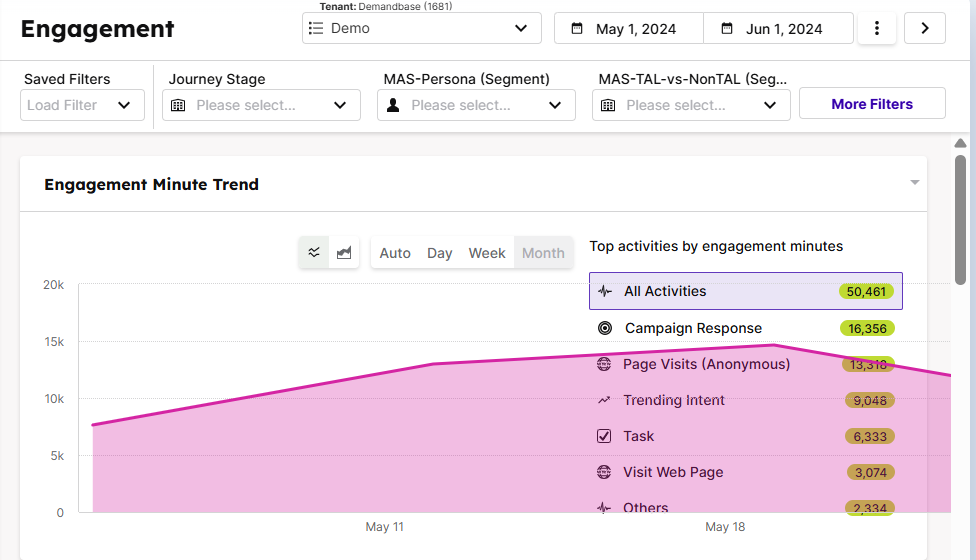

You can visualize this intent data with heatmaps that combine engagement and buying signals to guide sales engagement, marketing and sales alignment, and overall account-based advertising:

Beyond third-party intent, Demandbase logs first-party engagement too.

It tracks impressions, clicks, ad spend (from display ads or LinkedIn), website visits via its pixel, and even webinar signups or content downloads.

All of this rolls into an Account Engagement Score (quantified as Engagement Minutes) that helps sales and marketing teams gauge how warm a key account really is and where to focus sales outreach.

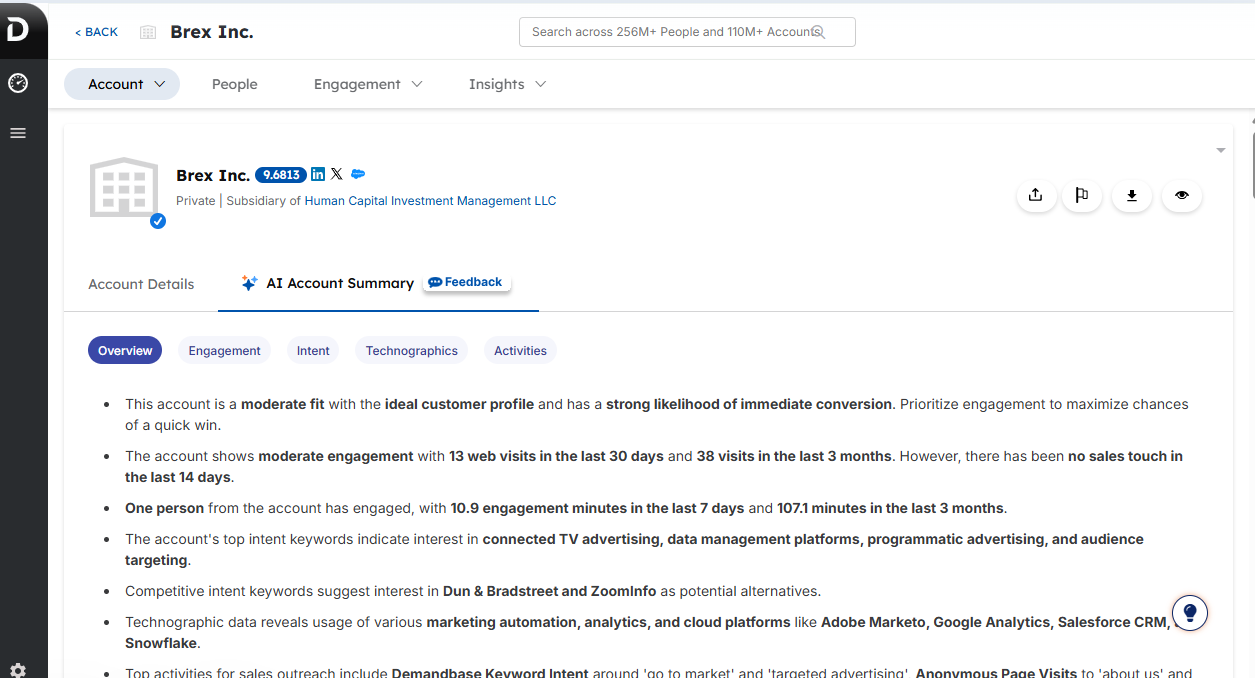

Each target company gets a 360° dashboard with firmographics, fit score, intent topics, engagement score, buying stage, open opportunities, and even top stakeholders.

Plus, an AI-generated summary makes the data easier to digest.

You can configure intent-based ABM alerts for spikes in interest, first-time site visits, or surging activity.

These show up in Slack, email, or as Snapshot Reports, ensuring sales reps get notified when a high-value account is heating up, which improves marketing and sales efforts.

Other stuff you get in Demandbase:

Demandbase doesn’t talk about numbers on the site, but some important points are mentioned:

Information I got from third-party sources, not official Demandbase disclosures, so treat them as approximate ranges:

| Organization size / need | Estimated annual cost |

|---|---|

| Smaller companies | ~ US$18,000 to US$32,000/year |

| Mid-market companies | ~ US$43,000 to US$61,000/year |

| Larger / enterprise | US$60,000-US$110,000+ / year depending on scope, features, number of accounts/users, etc. |

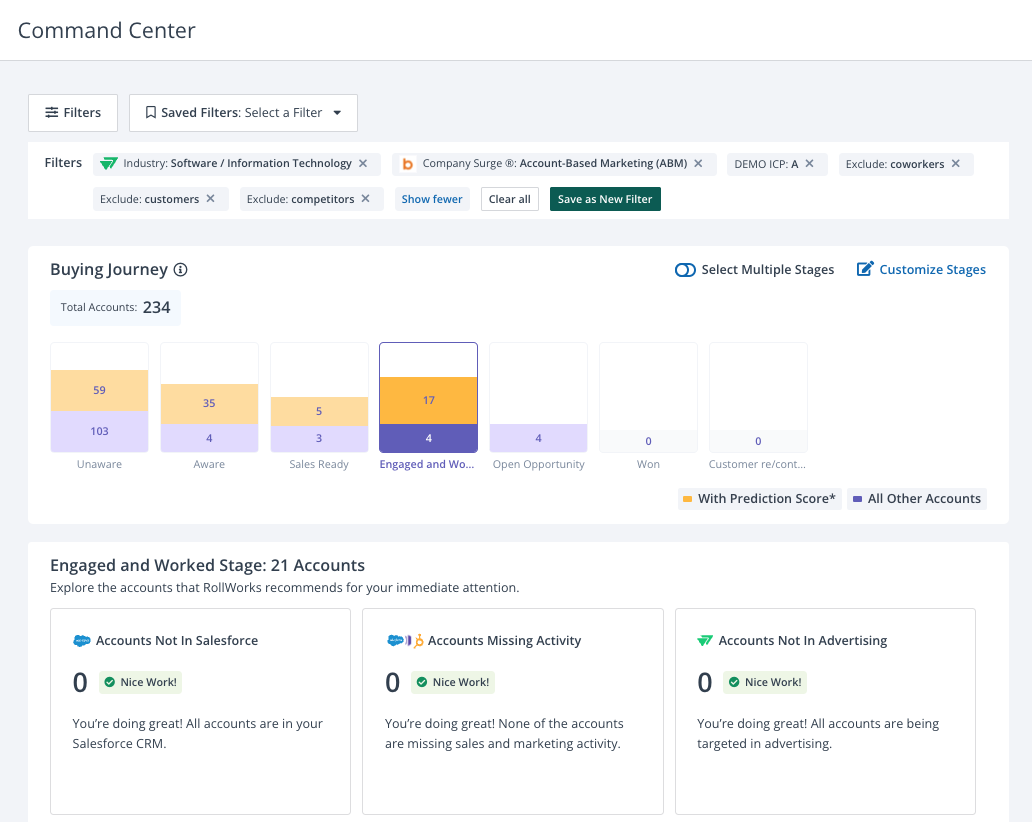

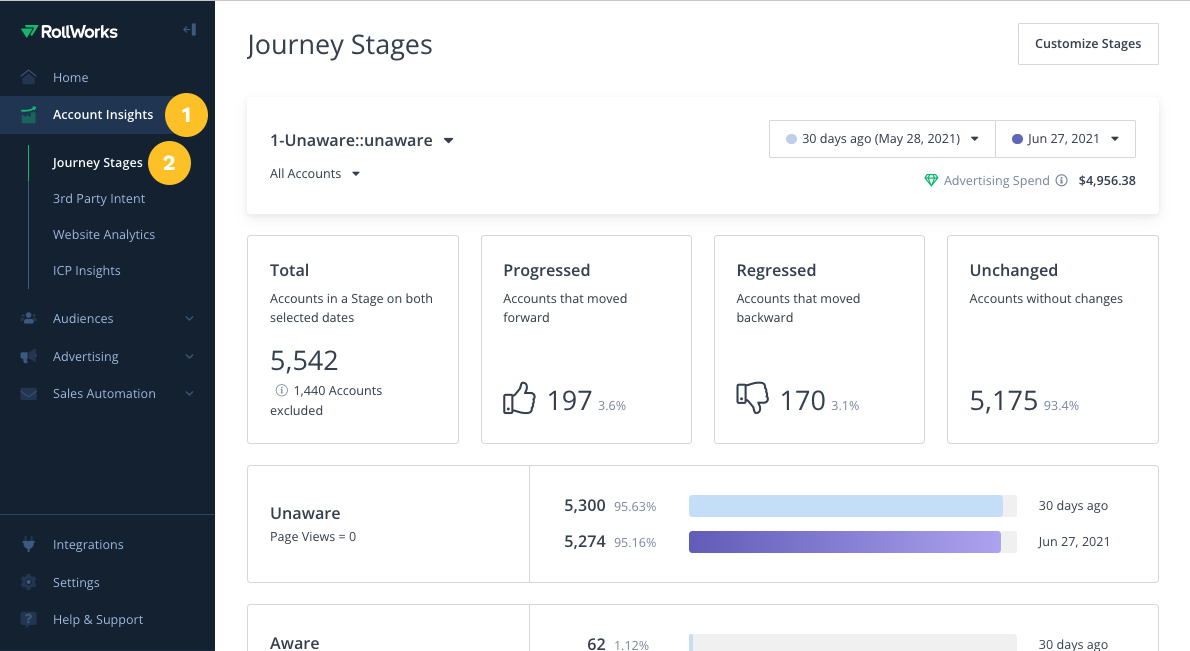

RollWorks is the ABM arm of NextRoll (makers of AdRoll), combining digital ad expertise with intent data and account targeting.

It ingests intent signals (like Bombora, used in their Okta case study) and automatically adjusts targeting and bids toward high-intent accounts. Sales teams also benefit from real-time alerts and orchestration.

Compared to 6sense or Demandbase, RollWorks is a more accessible intent-based ABM tool, with self-service-friendly tiers.

If you want your ads to only reach accounts that matter and even auto-boost spend for hot accounts, RollWorks is worth a look.

Let’s break down its intent-based ABM features:

RollWorks tracks keyword intent across the web to flag accounts actively researching solutions like yours.

You can select the keywords you care about, monitor surges, and drill down to see activity at the account level.

Data sources include RollWorks’ own pool and partners like Bombora.

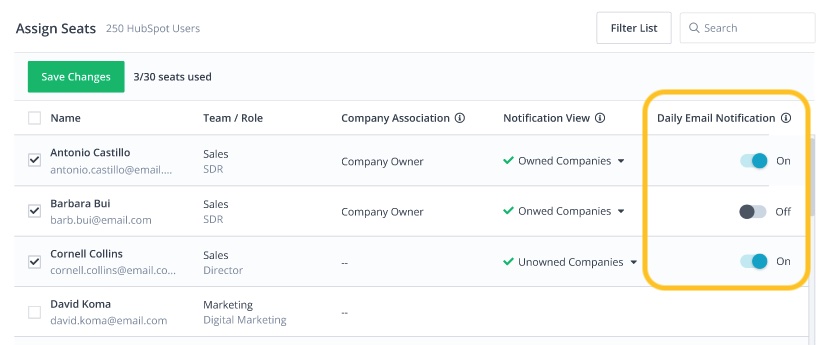

With its site pixel, RollWorks deanonymizes your web traffic, showing which target accounts visit your site.

Beyond company names, it can also surface key contacts inside those accounts, turning anonymous visits into actionable sales opportunities and helping sales and marketing teams improve sales engagement with high value accounts.

RollWorks continuously monitors account behavior (ad clicks, visits, email opens) and flags unusual surges in engagement.

Sales reps get daily “Account Spike Alerts” with details on what happened and who engaged.

These alerts sync with Salesforce/HubSpot, so hot accounts are automatically visible in CRM for sales teams and marketing teams.

Your account lists aren’t static.

If a new account matches your ICP and shows intent, RollWorks adds it to your TAL.

If an account drops out of fit, it can be downgraded or removed.

The system also provides AI-driven recommendations for marketing tools users and sales teams – for example, suggesting a higher ad budget for high-fit but under-engaged accounts.

Here’s more that RollWorks has to offer:

RollWorks (AdRoll ABM) follows a mostly custom pricing model.

It does offer a Free Tier with basic ad and retargeting features, but serious ABM capabilities require a paid plan. For smaller teams, pricing typically starts under $1,000/month, with the Salesforce ABM integration known to cost around $975/month.

Beyond that, the cost scales based on how many accounts you want to target, how much intent data and predictive scoring you need, and the size of your ad spend across channels. For enterprise setups, the pricing is entirely quote-based, so you’ll need to contact RollWorks directly for an exact number.

ZoomInfo, the giant of B2B contact data, was once a partner with Bombora, but later rolled out its native intent data solution.

It uses a vast data crawling infrastructure to track online behavior and signals.

One advantage: ZoomInfo’s intent topics can be very granular, and you can request new topics on the fly.

Plus, it ties in nicely with their contact database – so you identify a surging account and immediately pull the contacts to target for sales outreach and personalized messaging.

Its intent-based ABM features:

ZoomInfo doesn’t put the prices directly on the site.

Here’s what I found on other sites:

Intent-based ABM is no longer optional if you want to compete in crowded B2B markets, especially if your account-based marketing strategy targets high-value accounts and high-intent accounts.

The right tool depends on your scale and budget: smaller teams should lean on RollWorks or ZoomInfo, while data-heavy marketing teams may prefer a broader account-based marketing platform. Enterprise-level companies with dedicated ops teams can consider 6sense or Demandbase for full-stack predictive analytics and personalization power that aligns sales and marketing.

ZenABM provides something unique: first-party intent data based on ad engagements and clear account engagement insights for sales teams and marketing teams.

This makes it meaningful for all tiers of businesses because leveraging intent data improves sales and marketing efforts across the sales cycle.

Small businesses can start with ZenABM, while larger organizations can keep it alongside other intent data tools and account-based marketing software to maximize coverage of target accounts and target audience segments.