In this guide, I have compared Demandbase vs. 6sense across features, data and identity, advertising and LinkedIn activation, integrations, pricing and total cost of ownership, implementation, analytics, and fit by company size and motion.

I have tried to answer what most buyers actually need to decide, and have also suggested a third lighter alternative for LinkedIn ABM (ZenABM), and where it might make more sense than these enterprise tools.

In case you don’t have 15 minutes, here are the key differences between Demandbase and 6sense, especially in terms of features, pricing, and positioning.

| Dimension | Demandbase | 6sense |

|---|---|---|

| Core positioning | Full-stack ABM with native B2B DSP, audience and orchestration, buying committees, and web personalization. Demandbase positions itself as the only pipeline AI platform for account-based GTM strategies. | Revenue AI for GTM with predictive buying stage and fit, segments, orchestration, and sales intelligence |

| Advertising backbone | Native B2B DSP for open internet reach and retargeting | Activation via The Trade Desk for display, video, and CTV |

| LinkedIn activation | Audience destinations and daily sync to Campaign Manager, plus campaign reporting sync | Build and sync segments that align with LinkedIn and programmatic plans |

| Sales workflow depth | Solid, with buying group views and alerts | Deeper out of the box with Sales Intelligence and prospecting tools |

| Typical fit | Mid-market and enterprise with meaningful media budgets and multi-channel ABM | Mid-market and enterprise that want predictive-led orchestration across revenue teams |

| Pricing style | Enterprise plan, custom quotes, annual contracts are common. Pricing not publicly disclosed. | Enterprise plan, custom quotes, annual and multi-year terms are common. Pricing not publicly disclosed. |

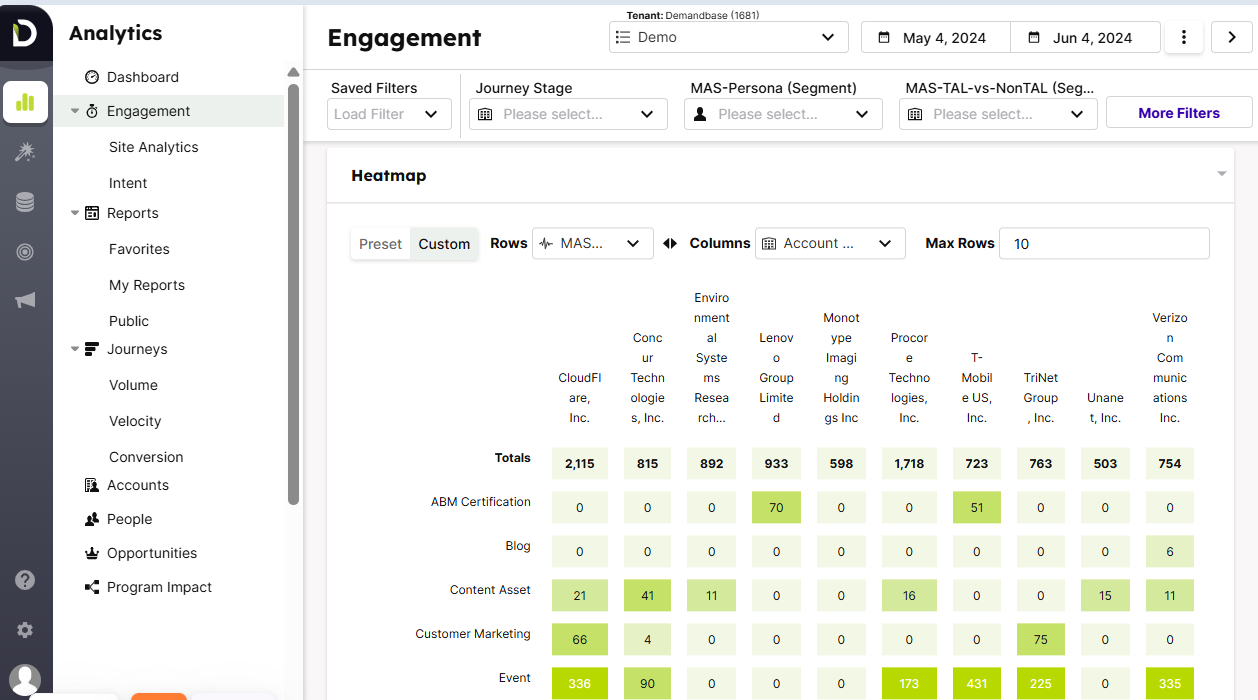

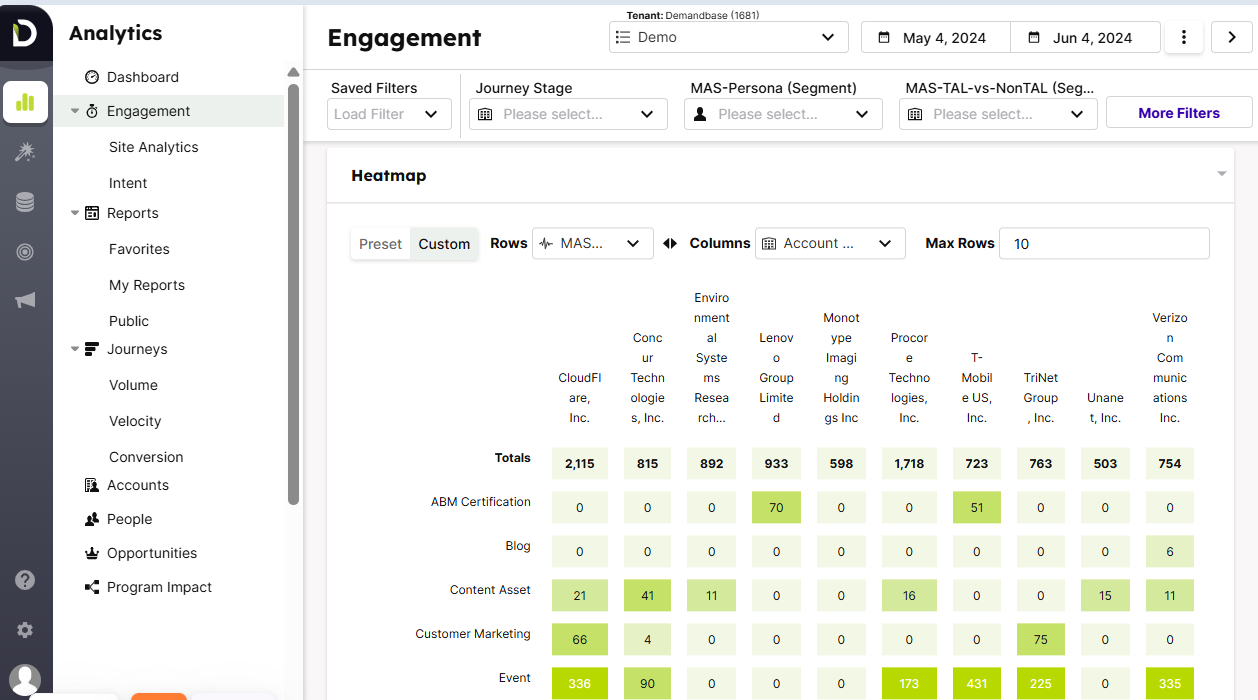

Demandbase is an enterprise ABM platform built as a central hub for account selection, activation, and measurement. As a pipeline AI platform, Demandbase unifies data and automates account-based strategies to help go-to-market teams maximize revenue and reduce waste.

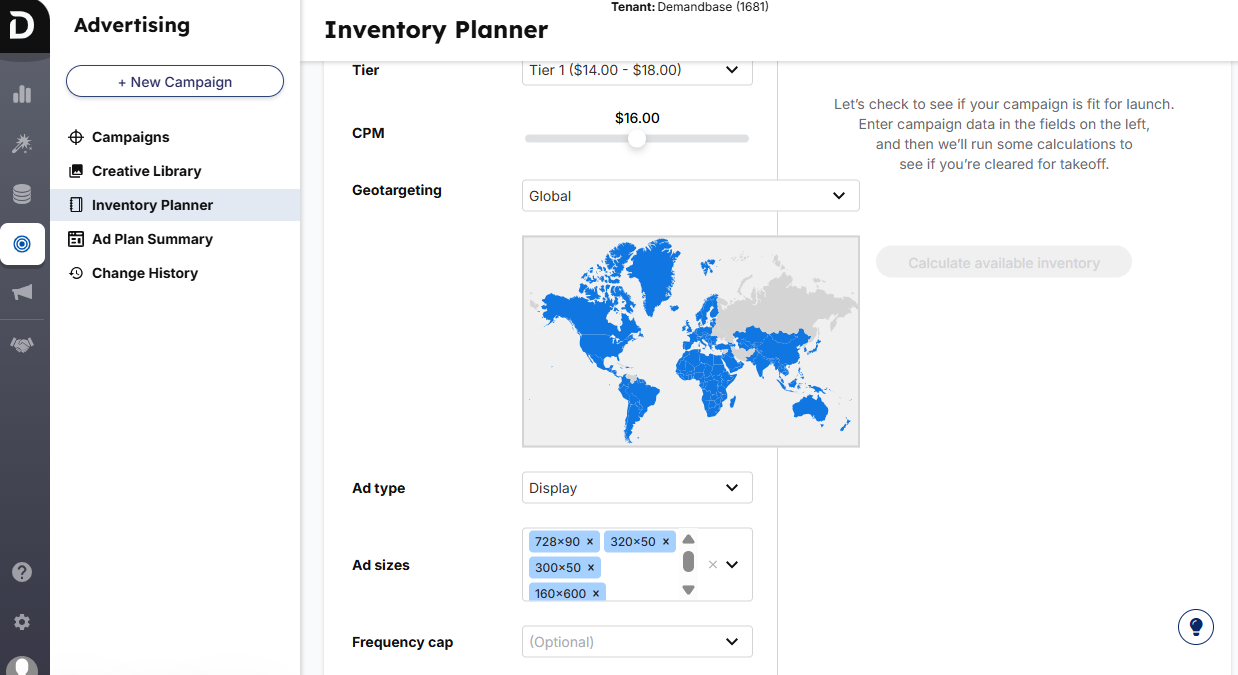

It includes a native B2B DSP for programmatic, plus multi-channel ad support across display, video, CTV, and social, with cenabling multi-channel engagement to reach prospects across various channels. Controls for account and people-based targeting, buying groups, AI-driven bidding, and account-level frequency capping are included.

The ad stack sits alongside TAL building methods such as CSV upload, web visitor deanonymization, and native account intelligence that factors firmographics, technographics, and intent.

Reporting surfaces account-level engagement, and an ad creative library streamlines asset reuse.

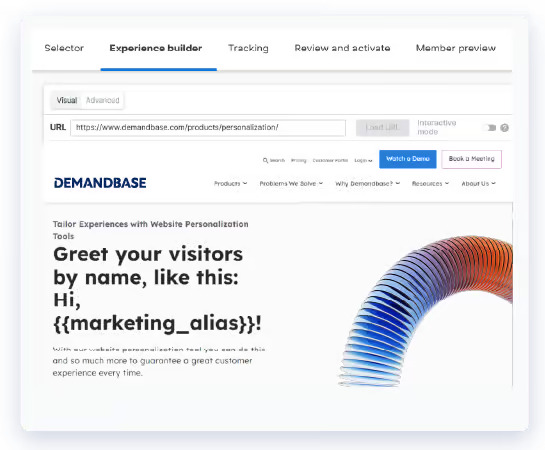

On the data side, Demandbase emphasizes identity through IP-to-account resolution and curated B2B inventory, and it layers predictive scoring and a Pipeline Predict signal to prioritize outreach, supporting predictive marketing to identify high-value accounts and enable targeted strategies.

Integrations cover major CRMs, MAPs, analytics, ad platforms, and sales tools so audiences and insights flow across your tech stack.

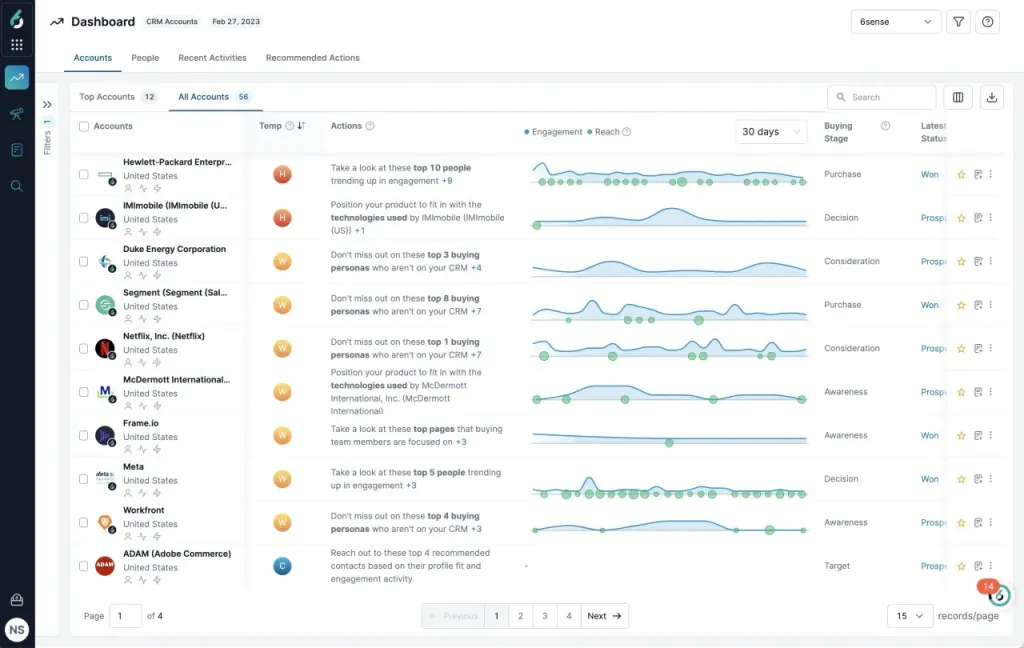

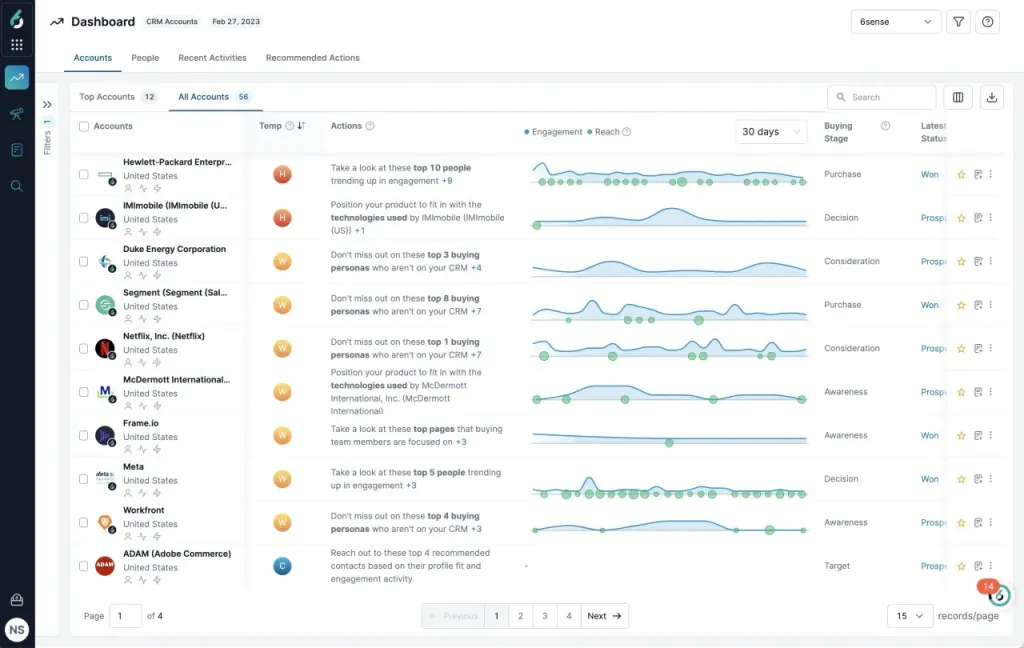

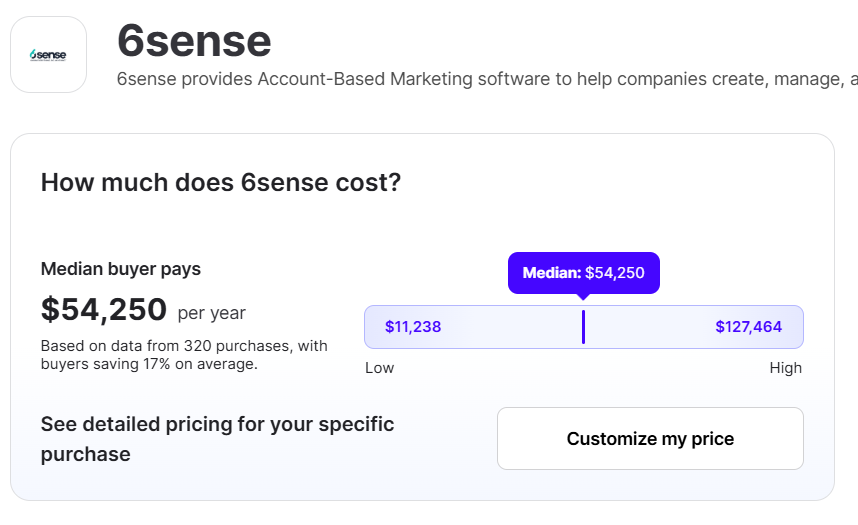

6sense is a B2B ABM platform that centers on AI-powered revenue intelligence and website visitor deanonymization.

As a pipeline AI platform, 6sense empowers go-to-market teams to automate growth, unify data, and execute account-based strategies effectively.

It supports multi-channel advertising and precise targeting, automates dynamic audience segments, and uses a proprietary Company Graph to map anonymous traffic to accounts.

Multi-channel engagement enables coordinated outreach to prospects across various communication channels, optimizing engagement and conversion.

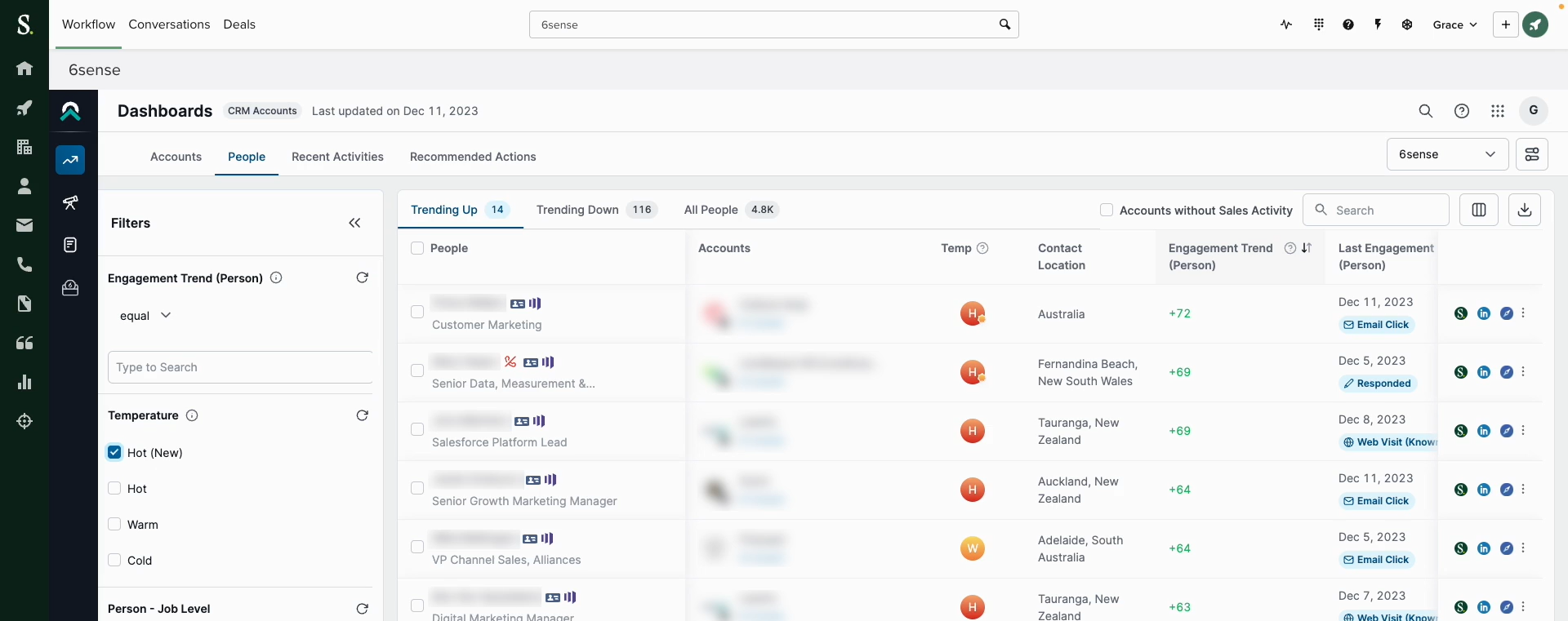

Predictive scoring and segmentation combine first-, second-, and third-party intent to produce buying stage and fit signals, whichleveraging predictive marketing to identify high-value accounts and predict purchasing readiness. These insights feed sales orchestration, next-best actions, and prospecting across CRM data and 6sense’s database.

The platform also includes attribution dashboards, sourced and influenced models, and AI-driven forecasting that connect account engagement to pipeline goals.

Teams can run display, video, and CTV, coordinate social and search, and extend intelligence into sales tools and a Chrome extension. 6sense integrates with CRM solutions like Microsoft Dynamics to enhance data sharing, streamline workflows, and improve team collaboration for greater sales effectiveness.

It is geared to mid to large enterprises that can invest in the breadth of features and associated operational lift.

Let’’s have a closer look at the key differences between Demandbase and 6sense by examining each platform’’s almost-unique offerings.

Demandbase has the following almost-unique highlights:

While most platforms offer features like predictive analytics, sales intelligence, and flexible segmentation, 6sense stands out for the depth of its predictive analytics and sales intelligence capabilities. 6sense offers the following almost-unique features (at least in comparison to Demandbase):

Bottom line: Demandbase leans into activation and media scale with strong ABM plumbing. 6sense leans into predictive and revenue alignment with a capable activation layer. Both can run sophisticated ABM programs if your GTM basics are not a mess.

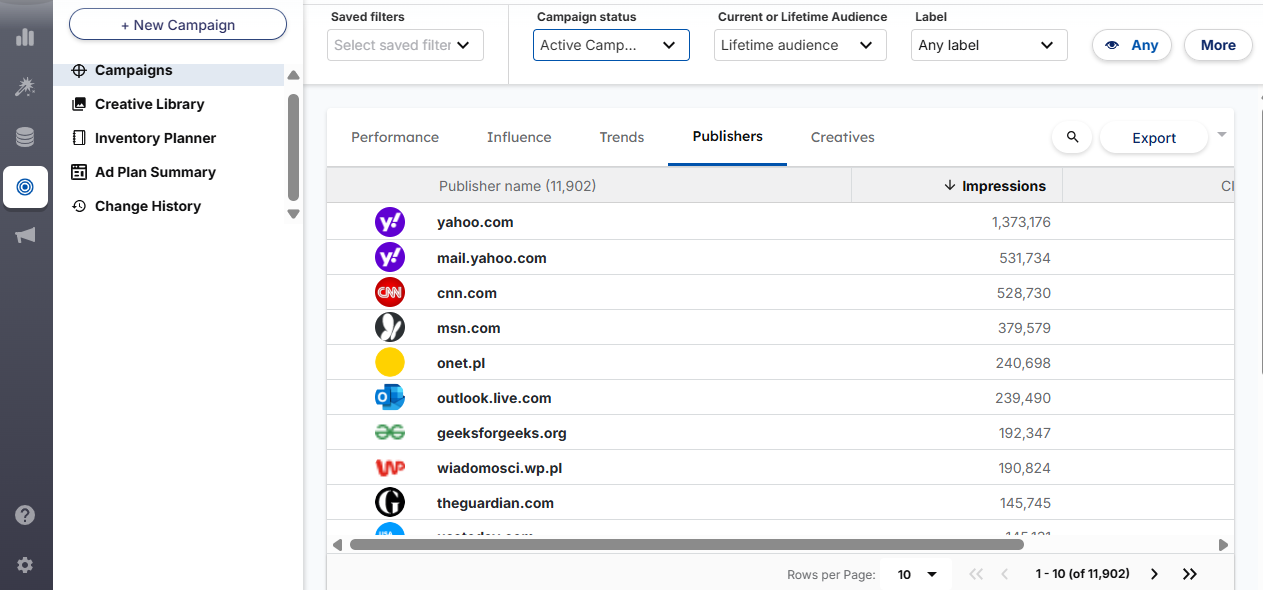

Demandbase gives you a native B2B DSP that handles reach outside walled gardens.

For LinkedIn, you can sync audiences daily and pull campaign reporting back into your ABM view.

This keeps journeys aligned when you are running social for precision and programmatic for efficient scale.

6sense extends segments to The Trade Desk, which suits teams that want a single predictive brain feeding both LinkedIn and open internet reach.

If your brand invests in video and CTV, or if you want to run retargeting across exchanges, this is an easy way to keep logic consistent.

Both platforms blend first-party engagement with partner data like intent, technographics, and firmographics. Each uses intent data along with first-party signals to score and segment accounts.

The mechanics are similar.

Each supports lead to account matching, unifies identity, and groups contacts into buying committees. Evaluate identity resolution quality and how it supports ABM decision-making.

What matters is not the marketing diagram.

What matters is your match rate for the accounts and regions you target, and how reliably that graph writes back to CRM so sales is not chasing ghosts.

These are the types of integrations and workflows possible with both the tools:

Both support Salesforce and, HubSpot, and Microsoft Dynamics, along with major MAPs and marketing automation platforms. Push only the fields RevOps can own and maintain. Keep naming consistent with your data dictionary to avoid reconciliation fights and ensure seamless data flow across the current stack.

Demandbase provides LinkedIn audience destinations and campaign reporting sync so your ABM platform reflects what actually ran. 6sense provides Trade Desk activation plus LinkedIn coordination from segments.

6sense’s sales intelligence is deeper out of the box – 6sense analyzes billions of intent signals across multiple touchpoints to provide actionable insights.

Demandbase’s buying committee lens and alerts are solid for teams that already have a strong sales infrastructure and do not want to switch prospecting tools. For sales and marketing teams that want one view, 6sense positions itself in the category for sales intelligence with AI-driven insights layered on top of data.

You can learn more about their integrations on their own site here:

There is no public, static price card for either platform.

Both are priced by quote.

Expect a core license, add-ons, data credits, and seat packs.

Expect services that can be vendor-provided or agency-led.

If you run programmatic, expect media budgets through the native DSP or The Trade Desk.

If you are LinkedIn heavy, that budget sits outside the platform license but still needs to be modeled in your ROI math.

6sense gives a free Sales Intelligence tier with a credits model that supports light prospecting and alerts – handy for testing workflows before a paid rollout.

It’s paid tiers sold by quote.

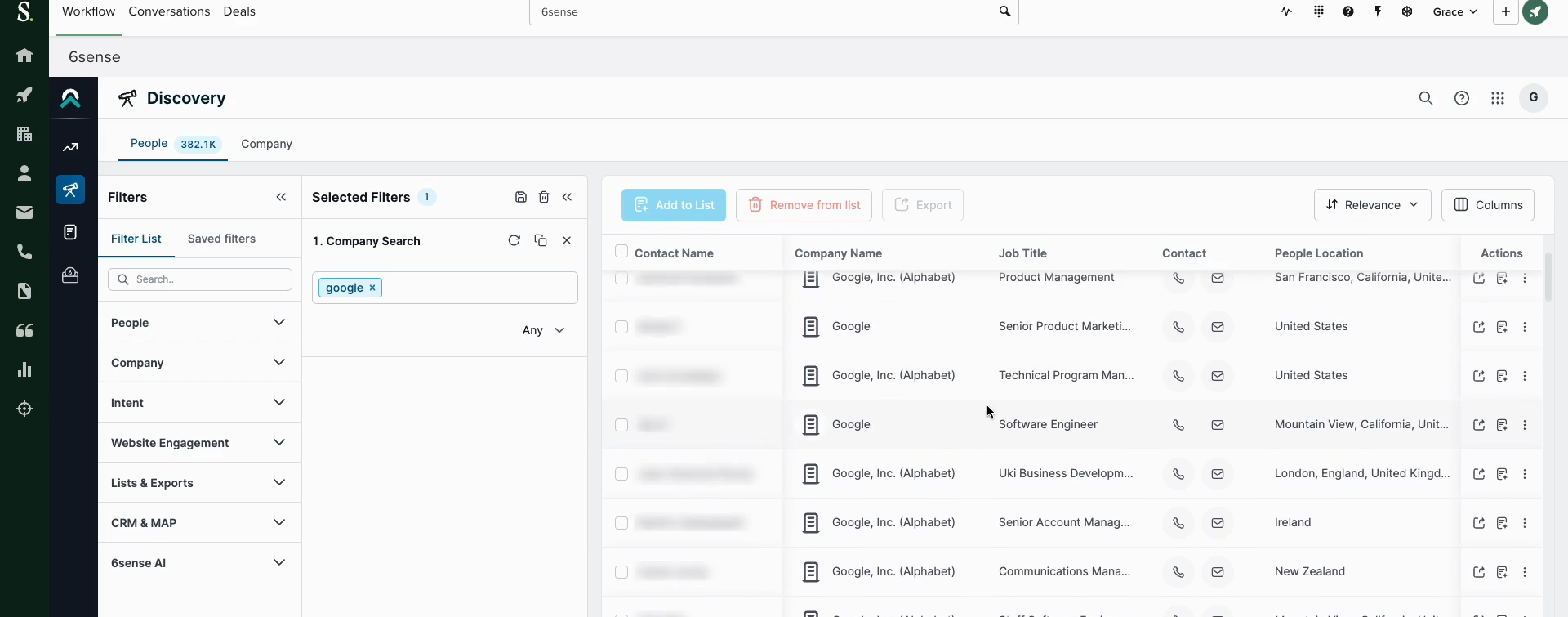

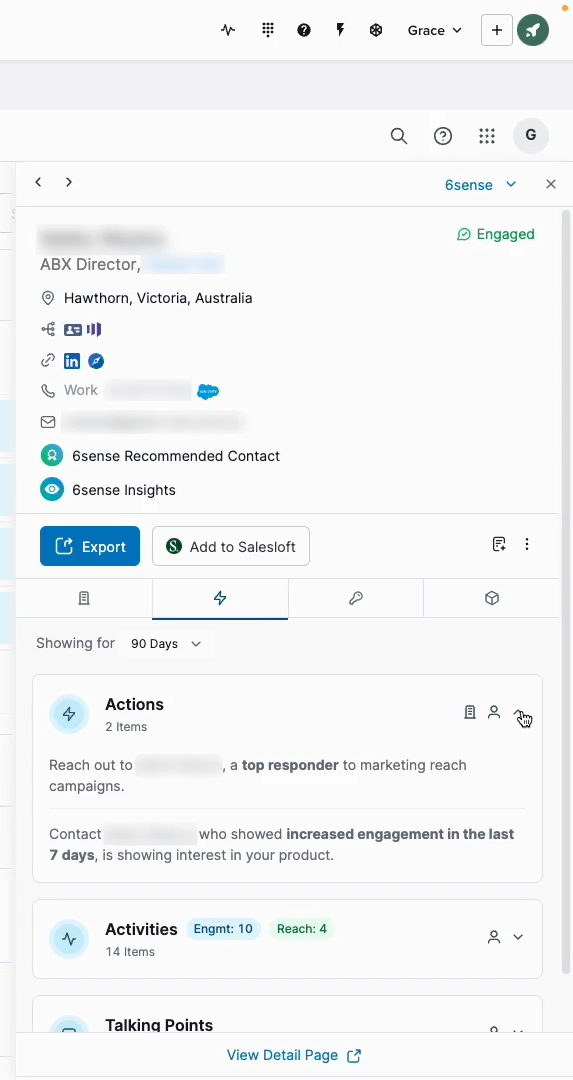

Observed ranges on platforms like Vendr commonly land in mid-five figures to low six figures per year, depending on scope and term, and the median price stands at $62,843.

Large enterprise rollouts can be higher.

Demandbase provides custom quotes aligned to modules and media strategy, and nothing is directly stated on their own site.

As per third-party sources, small packages can start in the lower bands, mid-market often lands in the middle, and large enterprises with multi-region activation can reach six figures.

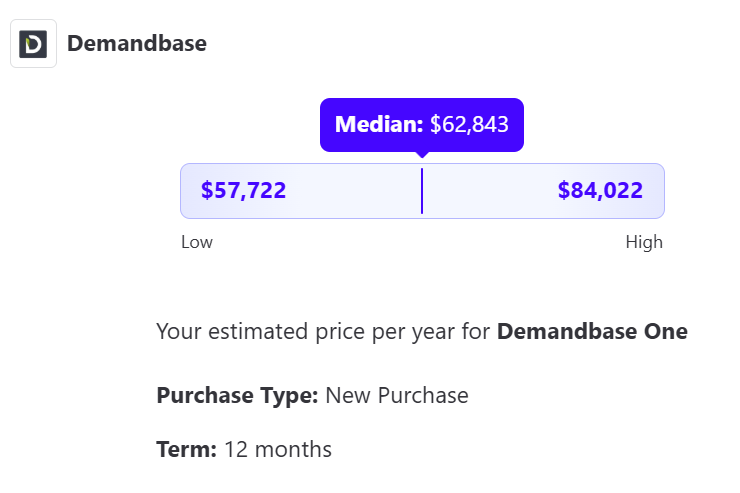

Vendr, for instance, keeps the median 6sense pricing at $54,250.

| Demandbase pros | Demandbase cons | 6sense pros | 6sense cons | |

|---|---|---|---|---|

| Summary | Native B2B DSP, strong LinkedIn sync, robust ABM plumbing and personalization | Complex for small teams, programmatic adds media and ops overhead | Predictive depth, sales intelligence, clean orchestration, Trade Desk reach | Complexity, quota creep for credits and seats, change management required |

| Best when | You need media scale plus ABM discipline in one place | Your plan is social only, or your team is one person | You need signals that unify sales and marketing and guide timing | Your ICP is too small to train models or your data hygiene is poor |

SMB and lower mid-market teams often find both Demandbase and 6sense overkill unless they have a dedicated RevOps owner and a media budget that justifies programmatic, so a LinkedIn-first-stack with a strong analytics layer is usually smarter – something a tool like ZenABM can help you with.

In the mid-market, both platforms can work:

While both Demandbase and 6sense are enterprise ABM platforms for account-based marketing, they have their differences, and you should choose while considering these pointers:

Here’s how ZenABM can support a lean ABM strategy on LinkedIn:

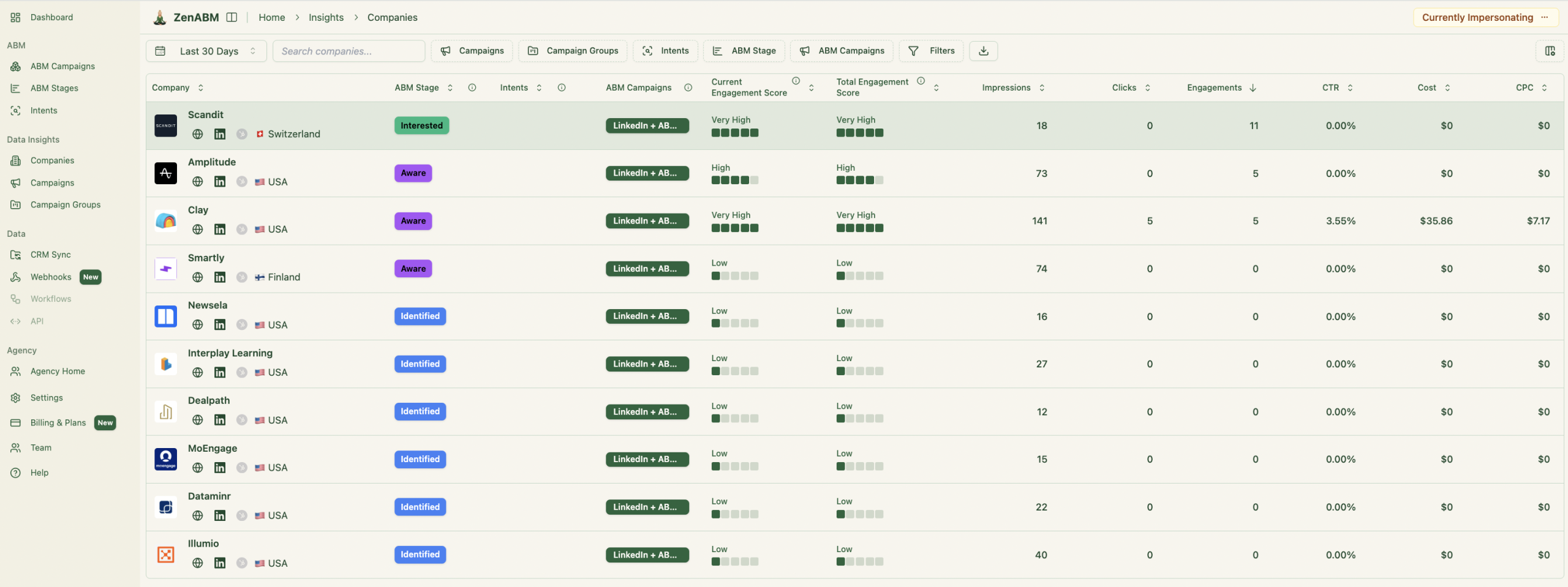

ZenABM pulls company-level LinkedIn ad engagement data (impressions, clicks, and engagements) and ad spend for each of your LinkedIn ad campaigns:

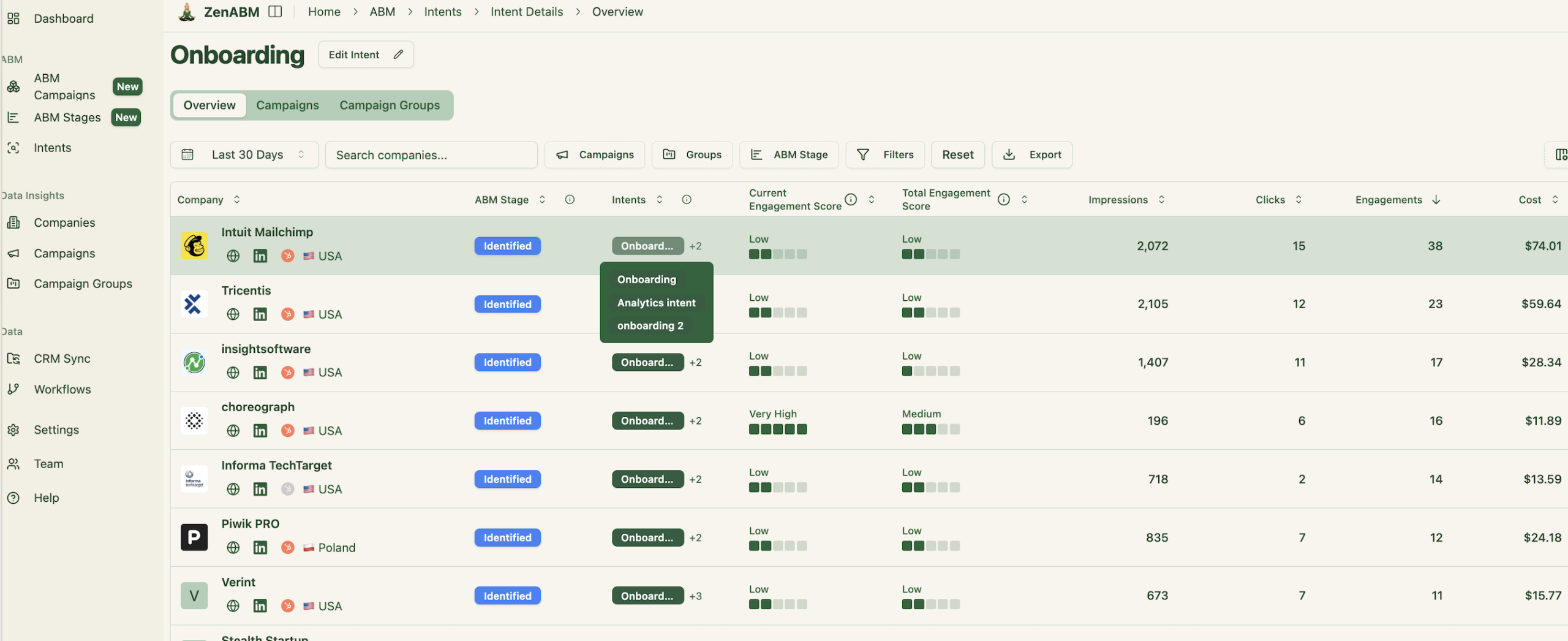

Apart from giving you raw engagement data of each company with each campaign, ZenABM sums up the historic and current engagement rate of all companies across all your ad campaigns to give you a lead score – a score telling you how aware or engaged a company is with your overall brand and campaign.

Plus, based on these engagements and your CRM data, ZenABM assigns an ABM stage to each account.

The best part? The engagement thresholds for these ABM stages are customizable at the user’s end:

We just saw that ZenABM tracks the ABM stage of each account based on engagement and CRM data.

To add more convenience for your sales team, ZenABM assigns hot accounts (accounts that have reached the interested stage) to your BDRs in your CRM:

So, your BDR outreach is immediate to hot accounts without manual daily look ups and manual alerts to your BDRs in, say, Slack.

While your run ABM on LinkedIn, your marketing team will live in ZenABM and MAPs, but sales team prefer their comfort zone – the CRM.

Well, for bridging the gap and eliminating manual data downloads and uploads, ZenABM automatically pushes all engagement data for accounts as company properties to your CRM:

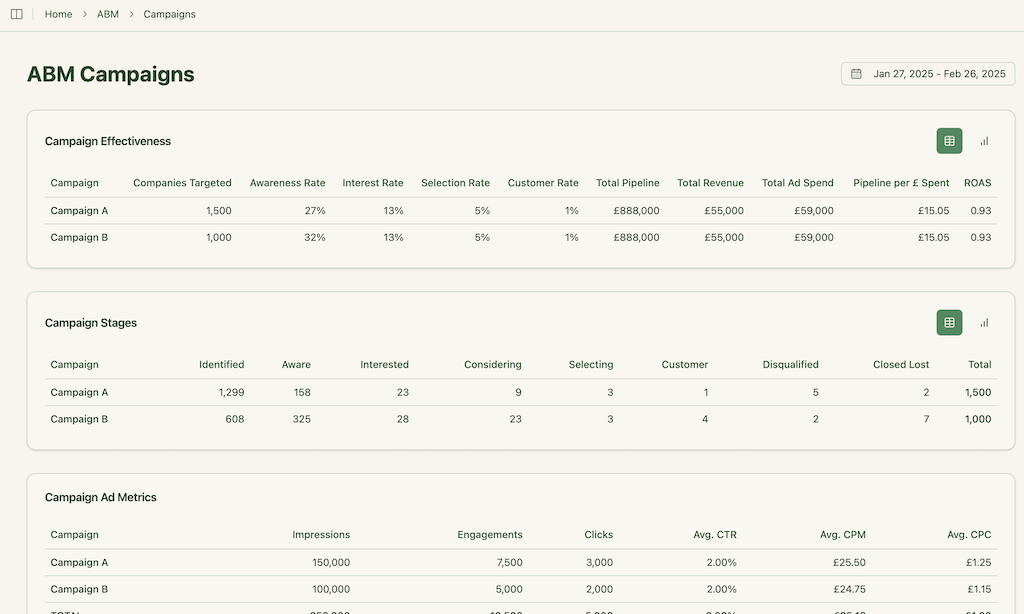

And as for the other way of this two-way CRM integration, ZenABM matches engaged companies to the deals in your CRM and pulls the deal value of each company.

ZenABM, empowered with its company-matching and deal-value-pulling feature, provides you with ready-made ABM analytics and ROI attribution dashboards.

Demandbase and 6sense rely on third-party sources like Bombora to find the qualitative intent data for themes like the pain point, the feature, or the offer that the prospect is interested in.

They do this by tracking the keywords being searched by accounts‘ members.

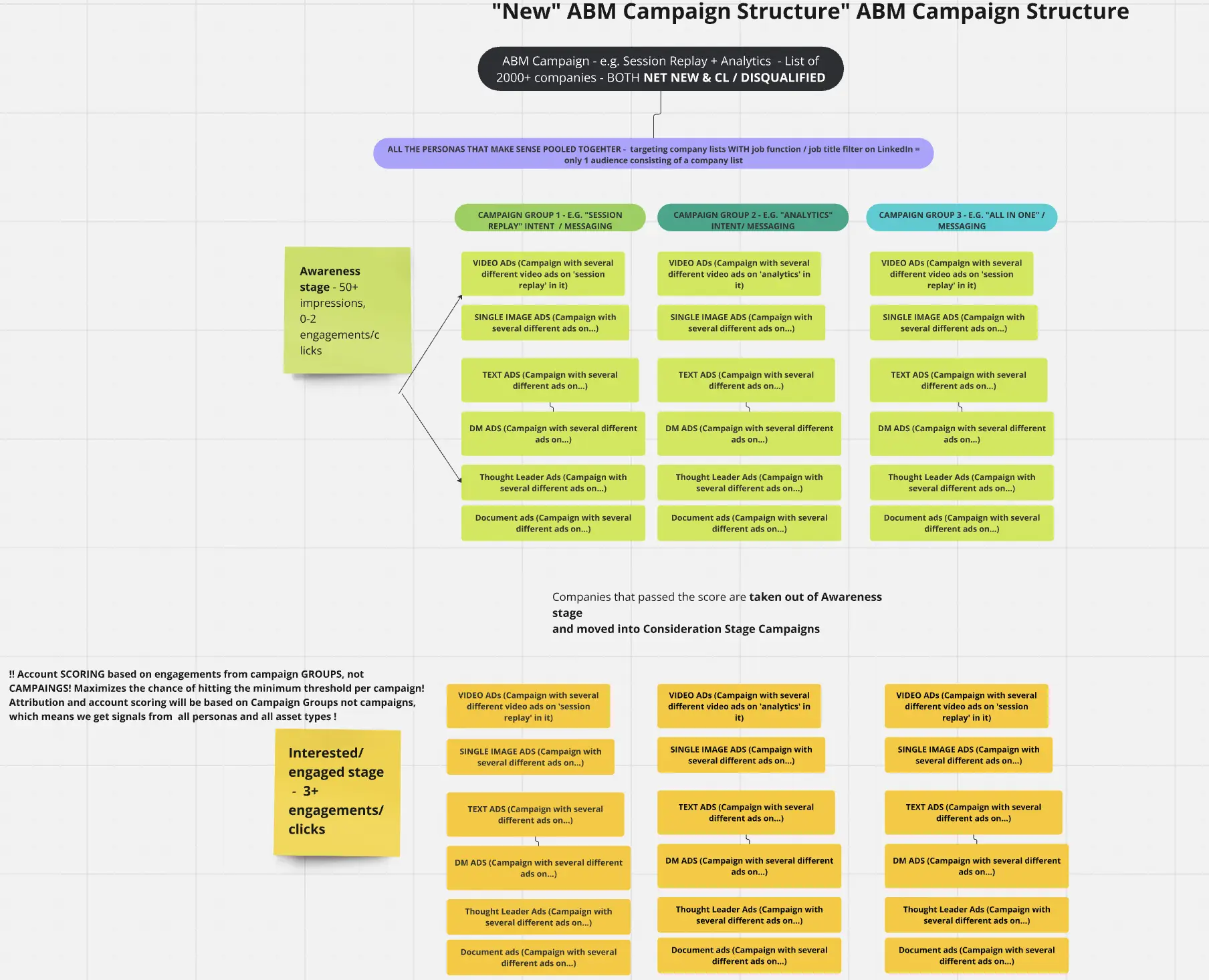

But I suggest a better way: stop paying for third-party data and embed qualitative intent in your ads themselves, which you are already paying for anyway.

For instance, if you have a product management SaaS, make different ad campaigns for different intents like product analytics, onboarding, session recording, all-in-one, etc.

Something like this:

Then, tag each campaign with intent in ZenABM, and ZenABM will tell you the qualitative intent of each company:

It will also group all companies with similar intent together for your convenience:

Plus, ZenABM will also push intent as company property to your CRM:

So, now your BDRs won’t just know the hot accounts, but also what to talk about with the accounts during the outreach.

ZenABM clearly maps out the number of companies in each stage – from initial to final stages- and also how they move. This helps you find where the friction is.

For instance, if a lot of companies are moving from ‘aware’ to ‘interested’ but don’t move out of ‘interested’, you know where the friction is and can act accordingly.

Pick Demandbase when your plan relies on programmatic plus LinkedIn, and you want a native B2B DSP with audience orchestration, buying committees, and web personalization that ties journeys together for account-based marketing.

Pick 6sense when predictive buying stage and fit are the backbone of your GTM, and when sales intelligence, segments, and Trade Desk activation will help you scale outreach with timing that does not annoy buyers. If you are early in account-based maturity, begin with LinkedIn and add layers later. Platforms like 6sense use AI to predict which accounts are likely to convert. So, if predictive ABM is your forte, go for it.

If your reality is LinkedIn-heavy and you value clarity over complexity, a LinkedIn-first stack anchored by ZenABM can deliver clean LinkedIn-ad company engagement, CRM properties, ABM stages, and revenue dashboards now.

You can always graduate to a fuller suite later once the basics are humming. This path keeps predictive analytics and intent data in reach without unnecessary bloat.

So, give ZenABM a try for free now or book a demo to know more!

6sense offers a free sales intelligence space with limited credits.

Demandbase does not list a free ABM suite plan.

Both support LinkedIn audience workflows.

Demandbase provides audience destinations with daily sync and campaign reporting integration. 6sense lets you coordinate LinkedIn from segments while using The Trade Desk for the open internet.

Demandbase uses a native B2B DSP.

6sense activates through The Trade Desk integration.

Modules, data credits, audience size, seats, and term length.

Media budgets for programmatic are separate. Services can add up if you need heavy onboarding and custom modeling.

Bad CRM hygiene, unclear ICP, no agreement on stage definitions, and trying to launch every channel at once.

Start focused, verify signal quality, then scale.