Userpilot’s ABM strategy just nailed it.

They bagged over $900,000 in pipeline with $8 in pipeline per $ spent, and ZenABM was born in the process 🙂

I’ll tell you each detail of their ABM strategy, along with some wisdom from ABM pros.

Attention: This will not be a high-level summary but a full-funnel ABM strategy tactical guide. Like I won’t leave you at ‘figure it yourself’ moments like these:

Let’s go!

The foundation of any ABM strategy is knowing exactly who you’re targeting.

Start by defining your Ideal Customer Profile (ICP) based on the firmographic and technographic traits that make an account a high-value fit.

This could include:

Plus, ‘Data > intuition.’

So, analyze your best customers to find common traits.

Modern ABM pros even use AI to identify patterns in their customer base and spot lookalike prospects.

The key is to move beyond guesswork; target accounts should be chosen based on evidence of fit and potential.

Pro Tip: Collaborate with Sales when building the TAL. Sales reps often know which companies are showing interest or which deals tend to close faster. In fact, ABM only works if Sales and Marketing agree on the target accounts from day one. For there’s a common saying in B2B ABM: ‘Your list is your strategy’.

For a pilot ABM campaign, you might start with a few hundred accounts rather than thousands.

You can also work backwards from your revenue goal to determine the size of your TAL.

Here’s a hypothetical calculation:

Example: “We need $2 M in closed-won revenue from ABM this fiscal year.”

Opportunities = Revenue Goal ÷ (ADS × Close Rate)

= $2,000,000 ÷ ($50,000 × 0.25)

= 160 opportunities

| Funnel Stage* | Typical Conversion* | Math | Cumulative Accounts |

|---|---|---|---|

| Target → Engaged (≥ 1 meaningful ad click/visit) | 10 % | 160 ÷ 0.10 | 1,600 |

| Engaged → Opportunity (meeting/demo) | 20 % | 160 ÷ 0.20 | 800 |

| Opportunity → Closed-Won | 25 % (used above) | — | 160 |

*Replace the name and number of stages and their thresholds as per your strategy. I have suggested a framework of ABM stages inspired by experts and the Userpilot case study later in the article.

*Replace these with your own historical numbers; even rough internal data beats a guess.

Assume cost per engaged account (CPEA) on LinkedIn Ads = $70

Budget = Engaged Accounts × CPEA = 1,600 × $70 ≈ $112 k

Work the numbers, sanity-check them, and let the data set both the size of your target-account list and your ad spend.

Free Resource: Though the budget estimation above gives a rough target, the ABM Budget Calculator goes deeper.

For their debut ABM push, the team reused the cold-outbound list from H1. They filtered growth & enterprise “loss” accounts by firmographics (size, region, etc.) and removed any customers that had already converted.

The follow-up campaign targeted companies running a specific technology stack (Clay + BuiltWith APIs helped with the enrichment):

They also considered accounts lost to competitors:

Userploit went further to enlist personas too, using Apollo/Clay:

But that’s up to you. Even company-level targeting works.

Saying it again, your list is indeed your strategy.

In fact, SaaS founders like Dmitri argue that ICP research for building a TAL doesn’t just help with the list itself but can also transform your entire GTM motion for good:

Not all target accounts are equal, which makes segmentation necessary.

You must break your target list into segments or tiers so you can tailor tactics.

Here’s an example:

Now, at Userpilot, they were sure about going with the one-to-many approach with LinkedIn ads.

And if you are wondering if they ever adopted one-to-one hyper-personalisation for Tier 1 accounts, they left it to BDR outreach and not ads.

Within their one-to-many approach, they created 8 segments for their target accounts based on persona.

So, each persona saw messaging meant for their role (e.g. product manager vs. CMO saw different ads).

And yes, it paid off: by monitoring which persona-ad each account engaged with, they could infer what pain point resonated for that company.

Also, they ensured their segments were dynamic.

As accounts engage and move down the funnel, effectively, they become a “segment of interested accounts” that warrant more direct attention.

For instance, from Userpilot’s one-to-many LinkedIn ads, when any account moved from “Identified” to “Interested,” the awareness ads were paused, and the mid-funnel creatives were activated for that account

Example of ads by persona & stage:

This persona-plus-stage segmentation sharply boosted CTR and funnel progression by serving each buyer exactly what they needed to see and when needed.

In short, segment early and segment often and segment even if you run one-to-many campaigns – it’s the backbone of delivering the right ABM approach to the right accounts.

If your ad content is just generic value props, sorry, but that’s not ABM, and all your segmentation efforts are just going down the drain.

You need to hit on the specific pain points, goals, or trigger events that matter to each account (or segment) via your ad campaigns.

Start by mapping out key messages for each target segment or persona.

For example:

At Userpilot, they found that running multiple angles in parallel was extremely useful. It essentially let the accounts tell what they cared about.

They showed different ad messages (productivity, cost savings, competitor comparison, etc.) and watched what got clicks.

This tactic was inspired by a candid insight: it’s easier to show people a buffet of messages and see what they engage with – to gauge intent – than to guess and go in cold.

For instance, one of their best-performing plays was inviting accounts to a “gateway” piece of content (a virtual conference) to see who was interested in that topic.

Those who clicked that ad clearly had that pain point, which informed the sales follow-up (“Hey, saw you checked out our {event} on {pain point}…”).

Pro Tip: Personalization is key, but scale wisely. Use templates that you can slightly tweak for each account or persona. Like for LinkedIn Ads, Userpilot dynamically inserted industry names into ad copy for relevance. For one-to-one email, their BDRs used intent data from ZenABM to personalize outreach – e.g. if ZenABM showed an account heavily engaged with a “VS. Competitor” campaign, the rep’s email would directly address how they stack up to that competitor (because they knew that was the prospect’s interest!).

This is ZenABM’s intent tagging feature – it pushes which campaign topics an account engaged with straight into the CRM as company property, so sales can message accordingly:

With target accounts and messaging in hand, plan out your full-funnel ABM campaign strategy – all the touchpoints from initial awareness to pipeline conversion.

A common pitfall is to think of ABM as just ads or just sales outreach. In reality, it’s the orchestrated sequence of both, plus a lot more, that makes ABM powerful.

Here’s how to plan it:

Define what success looks like.

Is it 5 demos from Fortune 100 accounts? $1M in pipeline in a quarter?

Align on KPIs like the number of target accounts engaged, opportunities created, pipeline generated, etc.

Unlike lead-gen campaigns, ABM success is about deeper funnel metrics (engagement, pipeline, revenue).

Ensure BDRs/AEs know which accounts are in the program and what the timeline is.

For instance, the sales team at Userpilot was involved in their ABM initiative from day one.

They even co-designed some outreach cadences for when accounts hit certain engagement scores.

LinkedIn Ads were the spearhead channel for awareness (thanks to its precise targeting by company and job title) at Userpilot.

They invested heavily there; ~$47K on LinkedIn ads in the first 3-month campaign!

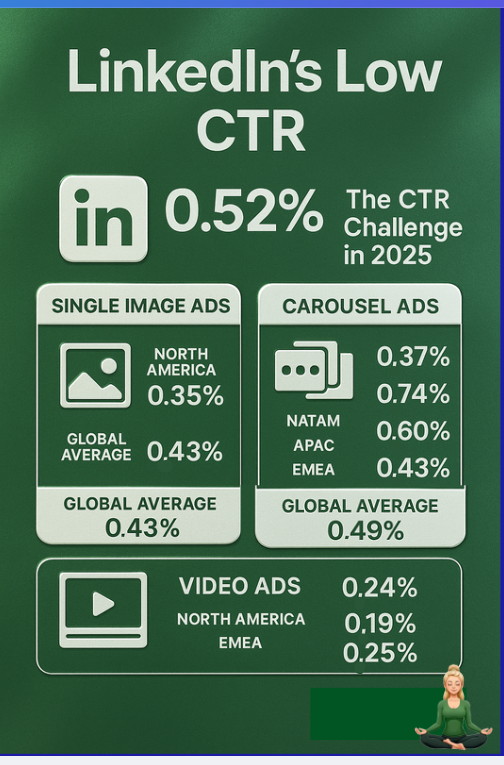

And I’d second that confidence on LinkedIn ads because the platform allows you to get in front of exactly the right people at target accounts.

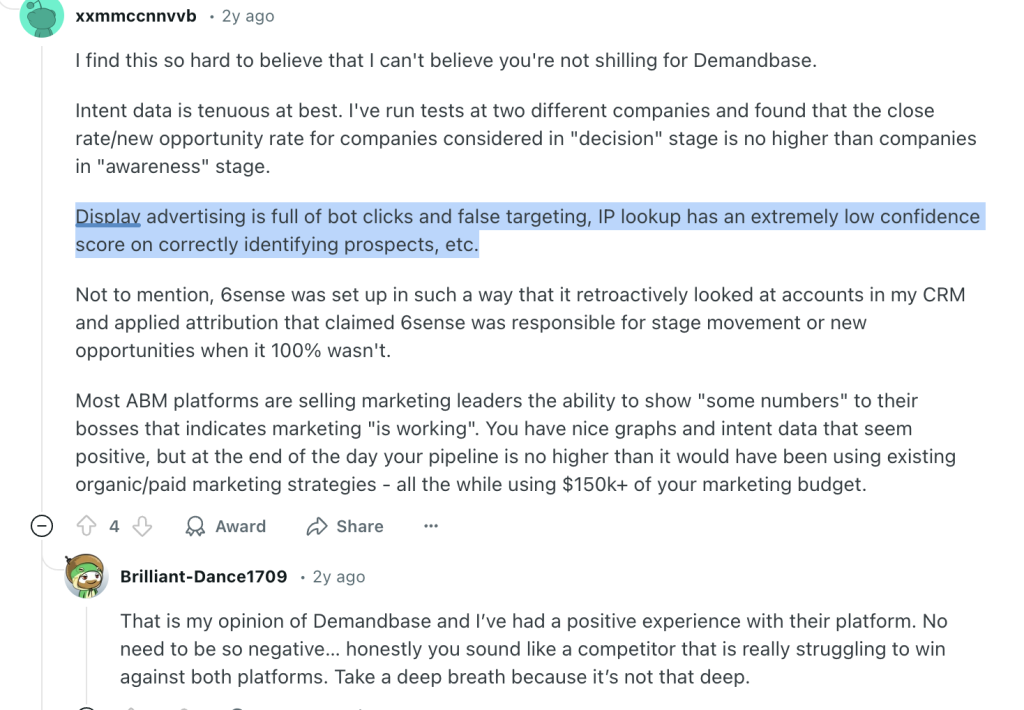

If you have the budget and bandwidth, you can also use targeted display ads, but I’d always cheer for LinkedIn because bot fraud has plagued the DANs:

Also, don’t forget direct outreach: In a full-funnel ABM plan, digital ads warm up the account and sales outreach (emails, calls, LinkedIn messages) seals the deal once interest is shown.

Plan these touches in sequence.

For example, after 50+ impressions (aware stage) and a couple of clicks, an account might start seeing a more product-focused ad and get a friendly intro email from their assigned BDR.

By staging touches based on the funnel stage, we ensure prospects get the right interaction at the right time.

Now, let’s get into the thick of it and draw how the ABM campaign/campaigns should look.

Userpilot, again, gives great inspiration for this:

Before they created a single ad or landing page, the Userpilot peeps had to decide how to map content to their ABM campaign stages and LinkedIn’s ad setup.

In their first push—“Product Drive 2024”—they targeted 1,417 accounts that hadn’t converted during H1’s cold outbound.

Then, they split them into eight personas and launched separate LinkedIn campaigns, each with messaging matched to that persona’s JTBD.

So, the ABM campaign consisted of campaign groups based on these personas:

The groups further consisted of individual ad campaigns, which were DM ads, video ads, image ads, etc. and were different for each stage:

With ZenABM helping them with company-level engagement per campaign:

They planned to pinpoint intent at the account-plus-persona level and trigger BDR outreach with surgical precision.

The catch?

Three LinkedIn API constraints hit fast:

At this point, they pivoted to an intent-first structure:

Cost-Savings, Vs Competitor) instead of persona.Why this worked:

So, finally, the new ABM campaign structure looked like this:

It was a shift from persona-first campaign structure to intent-first (intent here means the specific feature/service being advertised by the specific ad) approach.

So, the ABM campaign now consisted of three campaign groups based on intent (i.e. session replay, analytics and all-in-one). The groups further consisted of individual ad campaigns, which were DM ads, video ads, image ads, etc., and were again different for each stage.

We have frequently talked about how the ad content and outreach must respect the ABM stage the account is in.

So, let me show you how to build an ABM stages framework in the first place.

For this, I’d love to share insights from Kyle Poyar’s article:

Even the peeps at Userpilot used it (tweaking it slightly, as below) to decide on:

And here’s what the stages of their ABM strategy looked like:

The accounts in each state were then shown different content (ads), and the ones that reached the ‘Interested’ stage were assigned to BDRs.

“At first, we overcomplicated things, adding factors such as page visits (qualitative/intent signals) and weights to specific ads/ page visits.

This proved to be too hard to execute, for once, because, as we learned the hard way, website visitor deanonymization is too unreliable to use for consistent account scoring. The accounts we were targeting simply wouldn’t show up in any website visits, even though we knew they landed on the landing pages for the ABM ads we created specifically for them.

How do we know? We’ve set up a separate no-index domain for our ABM ad campaigns to be sure 100% of the traffic landing there is our ‘target accounts’. And sadly, from the ~300 visitors to a certain page path on that website, in 90 days, Breeze Intelligence (based on Clearbit’s API) identified only 1 company…ourselves!

And according to a study by Syft, Clearbit is the most accurate among many popular deanonymization services 😬:

So we decided to simplify the account scoring and use only quantitative ad engagement data from LinkedIn in our CRM, and use the qualitative aspect (which ad campaign groups – organized by intent – the accounts engaged in) for personalizing the BDR outreach.

For this, we needed company-level ad engagement data (impressions, clicks, etc.) per campaign. LinkedIn campaign manager didn’t provide it natively (at least till now). We stumbled on Fibble, which did provide the breakdown, but again, it only provided quantitative data (total ad impressions of a company) and not qualitative data (exactly which ad the company engaged with, which helps us know the intent of the buyer).

That’s when I asked my partner to build ZenABM, which pushed both quantitative and qualitative company-level ad engagement data to the account lists in our CRM. It does a lot more now, though!”

– Emilia Korczynska, VP of Marketing at Userpilot

*The tools and ops used for executing account scoring are discussed in the tool-stack section.

ABM campaigns can get complex with the number of ad assets.

Userpilot also had more than 100 ad creatives, multiple landing pages, and email templates, all in flight

So, they maintained a Notion board to track asset creation and deadlines:

Plus, they established a campaign launch timeline (e.g. “Week 1: launch ads, Week 3: start outbound emails to engaged accounts, Week 6: invite hot accounts to a webinar or send direct mail”, etc.).

This kept everyone on the same page and prevented dropped balls.

Emilia (their VP of Marketing) said, “Don’t even think about starting ABM without a marketing ops manager, as the amount of ops work is brutal.”

Free Resource: Here’s an ABM template to help you set up an ABM campaign structure and manage ad assets.

Once the campaign is live, execution isn’t “set it and forget it.”

Monitor performance and be ready to adapt your tactics on the fly.

Here’s what to keep an eye on:

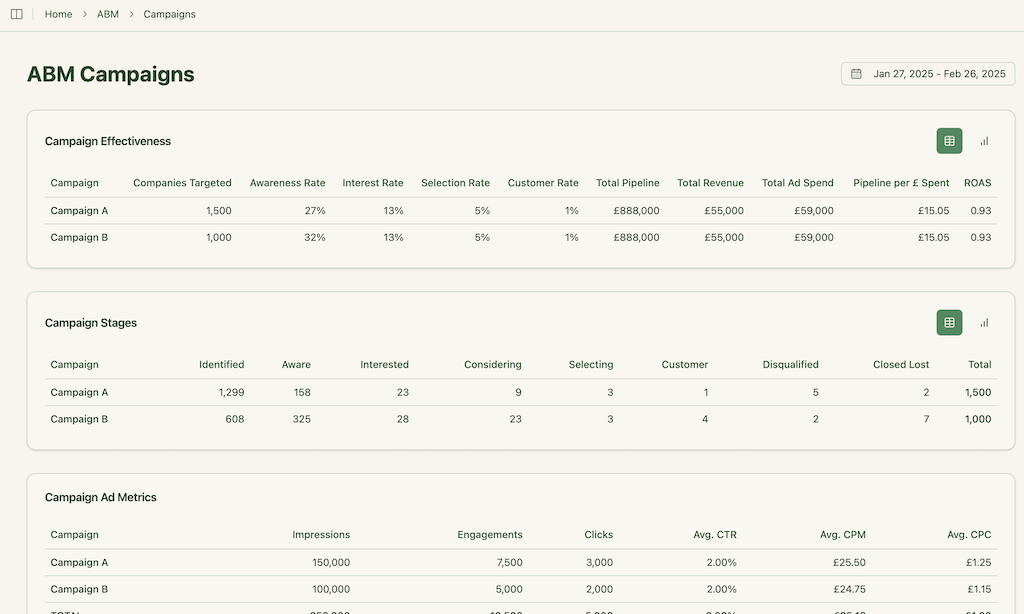

Are your target accounts seeing the ads? LinkedIn will show you account-level impression and click data if you pull it via the API (or use a tool like ZenABM).

Now, if a chunk of accounts are seeing enough impressions, it could mean your bid is too low or your audience definition is off – adjust budgets or broaden targeting slightly to ensure coverage.

On the flip side, watch CTRs and CPCs by creative. Like in the Userpilot campaign, single-image ads had ~0.35% CTR and $19 CPC, while video ads had 0.28% CTR at $24 CPC.

They were actually tracking conversion metrics for each type of ad to find the star performers:

This is important to track: If one message variant is outperforming (CTR or conversion-wise), shift more budget to it.

We discussed an ABM stages framework that was used at Userpilot, which was based on account engagement score thresholds:

You, too, should closely monitor the engagement score and corresponding ABM stage of each account.

You can also use dedicated tools like ZenABM for this, just like they did at Userpilot. ZenABM tracked each account’s engagement, and as soon as an account became “Interested,” their BDRs were alerted automatically by the tool to start personalized outreach:

After all, speed matters in ABM 🙂

Plus, speed here isn’t just about finding hot accounts but also about spotting the ones that are not engaging and stop wasting your budget on them instantly, suggests Clint Buechler, and I agree.

We discussed how marketing + sales alignment is fundamental to ABM.

It starts when you heed the feedback your sales team gives.

Ask:

The Userpilot team’s ABM strategy was a finite 3-month campaign cadence (with a specific start and end) for their first round.

But there’s another way: an ‘Always-on’ type of ABM strategy where the ads run continually, engaging the target list.

Here’s a comparison table showing key differences and which one’s better for you:

| Aspect | Always-On ABM | Campaign Cadence ABM |

|---|---|---|

| Key Characteristics |

|

|

| Benefits |

|

|

| Challenges |

|

|

| Best Use Case | Targeting high-value accounts with long sales cycles (e.g., enterprise B2B); mature ABM programs with robust tech stacks. | New product launches, seasonal promotions, or testing new markets with limited budgets. |

| When to Choose |

|

|

| Alignment with Sales | Requires deep sales-marketing alignment from day one to define accounts and tailor messaging, avoiding errors like unreliable deanonymization. | Needs early sales input to ensure viable accounts, preventing missteps like overcomplicated scoring. |

| Metrics for Success |

|

|

Anyways, whichever approach you choose, you must continuously monitor stage progression.

Traditional marketing often lives and dies by lead volume.

ABM is different.

It’s about engagement quality and revenue impact. As you wrap up a campaign (or on a monthly/quarterly basis), measure it rigorously.

Here’s how to approach ABM measurement and attribution:

Forget vanity metrics.

Key ABM KPIs include things like:

An ABM program might only yield a few dozen engaged accounts, but if those turn into $M deals, it’s a win.

Keep that mindset when reporting up to stakeholders – emphasize how many target accounts moved to sales stages or how deal sizes increased, rather than raw MQL counts.

As discussed, the Userpilot team had set up clear stages (Identified → Aware → Interested → Consideration → Selecting) and engagement/conversion benchmarks for each.

Further, they measured the flow.

For example, “50% of the 300 identified accounts became Aware (50+ impressions), 15% reached Interested (multiple clicks), and 5% entered Consideration (demo or trial).”

These conversion rates tell you where the funnel might be leaky. If lots of accounts get aware but very few get interested, maybe the content isn’t compelling enough to click. That’s a signal to optimize the creatives.

For this ‘leak analysis’, the Userpilot team created custom HubSpot dashboards to track these stage counts in near real-time:

Don’t worry!

You won’t have to.

ZenABM does this out-of-the-box, segmenting accounts into funnel stages automatically:

and showing how many are progressing week by week:

Ultimately, ABM must drive revenue, right?

Here’s a summary of what Userpilot’s first campaign achieved:

Plus, they found that ABM (ads + targeted outreach) generated a pipeline 2× faster and 51% cheaper than their previous pure outbound efforts.

But accurate ROI measurement and attribution is only possible if you know exactly which ad creatives and campaigns deserve the credit for the closed deals and the ones in the pipeline.

This can be tricky because ABM deals often have many touches plus LinkedIn ads, being more about awareness than clicks, need a strong view-through attribution strategy.

The Userpilot team integrated their CRM with company-level ad engagement (to the level of impressions and not just clicks) data per campaign using ZenABM.

And not only did ZenABM pull company-level engagement data per campaign from LinkedIn’s official ads API:

It also pushed the same data as company properties into the HubSpot account lists periodically:

Plus, the tool also matched companies engaging with ads with the deals in CRM to map the impact of LinkedIn ads on pipeline and revenue:

The final step of measurement and attribution is turning insight into action.

Analyze which campaigns or content pieces drove the most engagement and pipeline.

Did your “Competitor X” ads produce more opportunities than your “Thought Leadership Y” ads? Double down on what worked in the next cycle.

Also, gather qualitative feedback: ask Sales which accounts moved fastest and why. Maybe accounts that engaged with a certain content offer closed quicker – that’s a pattern to repeat.

ABM is a continuous improvement loop.

We saw all the steps of a solid ABM strategy inspired by the pretty successful campaign they ran at Userpilot

But before closing, I’d like to put the tool-stack used in one place for easy reference:

| Need / Category | Tool(s) | Why It Matters |

|---|---|---|

| Core CRM & Automation | HubSpot CRM + HubSpot Marketing Hub | Logs every touch; central hub for marketing + sales alignment. |

| Sales Outreach | SalesLoft · Apollo | Sequenced email / call cadences for engaged accounts. |

| List Building & Tech Signals | Clay · BuiltWith APIs | Enrich domains, identify tech stacks, and pull intent-like triggers. |

| Project Management | Notion | Tracks asset production, launch dates, and campaign tasks. |

| ABM Analytics & First-Party Intent | ZenABM |

|

I hope you found the ABM strategy guide helpful.

You can contact me (the content guy at ZenABM) or Emilia Korczynska (VP of Marketing at Userpilot) herself for more info regarding their ABM strategy that, bragging again, bagged more than $900,000 in pipeline with a $52191 investment (LinkedIn ad spend + Tools).

Plus, you can try ZenABM now for free!