In this article, I compare RollWorks vs. Terminus across features, pricing, and real-world fit so marketing and sales teams can pick the ABM platform that actually supports their program.

I also show where ZenABM fits as a lightweight, cost-efficient alternative or companion layer to these enterprise ABM suites because it takes a different approach.

Read on…

RollWorks vs. Terminus: Quick Summary

If you want the short version:

- RollWorks: Advertising-first ABM stack for account discovery, fit scoring, and programmatic plus LinkedIn activation. Fast to launch and a good fit for SMB and mid-market teams.

- Terminus: Broader ABM and multi-channel engagement platform that spans ads, chat, web personalization, and email signatures. Better suited to mature teams and large organizations.

- Pricing: RollWorks typically starts near $1K per month. Terminus is custom quoted and often ranges from $50K to $250K+ per year.

- Fit: Pick RollWorks if your program is ad-led. Choose Terminus if you need enterprise-grade orchestration across many channels.

- ZenABM as an alternative: Uses first-party LinkedIn ad intent, both quantitative and qualitative, to score and track accounts, syncs intent to your CRM, routes hot accounts to BDRs, and ties ad spend to pipeline and revenue for trustworthy ROI. Starts at $59 per month with a 37-day free trial, giving ABM visibility without enterprise pricing.

RollWorks Overview: Key Features, Pricing, and More

RollWorks is the ABM division of NextRoll (the company behind AdRoll) built to link digital advertising with account-based marketing.

It is often seen as an entry-level enterprise ABM option for teams preparing to scale.

RollWorks combines NextRoll’s programmatic expertise with an ABM lens: selecting target accounts, engaging them with coordinated ads, and measuring impact across the funnel.

Here are the highlights:

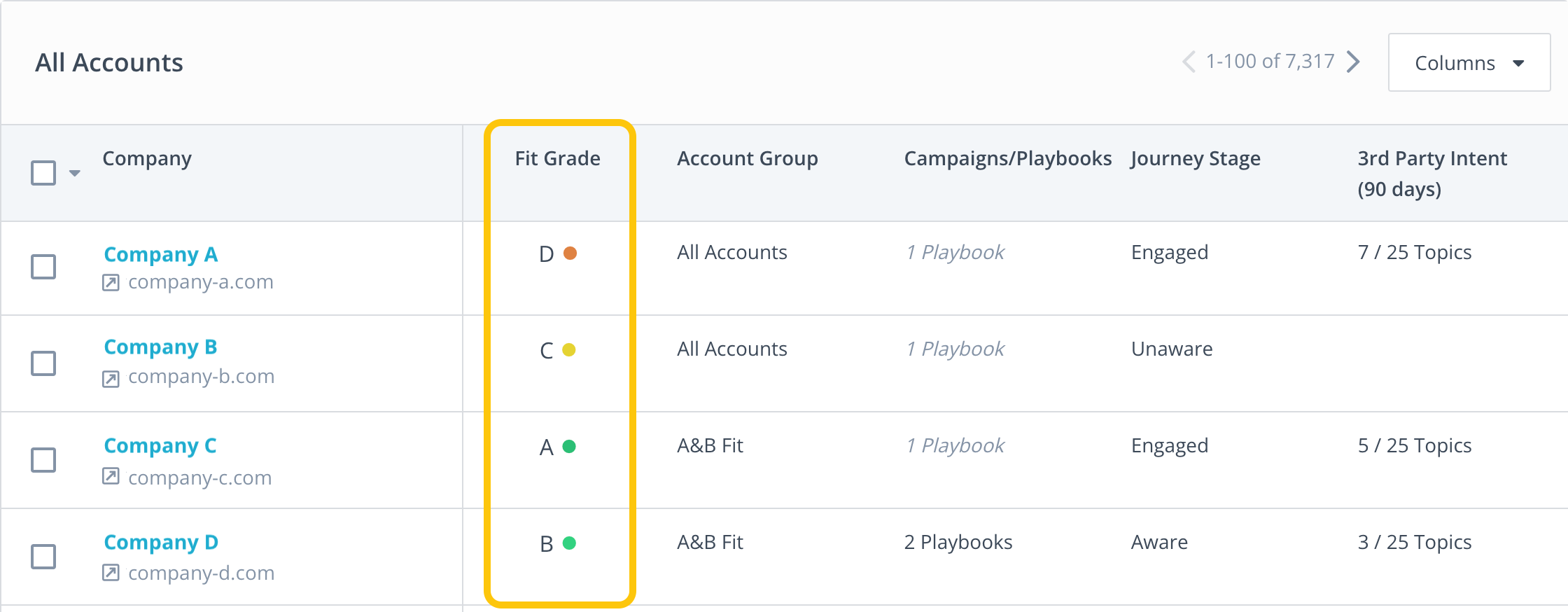

Account Identification & Scoring

You can import or build target account lists and evaluate them on fit and intent.

RollWorks assigns an ICP Fit grade from A to D using firmographics, technographics, and your CRM data.

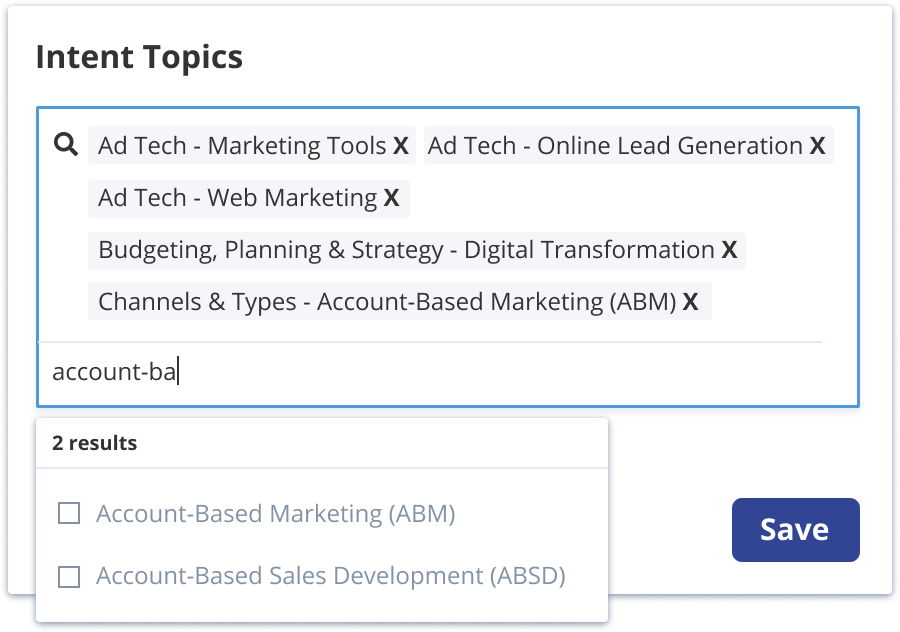

It also tracks in-market research via keyword intent. Choose topics that matter, and RollWorks flags companies investigating those themes around the web.

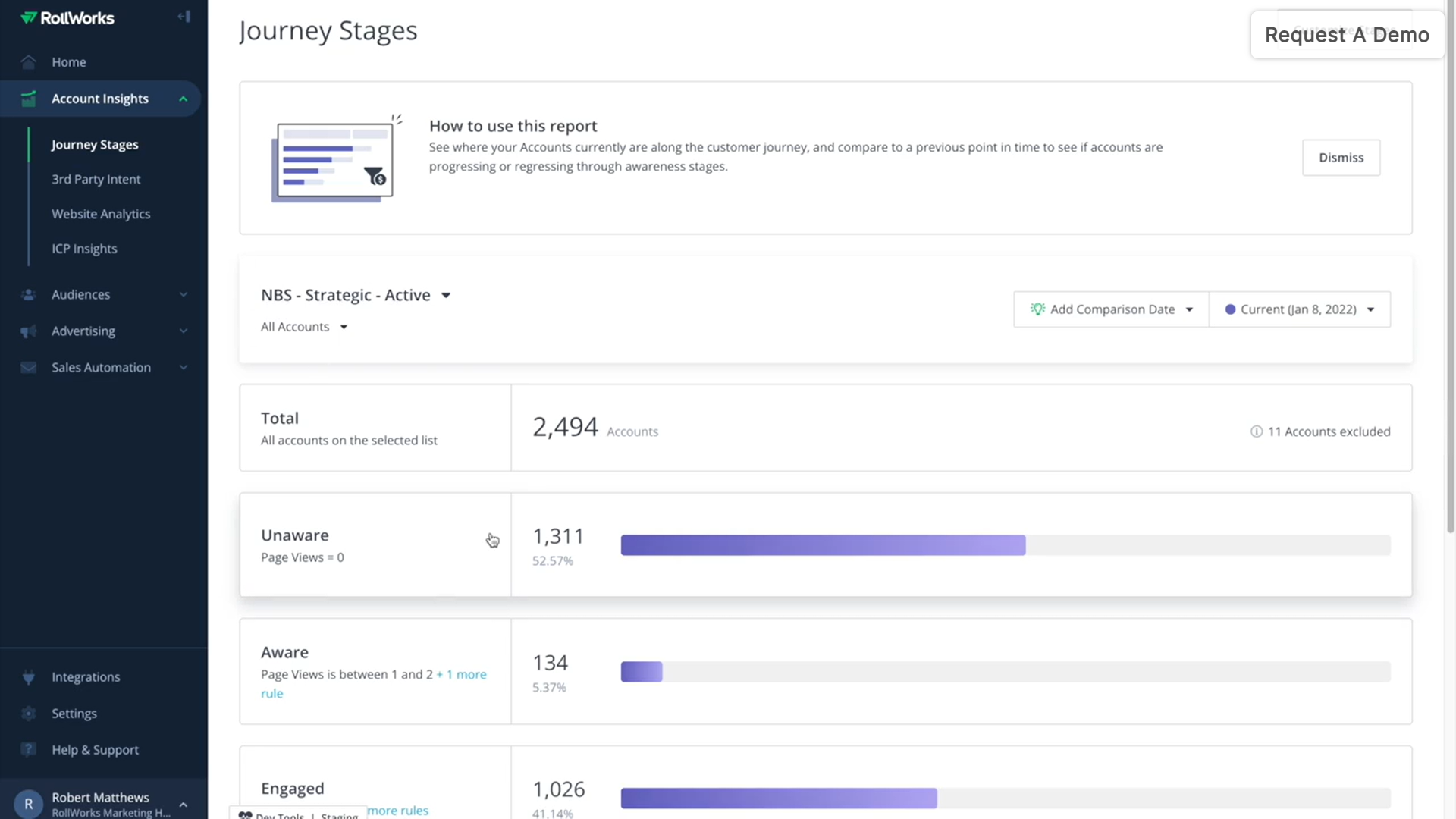

These signals, from RollWorks’ data set and partners like Bombora, feed a Journey Stages model that classifies accounts as Unknown, Aware, Engaged, Open Opportunity, and more based on activity.

Pro Tip: Where possible, prioritize first-party signals over third-party keyword spikes.

ZenABM captures qualitative intent by tracking which LinkedIn ads a company actually interacts with, giving you precise signals you can act on.

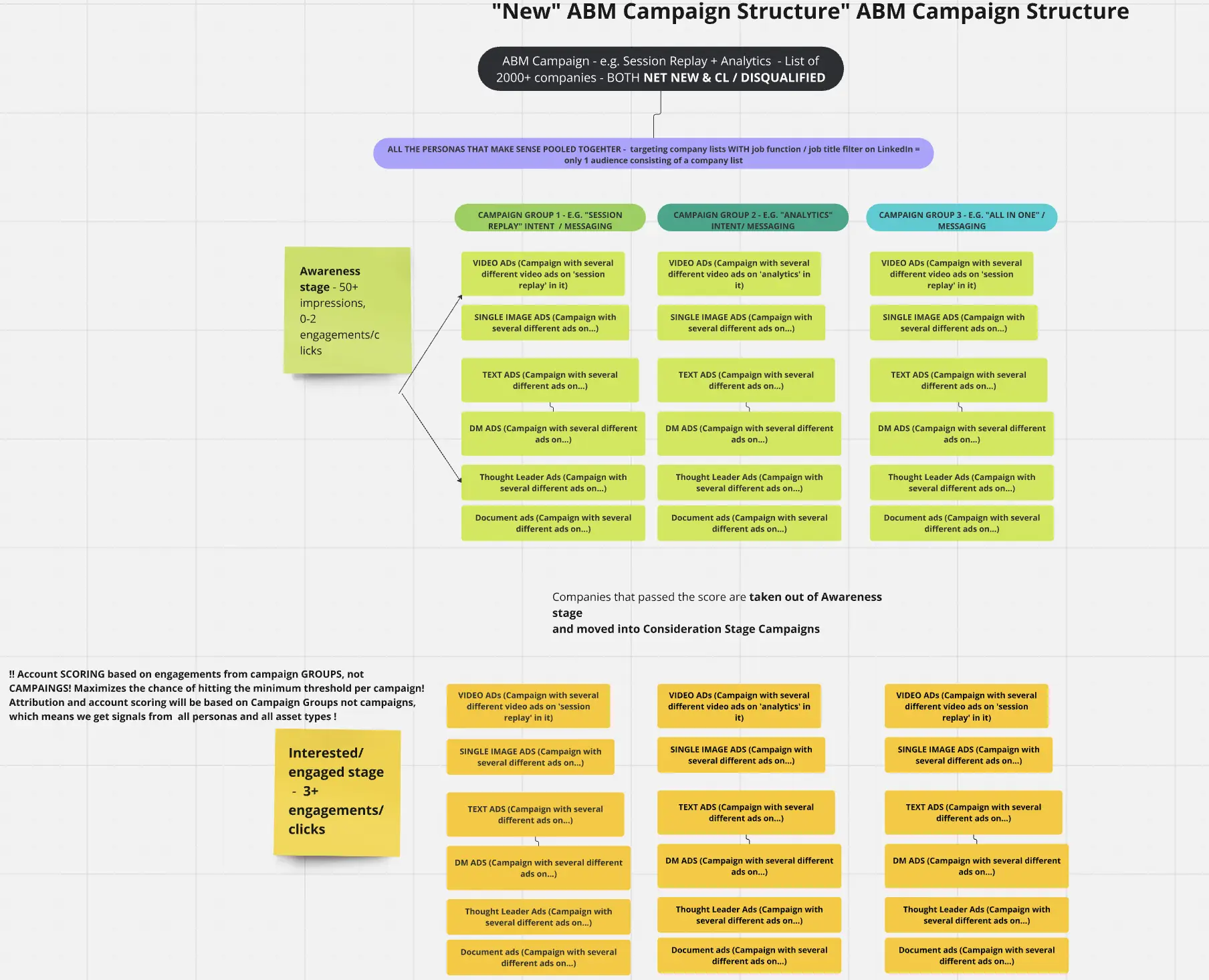

Teams like Userpilot have built full ABM programs around this method by tagging campaigns by pain point and increasing BOFU spend where accounts keep engaging.

Their campaign structure:

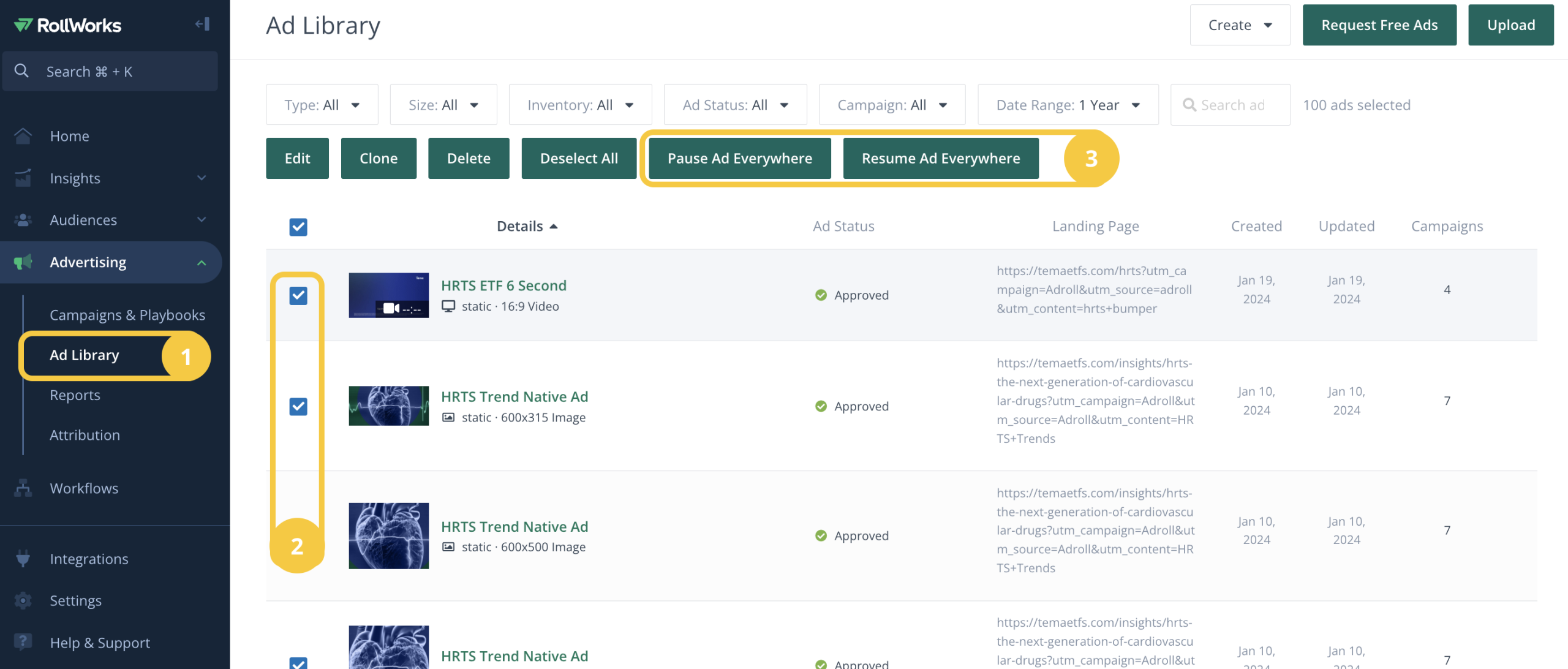

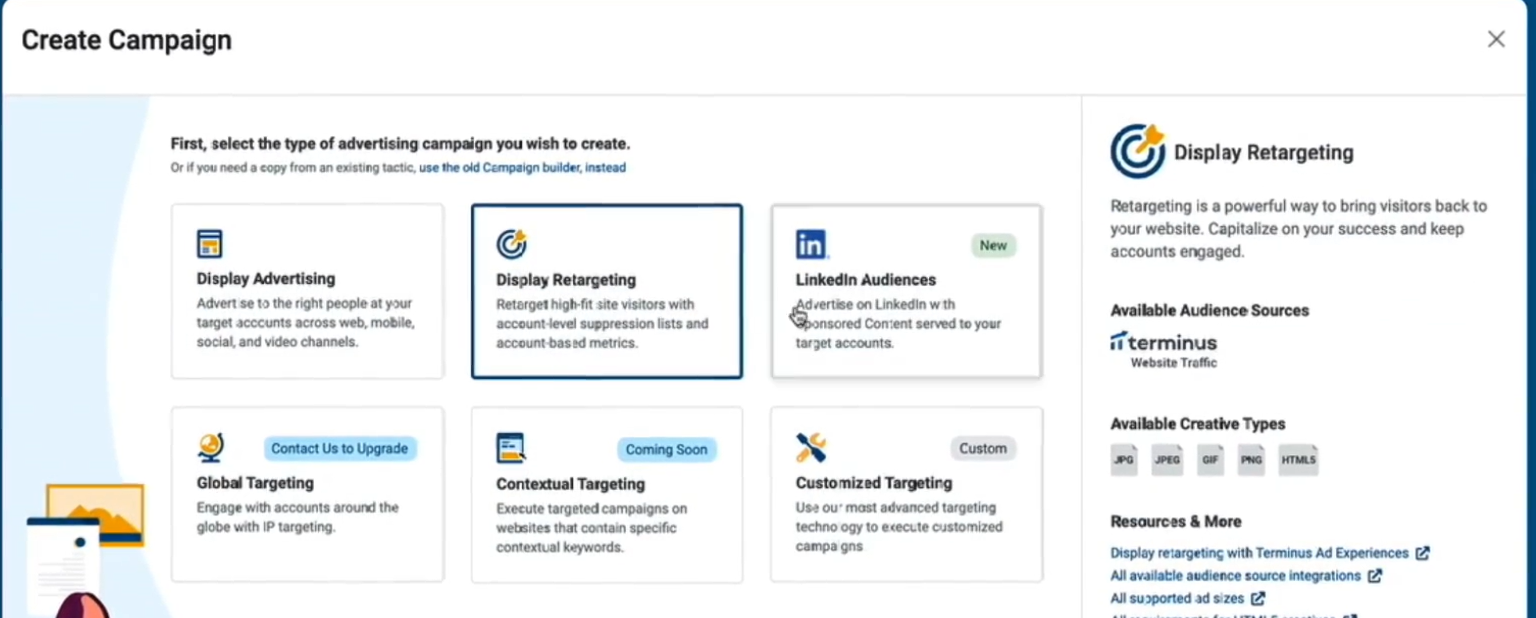

Multi-Channel Account-Based Advertising Orchestration

RollWorks includes a native display network powered by AdRoll’s DSP and supports delivery across web display, retargeting, and social.

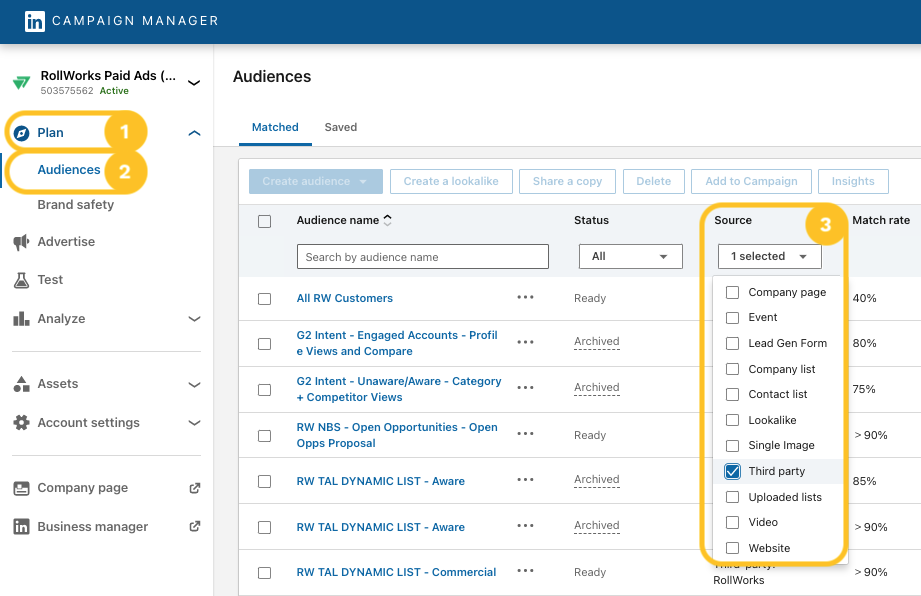

You can run programmatic ads to your TAL and connect LinkedIn ads through RollWorks via the LinkedIn Marketing API for audience and campaign sync.

Persona targeting lets you tailor ads by seniority or role so the right decision makers see the message.

A creative library and dynamic formats help you manage and adjust assets at scale.

Website Visitor Identification

To link ads to the pipeline, RollWorks uses a website pixel that attempts to de-anonymize visits by matching IP or cookies to company data.

If a visitor from a target account lands on your site, RollWorks attempts to identify the company and can suggest contacts to pursue.

Intent Spike Alerts & Sales Integrations

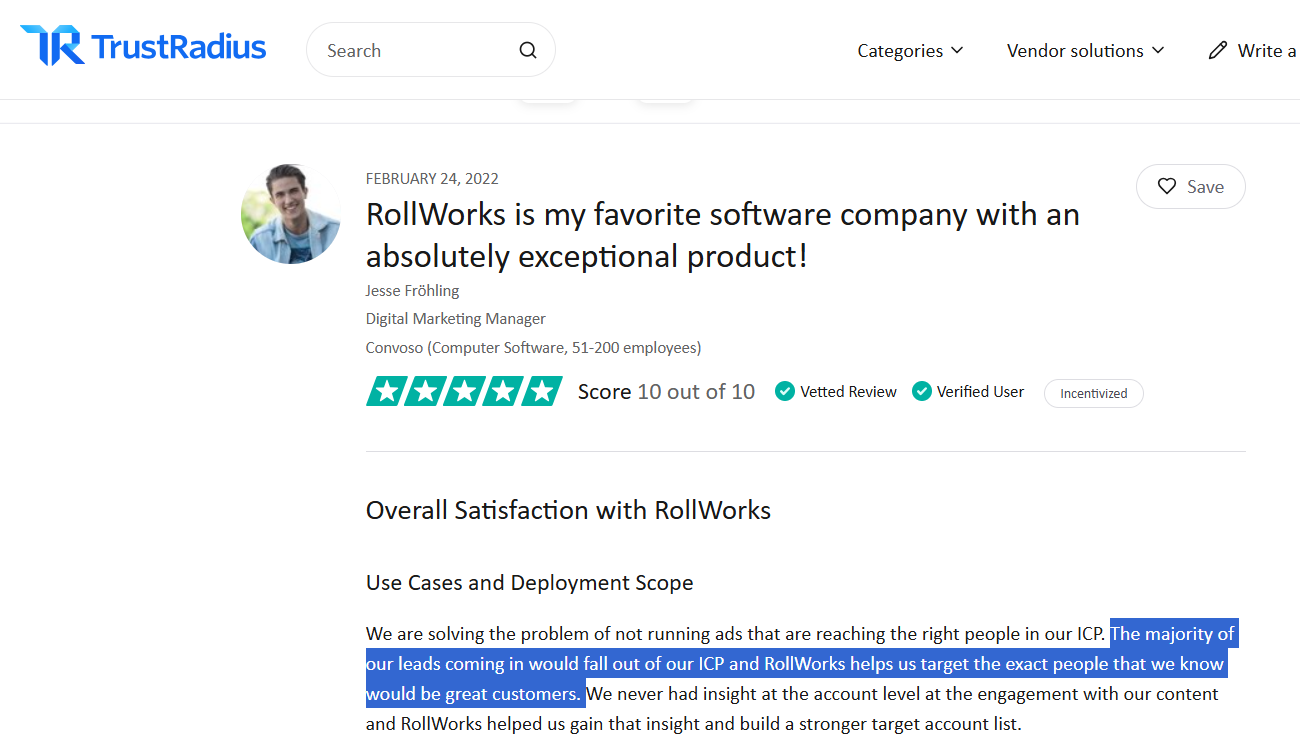

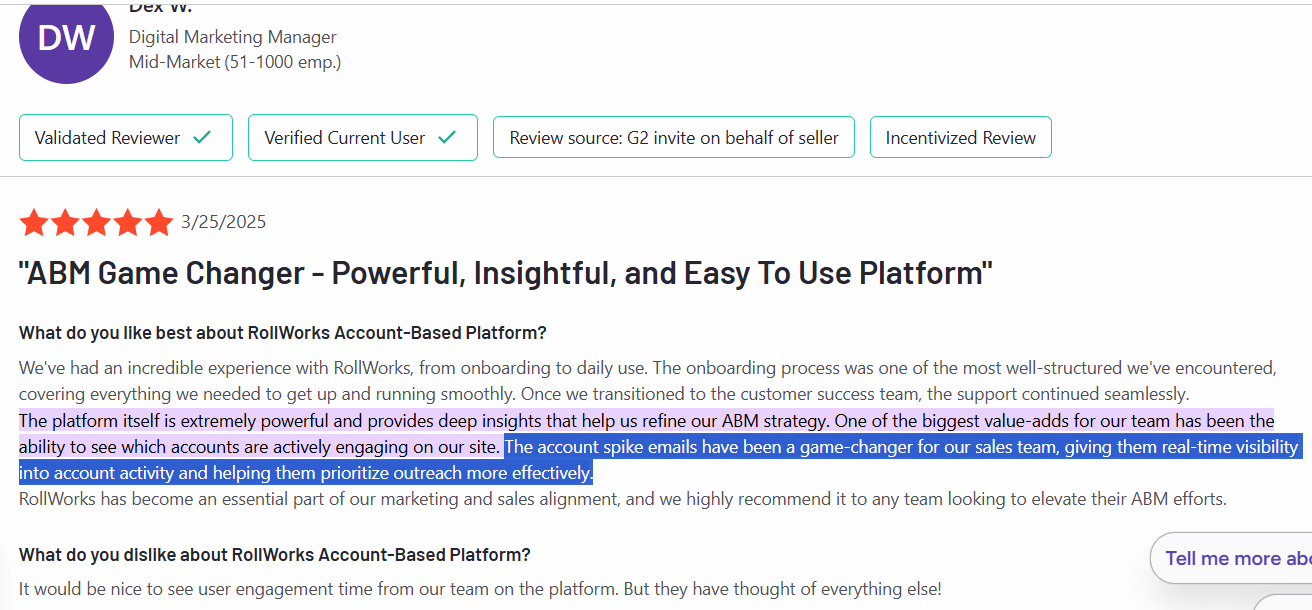

RollWorks monitors account engagement across impressions, clicks, site activity, and connected email, then triggers “Account Spike Alerts.”

A G2 reviewer called these emails “a game-changer for our sales team,” since they surface timely account activity and help prioritize outreach.

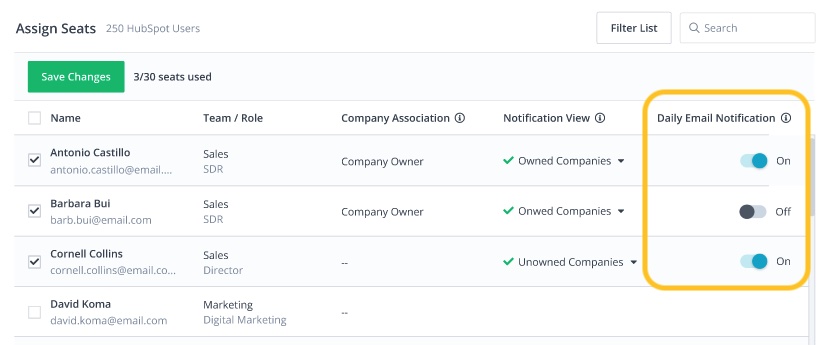

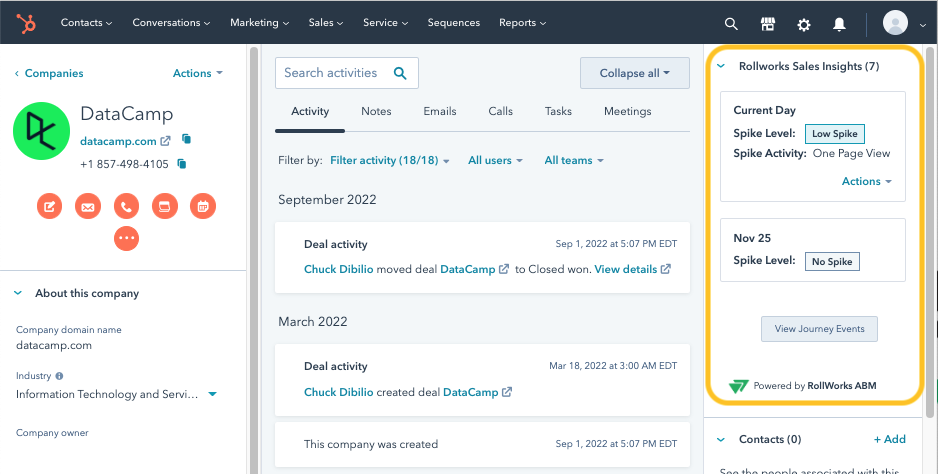

RollWorks also offers Sales Insights panels inside CRM, such as a Salesforce widget that shows recent account activity and recommended next steps, so sales has ABM context in their workflow.

Automation & Analytics

The platform automates workflows such as moving accounts between audiences, creating CRM tasks, or adjusting bids based on behavior.

For example, when an account hits the Opportunity stage, RollWorks can reduce frequency or switch content. If Bombora shows a topic surge, it can auto-add the account to a campaign and increase bids.

Journey Stages include recommended actions, like increasing budget for high-fit accounts that remain cold.

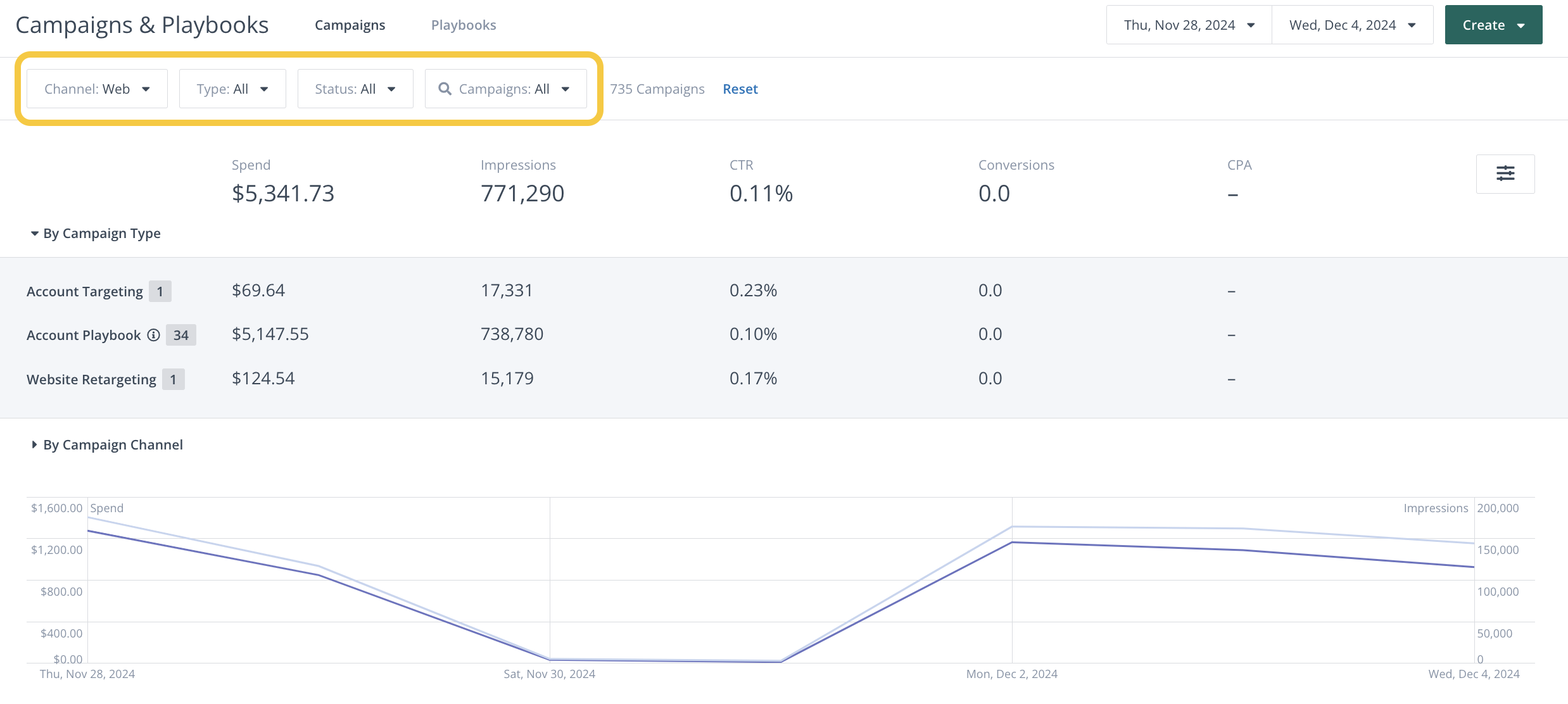

For analytics, RollWorks provides unified dashboards that tie ad performance to pipeline so you can see impressions, clicks, and attributed opportunities or revenue in one place.

Some users say attribution can feel basic and may require extra manual work.

Integrations

RollWorks connects to major CRMs like Salesforce and HubSpot for two-way sync.

It also integrates with MAPs such as Marketo and Pardot, and with sales engagement tools like Outreach and Salesloft via API or native apps.

For intent and firmographics, it partners with Bombora, G2, and data providers like ZoomInfo.

For the full list, see our RollWorks for ABM guide.

RollWorks Pricing

RollWorks uses a tiered and usage-based structure rather than a simple self-serve plan. Parts of the product now appear under the AdRoll ABM umbrella.

There is a limited free or self-service level that lets you run retargeting and basic account targeting by paying for media only.

Richer ABM features live in paid packages that require a sales quote.

The entry cost is lower than heavier enterprise suites.

For smaller to midsize teams, RollWorks often starts just under $1,000 per month.

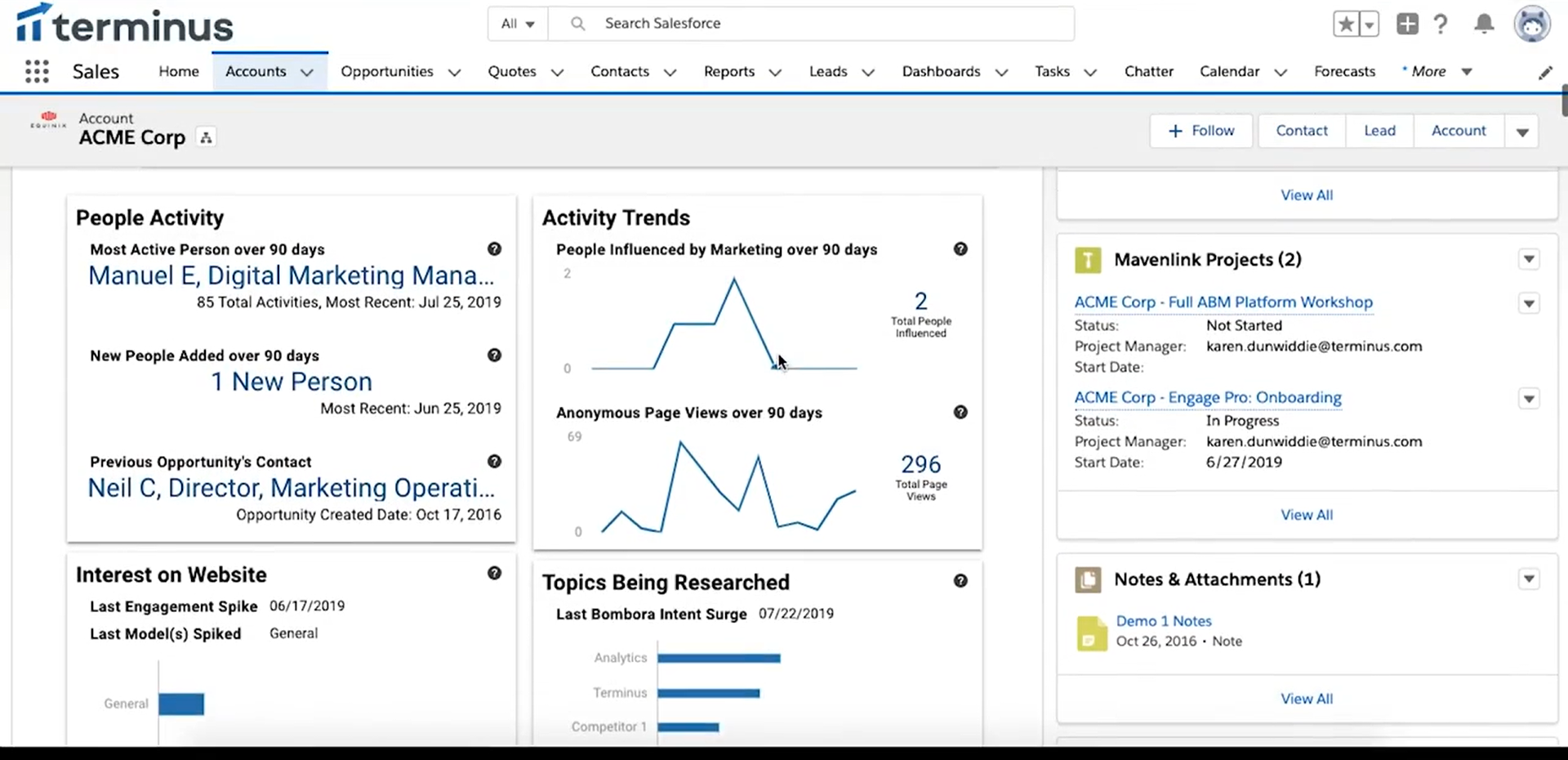

Terminus Overview: Key Features, Pricing, and More

Terminus is often described as a full-stack ABM platform known for its wide feature set and integrations. It attracts B2B marketers who want a unified ABM hub across ads, web, and sales touchpoints.

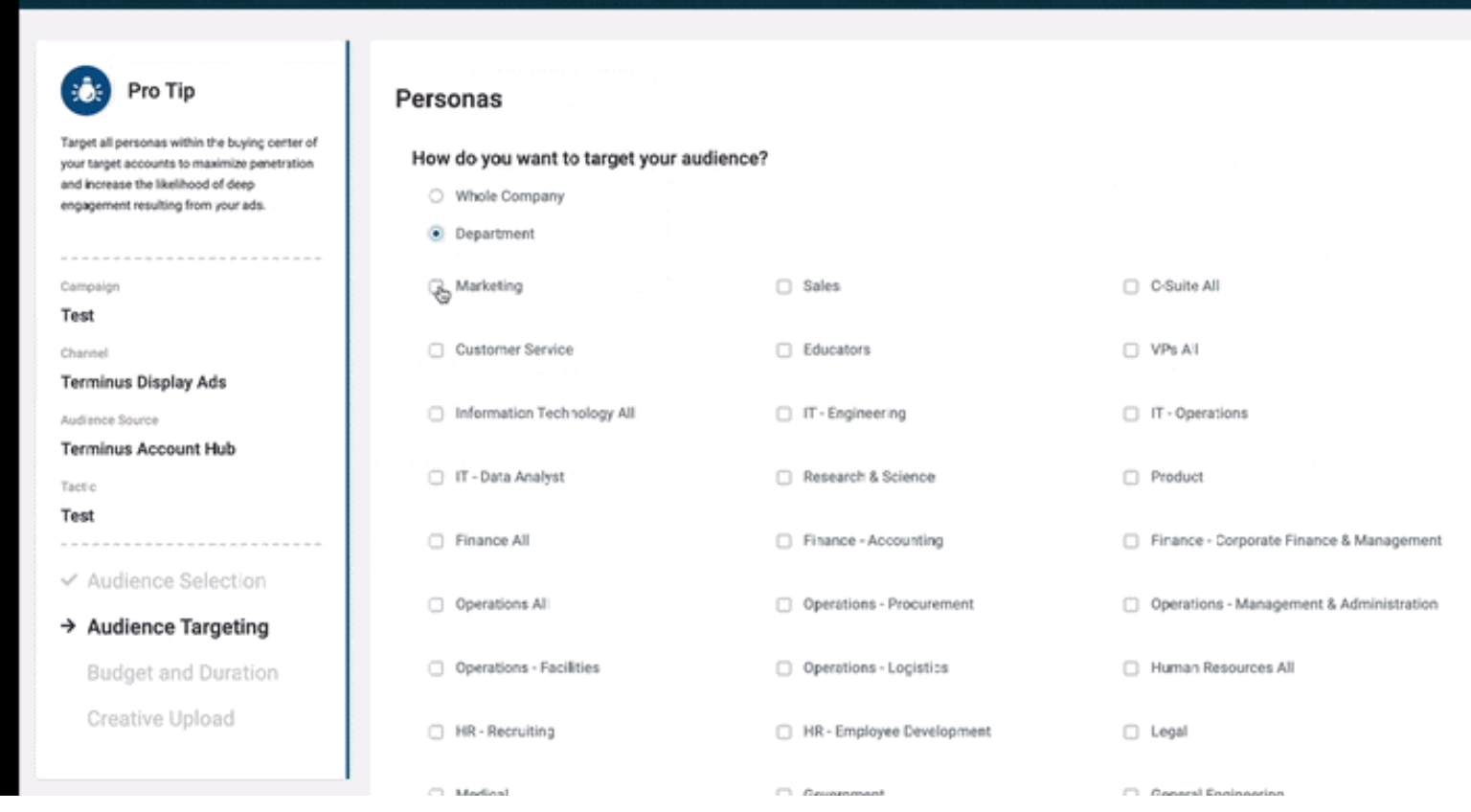

Multi-Channel Ad Support

Run and manage ads across many channels natively, including display, retargeting, LinkedIn, connected TV, and audio. By centralizing channels, Terminus helps reach your target account list on web and social while balancing impression share.

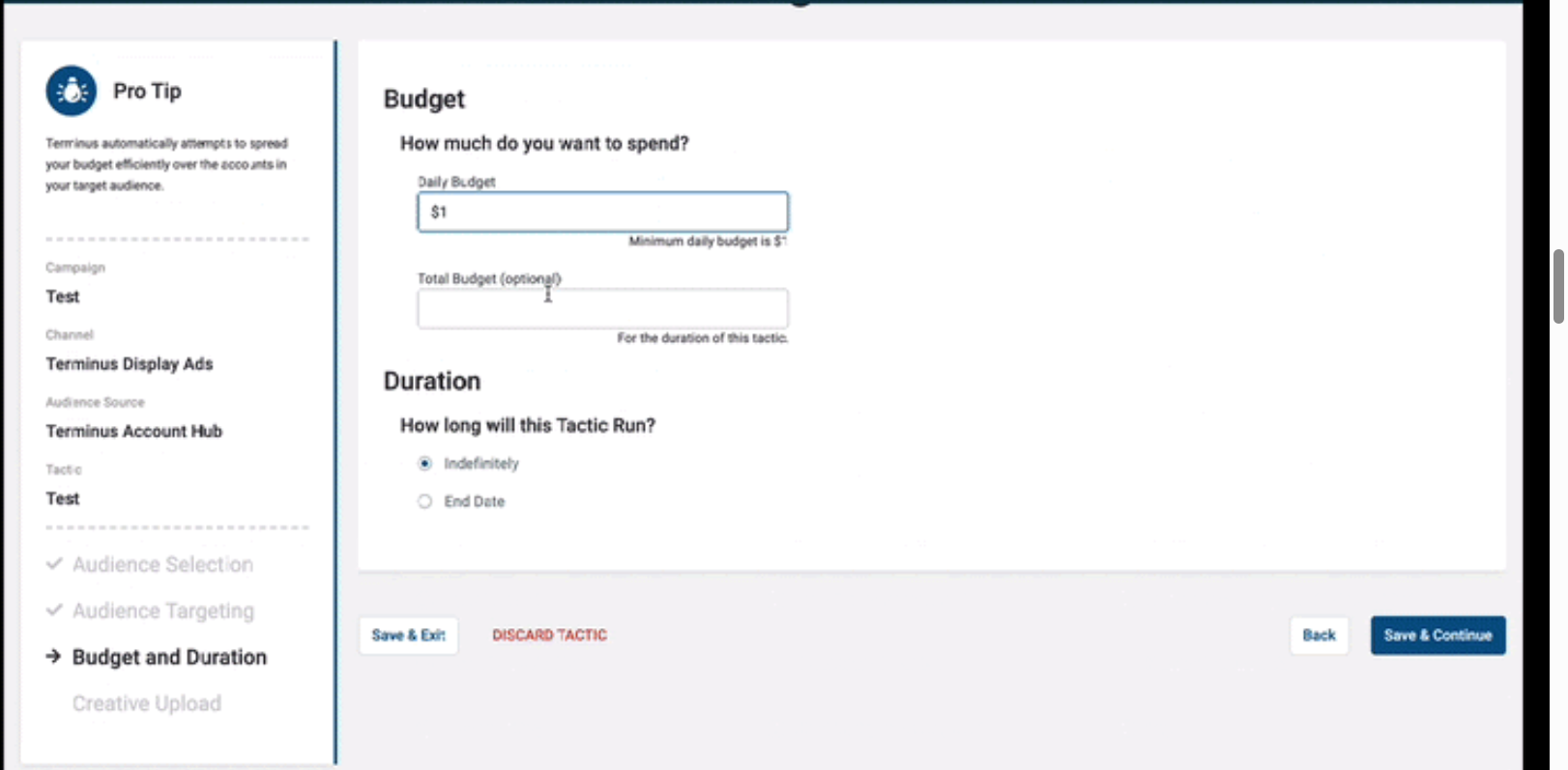

Account & Persona Targeting

Upload or sync target account lists from your CRM and refine audiences by department, seniority, or role.

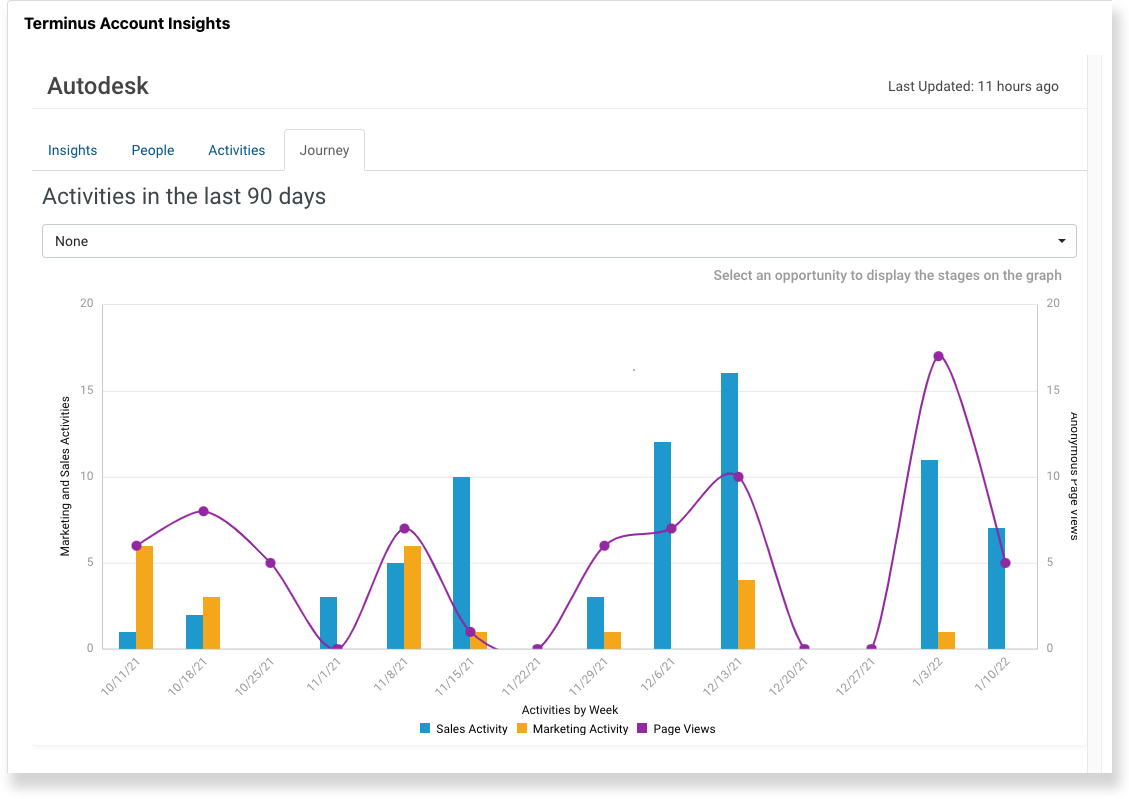

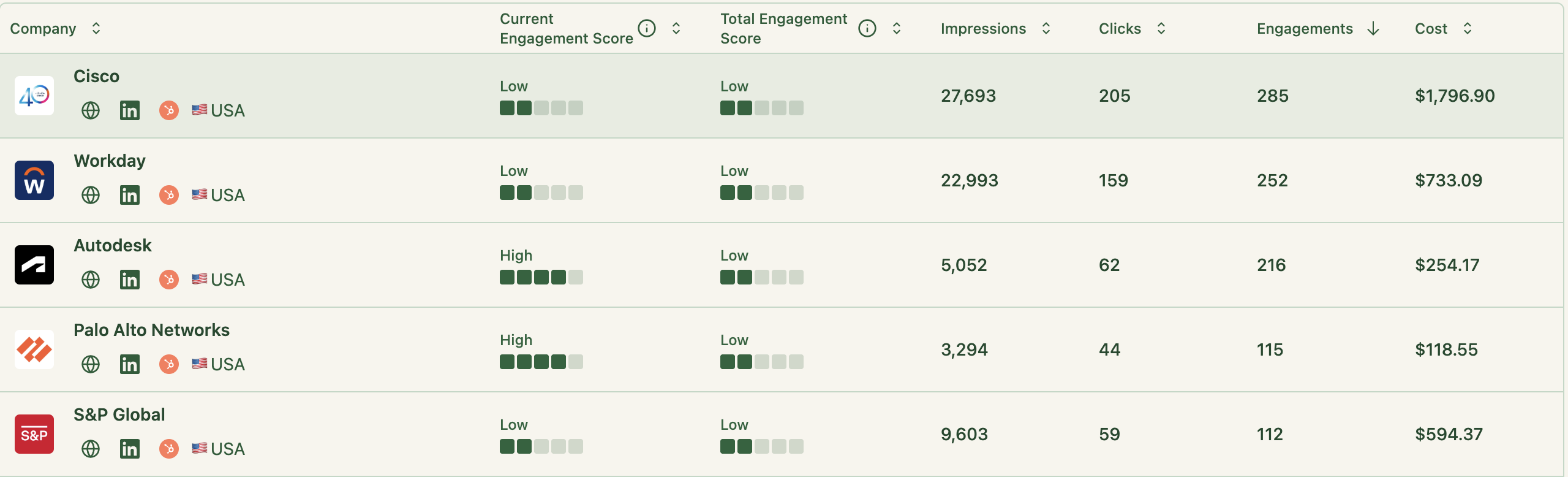

Account-Level Engagement Tracking

Terminus records impressions and clicks at the account level so marketers can see which companies are engaging even without direct clicks.

The Account Hub aggregates engagement such as impressions, site visits, and campaign touches.

Website Visitor Identification

Terminus’s Visitor ID de-anonymizes website traffic with reverse IP, cookies, and CRM matching. It links anonymous visits to known accounts, though accuracy is often around 40 to 50 percent.

Pro Tip: ZenABM can reveal anonymous visitors without extra tools. Retarget site visitors with inexpensive LinkedIn text ads, and ZenABM will list the companies that saw those impressions.

Intent Data

Terminus integrates with third-party intent sources like Bombora to identify in-market accounts.

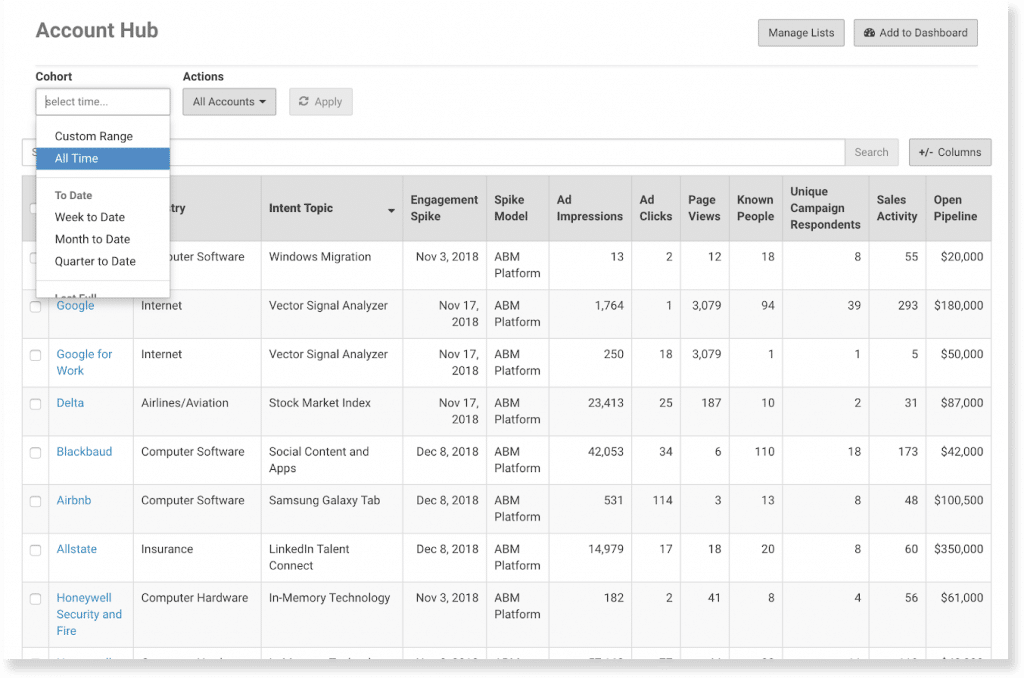

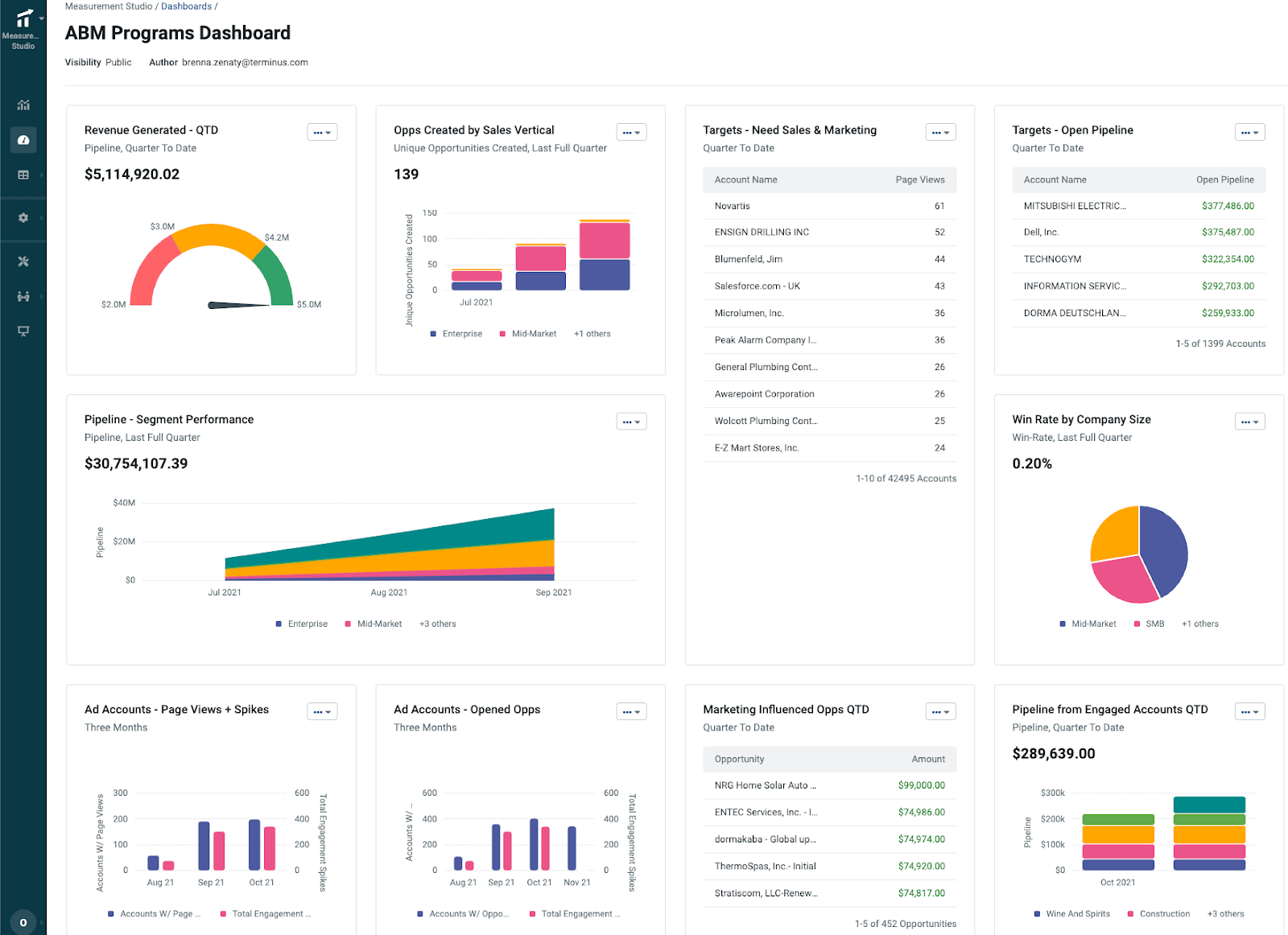

ABM Analytics and Attribution

Measurement Studio offers multi-touch attribution and account-level analytics. Activities roll into an Account Journey view that shows movement from engagement to revenue. Dashboards include revenue influenced, opportunities created, and top engaged accounts.

Integrations

Terminus connects with CRMs (Salesforce, HubSpot, Microsoft Dynamics), MAPs (Marketo, Pardot, Eloqua), ad platforms (LinkedIn, Google), sales tools (Outreach, Salesloft), analytics (Google Analytics, PathFactory), and data providers (Bombora, G2, Clearbit).

See the full catalog in the Terminus docs.

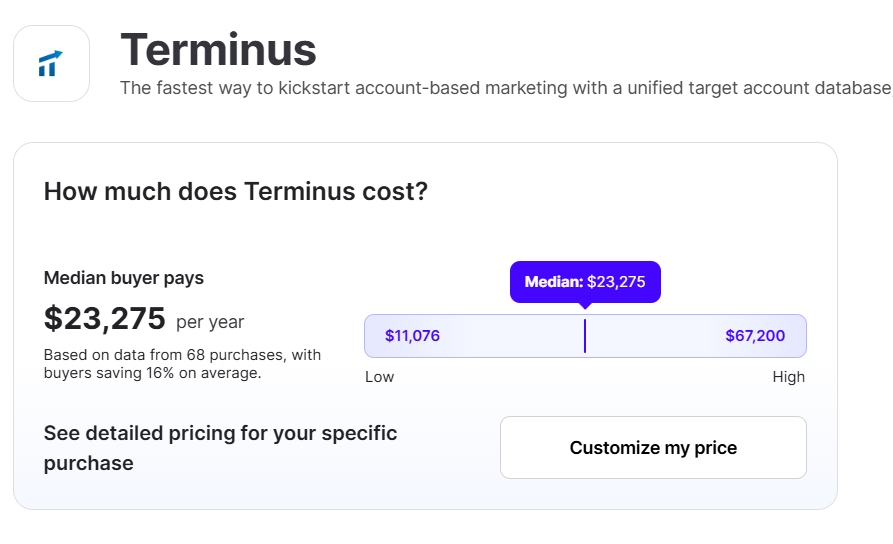

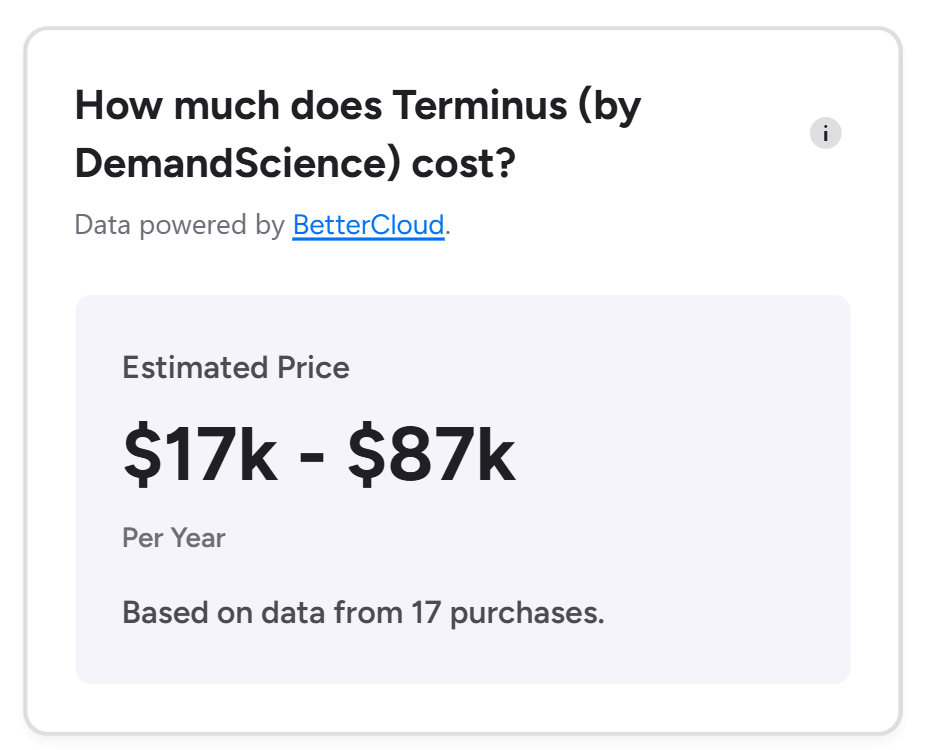

Terminus Pricing

Pricing is custom and typically lands in the mid five figures per year, reaching $100K to $250K+ for large enterprises.

Vendr shows a $23K median, while CMO.com lists starting costs around $57,500 annually.

RollWorks vs. Terminus: Key Differences

Major contrasts between RollWorks and Terminus you should consider:

| Category | RollWorks (AdRoll ABM) | Terminus (DemandScience) |

|---|---|---|

| Positioning and Scope | Advertising-led ABM platform for identifying and grading accounts, advancing them through Journey Stages, and activating across programmatic and social, with tight LinkedIn connectivity. Also referenced as AdRoll ABM in G2 and help docs. | ABM and account engagement suite that enables multi-channel experiences across ads, chat, email signatures, web, and sales. |

| Signals and Intent | Combines ICP Fit with firmographic and technographic data, keyword intent, and web engagement. Accounts progress from Unaware to Won Deal. | Centers on account-level engagement and intent and applies that context across channels, including email signature marketing targeted by recipient. |

| Activation and Channels | Focuses on programmatic and retargeting plus native LinkedIn audience sync and campaign control. Media billed on dynamic CPM. | Delivers coordinated engagement across advertising, chat, email signatures, website personalization, and sales experiences with Data Studio driven segmentation. |

| Sales Workflow Depth | Surfaces journey and engagement context in CRM and MAPs so sellers see activity inside Salesforce and HubSpot. | Provides sales experiences and partner integrations that route conversations by account, for example account-based chat routing via Salesloft. |

| Packaging and Pricing | Has a pricing page but final quotes come through sales. Media runs on dynamic CPM. Entry quotes often land just under $1,000 per month. | Custom pricing. Since the November 2024 merger, packaging and contracting sit under DemandScience. Quotes commonly land in the mid five figures and can reach $100K–250K+ for large enterprises. Vendr shows a $23K median, and CMO.com lists starting costs around $57,500 per year. |

| User Sentiment | Often praised for ease of use, onboarding, and targeting. Common critiques mention reporting gaps and a light learning curve. Suits fast-moving marketing teams. | Reviewers cite strong campaign management and ABM capabilities, with occasional notes on speed or integrations. Sentiment improves once the stack is dialed in. |

So, Which is Better for ABM?

Choose RollWorks if:

- Your ABM is ad-led and you want practical wins without adopting a large suite.

- You plan to push target account lists, retarget, coordinate LinkedIn audiences, and steer spend with Journey Stages.

- You want a dynamic CPM model that paid teams already understand.

Choose Terminus if:

- Your playbook includes engagement far beyond ads.

- You want one platform to combine advertising with email signature marketing, chat, website personalization, and sales experiences under the DemandScience umbrella.

Reality Check by Company Size

- SMB and lower mid-market: RollWorks usually stands up quickly for ads and retargeting. Terminus can work at this size when you have clear reasons to manage multiple channels in one place.

- Mid-market: Both can make sense. Choose RollWorks for activation-led ABM with clear levers for media and LinkedIn. Pick Terminus if you need coordinated engagement across email signatures, chat, web, and ads.

- Enterprise: Either can scale. The choice is whether you want an ad execution stack with ABM scaffolding or a broader engagement platform that spans many channels.

Btw, if most of your motion runs on LinkedIn, heavy suites are not mandatory.

ZenABM pulls first-party company engagement directly from the LinkedIn API, scores accounts, tracks ABM stages, and writes back to your CRM.

Pricing starts at 59 dollars per month with a 37-day free trial.

Here is how it helps.

ZenABM Overview: Key Features, Pricing, and Essentials

ZenABM is a modern, lightweight ABM platform built for LinkedIn-centric account programs.

Key capabilities include:

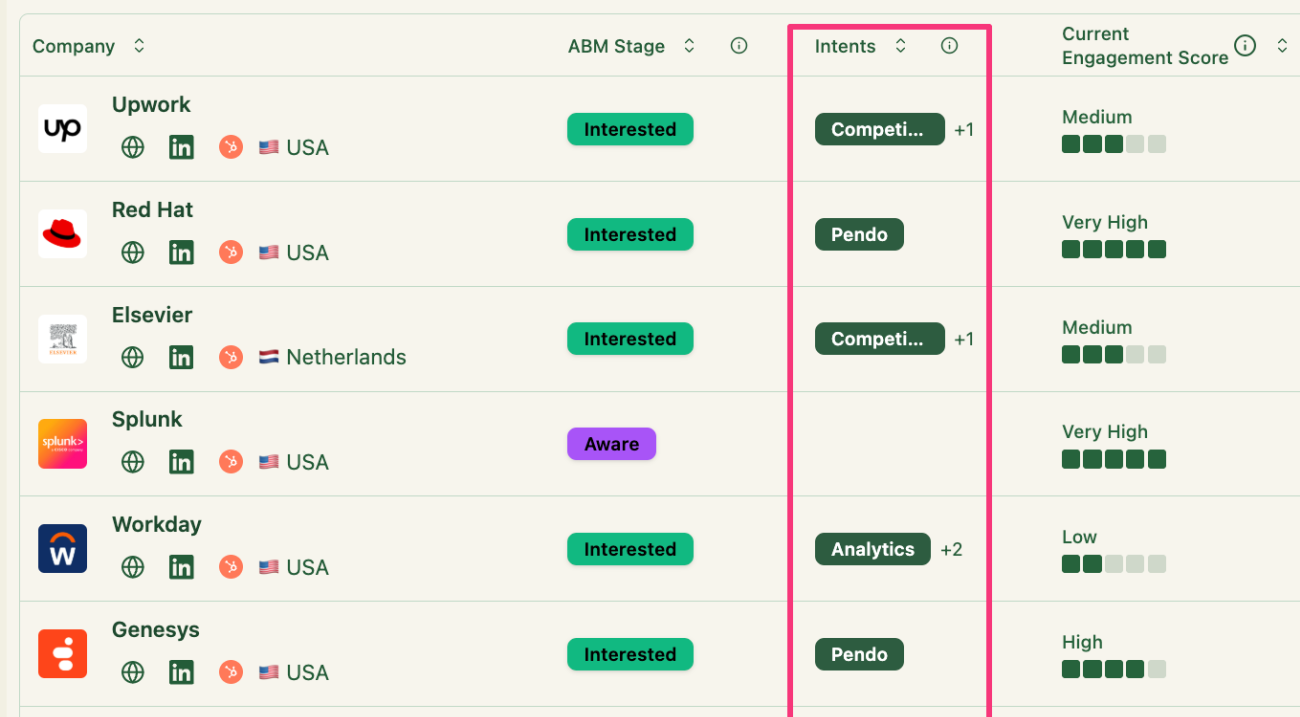

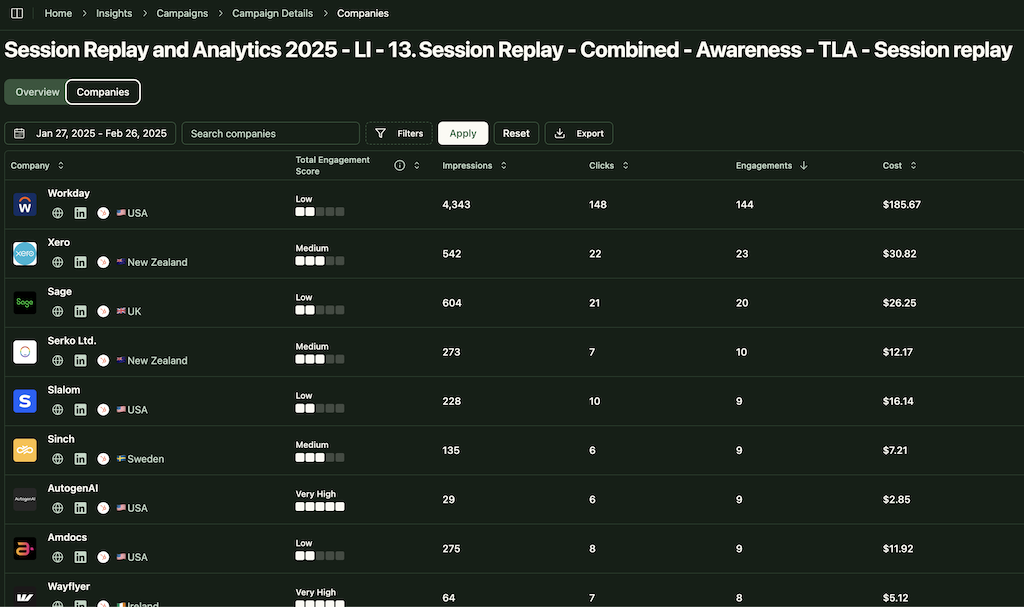

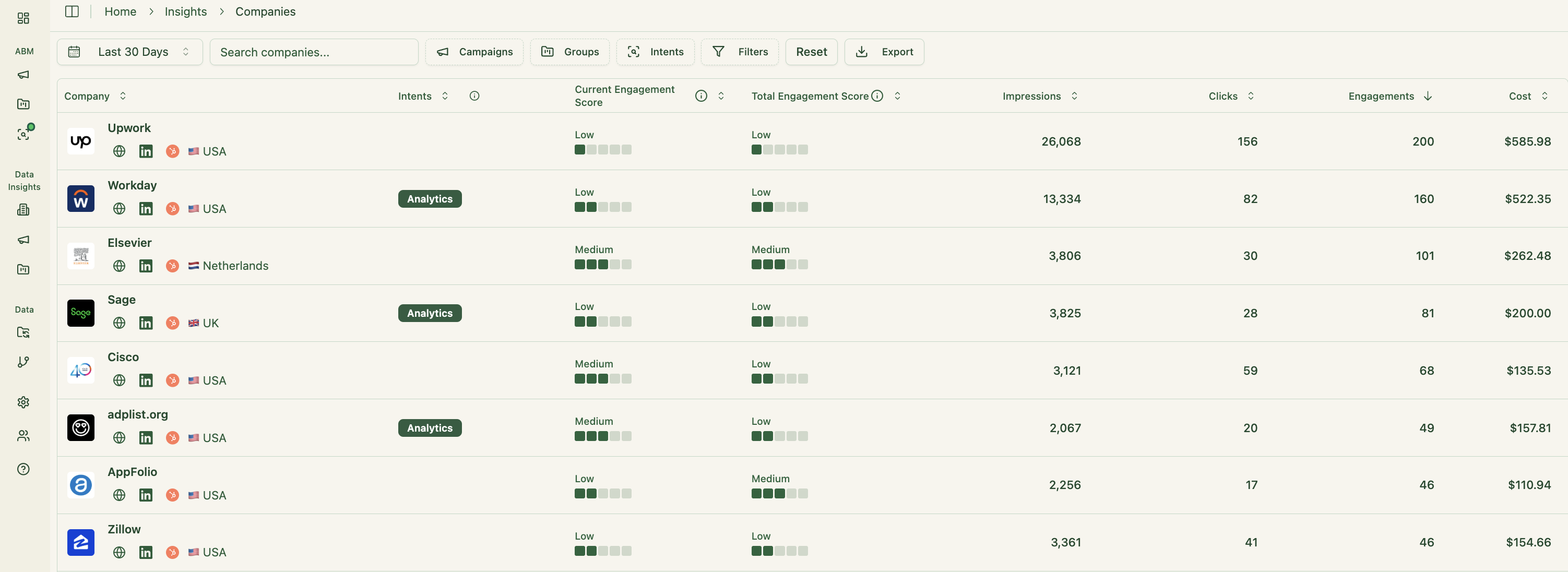

Account-Level LinkedIn Ads Engagement

ZenABM connects to the LinkedIn Ads API to pull account-specific data from every campaign.

You can see which target accounts are engaging with your ads, including impressions and clicks, mapped to company names.

Because this is first-party data from LinkedIn, accuracy is high. Many ABM platforms still rely on probabilistic methods like IP or cookies to guess who visited.

Those guesses can be shaky. Research from Syft found IP-based identification correctly matches companies roughly 42 percent of the time.

ZenABM’s first-party approach yields cleaner, intent-driven signals from real ad engagement. When multiple people from one company interact with your ads, it is a strong indicator that the account is warming up.

Pro Tip: ZenABM can also surface anonymous visitors without extra tools. Retarget them with low-cost LinkedIn text ads and ZenABM will list the companies that saw those impressions.

Real-Time Engagement Scoring

ZenABM updates scores continuously from ad interactions.

Track recent surges and historical patterns to spot heating accounts.

These scores help marketing and sales prioritize target accounts.

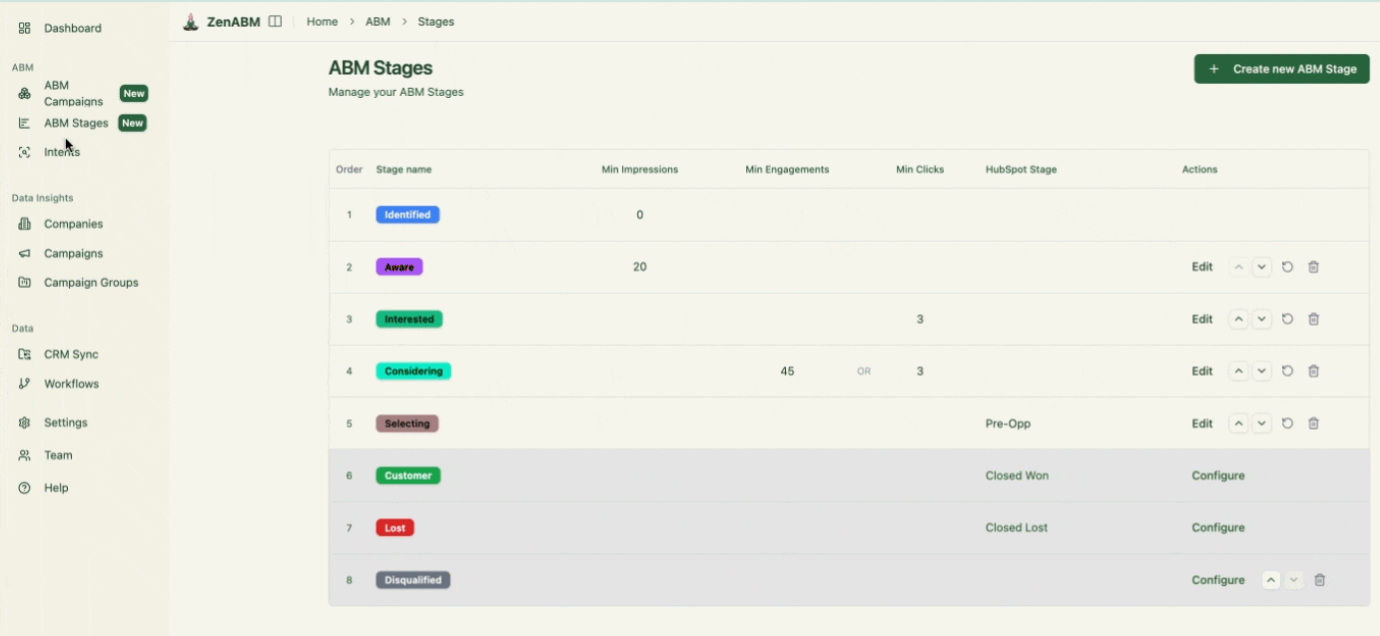

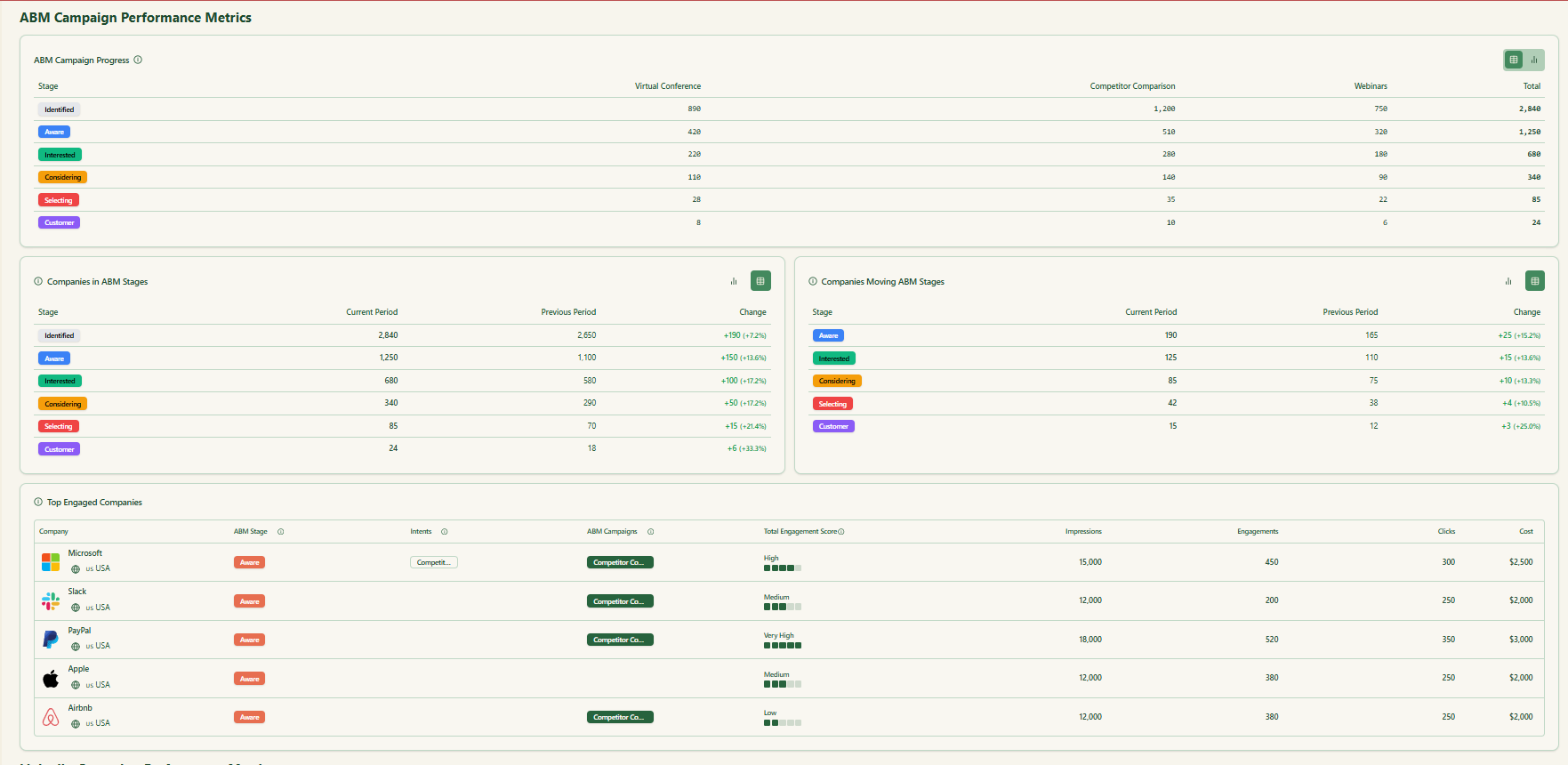

ABM Stage Tracking

ZenABM lets you define your ABM stages such as Identified, Aware, Engaged, Interested, and Opportunity, then auto-classifies accounts using engagement and CRM data.

You control thresholds, and ZenABM tracks stage changes automatically.

This gives you full-funnel visibility similar to larger ABM platforms so you can find friction points quickly.

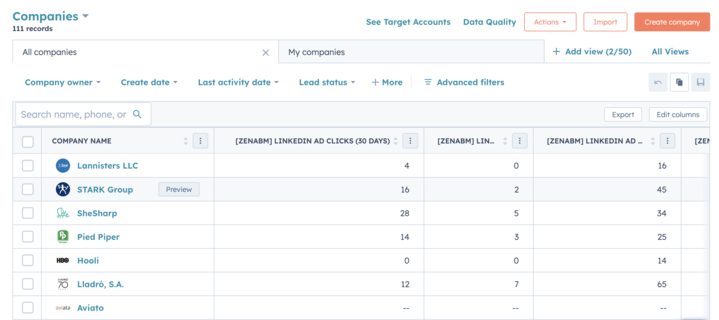

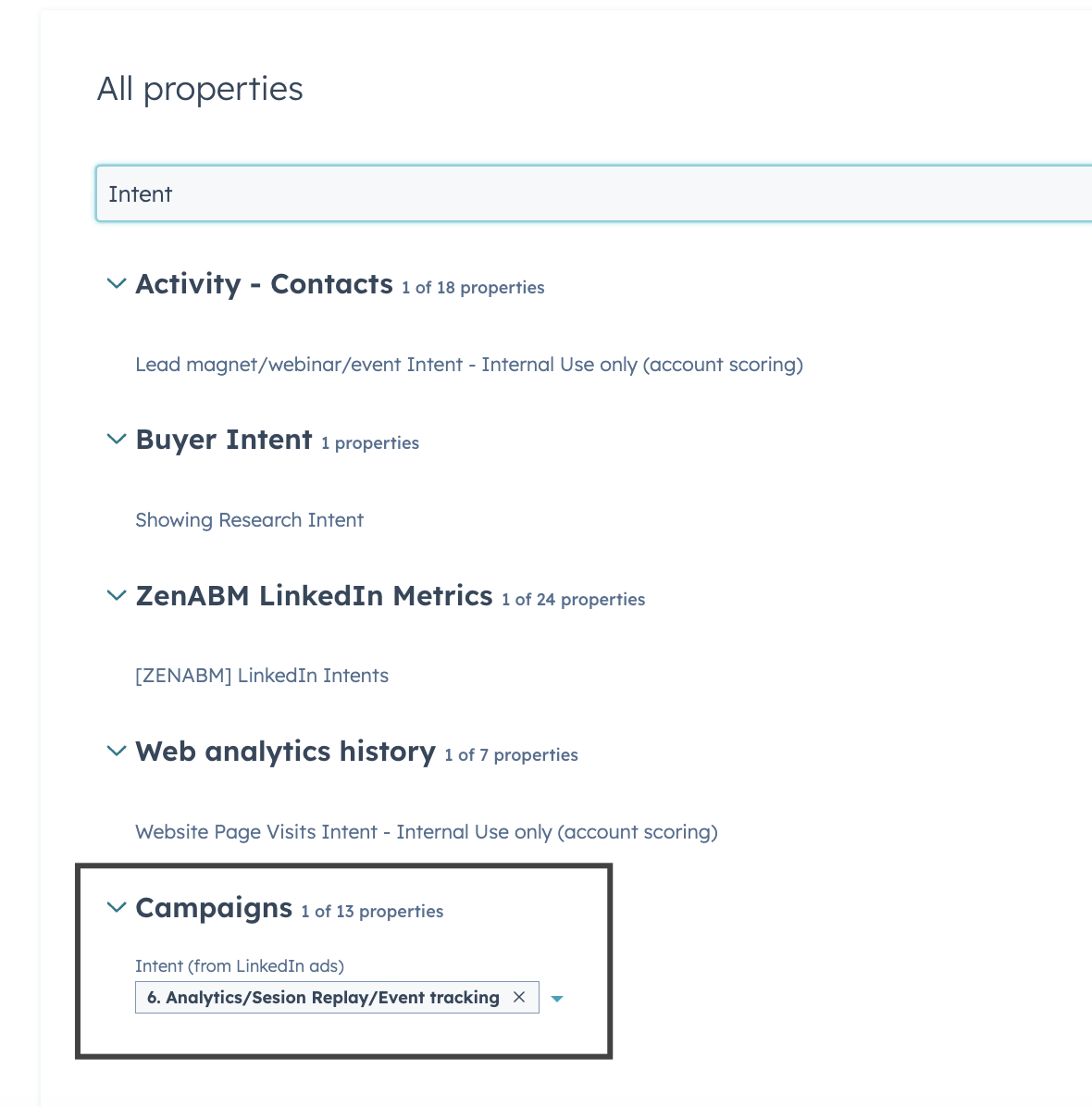

CRM Integration and Workflows

ZenABM syncs two ways with CRMs like HubSpot and supports Salesforce on higher plans.

LinkedIn engagement is written to your CRM as company properties so sales has context at all times:

ZenABM can flag an account as “Interested” when engagement crosses a threshold and assign it to a BDR automatically.

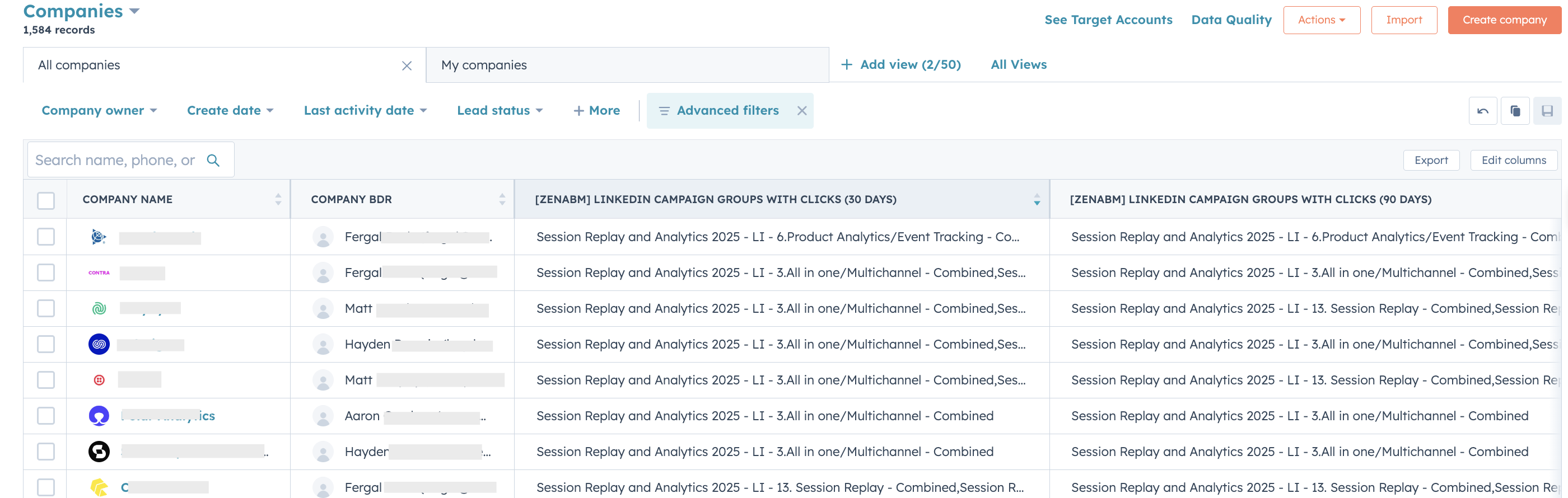

Intent Tagging from LinkedIn Ads Engagement

ZenABM lets you tag campaigns by theme, for example Feature A vs Feature B, then shows which accounts engage with which themes so you can see buying priorities.

This is real first-party intent. Instead of paying for inferred keyword interest, you see proof that Account Z engaged with “Feature A,” which signals genuine interest.

Those insights sync to your CRM so you can tailor outreach precisely.

Your sales team gets immediate context on the topics and pain points each account cares about.

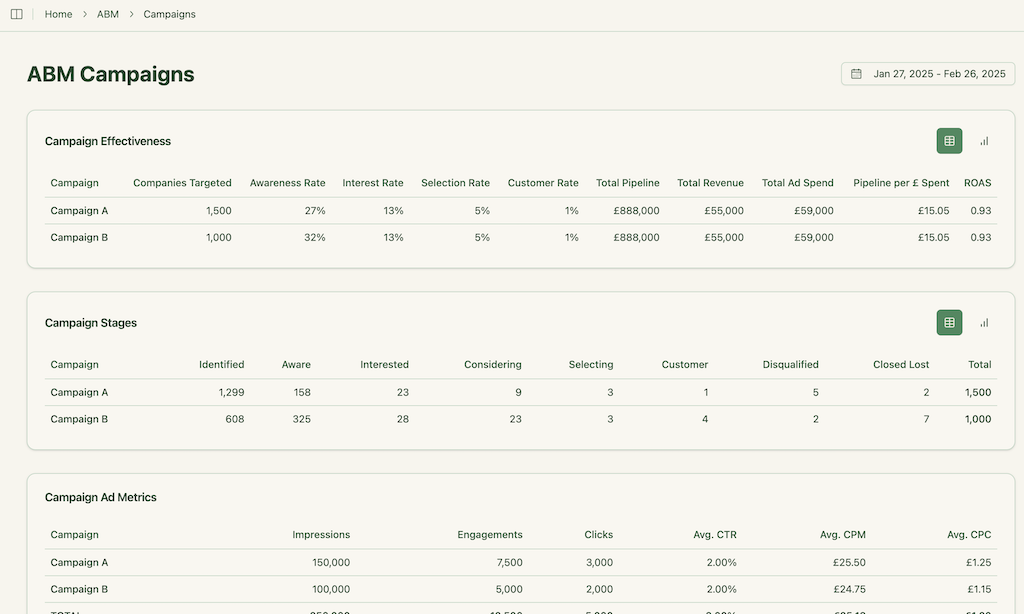

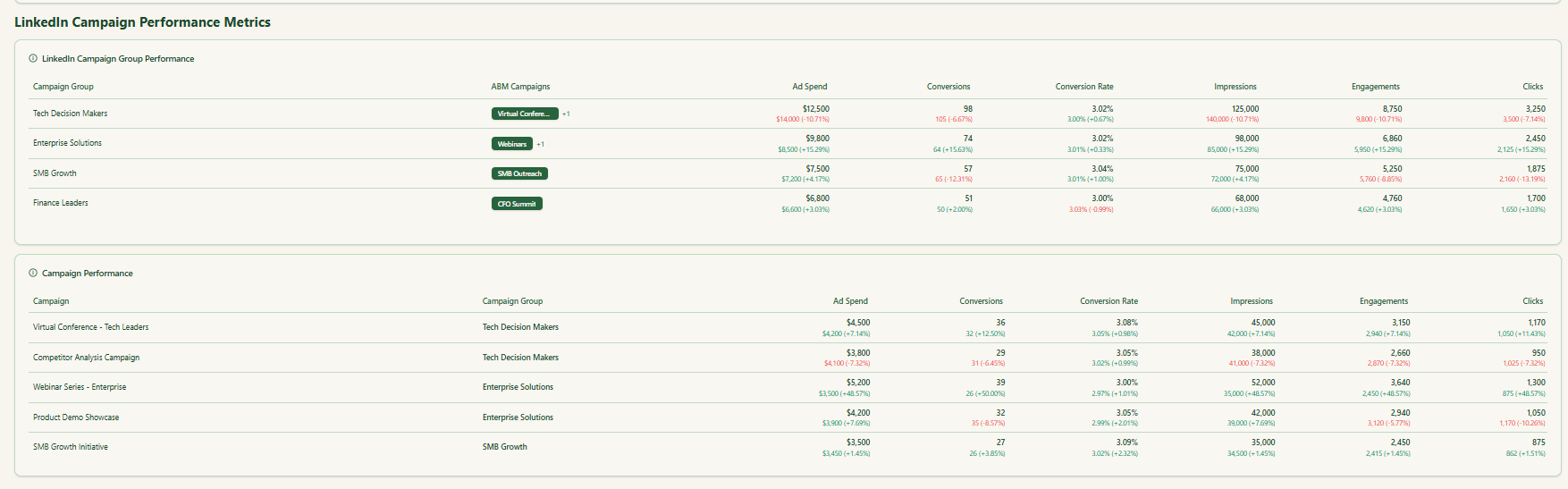

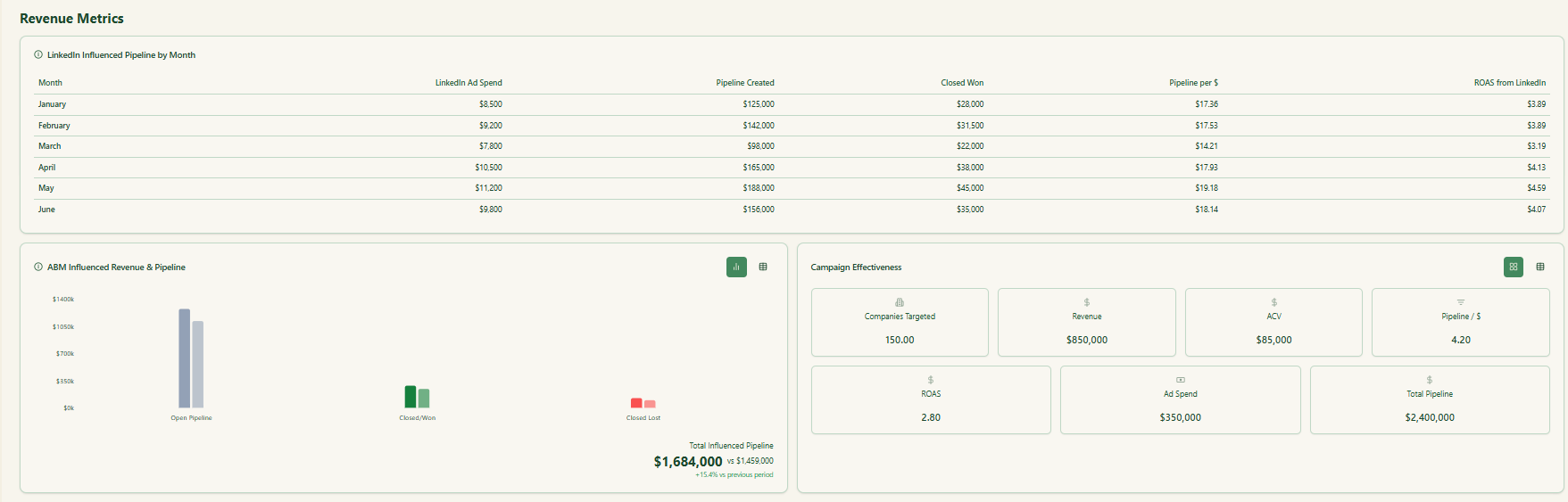

Built-in Dashboards and ABM Analytics

ZenABM ships with ABM dashboards that connect ad exposure, engagement, funnel stages, and pipeline.

- Track performance across campaigns, LinkedIn groups, and individual ads:

- Because ZenABM has both deal value and ad spend per account and campaign, it calculates ROAS, pipeline per dollar, and revenue so revenue teams can optimize for impact, not vanity metrics

ZenABM Pricing

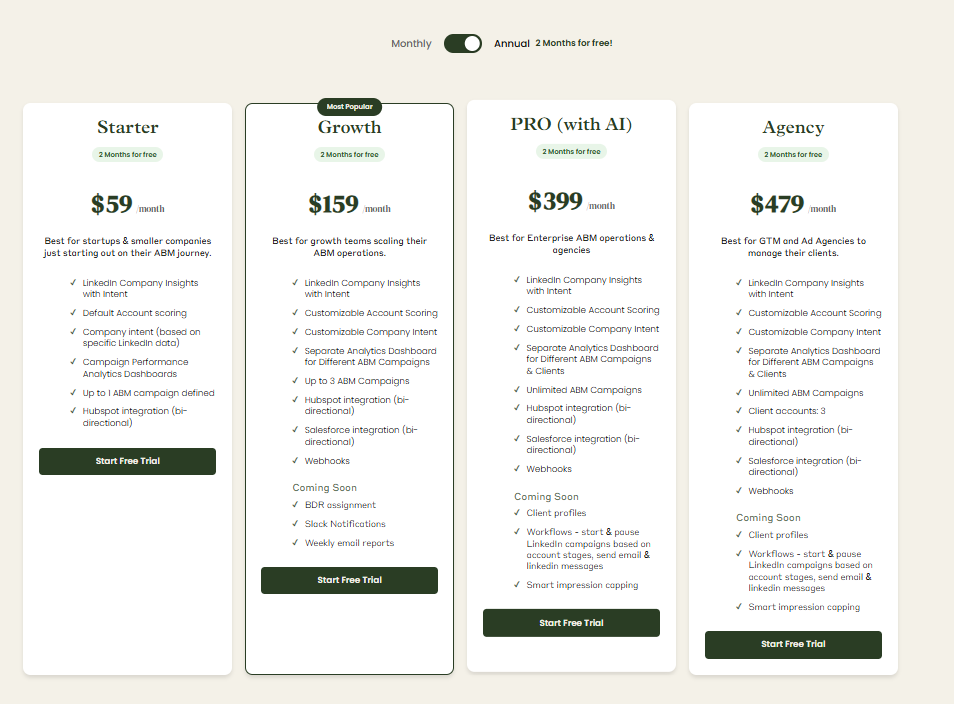

Plans start at $59 per month for Starter, $159 for Growth, $399 for Pro (AI), and $479 for the agency plan.

Even the top tier stays under $6,000 per year, far below RollWorks or Terminus.

All plans include the core LinkedIn ABM features.

Higher tiers expand limits or add Salesforce.

You can pay monthly or annually with two months free, and there is a 37-day free trial, so you can test it first.

Conclusion

RollWorks and Terminus both deliver serious ABM muscle, but they’re built for different realities. RollWorks wins on ad-led simplicity, quick setup, and approachable pricing.

Terminus goes wide, pulling ads, chat, and web personalization into one heavy-duty suite for enterprise teams with deep pockets and time to orchestrate.

If your pipeline depends mostly on LinkedIn and CRM visibility, you don’t need the bloat.

ZenABM gives you first-party LinkedIn intent, real-time account scoring, CRM sync, and stage tracking starting at $59/month, so you can build precision ABM without burning enterprise money.