©2026 ZenABM - All Rights Reserved.

In this article, I compare RollWorks vs. Common Room across features, pricing, and practical fit so marketing and sales teams can choose the platform that best supports their account-based marketing program.

I also explain where ZenABM can play as a lean, cost-effective alternative or a complementary layer to these enterprise ABM suites because it works differently.

Read on…

In case you’re short on time, here’s a summary:

RollWorks is the ABM arm of NextRoll (the company behind AdRoll), built to connect digital advertising with account-based marketing.

It is widely seen as an entry-level enterprise ABM platform for teams ready to scale.

RollWorks blends NextRoll’s programmatic know-how with an ABM approach: pinpointing target accounts, engaging them with coordinated ads, and measuring full-funnel impact.

Here are the standout capabilities:

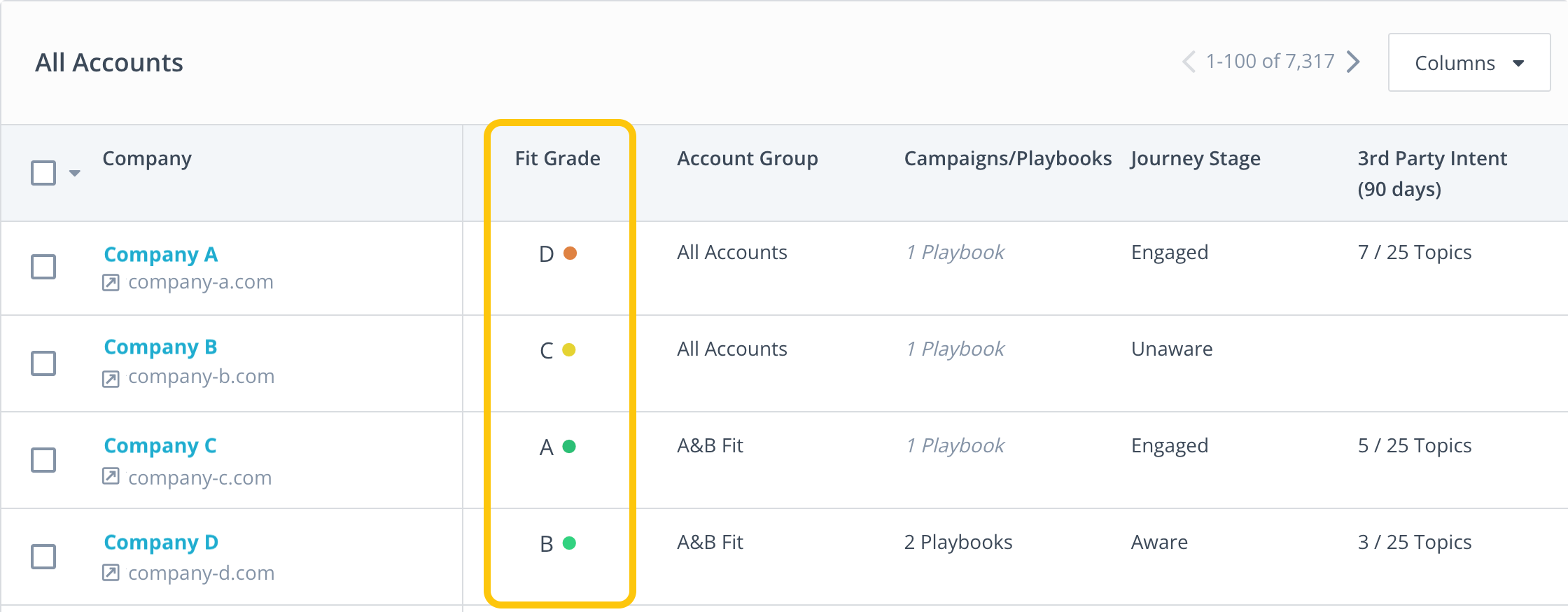

You can import or create target account lists (TALs) and grade them on fit and intent.

RollWorks assigns an “ICP Fit” grade from A to D using firmographics, technographics, and your CRM data.

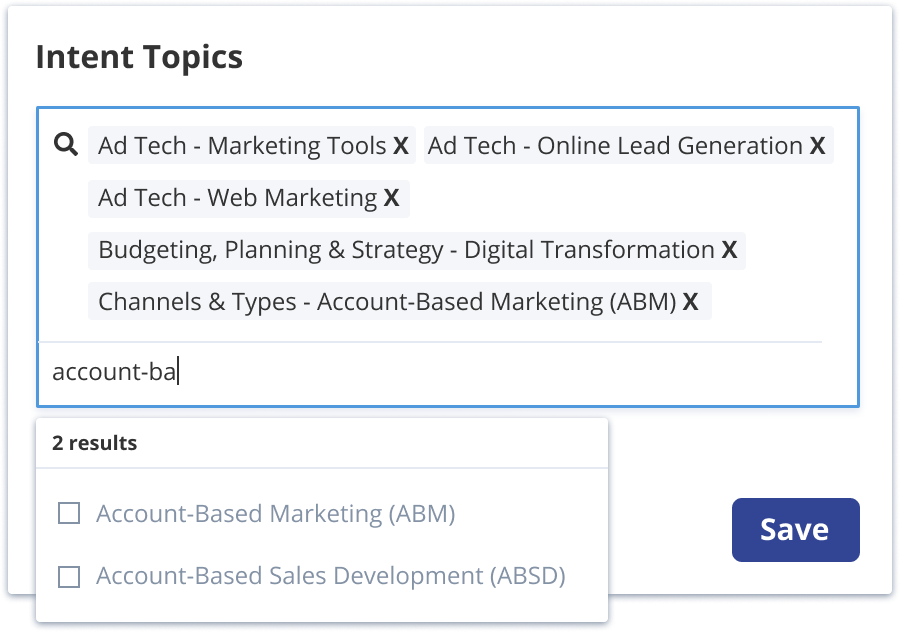

It also watches accounts for in-market research using keyword tracking. You choose the keywords or topics, and RollWorks flags companies exploring those themes across the web.

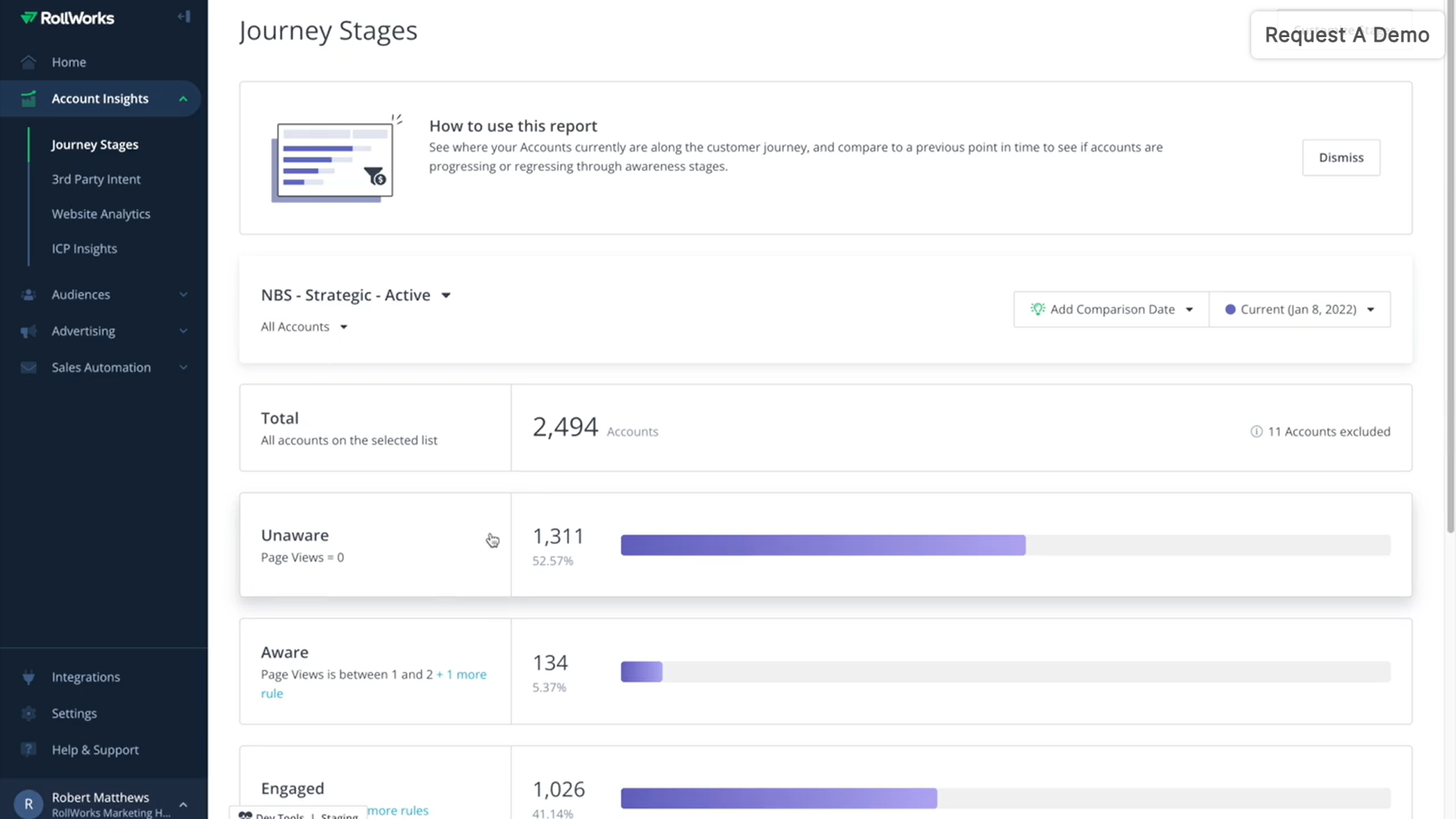

Those signals, from RollWorks’ data set and partners like Bombora, feed a Journey Stages model that classifies accounts as Unknown, Aware, Engaged, Open Opportunity, and so on based on engagement.

Pro Tip: Skip third-party keyword surges when you can and lean on first-party signals.

ZenABM captures first-party qualitative intent by tracking which LinkedIn ads a company interacts with, which gives you precise, usable signals.

Teams like Userpilot have built entire ABM motions around this idea, tagging campaigns by pain point then doubling down on BOFU ads that those accounts keep engaging with.

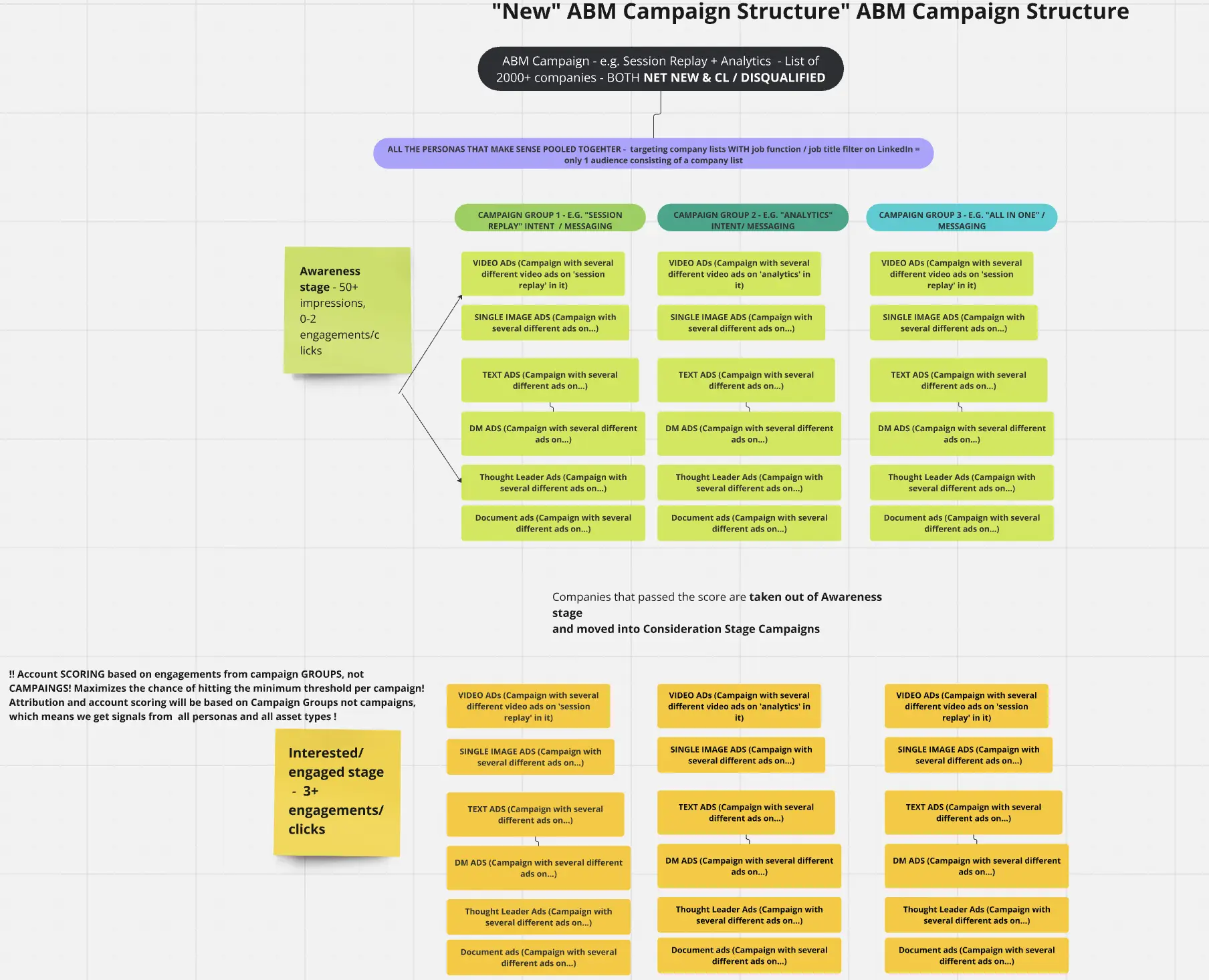

Their campaign structure:

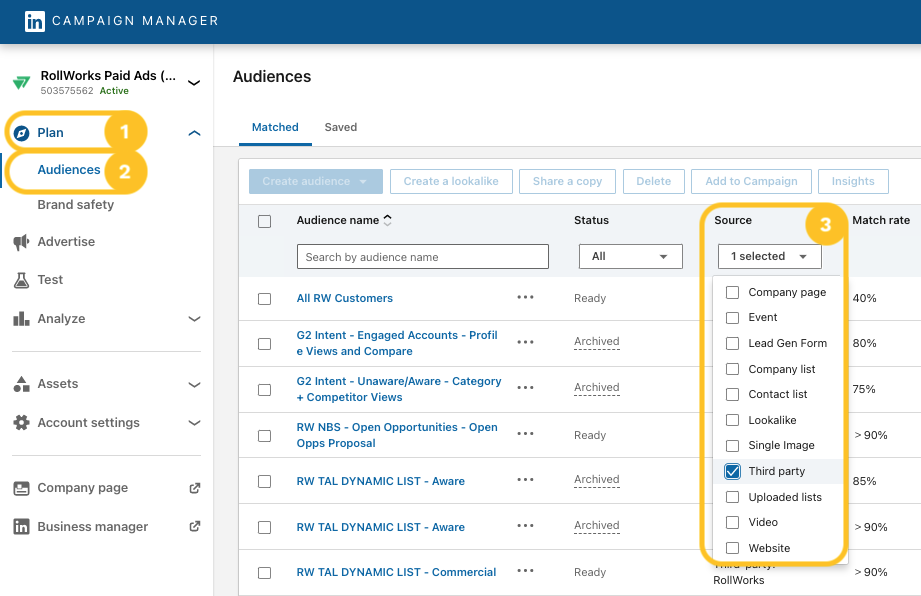

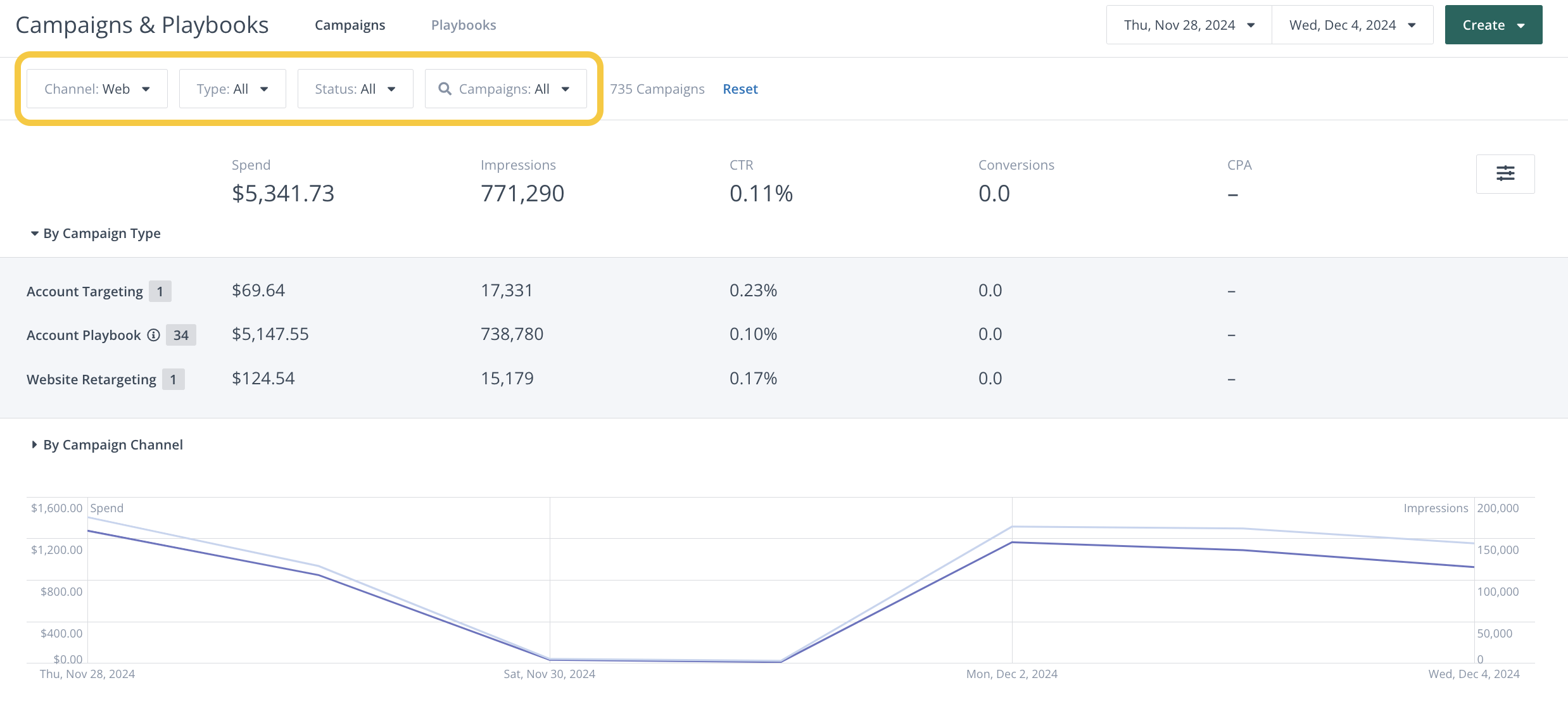

RollWorks includes a native display network powered by AdRoll’s DSP and supports delivery across web display, retargeting, and social.

For example, you can run programmatic display ads to your target accounts and also integrate LinkedIn ads through RollWorks using LinkedIn’s Marketing API to sync audiences or campaigns.

Persona targeting is supported, too, so you can tailor ads by seniority or role to reach the right decision makers.

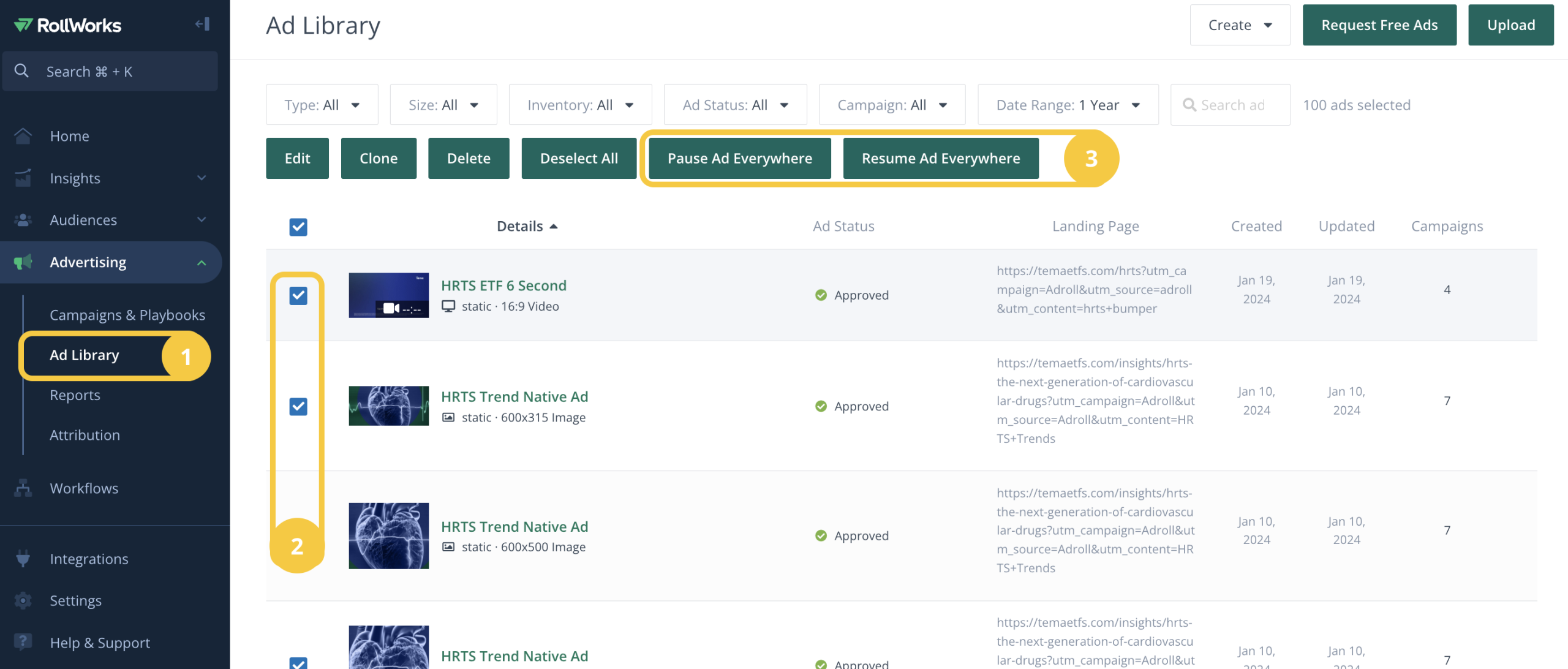

A creative library and dynamic ads help manage and adjust assets at scale.

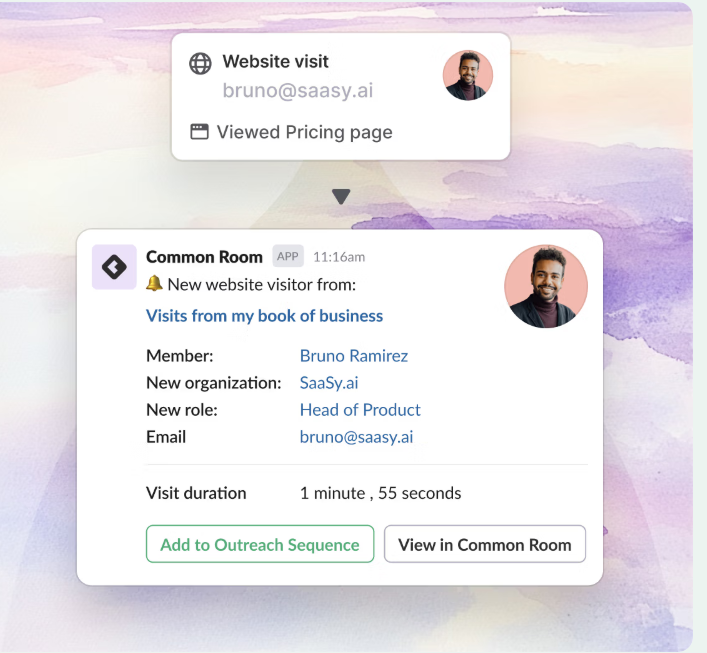

To connect ads to the pipeline, RollWorks uses a site pixel that attempts to de-anonymize visitors by matching IP or cookies to company data.

When someone from a target account lands on your site, RollWorks aims to identify the company and can suggest contacts from that account.

RollWorks keeps tabs on account engagement across touchpoints such as ad impressions and clicks, site visits, and email if connected, then triggers “Account Spike Alerts.”

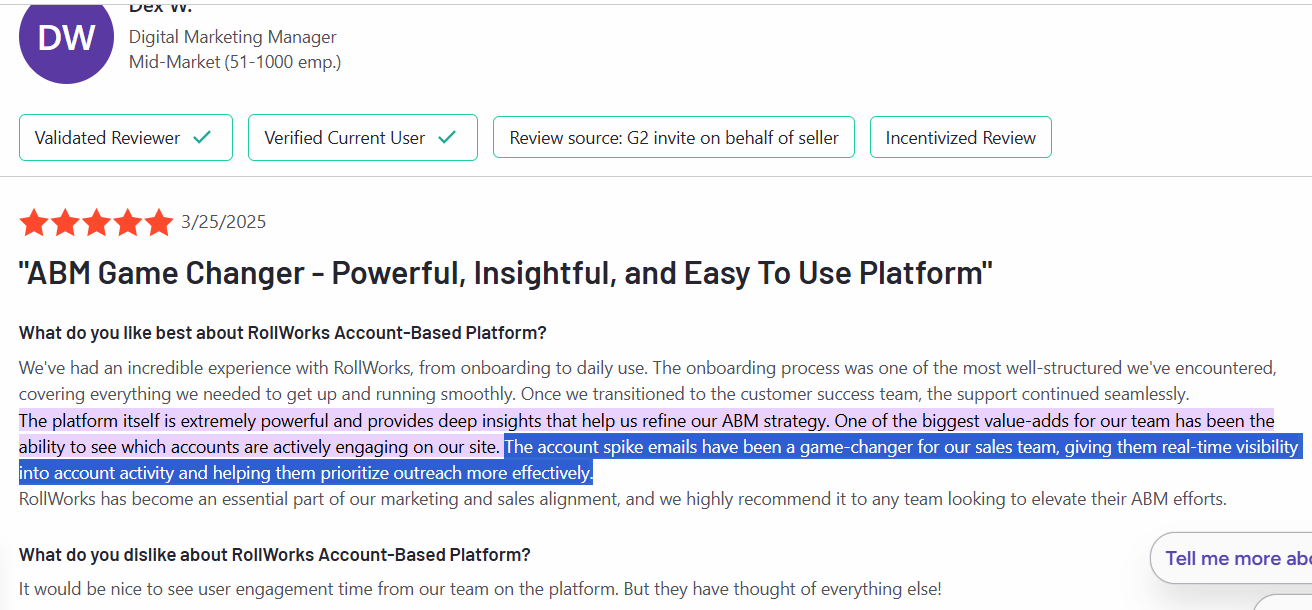

A G2 reviewer called those emails “a game-changer for our sales team,” since they surface timely account activity and help prioritize outreach.

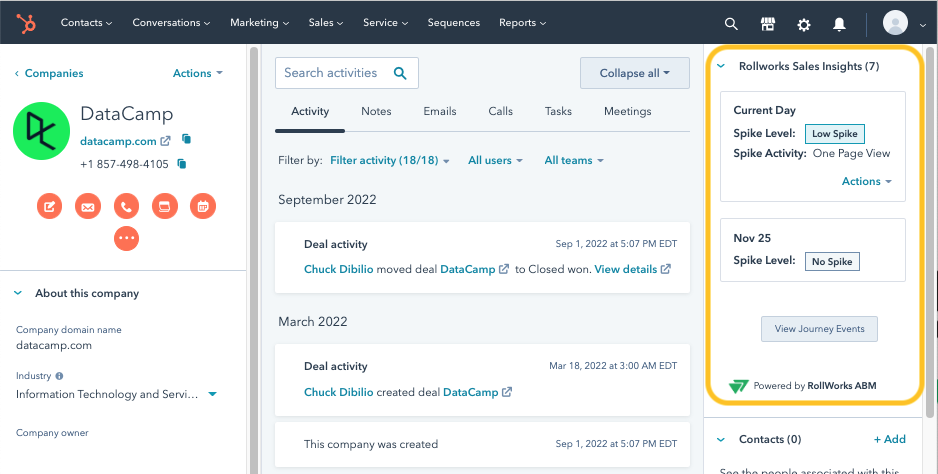

RollWorks also provides Sales Insights widgets inside CRM, for example, a Salesforce panel that shows recent account engagement and suggests next steps so sales sees ABM activity in their workflow.

The platform automates workflows like moving accounts between segments, creating CRM tasks, or changing bids based on behavior.

If an account enters the “Opportunity” stage, RollWorks can cut back frequency or switch content. If Bombora intent spikes on a topic, it can auto-add the account to a campaign and raise bids.

Journey Stages also include recommended actions, such as increasing budget for high-fit accounts that remain cold.

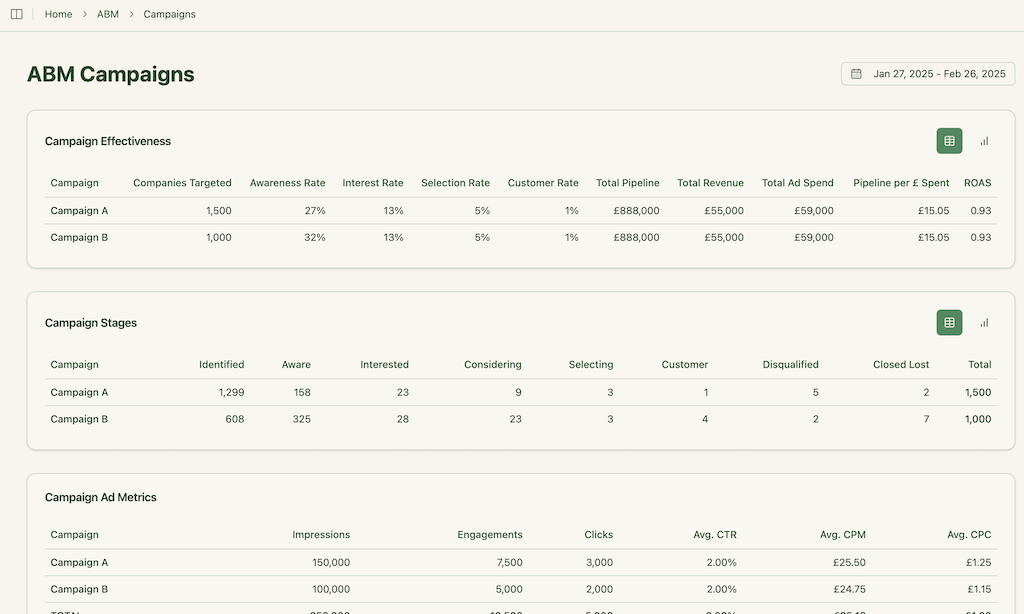

For analytics, RollWorks offers unified views tying ad performance to pipeline so you can see impressions, clicks, and attributed opportunities or revenue in one place.

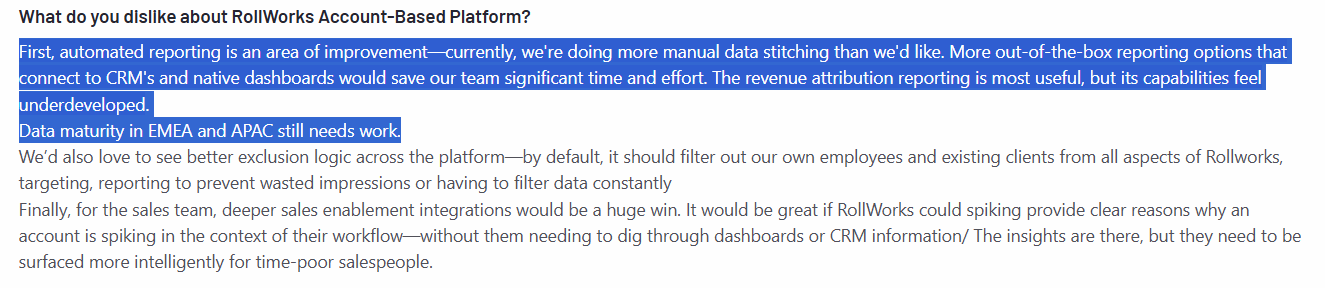

Some users note that attribution in RollWorks can feel basic and may need extra manual effort.

RollWorks connects with major CRMs like Salesforce and HubSpot for two-way sync.

It also integrates with MAPs such as Marketo and Pardot and with sales engagement tools like Outreach and Salesloft via API or native apps.

For intent and firmographics, it partners with Bombora, G2, and providers like ZoomInfo.

You can explore the full set in our RollWorks for ABM guide.

RollWorks follows a tiered and usage-based approach rather than simple self-serve pricing. As of 2025, parts of the product are presented under the AdRoll ABM umbrella.

There is a limited free or self-serve tier that lets you run retargeting and basic account targeting by paying only for media.

The richer ABM feature set sits in paid plans that require a sales quote.

The entry cost is not sky-high compared with heavier suites.

For small to midsize teams, RollWorks often starts just under $1,000 per month.

Common Room is a comprehensive customer intelligence and ABM platform that aggregates data from dozens of sources to give a 360° view of your prospects.

The name is indeed apt.

It’s a “common room” where signals from web traffic, product usage, community interactions, and more are unified into one place.

Plus, unlike most ABM tools, Common Room takes a completely person-centric approach.

Let’s look at its key features:

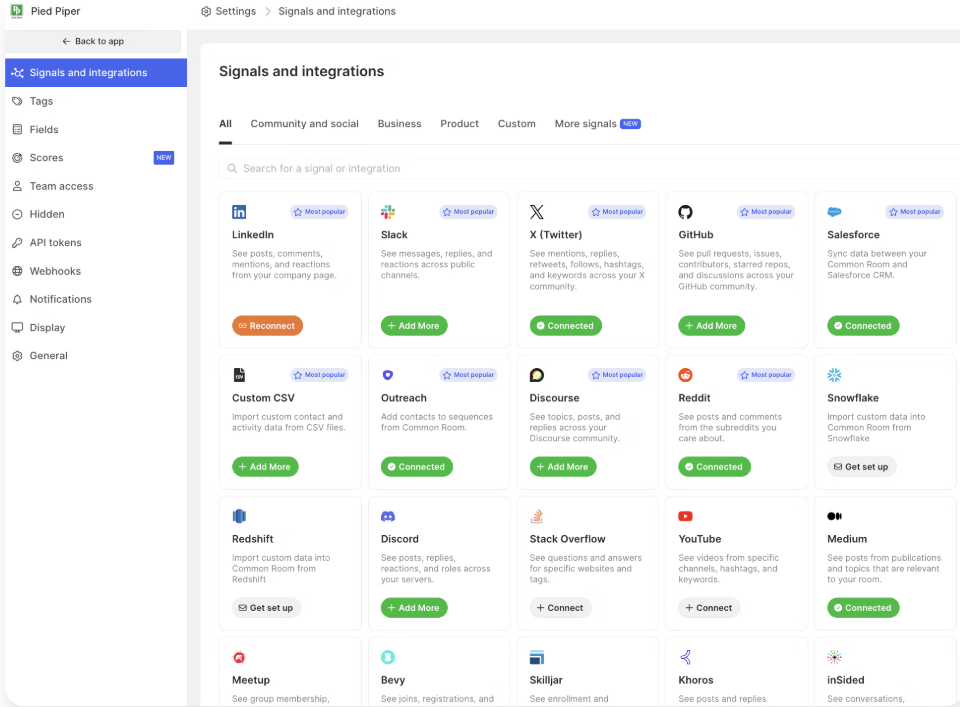

Common Room pulls in buying signals from 50+ native integrations across social media, community forums, CRM, product analytics, and more.

These include Slack, Discord, GitHub, LinkedIn, Twitter, Salesforce, HubSpot, Marketo, and even platforms like G2 and Stack Overflow.

All integrations are code-free, making it easy to connect your data sources.

Once data flows in, Common Room’s Person360™ AI engine automatically merges activities into unified contact and account profiles.

It uses advanced matching (beyond simple email) to deduplicate and link identities across channels, flagging any uncertain matches for manual review. T

This creates a “single source of truth” for each lead.

For example, tying an anonymous website visitor to their Slack and GitHub persona once identified.

After identity resolution, a waterfall enrichment process kicks in: Common Room appends firmographic and technographic details (company size, industry, tech stack, etc.) from hundreds of data partners, with daily refreshes.

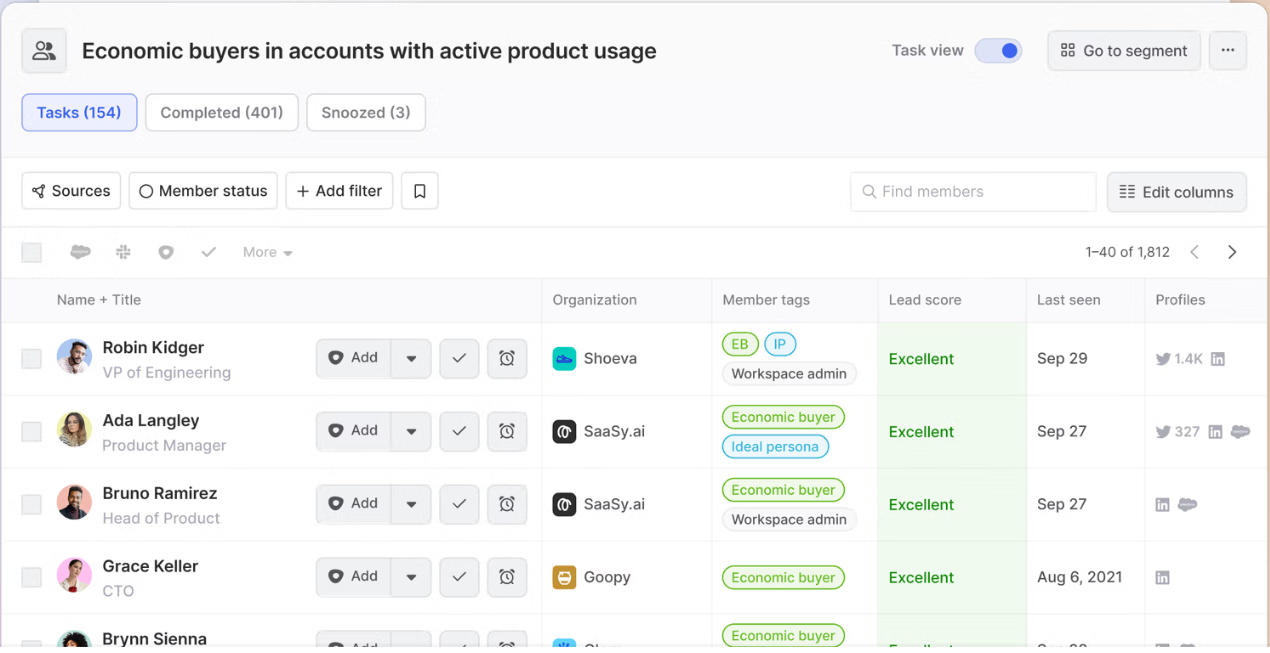

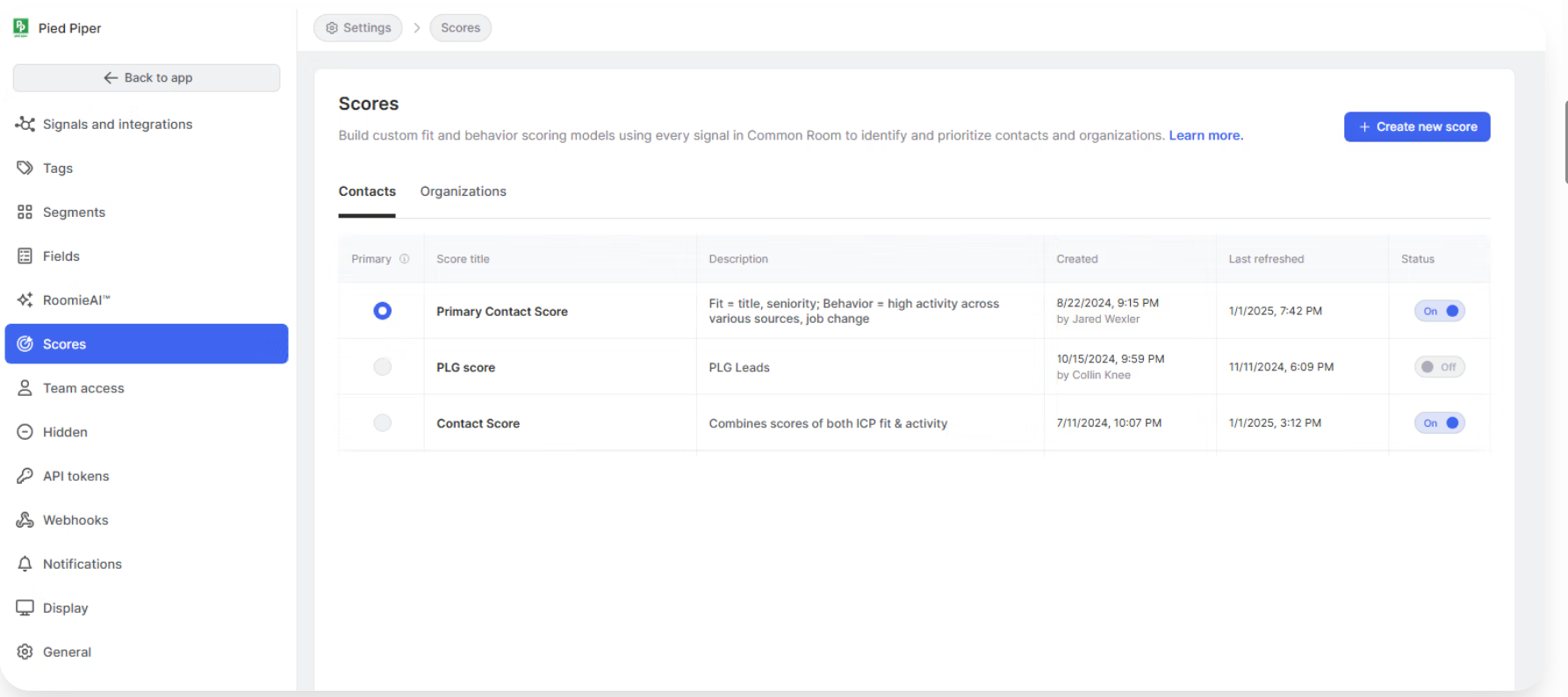

Common Room’s AI (nicknamed RoomieAI™) scores and filters leads based on fit and intent.

Users can define custom scoring models that combine any signals (e.g. job title seniority, product usage frequency, community posts) with firmographic criteria.

The platform supports hundreds of buying signals (everything from email opens and form fills to GitHub stars and G2 page visits) as inputs to the scoring engine.

These roll up into both contact-level and account-level scores, so sales teams get prioritized lists of high-fit, high-intent contacts.

For instance, Notion’s sales team uses Common Room to tag “high-fit” accounts and trigger Slack alerts whenever those accounts exhibit buying behavior.

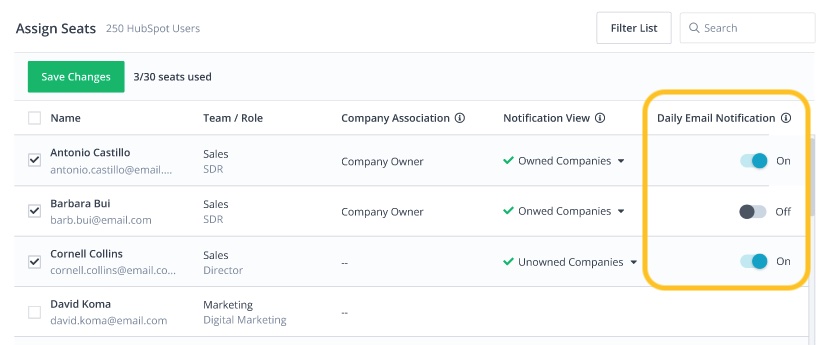

Btw, ZenABM also helps with account scoring based on LinkedIn ad engagements:

So, if your ABM motion is LinkedIn-centric, you may want to give ZenABM a try.

Going beyond your internal data, Common Room includes a prospecting tool tapping a 200M+ contacts database.

You can input your Ideal Customer Profile (ICP) filters (e.g. industry, role, company size), and Common Room will suggest new accounts and contacts that match, complete with scores based on third-party enrichment.

This helps expand your reach by finding lookalike prospects you might have missed.

Common Room also identifies anonymous web traffic at the account level.

By using a first-party cookie and IP lookup, it can reveal which company a visitor is from (even if the individual isn’t yet known).

Once that visitor converts (fills a form or signs up), their historical page view activity is attached to their profile.

This means marketing can see if someone from a target account has been lurking on the pricing page or docs before they ever raise their hand.

Pro Tip: Roughly 42% (as one study found) is where IP lookup for website visitor deanonymization peaks in accuracy.

ZenABM suggests running low-cost LinkedIn text ads targeted at your website visitors as a way to reveal interested accounts.

Text ads on LinkedIn have very low click-through rates (so they’re inexpensive to serve), but ZenABM will show you which companies saw those ads frequently, meaning those companies’ employees likely visited your site’s key pages.

This first-party deanonymization tactic can identify engaged accounts more reliably than fuzzy IP matches and for almost free.

A standout feature of Common Room is its deep integration with community and developer channels – the so-called “dark funnel” where prospects engage before formal sales.

It links with Slack, Discord, Discourse forums, GitHub, Reddit, and more to surface meaningful activities.

For example, if an engineer at a target account asks a question on your community Slack or stars your GitHub repo, Common Room captures that and attributes it to the person and account.

Sales reps can then get notified and reach out in context.

E.g. “Saw you checked out our GitHub project; can I answer any questions?”

Common Room helps you act on all these insights with built-in automation.

Team Alerts let you set up real-time triggers.

There’s also a no-code workflow builder to create multi-step automation.

To complement its data intelligence, Common Room offers RoomieAI™ Activate .

It’s an AI writing assistant for sales emails.

It can generate personalized outreach messages based on the prospect’s specific signals and context.

Note: G2 shows that the AI-generated messaging feature has received mixed feedback, with some users finding the output to be generic or lacking in personalization.

Common Room natively connects to a vast array of tools in your stack, ensuring it slots into your workflow.

Its integration list spans CRMs (HubSpot, Salesforce), marketing and sales tools (Marketo, Outreach, 6sense, Demandbase, etc.), data warehouses (Snowflake, BigQuery), community platforms (Slack, Discord, InSided), and more.

For more details, you can visit Common Room’s Docs.

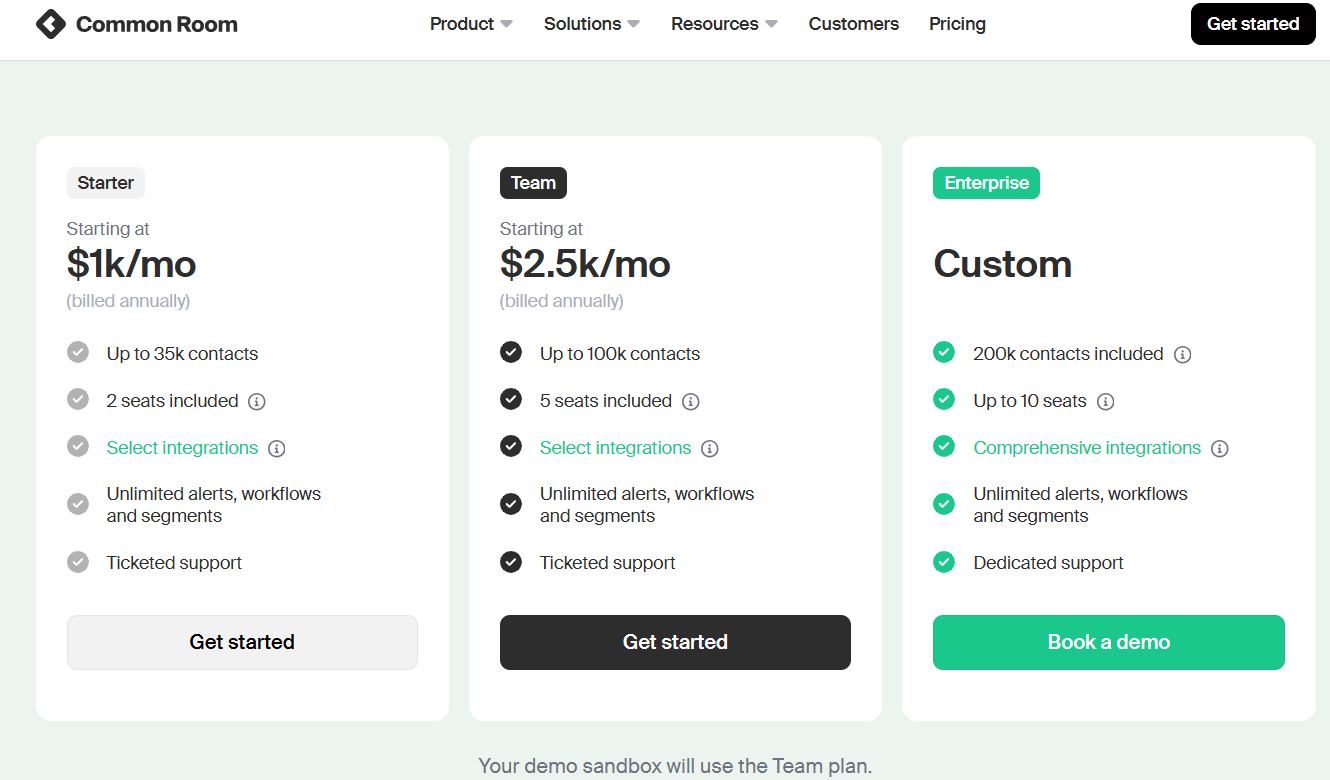

Common Room is a premium B2B product; pricing scales with contact volume and user seats.

The entry-level Starter plan (about $1,000/mo billed annually) includes ~35,000 tracked contacts and 2 user seats, plus basic integrations and unlimited alerts/workflows.

The mid-tier Team plan (around $2,500/mo) raises limits to ~100,000 contacts and 5 seats.

Both tiers include most core features (visitor tracking, Person360 enrichment, workflow automation, etc.).

An Enterprise plan (custom pricing) accommodates ~200K+ contacts, 10+ seats, and adds all advanced integrations (e.g. full Salesforce data sync, custom objects) and dedicated support.

Also, a free trial is available on the Team tier (no credit card).

Major differences between RollWorks vs. Common Room that you should review:

| Category | RollWorks | Common Room |

|---|---|---|

| Positioning and scope | RollWorks is an advertising-led ABM platform. It identifies, grades, and progresses accounts through Journey Stages, then activates audiences across web, CTV, and social with an owned ad stack. | Common Room is a signal and intent layer for GTM. It captures multi-source account signals, matches them to real people, and powers SDR and AE outreach with AI. It is less about running ads and more about turning activity into contact-level action. |

| Signals and intent | RollWorks blends fit, web engagement, and third-party intent into a stage model from Unaware to Won Deal, with options to incorporate partner intent like G2 or Bombora inside stage logic. | Common Room emphasizes signals beyond the usual ad and web clicks. Community activity, product usage, social engagement, and review-site intent are mapped to accounts and then resolved to specific people for timely outreach. |

| Activation and channels | RollWorks centers on programmatic and retargeting, ICP-driven segments, and guided playbooks. Media runs on a dynamic CPM model and can be optimized by its BidIQ system. | Common Room focuses on alerts, segments, and automations that deliver person-level context to sellers. It is built to operationalize signals across dozens of sources rather than manage media buying. |

| Sales workflow depth | RollWorks pushes journey and engagement insights into CRM and MAPs so sales can see activity in tools like Salesforce and HubSpot. | Common Room is designed to bridge the account intent to named contacts quickly. Materials highlight SDR and AE workflows built on identity resolution and enrichment. |

| Packaging and pricing posture | RollWorks routes platform pricing through sales and prices media on dynamic CPM. That aligns well with paid media teams that flex budgets by stage and audience. | Common Room publishes starting points. Starter begins at about $1k per month billed annually for up to 35k contacts, Team starts around $2.5k per month for up to 100k contacts, with Enterprise custom. |

| Complexity and time to value | RollWorks is narrower and often quicker to stand up for ad-led ABM. Journey Stages, ICP Fit, and playbooks make iteration straightforward for lean teams. | Common Room narrows the blast radius to finding and activating signals. Teams that already have an ad stack or MAP often ramp quickly because they are not adopting a full buying platform. |

| What users tend to say | Public reviews like the ease of targeting, onboarding help, and the way Journey Stages guide spend and timing. Critiques mention reporting gaps that sometimes require manual work, and limits such as Journey views that do not always cover long sales cycles | Review and vendor pages consistently highlight its ability to consolidate signals, identify people, and accelerate personalized outreach for SDRs and AEs. Feedback also notes there is still a learning curve, but the scope is lighter than adopting an ad-orchestration suite. |

Choose RollWorks if:

Choose Common Room if:

Btw, if your motion is mostly LinkedIn, heavy suites are not mandatory.

ZenABM pulls first-party company engagement directly from the LinkedIn API, scores accounts, tracks ABM stages, and writes back to your CRM.

Pricing starts at 59 dollars per month with a 37-day free trial.

Let me tell you more about it.

ZenABM is a modern, lightweight ABM solution built for LinkedIn-based account campaigns.

Key offerings in ZenABM include:

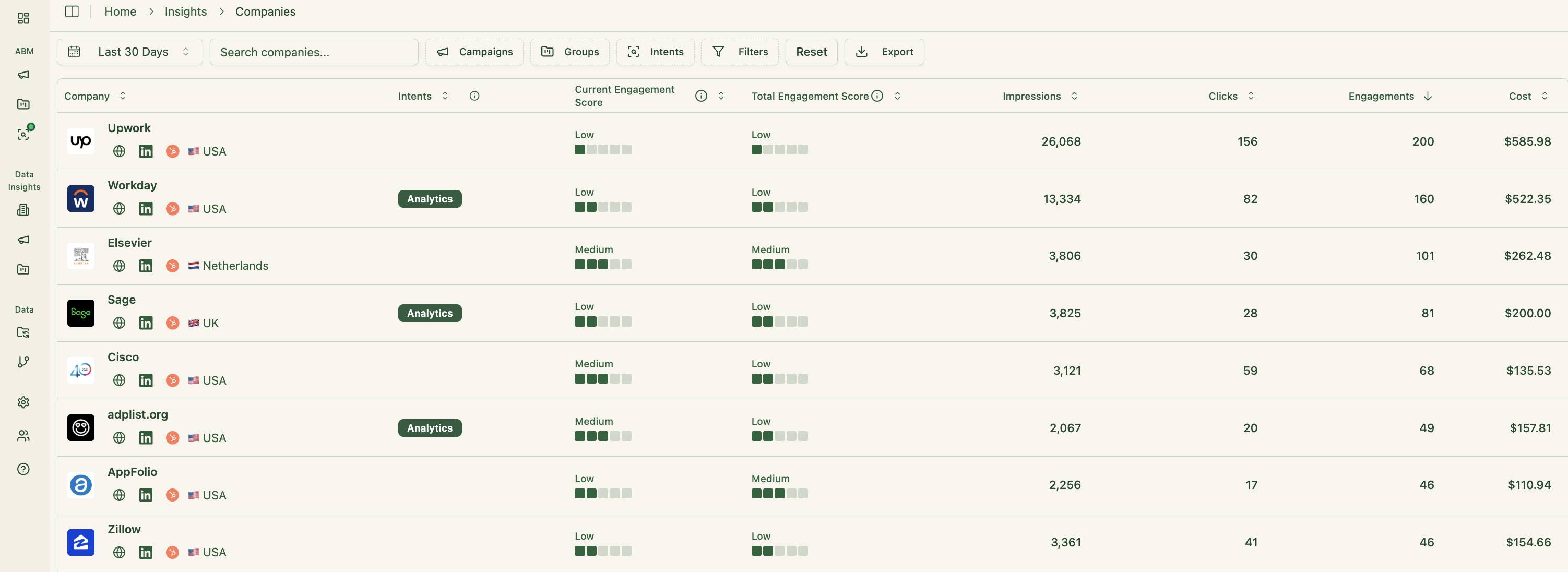

ZenABM connects directly to the LinkedIn Ads API to pull account-specific data from every campaign.

You can see exactly which target accounts are engaging with your ads, including impressions and clicks, mapped to company names.

Because the data comes from LinkedIn, accuracy is high. Many larger ABM platforms still depend on probabilistic methods such as IP or cookies to guess visitor identity.

Those estimates are shaky. Research from Syft found IP-based identification correctly matches companies only about 42 percent of the time.

ZenABM’s first-party approach delivers cleaner, intent-driven signals from real ad engagement. When multiple employees from one company interact with your ads, you can trust that the account is warming up.

Pro Tip: ZenABM can also reveal anonymous site visitors without extra tools. Retarget them with low-cost LinkedIn text ads, and ZenABM will list the companies that saw the impressions.

ZenABM updates engagement scores continuously from ad interactions.

Track recent trends or historical patterns to spot heating accounts.

These scores help marketing and sales prioritize high-value accounts.

ZenABM lets you define your ABM funnel stages such as Identified, Aware, Engaged, Interested, and Opportunity, then auto-classifies accounts using engagement and CRM data.

You can set your own thresholds, and ZenABM tracks stage transitions automatically.

This gives full-funnel visibility similar to enterprise ABM platforms so you can see where accounts stall and where they move.

ZenABM syncs bidirectionally with CRMs like HubSpot and supports Salesforce on higher plans.

LinkedIn engagement is written to your CRM as company properties so sales never loses context:

ZenABM can mark an account “Interested” when engagement crosses a threshold and assign it to a BDR automatically.

ZenABM lets you tag campaigns by theme, for example Feature A vs Feature B, then shows which accounts engage with which themes so you can see priorities.

This is true first-party intent. Instead of paying for inferred keyword interest, you get proof that Account Z engaged with “Feature A,” which signals real buying interest.

Those insights sync to your CRM, which supports highly targeted messages and outreach.

Your sales team can immediately see the topics and pain points each account cares about.

ZenABM ships with ABM dashboards that link ad exposure, engagement, funnel stages, and pipeline.

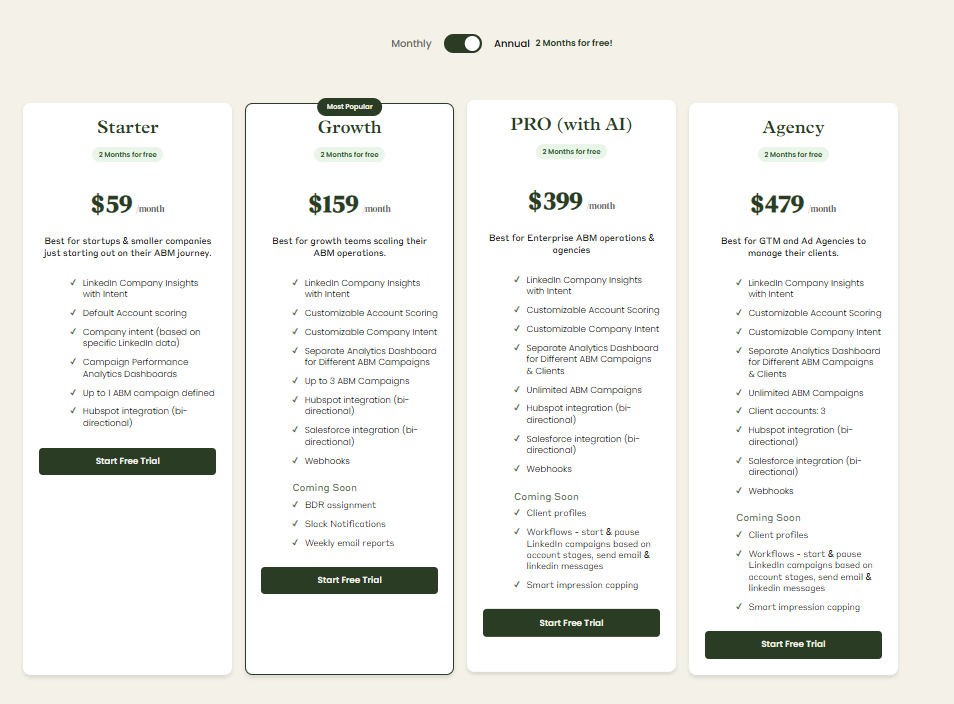

Plans start at $59 per month for Starter, $159 for Growth, $399 for Pro (AI), and $479 for the agency plan.

Even the top tier is under $6,000 per year, which is far below RollWorks or Common Room.

All plans include the essential LinkedIn ABM features. Higher tiers expand limits or add Salesforce.

You can pay monthly or annually with two months free, and there is a 37-day free trial, so you can test before committing.

Choosing between RollWorks and Common Room comes down to what fuels your ABM motion – paid activation or signal precision.

RollWorks is ideal if you want fast, ad-led reach and an easy on-ramp to account-based marketing.

Common Room suits teams chasing deeper, people-level intent and faster outreach.

Both platforms are powerful, but neither is lightweight nor cheap to maintain.

That’s where ZenABM fits: it delivers first-party LinkedIn ad engagement data, CRM sync, and ABM stage tracking at a fraction of the cost.

For teams that care more about traction than tech bloat, ZenABM offers the same strategic clarity without enterprise drag.