Dreamdata bills itself as a B2B “Activation & Attribution Platform” that can map every buyer touchpoint and tie it to revenue.

But it is a pricey and feature-heavy enterprise suite.

In this deep dive, I’ll dissect Dreamdata’s key features, pricing, and user feedback, and help you decide if Dreamdata is your ABM fit (or an overkill?).

I’ll also discuss how ZenABM (a first-party LinkedIn-focused ABM platform) might be a better alternative or even serve as a complementary layer to Dreamdata (or whichever ABM suite you may have) due to its unique features.

Dreamdata for ABM: Quick Summary

In case you want it short:

- Dreamdata is a full-scale B2B attribution and activation platform that maps every touchpoint and ties it to revenue across channels, but it is built and priced for enterprise teams.

- It offers seven attribution models, deep revenue analytics, account-based journey views, and audience-building features, yet demands significant setup effort and has a high learning curve.

- User reviews highlight strong funnel visibility and better ROI clarity, but also complain about complex onboarding, limited dashboard customization, and higher-than-average pricing.

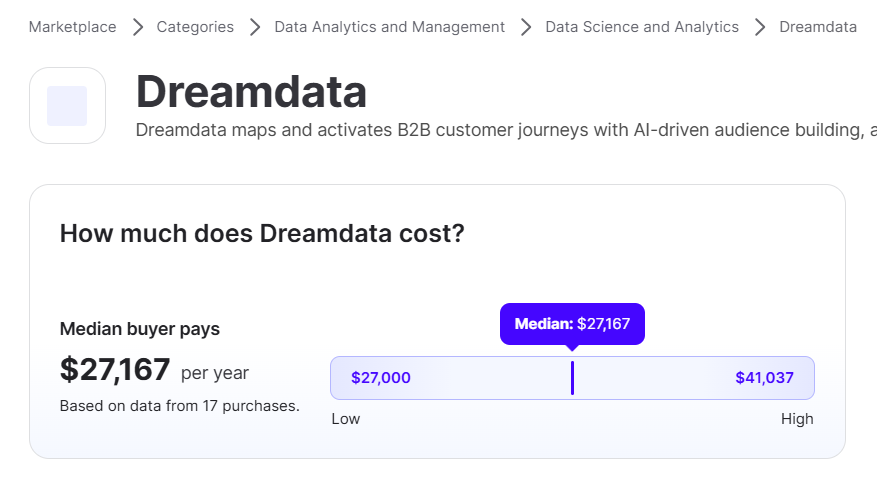

- The free tier is usable only for basic needs, while paid plans typically start around $750 per month (as per third-party sources) and can climb into enterprise territory quickly. Vendr keeps the median Dreamdata pricing at $27k.

- Alternative Worth Considering: ZenABM offers account-level LinkedIn ad engagement tracking, ad engagement-to-pipeline analytics with plug-and-play dashboards, account scoring, ABM stage tracking, CRM sync, first-party qualitative intent, automated assignment of BDRs to hot accounts, custom webhooks, and ad engagement tracking at the job-title level. All this starts at just $59/month!

Key Features of Dreamdata

Dreamdata’s feature set is extensive.

It aims to be your one-stop shop for connecting marketing spend to revenue outcomes.

Here are the highlights:

Multi-Touch Attribution Models

Dreamdata provides a buffet of attribution models: first-touch, last-touch, W-shaped, time decay, and even fancy “data-driven” models.

In fact, it offers seven out-of-the-box multi-touch models, so you can slice and dice credit for a sale across all the touches that led up to it.

Marketers can finally move beyond the simplistic “last click wins” approach.

Of course, with great flexibility comes great complexity.

More models mean more chances to argue with your colleagues over which model is “right” for your business. (Spoiler: none are perfect.)

Plus, by aggregating data from your CRM, website, ads, etc., into a single timeline, Dreamdata helps expose how that whitepaper download, webinar, and six LinkedIn ad clicks all contributed to a deal.

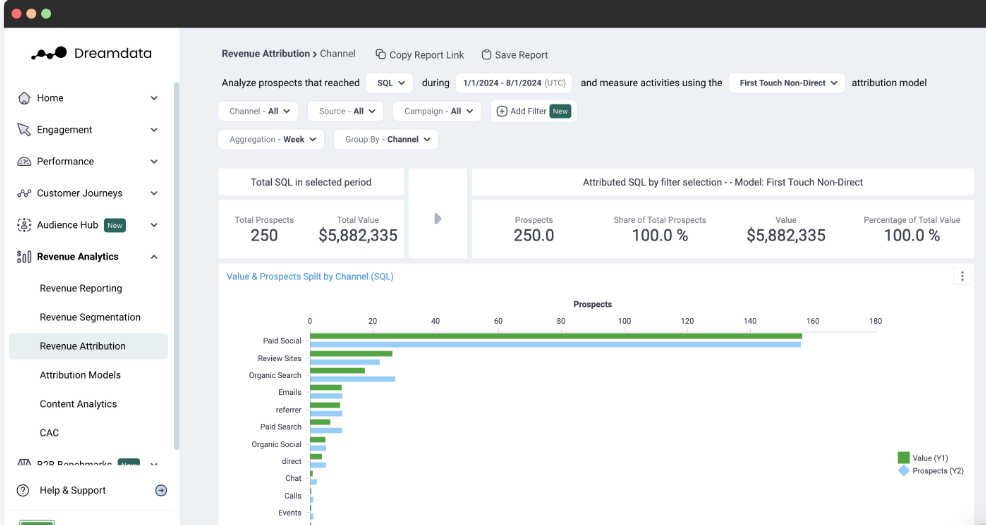

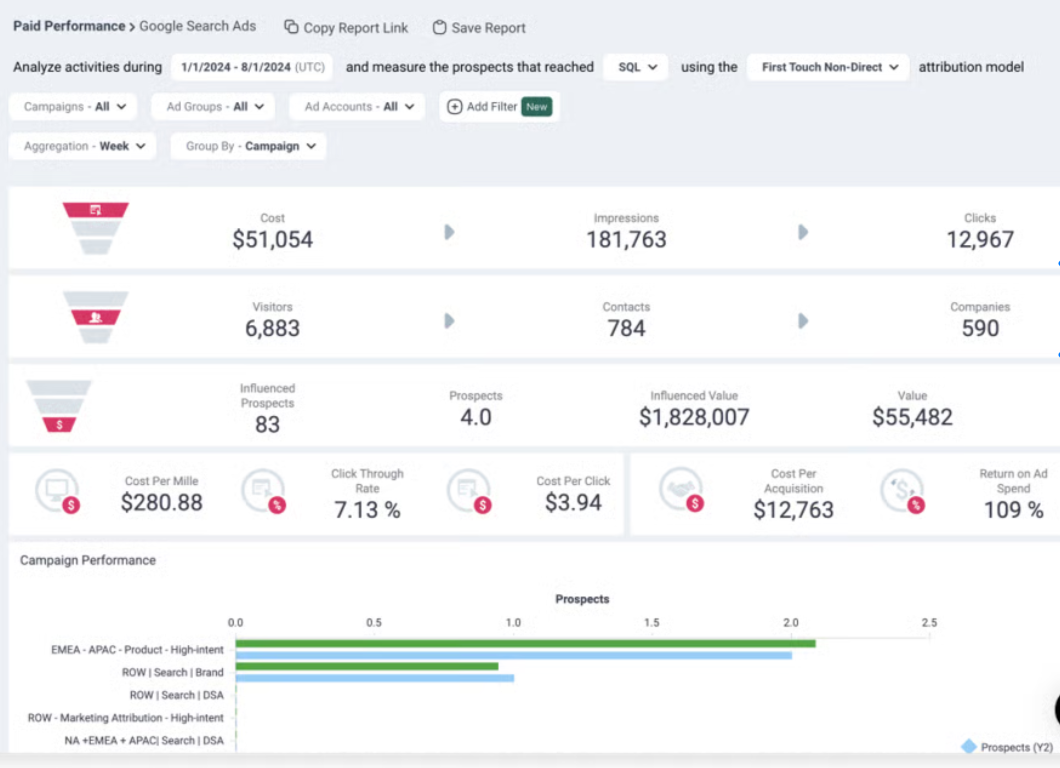

Revenue Analytics & Funnel Reporting

The platform doesn’t stop at attribution models.

It rolls up data into slick revenue analytics dashboards, showing pipeline and ROI by channel, campaign, and content piece. etc.

You can track metrics like Time to Revenue (the time from first touch to closed deal) and view pipeline velocity by stage.

Dreamdata basically builds a complete B2B customer journey map for each account, then lets you report on it from multiple angles.

In practice, some users on G2 mention that not all pre-built reports are equally useful, and it can take a while to figure out which ones actually matter for your business. The learning curve is real (more on that shortly).

By the way, ZenABM also provides detailed plug-and-play account-based LinkedIn ad revenue attribution dashboards for a starting price of just $59/month.

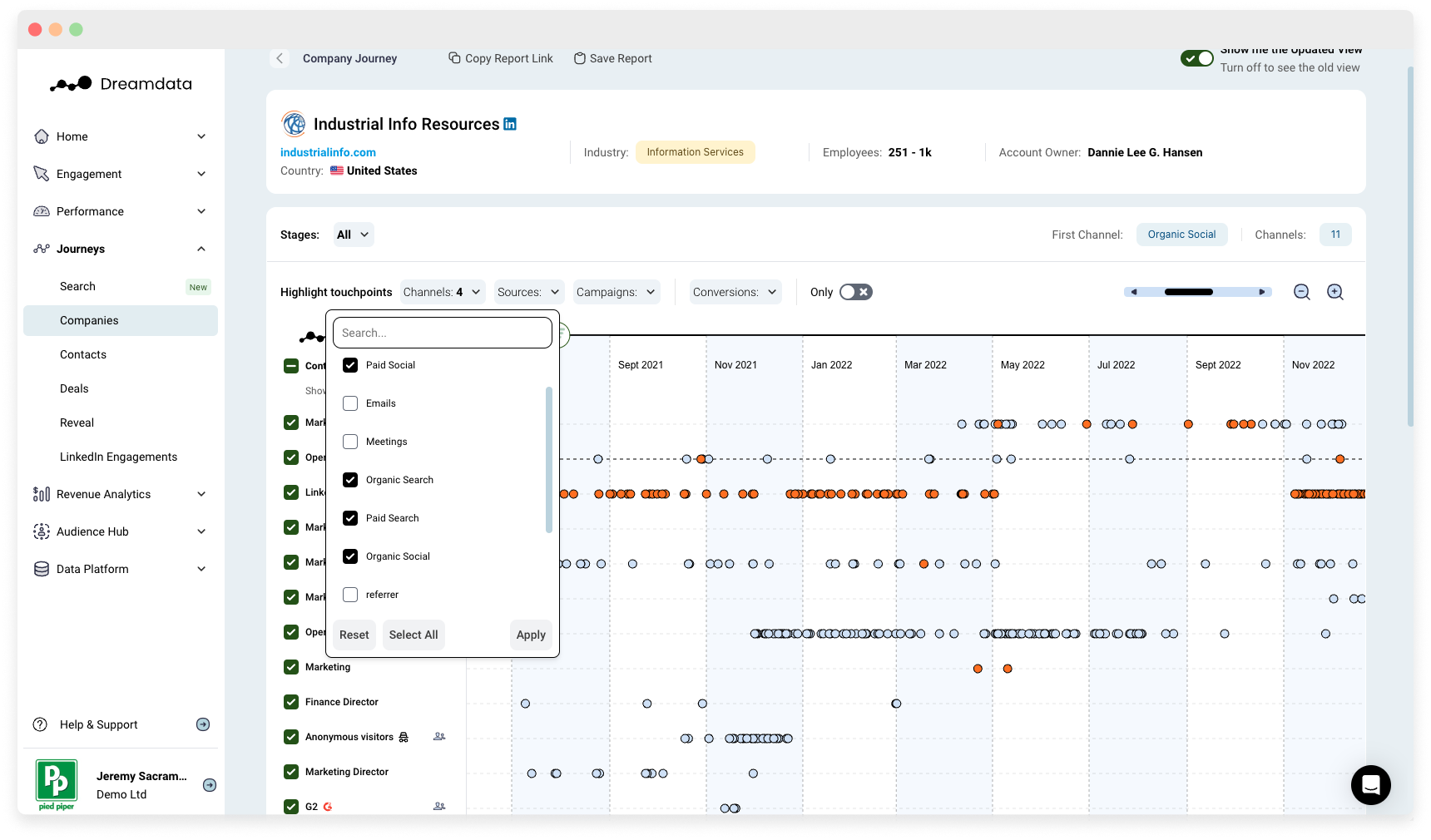

Account-Based Data Views (ABM Capabilities)

Dreamdata is keen to position itself as an ABM ally.

It automatically organizes all those individual touchpoints into account-level journeys, so you see how an entire buying committee moved from initial engagement to close.

There’s an “ABM view” that marketers love to whip out to prove their influence.

One marketing director joked that whenever Sales brags about a “sales-generated” deal, her team flashes the Dreamdata ABM view showing how Marketing “surrounded that account across multiple channels for months.”

In other words, Dreamdata helps marketers claim credit (and rightfully so) for warming up target accounts.

It also tracks account-level engagement.

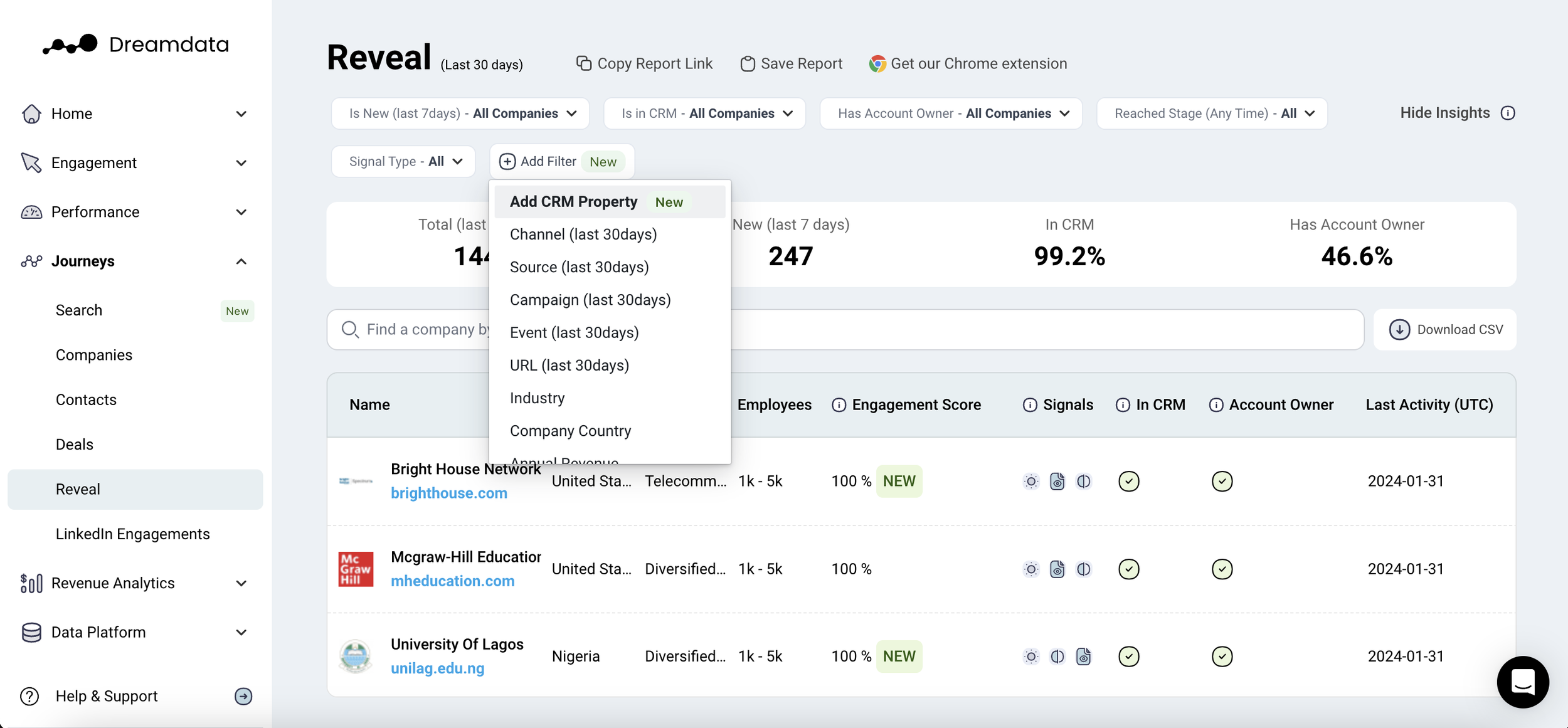

The “Reveal” module identifies which companies are engaging with your brand most, scores their activity, and even flags when an account that fits your ICP visits your site or interacts with your content.

Audience Building & Activation

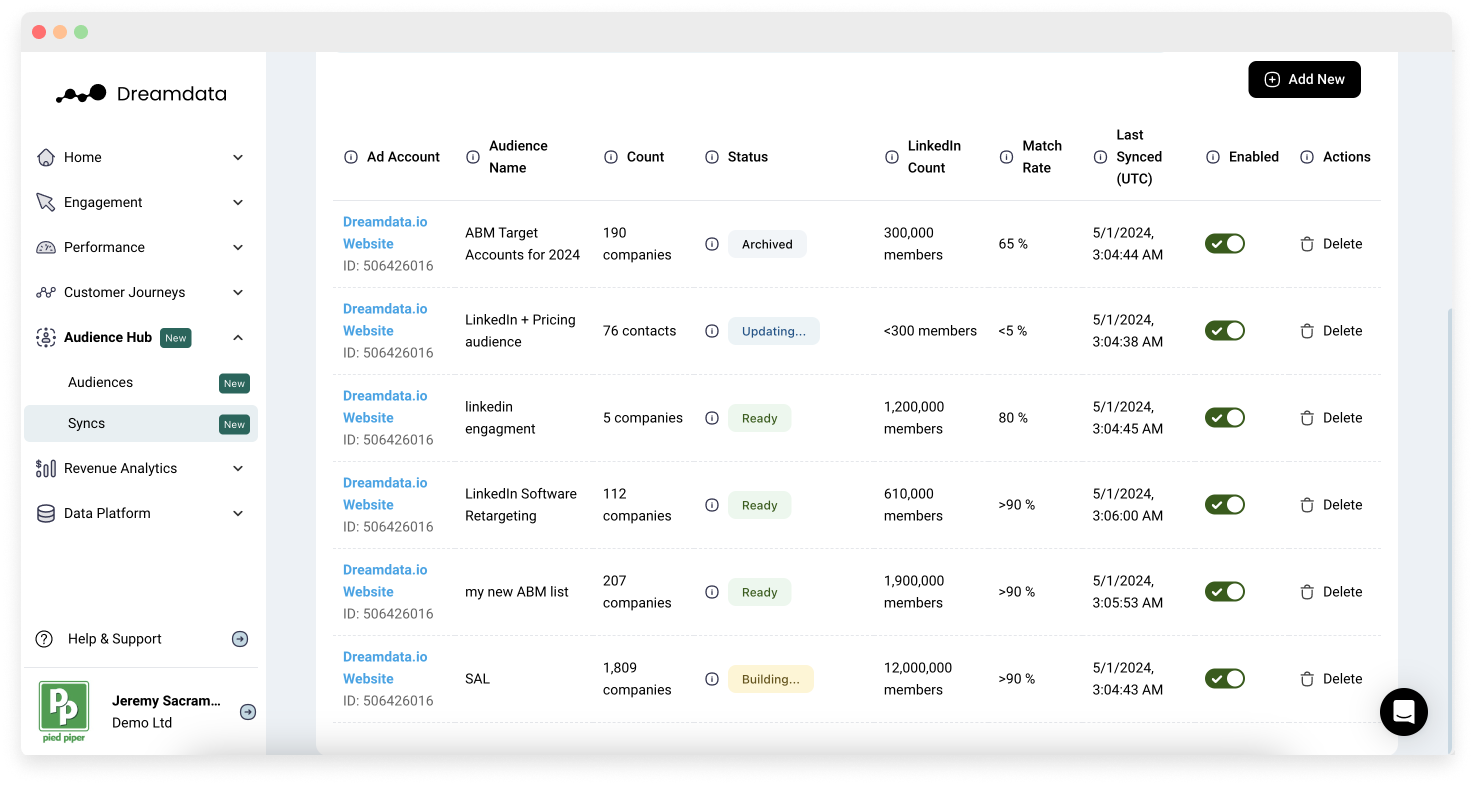

Beyond analytics, Dreamdata ventures into light Customer Data Platform (CDP) territory.

It lets you build precise audiences using “unlimited filtering” across all your data, and then sync those audiences to major ad platforms.

Example: You could create a segment of all accounts that visited your pricing page twice in the last week and push that list to LinkedIn for a retargeting campaign.

Dreamdata’s Audience Hub makes this possible without a data engineer on staff.

It also recently launched one-click conversion syncing to ad platforms.

This means if a lead becomes an SQL or a deal closes in your CRM, Dreamdata can auto-feed that event back into Google, Facebook, LinkedIn, etc., helping their algorithms optimize for actual revenue, not just form fills.

Integrations

Dreamdata boasts 40+ integrations spanning CRMs, marketing automation, ads, analytics, and more.

Big ones:

- Salesforce

- HubSpot

- Microsoft Dynamics

- Marketo/Eloqua

- Google Ads

- LinkedIn Ads

- Facebook/Meta Ads

- Bing Ads

- Twitter Ads

- G2 intent data

- Capterra

- Segment

- Data warehouses

- Outreach

- Salesloft

- Slack

Dreamdata Pricing: How Much Does It Cost?

Dreamdata isn’t the most transparent about pricing on its homepage.

Here’s what we know:

- Free Plan: Dreamdata offers a free tier, which is relatively rare for B2B attribution tools. The free plan includes the basics: account-level tracking, revenue analytics, attribution, audience building, and even intent signals (like their account Reveal). It might cap how much data or how many integrations you can use. Think of it as a toe-in-the-water, not a long-term solution for a serious marketing team (unless your needs are extremely simple).

- Paid Plans: According to G2 and TrustRadius, Dreamdata’s “Activation Starter” plan starts at $750 per month. This likely unlocks more integrations and data volume. For advanced attribution features, there’s an “Attribution Advanced” tier, which is enterprise (Contact Us) pricing. Dreamdata’s pricing positions it as a premium solution; several reviewers mention it’s priced higher than competitors in the attribution space. And unlike some competitors, there’s no simple self-serve credit card signup for the high-end plan – you’ll be in enterprise negotiation land. This can make it hard to gauge the true cost.

- Vendr, by the way, puts the median Dreamdata pricing at $27k/mo.

If you are looking for a leaner yet effective tool, I present ZenABM, starting at just $59/month.

ZenABM offers account-level LinkedIn ad engagement tracking, ad engagement-to-pipeline analytics with plug-and-play dashboards, account scoring, ABM stage tracking, CRM sync, first-party qualitative intent, automated assignment of BDRs to hot accounts, custom webhooks, and ad engagement tracking at the job-title level.

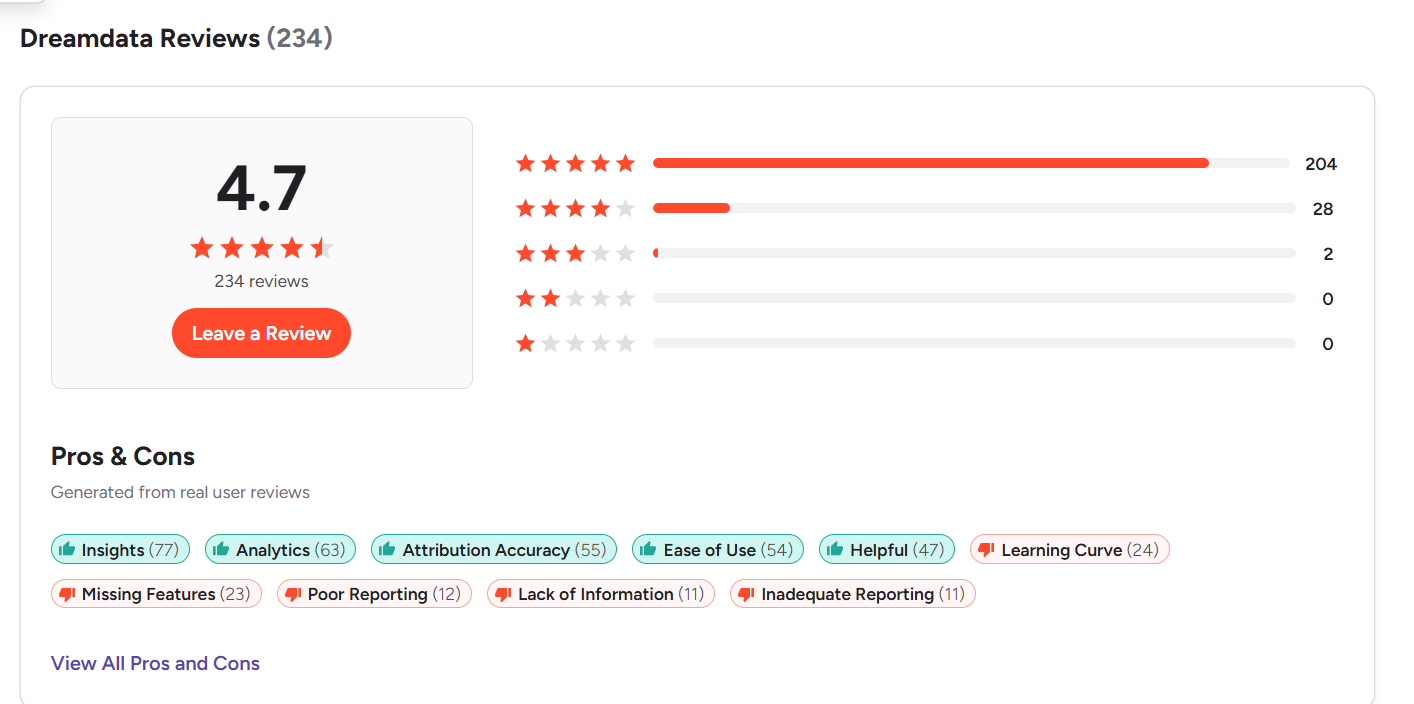

User Impressions and Reviews

No marketing tool is loved by everyone, and Dreamdata is no exception.

I scoured review sites for the common themes in user feedback.

Here’s the consensus from the trenches:

- “We Can Finally See What’s Working!” (Praise): Many marketers sound genuinely relieved that a tool like Dreamdata exists. They’re happy to leave behind the dark days of single-touch attribution. Users frequently praise Dreamdata for providing clarity in B2B funnels that were previously opaque. For instance, one reviewer talked about “deep, nuanced insights” into the marketing and sales funnel, crediting Dreamdata with revealing the multi-channel influence that their CRM and Google Analytics couldn’t show. Others love how it “gives us the full picture” of customer journeys and helps decide which campaigns actually drive the pipeline. Content marketers mention using Dreamdata to prove that their top-of-funnel efforts (like blogs or webinars) contributed to downstream revenue (something hard to do before). And almost everyone appreciates the ability to measure Return on Ad Spend (ROAS) more holistically. A marketing director on G2 said, “Without Dreamdata, I’d still be relying on first/last touch and likely over- or under-investing in channels”. Now she uses Dreamdata daily to watch how content and ads influence conversions. Another user gave a concrete win: integrating Dreamdata with LinkedIn showed a 3× increase in companies reached and lowered cost per SQL, which made it easier to justify ad budget to leadership. Several reviews also praise Dreamdata’s customer support team, calling them “awesome” and “super helpful” in getting set up and answering questions.

- “It’s Powerful… Once You Figure It Out” (Pain Points): On the flip side, users don’t hold back about Dreamdata’s quirks and shortcomings. A common gripe is the usability and learning curve. One enterprise user gave Dreamdata a lukewarm 3.5/5, saying they “really wish Dreamdata had the capability [to] compare two time periods like Google Analytics” and noted limited ways to customize views of the data. The limited customization complaint pops up often – marketers want to tailor reports or dashboards more than Dreamdata easily allows. There’s also the issue of not using 100% of the tool: “Some pre-built reports aren’t that valuable, I don’t find myself using 100% of Dreamdata”, said one reviewer, who also mentioned the UI isn’t super intuitive for new users. Newbies can feel overwhelmed by the myriad menus (Customer Journeys, Attribution, Revenue Analytics, Signals, etc.). As another user put it, “there are new features all the time, which is great, but some core elements could be improved” – a polite way of saying the product sometimes prioritizes shiny new features over polishing the basics. Data setup is another recurring theme: Dreamdata is only as good as the data you feed it. One candid reviewer said there’s nothing bad to say about Dreamdata itself, “The only downside is that you have to connect all data sources and make sure you’re sending the right data – garbage in, garbage out.” It took their team 2–3 weeks to get everything set up correctly. So, expect a significant onboarding period where you’re aligning tracking, fixing CRM data hygiene issues, and generally cleaning house.

- Common Gripe: Price and ROI: It’s worth noting that a few users mention cost as a pain point. Not surprising given the earlier pricing discussion. “Dreamdata is priced higher than its competitors,” one industry blog observed bluntly, summarizing user reviews. If a marketing team invests big bucks in an attribution tool, they expect big returns (or at least time savings).

ZenABM: A Lean First-Party LinkedIn ABM Alternative

One alternative to Dreamdata is ZenABM.

It is specifically designed for LinkedIn ABM, so it can either be a complete, lean and affordable alternative to Dreamdata for teams that mainly advertise on LinkedIn.

Even for teams running multi-channel ABM, ZenABM can be a complementary layer to Dreamdata or whichever bigger ABM suite they are using because of ZenABM’s unique features.

Let’s look at those features:

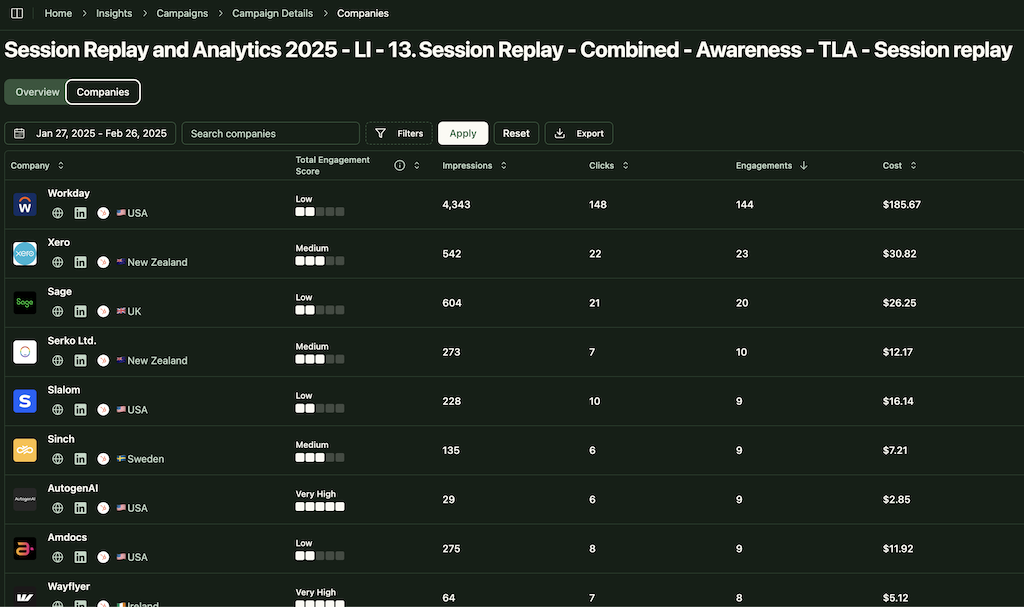

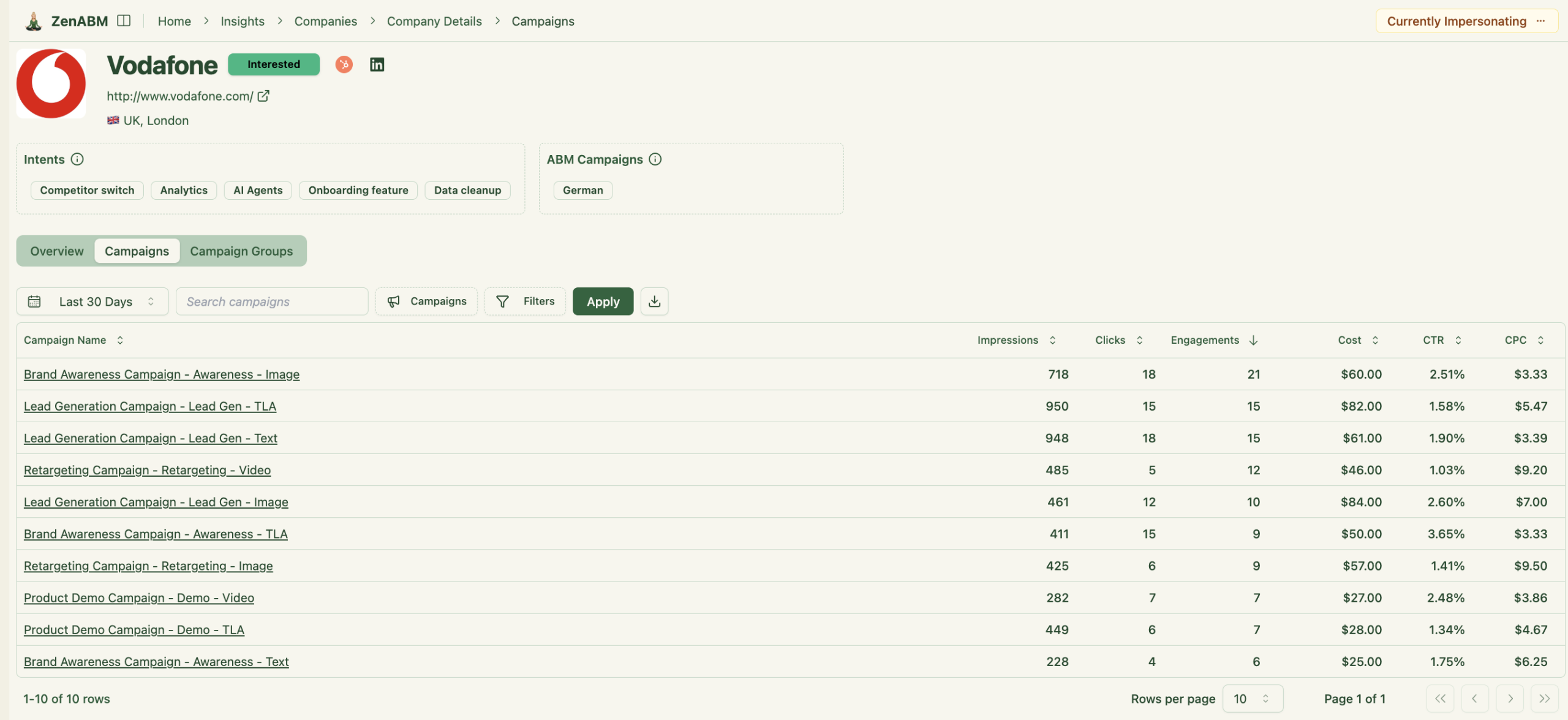

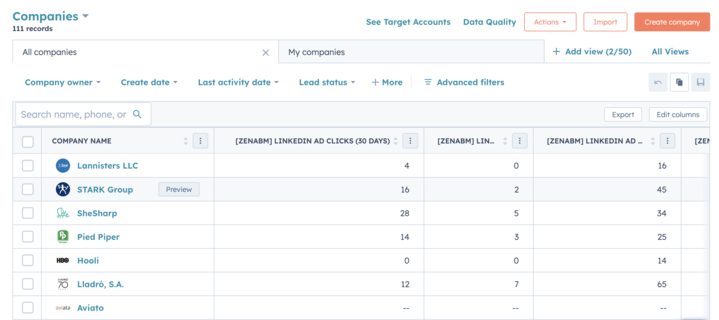

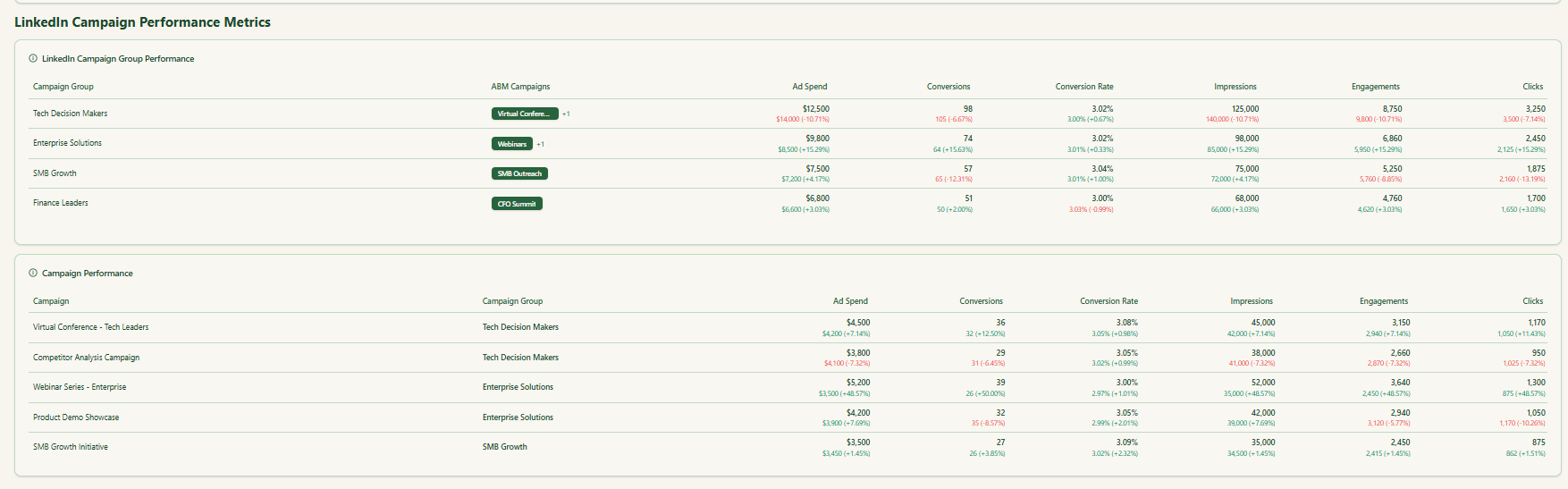

LinkedIn Ads Engagement at the Account Level

ZenABM integrates directly with the LinkedIn Ads API to pull account-specific data from all campaigns.

This allows you to identify precisely which target accounts are interacting with your LinkedIn ads (impressions, clicks, etc.), all mapped to individual companies.

Pro Tip: ZenABM can also reveal anonymous website visitors for free. Retarget them with inexpensive LinkedIn text ads, and ZenABM will identify the companies that saw your impressions.

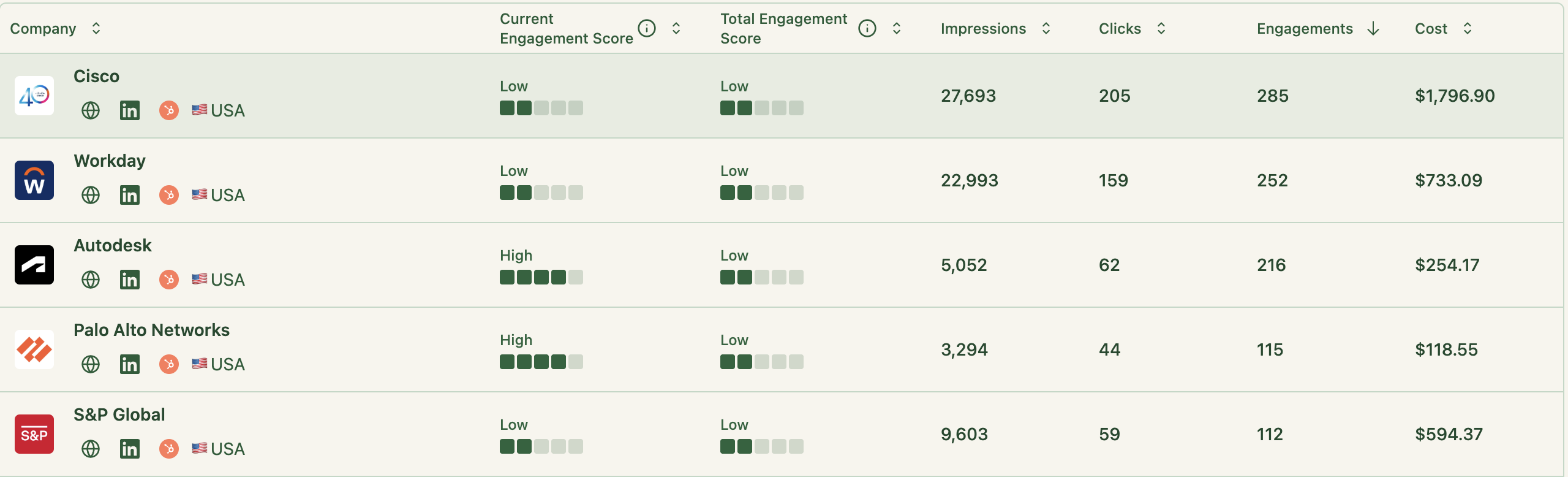

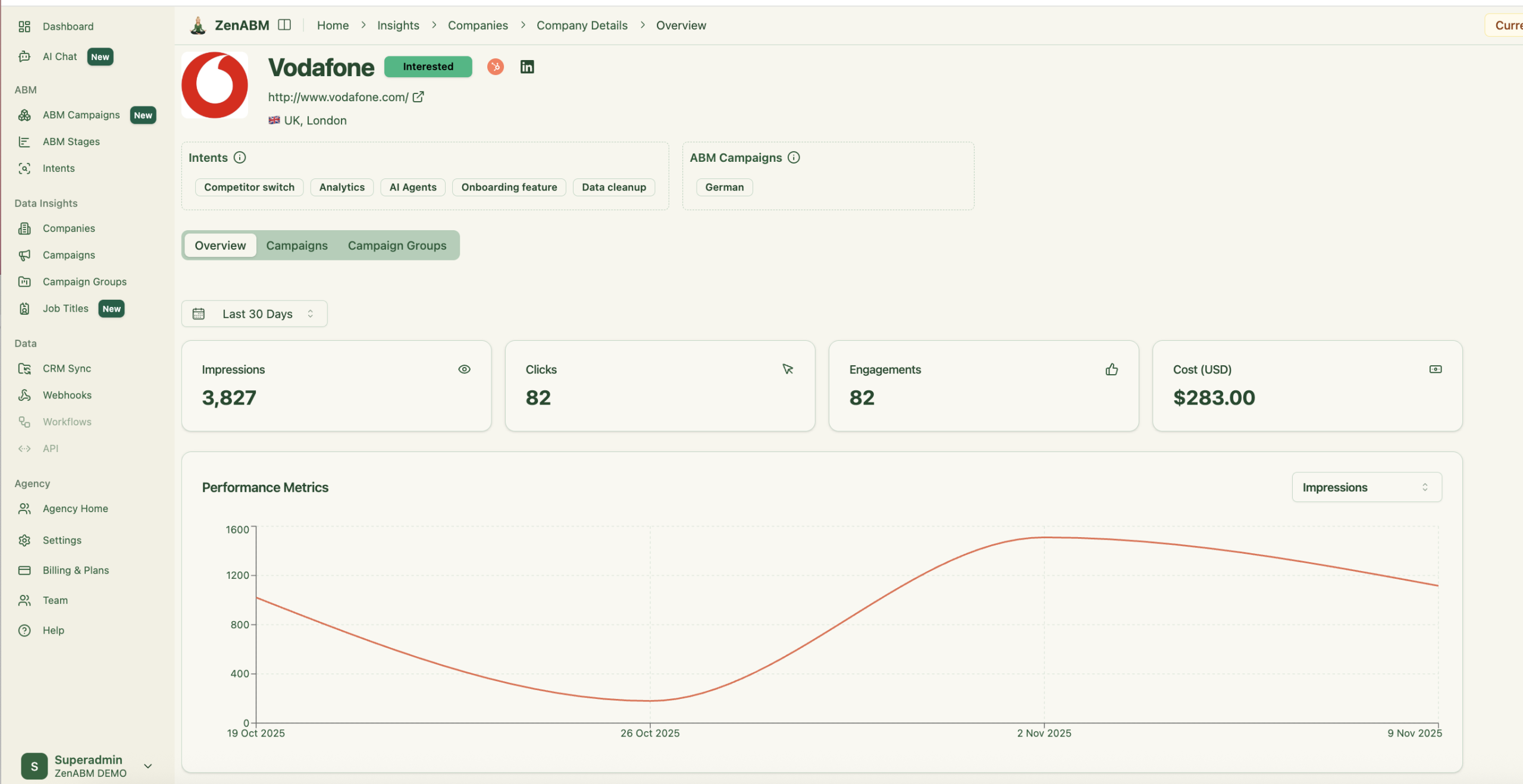

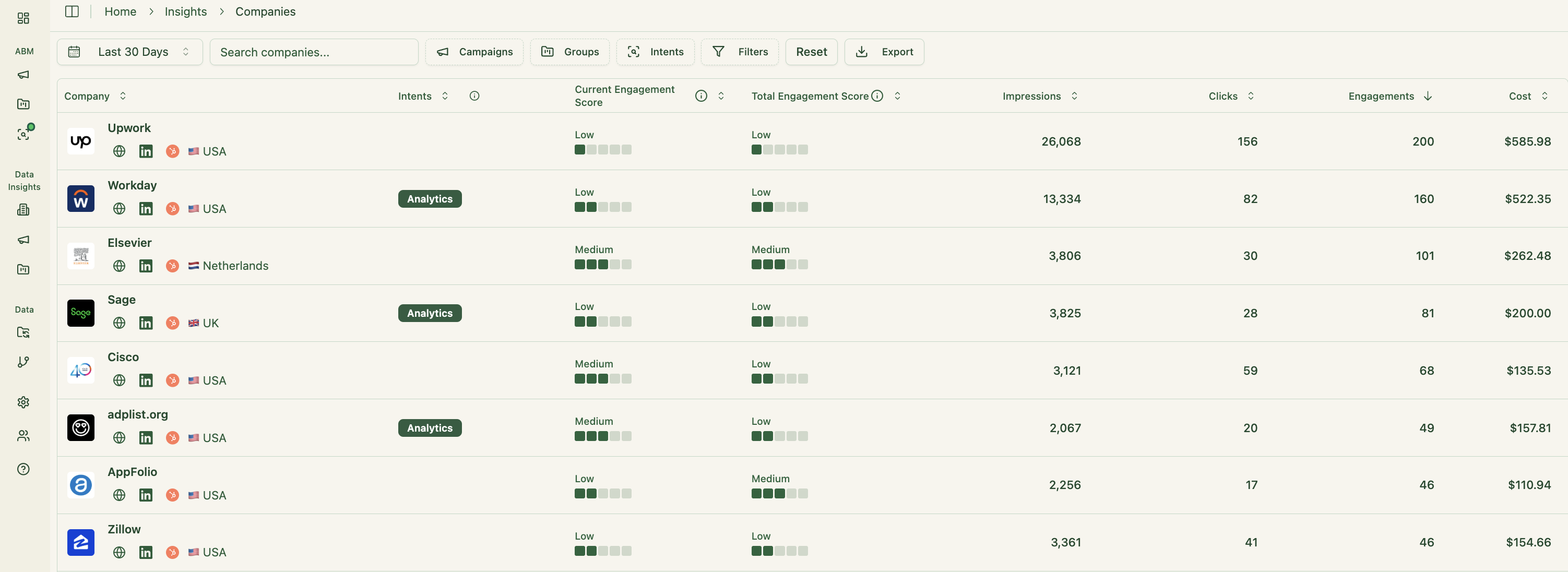

Real-Time Engagement Scoring + Full Touchpoint Timeline

ZenABM continuously updates engagement scores from ad interactions. You can monitor recent trends (like the past week) or historical patterns to identify accounts heating up.

These scores help marketing and sales prioritize high-value accounts for follow-up.

Plus, the tool displays the full touchpoint timeline of each account:

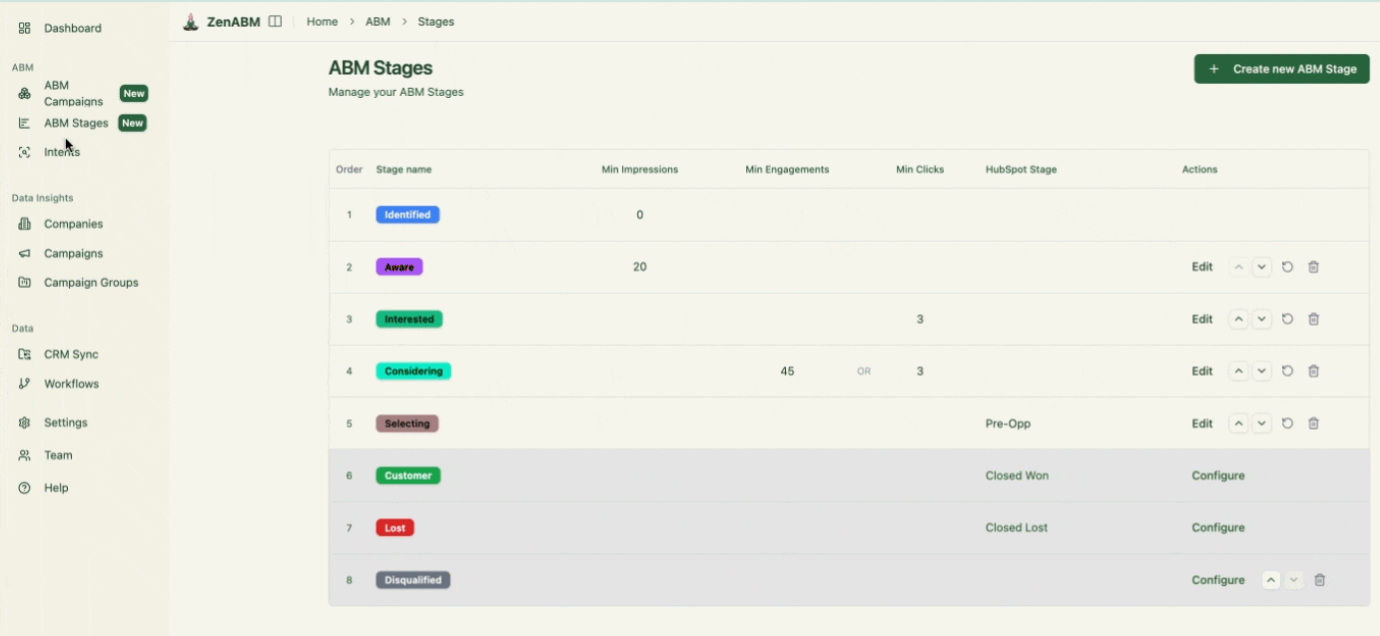

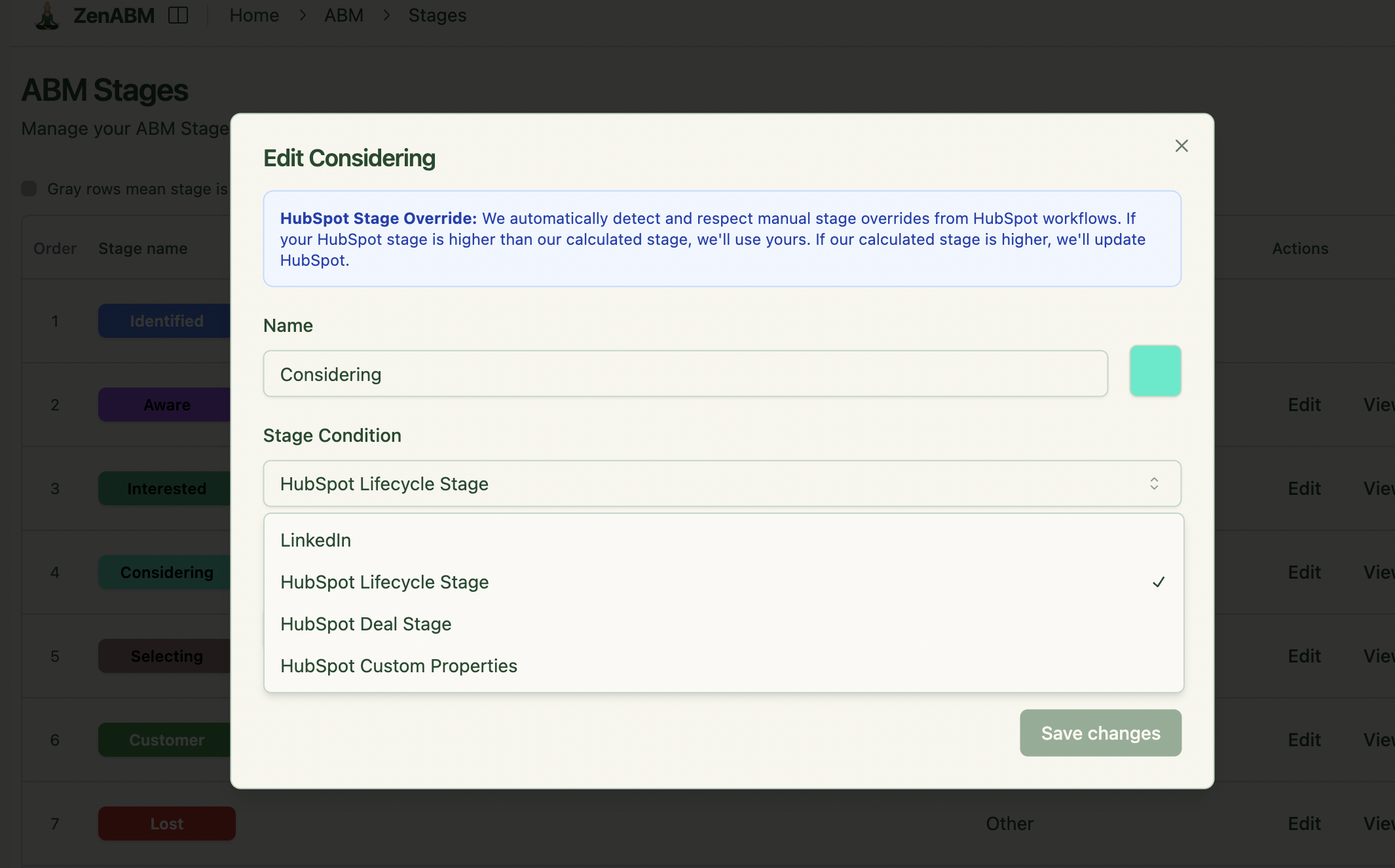

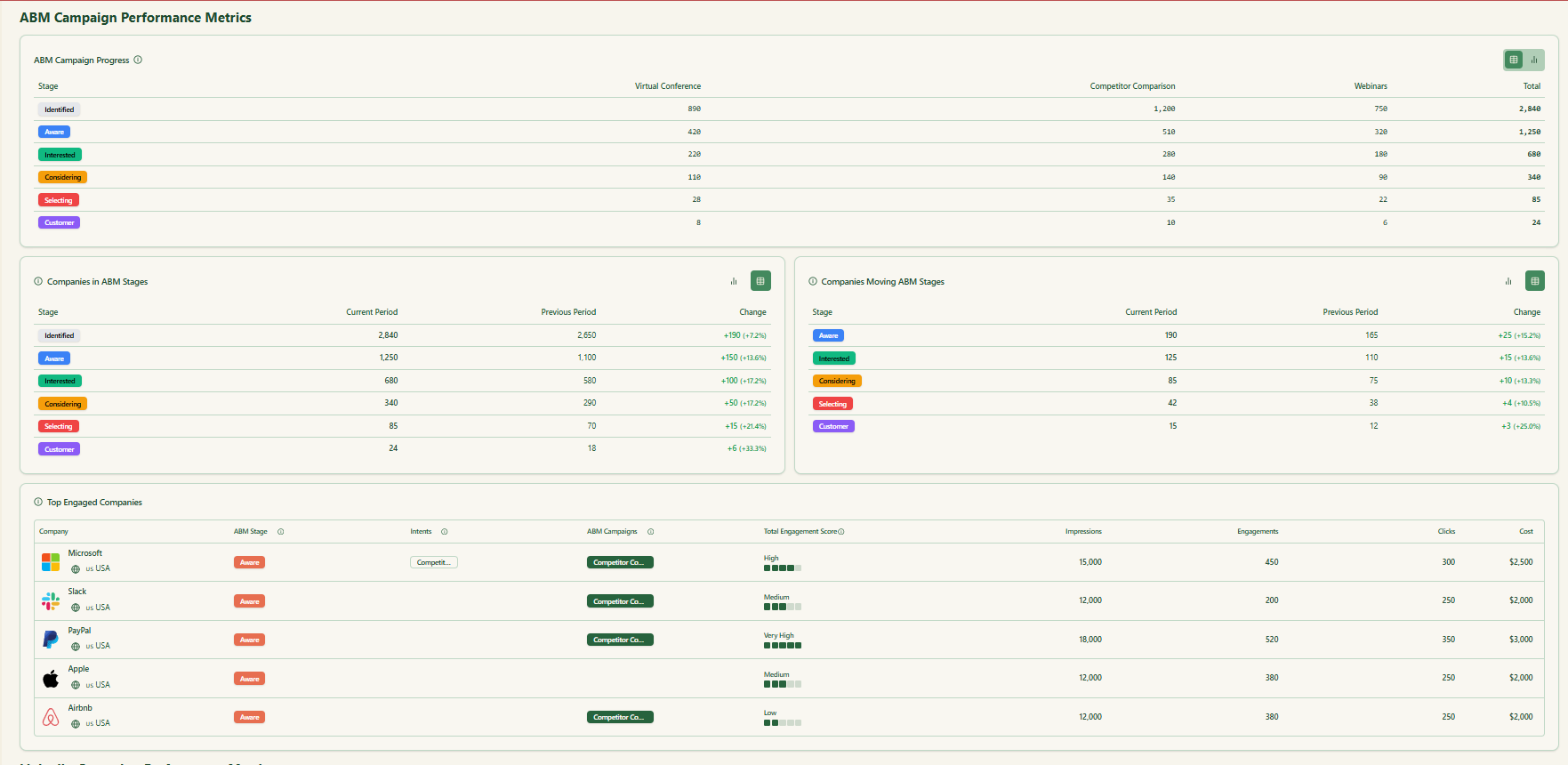

ABM Stage Tracking

ZenABM enables you to define your ABM funnel stages (e.g., Identified → Aware → Engaged → Interested → Opportunity) and automatically classifies accounts using engagement and CRM information.

You can set your own thresholds for “Engaged” or “Interested,” and ZenABM will track stage transitions automatically.

This delivers full-funnel visibility like enterprise ABM platforms, highlighting where accounts stall and where progress accelerates.

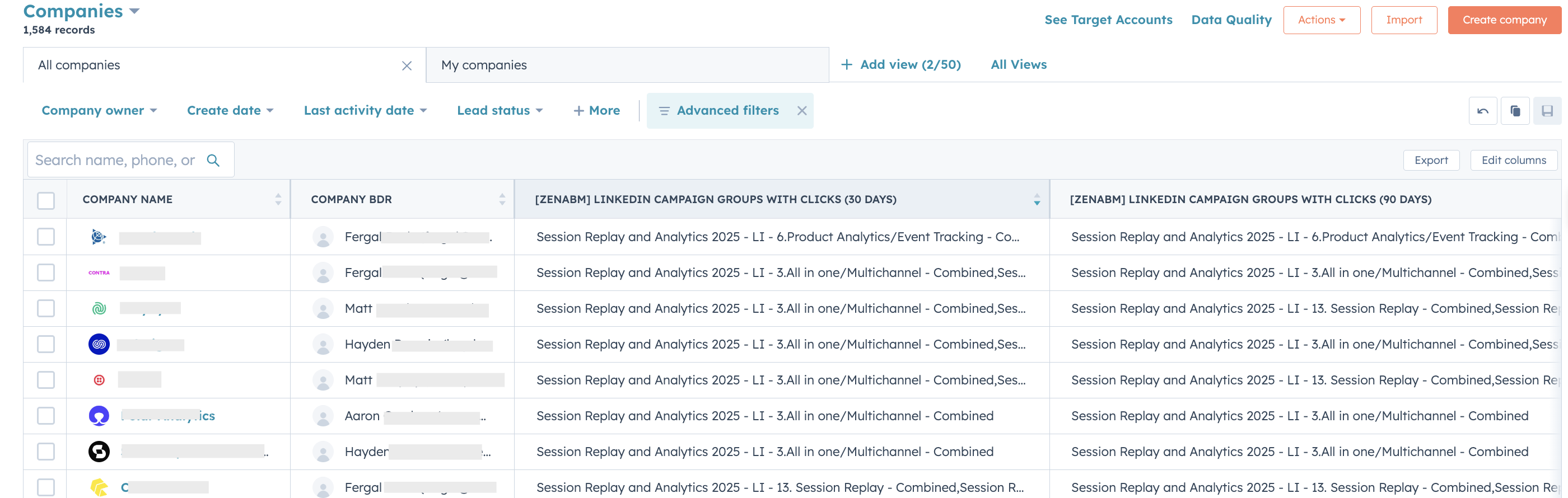

Bi-Directional CRM Integration and Workflows

ZenABM integrates bidirectionally with CRMs such as HubSpot (Salesforce available on higher plans).

LinkedIn engagement data feeds directly into your CRM as company-level properties, keeping sales teams informed:

ZenABM can auto-update account stages to “Interested” when engagement passes a set threshold and assign accounts to specific BDRs for follow-up.

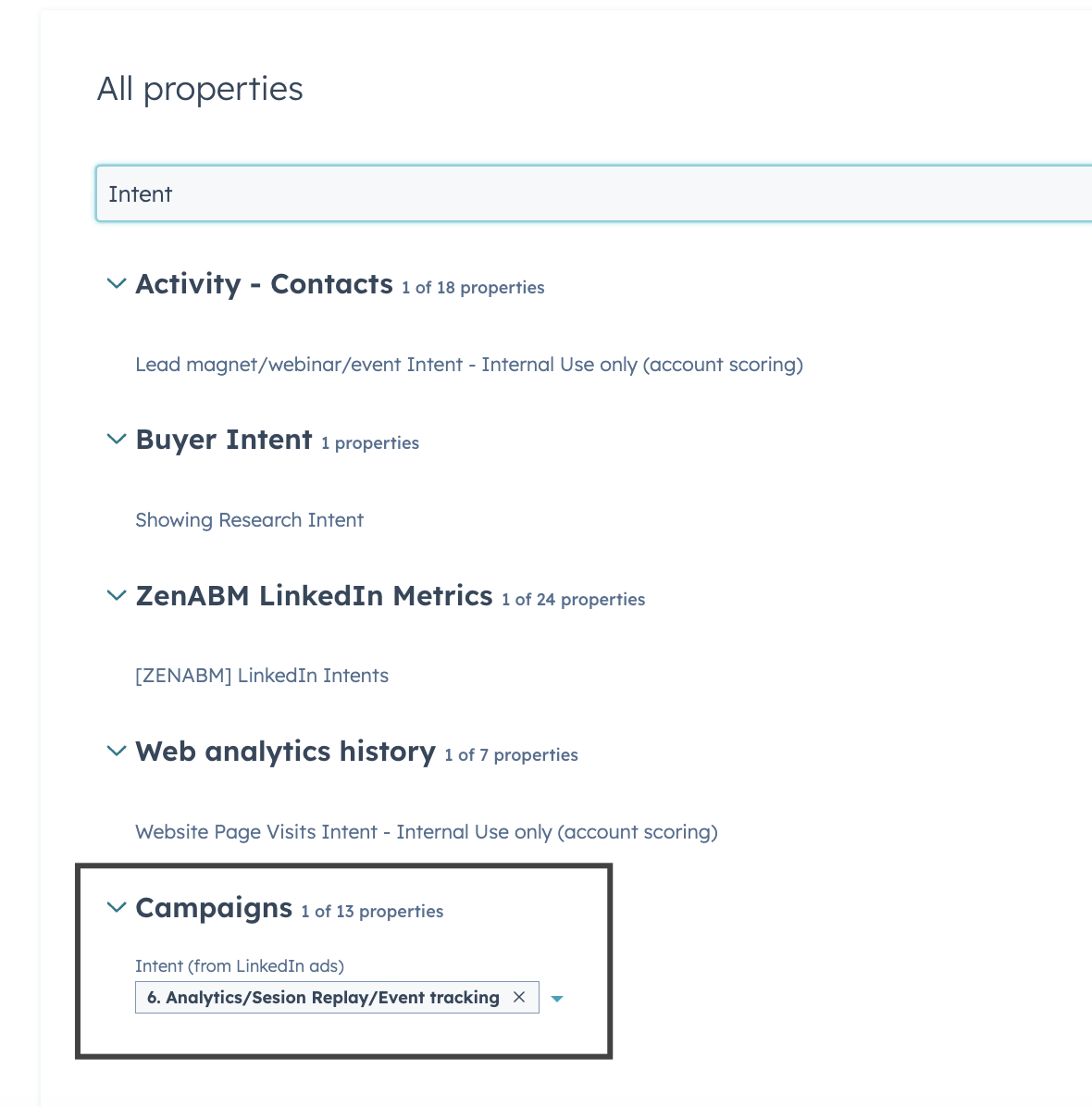

Intent Tagging from LinkedIn Ads Engagement

ZenABM allows you to tag campaigns by theme (like “Feature A” vs. “Feature B”) and shows which accounts engage with which themes, revealing their priorities.

This is genuine first-party intent. Instead of paying for inferred keyword interest, you get direct proof like Account Z clicking “Feature A” ads, demonstrating actual buying interest.

These insights also sync to your CRM, supporting highly targeted outreach and relevant messaging.

Your sales reps can instantly see which topics or pain points each account reacts to most.

This feature is fairly unique to ZenABM, making it a worthwhile add-on even if you already have an existing subscription to some other ABM tool.

Job-Title Analytics

ZenABM also gives a breakdown of the specific job titles that interact with your ads.

Raw metrics, dwell time, full video funnel – all available out of the box.

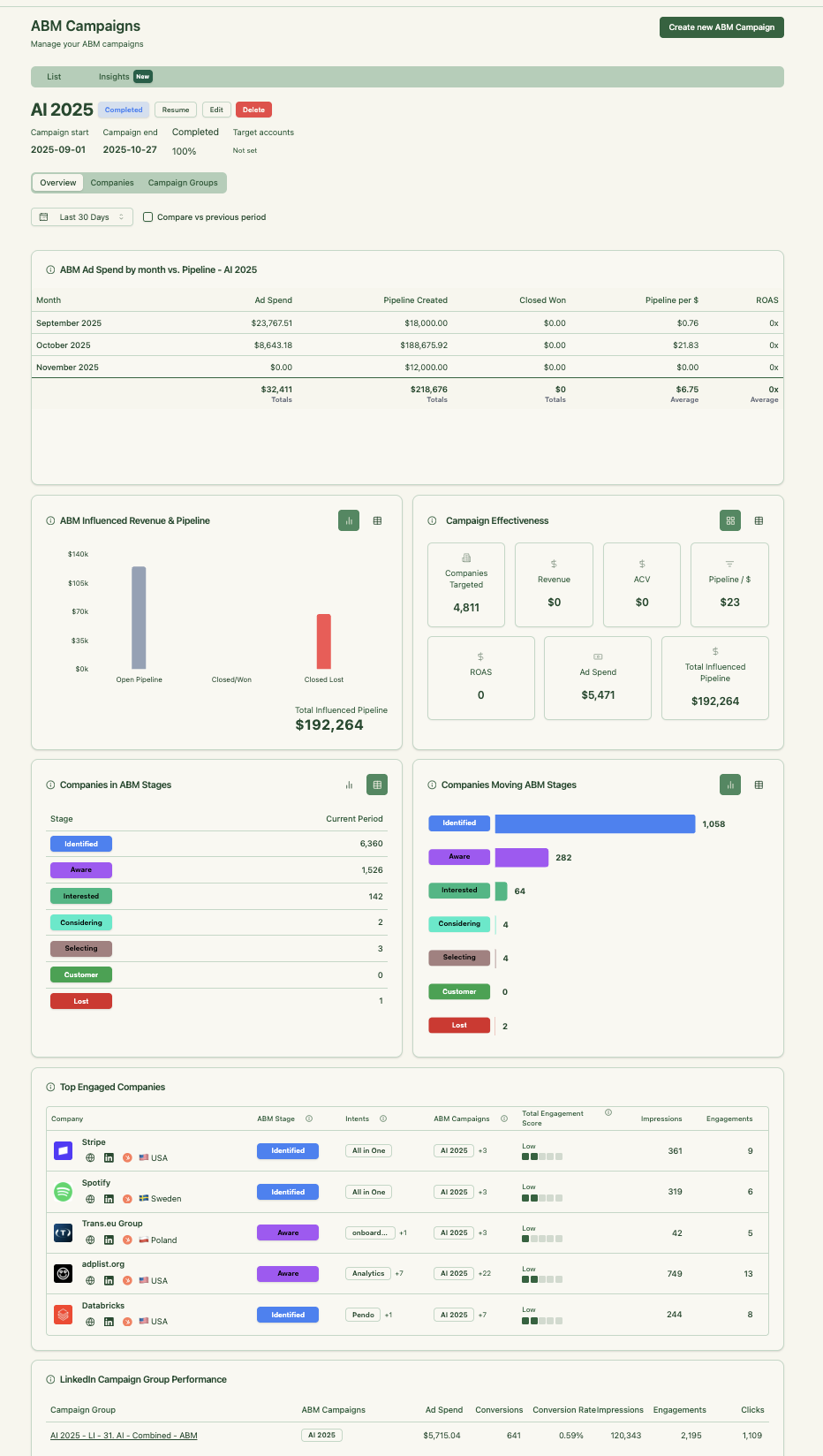

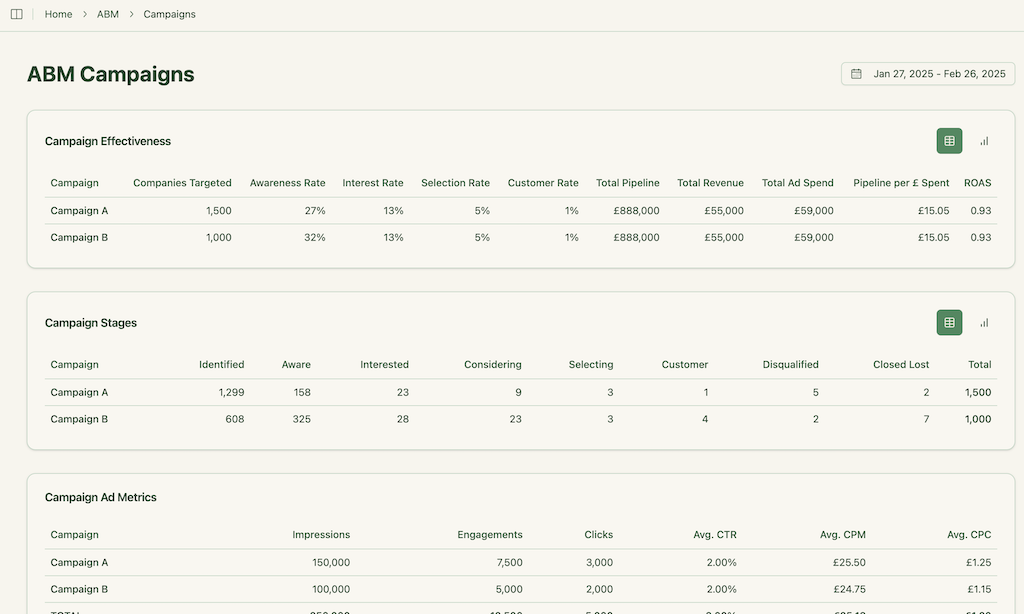

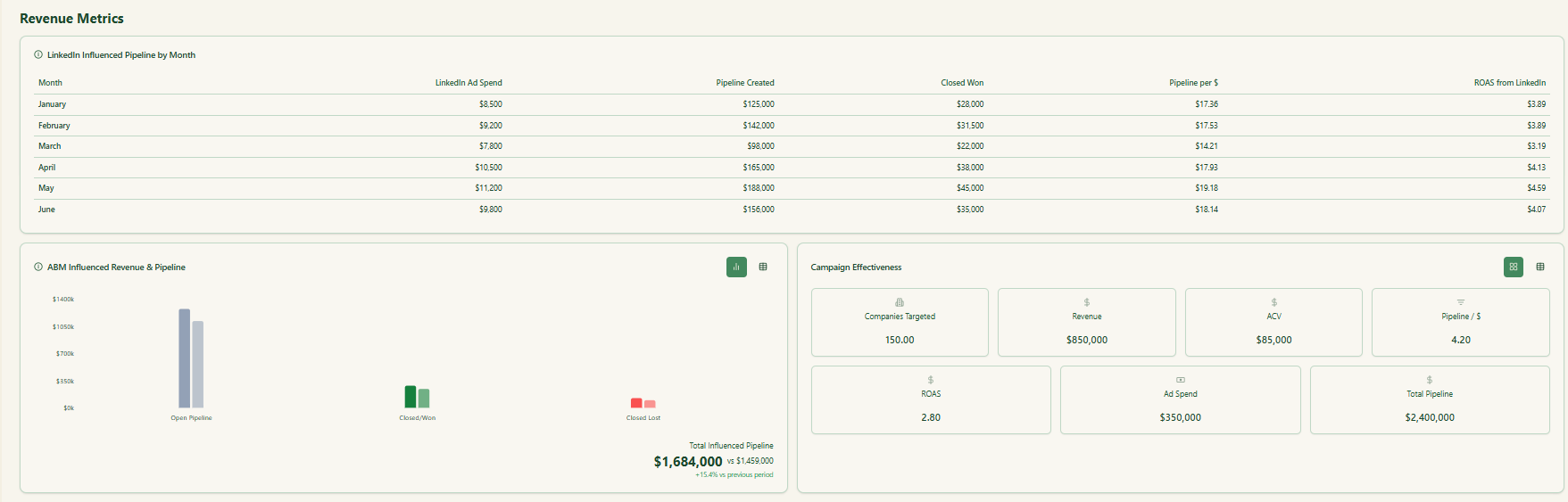

Built-in Dashboards and ABM Analytics

ZenABM includes pre-built ABM dashboards linking ad exposure, engagement, funnel stages, and pipeline metrics.

- Track performance across campaigns, LinkedIn groups, and individual ads:

- ZenABM tracks both deal size and ad spend per account/campaign, enabling ROAS, pipeline per dollar, and campaign-driven revenue insights. Revenue teams can use this to optimize engagement and accelerate deal closure rather than focusing on vanity metrics

ABM Campaign Objects for True Multi-Campaign Attribution

Unlike standard analytics tools that treat every LinkedIn campaign separately, ZenABM lets you combine multiple campaigns into one ABM campaign object.

This gives a unified view of performance across markets, persona variations, or creative groups.

You can see total influenced pipeline, account movement, spend, ROAS, and progression for the entire initiative instead of fragmented reports inside Campaign Manager.

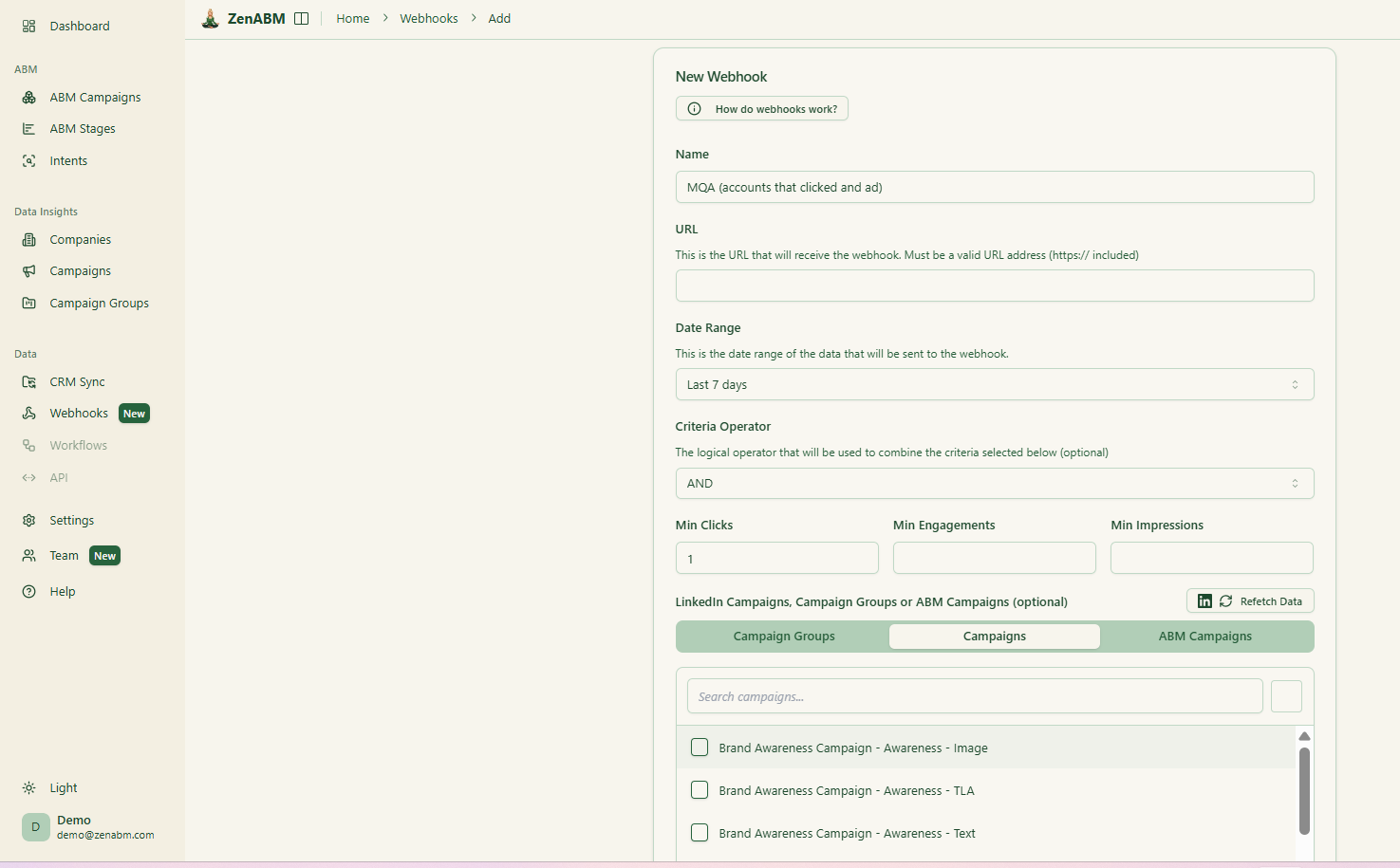

Custom Webhooks

With the newly rolled out custom webhooks, ZenABM can fit into any of your workflows as needed.

AI Chatbot to Analyze Your LinkedIn and ABM Data

ZenABM now includes an AI chatbot layered on top of your LinkedIn API data and processed ABM insights.

Instead of exporting CSVs or building Looker dashboards, you can literally ask questions like “Which accounts moved from Interested to Selecting last month” or “What is my pipeline per dollar across retargeting campaigns” in natural language.

The AI pulls from raw ad engagement, ABM stages, intent tags, campaign groups, and CRM properties to give instant, contextual answers.

Multi Client Workspace for Agencies

ZenABM now supports agencies with a dedicated multi-client environment.

Agencies can manage unlimited ad accounts and clients in one place, with separate dashboards, ABM campaigns, and client-specific analytics.

This removes the headache of switching accounts in LinkedIn Campaign Manager.

ZenABM Pricing

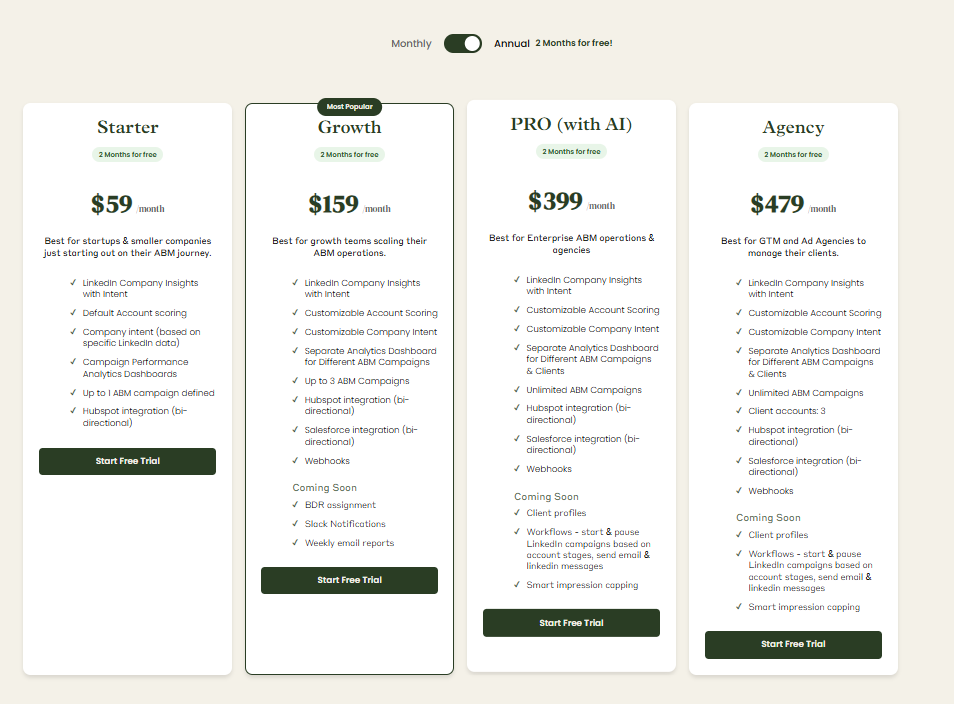

Plans start at $59/month for Starter, $159/month for Growth, $399/month for the Pro (AI) tier, and $479/month for the agency tier.

Even the highest tier costs under $6,000/year, far less than Dreamdata.

All plans cover essential LinkedIn ABM functions, with higher tiers mostly expanding limits or adding Salesforce integration.

Pricing is flexible (monthly or annual with two months free), and a 37-day free trial allows teams to try before buying.

Conclusion

Dreamdata is powerful, but it comes with enterprise weight, enterprise complexity, and enterprise pricing.

If you need multi-touch attribution across a sprawling go-to-market motion, it does the job, provided you have the patience and budget to match.

But if your growth engine leans heavily on LinkedIn and you care more about seeing which accounts are engaging, moving stages, showing intent, and generating pipeline right now, a leaner tool wins.

ZenABM gives you that focus with first-party account-level LinkedIn insights, a cleaner setup, predictable pricing, and fast visibility into what is working.

For many teams, it is the more practical choice, and for others, it is the perfect complement.

The 37-day free trial makes the decision pretty painless.