When my marketing team at Userpilot first dabbled in LinkedIn ABM, we quickly learned one thing: identifying intent signals is the secret sauce to driving pipeline. In fact, that early campaign generated nearly $900k in pipeline because we doubled down on accounts showing buying intent. But back then, we had to do it the hard way – lots of manual tracking and guesswork. Fast forward to today: my partner founded ZenABM to make capturing LinkedIn intent signals a breeze. In this post, I’ll share how to detect those intent signals on LinkedIn (from first-party engagement to third-party intent data) and compare the best tools that help along the way.

Summary – All You Need to Know About LinkedIn Intent Signals in a Nutshell

- What are intent signals? They’re the behavioral clues that a target account is “in market” – e.g. engaging with your LinkedIn ads, visiting your website, searching certain keywords, etc. Only about 5% of your total addressable market is actively buying at any given time:contentReference[oaicite:0]{index=0}, so intent signals help you pinpoint that 5%.

- First-party vs Third-party intent: First-party intent comes from interactions with your assets (LinkedIn ad clicks, your site visits, email opens):contentReference[oaicite:1]{index=1}. Third-party intent comes from external behavior (research on 3rd-party sites, content consumption across the web):contentReference[oaicite:2]{index=2}. First-party signals are proprietary and precise to your solution:contentReference[oaicite:3]{index=3}, while third-party data casts a wider net to find who’s generally researching a topic.

- Why LinkedIn for ABM intent: LinkedIn is a goldmine for B2B intent signals. You can target specific accounts with ads and then see exactly which companies engage (impressions, clicks, etc.). A LinkedIn ad click from your target buyer is a strong buying signal – they’re actively interacting with your content in a professional context. We found at Userpilot that when multiple people at an account clicked our LinkedIn ads, that account was very likely to book a demo.

- Native LinkedIn tools have limits: LinkedIn’s Campaign Manager has a “Companies” report that shows which companies engaged with your ads:contentReference[oaicite:4]{index=4}, but it aggregates data across all campaigns. You can’t tell which ad or message sparked their interest:contentReference[oaicite:5]{index=5}. For true ABM, you need per-account, per-campaign insight.

- Tools to automate intent detection: New ABM tools help you capture and act on these signals. First-party intent platforms like ZenABM pull in LinkedIn ad engagement data at the account level (so you see exactly which company clicked which ad) and sync it to your CRM with intent scores. Third-party intent providers like Bombora or 6sense monitor broader buyer research activity to surface “in-market” accounts. And data enrichment tools like Clearbit can reveal which target companies are visiting your site (another form of intent). Each has its role – often the best strategy is a smart combo.

What Are Intent Signals in ABM?

In account-based marketing, intent signals are the breadcrumbs that tell you a target account is interested in what you offer. Think of them as buyer “hand raises” – actions that suggest an account is actively researching or considering a solution like yours. These signals can be:

- On-platform engagement: For LinkedIn ABM, this means a target account’s employees viewing, clicking, or commenting on your LinkedIn ads. For example, if several people from Acme Corp download your LinkedIn-sponsored case study, that’s a solid intent signal that Acme Corp is exploring solutions.

- Website interactions: Visits to your pricing page, multiple sessions from the same company, webinar sign-ups, content downloads – these first-party interactions on your own site indicate interest. (Clearbit’s tools, for instance, can help identify which company a visitor belongs to, turning anonymous traffic into intent data.)

- Third-party research activity: This is where intent data providers come in. They track if people at a company are consuming content related to your product category across the web. For instance, Bombora’s network monitors 4,000+ B2B sites and can tell if “Company X” is suddenly reading lots of articles about CRM software:contentReference[oaicite:6]{index=6}. That spike (a “surge” score) is a buying signal – even if Company X hasn’t touched your ads or site yet.

The beauty of intent signals is that they help you focus your ABM efforts on the accounts that are heating up right now. Rather than guessing or waiting for a prospect to fill out a form, you watch for these digital cues that say, “Hey, this account is showing interest!” It flips your approach from casting a wide net to zeroing in on likely buyers.

Of course, not all signals are created equal. A single random website visit might be a fluke, whereas multiple senior stakeholders from the same account engaging with your LinkedIn posts and visiting your site within a week screams intent. The key is to gather as many signals as possible and interpret them in context.

First-Party vs Third-Party Intent Signals (What’s the Difference?)

Intent data comes in two flavors: first-party and third-party. Understanding the difference is crucial for ABM on LinkedIn, because it affects how you gather and use these signals.

| Aspect | First-Party Intent Signals | Third-Party Intent Signals |

|---|---|---|

| Source of data | Your own properties and campaigns. These signals come from your touchpoints: LinkedIn ad engagements, your website analytics, emails, product usage, etc. It’s data about how accounts interact with you. | External web activity outside your direct channels. Providers like Bombora aggregate behavior from thousands of websites – things like what topics people at Account XYZ are researching on industry sites, blogs, review platforms, and forums. |

| Examples | Company A had 3 team members click your LinkedIn ad and two visit your pricing page. Company B’s VP of Engineering signed up for your webinar. These are all first-party intent signals you can track directly. | Bombora reports that Company A showed a “surge” in interest for “onboarding software” this week (meaning its employees’ web searches and content consumption on that topic spiked). 6sense might tell you Company B’s executives have been reading Gartner reports about your category. |

| Specificity & context | Highly specific to your product and content. First-party signals show direct interest in your solution – e.g. they clicked your ad or visited your site. This often indicates deeper consideration or familiarity with your brand (or at least your messaging). | Broader and topic-based. Third-party intent indicates a company is interested in a general problem or category, not necessarily you specifically. It’s great for finding companies that fit your ICP and are doing research, but they might not know about your product yet. |

| Data ownership | You own the data. It’s proprietary insight no competitor has:contentReference[oaicite:9]{index=9}. Because it’s based on users engaging with your assets, it’s privacy-compliant by default (they willingly interacted). And you’re not sharing these signals with anyone else – it’s your secret weapon. | Shared and purchased data. Third-party intent is sold to multiple vendors’ customers – meaning your competitors could be seeing the same intent signals about an account. Also, it often relies on cookies or data partnerships. (Notably, third-party cookies are being phased out, which is one reason marketers are moving toward first-party strategies.) |

| Volume of signals | Narrower in scope – limited to accounts that have engaged with you. If an account hasn’t interacted with any of your campaigns or content, you won’t see a first-party signal from them. It’s a smaller pool of data, but highly relevant. | Broader coverage of the market. Third-party providers can cast a wide net across many accounts in your TAM. You might discover completely new “in-market” accounts that weren’t on your radar. However, it can also produce noise (not every curious research activity turns into a purchase). |

| Cost | Typically low cost or already paid for. First-party data is free (it’s your LinkedIn ad analytics, your Google Analytics, etc.), though you might invest in tools to aggregate and analyze it (for example, ZenABM to gather LinkedIn engagement automatically). These tools tend to be relatively affordable SaaS subscriptions (ZenABM starts at ~$59/mo for context). | Usually requires a significant investment. Premium third-party intent data like Bombora’s can run tens of thousands per year (median ~$25k/year for mid-sized deployments:contentReference[oaicite:11]{index=11}), and full platforms like 6sense often cost even more for enterprise packages. You’re paying for access to that extensive data co-op and the intelligence on top of it. |

Bottom line: First-party intent signals (like LinkedIn ad engagement data) are ultra-relevant and exclusive to you – perfect for tailoring your ABM outreach and timing. Third-party intent signals cast a wider net to uncover who’s researching broadly in your space, which can feed your account selection and prioritization. In practice, many ABM pros use both: start with third-party data to discover “who’s warm out there,” then use first-party signals to drill down into which of those accounts are engaging with us and how.

Why LinkedIn ABM Is Uniquely Suited for Intent Detection

LinkedIn is my favorite playground for ABM intent signals, and it’s not just because I’m a LinkedIn junkie. It’s because LinkedIn offers a rare combination: you can precisely target the accounts you care about, and then directly observe their engagement. In other words, LinkedIn lets you deliberately “poke” your target accounts with content and see who bites.

When we launched our first LinkedIn ABM campaigns at Userpilot, this was our strategy: run ads specifically to our target accounts (one campaign per vertical), and monitor engagement like a hawk. Sure enough, we started seeing patterns. For example, one target account – a mid-market pharma tech company – suddenly had multiple people clicking our LinkedIn ads and even liking one of our posts. That account (let’s call them Farseer Pharma) became a top priority for our sales team. It turned out they were indeed evaluating user onboarding solutions (our category) at that time. That early win convinced me: LinkedIn engagement is as strong an intent signal as it gets.

One caveat: LinkedIn’s native data only takes you so far (more on that below). It will show you that Company X had, say, 20 impressions and 2 clicks in the last 30 days, but it won’t tell you which specific ads or topics they engaged with if you’re running multiple campaigns.

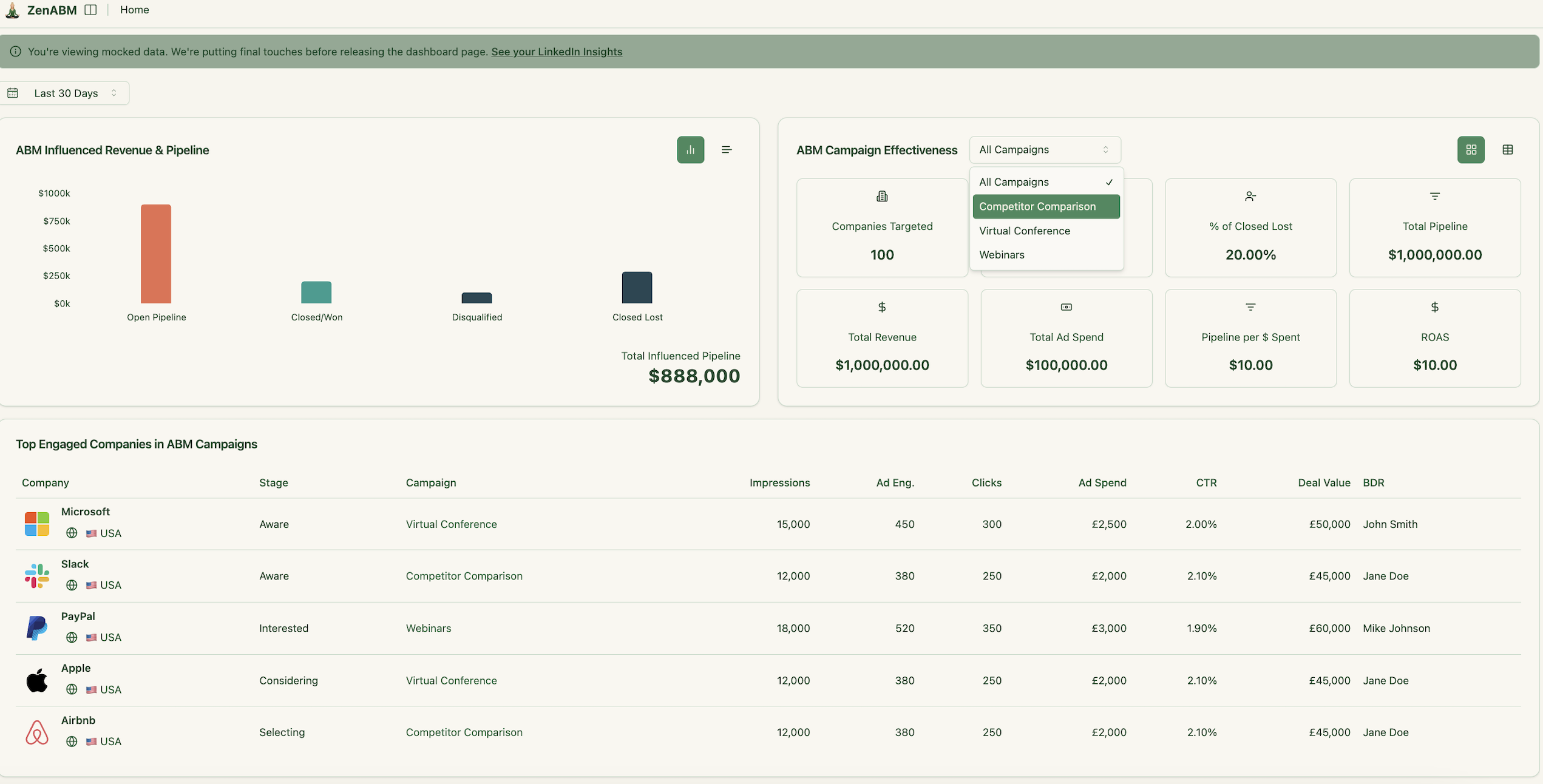

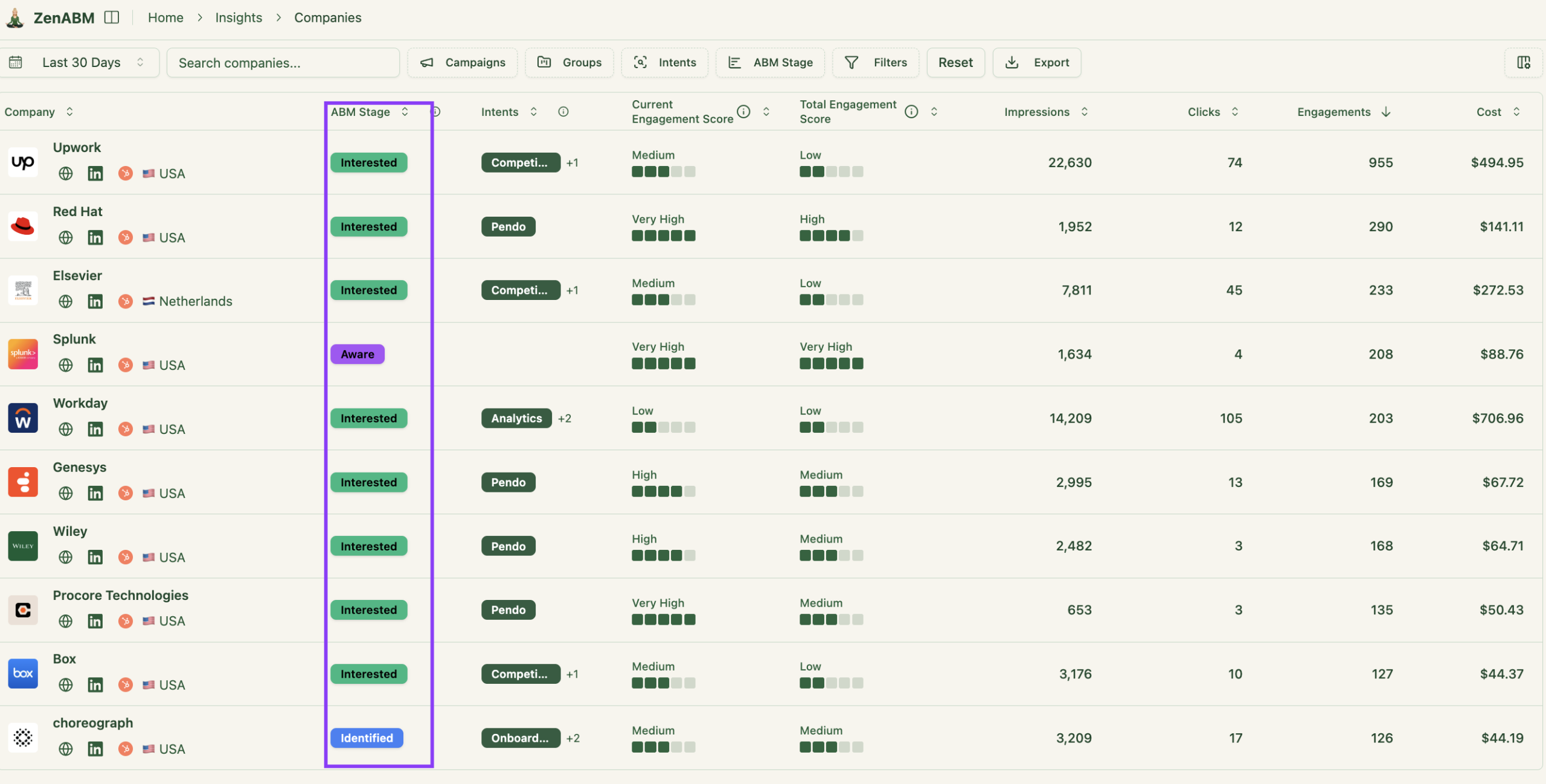

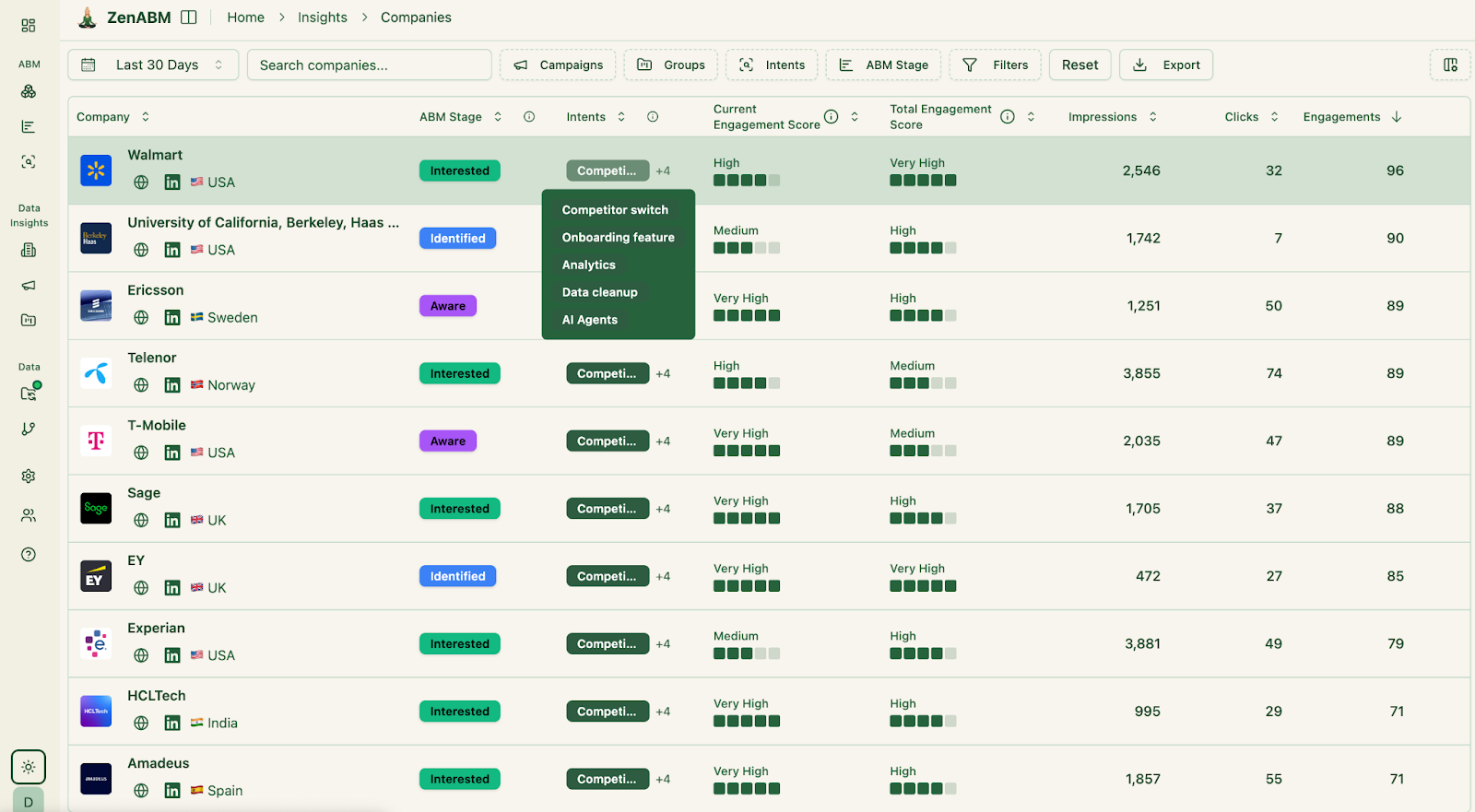

Above: Example of intent signals from LinkedIn – a dashboard showing top engaged target accounts and their interactions. When multiple people from one company (e.g. Farseer Pharma) engage with your LinkedIn content, it’s a strong buying signal.

How ZenABM Automates LinkedIn Intent Signal Detection (and Why It’s a Game-Changer)

I’ll be honest – ZenABM exists because I was my own first customer. I knew exactly what I wished I’d had at Userpilot: a way to automatically see, for every LinkedIn campaign, which target accounts engaged and what they did. So we built it!

ZenABM is designed to take all that manual legwork I described and do it for you, in real time. Here’s how it works and the key benefits, from an ABM practitioner’s perspective:

- Direct integration with LinkedIn Ads: You connect your LinkedIn Ads account to ZenABM, and it immediately starts pulling in engagement data at the account level. It uses LinkedIn’s official API to fetch which companies saw, clicked, or engaged with each ad campaign. No scraping or hacks – it’s pulling the real data (that even LinkedIn’s UI doesn’t fully expose easily) in a compliant way.

- Per-campaign and per-account breakdown: Remember how LinkedIn’s native report lumps all campaigns together? ZenABM fixes that. In your dashboard, you can pick any campaign or campaign group and see a list of engaged accounts for that specific campaign. For example, you can see that Farseer Pharma had 10 impressions and 2 clicks on your “Product A Awareness” campaign, and separately 5 impressions and 1 click on your “Product B Demo” campaign. This granularity tells you exactly which message resonated.

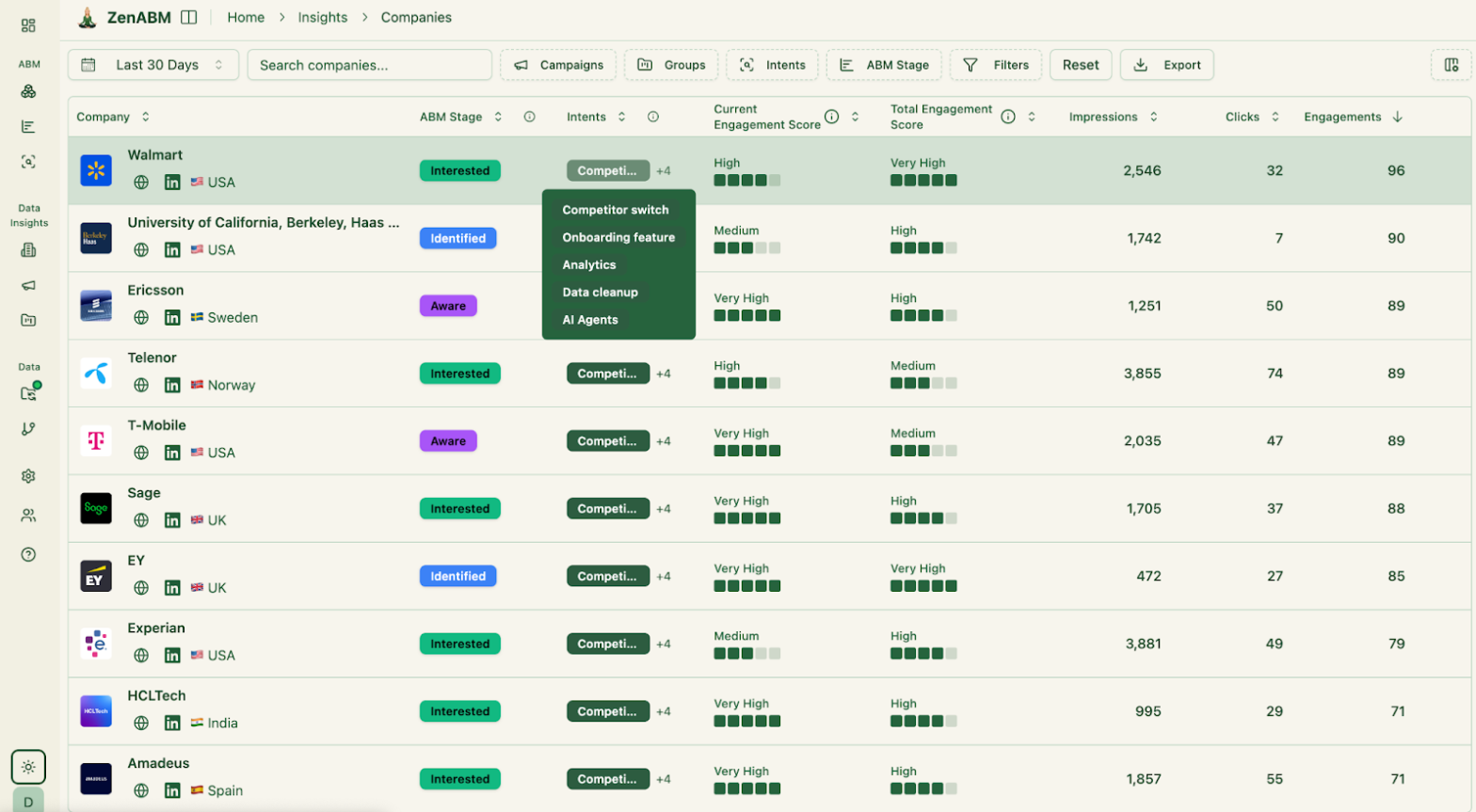

- Intent scoring and stages: The platform doesn’t just show raw numbers – it scores account engagement. ZenABM can assign an intent score or engagement score to each account based on cumulative interactions (impressions, clicks, form fills, etc.) and even categorize accounts into stages (aware, interested, etc.) automatically. This is like having an early warning system for your hottest accounts. Instead of manually eyeballing who has “a lot” of engagement, you get a quantified score that says “Account XYZ = 87 (very high engagement)”. We configured ours so that any account with a score over a threshold triggers an alert for sales.

- Qualitative intent insights: One of my favorite features – you can tag your LinkedIn campaigns by theme or content (e.g. “Feature: Analytics” vs “Feature: Security” or pain points like “Scale onboarding”). ZenABM then tells you which intent theme each account engages with most: This is huge for personalization: if Farseer Pharma mostly clicked on our “Security” themed ads, we know to lead our sales conversation with security pain points. It’s like reading their mind – we know what they care about, straight from their engagement pattern.

- CRM synchronization: Gone are the days of copying data into spreadsheets. ZenABM pushes these intent signals right into our CRM (we use HubSpot) as company properties. That means the sales reps can see on the account record things like “Last 30-day LinkedIn Ad Clicks = 3” and “Top Engaged Campaign Theme = Security”. We even set up workflows: e.g., if an account reaches the “Interested” stage in ZenABM, it automatically assigns that account to a BDR and notifies them to follow up. Talk about alignment – marketing doesn’t have to spoon-feed anything, the system does it.

- Real-time and historical tracking: ZenABM updates continuously, so if someone clicked an ad this morning, by afternoon our team knows. It also keeps historical data, so you can observe trends (did engagement spike after last month’s event? Are we steadily warming Account X over three months?). This helps in quarterly ABM reviews – we can actually show the progression of account engagement and correlate to pipeline.

The result of all this automation? A dramatic reduction in response time and effort. Instead of spending 5 hours a week cobbling together reports, I spend those hours strategizing with sales on how to approach the engaged accounts that ZenABM surfaced. Our ABM campaigns feel like they run on autopilot now – we launch LinkedIn ads, and ZenABM immediately tells us which accounts are biting and how strongly.

From a numbers perspective, using ZenABM internally, we saw improvements such as a higher meeting booking rate from the target accounts (because we reach out at the right time with the right context) and shorter sales cycles (because we catch intent early on, while the window of interest is open). It’s incredibly validating to build a tool and then have it solve your own pain points so effectively.

Above: ZenABM in action – listing engaged companies per LinkedIn campaign. This view shows exactly which accounts engaged with a specific ad campaign, along with their engagement metrics. No more guesswork on what content each account saw – it’s all laid out for you.

Shameless plug: I’m obviously biased as a co-founder, but ZenABM truly changed how we run LinkedIn ABM. What used to be a manual grind is now a slick dashboard and automated alerts. If you’re running LinkedIn ads for ABM and find yourself manually pulling reports like I did, do check it out – it might save you a ton of time (and help you catch hot accounts you’d otherwise miss). ZenABM starts from just $59 per month, and with that – you can deanonymize your Linkedin ad engagements on company level (directly from LinkedIn API – no guesswork!), and send them anywhere (filtered by stage, intent etc.) via a simple webhook.

As well as the intent and engagement scores, ZenABM gives you the stages of the funnel each company is in, as defined by you in the “ABM stages”:

How to identify your target accounts’ intent based on their LinkedIn Ads’ engagements with ZenABM?

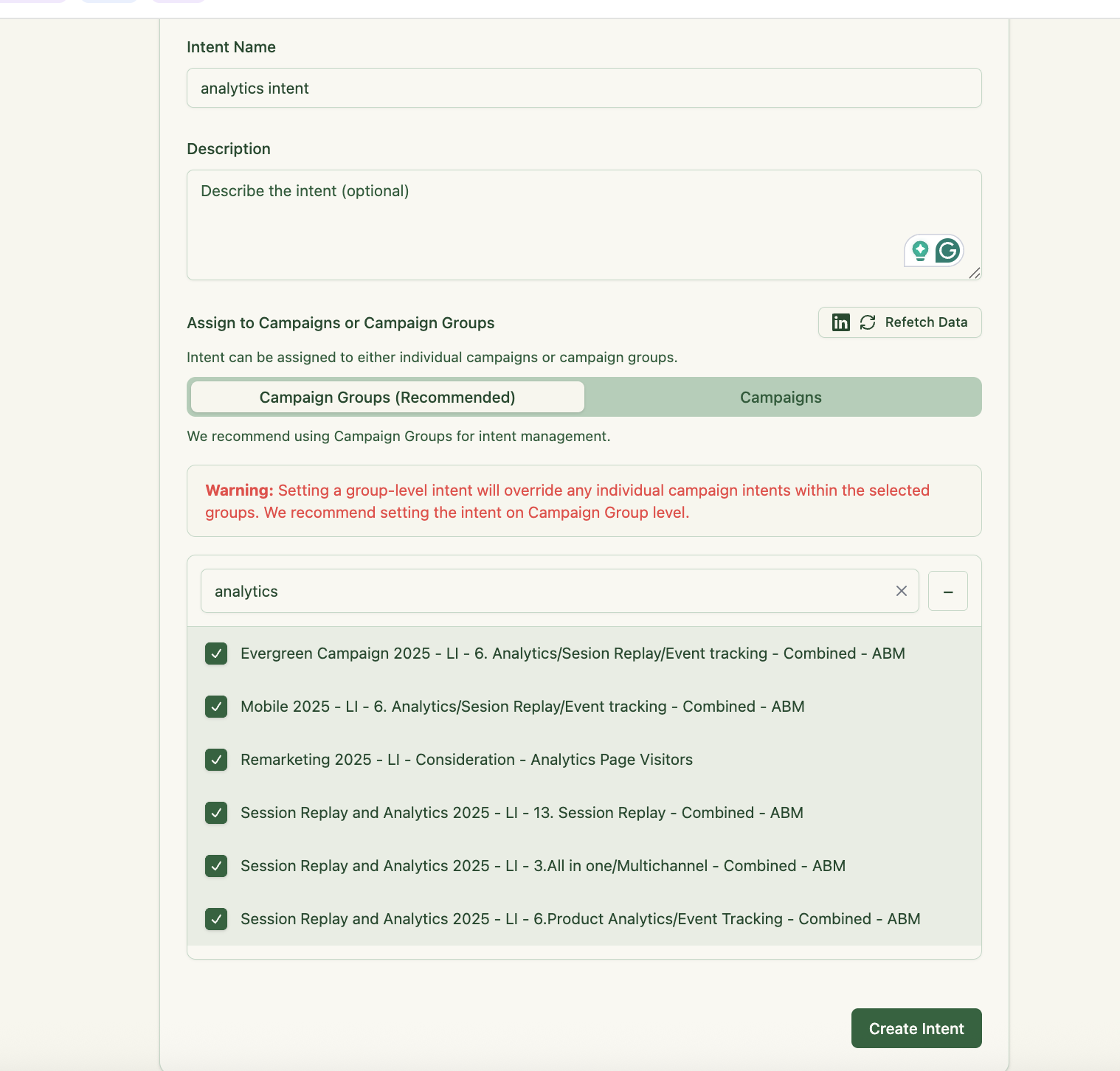

Basically – ZenABM detects which company has been engaging with which ad content most, and let label your target accounts with “intents” based on which campaigns they are engaging with.

The intents are fully customizable and take a minute to set up:

You basically easily tag certain campaigns (or groups) with an intent theme (e.g., “Analytics,” “Adoption,” “Security,” “AI Features”), and ZenABM automatically assigns those intents to companies when they engage with the corresponding ads:

This means if an account repeatedly clicks on analytics-focused ads, ZenABM labels them with an “Analytics intent”.These intent signals are then pushed into your CRM as company properties:

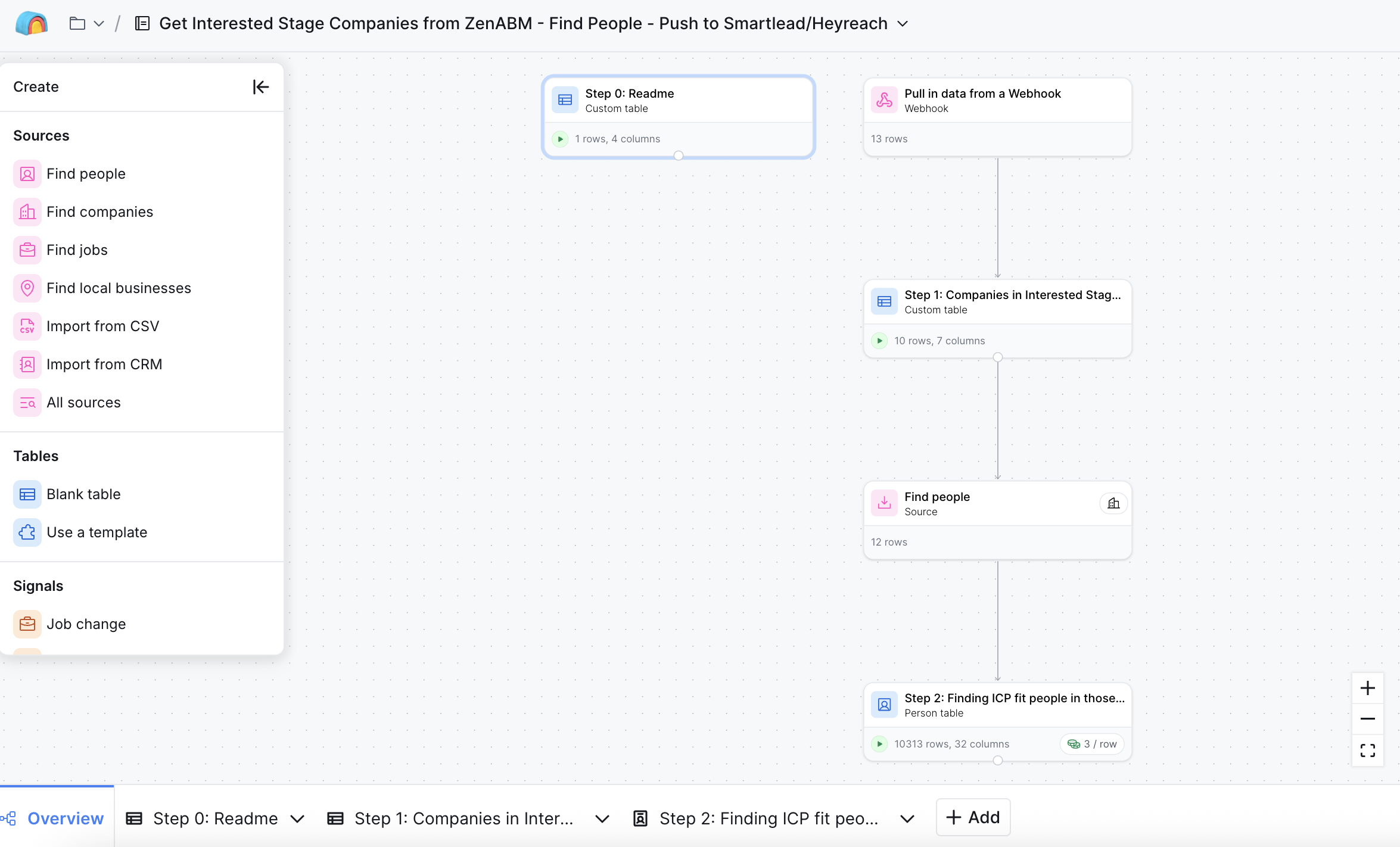

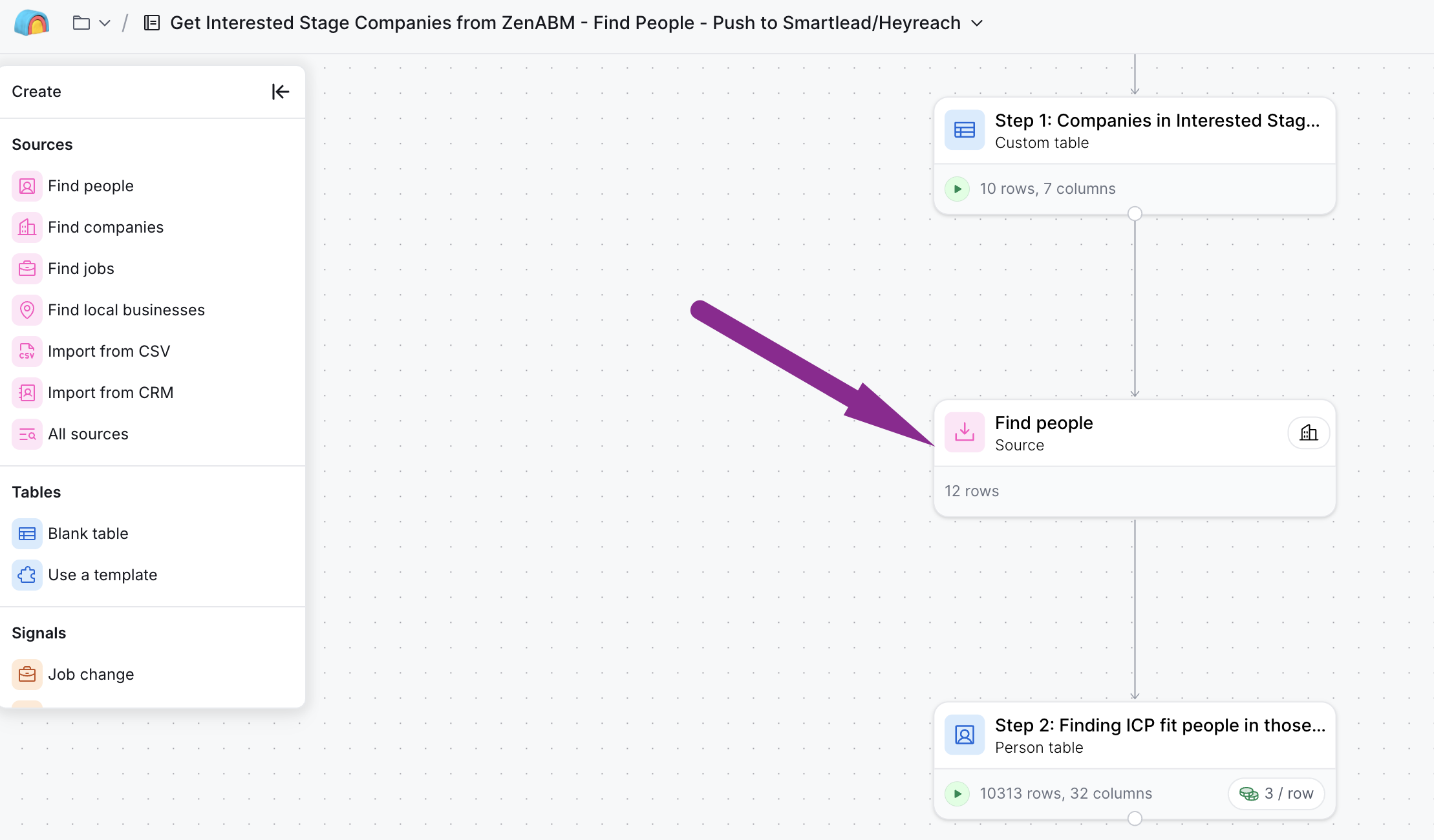

How to send accounts with intent signals from your LinkedIn ads into Clay?

Now – in order to really do anything with the ABM stage or intent data – you need to have a list of contacts (matching your ICP profile) in your target accounts.

In order to do it – you can use Clay or first need to pull these data into Clay (or any other data prospecting/ data enrichment platform – but we use Clay, so we’ll stick to it as an example.)

Here’s exactly how to do that with ZenABM’s webhooks:

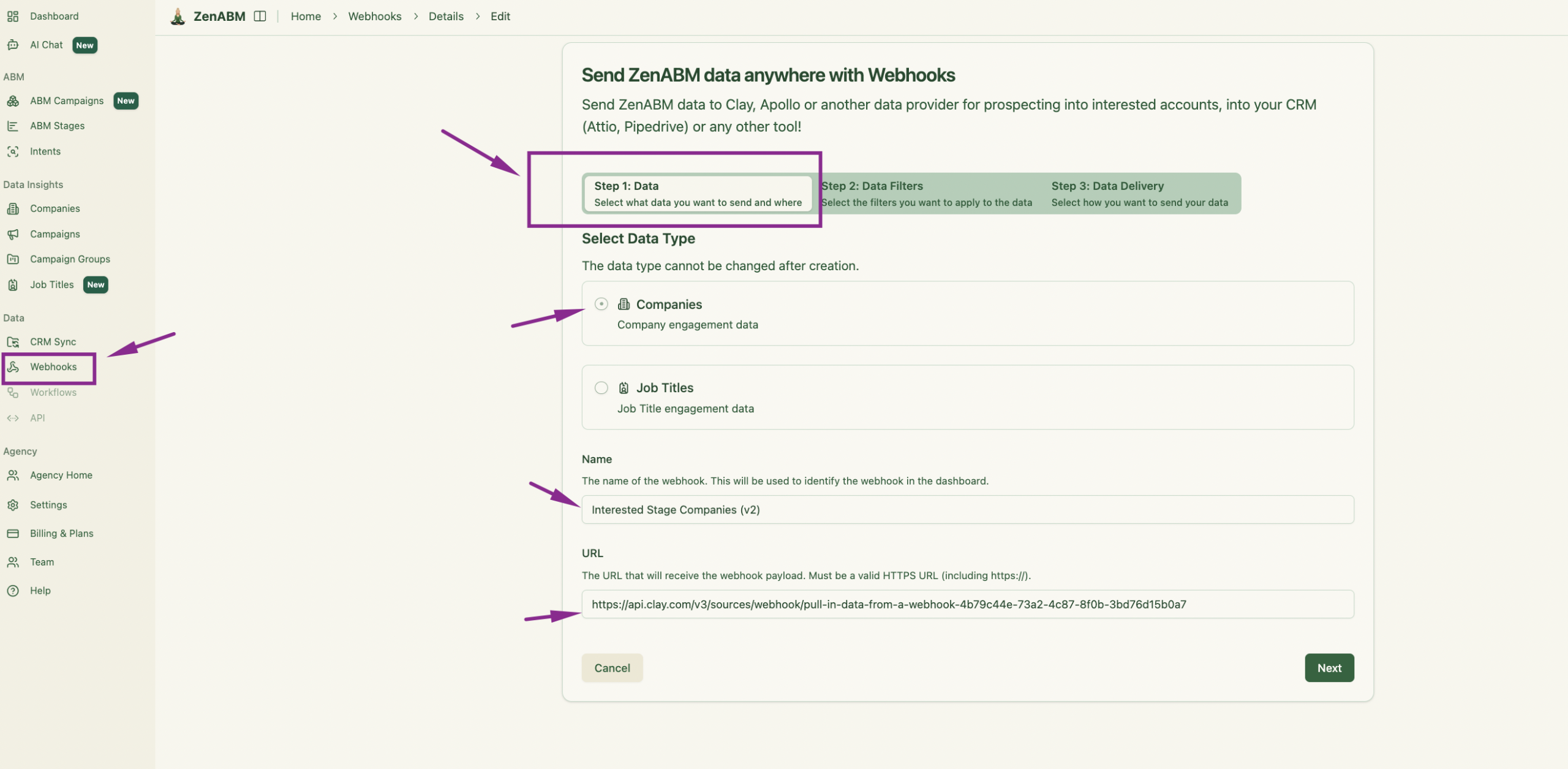

STEP 1: Go to ZenABM’s “webhooks” on the right-hand side menu

In Step 1: Data, select “Companies” as data type, and add the name of your webhook + the destination URL you want to send it to (in this case, the Clay table – grab this Clay template here – copy it to your account)

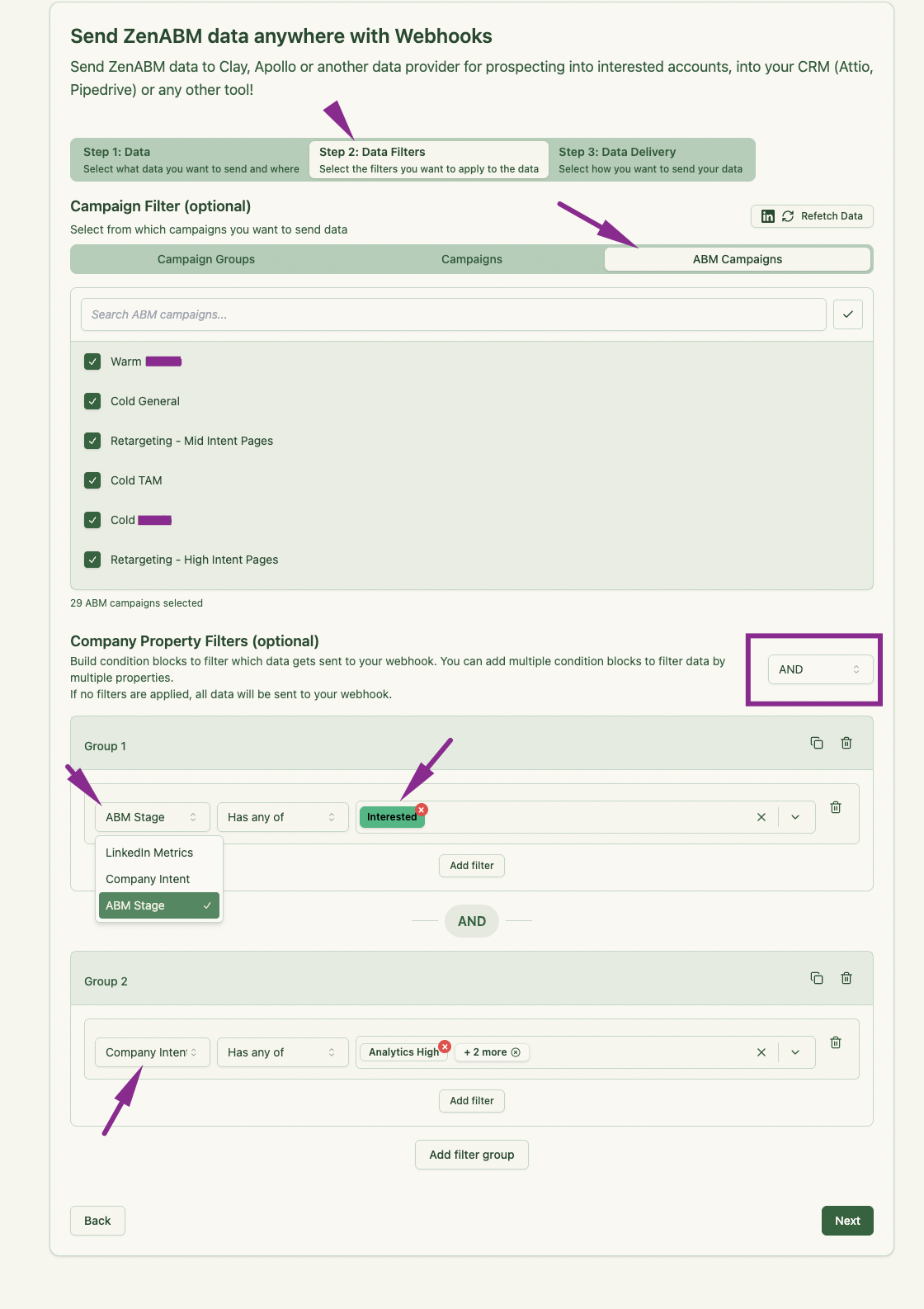

Step 2: Selet the filter you want to apply to your company LinkedIn ad engagement data before sending it to Clay:

- Select which specific ABM campaigns, LinkedIn Campaigns or Campaign Groups you want to send the data from:

- Then select the specific company properties (Intent, ABM stage, LinkedIn Ad Engagement or Spend) etc. – in our case, use “Interested” ABM Stage AND any intent you want to send.

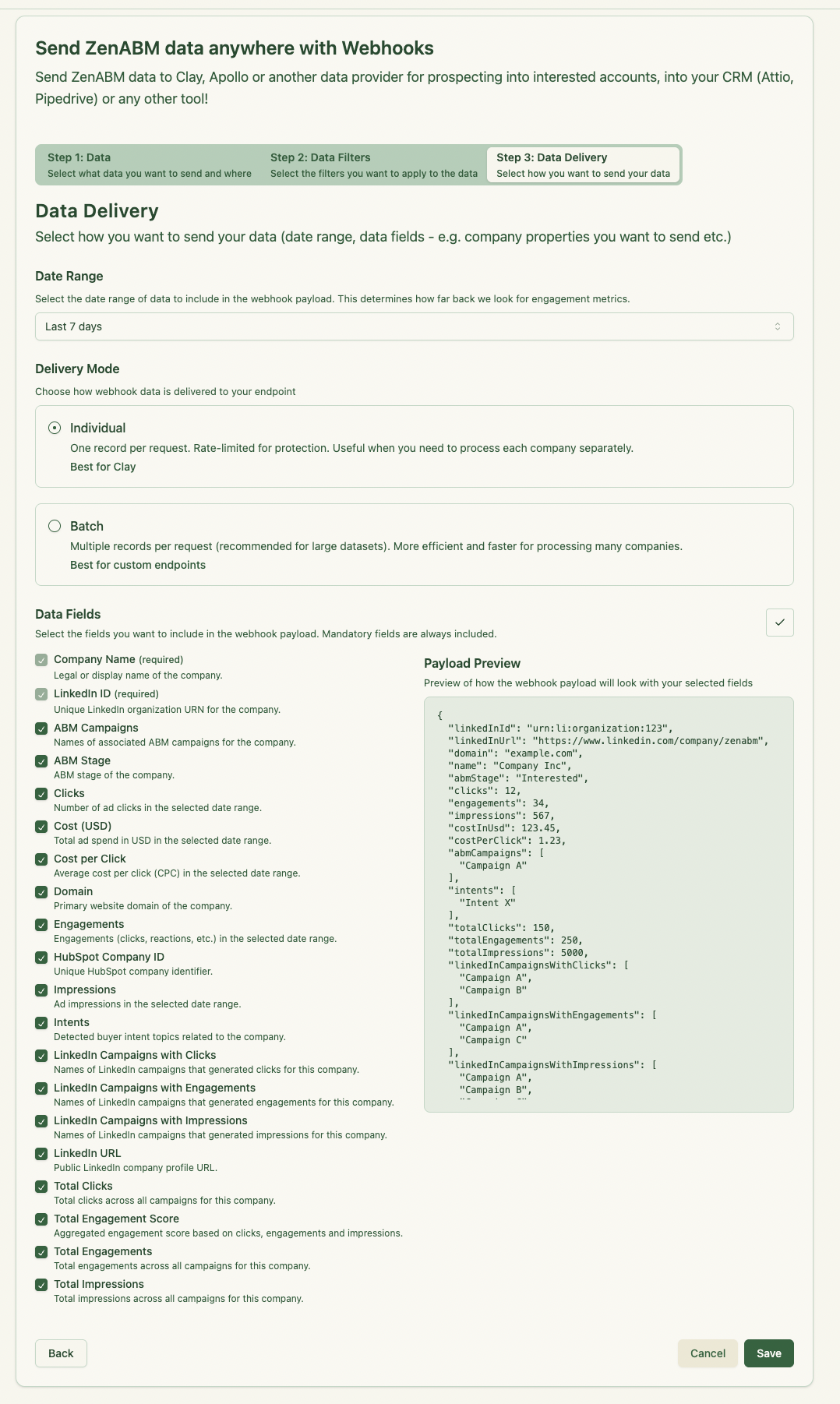

Step 3: Select how you want to send your data from ZenABM to Clay

In STEP 3 – Data Delivery – select date range, data fields – e.g. company metrics you want to send. In our case, we want to send the data:

- every 7 days (when ZenABM fetches fresh companies and updates the ABM stages).

- individual companies (1 company per row in your Clay table)

- all the data fields:

Now, click “SAVE” and your webhook will now be sending a fresh batch of “interested” stage companies into the Clay table (copy this template to your Clay account) with the selected intent (in our case “analytics high”) every 7 days – on Sunday night!

Great, now – how do you find the right people in these interested companies, so you can add them to the email outreach / LinkedIn outreach sequences?

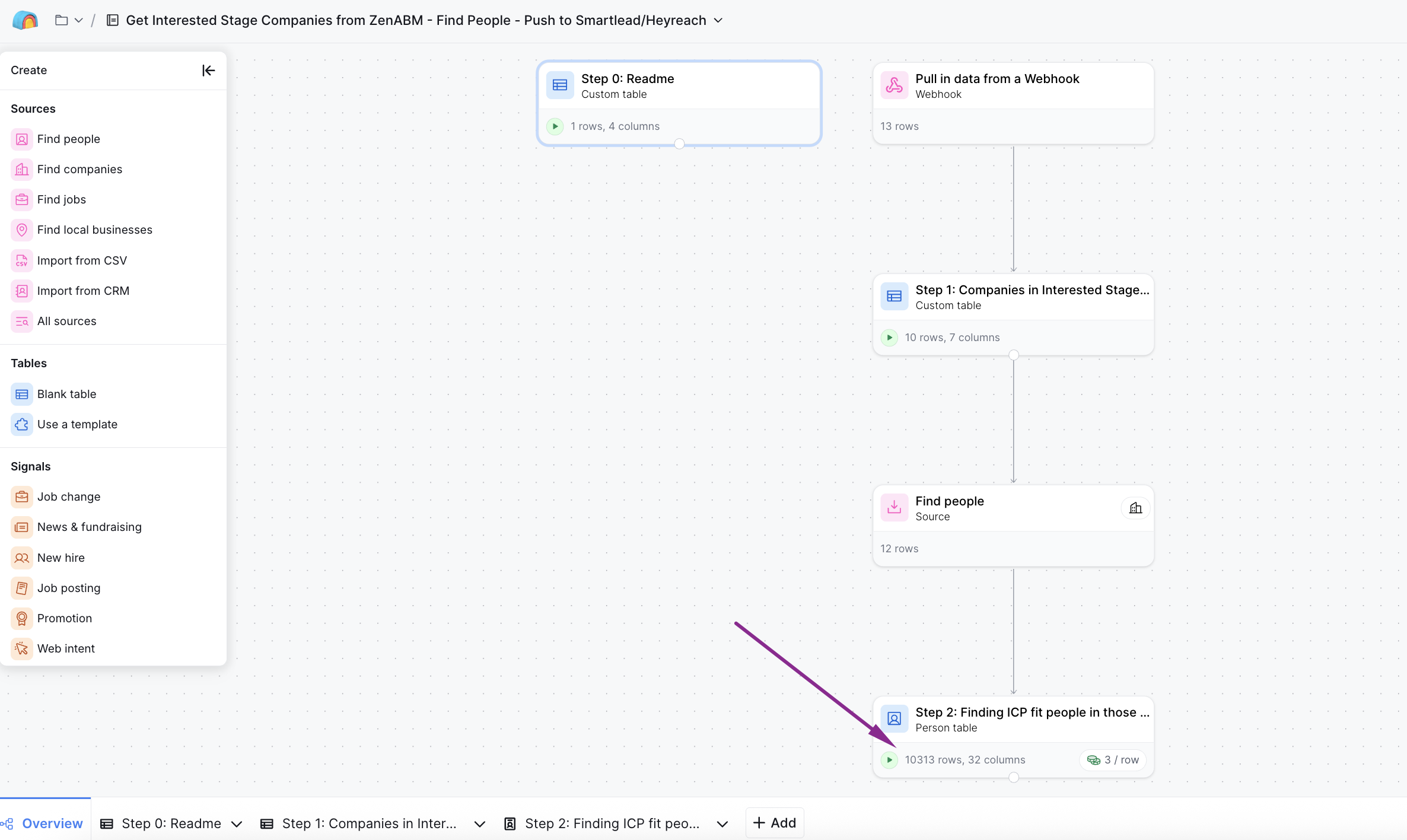

How to automatically prospect into the “interested” accounts in Clay [Clay auto-prospecting templates] by ICP

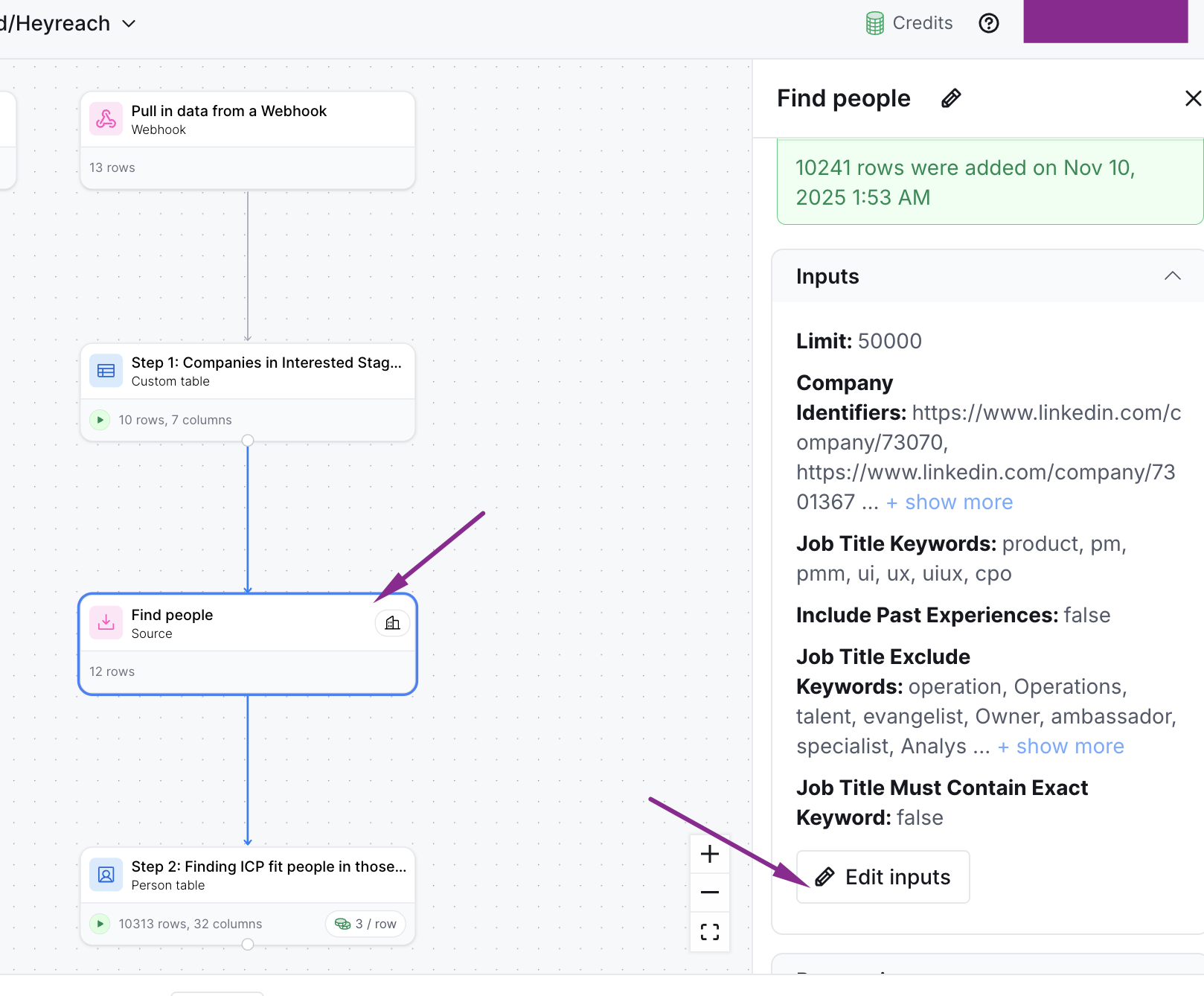

This is the next step in our Clay flow:

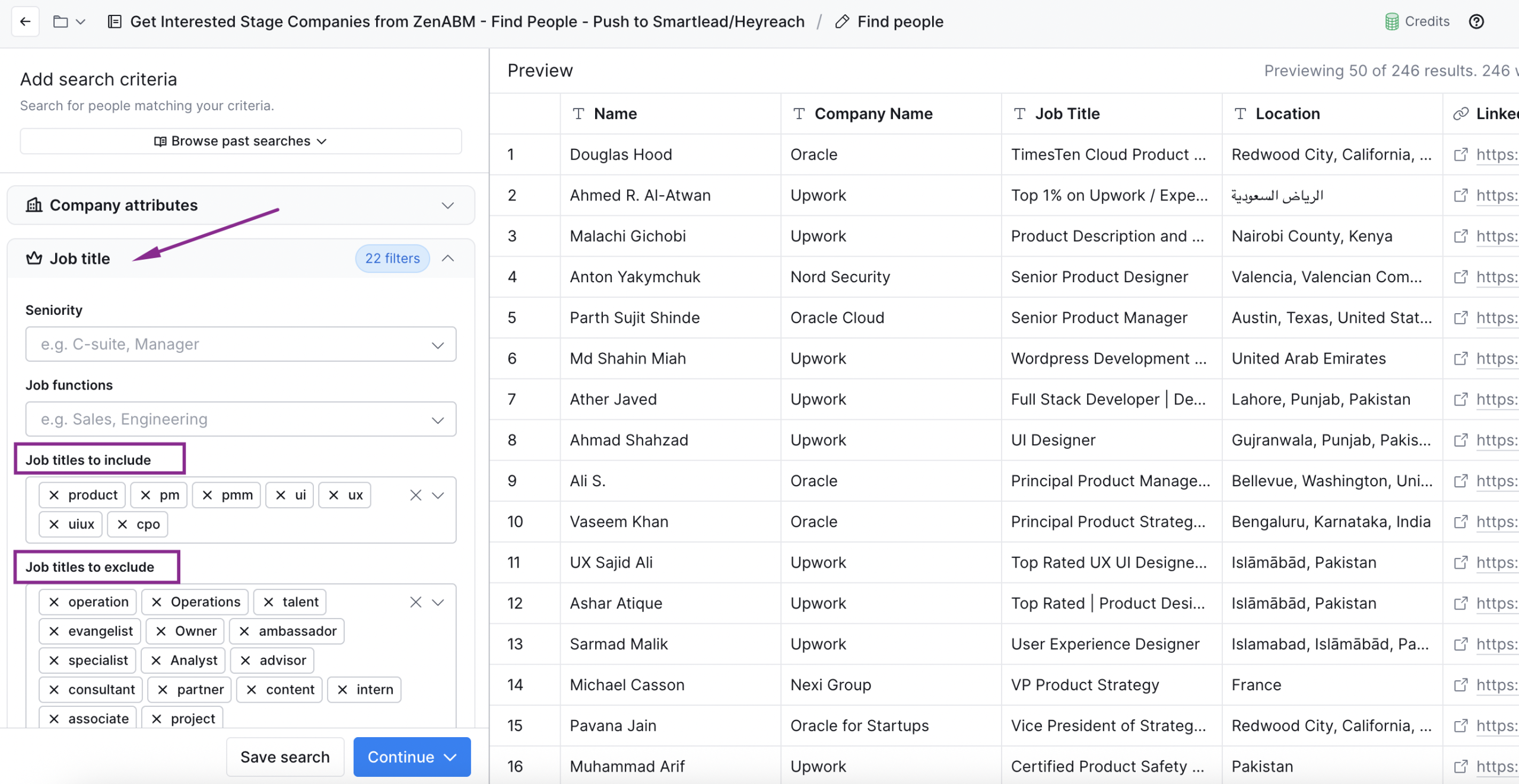

Click on ‘find people’, and then – ‘edit inputs’:

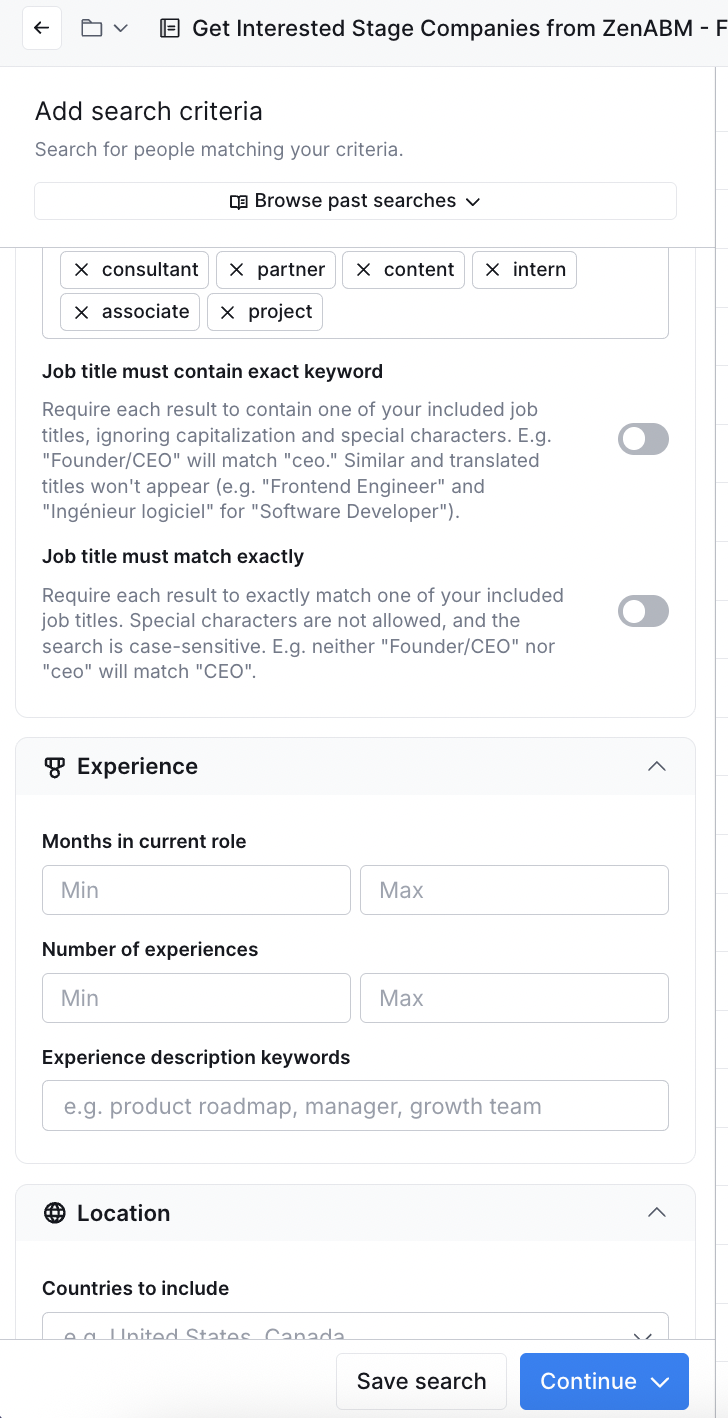

Then, click on “Job title” and change the ‘job title filters’ to match your ICP – you can filter your “find people” search by seniority, job functions, job titles…and exclude irrelevant ones too:

You can also select additional filters, like whether you want the job titles to be “exact matches”, and if you want to search for people that have been in the specific role for X months, and also filter them by location (country, city etc.):

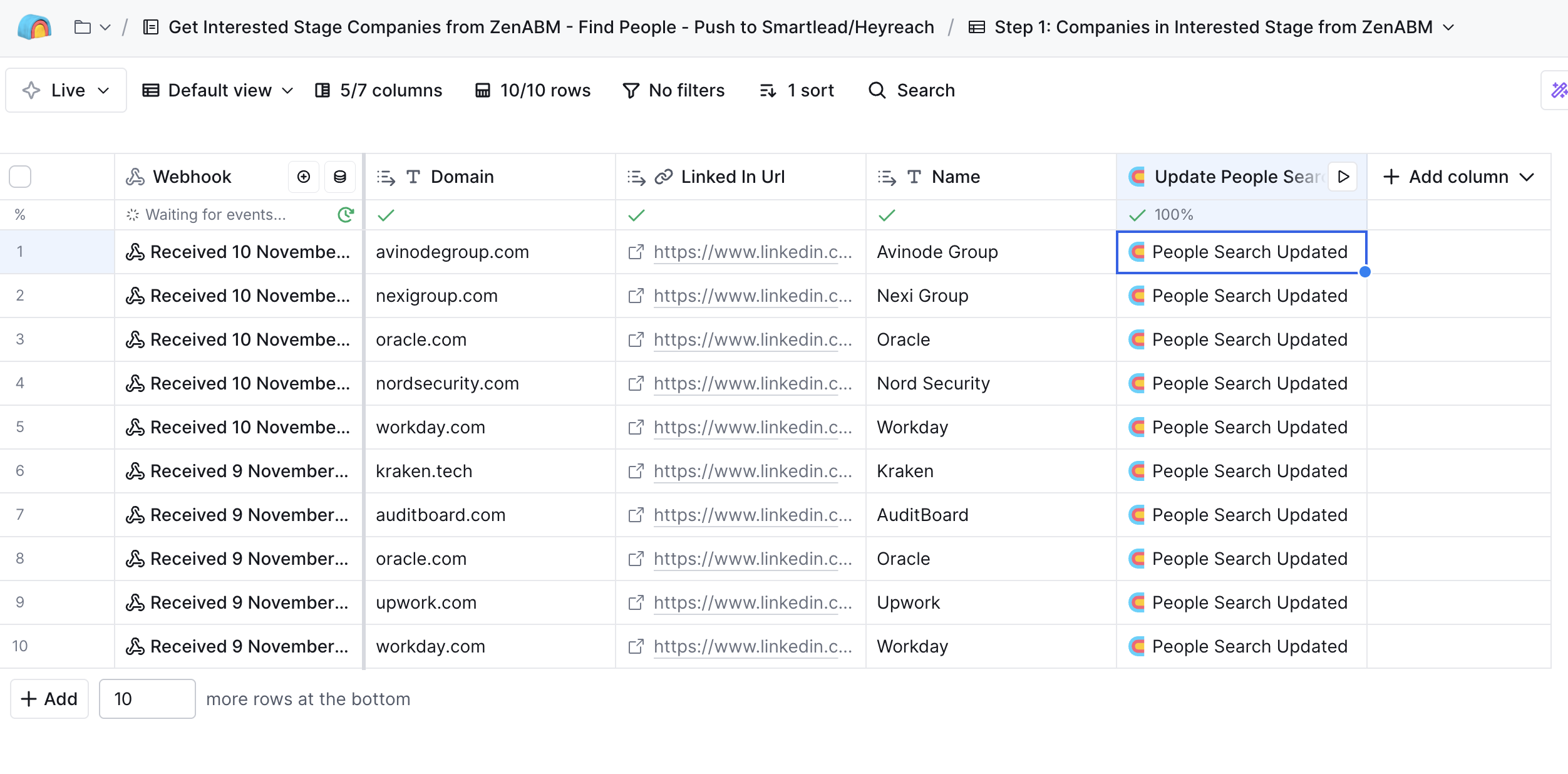

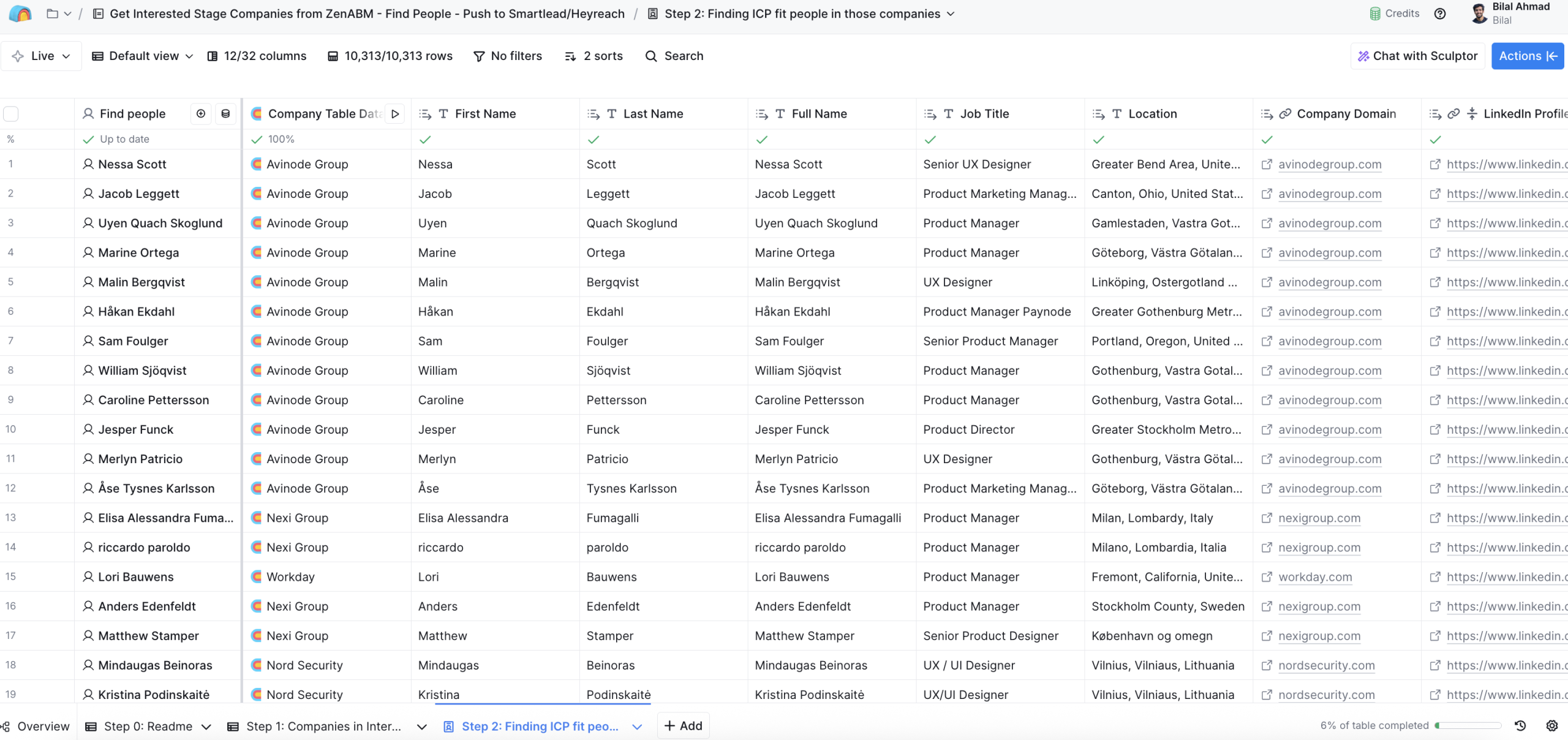

Now, save your search and click continue. Go back to the flow chart, and click on the step 2: this is your ICP table:

When you double click on STEP 2, you will see your Clay table with the list of prospects from your “interested stage” companies form ZenABM!

Best Tools to Detect Intent Signals on LinkedIn (Comparing ZenABM vs Bombora vs 6sense vs Clearbit)

Now that we’ve covered the concepts, let’s compare some of the top tools and platforms for capturing intent signals – both on LinkedIn and beyond. Each of these tools approaches intent a bit differently, so I’ll break down how they work and their strengths:

| Tool | Type of Intent Data | How It Works (Key Features) | Ideal For | Pricing (Ballpark) |

|---|---|---|---|---|

| ZenABM | First-party (LinkedIn Ads engagement) |

Tracks company-level LinkedIn ad engagements via API:contentReference[oaicite:23]{index=23}. Shows which accounts saw, clicked, or engaged with each ad campaign. Provides qualitative intent (by tagging campaigns/themes): and quantitative scores. Auto-syncs data to CRM with account scores, stages, and intent tags. Basically a plug-and-play LinkedIn ABM analytics and intent platform. | Teams doing LinkedIn ABM who need immediate, actionable insight into target account engagement. Great for SMBs and mid-market (or any resource-strapped team) that want enterprise-level ABM analytics without a big tech stack. Also ideal if you want to prove LinkedIn ad ROI to sales by tying ad engagement to pipeline. | Subscriptions start at ~$59/month (very affordable for intent software). Higher plans for more ad spend/CRM integrations. In other words, a fraction of the cost of big enterprise platforms. |

| Bombora | Third-party (Off-site intent data) |

Bombora is the OG of intent data co-ops. It monitors content consumption across 4,000+ B2B websites:contentReference[oaicite:26]{index=26}. Delivers “Company Surge” scores indicating when a target account’s employees are searching for or reading about specific topics significantly more than usual. You pick keywords/topics (e.g. “ABM software”), and Bombora tells you which companies show a surge of interest in those topics. Often integrated into other platforms; also offers audience segments you can push to ad platforms. | Mid-size to enterprise B2B companies that want to expand their reach to “in-market” accounts not yet engaging with them. Great for filling the top of funnel ABM list with net-new accounts showing interest in your category. Also useful for sales intelligence – knowing a prospect company is researching your space is a prompt for BDR outreach. Keep in mind it’s topic-based, so it’s best for broad indications of interest. | Custom pricing, usually hefty. Common range is ~$25k/year for a mid-range package:. Cost scales with how many topics and accounts you track and which integrations you need. It’s a significant investment, so typically used by companies with sizeable ABM programs (and budgets). |

| 6sense | Mixed (First + Third-party) |

6sense is a full-fledged account engagement platform that combines multiple data sources: it uses third-party intent (Bombora, G2, etc.) plus your first-party data (website visits, marketing automation engagement, etc.).. Their AI models stitch this together to identify accounts in different buyer stages (awareness, consideration, decision) and even predict timing. Key features include account scoring, segmentation, and orchestrating ads + sales plays when an account hits a certain threshold. It’s like intent data on steroids – layered with predictive analytics and an “orchestration” engine. | Organizations that want an all-in-one ABM command center. Often upper mid-market or enterprise with dedicated ops resources. If you have a multi-channel ABM strategy (ads, website personalization, outbound sales, etc.) and need to unify signals from all those channels, 6sense is a powerful (though complex) solution. It’s also great for companies that want to leverage AI to prioritize accounts and are willing to invest in setup and tuning. | High-end pricing. 6sense doesn’t publish prices; it’s tailored to each customer. Roughly, it’s a 5- or 6-figure annual investment (small teams might start around $30k/yr; large enterprises can spend well into six figures). Price depends on number of accounts, users, and modules. In short, be prepared to pay for the depth of capability – it’s not a casual spend. |

| Clearbit | First-party (Website & data enrichment) |

Clearbit is known for enriching data, but here we focus on its Reveal product which turns your anonymous website visitors into firmographic insights. Essentially, Clearbit Reveal identifies which company a visitor is from by mapping their IP address, and gives you details on that company. This means if someone from “Acme Corp” visits your pricing page, you’ll know Acme Corp was on your site – a strong intent signal in itself. Clearbit can then push those visitors into audiences or alert your sales team. It’s like caller ID for your website: you see which target accounts are “knocking on your door” (even if they never fill a form). Clearbit emphasizes these as real buying intent signals from your traffic. | B2B companies that have decent web traffic and want to leverage it for ABM. If you have an account list and you’re driving them to your site via ads or content, Clearbit Reveal ensures you don’t miss out on knowing they came. It’s also ideal for augmenting first-party intent: pair it with LinkedIn ads (to see who clicks ads and who then visits the site). Also great for companies using HubSpot or similar, since Clearbit now integrates tightly (HubSpot acquired Clearbit’s assets in 2023). | Ranges widely. There are entry-level plans (a few hundred dollars a month for basic data or small volume), but robust usage can run into the tens of thousands per year. For instance, some reports suggest starting around $3–4k/year for basic Reveal, scaling up to $20k+ for larger site traffic volumes and full enrichment suites. It’s more flexible than Bombora/6sense in pricing – you can start smaller – but if you’re a high-traffic SaaS using a lot of data, budget accordingly. |

Each of these tools has a unique value prop, and they aren’t purely apples-to-apples – sometimes they even complement each other. For example, we use ZenABM for our LinkedIn first-party intent and have considered adding Bombora data to find additional accounts showing intent beyond our reach. A company might use 6sense as the overarching platform (which can ingest Bombora and website data, etc.), or use Clearbit Reveal alongside ZenABM to get a full picture of both ad engagement and site engagement from target accounts.

The good news is you don’t have to use everything. If LinkedIn is your main ABM channel, a focused tool like ZenABM might cover 90% of your needs at a far lower cost than a behemoth like 6sense. If you’re at a larger organization with budget and an ABM operations team, 6sense can be transformative. Bombora is almost a staple for many ABM programs to plug intent data into their marketing and sales workflows (some marketing automation and sales outreach tools have Bombora integrations to trigger actions when an account surges). And Clearbit is a favorite for growth teams to maximize value from web traffic and make their advertising more efficient (e.g. creating LinkedIn ad audiences of accounts that visited your site – very handy!).

Conclusion: Turning LinkedIn Intent Signals into Pipeline

LinkedIn has changed the game for ABM by allowing us to see which target accounts are showing interest, in nearly real time. Intent signals – whether it’s a flurry of ad clicks from one account or a Bombora surge score lighting up – are like shining beacons telling you where to focus. The key is to act on them quickly and intelligently. In my experience, when marketing and sales align around these signals, the results follow. At Userpilot, once we started zeroing in on high-intent accounts, our conversion rates jumped and we squeezed way more ROI from our LinkedIn spend.

As we’ve discussed, you have a variety of tools at your disposal to help detect and leverage intent signals. If you’re just starting, you can do a lot with LinkedIn’s native features and some hustle (I did, and it worked). But to really scale and win consistently, leveraging platforms purpose-built for intent data will save your sanity and boost your outcomes. Personally, I’m excited about how accessible this is becoming – even a lean team can afford something like ZenABM to punch above their weight in ABM.

In summary, don’t fly blind. Use intent signals to guide your ABM targeting and outreach. It’s incredible how much more effective your campaigns become when you’re engaging the accounts that are already warming up to you instead of spraying and praying. LinkedIn is an intent goldmine – make sure you’re mining it! And if you need a pickaxe (or a high-tech drill, really), there are tools ready to help.

Ready to put LinkedIn intent data to work? Keep an eye on those engagement metrics, consider supercharging your stack with one of the tools above, and go turn those signals into pipeline. Happy hunting!