DemandSense markets itself as a LinkedIn-centric account-based marketing/demand-gen platform for B2B marketers and agencies.

But in practice, many such ABM tools come loaded with big claims, plenty of features, hefty price tags, and a steep learning curve.

In this article, I’ll show you all that DemandSense offers, its reviews, help you decide if it’s actually the right fit for your ABM strategy, or an overkill, and discuss where a lean alternative like ZenABM might make more sense, or may even serve as a complementary layer due to its unique features.

Let’s get started!

DemandSense for ABM: Quick Summary

In case you want it short:

- DemandSense promises LinkedIn-centric ABM with intent data, scheduling, budgeting, revenue attribution, hourly reports, and visitor ID, but most of its value sits behind credit-based limits.

- The $149 plan includes only 250 monthly credits, which run out fast and make overages the real cost driver.

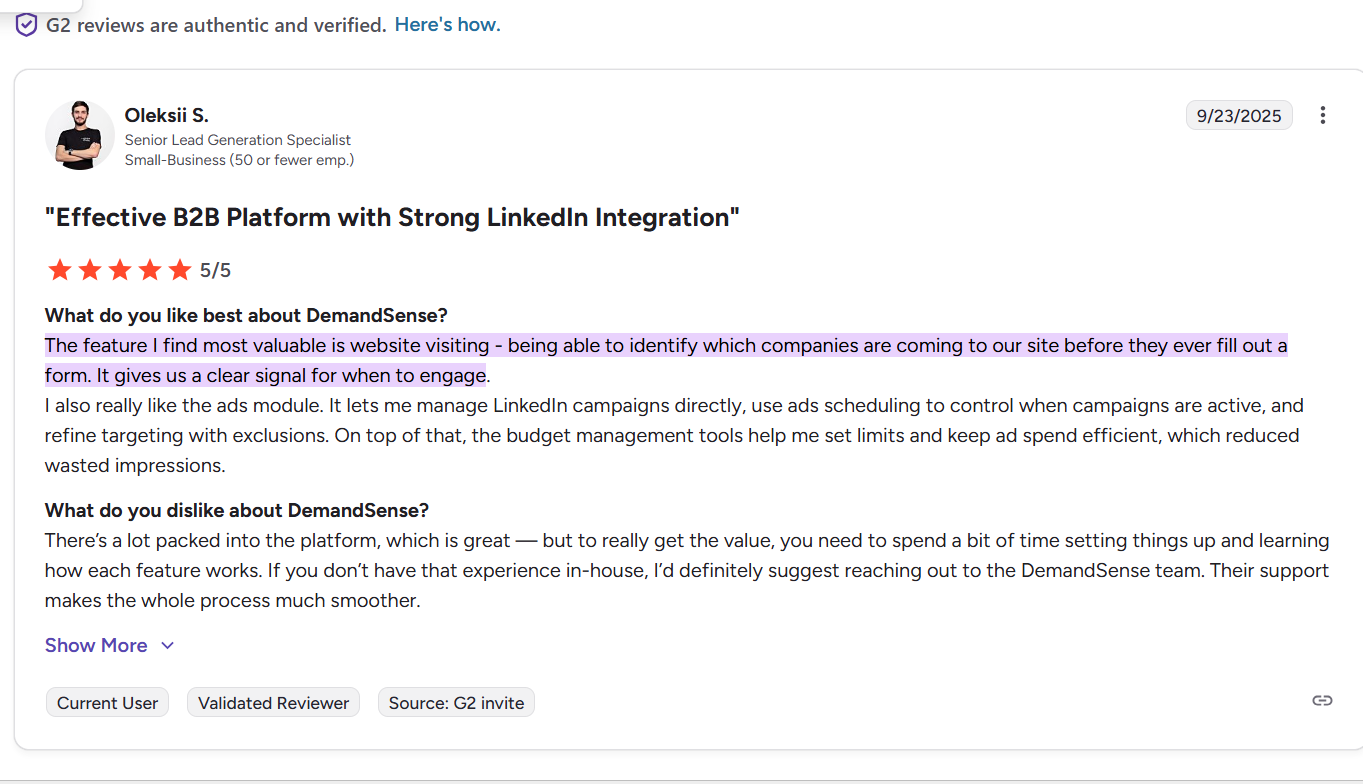

- Reviews are minimal, with one G2 reviewer praising ROI but warning about setup complexity.

- Alternative Worth Considering: ZenABM offers account-level LinkedIn ad engagement tracking, ad engagement-to-pipeline analytics with plusg-and-play dashboards, account scoring, ABM stage tracking, CRM sync, first-party qualitative intent, automated assignment of BDRs to hot accounts, custom webhooks, and ad engagement tracking at the job-title level. All this starts at just $59/month!

Key Features of DemandSense

DemandSense mashes together LinkedIn ad optimization, intent data, and lead prospecting tools into one “growth platform.”

You can unmask anonymous site visitors, capture buying intent from LinkedIn ads, and auto-adjust budgets, schedules, and targeting.

Its core capabilities span several areas:

Intent Signal Ingestion

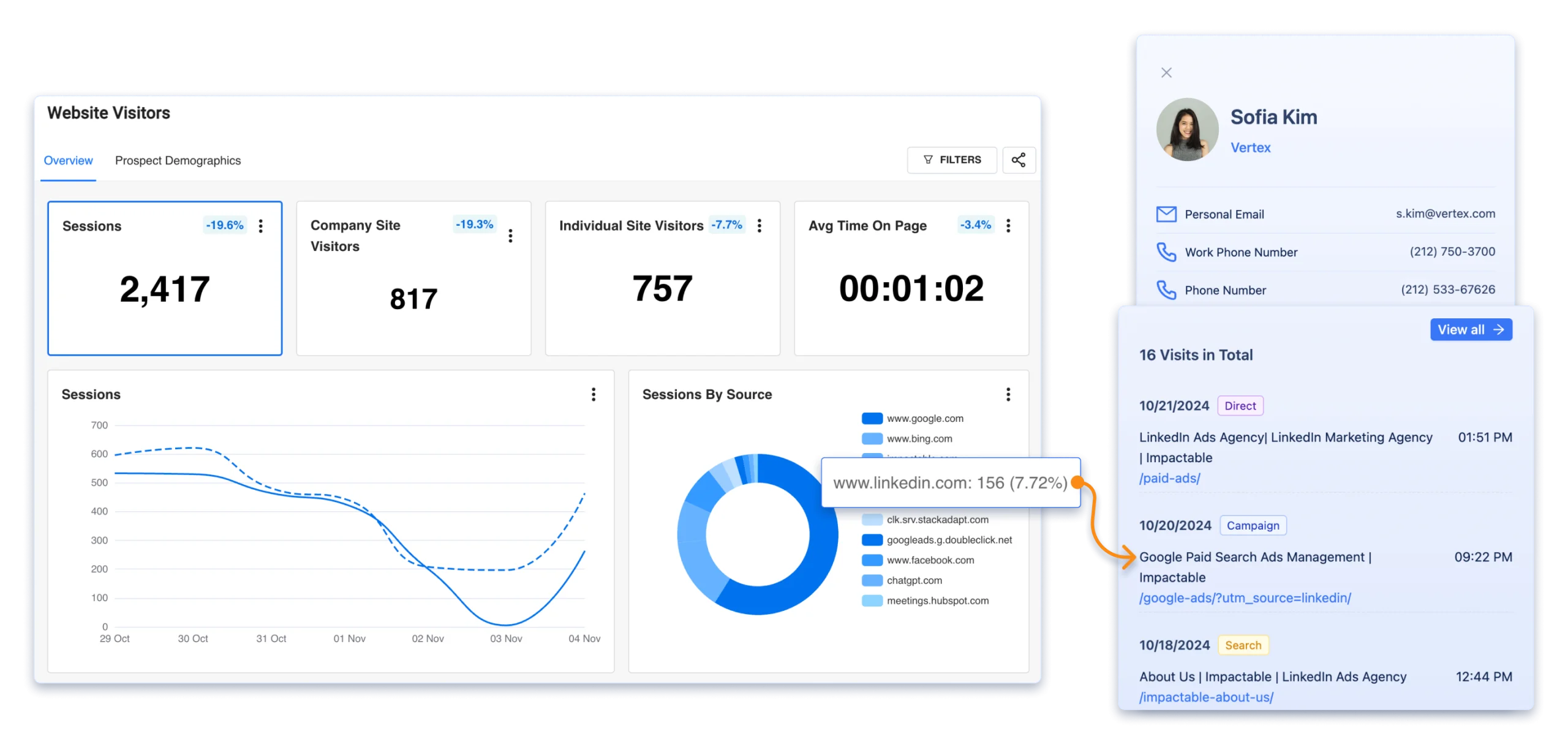

DemandSense claims to unmask anonymous website visitors showing intent and reveal companies demonstrating buying signals.

In other words, it tries to identify which companies (and even contacts) are researching you online.

The platform’s Visitor ID or IntentID features use LinkedIn data and site-tracking scripts to match ad clicks and site visits back to firms. It then pushes that information into audiences and even your CRM.

One user on G2 claims: “Being able to identify which companies are coming to our site before they fill out a form… gives us a clear signal for when to engage.”

Note: I still don’t trust website visitor deanonymization because it’s based on IP-matching and cookies. IP-matching fails because of remote work and private networks, the company not registering their IPs, databases being old, etc. Cookies are anyway being phased out by browsers. Even a study by Syft found that IP-matching accuracy tops at a mere 42%.

Account-Level Audience Building & Segmentation

Once signals are ingested, you can group accounts by intent and engagement level and build a firmographically- or behaviorally-filtered audience.

DemandSense lets you create custom audience lists for retargeting on LinkedIn (or Facebook/programmatic channels) based on those signals.

You can exclude poor-performing segments and cap impressions per account, so big accounts don’t burn out their budget seeing the same ad over and over.

LinkedIn-Centric Campaign Management

DemandSense layers on top of Campaign Manager to give enterprise-grade ad controls without enterprise complexity.

It auto-tunes LinkedIn campaigns with features like:

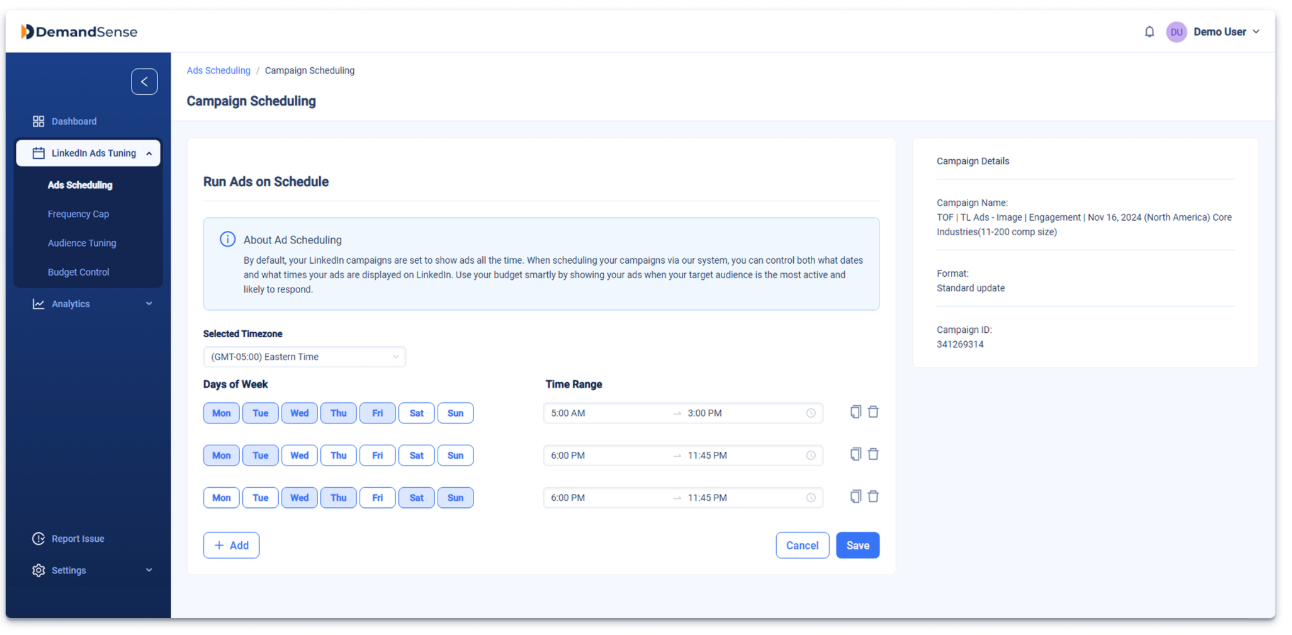

- Advanced Scheduling: Analyze hour-by-hour performance and automatically pause ads during low-engagement times.

LinkedIn ad campaign scheduling in DemandSense - Smart Budgeting: Set account-level or campaign-level budget caps and thresholds. DemandSense will redistribute spend into high-performing times/audiences and alert you or pause campaigns when caps are hit.

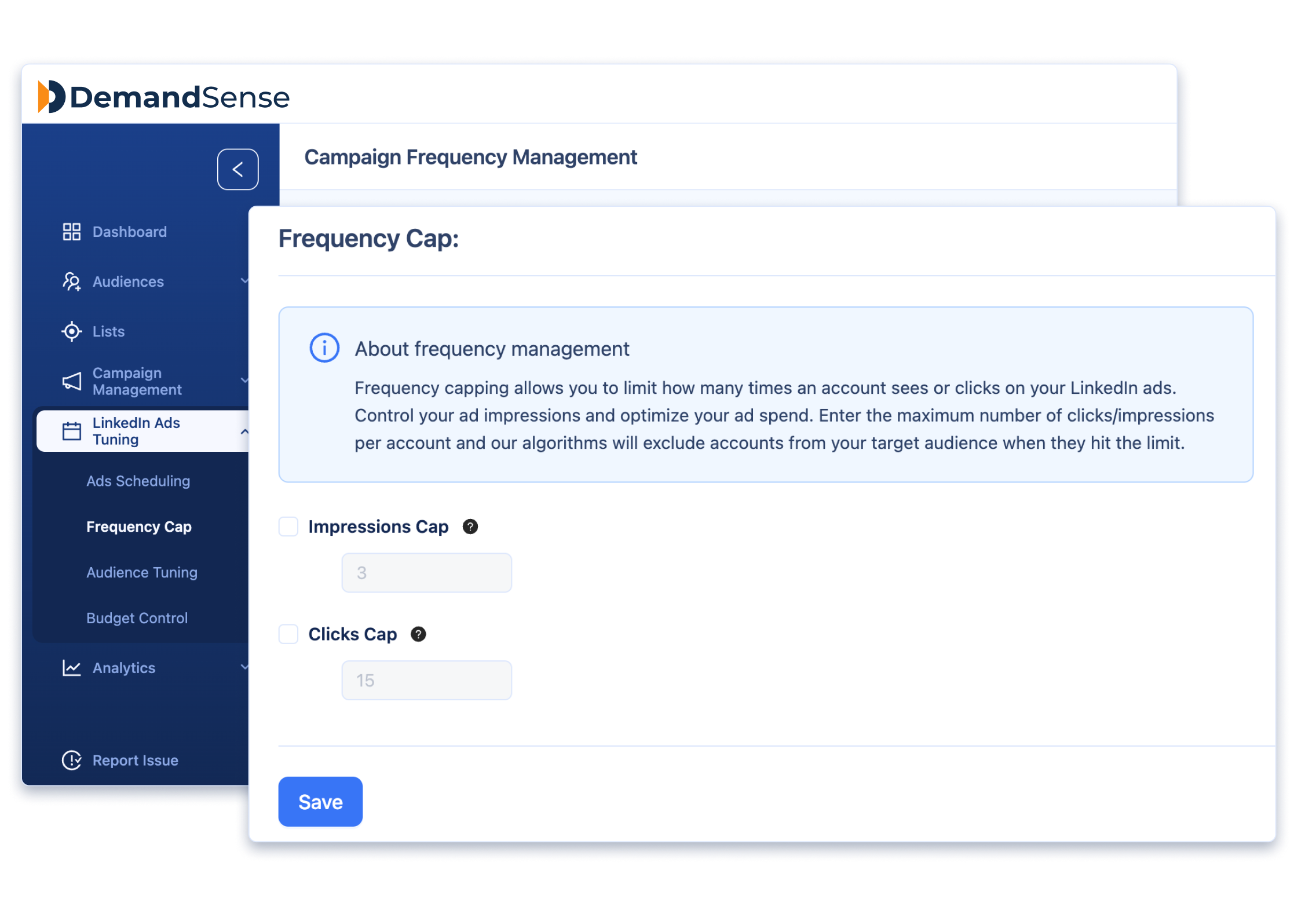

- Frequency Capping: Limit how many times each company sees an ad (“max views/clicks per company”) to reduce fatigue.

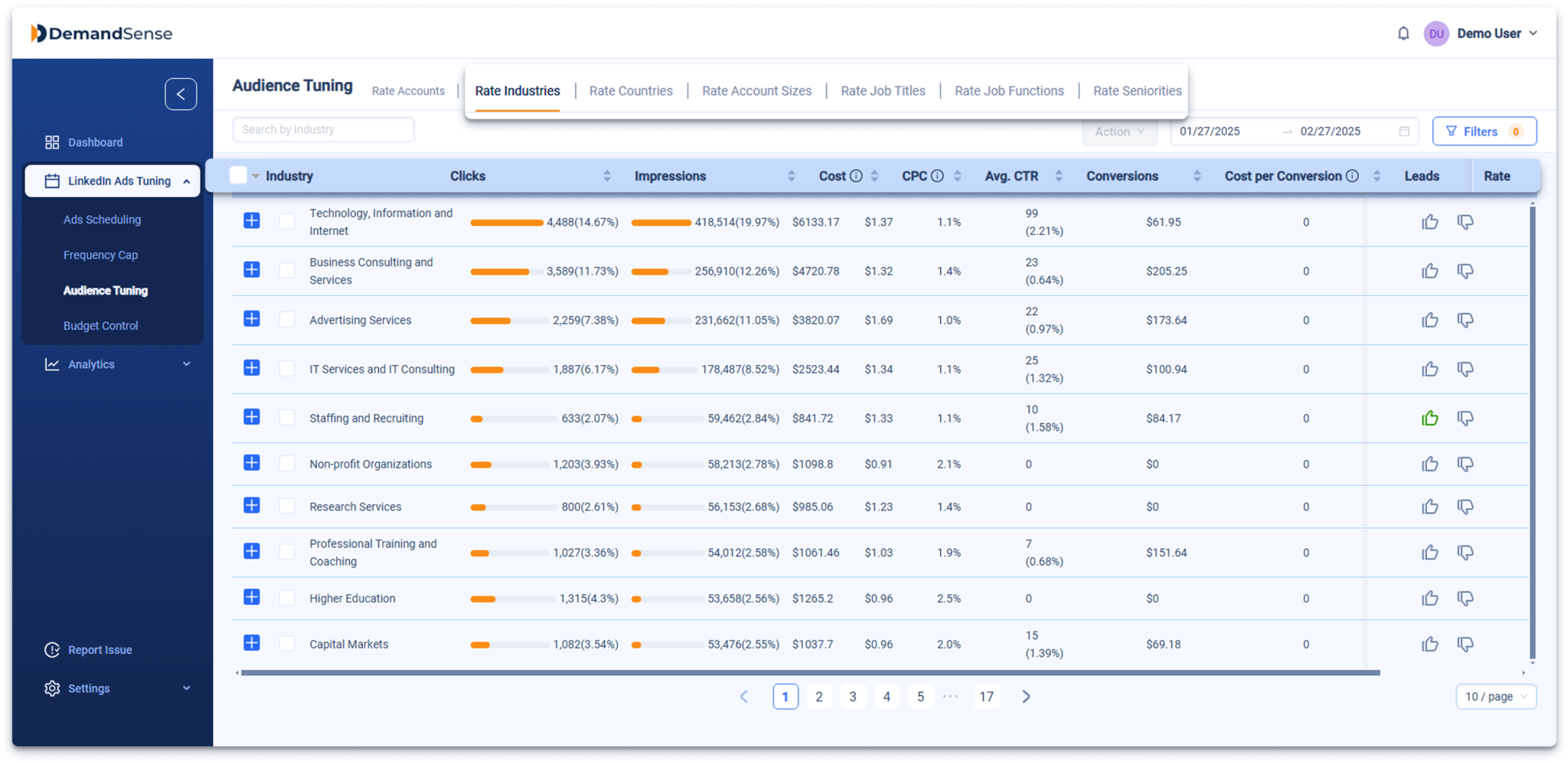

Frequency capping in DemandSense - Audience Tuning: Beyond LinkedIn’s native breakdowns, DemandSense shows which industries, departments, or accounts are converting and lets you exclude underperformers or scale winners with one-click adjustments.

Audience tuning in DemandSense

Multi-Channel Activation

Although LinkedIn is the star, DemandSense can extend your reach. The platform advertises integration with Facebook and even display/CTV programmatic networks.

In practice, this usually means you use the same account lists (from site intent or ABM research) to target on those channels via custom audiences.

The idea is a unified journey: someone clicks your LinkedIn ad, visits your site, then sees a follow-up on Facebook – all tracked by DemandSense.

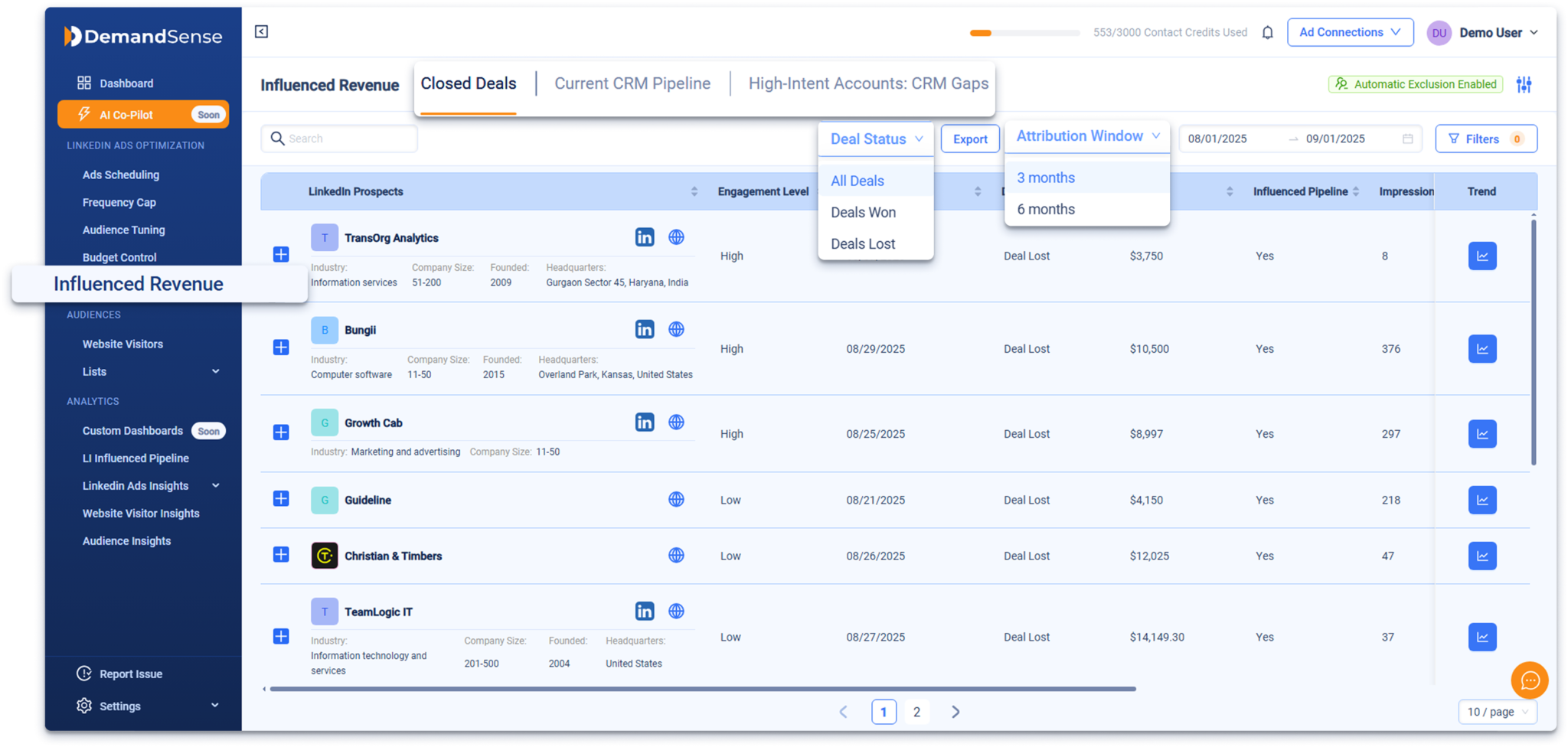

CRM/Data Integration & Engagement Insights

DemandSense isn’t just about ads.

It wants to tie everything back to revenue.

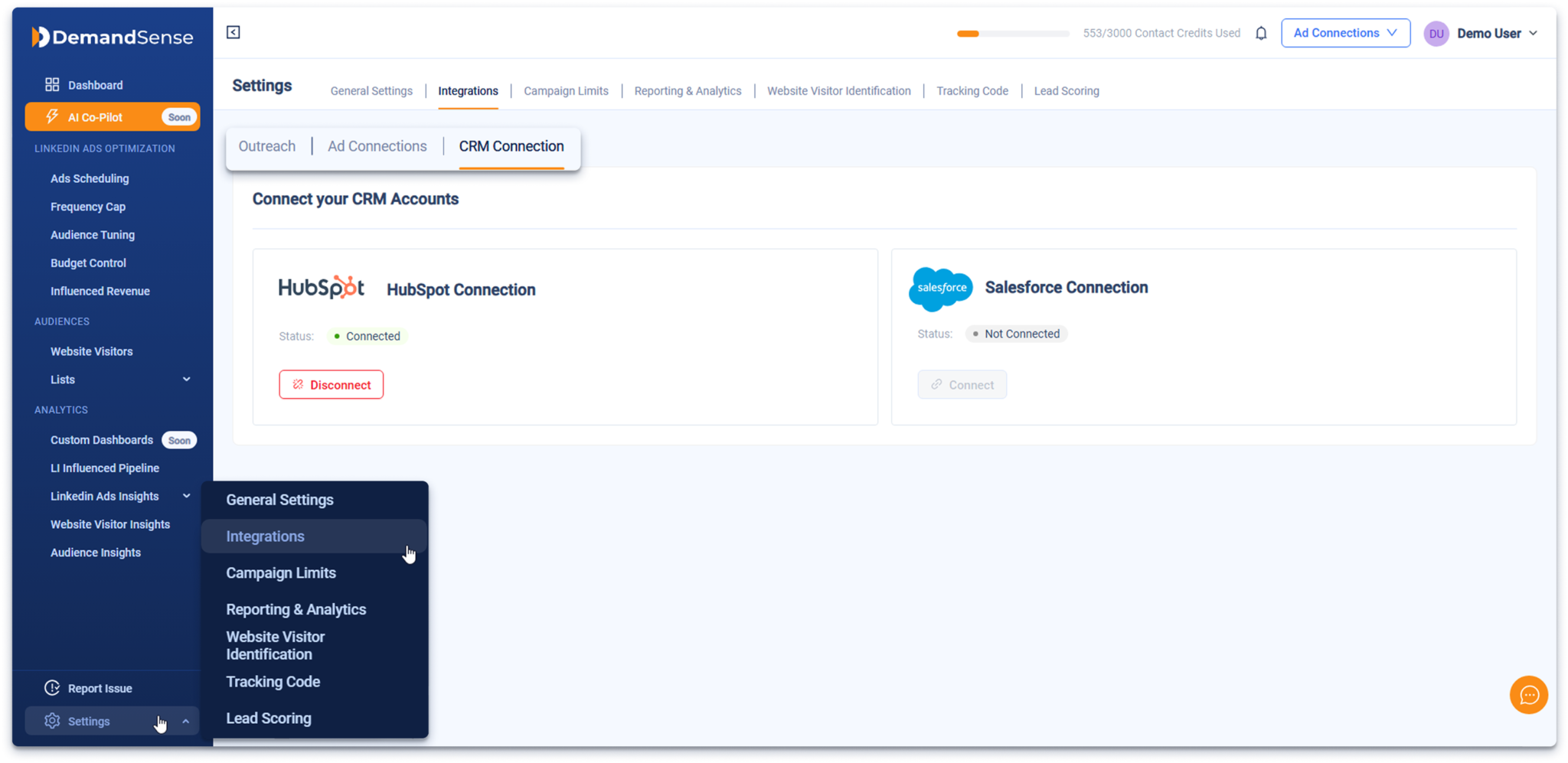

It pushes engagement data into your CRM and syncs with tools like HubSpot and Salesforce to update CRM company records with LinkedIn impressions, clicks, and account scores.

This gives sales teams signals (e.g. “Acme Corp viewed your pricing page after clicking a LinkedIn ad”) and lets you attribute ad spend to the actual pipeline.

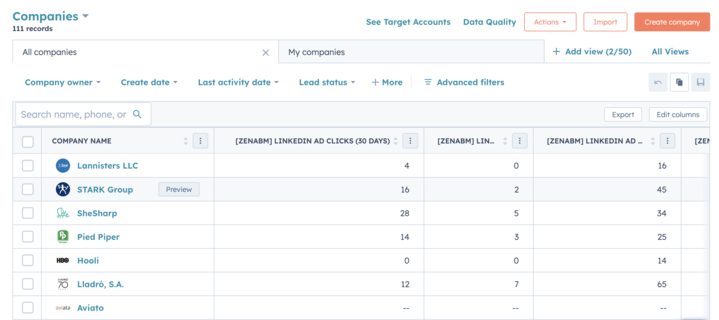

By the way, ZenABM also pushes account scores and engagement into CRM company records as company properties (starts @$59/month only!).

Hourly Reporting

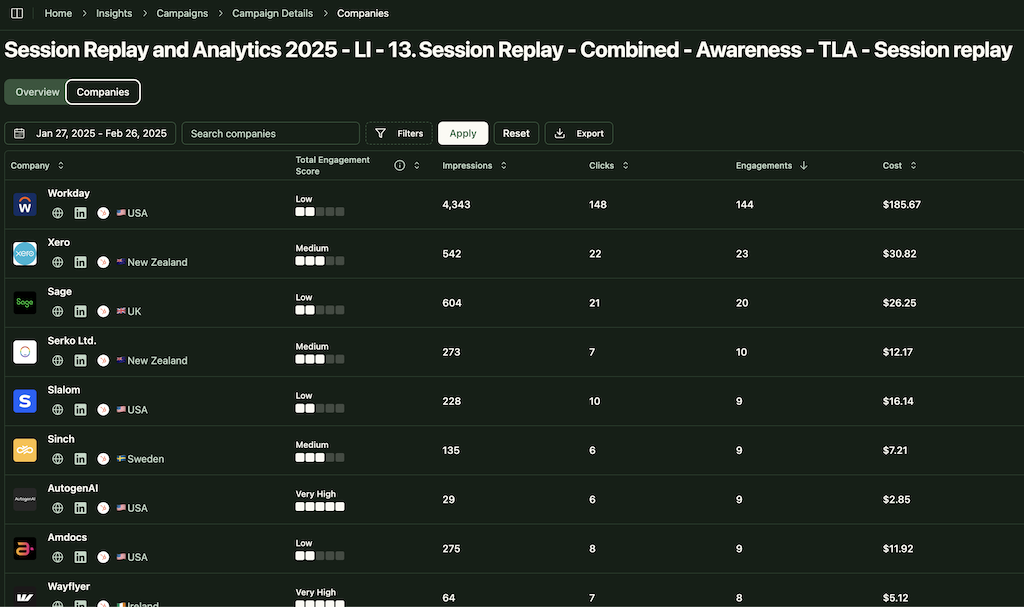

DemandSense provides hourly breakdowns of ad-engagement, spend, and more:

DemandSense Pricing: How Much Does It Cost?

The pricing for DemandSense is built around two primary tiers that reflect how deeply a team wants to integrate buying intent signals into their LinkedIn and cross channel GTM efforts. T

he DemandSense Basic plan, priced at $99 per month, gives marketers and sales teams a self-serve entry into the platform.

It includes audience tuning so users can see which companies have viewed or interacted with their LinkedIn ads and refine targeting through an interactive interface.

It also unlocks ad scheduling, frequency capping, and richer reporting that surfaces deeper LinkedIn insights.

For companies that want intent data flowing directly from their website into their sales motion, DemandSense Plus starts at $149 per month.

It includes everything in the Basic tier, along with 250 monthly data credits that can be used to identify anonymous website visitors or uncover sales leads from target accounts.

This tier gives users access to the Website Visitor ID module and the ability to reveal decision-maker-level contact information whenever an account shows buying signals.

Together, the two plans position DemandSense as an accessible but scalable LinkedIn-centric intent tool for B2B teams that want sharper targeting, cleaner budget control, and a clearer line of sight from ad engagement to real revenue action.

DemandSense vs. ZenABM: Pricing Comparison + Free Website Visitor Reveal Hack

The $99 and $149 DemandSense plans look friendly on paper, but the moment you notice that the Plus tier only includes 250 monthly credits, the shine fades fast. Any decent volume of traffic or sales research burns through those credits in no time, and once you hit overages, you start paying the real bill, which is where the platform stops feeling “affordable” and starts acting like a typical intent data upsell machine.

ZenABM appears to be a smarter alternative, starting at ~$59/month for a starter plan and its highest agency-level tier with unlimited offerings (no credit-based system) also doesn’t exceed $6k/year.

Plus, you get all you need for LinkedIn ABM: account-level ad engagement tracking, account scoring, ABM stage tracking, assignment of hot accounts to BDRs, bi-directional CRM sync, custom webhooks, qualitative company buyer’s intent tracking, job-title-level ad engagement tracking, and plug-and-play ROI attribution dashboards.

In fact, ZenABM also provides you with unlimited website visitor identification for free. You just have to retarget website visitors with LinkedIn text ads, which are dirt-cheap, and ZenABM will list out the companies that were served impressions, essentially deanonymizing the website visitors.

Plus, you’ll also be creating awareness!

User Impressions and Reviews

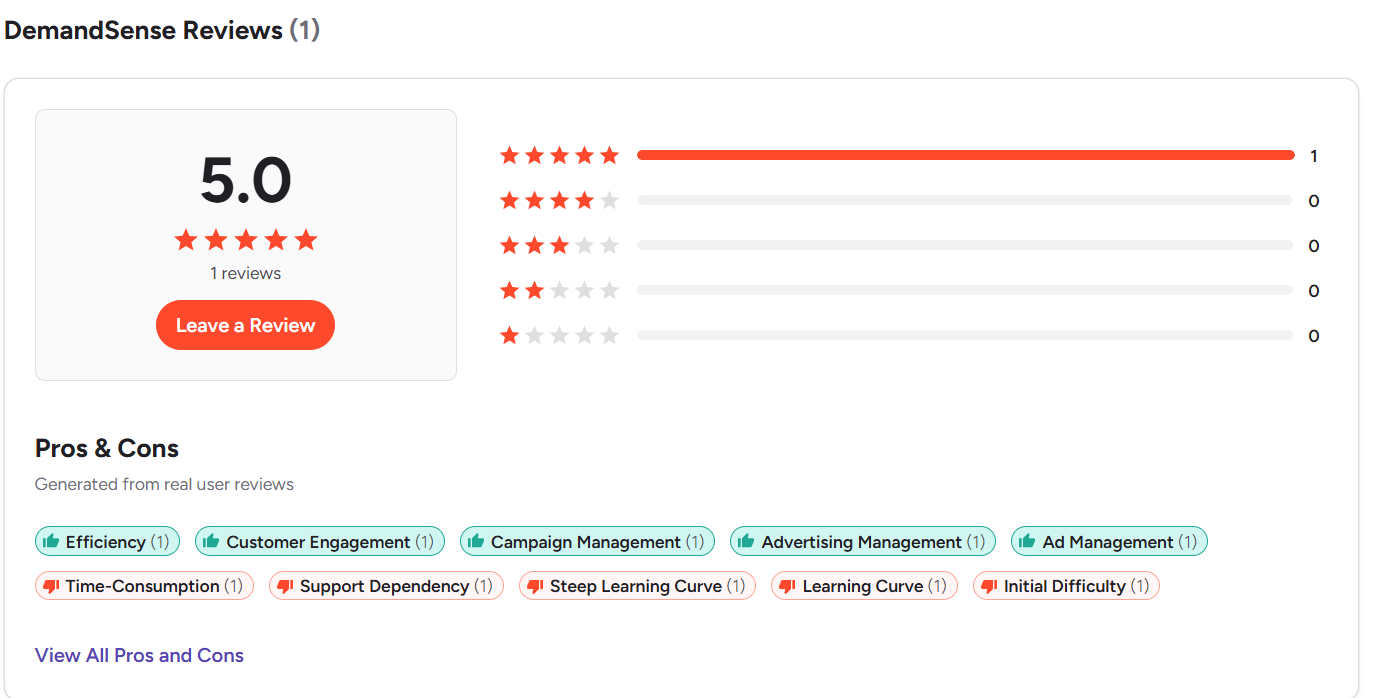

There aren’t a ton of public reviews yet.

On G2, DemandSense has one 5-star review from an agency user.

Yes, the review is from just one user:

The reviewer praises the LinkedIn integration and clear ROI gains.

The same reviewer warns of a learning curve: “there’s a lot packed into the platform… to really get the value, you need to spend time setting things up.”

In practice, that means small teams may need patience or vendor help.

He even advises new users to enlist DemandSense support to get going.

ZenABM: A Lean First-Party LinkedIn ABM Alternative

One alternative to DemandSense is ZenABM.

It is specifically designed for LinkedIn ABM, so it can either be a complete, lean and affordable alternative to DemandSense for teams that mainly advertise on LinkedIn.

Even for teams running multi-channel ABM, ZenABM can be a complementary layer to DemandSense or whichever bigger ABM suite they are using because of ZenABM’s unique features.

Let’s look at those features:

LinkedIn Ads Engagement at the Account Level

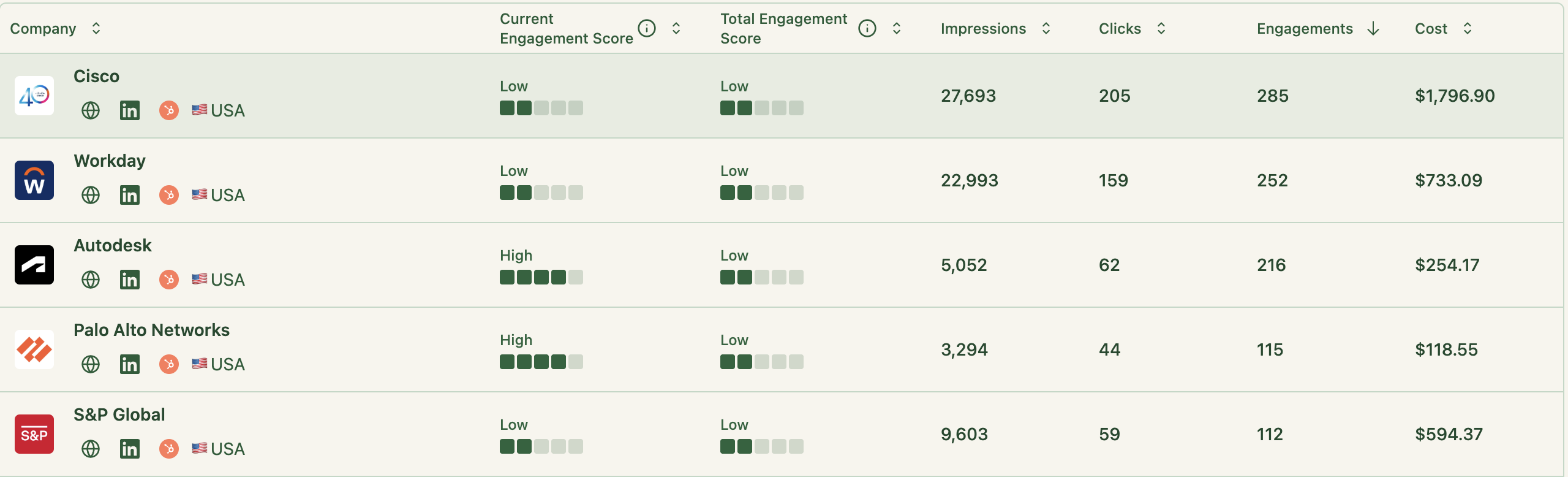

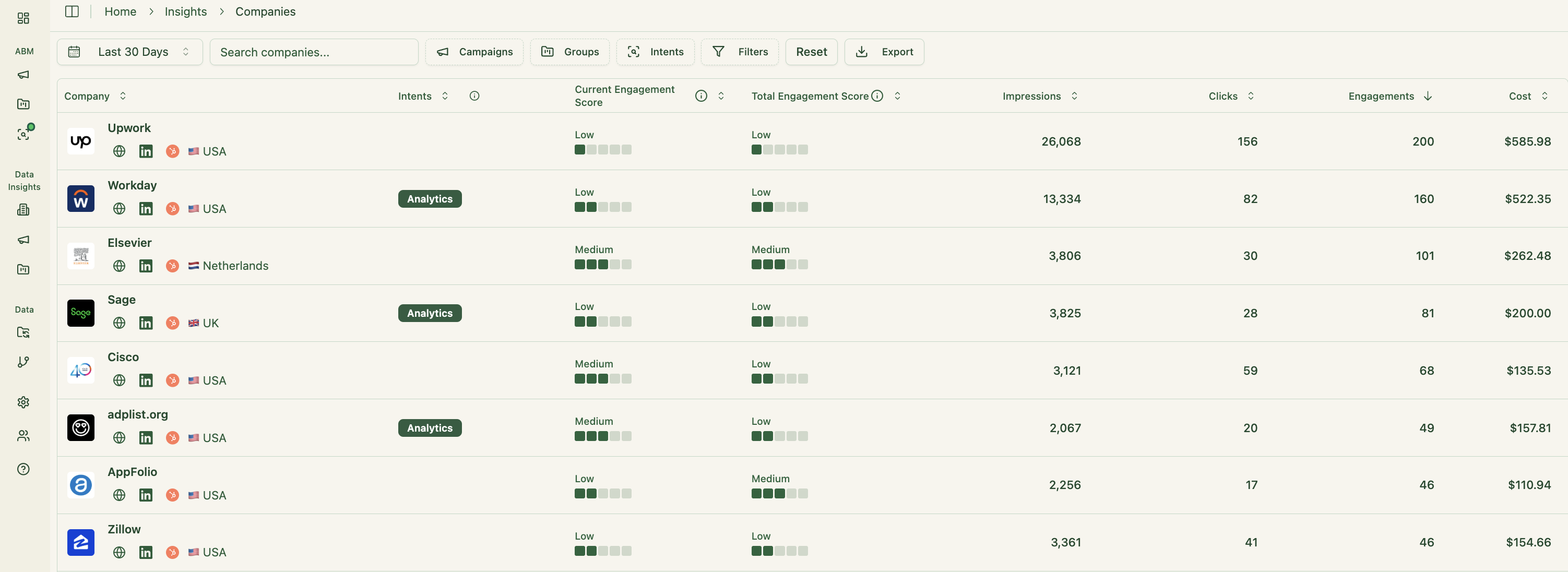

ZenABM integrates directly with the LinkedIn Ads API to pull account-specific data from all campaigns.

This allows you to identify precisely which target accounts are interacting with your LinkedIn ads (impressions, clicks, etc.), all mapped to individual companies.

Pro Tip: ZenABM can also reveal anonymous website visitors for free. Retarget them with inexpensive LinkedIn text ads, and ZenABM will identify the companies that saw your impressions.

Real-Time Engagement Scoring

ZenABM continuously updates engagement scores from ad interactions. You can monitor recent trends (like the past week) or historical patterns to identify accounts heating up.

These scores help marketing and sales prioritize high-value accounts for follow-up.

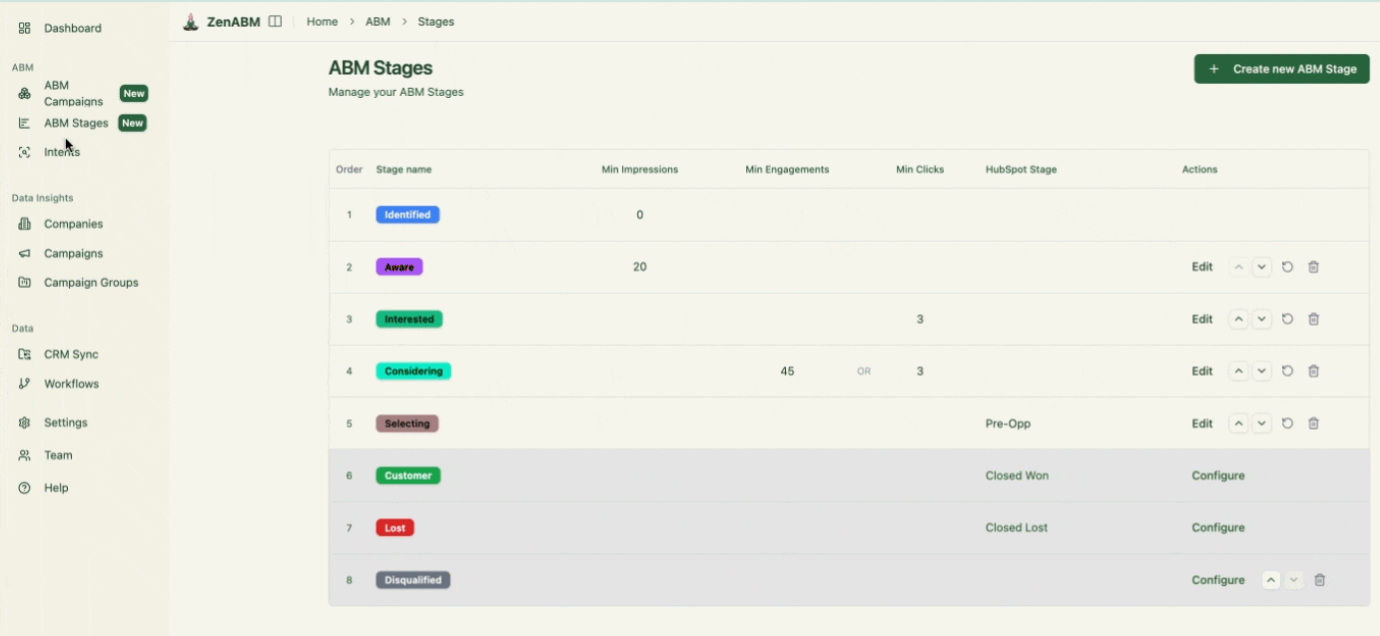

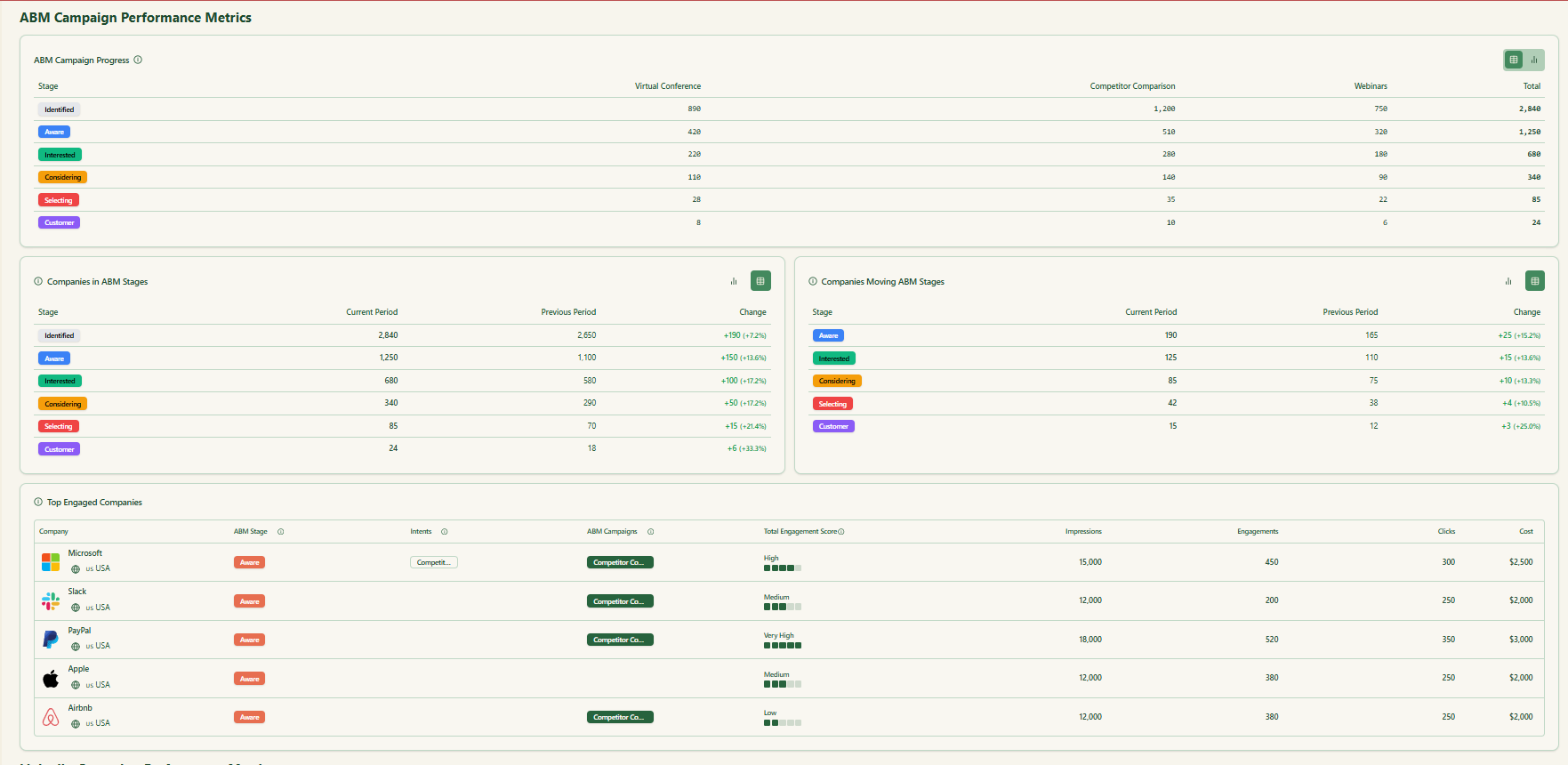

ABM Stage Tracking

ZenABM enables you to define your ABM funnel stages (e.g., Identified → Aware → Engaged → Interested → Opportunity) and automatically classifies accounts using engagement and CRM information.

You can set your own thresholds for “Engaged” or “Interested,” and ZenABM will track stage transitions automatically.

This delivers full-funnel visibility like enterprise ABM platforms, highlighting where accounts stall and where progress accelerates.

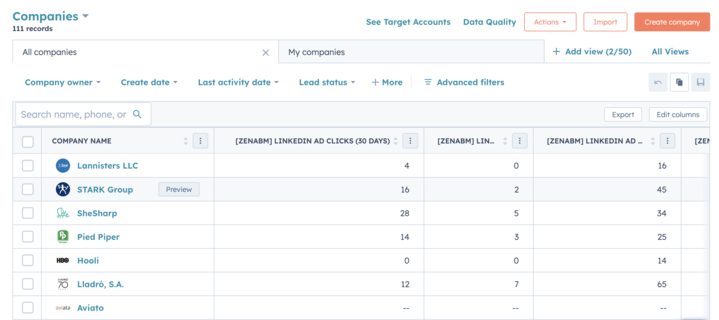

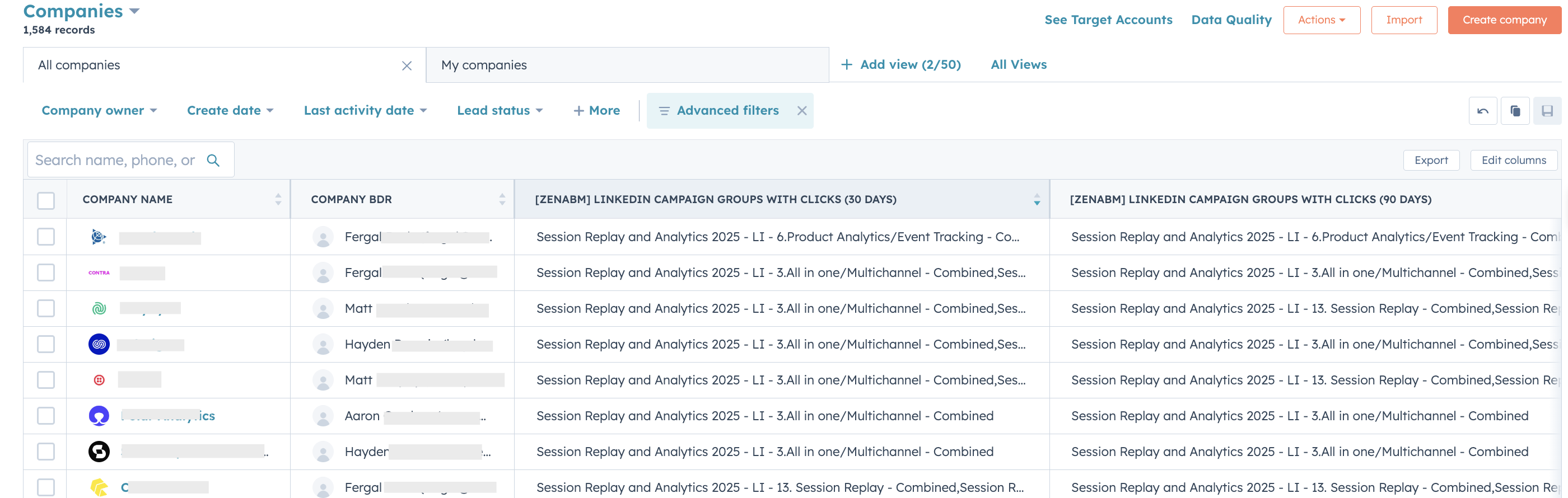

CRM Integration and Workflows

ZenABM integrates bidirectionally with CRMs such as HubSpot (Salesforce available on higher plans).

LinkedIn engagement data feeds directly into your CRM as company-level properties, keeping sales teams informed:

ZenABM can auto-update account stages to “Interested” when engagement passes a set threshold and assign accounts to specific BDRs for follow-up.

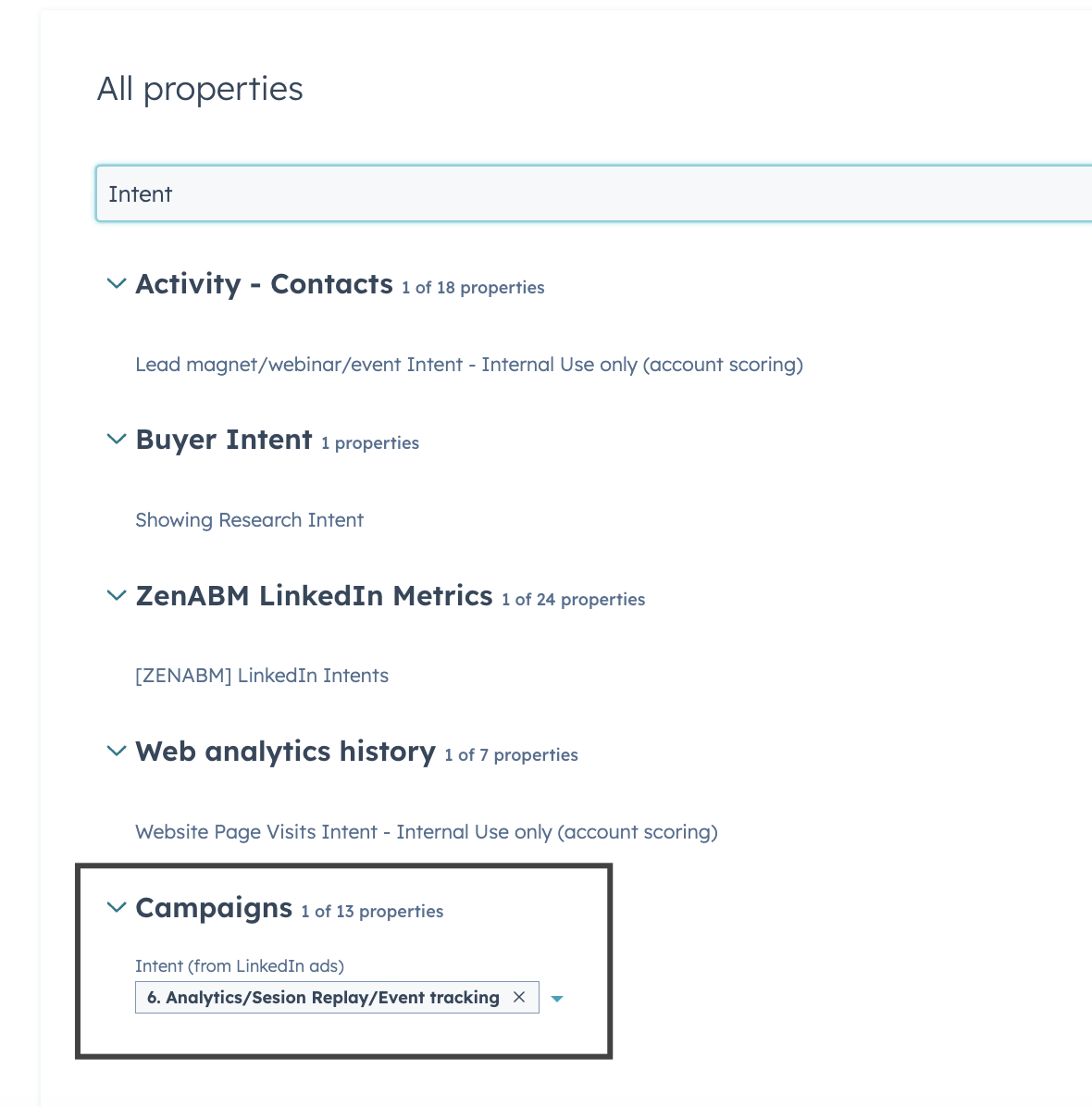

Intent Tagging from LinkedIn Ads Engagement

ZenABM allows you to tag campaigns by theme (like “Feature A” vs. “Feature B”) and shows which accounts engage with which themes, revealing their priorities.

This is genuine first-party intent. Instead of paying for inferred keyword interest, you get direct proof like Account Z clicking “Feature A” ads, demonstrating actual buying interest.

These insights also sync to your CRM, supporting highly targeted outreach and relevant messaging.

Your sales reps can instantly see which topics or pain points each account reacts to most.

This feature is fairly unique to ZenABM, making it a worthwhile add-on even if you already have an existing subscription to some other ABM tool.

Job-Title Analytics

ZenABM also gives a breakdown of the specific job titles that interact with your ads.

Raw metrics, dwell time, full video funnel – all available out of the box.

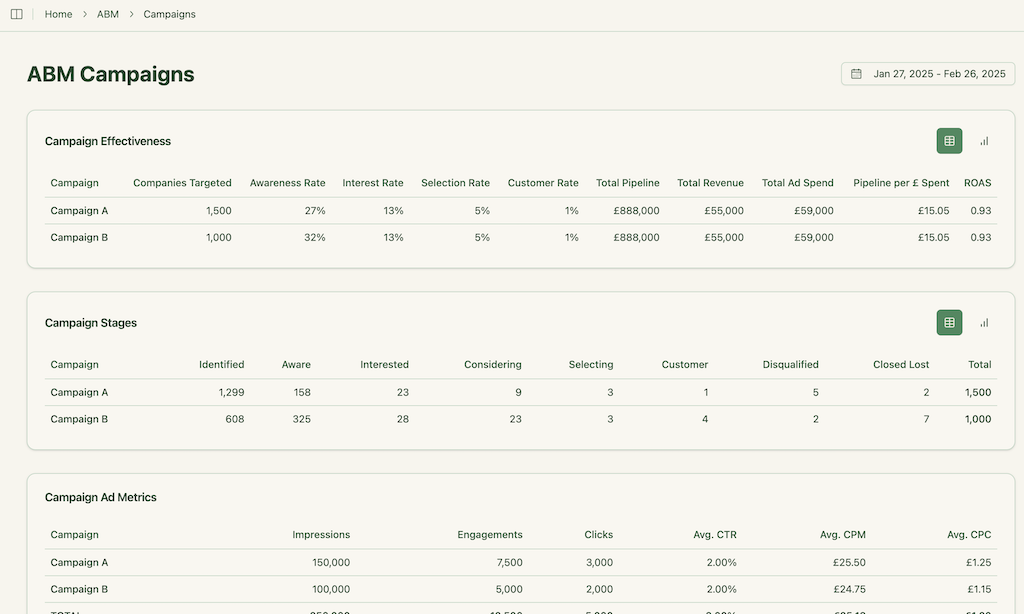

Built-in Dashboards and ABM Analytics

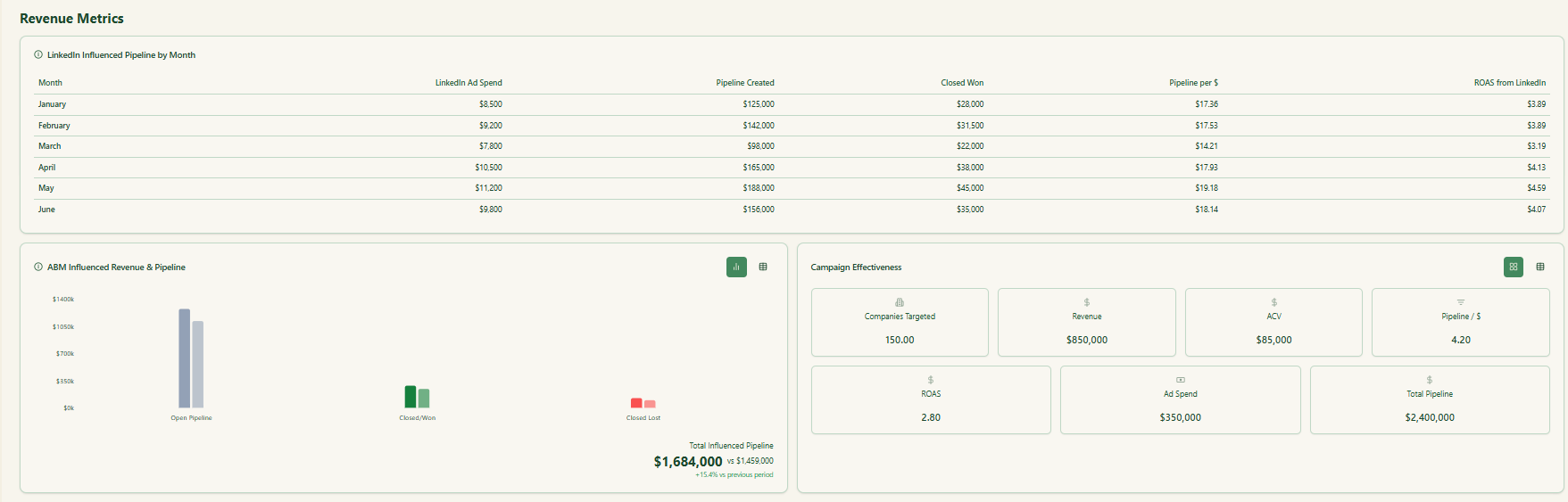

ZenABM includes pre-built ABM dashboards linking ad exposure, engagement, funnel stages, and pipeline metrics.

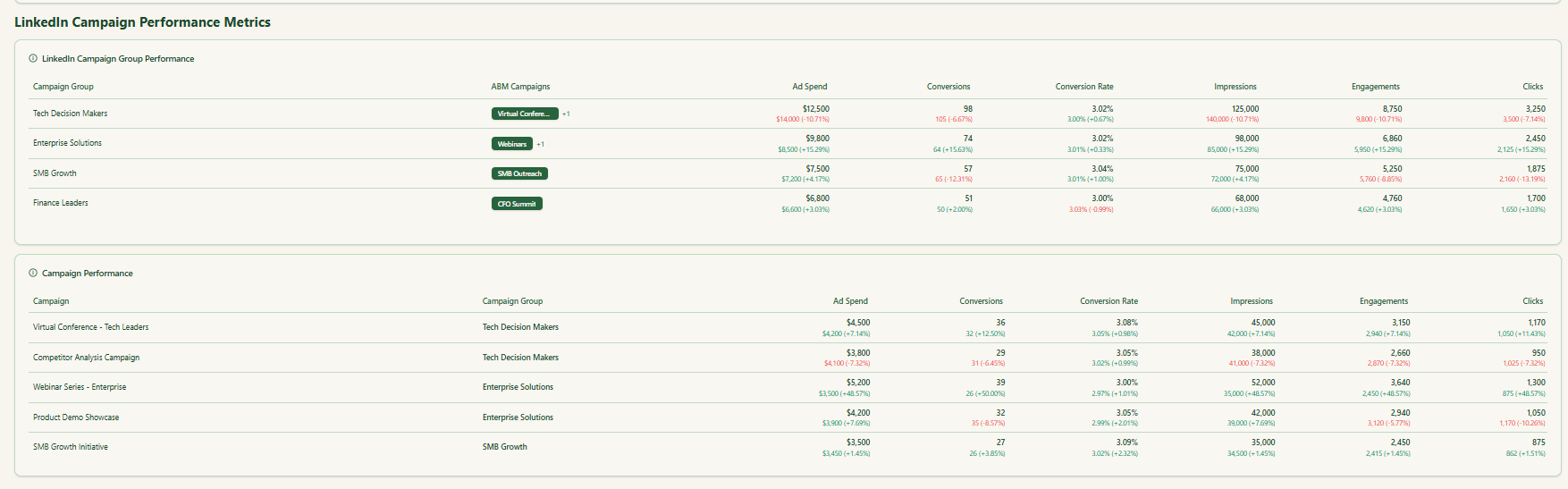

- Track performance across campaigns, LinkedIn groups, and individual ads:

- ZenABM tracks both deal size and ad spend per account/campaign, enabling ROAS, pipeline per dollar, and campaign-driven revenue insights. Revenue teams can use this to optimize engagement and accelerate deal closure rather than focusing on vanity metrics

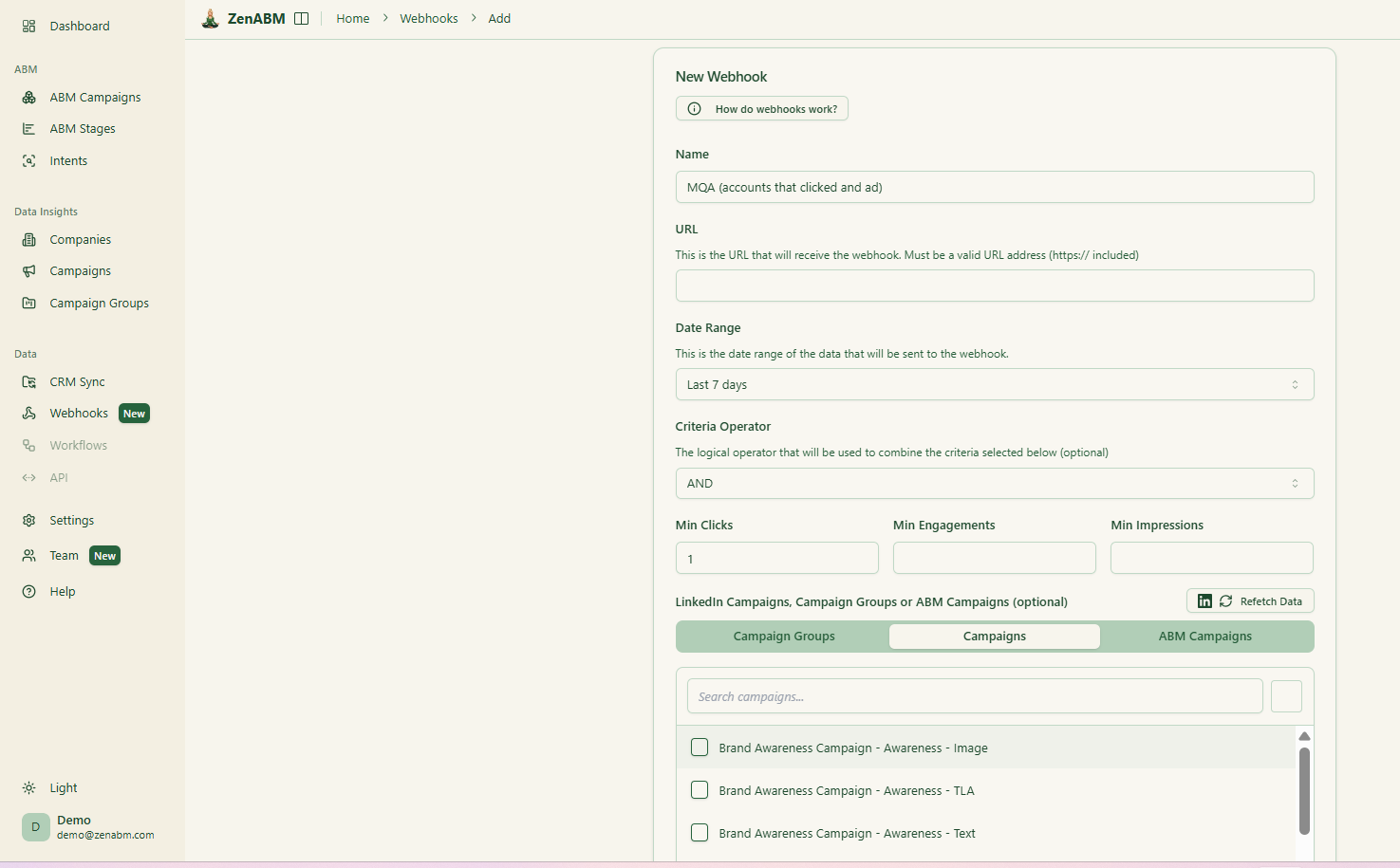

Custom Webhooks

With the newly rolled out custom webhooks, ZenABM can fit into any of your workflows as needed.

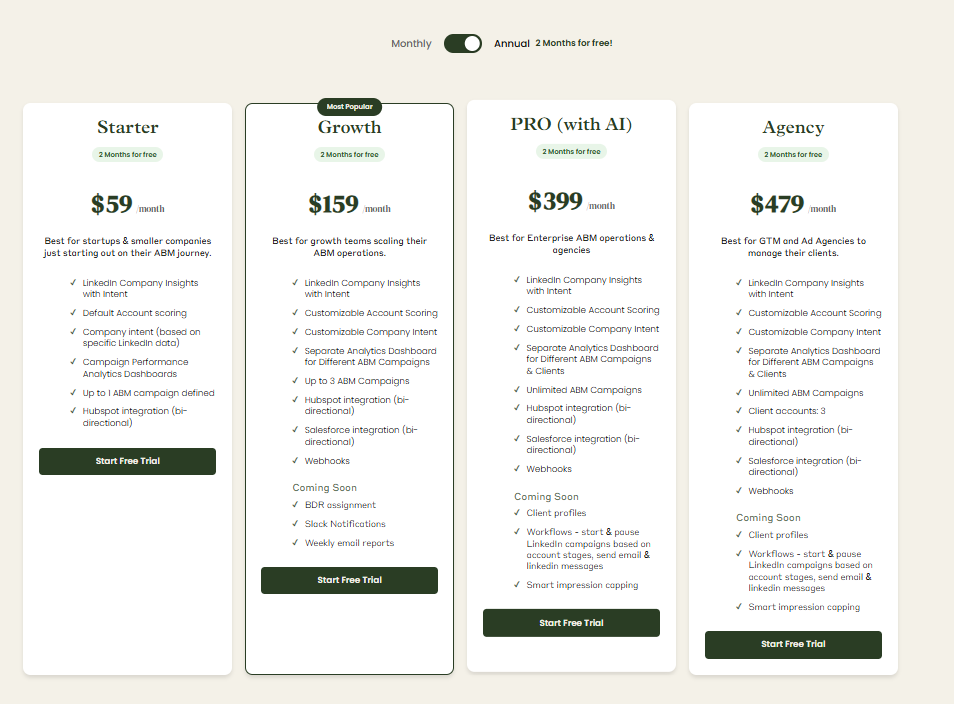

ZenABM Pricing

Plans start at $59/month for Starter, $159/month for Growth, $399/month for the Pro (AI) tier, and $479/month for the agency tier.

Even the highest tier costs under $6,000/year, far less than what DemandSense would cost, keeping in mind the overages, as its $149 plan only comes with 250 monthly credits, which are inadequate.

All plans cover essential LinkedIn ABM functions, with higher tiers mostly expanding limits or adding Salesforce integration.

Pricing is flexible (monthly or annual with two months free), and a 37-day free trial allows teams to try before buying.

Conclusion

DemandSense packs plenty of features, but it also carries the usual tradeoffs that come with intent data tools that rely on credit limits, layered modules, and a learning curve that small teams often struggle with.

It can work well for brands that want a heavier, multi-channel setup, but its true cost becomes clear only once you start burning through credits and paying for overages.

If your primary focus is LinkedIn ABM and you want first-party engagement insight, cleaner pricing, and a faster path to pipeline visibility, ZenABM is the more practical fit.

It delivers the core capabilities most teams actually need without the bulk or the surprise bills.

Whether you’re starting your ABM journey or looking to fill gaps in your current stack, it’s worth exploring ZenABM’s 37-day free trial.