In this article, I compare Common Room vs. Terminus across features, pricing, and practical fit so marketing and sales teams can choose the platform that best supports their account-based marketing program.

I also explain where ZenABM can play as a lean, cost-effective alternative or a complementary layer to these enterprise ABM suites because it works differently.

Read on…

Common Room vs. Terminus: Quick Summary

In case you’re short on time, here’s a summary:

- Common Room: Best for signal intelligence, identity resolution, and SDR/AE activation. Starts around $1K/month.

- Terminus: Broad ABX platform for ad, web, and email orchestration. Enterprise-level cost ($23K–$250K+/year). Only offers paid plans with no free tier.

- Complexity: Common Room = fast setup; Terminus = process-heavy and may require a complex setup for full deployment, but powerful.

- Pricing Transparency: Common Room publishes clear tiers; Terminus is quote-only.

- Integration Depth: Both integrate deeply, but Common Room emphasizes “signals-to-people,” while Terminus emphasizes “multi-channel engagement.”

- ZenABM as an alternative: Lightweight, LinkedIn-first ABM suite with first-party ad engagement intent data straight from LinkedIn’s official ads API, qualitative intent tracking, full two-way CRM sync, account scoring, and ROI attribution. Starts at $59/month with a 37-day free trial.

Common Room Overview: Key Features, Pricing, and More

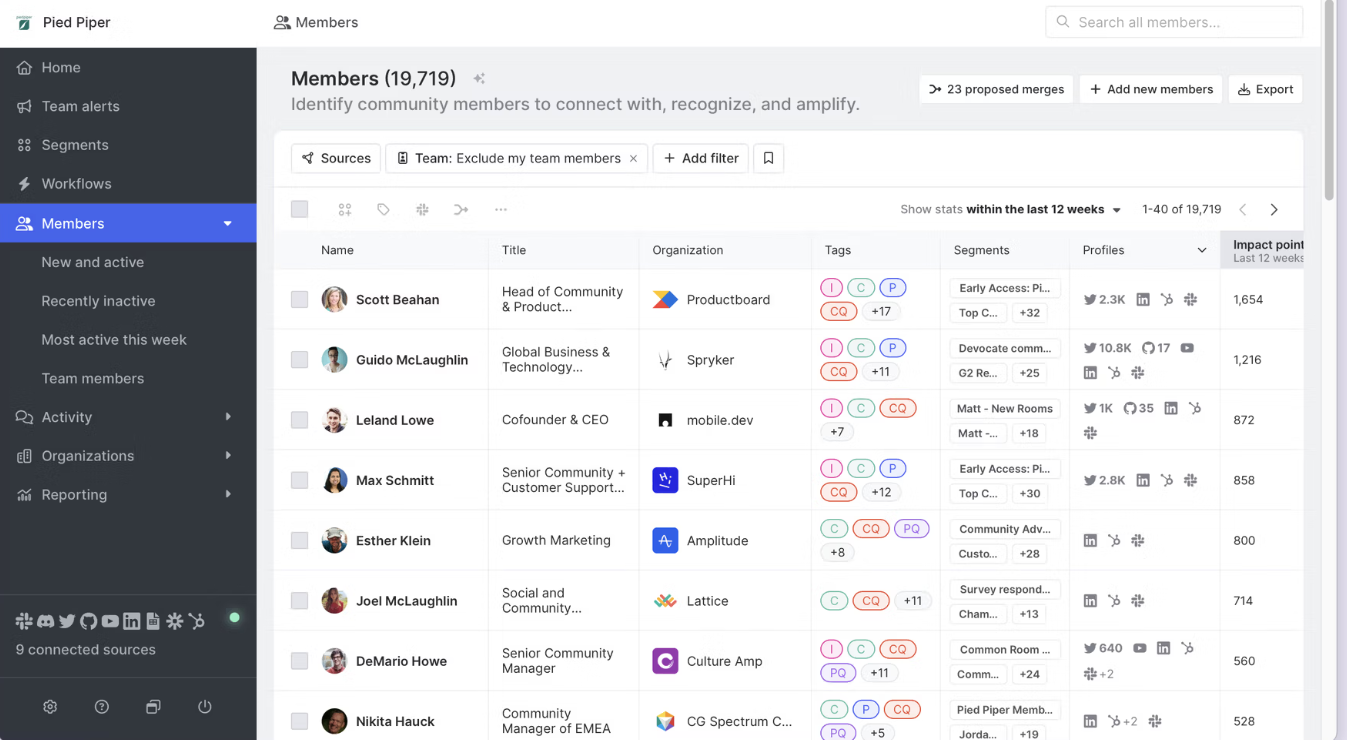

Common Room is a comprehensive customer intelligence and ABM platform that aggregates data from dozens of sources to give a 360° view of your prospects.

The name is indeed apt.

It’s a “common room” where signals from web traffic, product usage, community interactions, and more are unified into one place.

Plus, unlike most ABM tools, Common Room takes a completely person-centric approach.

Let’s look at its key features:

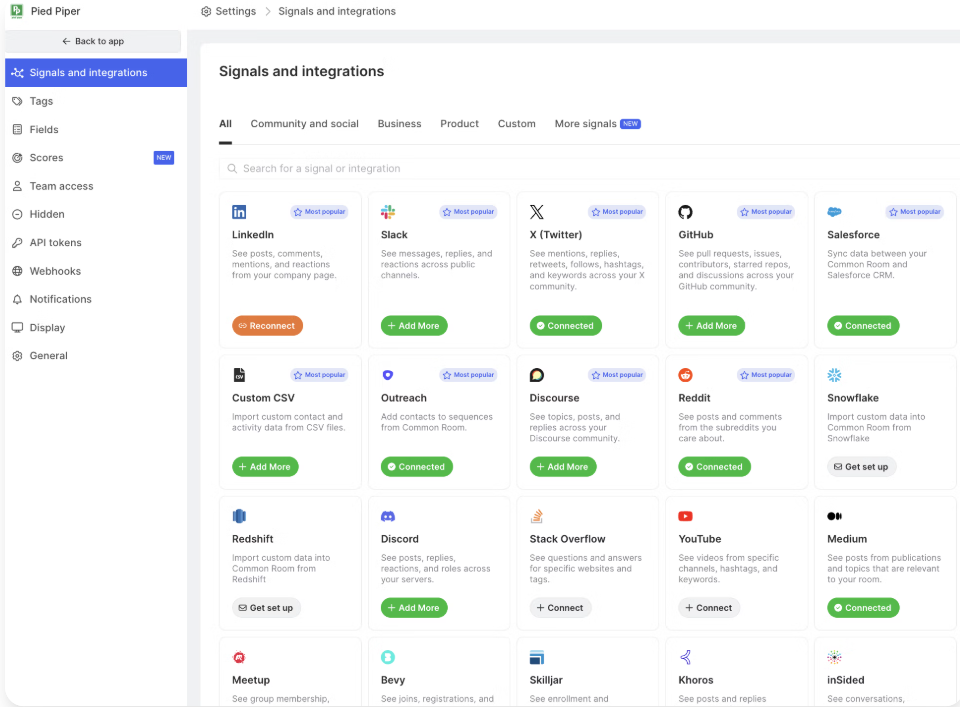

Massive Signal Integration

Common Room pulls in buying signals from 50+ native integrations across social media, community forums, CRM, product analytics, and more.

These include Slack, Discord, GitHub, LinkedIn, Twitter, Salesforce, HubSpot, Marketo, and even platforms like G2 and Stack Overflow.

All integrations are code-free, making it easy to connect your data sources and provide a unified view of customer and account activity.

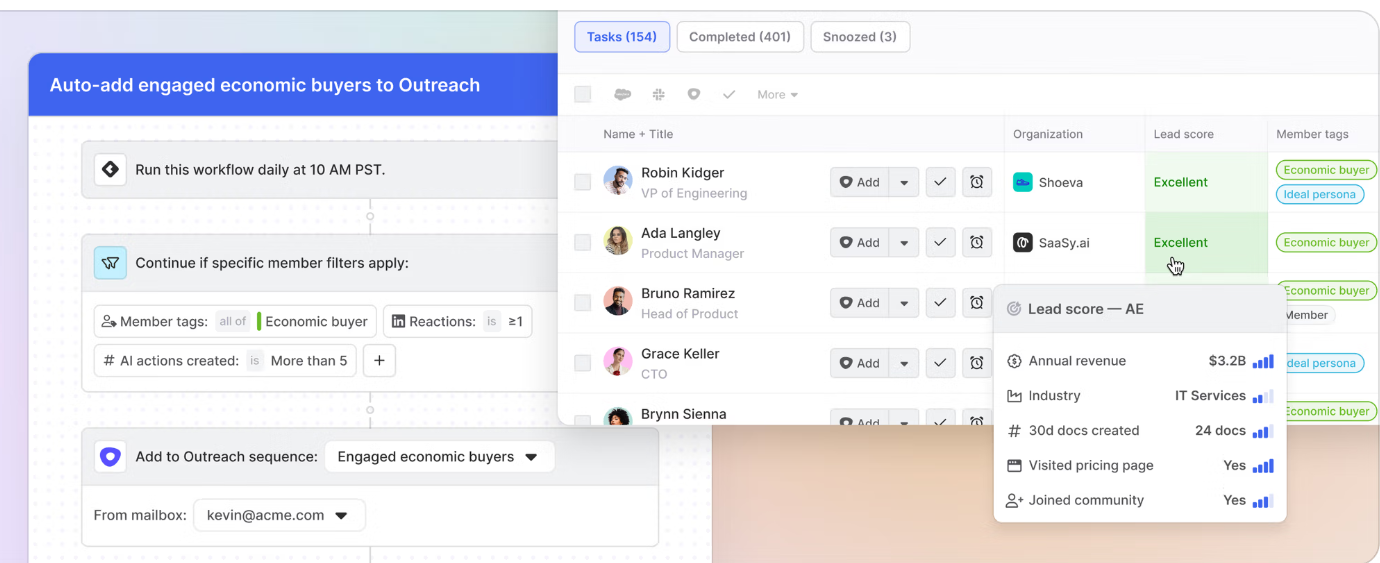

AI-Powered Identity Resolution (Person360™)

Once data flows in, Common Room’s Person360™ AI engine automatically merges activities into unified contact and account profiles.

It uses advanced matching (beyond simple email) to deduplicate and link identities across channels, flagging any uncertain matches for manual review. T

This creates a “single source of truth” for each lead.

For example, tying an anonymous website visitor to their Slack and GitHub persona once identified.

After identity resolution, a waterfall enrichment process kicks in: Common Room appends firmographic and technographic details (company size, industry, tech stack, etc.) from hundreds of data partners, with daily refreshes.

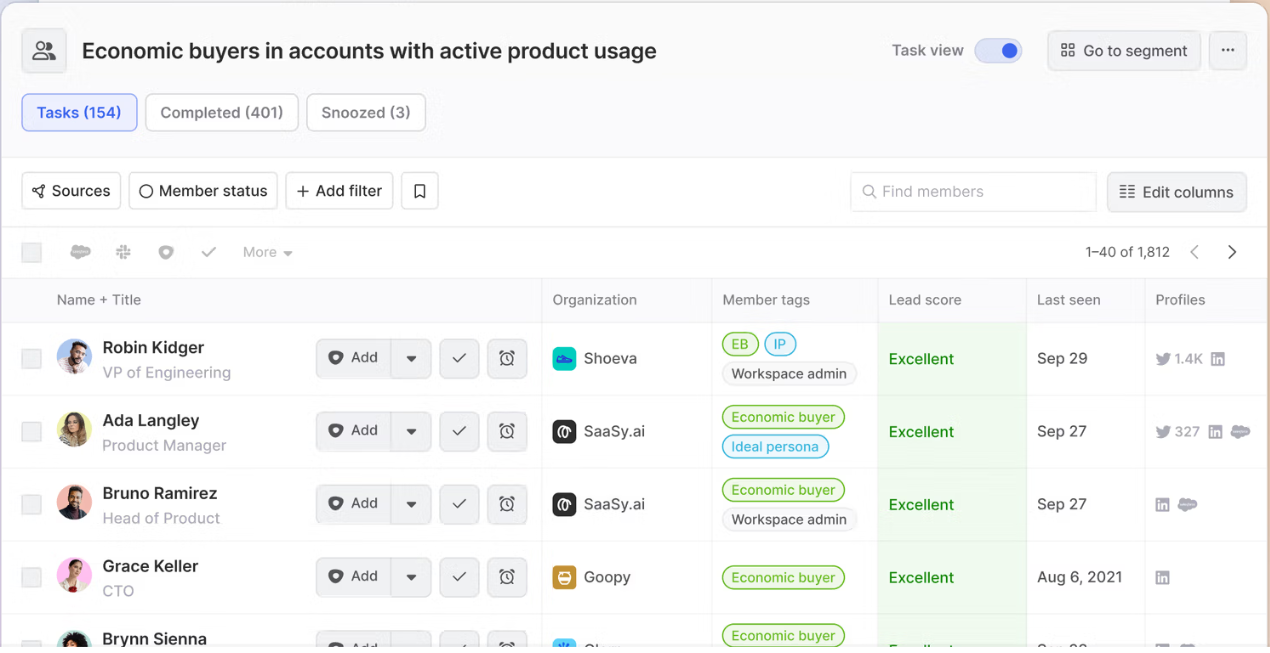

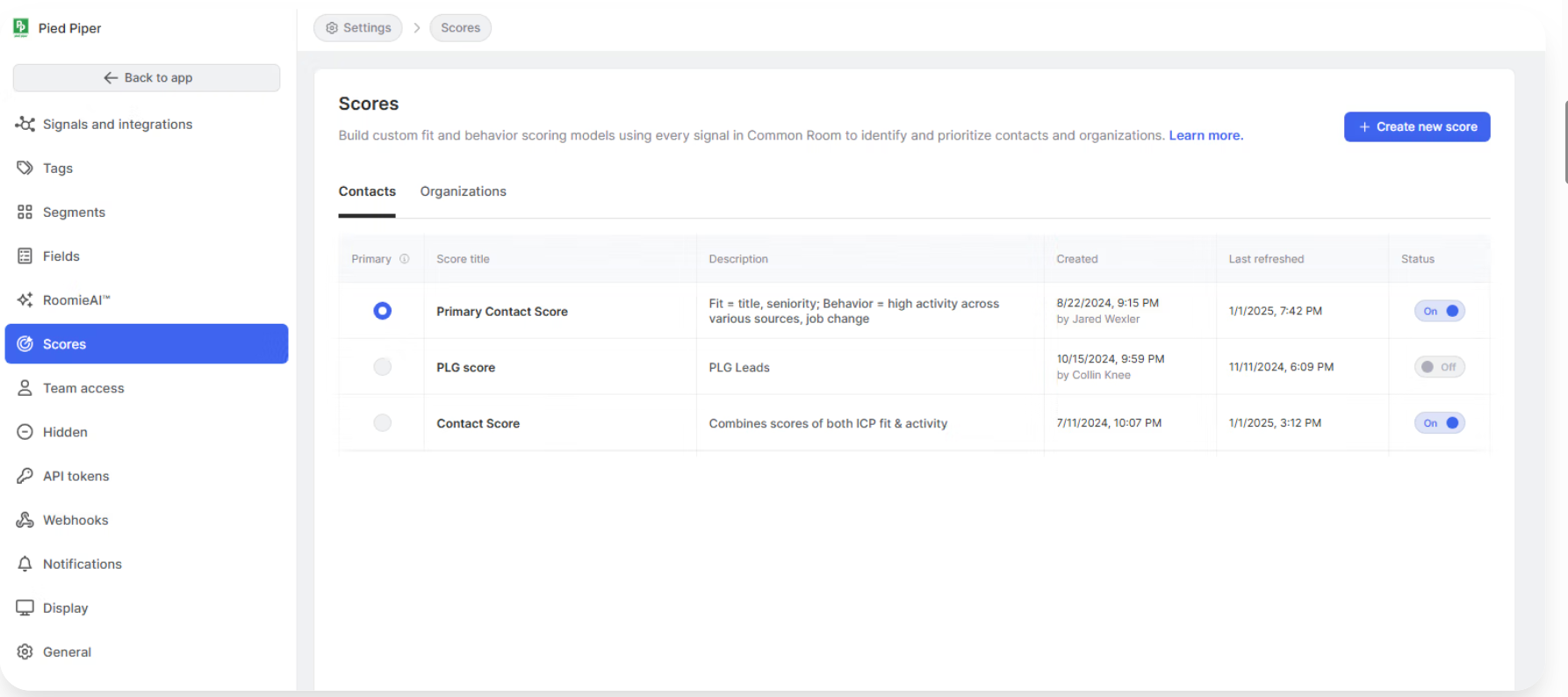

Lead & Account Scoring

Common Room’s AI (nicknamed RoomieAI™) scores and filters leads based on fit and intent.

Users can define custom scoring models that combine any signals (e.g. job title seniority, product usage frequency, community posts) with firmographic criteria.

The platform supports hundreds of buying signals (everything from email opens and form fills to GitHub stars and G2 page visits) as inputs to the scoring engine.

These roll up into both contact-level and account-level scores, so sales teams get prioritized lists of high-fit, high-intent contacts.

For instance, Notion’s sales team uses Common Room to tag “high-fit” accounts and trigger Slack alerts whenever those accounts exhibit buying behavior, helping them quickly identify and act on high intent leads.

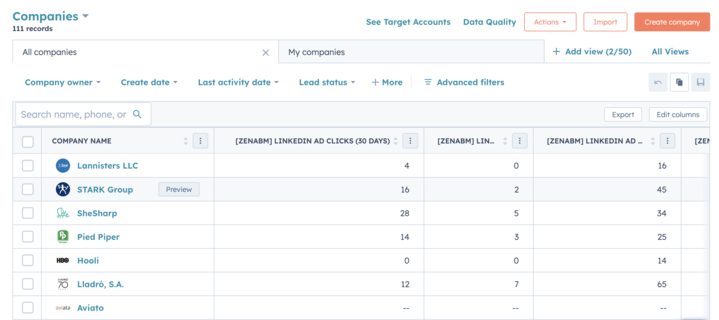

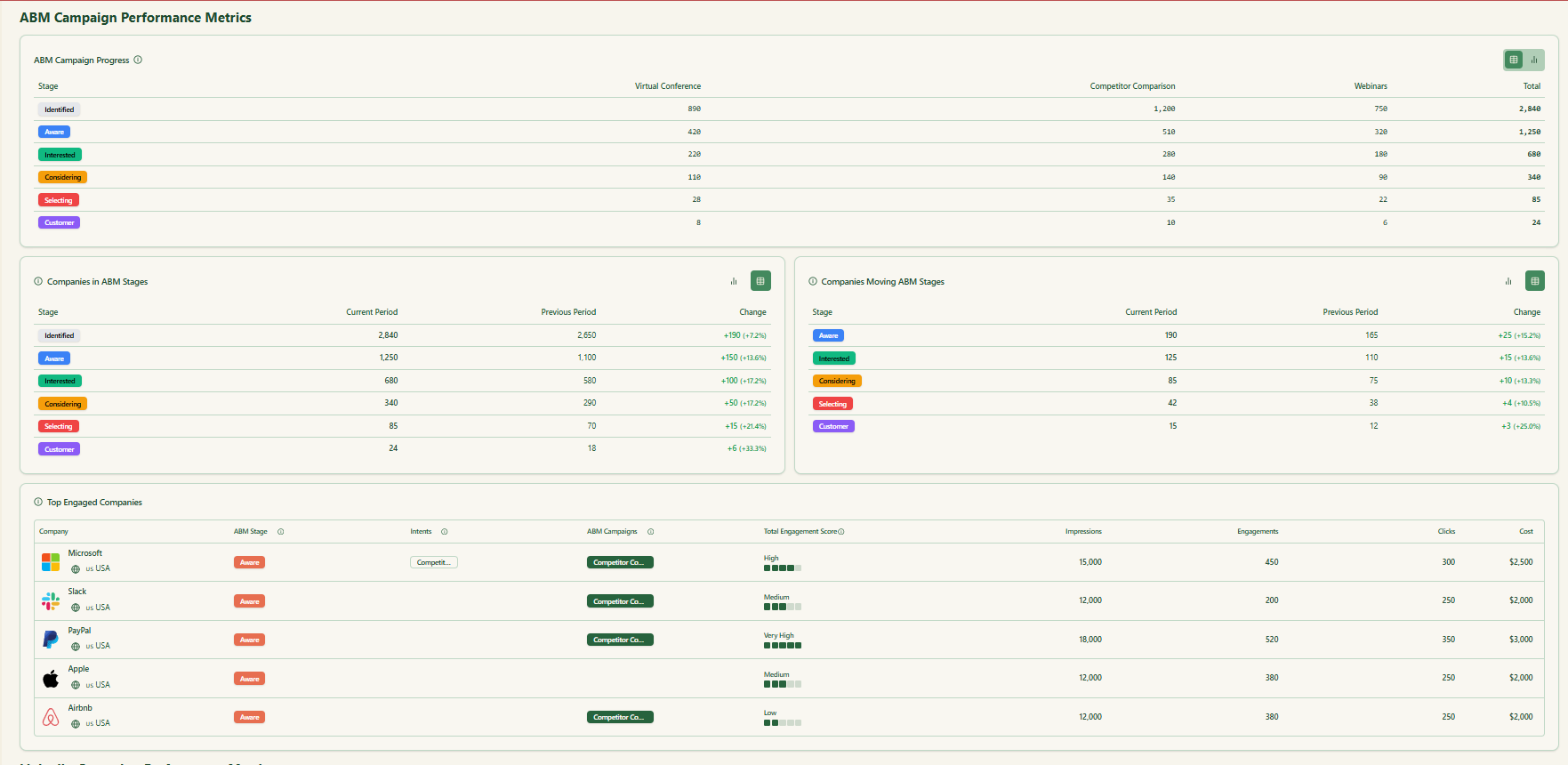

Btw, ZenABM also helps with account scoring based on LinkedIn ad engagements:

Plus, the source of this score is, as I said, LinkedIn ad engagements, which are first-party, so the data accuarcy here is higher.

So, if your ABM motion is LinkedIn-centric, you may want to give ZenABM a try.

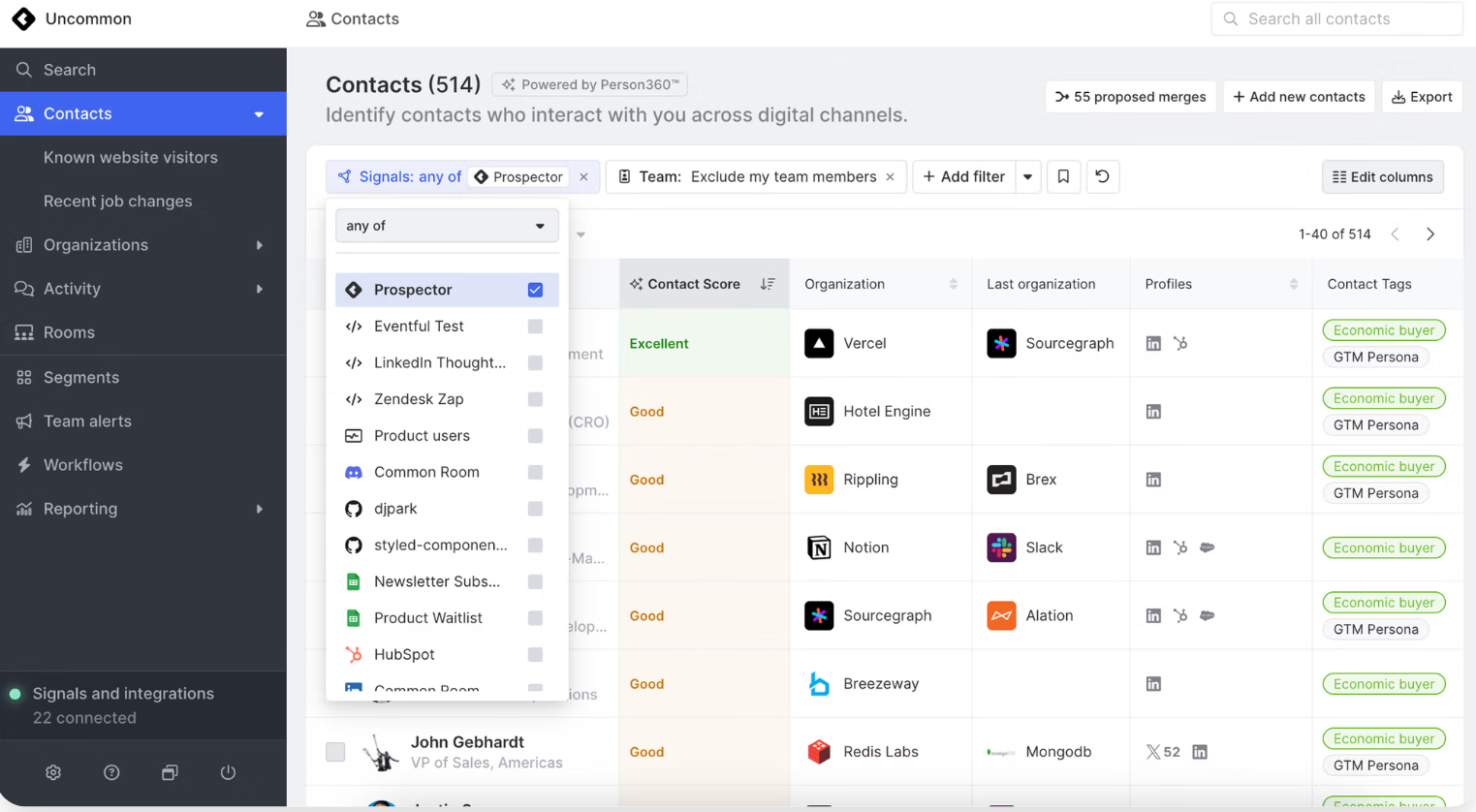

Prospector Database

Going beyond your internal data, Common Room includes a prospecting tool tapping a 200M+ contacts database.

You can input your Ideal Customer Profile (ICP) filters (e.g. industry, role, company size), and Common Room will suggest new accounts and contacts that match, complete with scores based on third-party enrichment.

This feature helps uncover lookalike potential buyers who match your ICP, enabling you to engage with accounts most likely to convert.

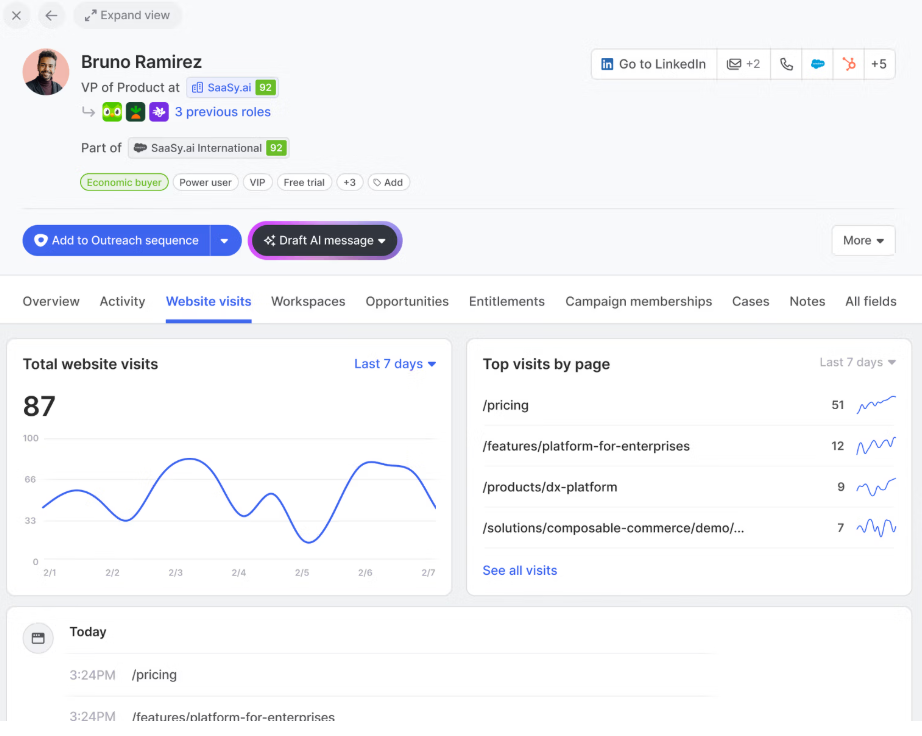

Website Visitor Tracking

Common Room also identifies anonymous web traffic at the account level.

By using a first-party cookie and IP lookup, it can reveal which company a visitor is from (even if the individual isn’t yet known).

Once that visitor converts (fills a form or signs up), their historical page view activity is attached to their profile as part of their entire customer journey that includes other multiple touchpoints.

This means marketing can see intent signals if someone from a target account has been lurking on the pricing page or docs before they ever raise their hand.

Pro Tip: Roughly 42% (as one study found) is where IP lookup for website visitor deanonymization peaks in accuracy.

ZenABM suggests running low-cost LinkedIn text ads targeted at your website visitors as a way to reveal interested accounts.

Text ads on LinkedIn have very low click-through rates (so they’re inexpensive to serve), but ZenABM will show you which companies saw those ads frequently, meaning those companies’ employees likely visited your site’s key pages.

This first-party deanonymization tactic can identify engaged accounts more reliably than fuzzy IP matches and for almost free.

Community & “Dark Funnel” Insights

A standout feature of Common Room is its deep integration with community and developer channels – the so-called “dark funnel” where prospects engage before formal sales.

It links with Slack, Discord, Discourse forums, GitHub, Reddit, and more to surface meaningful activities.

For example, if an engineer at a target account asks a question on your community Slack or stars your GitHub repo, Common Room captures that and attributes it to the person and account.

Sales reps can then get notified and reach out in context.

E.g. “Saw you checked out our GitHub project; can I answer any questions?”

These integrations also provide deeper customer engagement insights from non-traditional channels, helping teams understand and act on valuable feedback and signals.

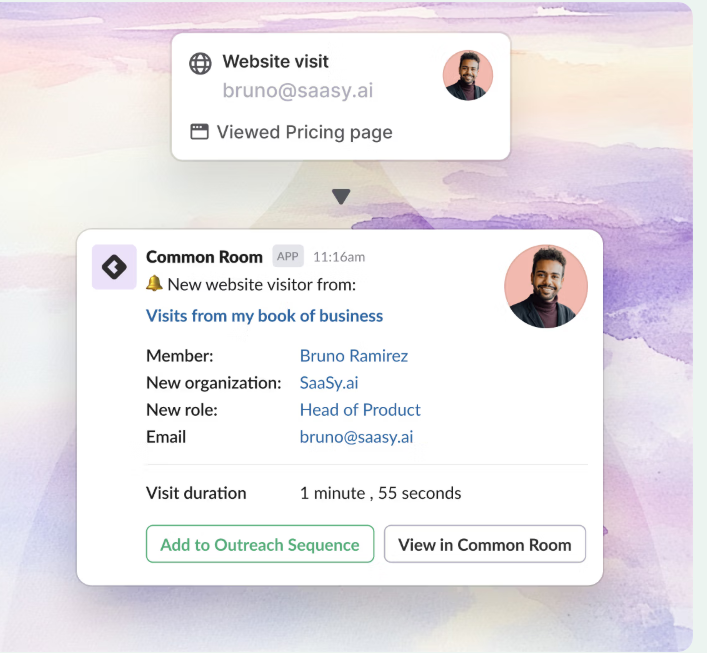

Workflow Automation and Alerts

Common Room helps you act on all these insights with built-in automation.

Team Alerts let you set up real-time triggers.

There’s also a no-code workflow builder to create multi-step automation. These automation features enable GTM teams to respond to signals in real time.

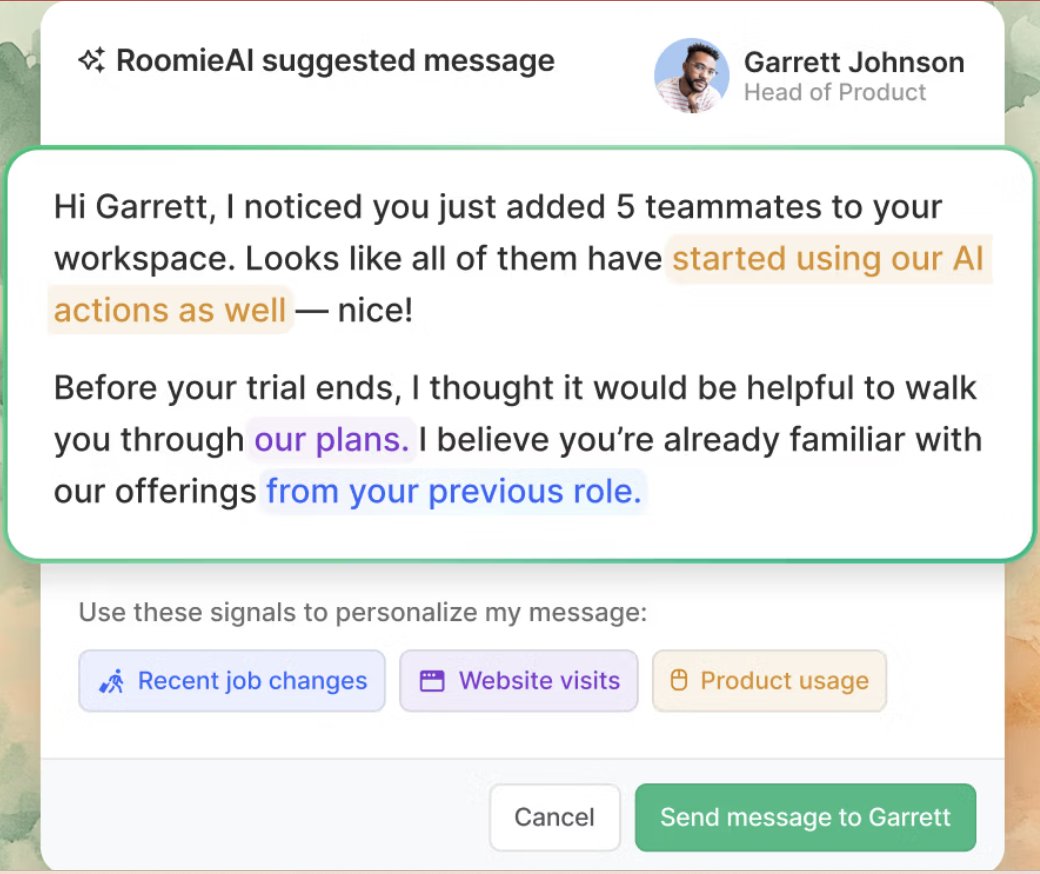

AI Outreach Assistant

To complement its data intelligence, Common Room offers RoomieAI™ Activate .

It’s an AI writing assistant for sales emails.

It’s primary goal is to generate personalized outreach messages based on the prospect’s specific signals and context.

Note: G2 shows that the AI-generated messaging feature has received mixed feedback, with some users finding the output to be generic or lacking in personalization.

Integrations Ecosystem

Common Room natively connects to a vast array of tools in your stack, ensuring it slots into your workflow.

Its integration list spans CRMs (HubSpot, Salesforce), marketing and sales tools (Marketo, Outreach, 6sense, Demandbase, etc.), data warehouses (Snowflake, BigQuery), community platforms (Slack, Discord, InSided), and more, showcasing the breadth of Common Room’s integration ecosystem.

For more details, you can visit Common Room’s Docs.

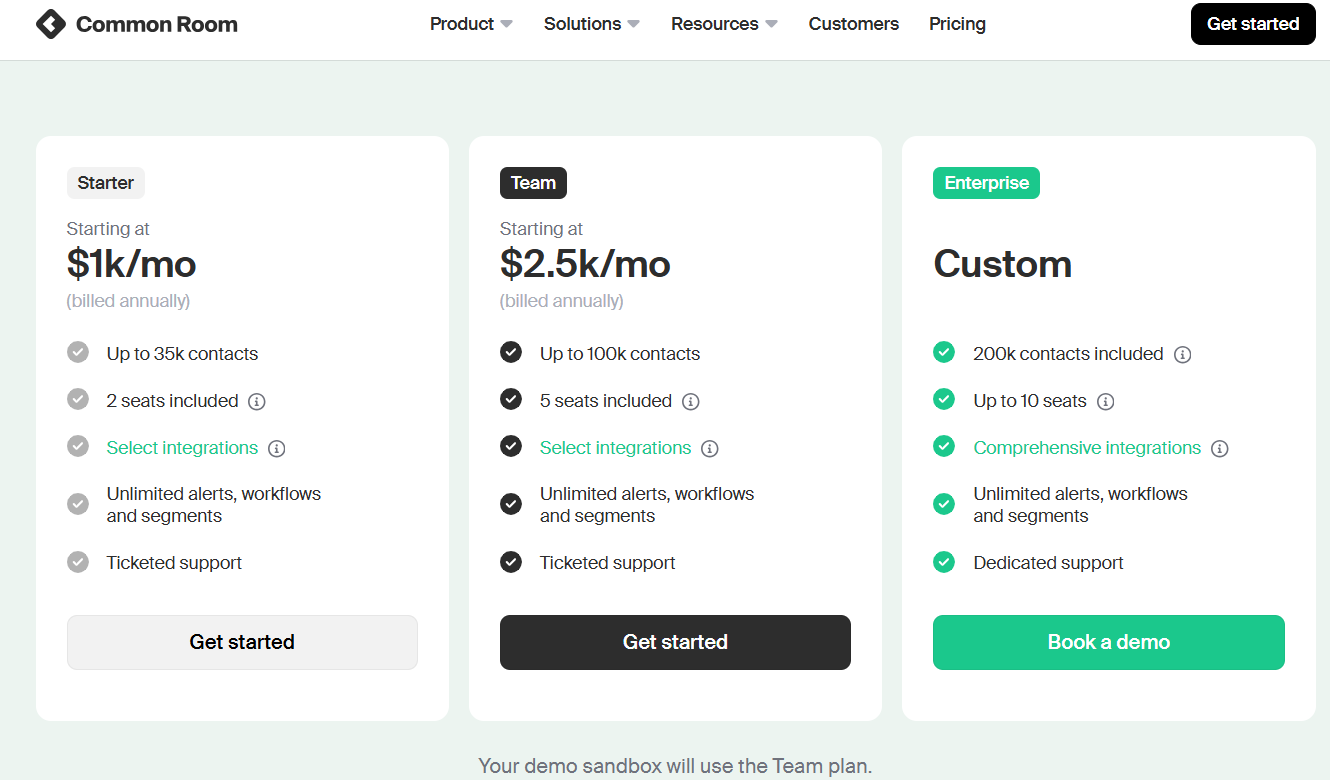

Common Room Pricing

Common Room is a premium B2B product; pricing scales with contact volume and user seats.

The entry-level Starter plan (about $1,000/mo billed annually) includes ~35,000 tracked contacts and 2 user seats, plus basic integrations and unlimited alerts/workflows.

The mid-tier Team plan (around $2,500/mo) raises limits to ~100,000 contacts and 5 seats.

Both tiers include most core features (visitor tracking, Person360 enrichment, workflow automation, etc.).

An Enterprise plan (custom pricing) accommodates ~200K+ contacts, 10+ seats, and adds all advanced integrations (e.g. full Salesforce data sync, custom objects) and dedicated support.

Also, a free trial is available on the Team tier (no credit card).

However, the entry-level pricing may be out of reach for smaller businesses seeking ABM solutions.

Terminus Overview: Key Features, Pricing, and More

Terminus is often described as an end-to-end ABM platform.

It gained prominence for its breadth of features and integrations, appealing to B2B marketers who want a unified ABM “Engagement Hub” covering advertising, web, and sales touchpoints.

Let’s have a look at its key features:

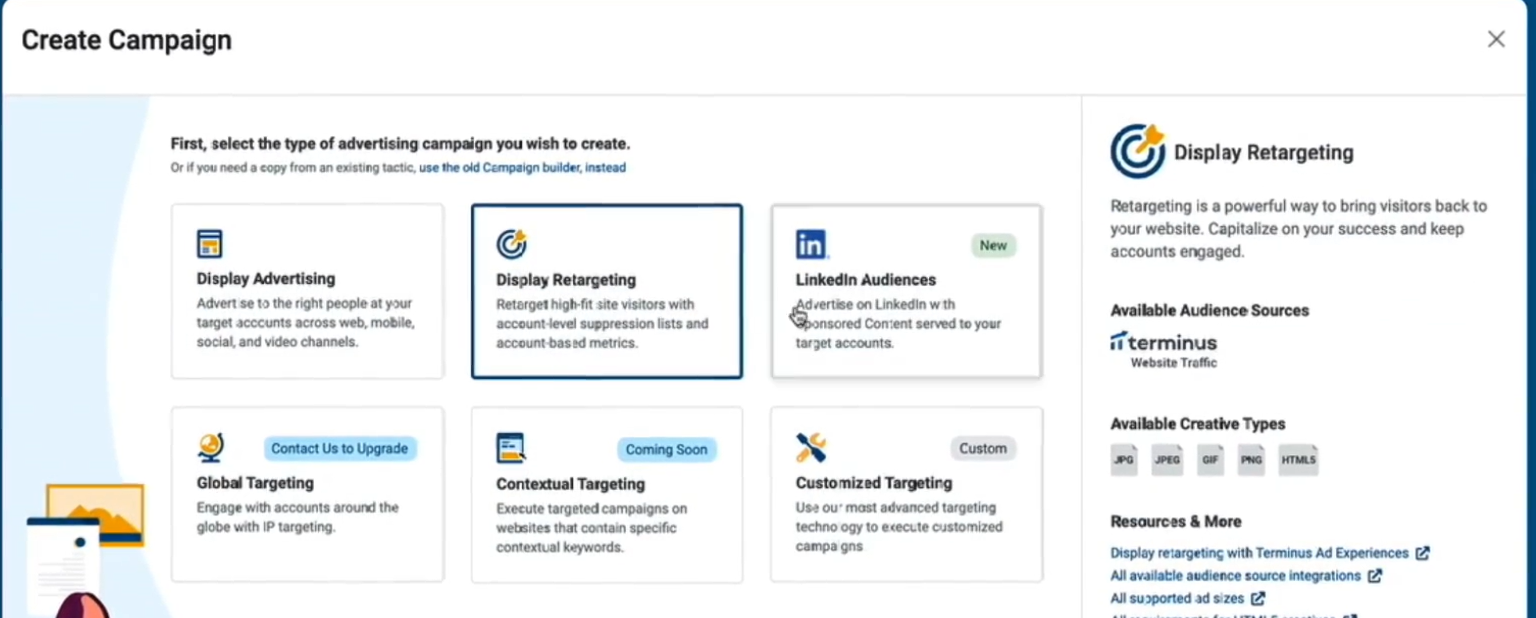

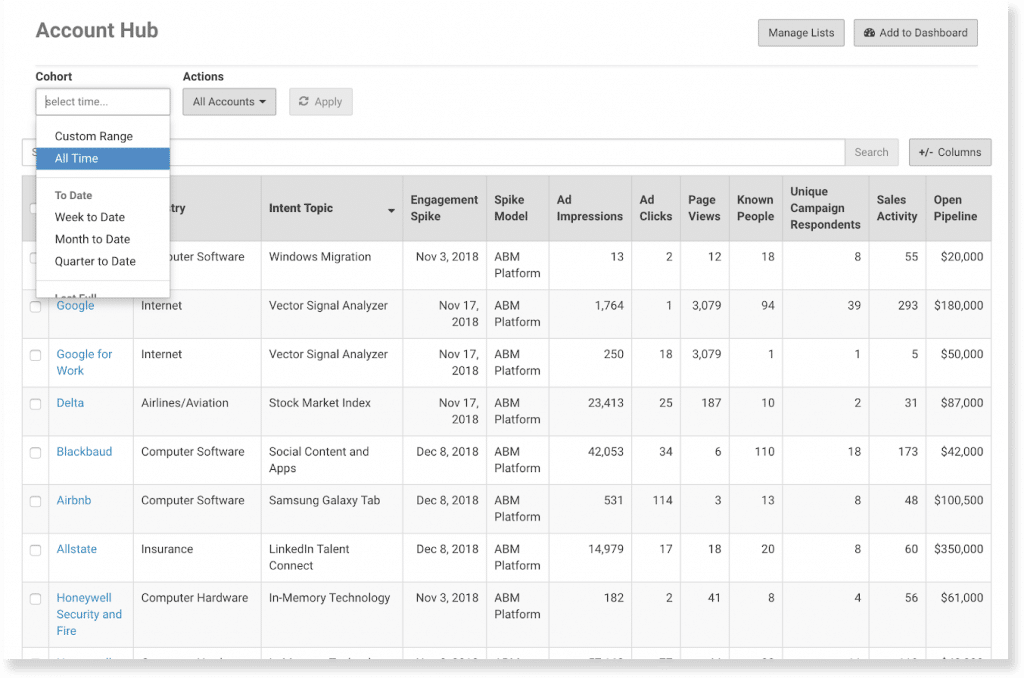

Multi-Channel Ad Support

Terminus allows you to run and manage ads across a wide range of channels natively.

This includes traditional display ads (across thousands of websites via an account-based DSP), retargeting ads, LinkedIn Ads, and even newer formats like connected TV and audio ads.

By consolidating ad channels, Terminus helps you reach target accounts on the web, social (LinkedIn), and other avenues from one platform.

It also inherently balances impressions across your target account list so that no single account consumes your entire budget.

For organizations seeking centralized ad management across channels, Terminus may be the right tool to streamline multi-channel orchestration and support your GTM strategy.

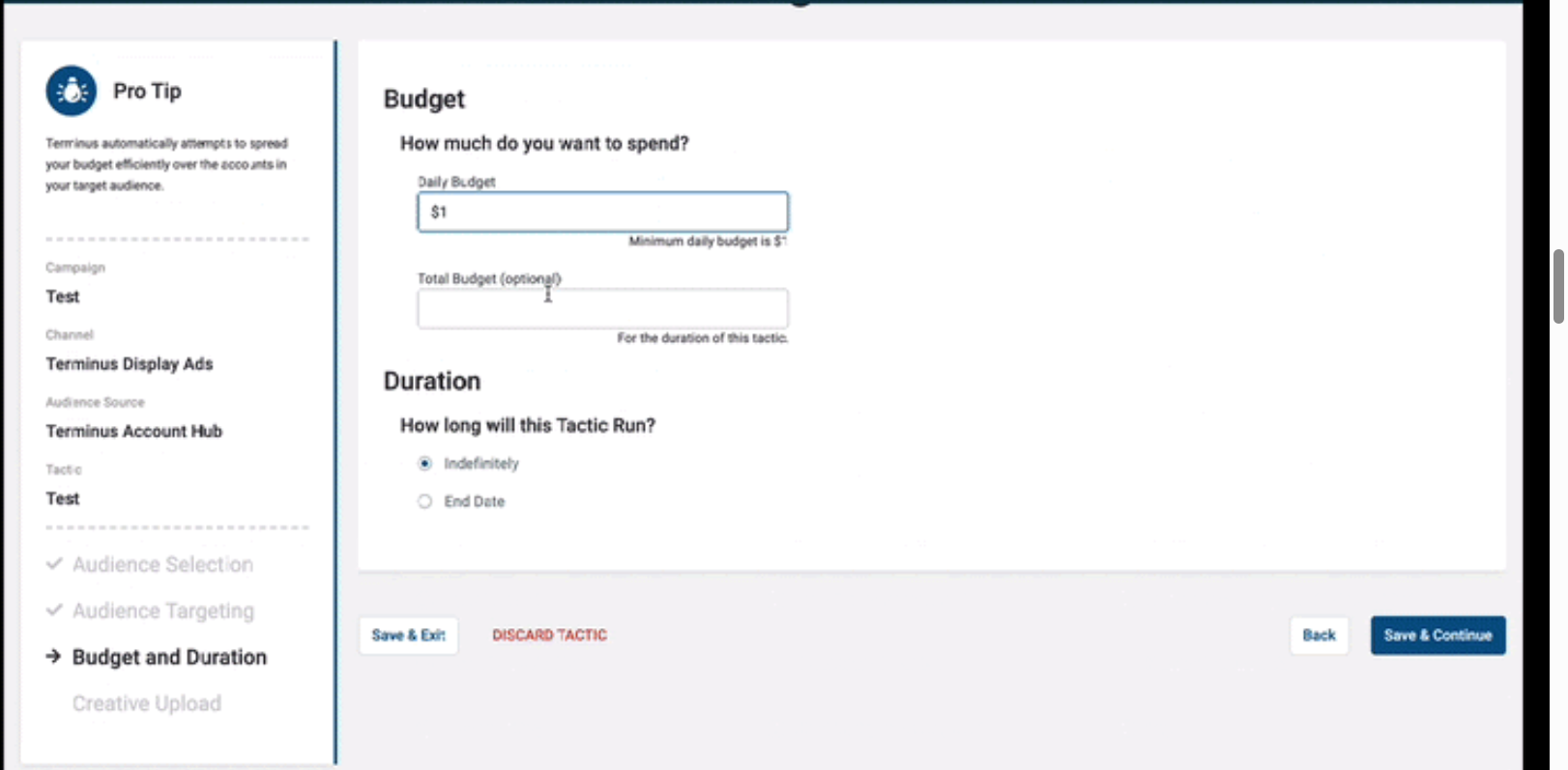

Account & Persona Targeting

You can upload or sync target account lists (TALs) from your CRM into Terminus and refine audiences by persona attributes like department, seniority, or role.

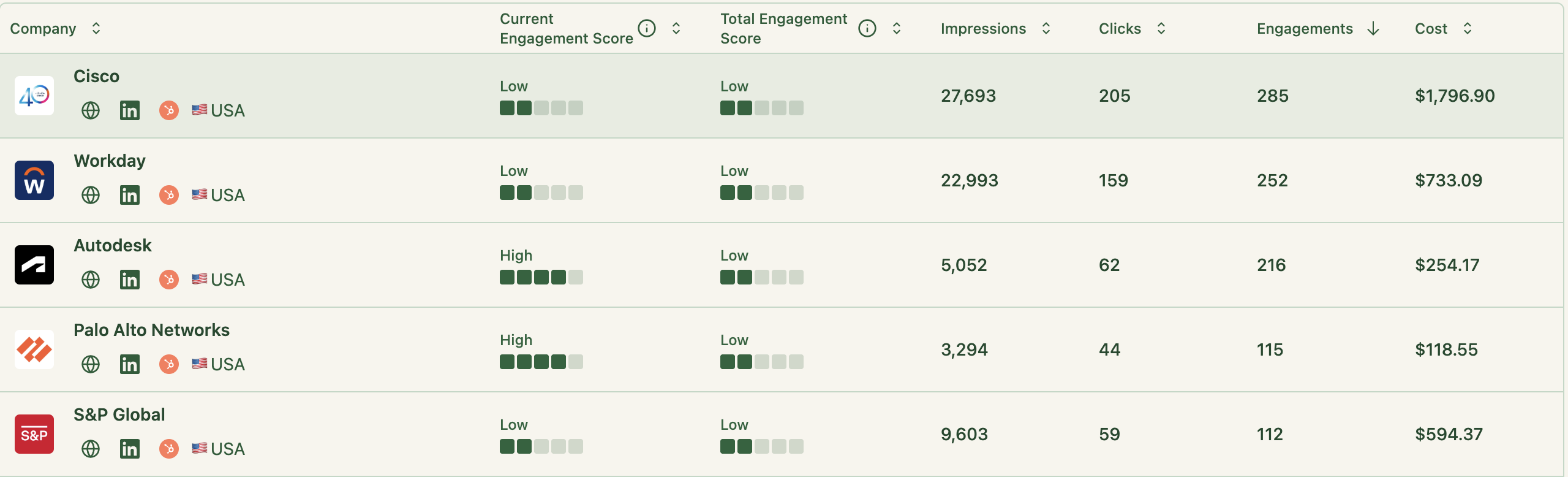

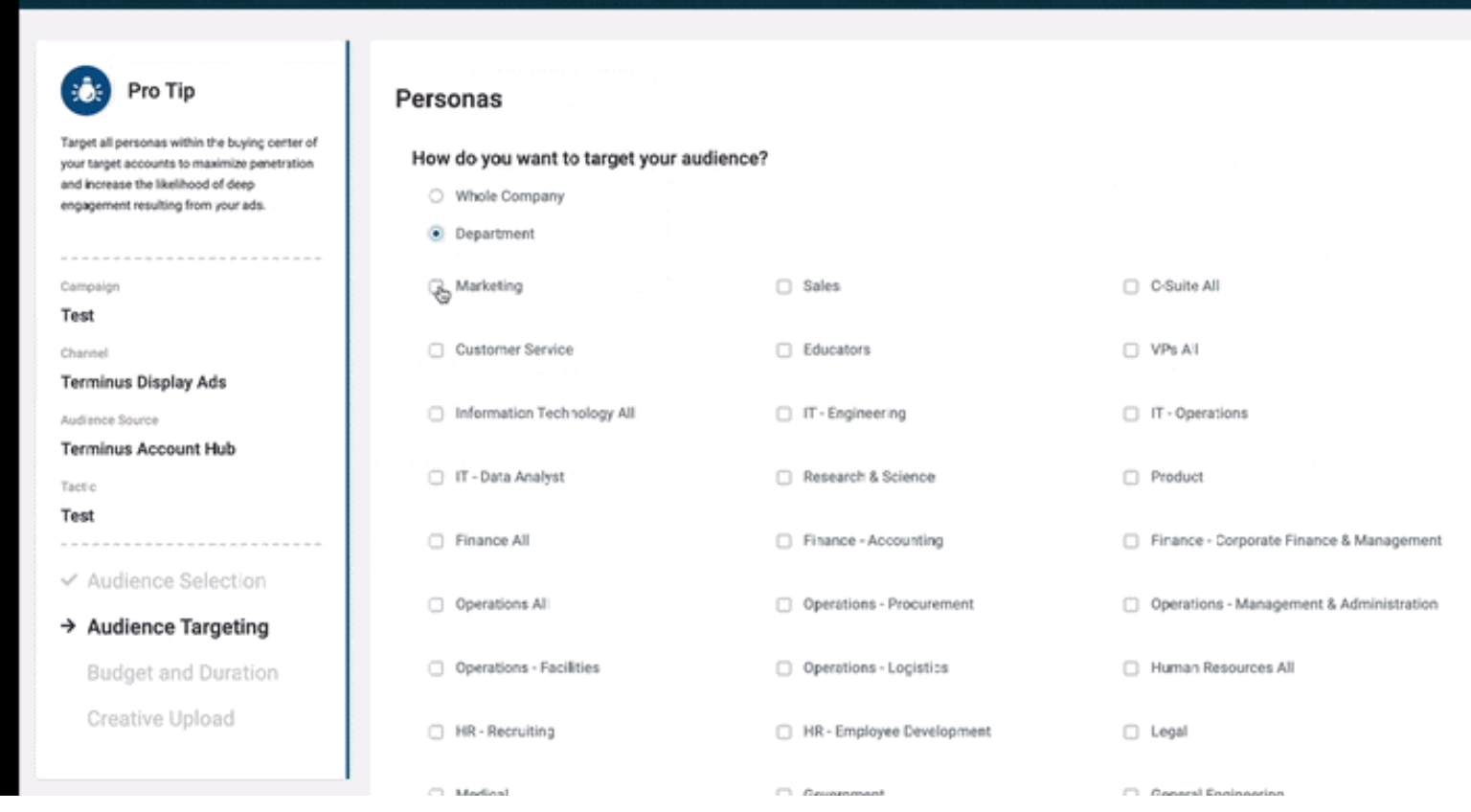

Account-Level Engagement Tracking

The platform tracks not just clicks but also impressions at the account level.

This is critical in ABM, where seeing that target account X saw an ad (even without clicking) is valuable. Terminus’s Account Hub compiles these engagement metrics for each account, showing impressions, clicks, site visits, and more tied to your campaigns. These engagement metrics also support more accurate marketing attribution for ABM campaigns, helping you analyze the impact of each touchpoint across the buyer journey.

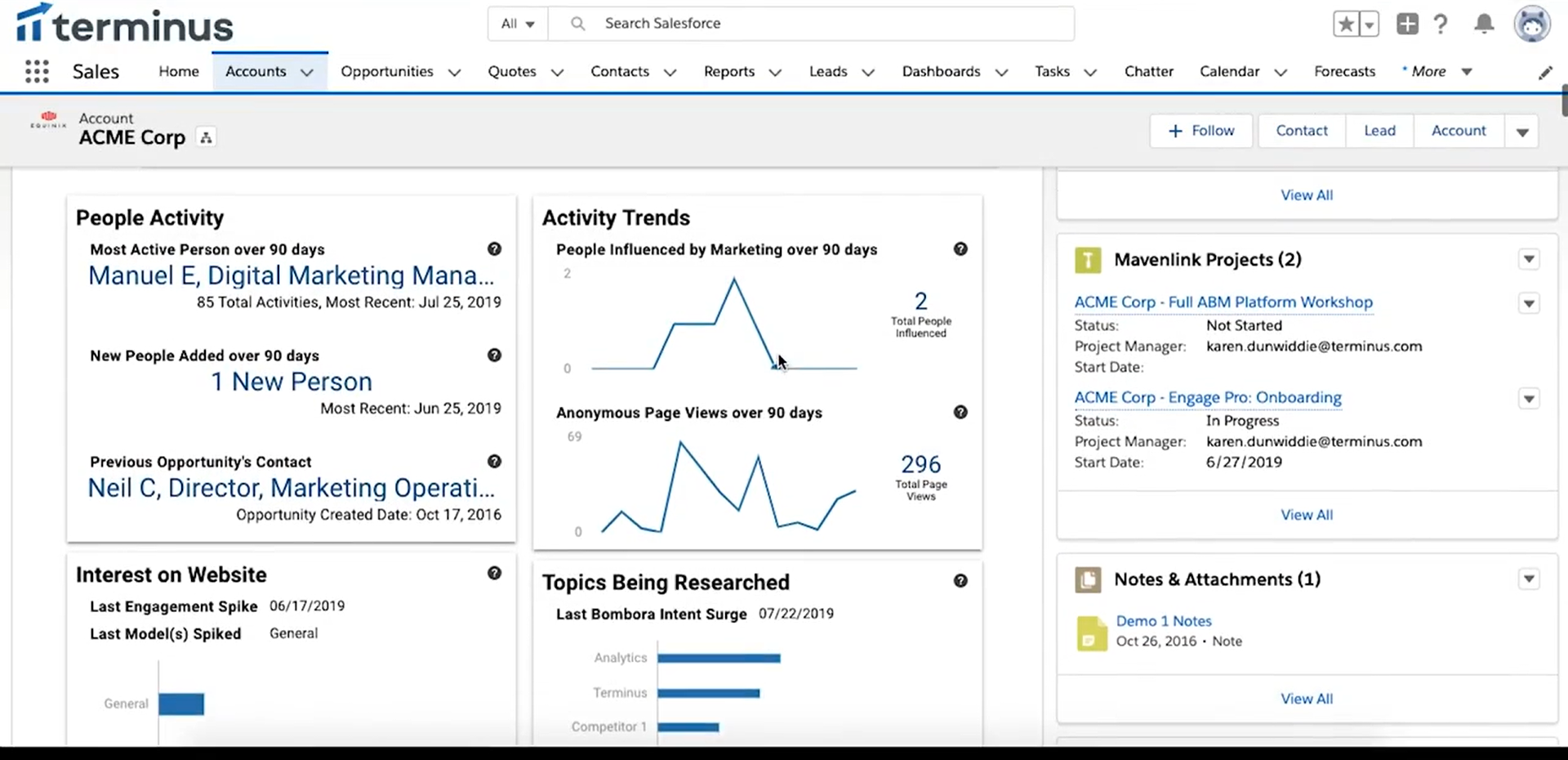

Website Visitor Identification

Terminus includes a Visitor ID feature to de-anonymize website traffic.

It uses techniques like reverse IP lookup, cookies, and CRM matching to recognize which companies (and sometimes which known contacts) are visiting your site.

For instance, Terminus can drop cookies so that if an anonymous visitor later fills out a form, their past visits are attributed to that account.

It also matches known CRM leads to visits (by email domain), telling you if, say, a director from Acme Corp in your CRM visited the pricing page.

Intent Data

Terminus integrates intent data from partners (e.g., Bombora) to identify in-market accounts, so you can prioritize ad spend on companies showing buying signals.

Pro Tip: Skip unreliable third-party intent surges and focus on first-party insights instead.

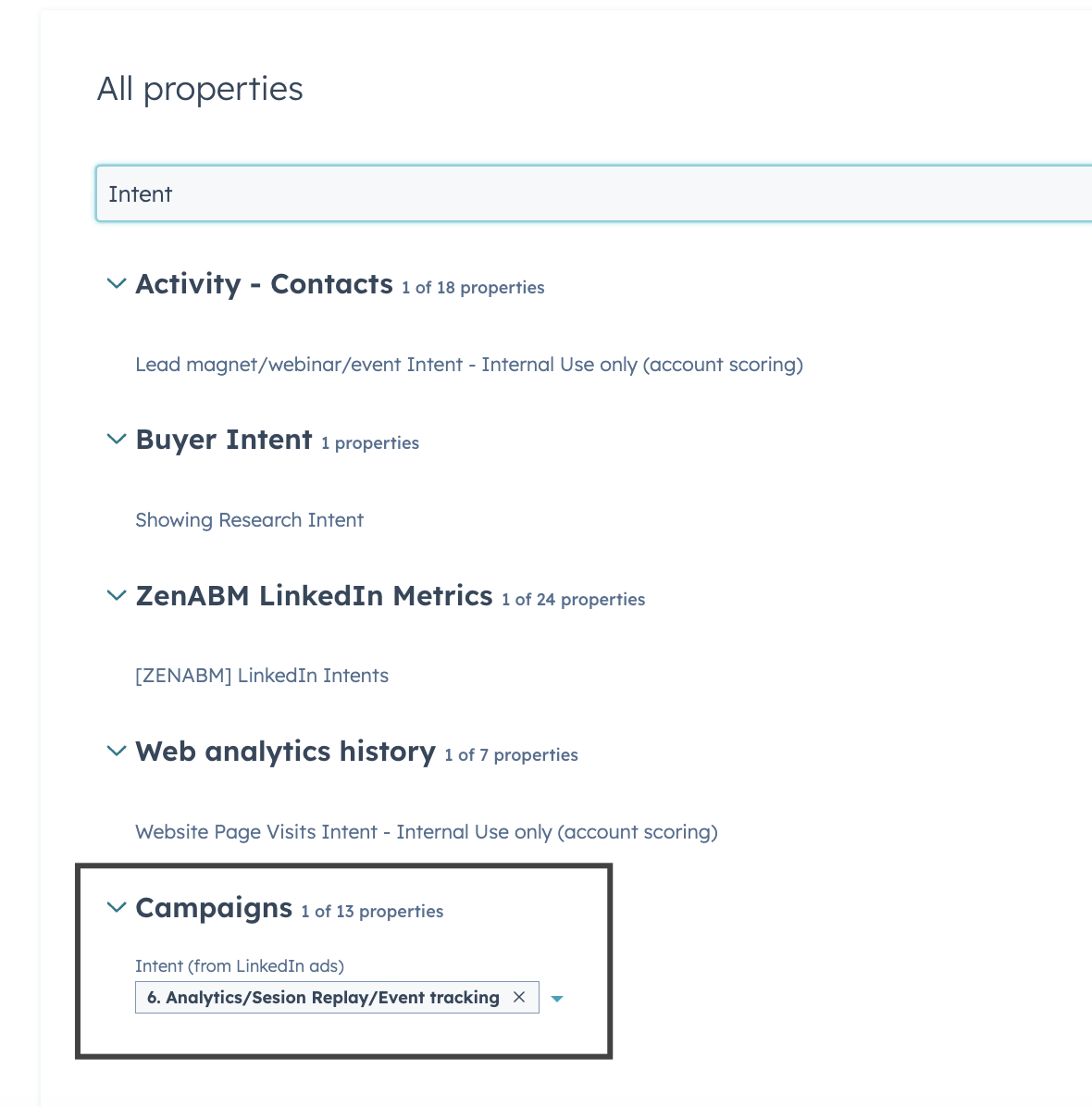

ZenABM captures authentic, first-party qualitative intent by tracking which LinkedIn ads a company actually engages with, offering clear, actionable buying signals.

For example, the team at Userpilot (a ZenABM customer) built their ABM playbooks entirely around this method, tagging campaigns by pain points and doubling down on bottom-of-funnel ads that specific accounts were interacting with.

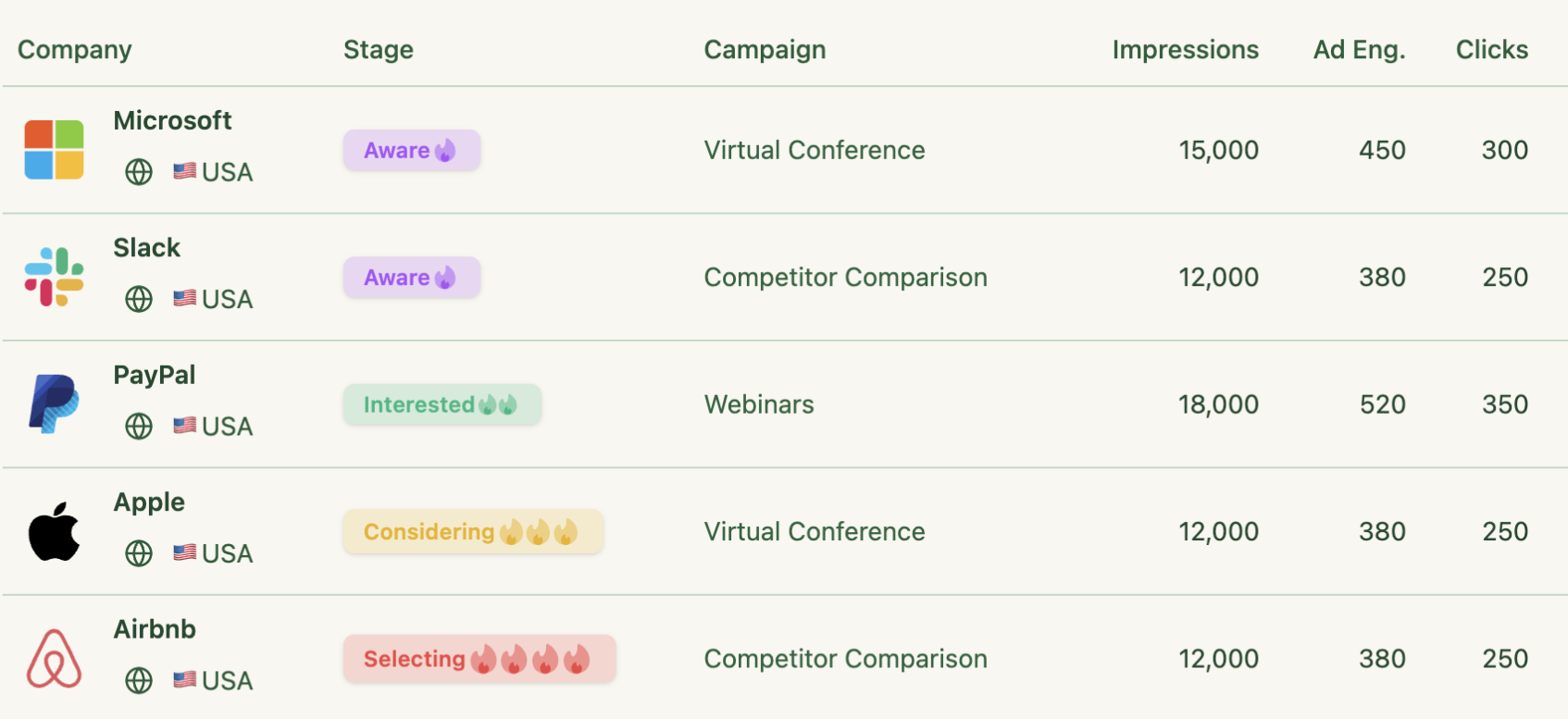

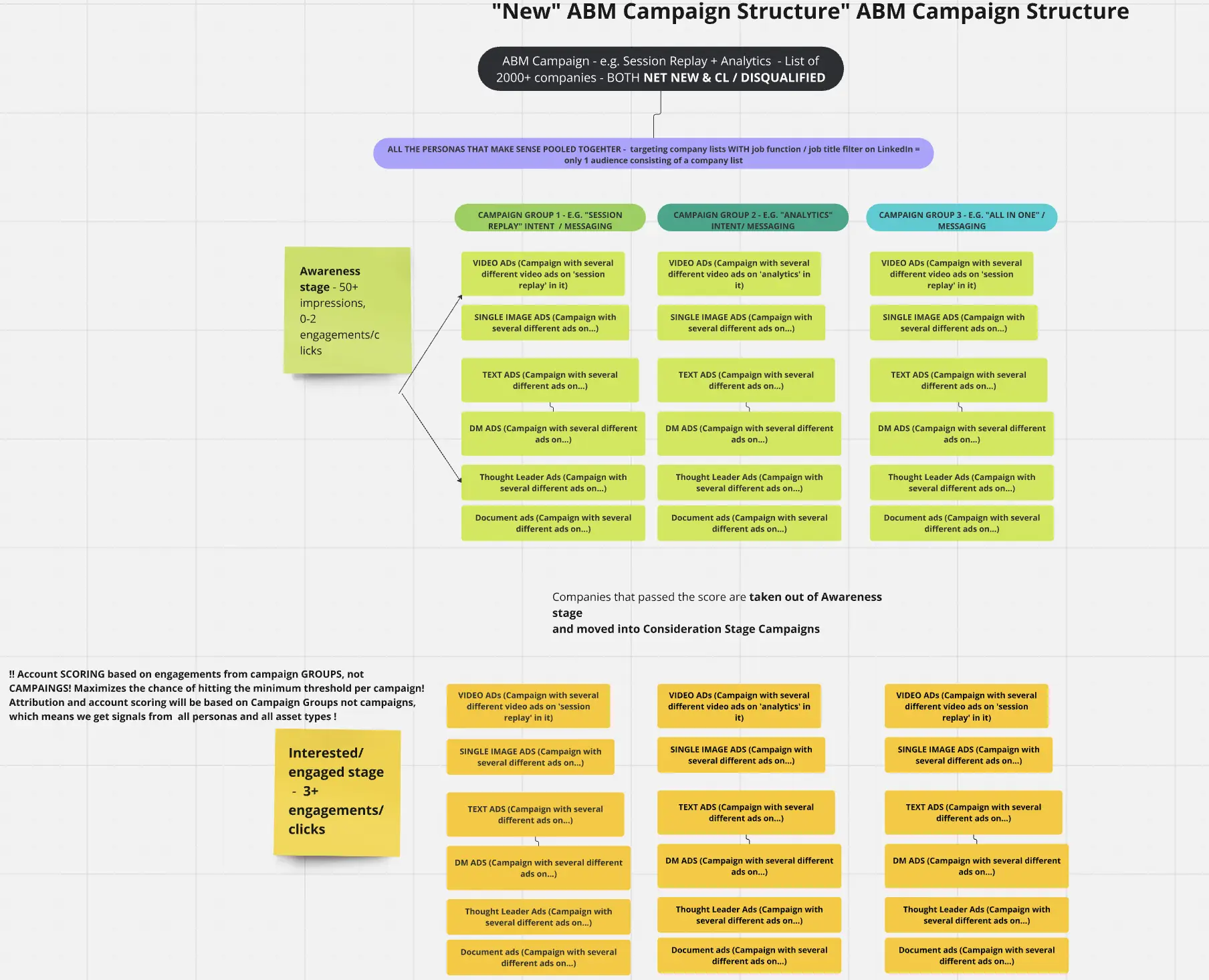

Their campaign structure looked like this:

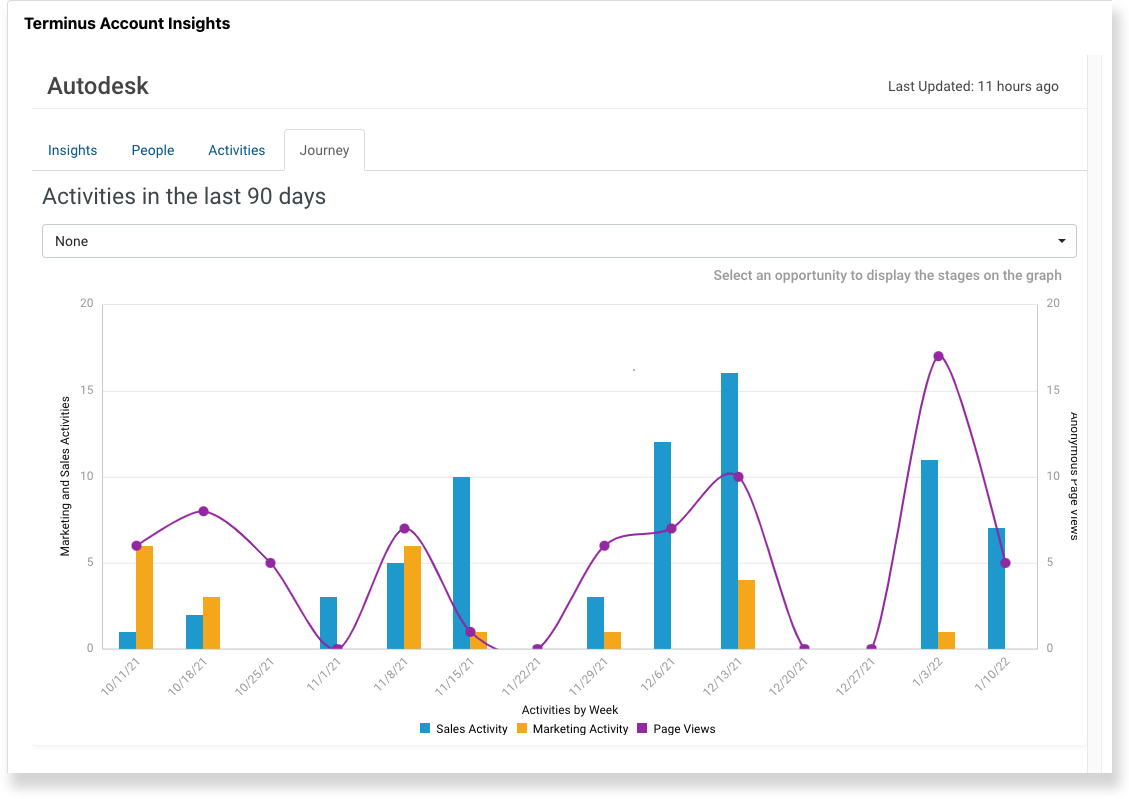

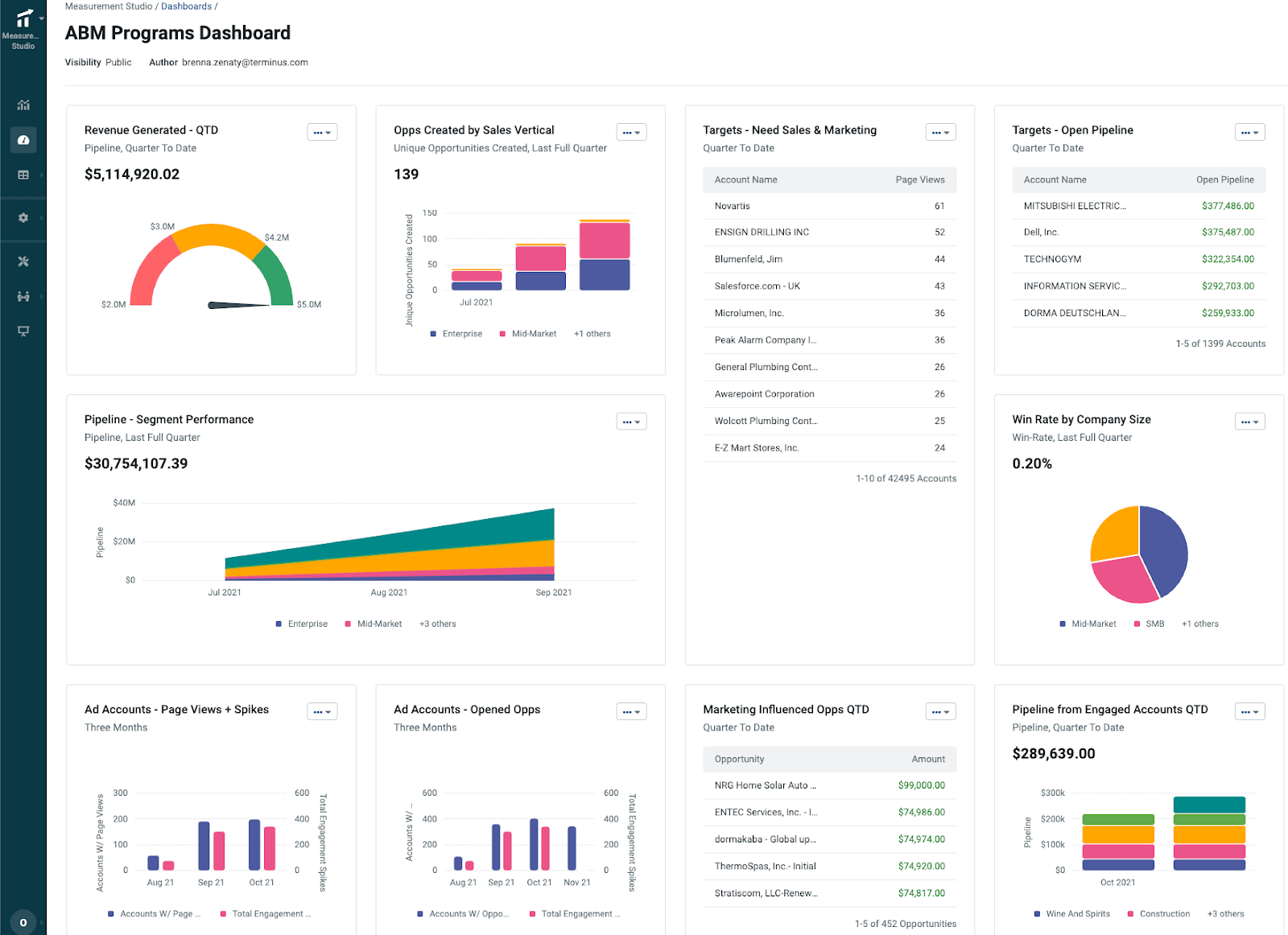

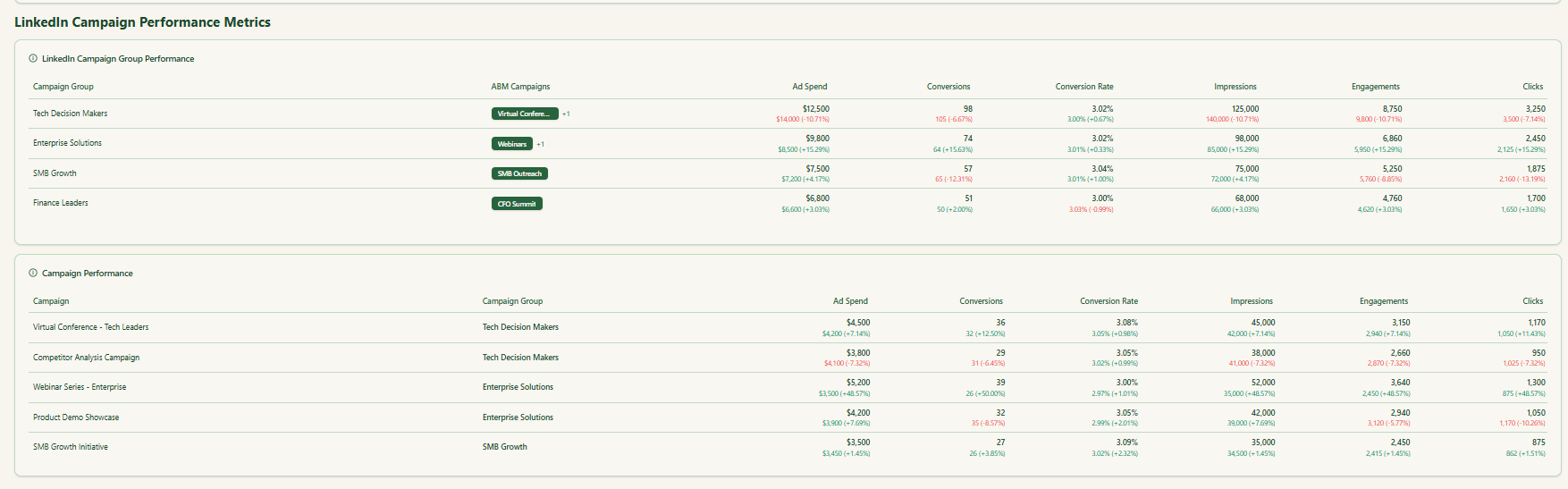

ABM Analytics and Attribution

Measurement Studio in Terminus (bolstered by Terminus’s acquisition of BrightFunnel) provides multi-touch attribution across accounts.

Marketers can track how different touchpoints (ads, emails, website visits, events, etc.) influence pipeline and revenue, with support for first-touch, last-touch, and custom multi-touch models.

Importantly, all attribution is account-centric by default: activities roll up into an “Account Journey” view to see how an account progressed from engagement to pipeline to deal.

Terminus also offers out-of-the-box dashboards for ABM programs, showing metrics like revenue generated, opportunities created, pipeline influenced, top engaged accounts, and more. Marketers can also track engagement with related topics to identify new opportunities.

Integrations

Terminus integrates with many systems in the B2B marketing stack.

Out-of-the-box connectors include major CRMs (Salesforce, HubSpot, Microsoft Dynamics), marketing automation platforms (Marketo, Pardot, HubSpot Marketing Hub, Eloqua), advertising channels (LinkedIn Ads, Google Ads), sales enablement tools (Outreach, Salesloft, etc.), analytics tools (Google Analytics, Adobe Analytics, PathFactory), data providers (Bombora, G2 intent, Clearbit/DemandScience), and more.

You can explore each integration in detail in the Terminus docs.

Terminus Pricing

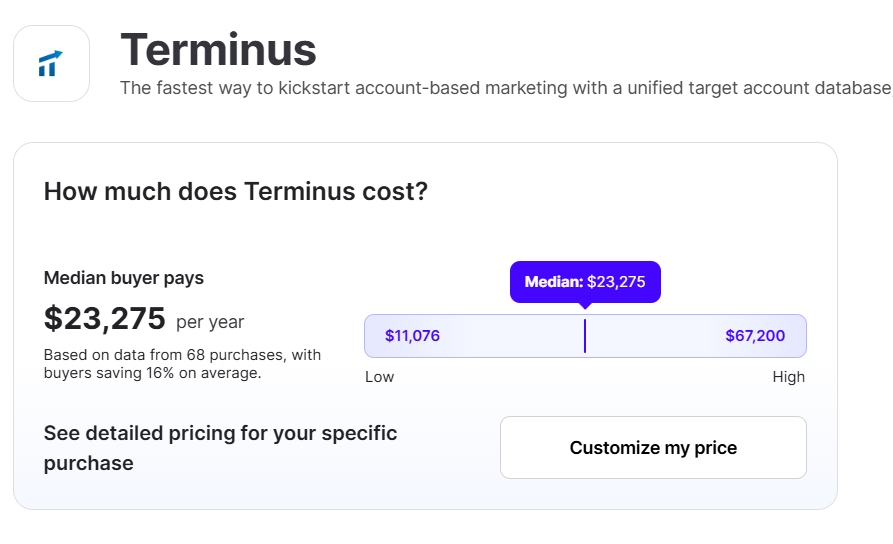

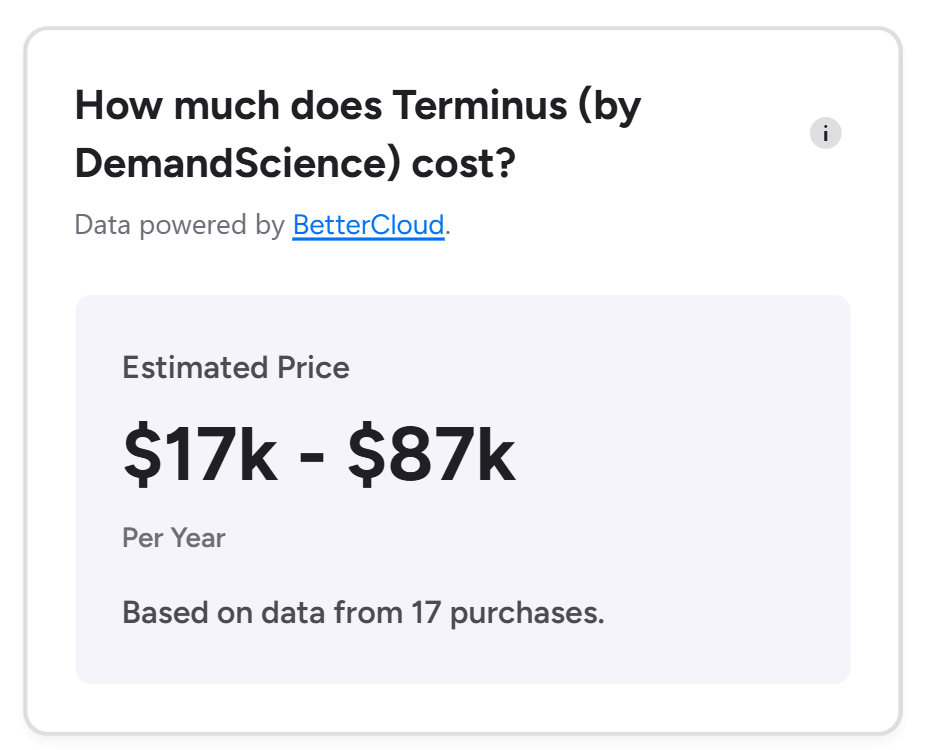

Terminus is known for its premium, custom-quoted pricing.

There are no public price tiers on their site; you need to go through sales for a quote.

Research indicates typical Terminus deals are in the mid-five figures annually, scaling up to six figures for large enterprise deployments.

Vendr, for example, says median Terminus pricing is about $23,000 per year, while large enterprises might pay $100K–250K+ annually.

CMO.com, on the other hand, claims the cost to start from $57,500 per year, with large enterprise contracts reaching $266,000, and G2 (based on 17 reviews) gives a broad range of $18-87,000. This pricing structure is not suitable for small businesses with limited budgets.

Common Room vs. Terminus: Key Differences

Major differences between Common Room and Terminus that you should review:

| Category | Common Room | Terminus |

|---|---|---|

| Positioning and Scope | Common Room is a signal and intent layer. It captures multi-source account signals, resolves them to real people, and operationalizes SDR and AE outreach. It is not trying to be your ad buying platform. | Terminus, now part of DemandScience, positions an ABX platform that blends ABM and demand gen across ads, chat, email signatures, web experiences, and sales. It’s a wider engagement suite. |

| Signals and Identity | Common Room emphasizes community, product, social, website, and review-site signals, then maps them to contacts for fast, personalized follow-ups. The pitch: “account intent to a named person, quickly.” | Terminus tracks first-, second-, and third-party account intelligence, then applies it across channels like display, chat, and email signatures to surround accounts with coordinated touchpoints. |

| Activation and Channels | Common Room focuses on alerts, segments, and automations that feed sellers and sequences. It complements, rather than replaces, your ad or MAP stack. | Terminus is activation-heavy. Expect coordinated advertising, website experiences, account-based chat routing, and email-signature banners that follow prospects via rep replies. |

| Packaging and Pricing Posture | Common Room publishes starting points: Starter begins around $1K/month billed annually for up to 35K contacts and 2 seats; Team starts near $2.5K/month for up to 100K contacts and 5 seats. Third-party pages echo those ranges. | Terminus pricing is quote-based under the DemandScience umbrella post-merger. Public guidance focuses on use-case breadth rather than list prices.Research indicates typical Terminus deals are in the mid-five figures annually, scaling up to six figures for large enterprise deployments.

Vendr, for example, says median Terminus pricing is about $23,000 per year, while large enterprises might pay $100K–250K+ annually. CMO.com, on the other hand, claims the cost to start from $57,500 per year, with large enterprise contracts reaching $266,000, and G2 (based on 17 reviews) gives a broad range of $18-87,000. |

| Complexity and Time to Value | Common Room narrows the blast radius to finding and activating signals. Teams with an existing ad or MAP stack typically ramp fast. | Terminus is broader. You get the most return when you actually run several channels from the same place, which raises the bar on ops maturity and process. However, this broader feature set can come with a steep learning curve for new users, potentially impacting how quickly teams become proficient. |

| What Users Tend to Say | Customer stories emphasize the ability to capture account intent, resolve to people, and move quickly with personalized outreach. Reviews highlight SDR and AE usability on top of the signal graph. | Review roundups describe strong ABM programs across ads, web, chat, and email signatures, with the caveat that multi-module deployments require discipline and that post-merger operations run through DemandScience. |

So, Which is Better for ABM?

Choose Common Room if:

- Your edge is catching non-obvious signals and getting to the right people fast.

- You want to unify community, product, social and web intent, connect it to contacts, and arm SDRs with context without adopting a heavy ad-orchestration suite.

Choose Terminus if:

- Your playbook includes multi-channel engagement beyond ads.

- You want to coordinate display, chat, email signatures, web experiences, and sales touches from one platform, now under the DemandScience brand.

Reality Check by Company Size

- SMB and lower mid-market: Common Room’s Starter tier gives a defined envelope of contacts and seats so you can operationalize signal-to-contact workflows quickly. Terminus can work at this size when you have a clear reason to run several channels from one place.

- Mid-market: Both can work. Pick Common Room if your backbone is signal coverage and fast person-level action for SDRs. Pick Terminus if you want coordinated engagement across ads, web, chat, and signatures.

- Enterprise: Either can scale. The call usually comes down to whether you want a signals-to-people system to complement your existing ad and MAP stack, or a broader engagement platform that centralizes many channels.

Btw, if your motion is mostly LinkedIn, heavy suites are not mandatory.

ZenABM pulls first-party company engagement directly from the LinkedIn API, scores accounts, tracks ABM stages, and writes back to your CRM.

Pricing starts at 59 dollars per month with a 37-day free trial.

Let me tell you more about it.

ZenABM Overview: Key Features, Pricing, and Essentials

ZenABM is a modern, lightweight ABM solution built for LinkedIn-based account campaigns.

Key offerings in ZenABM include:

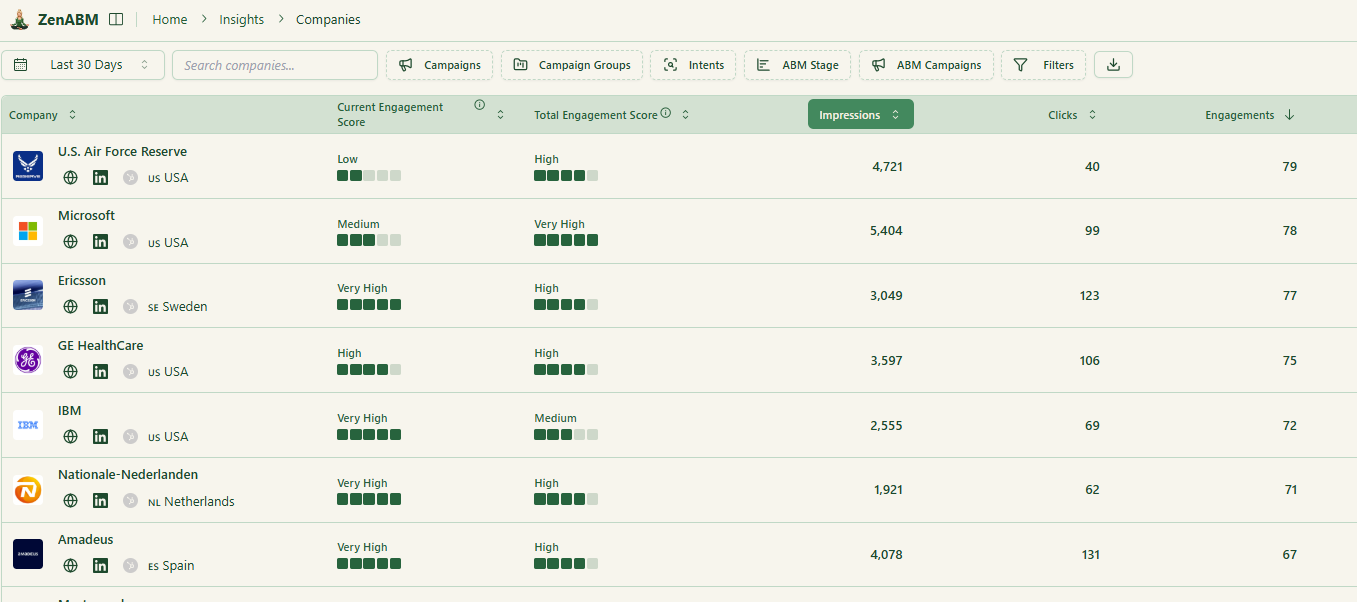

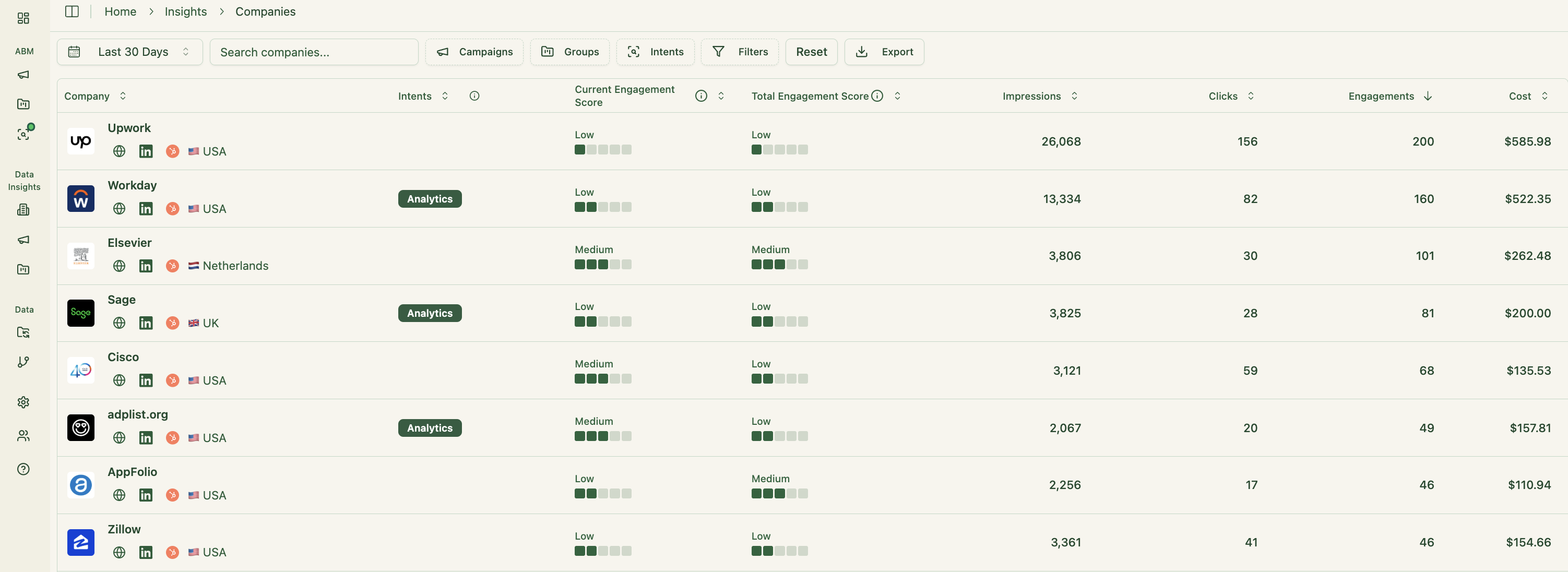

LinkedIn Ads Engagement at the Account Level

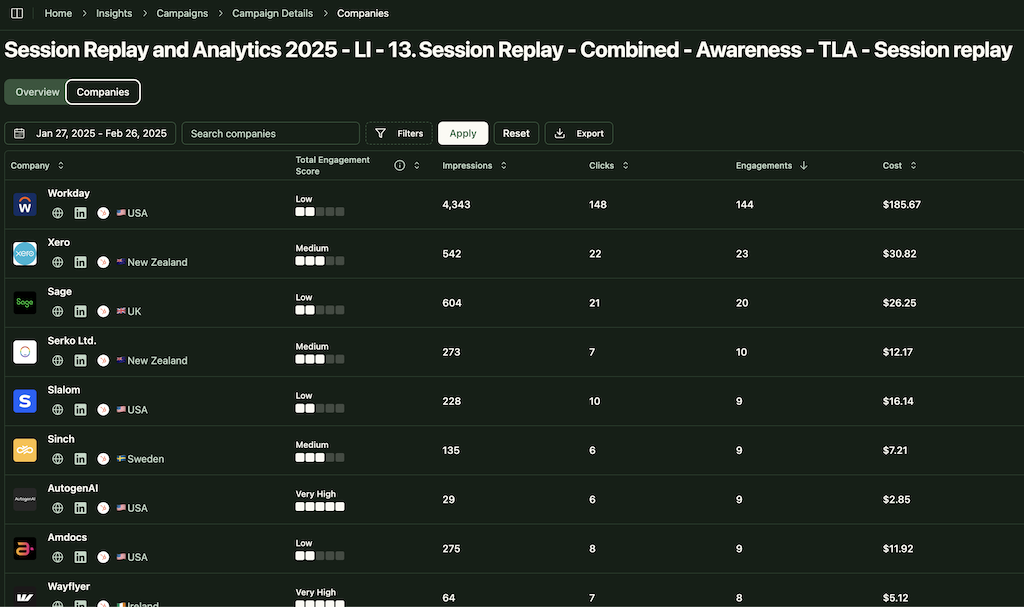

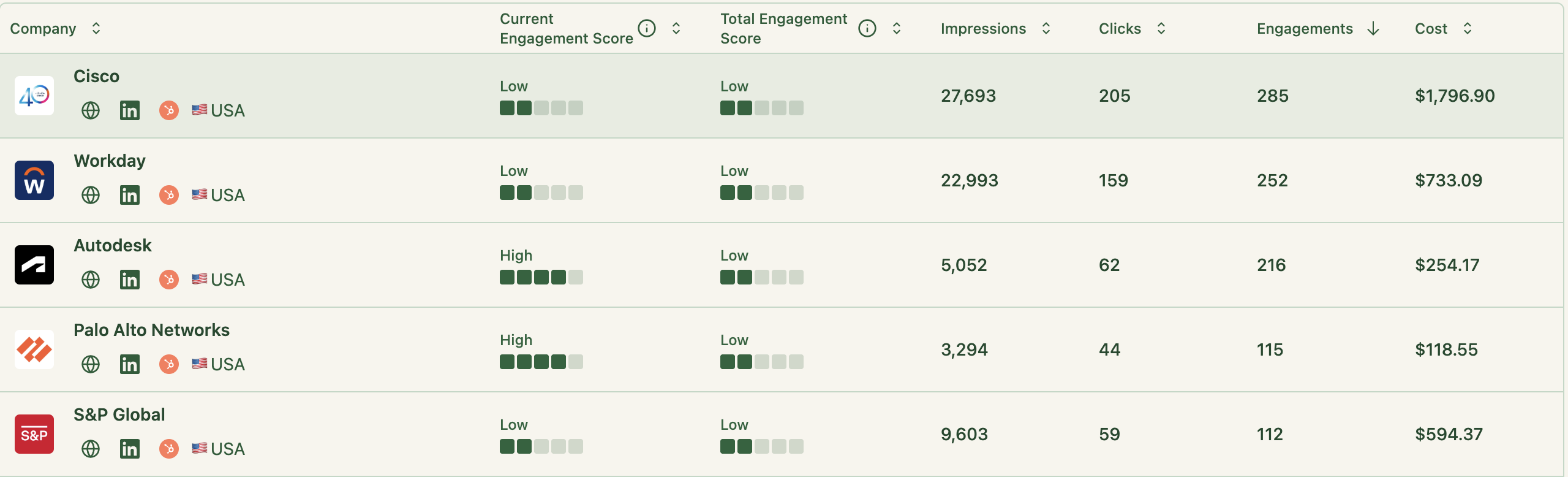

ZenABM connects directly to the LinkedIn Ads API to pull account-specific data from every campaign.

You can see exactly which target accounts are engaging with your ads, including impressions and clicks, mapped to company names.

Because the data comes from LinkedIn, accuracy is high. Many larger ABM platforms still depend on probabilistic methods, such as IP or cookies, to guess visitor identity.

Those estimates are shaky. Research from Syft found IP-based identification correctly matches companies only about 42 percent of the time.

ZenABM’s first-party approach delivers cleaner, intent-driven signals from real ad engagement. When multiple employees from one company interact with your ads, you can trust that the account is warming up.

Pro Tip: ZenABM can also reveal anonymous site visitors without extra tools. Retarget them with low-cost LinkedIn text ads, and ZenABM will list the companies that saw the impressions.

Real-Time Engagement Scoring

ZenABM updates engagement scores continuously from ad interactions.

Track recent trends or historical patterns to spot heating accounts.

These scores help marketing and sales prioritize high-value accounts.

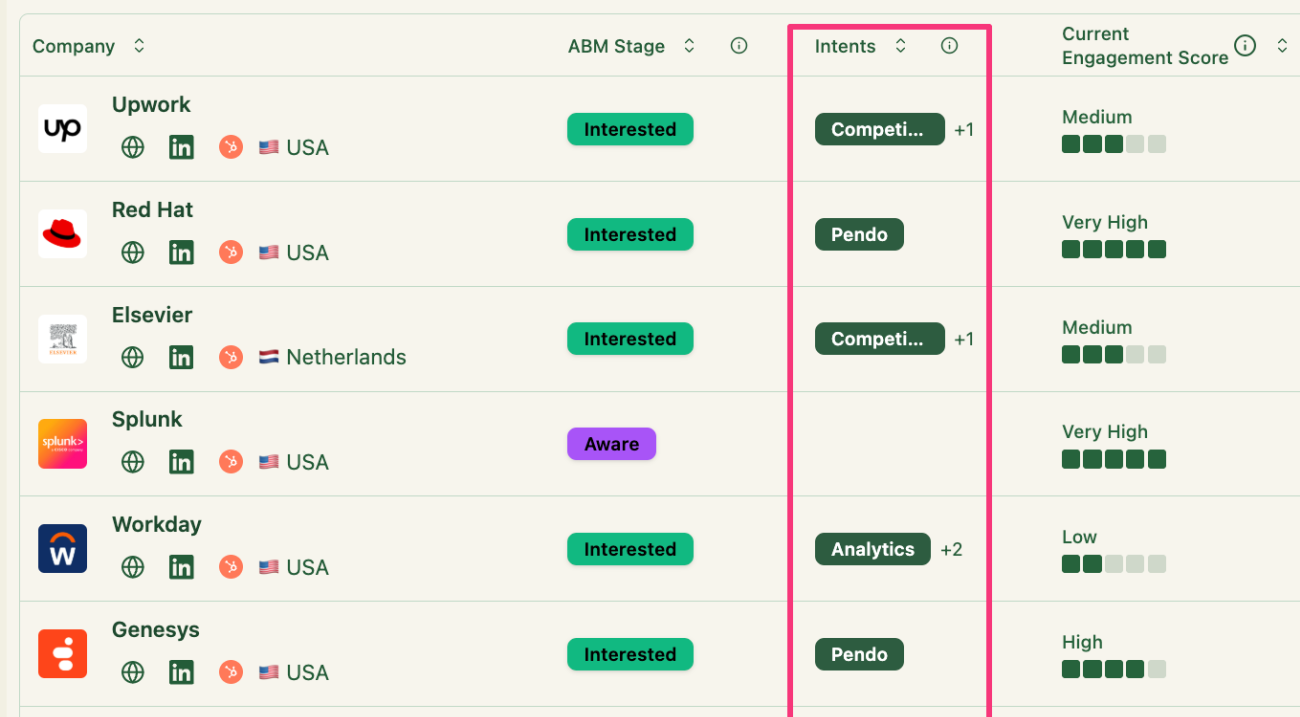

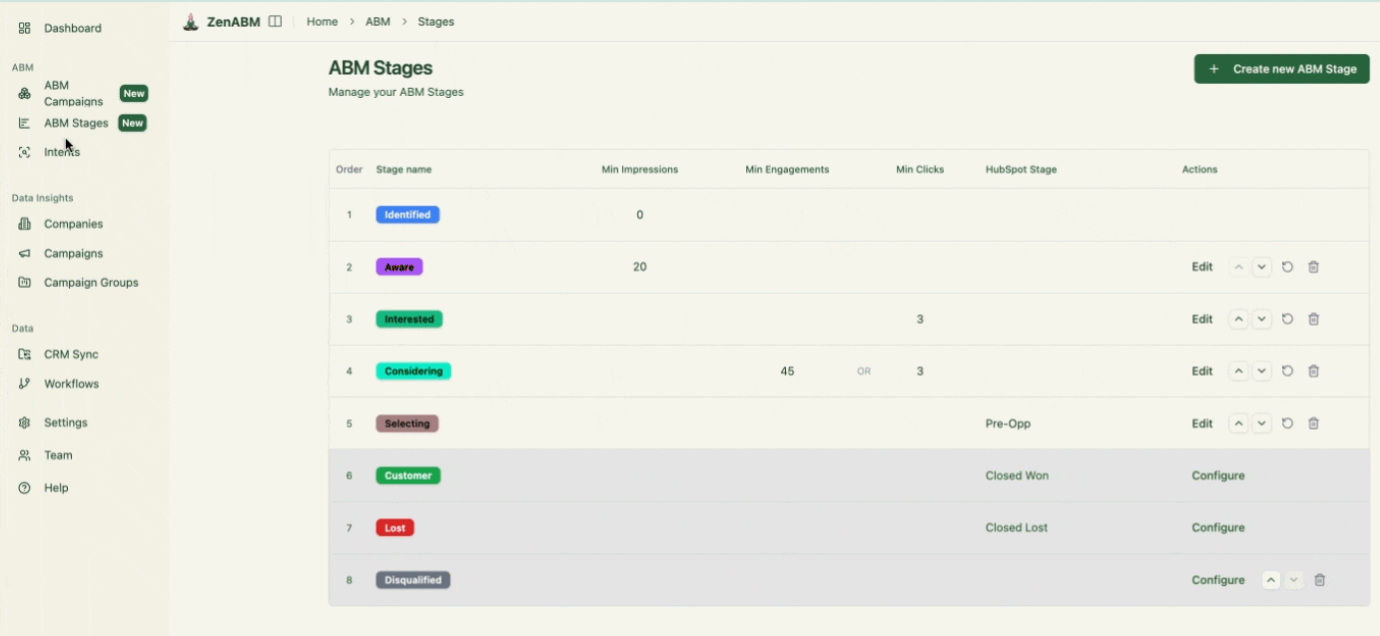

ABM Stage Tracking

ZenABM lets you define your ABM funnel stages such as Identified, Aware, Engaged, Interested, and Opportunity, then auto-classifies accounts using engagement and CRM data.

You can set your own thresholds, and ZenABM tracks stage transitions automatically.

This gives full-funnel visibility similar to enterprise ABM platforms so you can see where accounts stall and where they move.

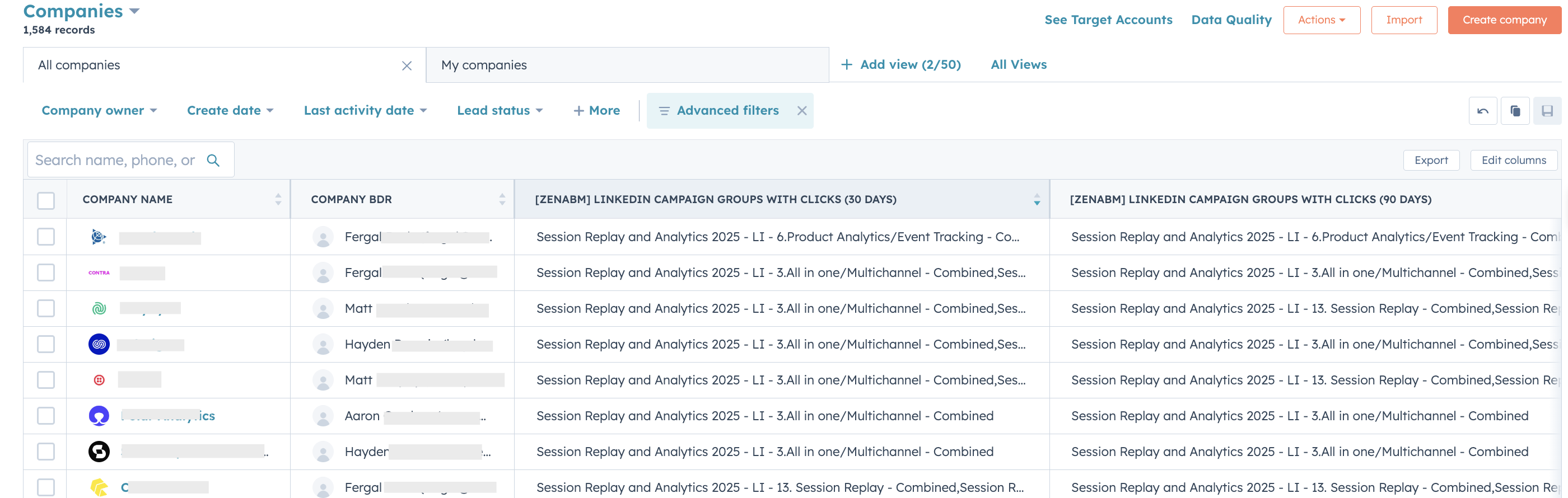

CRM Integration and Workflows

ZenABM syncs bidirectionally with CRMs like HubSpot and supports Salesforce on higher plans.

LinkedIn engagement is written to your CRM as company properties so sales never loses context:

ZenABM can mark an account “Interested” when engagement crosses a threshold and assign it to a BDR automatically.

Intent Tagging from LinkedIn Ads Engagement

ZenABM lets you tag campaigns by theme, for example, Feature A vs Feature B, then shows which accounts engage with which themes so you can see priorities.

This is true first-party intent. Instead of paying for inferred keyword interest, you get proof that Account Z engaged with “Feature A,” which signals real buying interest.

Those insights sync to your CRM, which supports highly targeted messages and outreach.

Your sales team can immediately see the topics and pain points each account cares about.

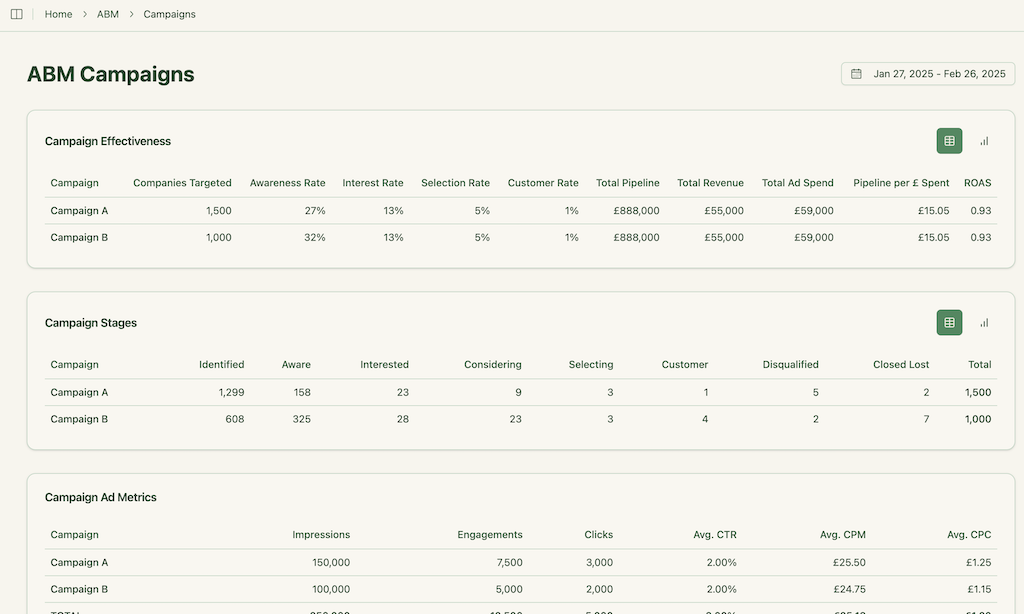

Built-in Dashboards and ABM Analytics

ZenABM ships with ABM dashboards that link ad exposure, engagement, funnel stages, and pipeline.

- Track performance across campaigns, LinkedIn groups, and individual ads:

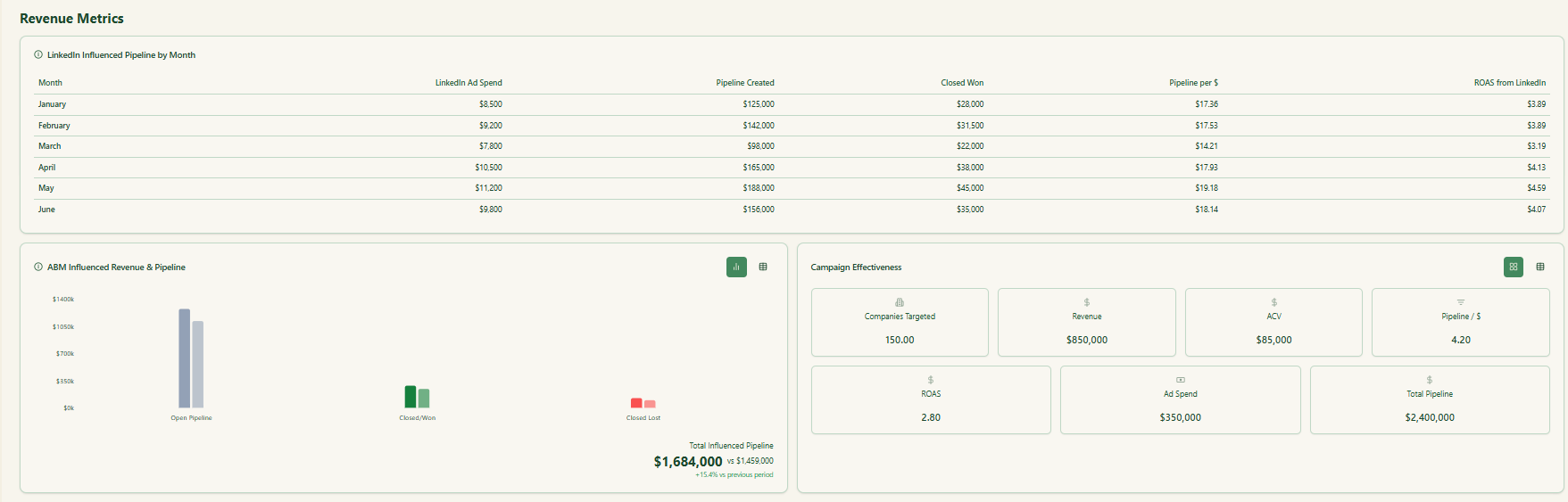

- Because ZenABM has both deal value and ad spend per account and campaign, it calculates ROAS, pipeline per dollar, and revenue. Revenue teams can optimize engagement and accelerate wins rather than chase vanity metrics

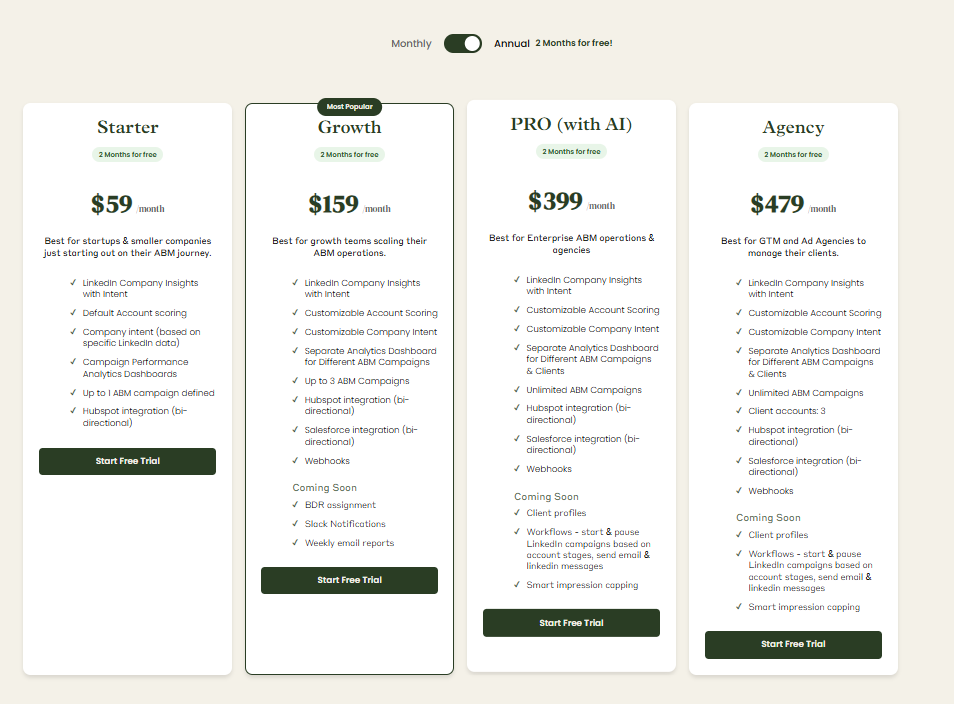

ZenABM Pricing

Plans start at $59 per month for Starter, $159 for Growth, $399 for Pro (AI), and $479 for the agency plan.

Even the top tier is under $6,000 per year, which is far below Common Room or Terminus.

All plans include the essential LinkedIn ABM features. Higher tiers expand limits or add Salesforce.

You can pay monthly or annually with two months free, and there is a 37-day free trial, so you can test before committing.

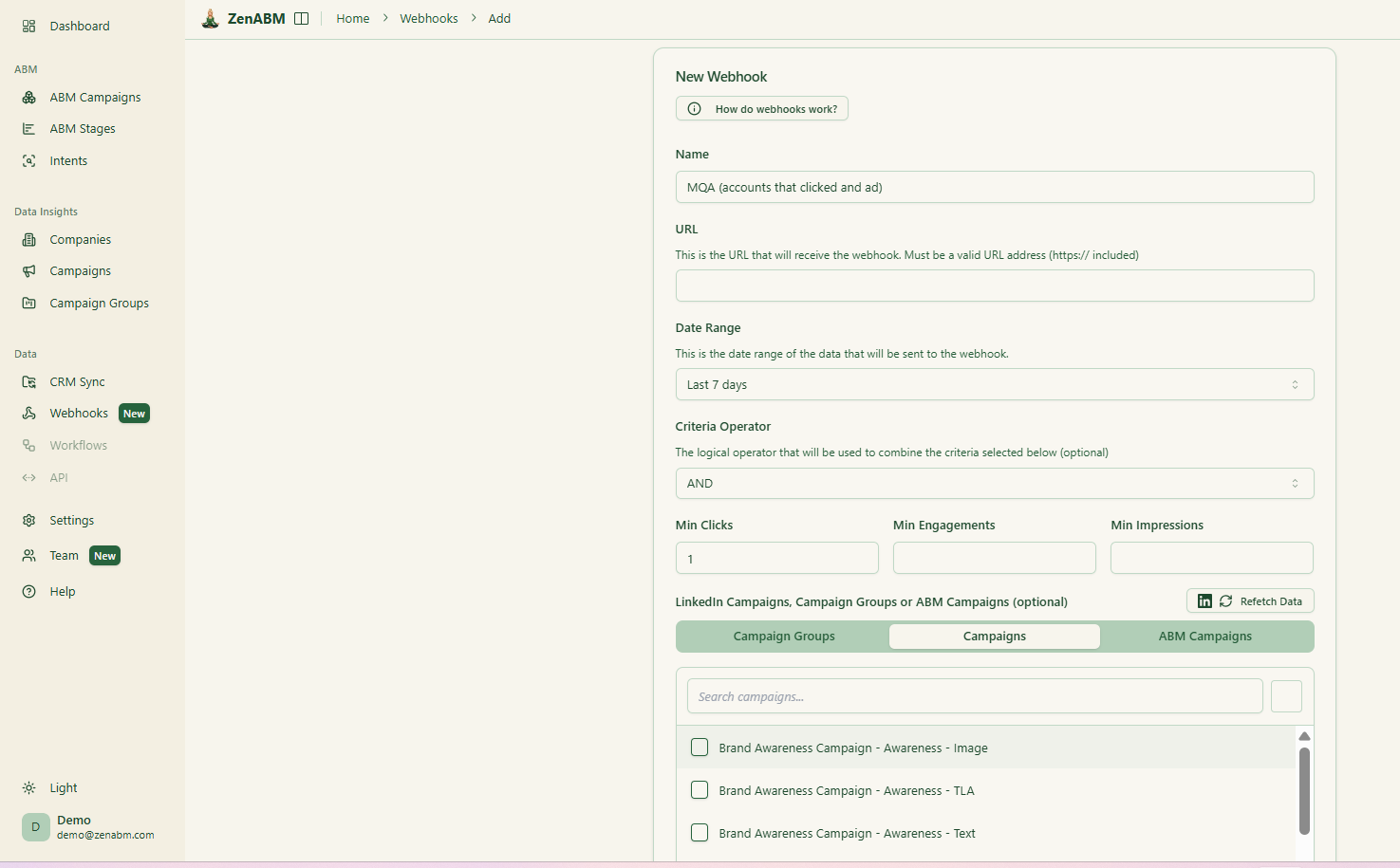

Custom Webhooks

ZenABM also provides custom webhooks so that you can put in any of your routine go to market workflows or connect with the marketing automation platforms of your choice without hassle:

Conclusion

Common Room and Terminus (now under DemandScience) both serve ABM goals but from entirely different angles.

Common Room wins if your strategy revolves around uncovering signals, mapping them to people, and arming sales with context. It’s fast to deploy, friendly to existing stacks, and excels at first-party, community-driven intelligence.

Terminus, on the other hand, is built for large, coordinated multi-channel engagement, including ads, chat, email signatures, and web experiences under one roof, but it demands heavier investment and operational muscle.

But both these tools cost at least $12k/year.

If your GTM motion lives mostly on LinkedIn, ZenABM is a smarter, leaner alternative.

It delivers first-party LinkedIn ad intent, CRM sync, and ABM analytics starting at just $59/month, making enterprise-grade ABM accessible without enterprise bills.