In this article, I have set 6sense vs. Factors.ai side by side on capabilities, pricing, and practical fit so marketing and sales teams can choose the platform that best supports their account-based marketing plans.

I also explain how ZenABM can serve as a lean, cost-effective substitute or a complementary layer to these enterprise ABM suites because of its different approach.

Read on…

6sense vs. Factors.ai: Quick Summary

If you are pressed for time, here is the snapshot:

- 6sense is an enterprise-class Revenue AI platform for predictive intent, orchestration, and cross-channel ABM. It stands out for buying-stage scoring, account prioritization, and tight sales alignment, and it is pricey (≈$50K–$120K per year) with a complex rollout. It suits larger teams with mature RevOps.

- Factors.ai is an ABM analytics and attribution solution tailored to campaign-led teams. It maps end-to-end journeys, supports multi-touch attribution, and matches website activity to accounts. It provides a free tier and lower-cost paid plans (~$10K–$25K per year), making it ideal for B2B marketers focused on ad-to-pipeline clarity and ROI proof.

- ZenABM captures first-party LinkedIn ad engagement, syncs qualitative and quantitative intent to your CRM, tracks each account’s ABM stage, scores accounts, routes hot accounts to BDRs, and ties ad spend to pipeline. Starting at $59 per month with a 37-day free trial, it is a strong lean alternative or companion for teams that want first-party intent and fast time to value.

- Bottom line: choose 6sense for predictive orchestration at scale; choose Factors.ai for attribution-driven ABM analytics; choose ZenABM for affordable, first-party LinkedIn-based intent programs.

6sense Overview: Core Features, Pricing, and More

6sense is an AI-driven B2B ABM platform known for revenue and sales intelligence strengths.

It enables revenue teams to answer “who is demonstrating intent” and “which accounts deserve attention right now” by combining large-scale data with machine learning.

The feature set is broad for marketing and sales teams and is designed for mid-market and enterprise organizations.

Here are the highlights:

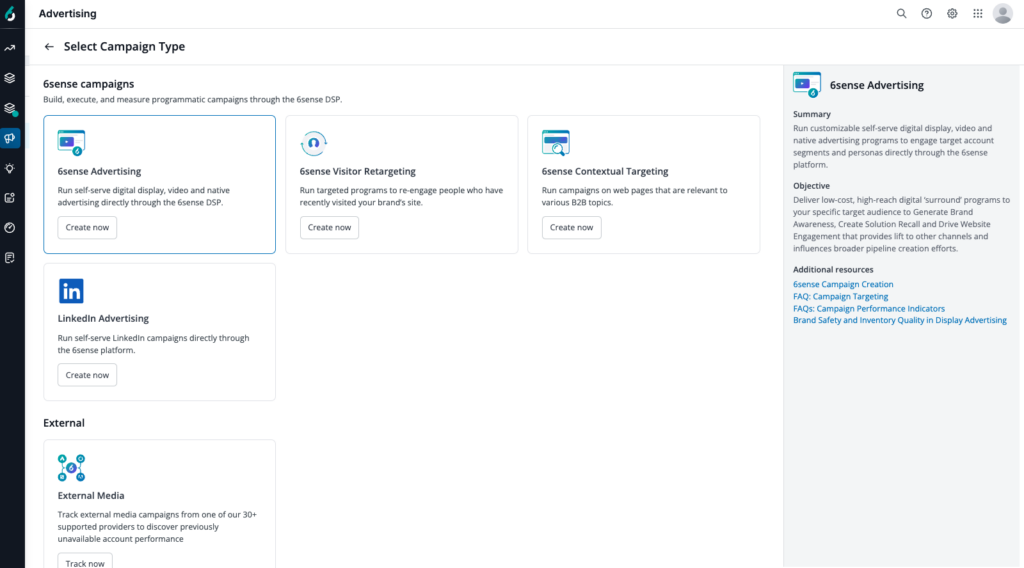

Multi-Channel Account Advertising & Orchestration

6sense includes a B2B DSP and integrations to run ads across display, video, CTV, LinkedIn, Facebook, Google Ads, and more.

Teams can assemble dynamic audiences using firmographics, technographics, intent topics, CRM data, and similar inputs to sharpen targeting.

Its orchestration lets ads, email, and sales outreach coordinate based on real-time account behavior.

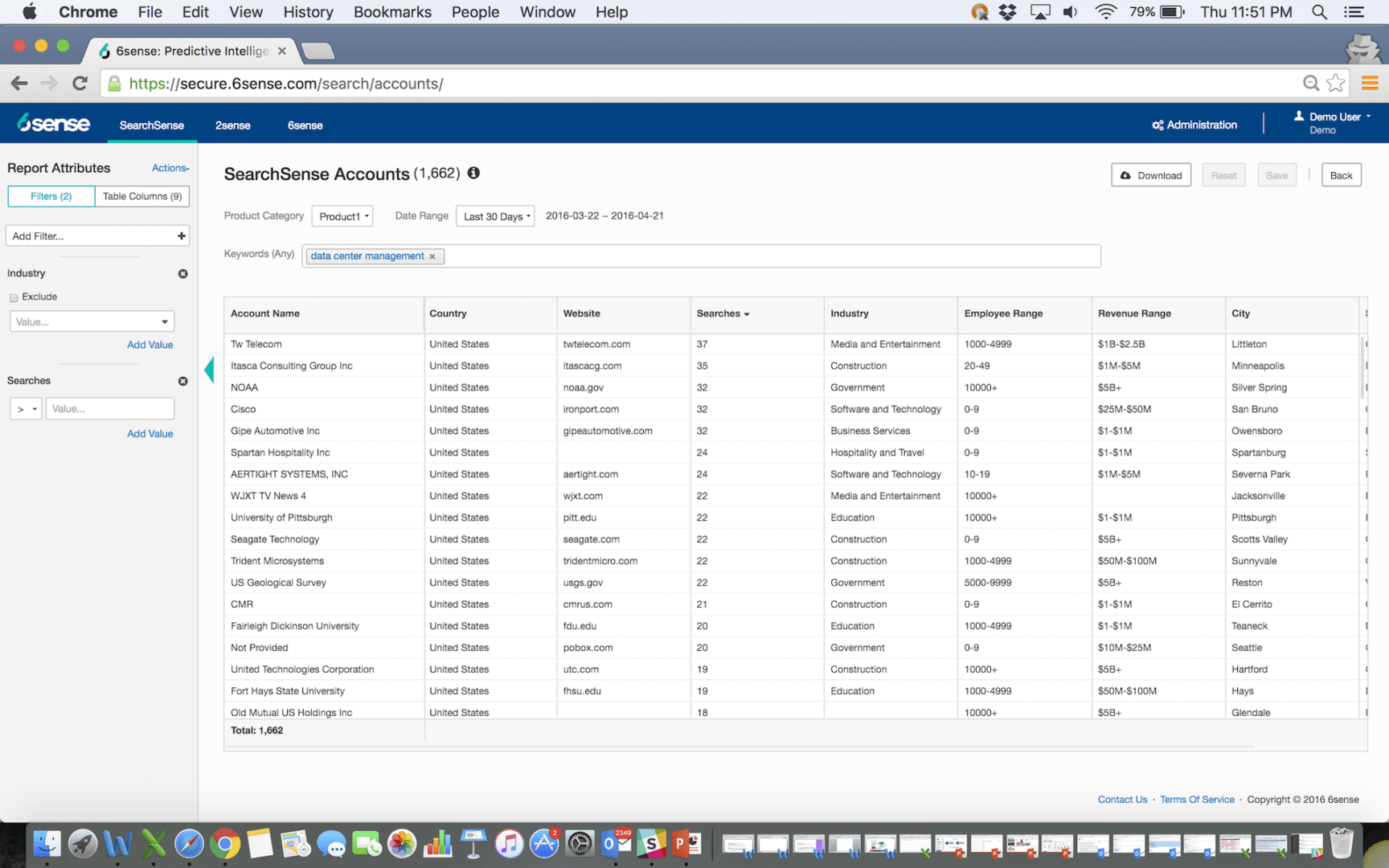

Predictive Intent Data & AI Scoring

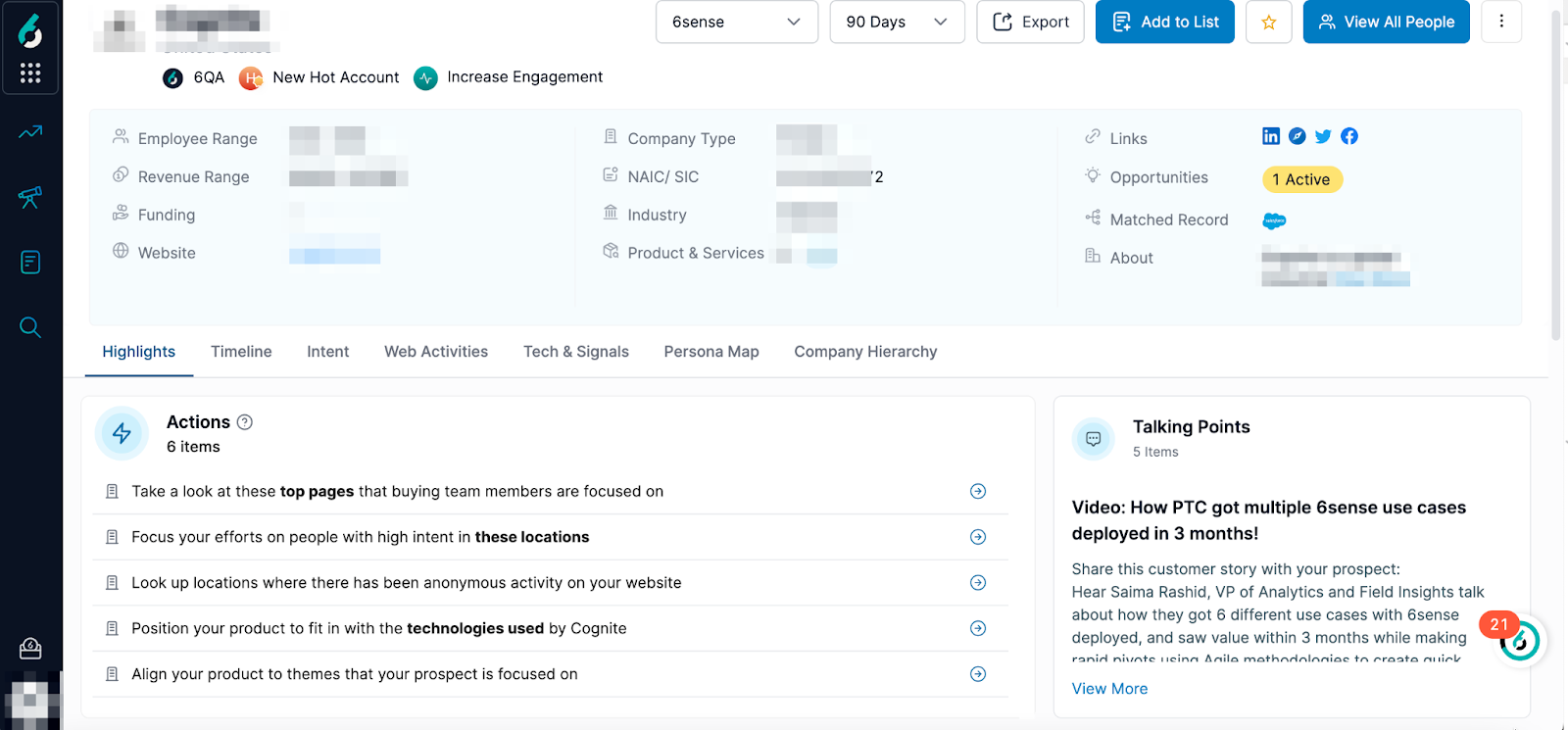

6sense’s signature capability is AI-powered intent and predictive scoring.

It blends first-party signals such as site visits, second-party review-site data, and third-party research patterns to produce a 0–100 score.

Those scores map to buying stages and likelihood to convert.

For example, 6sense’s predictive analytics can alert sales when an account surges on specific research themes or hits high-value pages, signaling possible in-market status.

This gives sales a proactive path to prioritize high-intent accounts.

Pro Tip: Favor first-party intent over third-party keyword spikes.

ZenABM captures qualitative intent by tracking which LinkedIn ads a company actually engages with, so signals are clearer and more actionable.

Teams like Userpilot have built ABM playbooks around this idea by tagging campaigns to pain points and increasing BOFU spend on the themes accounts interact with.

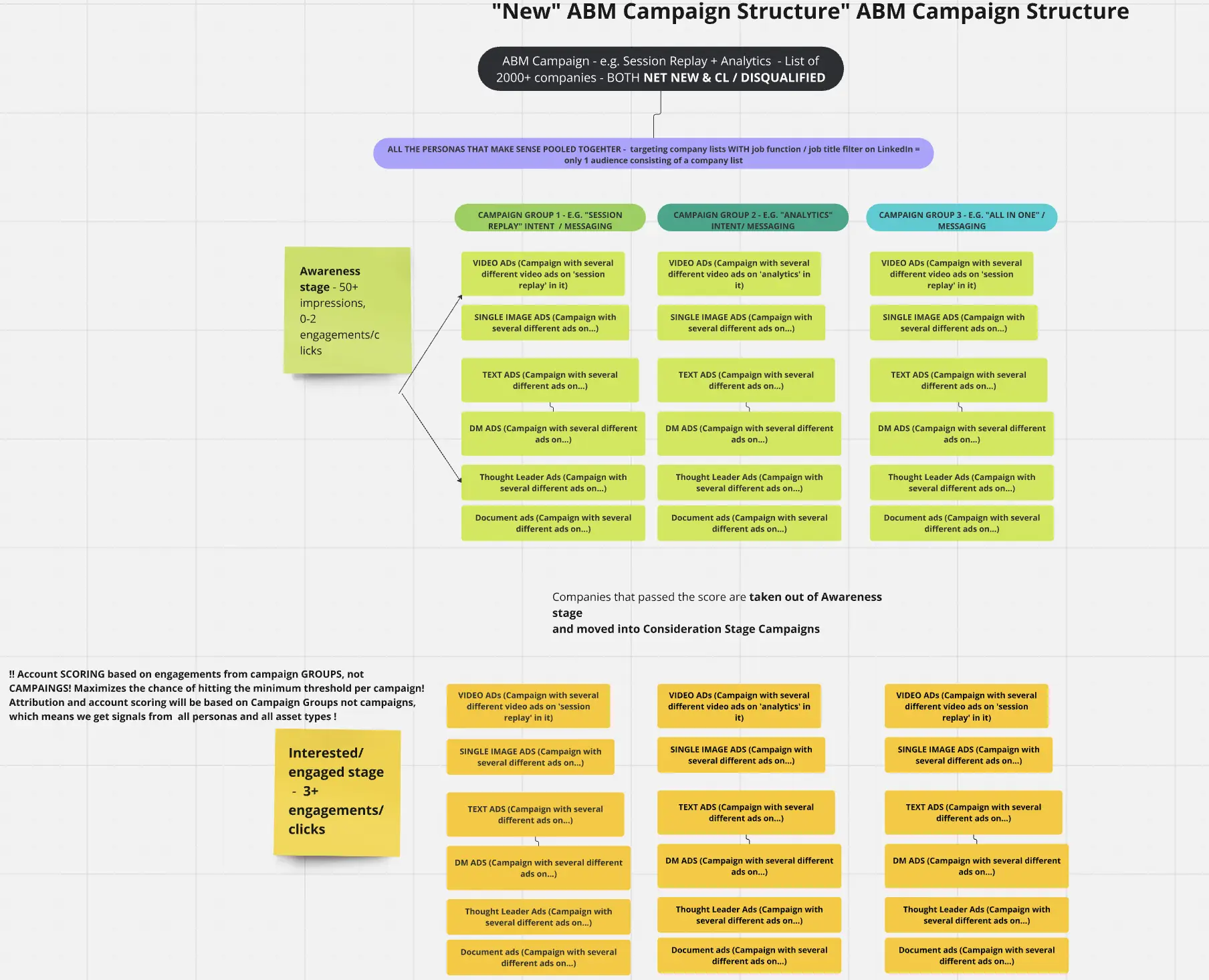

Their campaign blueprint:

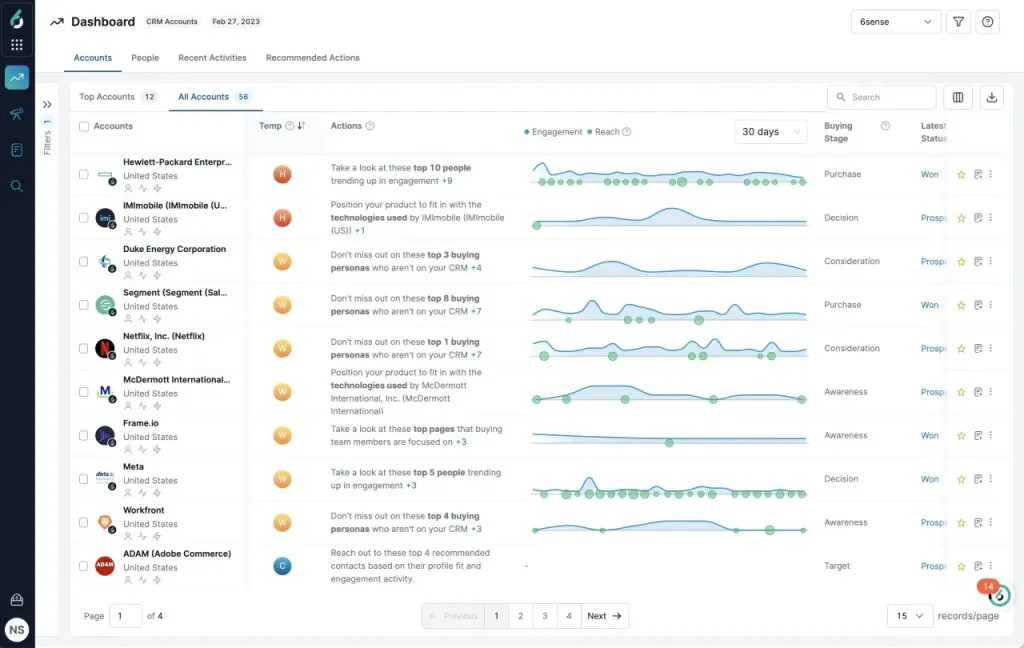

Account Intelligence & Contact Data

6sense compiles detailed account records with firmographics, technographics, key contacts, and behavioral context.

It often augments profiles with third-party enrichment for contact data. Some users note that international coverage can vary.

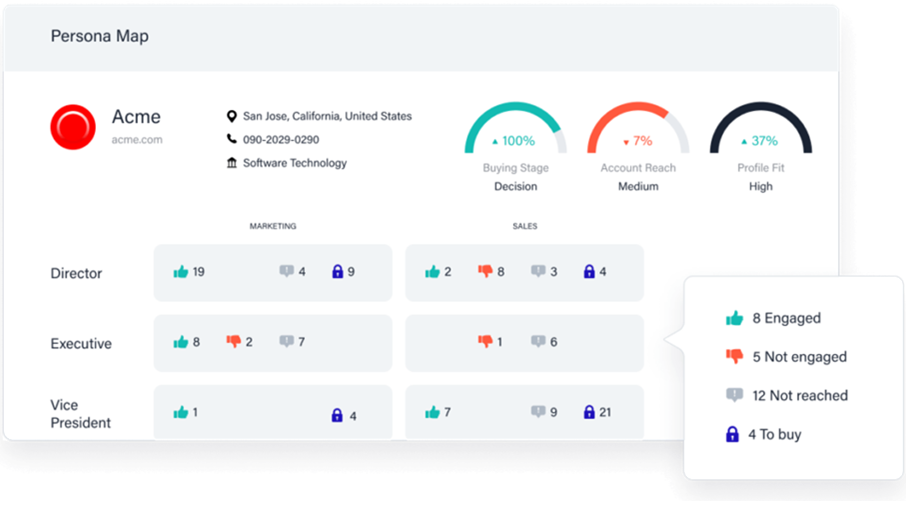

The sales intelligence features, including buying committee maps and next best actions, equip reps with useful context.

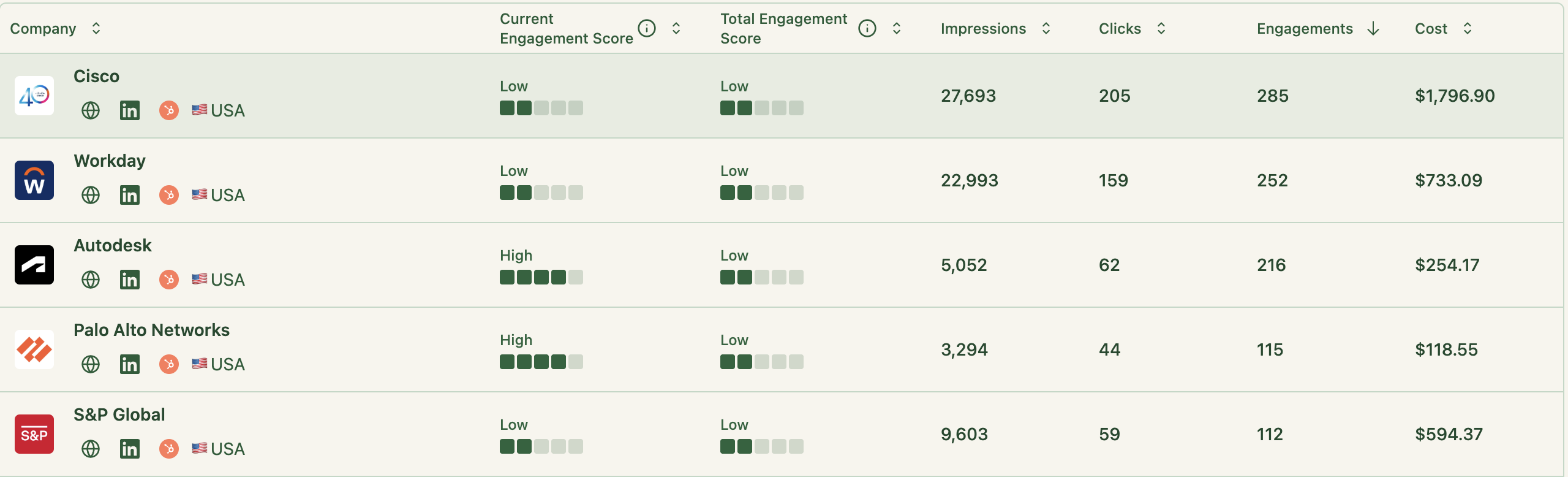

Analytics, Attribution & Reporting

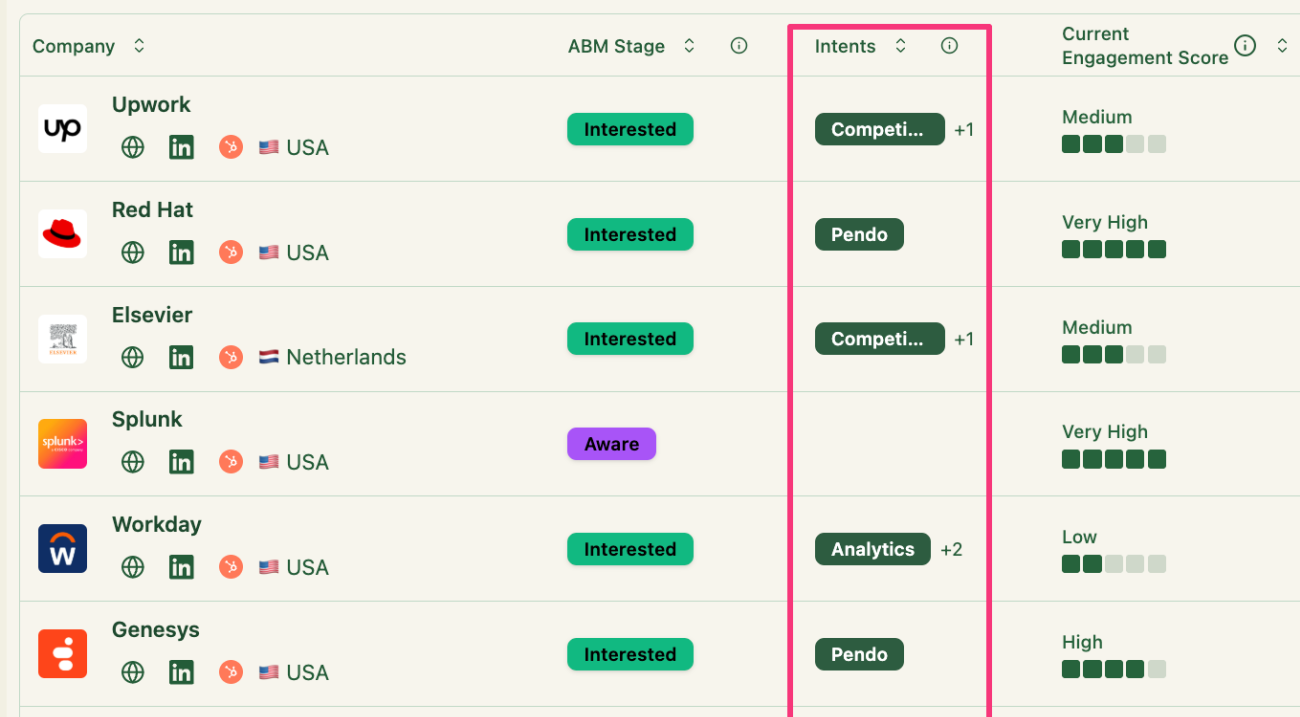

![]()

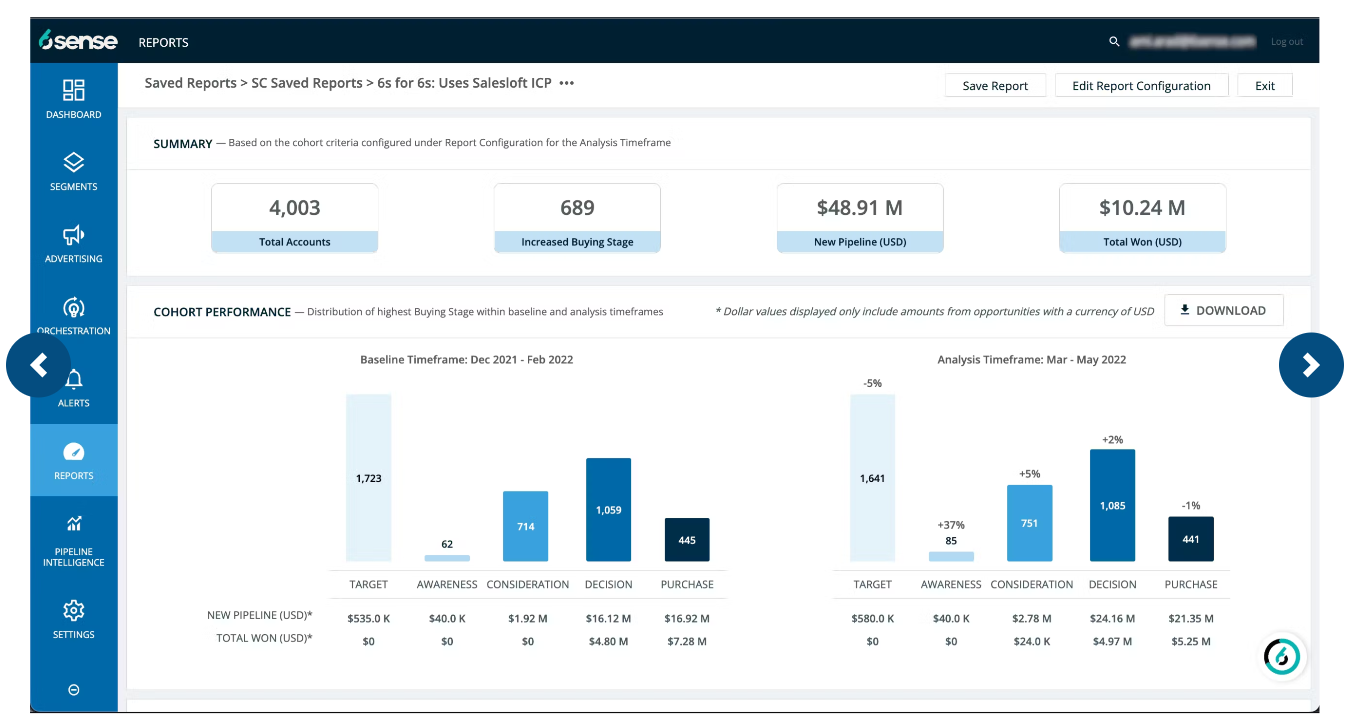

6sense offers extensive dashboards for both marketing and sales outcomes.

It supports multi-touch attribution that connects pipeline to programs, distinguishes influenced from sourced revenue, and can forecast the pipeline using AI.

You can monitor how accounts progress across buying stages and how engagement correlates with wins.

6sense also integrates with tools like Mutiny for web personalization and Drift for chat to extend experiences.

Integrations & Workflow

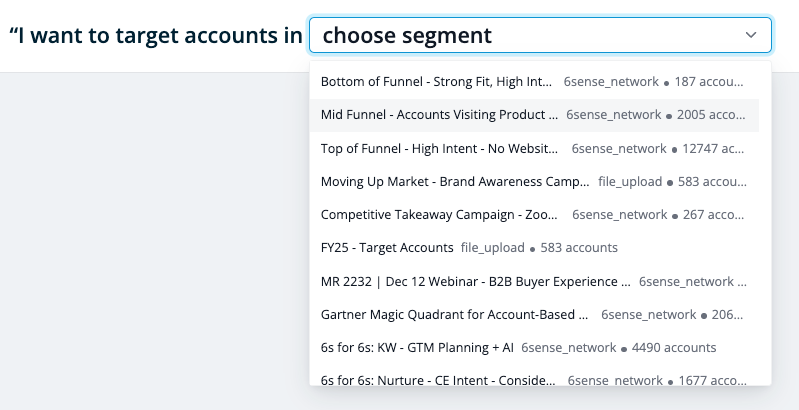

As an enterprise suite, 6sense connects with major CRM and marketing automation platforms such as Salesforce, HubSpot, and Marketo, plus sales engagement tools like Salesloft and Outreach, and enrichment vendors.

It aims to be the intelligence layer for your GTM stack, improving coordination between marketing and sales.

For instance, segments from 6sense can sync to LinkedIn Campaign Manager or trigger sales sequences.

This helps both teams operate from the same list of in-market accounts.

For details, see 6sense’s integrations page.

6sense Pricing

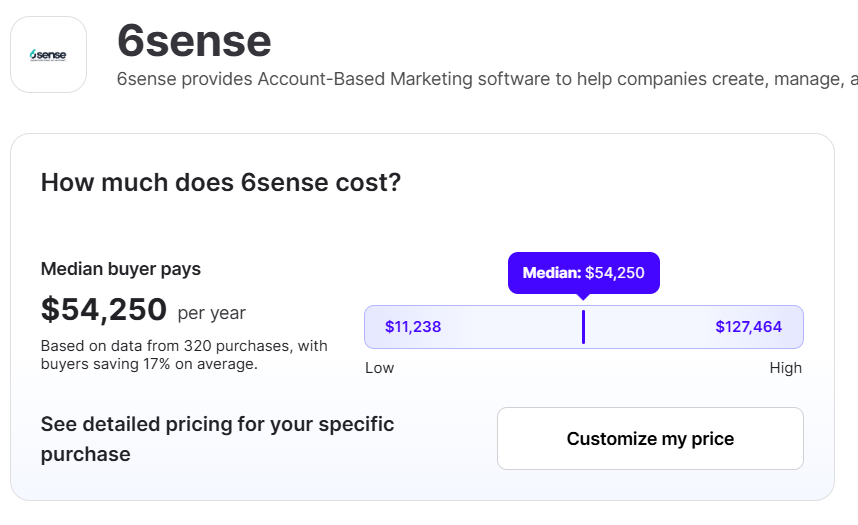

6sense is a premium platform with no public price card. You will need to engage sales for a tailored quote.

Contracts are typically annual or multi-year and may include services or media-related components depending on usage.

What should you budget?

While final numbers depend on scope, most buyers should expect mid-five figures to six figures per year for a complete rollout.

Vendr cites a median 6sense price of $54,250 per year.

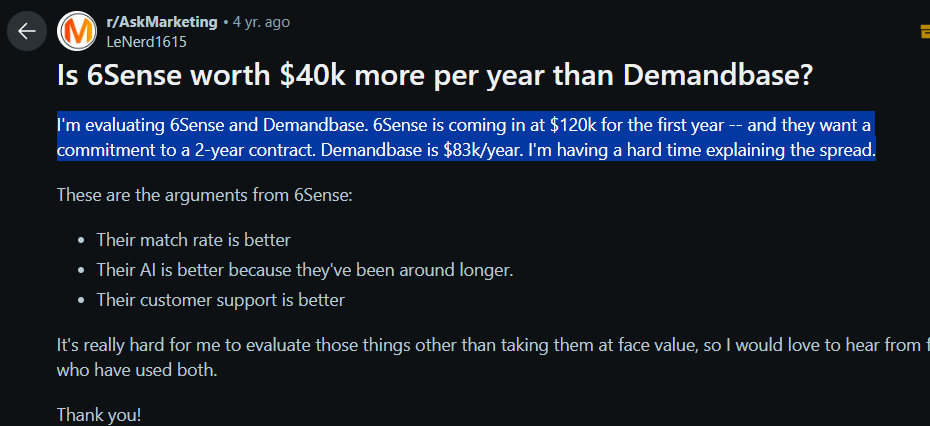

A user on Reddit shared a first-year quote of $120K from 6sense.

Given the investment and the ramp, 6sense fits organizations that will fully use its advanced features.

Smaller teams focused on one or two channels may find the cost and complexity tough to justify.

Factors.ai Overview: Key Features, Pricing, and More

Factors.ai presents itself as an “all-in-one” ABM intelligence and analytics platform for B2B marketers.

Its core model is to connect website, advertising, and CRM data to reveal the account-level journey end to end, then help teams act on those insights.

Below is a breakdown of the main capabilities, pricing approach, and common applications.

Multi-Touch Attribution & Journey Analytics

Factors.ai can collect and attribute touches across channels such as site behavior, ad engagement, email, and CRM events, assigning credit via multiple models.

Out of the box, it supports about nine models, from first-touch and last-touch to linear, time-decay, and U- or W-shaped options, and allows comparisons in parallel.

Marketers get a clearer read on which programs and assets contributed to the pipeline and revenue, rather than leaning on a single-touch metric.

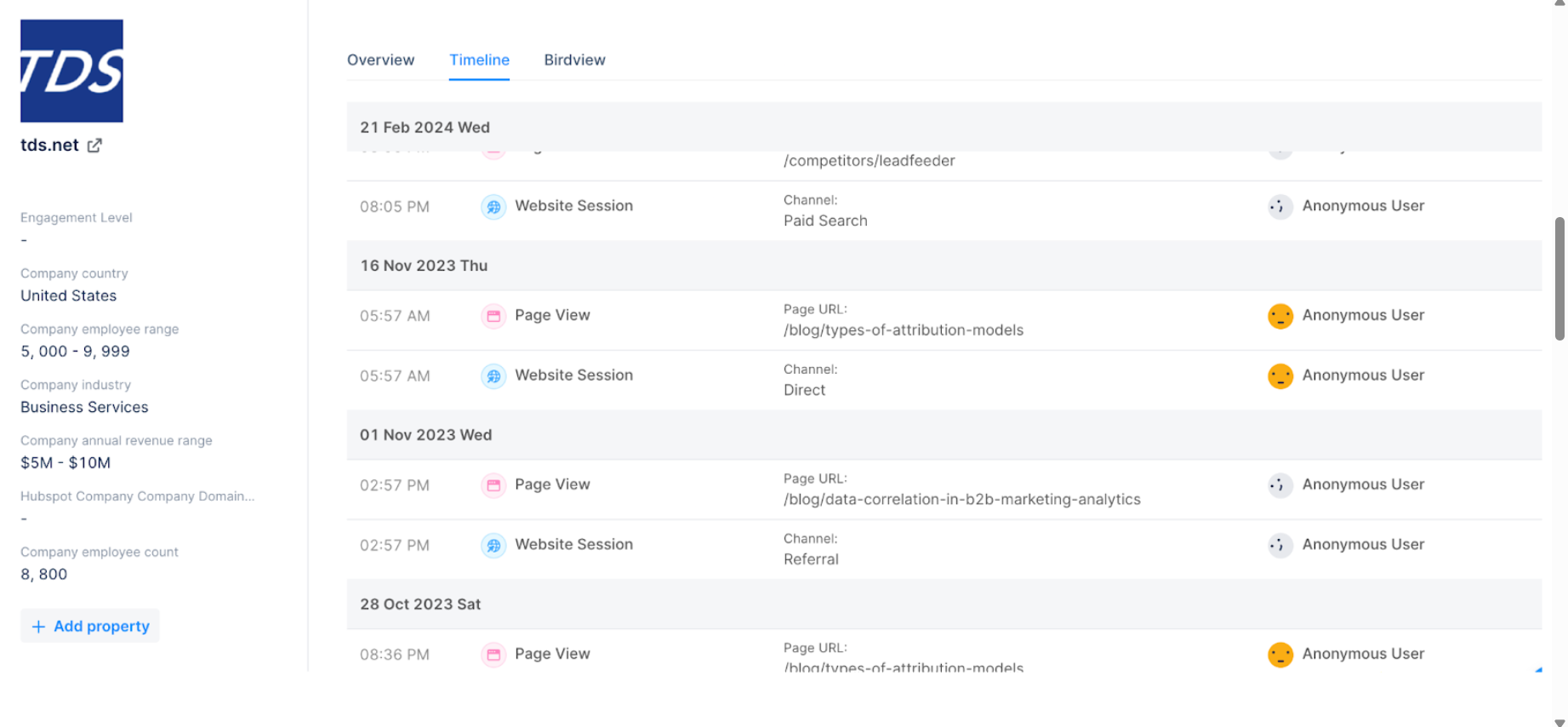

All interactions feed an Account Timeline that sequences every touch, from anonymous web sessions to ad interactions and sales activity.

Website Visitor Identification (Site-to-Account Matching)

A defining capability of Factors.ai is inferring which companies are browsing your site, even when visitors remain anonymous.

Through IP resolution and partners like Clearbit Reveal and 6sense, Factors.ai reports deanonymization rates around 64 percent by mapping IPs to company domains.

In practice, if someone from Acme Corp visits, Factors.ai can surface “Acme Corp” in reporting along with firmographics such as industry and size.

This site-to-account matching populates Account Intelligence so you can see which target accounts are engaging with your properties.

Important caveat: IP-based identification is imperfect. Studies like the one from Syft estimate real-world accuracy near 42 percent.

A clever workaround using ZenABM: Retarget anonymous visitors with low-cost LinkedIn text ads, then let ZenABM reveal the companies that received those impressions.

Account Intelligence & Scoring

Factors.ai enriches discovered accounts with firmographics and intent signals.

With Clearbit, you can append attributes such as industry, headcount, revenue bands, and location.

Via 6sense or similar sources, it can also infer buying stages or topic-level interest.

All of an account’s interactions across web views, ad clicks and impressions, and form fills are rolled into a per-account engagement score.

Scoring models are configurable, so you can combine fit criteria with engagement weights to surface the warmest accounts.

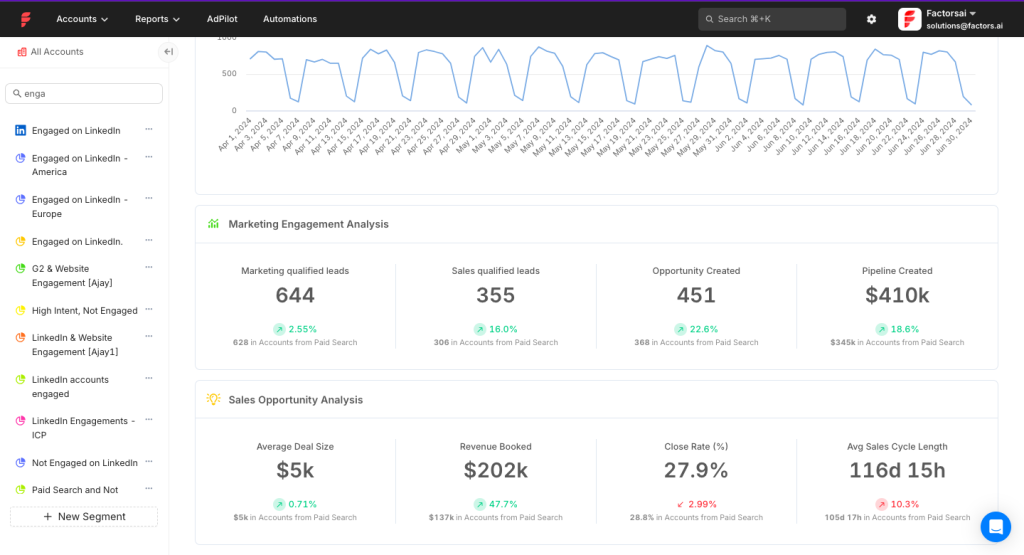

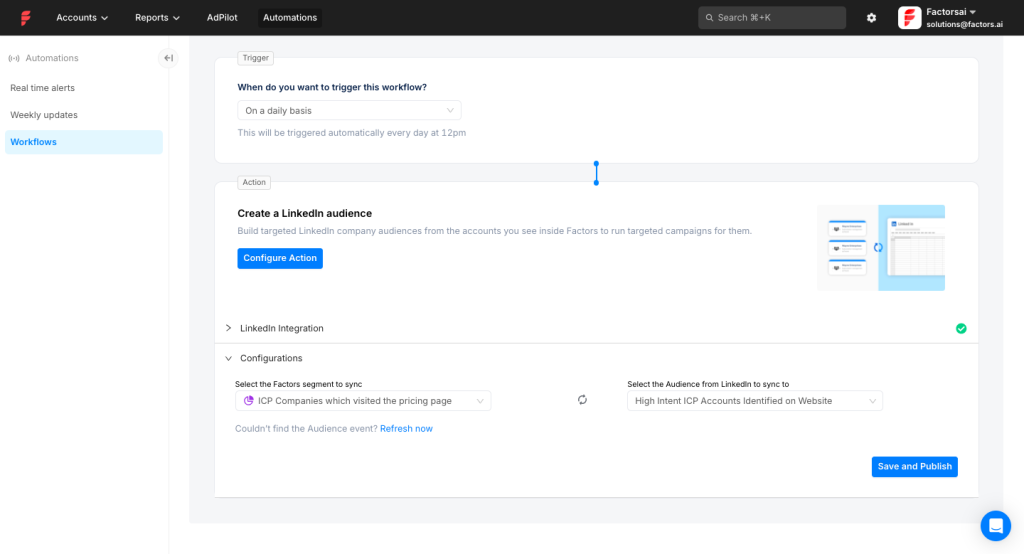

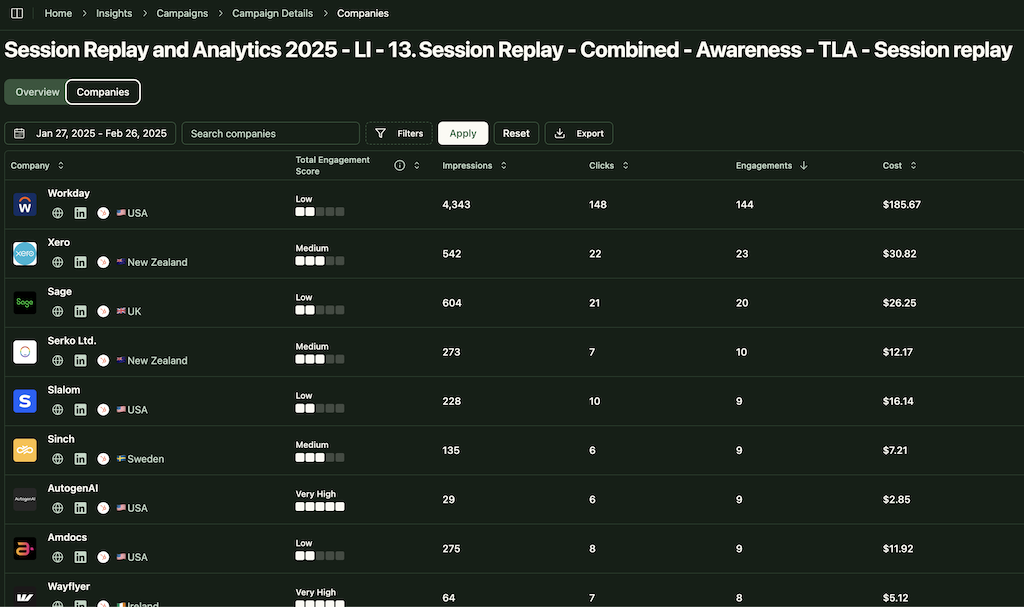

Advertising Analytics and AdPilot

Factors.ai integrates with major ad platforms such as LinkedIn, Google Ads, Facebook or Meta, and Microsoft Ads to ingest campaign performance and push audiences.

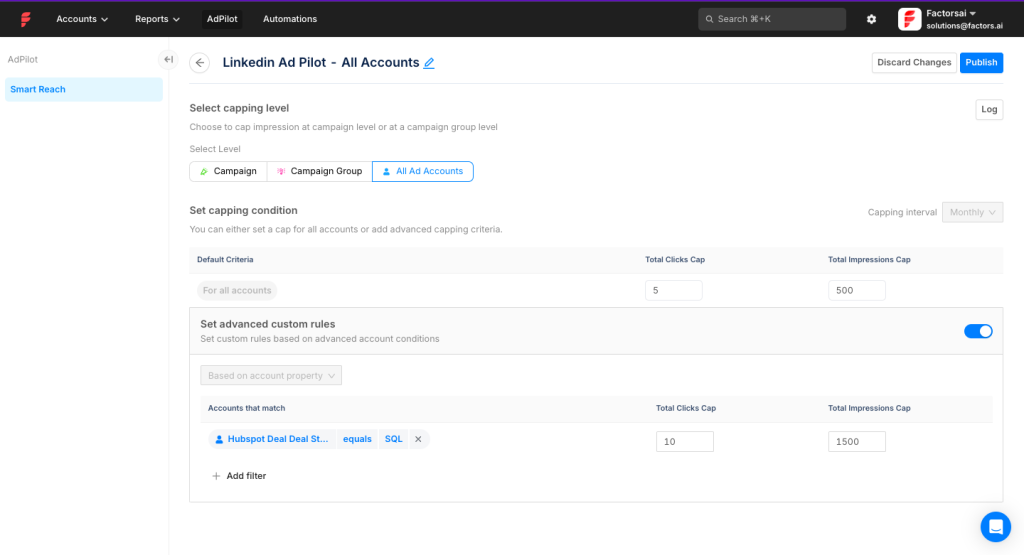

A distinctive module is LinkedIn AdPilot, an AI-assisted tool that helps automate LinkedIn ABM operations.

AdPilot can dynamically manage targeting, such as building LinkedIn audiences from account segments in Factors, and enforcing per-account impression caps so spend is distributed more evenly.

Factors.ai also records impression-level data for LinkedIn, not just clicks, which enables view-through attribution, so influenced accounts get credit even without a click.

Pro Tip: Like Factors.ai, ZenABM captures company-level LinkedIn impressions as well as clicks, and goes further by showing which specific ads each account interacted with, revealing what the company actually cares about.

You can tag campaigns by theme or feature, and ZenABM will surface each account’s intent signals while syncing both qualitative and quantitative engagement into your CRM.

This gives BDRs context on which accounts are warming up and which topics opened the door, making outreach more relevant.

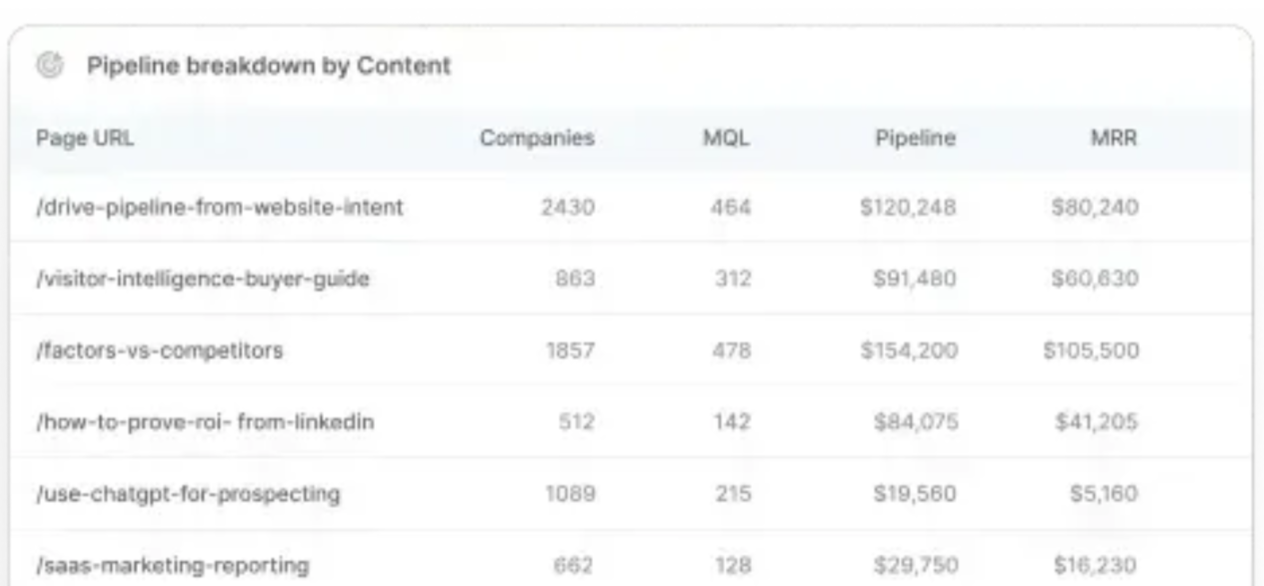

Reporting & Analytics

Beyond attribution, Factors.ai includes dashboards dedicated to ABM analytics.

You can track “Visits by target account,” “Pages per account,” “Ad impressions per account,” and similar views to gauge engagement from key companies.

Higher tiers unlock prebuilt ABM dashboards that surface which programs drive the most account engagement, how accounts spread across funnel stages, and what portion of the pipeline marketing influenced.

Custom reporting is available, with allowances that grow across tiers. For example, Basic may include around ten custom reports.

Some G2 reviewers mention customization limits.

Those same reviews point to a few friction points:

- Onboarding curve: Better tutorials would help.

- Data gaps: occasional mismatches in visitor ID or credit assignment.

- Performance: The segment builder can feel slow.

- Manual steps: certain Salesforce sync tasks still need handoffs.

Factors.ai Pricing

Factors.ai follows a multi-tier approach with a free entry plan and several paid tiers.

Specific prices for paid plans are not listed publicly. The site emphasizes “custom pricing for your needs” and asks prospects to book a demo for precise quotes.

Officially, there are four tiers:

- Free: for teams that want to try essentials such as identifying which companies visited the website, with no commitment.

- Basic: an entry option for turning anonymous traffic into qualified leads for sales.

- Growth: a mid-tier that expands account insights, improves targeting, and deepens analytics.

- Enterprise: intended for large ABM budgets, with the most advanced targeting and analytics for scaled programs.

All packages include core account identification and analytics foundations.

A free trial is available so teams can validate value before buying.

6sense vs. Factors.ai: Key Differences

Here are the major distinctions between 6sense and Factors.ai you should weigh:

| Category | 6sense | Factors.ai |

|---|---|---|

| Positioning and scope | 6sense describes a Revenue AI platform that predicts buying stages, prioritizes accounts, and orchestrates actions for marketing and sales across channels. Predictive modeling and intent capture sit at the core. | Factors.ai frames itself as an AI-powered demand generation and ABM analytics platform. It unifies ad, web, and CRM signals to identify accounts, run ABM, and measure ROI. |

| Signals, modeling, and intent | 6sense leans on predictive buying-stage models that map accounts from early research to active evaluation. Those stages drive prioritization, alerts, and GTM plays. | Factors.ai focuses on first-party and advertising signals, account discovery, and journey analytics. It highlights impression-to-pipeline visibility for LinkedIn and Google, plus AI agents for recurring GTM tasks. |

| Activation and orchestration | 6sense aims to be the orchestration brain for revenue teams, connecting intent and predictions to programs and seller workflows, including Sales Intelligence for reps. | Factors.ai concentrates on campaign analytics, ABM workflows, and attribution. The emphasis is showing which ads and touches influenced opportunities and revenue, then suggesting next steps. |

| Analytics and attribution depth | 6sense reports tie predictions and signals to account progression and GTM performance. The value comes from using buying-stage movement to guide marketing and sales. | Factors.ai is built to answer “what worked” for paid and multi-touch efforts. Its materials stress visibility across the buyer journey, campaign impact, and ABM ROI measurement. |

| Integrations and sales workflow | 6sense’s Sales Intelligence gives reps company and people search, alerts, list building, and a Chrome extension. A permanent Free plan includes 50 monthly credits. The full suite is quote-based. | Factors.ai connects with ad platforms, web analytics, and CRMs to consolidate signals for ABM analytics and account scoring. Marketing uses it to guide budgets and outreach. |

| Pricing posture | 6sense does not publish list prices for the core platform. Third-party explainers say paid tiers are custom and costly for smaller teams, while Sales Intelligence Free includes 50 credits per month. Vendr lists a median of $54,250 per year. | Factors.ai displays a tiered model with a Free plan and paid tiers such as Basic, Growth, and Enterprise. Specific prices are gated behind “Book a demo.” In practice, Factors.ai is far cheaper than 6sense (roughly $10K–$25K annually). |

| Complexity and time to value | 6sense is powerful and wide-ranging, which typically means heavier implementation and change management to realize predictive and orchestration benefits. | Factors.ai is often adopted to clarify ad-to-pipeline results and ABM analytics, which many teams can operationalize quickly if their motion is campaign-led. |

| What users tend to say | Public reviews frequently praise buying-stage visibility and prioritization for SDRs and AEs. Cost and setup effort appear as the common tradeoffs for the breadth. G2 comments highlight predictive analytics and intent data that help focus on in-market accounts. | Users often cite ease of use and clarity on paid performance and lead sources. A Capterra review notes tracking became “a piece of cake,” with a 4.3% conversion lift and about 15% revenue impact. G2 reviews echo strengths in visitor tracking and actionable insight, with notes on segmentation complexity at very large scale. |

So, Which is Better for ABM?

It depends on your priorities:

- Choose 6sense if your program relies on predictive alignment across marketing and sales. If you want buying-stage scoring, intent-driven prioritization, and orchestration that feeds the same signals into rep workflows, 6sense is a strong fit. This works best with a mature RevOps function and appetite for change across teams.

- Choose Factors.ai if your priority is proving and improving paid impact by account. If you need clear ad-to-pipeline attribution, journey analytics, and practical ABM workflows without a heavyweight suite, Factors.ai fits well. Teams centered on LinkedIn and Google campaigns will feel at home.

Reality Check by Company Size.

- SMB and lower mid-market: 6sense’s Sales Intelligence Free tier is a low-friction toe dip, but the full platform can be overkill without dedicated ops. Factors.ai’s free tier and campaign-first focus can show value quickly.

- Mid-market: Both can work. Pick 6sense for predictive-led alignment across revenue teams. Pick Factors.ai if the main goal is channel performance clarity and ABM analytics you can stand up quickly.

- Enterprise: Either can scale. The call usually hinges on whether you want a predictive brain spanning GTM motions or a measurement-first stack that makes paid ROI impossible to miss.

ZenABM as an Alternative: Key Features, Pricing, and More

ZenABM is a lean ABM platform designed for running LinkedIn-led ABM programs.

Key capabilities include:

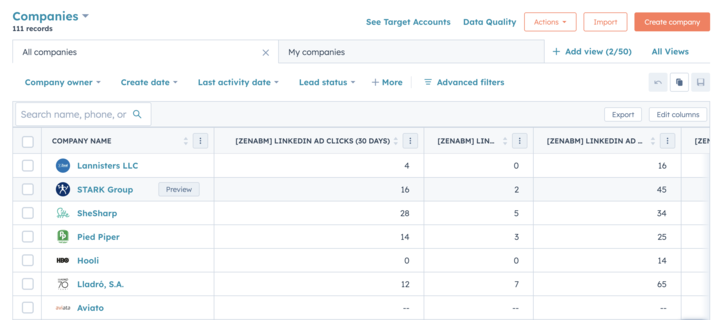

Account-Level LinkedIn Ads Engagement Tracking

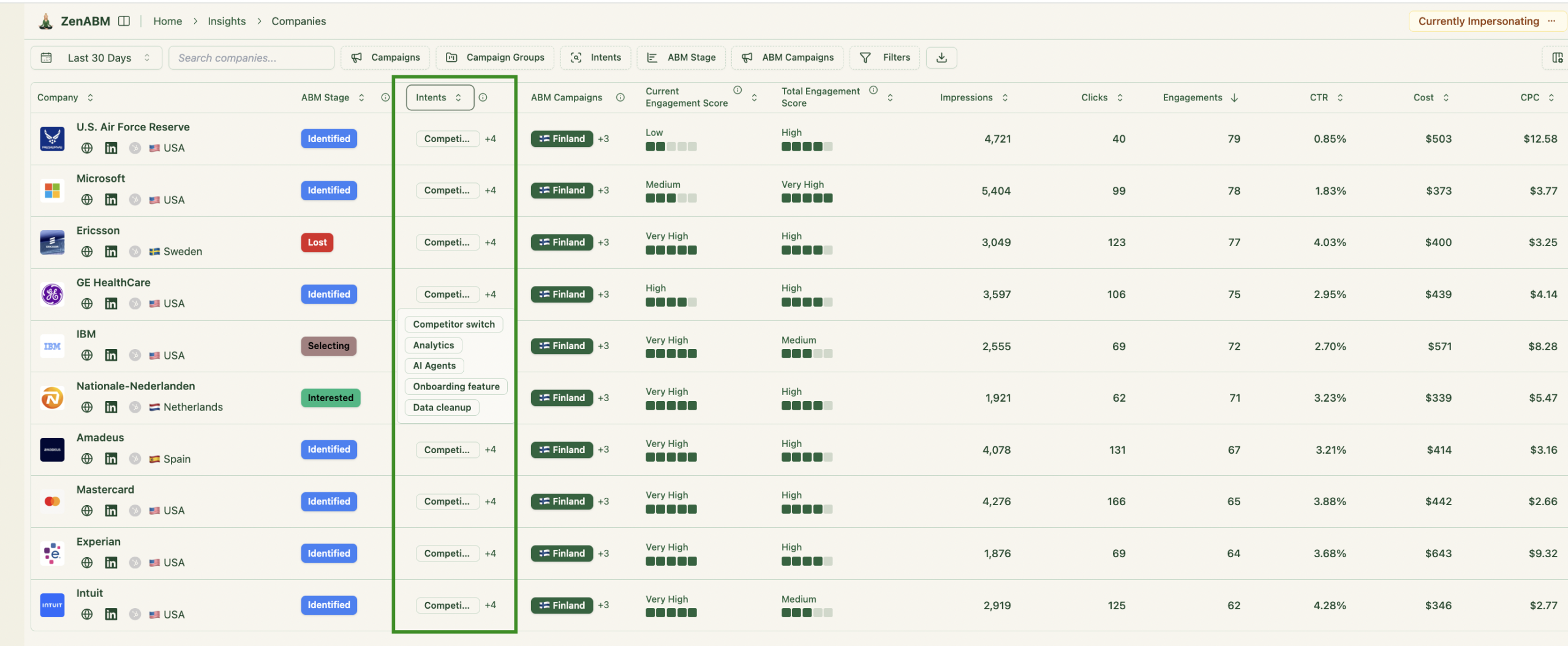

ZenABM connects directly to the LinkedIn Ads API to bring in account-level data from every campaign.

You can see which target companies respond to your LinkedIn ads, including impressions and clicks, mapped at the account level.

Because this is first-party data from logged-in users, accuracy is high. Many ABM platforms still depend on probabilistic IP or cookies to infer identity.

That guesswork can be unreliable. A Syft study found IP matching tools correctly identify companies about 42 percent of the time.

ZenABM’s first-party approach yields cleaner intent signals from ad engagement. If several people at the same company interact with your ads, you know that account is warming up without buying third-party data.

Pro Tip: You can also reveal many website visitors at the company level by retargeting them with low-cost LinkedIn text ads. ZenABM will then surface the companies that received impressions.

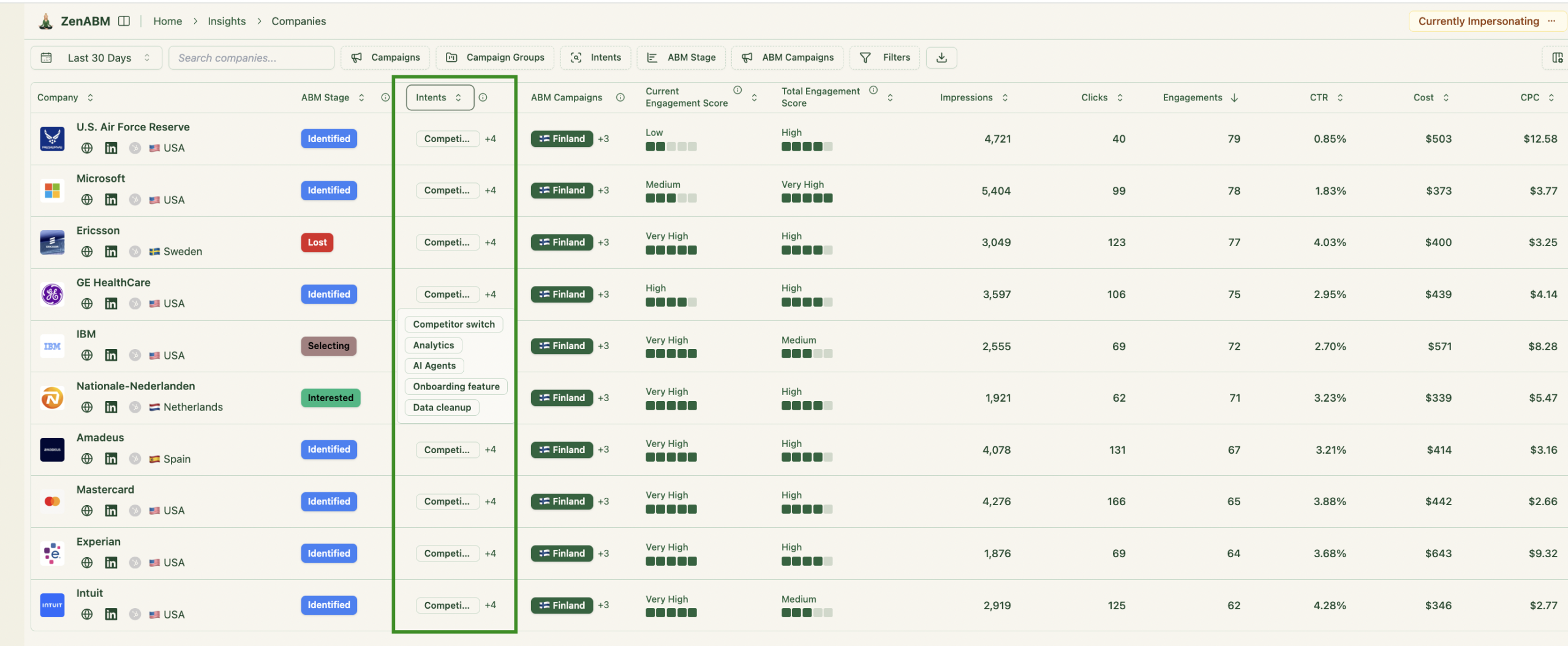

Real-Time Engagement Scoring

ZenABM continuously updates engagement scores based on ad interactions. You can compare recent and historical trends to spot accounts heating up.

These scores help teams focus outreach on the right companies at the right time.

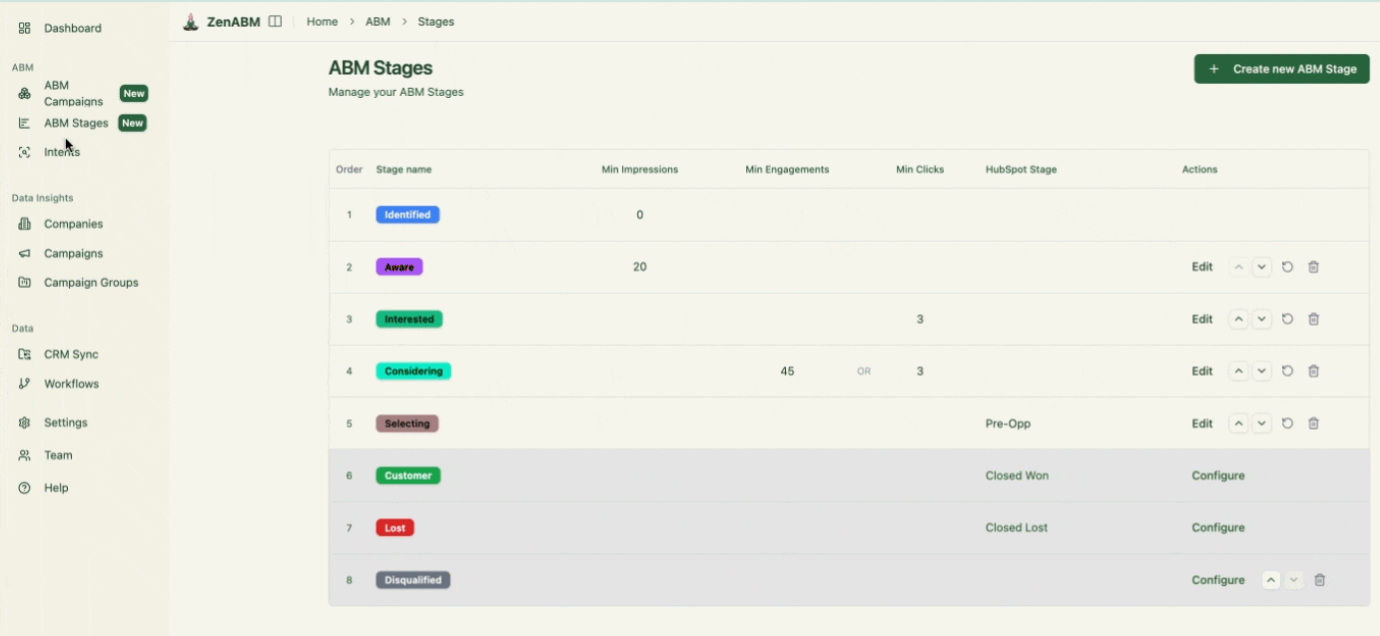

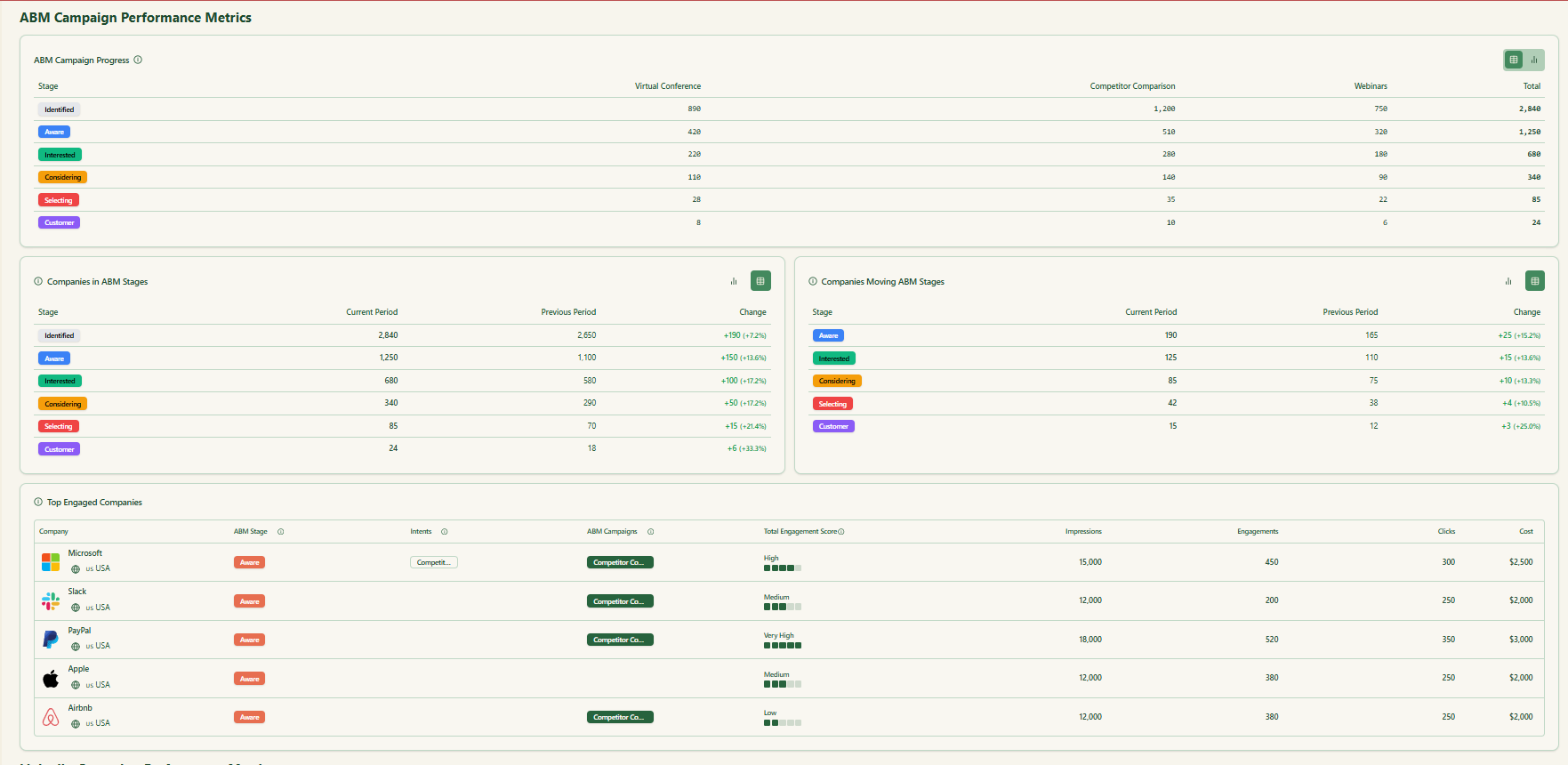

ABM Stage Tracking

ZenABM lets you define ABM stages like Identified, Aware, Engaged, Interested, and Opportunity. It then classifies each account using engagement and CRM data.

You can tune thresholds for each stage, and ZenABM tracks movement across the funnel automatically.

This delivers full-funnel visibility similar to enterprise ABM suites and helps you spot friction points.

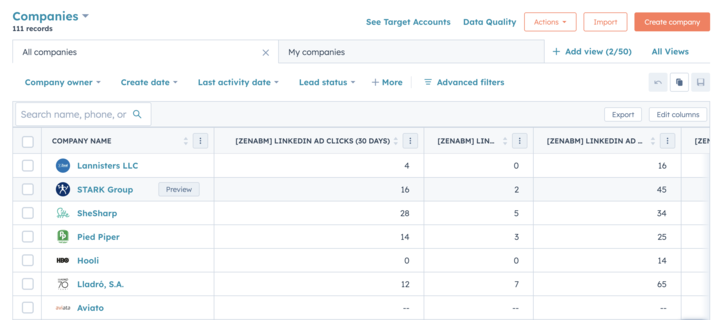

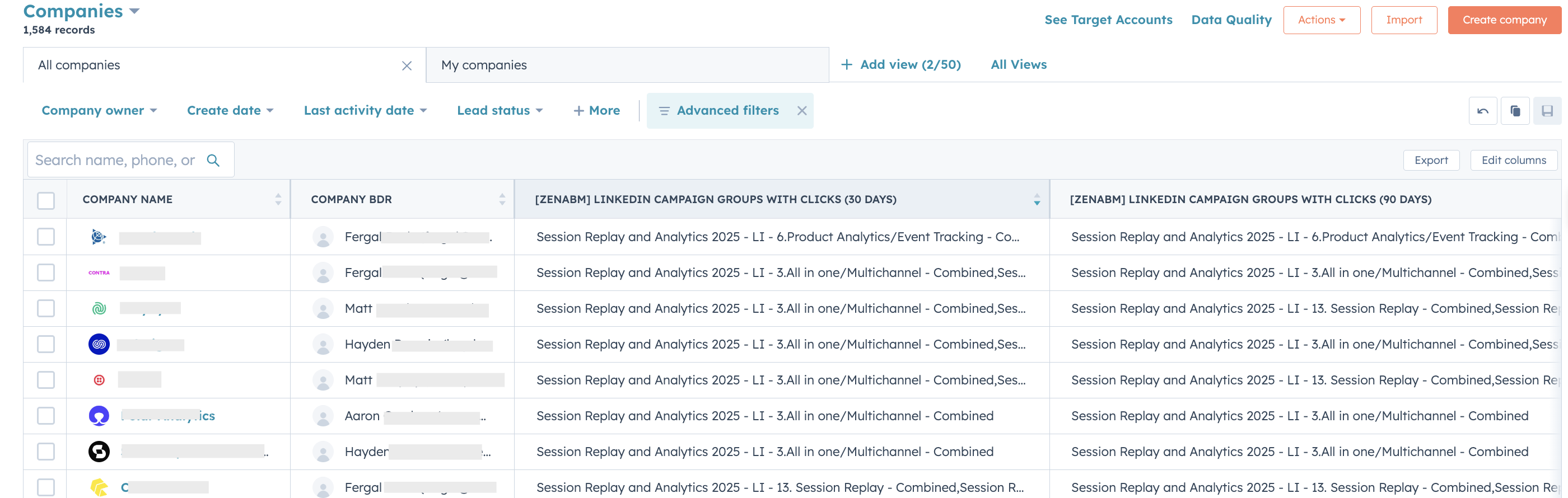

CRM Integration and Workflows

ZenABM syncs bi-directionally with CRMs such as HubSpot and Salesforce on higher plans.

LinkedIn engagement is written to your CRM as company properties so sales can act immediately:

ZenABM can also move accounts to Interested when engagement meets your threshold and assign them to BDRs for prompt follow-up.

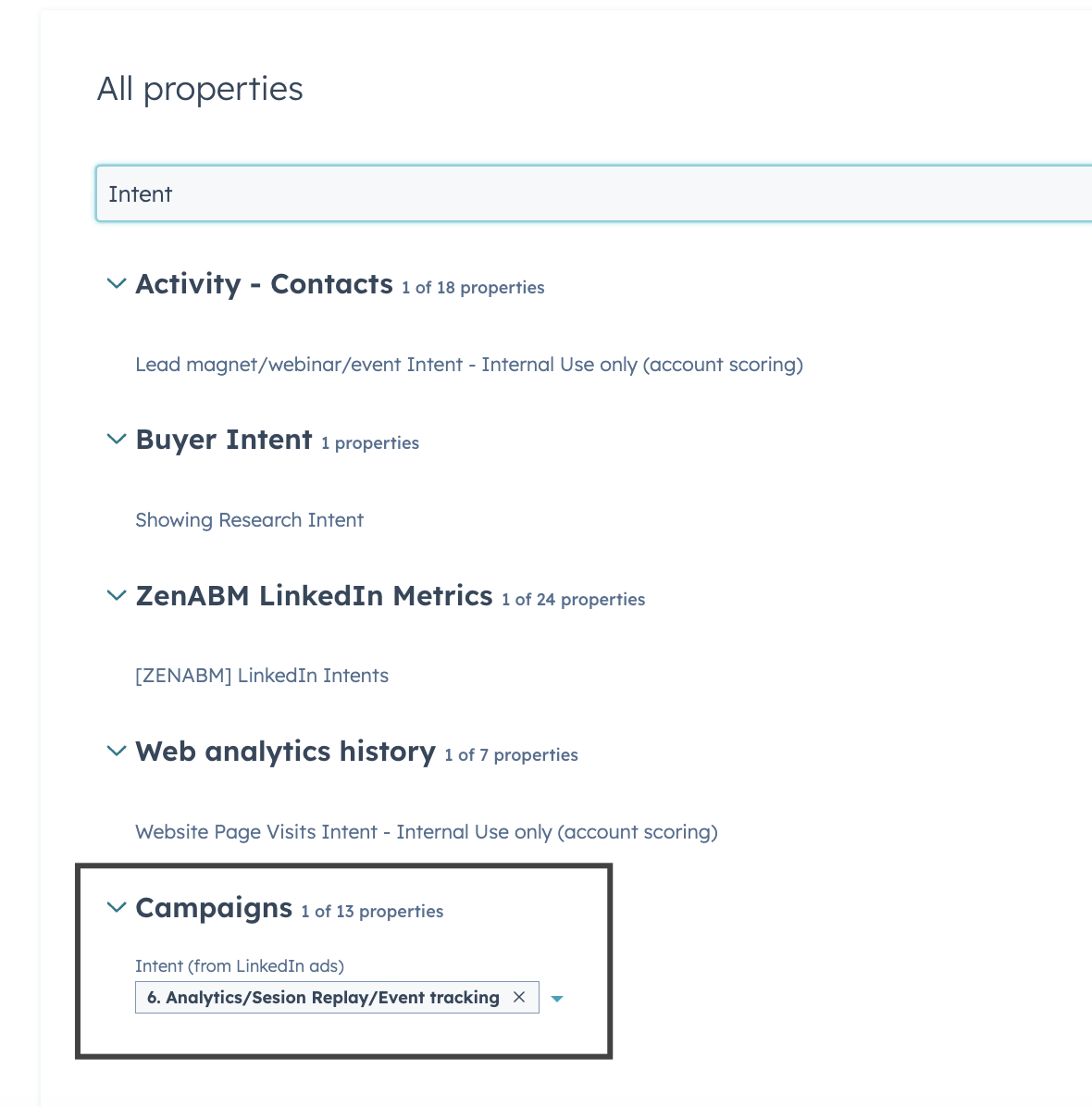

Intent Tagging from LinkedIn Ads Engagement

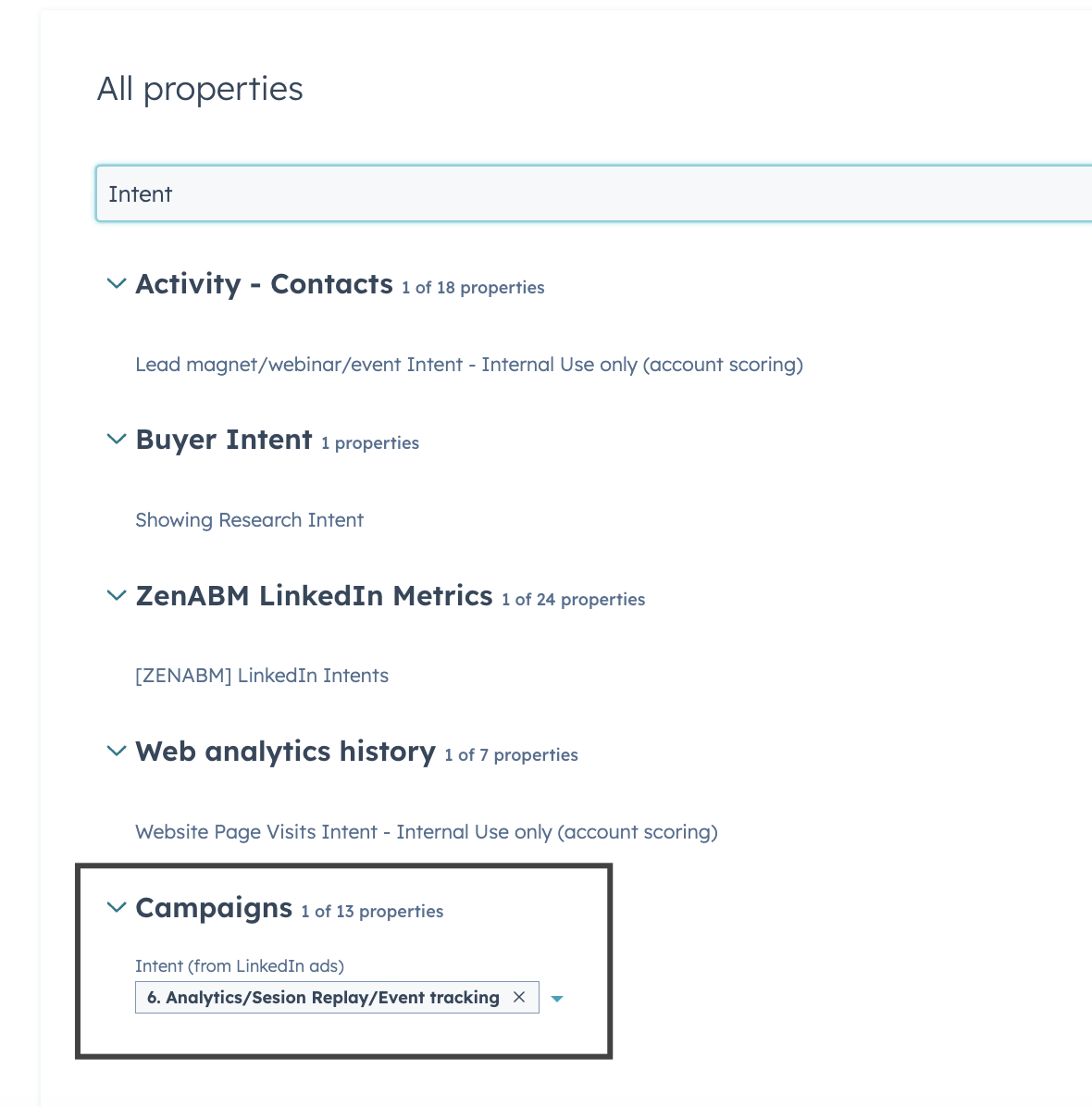

ZenABM lets you tag each LinkedIn campaign by theme or problem area. It then shows which accounts interacted with which themes, so you know what each company cares about.

This is genuine first-party intent. Instead of paying for inferred interest, you get direct evidence. If Account Z clicks a “Feature A” ad, you know the interest is real.

These insights sync to CRM, which enables highly relevant outreach and messaging.

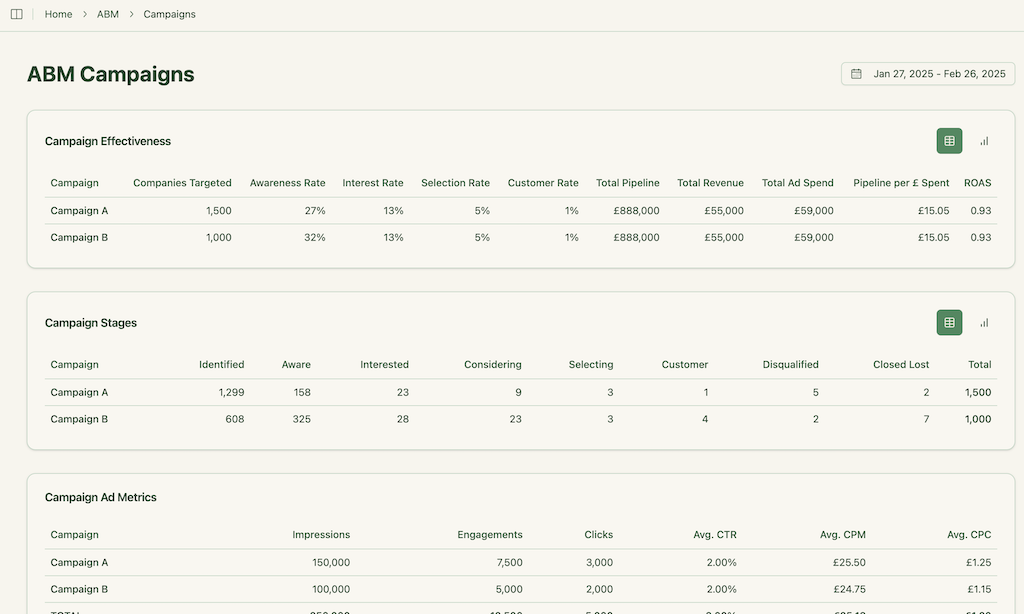

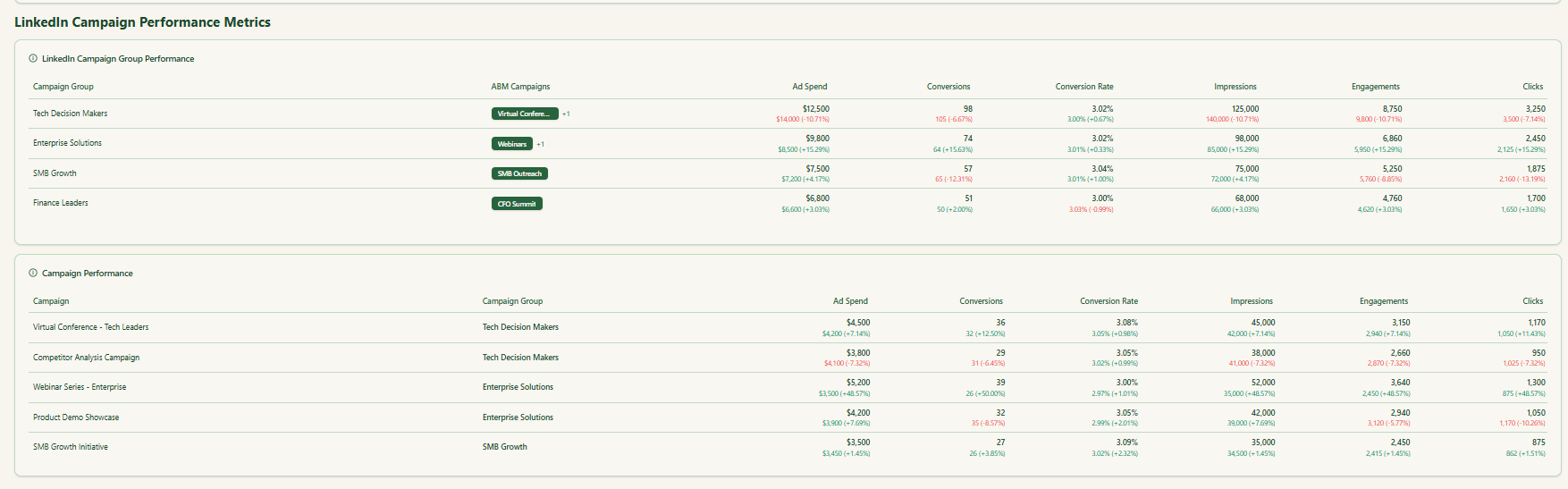

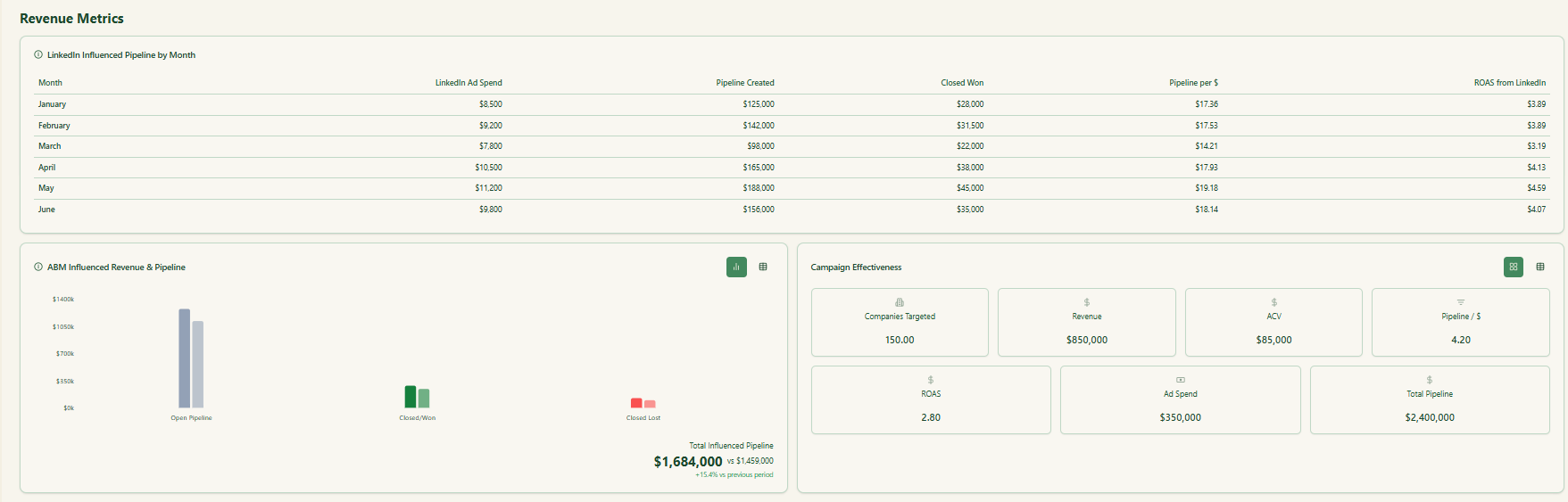

Built-in Dashboards and Account-Based Marketing Analytics

ZenABM includes ready-made dashboards that connect ad exposure, engagement, funnel stages, and pipeline.

- Analyze performance across ABM campaigns, LinkedIn campaign groups, and individual ads:

- Because ZenABM tracks deal value and ad spend by account and campaign, it calculates ROAS, pipeline per dollar, and campaign-driven revenue. These insights let revenue teams focus on business impact, not vanity metrics

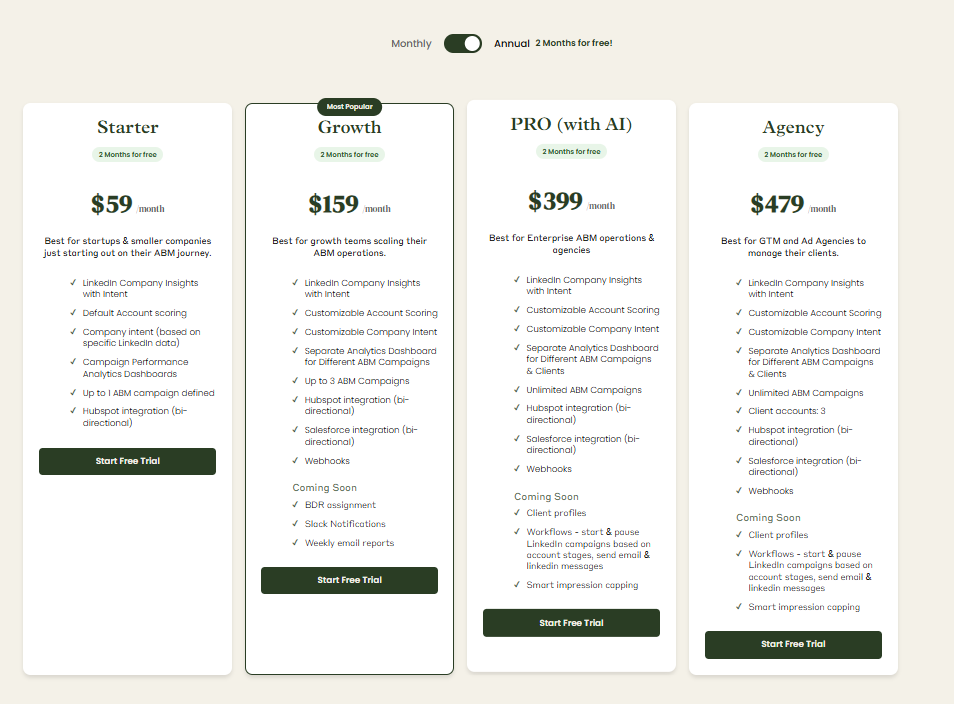

ZenABM Pricing

ZenABM starts at $59 per month for Starter, $159 per month for Growth, $399 per month for Pro (AI), and $470 per month for the agency tier.

Even the top plan stays under $6,000 per year, which is a fraction of typical 6sense or Factors.ai quotes.

All plans include core LinkedIn ABM features. Higher tiers mostly raise limits or add Salesforce integration.

You can pay monthly or annually with two months free, and there is a 37-day free trial to evaluate before committing.

Conclusion

6sense and Factors.ai both deliver meaningful ABM value, but they solve different problems.

6sense fits teams chasing predictive orchestration across the revenue engine, while Factors.ai gives campaign-heavy marketers clarity on what truly drives the pipeline.

Most B2B teams do not need a six-figure suite to see results.

ZenABM provides first-party, LinkedIn-based ABM intelligence at a fraction of the cost, enabling data-driven, intent-led programs that scale as you grow.