Terminus is marketed as a complete account-based marketing (ABM) platform with a wide feature set.

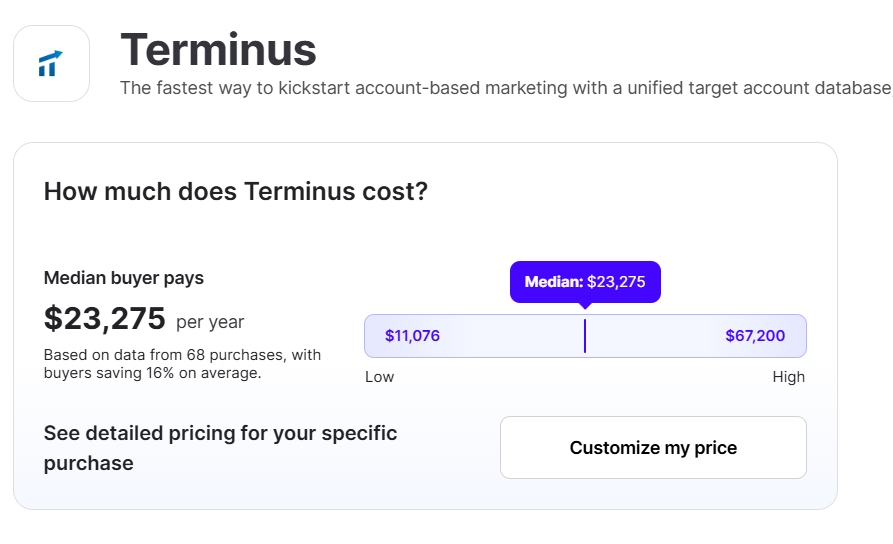

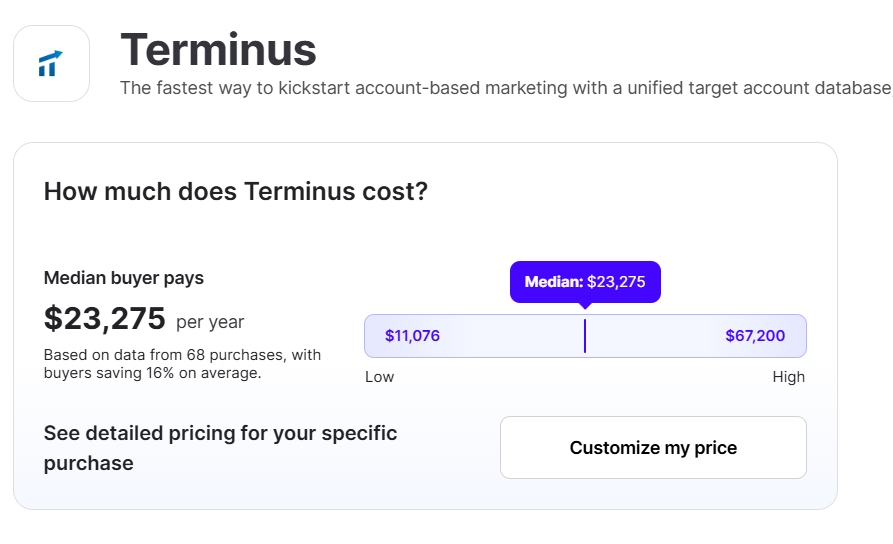

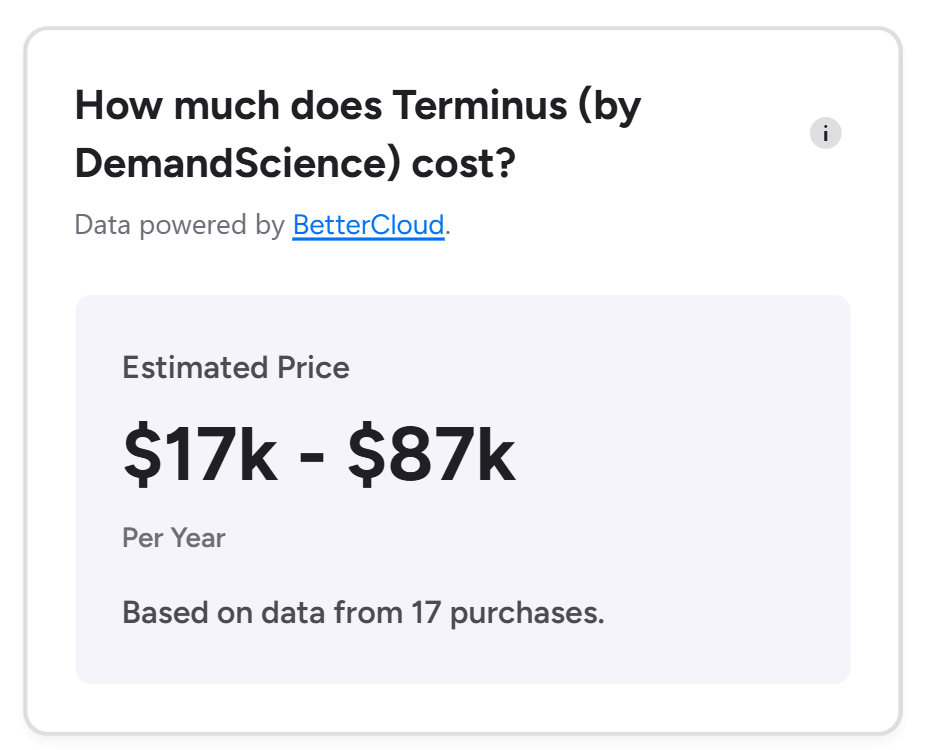

But its pricing reflects that too. Vendr, for instance, reports the median Terminus cost to be about $23k per annum.

And as Terminus doesn’t share pricing publicly, I dug into user feedback and industry chatter, where I found one consistent point: Terminus is often expensive for smaller companies that want to run targeted account-based marketing campaigns without layering on unnecessary tech complexity.

See: It’s less about the dollar figure and more about whether SMBs or mid-market ventures can justify buying the entire platform.

So, in this article, I’ll go beyond headline pricing to discuss scenario-based cost breakdowns, hidden fees, feasibility for different business sizes, and where a lean tool (like ZenABM) might be better.

Terminus Pricing: Quick Summary

- Custom & Premium: Terminus doesn’t publish pricing; quotes depend on modules, database size, and usage.

- Typical Ranges: Anywhere from $23K/year for smaller packages to $250K+ for enterprise deployments.

- Contract Lock-In: Usually annual or multi-year, with ~12 months needed to see ROI.

- Hidden Costs: Add-ons like Bombora intent data, larger account tiers, and professional services can push costs higher.

- User Feedback: Strong account-based marketing capabilities, but “too expensive unless you use the full suite.” SMBs often find it overkill.

- Best Fit: Mid-market and enterprise B2B orgs with large target account lists, sales alignment, and account-based marketing maturity.

- Poor Fit: Startups, small businesses, or narrow use cases (ads-only, visitor ID-only). Cheaper point tools or leaner options make more sense.

- Accuracy Caveat: Heavy reliance on third-party info (IP, cookies, Bombora) – often only ~40–50% reliable.

- Lean Alternative: ZenABM, with first-party LinkedIn intent data and pricing starting at $59/month, suits smaller teams or LinkedIn-centric account-based marketing campaigns.

Terminus Pricing Overview: Premium, Modular & Custom-Quoted

Terminus, like multiple software in its category ,does not publish fixed pricing; packages are custom-quoted based on the modules you need and the scale of your database.

In practice, Terminus primarily sells an all-in-one account-based marketing “Engagement Hub” (covering ads, web personalization, analytics, etc.), but you can start with fewer components (for example, just the advertising module or just web personalization or just the account hub for your sales team) if budget is a concern.

Typical Cost Range

Industry sources indicate Terminus often costs mid-five figures annually, scaling to six figures for large enterprises.

Vendr puts the median Terminus subscription around $23,000 per year, with large enterprise contracts reaching.

CMO.com, on the other hand, claims the cost to start from $57,500 per year, with large enterprise contracts reaching $266,000, and G2 (based on 17 reviews) gives a broad range of $18-87,000.

For context, enterprise ABM platforms in general can range from ~$35,000 up to $1M+ annually, depending on scope.

Terminus tends to be in the centre of that spectrum for a full-featured deployment.

Modular “Menu” Pricing

Terminus’s cost is often bundled by module and usage.

The core ABM platform includes account targeting and analytics, but add-ons like display ad campaigns, website personalization, Bombora intent data, or advanced analytics may each ratchet up the cost.

Tiered by Account Database Size

A key pricing driver is the number of accounts or contacts in your account-based marketing program.

Terminus often limits how many accounts you can load or target per tier.

If your target account list is, say, 5,000 accounts but your plan tier supports 1,000, you’ll be looking at a pricier plan.

Ensure any quote covers your database size and engagement volume (web traffic, ad impressions) with room to grow; otherwise, overage fees or forced upgrades could apply later.

Typical Contract Structure

Expect locked-in annual contracts at a minimum.

Many enterprise deals are multi-year, but commitment is standard, and discounts may kick in for longer terms.

Also, budget for implementation time: on average, users report ~1 month to implement and ~12 months to see ROI, meaning a one-year contract is the minimum to test value.

User Feedback on Cost, Value, and ROI

User feedback on Terminus cost and ROI paints a mixed but consistent picture: the platform delivers strong, end-to-end ABM capabilities with good UX and solid support, but many marketers find the cost steep and only worthwhile if the full suite is used.

Users frequently describe it as “great ABM features for pursuing target accounts but expensive,” with some feeling it’s overkill if you only need a few functions like ads or visitor ID.

But compared to other enterprise ABM tools like Demandbase, Terminus is deemed as easier and more cost-effective for teams new to account-based marketing, though still pricier than lighter tools like RollWorks, Triblio, or ZenABM.

Value seems tied to scale: mid-market and enterprise teams with large account lists report clear ROI, even citing cases like a 60% drop in CAC, while smaller companies often find it too complex and costly for their maturity stage, sometimes leaving features unused.

On the positive side, users highlight attentive customer success and an intuitive interface that smooths adoption.

Hidden Fees, Overage Charges, and “Gotchas”

Beyond the sticker subscription price, what extra costs might you encounter with Terminus?

Officially, Terminus doesn’t talk about hidden/overage costs, and neither do users on review sites, but still consider these points before you sign the contract:

- Unlike most martech tools, Terminus’s cost is not primarily per-seat. You’re generally paying for the platform and usage, not $X per user. That said, always clarify how many team members can access the platform under your license.

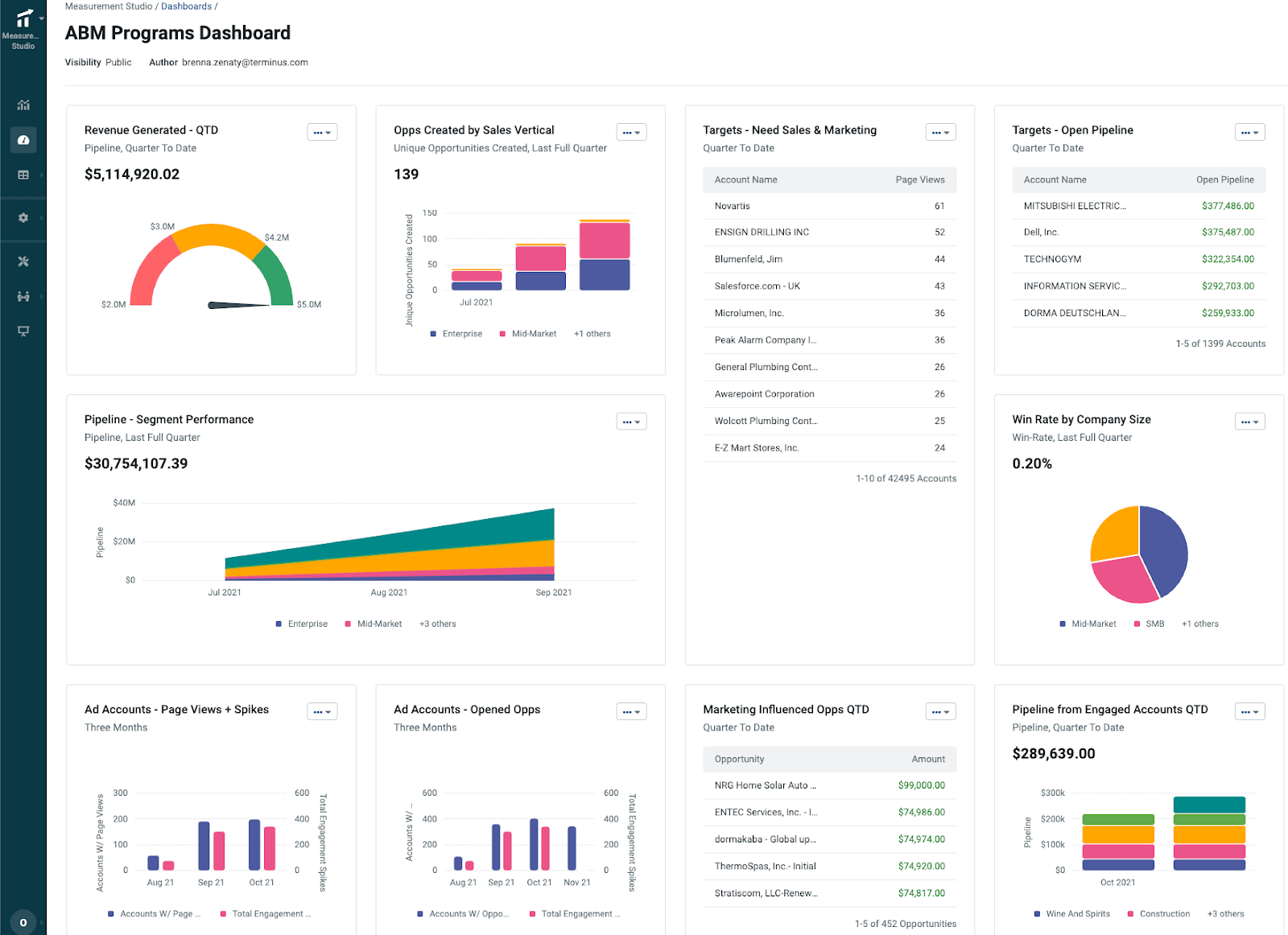

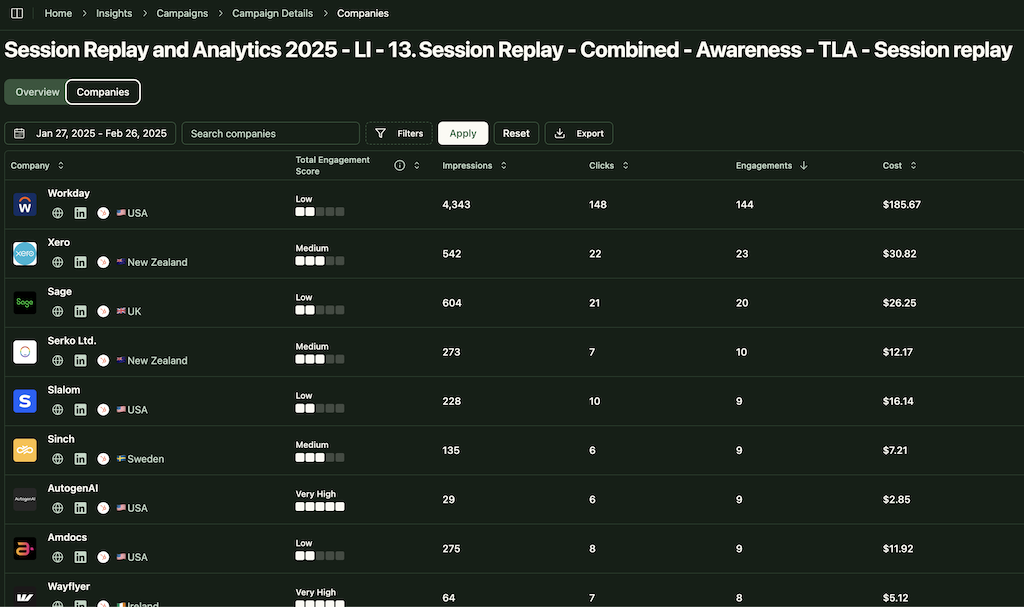

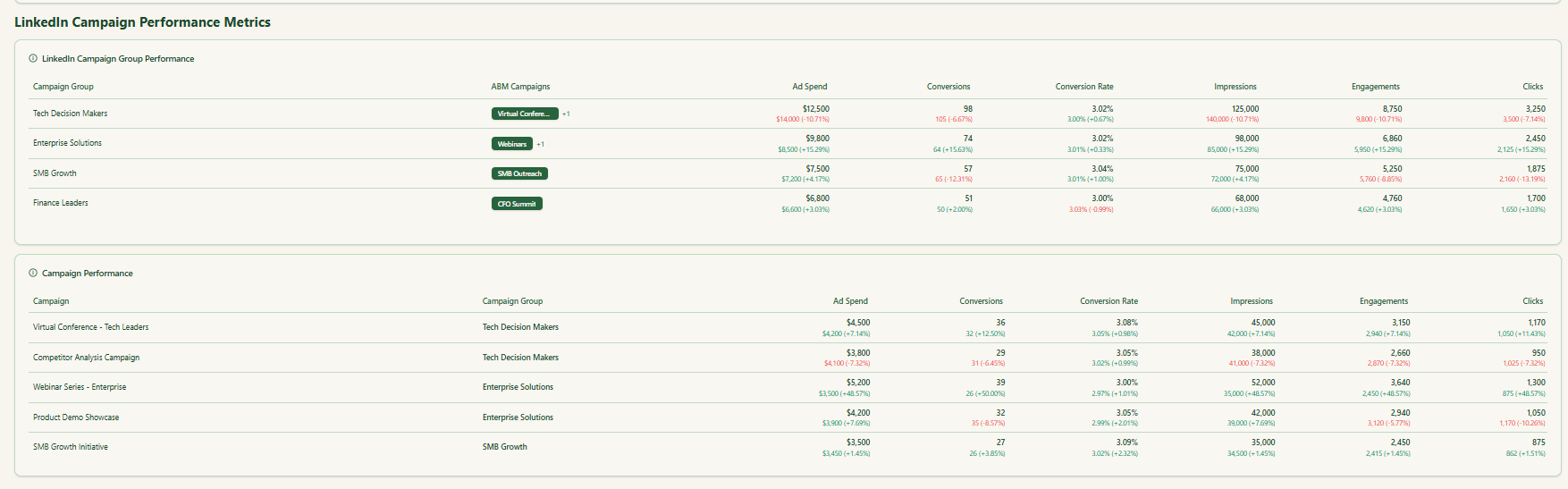

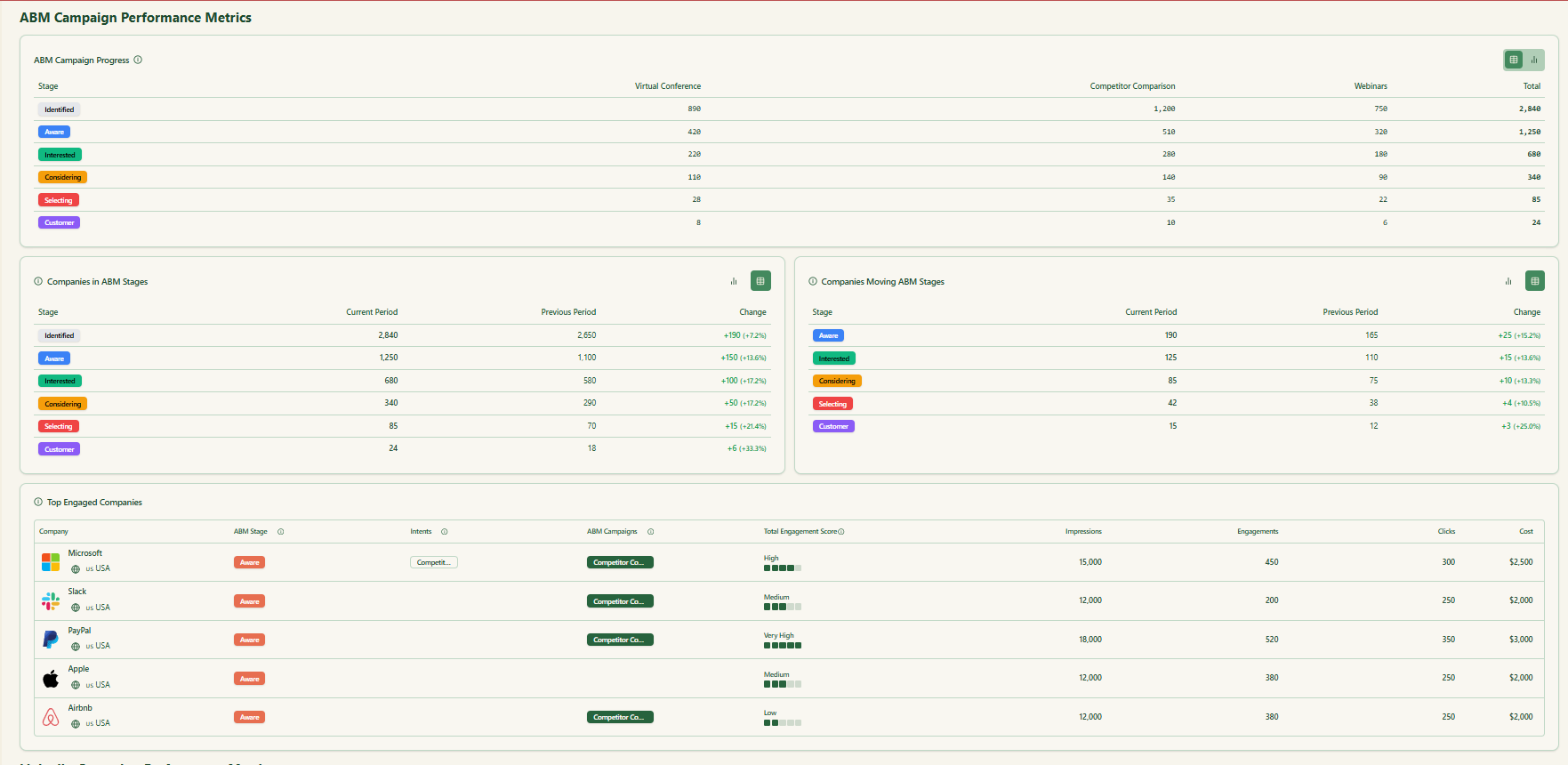

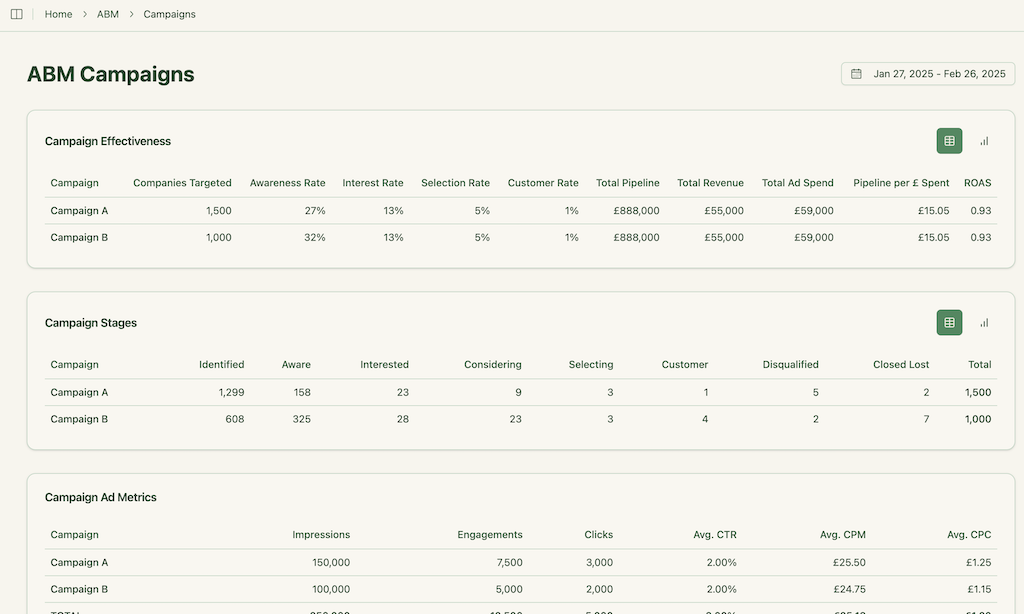

- Terminus provides a dedicated account team and onboarding support for new customers. Basic onboarding is usually baked into the subscription (as part of why it’s expensive). However, if you need extra training sessions, custom work, or professional services (e.g. setting up complex integrations, managing campaigns on your behalf), those could be line-item services at additional cost. Many users feel Terminus’s onboarding is solid, but it does require significant time investment from your team as well to learn the platform. I mean, reading and making sense of overwhelming technical dashboards like these ain’t a piece of cake:

![]()

- Officially, Terminus does not mark up your media spend or mandate a minimum. You control your ad budgets in the platform (e.g. setting a monthly budget for a campaign) and pay directly for the ads served.

- Terminus now integrates third-party intent and contact data (due to their DemandScience acquisition and Bombora partnership). Access to these data feeds might be tier-dependent. High-level intent signals (like Bombora “surging topics” for your accounts) could be included in enterprise packages, but if not, you might pay extra. For instance, Bombora data isn’t cheap. Vendors typically bake in that licensing cost. If your ABM strategy relies on enriching contacts or grabbing intent data on thousands of accounts, clarify if that’s included or if there’s a volume cap. It’s only wise to confirm if exporting those contacts or fully integrating them into your CRM comes with limitations or fees.

Who Is Terminus Best Suited For?

Not every B2B company will get a good return from an expensive ABM platform.

Based on Terminus’s capabilities and feedback, here’s a feasibility analysis of where Terminus makes sense:

Best Suited For:

- Mid-Market & Enterprise B2B Teams: Hundreds/thousands of accounts, six-figure deal sizes, account-based marketing is core strategy.

- Multi-Channel ABM Programs: Need orchestration across ads, web personalization, outbound, chat, and sales alerts.

- Analytics & Attribution Needs: Long sales cycles where proving pipeline impact is key.

- Sales-Aligned Orgs: Teams where sales actively acts on intent signals and CRM integrations.

- Resourced ABM Teams: At least one ABM manager/ops specialist to run campaigns and onboard others.

Overkill / Poor Fit For:

- Small Businesses & Startups: Too costly and complex without large budgets or deal sizes.

- Single-Tactic Use Cases: If you only need ads, visitor ID, or enrichment, cheaper point solutions suffice.

- ABM Beginners: Without a mature strategy or sales alignment support, Terminus won’t deliver ROI.

- Low-Deal Value Orgs: Hard to justify $50K+ annually if average deal size is small.

Third-Party Sources’ Accuracy & Pitfalls Recap

It’s worth noting that ABM platforms like Terminus rely on third-party sources: IP matching for visitors, cookies for ads, Bombora for intent, etc.

These can be powerful but are not 100% accurate.

In fact, far from it.

For instance, a Syft Study found that most reverse IP lookup tools used for website visitor deanonymization are 42% accurate at best.

It’s because cookies get deleted, people work remotely (so IP = their ISP, not their company), and intent data might misattribute interest.

In fact, some companies don’t even register their IPs.

And data decay is a reason, too (Gartner estimates B2B data decays at ~20% per year due to role and org changes).

So one word of caution: when budgeting for Terminus to target the right accounts, also budget effort for data maintenance and validation. The platform will surface a lot of data; you’ll need to continuously refine target account lists, import fresh CRM data, and sanity-check what the AI is telling you.

On the flip side, a platform like ZenABM sidesteps a lot of third-party issues by relying on first-party signals (e.g. direct from LinkedIn’s API for who saw/clicked your ads).

This means no dependence on IP guesswork or cookie pools, and bots and random eyeballs are filtered out, and you know exactly which target companies engaged.

It’s a simpler, more accurate foundation for certain account-based marketing plays, albeit focused on LinkedIn as the channel.

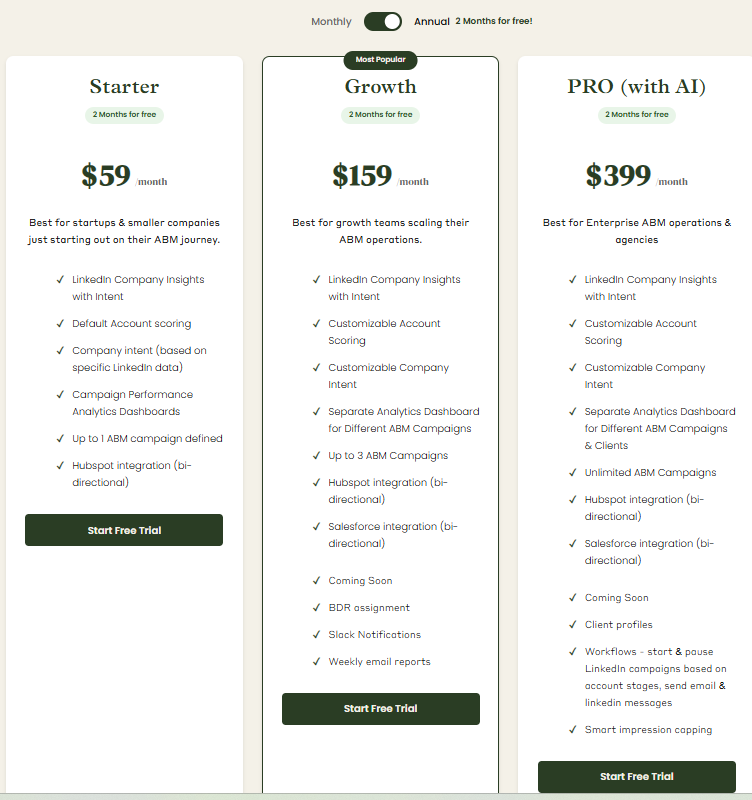

Additionally, ZenABM’s pricing is far simpler.

It starts at $59/month vs. Terminus’s custom five-figure deals.

If your ABM is heavily LinkedIn-centric or you’re a smaller team, that contrast is worth noting.

Well, let me tell you more about how ZenABM can be a lean alternative for Terminus, especially if LinkedIn is your primary ad channel.

ZenABM: A Streamlined, First-Party Alternative

Unlike Terminus’s enterprise-heavy, all-in-one model with steep costs, ZenABM takes a leaner, LinkedIn-first approach. It gives teams predictable pricing and actionable first-party engagement data instead of relying on guesswork from third-party intent signals.

Here’s what ZenABM offers:

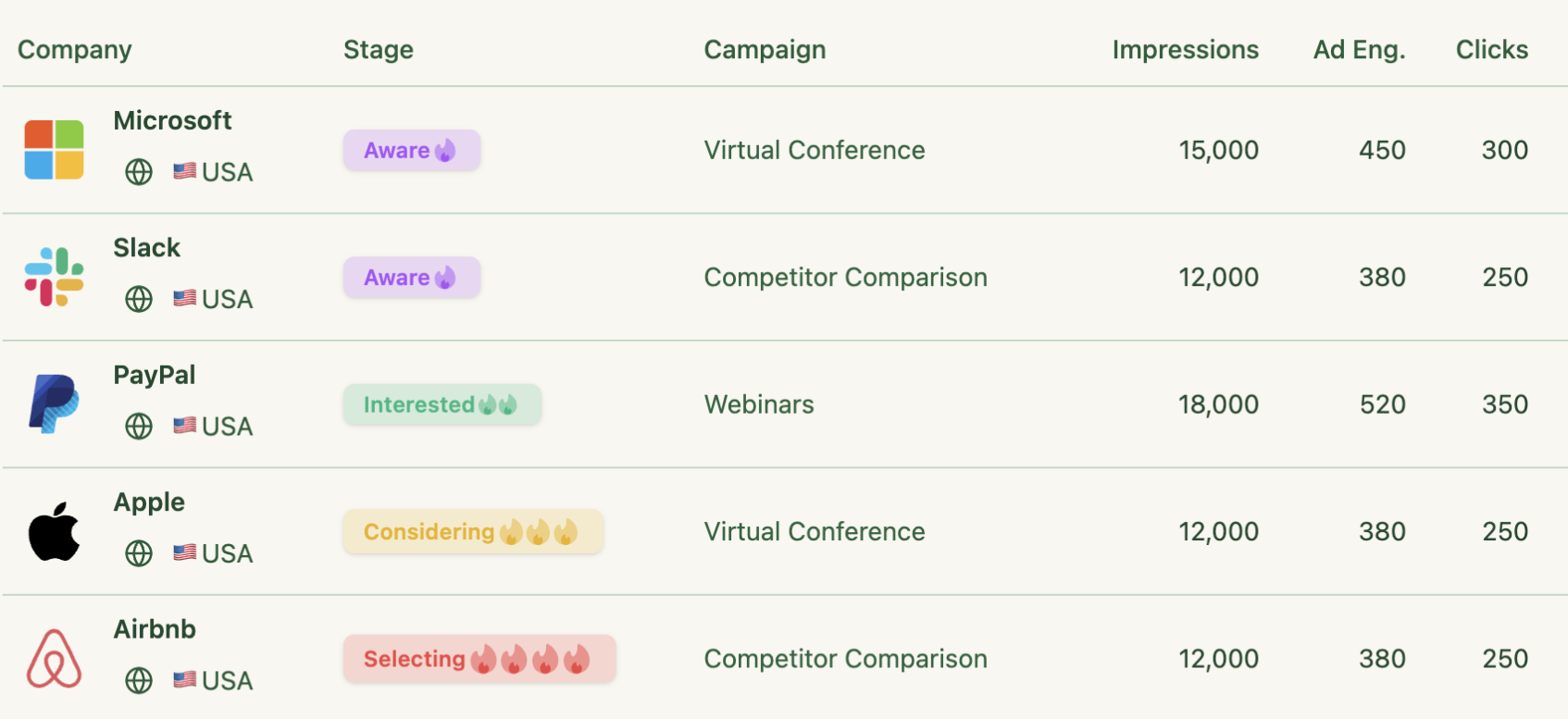

Company-Level Engagement Tracking with LinkedIn’s Official API

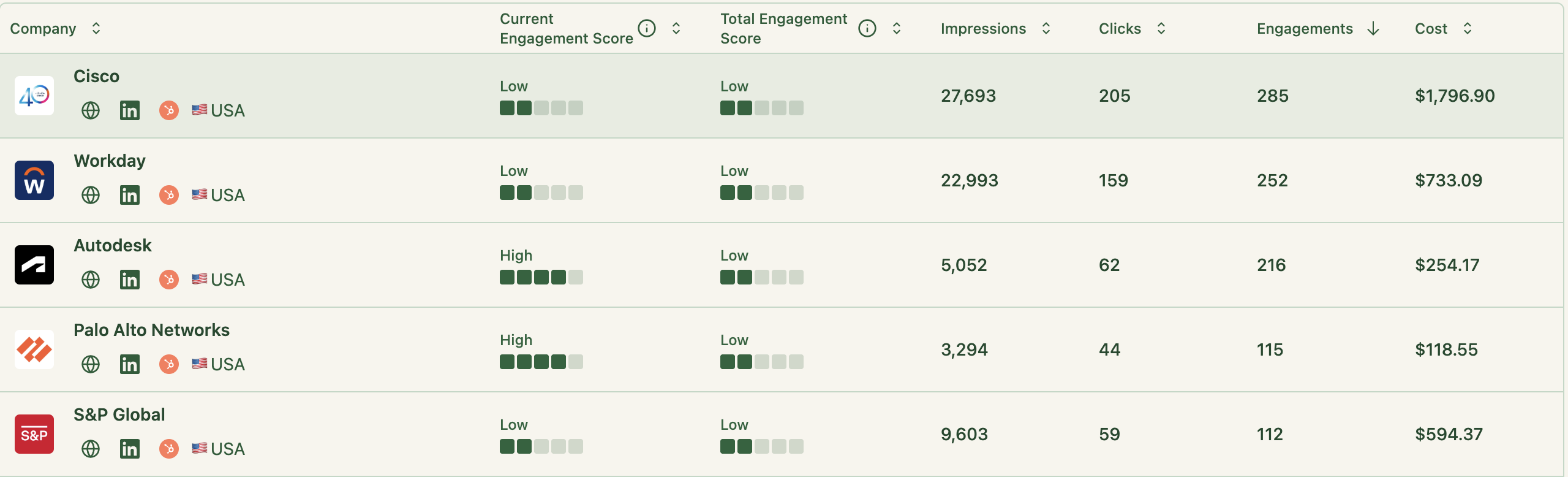

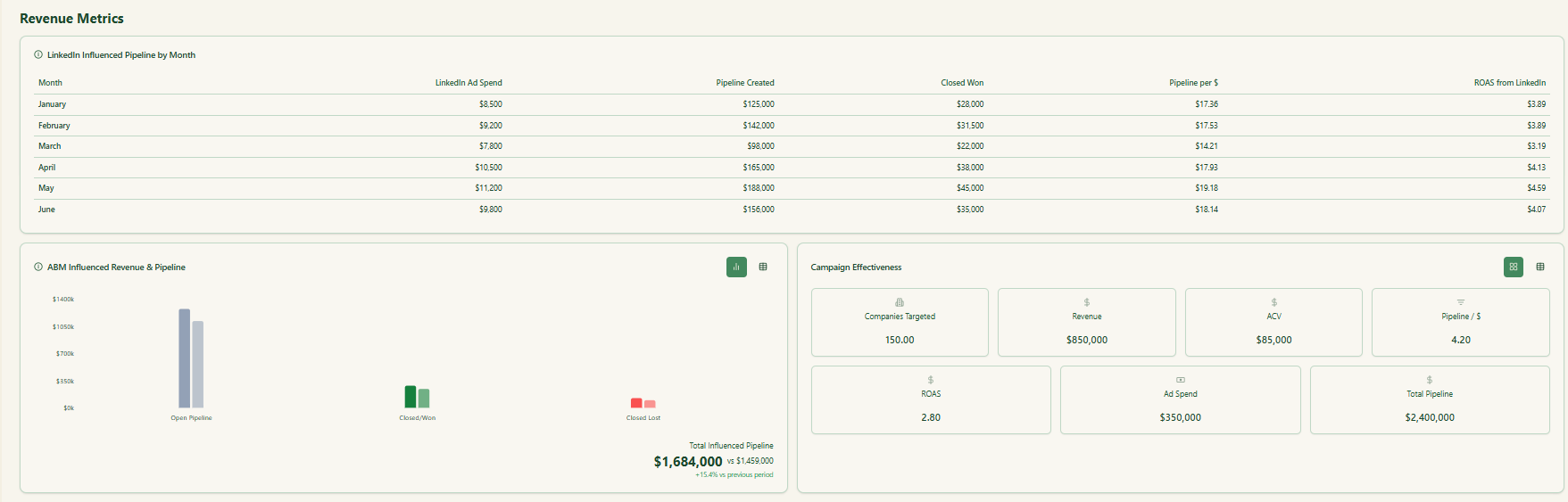

ZenABM captures company-level engagement (impressions, clicks, spend) across LinkedIn campaigns. Both marketing and sales teams can track how target and high-value accounts are engaging.

Engagement-Based Scoring and Stage Mapping

Beyond raw metrics, ZenABM consolidates historic and real-time engagement data across campaigns to calculate account scores and map them to ABM funnel stages.

It then assigns each account an ABM stage, blending campaign engagement with CRM signals, which improves targeting and outreach precision.

Automated BDR Routing

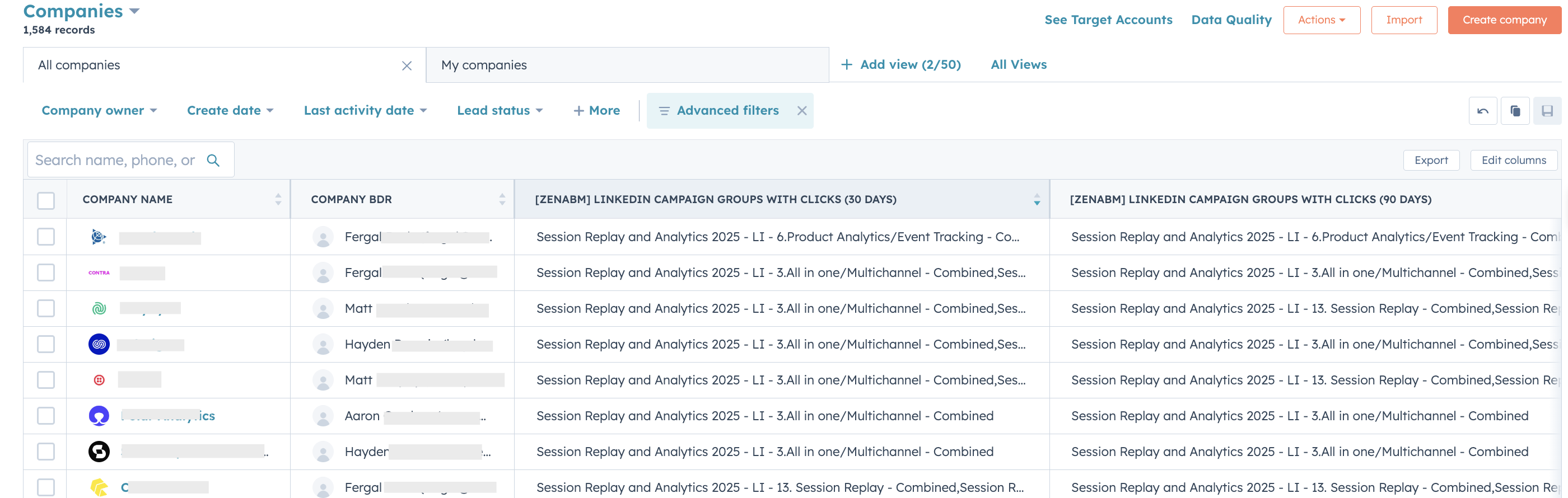

With automated account-to-BDR assignment, hot accounts are sent straight to reps inside your CRM for faster outreach.

Two-Way CRM Sync

ZenABM continuously updates company properties in CRM while also pulling in deal values – giving a fuller view of engagement plus pipeline impact.

Out-of-the-Box ABM Dashboards

Dashboards come pre-built for attribution and ABM analytics, surfacing both revenue impact and actionable insights from engagement data.

Intent, Funnel Health & Leakage Analysis

Instead of noisy third-party intent feeds, ZenABM surfaces first-party signals from ads to reveal qualitative buying intent for target segments.

ZenABM’s funnel analysis dashboards highlight where accounts drop off in the journey so teams can address leaks and avoid wasting effort on vanity metrics.

Conclusion

Terminus is a powerful but pricey ABM platform. For companies with large deal sizes, mature sales alignment, and the resources to run orchestrated multi-channel plays, the investment can pay off with clear ROI.

But for smaller teams or those just starting out, Terminus is usually too costly and too complex. Many features will sit unused.

If your ABM strategy is LinkedIn-heavy or you simply want predictable, first-party data without a six-figure platform commitment, tools like ZenABM offer a more practical path.