Choosing an ABM tool can feel harder than running ABM itself, especially if your priority is LinkedIn advertising.

So many marketers jump into shiny platforms without mapping needs to outcomes and end up with overkill, or something painfully underpowered.

To solve that for you, I’ve compared the 7 best ABM tools for LinkedIn advertising and mapped their fit for small, mid, and enterprise teams.

Read on and pick what actually matches your motion…

7 Best ABM Tools for LinkedIn Advertising (2025): Tabulated Summary

| ABM Tool | LinkedIn Ads Integration | Direct API Integration | Real-Time Engagement | Multi-Channel Ads | Intent Data (3rd-party) | CRM Integration | AI Predictive Analytics | Community/Organic Tracking | Pricing (Entry-level) | Best for |

|---|---|---|---|---|---|---|---|---|---|---|

| ZenABM | ✅ | ✅ | ✅ | ❌ | ❌ | ✅ | ❌ | ❌ | Low | LinkedIn-centric ABM |

| Demandbase One | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | High | Enterprise ABM |

| 6sense | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | High | AI-driven ABM |

| Terminus | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | ❌ | ❌ | High | Sales & Marketing alignment |

| RollWorks | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | Medium | Ad-focused ABM |

| Common Room | ❌ | ❌ | ✅ | ❌ | ❌ | ✅ | ✅ | ✅ | Medium | Community-led ABM |

| Factors.ai | ✅ | ❌ | ✅ | ❌ | ✅ | ✅ | ✅ | ❌ | Flexible | Analytics-focused ABM |

1. ZenABM: Best for Running ABM on LinkedIn

ZenABM is a plug-and-play ABM analytics platform built for teams prioritizing LinkedIn advertising in their ABM mix.

From capturing LinkedIn ad engagement to tying it back to the pipeline, it covers end-to-end LinkedIn-first ABM execution.

Key Features & Advantages of ZenABM

Here’s what ZenABM offers:

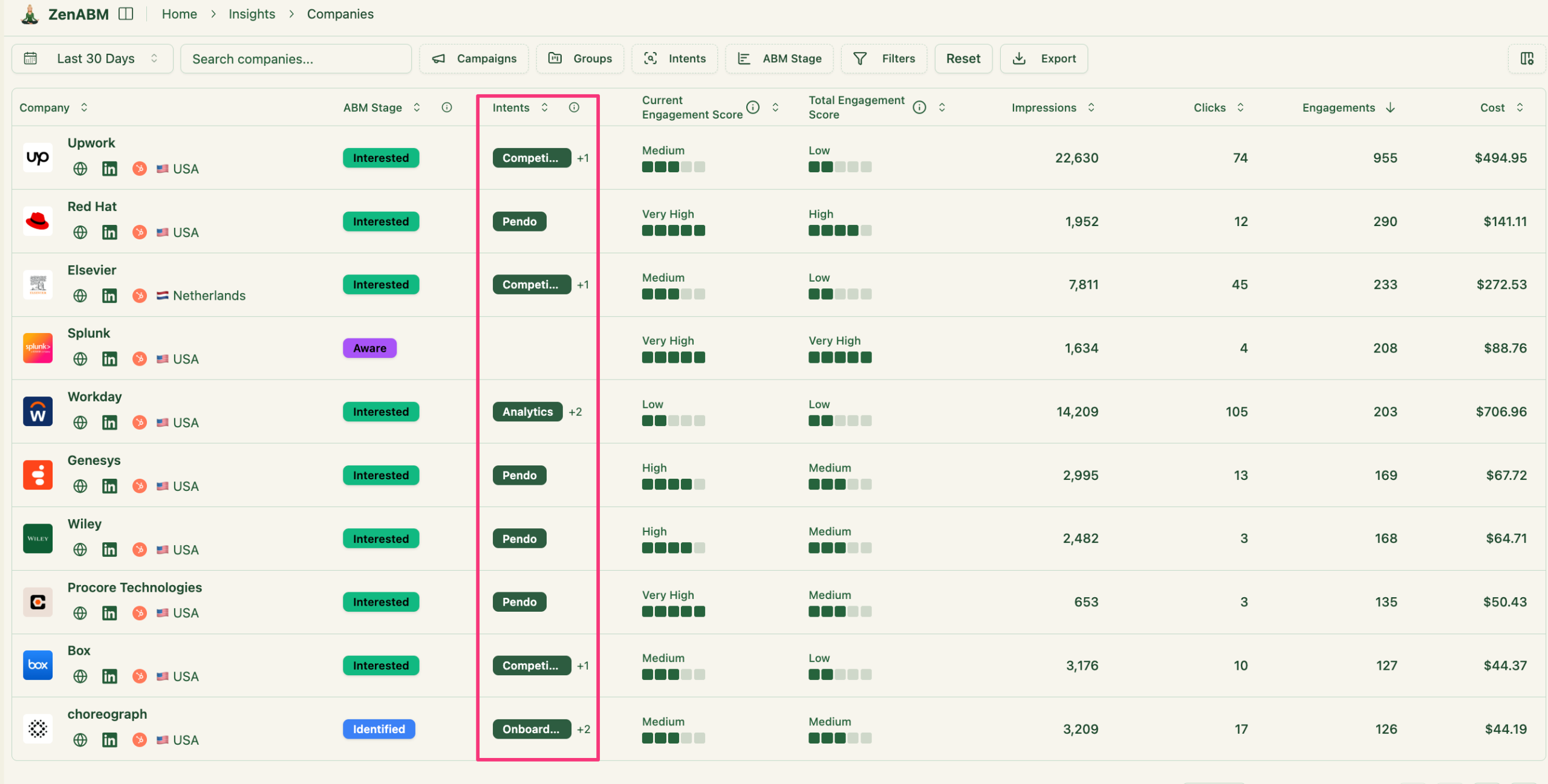

Account-Level Engagement Tracking Using Direct LinkedIn API Integration

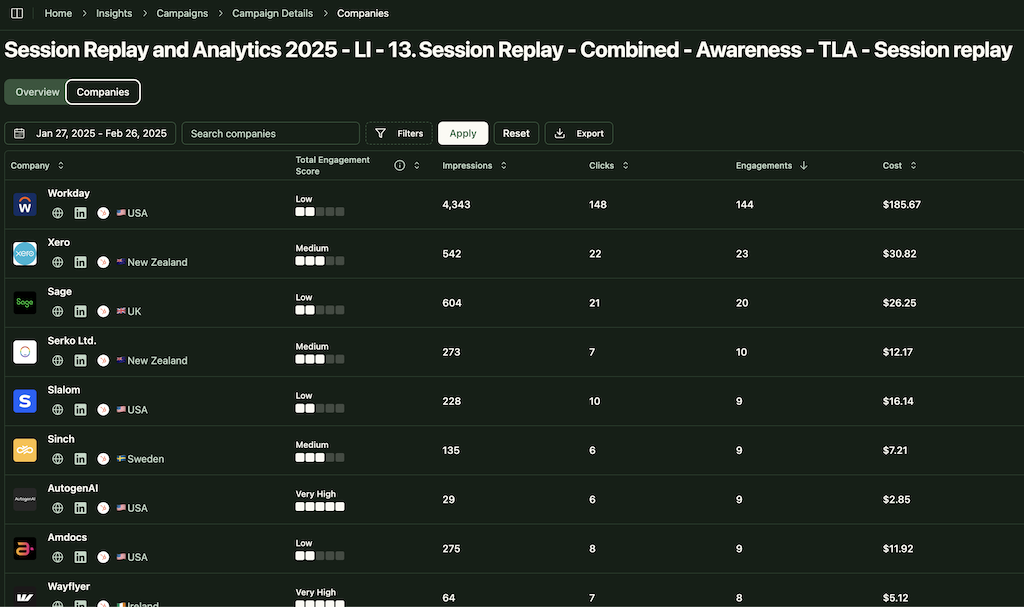

ZenABM ingests first-party, company-level metrics for every LinkedIn campaign directly from the official API.

That’s rare. Many ABM suites still lean on cookies or shaky IP match.

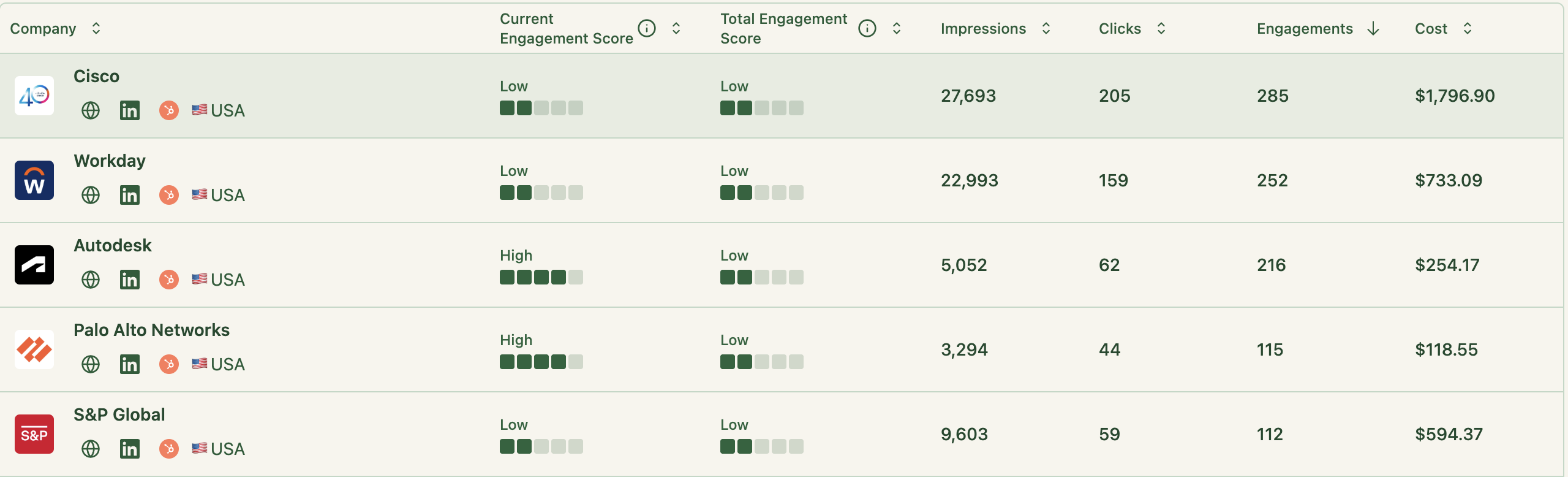

Real-Time Engagement Scoring

The platform auto-scores each account’s LinkedIn engagement over your chosen window (e.g., last 7 days). This rolling “current engagement score” spotlights this week’s hottest accounts, not just historical activity.

Why it matters:

Your sales team can pounce the moment interest spikes. Think intent detection, but tuned to LinkedIn signals.

You also get an all-time score for context.

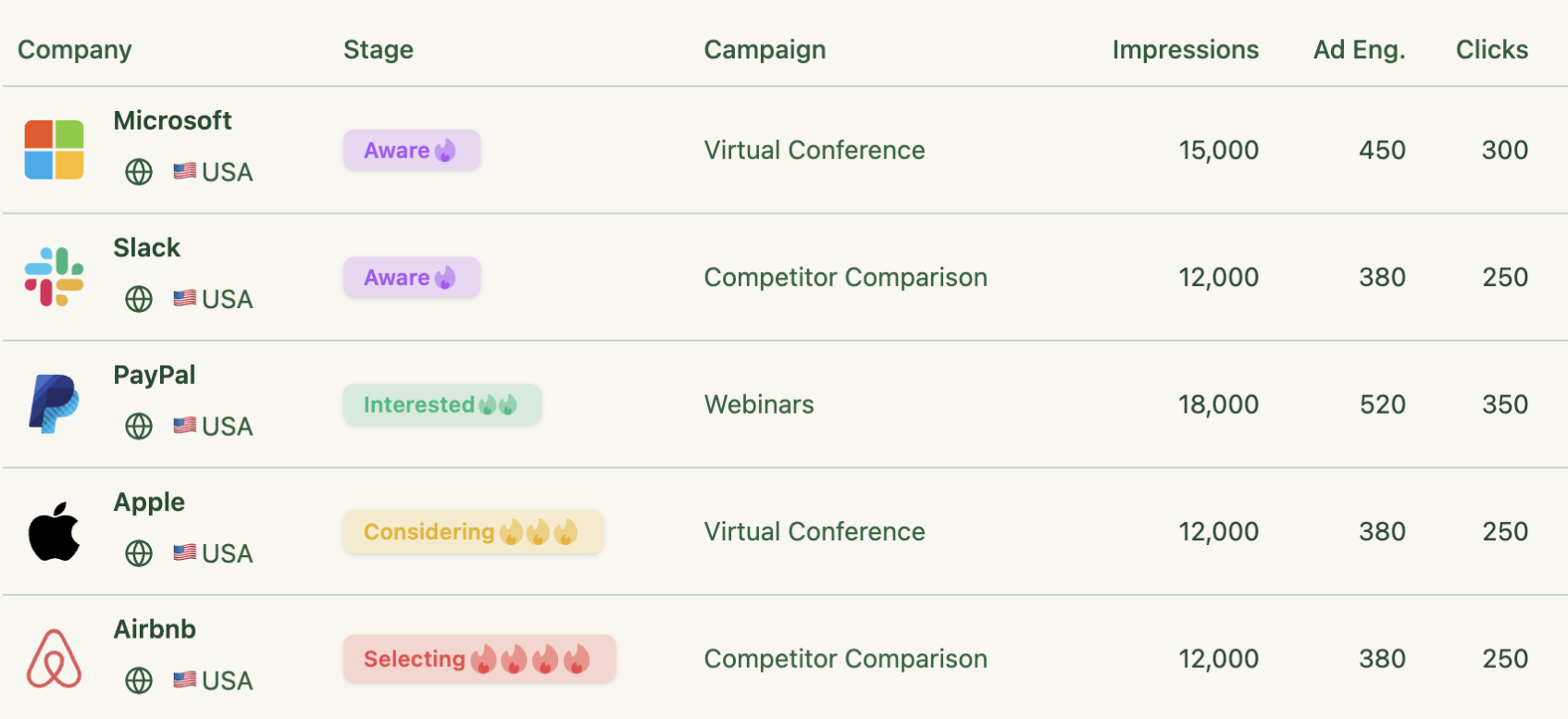

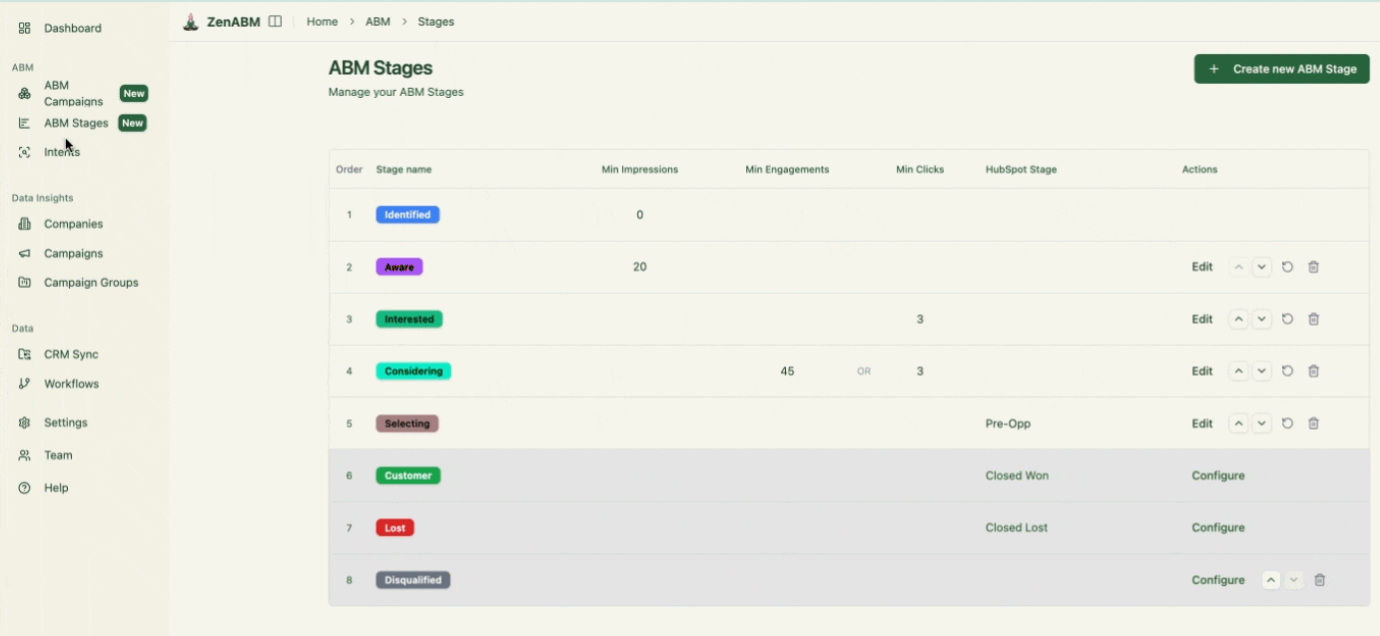

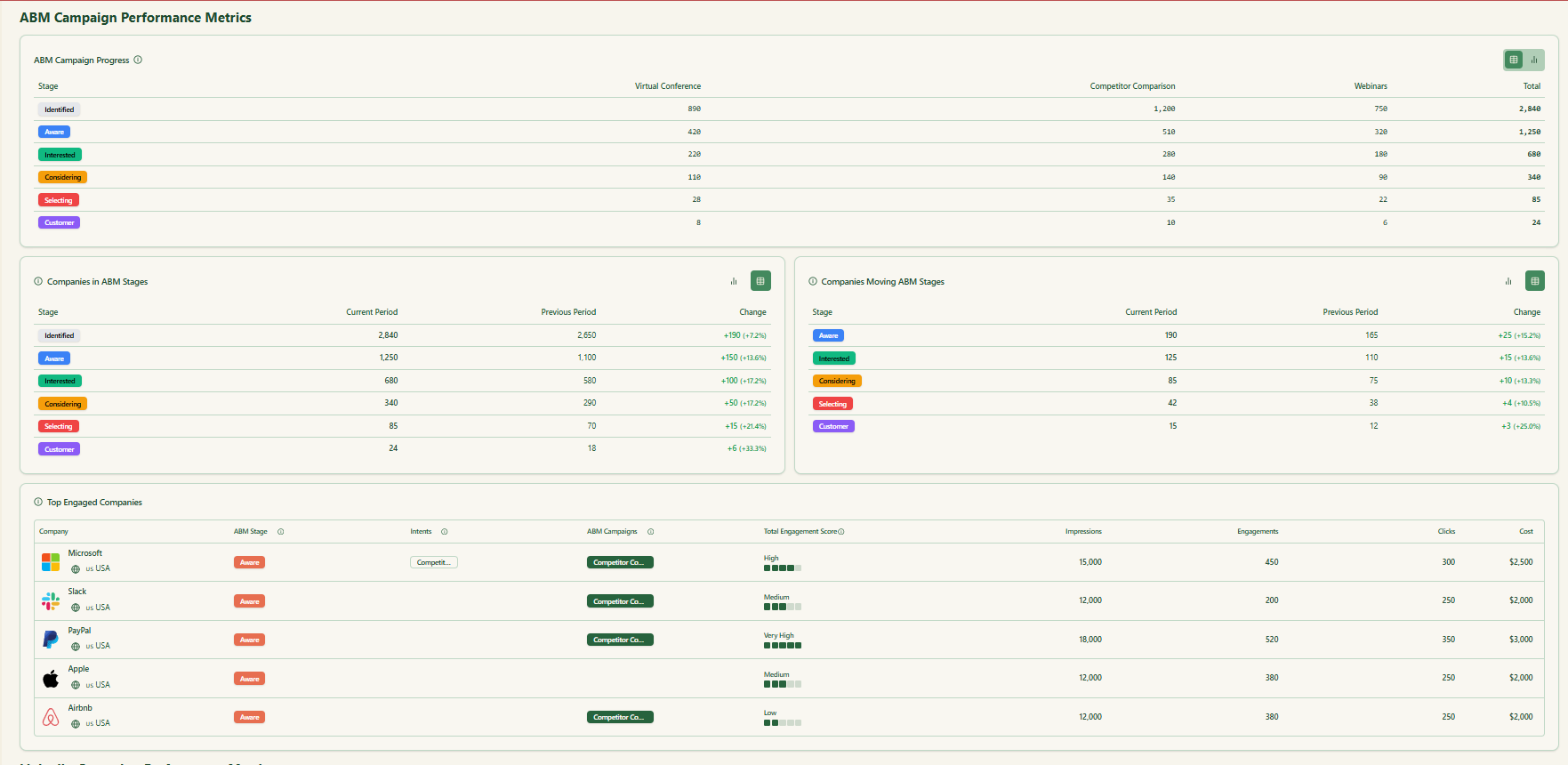

ABM Stage Tracking and Funnel Leak Analysis

ZenABM combines its engagement score with CRM data to track each account’s ABM stage.

Best of all:

You control stage thresholds.

And because ZenABM tracks ABM stages, it visualizes how accounts move, so leaks and friction are obvious:

Automated CRM Updates & BDR Assignment

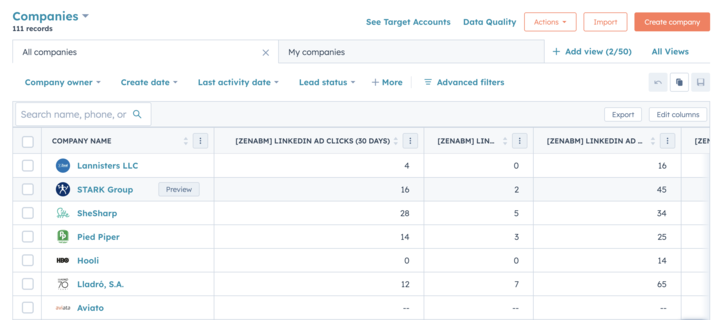

ZenABM syncs LinkedIn engagement straight into your CRM (HubSpot and Salesforce today; more via webhooks).

It writes a single company property with metrics like “LinkedIn Ad Engagements (last 7 days)” so reps get instant context.

It can also auto-assign a BDR once engagement crosses your threshold (e.g., enters “Interested”).

Goodbye, missed follow-ups and spreadsheet roulette.

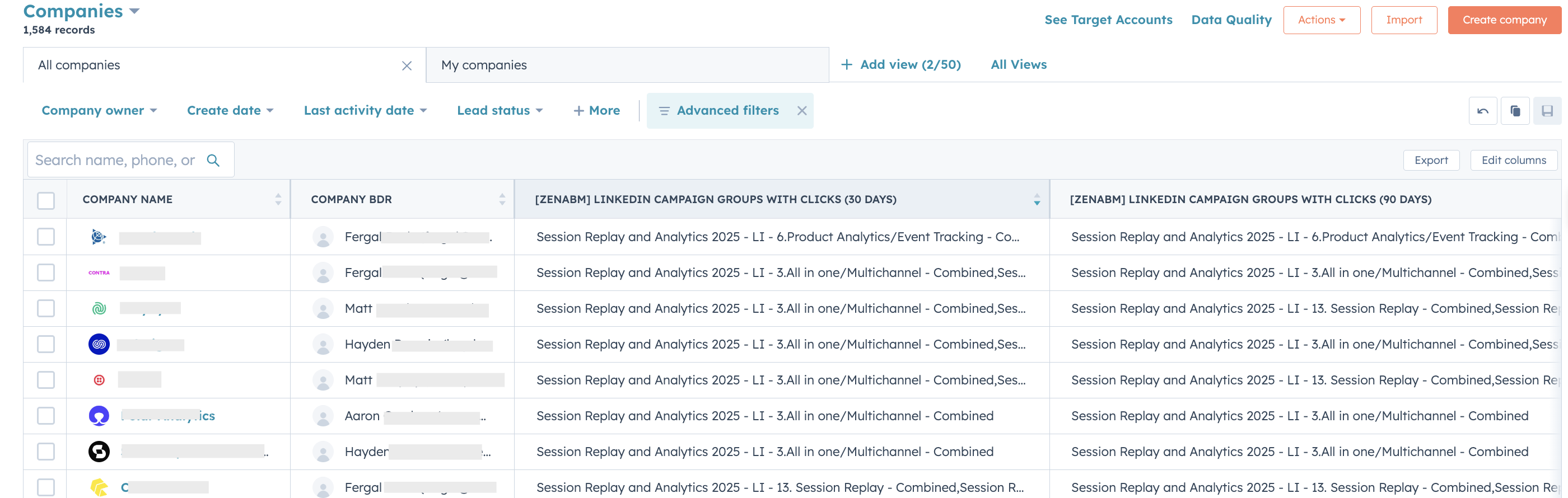

Intent Tagging for Personalization

Running multiple LinkedIn campaigns around different offers or features?

ZenABM lets you tag campaigns by intent and tracks which accounts engage with which narrative. It clusters companies by interest and syncs those intent signals back to CRM.

Now sales can lead with what the account is actually interested in: “XYZ keeps engaging with our cloud security ads; start there.”

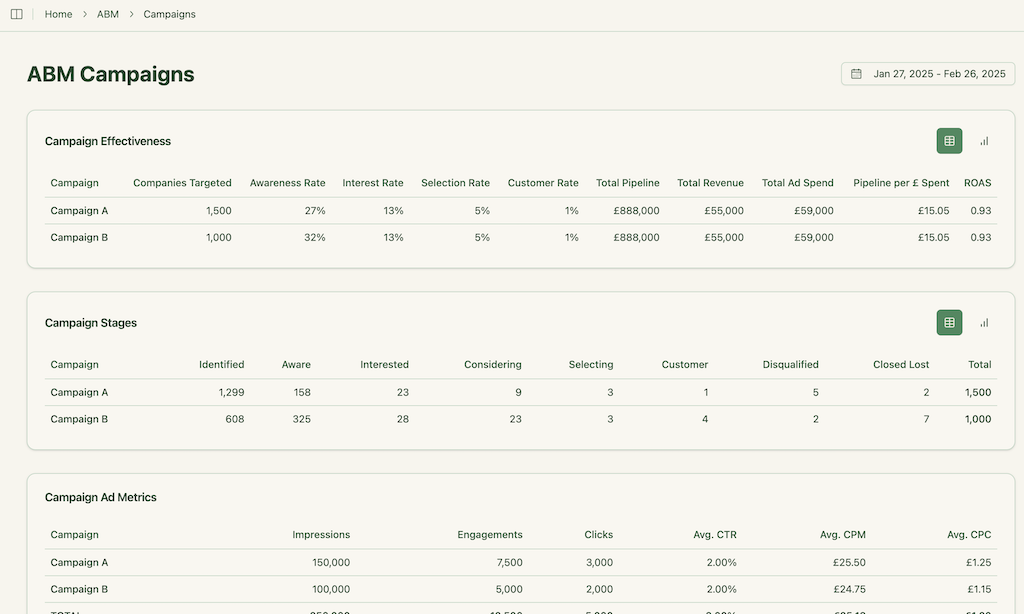

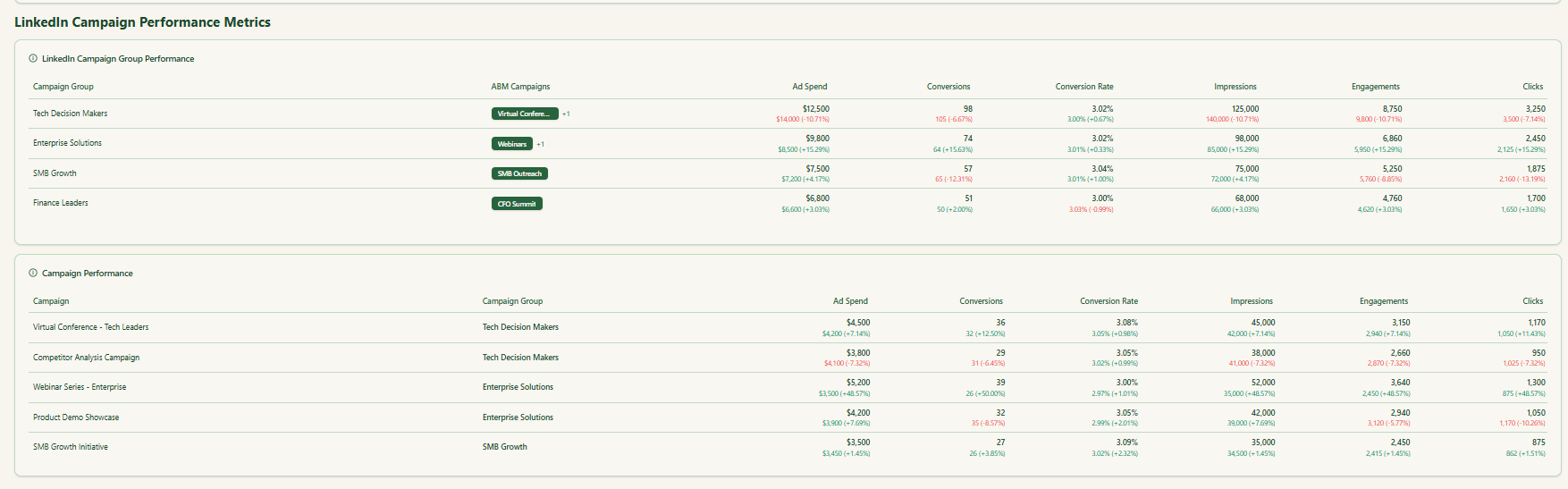

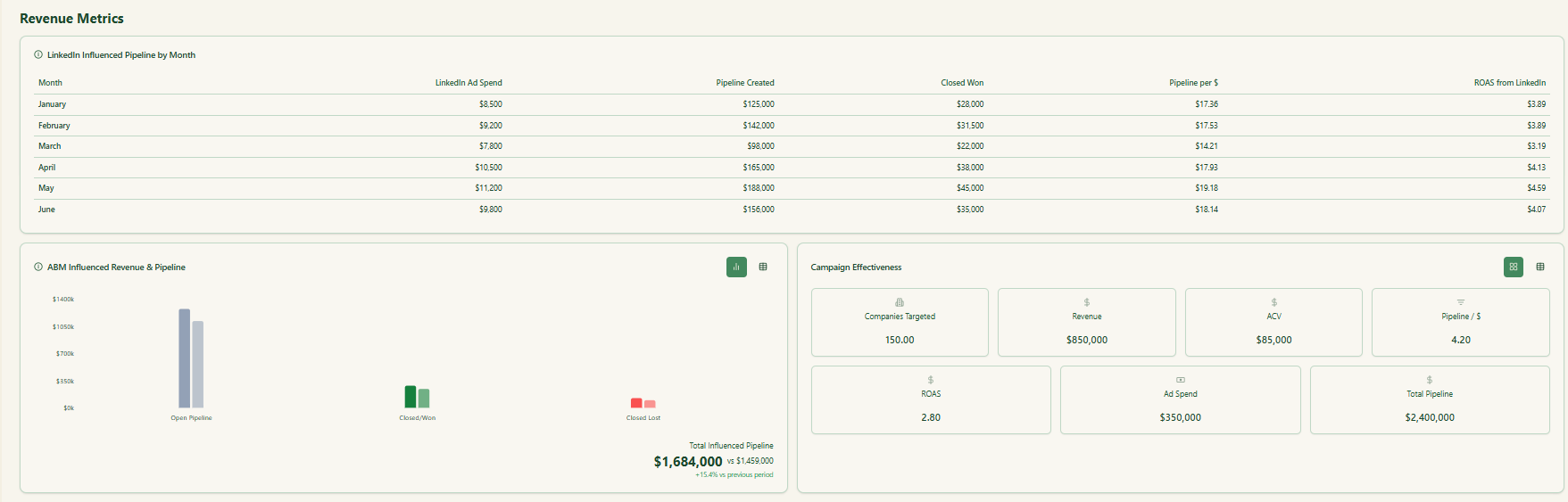

Built-in ABM Dashboards

Like the big suites, ZenABM ships with dashboards for performance and ROI. It auto-matches LinkedIn-engaged companies to CRM deals to calculate influenced pipeline, revenue, win-rate, and ROAS.

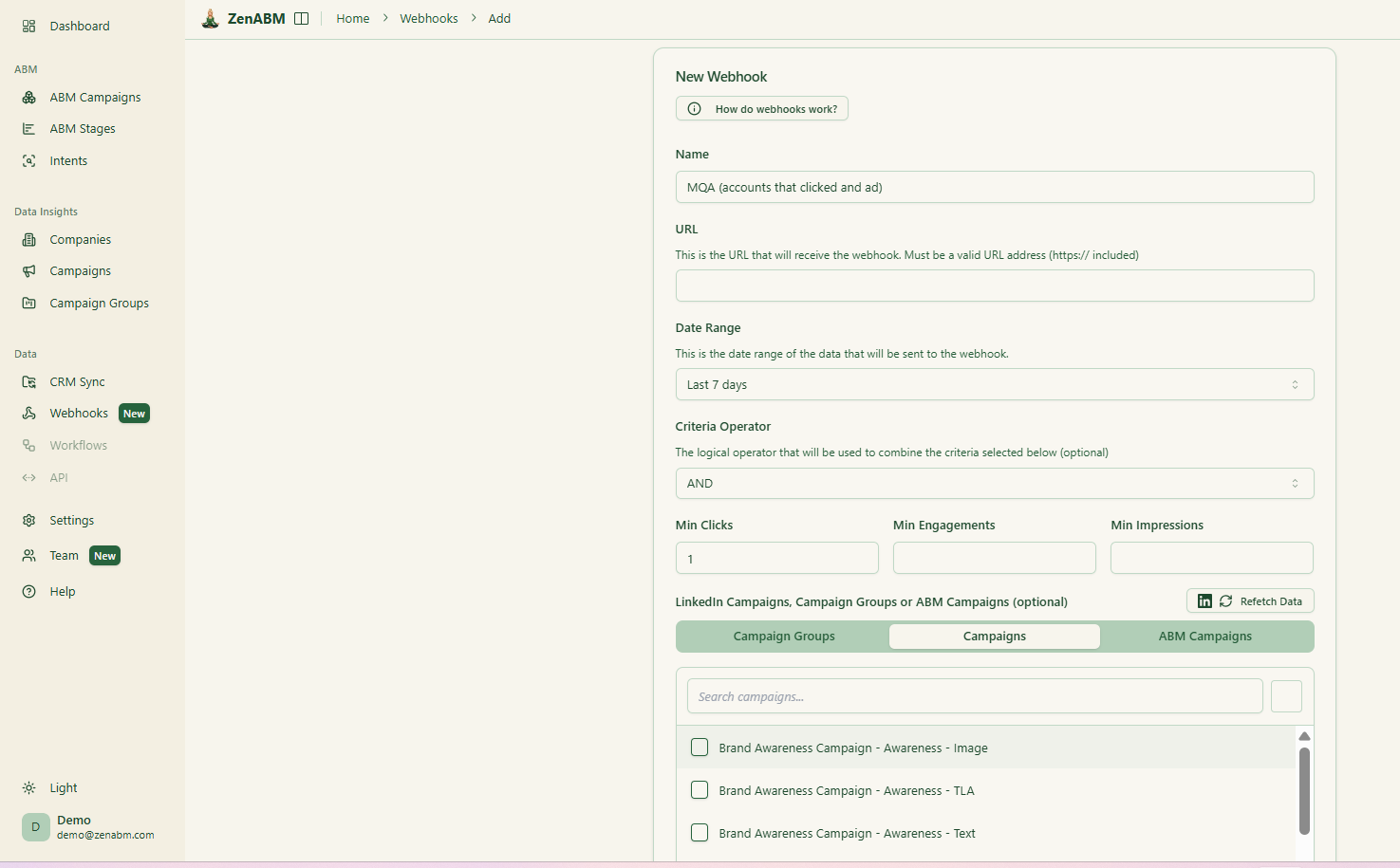

ZenABM Webhooks

You can pipe ZenABM into the rest of your stack via custom webhooks:

Lightweight & Affordable

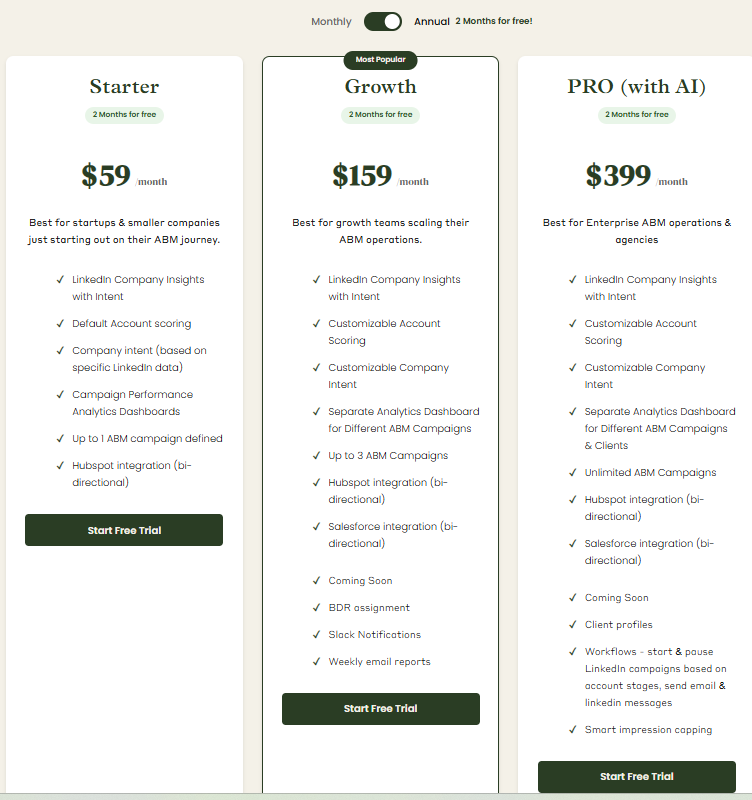

Unlike enterprise ABM suites that run into tens of thousands yearly, ZenABM starts at $59/month for a full LinkedIn-first ABM setup.

You get LinkedIn tracking, scoring, CRM sync, and dashboards in that flat price.

Perfect for small and mid-market teams who want LinkedIn ABM without enterprise bloat.

Drawbacks

By design, ZenABM specializes in LinkedIn.

It’s world-class at LinkedIn ad analytics + attribution, but it’s not trying to be your multi-channel control center.

Need display, deep web personalization, or sales sequence management? Run ZenABM alongside those tools.

Ideal Use Case

If your ABM plan is LinkedIn-heavy, ZenABM is a layup.

You’ll get enterprise-grade visibility at a fraction of the cost, and value from week one (no marathon onboarding).

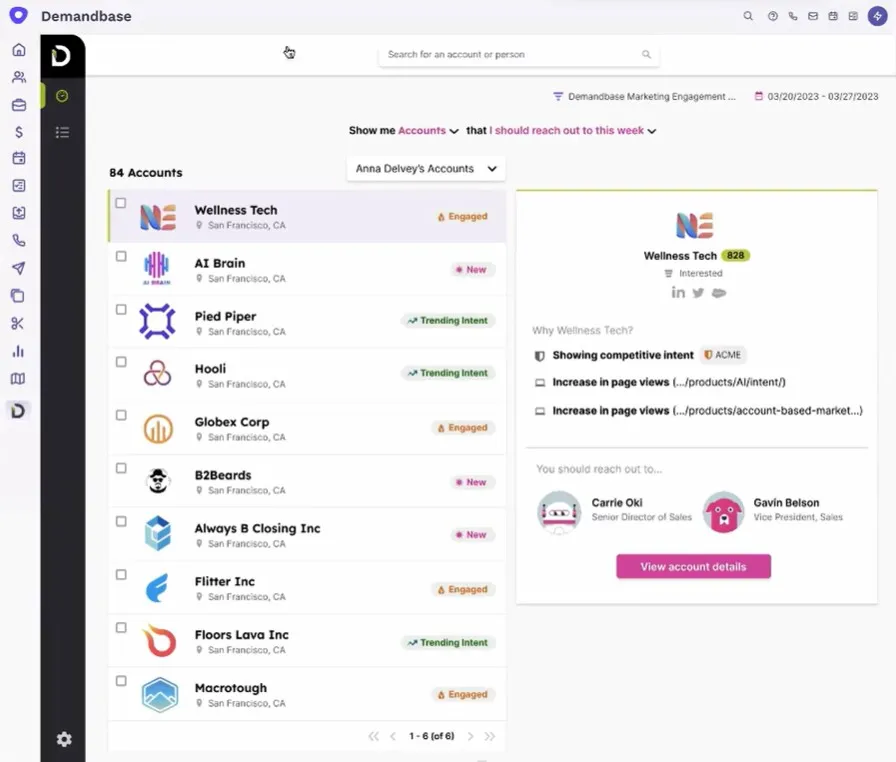

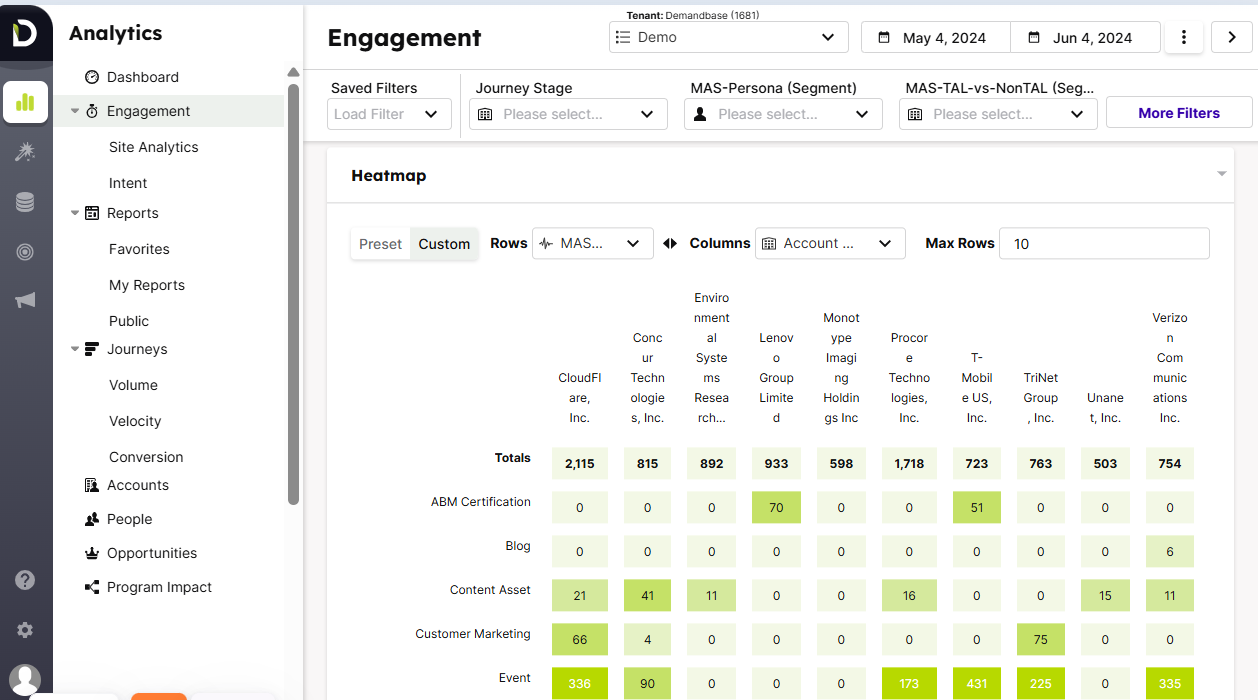

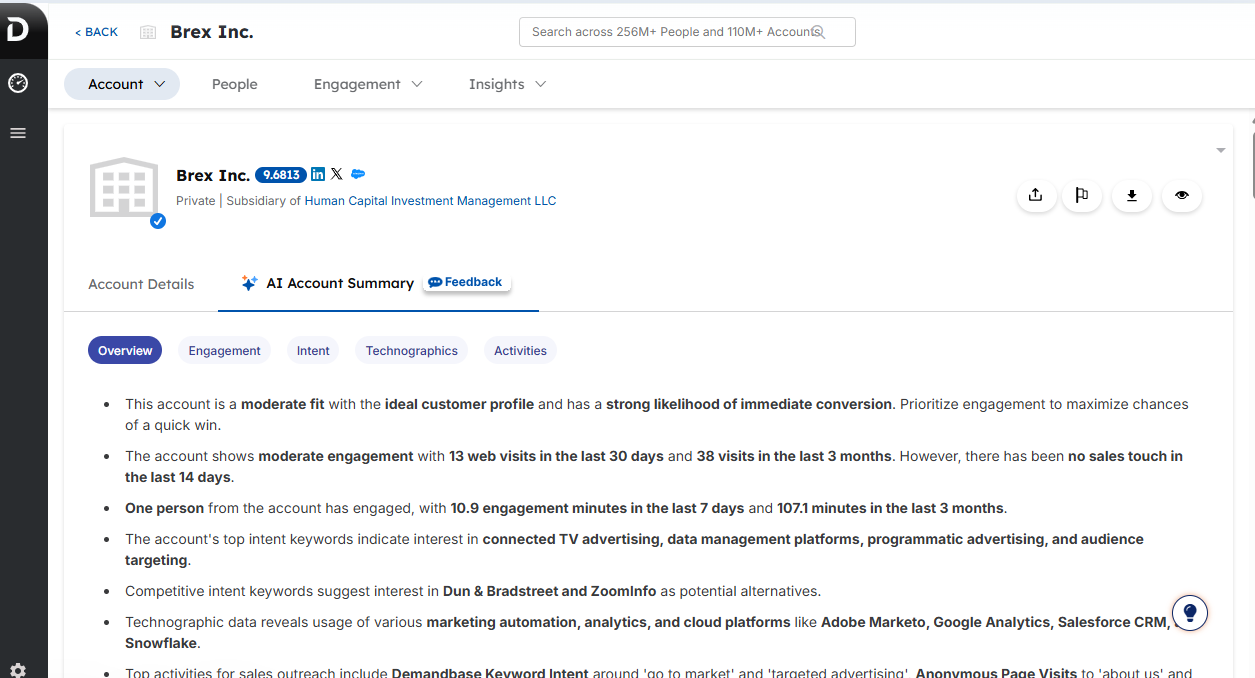

2. Demandbase One: Best All-in-One ABM Platform for Enterprises

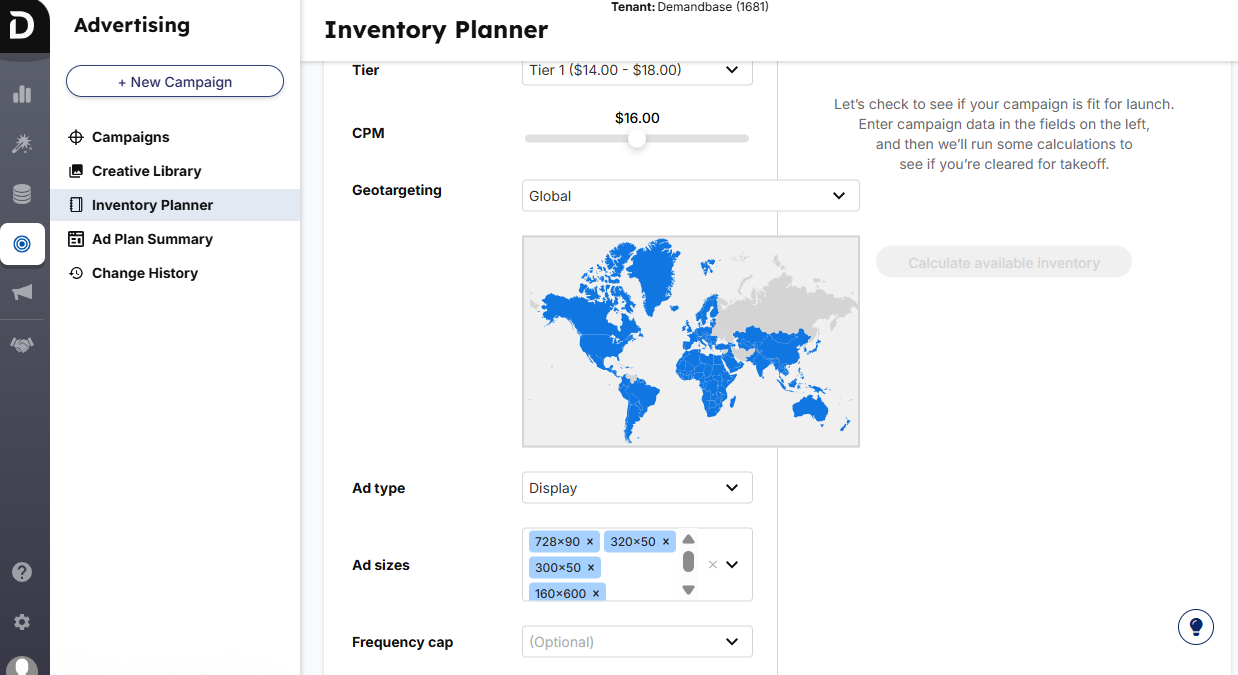

Demandbase One is a full-stack, enterprise ABM platform.

It spans target account building, multi-channel campaign execution, web personalization, and end-to-end measurement inside one umbrella.

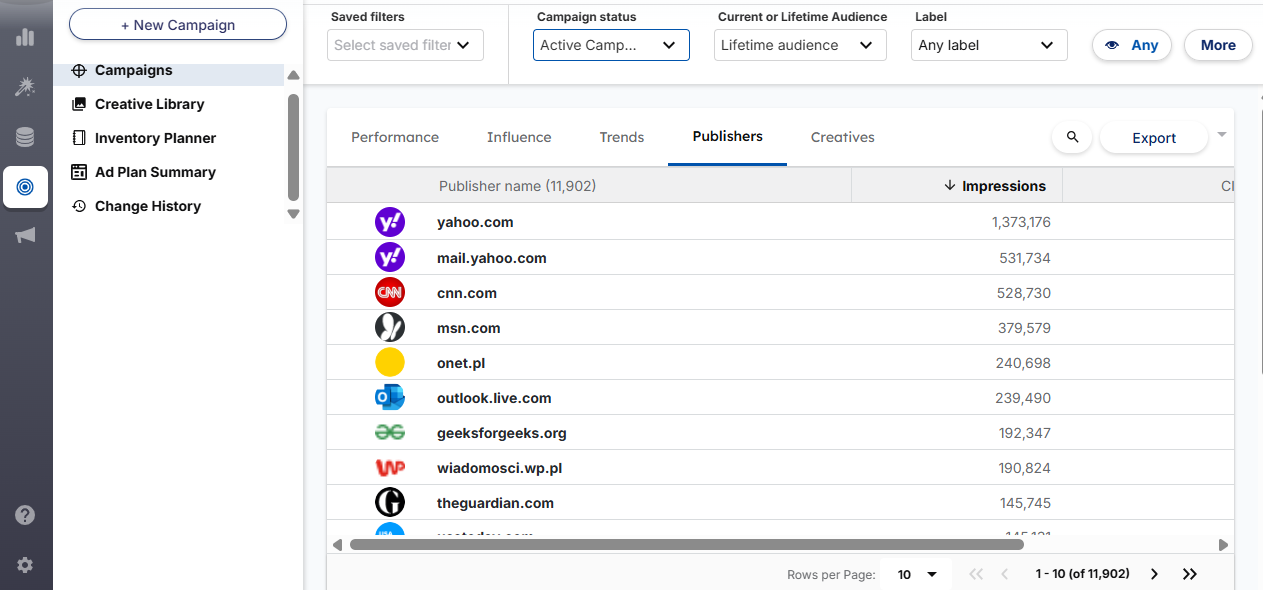

Demandbase’s Features

Here’s a quick tour of its features:

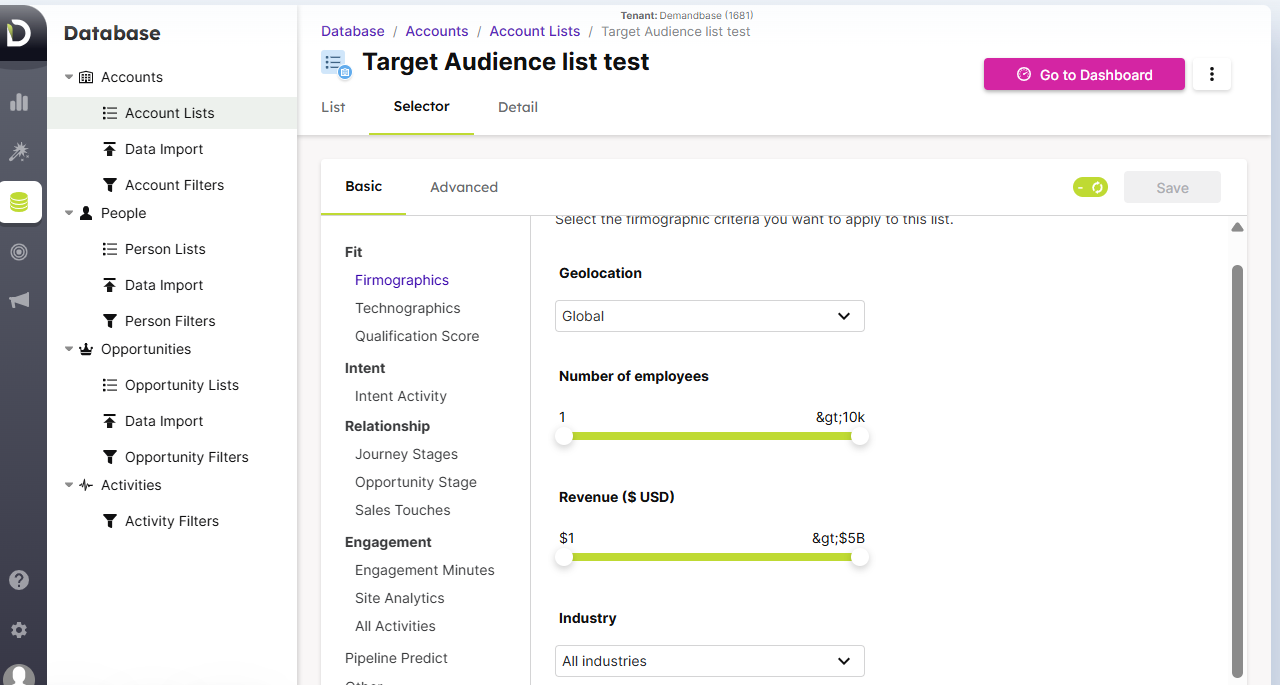

Great Target Account Selection Capability

Demandbase helps assemble and refine Target Account Lists (TAL) using your data + theirs.

Upload your list, deanonymize web visitors, or lean on its firmographic/technographic + AI suggestions (even hiring signals).

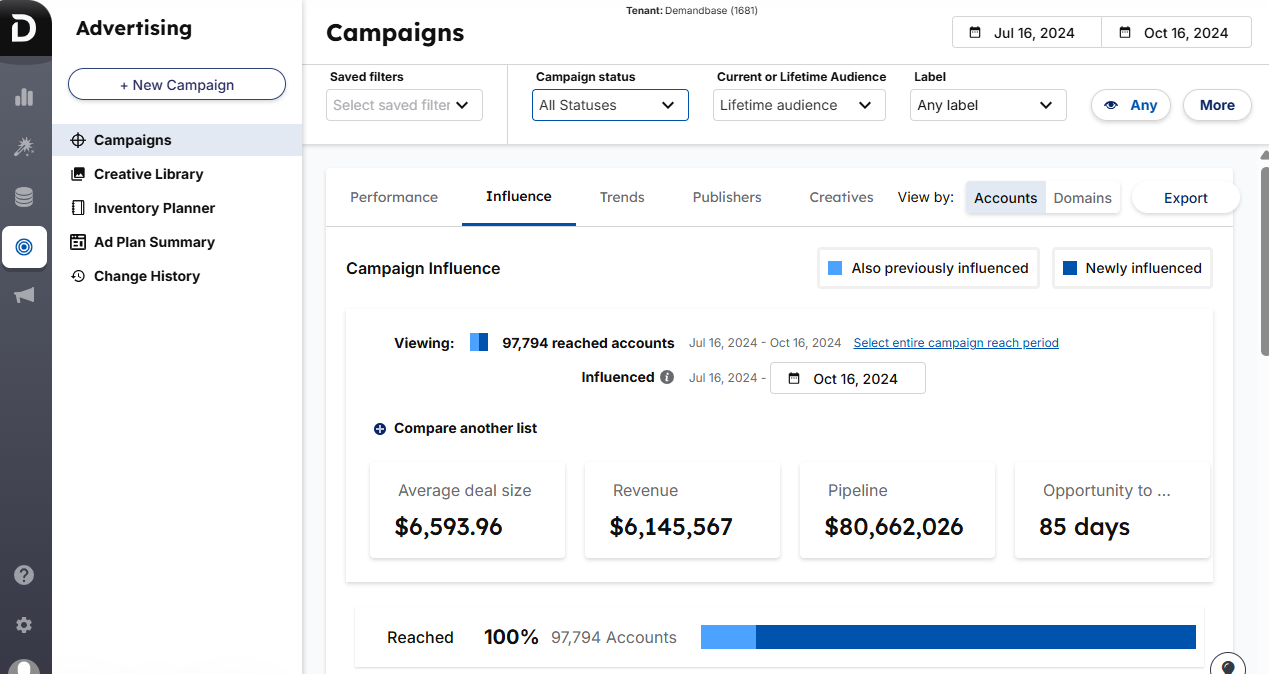

Multi-Channel Advertising (Including LinkedIn)

Demandbase includes a native B2B DSP for programmatic (display, retargeting, native, CTV) plus integrations to manage LinkedIn, Google, and more, complete with account-level frequency caps and AI budget optimization.

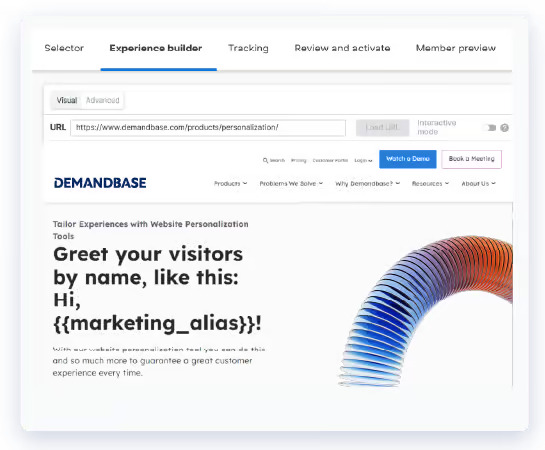

Personalization & Web Experience

Personalize your site for target accounts. Think industry-specific messages and micro-sites based on IP/cookie recognition and rules.

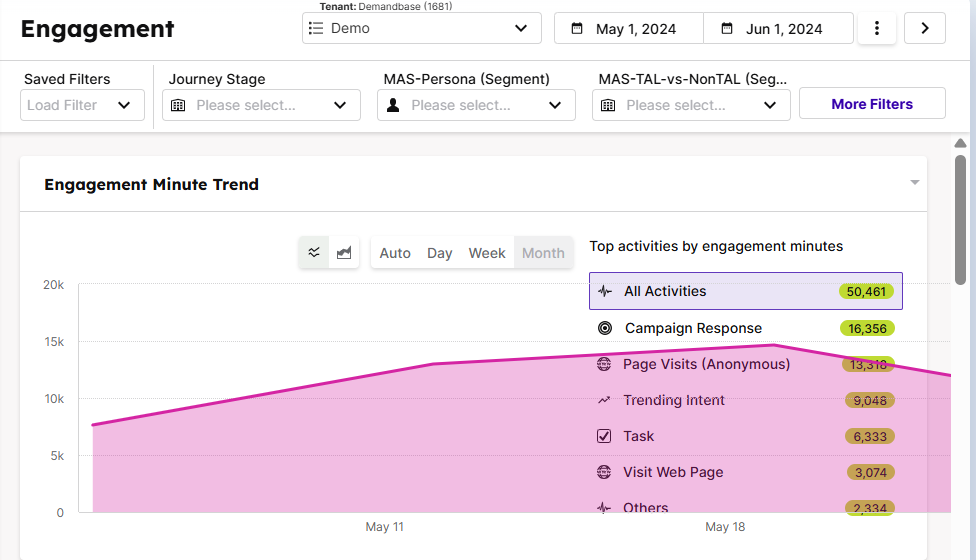

Account Intelligence and Intent Data

Demandbase blends first-party engagement with third-party intent (e.g., Bombora) to build deep account profiles: firmographics, technographics, trending topics, and engagement heatmaps.

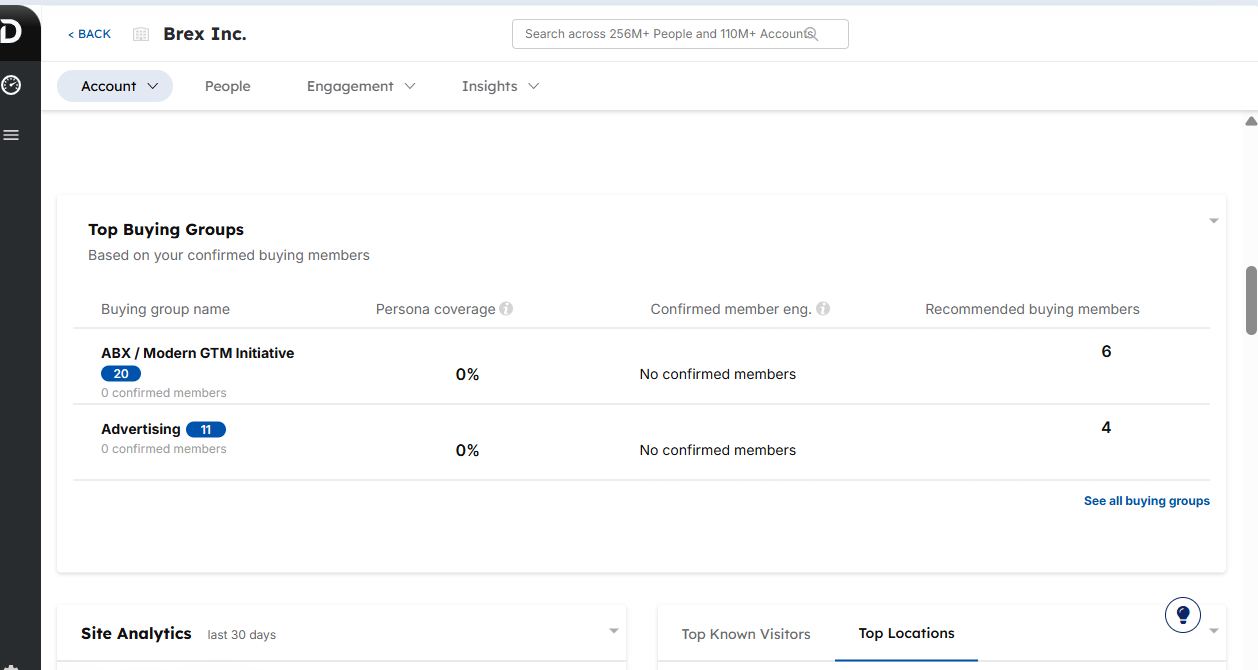

People-Based Targeting

Go beyond “account” to the actual buying committee: map personas, identify decision-makers, and target by role.

Analytics and Attribution

Dashboards track cross-channel engagement, funnel progression, and influenced pipeline. E.g., your Q1 LinkedIn campaign drove $2M in pipeline; AI adds a Pipeline Predict Score for “most likely to win.”

Integrations and Ecosystem

Demandbase connects to the usual GTM stack (Salesforce/MA tools, sales engagement, etc.) and has a sales module to surface insights where reps work.

See more in the Demandbase official docs.

Pros

Demandbase One is best for mature ABM teams that want everything in one place: ads, personalization, intent, analytics, and sales enablement. It’s powerful for large target account lists and multi-channel strategies, and it aligns big sales teams with real-time account insights. Post-Engagio merger momentum keeps it on the ABM leading edge.

Cons

Three biggies: steep learning curve, premium pricing, and a real chance it’s overkill for smaller programs.

Ideal Use Case

Large B2B orgs with established ABM and real budgets. If you’ve got a dedicated ABM team, thousands of accounts, and multi-channel plays to unify, Demandbase earns its keep.

It’s also ideal for consolidating point tools. E.g., fold ads, intent, and web personalization into one platform.

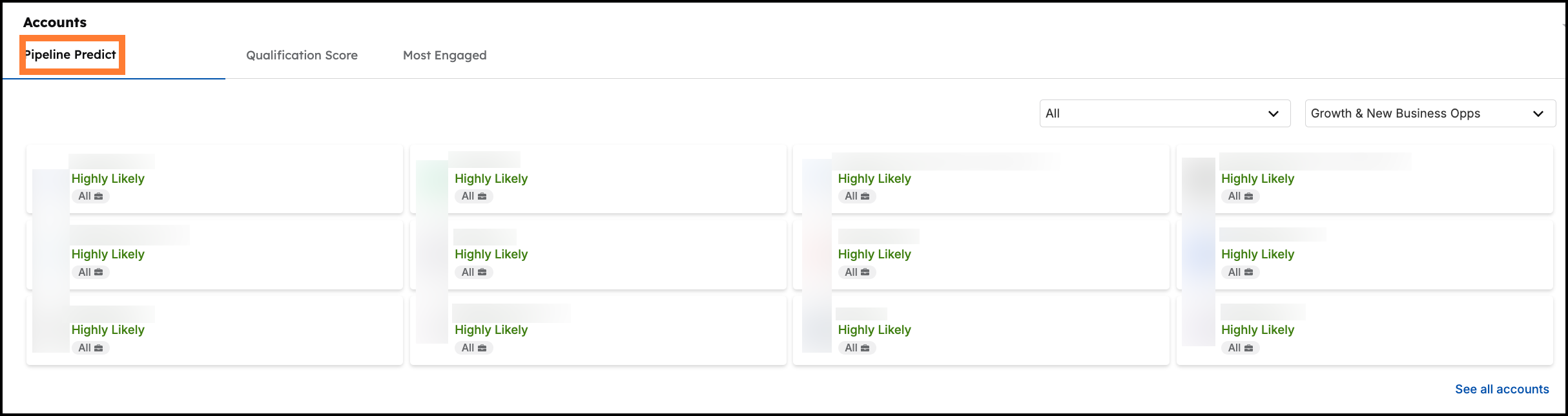

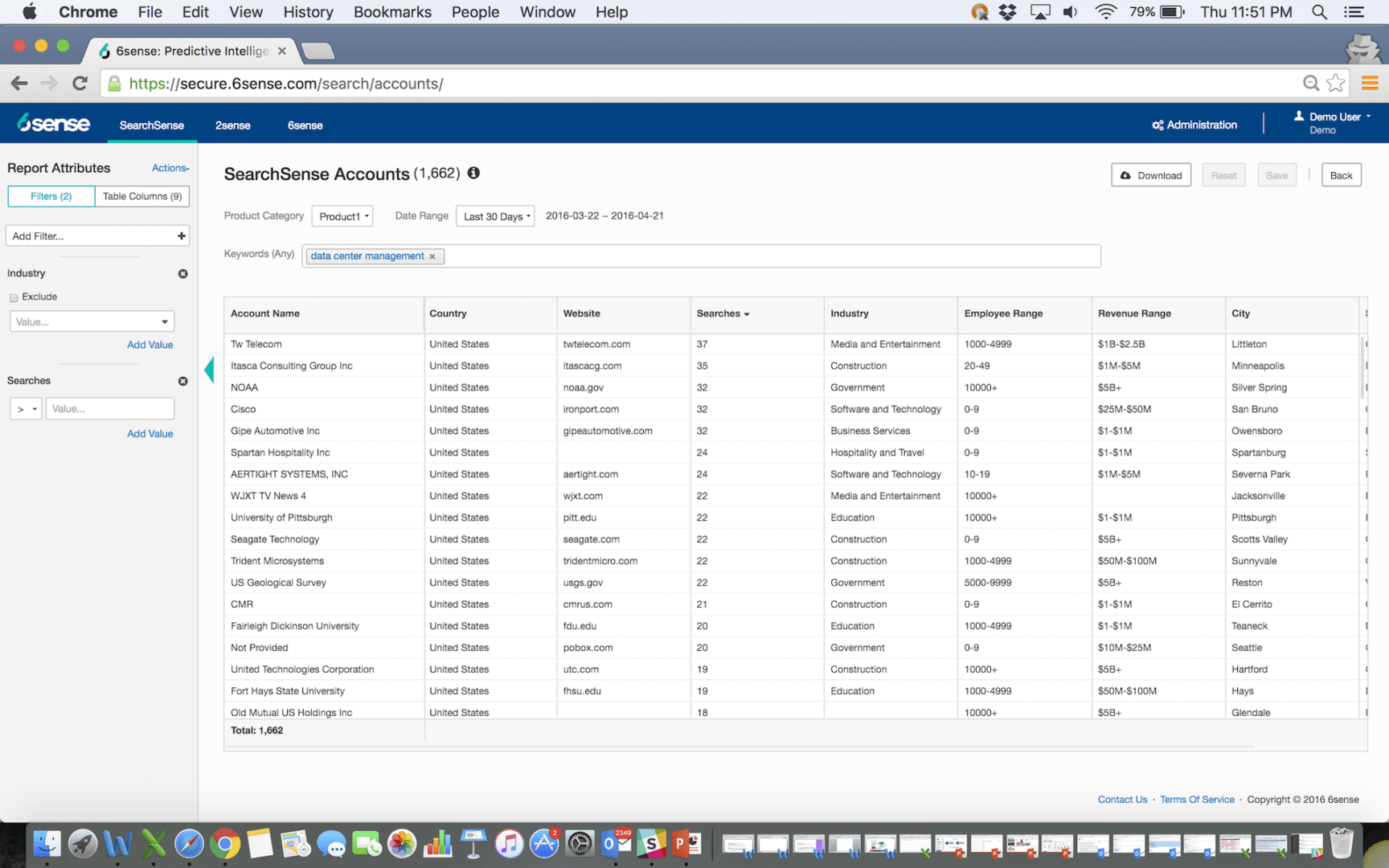

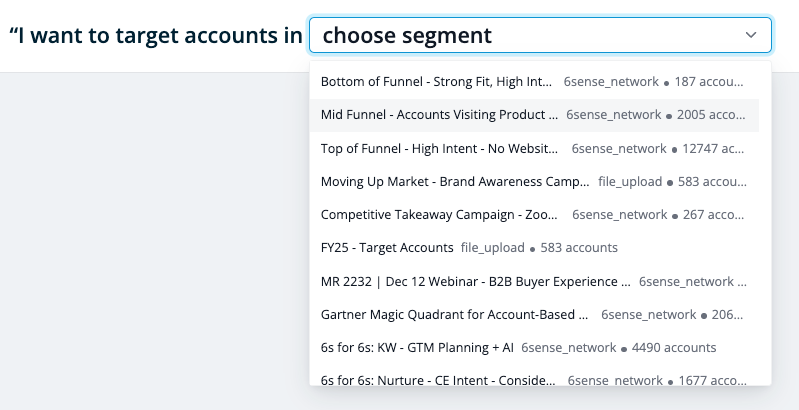

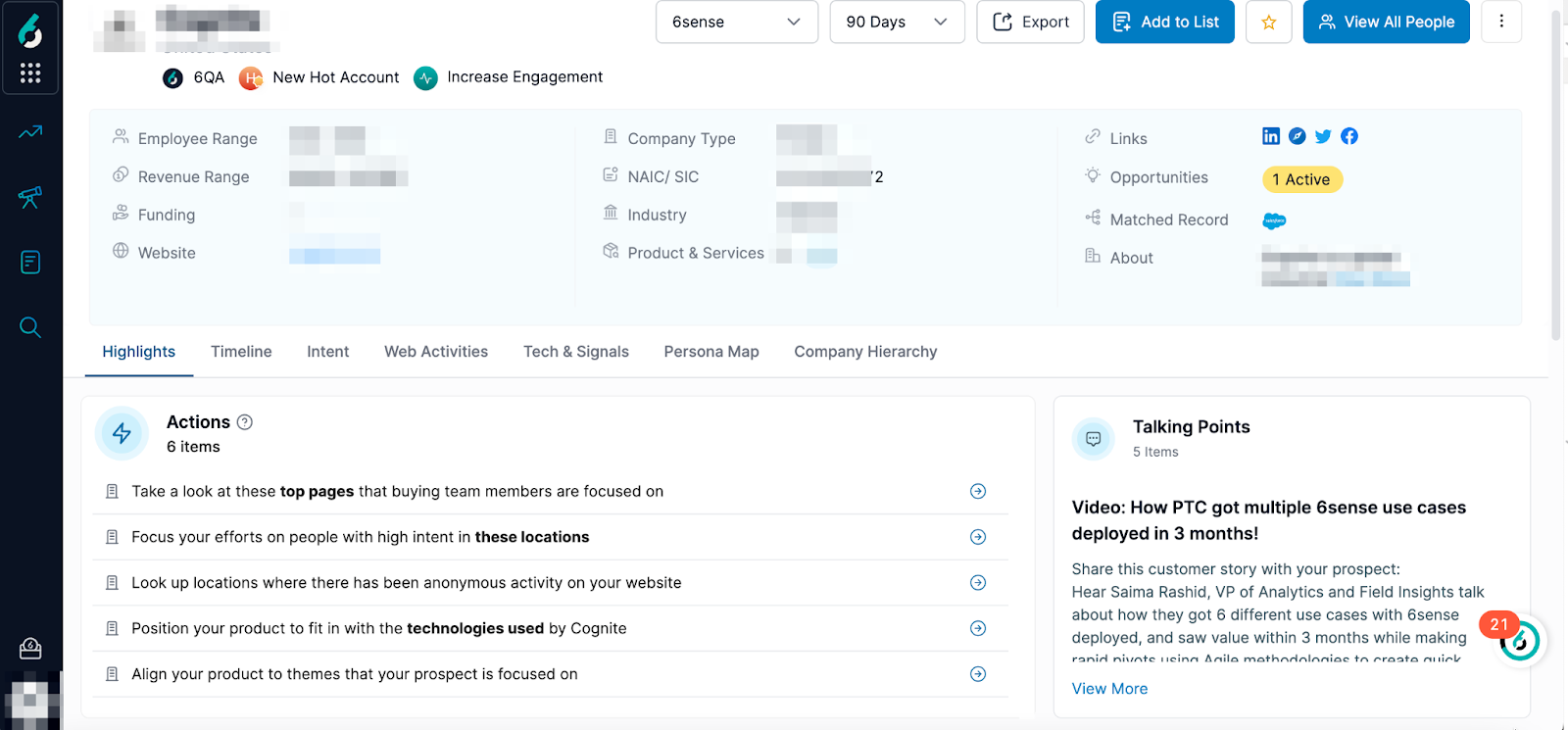

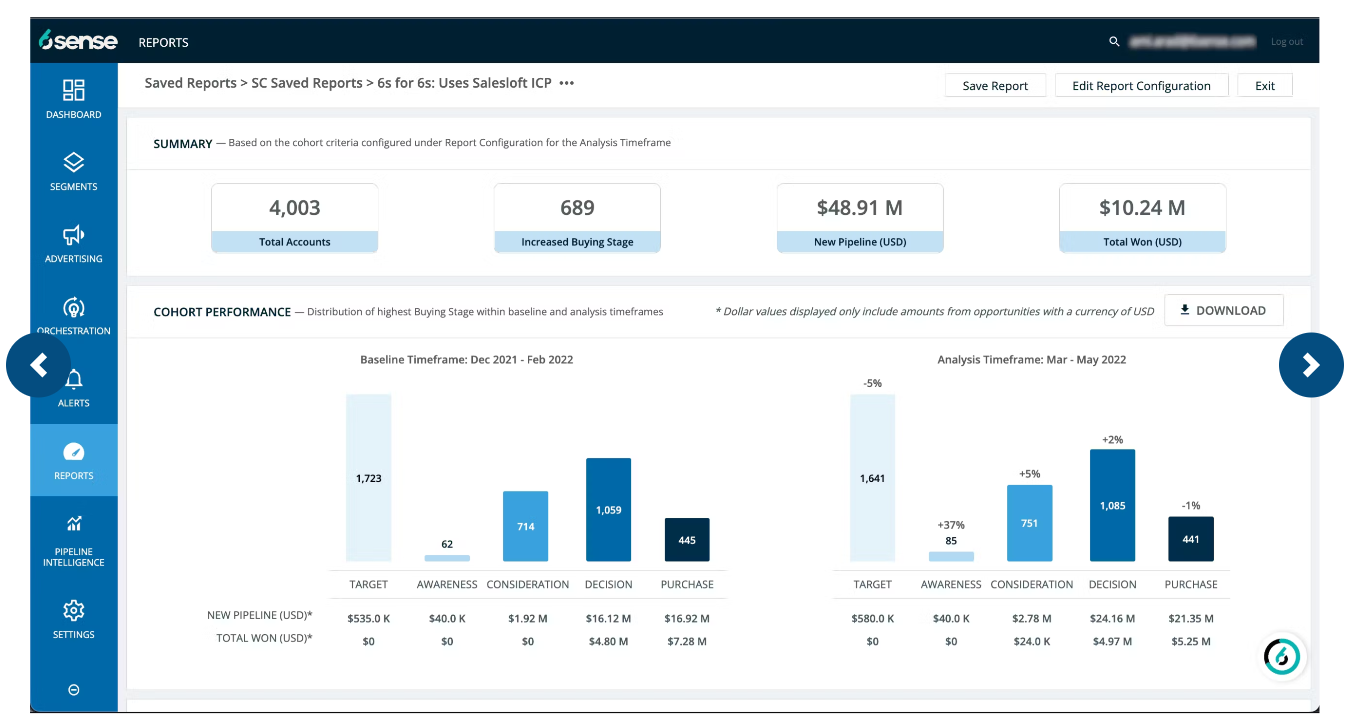

3. 6sense: Best AI-Driven ABM Platform for Intent Data & Predictive Analytics

6sense is famous for **predictive intelligence** – AI that helps revenue teams decide who’s in market and what to do next.

In short, it answers:

- Which accounts are researching (even anonymously)?

- Who should sales prioritize?

- Which campaigns will most likely convert?

It blends multi-channel execution with a strong AI core.

Key Features of 6sense

Here’s what stands out about 6sense:

Anonymous Visitor Identification

6sense’s Company Graph (IP, cookies, device IDs) can reveal which company an unknown visitor likely belongs to.

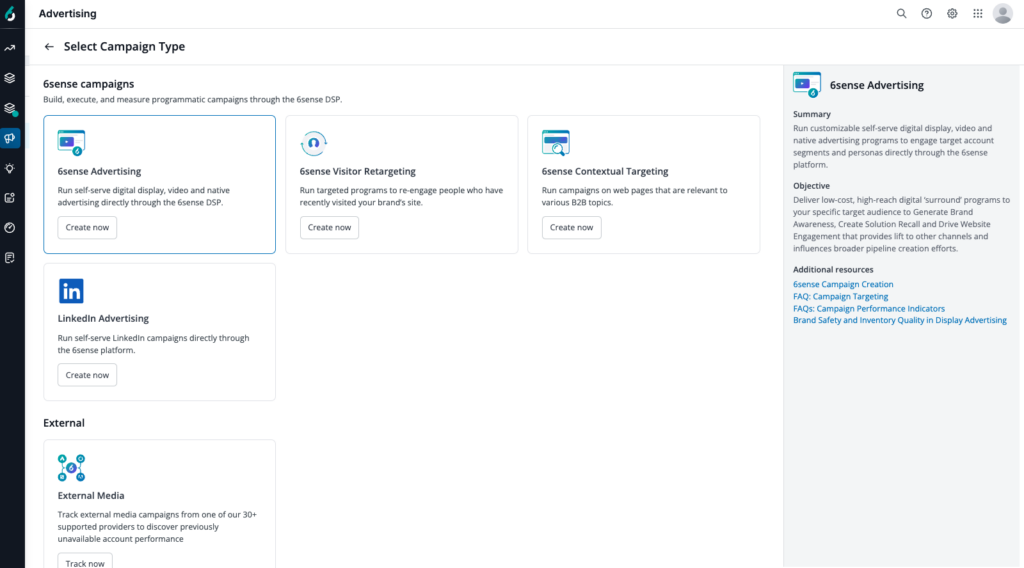

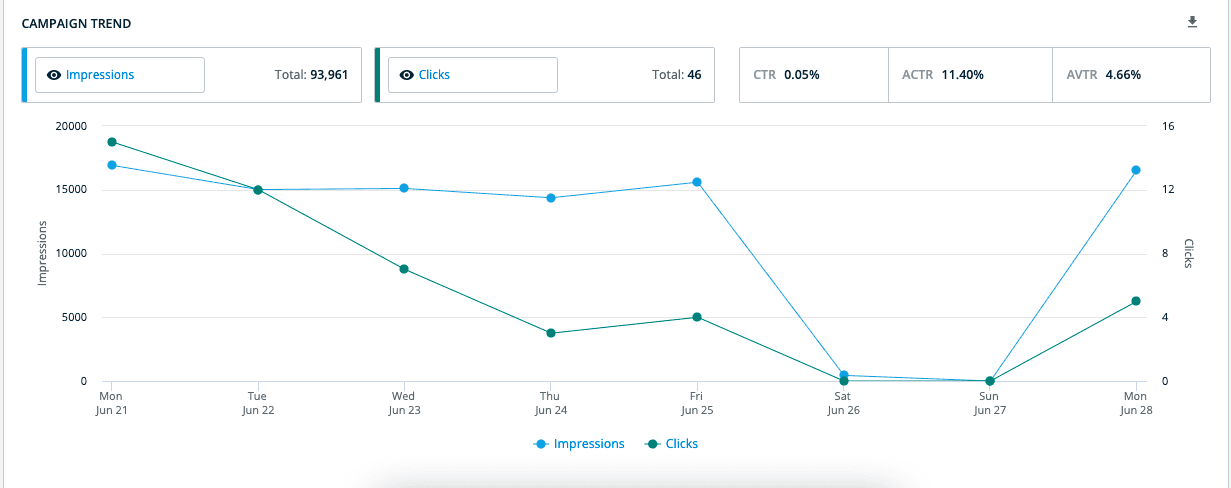

Multi-Channel Advertising & Orchestration

Run ads across channels in-platform like B2B DSP for display/video/CTV plus native LinkedIn and Google integrations. Trigger personalized web and sales touches (e.g., Salesloft/Outreach) too.

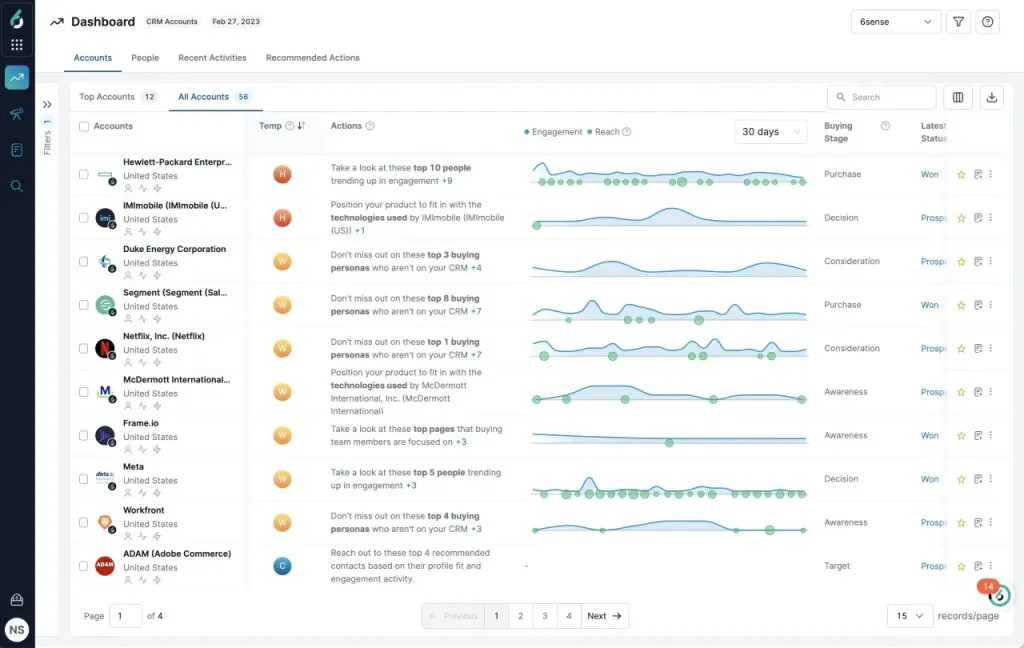

AI-Powered Account Scoring

6sense ingests:

-

- firmographics,

- web behavior,

- third-party intent (Bombora, G2),

- email engagement, and more.

It then predicts buying stages (Target → Decision) or assigns a 0-100 propensity score.

Sales gets “top 10 accounts this week” type alerts. no guesswork.

Intent Data Aggregation

6sense unifies first-, second-, and third-party intent so you’re not blind to buyer research happening offsite.

Rich Account & Contact Data

Profiles include firmographics, technographics, key contacts + engagement, and sometimes psychographics, so you can segment surgically.

Sales Insights & Next-Best Actions

Surfaced decision-stage accounts, key contacts, and suggested actions help reps move faster.

Attribution & Analytics

See sourced vs. influenced pipeline, multi-touch attribution, forecasting, and time-in-stage analytics.

Pros

Highly regarded for intent and predictive accuracy. Brings anonymous + known signals together. For data-driven teams wanting one hub for ads + insights, it’s powerful and scales well for larger sales orgs.

Cons

Power comes with complexity and premium pricing, often on par with or above Demandbase. Steep learning curve. Garbage-in/garbage-out risk if CRM hygiene is poor. If you’re LinkedIn-only, 6sense may be overkill.

Ideal Use Case

6sense is best for mid-to-large B2B orgs with long cycles, big TALs, and sales ready to act. If you already buy intent and run ads, 6sense unifies it and tells you where to focus.

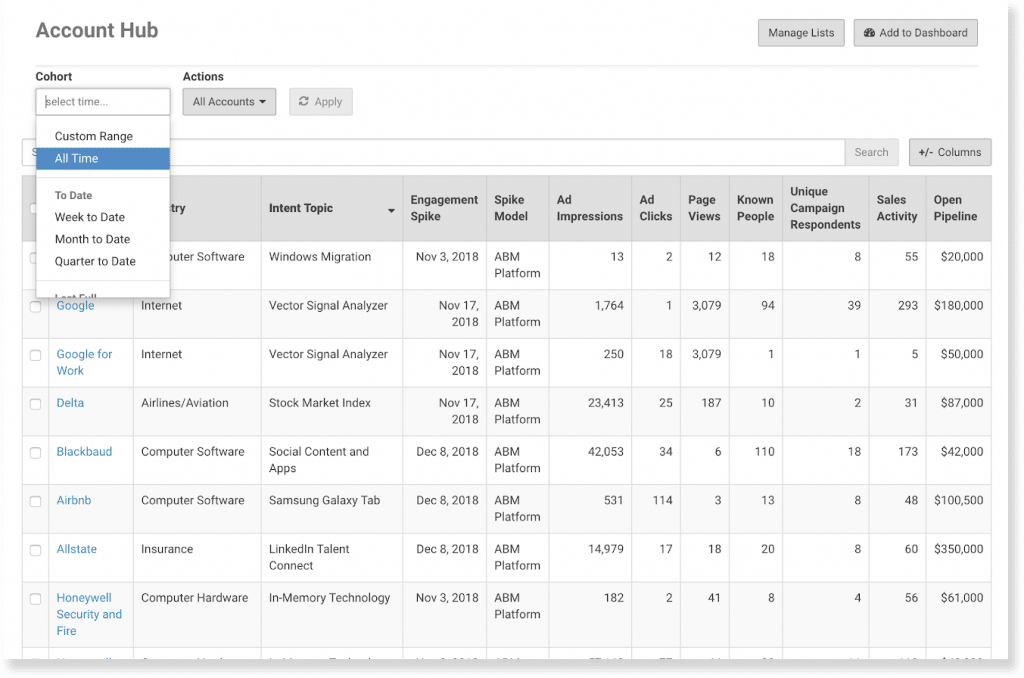

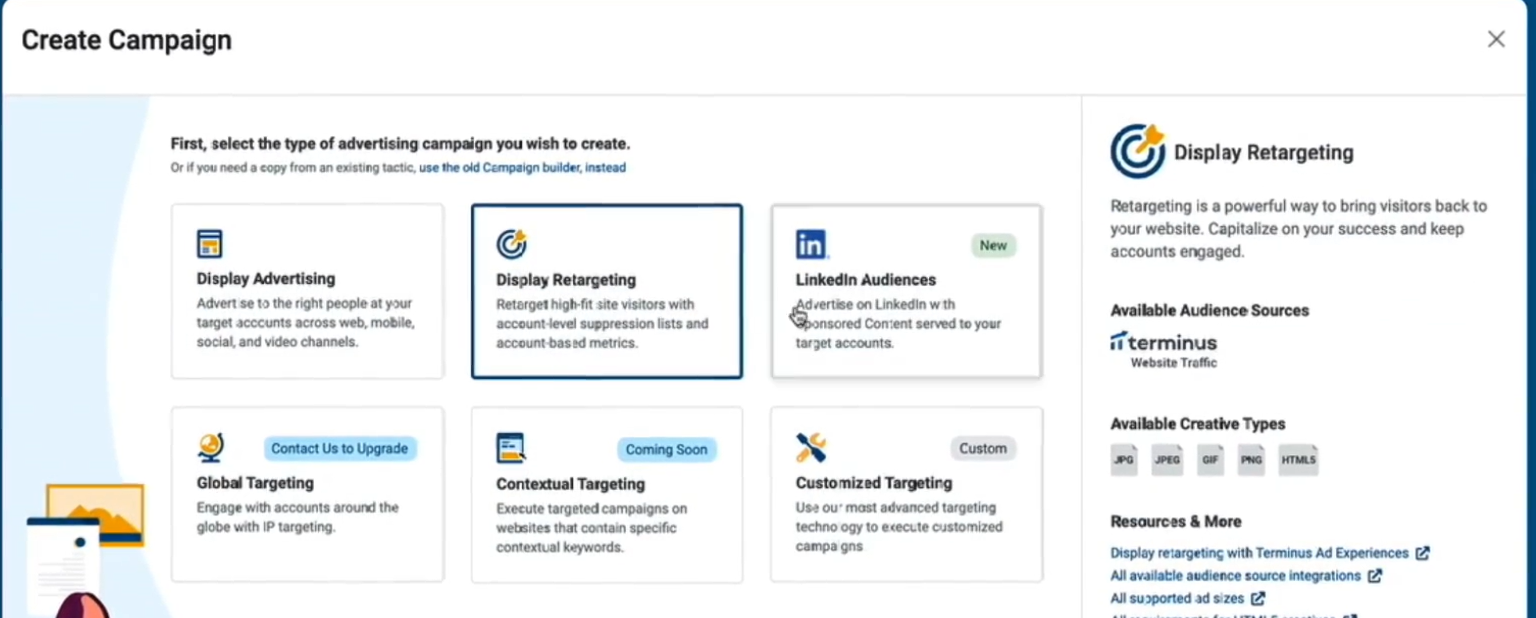

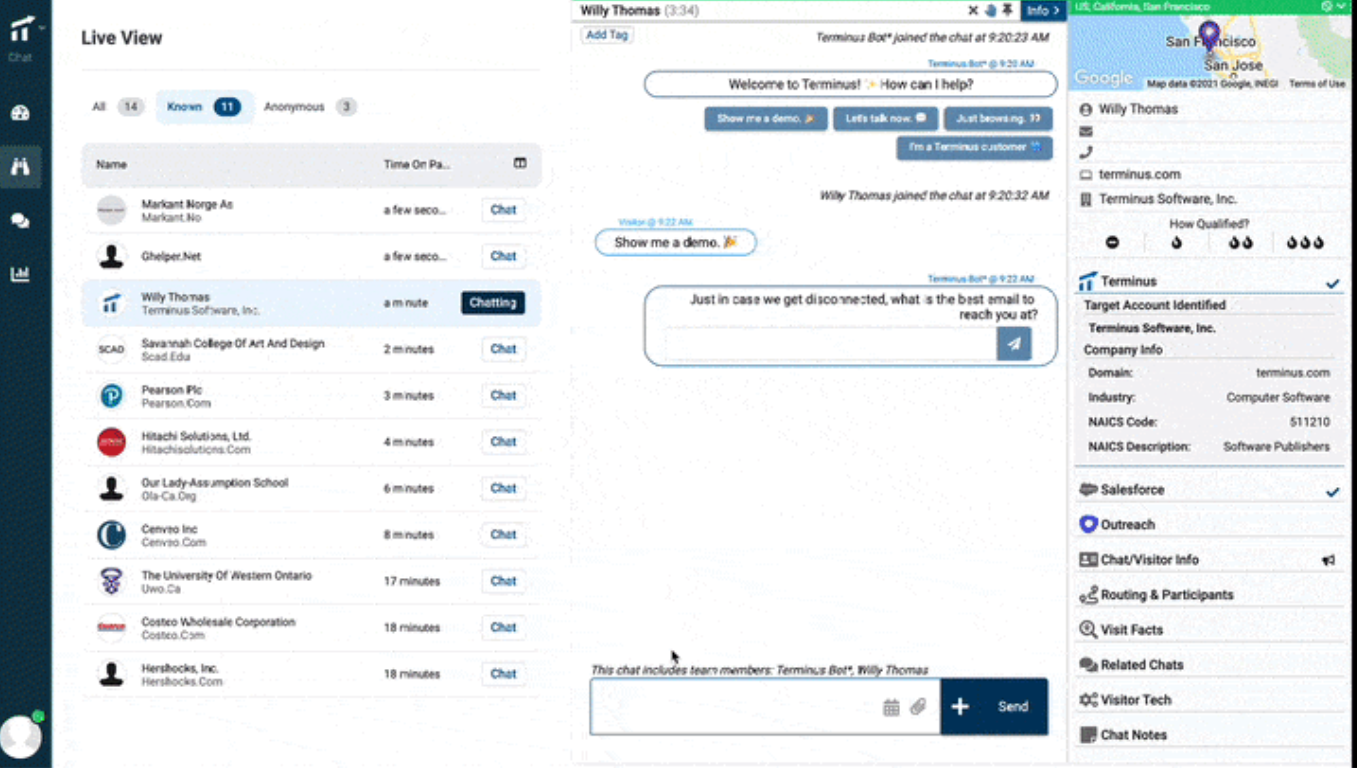

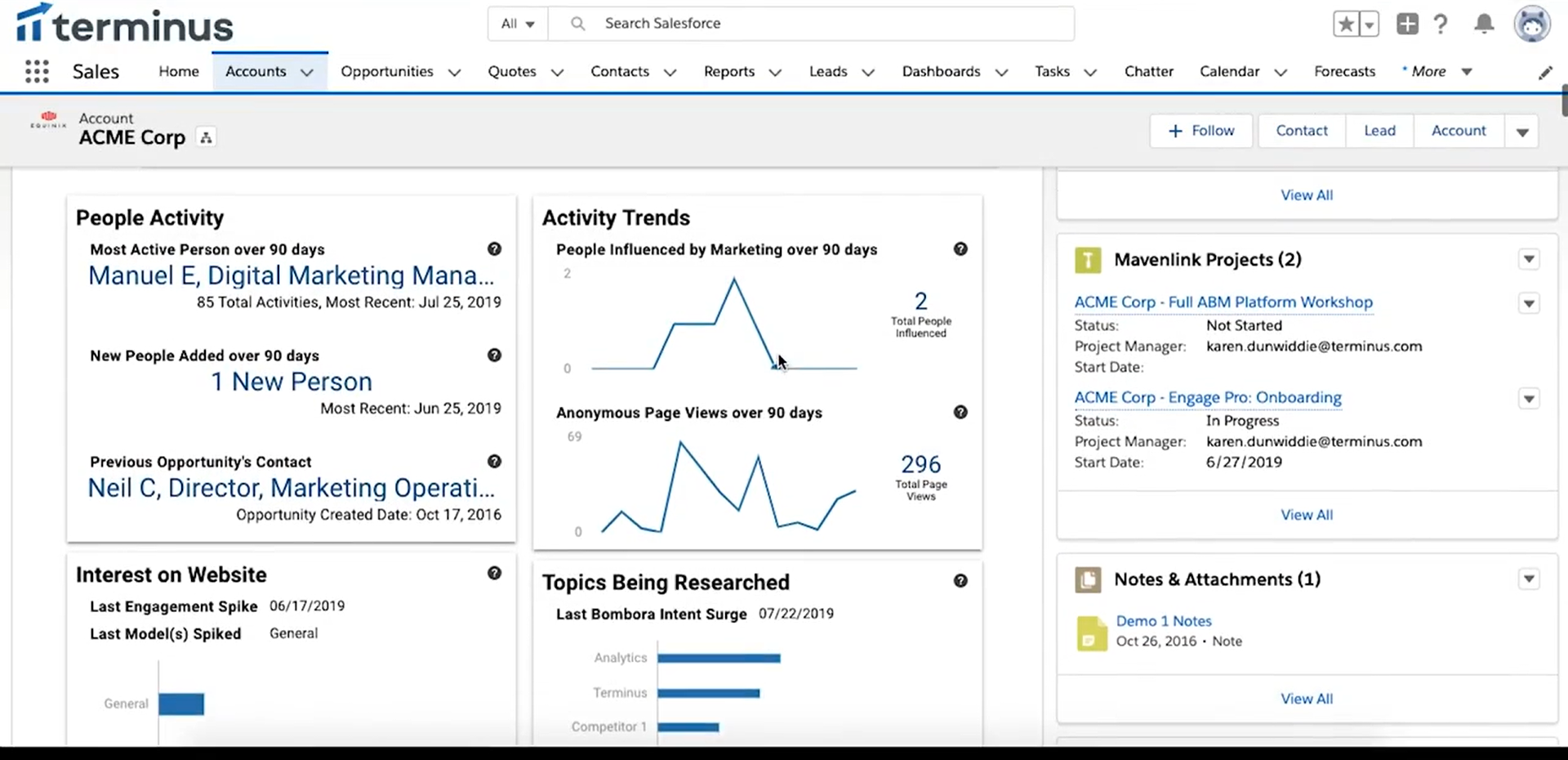

4. Terminus: Best ABM Platform for Multi-Channel Orchestration & Sales Alignment

Terminus stands alongside 6sense/Demandbase, with a distinct orchestration bent.

It started in ads (like RollWorks) and expanded via acquisitions into email signature marketing, chat, and strong sales alignment.

Core Capabilities of Terminus

Here are the notable capabilities of Terminus:

Advertising Across Key Channels

Launch account-targeted ads on Google, LinkedIn, and display. Not as many channels as Demandbase, but it nails the core B2B ones.

Email Signature & Web Engagement

Turn every employee email footer into an ABM placement (Sigstr). Add chatbot/personalization so target accounts see relevant experiences.

Sales Outreach Integration

Deep ties to Outreach/Salesloft trigger cadences/tasks when accounts heat up.

Data Integrations & Intent

Connects to Salesforce/HubSpot/MS Dynamics, Marketo/Pardot/HubSpot Marketing, Bombora/G2 intent, enrichment, and Slack notifications.

Explore the catalog in the Terminus docs.

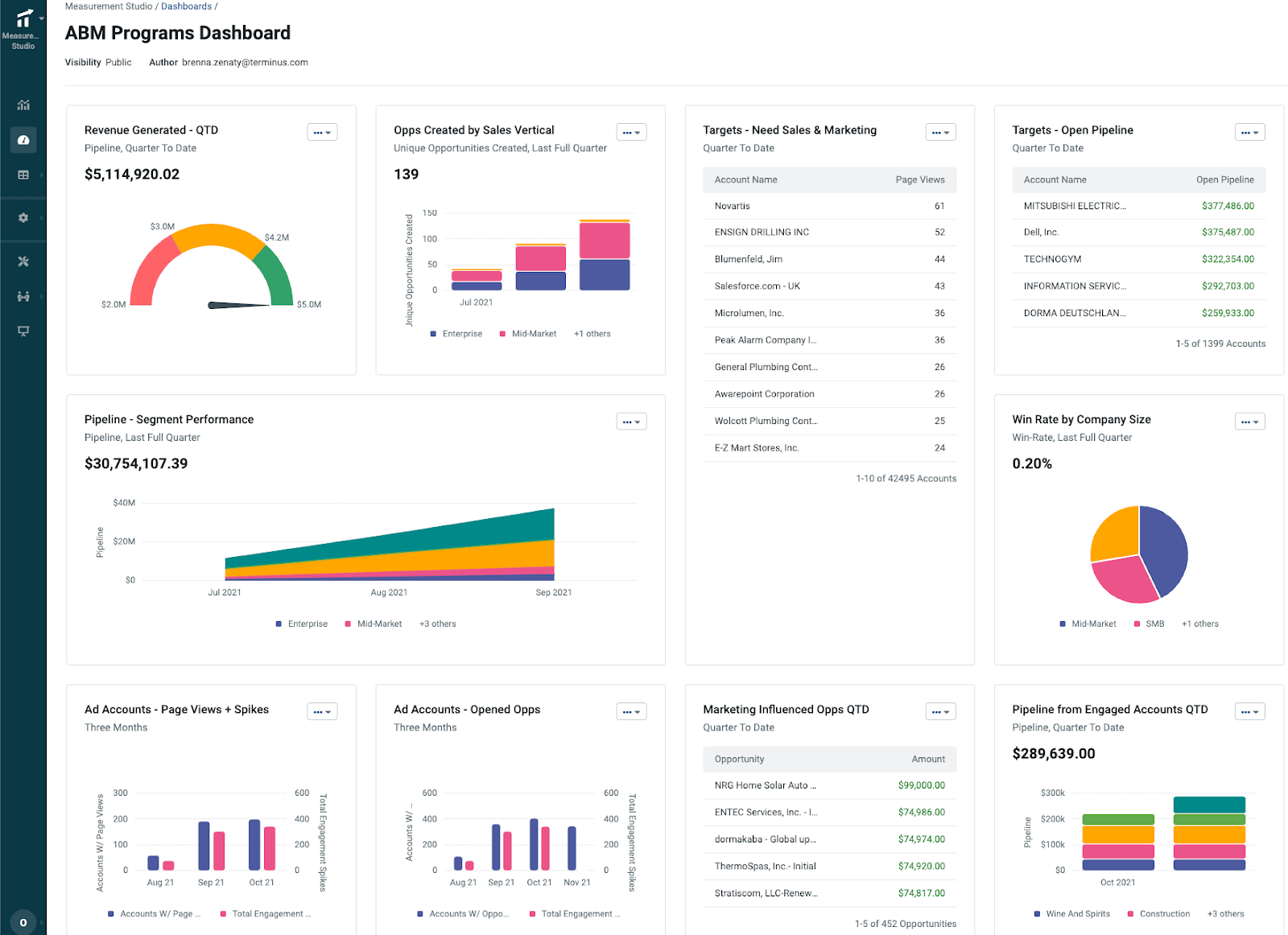

Measurement Studio (Analytics)

Out-of-the-box attribution and ROI views: revenue, new opps, open pipeline, and progression—plus customizable windows and AI pattern-finding.

Pros

A genuinely holistic toolkit (ads, email sigs, chat, analytics) in one UI. Great for syncing multi-channel plays and proving ROI. Flexible to start small and expand.

Cons

Premium pricing (sales-led). Extra costs for intent and some integrations. Review sites (Trustradius, Infotech.com, Software Finder) mention caps/limits and occasional sync hiccups. If your ABM is simple, it can feel like overkill.

Ideal Use Case

Terminus suits teams serious about multi-channel ABM with budget and headcount. If you’ve got 5+ marketers and a comparable sales team, it’s great for coordinating digital and “non-standard” plays (direct mail, email signatures). Best for mature industries with larger ACVs; smaller teams may wait until they’re ready.

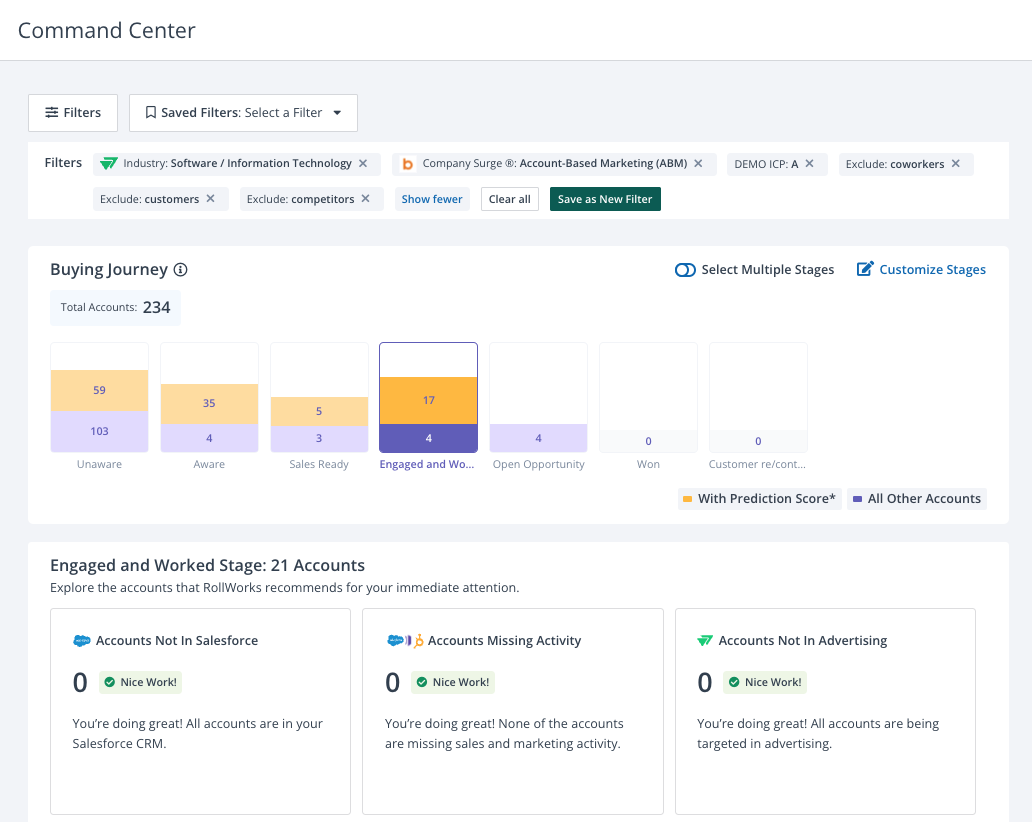

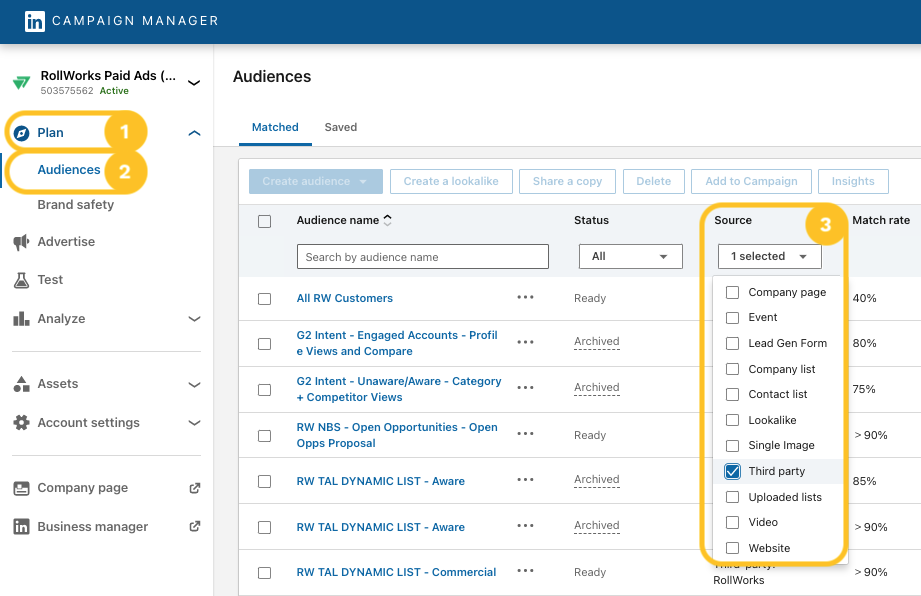

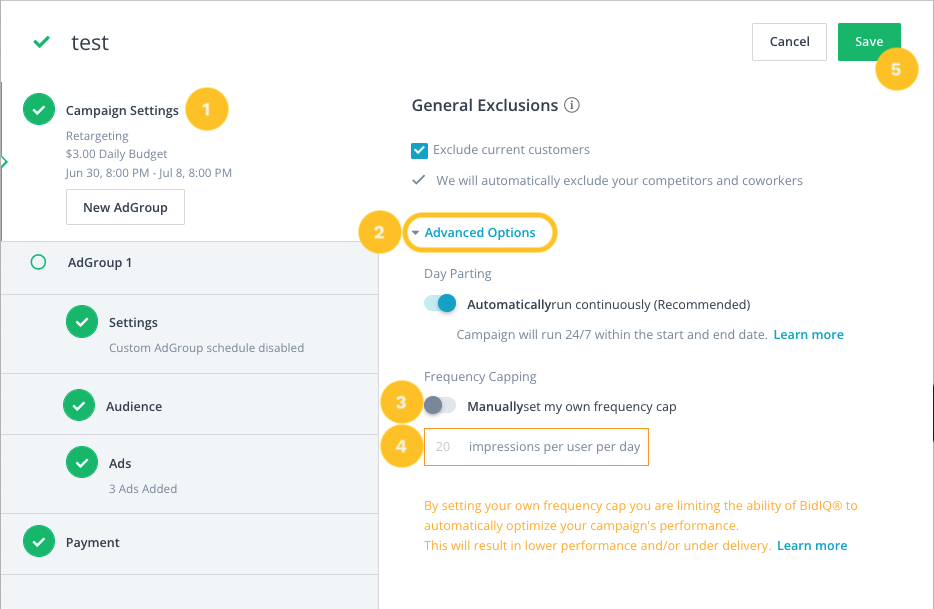

5. RollWorks: Best ABM Advertising Suite for Scaling Account-Based Campaigns

RollWorks is often the “entry” enterprise ABM platform.

It bundles advanced account scoring, intent, and a native ad network and is frequently more approachable (and sometimes more affordable) than the top-tier suites. Backed by NextRoll, RollWorks’ lane is digital advertising + audience management.

If your core ABM play is targeted ads (display/LinkedIn) to a TAL, RollWorks is built for you.

Key Features of RollWorks

Let’s look at the key features of RollWorks:

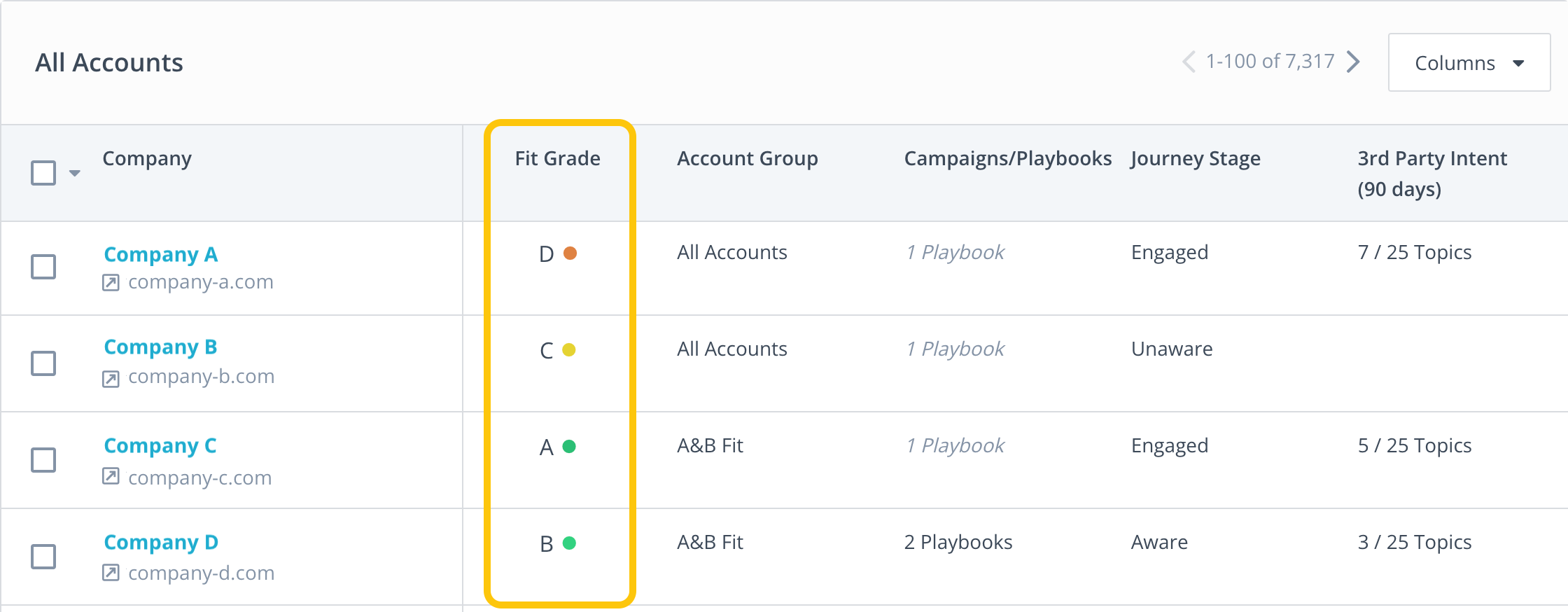

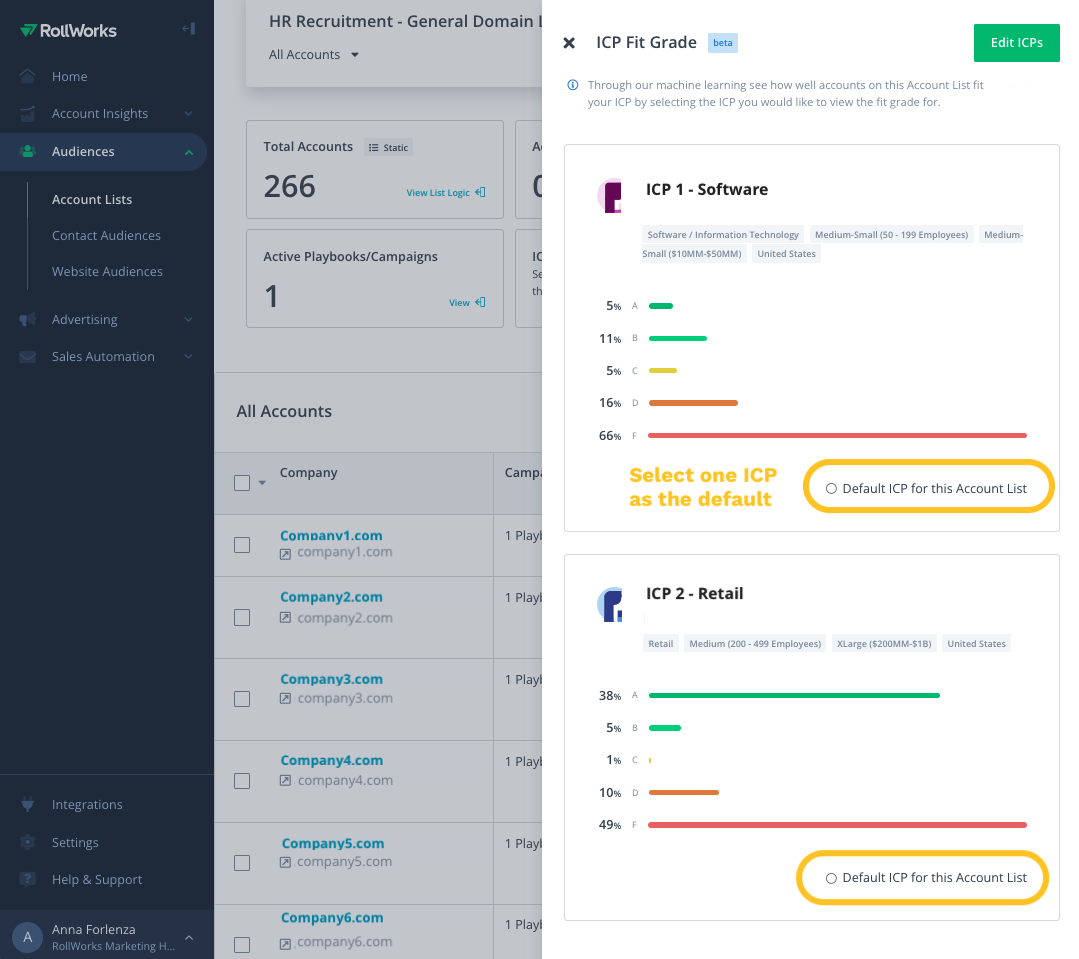

Account List Building & Scoring

Import TALs from your CRM/MA, or generate with RollWorks’ data + models. The ICP Fit grade (A–D) uses firmographics, tech, revenue, etc., and supports multiple ICPs.

Intent Data & Account Insights

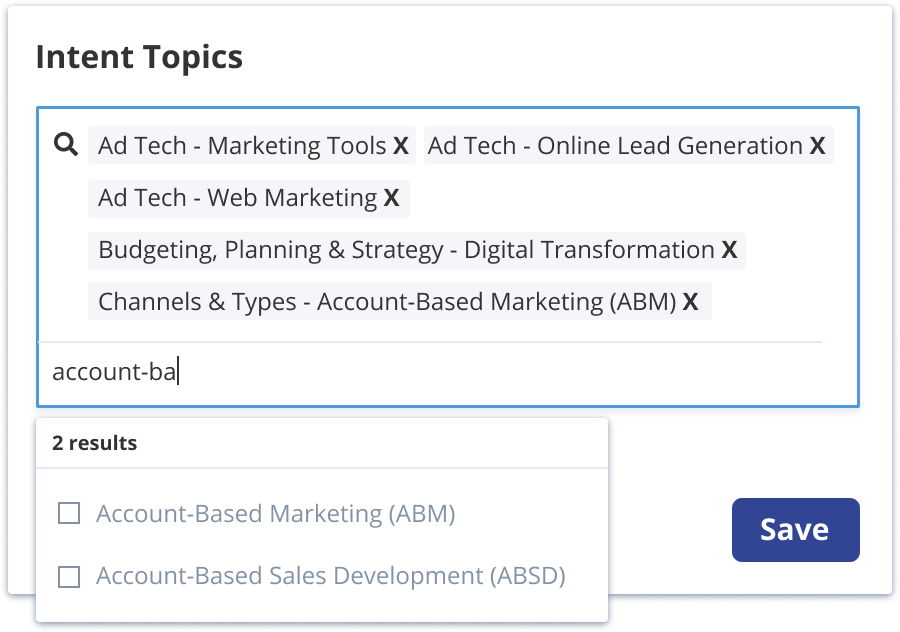

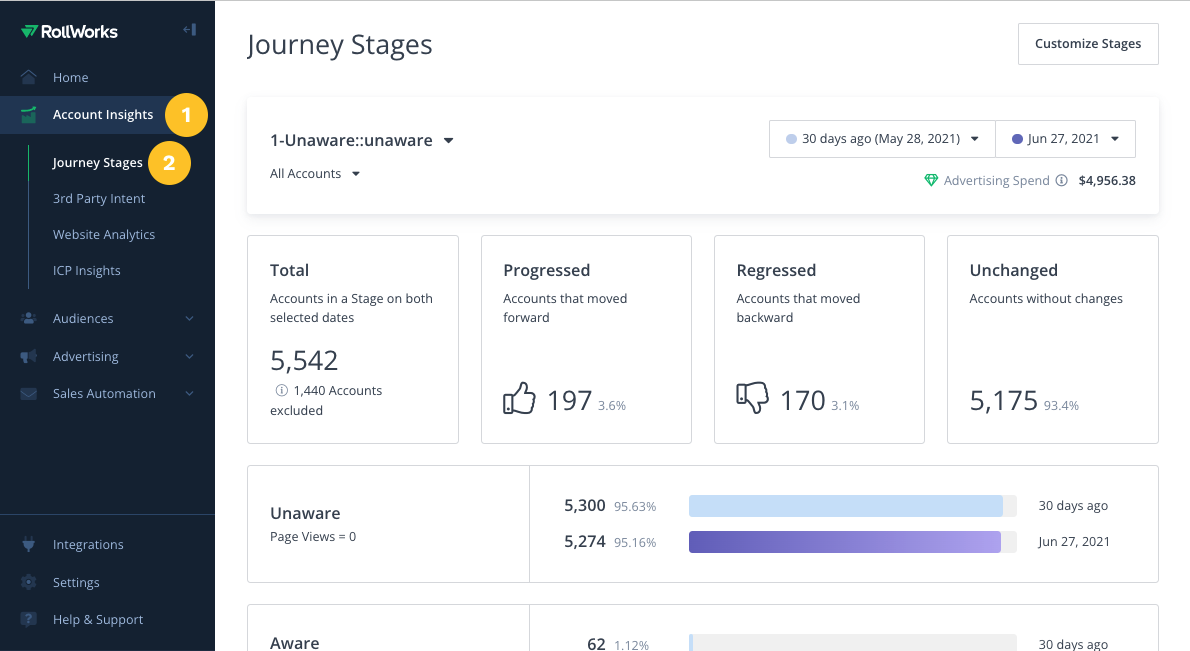

Monitor “in-market” activity via web keyword/topic tracking and view “Journey Stages” to see where each account sits.

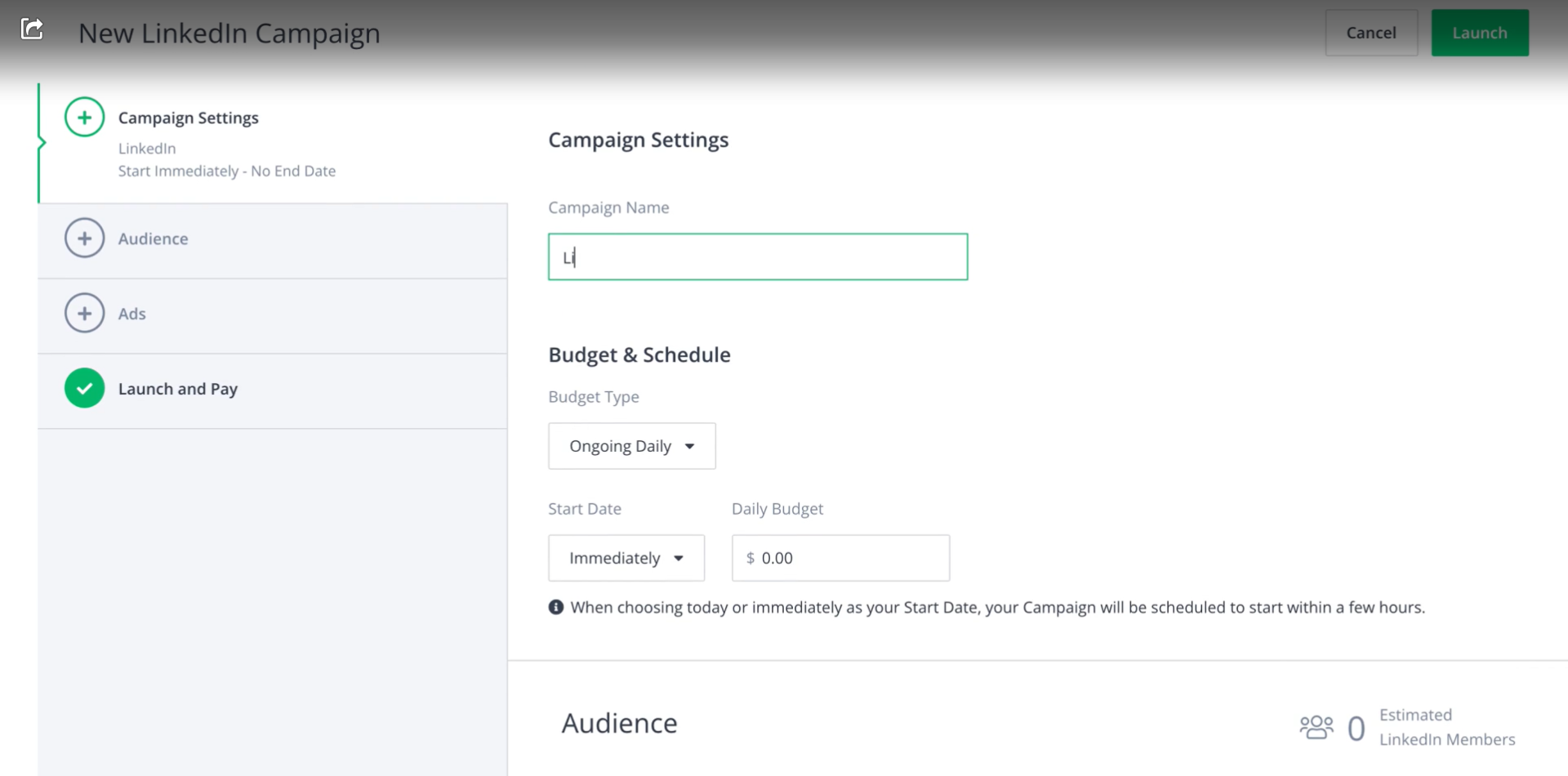

Advertising Capabilities

Run programmatic display/retargeting via RollWorks DSP, integrate LinkedIn through the Marketing API, and manage audiences centrally.

You’ll also find budget optimization and account-level frequency caps.

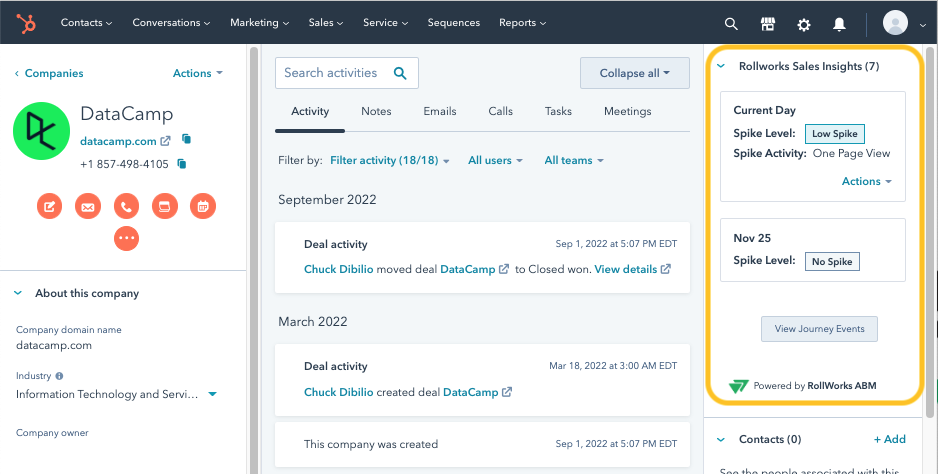

Sales Alignment & CRM Integration

Two-way CRM sync, sales alerts, and a CRM widget keep GTM aligned; hooks to Outreach/Slack notify reps on hot accounts.

Integrations & Ecosystem

Connectors for HubSpot/Marketo, etc., for audiences and measurement; partner tools fill gaps RollWorks doesn’t cover.

Read more in this guide.

Pros

Strong for ads + account targeting without the intimidation tax. Handy UI, detailed account-level ad performance, and a sensible step-up from pure LinkedIn native.

Cons

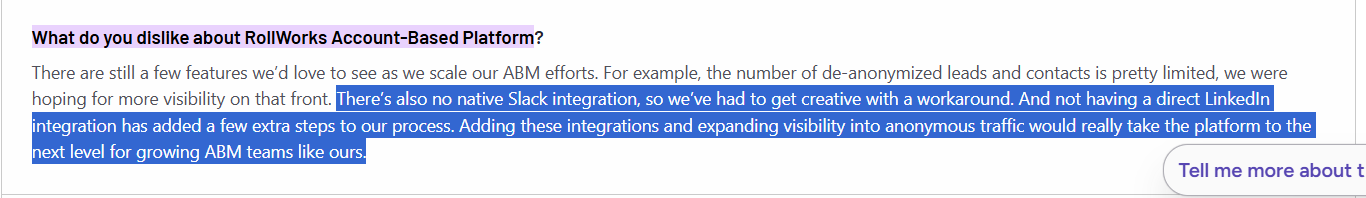

Still requires meaningful budget: $2K–$5K/month in ads plus platform fees. Focused on digital + CRM outreach (no native direct mail or advanced web personalization). Less predictive than 6sense, and users cite limits on lists/ad volumes, integrations, and reporting.

Ideal Use Case

Perfect for mid-market teams moving from manual ABM to scalable, ad-led plays.

Expand a pilot, saturate your TAL on LinkedIn + display, and measure deeply without adopting a complex AI suite.

Popular with SaaS and mid-size tech needing a dedicated ABM ads tool, not a full enterprise stack.

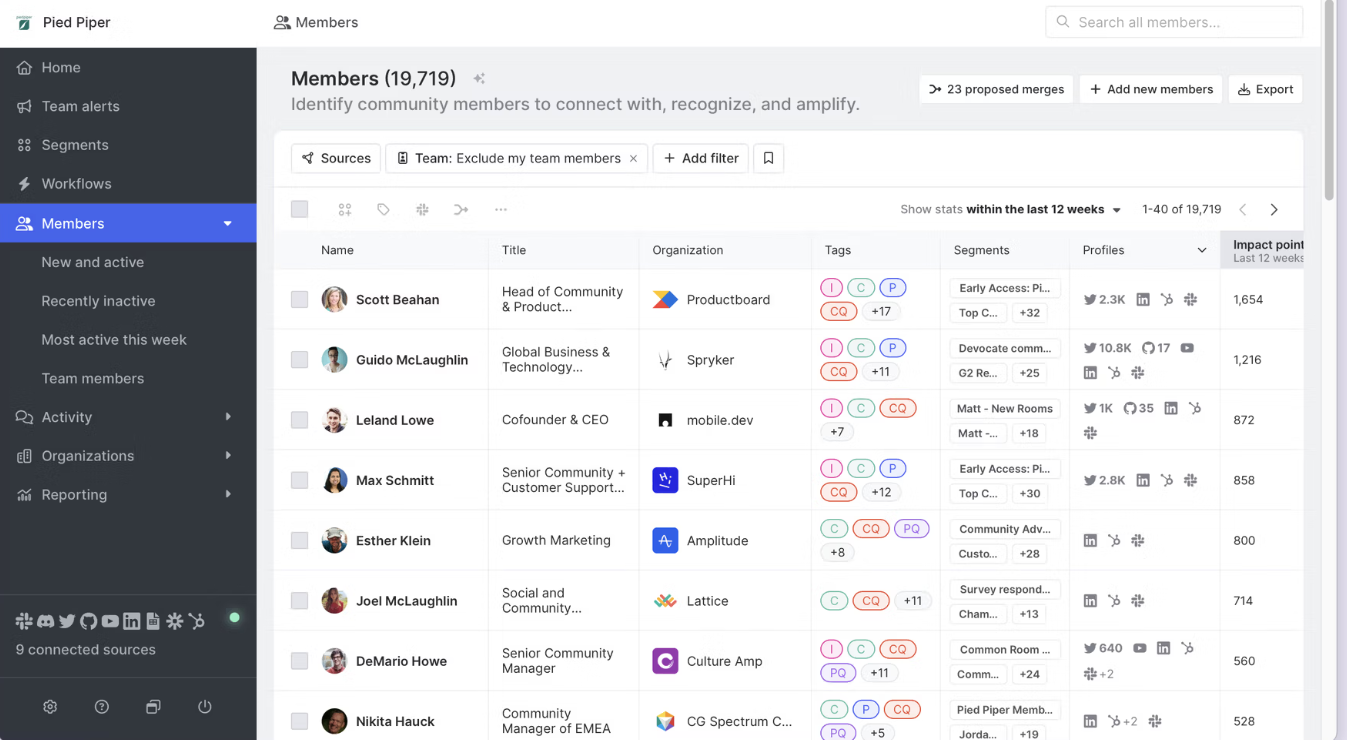

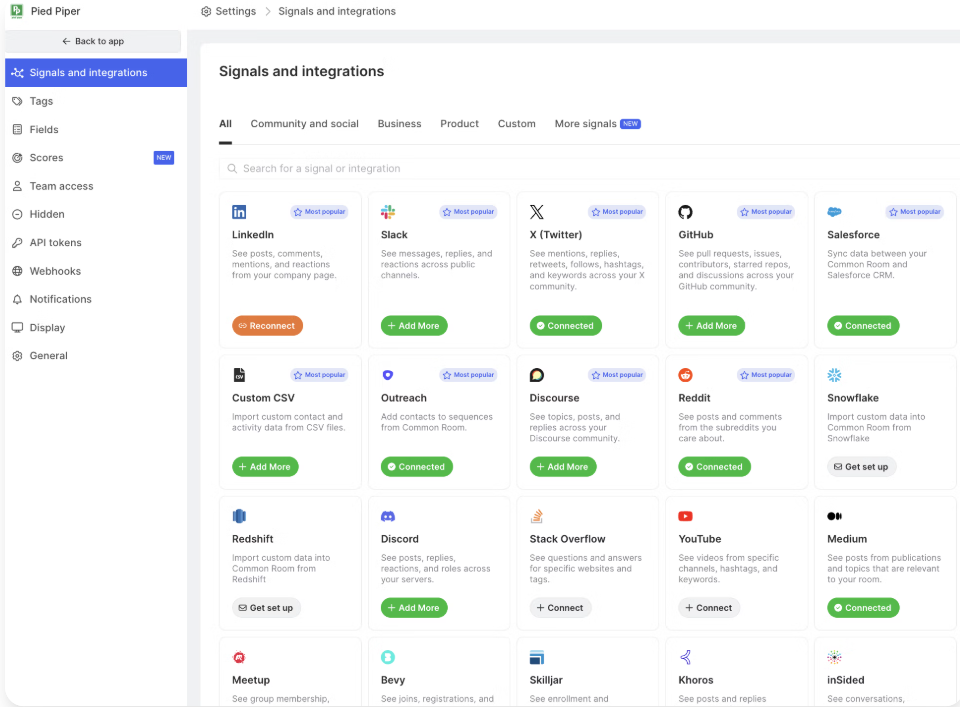

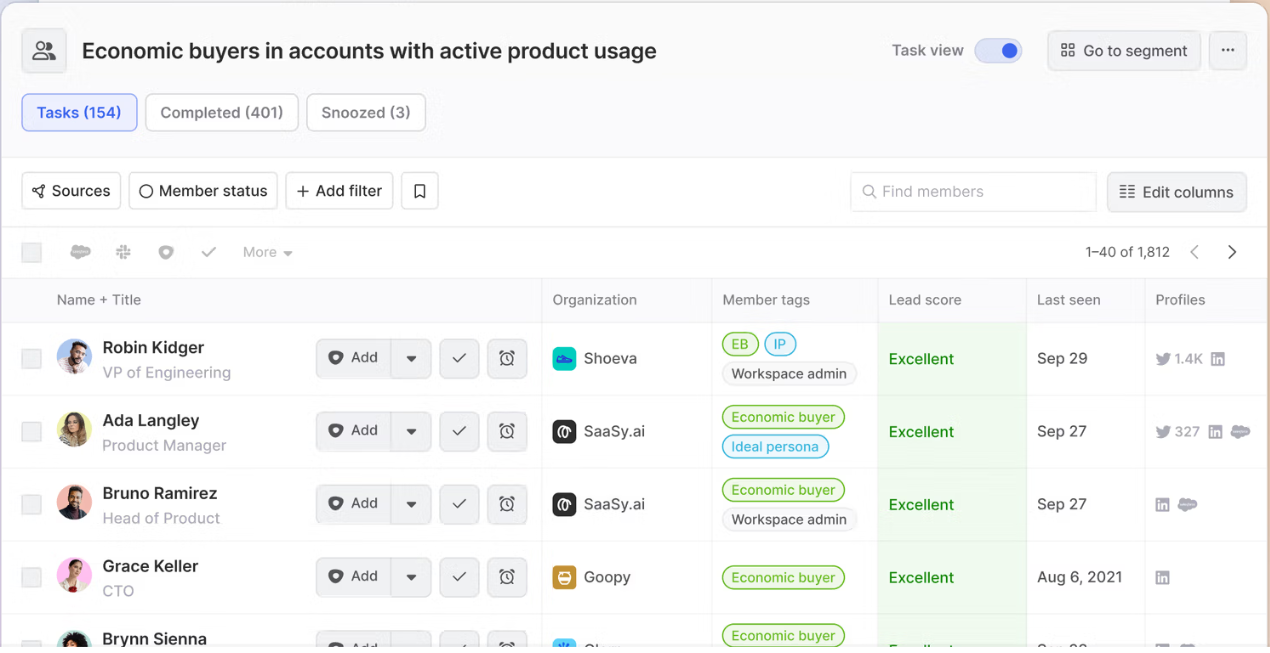

6. Common Room: Best for Community-Led ABM and Developer-Focused Marketing

Paid ads aren’t the only way to ABM.

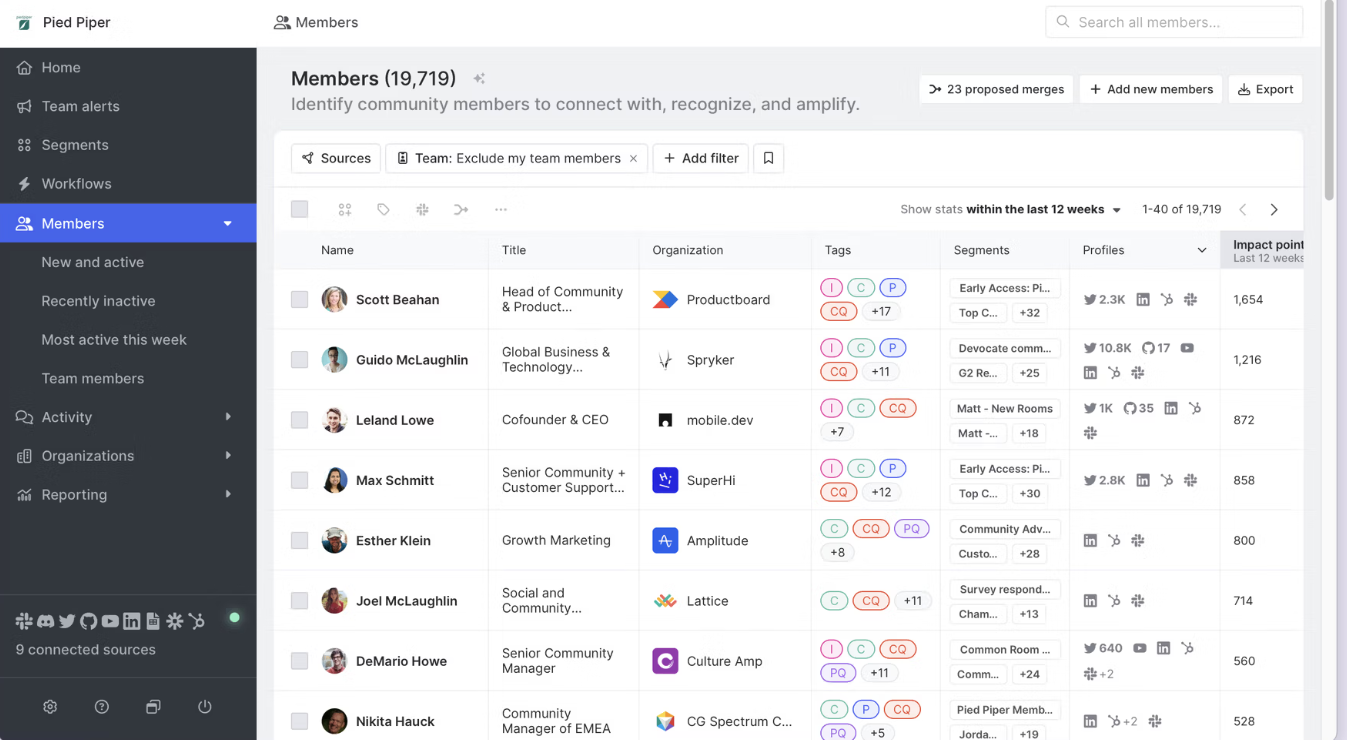

Common Room powers account growth from community and organic engagement: Slack, forums, GitHub, socials, product signals, and more.

Key Capabilities of CommonRoom

Let’s look at the core features offered by CommonRoom:

Unified Engagement Data (Person360)

Aggregate signals from Slack/Discord/Discourse, Twitter/LinkedIn, GitHub/Stack Overflow, HubSpot/Salesforce, CS tools, and your warehouse rolled to people and accounts (e.g., Jane stars GitHub + joins Slack + attends a webinar → one profile).

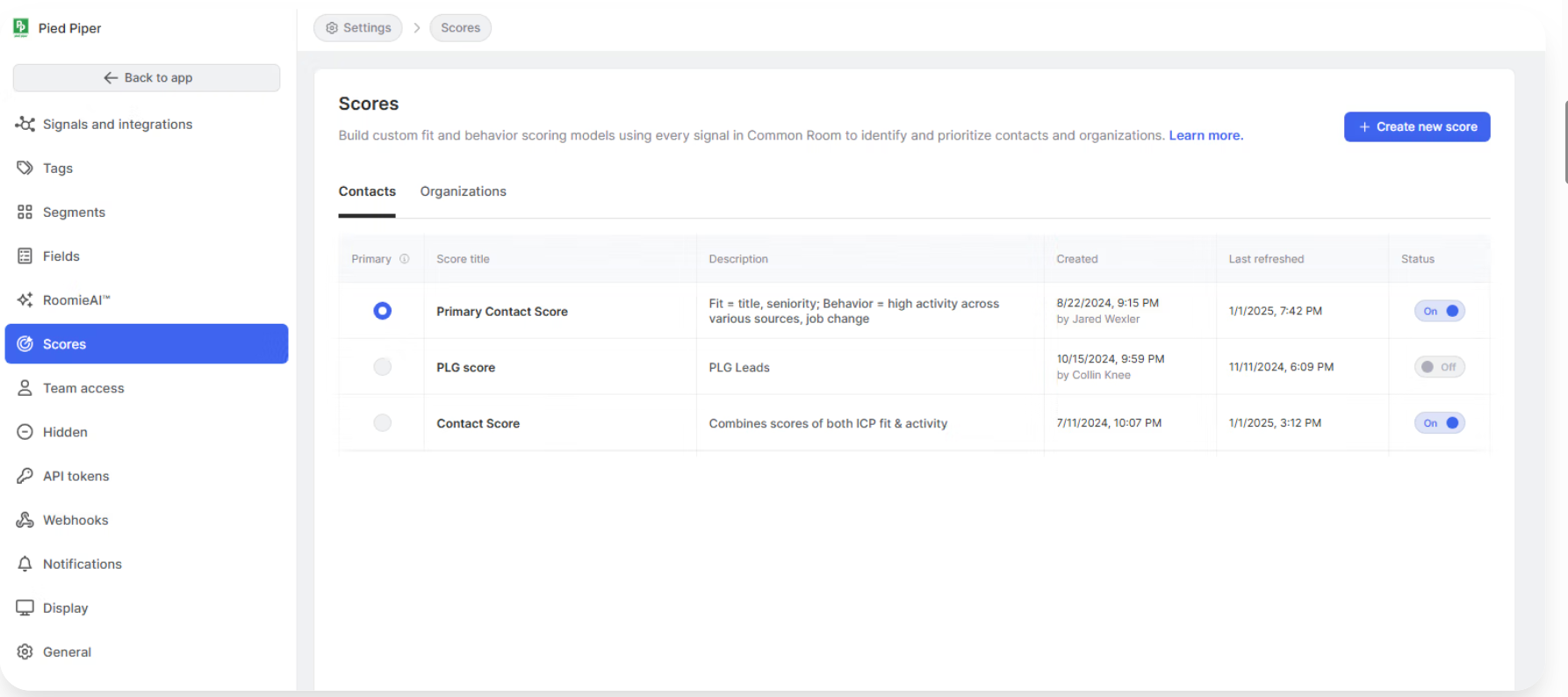

Contact and Account Scoring (AI-Powered)

AI ranks the most engaged people/accounts; scoring is highly configurable.

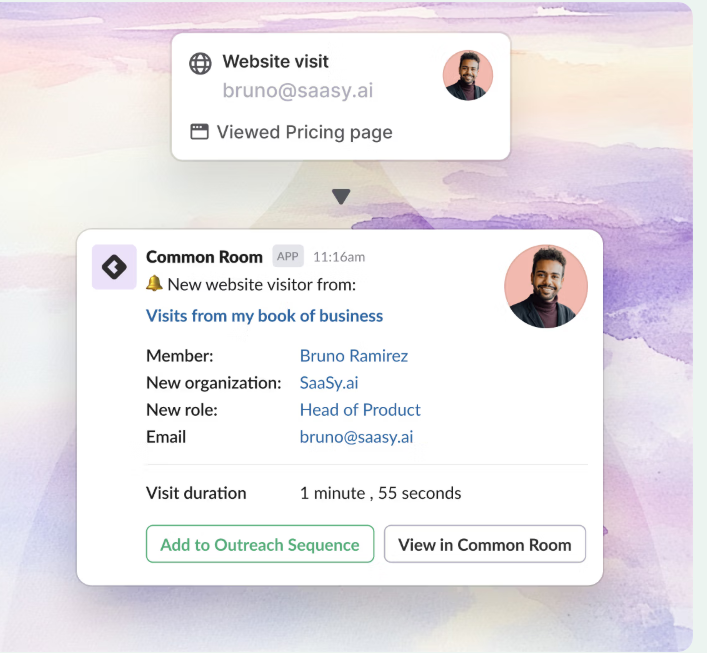

Workflow Automation & Alerts

Create alerting: VP from a target account joins Slack → ping owner; engagement jumps → open a task.

Integrations and Enrichment

Enrich profiles with title/LinkedIn, push hot contacts to Outreach, and blend in product events (Segment/warehouse).

Analytics and Reporting

Track community growth, account engagement, and pipeline impact (for community, not ads). See which motions correlate with closes and where to double down.

Pros

Built for community-/product-led growth. If you’ve got inbound energy, it surfaces the most engaged accounts and people. Instead of hunting across Twitter/Slack/GitHub, you get one view (fully customizable). It gives you an early-funnel edge that ad-centric tools miss.

Cons

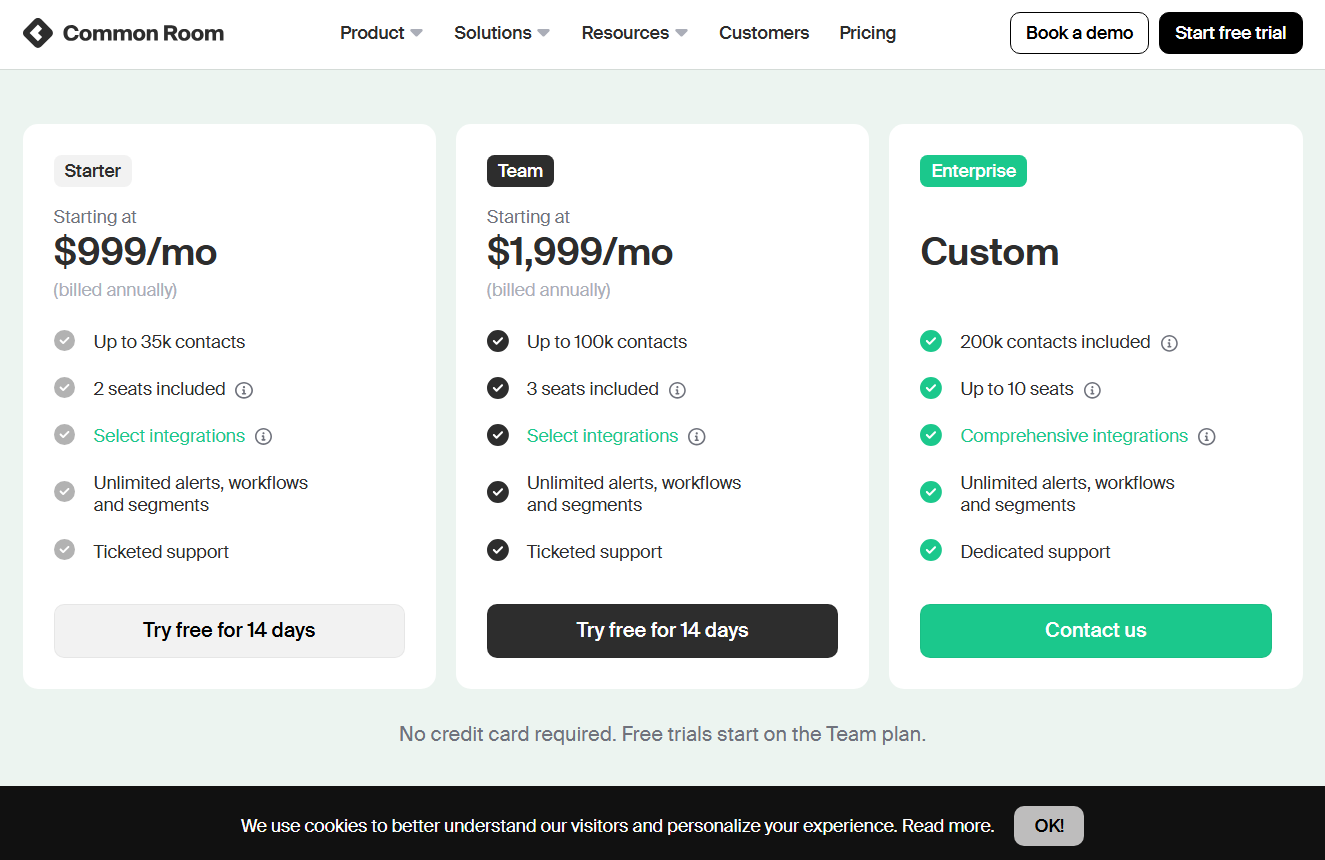

Not a traditional ABM suite: no full ad management, anonymous web tracking, or multi-touch revenue attribution. Most teams pair it with an ads/MA platform. Without a lively community, ROI is limited. Pricing starts ~$1K/mo and can reach tens of thousands; AI outreach can be hit-or-miss; setup/scoring has a learning curve.

Ideal Use Case

Common Room is perfect for companies with active communities like developer tools (GitHub/Stack), SaaS with Slack groups, or PLG with heavy user chatter. It lets ABM tap advocates and early signals; CS can track ongoing engagement. Pair with a LinkedIn-focused tool like ZenABM to see both organic and paid activity.

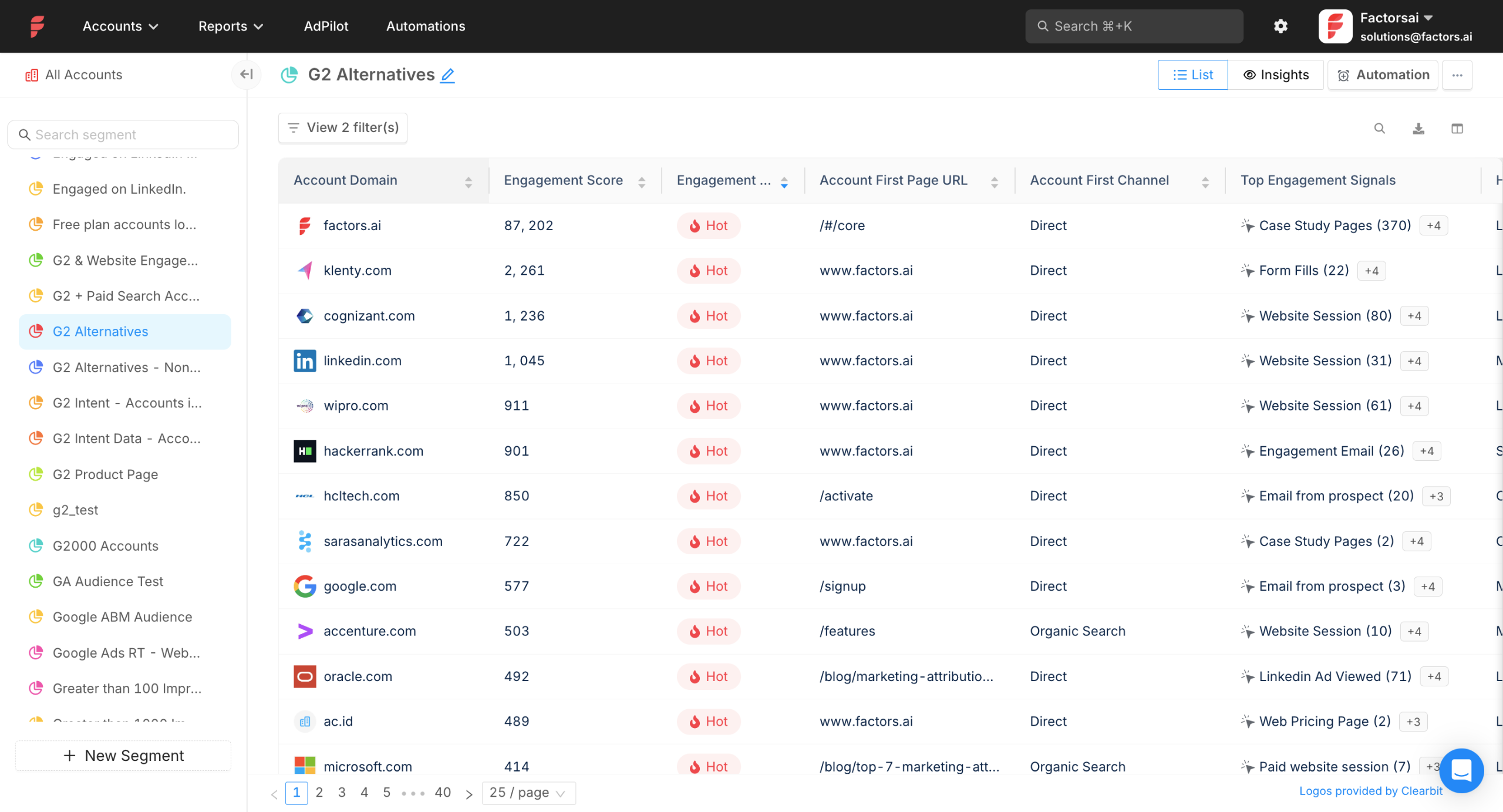

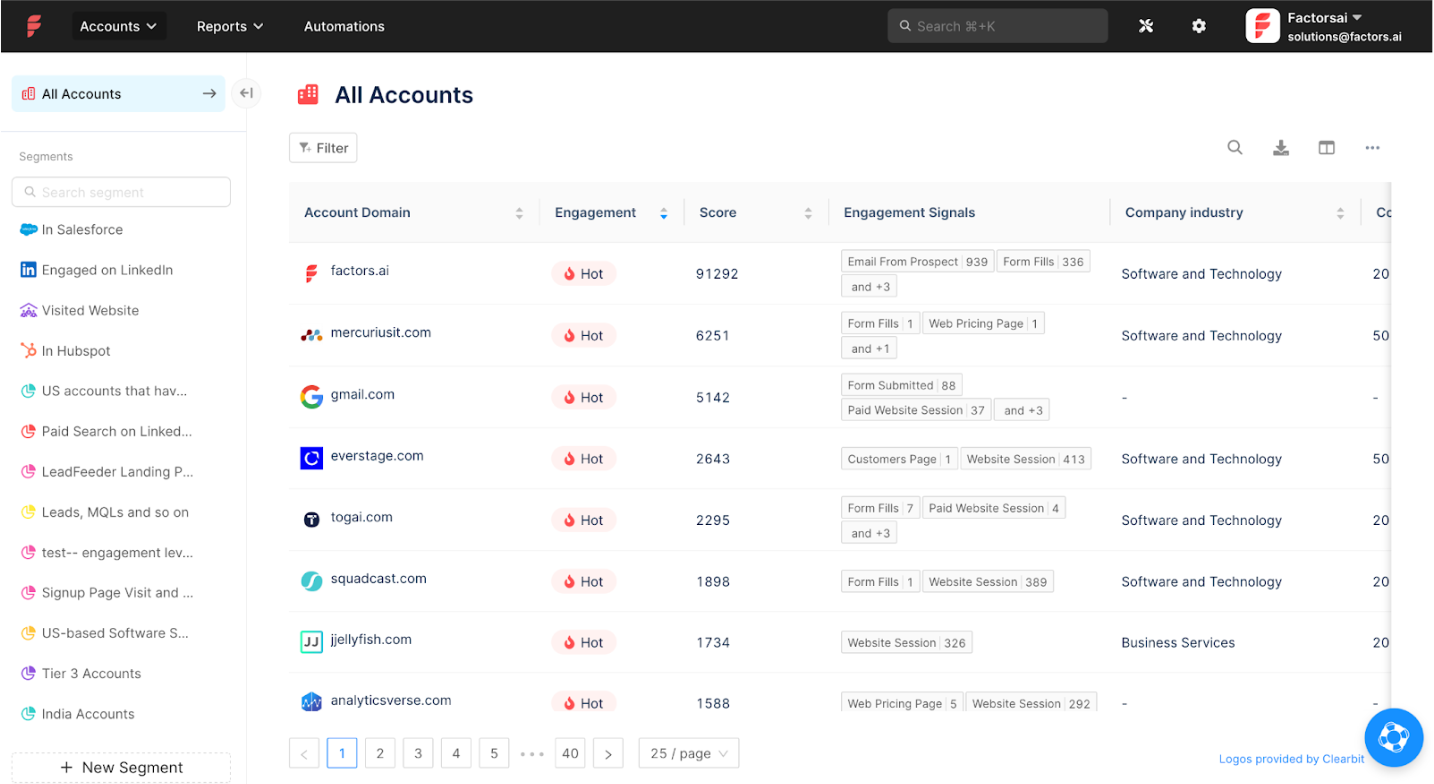

7. Factors.ai: Best for ABM Analytics & Attribution on a Flexible Budget

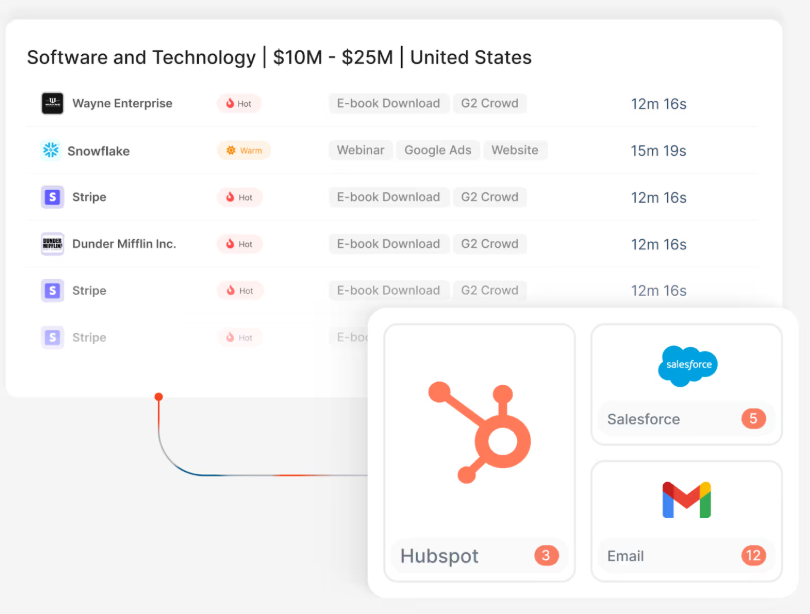

Factors.ai focuses on connecting ABM activities to revenue, answering which channels and campaigns moved target accounts.

Unlike monolithic suites, it’s modular and usage-based (easy to start, but scale costs need watching).

Core features of Factors.ai

Let me show you the core features of Factors.ai:

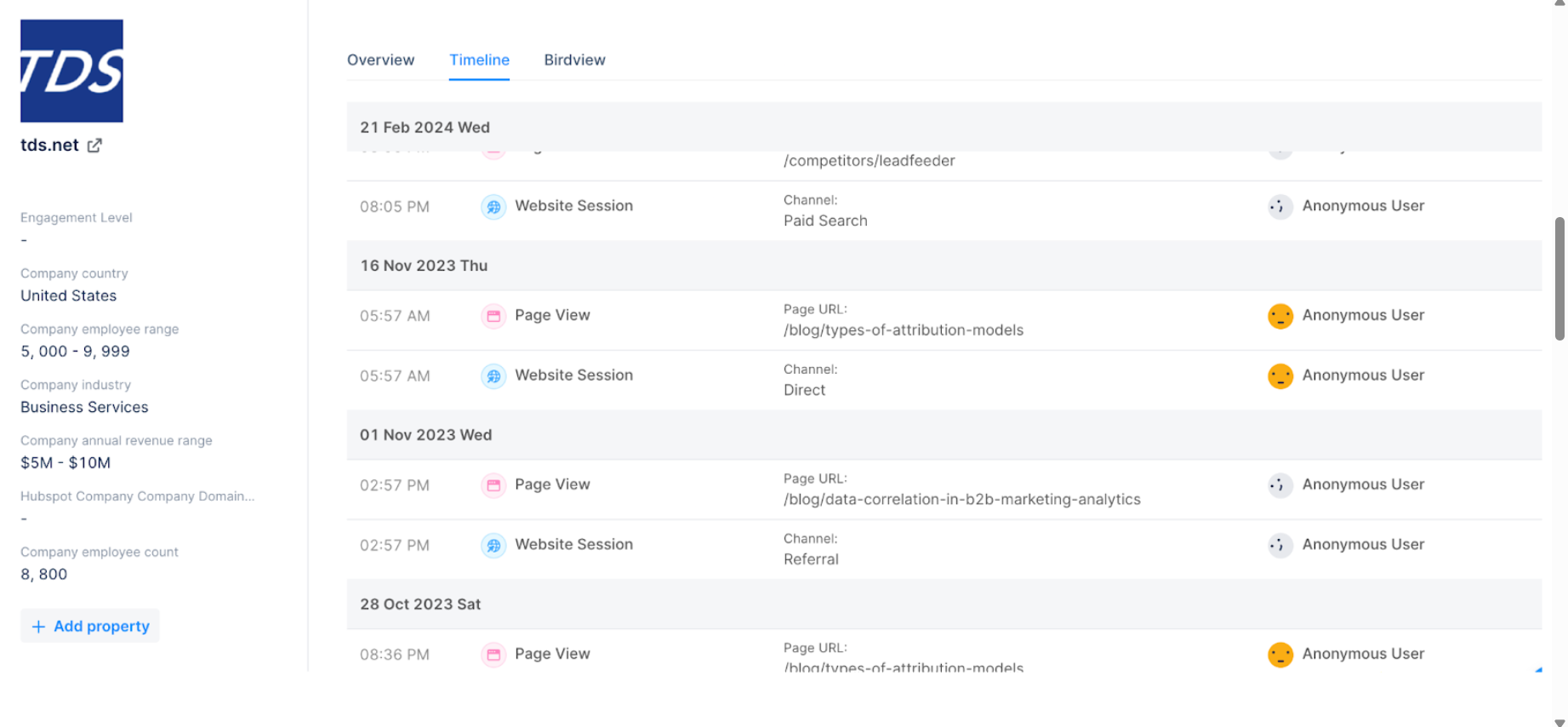

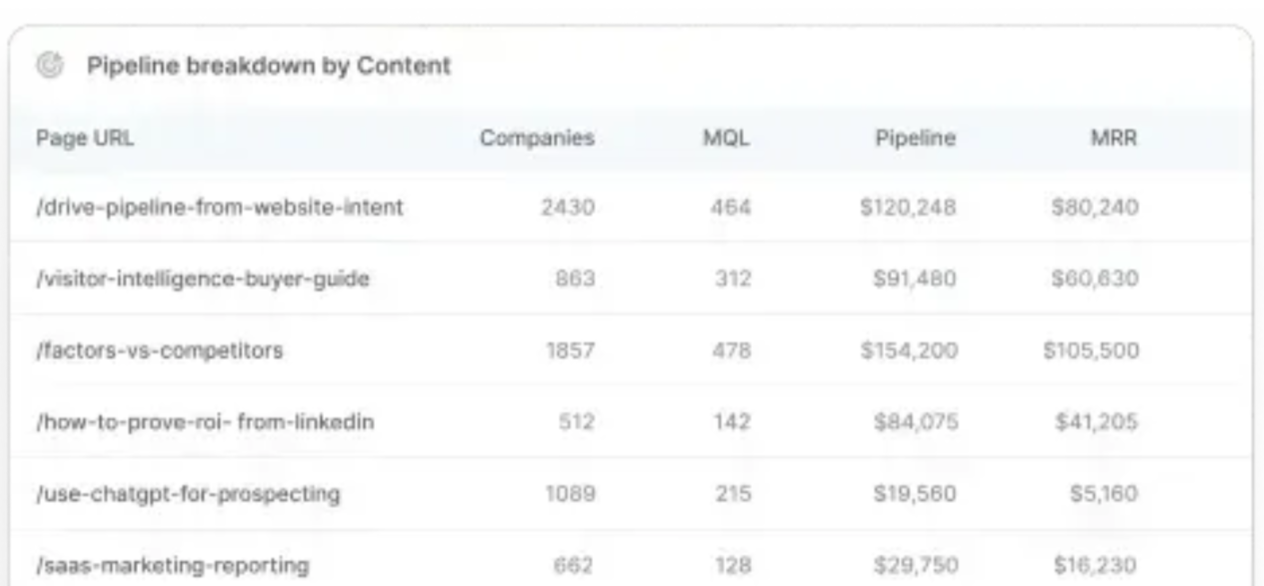

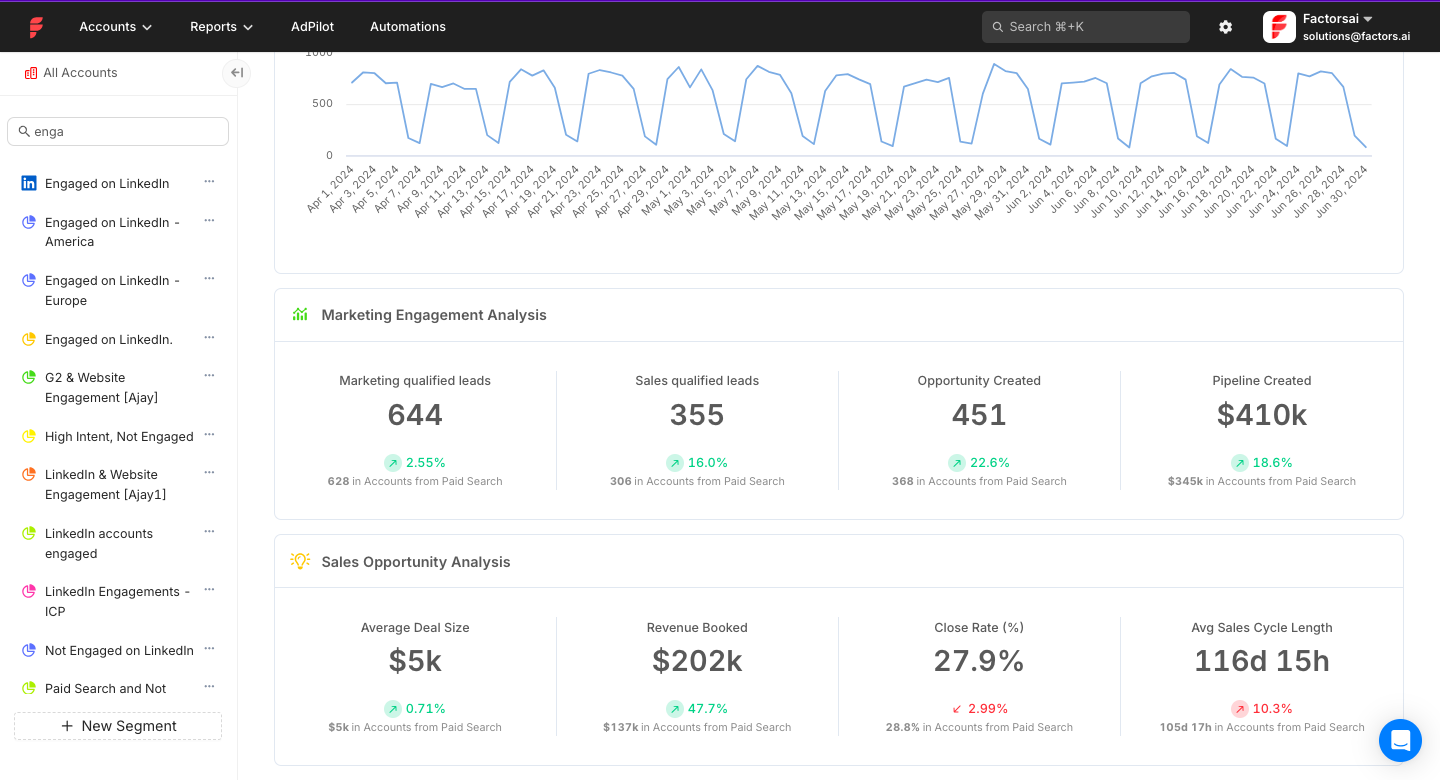

Account-Based Analytics Dashboards

Pre-built ABM reports: stage movement, touchpoint paths, and pipeline influence like multi-touch attribution without DIY BI.

Website Visitor Deanonymization and Content Attribution

Identify some visiting companies via IP matching scripts and tie content touches to account journeys.

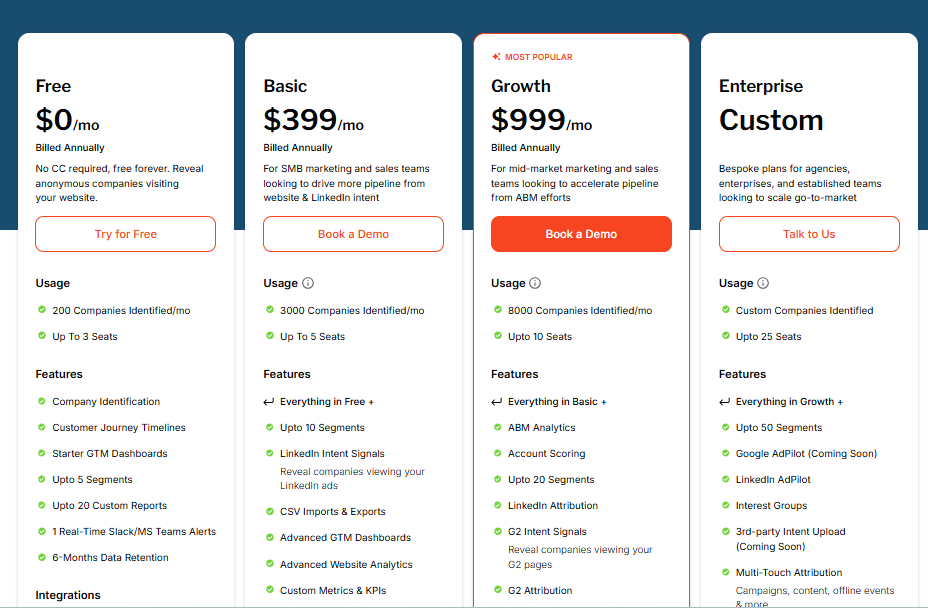

Usage-Based Pricing Model

Transparent pricing: free tier (200 identified companies/3 users), then Basic ($399/mo ~3,000 companies/5 users) and Growth ($999/mo ~8,000/10 users).

Great for starting small but overages (extra accounts/users/segments/reports) can stack quickly if traffic or team size spikes.

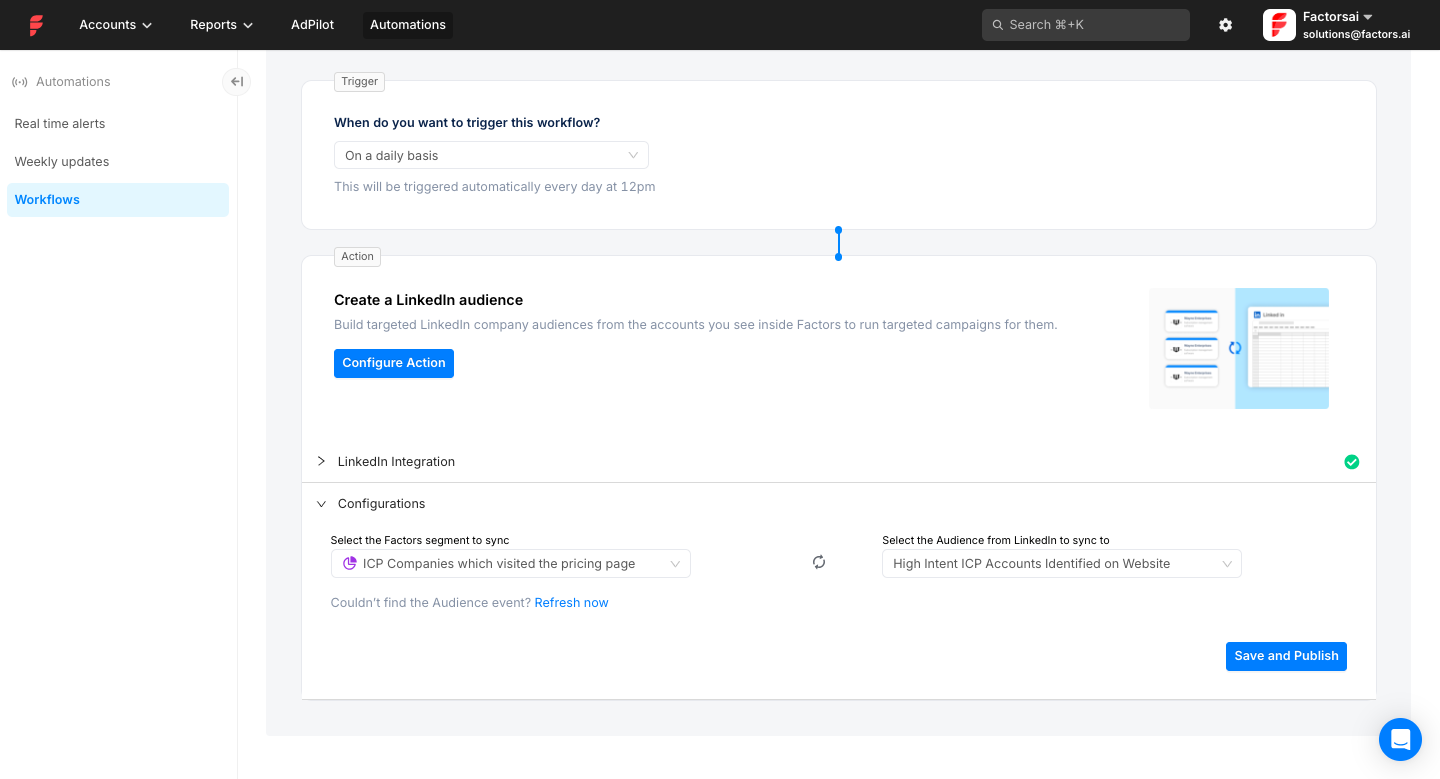

LinkedIn Ads and Intent Integration

“Interest Groups” (intent segmentation) and “LinkedIn AdPilot” add ABM power but at a premium (+$750/mo and +$1,000/mo, respectively).

CRM and Marketing Automation Sync

Pulls deals from CRM (HubSpot/Salesforce) and ad/analytics data to connect impressions/visits with pipeline.

Pros

Analytics-first ABM without ripping and replacing your stack. Keep LinkedIn + your CRM; layer Factors.ai for insight. Clear entry pricing (e.g., $399/mo) and a free trial help teams get started fast.

Cons

Usage pricing can balloon as you scale. IP match rates (~42%) mean paying for lots of “unknowns.” Add-ons (intent/AdPilot) hike cost, sometimes rivaling big suites, yet execution still lives elsewhere. It’s primarily analytics, so you’ll need other tools to run campaigns.

Ideal Use Case

Factors.ai suits teams with an ABM process already in place who want better insights and attribution without buying a full suite. Ops and analytics leaders can use it to prove ABM ROI, startups can test and learn before upgrading, and finance teams can stick to base plans for predictable costs. But if you plan to scale fast, a fixed-cost ABM platform may be the smarter long-term bet.

Conclusion

Don’t pick the biggest logo. Pick the tool that matches your stage, channels, and budget.

For LinkedIn-first ABM, ZenABM is the obvious winner. For enterprise scale, Demandbase or 6sense. If community’s your growth engine, Common Room.

Buy for your real GTM motion, not a deck.

That’s how you win ABM.

Anyways, you can try ZenABM for free now or book a demo here.

![7 Best ABM Tools for LinkedIn Advertising [2025]](https://zenabm.com/wp-content/uploads/2025/08/7-Best-ABM-Tools-for-LinkedIn-Advertising-2025-1024x536.jpg)