I was lurking on LinkedIn as usual when I found Ishaan (Founder at SpearGrowth) talking about how their enterprise account-based marketing (ABM) ads strategy pitch won them a client with the average deal size of $80K (pretty big fish in the hook, I must say).

And as soon as I read that ZenABM was part of the strategy they pitched, I jumped into his DM and demanded to know the whole strategy that he shared in the pitch.

He complied 🙂

The client SpearGrowth pitched their strategy to and won, is a Europe-based fintech selling into the US, UK, and LATAM, and their Average deal size sits around 80,000 USD.

And while enterprise marketing is already a grind, this company added a few extra headwinds.

SpearGrowth built a clear strategy to tackle all these problems the company was facing and pitched it to them. Yes, I’m getting straight to it now – I’ll discuss it in a challenge and solution format.

Problem: The company grew through a sales-first motion, so it never needed dedicated landing pages. That was a blocker now, since effective ads and SEO both rely on focused, high-converting pages.

Solution: SpearGrowth, in their strategy pitch, suggested beginning with keyword research for organic and paid. They also mentioned adding their proprietary tool, Chosenly.com, to gauge market footprint and pinpoint the assets required to surface in LLM-influenced searches. With that insight, they planned to spend the first 1 to 2 months partnering with the client’s team to build conversion-optimized landing pages mapped to the right search intent and ad intent.

Problem: In typical search advertising, businesses chase clear category keywords like “HR software.” This client’s product does not sit inside any established category, so conventional keyword targeting was a poor fit.

Solution: SpearGrowth planned to aim at neighboring industries with the same problems and build campaigns around pain alignment instead of competitor terms, since true direct rivals were basically absent.

Problem: The client’s product was unorthodox, so the target audience didn’t have preset expectations. Even if someone found the solution relevant, they won’t convert in the same session; it would take conversations. Standard attribution models, being used by the client then couldn’t capture such a journey.

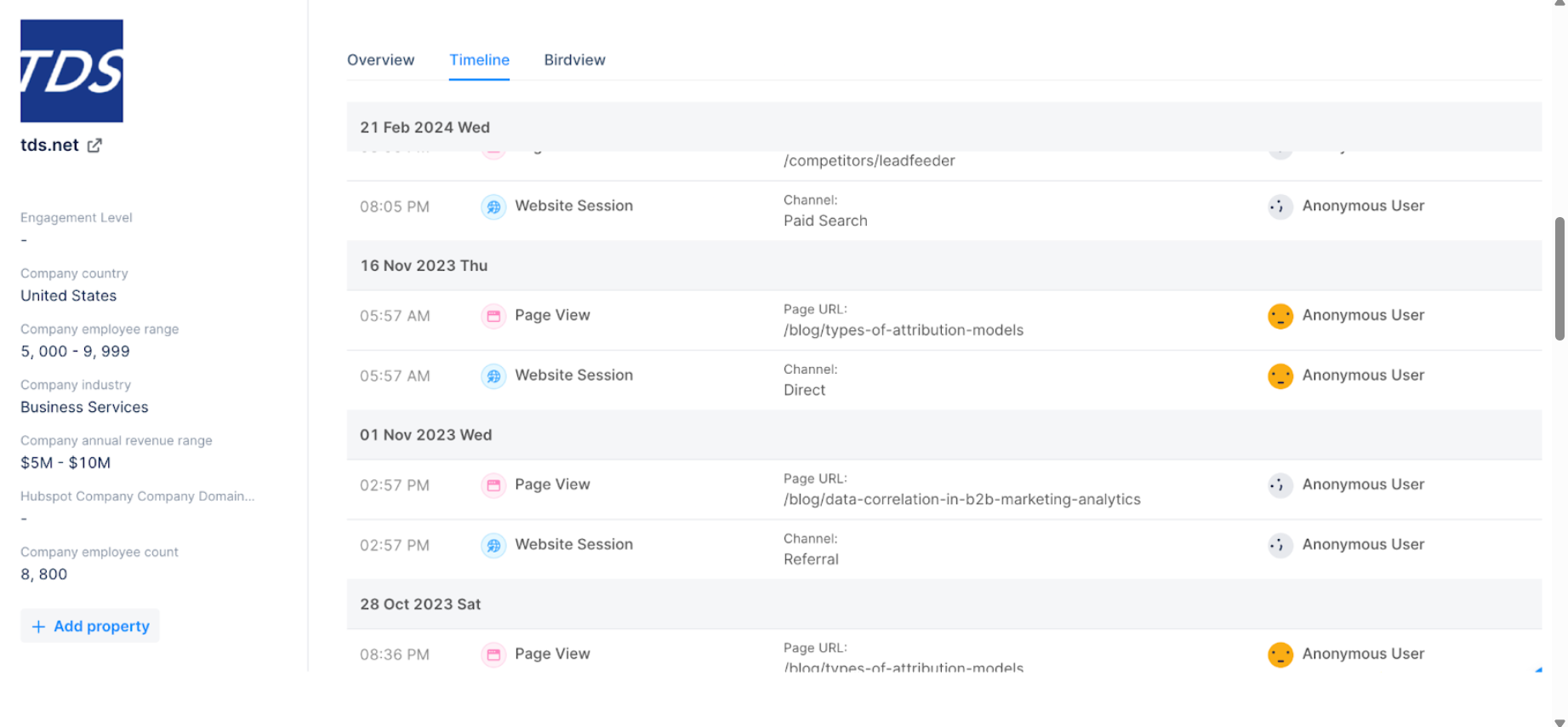

Solution: SpearGrowth value search intent as one of the best forms of intent. So, they planned to deanonymize website visitors at the company level with tools like Factors.ai and RB2B. Once identified, they intended to pass the company data to sales, who can then follow up and nurture appropriately.

Problem: LinkedIn’s native platform only gives surface-level attribution. You get job title and company data for up to 90 days, and even that’s often incomplete. For a high-ticket, multi-touch sale, that’s not enough. It’s hard to know who’s engaging, what content they’re engaging with and run accurate retargeting.

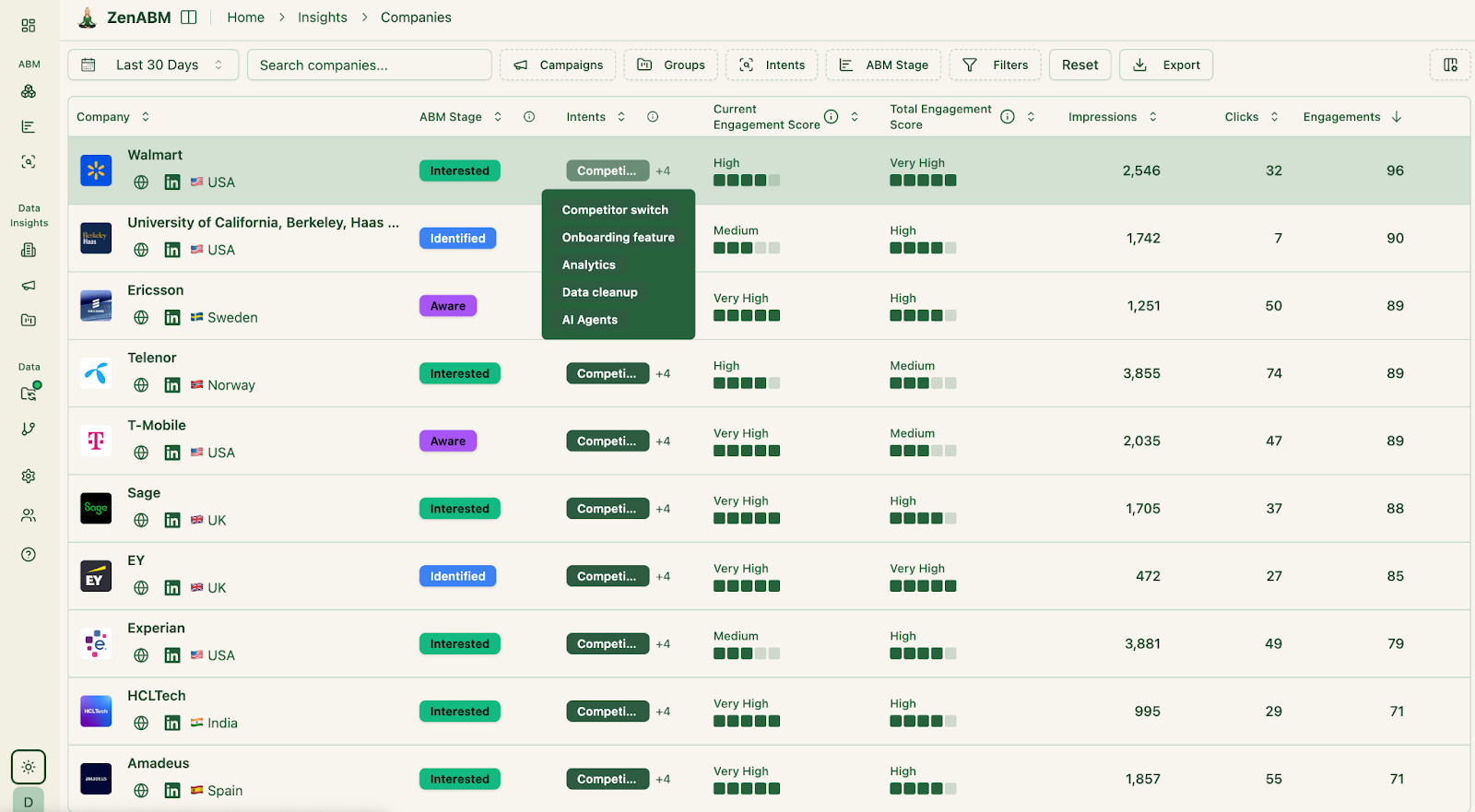

Solution: Here’ where ZenABM comes into the picture. SpearGrowth uses it to track engagement signals at the company level, mapped to the specific messaging/problem being addressed in the ads. This can help them see which specific problem a company is responding to, not just that a click happened.

SpearGrowth suggested they would apply this for the client and also that they would push that context to the client’s sales team, so outreach starts warm with a clear record of what the prospect viewed, what they engaged with, and the right angle for the first conversation. This, too, is simplified by ZenABM – it pushes intent as a company property to the CRM:

Problem: In typical accounts, ZenABM’s company-level engagement is enough to activate 3 to 7 stakeholders. For this client, the buying group can exceed 50 people across regions based on the deals they have had historically, which makes company-level signals too broad to act on.

Solution: SpearGrowth pitched that they would utilize ZenABM’s capability to report company-level LinkedIn ad engagement for each specific campaign by splitting campaigns by role and region (Yes, LinkedIn lets you target specific job-roles, etc.). So, when an account shows engagement for certain campaigns, it will also reveal the job titles from their specific regions in that account that are engaged. Then, as soon as an account would cross the engagement threshold, they will hand sales a clear view of which job titles are active and from which locations, so follow-ups are precise and relevant.

![]()

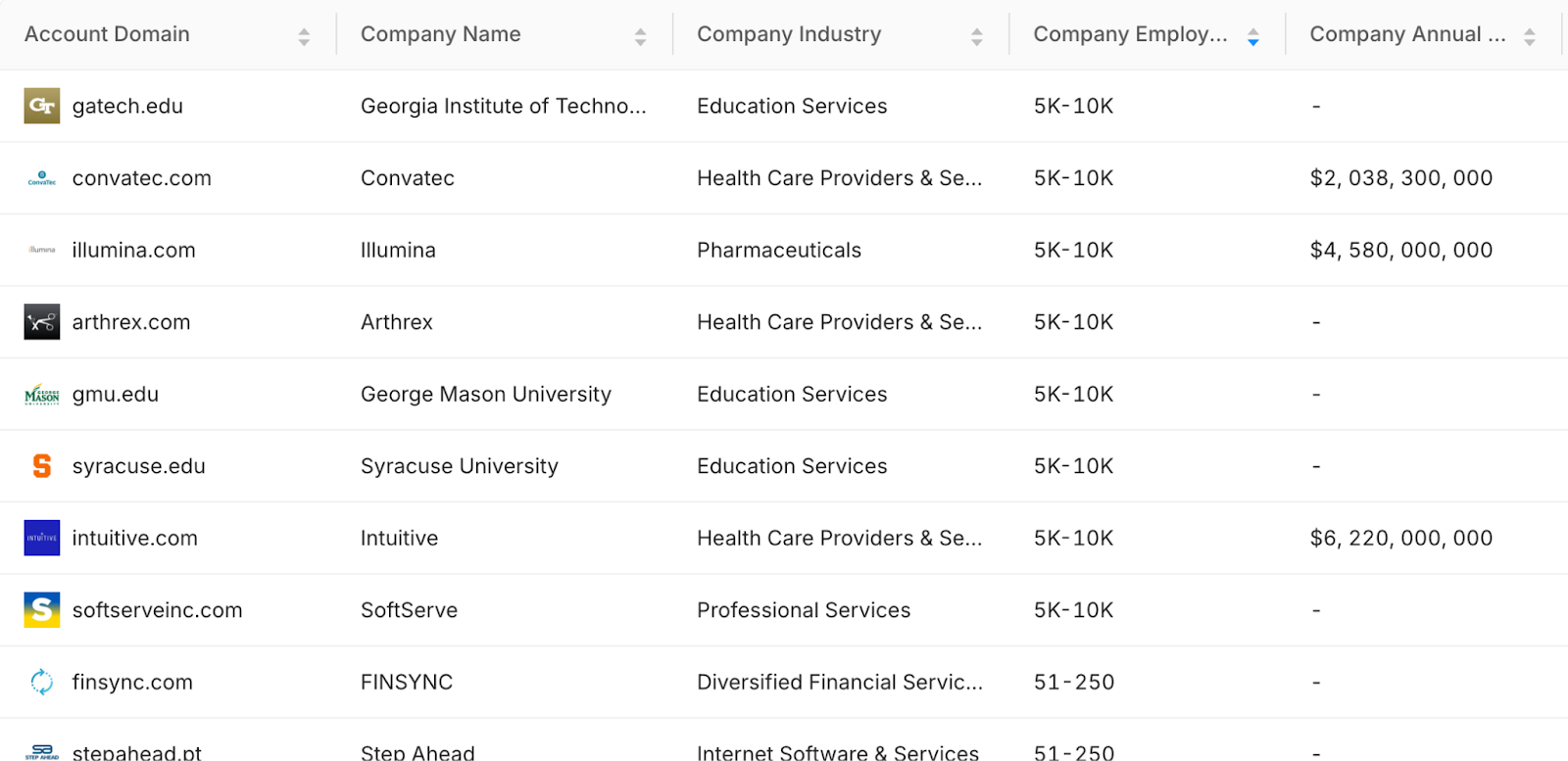

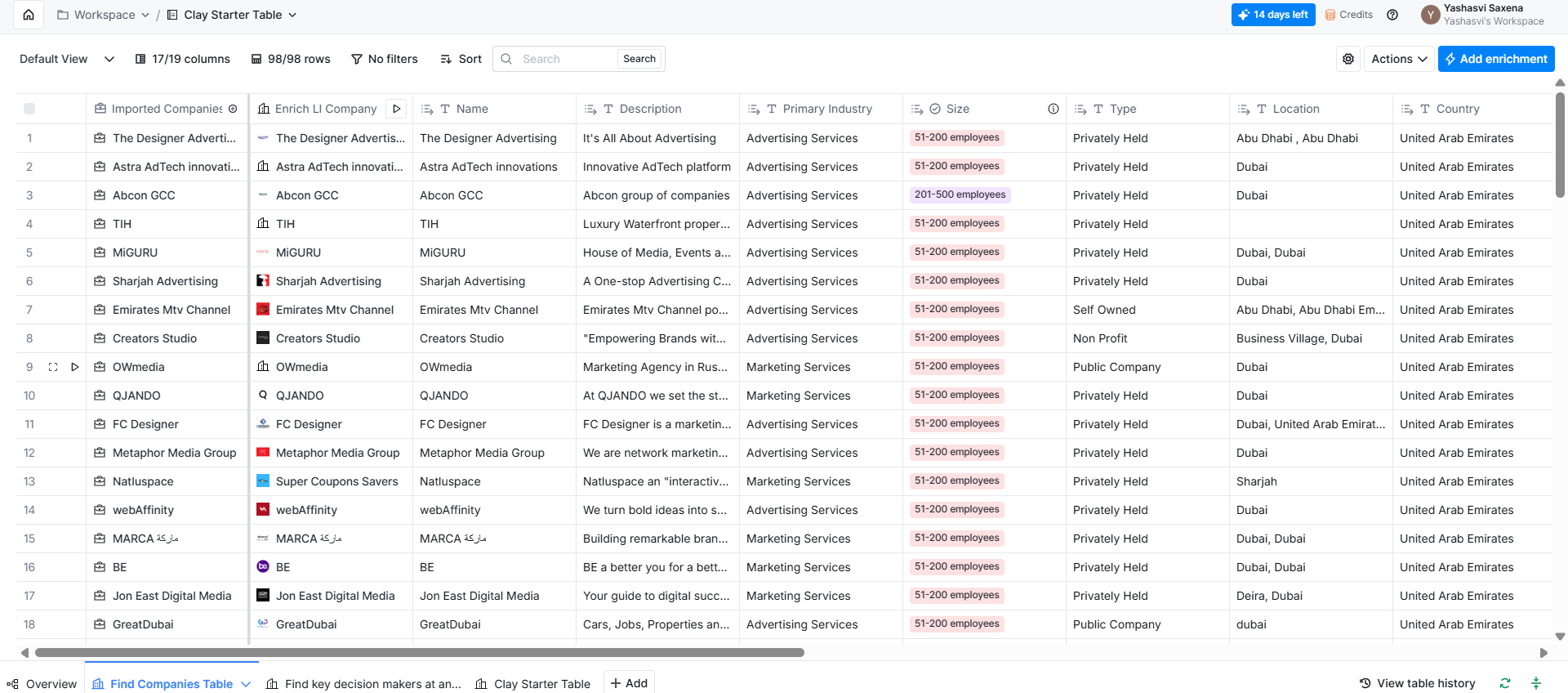

Problem: During their pitch, they discovered that the client had a list of 4,000+ companies but lacked filters to segment it into actionable subsets.

Solution: SpearGrowth said they will use Clay to crawl company websites, enrich the data, and filter accounts based on on-site content. That enables sharper segmentation than leaning only on LinkedIn Sales Navigator, Apollo, or Crunchbase.

Here’s the tech stack of the strategy they pitched and won the client with:

Tracks company-level LinkedIn ad engagement for each campaign and campaign group:

And pushes these quantitative intent metrics as company properties into the CRM:

Connects engagement back to the exact problem theme or message inside each campaign:

And pushes that qualitative intent also into the CRM as a company property:

Instead of a generic “this company clicked,” you see what they clicked and which narrative landed. That lets you segment by interest and sync precise context to sales.

De-anonymizes website visits from Google Ads and other sources. You can see which companies hit priority pages even without a form fill, then convert those visits into actionable sales signals.

Internal analyzer for how companies appear inside LLMs like ChatGPT and Gemini. Guides content and landing page plans by revealing gaps in the current digital footprint.

Enriches and filters very large account lists using real website content, not just basic firmographics. Produces tighter segments than broad filters, such as industry or headcount.

Other tools in the stack: Apollo, Crunchbase, LinkedIn Sales Navigator, Google Ads, and LinkedIn Campaign Manager.

Enterprise ABM is messy, but this case shows it can be made predictable.

SpearGrowth solved missing foundations, category ambiguity, attribution blind spots, and massive buying committees by pairing smart strategy with the right tools.

ZenABM anchored the stack by turning anonymous ad engagement into company-level intent synced to the CRM, while Factors.ai, Chosenly, and Clay handled attribution, footprint analysis, and segmentation.

Want to know how ZenABM can help your GTM workflow?