©2026 ZenABM - All Rights Reserved.

Recotap presents itself as a LinkedIn-first ABM platform for B2B teams that want to identify, engage and convert high-value accounts with more precision.

Madison Logic, on the other hand, is an enterprise ABM platform that helps you reach named accounts across several paid channels from one place.

In this guide, I compare Recotap vs. Madison Logic on features, pricing and ABM fit so marketing and sales teams can quickly see which platform lines up with their motion.

I also cover how ZenABM can work as a lean LinkedIn first alternative or sit beside them as a lighter ABM analytics layer.

In case you’re short on time, here is the snapshot:

Recotap presents itself as a LinkedIn first ABM platform for B2B teams that want to identify, engage and convert high-value accounts with more precision.

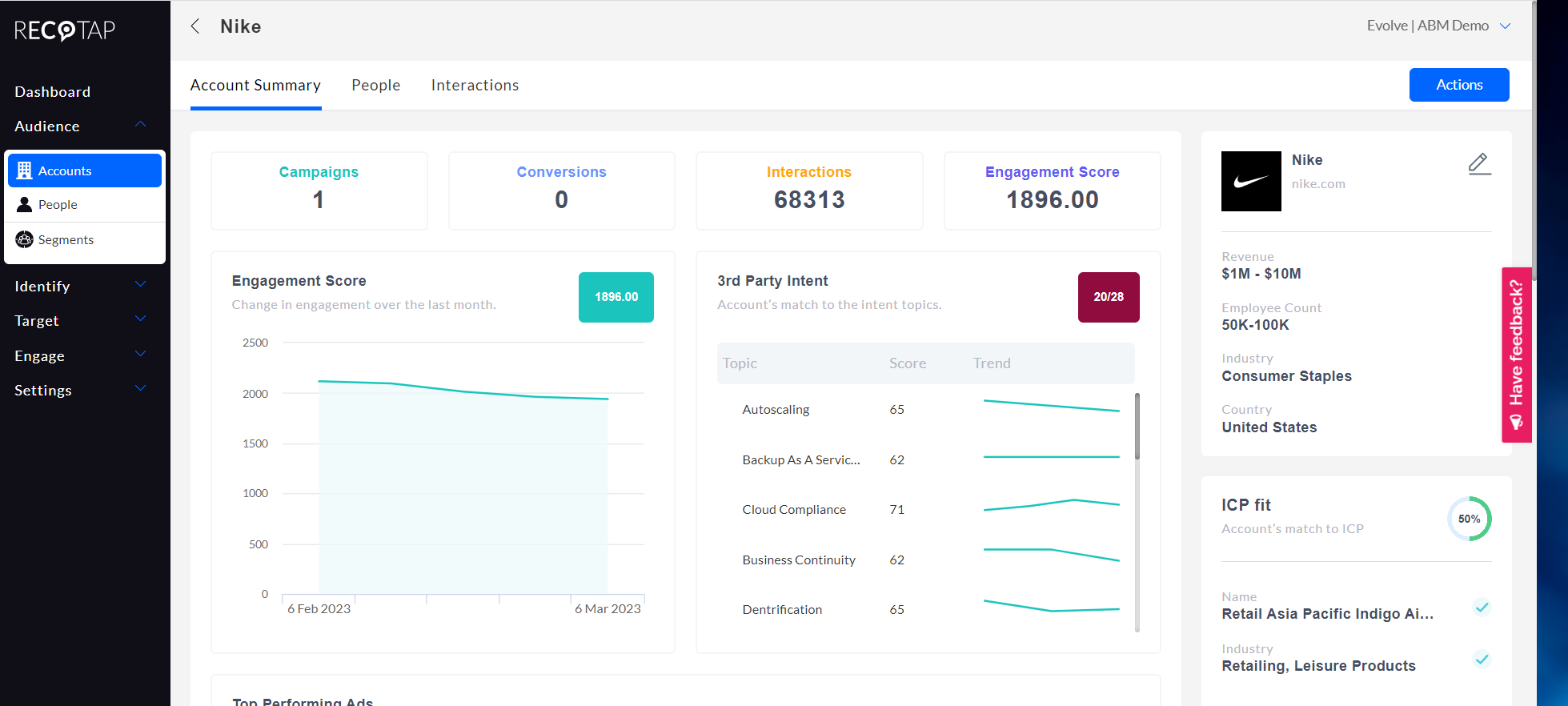

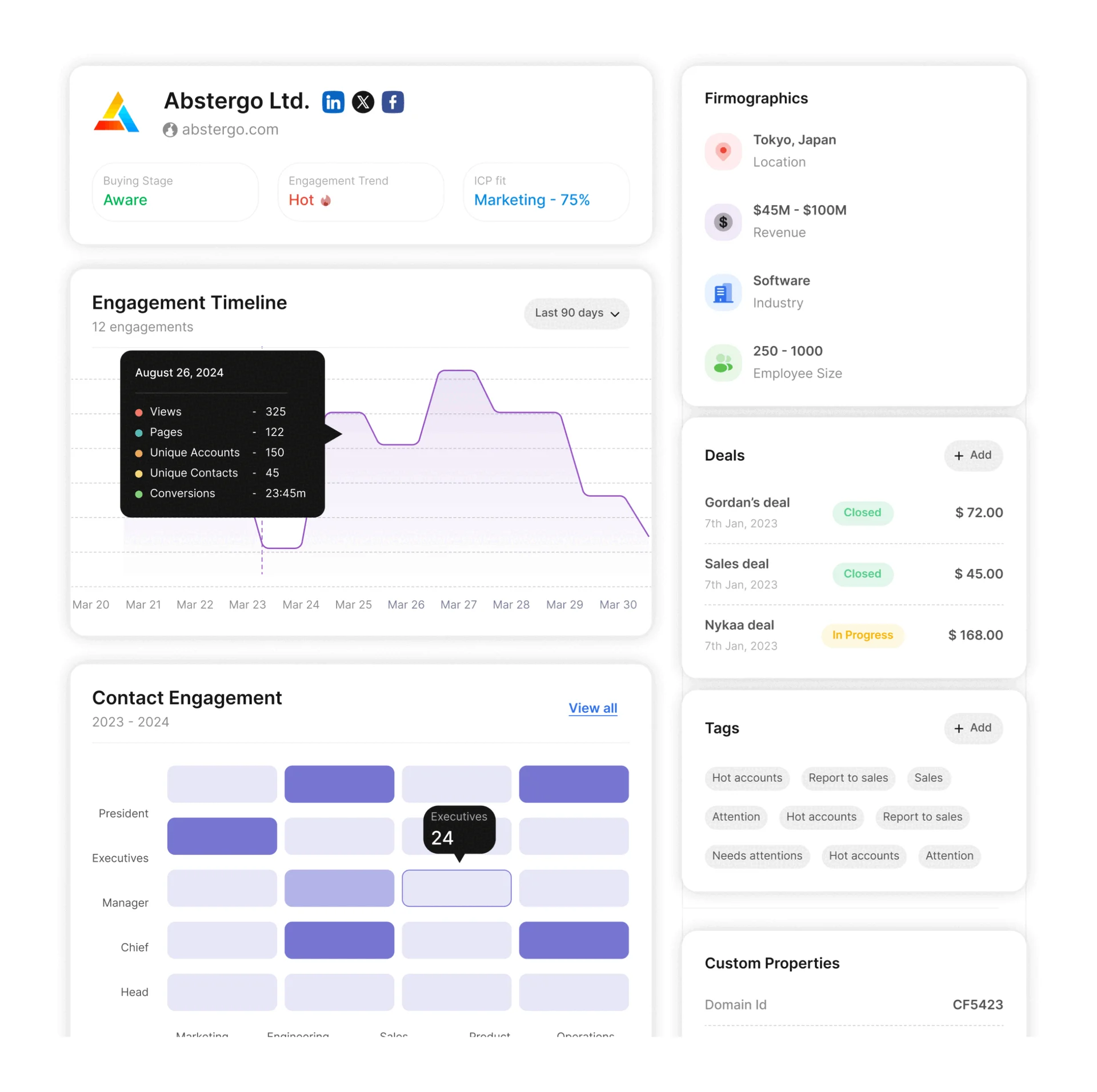

Recotap is an all-in-one ABM system that covers data, advertising, web experience and analytics.

Recotap pulls data from your CRM, marketing automation, website and third party intent providers into a single account view.

In practice, it joins signals like site visits, ad clicks, external intent (Bombora, G2, TrustRadius) and CRM data so you can segment and score accounts by fit and activity.

The aim is to understand where each account is in its buying journey and point campaigns at those that match timing and fit.

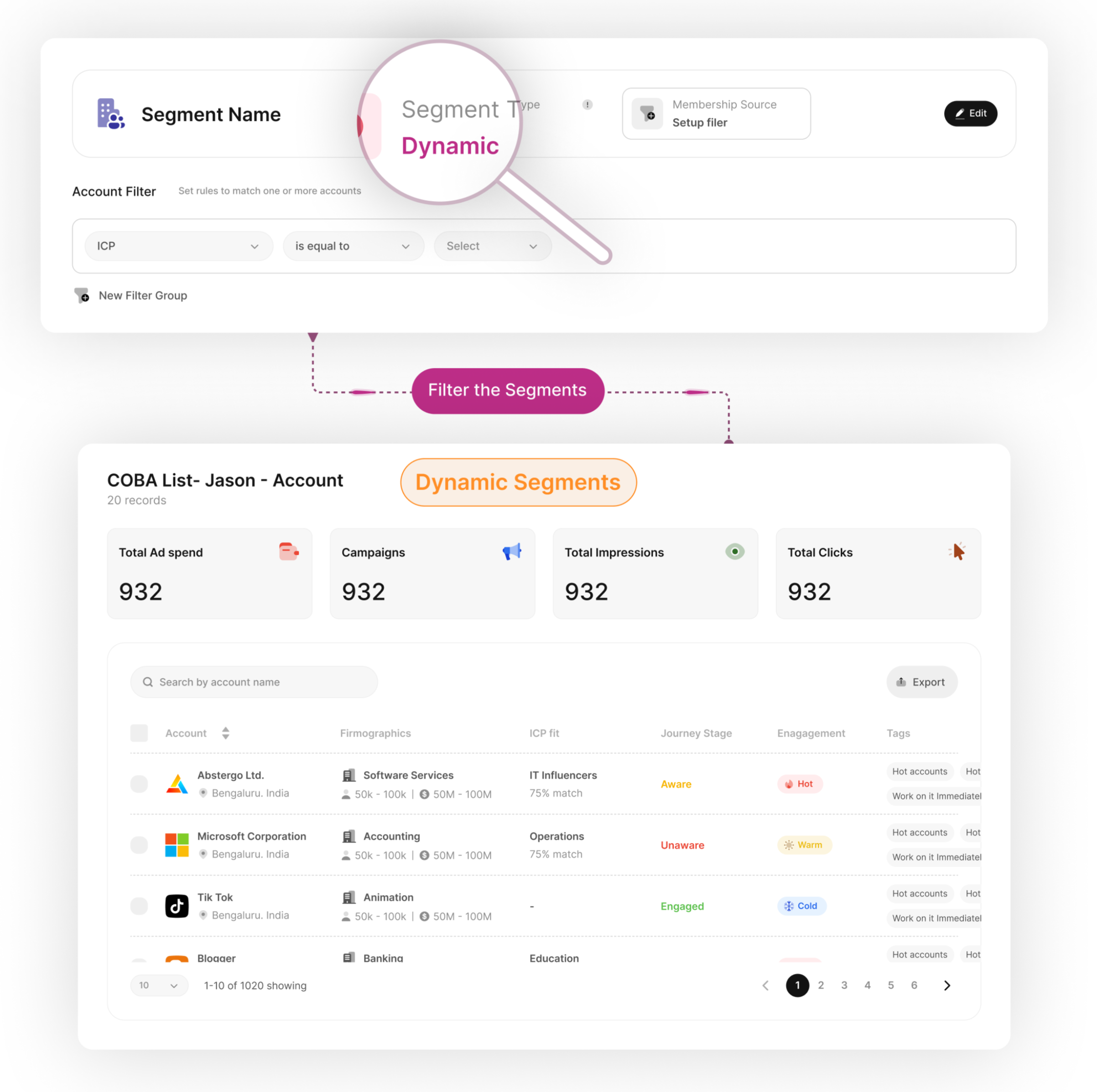

Recotap leans on dynamic segments and AI scoring. You define segments using firmographics, engagement, ICP fit and intent level, and the system keeps these lists refreshed automatically as data changes.

This cuts down manual work on target account lists. Recotap’s AI can also estimate journey stages so you know if an account is early research, actively engaged or close to sales.

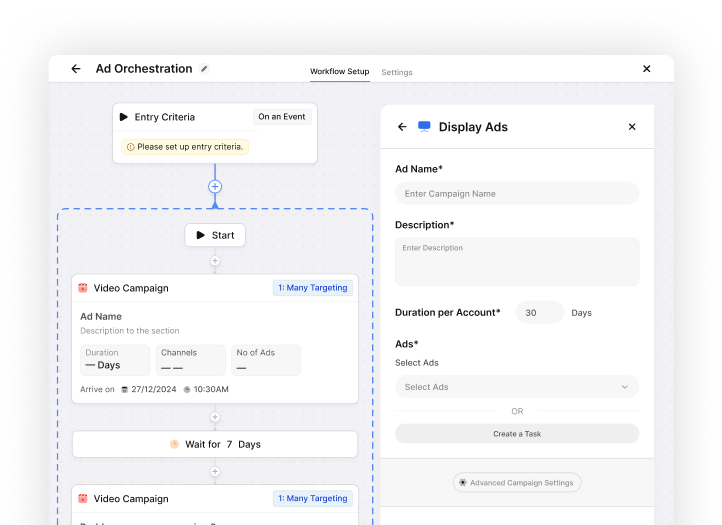

As an official LinkedIn Marketing Partner, Recotap is built for advanced LinkedIn Ads management.

It supports account based LinkedIn campaigns and helps marketers roll out highly tailored LinkedIn ads for dozens or hundreds of accounts at once.

Recotap extends personalization to your website. You can set up 1:1 landing page experiences for target accounts without heavy engineering, putting it closer to web personalization modules in tools like Terminus or Demandbase.

Recotap integrates with major CRM and marketing automation platforms so sales and marketing can work from shared data.

Salesforce and HubSpot CRM are supported with bi-directional sync for accounts, contacts and deals, alongside Marketo and Pardot for marketing automation.

It also connects to sales tools like Outreach and Salesloft, plus Slack and Microsoft Teams, so BDRs get alerts when a target account crosses a threshold.

Recotap includes AI-powered analytics and revenue attribution dashboards.

Its Revenue Impact view links campaigns to pipeline and revenue so you can see which programs drive closed deals and how account journeys progress from first touch to conversion.

Recotap automates repetitive ABM tasks so lean teams can still run complex programs.

It tracks intent spikes, refreshes segments and triggers outreach when an account hits a hot score. One G2 reviewer notes that Recotap’s UX is built to simplify ABM without sacrificing outcomes.

Recotap’s main differentiator is how it merges and interprets intent data to run smarter ABM campaigns.

Its ABM Signal Hub blends first-party engagement data from CRM, website and marketing tools with third-party intent from G2, TrustRadius and Bombora, removing data silos and giving a more complete view of each account.

The intent scoring engine aggregates these signals, ranks accounts by readiness and pushes hot ones into campaigns or sales queues. Because sync is real-time, Recotap can trigger LinkedIn ad sequences as soon as an account shows buying behavior.

The upside is precise targeting with less manual monitoring, though the flexibility introduces some complexity. Reviewers say that once configured, intent orchestration feels close to what you get in tools like 6sense or Demandbase.

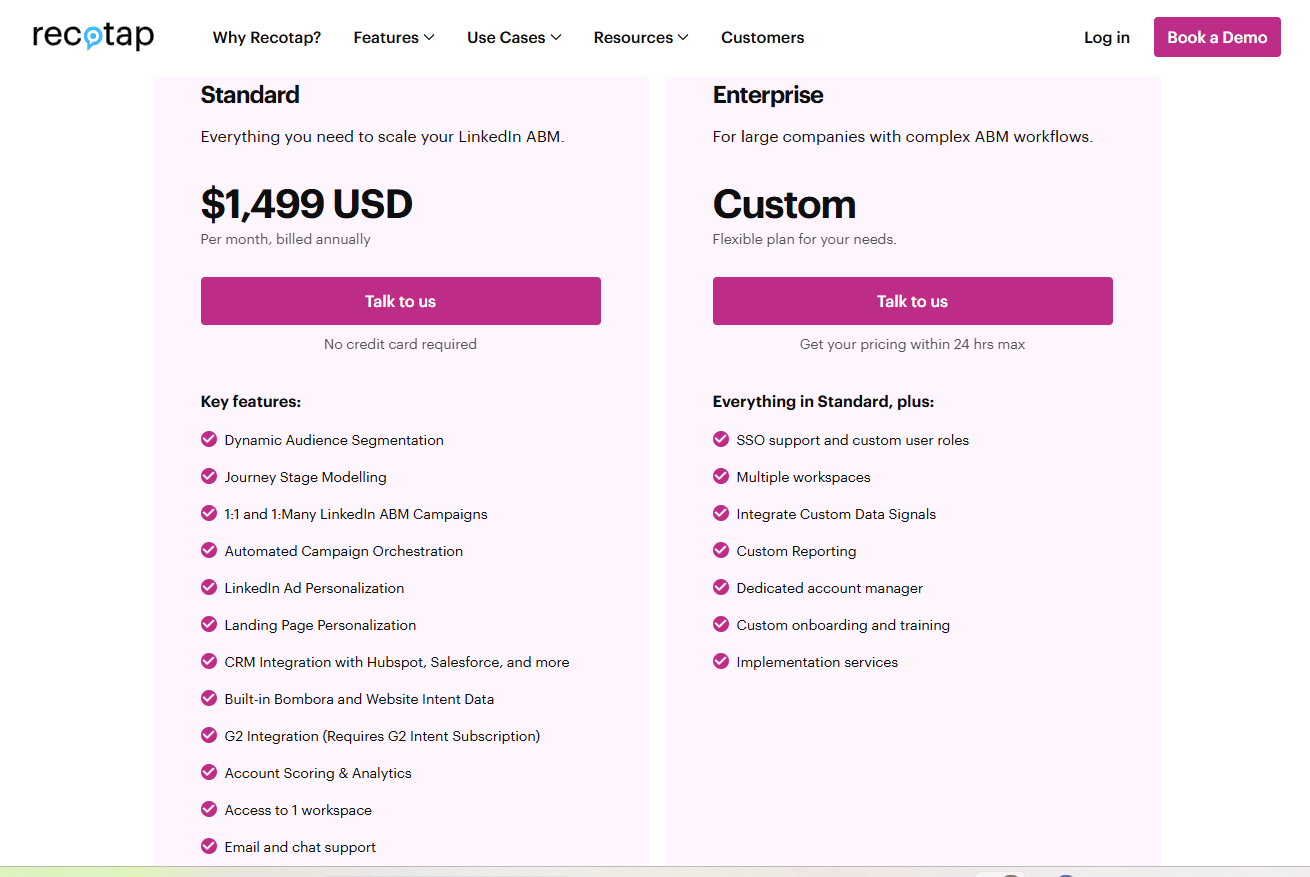

Recotap publishes pricing on its site, which makes budgeting easier.

Given that Recotap’s entry plan already comes in above $10K per year, ZenABM stands out as a more budget-friendly option, starting at ~$59/month for the Starter plan, with the top tier still under $6K per year.

ZenABM still covers core LinkedIn ABM needs such as account-level ad engagement tracking, account scoring, ABM stage tracking, routing hot accounts to BDRs, bi-directional CRM sync, custom webhooks, qualitative company intent and plug and play ROI dashboards.

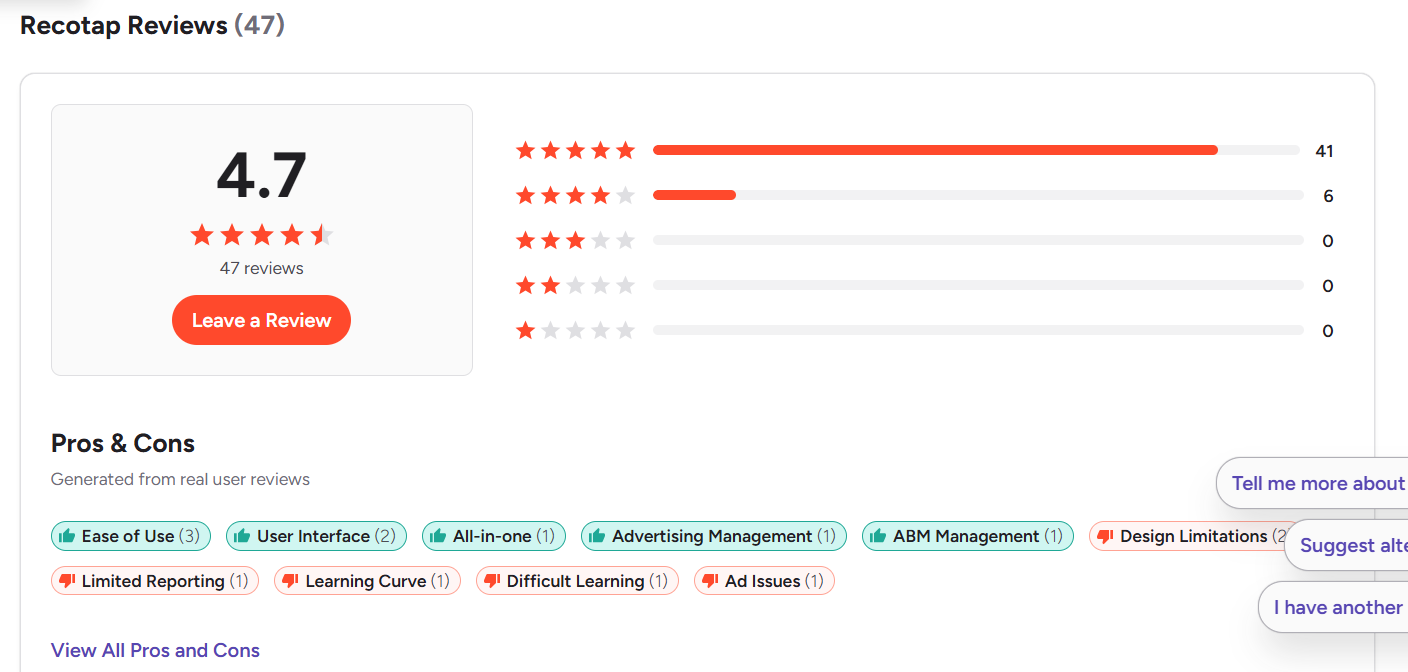

Recotap holds a 4.7 out of 5 rating on G2 from 47 reviews.

Most reviewers are based in Asia, which hints that Recotap’s GTM motion is currently APAC heavy.

Users often praise:

Common issues include:

TrustRadius and other review platforms are still relatively quiet on Recotap.

Madison Logic is an enterprise ABM platform that helps you reach named accounts across several paid channels from one place.

Here is a condensed look at what it does, what it costs and how users see it.

The Activate ABM platform combines content syndication, ads and intent data in a single system.

Madison Logic coordinates content syndication, display, LinkedIn ads, CTV and digital audio in one platform.

You can reach target accounts through whitepapers, webinars, LinkedIn Sponsored Posts and streaming TV or audio placements.

Madison Logic claims a large B2B intent graph built over many years and a broad set of accounts and contacts.

These signals feed ML Insights, which scores and prioritizes in market accounts so you know who to focus on.

Madison Logic can syndicate your content through its publisher network to generate MQLs from target accounts.

The vendor highlights tight filters, although some marketers view syndication as opaque and inconsistent on lead quality, with one Redditor calling it “a blind network with no way of filtering out of spec leads.”

Madison Logic runs programmatic display and LinkedIn campaigns against your account list.

As a LinkedIn Marketing Partner, it syncs segments into Campaign Manager and includes LinkedIn as part of multi channel sequences.

The goal is sustained exposure across display, social and other channels, even though display networks still struggle with bots and banner blindness.

For teams with creative capacity and budget, Madison Logic can also activate CTV and digital audio campaigns as part of an ABM mix.

ML Measurement and the ML Intent Dashboard connect engagement to pipeline and revenue. The Intent Dashboard centralizes intent, engagement and benchmarks, then surfaces hot accounts and recommended next steps, with views for stage movement and cross channel performance.

Madison Logic built its edge on deep intent data.

Its data arm later became Bombora, and the platform still blends first party engagement with Bombora Company Surge plus firmographic and technographic data inside the ML Data Cloud.

Targeting uses firmographics and job attributes, so you can reach the right roles and regions via syndication, display and LinkedIn.

Third party keyword surge intent can skew toward curiosity rather than purchase intent, and some G2 reviews point out a strong top of funnel tilt.

Pro Tip: Third party surge data can be noisy and expensive. ZenABM instead focuses on first party qualitative intent by tracking how companies interact with each LinkedIn ad you run. You tag campaigns by theme, and ZenABM groups accounts by what they actually click, giving sales and marketing clearer signals.

Madison Logic connects to major CRM, MAP and sales tools, which suits complex B2B stacks, although setup and upkeep can require ops effort.

| Platform | Integration Details | User Notes |

|---|---|---|

| Salesforce (CRM) | Embeds account insights and engagement data and connects campaigns to the pipeline. | “The integration with Salesforce is everything when it comes to our reporting.” |

| HubSpot, Marketo, Pardot (MAP) | Pushes leads and engagement data into nurture flows that sync with CRM. | Some users mention early setup friction and occasional manual CSV fallback. |

| LinkedIn Marketing Solutions | Exports account segments into Campaign Manager for activation. | Reported to streamline activation and reduce launch time. |

| Gong | Feeds intent-backed insights into call prep and follow-ups. | Used to personalize conversations with AI-supported cues. |

| Convertr | Enriches leads in real time with intent scores and topics. | Helps route qualified leads faster into the right workflows. |

| Adobe Experience Platform | Feeds intent data into Adobe tools such as Journey Optimizer. | Supports full funnel personalization for enterprise programs. |

Madison Logic does not share list pricing publicly, so most buyers will see custom enterprise quotes.

Public benchmarks suggest:

User feedback reflects strong capabilities along with predictable tradeoffs.

Pros:

Cons:

The key differences between Recotap and Madison Logic are summarized here.

| Aspect | Recotap | Madison Logic | Best suited for |

|---|---|---|---|

| Core positioning | LinkedIn first ABM platform covering data, ads, website personalization and analytics | Enterprise ABM platform combining syndication, multi-channel ads and intent | Teams choosing a LinkedIn and web-centric suite vs a broad enterprise ABM environment |

| Data foundation | ABM Signal Hub unifies CRM, MAP, website, and intent feeds into one account view | ML Data Cloud uses a long-running intent graph, Bombora-style surges and firmographics | Stacks needing unified first party plus selected third party intent vs large intent catalogs |

| Intent model | Blends first party engagement with G2, TrustRadius and Bombora, then scores and stages accounts | Relies on extensive third-party intent and surge topics to rank in market accounts via ML Insights | Teams wanting balanced first and third-party intent vs orgs leaning heavily on surge data |

| Primary channel focus | Strong LinkedIn Ads orchestration and account-based website experience | Content syndication, display, LinkedIn, CTV and digital audio from one system | LinkedIn and web-centric ABM vs full-spread multi-channel programs |

| LinkedIn capabilities | 1 to 1 and 1 to many LinkedIn ABM with hyper-personalised ads and pages | LinkedIn runs as one channel inside larger orchestrated sequences | Teams needing deep LinkedIn personalization vs those treating LinkedIn as one of many channels |

| Website personalization | Built in 1 to 1 landing pages and website personalization for key accounts | Focus is more on paid distribution and content than on site personalization | Orgs that want tailored on-site journeys vs those focused on off-site reach |

| Content syndication | No native syndication network, leans on LinkedIn ads and owned web | Strong syndication through publisher network to source MQLs | Teams that do not depend on syndication vs programs built around syndicated leads |

| Automation and journeys | Dynamic segments, AI journey staging and smart automations for LinkedIn and sales plays | Multi-channel sequences driven by intent dashboards and ML Insights | Teams wanting journey-aware LinkedIn first automation vs full funnel enterprise flows |

| Analytics and attribution | Revenue Impact dashboards connect ABM campaigns to pipeline and revenue | ML Measurement and Intent dashboards show engagement, benchmarks and pipeline impact | Teams needing clear LinkedIn and web ROI views vs orgs needing broad multi-channel attribution |

| Integrations | Bi directional Salesforce and HubSpot sync, MAP and sales tools, Slack and Teams alerts | Integrates with Salesforce, major MAPs, LinkedIn, Gong, Convertr and Adobe | Stacks centered on LinkedIn plus core CRM and MAP vs large enterprise ecosystems |

| Pricing level | Standard around 1,499 USD per month on annual billing, Enterprise custom | Custom enterprise pricing, often thousands per month plus media | Mid-market teams with defined LinkedIn budgets vs enterprises with large paid ABM allocations |

| Complexity and learning curve | Has a learning curve but aims to simplify ABM once configured | Often described as powerful but complex with a steep learning curve | Teams wanting a focused LinkedIn ABM suite vs orgs prepared for heavy platform onboarding |

| ABM breadth | Covers data unification, LinkedIn orchestration, web personalization and analytics | Covers syndication, multi-channel ads, intent and enterprise-level ABM analytics | Companies choosing between a LinkedIn-led ABM stack and a broad enterprise ABM program |

If your ABM program lives mainly on LinkedIn and your website, Recotap is closer to what you need.

It unifies CRM and intent data into one account view, automates LinkedIn targeting and journeys and adds website personalization so ads and landing experiences stay aligned.

That gives lean teams enough power to run serious ABM without jumping straight into heavy enterprise software.

Madison Logic fits better when your strategy depends on scale and variety across channels.

It combines long-running intent data with content syndication, display, LinkedIn, CTV and audio, then shows how that mix feeds the pipeline.

This suits larger teams with bigger paid budgets and patience for syndication workflows, analytics setup and enterprise-level complexity.

If your main questions are “which companies saw our LinkedIn ads, who is heating up and how much pipeline those campaigns created,” both tools can feel heavier than needed.

If you primarily care about first-party accuracy on LinkedIn, account scoring, ABM stages, CRM sync and revenue attribution, a lighter platform is easier to roll out.

This is where ZenABM comes in.

Even for teams running heavy multi-channel ABM, ZenABM adds a focused LinkedIn analytics and intent layer.

ZenABM connects directly to the official LinkedIn Ads API and records account-level data per campaign.

You see which companies view and engage with your ads using first-party LinkedIn data instead of IP or cookie matching. A Syft study suggests IP identification often peaks near 42 percent accuracy, so ZenABM treats ad engagement as the stronger intent signal.

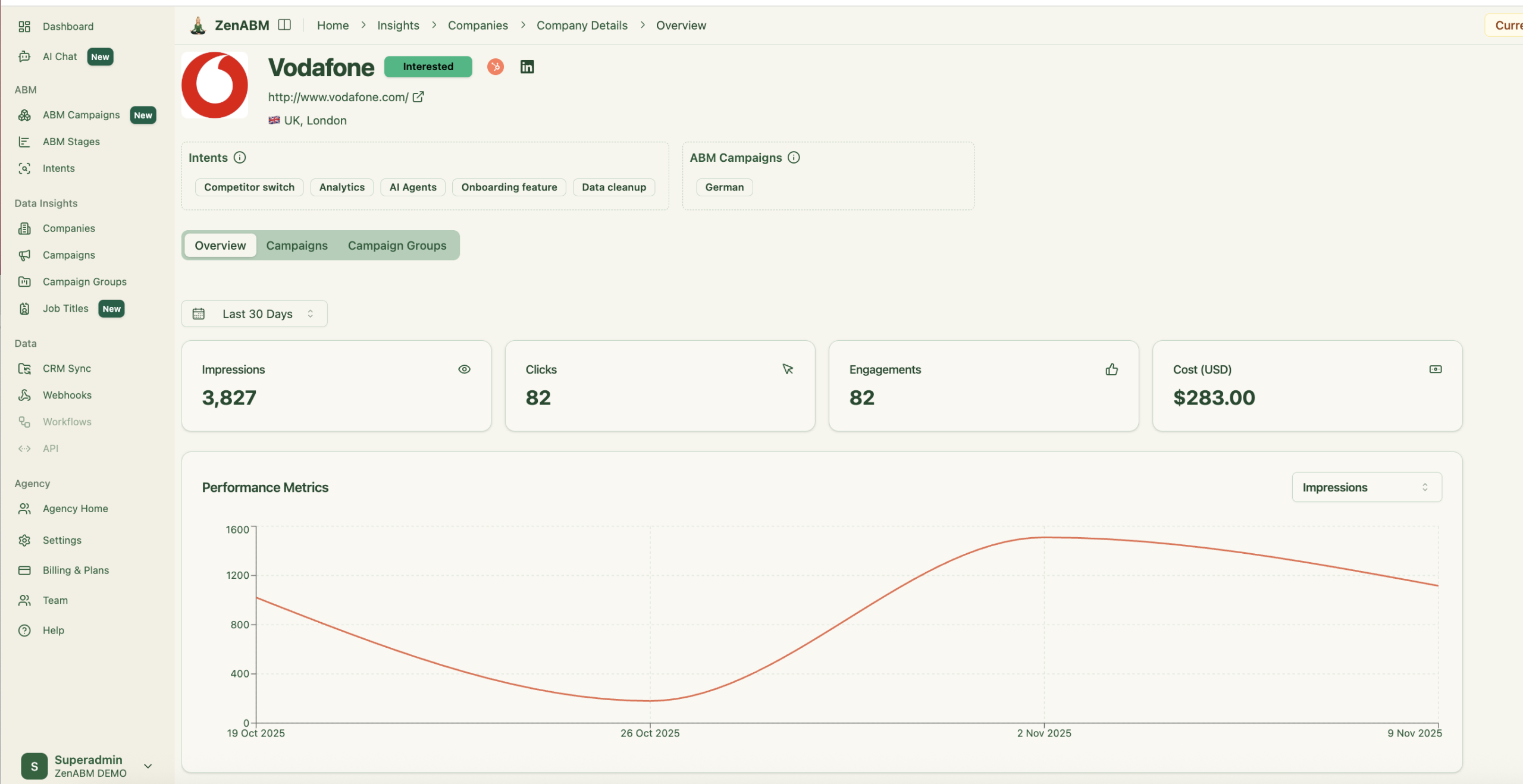

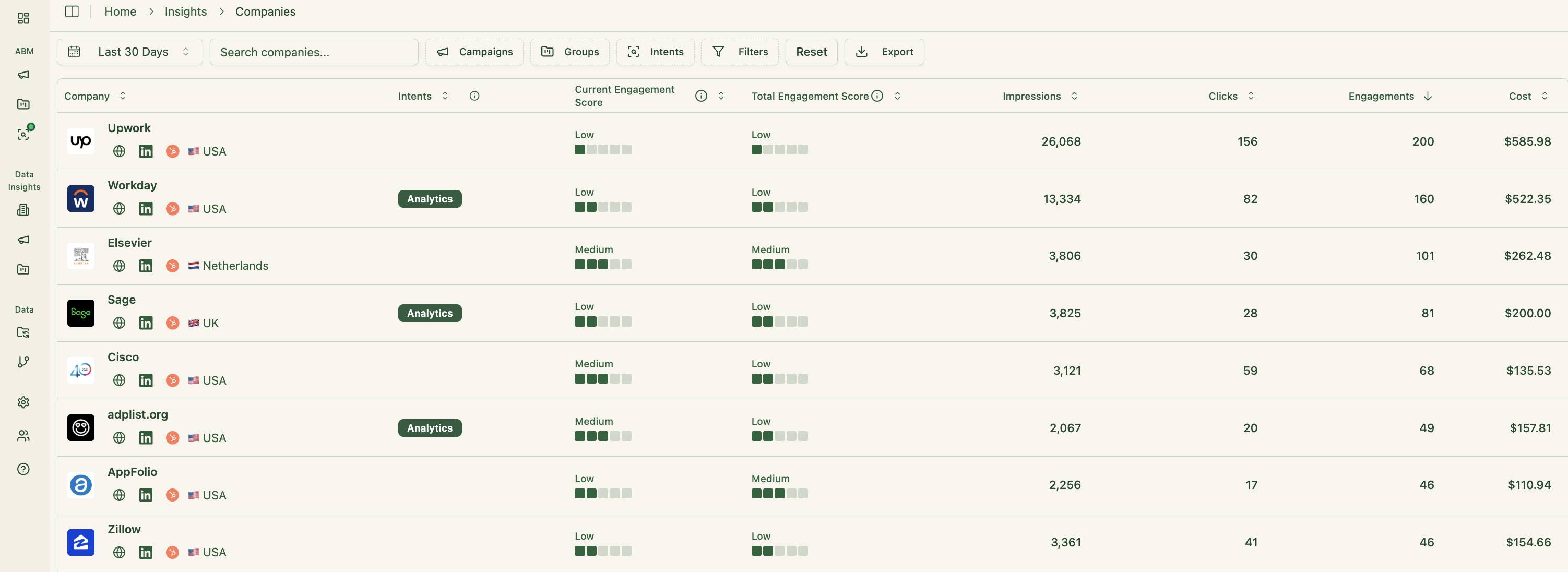

ZenABM updates engagement scores continuously as accounts interact with your ads. You get a full touchpoint history and can define stages such as Identified, Aware, Engaged, Interested and Opportunity.

ZenABM syncs bi-directionally with HubSpot and supports Salesforce on higher plans. All LinkedIn metrics can be written as company properties inside your CRM.

When an account crosses your scoring threshold, ZenABM can update its stage and auto assign a BDR for timely outreach.

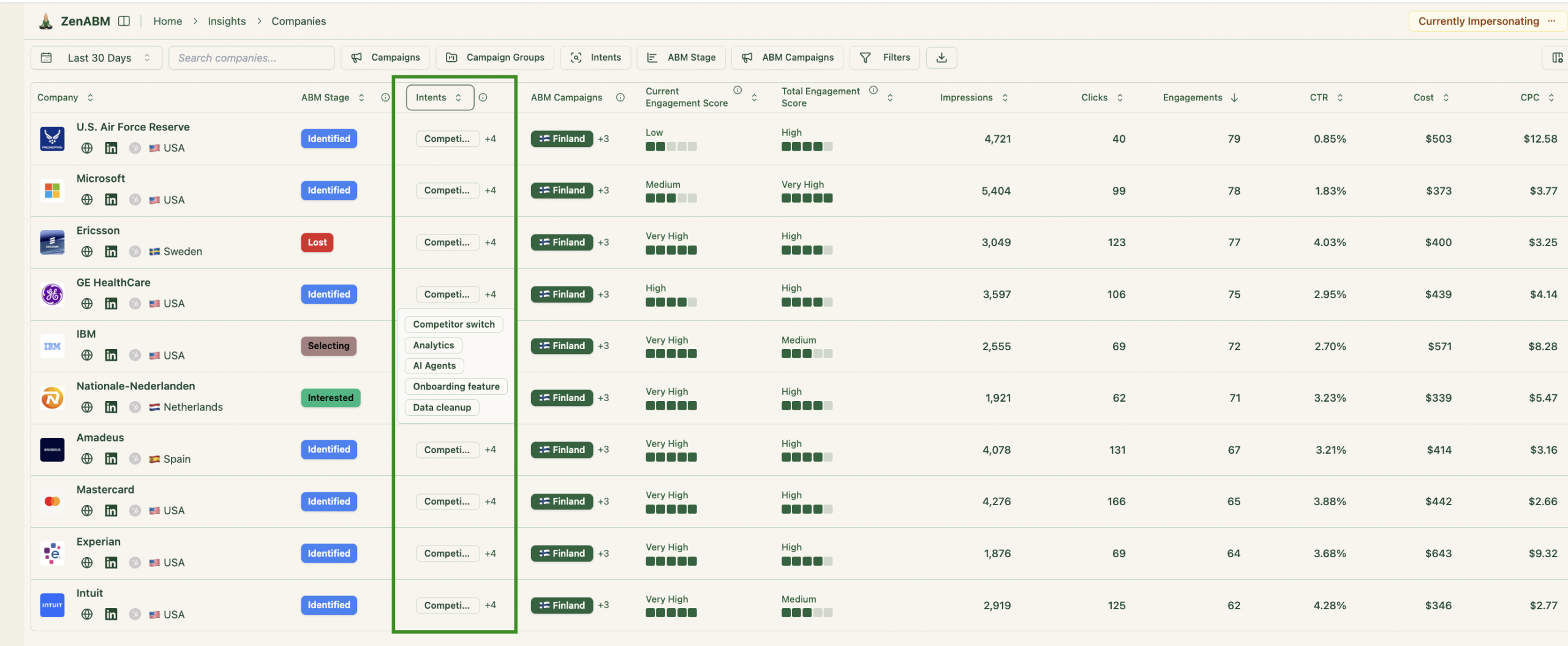

ZenABM lets you pull intent topics from LinkedIn campaigns and tag campaigns by feature, use case or offer.

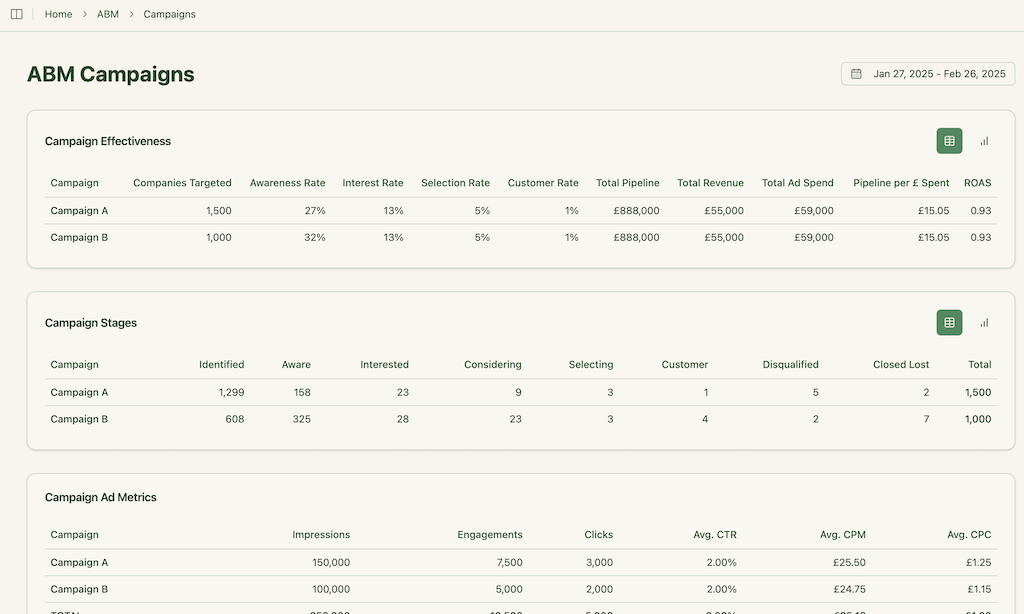

Its ABM dashboards connect LinkedIn ads to account engagement, stages and revenue. Because ZenABM tracks deal value and ad spend per company and campaign, it can calculate ROAS and pipeline per dollar automatically.

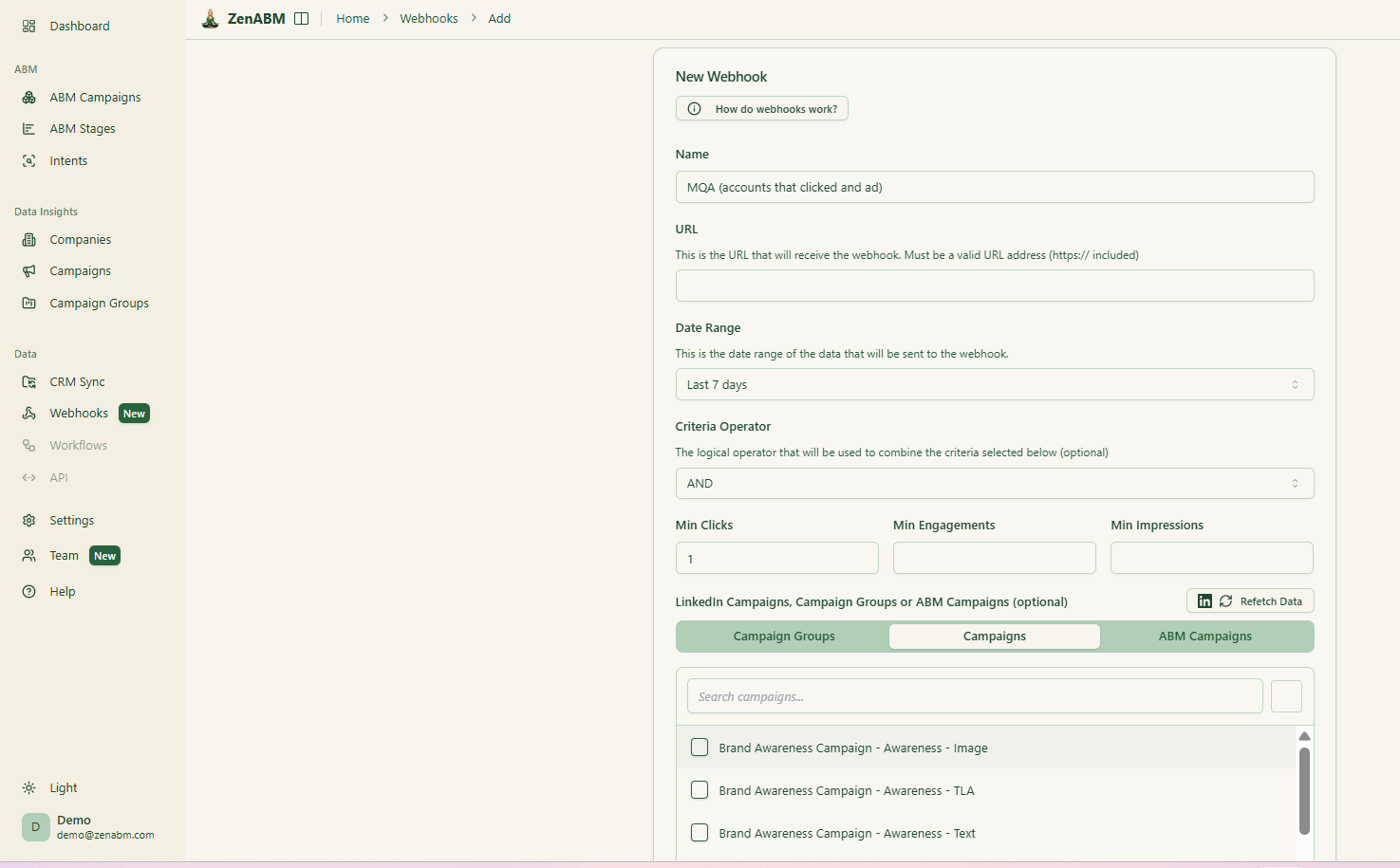

ZenABM webhooks send events into your stack for Slack alerts, enrichment flows and other automation.

You can group LinkedIn campaigns into ABM campaign objects and view performance across markets, personas or creative clusters rather than juggling individual reports.

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model so you can ask questions like “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting campaigns?”

Agencies can use the multi-client workspace to run several ad accounts and ABM campaigns with separate dashboards and reporting without constant switching in Campaign Manager.

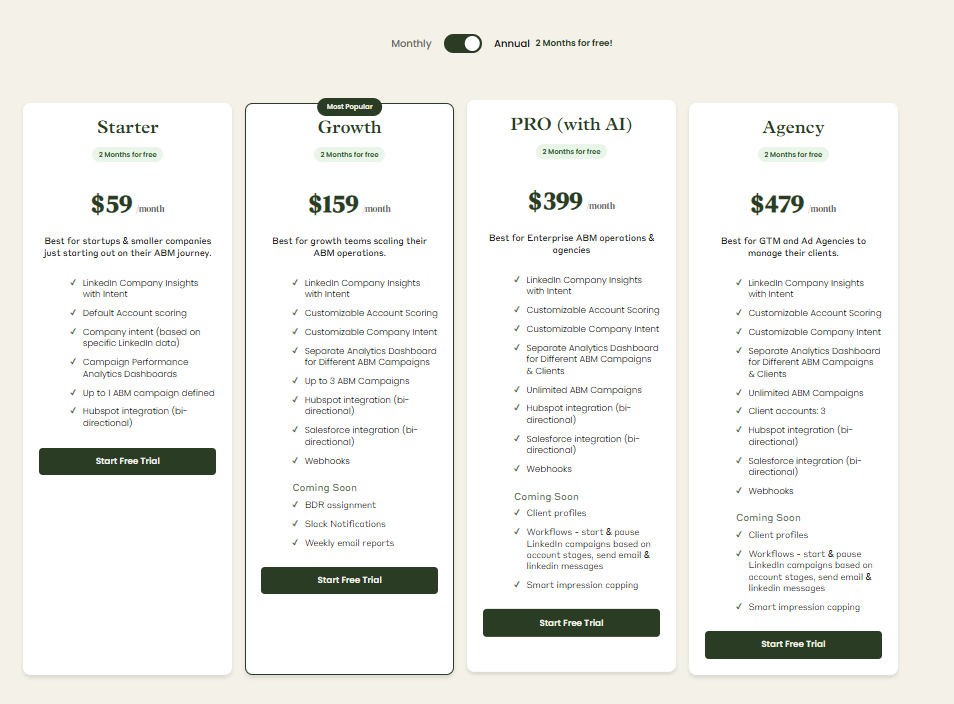

Plans start at $59 per month for Starter, $159 per month for Growth, $399 per month for Pro (AI) and $479 per month for Agency.

The Agency plan still stays under $6,000 per year, and all tiers include core LinkedIn ABM capabilities. Higher tiers mainly lift limits and add Salesforce sync.

Every plan comes with a 37-day trial.

Recotap is a strong fit if your ABM strategy revolves around LinkedIn and your website. It unifies data and intent, runs LinkedIn ABM and personalizes web experiences while automating key plays, which gives lean teams enough lift without jumping into full enterprise suites.

Madison Logic is better for larger organizations that want to blanket target accounts with content and ads across channels.

It combines syndication, display, LinkedIn, CTV and audio with a deep intent graph and enterprise-level reporting, in exchange for higher cost and complexity and a natural tilt toward top of funnel volume.

If your real need is reliable company-level LinkedIn engagement, clear ABM stages, CRM sync and honest revenue attribution for LinkedIn ads, ZenABM keeps the stack much lighter.

You get first-party LinkedIn intent, account scoring, pipeline dashboards and workflows without the overhead of a full suite, and you can still add Recotap or Madison Logic later if your program grows to that stage.