©2026 ZenABM - All Rights Reserved.

In this guide, I break down how N.Rich vs. DemandSense differ on features, pricing, and where they fit in an ABM stack, so marketing and sales can see which one actually suits their motion.

I also show how ZenABM can act as a lean, LinkedIn-first alternative or sit on top of either tool when you only need precise LinkedIn ABM analytics.

In case you’re short on time, here is the snapshot:

N.Rich presents itself as an agile ABM execution layer for mid-market and enterprise teams. Under the hood, it is a B2B DSP with intent, ICP, and ABM workflows built on top.

Core N.Rich capabilities for ABM include ICP building, intent scoring, programmatic campaigns, and account-level analytics.

N.Rich pulls in CRM opportunity data to learn what your best customers look like and then scores new accounts against that pattern.

You can spin up target lists in minutes using filters such as industry, employee count, and tech stack.

The goal is to move beyond gut-feel account picks, although output still depends heavily on CRM data quality.

N.Rich blends first-party signals (site visits, ad engagement) with third-party intent feeds to highlight accounts researching key topics.

Accounts receive intent scores so sales and marketing can focus on those showing the strongest, consent-based interest.

The platform tracks thousands of topics and syncs them into your CRM for timely, theme-based outreach.

N.Rich ships with a built-in DSP to run programmatic display to target accounts and supports native and video formats.

You can connect LinkedIn Ads to keep display and LinkedIn campaigns aligned, and Capterra reviews note a simple campaign builder that supports bulk creatives and A/B tests.

N.Rich provides account-level analytics so you can see how engagement connects to pipeline and revenue.

The Opportunity Attribution dashboard links impressions, clicks, and visits with opportunities and closed deals so you can see which accounts actually moved.

The system also calculates an ICP Sales Velocity Score for each account and can sync all of this back to the CRM on higher tiers.

N.Rich integrates with the main CRMs and marketing tools.

Native connectors exist for Salesforce, HubSpot (Marketing and Sales Hub), and LinkedIn ads, letting you pull CRM data for segmentation and push back engagement, topics, and velocity scores.

Some connectors are reserved for higher plans, and N.Rich also offers firmographic and technographic enrichment so you can see what tools target accounts use.

N.Rich has simple tiered pricing tied to team size and ABM maturity. All plans aim to turn intent data into deals, with clear published ranges.

For smaller teams starting with intent-driven ABM.

Includes 1 Intent Report, 10 topics, 1 marketing seat, 3 sales seats, 1 N.Rich account, 1 ABM campaign, and chat support.

For teams scaling ABM and needing closer sales and marketing alignment.

Includes everything in LITE plus:

For global, mature ABM programs with advanced orchestration needs.

Includes everything in GROWTH plus:

All plans benefit from N.Rich’s deep data and native ABM orchestration, but you still need to talk to sales for exact quotes.

Note: because N.Rich starts above $10K per year, ZenABM often looks leaner for LinkedIn first teams, starting at ~$59/month, with the top tier still under $6K per year. You still get core LinkedIn ABM essentials: account-level ad engagement tracking, account scoring, ABM stage tracking, hot account routing, bi-directional CRM sync, custom webhooks, qualitative intent, and plug-and-play ROI dashboards.

N.Rich scores 4.7 out of 5 on G2 (around 99 reviews), which suggests customers are broadly satisfied.

Across G2, TrustRadius, Reddit, and similar sources, a few themes show up.

DemandSense presents itself as a LinkedIn-centric account-based marketing and demand gen platform for B2B marketers and agencies.

It combines LinkedIn ad optimization, intent data, and prospecting so you can unmask visitors, capture buying intent, and adjust budgets, schedules, and targeting.

DemandSense blends several capabilities into one growth platform.

DemandSense aims to unmask anonymous website visitors and identify companies showing buying interest.

Its Visitor ID or IntentID uses LinkedIn data and site tracking scripts to match ad clicks and visits back to firms, then pushes that data into audiences and your CRM.

A G2 user says they can see which companies visit before forms are filled and use that as a clear engagement signal.

Note: Website visitor deanonymization still leans on IP matching and cookies, which are fragile. Remote work, private networks, unregistered IPs, and aging databases hurt accuracy. Cookies are also being phased out. A Syft study puts IP-based identification at about 42 percent accuracy.

Once signals are in, you can group accounts by intent and engagement and build firmographic or behavioral audiences.

DemandSense supports custom lists for LinkedIn retargeting (and other channels), lets you exclude weak segments, and caps impressions per account so large accounts do not get spammed.

DemandSense sits on top of Campaign Manager to provide stronger ad controls without heavy complexity.

It auto-tunes LinkedIn campaigns with features like:

LinkedIn remains the core channel, but DemandSense can extend to Facebook and display or CTV networks by reusing the same account lists as custom audiences.

The idea is a connected journey: someone clicks a LinkedIn ad, visits your site, and later sees a follow-up elsewhere, all tracked inside DemandSense.

DemandSense is not only about ads. It tries to tie everything back to revenue.

It pushes engagement into your CRM and syncs with HubSpot and Salesforce so company records show LinkedIn impressions, clicks, and scores.

This gives sales signals such as “Acme viewed your pricing page after a LinkedIn click” and lets you attribute ad spend to the pipeline.

ZenABM likewise pushes account scores and engagement into CRM company records as properties, starting at $59 per month.

DemandSense breaks down ad engagement, spend, and performance by hour:

DemandSense pricing reflects how deeply you want intent baked into LinkedIn and cross-channel GTM.

The Basic plan at $99 per month gives marketers and sales a self-serve entry.

It includes audience tuning so users can see which companies interact with LinkedIn ads, plus ad scheduling, frequency capping, and richer reporting.

For companies that want intent data flowing directly from their website into sales, DemandSense Plus starts at $149 per month.

It adds everything in Basic plus 250 monthly data credits to identify anonymous website visitors or uncover leads from target accounts and unlocks the Website Visitor ID module.

Together, the tiers position DemandSense as an accessible LinkedIn intent tool with room to scale, provided you are comfortable with the credit model.

The $99 and $149 plans look attractive until you notice the Plus tier’s 250 credit cap. Any decent traffic or outbound research can burn through that fast, and overages are where the real costs sit, turning a friendly sticker price into a classic intent data upsell.

ZenABM often comes out smarter, starting at about $59 per month for Starter, with the highest agency tier (unlimited, no credits) still under $6K per year.

You get what you actually need for LinkedIn ABM: account-level engagement tracking, account scoring, ABM stage tracking, automatic routing of hot accounts to BDRs, bi-directional CRM sync, custom webhooks, qualitative buyer intent, job title level engagement, and plug-and-play ROI dashboards.

ZenABM also gives you unlimited website visitor identification if you retarget site visitors with cheap LinkedIn text ads and read back which companies were served impressions.

You get deanonymization and awareness in one go.

Public reviews for DemandSense are still sparse.

On G2, DemandSense currently has a single 5-star review from an agency user.

The reviewer praises the LinkedIn integration and ROI but warns that “there is a lot in the platform” and that you need time and possibly vendor help to set it up well.

Once you know both platforms, the contrast becomes clearer.

Tabulated here:

| Category | N.Rich | DemandSense | Where ZenABM Fits |

|---|---|---|---|

| Core positioning | ABM and intent platform with its own DSP and CRM driven ICP builder for mid market and enterprise teams. | LinkedIn centric demand gen and ABM platform focused on visitor reveal and campaign optimization. | LinkedIn first ABM analytics and routing layer that can sit alongside either tool or replace them when only LinkedIn is in scope. |

| Main focus | Turn intent and CRM insight into targeted programmatic and account-based advertising campaigns. | Improve LinkedIn performance with better scheduling, budgets, frequency capping, and account based audiences. | Show exactly which companies see and engage with LinkedIn ads, then score, stage, and route them in the CRM. |

| Data and intent model | Mix of first party engagement and third party intent topics tracked in a consent based framework. | Website visitor identification plus LinkedIn driven signals, leaning on IP matching and cookies for visitor reveal. | Pure first party intent from LinkedIn Ads API based company level engagement and campaign level intent tagging. |

| Channels and activation | Programmatic display via native DSP, with coordination for LinkedIn campaigns. | Primarily LinkedIn, with the option to reuse audiences in other paid channels for retargeting. | Deep LinkedIn coverage only, with ABM campaigns, retargeting insights, and company timelines across LinkedIn initiatives. |

| Pricing model | Tiered annual plans starting above $10K per year plus onboarding, scaling with users and features. | Subscription plans at $99 and $149 per month, with credit based pricing for visitor identification. | Flat tiered SaaS pricing from $59 to sub $6K per year, no credits, focused on LinkedIn ABM use cases. |

| Best suited for | Teams that want a DSP backed scaled account-based advertising motion | Teams and agencies that mostly run LinkedIn ads and want better control, reporting, and some visitor reveal. | Teams whose main growth lever is LinkedIn and who want clear company level intent, stages, and CRM ready signals. |

| Typical tradeoffs | Higher cost, more setup, and a stronger dependence on clean CRM and intent data. | Relies on IP and cookie based deanonymization and a credit model that can get expensive at scale. | Does not try to run display or syndication, instead goes deep on LinkedIn ads and ABM reporting. |

N.Rich is usually the better choice if you want a full ABM execution layer that turns CRM driven ICP and intent into targeted programmatic and LinkedIn campaigns, then traces those touches through to opportunities and revenue.

It suits mid market and enterprise teams that already have data and ops resources and can work with a five figure annual budget.

DemandSense is the better fit if your programs are heavily LinkedIn centric and you care more about practical controls such as hourly scheduling, frequency capping, audience tuning, and basic visitor reveal than about running a full DSP.

It suits lean teams and agencies that want more control over Campaign Manager without committing to an enterprise ABM suite.

If your real priority is squeezing more pipeline from LinkedIn with accurate first party company level engagement, ABM stages, CRM properties, and plug and play ROI reporting, both tools can be more than you need.

As I just said, if your main growth lever is LinkedIn and you mostly need first-party accuracy, account scoring, ABM stages, CRM sync, and revenue attribution, both can feel like overkill.

This is where ZenABM comes in.

In fact, even if you are using or decide to use N.Rich or DemandSense, ZenABM has unique features that make it important for your ABM tech stack.

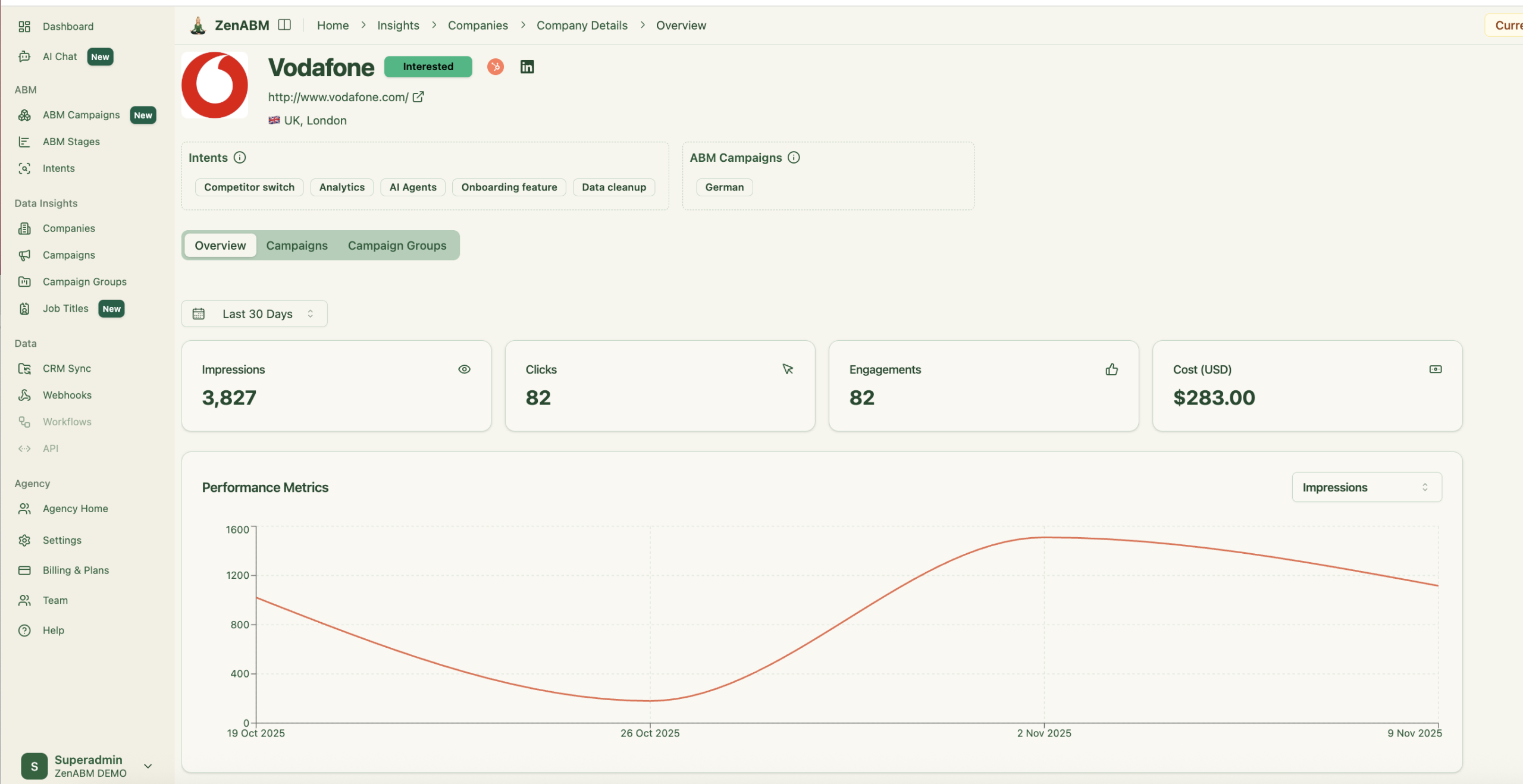

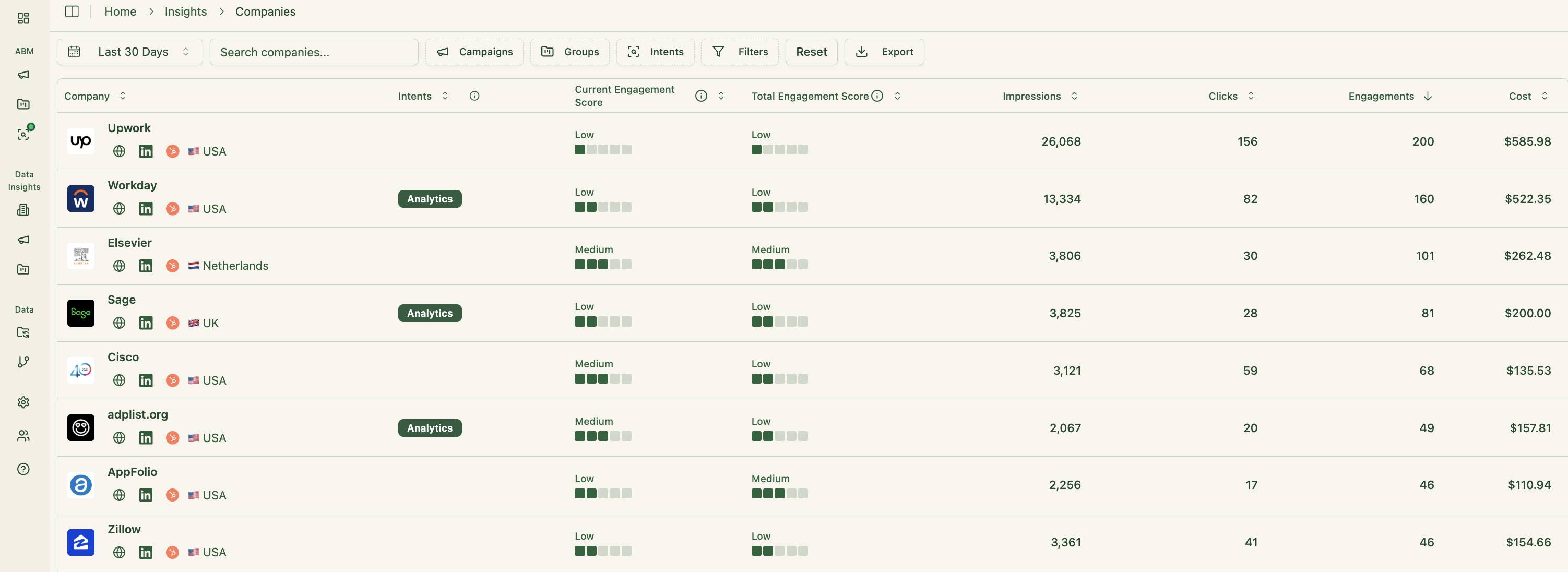

ZenABM connects directly to the official LinkedIn Ads API and records account-level data for every campaign.

You see which companies view and engage with your ads with account-level attribution, based on first-party LinkedIn data instead of noisy IP or cookie matching.

A Syft study suggests IP identification accuracy peaks around 42 percent, which is why ZenABM treats ad engagement as the primary intent signal.

ZenABM updates engagement scores continuously as accounts interact with your ads, across short and long windows.

Scores help prioritize accounts, and the interface shows a full touchpoint history for each company.

ZenABM lets you define custom stages such as Identified, Aware, Engaged, Interested, and Opportunity, then places accounts in the right stage based on scores and CRM signals.

This gives you funnel visibility close to large ABM suites, but concentrated on LinkedIn engagement.

ZenABM syncs bi directionally with HubSpot and adds Salesforce support on higher plans.

All LinkedIn metrics can be written as company properties in your CRM.

When an account crosses your score threshold, ZenABM updates the stage to “Interested” and assigns a BDR.

ZenABM lets you pull intent topics from LinkedIn campaigns. You can tag each campaign by feature, use case, or offer.

ZenABM then reports which accounts engage with which themes and lets you sync those topics into the CRM.

Reps can tailor outreach to what each account has actually explored instead of guessing.

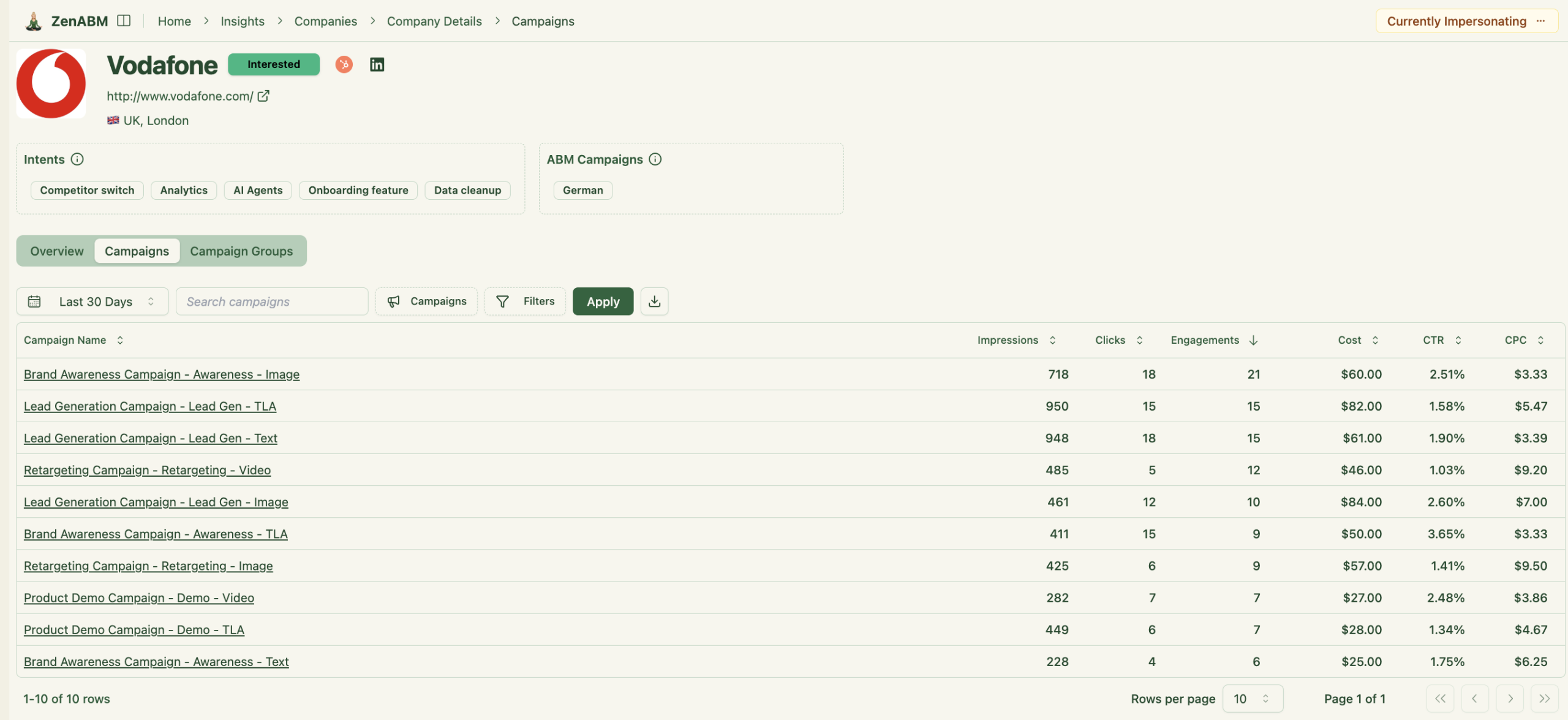

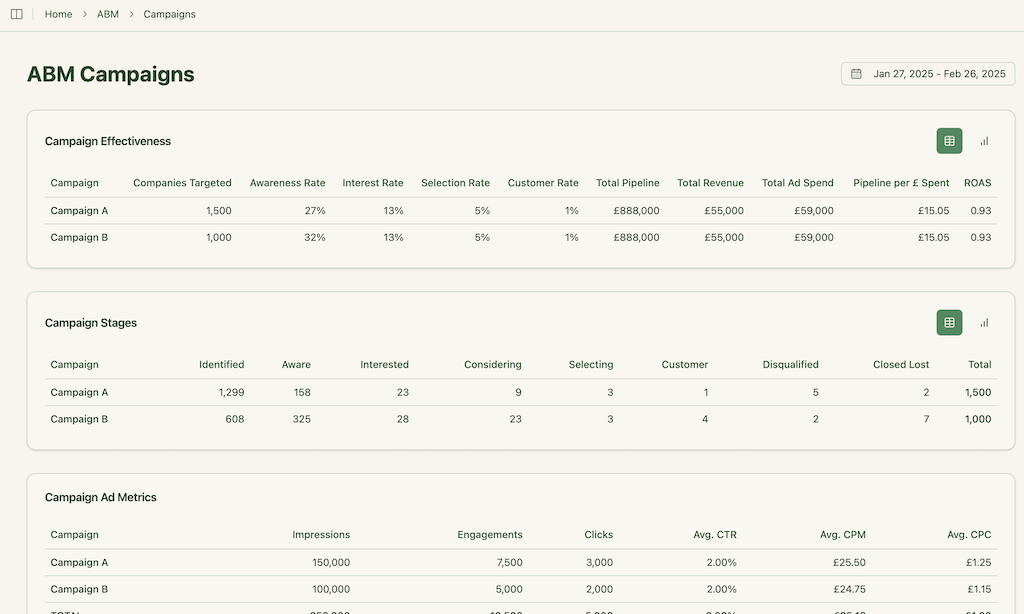

ZenABM includes ABM dashboards that tie LinkedIn ads to account engagement, stages, and revenue.

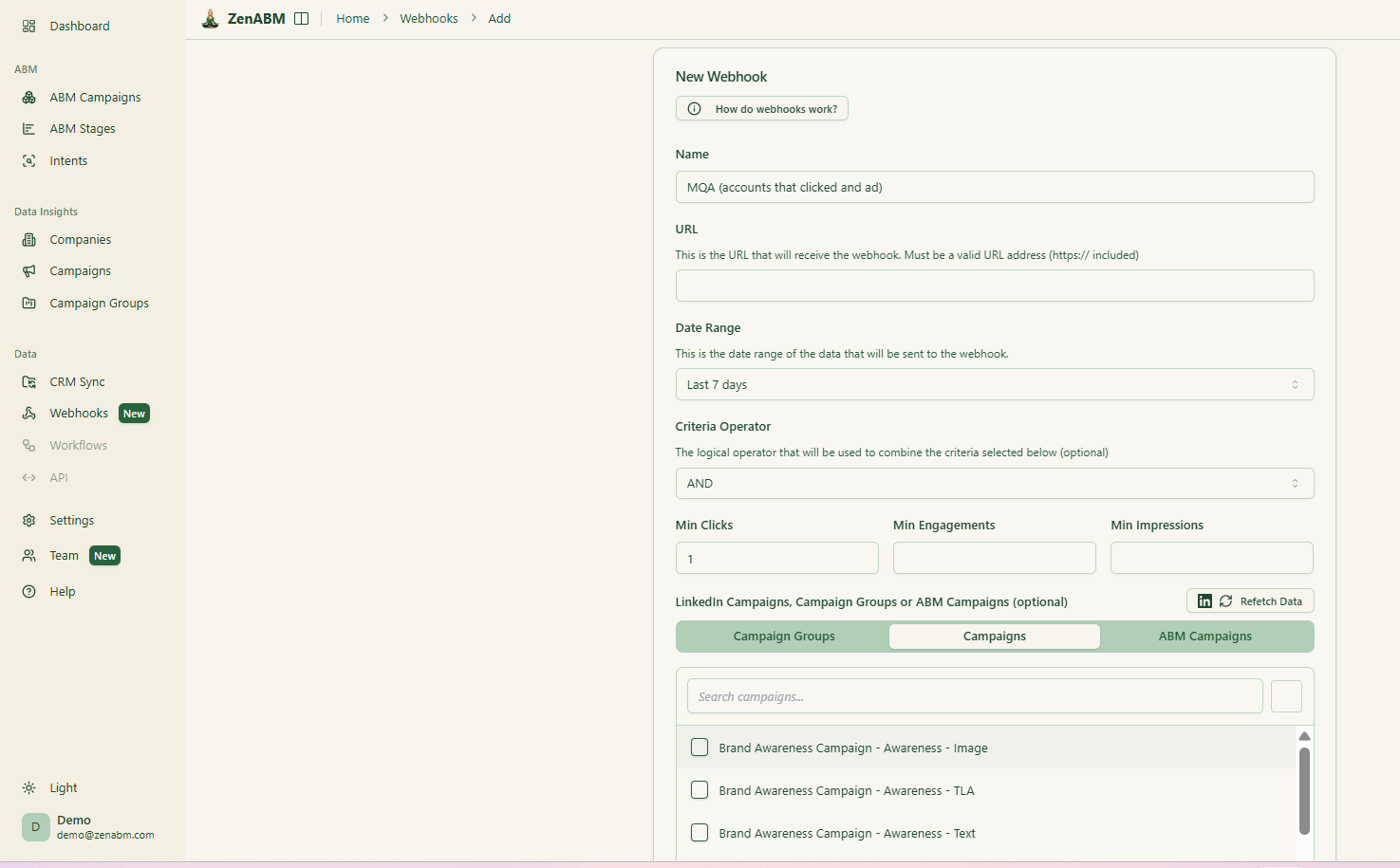

ZenABM’s webhooks send events into your stack for Slack alerts, enrichment flows, and other automation.

ZenABM shows which job titles interact with your creatives and how long they stay, plus video funnel analytics.

Instead of treating every LinkedIn campaign in isolation, ZenABM lets you group them into ABM campaign objects.

You can view performance across markets, personas, or creative clusters in a single place rather than juggling fragmented reports inside Campaign Manager.

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model.

You can ask questions such as “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting campaigns?” and get answers that reference live data instead of exports.

ZenABM supports agencies via a multi-client workspace so you can manage several ad accounts and clients in one environment with their own ABM campaigns, dashboards, and reporting without constant account switching in Campaign Manager.

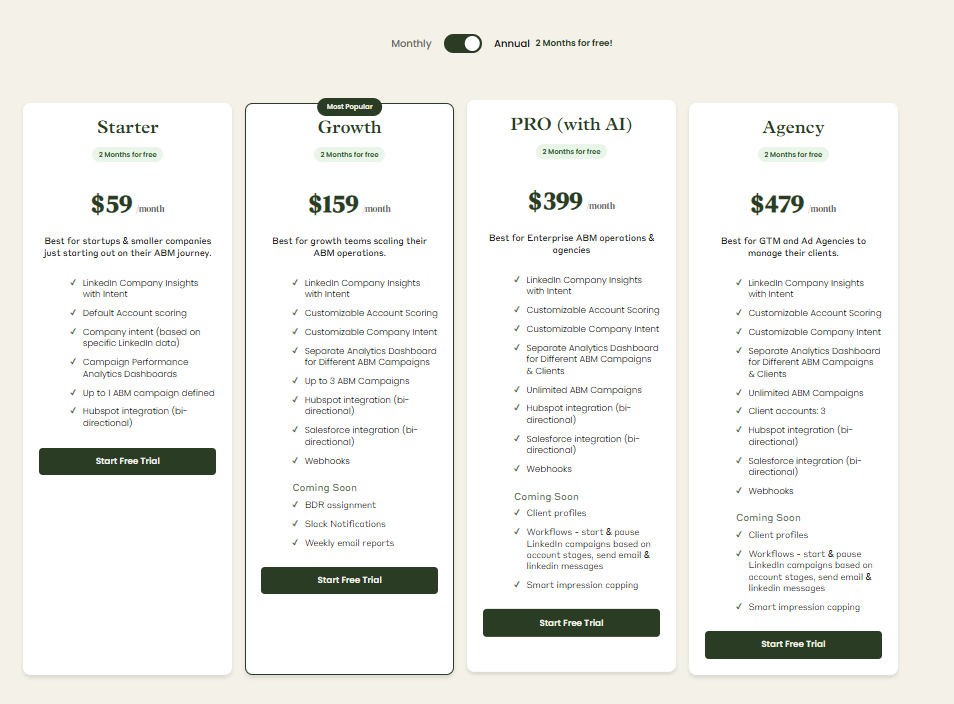

Plans start at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI), and $479/month for Agency.

Even the agency plan stays under $6,000 per year, with all tiers including core LinkedIn ABM capabilities. Higher tiers mainly raise limits and add Salesforce sync.

Monthly and annual billing are available, and every plan comes with a 37-day free trial period.

N.Rich is a strong fit if you want a structured ABM execution platform with DSP, CRM driven ICP, rich intent, and solid account level attribution, and you have the budget and ops maturity to support it.

DemandSense is the more practical option when you mostly care about improving LinkedIn performance, revealing engaged accounts, and fine tuning spend with hourly and frequency controls.

If you care less about running a full programmatic stack and more about knowing which companies are engaging with your LinkedIn campaigns, how they move through ABM stages, and how that ties to pipeline, ZenABM gives you a leaner answer.

You get company level LinkedIn engagement, first party intent, scoring, stages, CRM sync, and revenue dashboards from pricing tiers that do not require an enterprise budget.