©2026 ZenABM - All Rights Reserved.

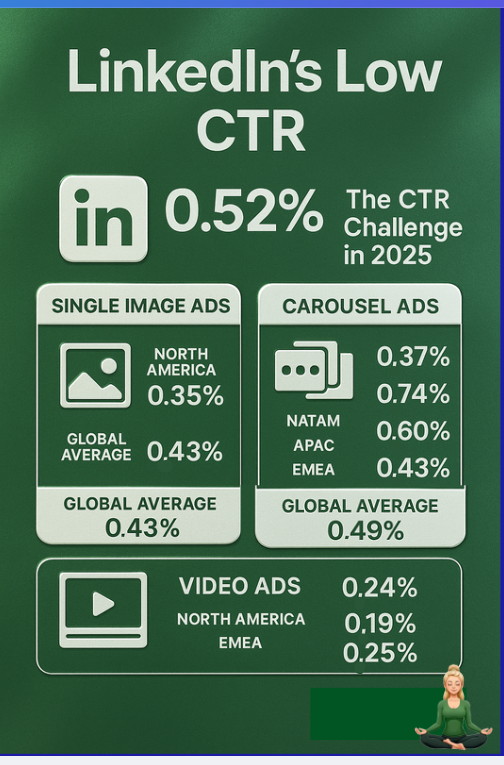

If you are running ABM on LinkedIn, you need reporting that breaks performance down by company for every single campaign. That is table stakes for any serious program. Too many teams still juggle a mess of tools and never get clean, reliable company data.

In this guide, I will show you how to track LinkedIn ad engagement at the account level. You will see why native CRM syncs, LinkedIn Campaign Manager, and deanonymization tools come up short, and how ZenABM closes the gap with first-party clarity.

Here is why these common approaches, even when stacked, fail to deliver true company-level LinkedIn reporting.

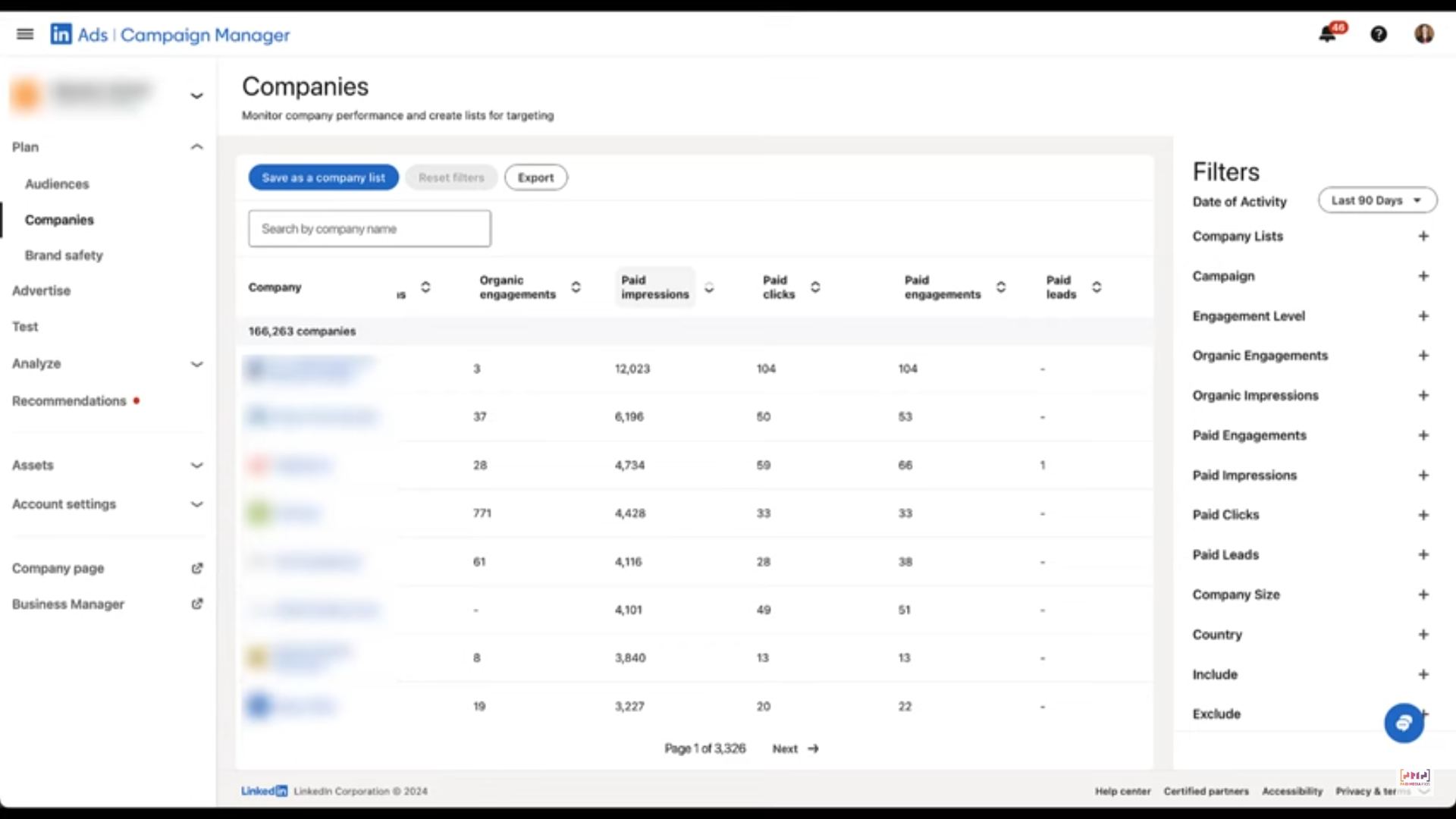

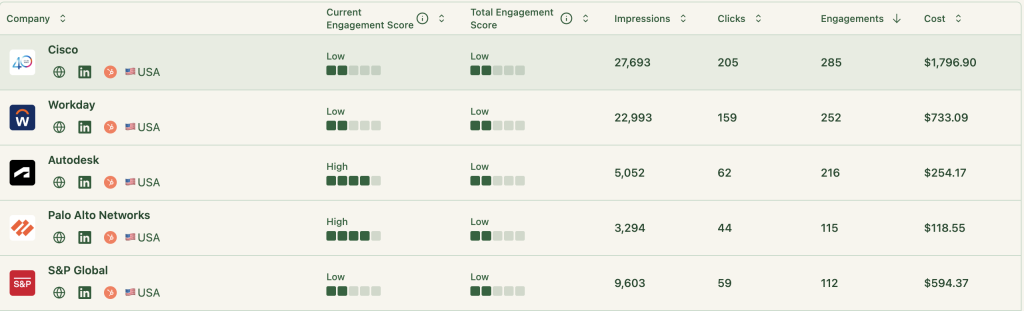

LinkedIn Campaign Manager only became somewhat ABM-friendly when the Companies tab shipped in 2024:  The tab now lists paid clicks, impressions, engagements, and leads, plus organic activity and an overall engagement score at the company level. Good progress, not the finish line.

The tab now lists paid clicks, impressions, engagements, and leads, plus organic activity and an overall engagement score at the company level. Good progress, not the finish line.

You can finally see company-specific impressions and engagements, yet the data is aggregated across the whole ad account. You still cannot pinpoint which creatives or campaigns resonated with each company.

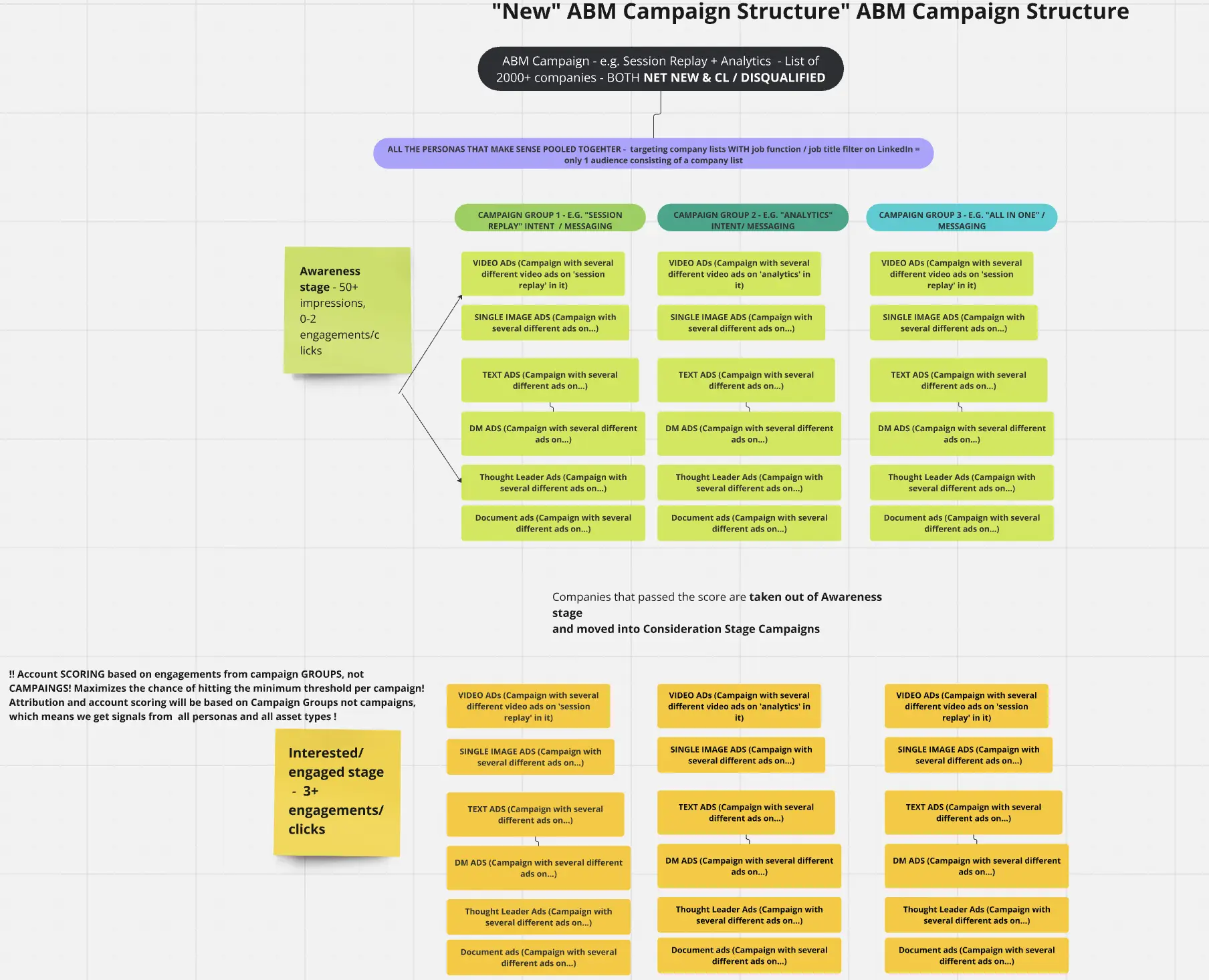

For ABM teams, that is a non-starter. Most run several motions at once, each split into multiple campaign groups, and each group holds multiple campaigns.

Those campaigns differ in:

Without company-by-campaign detail, you cannot read intent or attribute pipeline correctly. Look at the layered setup Userpilot runs:

When engagement rolls up to the ad account level, the signal is mushy. You need impressions, clicks, and engagement by company for every campaign, group, and ABM program. Why this matters:

When engagement rolls up to the ad account level, the signal is mushy. You need impressions, clicks, and engagement by company for every campaign, group, and ABM program. Why this matters:

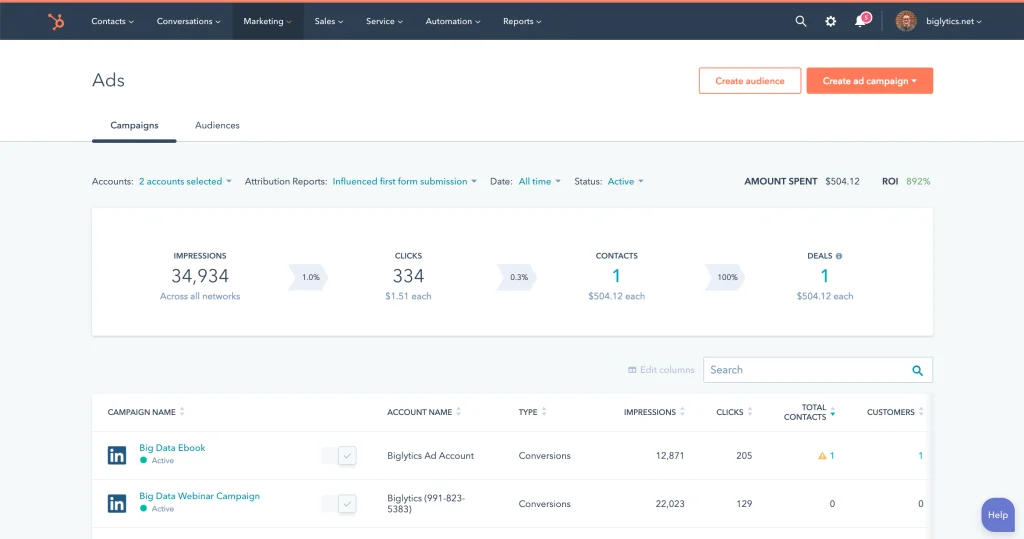

CRMs like HubSpot connect to LinkedIn Ads. For instance, the LinkedIn Ads–HubSpot integration shows ad metrics in HubSpot’s Ads tool:  This view is even more restrictive than Campaign Manager. You see campaign-level impressions and clicks, but the companies behind them disappear. The firmographic layer is gone.

This view is even more restrictive than Campaign Manager. You see campaign-level impressions and clicks, but the companies behind them disappear. The firmographic layer is gone.

Marketers often try one of these workarounds:

Marketers often try one of these workarounds:

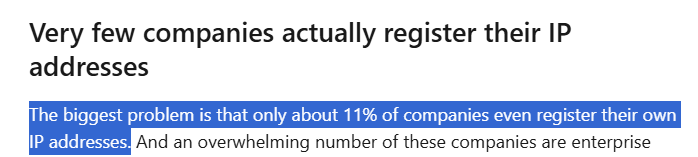

Then they add web visitor deanonymization software to reveal company identities. Under the hood, these tools lean on IP address matching against a database. That fails constantly due to:

The outcome is weak accuracy. These tools identify the visiting company correctly only about 42 per cent of the time:

One story nails why paying for IP matching rarely pays off:

The accounts we targeted never showed up in website analytics, even though they landed on bespoke landing pages for our ABM ads.

How do we know? We built a no-index domain only for those campaigns, so 100 per cent of visits came from target accounts. Over 90 days, Breeze Intelligence, using Clearbit’s API, detected a single company, our own.

– Emilia Korczynska, VP Marketing, Userpilot

This path also leans on clicks. If a company only views your ad and returns later via organic search, you lose attribution entirely. Bottom line: LinkedIn Campaign Manager aggregates at the account level, CRMs drop company details, and IP matching is unreliable. You need a platform that shows company-level LinkedIn metrics for every campaign, group, and ABM initiative.

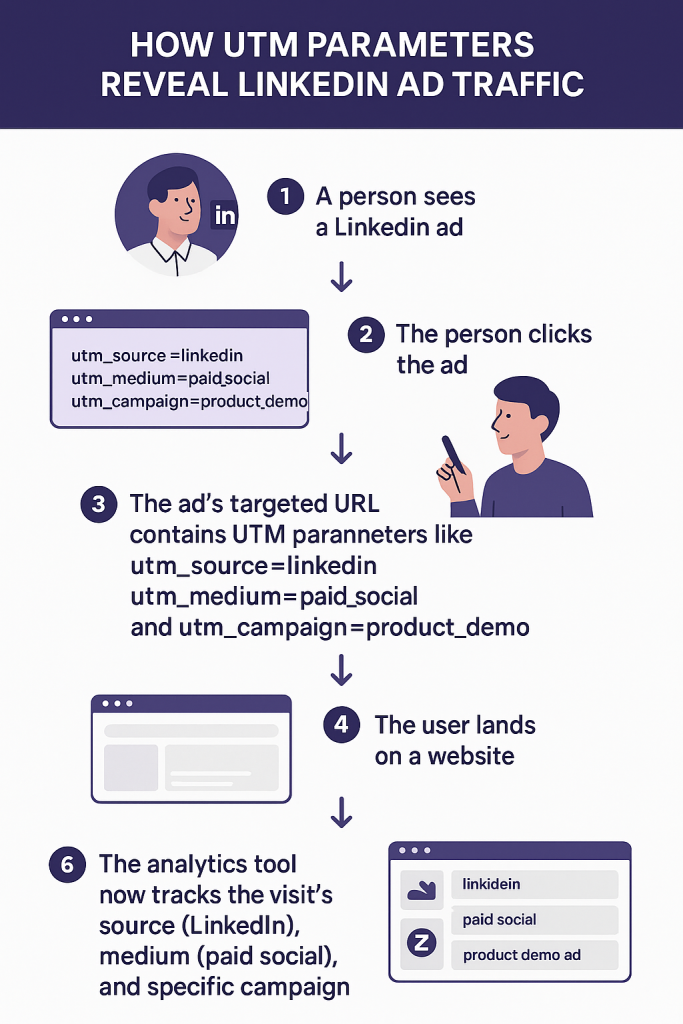

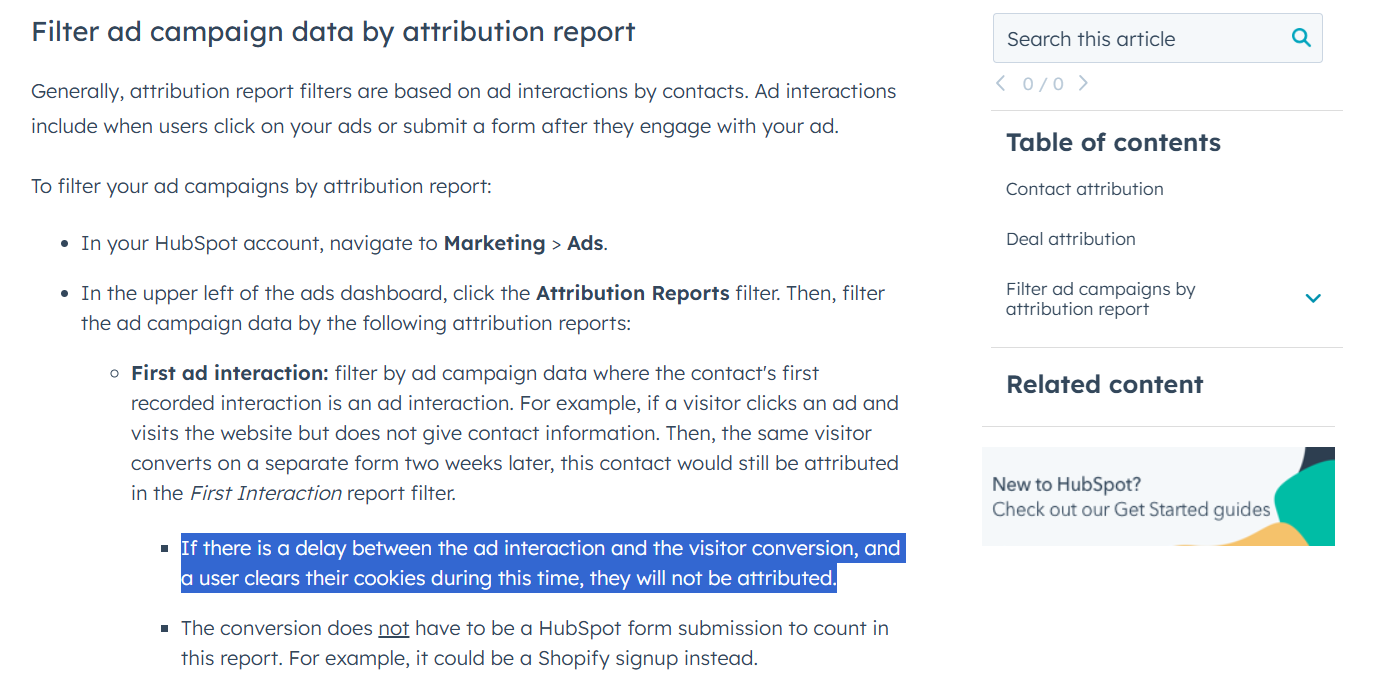

You can pair LinkedIn CAPI, the Insight Tag, or a CRM pixel with UTMs to capture ad clicks. Visibility still stays narrow. If someone clicks an ad and then skips the form in that session, CAPI and the Insight Tag cannot reveal their company. HubSpot can sometimes attribute a returning visitor to the original ad click even without a form fill. That chain depends on cookies, which are fading out.

Even if cookies behaved perfectly, two problems remain:

Bottom line: Even with flawless cookies and perfect forms, you will miss companies that viewed your ads and converted through a different route. A click-only approach does not cut it on LinkedIn. You need view through attribution with company-level impression and engagement reporting for ABM.

Here’s how ZenABM changes the game:

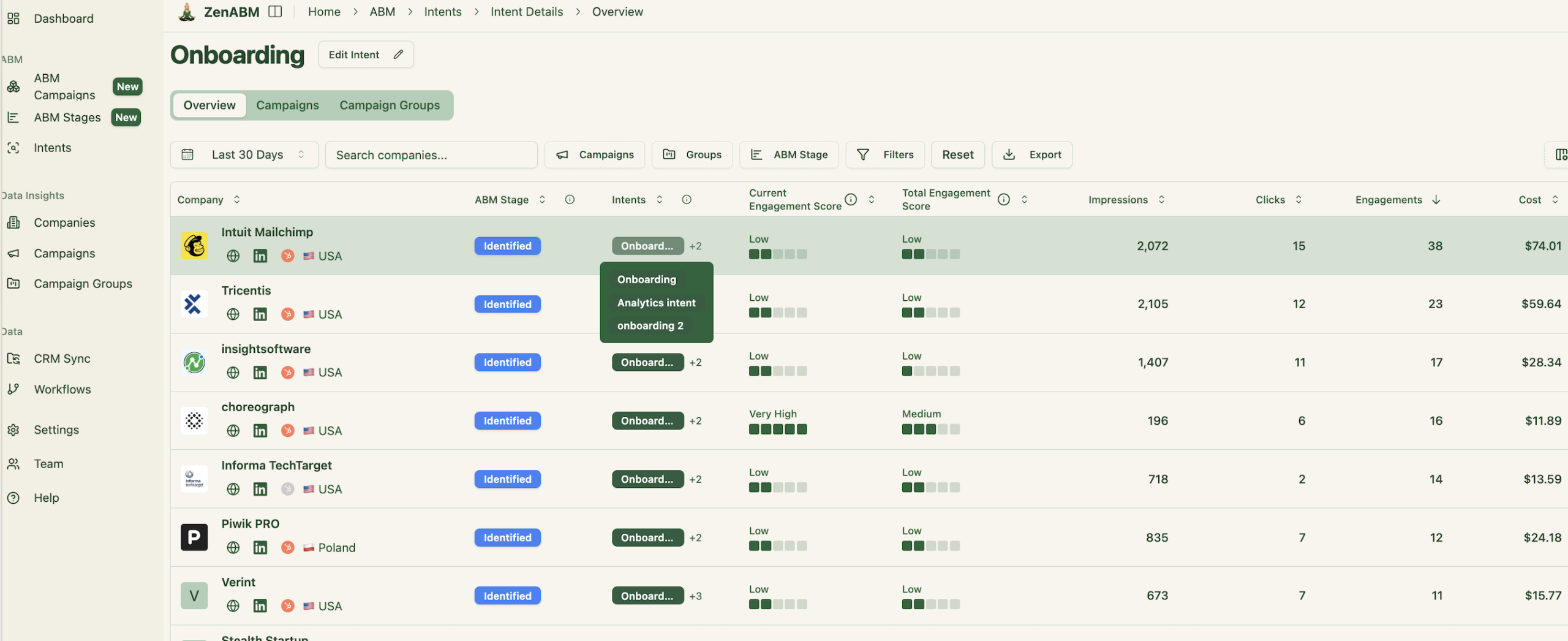

ZenABM pulls first-party data from the LinkedIn Ads API, breaks it down by company, and shows impressions, clicks, CTR, spend, and total engagements for each campaign and campaign group.

Connect ZenABM to HubSpot or Salesforce, and it maps ad engaged companies to your deals, pulls deal values, and surfaces a complete ABM scorecard:

Core metrics ZenABM calculates:

Tag each campaign or group with its underlying intent, such as feature, use case, or pain point. ZenABM clusters engaged companies by that intent, so BDRs can speak to what prospects care about.

ZenABM assigns each company to an ABM stage (Awareness, Interest, Selection, Customer) using ad signals plus CRM activity, and lets you tune the thresholds.

Two score types keep teams aligned:

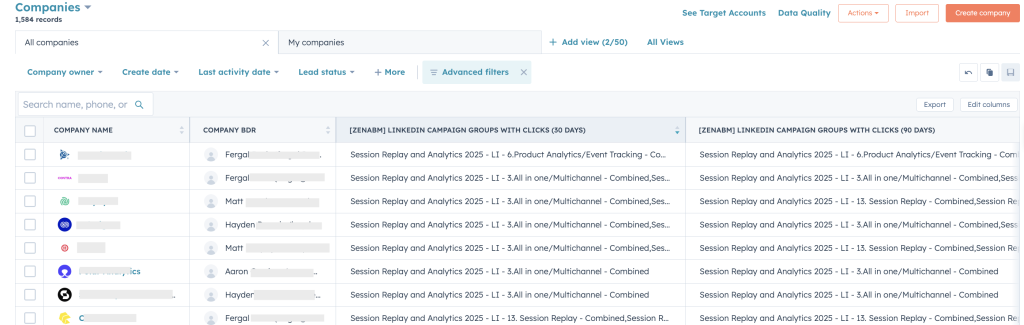

Impressions, clicks, intent, stage, and scores all sync to HubSpot or Salesforce as company properties. ZenABM can also assign a BDR once an account passes your engagement threshold.

LinkedIn Campaign Manager lumps data together. CRMs remove firm-level detail.

If you rely only on click-based methods like CAPI, the Insight Tag, or CRM pixels, you will miss companies that view ads without clicking.

Real ABM wins need a clean line from each company to the exact ads they saw and the actions that followed. That feeds outreach, scoring, and revenue attribution. If you care about how to track LinkedIn ad engagement at the account level, start with company-level impressions and engagement, not just clicks.

ZenABM gives you company-level metrics per campaign, automatic BDR assignment, real-time scoring, intent tagging, and a clean CRM sync.