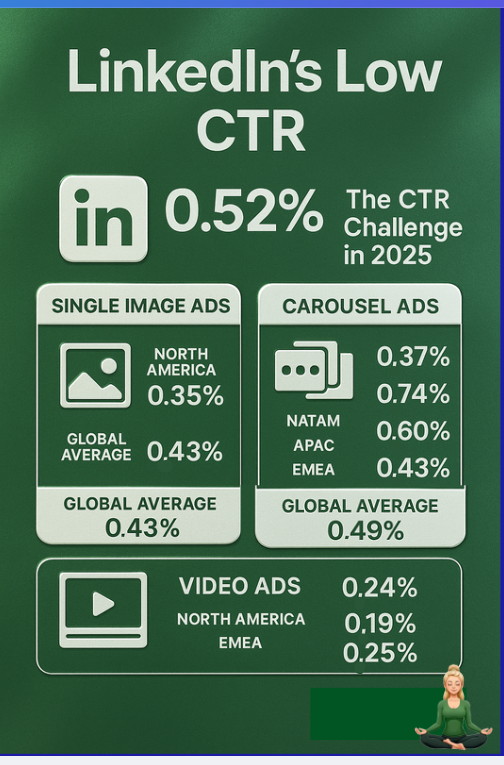

Folks running ads on LinkedIn know about the ‘no-click world’ before the SEOs started talking about it.

I mean, LinkedIn ads are not about clicks.

In fact, they are hardly clicked, but they do influence your prospects.

But as of now, there’s no native solution from LinkedIn, nor from leading CRMs, that can give you view-through attribution at the company-level for each specific ad campaign.

Then, how to link LinkedIn ad spend to revenue?

The answer is ZenABM.

Let me tell you more.

Native solutions from LinkedIn, leading CRMs, or other workarounds like IP matching tools, none of them show the full picture, even together!

Here’s why:

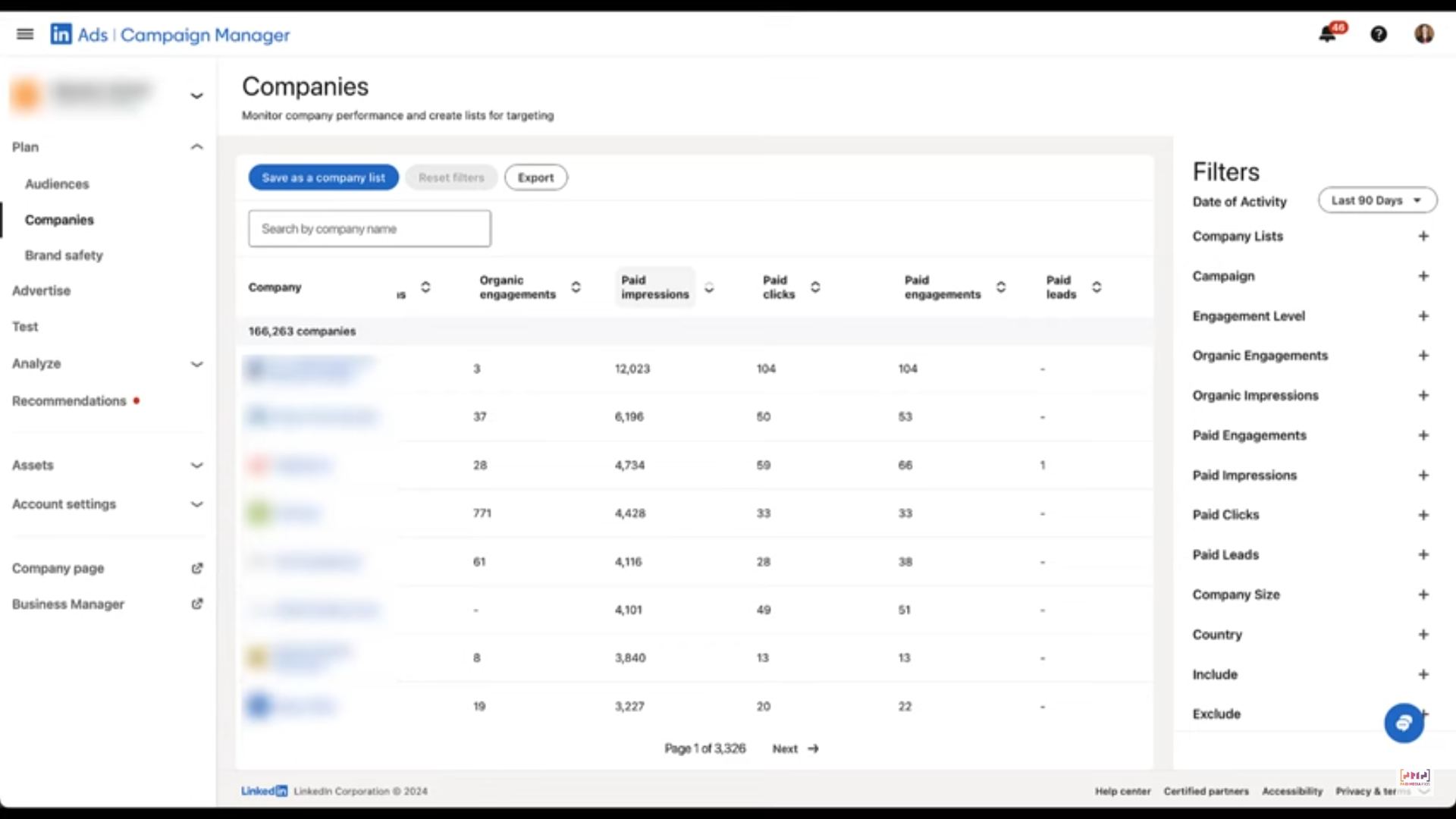

When LinkedIn launched the Companies tab in early 2024, B2B marketers finally saw which firms saw ads, clicked on ads, or filled out forms.

But those metrics remain jammed into the ad account.

There is no filter for individual campaigns, campaign groups, objectives or creatives:

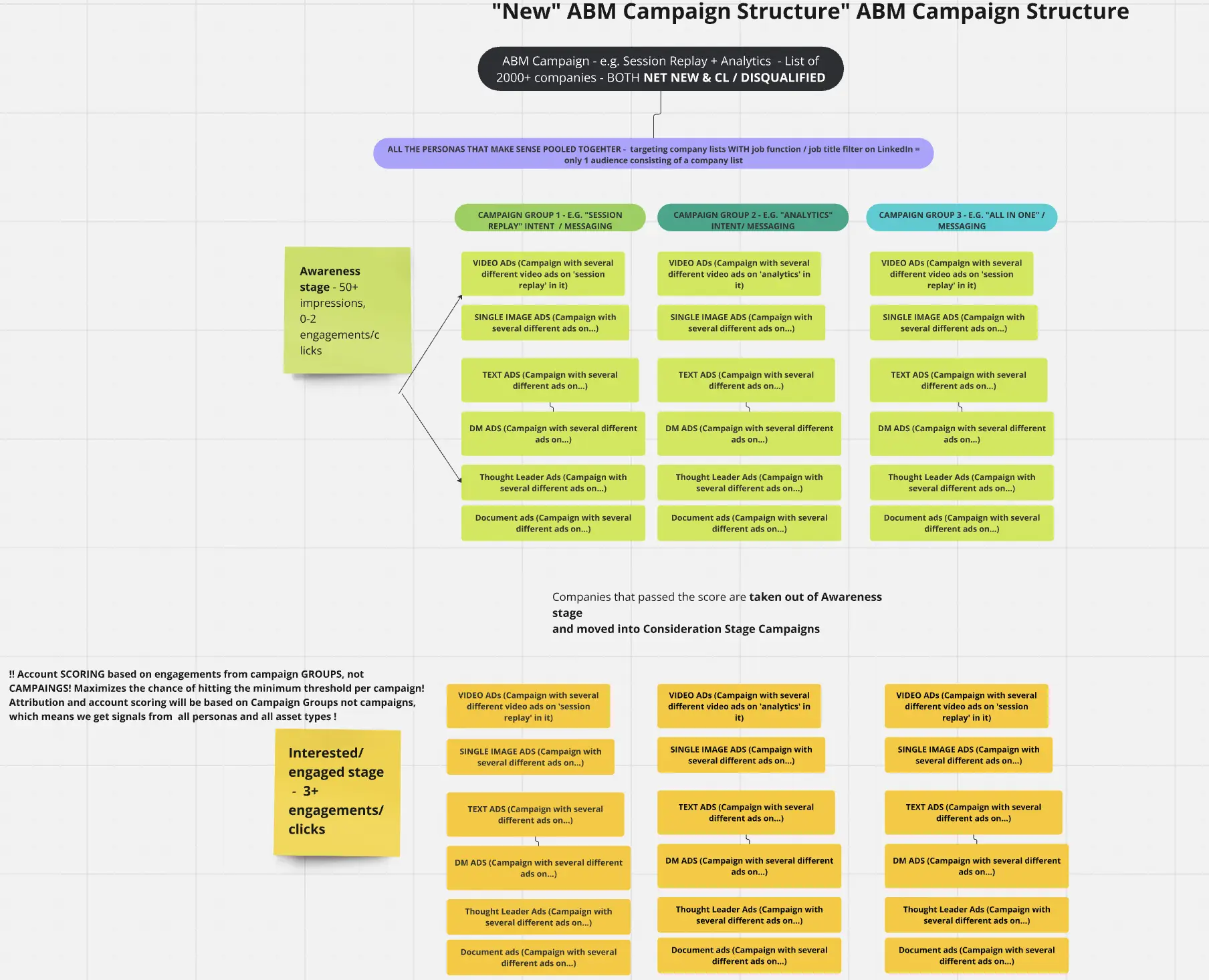

So, it’s totally inadequate for teams running a multi-threaded hierarchical ABM structure like this one:

For instance, you cannot isolate whether your “Product Update” carousel or your “Pain-Point Webinar” video drove the spike in pipeline.

Without campaign-by-company granularity, sales outreach stays generic, and A/B testing is impossible.

The 2025 Revenue Attribution Report lets advertisers push CRM opportunity data back into LinkedIn Business Manager to see pipeline, ROAS and revenue metrics.

It is a leap forward.

However, the report aggregates at the audience or campaign group level. You still cannot see:

For high-stakes ABM deals, that granularity is the difference between scaling profitably and burning cash.

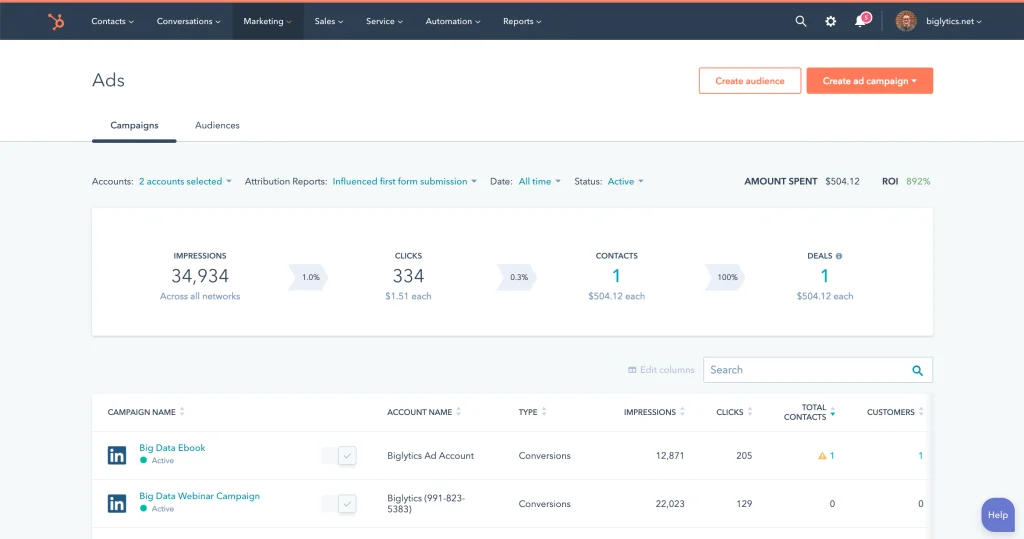

Syncing LinkedIn campaigns with HubSpot or Salesforce brings impressions, clicks, and cost, yet drops the name of the company that generated that cost.

Revenue influence becomes a finger-in-the-air exercise unless reps manually log every touchpoint.

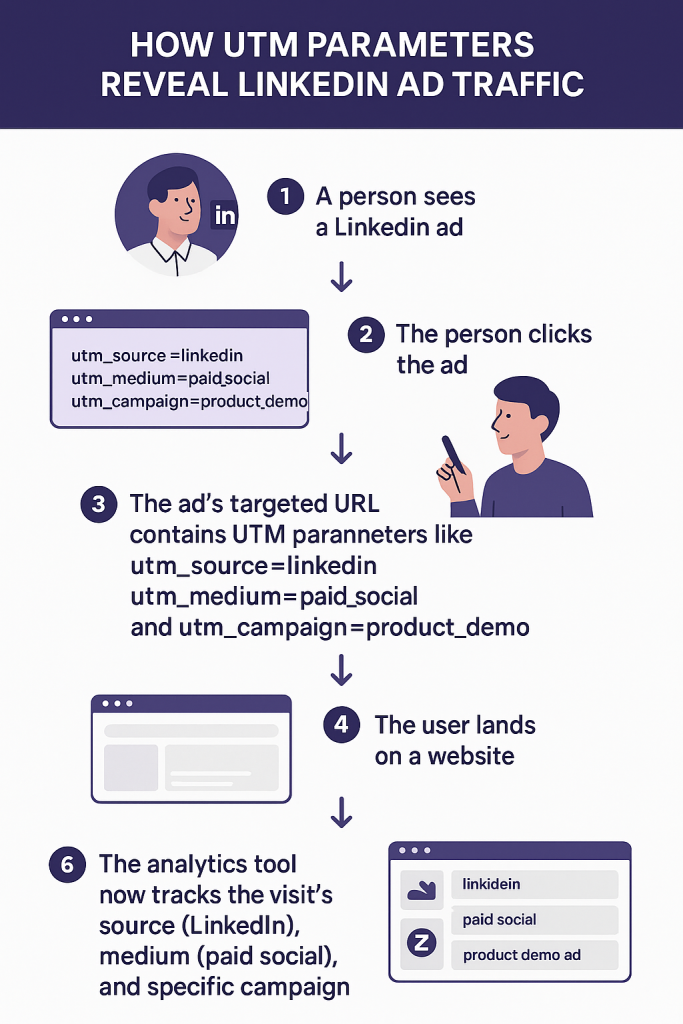

Placing UTMs or sending traffic to a vanity domain is fine for inbound clicks.

But most B2B buyers view an ad long before they click or fill a form.

VPN usage, remote work IPs, and cookie deprecation chop traceability in half (accuracy of these web visitor deanonymization tops at a mere 42%, reports Syft).

Real-world experiments by Userpilot showed that only 1 company ID out of 300 visitors surfaced in an IP-match tool.

“We created a no-index domain for our ABM ads to be certain all traffic was from target accounts. Out of roughly 300 visitors in 90 days, our IP tool recognised only one company – ours.”

– Emilia Korczynska, VP Marketing, Userpilot

Bottom line: traditional toolchains give you a blurred mirror. To tie LinkedIn ad spend to revenue, you need campaign-level, company-level, multi-touch measurement stitched straight into the CRM.

Here are the four steps to follow to link LinkedIn ad spend to revenue:

Implement the LinkedIn Insight Tag on all pages to collect post-view info.

Enable website and offline conversions in Business Manager.

Push opportunity created, pipeline value, revenue won from your CRM to LinkedIn via the Conversions API on a nightly job.

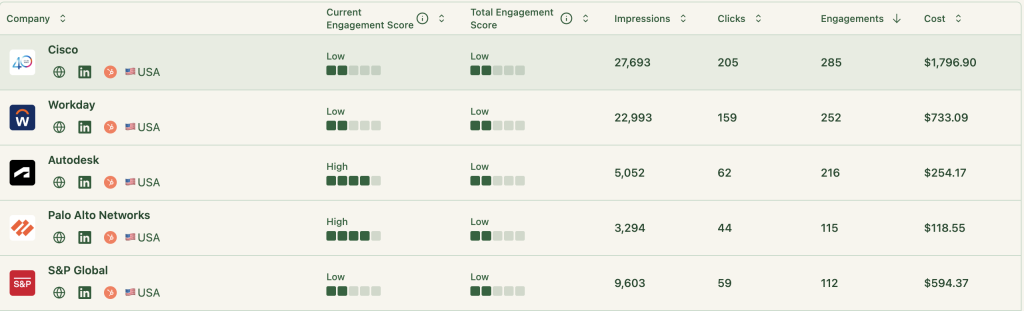

Use ZenABM’s LinkedIn Ads API connection to sync impressions, clicks, spend, CTR and creative IDs at the campaign + company level straight into HubSpot or Salesforce fields.

Create an ABM stages matrix and set threshold impressions, clicks, and engagements for each stage:

As you can see, you can also add HubSpot stages as a criterion for ABM stage determination.

ZenABM’s live and lifetime engagement scores bubble hot accounts without manual filtering:

And this is how ZenABM will be able to determine the stage of each account based on the thresholds you set.

When an account crosses your “Interested” threshold, ZenABM automatically:

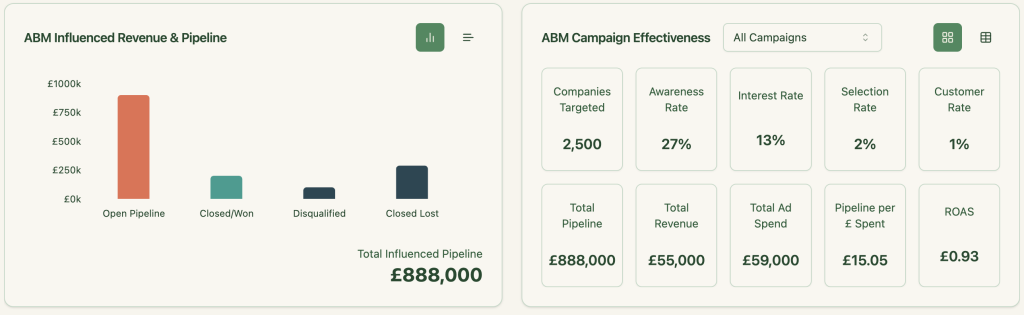

The same dataset powers ROAS, pipeline per dollar and revenue by theme or persona dashboards—fuel for both marketing optimisation and board-level roll-ups:

Native LinkedIn analytics, CRM ad integrations and IP-matching tools give partial truths at best. To link LinkedIn ad spend to revenue, you need:

ZenABM does that in minutes. Connect your ad account, choose your CRM, set your stage logic and watch every dollar of spend transform into pipeline insights your board will love.

Stop guessing. Start proving.

Try ZenABM for free and see how quickly you can map LinkedIn ad spend to revenue—campaign by campaign, company by company, deal by deal.