If you are running ABM on LinkedIn, you must know how to measure LinkedIn ad engagement for target accounts at the level of each individual campaign.

Even with a stack of tools, many marketers still cannot assemble this view reliably.

In this guide, I explain why native CRM integrations, LinkedIn Campaign Manager, and web-visitor deanonymization tools fall short, and how ZenABM closes the gaps.

How to measure LinkedIn ad engagement for target accounts: quick overview

- Effective ABM measurement on LinkedIn requires company-level metrics per campaign, not a single roll-up by ad account.

- LinkedIn Campaign Manager’s Companies tab shows firmographic data, but only as one combined account-wide view, so you still cannot tell which ads each company engaged with.

- CRM connectors like HubSpot sync campaign metrics while removing company granularity, which creates a major blind spot.

- IP-based deanonymization underperforms due to VPNs, remote work, shared networks, and unregistered IPs, so company identification is wrong far too often.

- Click tracking via the Insight Tag, CAPI, or CRM pixels misses firms that view an ad and return later through other channels, so view-through attribution is essential.

- ZenABM uses the LinkedIn Ads API to report company-by-campaign metrics, including impressions, clicks, CTR, spend, and engagements for every target account.

- The platform maps engaged companies to HubSpot or Salesforce deals, calculates ROI, pipeline, and ROAS, and auto-assigns BDRs once engagement crosses your chosen threshold.

- Added capabilities include intent tagging, customizable ABM-stage tracking, real-time and lifetime engagement scores, and a bidirectional CRM sync.

- Bottom line, native views and IP matchers keep ABM teams guessing, while ZenABM provides the company-level insight you need to attribute revenue, optimize campaigns, and move fast on hot accounts.

Why LinkedIn Campaign Manager, CRM integrations, and web-visitor deanonymization still miss the mark, even together

Here is why these approaches, even in combination, do not deliver precise company-level LinkedIn ad reporting.

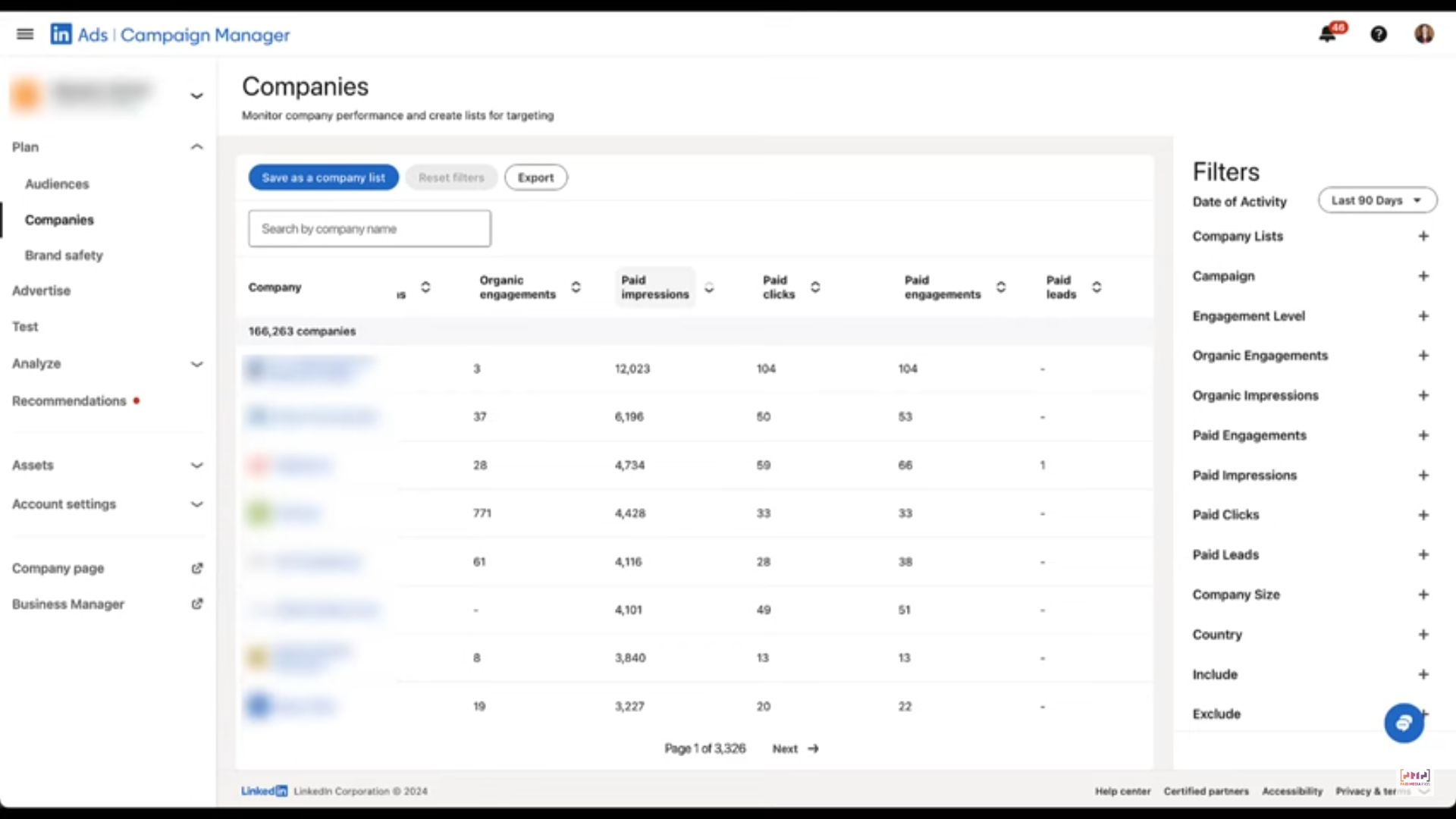

The Companies tab lacks campaign-level detail

LinkedIn Campaign Manager was not ABM-friendly until the Companies tab arrived in 2024:

The tab now shows paid clicks, impressions, engagements, and leads, plus organic counterparts and an overall engagement score at the company level.

This is progress, but it remains incomplete.

Although you can finally see company-specific impressions and engagements, those numbers are aggregated across the entire ad account. You still cannot identify which exact ads resonated with each company.

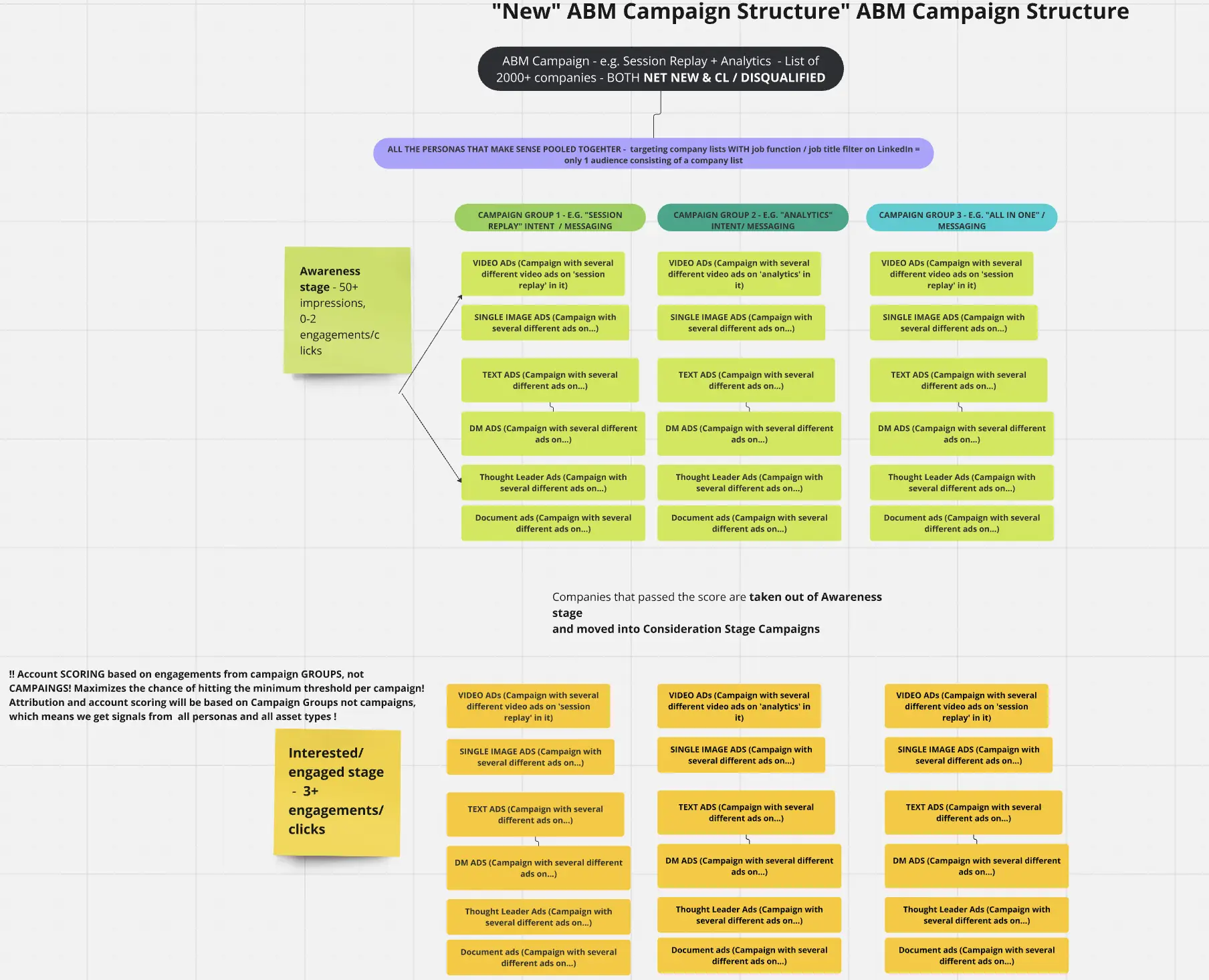

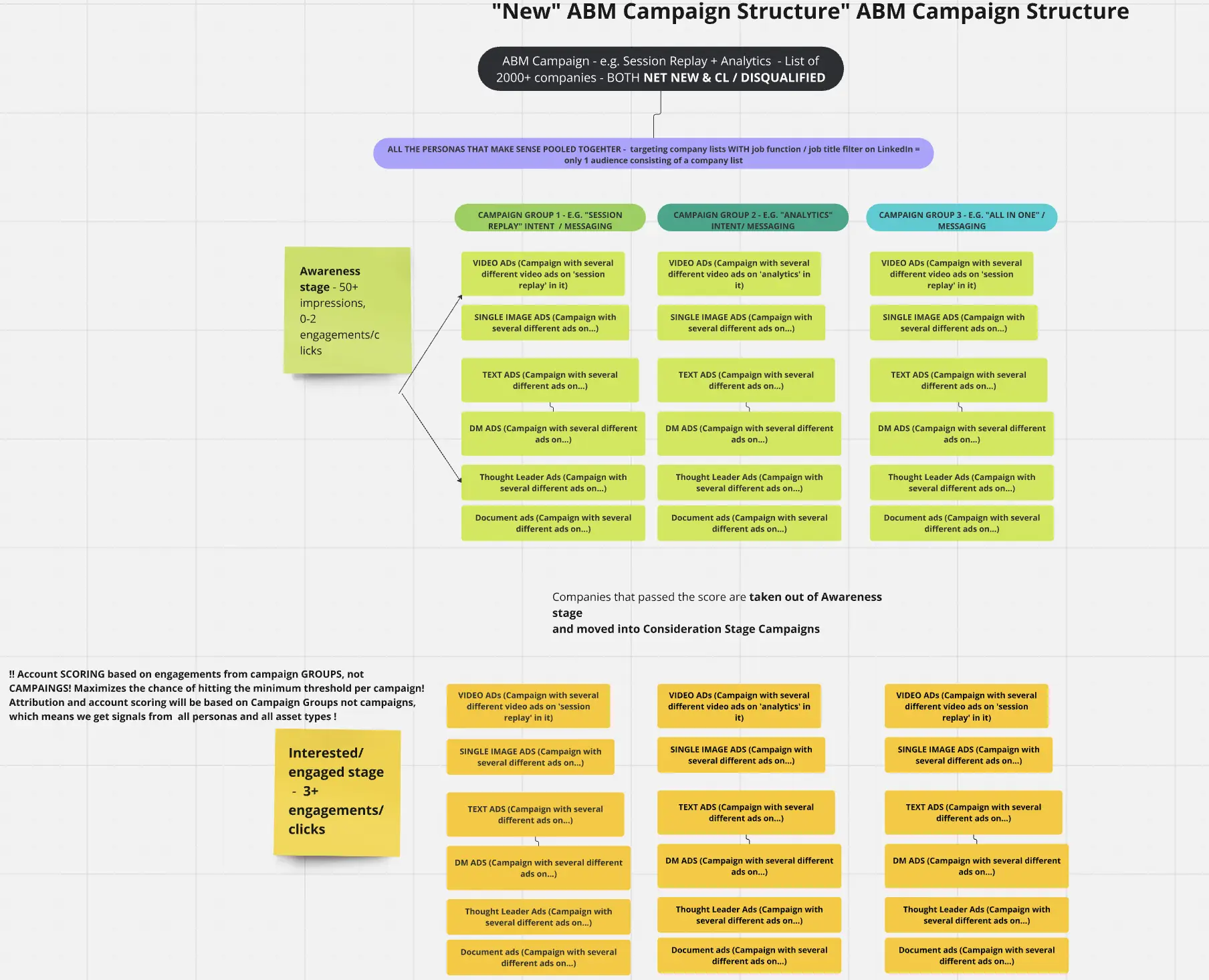

For ABM teams, that limitation breaks measurement. Most run multiple initiatives at once, often split into several campaign groups, with each group running multiple ad campaigns.

Those campaigns vary by:

- Ad format or creative

- Budget, schedule, owner, and frequency

- Buyer intent, such as specific features or benefits

Without company-by-campaign data, you cannot map buyer intent or attribute pipeline correctly. The layered structure Userpilot uses illustrates the point well:  When engagement is rolled up at the ad-account level, the data becomes close to useless. You need impressions, clicks, and engagement per company for each campaign, campaign group, and overall ABM program.

When engagement is rolled up at the ad-account level, the data becomes close to useless. You need impressions, clicks, and engagement per company for each campaign, campaign group, and overall ABM program.

Why this matters:

- BDRs can tailor outreach to the exact feature or value proposition a prospect engaged with.

- Without a campaign-level split, you cannot tell which ads won or lost, you cannot run meaningful A/B tests, and precise attribution is impossible.

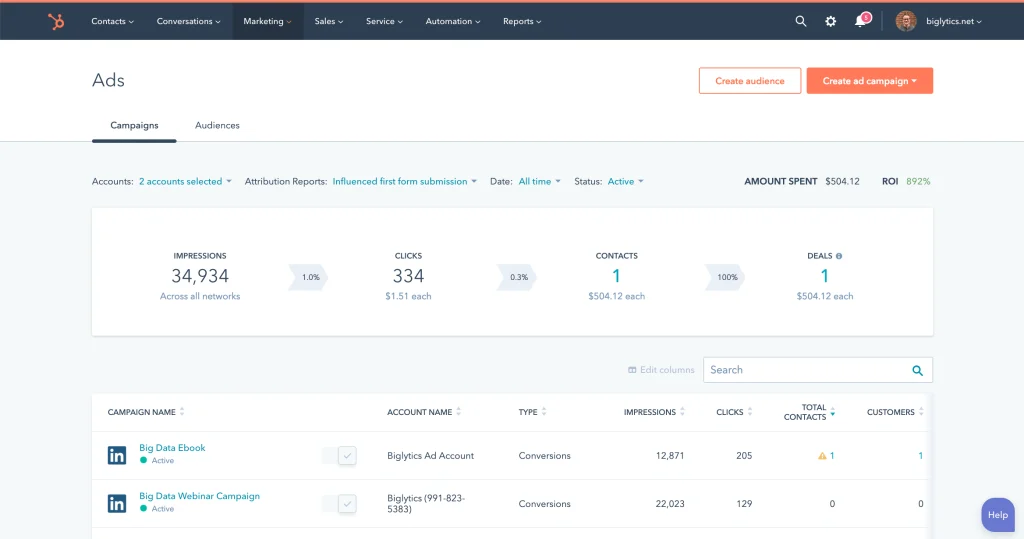

LinkedIn to CRM integrations fall flat

CRMs like HubSpot can connect to your LinkedIn Ads account. For example, the LinkedIn Ads to HubSpot integration lets you view ad-engagement metrics inside HubSpot’s Ads tool:  Surprisingly, this view is even more restrictive than LinkedIn Campaign Manager.

Surprisingly, this view is even more restrictive than LinkedIn Campaign Manager.

You do get campaign-level impressions and clicks, but the companies behind those numbers are not visible. The firmographic detail disappears entirely.

UTMs or separate domains plus deanonymization still fall short

Marketers often try one of these workarounds:

Marketers often try one of these workarounds:

- Create a separate domain exclusively for ad traffic so every visit must come from LinkedIn ads.

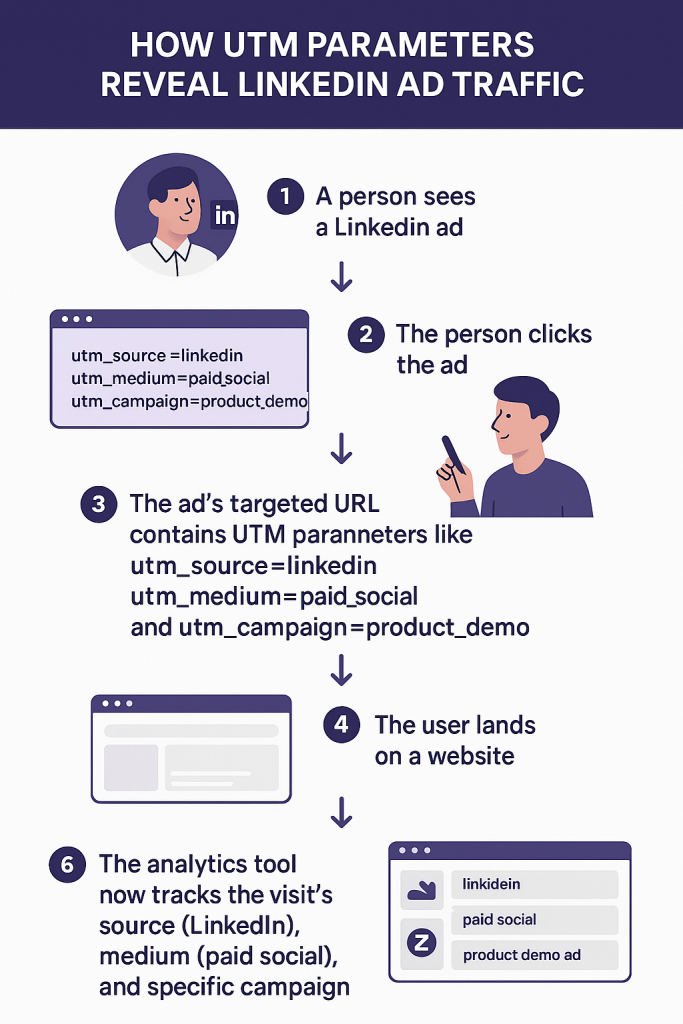

- Add UTM parameters to identify ad visitors.

They then deploy web-visitor deanonymization software to reveal company identities.

Under the hood, these platforms mostly rely on IP address matching against a database, which fails frequently due to:

- Widespread remote work

- VPN usage

- Shared public Wi-Fi

- Many firms never register their IPs

The result is poor accuracy. These tools correctly identify the visiting company roughly 42% of the time:

One more anecdote shows why paying for IP matching rarely pays off:

“The accounts we targeted never appeared in our website analytics, even though we knew they landed on the bespoke landing pages for our ABM ads.

How do we know? We built a no-index domain solely for the campaigns, ensuring 100% of visits came from target accounts. Over 90 days, Breeze Intelligence (using Clearbit’s API) spotted just one company… our own!”

– Emilia Korczynska, VP Marketing, Userpilot

This strategy also depends on clicks. If a company only views your ad and later arrives via organic search, the attribution disappears completely.

Bottom line: LinkedIn Campaign Manager aggregates by account, CRMs drop company details, and IP matching is unreliable. You need a platform that shows company-level LinkedIn metrics for each campaign, group, and ABM initiative.

Clicks and form fills are not enough

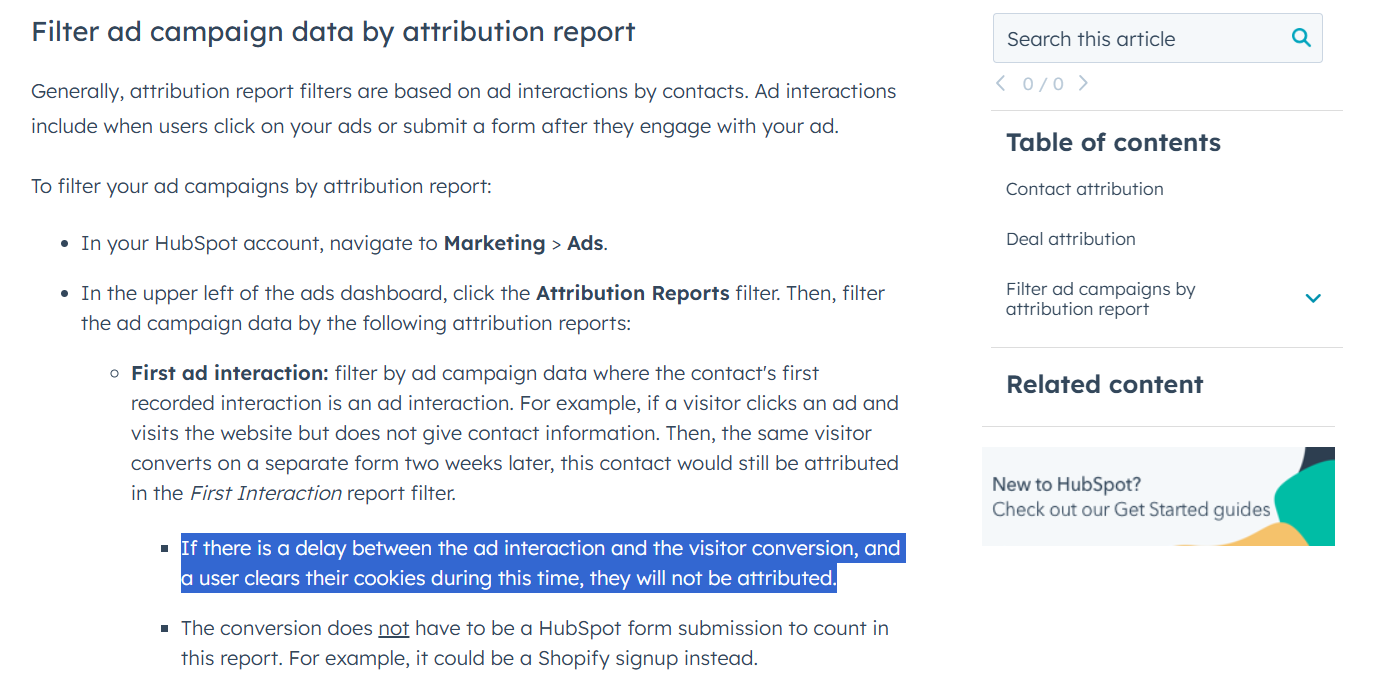

Yes, you can combine LinkedIn CAPI, the Insight Tag, or a CRM pixel with UTM parameters to catch ad visitors, but visibility is limited. If someone clicks an ad and does not submit a form in the same session, LinkedIn CAPI and the Insight Tag cannot reveal their company.

HubSpot can sometimes attribute a returning visitor to the original ad click without a form fill, but it depends on cookies, which are increasingly unreliable.

Even if cookies behaved perfectly, two problems remain:

- You still cannot identify the company until someone completes the form accurately.

- IP matching is too error-prone to fill the gap.

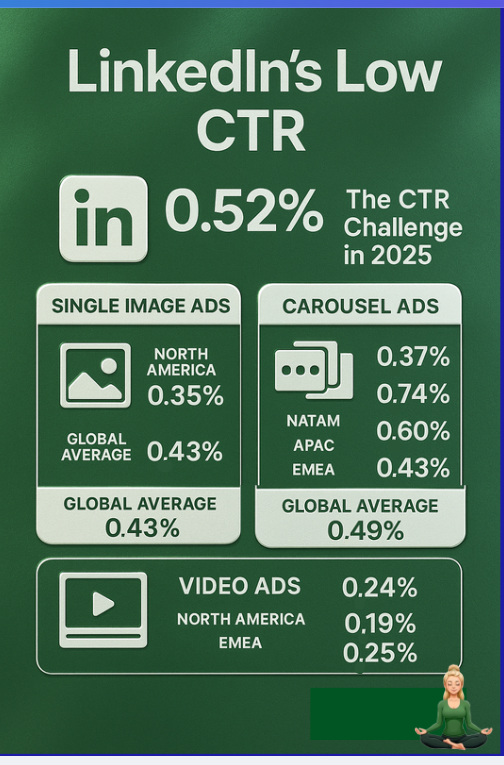

- LinkedIn CTRs are low:

Bottom line: Even with perfect cookies and flawless forms, you still miss companies that viewed your ad and converted through another path. A click-through approach is inadequate on LinkedIn. View-through attribution that captures company-level impressions and engagements is mandatory if you want to measure LinkedIn ad engagement for target accounts.

How ZenABM measures LinkedIn ad engagement for target accounts, and more

Here’s how ZenABM helps you measure LinkedIn ad engagements with utmost accuracy and automatically:

Company-level Engagement Tracking Per Campaign Using LinkedIn’s Official API

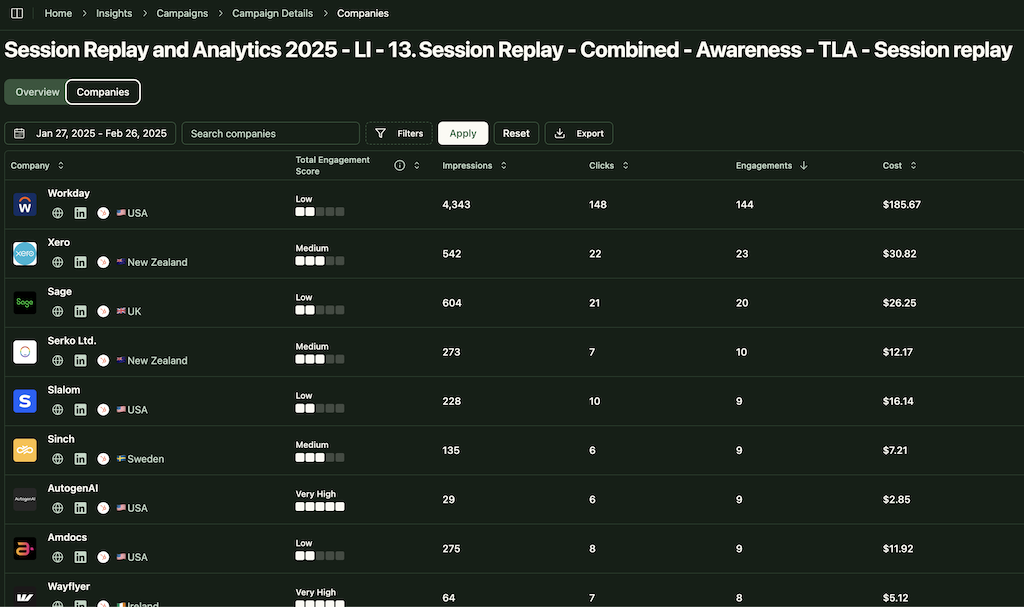

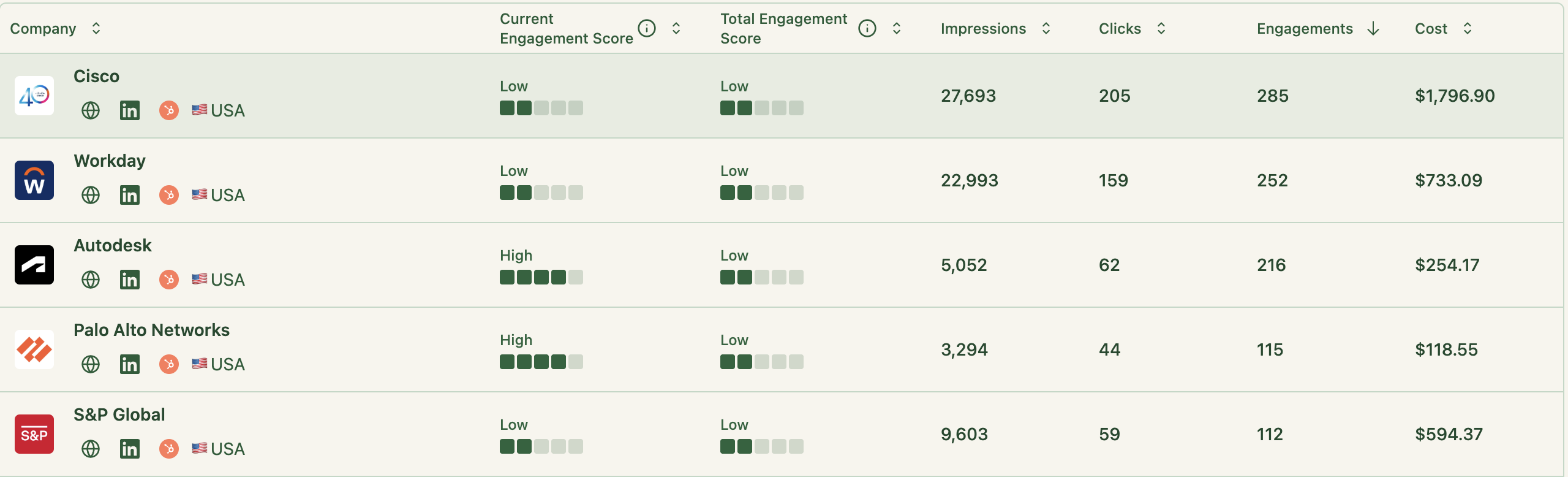

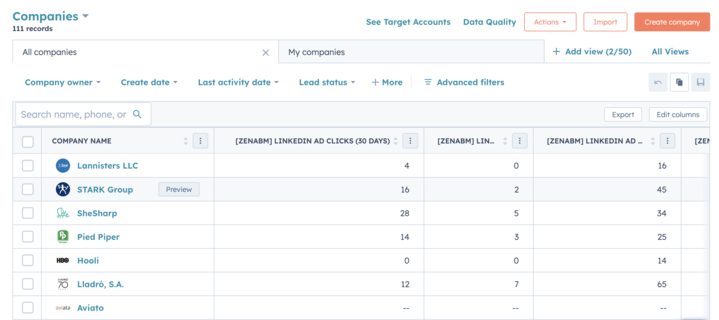

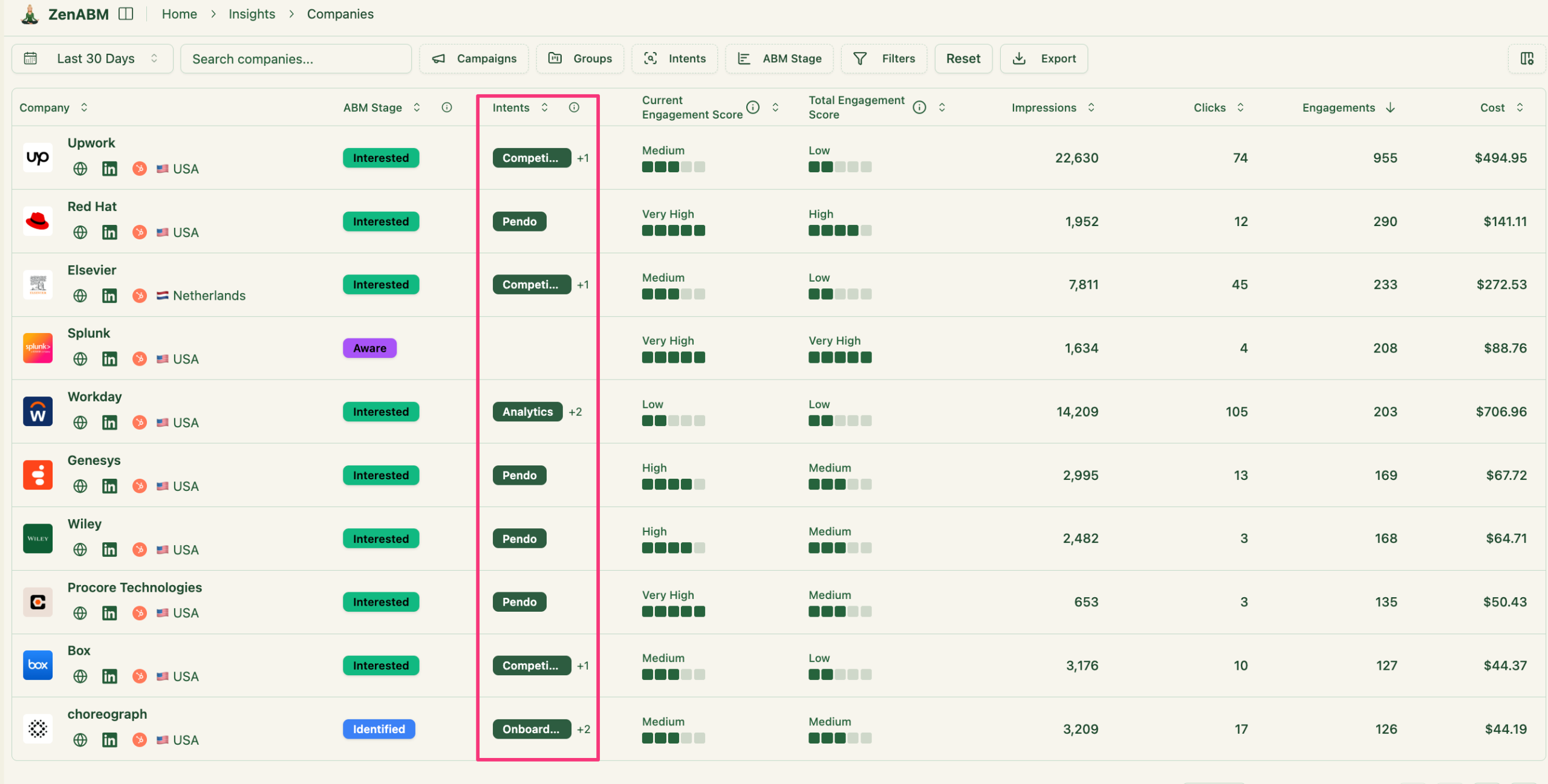

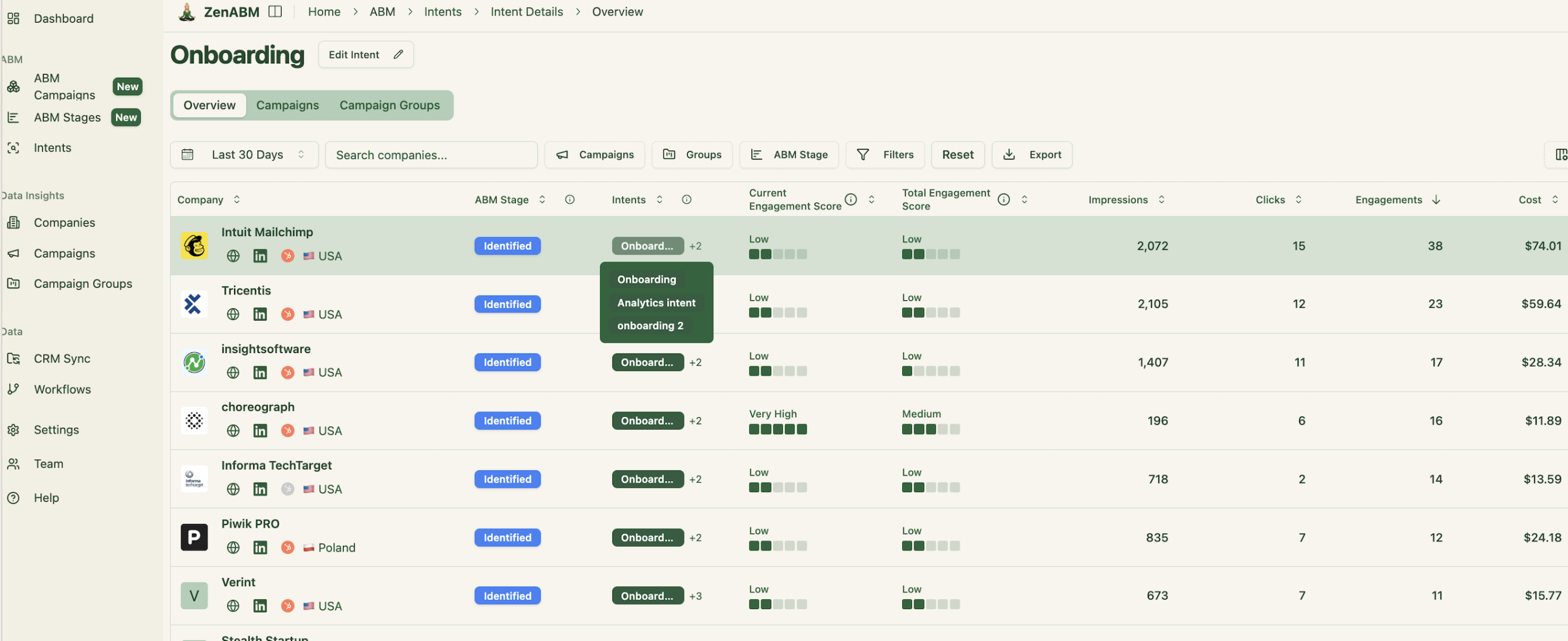

ZenABM pulls company-level LinkedIn ad engagement data (impressions, clicks, and engagements) and ad spend for each of your LinkedIn ad campaigns:

Engagement-Based Lead Scoring and ABM Stage Tracking

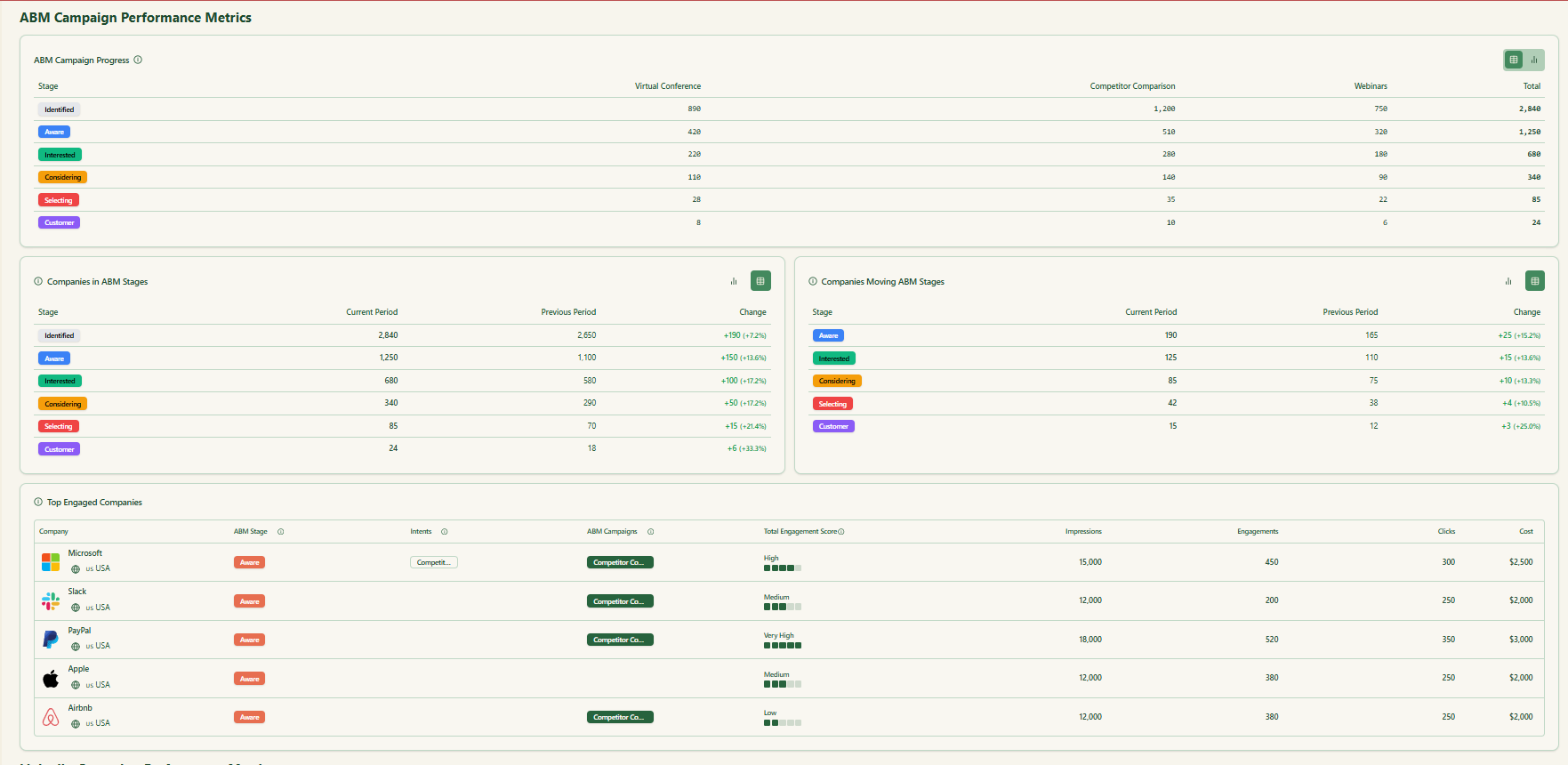

Apart from giving you raw engagement data of each company with each campaign, ZenABM sums up the historic and current engagement rate of all companies across all your ad campaigns to give you a lead score – a score telling you how aware or engaged a company is with your overall brand and campaign.

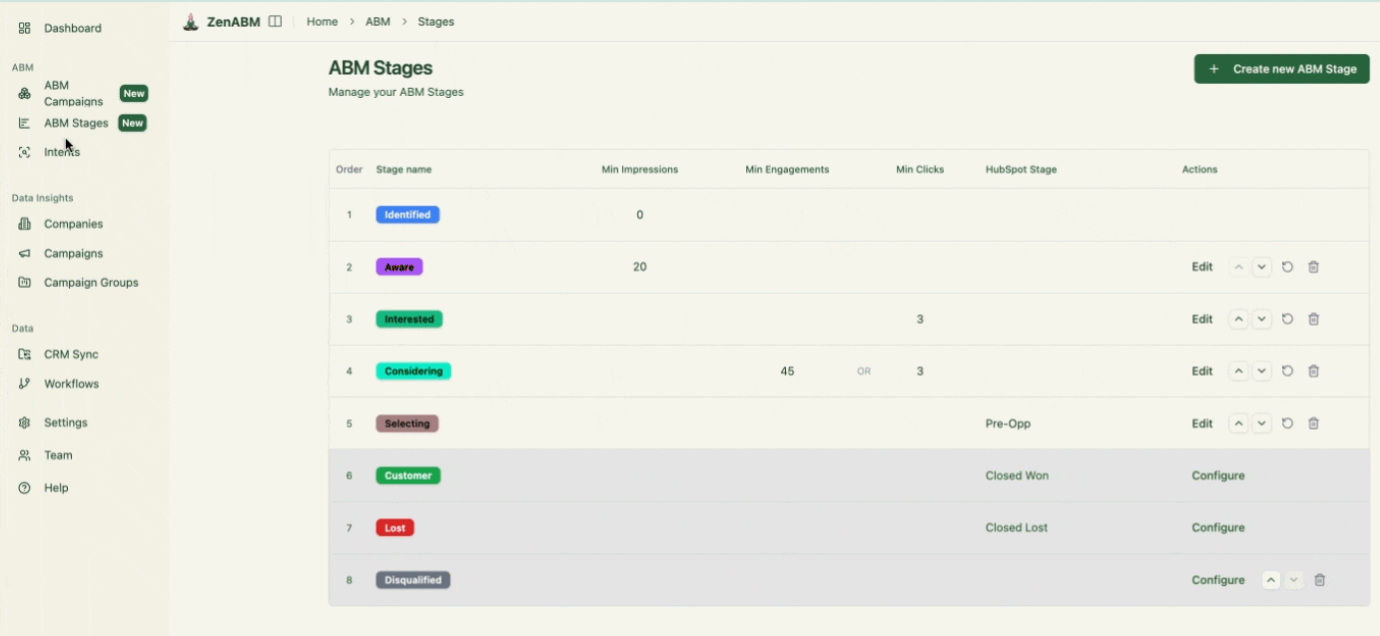

Plus, based on these engagements and your CRM data, ZenABM assigns an ABM stage to each account.

The best part? The engagement thresholds for these ABM stages are customizable at the user’s end:

Automated BDR Assignment

We just saw that ZenABM tracks the ABM stage of each account based on engagement and CRM data.

To add more convenience for your sales team, ZenABM assigns hot accounts (accounts that have reached the interested stage) to your BDRs in your CRM:

So, your BDR outreach is immediate to hot accounts without manual daily look-ups and manual alerts to your BDRs in, say, Slack.

Two-Way CRM Integration

While you run ABM on LinkedIn, your marketing team will live in ZenABM and MAPs, but the sales team prefer their comfort zone – the CRM.

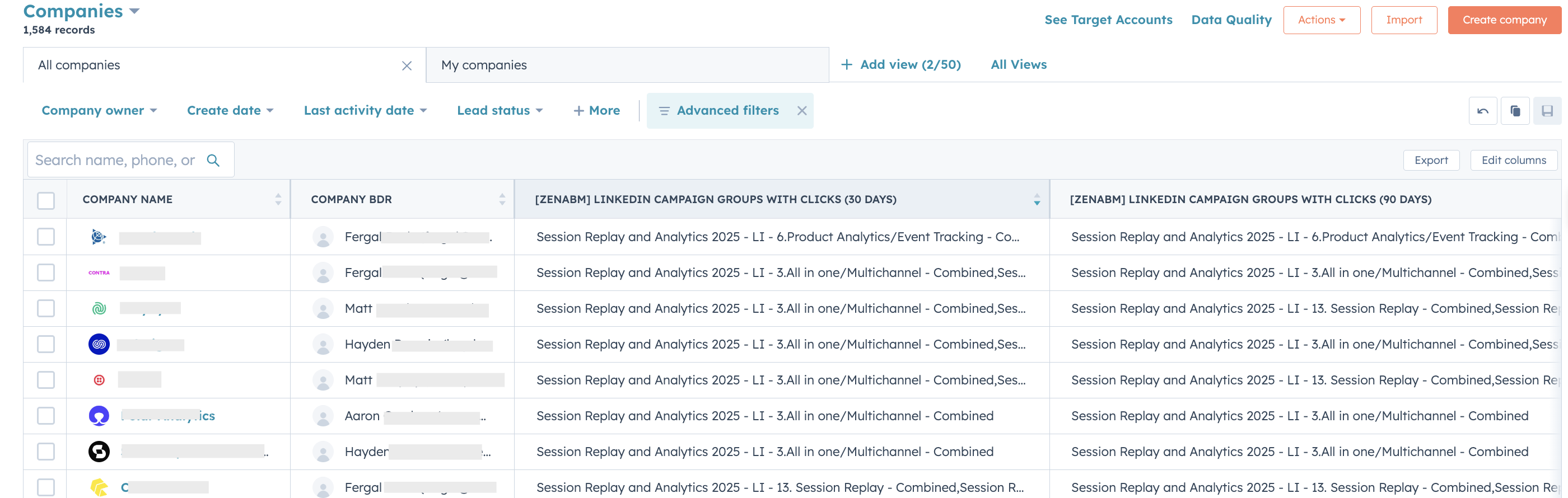

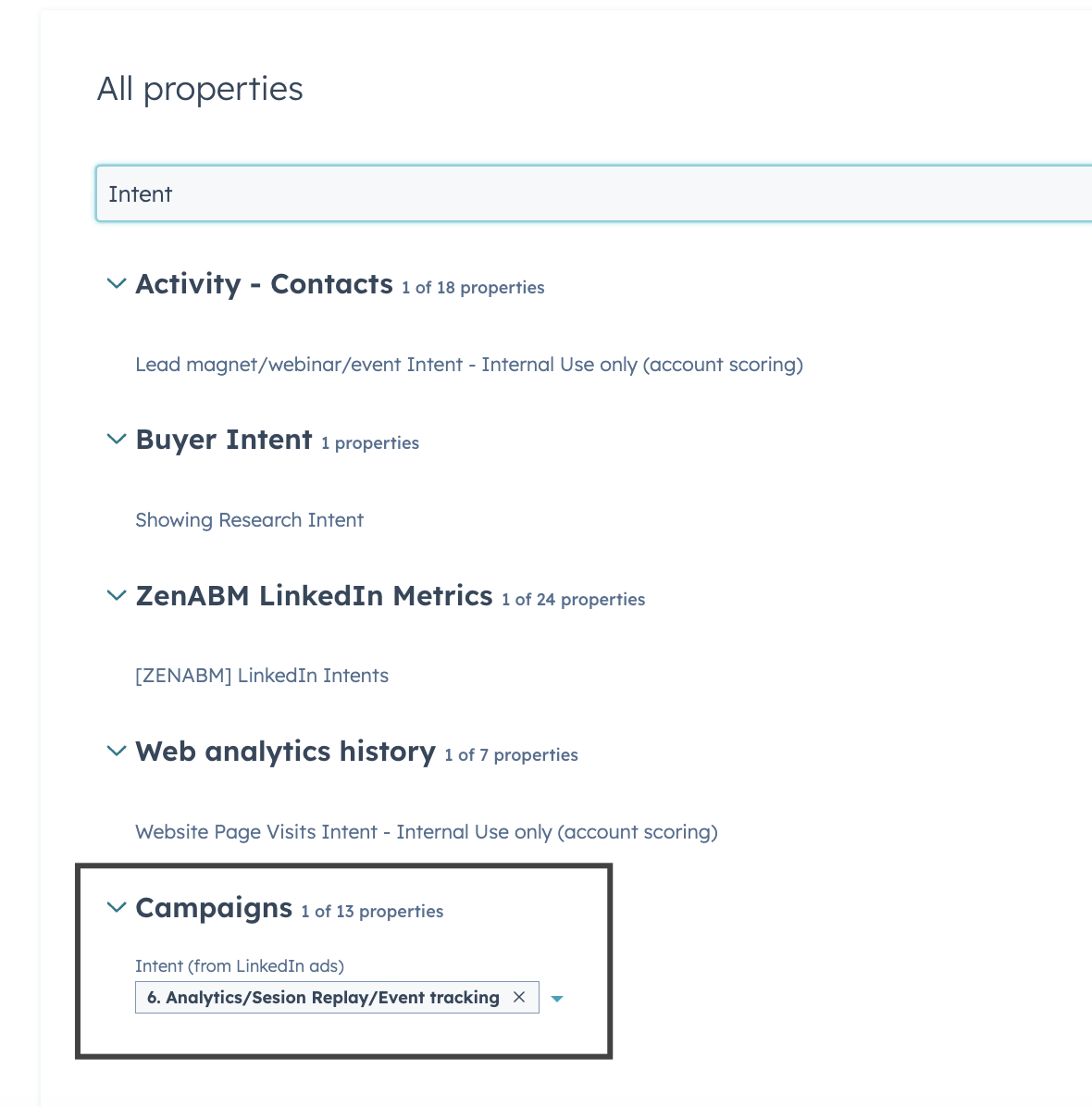

Well, for bridging the gap and eliminating manual data downloads and uploads, ZenABM automatically pushes all engagement data for accounts as company properties to your CRM:

And as for the other way of this two-way CRM integration, ZenABM matches engaged companies to the deals in your CRM and pulls the deal value of each company.

Plug-and-Play ABM Analytics and ROI Attribution Dashboards

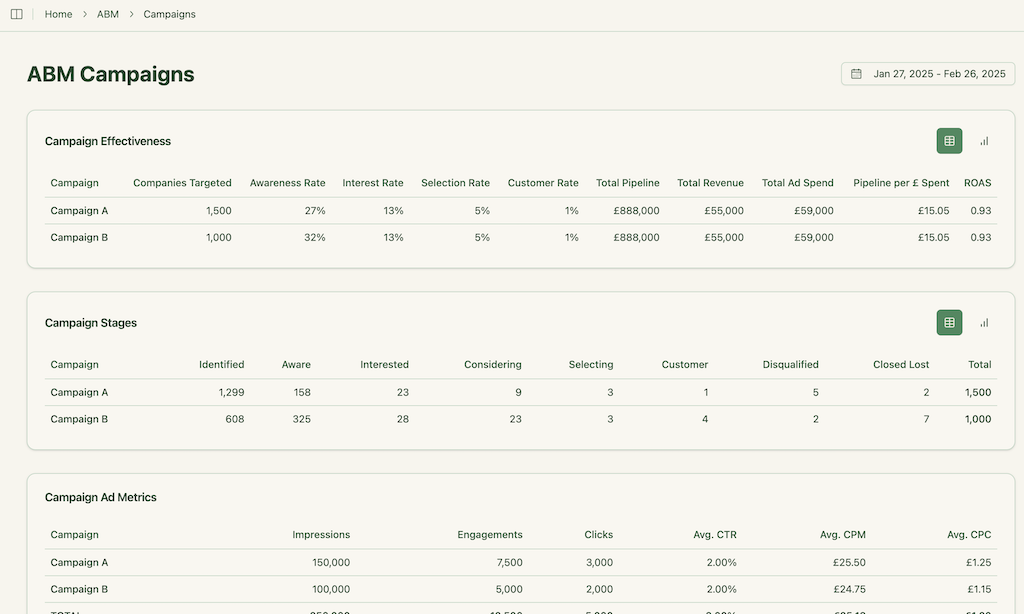

ZenABM, empowered with its company-matching and deal-value-pulling feature, provides you with ready-made ABM analytics and ROI attribution dashboards.

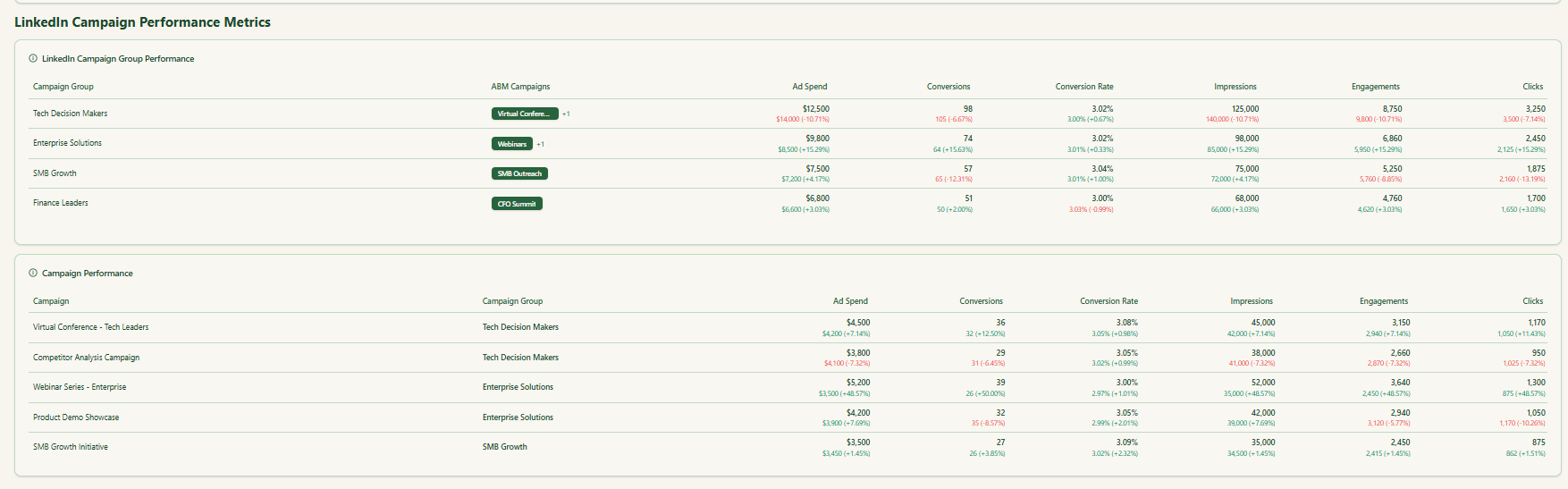

- You can see the ad performance at all levels, including ABM campaigns, LinkedIn campaign groups, and individual LinkedIn ad campaigns:

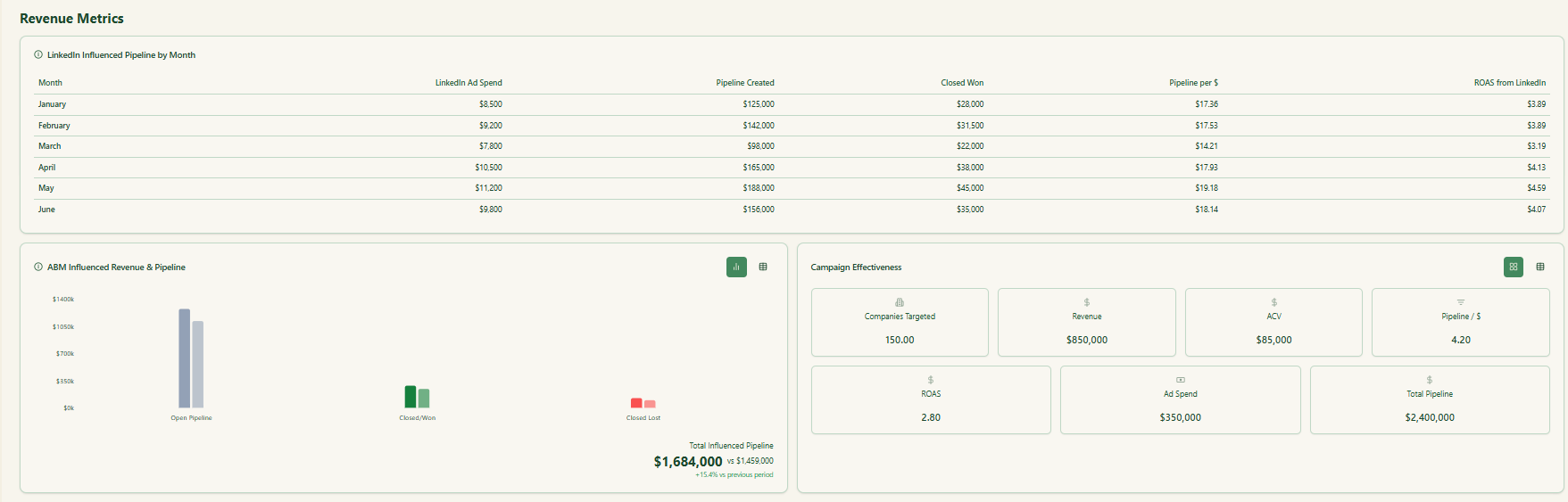

- Plus, as it has both the deal value and the ad spend for each company and campaign, it calculates revenue metrics, campaign effectiveness metrics like ROAS, pipeline per dollar spent etc. and also shows you the pipeline graphically:

Intent-Based ABM

Many pro ABMers use third-party tools like Bombora or ABM giants like Demandbase or RollWorks to find the qualitative intent (the pain-point, the feature, or the offer that the prospect is interested in). They do this by tracking the keywords being searched by accounts‘ members:

But I suggest a better way: Stop paying for third-party data and embed qualitative intent in your ads themsleves, which you are already paying for anyways.

For instance, if you have a product management SaaS, make different ad campaigns for different intents like product analytics, onboarding, session recording, all-in-one, etc.

Something like this:

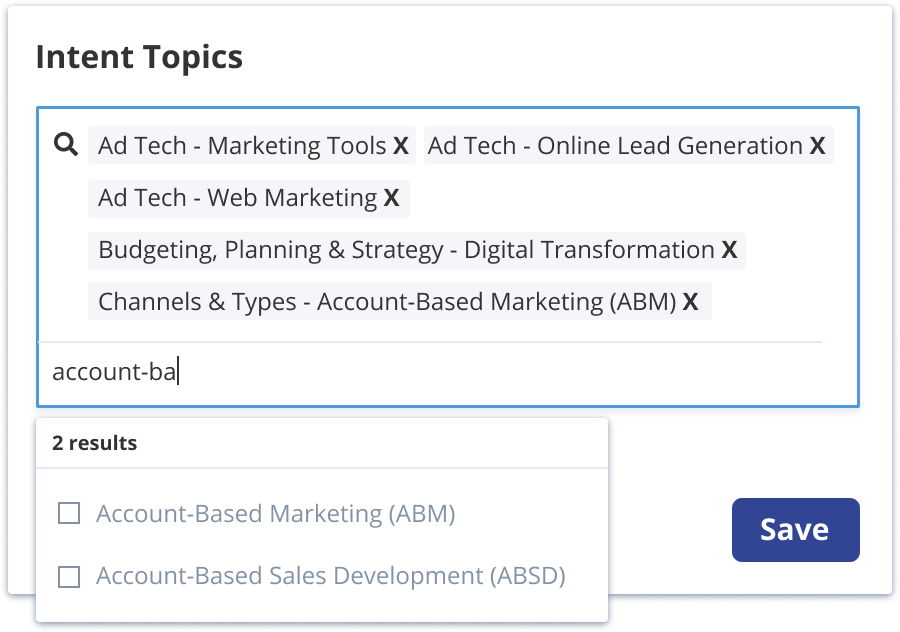

Then, tag each campaign with intent in ZenABM, and ZenABM will tell you the qualitative intent of each company:

It will also group all companies with similar intent together for your convenience:

Plus, ZenABM will also push intent as company property to your CRM:

So, now your BDRs won’t just know the hot accounts, but also what to talk about with the accounts during the outreach.

Funnel-Leak Analysis

ZenABM clearly maps out the number of companies in each stage – from initial to final stages- and also how they move. This helps you find where the friction is.

For instance, if a lot of companies are moving from ‘aware’ to ‘interested’ but don’t move out of ‘interested’, you know where the friction is and can act accordingly.

Over to you

LinkedIn Campaign Manager consolidates data, and CRMs often omit firm-level details.

If you rely only on click-through methods such as CAPI, the Insight Tag, or CRM pixels, you will miss companies that view ads without clicking.

ABM success depends on knowing exactly which companies engaged with which ads, and how that should drive outreach, scoring, and revenue.

ZenABM provides company-level insights for each campaign, automatic BDR assignment, real-time scoring, intent tagging, and a seamless CRM sync.