From new frameworks for segmentation like ‘SPICED’ to the traditional ones based on persona (job-roles/decision-roles) and firmographics, I have discussed them all in this article, along with what ABM experts suggest about ABM strategy and segmentation and how ZenABM can help along the way.

Read on if you’re up to ABM!

ABM Strategy and Segmentation: Quick Summary

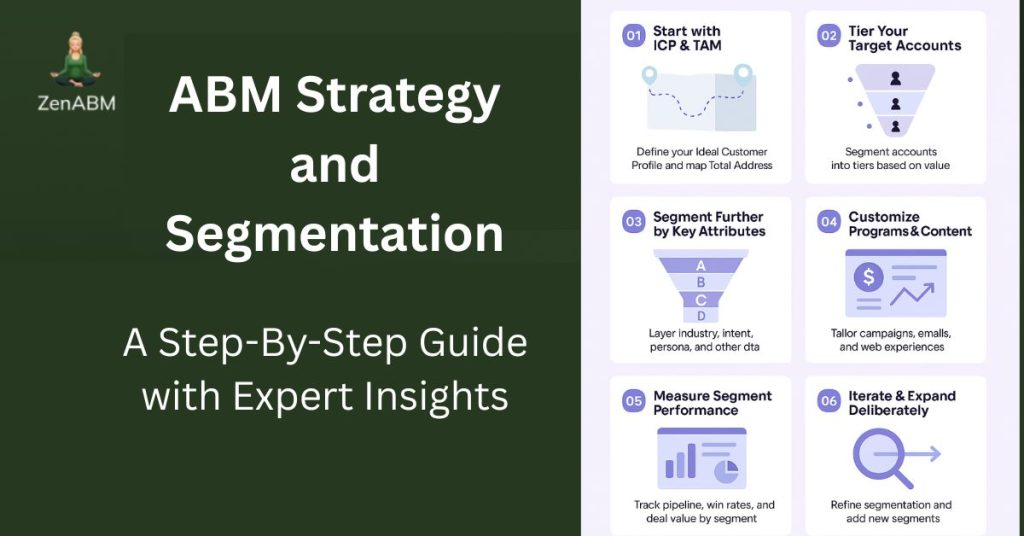

- Don’t over-promise and under-deliver. Avoid expensive 1:1 campaigns on low-value accounts that kill ROI.

- Segmentation is mission-critical. Every ABM motion from ICP/TAM to tiering and beyond relies on smart account division.

- Start with ICP & TAM. Define your best-fit customer blueprint and map how many such accounts exist.

- Tier accounts by value. Tier 1: “Whales” get white-glove 1:1 treatment. Tier 2: Clusters of 10 receive semi-custom 1:many campaigns. Tier 3: Broad 1:many plays uncover intent and feed higher tiers.

- Layer additional segments. Go beyond firmographics: industry verticals, intent signals, personas/buying committees, and even creative data sources like tech stacks or funding events.

- Align Sales & Marketing. Co-build and co-own your segments and success metrics to ensure unified execution.

- Customize every play. Tailor content tracks, email/ad sequences, dynamic web experiences, and multi-channel plays to each segment.

- Measure, iterate, repeat. Track pipeline, win rates, and deal value by segment. Use account scoring and feedback loops to promote or pivot segments. Attribute ROI per segment to guide budget and strategy.

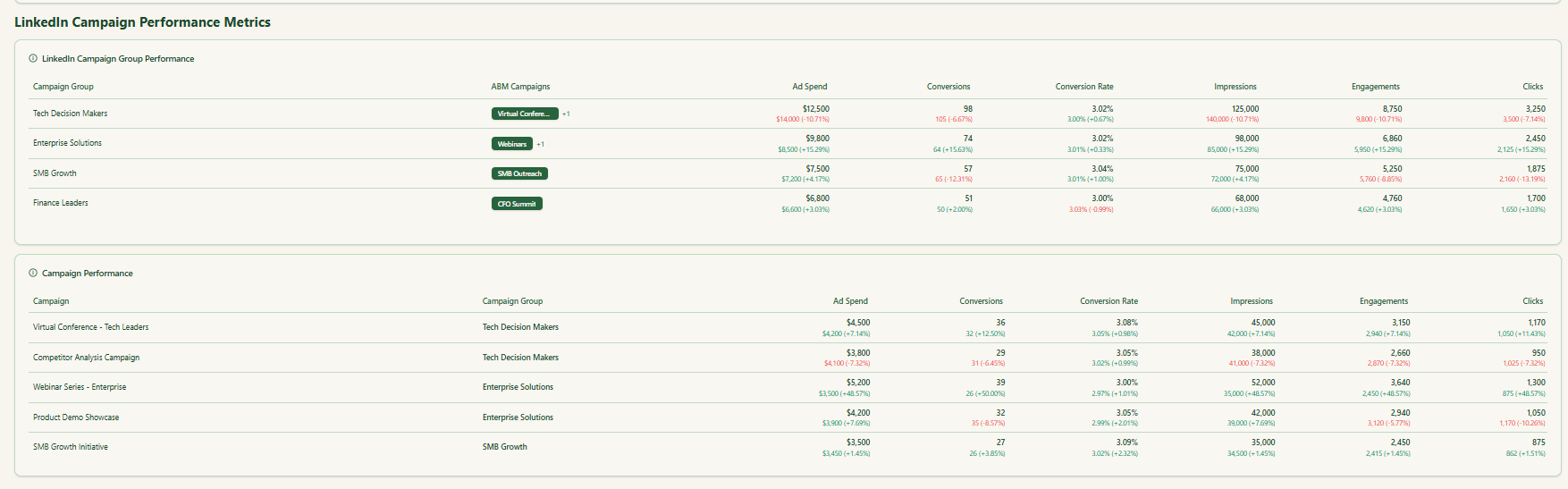

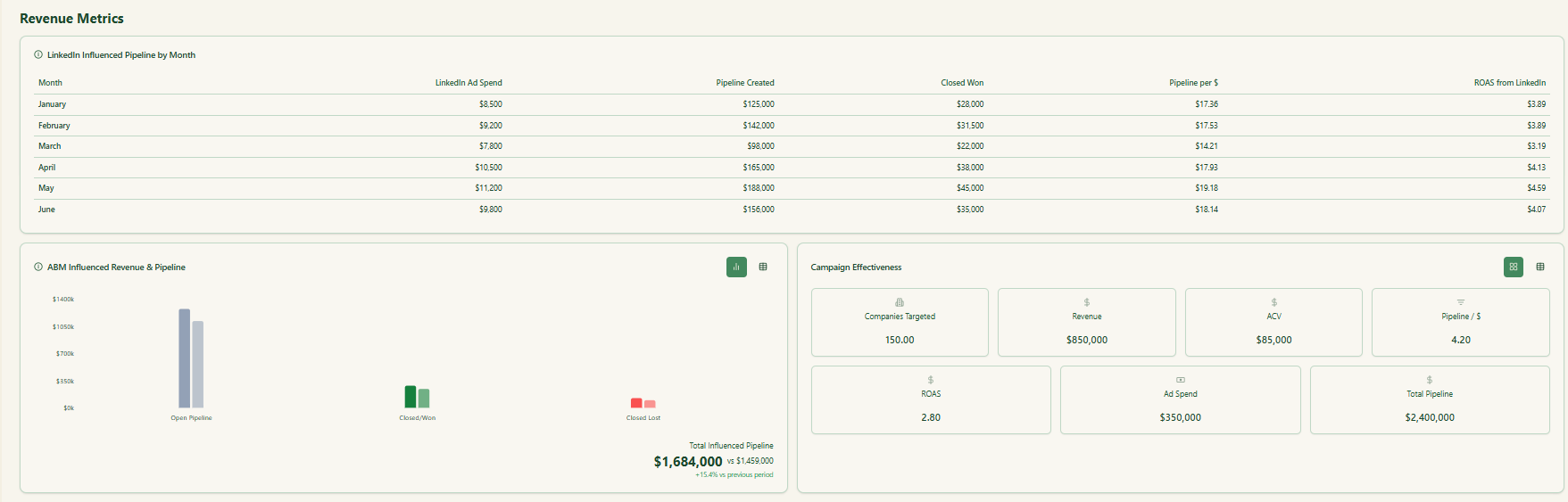

- Use ZenABM’s company-level ad engagement per campaign and deep ABM analytics to power every stage of your ABM, so you can focus on the accounts that matter most.

Why Segmentation Is the Foundation of ABM ROI

Ask any ABM thought leader the key to ROI, and the answer will be focus.

ABM doesn’t win by casting a wide net; it wins by precisely targeting the highest-value accounts and personalizing everything to them.

Demandbase’s ABX expert Stephanie McArthur notes that “one of the key reasons ABM delivers exceptional ROI is its precision. By identifying and focusing on high-value ABM accounts, B2B companies eliminate wasted efforts on unqualified leads.”

In other words, segmentation, done right, means every dollar of your budget and every minute of your time goes to prospects that actually move the needle and also each account receives the attention and effort it deserves, not less, not more.

Let’s look at how to do it.

Step 1: Start with ICP and TAM: Your “Who” and “Where” Maps

Every great segmentation strategy starts with clearly defined Ideal Customer Profiles (ICPs) and an understanding of your Total Addressable Market (TAM).

Think of ICP as the blueprint of your best-fit account, and TAM as the universe where those accounts live.

You can’t segment effectively if you don’t first know who you’re after and where to find them.

Define Your ICP

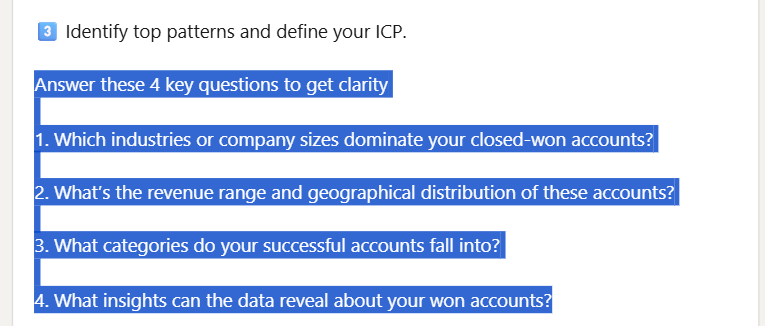

To build an idea of your ICP, analyze patterns in your existing data.

Look at your best customers and identify commonalities:

- Firmographics (company sizes, industries, revenue range, geographical distribution, etc.)

- Technographics (the tools and methodologies they use)

- Psychographics (values, interests, inspirations)

- Other behaviors and triggers, like pain points, the nature of the buying committee, etc.

So, essentially, it’s about figuring out what your highest-value customers have in common.

For instance, if most of your successful accounts are mid-market fintech companies in North America with a certain tech stack, that’s a strong ICP element.

Pro Tip: Have more disqualification criteria (e.g. industries or account types that don’t fit) than qualification criteria to keep your targeting as focused as possible.

Map the TAM and Segment It

Once you know who you’re targeting, outline how many such accounts exist, i.e figure out your TAM.

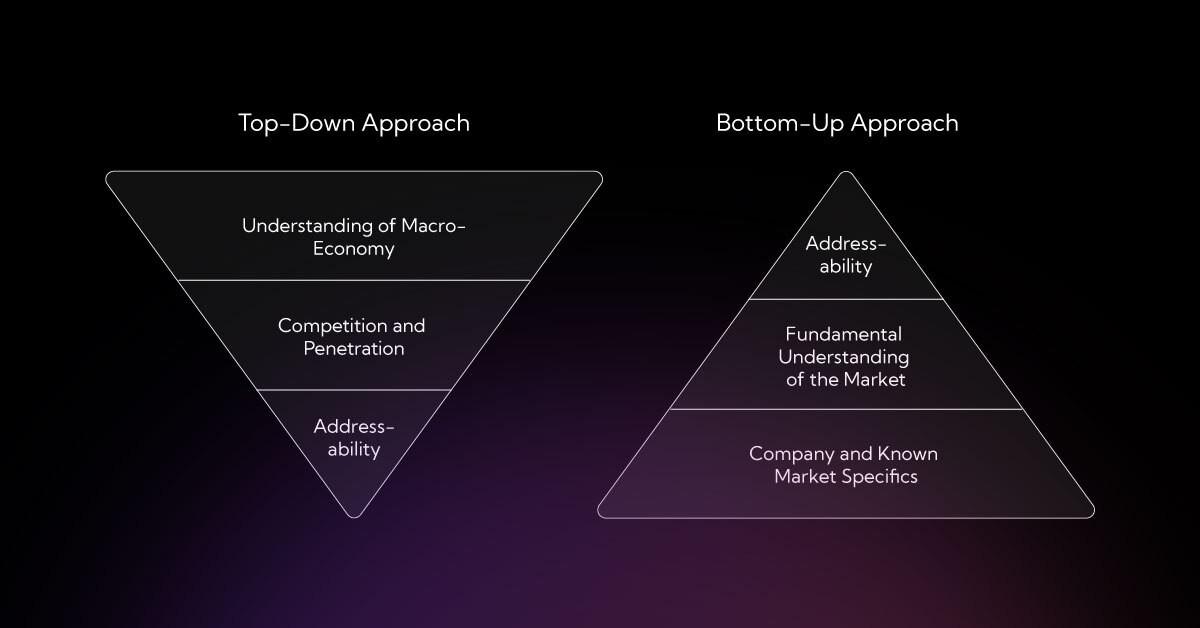

Now, whether you use the top-down approach or the bottom-up approach:

You’ll have to do segmentation (segmentation in ABM is constant; you’ll find yourself doing it too frequently!) because it’s helpful.

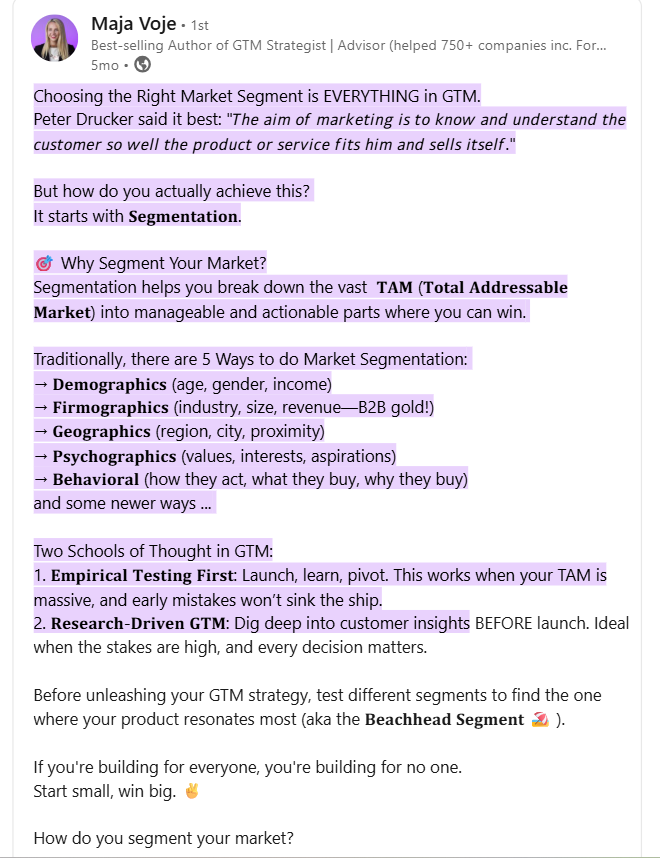

A GTM strategist, Maja Voje, lays out the reason: “Segmentation helps you break down the vast TAM into manageable and actionable parts where you can win.”

And I agree.

Rather than going after the entire universe at once, you must carve it into segments.

Traditionally, there are 5 ways to do market segmentation (Yes, these segments are the same as the commonalities we looked for in the best accounts in the previous step):

- 𝐃𝐞𝐦𝐨𝐠𝐫𝐚𝐩𝐡𝐢𝐜𝐬 (age, gender, income)

- 𝐅𝐢𝐫𝐦𝐨𝐠𝐫𝐚𝐩𝐡𝐢𝐜𝐬 (industry, size, revenue)

- 𝐆𝐞𝐨𝐠𝐫𝐚𝐩𝐡𝐢𝐜𝐬 (region, city, proximity)

- 𝐏𝐬𝐲𝐜𝐡𝐨𝐠𝐫𝐚𝐩𝐡𝐢𝐜𝐬 (values, interests, aspirations)

- 𝐁𝐞𝐡𝐚𝐯𝐢𝐨𝐫𝐚𝐥 (how they act, what they buy, why they buy)

And of all the criterion, firmographics is the most relevant one in B2B.

An Example: You might segment your TAM into verticals (e.g. Finance, Healthcare, SaaS) or by company size (SMB, Mid-Market, Enterprise).

Result of both these sub-steps?

- You’ll know what your ICP is.

- You’ll have your TAM divided into various segments.

Now you have to focus on the TAM segments that match your ICP and ditch the ones that don’t.

Step 2: Tier Your Target Accounts for Focused Effort

Ok, now you are done with the ICP analysis, TAM estimation, and have extracted the accounts in your TAM that matched your ICP to make your first target account list (TAL).

But one more segmentation remains: Segmentation based on value, aka tiers.

Importance: See, all your target accounts match your ICP and thus are important, but not equally important. Like toiling to attract each account equally regardless of expected deal value – how is that prudentially justifiable?

So, here are the tiers you must segment your TAL into and what effort each tier deserves:

| Tier | Description |

|---|---|

| Tier 1 | Your dream clients (“whales”, they call them) with high ACV potential or strategic value. These get a true 1:1 ABM treatment (white-glove hyper-personalization, executive outreach, bespoke content). You might only have a small number of Tier 1s (e.g. 20 accounts), but each could be worth 10x a typical deal. The ABM mantra here: “few but mighty.” |

| Tier 2 | Important accounts that fit your ICP well but aren’t quite the OGs. These often get a 1:few approach grouped by similarities. For instance, 50 accounts segmented into 5 clusters of 10 (maybe by sub-industry or common need), each cluster receiving personalized campaigns. There’s personalization, but more templatized, semi-custom content that speaks to that segment’s pains. |

| Tier 3 | Larger batches of good-but-not-top accounts. This is your 1:many play (programmatic ABM). These accounts get broad, automated campaigns (targeted ads, scaled outreach) to test for engagement. Tier 3 is often the farm team for Tier 2: you run wide programs to see which accounts “raise their hand” with intent, then graduate them upward for more attention. |

A Real-World Example

SalesLoft ran a tiered ABM segmentation model and achieved a 115 % lift in converting marketing leads into booked sales meetings.

The secret?

They isolated a subset of high-fit accounts, gave them richer data and more personalized touches.

Takeaway: Focusing extra effort on a well-segmented, well-tiered list gets you outsized returns compared with treating every lead the same.

Source: ABM in Action

Step 3: Segment Further By Key Attributes

With ICP and a tiered TAL in place, it’s time to get even more granular.

I mean, a sophisticated ABM strategy goes well beyond just “enterprise tech vs. mid-market tech” labels.

Here’s the other segmentation axes you must consider:

Segment by Industry and Vertical Niches

Vertical segmentation is one of the most common (and effective) approaches, especially in SaaS ABM.

If your product or solution addresses pain points that differ by industry, you should group accounts by industry vertical and send out industry-specific messaging.

For example, a B2B SaaS business that serves both financial services and healthcare will have to show distinct content to each.

Industry + Persona-Based Segmentation Brings Higher Revenue : A Real-World Example

At Clarabridge (a B2B CX platform), they started their ABM journey by segmenting into just two verticals: retail banking and healthcare insurance.

This focus allowed them to tailor content deeply to each vertical. They didn’t stop there and further broke down prospects by role within those target accounts (e.g. separating messaging for IT leaders vs. CMOs within the healthcare segment).

The result?

In just a few months, this comprehensive segmentation strategy influenced 96 deals worth ~$24 million in revenue!

Source: ABM in Action

Segment Based on Lifecycle Stage

Scan your TAL to segment out existing customers, open opportunities, churned customers, and totally new logos separately.

This step is absolutely necessary because the messaging for a new account and the upselling efforts for an existing one are going to be extremely different, right?

Segment by Engagement-Based Intent Signals

Now, this segmentation is for new logos.

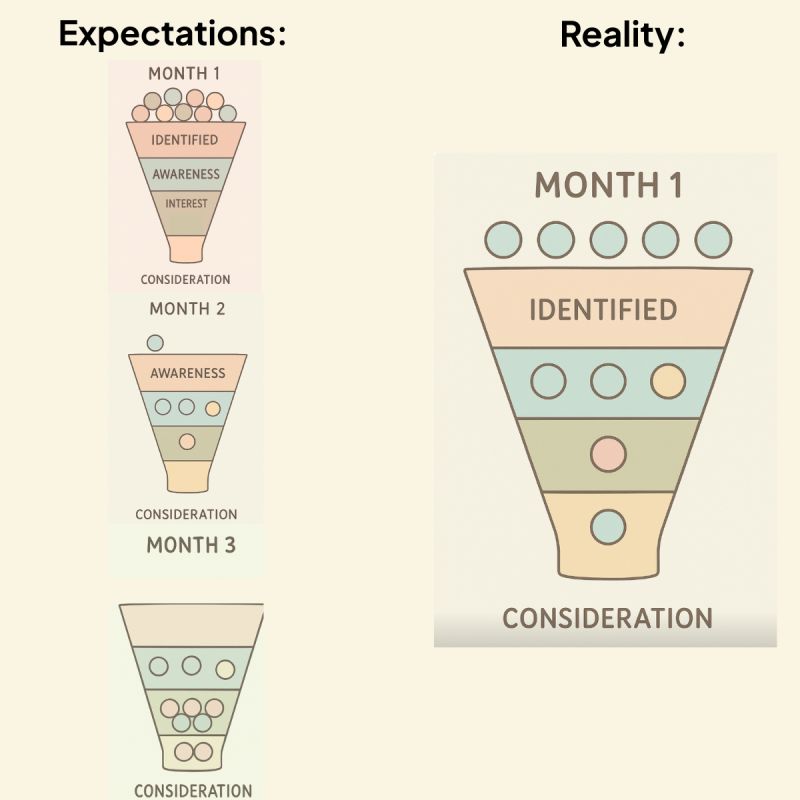

Emilia Korczynska (VP of marketing at Userpilot) suggests that assuming all the new logos in the entire TAL are unaware of your business and pushing them all into an ‘Awareness’ campaign, which includes only high-level surface-level TOFU content, is wrong.

- Your target account might already know you.

- Some might be problem-aware.

- Some might be solution-aware.

- Some might even be considering which tool/service to buy and need just a little nudge to come in your half of the court.

Solution?

You can first run a pilot campaign where you’ll show all types of content (TOFU, MOFU, and BOFU) to each account instead of assuming them as warm/cold.

Then, based on ad engagement, gauge their buying intent, and divide them into ‘low intent’ and ‘high intent’ segments. This will help you figure out who’s warm/cold, and you’ll be able to act accordingly.

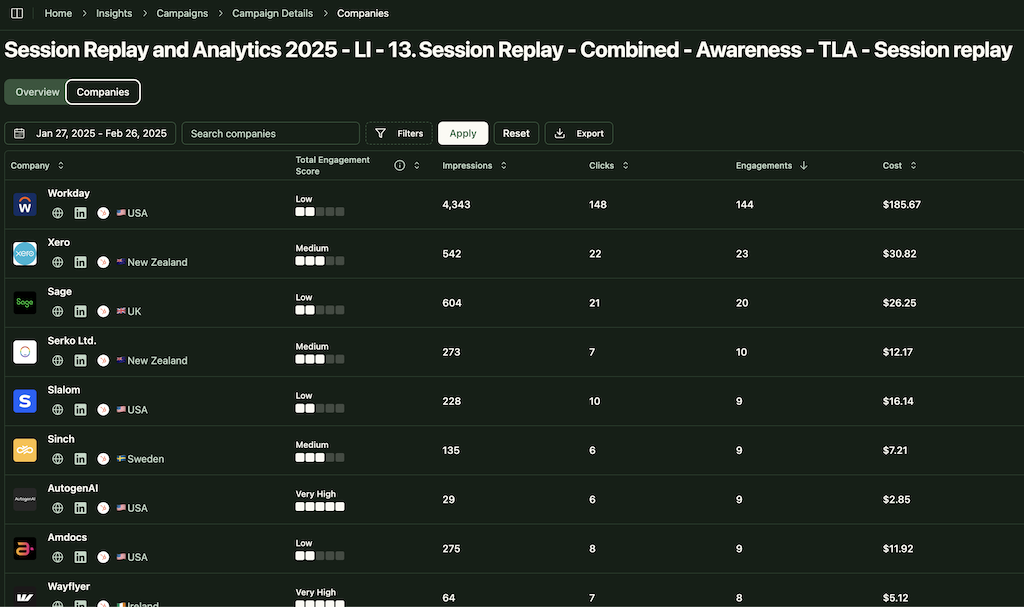

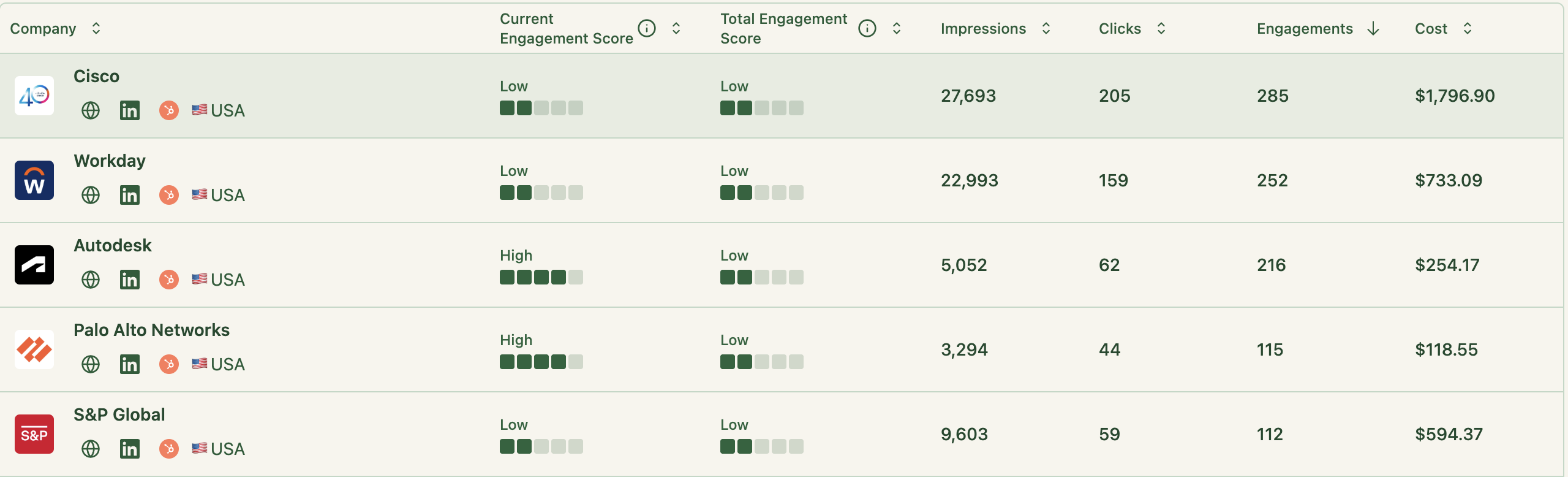

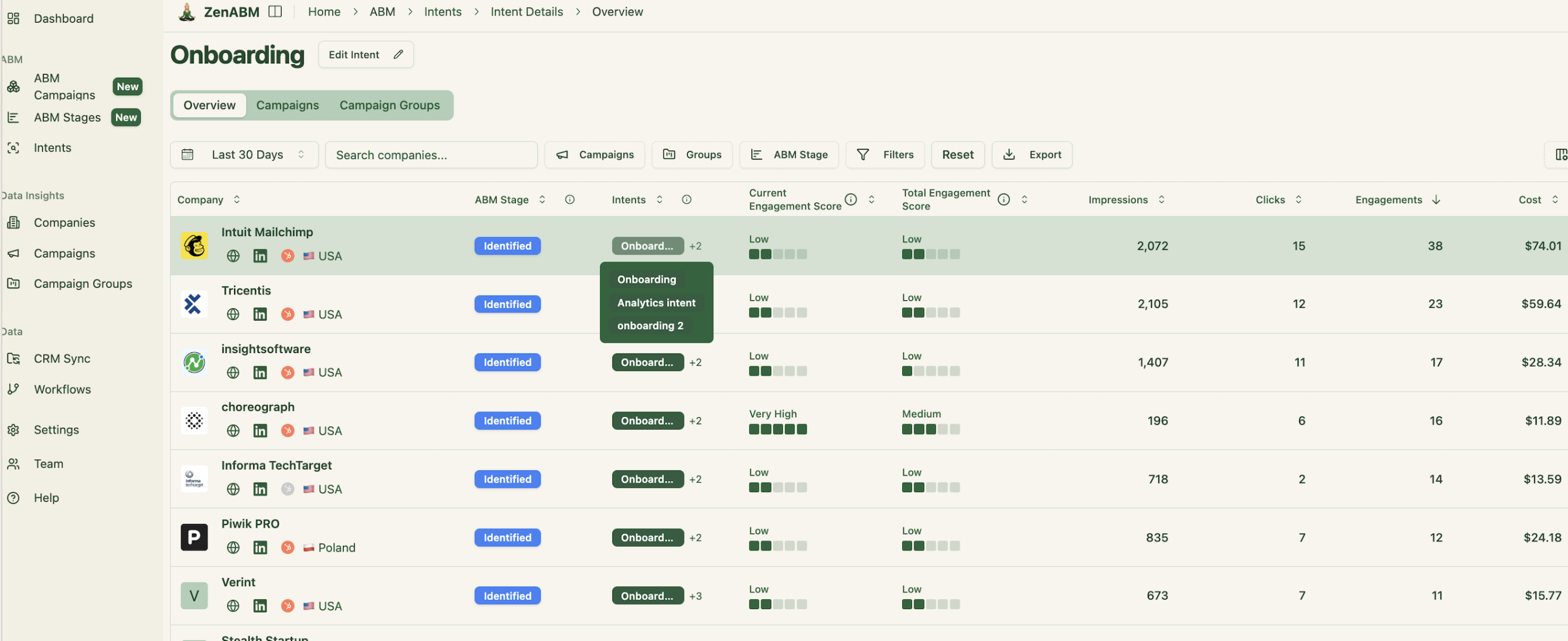

You can track each account’s engagement with each of your campaigns in ZenABM:

And also get historic and current account engagement scores of each account based on their activity with all of your ads:

This score is essentially your warm/cold score.

Note: Some businesses do intent segmentation by:

- Using tools like Bombora/6sense that provide third-party data regarding what keywords the accounts’ members are searching for, and check if any query relates to their business offering.

- Using IP matching tools for web visitor deanonymization and then checking which web pages the visitors are visiting.

I don’t recommend these methods because the intent data from 6sense/Bombora is well *third-party*, and the IP matching tools hardly work (their accuracy tops at a mere 42%, reports Syft):

Segment by Persona and Buying Committee

Within each account, ABM is still about people – the buying committee and the personas within.

And an effective ABM segmentation often means grouping contacts/personas across accounts to design suitable messages.

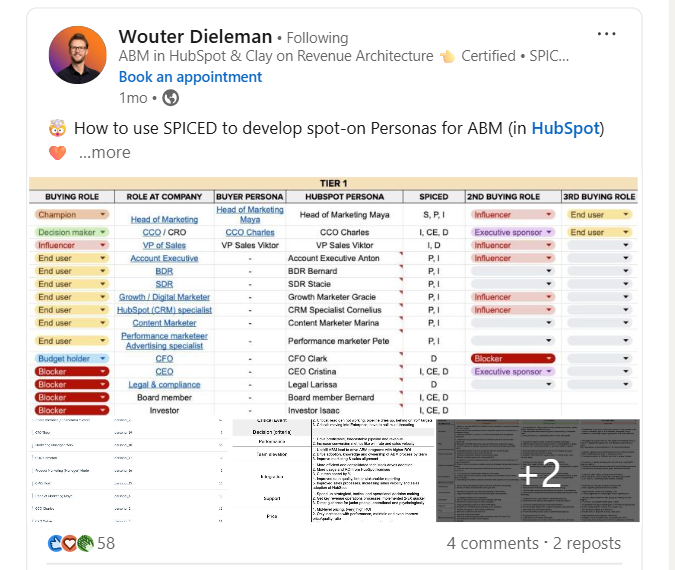

Wouter Dieleman (an ABM coach), for instance, also stresses developing spot-on personas and suggests using the SPICED framework for the same if you are using HubSpot:

Identify all roles in the ICP buying committee (e.g., Decision Maker, Champion, Influencer) using HubSpot’s roles:

- Decision Maker: Final approver.

- Budget Holder: Controls funds.

- Champion: Internal advocate.

- Influencer: Shapes decisions.

- End User: Product user.

- Executive Sponsor: Executive supporter.

- Legal/Compliance: Ensures compliance.

- Blocker: Potential opponent.

You can also go for secondary roles that pertain to the department, like IT, marketing, etc.

Then assign SPICED involvement per persona (e.g., Champion feels Pain, Decision Maker sets Criteria).

Log personas in HubSpot with memorable names (e.g., “CCO Charles”).

Finally, develop SPICED for Top 3 Personas (Champion, Decision Maker, Influencer):

- Situation: Persona’s current context (e.g., outdated tools).

- Pain: Specific challenge (e.g., inefficiencies).

- Impact: Business consequence (e.g., lost revenue).

- Critical Event: Trigger for action (e.g., contract renewal).

- Decision: Criteria/process (e.g., scalability, cost).

Don’t Over-Do Persona-Based Segmentation: Warning

We talked about how persona-based segmentation (SPICED or job-function or a combination) can be great for your ABM strategy, but overdoing it can backfire!

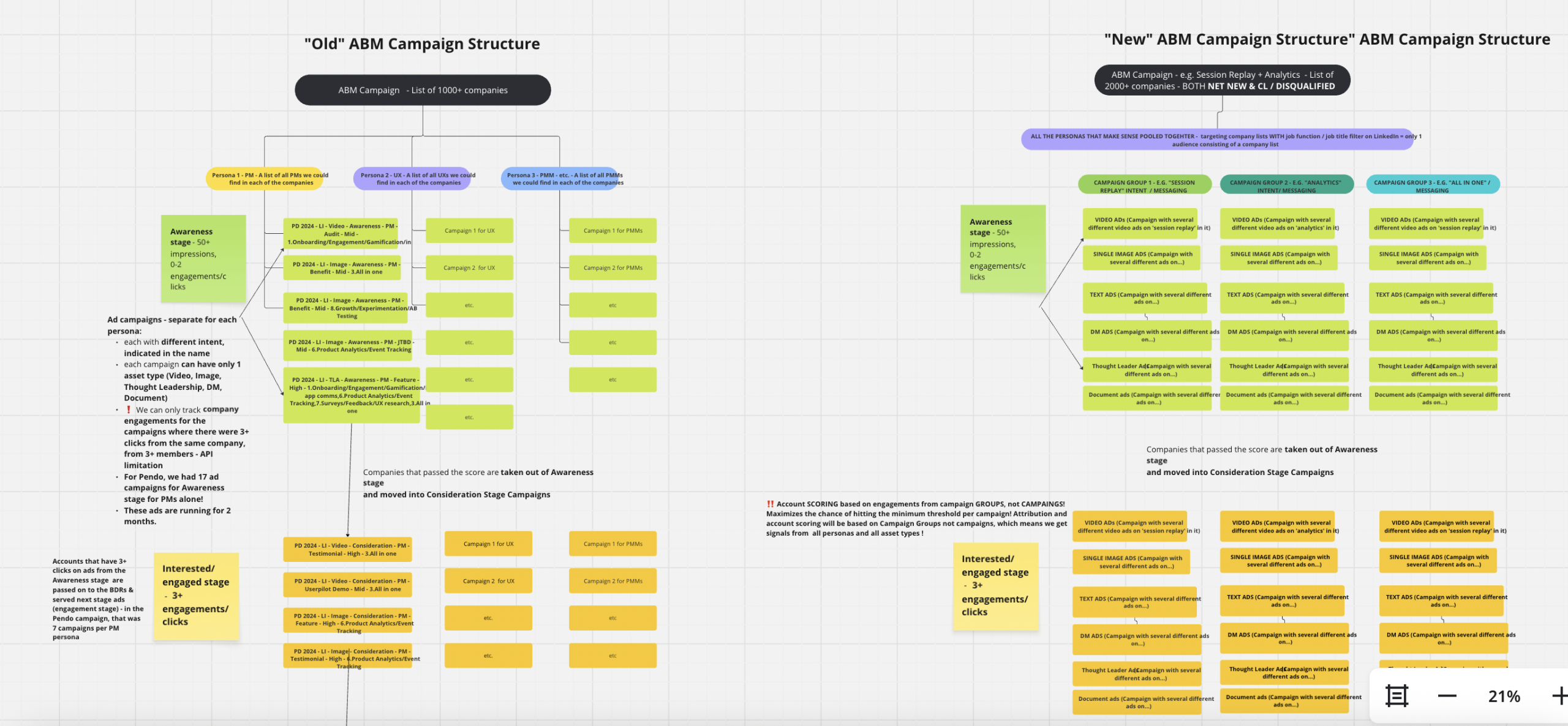

For instance, Emilia Korczynska (VP of Marketing at Userpilot) mentions in her case study at Growth Unhinged, how they segmented ad campaigns based on buying stage and job-function persona.

This didn’t go well because LinkedIn has a threshold for each campaign: At least about 300 members or so.

But the segments they made were too narrow to cross the threshold.

As a result, they ended up building an intent-first campaign structure and ditched their persona-first strategy.

Their old versus new campaign structure:

Some Other Creative Ways of Segmentation

| # | Segmentation Approach | Tools | Workflow |

|---|---|---|---|

| 1 | Technology Adoption + Employee Sentiment | G2 API, Zapier (LinkedIn Posts) | 1. Pull companies reviewing a category on G2 via API. 2. Monitor employee LinkedIn posts for sentiment keywords (e.g. “migrating to X”). 3. Build list of firms showing intent and pain signals. |

| 2 | Recent Funding Stage + Geo-Targeting | Crunchbase Pro, Clearbit Reveal | 1. Filter companies that raised Series A/B in last 6 months on Crunchbase. 2. Enrich IPs via Clearbit to get HQ location. 3. Tailor region-specific campaigns (e.g. “Congrats on your raise in Austin…”). |

| 3 | Content Engagement + Firmographics | Google Analytics API, ZoomInfo | 1. Query GA for company domains visiting top-of-funnel eBook pages. 2. Feed domains to ZoomInfo for firmographic data. 3. Segment into “SMB fintech” vs. “enterprise healthcare” and customize offers. |

| 4 | Job-Posting Signals + Stack-Match | Indeed/LinkedIn Jobs API, SimilarTech | 1. Scrape recent job postings for roles like “DevOps engineer.” 2. Cross-reference with SimilarTech for their marketing stack. 3. Target accounts hiring specific roles and using non-optimal tools. |

| 5 | Intent Topics + LinkedIn Matched Audiences | Bombora Company Surge, LinkedIn Campaign Manager | 1. Pull Bombora topic surge data (e.g. “ABM”). 2. Create Matched Audience in LinkedIn for those companies. 3. Run targeted ads timed to their interest spikes. |

| 6 | ESG News Mentions + Enrichment | Google News API, Clearbit | 1. Monitor Google News for “sustainability” mentions tagging companies. 2. Enrich profiles with Clearbit for size and industry. 3. Launch ABM plays around ESG features or services. |

| 7 | Salesforce “Stalled” Deals + Look-Alike | Salesforce CRM, Looker Studio, Demandbase | 1. Query Salesforce for opportunities stuck >45 days. 2. Group by industry/deal size in Looker Studio. 3. Feed profiles into Demandbase look-alike model. |

| 8 | Intent Podcast Listeners + Email Discovery | Spotify Podcast API, Hunter.io | 1. Identify companies subscribing to relevant podcasts. 2. Pull domains, then find decision-maker emails with Hunter.io. 3. Send personalized outreach referencing the podcast. |

| 9 | Web Traffic Clustering via BigQuery | Google BigQuery, Python (k-means) | 1. Export raw visitor logs into BigQuery. 2. Cluster by page-view patterns (pricing vs. blog). 3. Segment into “ready-to-buy” vs. “researching” groups. |

| 10 | Competitor Script Detection + Enrichment | Ghostery, Clearbit Autopilot | 1. Use Ghostery to detect competitor scripts on sites. 2. Enrich domains with Clearbit Autopilot. 3. Prioritize “at-risk to switch” accounts for an ABM play. |

| 11 | LinkedIn Ad Engagement + Deal Stage Targeting | ZenABM, CRM (Salesforce/HubSpot) | 1. Use ZenABM to pull companies with high engagement on your LinkedIn ads. 2. Filter those accounts by current deal stage in your CRM. 3. Launch targeted outreach (e.g. personalized nurture for “opportunity” stage vs. executive touch for “proposal” stage). |

Step 5: Customize Programs and Content to Each Segment

The segmentation is done.

Now it’s time to execute, so it truly pays off.

The goal is to deliver deeply relevant, segment-specific campaigns that make your targets feel like the marketing was made just for them.

We’re not talking “Hello <First Name>” token personalization – we’re talking content, creative, offers, and touchpoints aligned to each segment’s traits.

Some tactical ways to customize by segment:

Dedicated Content Tracks

Create content assets for each segment.

For example, if you have 3 core industry segments, build out an eBook, webinar, or case study for each that speaks the industry’s language (using their jargon, addressing their regulatory environment, etc.).

If segment A cares about cost savings and segment B cares about compliance, your messaging should reflect that.

Segmented Email & Ad Campaigns

Utilize marketing automation to separate contacts by segment and nurture them with carefully designed sequences.

On LinkedIn Ads or other ad platforms, build audience segments for each cluster of accounts and run ads with segment-specific imagery and copy. For instance, if you have separate banking and tech segments, run a “Financial Services Trends 2025” ad to your banking segment and a different ad to your tech segment.

Your CPC might be the same, but conversion rates will thank you.

Pro Tip: With ZenABM, you can truly utilize ad segmentation based on specific features/qualities of your campaign. For instance, you can structure your campaigns based on different features of your tool/service, and ZenABM will track which companies are engaging with which of your ads, thus telling you about what they are interested in – a feature extremely useful for BDR outreach.

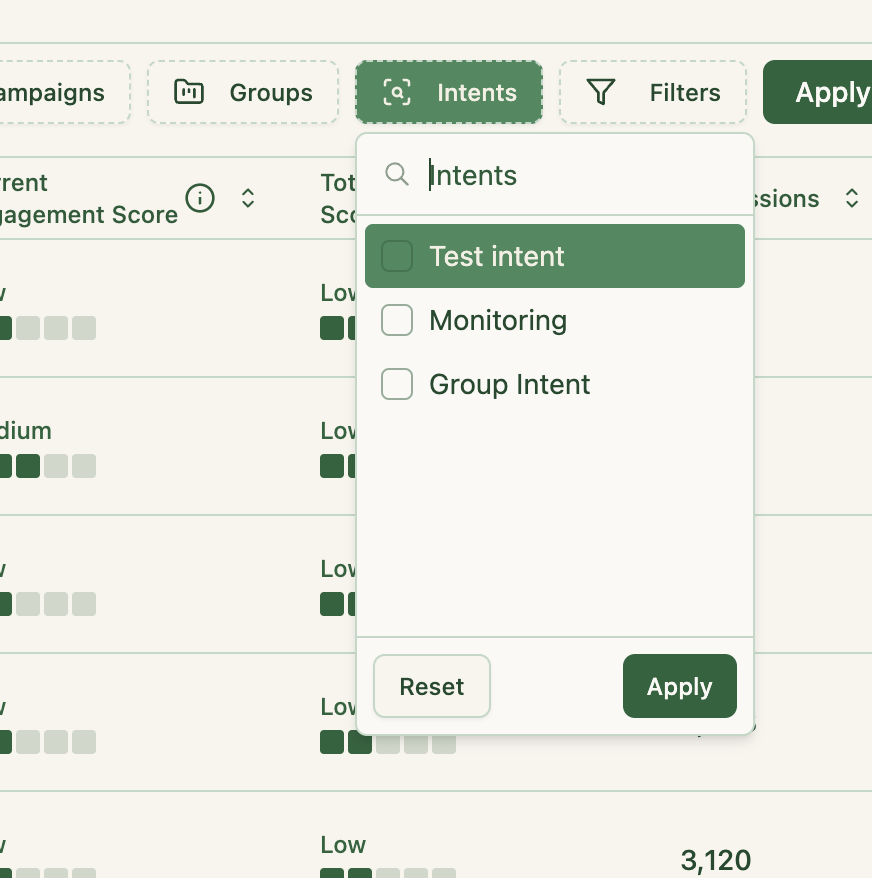

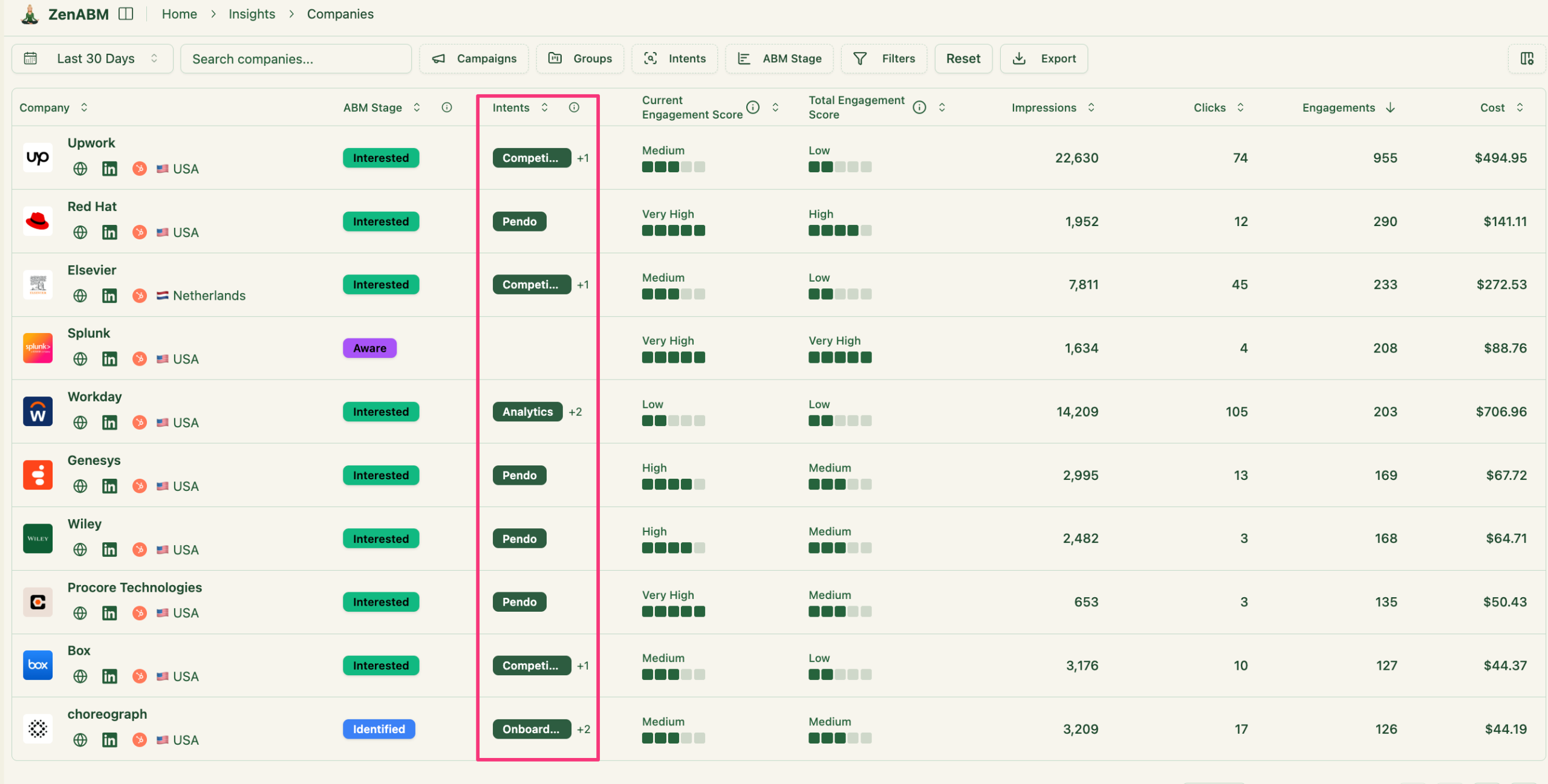

You can tag different ad campaigns in ZenABM with their intent:

And ZenABM will group companies showing similar intent in one place:

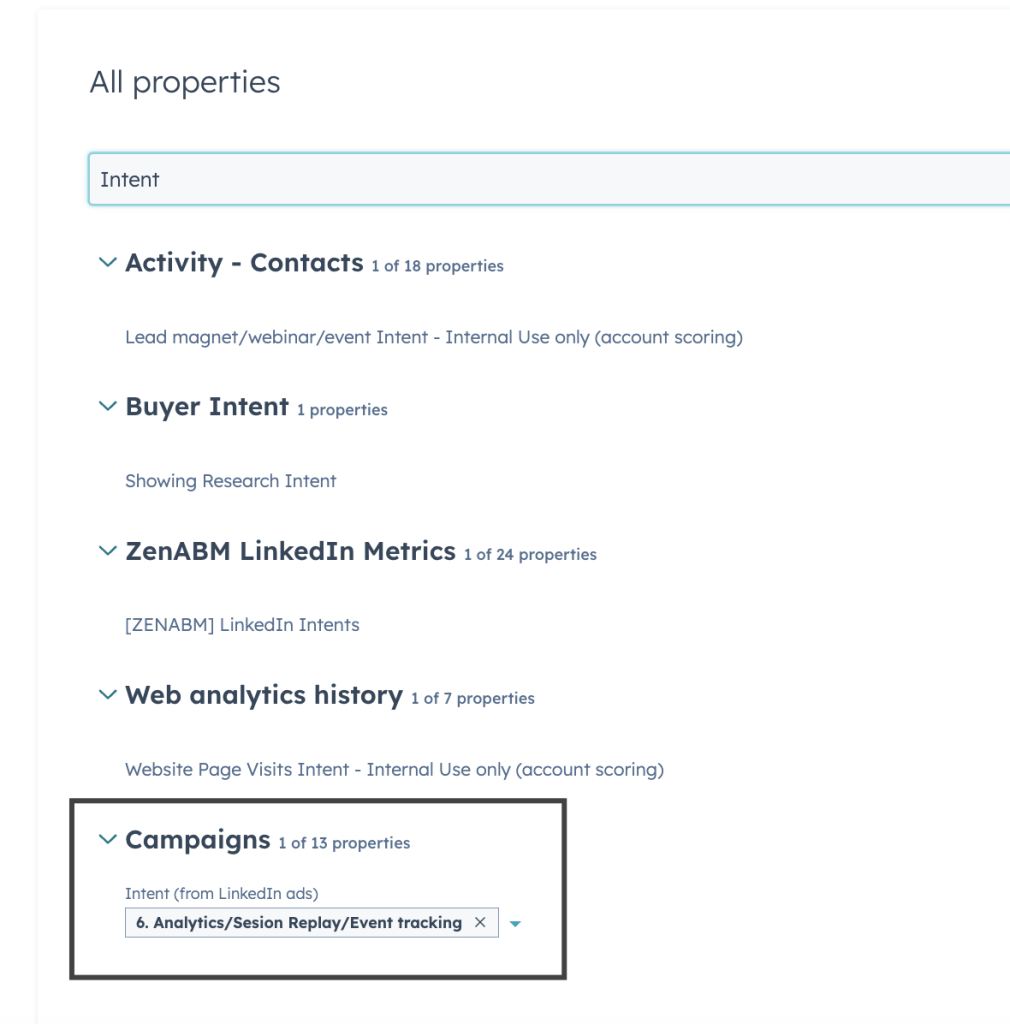

Plus, it also pushes the same intent as a company property to your CRM:

Personalization at Scale

Use tech to scale 1:1 touches within segments.

This can include dynamic content on your website that swaps out logos, industry names, or case studies depending on the visitor’s account segment (many ABM platforms and even some CMS tools enable this).

It also includes things like sending personalized video messages from sales reps to only the highest-tier accounts or specific personas.

Orchestrated Plays per Segment

Plan multi-channel “plays” unique to each segment. For example, for your enterprise tech segment (Tier 1), your play might be: send a customized executive letter or premium direct mail gift, follow up with an invite to a VIP roundtable event, and target them with ads featuring their company name (if the platform allows).

For your mid-market tech segment (Tier 2), the play might be a webinar featuring a use case specific to mid-market challenges, plus a follow-up email sequence with case studies from similar-sized clients.

The point is, each segment gets its own strategy.

The more an account sees content and outreach that resonates with their situation, the faster they move through the pipeline.

Step 6: Measure Segment Performance and Iterate

Segmentation isn’t a one-and-done play.

It’s an ongoing cycle of measurement and refinement. Monitor each segment’s pipeline, win rates, deal size, and engagement separately.

For example, if Segment A drives $X million at Y% win rate while Segment B lags, double down on A’s tactics or pivot B’s messaging. Clarabridge validated contacts within vertical segments, saw $24 M in revenue from their first two, and then added two new segments each quarter to keep scaling.

Use dynamic feedback loops to keep segments fresh. Implement account scoring—engagement points can bump an account from Tier 3 into Tier 2 for immediate follow-up.

When a low-priority account suddenly surges in intent, it automatically graduates for more personalized outreach.

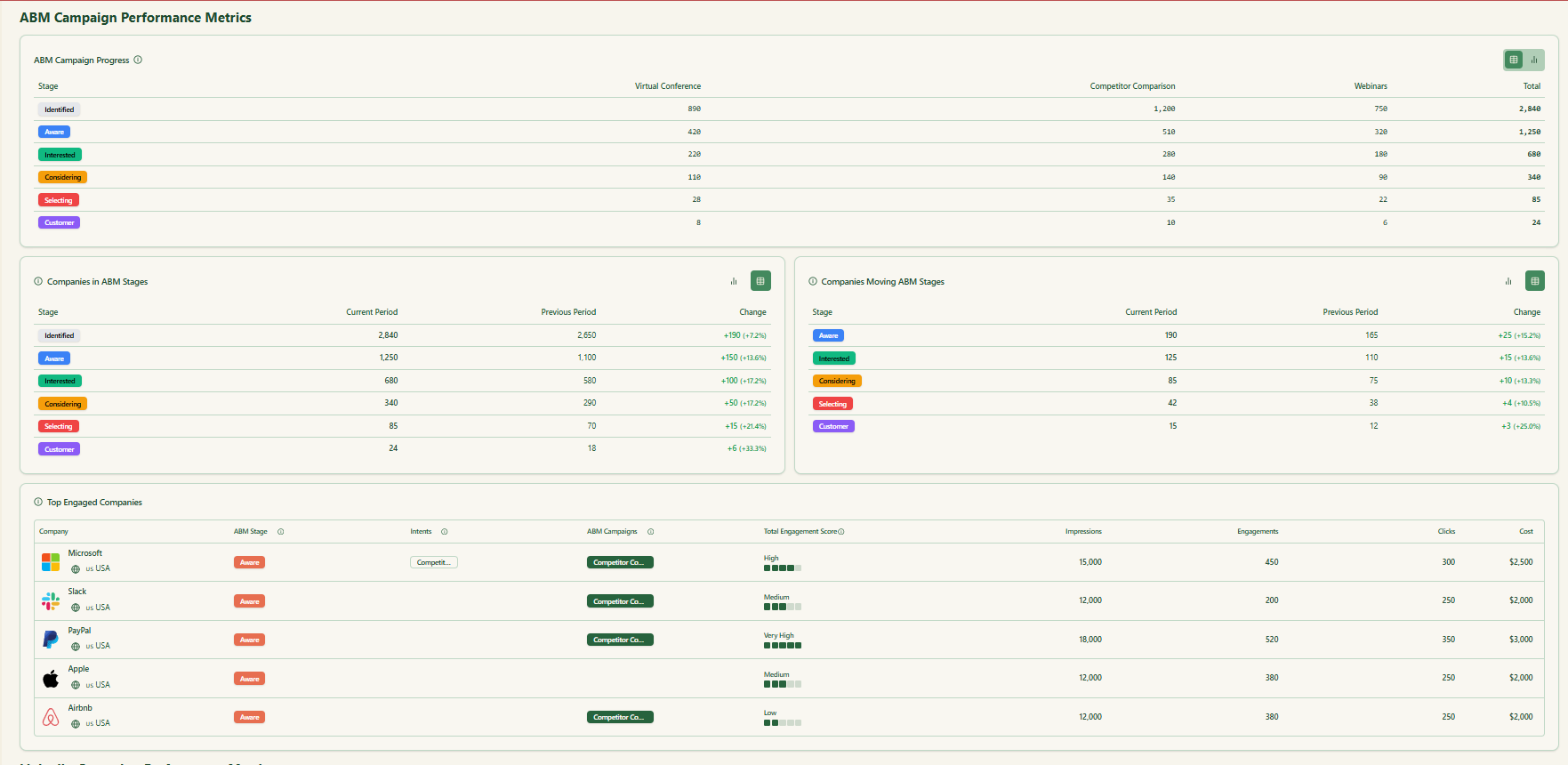

Pro Tip: You can see all campaign effectiveness metrics in ZenABM, as it monitors company-level engagement for each campaign and also pulls the deal value of each company from your CRM.

End Note

Segmentation isn’t a checkbox.

it’s your ABM superpower.

When you invest in defining, tiering, and refining segments, every dollar and every touchpoint works harder.

By aligning teams around precise ICP/TAM maps, executing tailored plays per tier and niche, and continuously measuring what moves the needle, you’ll transform scattershot outreach into high-impact, high-ROI growth. Start small, learn fast, and scale smart (your most valuable accounts are waiting).

Ready to supercharge your ABM?

Try ZenABM to unify segment-level insights and automate engagement tracking so you can close more deals, faster.