RollWorks is an enterprise-grade, account-based marketing (ABM) platform.

It is a complete solution for ABM professionals.

From precise advertisement filters and account-level intent data to CRM and MAP workflows and tons of integrations, RollWorks is feature-heavy.

But again, it comes with a premium price.

In this article, I’ll show you all the ABM features hosted by RollWorks, help you decide if it’s an overkill or your perfect ABM fit, and suggest an alternative.

Let’s go!

RollWorks is loaded with account-based advertising features, including its own demand-side platform (DSP) and customer data platform (CDP).

Let’s go through all of them:

ABM folks know and preach: Your list is your strategy

And RollWorks provides multiple ways to build your perfect TAL.

You can import account lists from your CRM or marketing automation platform, or even use RollWorks’ data and scoring tools to generate a TAL from scratch.

It helps you identify and score high-value accounts based on your own CRM data and its proprietary data that includes:

Just because an account is highly engaging with your ads, it doesn’t mean it matches your iCP.

To ensure you pursue the right accounts, combining buying signals with a fit grade is essential.

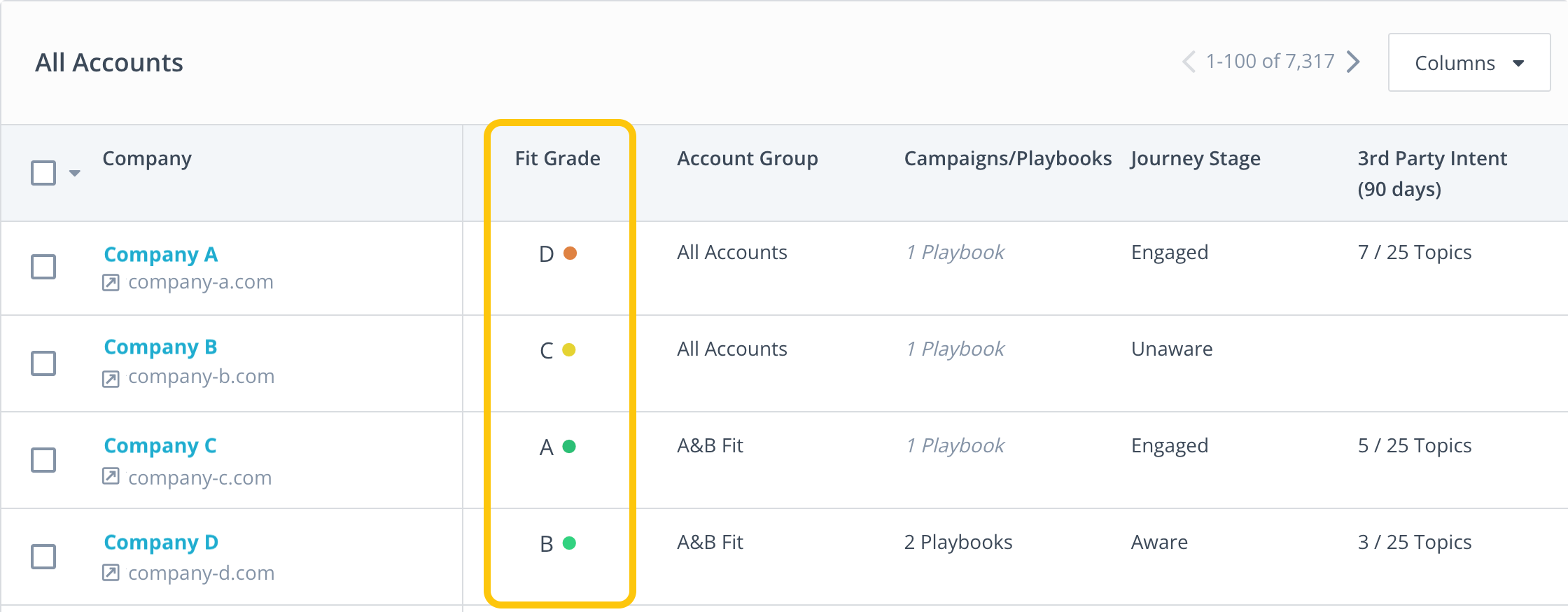

RollWorks can help with this. It analyzes firmographic/technographic data to define your Ideal Customer Profile and scores how well each account fits it using predictive analytics:

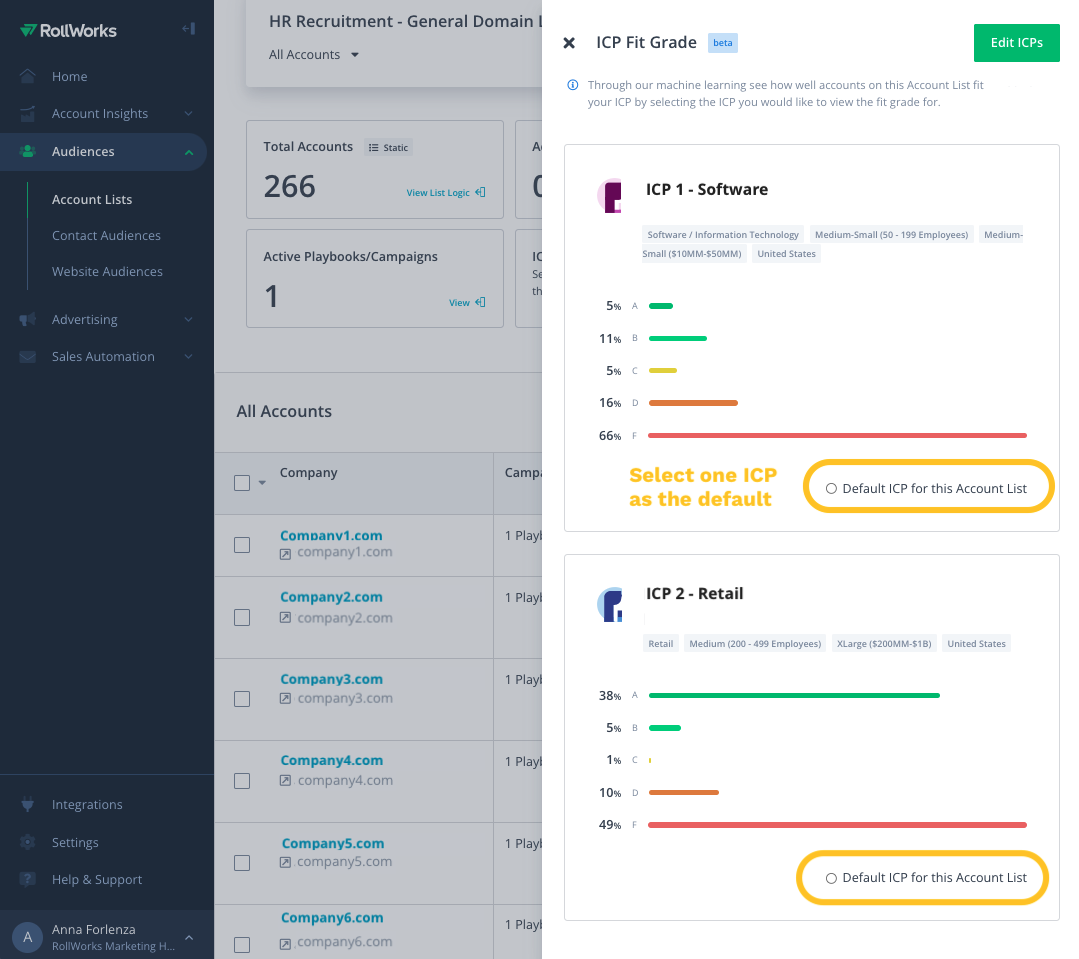

In fact, you can save many ICP definitions and choose a different one for each account list:

And if you are wondering about the exact criteria it uses for scoring, these are the firmographic ones:

Note: This is just the ICP fit scoring; there’s a deeper lead scoring available too, discussed later in the article.

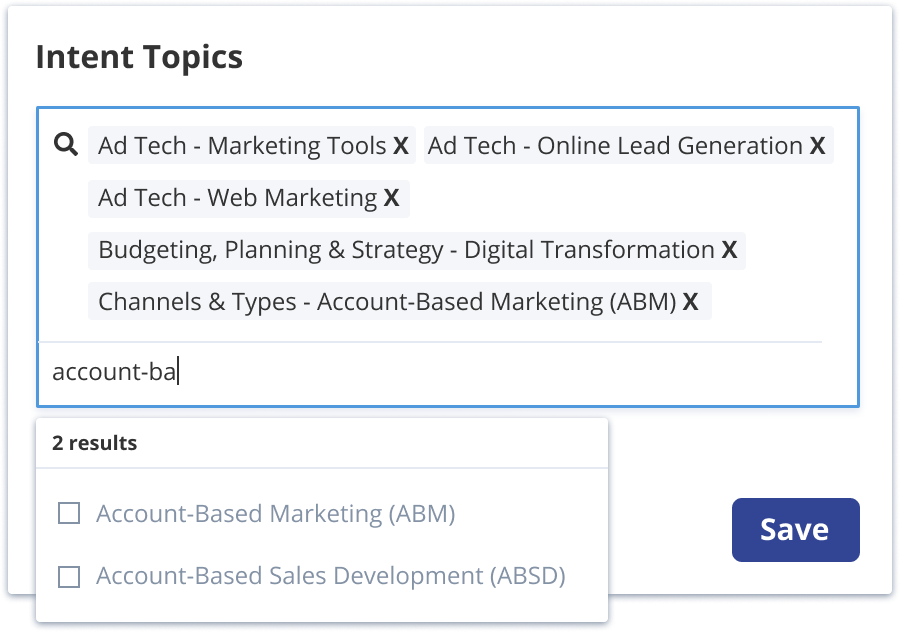

The platform also uncovers which accounts are “in market” by monitoring intent data.

RollWorks tracks keyword intent to lay out a list of accounts whose members are searching for certain keywords on the web.

You can choose your preferred keywords to track based on what your business solves or provides:

This helps you find accounts that are actively looking for solutions like yours and reach out to them before your competitors do.

You can also drill down to see all the web activity of each account and act immediately if you see a surge in relevant queries:

This intent data comes from sources like RollWorks’ own data and integrations like Bombora.

With the RollWorks site pixel, you can deanonymize your web traffic to see which target accounts (even previously unknown) are visiting your site.

Plus, RollWorks not only identifies the company, but can even help discover contacts at that account for your sales team.

This is good for turning anonymous traffic into an actionable TAL and retargeting pool.

Now, once you have a target account list, RollWorks’ Audience Builder lets you segment and filter it using countless attributes like firmographics (industry, employee count, etc.), technographics, engagement metrics, and more.

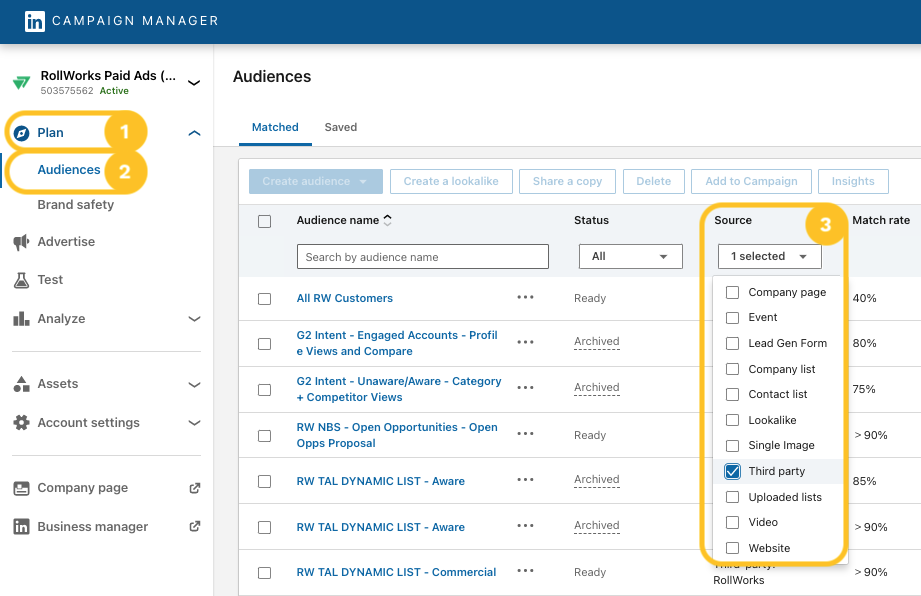

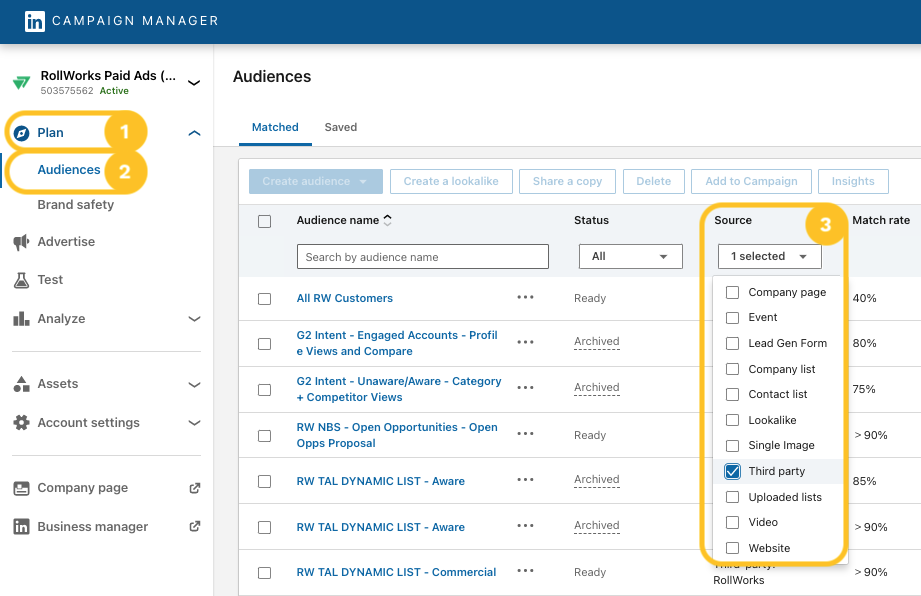

And you can push those audiences as TALs to ad platforms like LinkedIn:

One user on G2 noted that RollWork’s Audience Builder helps them create targeted segments for ad campaigns across its own DSP and other ad channels:

One of RollWorks’ biggest strengths is its cross-channel advertising reach.

Using its own DSP, RollWorks can serve account-targeted ads across a wide range of digital channels and inventory:

For other types of ads on LinkedIn, you can push the TAL segments you built in RollWorks to LinkedIn audiences:

For other types of ads on LinkedIn, you can push the TAL segments you built in RollWorks to LinkedIn audiences:  RollWorks also supports Facebook/Instagram and other social channels indirectly via its DSP or integrations.

RollWorks also supports Facebook/Instagram and other social channels indirectly via its DSP or integrations.Here’s how RollWorks helps with ad campaign management and analytics:

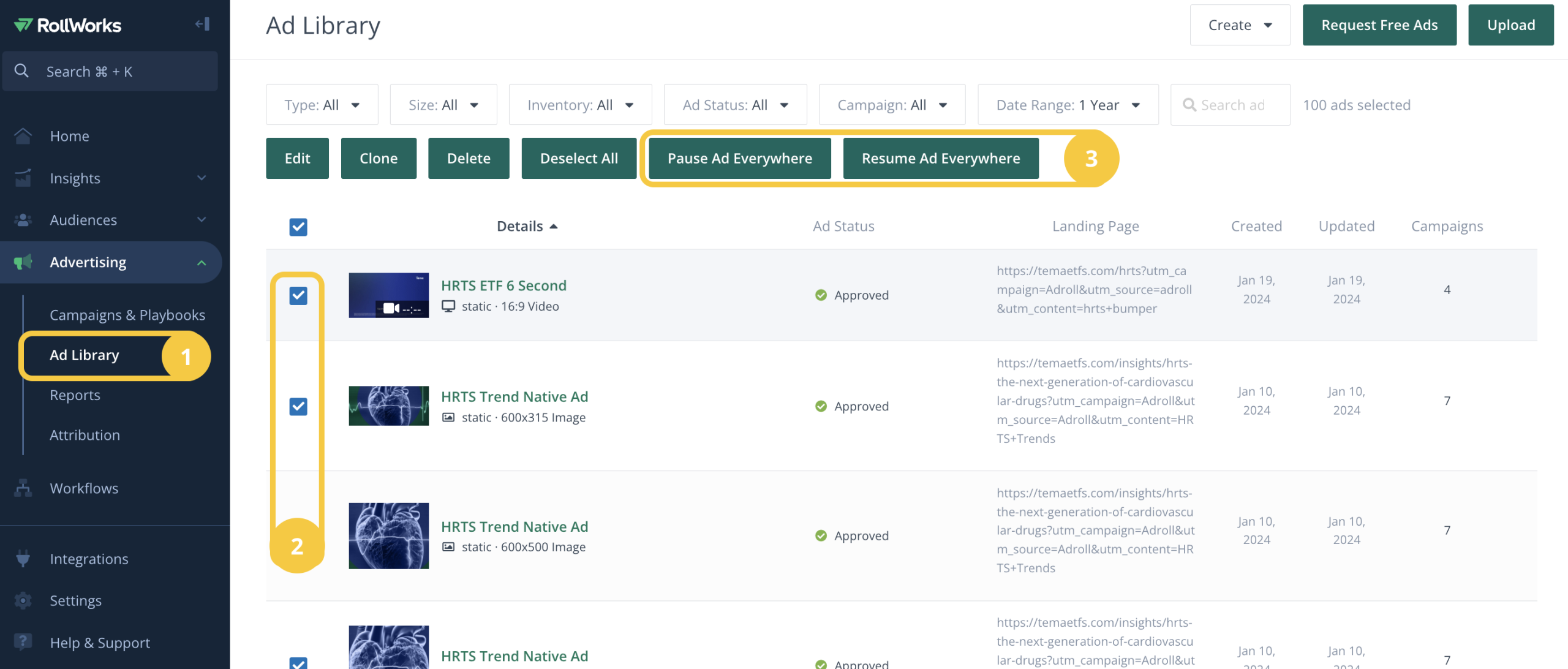

RollWorks has a dedicated ad library where you can manage all your ad creatives and even make adjustments to them, like changing the creative or the landing page, or pausing a particular ad.

All these changes are possible while the campaign is live!

Most ABM pros run many ABM campaigns across different ad channels and with multiple ad accounts.

With that said, optimizing bids and budgets for each campaign can get labor-intensive.

So, RollWorks gives you BidIQ. BidIQ is an AI-powered optimization engine that automatically adjusts your bids, budget allocation, and even creative selection in real time to maximize performance.

It does this based on the strategy and the goal you set for each campaign:

For example, you can go for a click-based strategy with a target CPC, and the tool will try to maximize clicks while keeping the CPC within the limits you set.

Once you set the goal and strategy, RollWorks will see which accounts are responding, which ads are performing best (yes, it does automatic A/B testing), and how close you are to achieving your goals, then make micro-adjustments continuously.

This means every advertising dollar is intelligently spent for maximum effectiveness, and manual trial-and-error has been given a farewell for good!

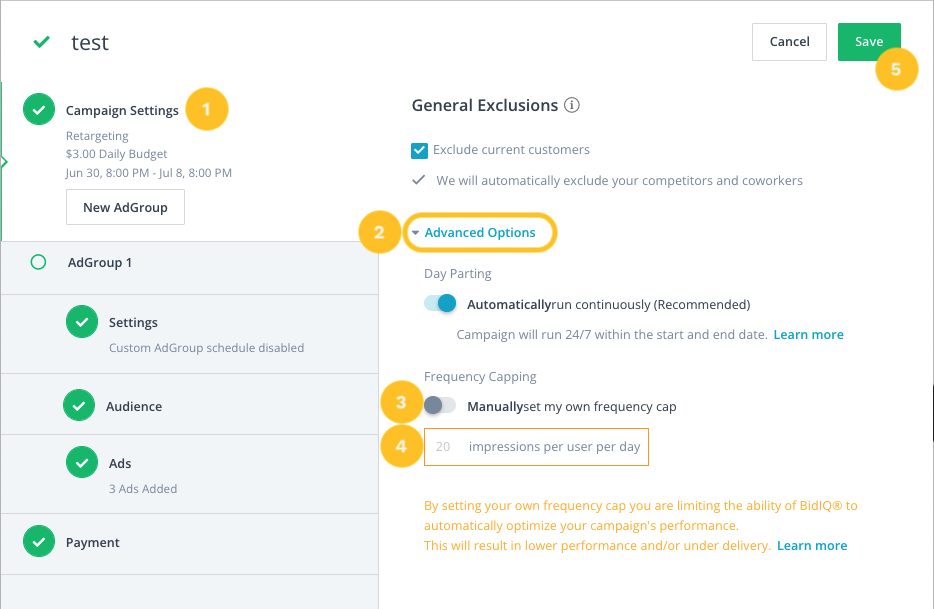

Also, you can set frequency caps for accounts:

This will stop over-saturation of a small target account with too many impressions and prevent large accounts from gobbling up all your budget.

You can learn more about this in RollWorks’ help center.

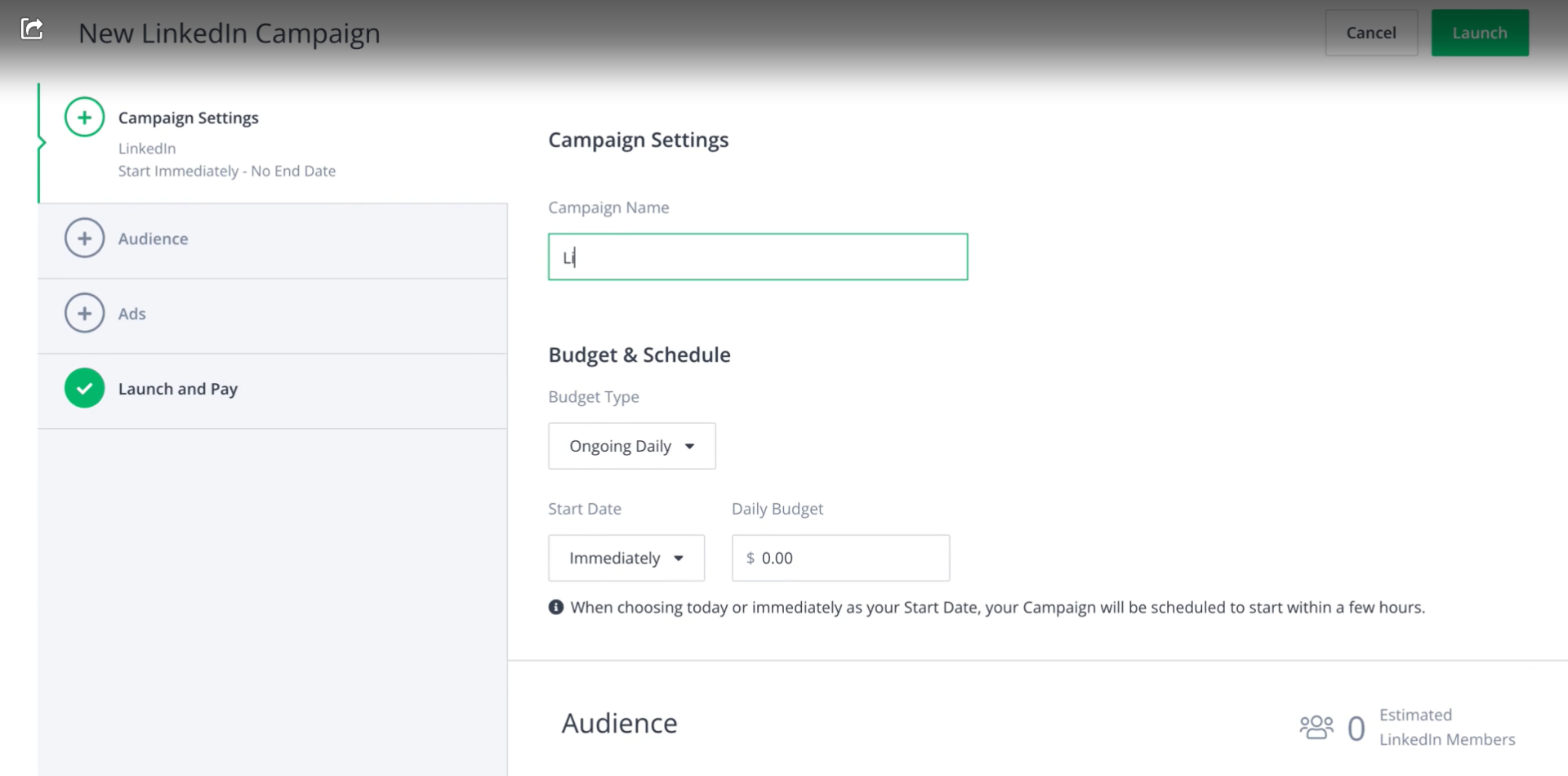

RollWorks calls its campaign setup wizard ‘Campaign Playbook’ or ‘Account Targeting Playbook.’

And it makes sense.

I mean, the setup wizard gives more than just fields to fill and preferences to set. It guides you through ABM best practices.

It helps define your audience, choose ad formats, set budget, and timing in a step-by-step flow so you don’t miss anything.

Also, users on G2 report that the platform’s user-friendly interface makes it easy to adjust campaigns frequently.

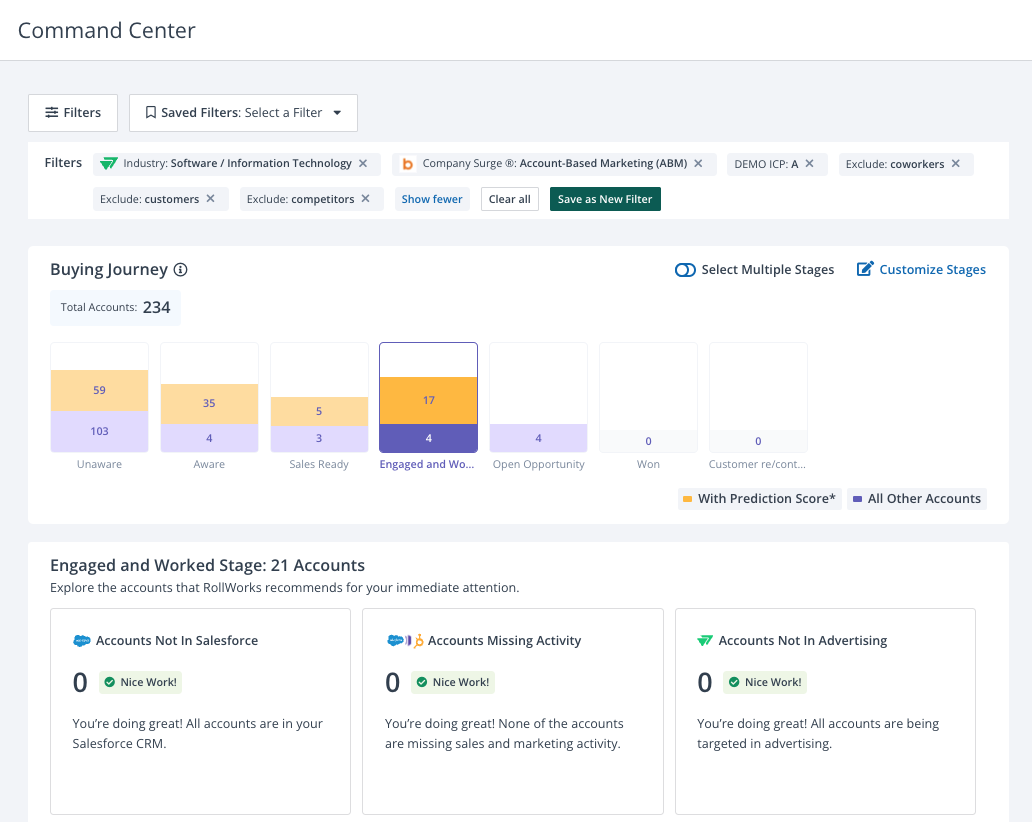

RollWorks recently launched a Command Center dashboard that gives a centralized, actionable view of all your account-based campaigns and their status.

It’s essentially a cockpit for your ABM program – showing which target accounts are in which funnel stage, which accounts are engaging or “uncaptured demand,” and suggesting next-best actions.

For instance, it lists out accounts:

This ties in campaign management with account intelligence (more on that later).

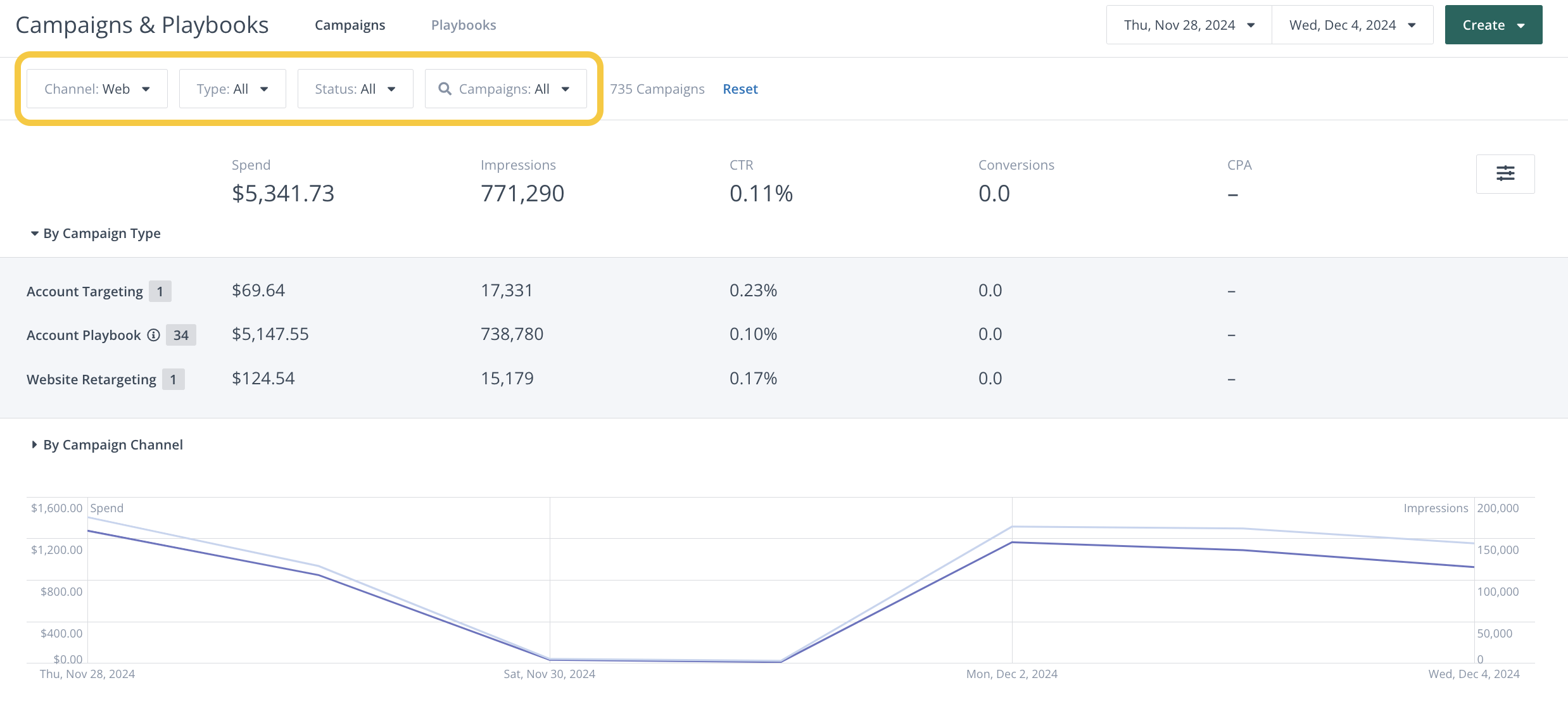

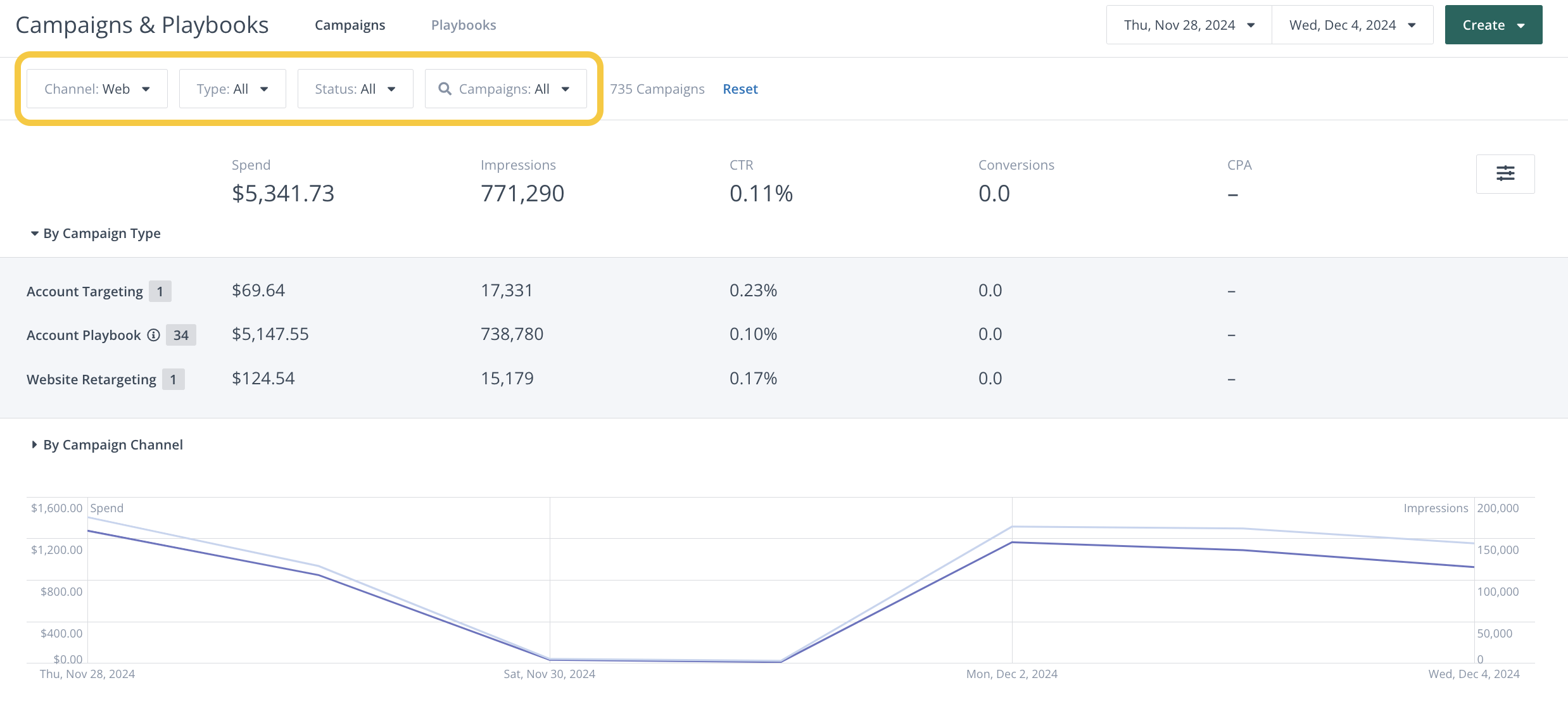

Coming to reporting, RollWorks tracks all the key advertising metrics you’d expect, like ad spend, impressions, clicks, click-through rates, conversions, etc., broken down by campaign and even by account.

This is available in the Campaigns Summary page of the Campaigns and Playbooks tab:

Plus, you also get clear reports comparing the average deal size, sales cycle duration, and win rate of ad-influenced and non-ad-influenced deals:

And also the total revenue, revenue won with ad influence, and revenue that had no ad influence:

Note: You can set your own minimum number of impressions, clicks, and engagements in a certain time period for the deal to be considered ad-influenced:

The most plausible thing about RollWorks’ revenue reporting is the view-through attribution you get for both LinkedIn and display ads. Especially for LinkedIn, where ads don’t drive immediate clicks but they sure do drive awareness and lead to subsequent conversions from other channels, a view-through attribution lens is utterly necessary, and RollWorks gives you that!

We talked about how RollWorks identifies audiences by defining ICPs and generating fit grades on the basis of the ICP definition using predictive analytics.

We also talked about its ultra-segmentation capabilities based on firmographics, technographics, and even keyword intent data.

But there’s more to its account identification, intent tracking and prioritization features:

Beyond static fit grades and intent scores, RollWorks uses advanced data science to detect engagement spikes among your target accounts.

This feature, part of Sales Insights, looks at all the behavioral data (ad clicks, website visits, email engagement, etc.) and identifies when an account shows a sudden increase in engagement (relative to its baseline).

These are the “surging” accounts that could indicate readiness to talk to sales.

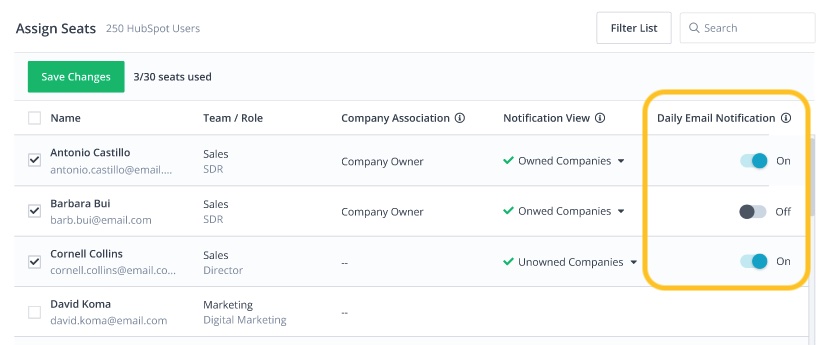

When RollWorks detects a spike, it automatically sends out Account Spike Alerts, like daily emails, to your sales reps highlighting the hot accounts they should focus on.

You can choose which sales reps should receive account engagement spike emails:

The alert includes details like which contacts at the account engaged and what they did (e.g. “5 people from ACME Corp visited the product page and one clicked an ad”).

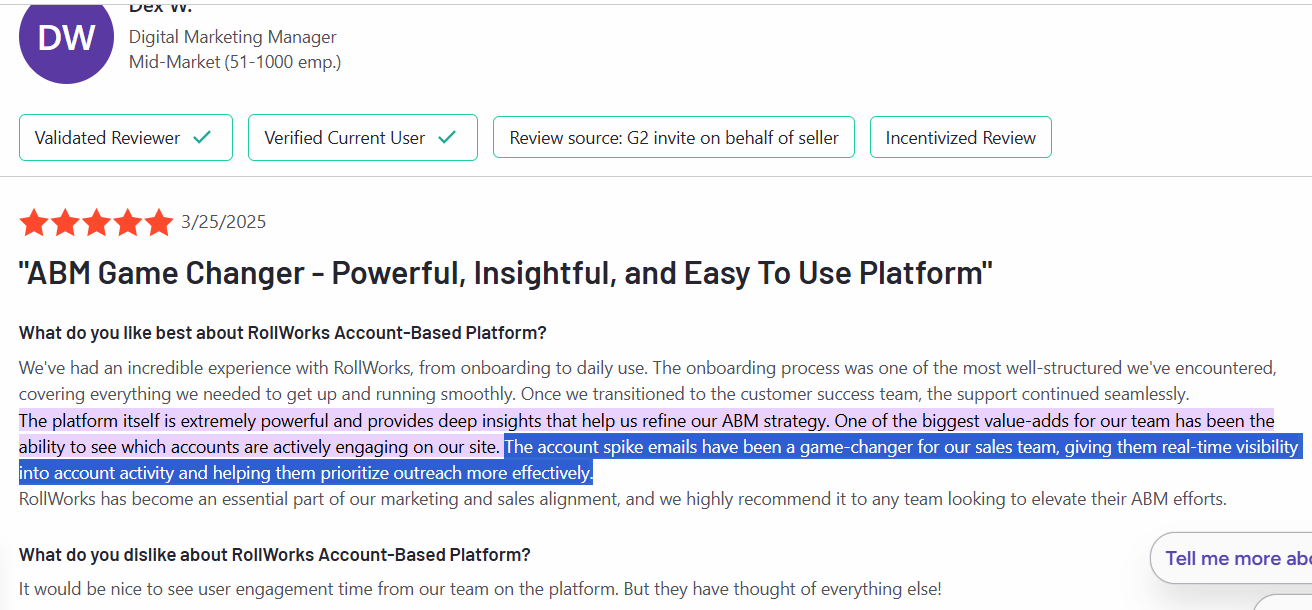

Sales teams absolutely love this. One G2 reviewer called the account spike emails “a game-changer for our sales team, giving them real-time visibility into account activity and helping them prioritize outreach more effectively.”

Instead of cold-calling or guessing, reps know exactly which accounts are “raising their hands” through activity.

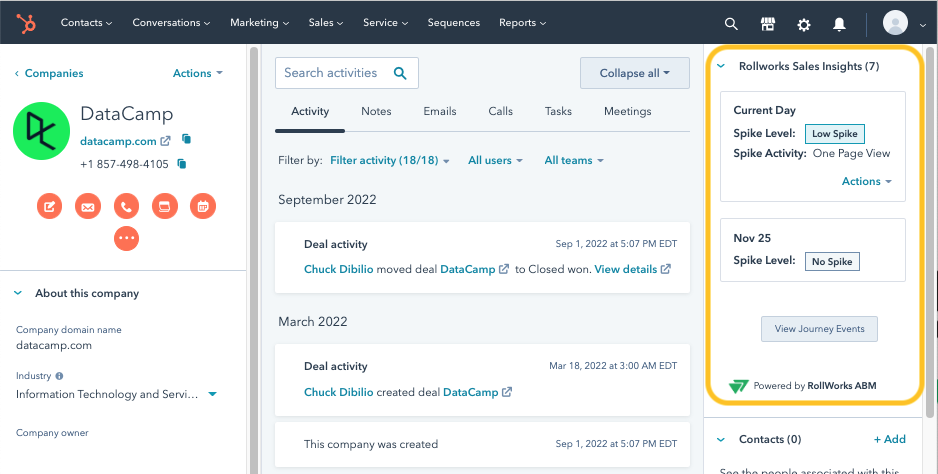

These spiking account signals are also pushed into your CRM (Salesforce or HubSpot) automatically.

RollWorks also adds custom fields like Spike Score or Spike Date on account records, so that at any given time, salespeople can see within CRM which of their accounts are hot.

This helps with sales prioritization and ensures marketing and sales are looking at the same data.

An important aspect of RollWorks’ audience management is that it’s dynamic.

Your account lists and segments aren’t static spreadsheets. They update based on new data and rules:

For example, the platform might recommend increasing the budget for a set of high-fit accounts that have low ad reach, or suggest a sales outreach for a spike account that hasn’t been touched by sales yet. These recommendations help you refine your audience targeting on an ongoing basis.

For example, the platform might recommend increasing the budget for a set of high-fit accounts that have low ad reach, or suggest a sales outreach for a spike account that hasn’t been touched by sales yet. These recommendations help you refine your audience targeting on an ongoing basis.Where RollWorks really differs from other standard ad tools is in its account-level insights and journey analytics.

It gives you a unified view of each account’s engagement, stage in the buying journey, and progression over time. Now that’s something I’d call pretty non-negotiable for true ABM.

Every target account in RollWorks has a comprehensive Account Profile that aggregates data from all sources:

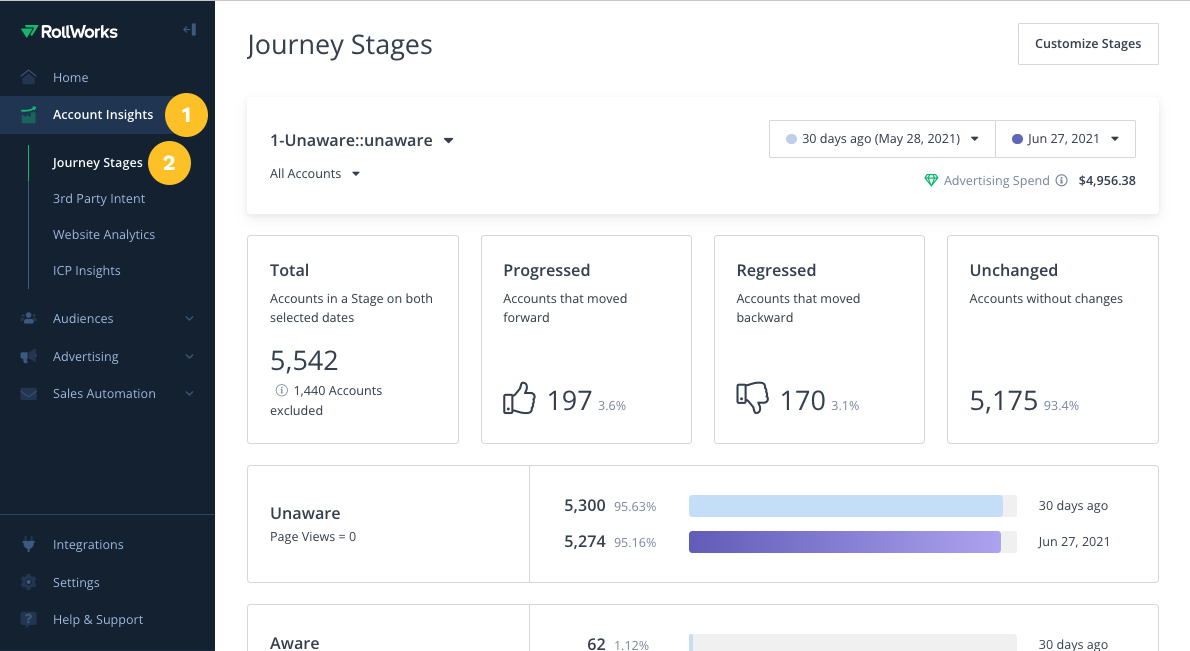

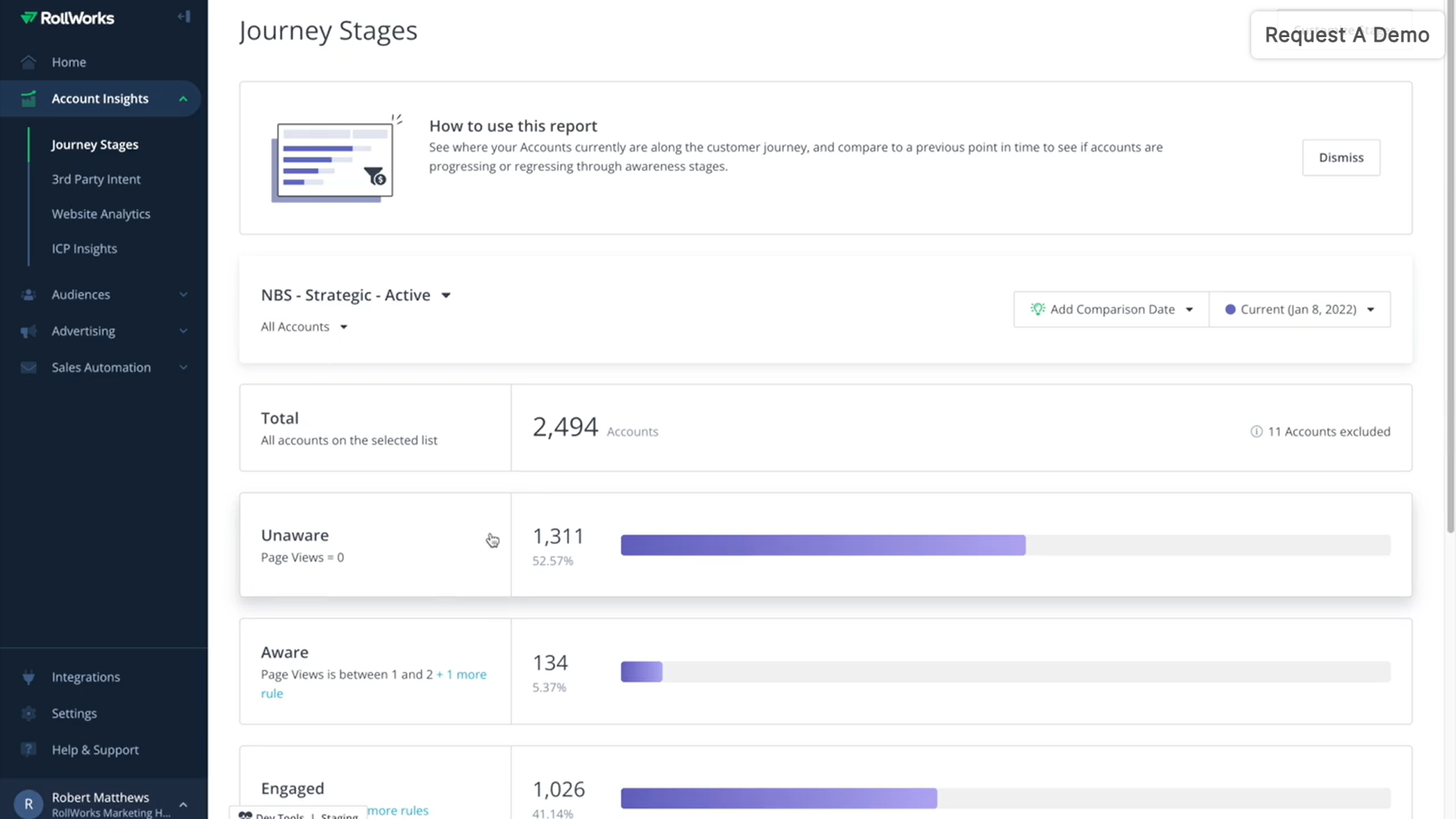

By default, RollWorks provides five stages (which you can customize): Unaware → Aware → Engaged → Open Opportunity → Won.

You can adjust or add stages to fit your specific funnel terminology (some companies include stages like “Marketing Qualified” or “Customer”, etc.).

What Journey Stages does is:

You can identify bottlenecks – e.g., if 70% of your accounts are stuck in “Aware” and not progressing to “Engaged,” that signals a need for different tactics.

You can identify bottlenecks – e.g., if 70% of your accounts are stuck in “Aware” and not progressing to “Engaged,” that signals a need for different tactics.

One all-time challenge in B2B marketing is proving ROI and attributing it to ads.

RollWorks tackles this with built-in account-based attribution and ROI dashboards.

Since RollWorks tracks everything from the first ad impression or site visit through to CRM opportunity creation, it can connect the dots and attribute pipeline to your ABM program in a way traditional analytics often miss.

Key aspects of RollWorks’ measurement:

RollWorks measures outcomes at the account level rather than the lead level. This means if multiple contacts at a target account interacted with different campaigns (ads, emails, etc.), RollWorks still rolls that up and credits the account’s progression appropriately.

It offers a “revenue influence” model where pipeline or revenue is attributed across all touches to an account. For example, if an account saw 10 ads and also attended a webinar before becoming a Closed-Won deal, RollWorks will show that those touches influenced the deal instead of giving sole credit to the last touch.

RollWorks has an Account-Based Dashboard that makes it simple to report on ABM impact.

It can show metrics like:

These dashboards can be filtered by campaign, timeframe, segments, etc., to slice the data as needed. The idea is that with one view, you can “show off the revenue influenced by your ABM advertising programs” to executives, without having to manually stitch together CRM reports and ad reports.

Because RollWorks plugs into Salesforce/HubSpot, you can even view attribution inside your CRM if desired. For instance, RollWorks can populate a field on the Opportunity object with “RollWorks Influenced = Yes/No” or a percentage of influence, and note which campaigns touched that account.

It’s important to note that some marketers caution against over-relying on any one attribution metric. As one anonymous reviewer put it: “RollWorks tries to help you show ROI tied to your pipeline. But it’s not really possible to say [precisely], because 1 person at an account MAY have seen our ad that influenced a buy. It’s a little hocus pocus here.”

In other words, RollWorks can indicate influence (like showing that 5 out of 10 closed deals had high engagement with ads), but you should combine that with sales feedback and other insights.

The good news is RollWorks at least brings those data points to light, whereas without it, you might have zero visibility that, say, your sales spike coincided with an ad campaign.

Use the RollWorks ROI metrics as directional proof, supported by qualitative evidence from sales.

Sales and marketing alignment is not just good for ABM but the very essence of it.

And RollWorks has taken care of that with its module for the Sales teams called Sales Insights.

As mentioned earlier, RollWorks will email your sales reps daily with a summary of which of their target accounts are “spiking” in engagement and what activities are happening.

RollWorks provides an in-CRM widget (in Salesforce and HubSpot) that surfaces key RollWorks account data to the salespeople in their native environment. When a sales rep clicks on an account in CRM, they can see if that account has: recent ad engagement, website visits, the current journey stage, Fit score, intent keywords, etc. This saves reps from having to log into RollWorks separately.

RollWorks data can also trigger sales plays.

If you have sales engagement tools (Outreach, Salesloft, etc.), you can use RollWorks to signal those systems. Even without those, RollWorks’ own sales email automation (covered above) can take a chunk of the outreach work. The platform essentially ensures that no high-priority account is left sitting idle. Either an automated touch is sent or a task is created for the rep.

Sales can also provide feedback through RollWorks (indirectly).

For instance, if a rep discovers an account isn’t actually a good target (maybe they have no budget or aren’t a fit), they can update a field in CRM, which RollWorks can recognize and then remove that account from campaigns.

RollWorks enables this kind of two-way alignment so that marketing isn’t persistently chasing an account that sales has disqualified.

We discussed some integrations here and there, but here’s a more convenient compilation:

| Workflow/Interaction | Trigger | Automated Action | Use Case / Value | Native or Integration | Integration Platform(s) |

|---|---|---|---|---|---|

| Journey Stage-Based Ad Targeting | Account reaches specified Journey Stage in RollWorks. | Adds account to relevant ad campaigns or playbooks. | Align ad messages to buyer stages. | Native | N/A |

| Contact List Targeting (Web & Social) | Contact list defined in RollWorks (often synced from CRM). | Serves ads specifically to these contacts. | Personalized ads across web/social channels. | Native (CRM sync optional) | Salesforce, HubSpot, Facebook/Instagram |

| Account Exclusion Lists | Account fits CRM-defined exclusion criteria. | Excludes account from active campaigns. | Prevent ad spend on unwanted targets. | Native + Integration | Salesforce, HubSpot |

| Workflow/Interaction | Trigger | Automated Action | Use Case / Value | Native or Integration | Integration Platform(s) |

|---|---|---|---|---|---|

| Dynamic CRM Audience Sync | CRM records meet specific criteria. | Auto-import/update Account or Contact lists in RollWorks. | Keep audiences in sync automatically. | Integration Required | Salesforce, HubSpot |

| RollWorks ➜ CRM Data Sync (Sales Insights) | Scheduled/event-driven data sync. | Writes account/contact insights back to CRM. | Enhanced CRM reporting and analytics. | Integration Required | Salesforce, HubSpot |

| Workflow/Interaction | Trigger | Automated Action | Use Case / Value | Native or Integration | Integration Platform(s) |

|---|---|---|---|---|---|

| Slack Alert for Hot Contacts | Hot prospect identified by engagement. | Sends Slack alert. | Instant sales team notifications. | Integration | Slack via Salesforce/HubSpot |

| Email Notification to Reps | Contact engagement threshold met. | Sends email alerts. | Ensure timely follow-up. | Native | |

| Outreach Sequence Enrollment/Task | High-priority contact identified. | Adds contact to Outreach sequences or tasks. | Automate sales follow-up. | Integration Required | Outreach via Salesforce/HubSpot |

| Salesloft Cadence Enrollment/Task | High-priority contact identified. | Adds contact to Salesloft cadences or tasks. | Improves sales productivity. | Integration Required | Salesloft via Salesforce/HubSpot |

| “Spiking Account” Email Alerts | Daily spike detection. | Sends account spike summary email to reps. | Daily prioritized sales outreach. | Native (CRM for mapping owners) | Email (optional CRM-triggered alerts) |

| Workflow/Interaction | Trigger | Automated Action | Use Case / Value | Native or Integration | Integration Platform(s) |

|---|---|---|---|---|---|

| Automated New Contact Creation | Target account shows signals; lacks contacts. | Auto-creates contacts in CRM. | Expands buying committee. | Native + Integration | Salesforce, HubSpot |

| Handoff Hot Contacts to Sales | Contact deemed hot based on engagement. | Routes to sales via CRM or MAP. | Quick lead handoff. | Integration Required | Salesforce, HubSpot, Marketo |

| Workflow/Interaction | Trigger | Automated Action | Use Case / Value | Native or Integration | Integration Platform(s) |

|---|---|---|---|---|---|

| RollWorks Insights → CRM Reporting | RollWorks performance data updated. | Updates CRM reporting dashboards. | Unified ABM performance visibility. | Integration Required | Salesforce, HubSpot |

Based on user reviews and feedback as of 2024-2025, here are some common cons and challenges to be aware of:

While RollWorks is more user-friendly than some competitors, it still has a lot of moving parts. New users can find the extensive features a bit overwhelming at first.

But at the same time, a user has praised RollWork’s onboarding and customer success department:

A user on G2 reported that there’s no Slack integration in RollWorks, and the integration with LinkedIn is that direct and needs a few extra steps from ops.

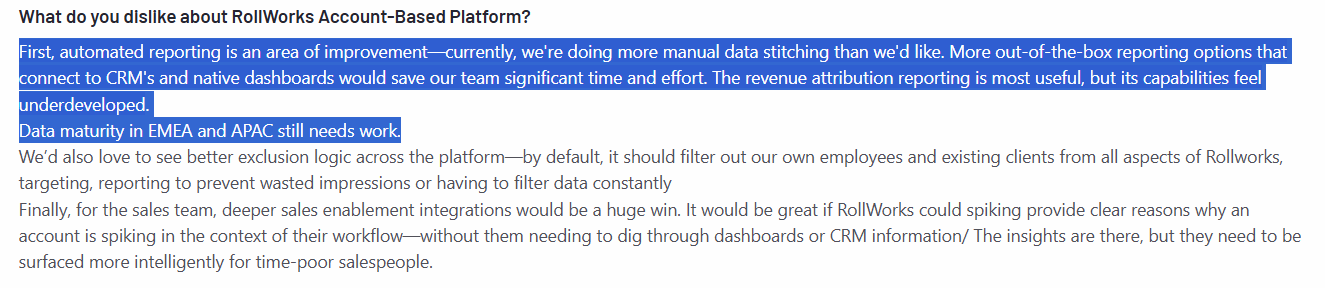

Users have called out that automated reporting could be stronger.

Some “out-of-the-box reporting options” are lacking, causing teams to do manual data stitching for certain views. For instance, you might want a combined report of ad engagement + sales touches, which might require exporting data.

The revenue attribution features, while useful, feel underdeveloped to some, meaning you get basic influence metrics, but not the depth of multi-touch modeling that an advanced analyst might want.

Also, data maturity in EMEA and APAC still needs work because RollWorks’ data is more focused on North America.

Tools like Demandbase provide native features for website personalization. With RollWorks, you’ll have to set up integrations with third-party tools for that.

A few users have been frustrated that RollWorks didn’t automatically exclude certain audiences (like your own employees or existing customers) from targeting and analytics.

You can set up these exclusions manually, but the ask was for more one-click, global exclusion settings to avoid skewing data or wasting spend. This is a minor quibble, and RollWorks may improve it, but be prepared to configure exclusion filters (for example, upload a list of domains to never target, such as your company’s domain).

Sales teams love the spike alerts, but one feedback was that the platform could do more to surface why an account is spiking and what to do about it, right in the alert or CRM widget.

Some smaller businesses or ABM beginners feel the pinch of the cost as they expand usage.

If your budget is only a few hundred dollars a month, RollWorks likely won’t fit. it’s better for organizations ready to commit a few thousand a month at least to ABM.

Also, if you dramatically increase ad spend, be mindful of your ROI so the platform fees + spend are justified by pipeline growth.

Finally, let’s consider who RollWorks is best suited for and when you might choose an alternative.

RollWorks is a strong choice if:

On the other hand, you might consider other options if:

If your primary ABM channel is LinkedIn advertising, and you’re looking for a highly focused, affordable tool, consider ZenABM as an alternative.

ZenABM is purpose-built for running ABM campaigns on LinkedIn, and it offers some unique capabilities for that niche:

Unlike RollWorks (which uses LinkedIn’s marketing integration), ZenABM connects directly to the LinkedIn Ads API to pull first-party, account-level data for each LinkedIn campaign. This means you get extremely accurate insights on which target companies saw or engaged with your LinkedIn ads, without relying on cookies or guesswork.

Every impression and click is tied to a company name through LinkedIn’s data, so you can trust that “bots and false positives aren’t counted”, and you know exactly which accounts are interacting.

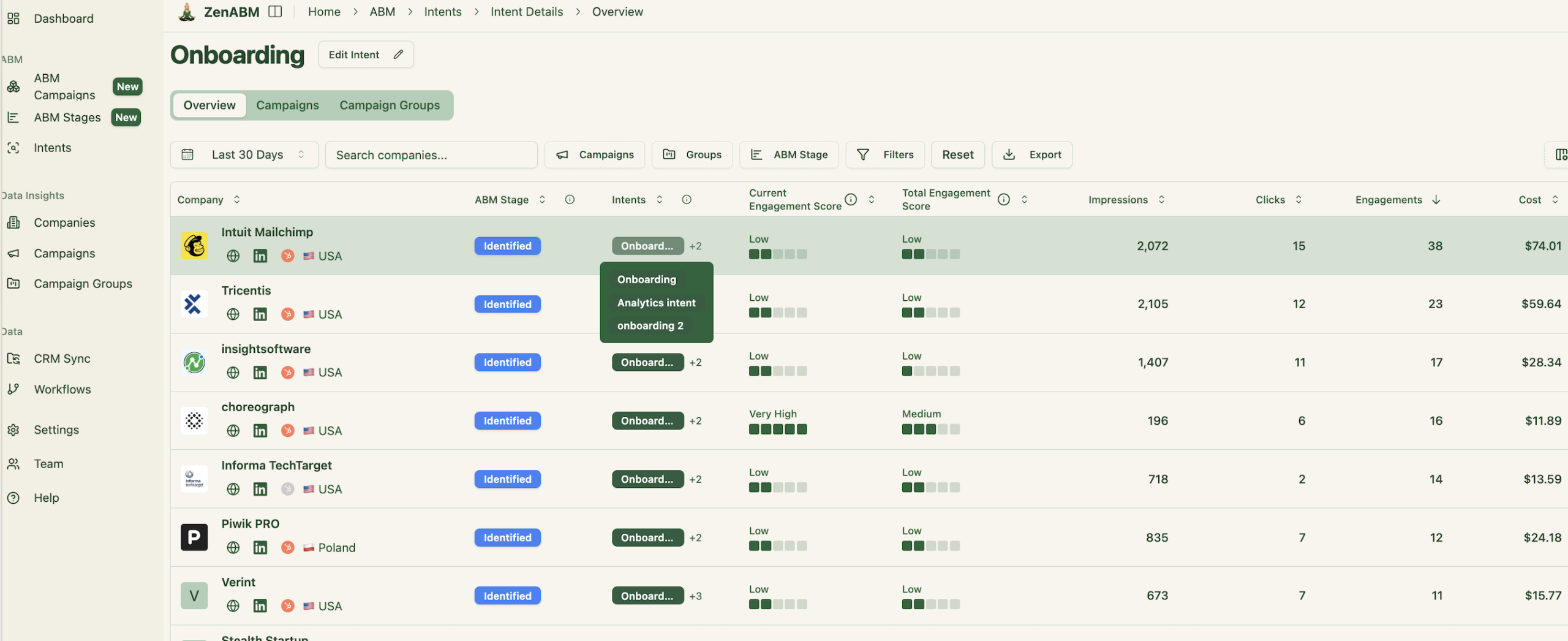

ZenABM automatically scores each account’s engagement on LinkedIn within your selected timeframe (say, the last 7 days).

This “engagement score” updates continuously to reflect recent activity, not just historical totals. The benefit is you can instantly identify your hottest accounts this week – those that have spiked in LinkedIn ad engagement – and focus sales outreach there. It’s a similar concept to RollWorks’ spikes, but specifically tuned to LinkedIn interactions.

With ZenABM, you can define the minimum engagement thresholds for each stage on your own:

And ZenABM will then track the funnel stage of each account automatically.

Unlike tools like RollWorks that source intent from third-party sources, ZenABM can help you gauge buyer intent with your own ads.

You just have to tag each campaign with the intent (i.e the particular feature/offer advertised by the ad), and ZenABM will then group all companies showing a particular intent together:

And will also push intent as company property to your CRM:

So, your BDRs will know what to talk to the hot accounts.

Keeping sales in the loop is automated with ZenABM. The platform can assign your BDRs to accounts that reach a certain engagement threshold (e.g. move into an “Interested” stage):

ZenABM also funnels all the LinkedIn ad engagement data it collects into your CRM as a company property (per account):

Having this directly in the CRM is hugely convenient. Your sales reps can view LinkedIn engagement for an account without logging into any separate tool.

Like most ABM giants, ZenABM frees you from the headache of building your own dashboards.

It matches ad-engaged companies with the deals in your CRM to analyse the impact of ads on your pipeline and revenue.

And then it presents the influenced pipeline, ad-won revenue, ROAS, etc. In intuitive dashboards:

RollWorks is undoubtedly a robust, feature-packed ABM platform ideal for mid-to-large B2B teams that prioritize precise account targeting, powerful advertising, and deep sales-marketing alignment. Its extensive integrations, automated workflows, and data-driven insights make it excellent for scaling ABM programs efficiently.

However, its premium price and complexity might not fit everyone, especially smaller businesses or teams just starting with ABM.

If LinkedIn Ads drive your ABM strategy, a dedicated solution like ZenABM offers targeted, streamlined, and cost-effective benefits, making it a compelling alternative or complementary choice.