In this guide, I break down how N.Rich vs. Satlo differ on features, pricing, and where they fit in an ABM stack, so marketing and sales can see which one suits their ABM motion.

I also show how ZenABM can act as a lean, LinkedIn-first alternative or serve as a complementary layer due to its unique features.

N.Rich vs. Satlo: Quick Summary

In case you’re short on time, here is the snapshot:

- N.Rich works as a full ABM execution layer with its own B2B DSP, multi-channel programmatic ads, dynamic ICP, and third-party intent.

- Satlo is a LinkedIn Ads analytics and buyer intent layer that focuses on company-level reporting and sales activation from LinkedIn only.

- N.Rich supports programmatic display plus LinkedIn alignment for broader multichannel ABM.

- Satlo is almost entirely LinkedIn-centric, built to expose what Campaign Manager hides and to surface high-intent accounts.

- N.Rich combines first-party data with third-party intent feeds, generates ICP scores and an ICP Sales Velocity Score, and enriches firmographics and technographics.

- Satlo relies on first-party LinkedIn ad engagement, intent scores from that engagement, and an AI companion that flags accounts ready for sales follow-up.

- N.Rich integrates with Salesforce, HubSpot, LinkedIn, and MAPs, and supports deeper ABM orchestration and workflows.

- Satlo integrates with tools like HubSpot and Apollo to push engaged company lists into CRM and sales tools, with exports and basic activation.

- N.Rich starts above 10 thousand dollars a year, with Growth at around 23.8 thousand dollars and Enterprise on a custom quote.

- Satlo is subscription-based at around 58 euro per month for Starter and 99 euro per month for Pro, with Enterprise as custom. It is closer to a premium LinkedIn analytics add-on than a full ABM platform.

- Choose N.Rich if you want multichannel programmatic ABM, heavy intent, and are comfortable with five-figure contracts and complex setup.

- Choose Satlo if you mainly want better LinkedIn reporting, company-level engagement, simple intent scoring, and lightweight sales handoff.

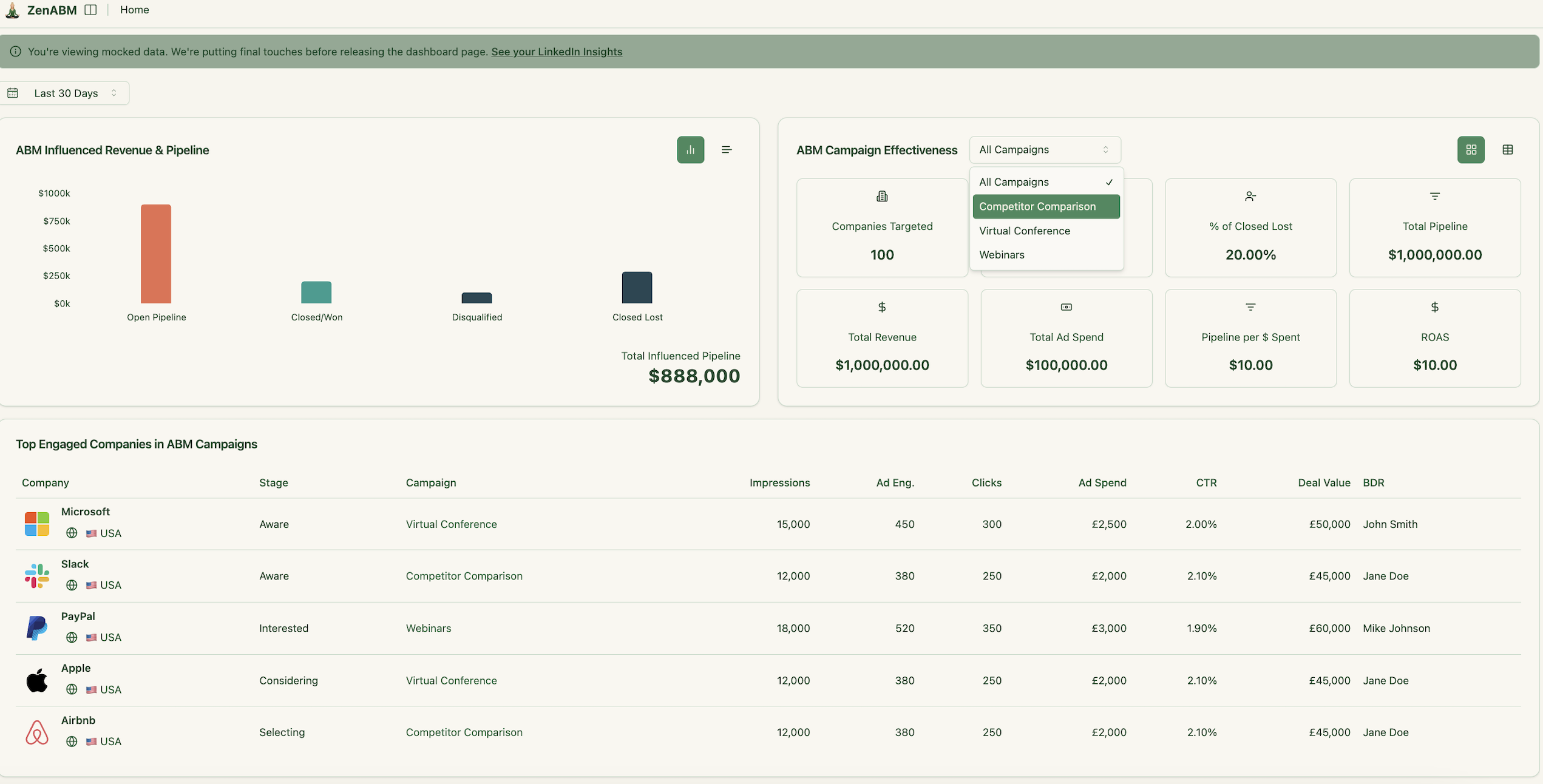

- A third option: ZenABM gives account-level LinkedIn ad engagement, engagement to pipeline dashboards, account scoring, ABM stages, CRM sync, first-party qualitative intent, automated BDR assignment, custom webhooks, an AI chatbot, and job title level engagement tracking, starting at $59 per month.

N.Rich Overview: Key Features, Pricing, and Reviews

N.Rich presents itself as an agile ABM execution layer for mid-market and enterprise teams, built on top of a B2B DSP with intent, ICP, and ABM workflows.

Key Features of N.Rich

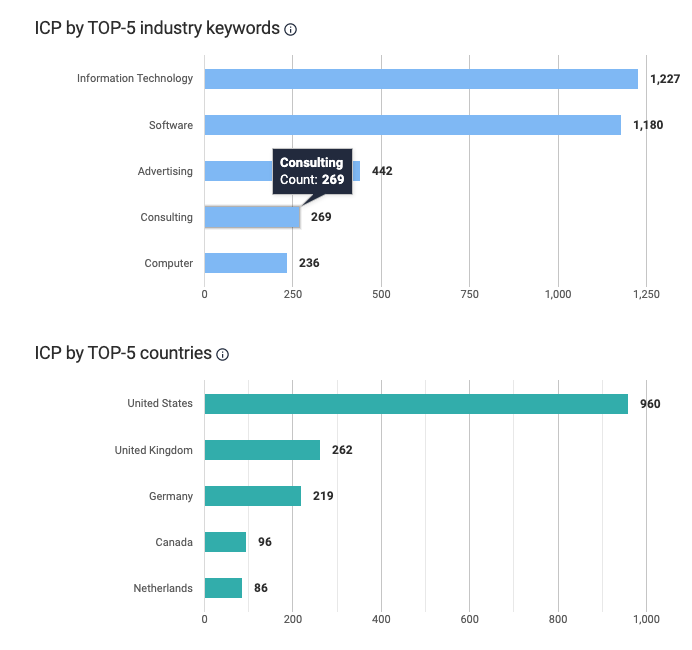

Core N.Rich capabilities for ABM include ICP building, intent scoring, programmatic campaigns, and account-level analytics.

Dynamic ICP & Target Account Lists

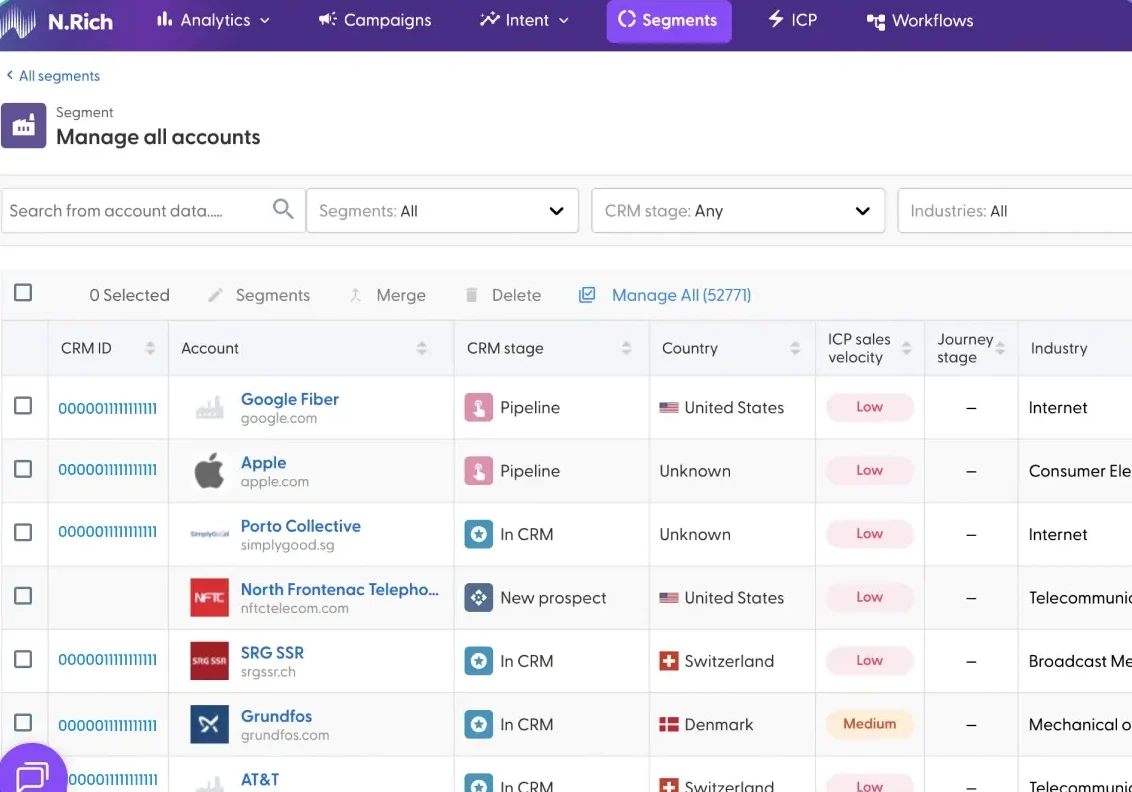

N.Rich pulls in CRM opportunity data to learn what your best customers look like, then scores new accounts against that pattern.

Target lists can be built quickly using filters such as industry, employee count, and tech stack.

The idea is to move beyond gut-feel account picks, although results still depend on CRM data quality.

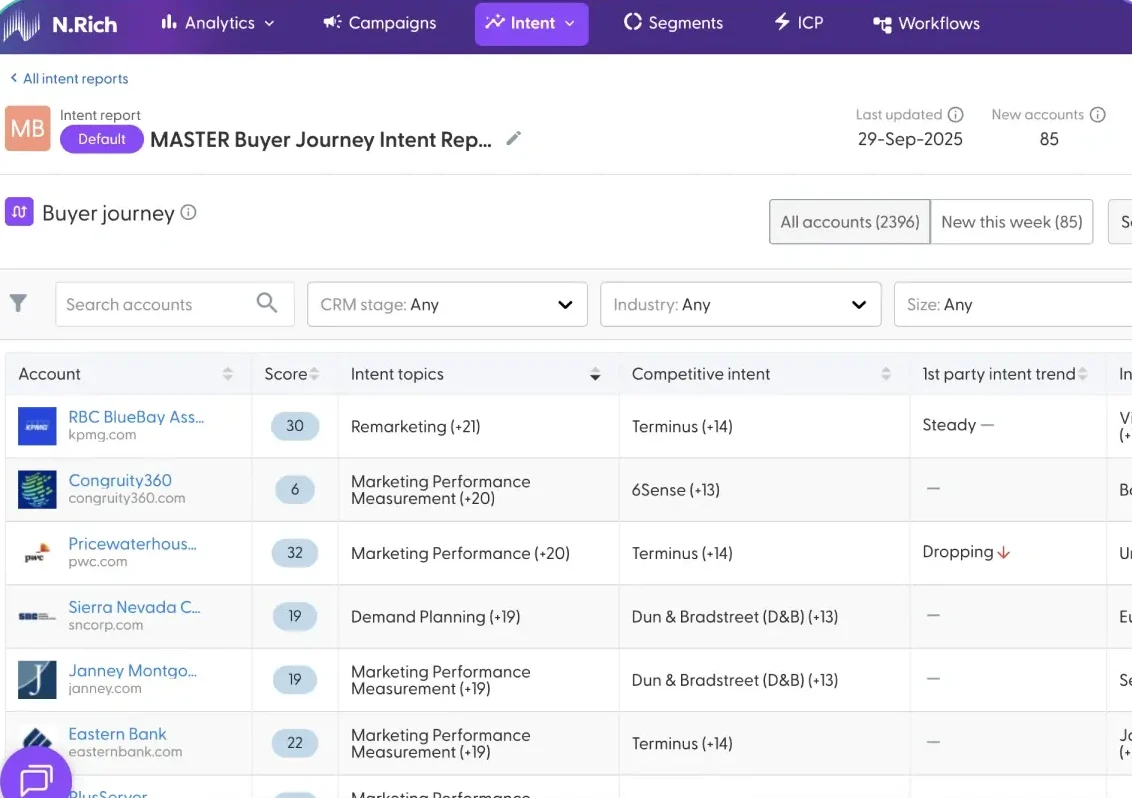

Intent Data & Account Scoring

N.Rich blends first-party signals (site visits, ad engagement) with third-party intent feeds to highlight accounts researching key topics.

Accounts receive intent scores so sales and marketing can focus on those showing the strongest, consent-based interest, while topic data syncs into your CRM.

Account-Based Advertising

N.Rich ships with a built-in DSP to run programmatic display to target accounts, supporting native and video formats.

You can connect LinkedIn Ads to keep display and LinkedIn campaigns aligned, and reviewers note a simple campaign builder with bulk creatives and A/B tests.

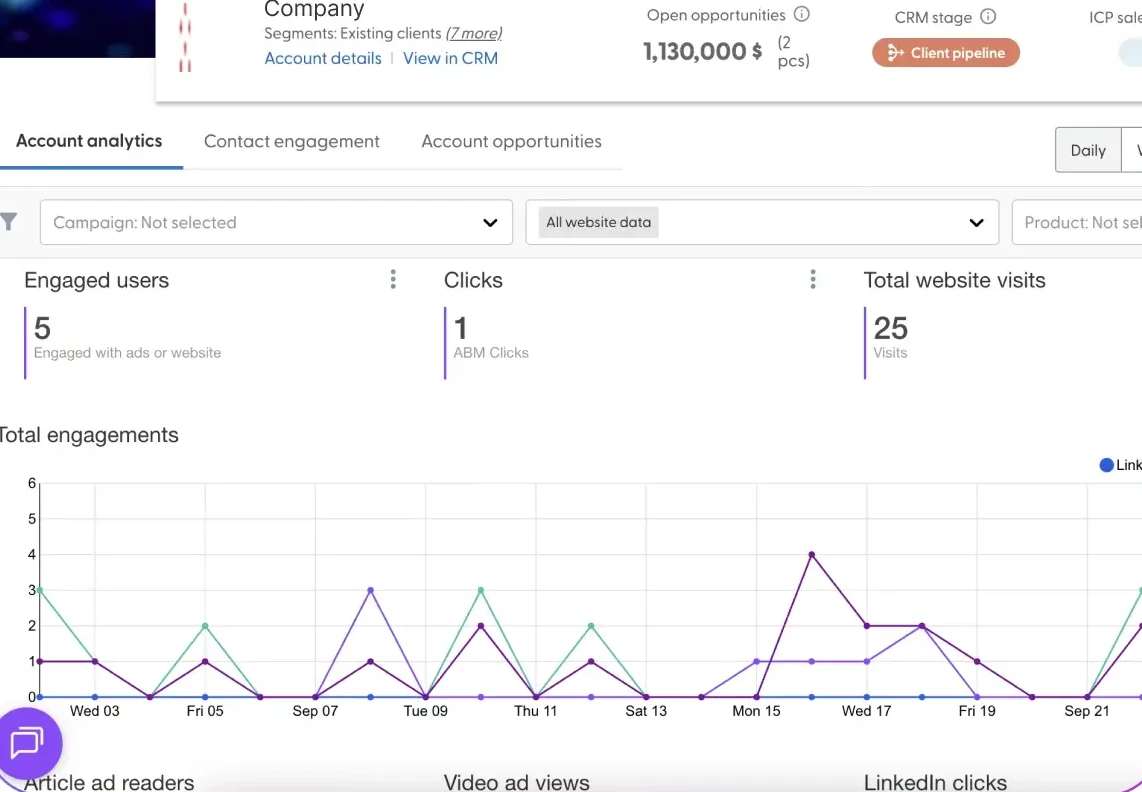

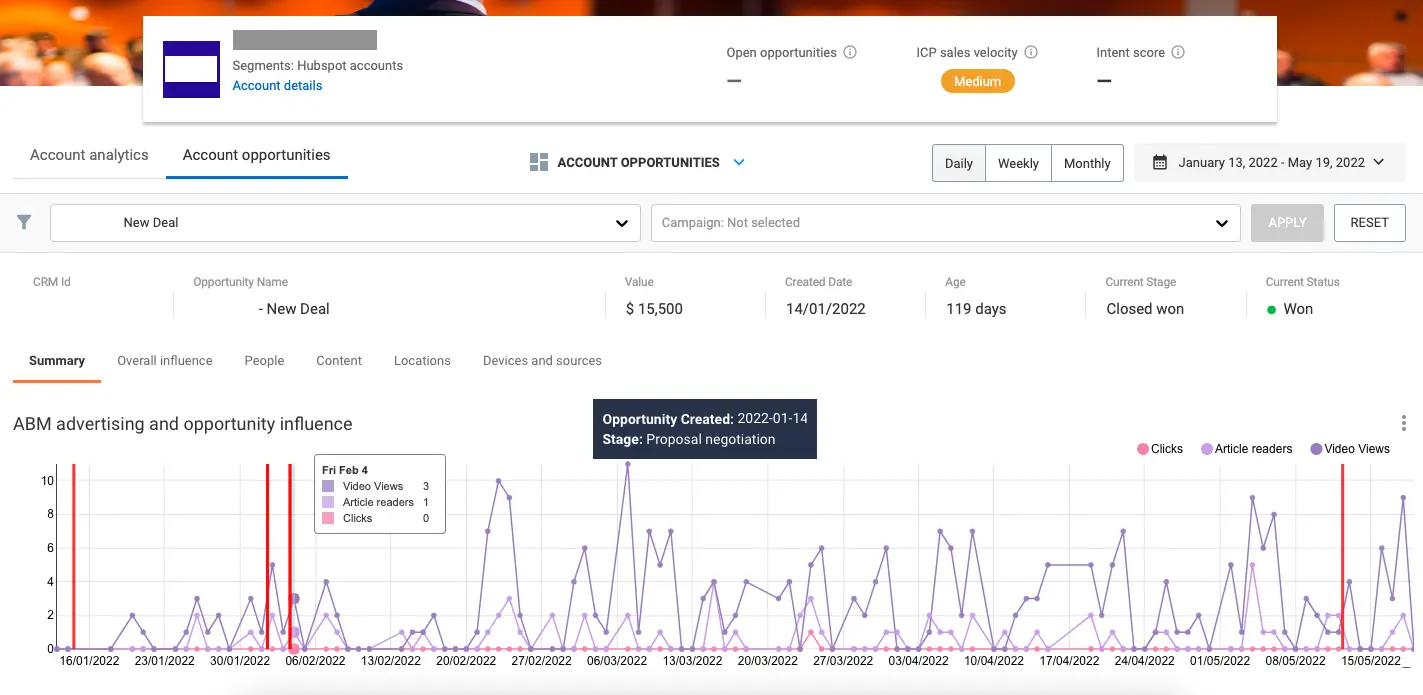

Analytics & Opportunity Attribution

N.Rich provides account-level analytics so you can see how engagement connects to pipeline and revenue. Its Opportunity Attribution dashboard links impressions, clicks, and visits with opportunities and closed deals.

The system also calculates an ICP Sales Velocity Score for each account, with data sync back to the CRM on higher tiers.

Integrations & Data Enrichment

N.Rich integrates with the main CRMs and marketing tools. Native connectors exist for Salesforce, HubSpot (Marketing and Sales Hub), and LinkedIn (Marketing Solutions and Sales Navigator), letting you pull CRM data for segmentation and push back engagement, topics, and scores. Higher tiers add firmographic and technographic enrichment.

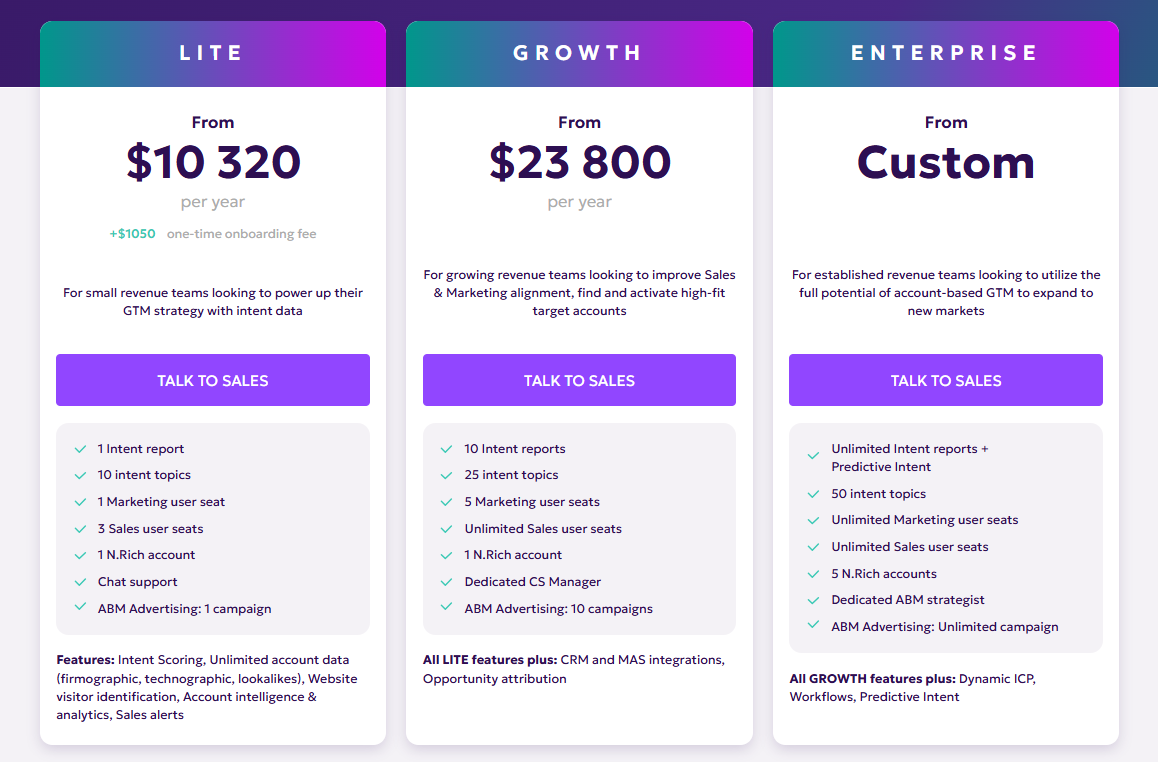

N.Rich Pricing: How Much Does It Cost?

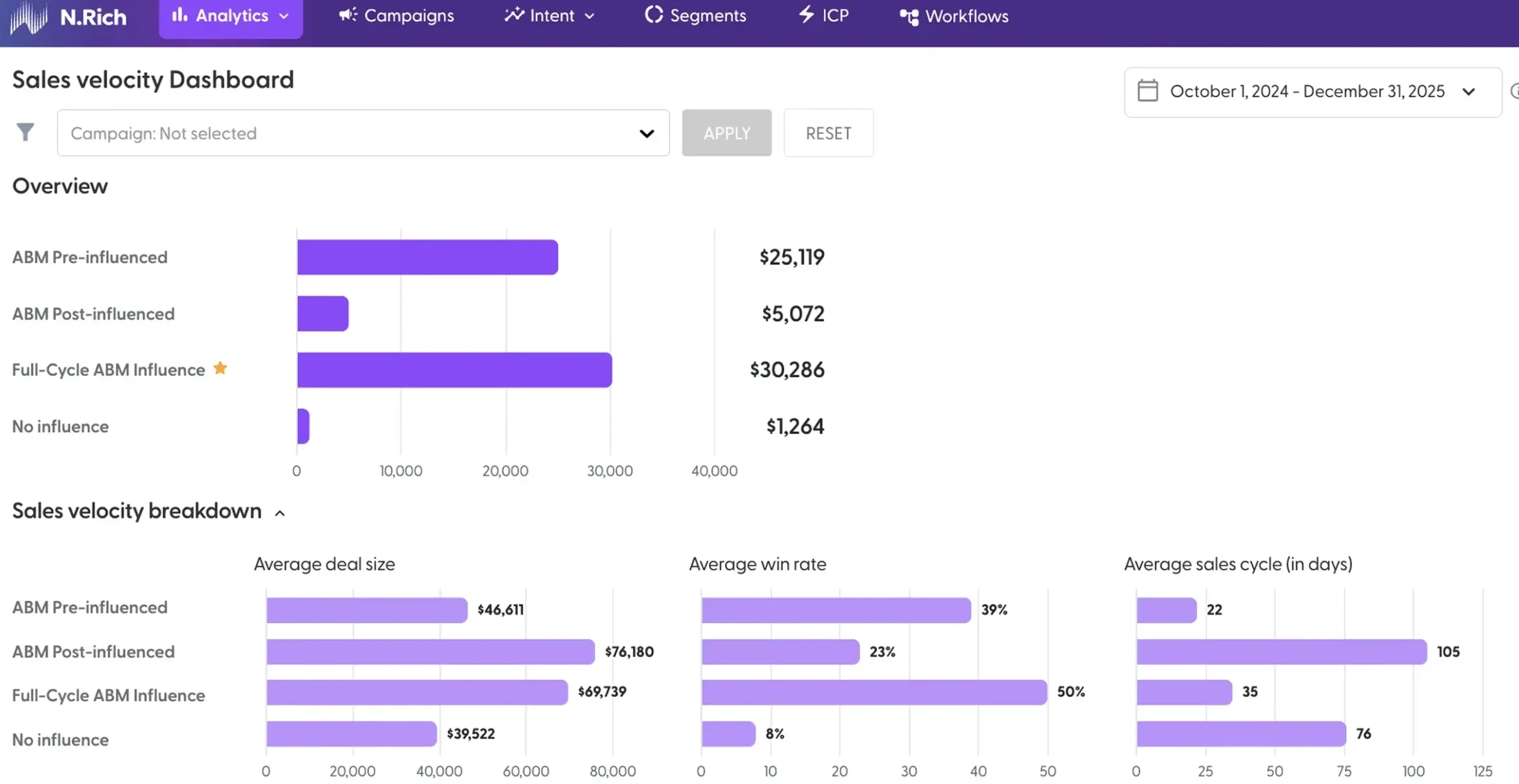

N.Rich has tiered pricing tied to team size and ABM maturity. All plans aim to turn intent data into deals.

LITE: Starting at $10,320/year + $1,050 One-Time Onboarding Fee

For smaller teams starting with intent-driven ABM.

Includes 1 intent report, 10 topics, 1 marketing seat, 3 sales seats, 1 N.Rich account, 1 ABM campaign, chat support, plus:

- Intent scoring

- Unlimited firmographic and technographic data

- Website visitor identification

- Basic account analytics and alerts

GROWTH: Starting at $23,800/year

For teams scaling ABM and needing closer sales and marketing alignment.

Includes everything in LITE plus:

- More intent reports and topics

- More marketing seats and unlimited sales seats

- CRM and MAP integrations

- Opportunity attribution and more ABM campaigns

- Dedicated Customer Success Manager

ENTERPRISE: Custom Pricing

For global, mature ABM programs with advanced orchestration needs.

Includes everything in GROWTH plus:

- Unlimited intent reports and higher topic limits

- Unlimited users and multiple N.Rich accounts

- Dynamic ICP Builder and open API

- Automated workflows and strategic consulting

All plans benefit from N.Rich’s data depth and native ABM orchestration, but you still need to talk to sales for exact quotes.

Note: because N.Rich starts above $10K per year, ZenABM often looks leaner for LinkedIn first teams, starting at ~$59/month, with the top tier still under $6K per year. You still get core LinkedIn ABM essentials: account-level ad engagement tracking, account scoring, ABM stage tracking, hot account routing, bi-directional CRM sync, custom webhooks, qualitative intent, and plug-and-play ROI dashboards.

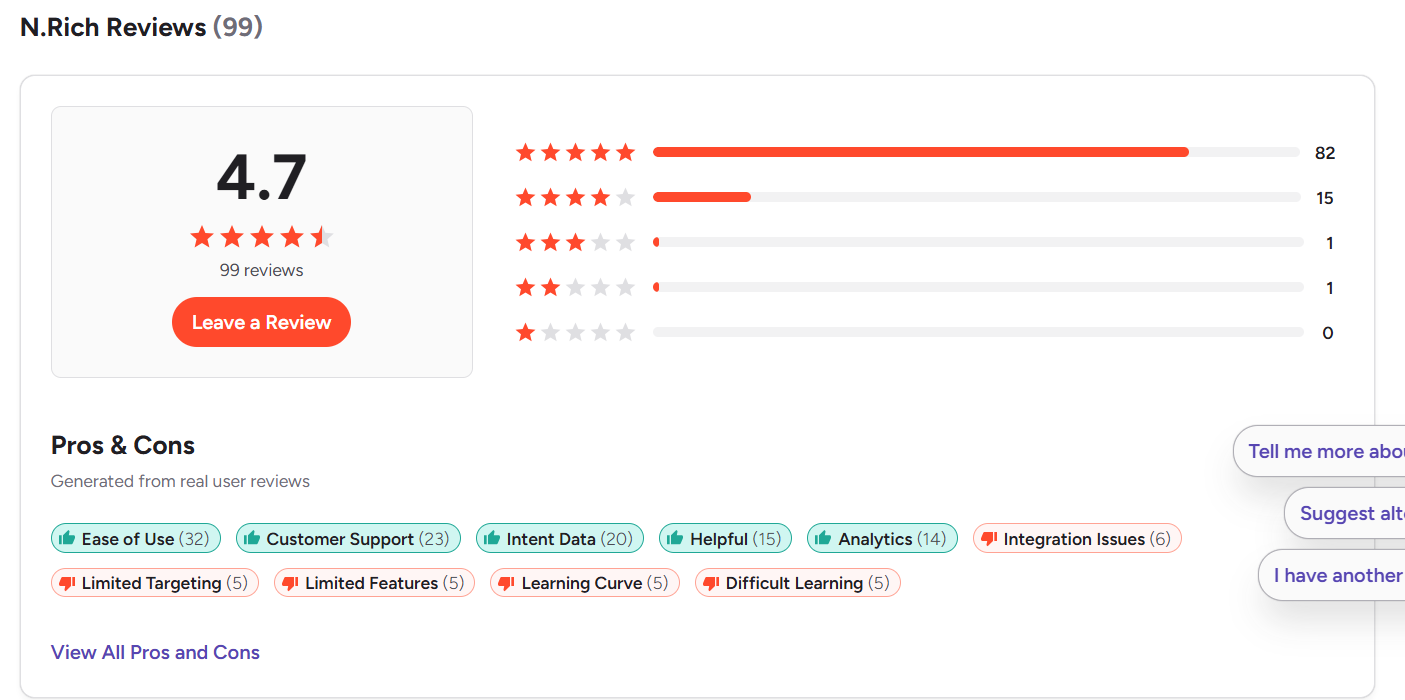

User Impressions and Reviews

N.Rich scores 4.7 out of 5 on G2 (around 99 reviews), which suggests customers are broadly satisfied.

Across G2, TrustRadius, Reddit, and similar sources, a few themes show up.

Pros (According to Users)

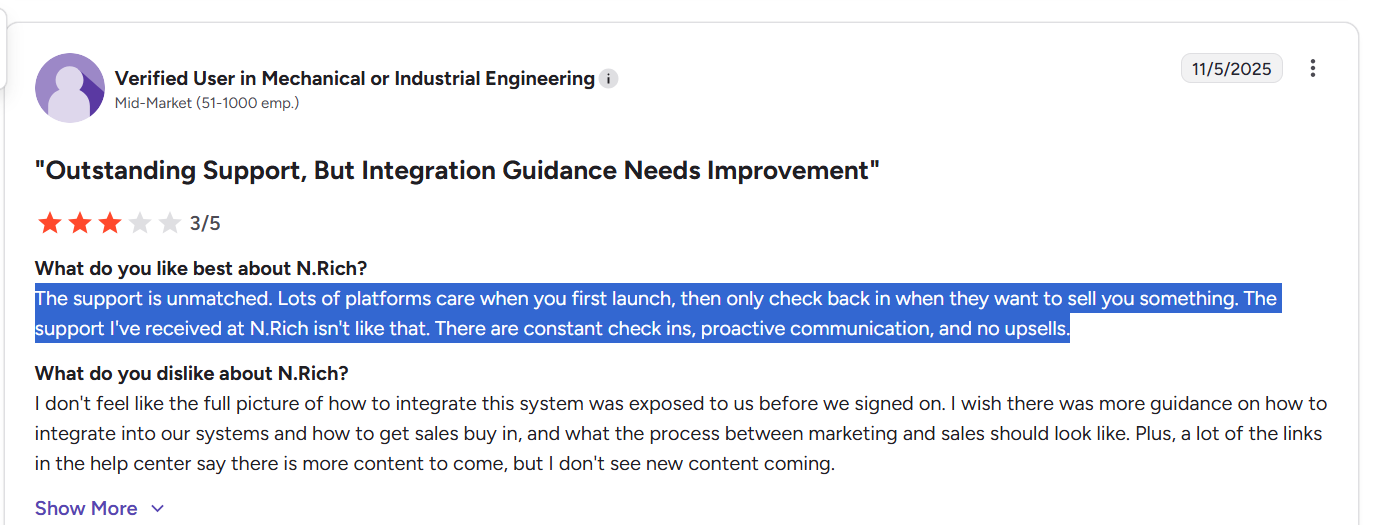

- Support that shows up: Reviewers often describe N.Rich’s support as responsive and proactive, with regular check-ins that are not just upsells.

- Usable once configured: Many call it easy and even “fun” to use once lists, reports, and campaigns are in place.

- Strong intent and targeting: Users praise the quality of intent and account selection for focusing ad spend on high-value accounts.

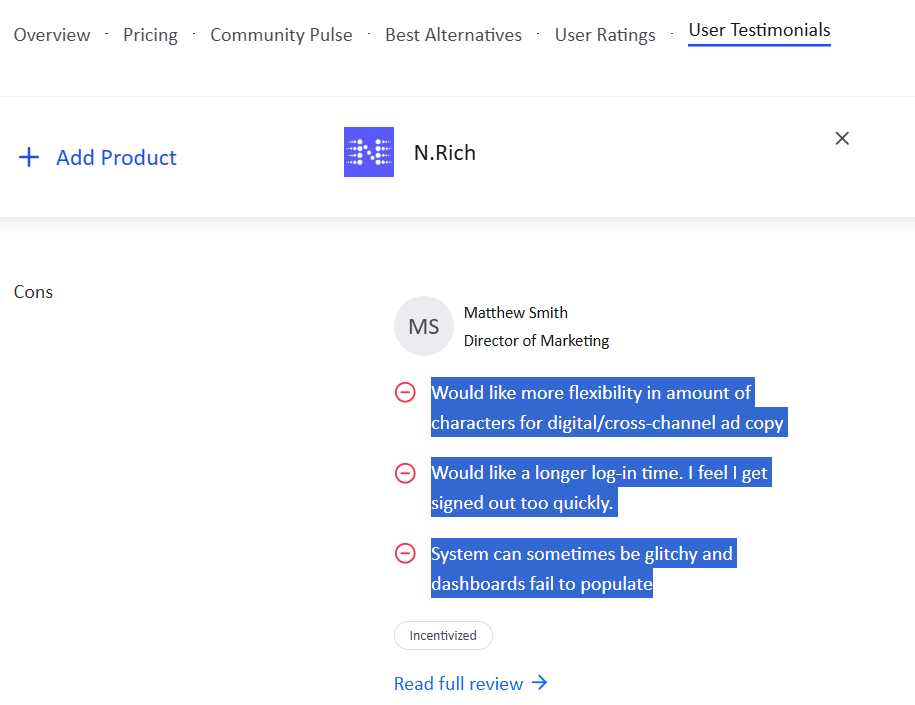

Cons (According to Users)

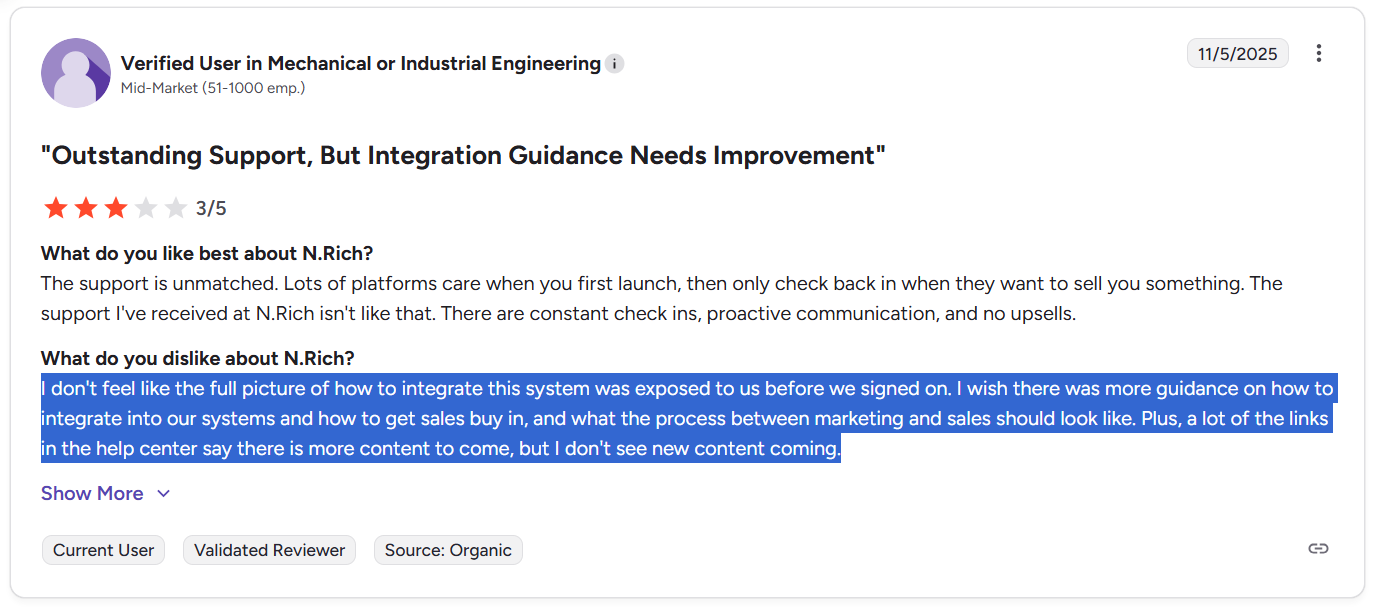

- Setup takes work: Onboarding, data mapping, and reporting usually need ops involvement.

- Integrations need clearer guidance: Some reviewers report integration surprises and wish the full picture had been clearer before signing.

- Feature gaps: A few users mention limits around ad copy, session timeouts, or glitches.

Satlo Overview: Key Features, Pricing, and Reviews

Satlo positions itself as a LinkedIn Ads analytics and buyer intent platform.

Here is how it works, what it costs and what users say.

Key Features of Satlo

Satlo markets itself as an ABM platform that bridges ad performance and sales activation.

It aims to fill LinkedIn’s reporting gaps and help B2B marketers detect buyer intent and pass qualified opportunities to sales.

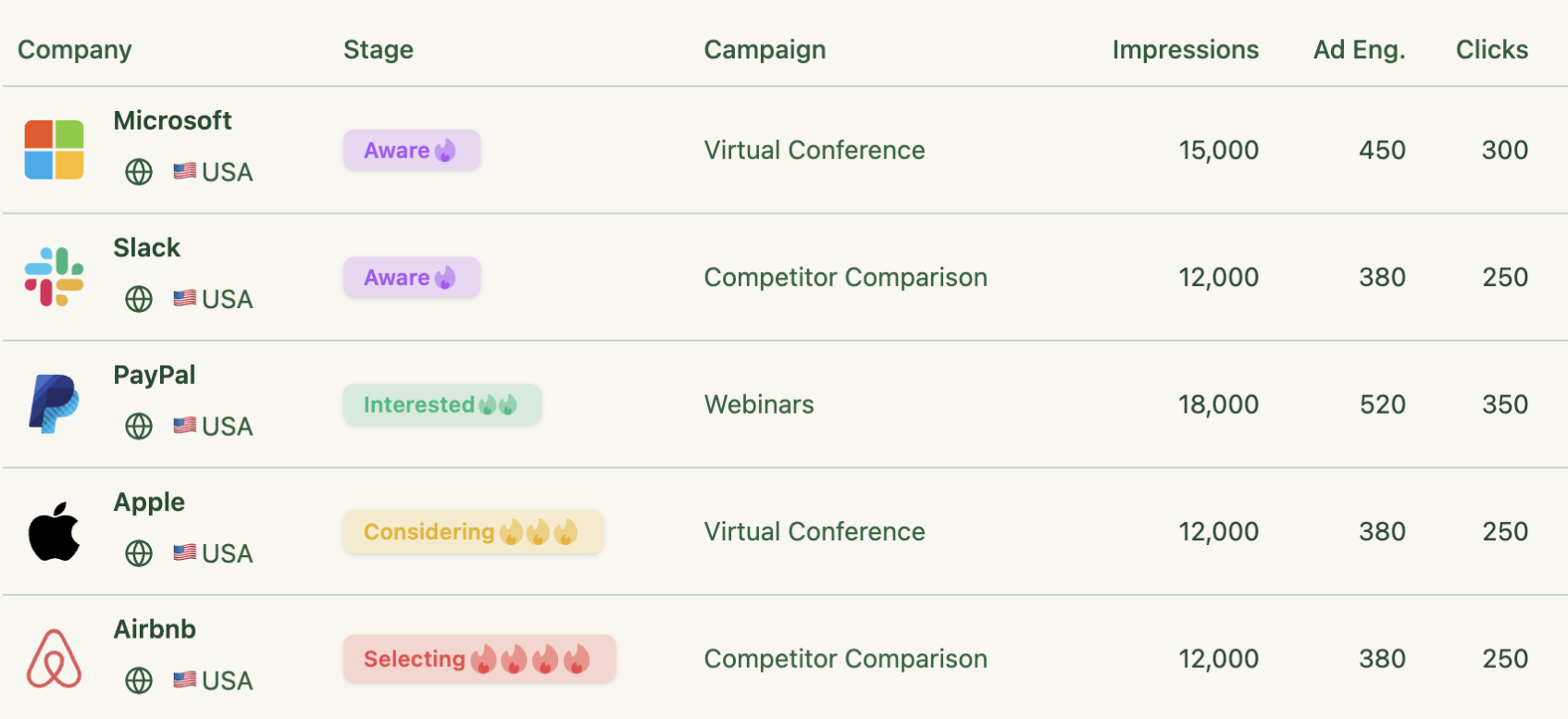

Company-Level LinkedIn Ad Engagement Tracking

Satlo provides company-level LinkedIn engagement data (impressions, clicks and so on), which LinkedIn Campaign Manager does not expose directly.

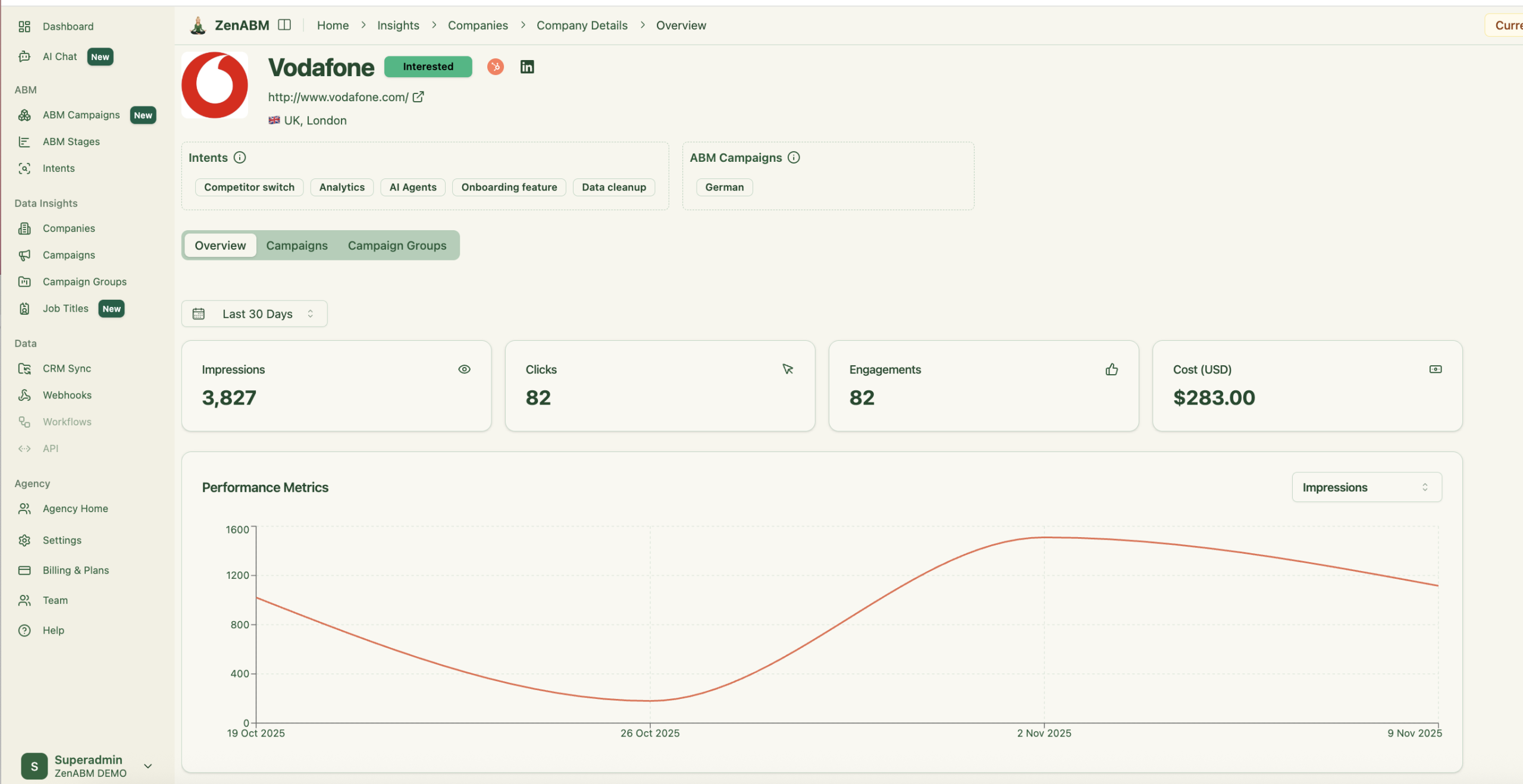

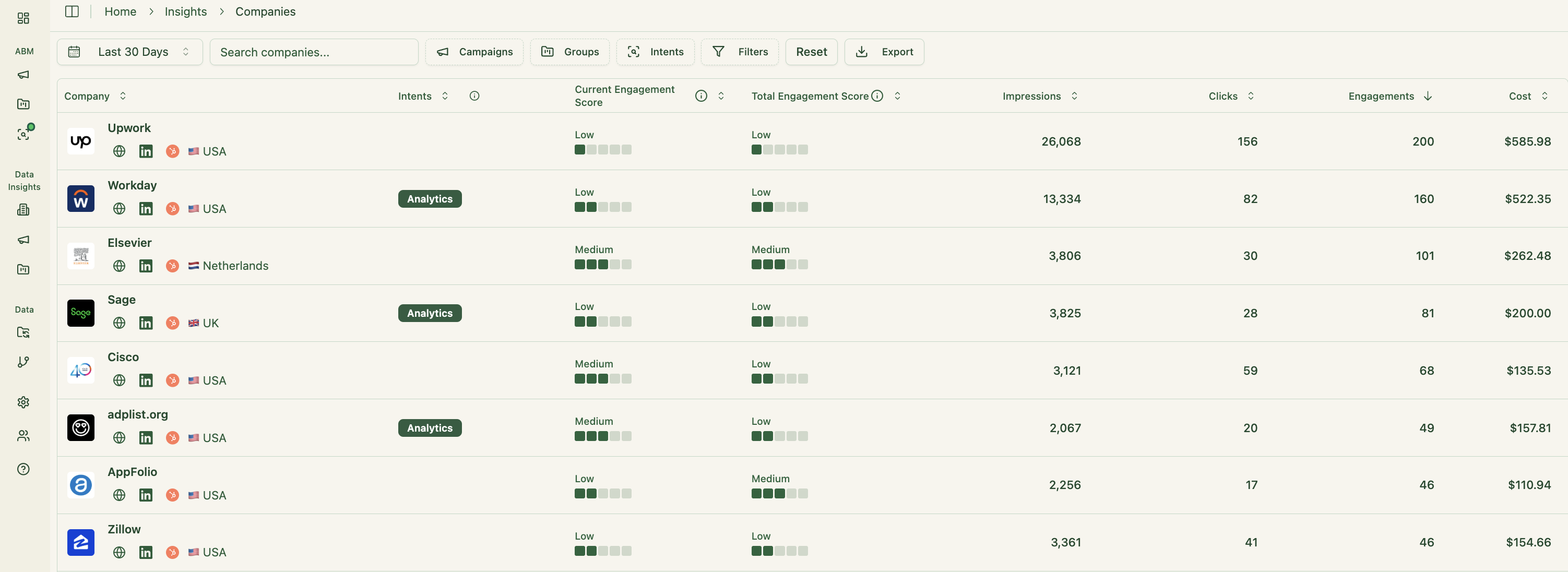

ZenABM offers similar company-level views:

CRM and MAP Integration

Satlo integrates with tools like HubSpot and Apollo to push company lists into sales workflows.

It identifies which companies engaged with your ads and writes those accounts into your CRM.

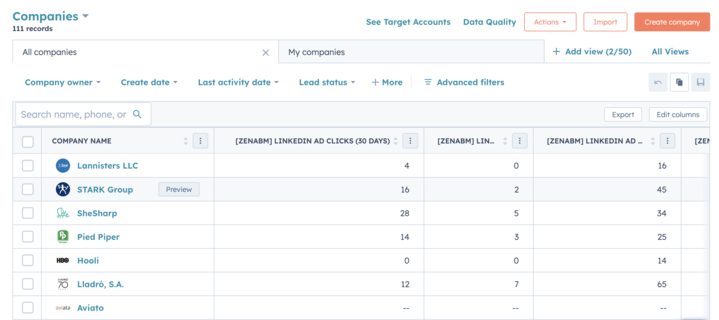

Pro Tip: ZenABM also focuses on CRM sync (HubSpot and Salesforce) but goes deeper:

- It pulls deal values of ad-engaged companies for revenue attribution and shows this in dedicated dashboards.

- It pushes LinkedIn engagement metrics as company properties.

- It assigns hot accounts to BDRs directly in your CRM for timely outreach.

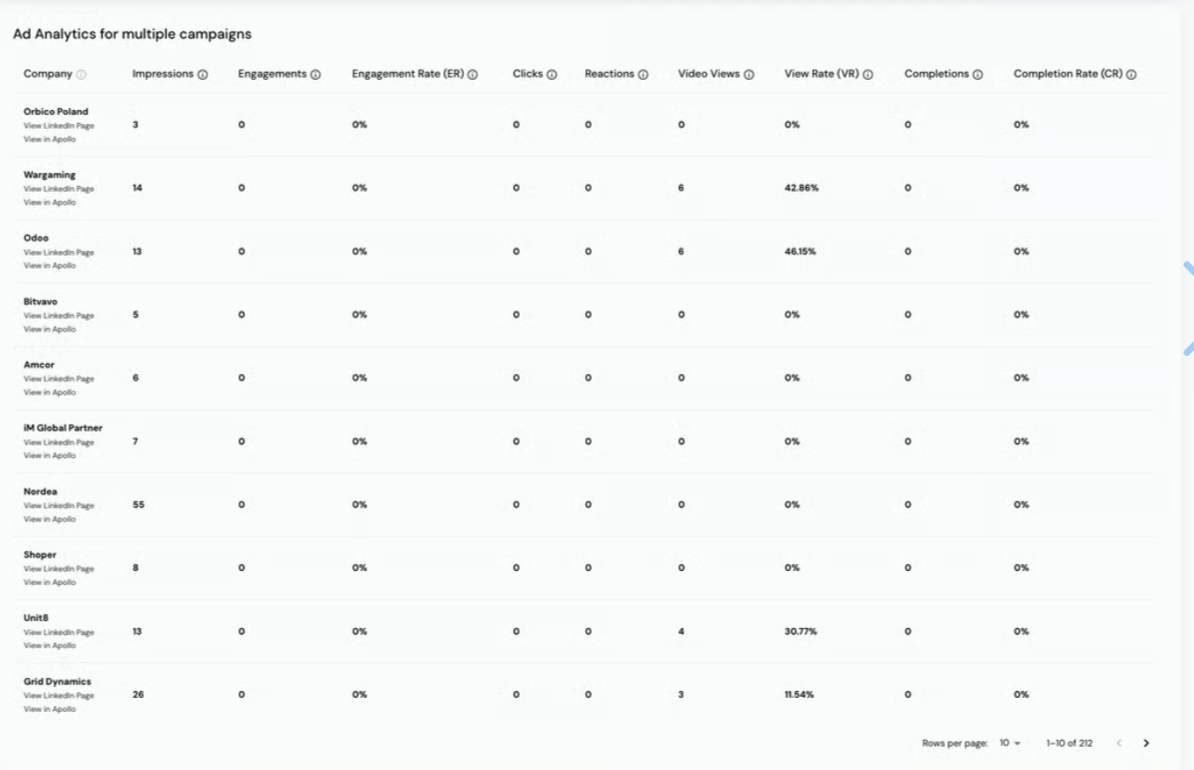

Analytics and Reporting

Satlo gives dashboards and exports that let marketers slice LinkedIn performance by account. Highlights include:

- Unlimited historical data and exports for CSV or PDF.

- Workspace overview for monitoring all LinkedIn campaigns across workspaces.

- Company-level engagement views showing impressions, clicks, video views and form fills over time.

- Intent scores and qualitative insights that convert engagement into a simple score.

- AI companion to query the data and get basic recommendations.

AI Companion

Satlo’s AI companion runs across all companies reached by your LinkedIn ads, surfaces sales actions and provides intent signals for key accounts.

It works across your ad accounts and unlimited data history and is available from the Pro tier onward.

The aim is to highlight accounts that shifted from passive exposure to active interest based on campaign interactions and company engagement, not just single clicks.

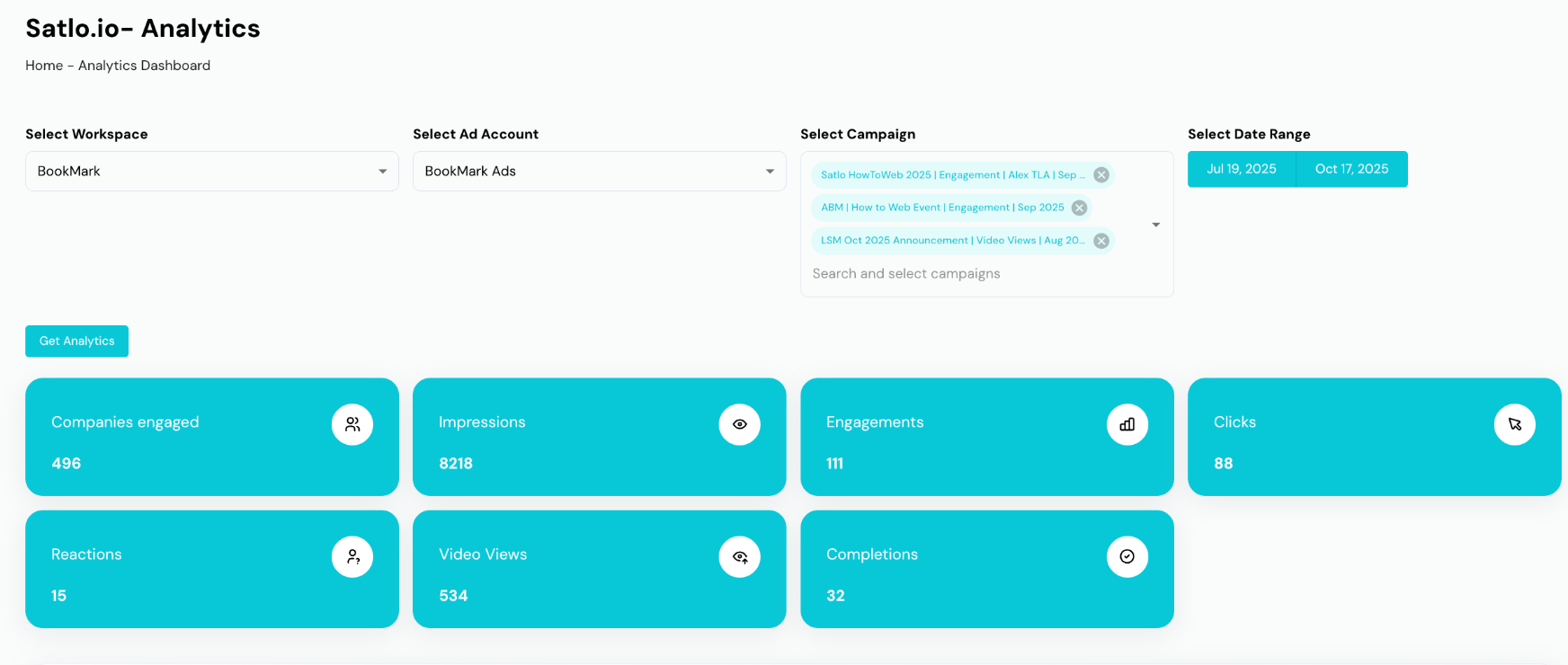

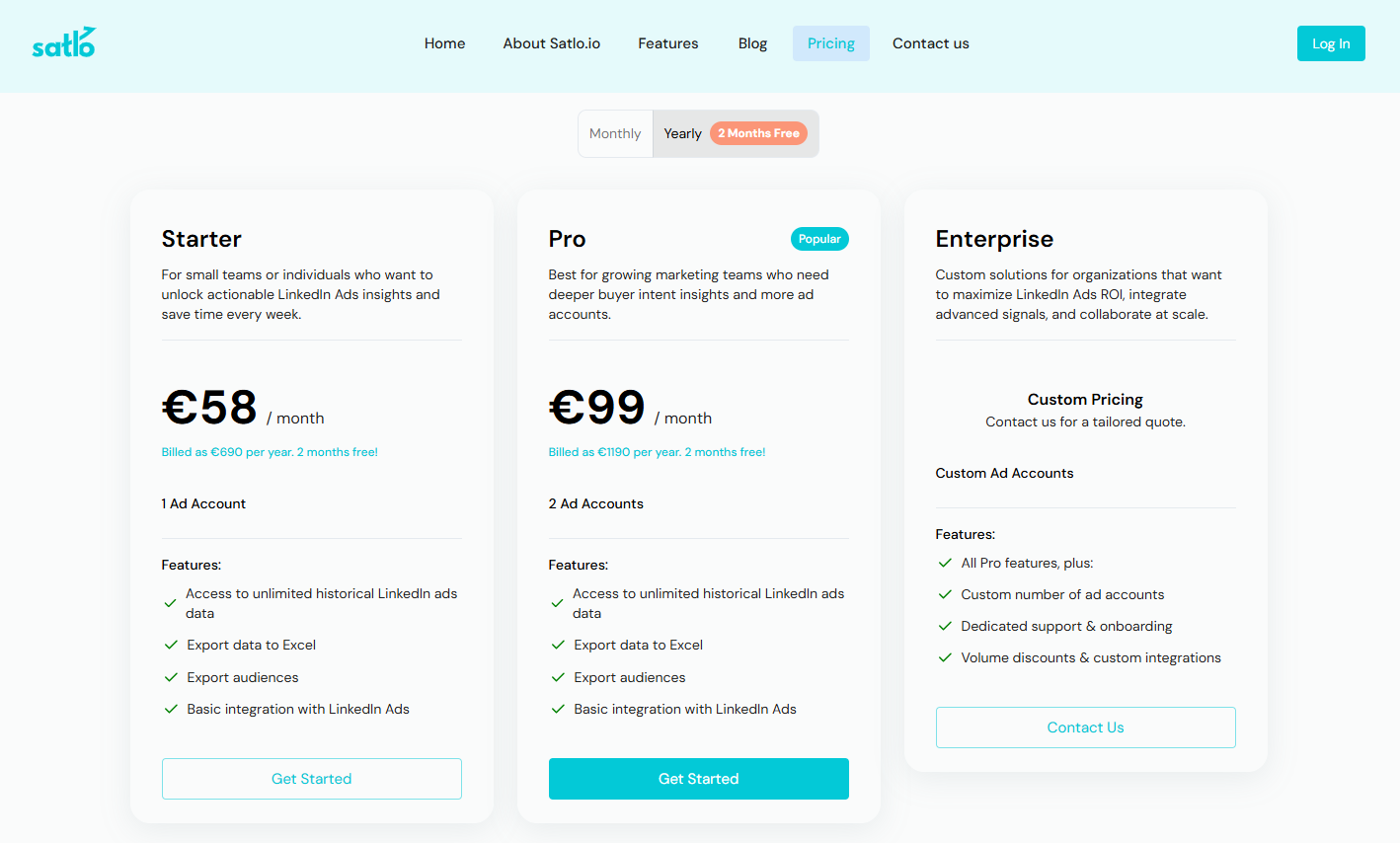

Satlo Pricing: How Much Does It Cost?

Satlo has three main plans, structured around the number of LinkedIn ad accounts and the depth of insight.

All plans include unlimited historical LinkedIn Ads data and the ability to export audiences and performance to Excel.

Starter — €58/month (billed yearly at €690)

For individuals or small teams that want faster LinkedIn analysis without complexity.

Includes:

- 1 LinkedIn ad account

- Unlimited historical data

- Basic LinkedIn integration

- Export to Excel

- Audience export

Pro — €99/month (billed yearly at €1,190)

For growing teams that need broader coverage and deeper buyer insights.

Includes:

- 2 LinkedIn ad accounts

- Unlimited historical data

- Basic LinkedIn integration

- Export to Excel

- Audience export

Enterprise — Custom Pricing

For larger organizations managing multiple accounts or needing custom integrations and support.

Includes:

- Custom number of LinkedIn ad accounts

- All Pro features

- Dedicated support and onboarding

- Volume discounts

- Custom integrations

Satlo also offers a 14-day free trial and uses Stripe for billing.

If you want a similarly priced but broader LinkedIn ABM tool, ZenABM starts at $59/month.

ZenABM offers account-level LinkedIn engagement tracking, pipeline attribution with plug-and-play dashboards, account scoring, ABM stages, CRM sync, first-party intent, BDR assignment, custom webhooks, AI chatbot, impression capping, ABM objects and job title level analytics.

N.Rich vs. Satlo: Key Differences

The key differences between N.Rich vs. Satlo are tabulated here.

| Aspect | N.Rich | Satlo | Best suited for |

|---|---|---|---|

| Core positioning | ABM execution layer built on a B2B DSP with ICP, intent, and programmatic workflows | LinkedIn Ads analytics and buyer intent platform focused on company level engagement | Teams that want a full ABM engine with media and orchestration |

| Primary channel focus | Programmatic display with LinkedIn alignment and multi channel ABM | LinkedIn Ads centric reporting and insights | Marketers choosing between multichannel ABM vs LinkedIn only analytics |

| Intent and scoring | Combines first party signals with third party intent, intent scores, and ICP Sales Velocity Score | Derives intent scores from LinkedIn engagement and highlights high intent accounts | Teams deciding between deep external intent vs first party LinkedIn intent only |

| ICP and targeting | Dynamic ICP builder using CRM opportunity data, target lists by firmographics and tech stack | No explicit ICP builder, focuses on company lists and engagement driven prioritization | Orgs that need modeled ICP vs simple LinkedIn engagement based lists |

| Campaign execution | Runs programmatic campaigns directly through its DSP plus LinkedIn connections | Does not buy media, analyzes and augments existing LinkedIn ad campaigns | Whether you want media execution in the platform or only analytics |

| Analytics and reporting | Account level analytics, opportunity attribution, velocity dashboards | Company level LinkedIn engagement, unlimited historical data, exports, AI assistant | Marketing teams choosing between broad funnel analytics vs LinkedIn specific views |

| Integrations | Salesforce, HubSpot, LinkedIn, MAPs, enrichment providers | CRM and tools like HubSpot and Apollo for pushing engaged accounts into workflows | Stacks that rely on MAP plus CRM vs lighter CRM centric setups |

| Pricing model | Annual contracts starting above 10,000 USD per year plus onboarding fee | Subscription pricing from about 58 EUR per month, Pro at about 99 EUR per month | Enterprise budgets vs smaller teams or agencies seeking monthly pricing |

| Typical complexity | Requires onboarding, data mapping, and ongoing ops support | Lighter to adopt, focuses on analytics and intent on top of existing campaigns | Teams with dedicated ops vs lean teams with limited technical resources |

| ABM breadth | Supports broader ABM programs across channels with orchestration | Improves LinkedIn Ads performance and sales handoff rather than full ABM orchestration | Full ABM strategies vs LinkedIn first performance and intent use cases |

N.Rich vs. Satlo: So Which Is Better for ABM?

If you are running a mature, multichannel ABM program and need a DSP, intent feeds, dynamic ICP models, and orchestrated workflows, N.Rich is the stronger fit, provided you have the budget and ops resources.

If your main problem is that LinkedIn Campaign Manager hides company-level engagement and you just want clean LinkedIn analytics, simple intent scoring, and sales-ready account lists at a reasonable monthly price, Satlo is the more pragmatic choice.

ZenABM as a LinkedIn First, First Party Lean ABM Alternative

If you mostly need first-party accuracy on LinkedIn, account scoring, ABM stages, CRM sync, and revenue attribution, a lighter option makes more sense.

This is where ZenABM comes in.

In fact, even for teams running heavy mult-channel ABM campaigns, ZenABM is valuable due to its following unique features:

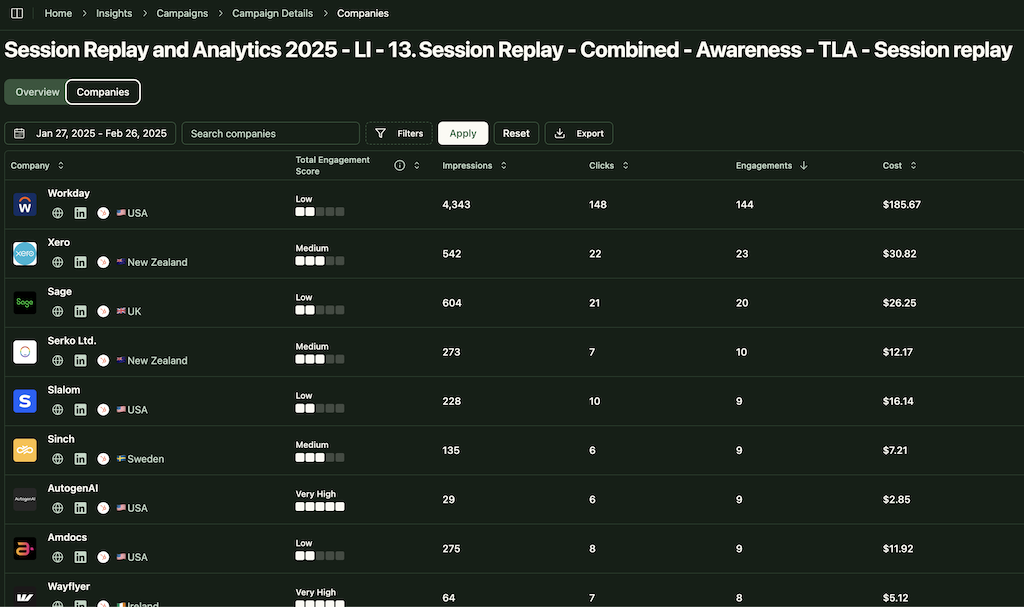

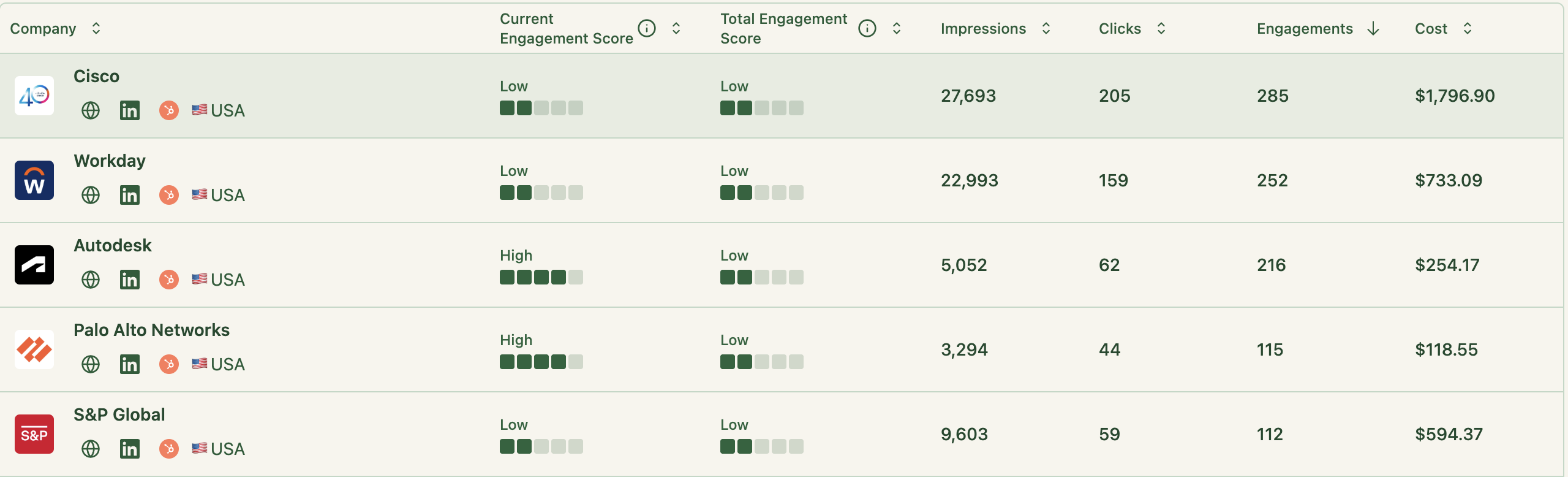

Account-Level LinkedIn Engagement Tracking

ZenABM connects directly to the official LinkedIn Ads API and records account-level data for every campaign.

You see which companies view and engage with your ads using first-party LinkedIn data instead of noisy IP or cookie matching. A Syft study suggests IP identification accuracy peaks around 42 percent, which is why ZenABM treats ad engagement as the primary intent signal.

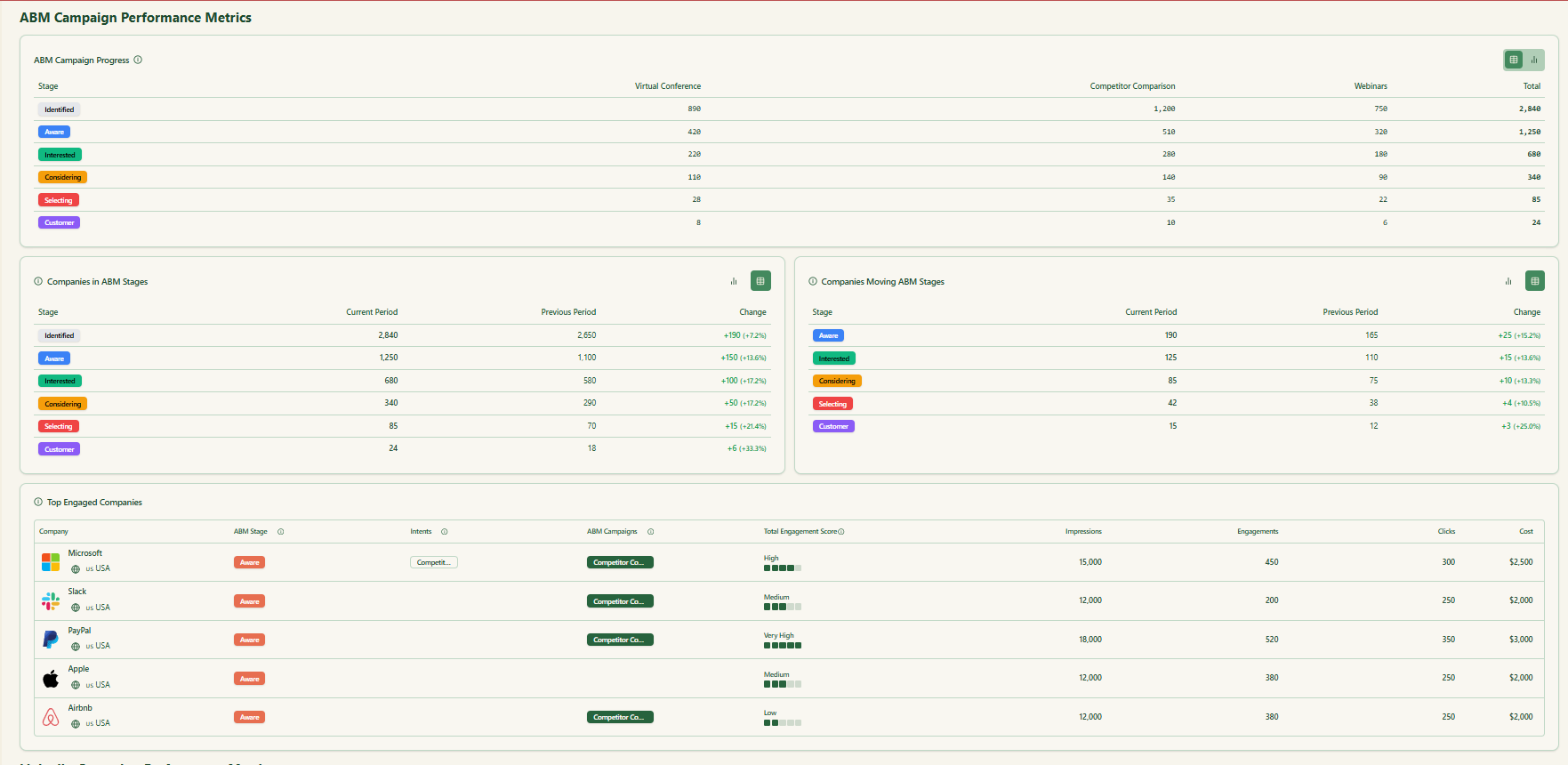

Real Time Engagement Scoring & ABM Stages

ZenABM updates engagement scores continuously as accounts interact with your ads. The interface shows a full touchpoint history and lets you define custom stages such as Identified, Aware, Engaged, Interested, and Opportunity.

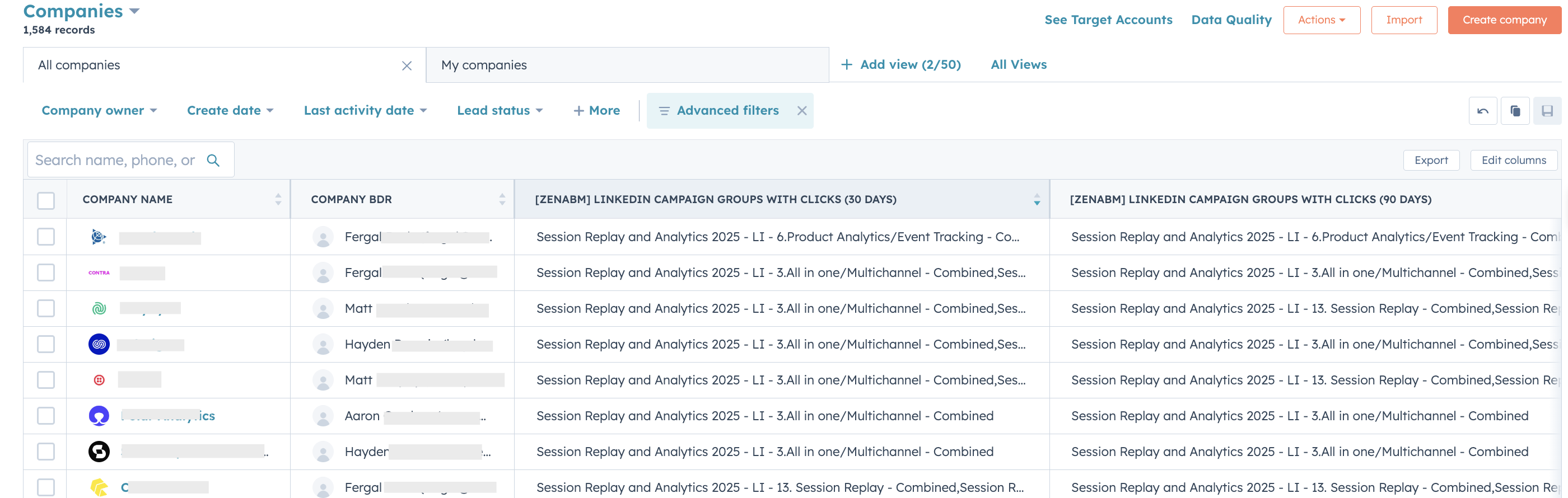

CRM Integration and Workflows

ZenABM syncs bi-directionally with HubSpot and adds Salesforce support on higher plans. All LinkedIn metrics can be written as company properties in your CRM.

When an account crosses your score threshold, ZenABM updates the stage and can assign a BDR automatically.

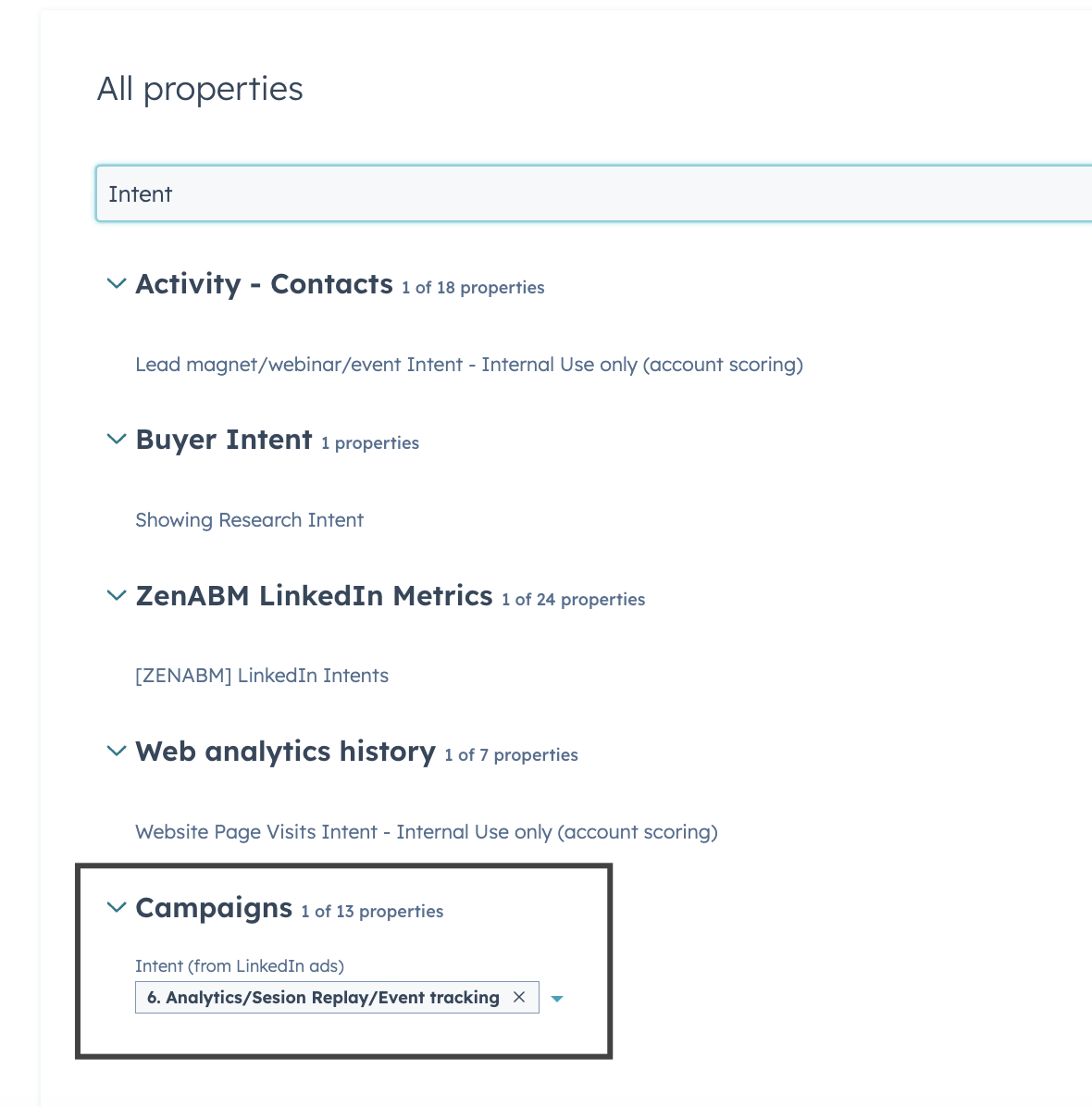

Intent Tagging and ABM Analytics

ZenABM lets you pull intent topics from LinkedIn campaigns and tag each campaign by feature, use case, or offer.

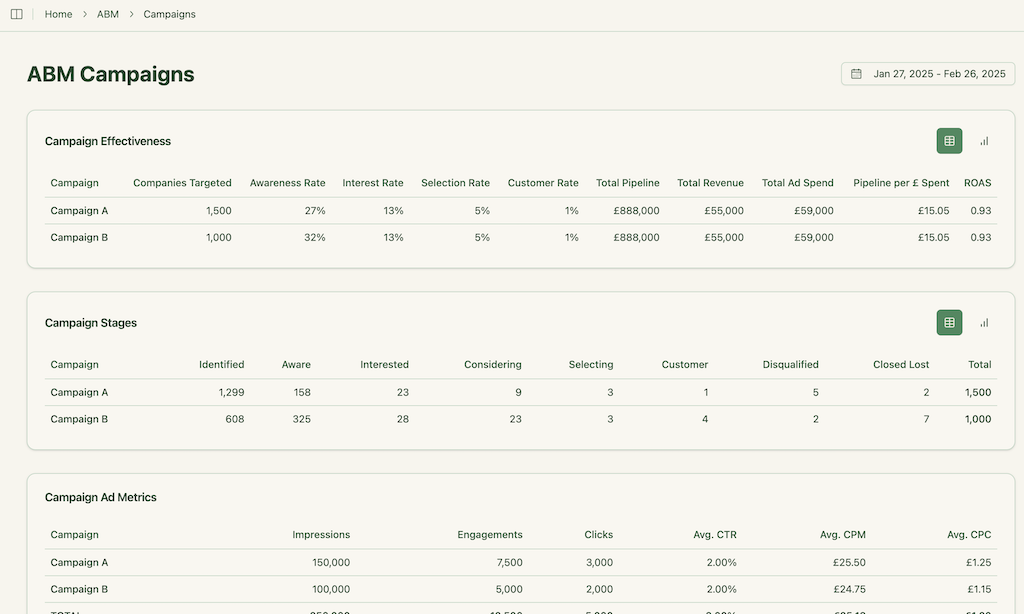

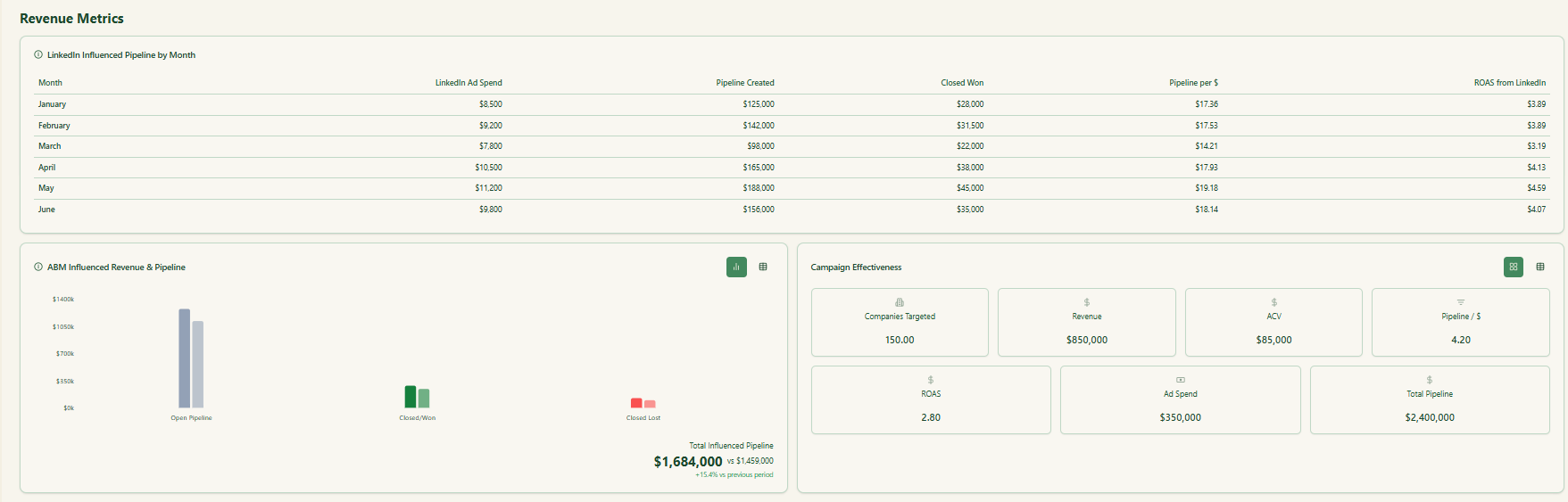

ZenABM includes ABM dashboards that tie LinkedIn ads to account engagement, stages, and revenue. You can see performance from ABM initiatives down to campaign groups and individual ads, and because ZenABM stores deal value and ad spend per company and campaign, it calculates ROAS and pipeline per dollar.

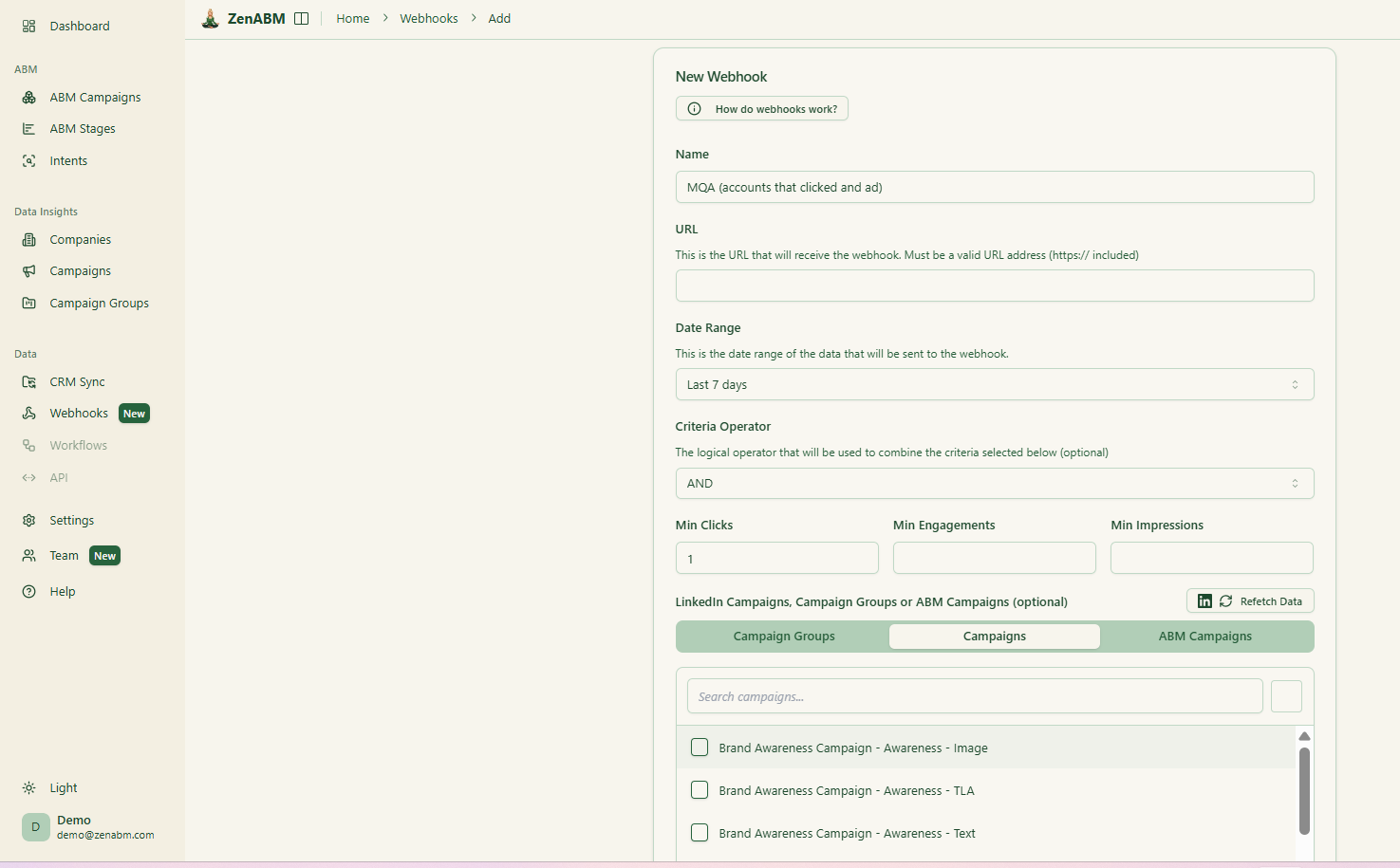

Webhooks, Job Title Analytics & Campaign Objects

ZenABM webhooks send events into your stack for Slack alerts, enrichment flows, and other automation.

You can also group LinkedIn campaigns into ABM campaign objects to view performance across markets, personas, or creative clusters instead of juggling isolated reports.

AI Chatbot & Multi Client Workspace

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model so you can ask questions like “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting campaigns?”.

It also supports agencies via a multi-client workspace, so you can manage several ad accounts and clients with separate ABM campaigns, dashboards, and reporting without constant account switching in Campaign Manager.

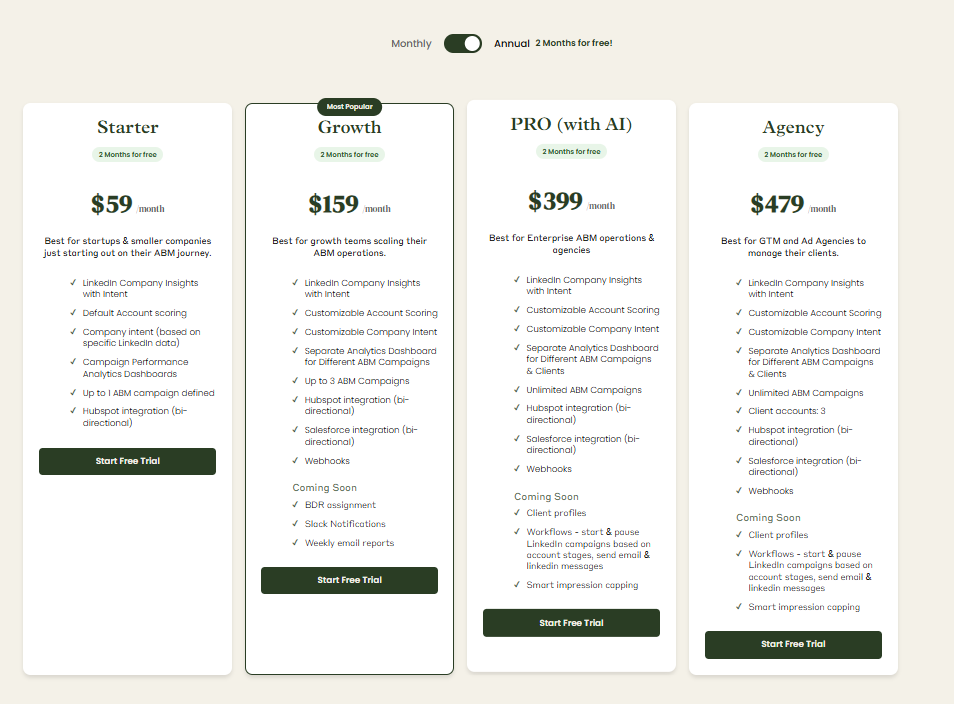

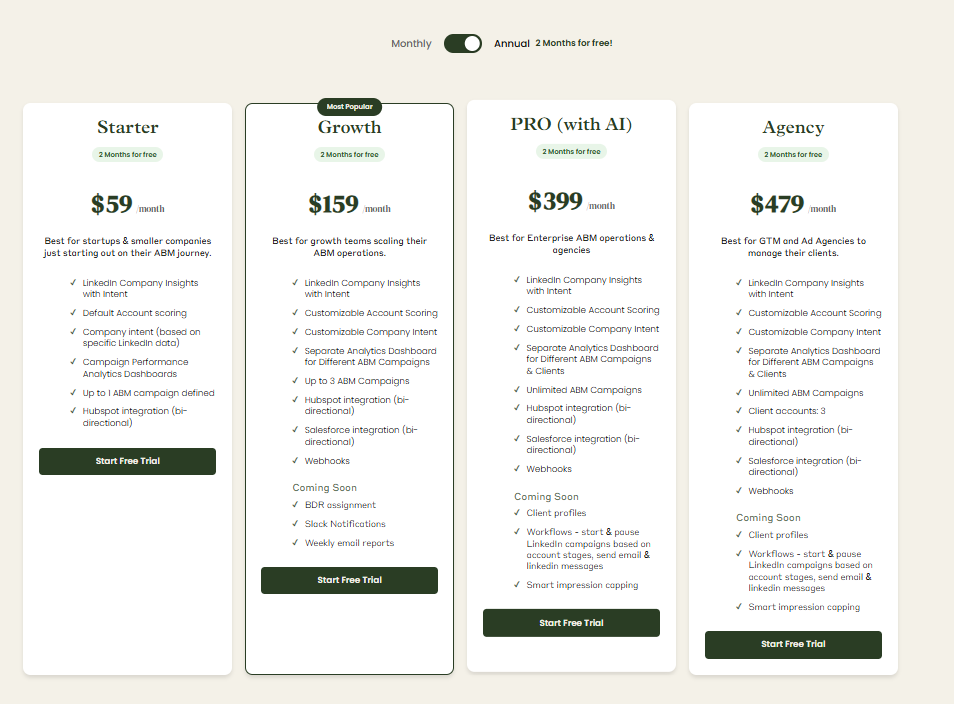

ZenABM Pricing

Plans start at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI), and $479/month for Agency.

Even the agency plan stays under $6,000 per year, with all tiers including core LinkedIn ABM capabilities.

Higher tiers mainly raise limits and add Salesforce sync.

All plans include a 37-day trial period.

Conclusion

N.Rich and Satlo sit in very different weight classes. N.Rich behaves like a full ABM operating system that runs programmatic media, scores intent from multiple sources, and ties everything back to revenue at the account level. It makes sense if you already have a serious ABM budget, a complex stack, and a team that can handle deeper implementation.

Satlo is closer to a sharp LinkedIn lens. It plugs into your LinkedIn ad accounts, exposes company-level engagement and intent, and lets you move warm accounts into CRM and sales workflows without pretending to be a full ABM suite. It suits teams that live inside LinkedIn Ads and want clarity rather than another giant platform.

If your growth is already centered on LinkedIn and you want reliable company-level engagement, account scoring, ABM stages, CRM sync, and attribution without five-figure contracts, ZenABM is usually the more efficient middle path. It covers the LinkedIn first ABM use cases that most B2B teams actually run, at a price point closer to Satlo than to N.Rich.