In this article, I compare InsightSync and Madison Logic on features, pricing, and ideal use cases so marketing and sales teams can see which one fits their account-based marketing plans.

I also explain how ZenABM can work as a lean, lower-cost alternative or complementary layer, thanks to its unique approach.

InsightSync vs. Madison Logic: Quick Summary

In case you’re short on time, here’s a quick overview:

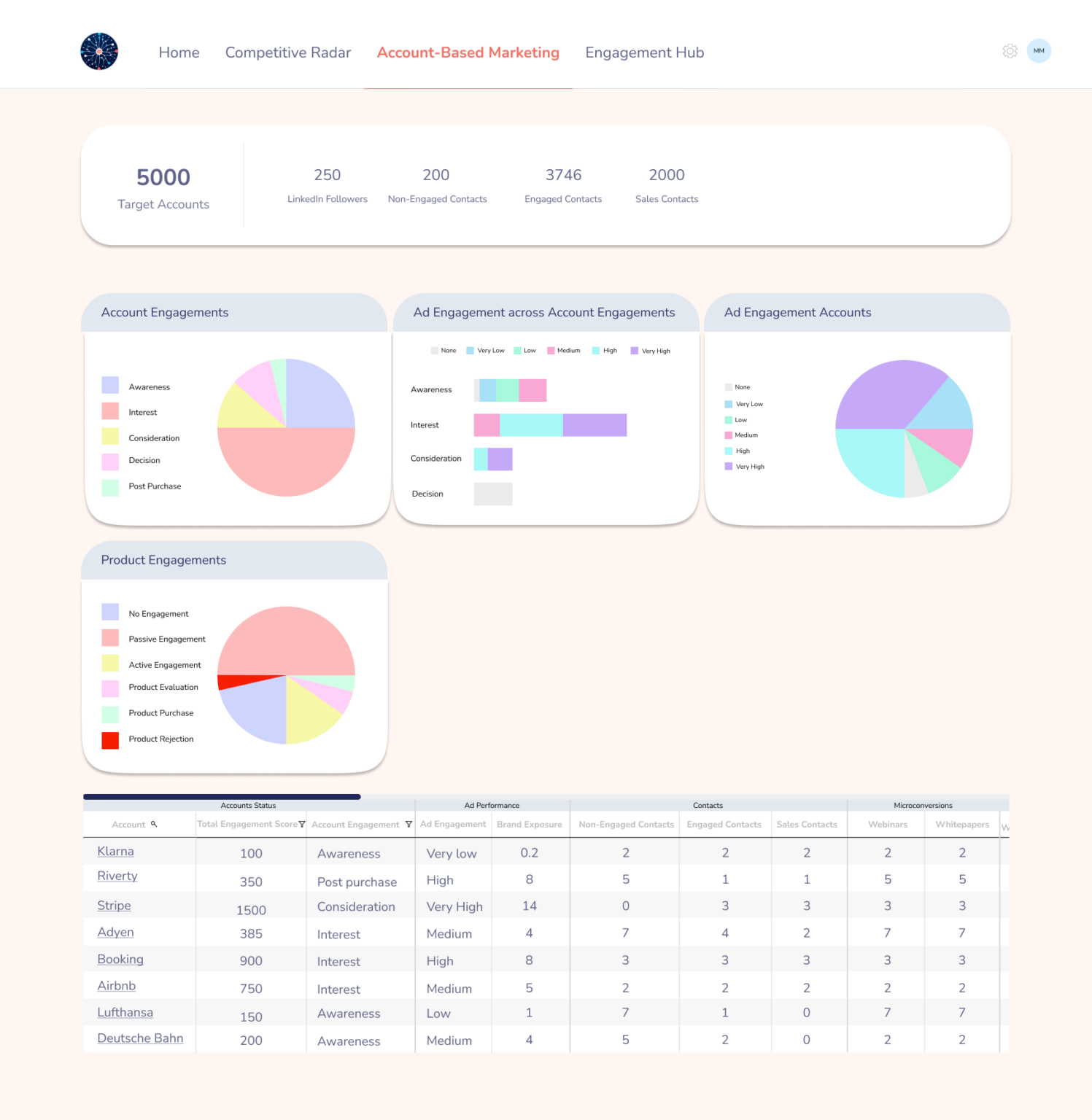

- InsightSync is a CI plus ABM analytics platform that centralizes competitor intel, target accounts, and multi-channel engagement in one place. Its three hubs are: Competitive Intelligence Hub (news feed, competitor profiles, AI doc search), ABM Hub (TAL management, engagement tracking, scoring), and Engagement Hub (account and contact level timelines and alerts).

- InsightSync does not execute ads. You still run campaigns in LinkedIn, HubSpot, and other tools. InsightSync ingests results for scoring, timelines, and optimization.

- InsightSync pricing sits in the premium mid-market: from about €699 per month, rising with Pro setup fees and custom CRM work, so roughly €8K per year at entry.

- Madison Logic is an enterprise-grade ABM execution platform that combines content syndication, display, LinkedIn, CTV, and audio in one paid media stack.

- It leans heavily on third-party intent and a large data graph rooted in Bombora heritage. This powers account prioritization and campaigns, but often skews to top of funnel volume and can get expensive fast.

- Reviews describe Madison Logic as powerful but complex, with a notable learning curve, occasional integration issues, and pricing that fits large enterprises more than lean teams.

- InsightSync fits teams that want strategic visibility, CI, and ABM analytics on top of existing execution tools. Madison Logic fits teams that want to bombard target accounts across channels and have the budget to sustain it.

- A third alternative: ZenABM offers account-level LinkedIn ad engagement tracking, plug-and-play engagement to pipeline dashboards, account scoring, ABM stage tracking, CRM sync, first-party qualitative intent, automated BDR assignment, custom webhooks, an AI chatbot, and job title-level ad engagement tracking, starting at $59/month.

InsightSync Overview: Key Features, Pricing and Reviews

InsightSync is a newer account-based marketing and competitive intelligence platform that aims to put your target accounts, engagement data, and competitor research in one shared system.

Its pitch is better alignment across GTM teams without adding another media platform.

Let’s look at features, pricing, and early feedback.

Key Features of InsighSync

InsightSync bundles three modules into one ABM platform.

Here is what each one does.

1. Competitive Intelligence Hub

This is InsightSync’s main differentiator compared to ABM only tools.

The Competitive Intelligence Hub monitors competitors and broader market activity.

Key highlights:

Unified News Feed

InsightSync aggregates competitor content from news sites, press releases, and your own and external blog posts into a single feed.

You avoid juggling multiple alerts and tools and instead scan one stream.

Entries can be tagged and categorized by competitor or topic. You can like important items and share them with colleagues.

You can also set up alerts on specific tags or keywords so you are notified when major events land, such as a rival announcing an acquisition.

Competitor Radar & Profiling

The CI Hub lets you build and maintain structured profiles for each competitor.

You can log customer logos, partnerships, alliances, pricing notes, and positioning angles so you have a consistent view across the team.

AI Document Search

Competitive intel often lives in PDFs, whitepapers, and internal decks.

InsightSync ingests these documents and lets you query them with AI search or pull quick summaries and key points.

2. Account-Based Marketing Hub in InsightSync

The ABM Hub answers three core questions:

- Who are we targeting?

- What do we know about them?

- How are we engaging them right now?

It is where your account-based marketing workflows live.

Key capabilities:

Target Account List Management

You can import or build your target account list inside InsightSync from your CRM or CSV files.

Each account becomes a record you can track and enrich over time.

Firmographic data such as industry, size, and tech stack can be synced from other tools or added manually.

Multi-channel Engagement Tracking

Once your TAL is in place, InsightSync tracks engagement from ads, email activity, and meetings in a single timeline.

You can assign scores to events, so actions like demo requests count more than casual newsletter opens.

Higher-scoring accounts float to the top as more sales-ready.

Real-Time Alerts & Optimization

InsightSync alerts you when accounts heat up or cool down.

Teams can focus efforts on accounts that are progressing and step in early when key accounts drop in engagement.

Account-level visibility also makes it easier to shift budget toward engaged accounts or refine messaging for segments that lag.

Scalability & Workflow Automation

InsightSync positions itself as a platform that scales with your ABM maturity.

It references automated workflows for personalized outreach, although public details are still light.

Important context: InsightSync’s ABM Hub is channel agnostic and analytics-focused. It is not an ad network or marketing automation platform like Demandbase or RollWorks. You continue running campaigns in LinkedIn, HubSpot, and other tools, while InsightSync ingests data for attribution and analysis.

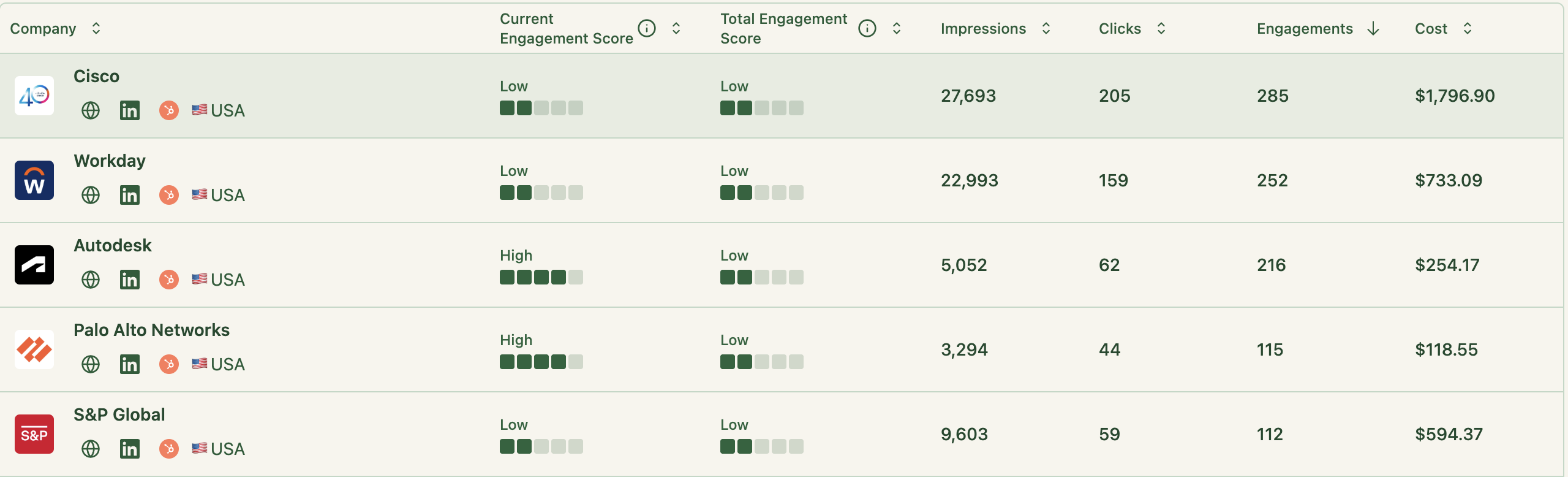

For LinkedIn-heavy teams, ZenABM provides a more direct path via the official LinkedIn Ads API.

It pulls company-level impressions, clicks, engagement, and spend, scores accounts, syncs this data to the CRM as company properties, and routes hot accounts to BDRs automatically.

ZenABM then connects ad engaged accounts to CRM deals and provides revenue and attribution dashboards so you can see the impact of your LinkedIn ABM on pipeline and closed revenue.

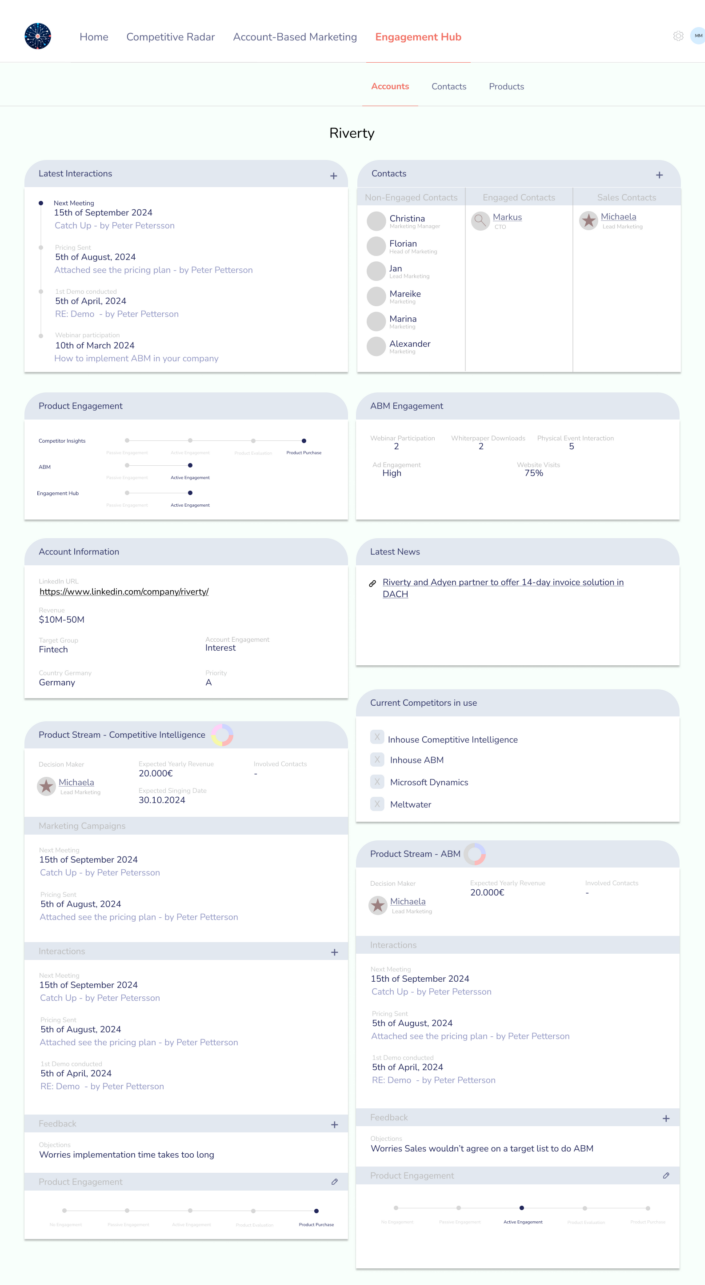

3. Engagement Hub

InsightSync’s Engagement Hub pulls together account activity such as web visits, ad clicks, email opens, and event attendance across contacts.

It highlights trends like rising interest or sudden silence so teams can prioritize active accounts and re-engage those going quiet.

At the contact level, you can see who viewed pricing pages, who registered but skipped webinars, and who is consistently active, so sales can adjust outreach and marketers can refine content.

These patterns help you map buyer roles and intent, infer funnel stage, and trigger timely follow-ups.

The Engagement Hub does not run campaigns itself, but aims to align marketing and sales around a shared view of account engagement and behavior.

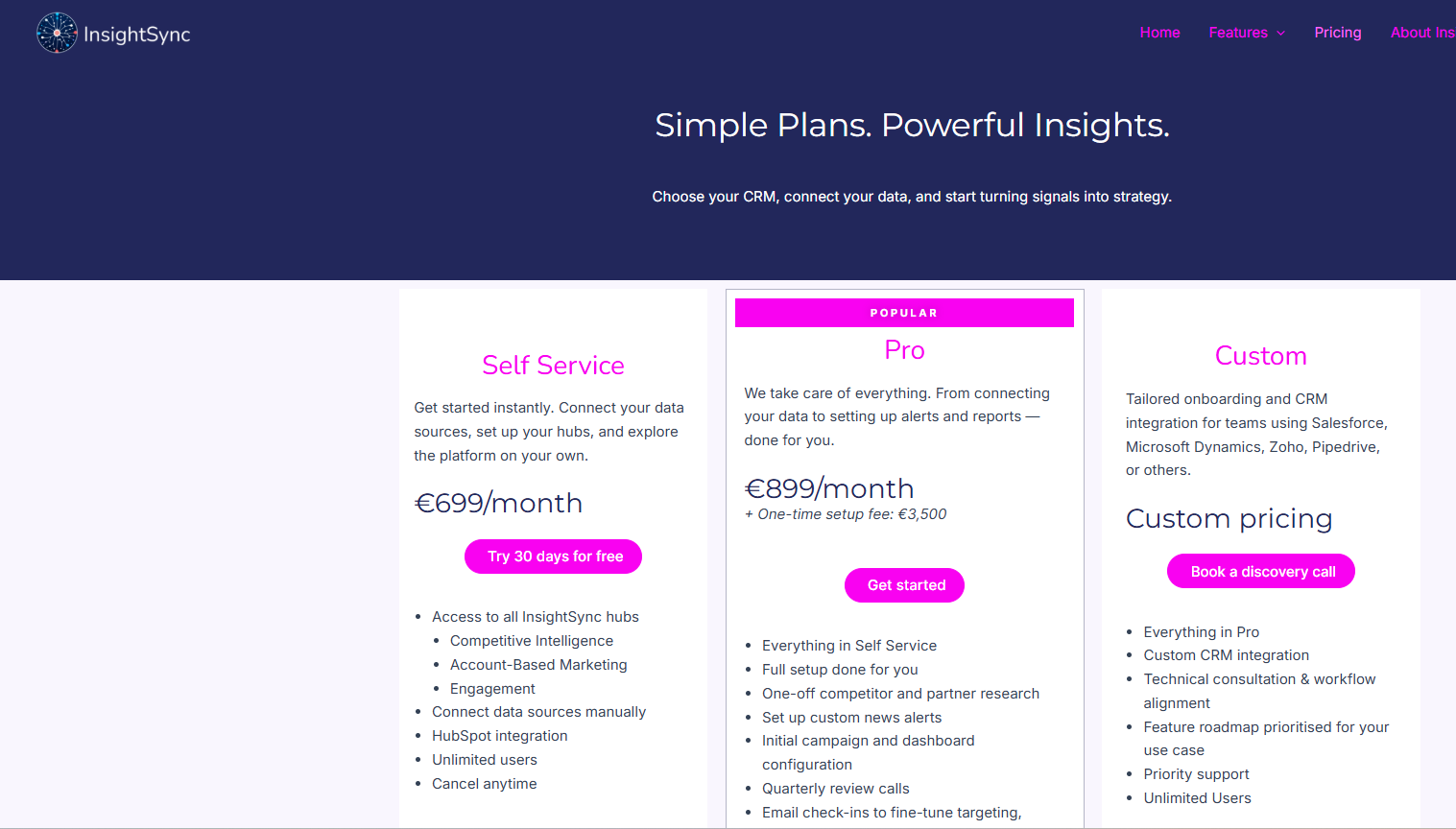

InsightSync Pricing: How Much Does It Cost?

InsightSync sits in the premium bracket and targets teams ready to invest in a combined ABM plus CI platform.

Here is the pricing as of late 2025:

- Self Service – €699/month: Entry-level tier with all three hubs and unlimited users. You handle setup yourself and can connect data sources manually or via the HubSpot integration, currently the only native CRM. They show monthly pricing and offer a 30-day free trial.

- Pro – €899/month (+ €3,500 one-time setup fee): Adds white glove onboarding. InsightSync’s team connects data, configures alerts and dashboards, and delivers a one-off competitor and partner research project plus quarterly reviews. The monthly uplift over Self Service is modest, but there is a sizable one-time service fee.

- Custom – Contact for pricing: For teams using CRMs like Salesforce, Microsoft Dynamics, Zoho, or Pipedrive. InsightSync is still building these integrations and offers early access programs. Custom plans include everything in Pro plus bespoke CRM integrations, technical consulting, prioritized feature work, and priority support.

So InsightSync is cheaper than the biggest ABM suites but still upper mid-market. It can make sense if you treat it as your CI system, ABM analytics layer, and light CRM adjunct in one.

Early or lean ABM teams may still balk at a starting price around €8K per year.

In contrast, ZenABM starts at ~$59/month for its starter plan, which is a small fraction of that.

User Impressions and Reviews

Public feedback on InsightSync is still limited, but a few themes emerge:

- Origin Story – Built by Practitioners: InsightSync started as an internal tool created by a B2B marketing lead at Riverty, then spun out into a standalone product. ZenABM has a similar story. Michael Jackowski first built it for Emilia Korczynska at Userpilot to solve LinkedIn ABM reporting, then turned it into a dedicated LinkedIn ABM SaaS. Customers like Productive and Spear Growth report strong results with ZenABM.

- Website Testimonial: A testimonial from “John Doe, Riverty” says InsightSync has aligned marketing and sales and that the CI Hub alone saves hours each week.

- No G2/TrustRadius Presence (Yet): As of November 2025, InsightSync is not listed or reviewed on G2 or TrustRadius.

Madison Logic Overview: Key Features, Pricing, and Reviews

Madison Logic is an enterprise grade ABM platform that promises to put your paid efforts in front of high-value accounts across many channels.

Here is a condensed view of what it offers, what it costs, and what users say.

Key Features of Madison Logic

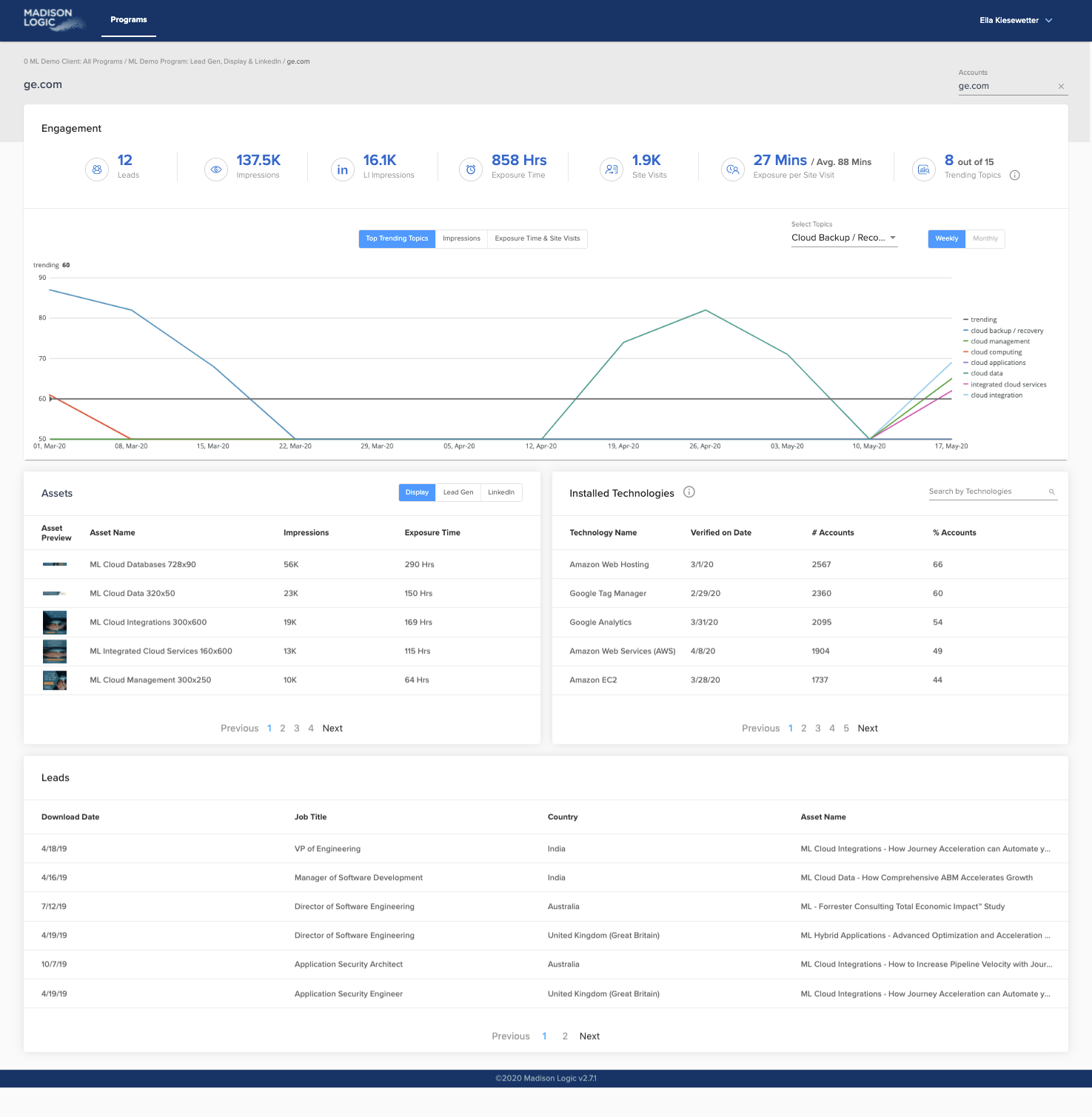

Madison Logic’s Activate ABM™ platform combines several tactics in one environment.

Key features include:

Multi-Channel Advertising

Madison Logic unifies content syndication, display, LinkedIn ads, connected TV, and digital audio in one platform.

You can reach target accounts via whitepapers, webinars, LinkedIn Sponsored Posts, and even streaming TV spots from one stack.

Intent Data & Account Prioritization

Madison Logic leans heavily on data.

It claims 20-plus years of B2B intent and an audience of 45 million accounts and 417 million contacts across 129 industries.

These signals feed its ML Insights engine, which scores and prioritizes accounts thought to be in market.

ABM Content Syndication

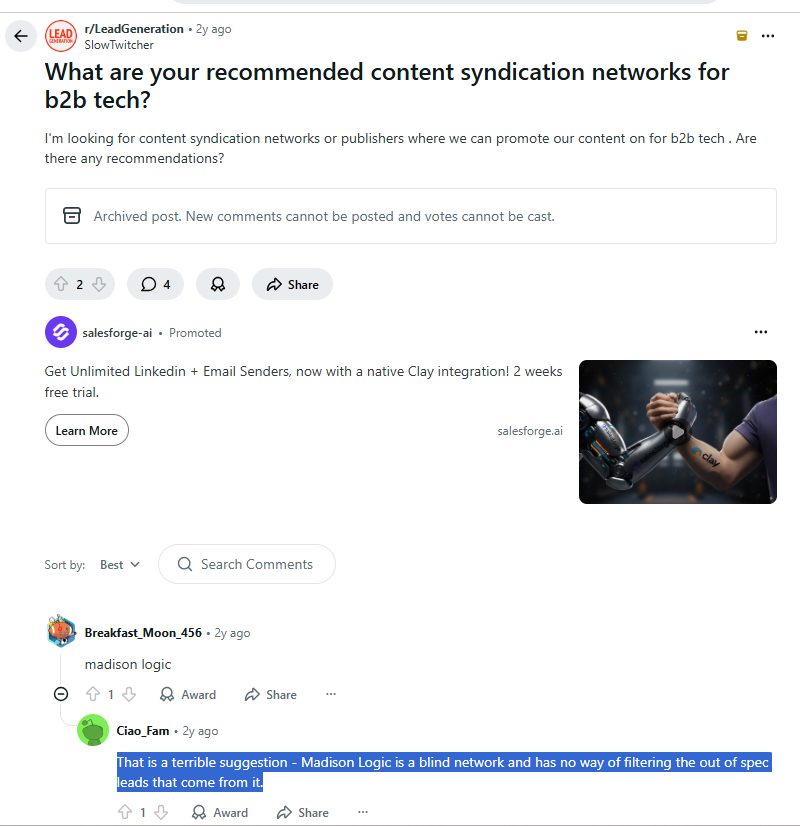

Madison Logic can syndicate your content across its publisher network to generate MQLs from target accounts.

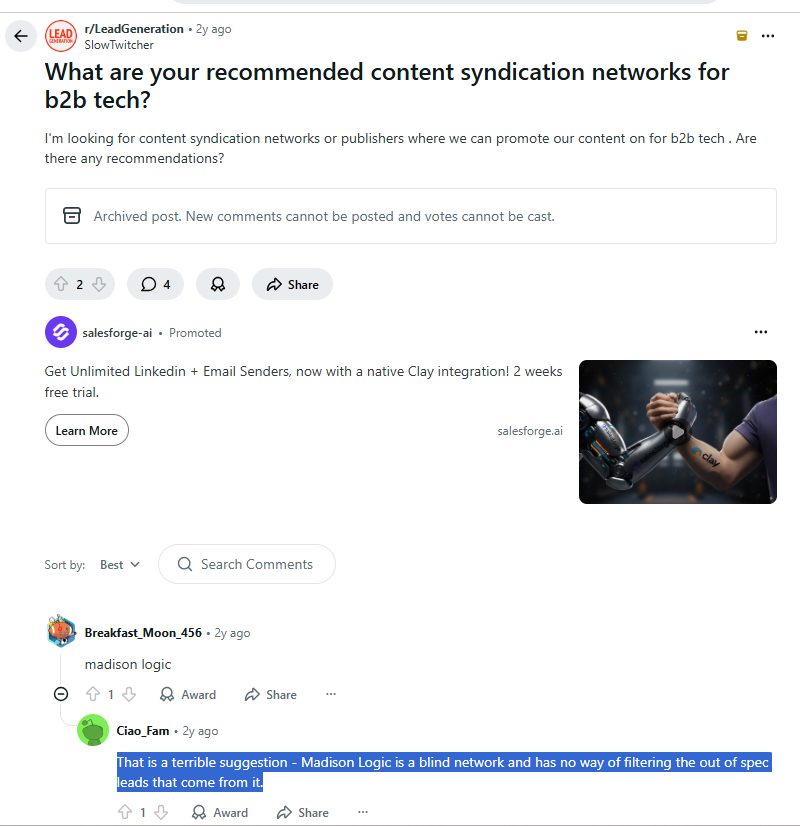

They promote strict filters, but some marketers see content syndication as a blind network with uneven lead quality.

One Reddit user called it “a blind network with no way of filtering out-of-spec leads,” reflecting concerns about transparency.

ABM Display & Social Ads

Madison Logic runs programmatic display ads and LinkedIn ads against your account list.

It is a LinkedIn Marketing Partner, so you can sync your Madison Logic account lists to Campaign Manager and include LinkedIn as part of an orchestrated play.

The goal is continuous account exposure through display, social, and other channels.

But display ads still face challenges such as banner blindness and bot-driven impressions.

Connected TV & Audio Ads

Madison Logic also offers targeted CTV and digital audio, which few ABM platforms do.

This supports omnichannel presence if your budget and creative resources can keep up.

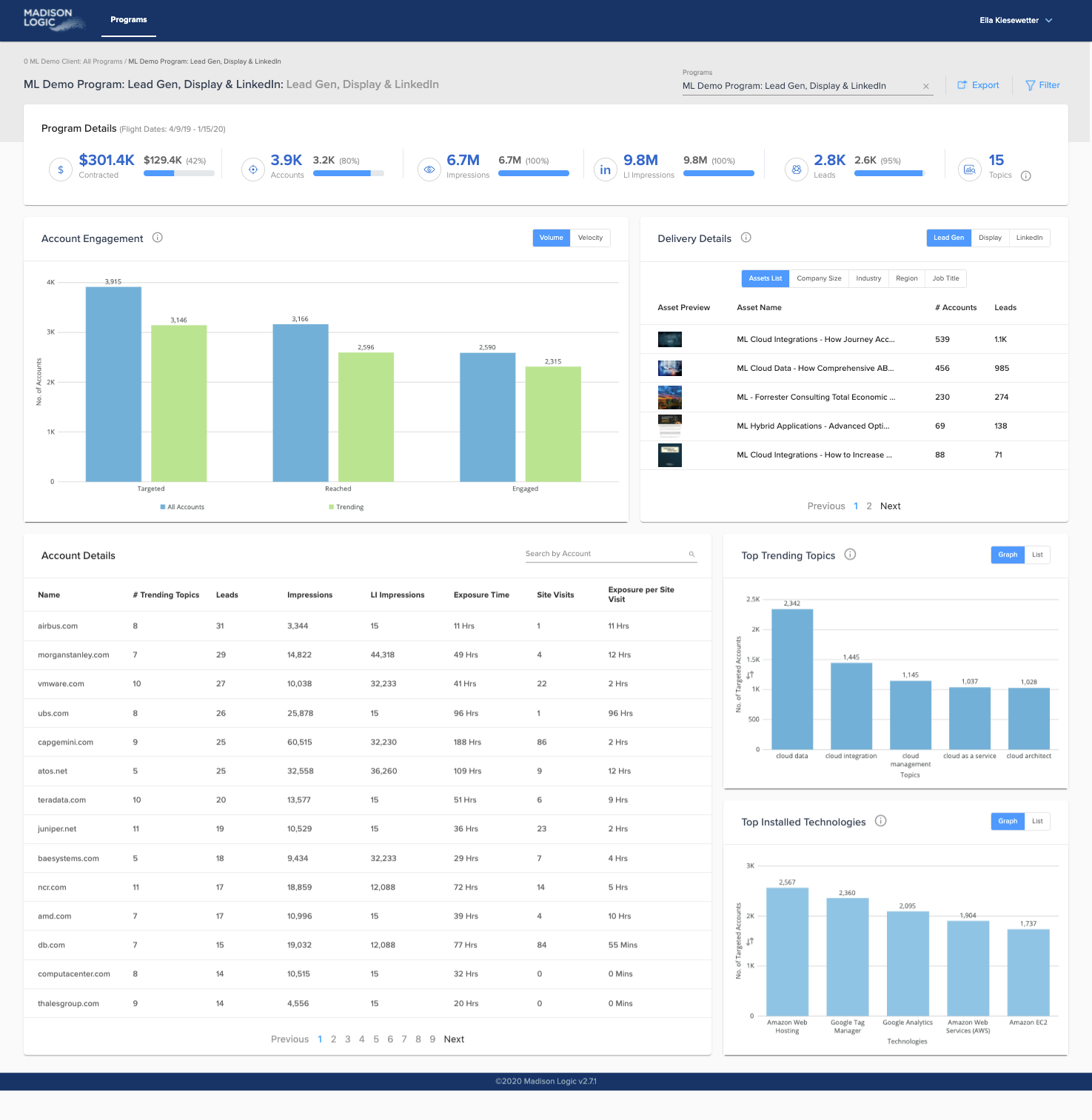

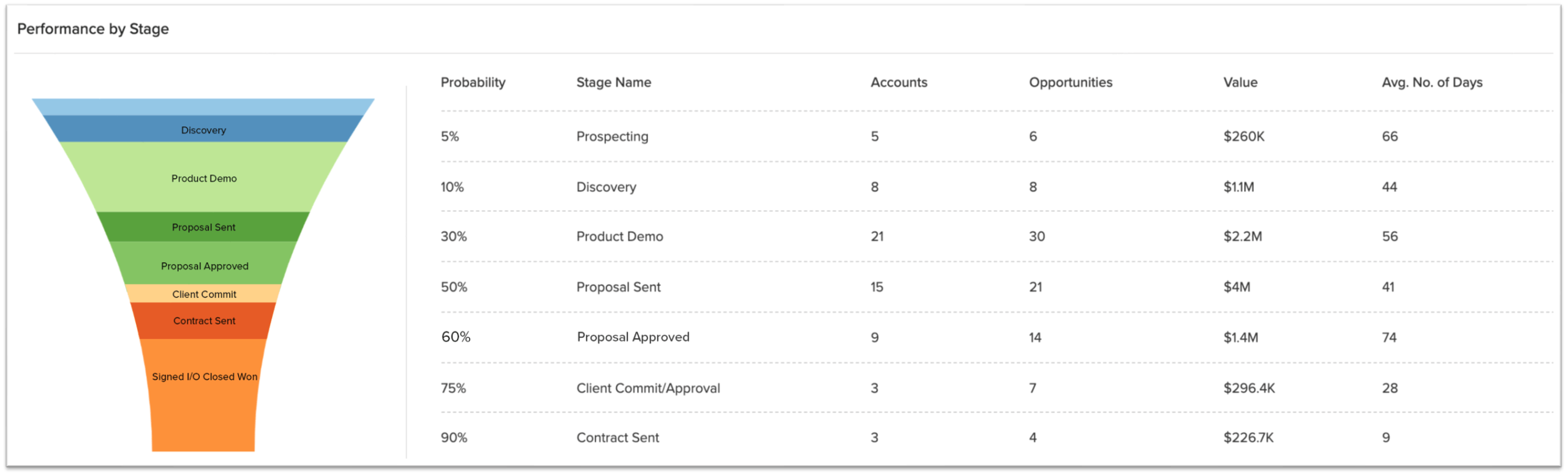

Analytics and Attribution

Madison Logic’s ML Measurement dashboards and ML Intent Dashboard aim to tie engagement back to pipeline and revenue.

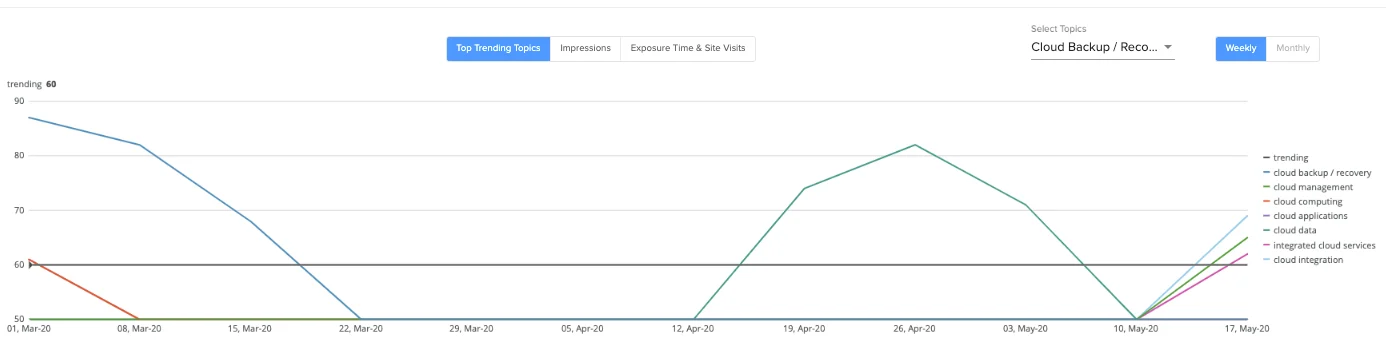

The Intent Dashboard, launched in November 2025, consolidates intent signals, engagement, and even competitive benchmarks, then suggests next best actions such as hot accounts or topics to focus on.

You get views of account engagement, cross-channel performance, pipeline impact, and stage progression.

Data Sources and Targeting Capabilities

Madison Logic built its edge on deep intent data.

Its data arm spun off into Bombora in 2015, and the platform still taps that lineage, blending first party engagement with Bombora Company Surge and firmographic and technographic data.

The ML Data Cloud leans on years of behavior data to highlight high-potential accounts.

Targeting is done by firmographics and job data across channels, so you can reach specific roles and regions through syndication, display, and LinkedIn.

Still, third-party keyword surge intent has limits.

G2 reviews mention a large share of top-of-funnel leads. Reading content on a topic does not always equal purchase intent.

Pro Tip: Third-party keyword surge data often surfaces curious accounts rather than buyers and usually carries an extra fee. ZenABM takes a different route. It focuses on first-party qualitative intent by tracking how companies engage with each LinkedIn ad. You tag campaigns by theme, and ZenABM groups companies by what they actually click.

You see who is engaging and what they care about, so sales and marketing can start from that interest instead of guessing.

Madison Logic’s Integrations: Fitting into the Martech Stack

Madison Logic integrates with major CRM, MAP, and sales tools, which suits complex B2B stacks, though setup effort varies.

| Platform | Integration Details | User Notes |

|---|---|---|

| Salesforce (CRM) | Embeds account insights and engagement data and ties campaigns to pipeline. | “The integration with Salesforce is everything when it comes to our reporting.” |

| HubSpot, Marketo, Pardot (MAP) | Pushes leads and engagement data into nurture streams and syncs with the CRM. | Some users mention initial setup hiccups and occasional fallback to CSV imports. |

| LinkedIn Marketing Solutions | Exports account segments into Campaign Manager for activation. | Reported to “streamline the activation process” and save time. |

| Gong | Feeds insights into call scripts and follow-ups based on intent data. | Used to personalize sales conversations with AI driven cues. |

| Convertr | Enriches leads in real time with intent scores and topics. | Helps route qualified leads faster to appropriate workflows. |

| Adobe Experience Platform | Feeds intent data into Adobe’s orchestration tools such as Journey Optimizer. | Supports full funnel personalization for enterprise programs. |

Madison Logic Pricing: How Much Does It Cost?

Madison Logic does not publish pricing on its website, signaling custom enterprise deals.

Some public listings give rough benchmarks:

- A HubSpot Marketplace listing cites a Professional plan at $3,000 per month plus media costs. Pricing is described as “$3,000/mo – CPM/CPL based on volume,” implying the platform fee sits on top of media and lead costs. The listing dates back to 2020, so real figures today may be higher.

- Salesforce’s AppExchange mentions “Starting at $1 USD/company/month.” In practice, that scales quickly. A 5,000 account list implies $5,000 per month. A 50,000 account ABM list would be $50,000 per month. It is more signal than strict quote, but shows that cost grows with account volume.

- A Forrester “Total Economic Impact” study sponsored by Madison Logic claims 507 percent ROI over three years and payback in less than 6 months. As with most vendor-backed studies, it should be read as part of the pitch, not neutral research.

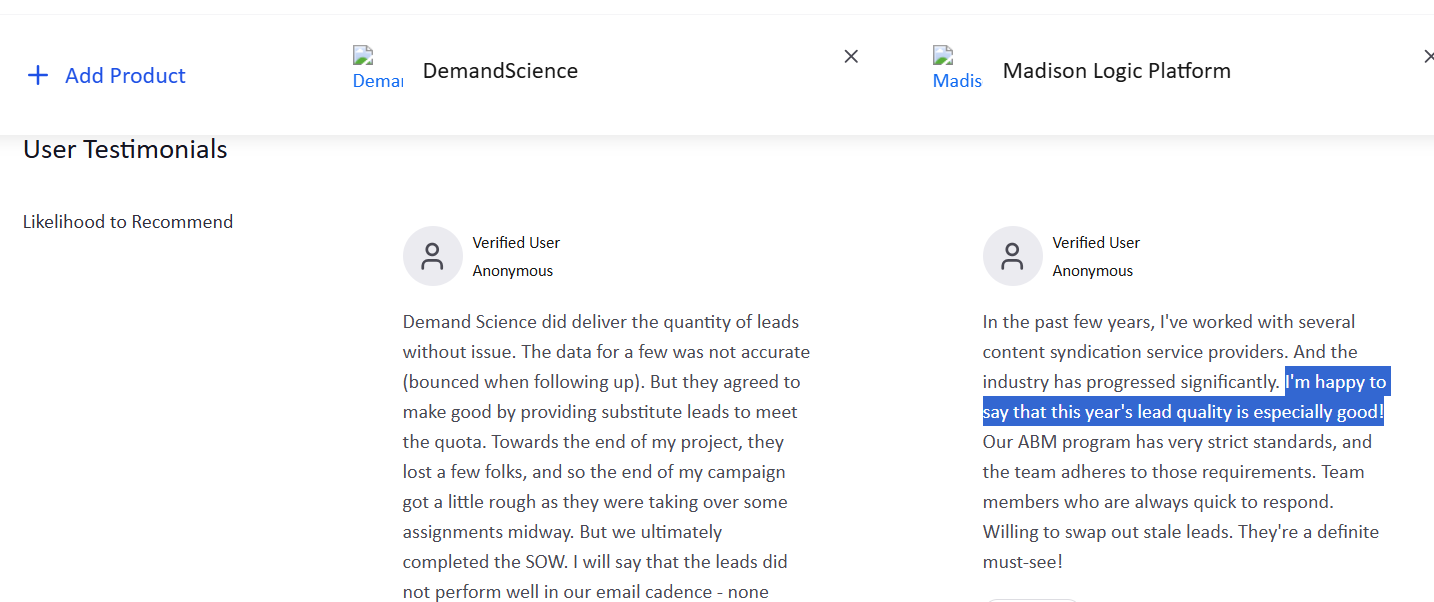

User Impressions and Reviews

User feedback highlights both strengths and tradeoffs.

Pros:

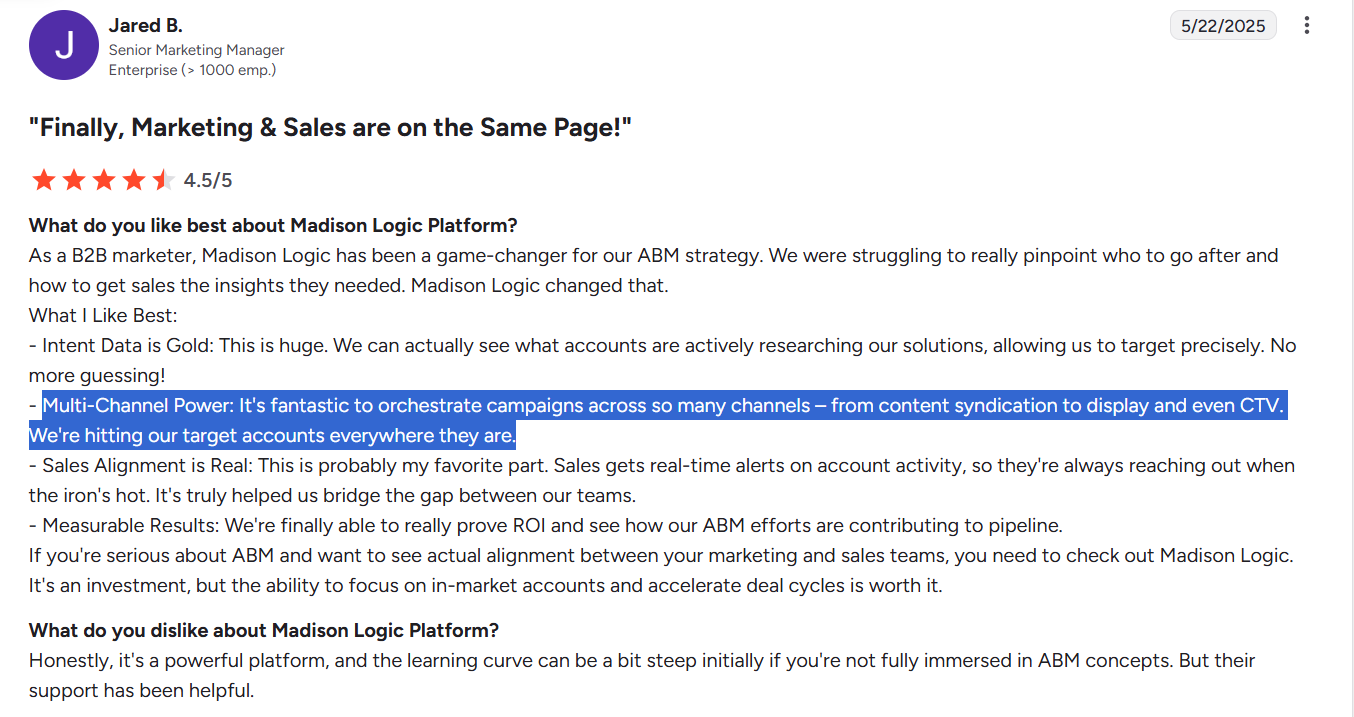

- Effective Multi-Channel ABM: Many reviewers say Madison Logic delivers broad reach across target accounts. On G2, one user reports “hitting target accounts everywhere they are,” from syndication to display to CTV.

Others like having ABM insights, intent data, and performance analytics unified in one place.

Others like having ABM insights, intent data, and performance analytics unified in one place. - Quality Lead Generation: Content syndication gets credit for delivering volume that broadly matches targeting criteria. A TrustRadius reviewer wrote that “lead quality is especially good… team adheres to strict requirements and will swap out stale leads.”

- Madison Logic also earns praise for responsive support and useful insights, with an overall G2 rating of around 4.3 based on 200 plus reviews.

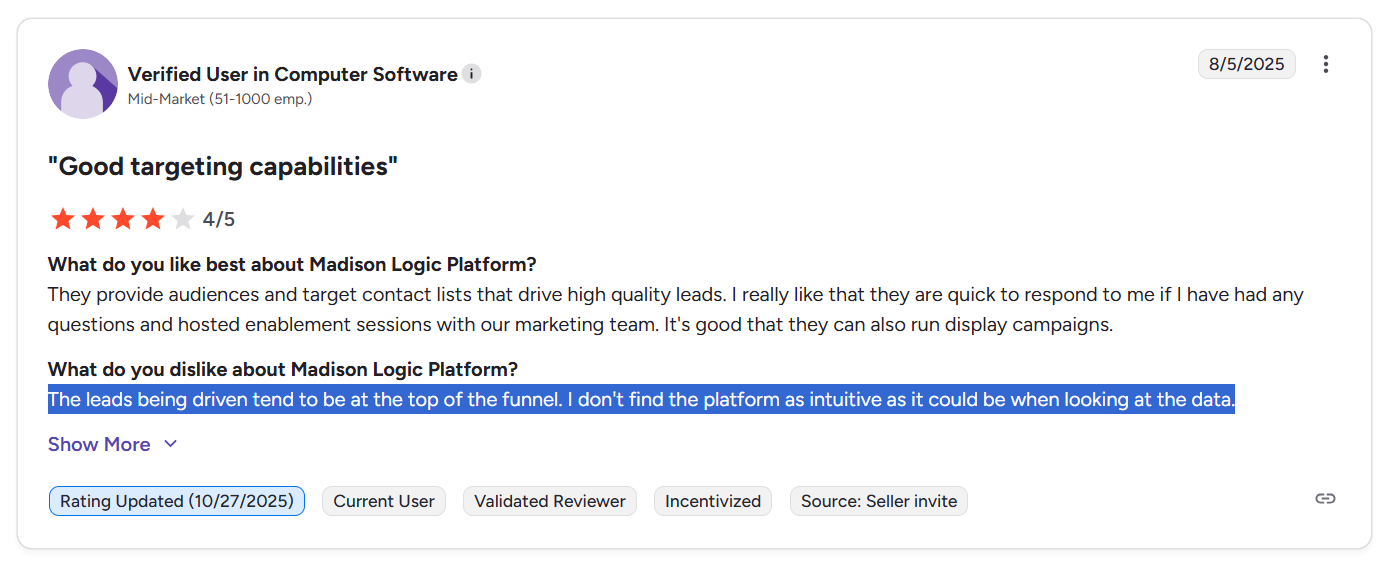

Cons:

- Steep Learning Curve & UI Issues: Many reviewers stress that Madison Logic is powerful but complex. A G2 reviewer notes the learning curve is “a bit steep,” especially for teams new to ABM. Others find navigation confusing and the data views less intuitive than they would like. Training from Madison Logic’s team is often needed to get full value.

- Integration Hiccups: Despite strong integration claims, some users report lead sync failures that required manual CSV exports and initial friction with the HubSpot integration. Multi region or multi entity setups sometimes need separate instances due to billing constraints.

- Top-of-Funnel Emphasis: Several reviews say that many Madison Logic leads are early stage. One user notes that “leads being driven tend to be at the top of the funnel” and wishes deeper funnel analysis were easier.

- Cost and Scale: While smaller companies rarely review Madison Logic, Reddit discussions suggest it is best suited to large enterprises. In one thread, some mention it as an option for syndication, while others dismiss it as overkill or outdated for modern agile teams. One user calls it “a terrible suggestion” for content syndication.

- Miscellaneous: A few reviewers mention billing and instance management quirks for organizations with multiple entities.

InsightSync vs. Madison Logic: Key Differences

Here is a direct comparison of InsightSync vs. Madison Logic across core dimensions.

| Feature Category | InsightSync | Madison Logic |

|---|---|---|

| Core Positioning | Competitive intelligence plus an ABM analytics platform that centralizes accounts, engagement, and CI data | Enterprise-grade multi-channel ABM execution platform built around intent data and paid media |

| Primary Strength | CI Hub with unified news feed, competitor profiles, AI document search, and account-level engagement timelines | Content syndication, display, LinkedIn, CTV and audio campaigns activated from one environment |

| ABM Focus | Target account list management, multi-channel engagement tracking, account scoring and alerts | Reaching target accounts across channels, generating leads via syndication and media, and scaling reach |

| Intent Data | Mainly first-party engagement signals from your tools, no native third-party keyword surge feeds | Large third-party intent graph plus first-party engagement, Bombora heritage and ML Data Cloud |

| Advertising Capabilities | No native ad execution, focuses on analytics and attribution on top of existing channels | Runs content syndication, programmatic display, LinkedIn ads, CTV and audio directly from the platform |

| Channels Covered | Reads from channels such as ads, email and meetings, but you execute campaigns elsewhere | Content syndication network, display inventory, LinkedIn, streaming TV and digital audio |

| Data Sources | Engagement data from your CRM, MAP and ad tools, plus uploaded documents and CI sources | 20+ years of B2B behavior data, Bombora Company Surge, firmographic and technographic data |

| CRM & MAP Integrations | Native HubSpot integration, other CRMs such as Salesforce or Dynamics, via a custom tier | Integrations with Salesforce, HubSpot, Marketo, Pardot, LinkedIn Marketing Solutions, Gong, Convertr, Adobe and more |

| Competitive Intelligence | Strong CI module with news monitoring, competitor profiling and AI search across documents | No dedicated CI hub, competitive view inferred from intent and engagement data only |

| Analytics & Reporting | Account timelines, scoring, alerts, and ABM visibility across channels | ML Measurement and ML Intent dashboards for multi-channel engagement, pipeline impact and next best actions |

| Learning Curve | Medium learning curve, relatively straightforward once configured | Steep learning curve and occasionally confusing UI, users often rely on vendor training |

| Review Footprint | Very limited public reviews and no presence on G2 or TrustRadius yet | Rated around 4.3 on G2 with 200+ reviews, more community feedback and Reddit chatter |

| Pricing Transparency | Public pricing from €699 per month to €899 per month, plus setup, custom for other CRMs | No public price list, hints of $3K per month platform fee plus media and per company pricing on listings |

| Typical Cost Level | Upper mid-market, roughly €8K per year at entry level | Enterprise-oriented, total spend can climb quickly with media and account volumes |

| Ideal Buyer Profile | Teams that want strategic visibility into accounts and competitors, and already have execution tools | Large B2B teams that want multi-channel ABM, content syndication and paid media at scale |

| Best Use Case | Align GTM teams around who to target, how they engage and what competitors are doing | Blast target accounts across channels, fill the funnel with syndicated content leads and display traffic |

InsightSync vs. Madison Logic: So, Which Is Better for ABM?

InsightSync is better for teams that first want clarity and alignment on accounts and competitors.

It centralizes CI, TALs, engagement, and scoring while you keep running campaigns in existing tools.

If your main problem is “we cannot see what is happening across accounts and competitors in one view,” InsightSync is closer to what you need.

Madison Logic is better for teams that have clear priorities and want to surround those accounts with paid media.

It combines third-party intent, content syndication, display, LinkedIn, CTV, and audio so your brand is everywhere the buying committee looks.

The tradeoff is higher cost, more complexity, and a strong bias toward top-of-funnel lead volume.

ZenABM as a LinkedIn-First, First-Party Lean ABM Alternative

There’s a third option: ZenABM

ZenABM is built for teams that rely on LinkedIn as their main ABM channel and want first-party accuracy, automation, and revenue insight without a huge price tag or multi-channel complexity. It is tuned for LinkedIn-centric ABM, not general ad buying.

Here are its key features:

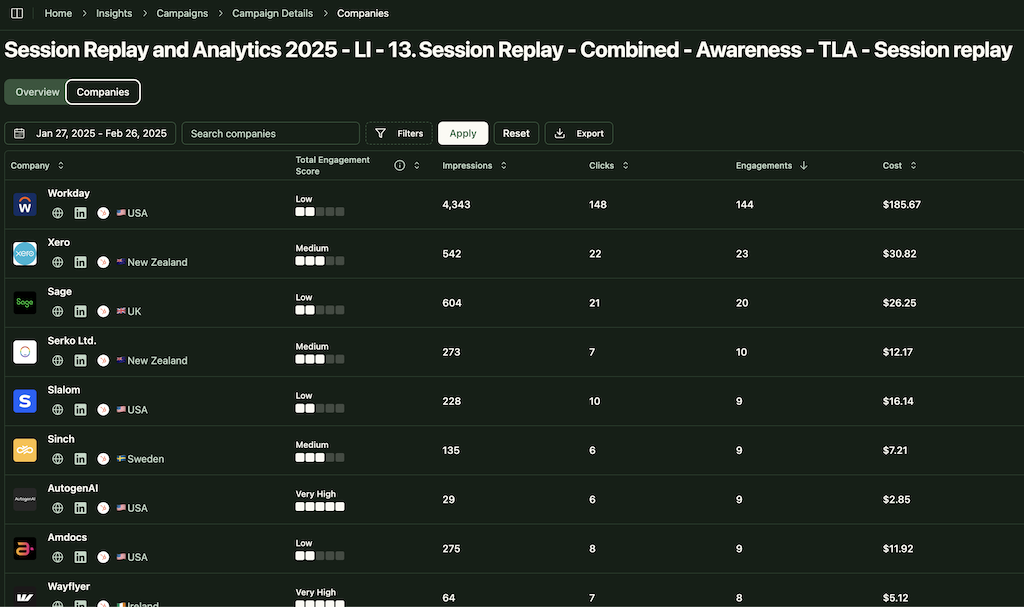

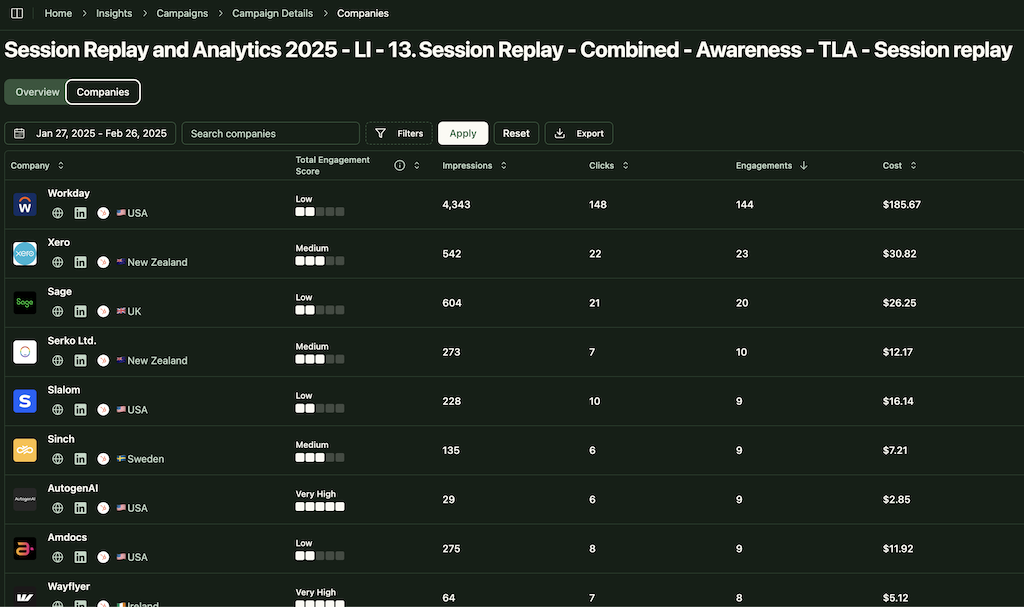

Account-Level LinkedIn Engagement Tracking

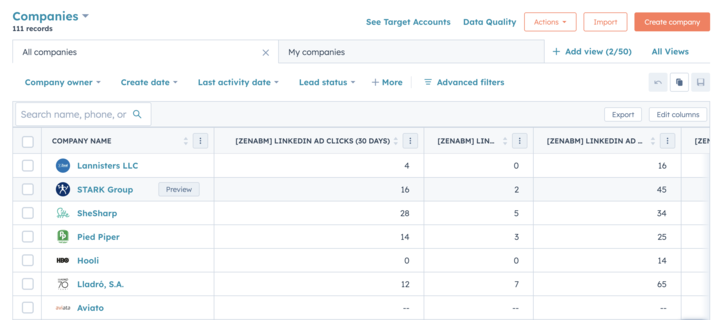

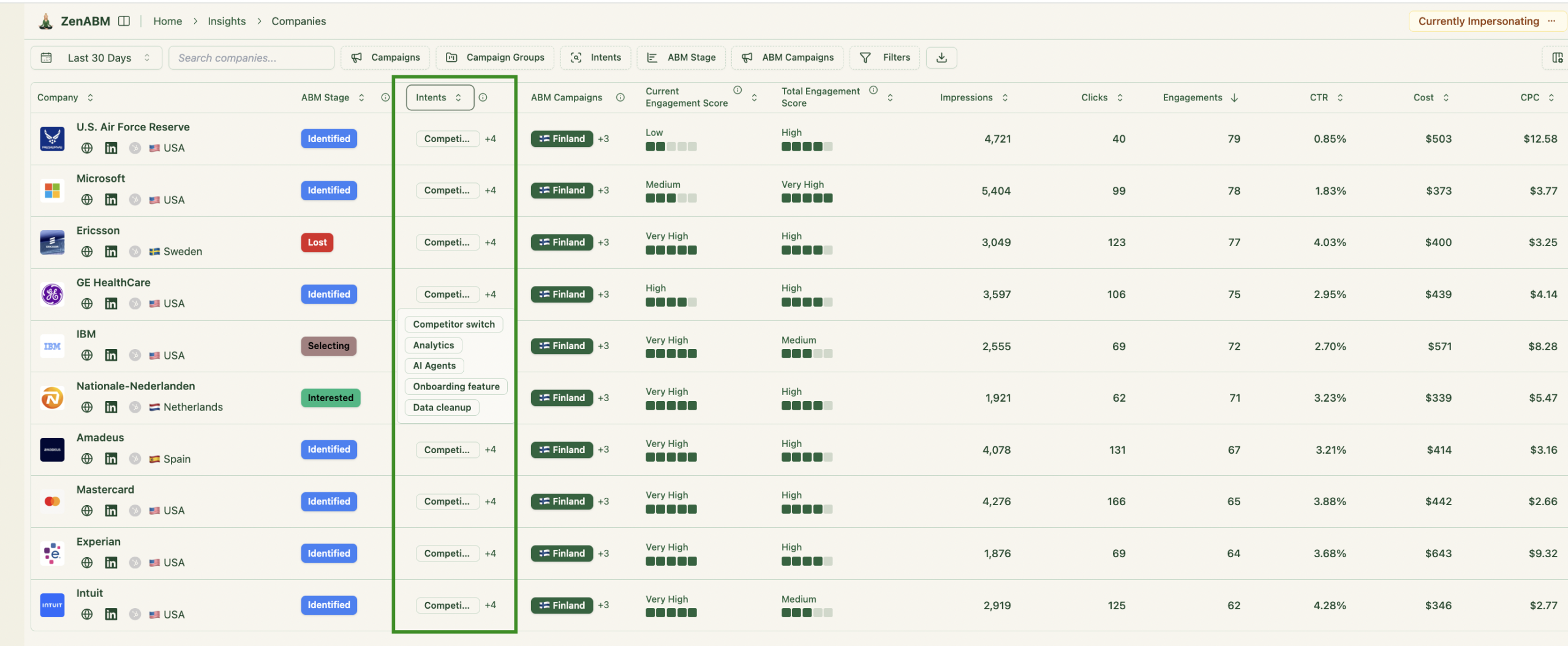

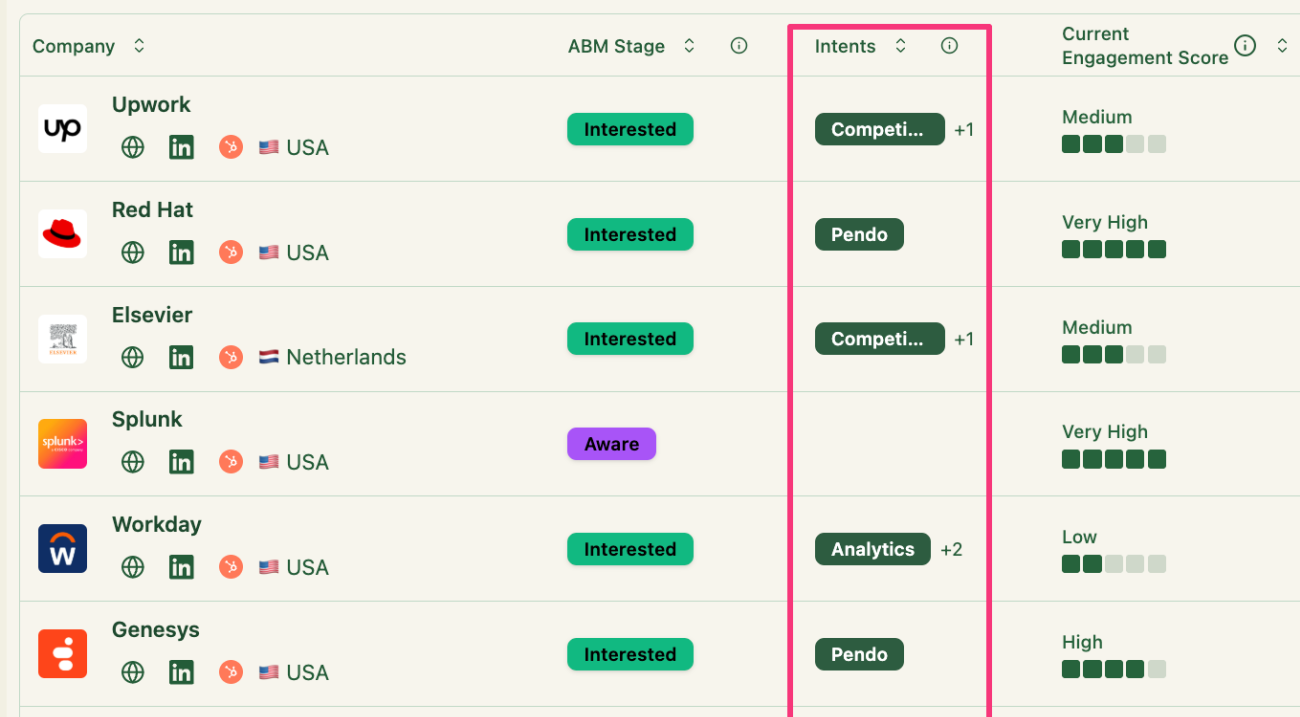

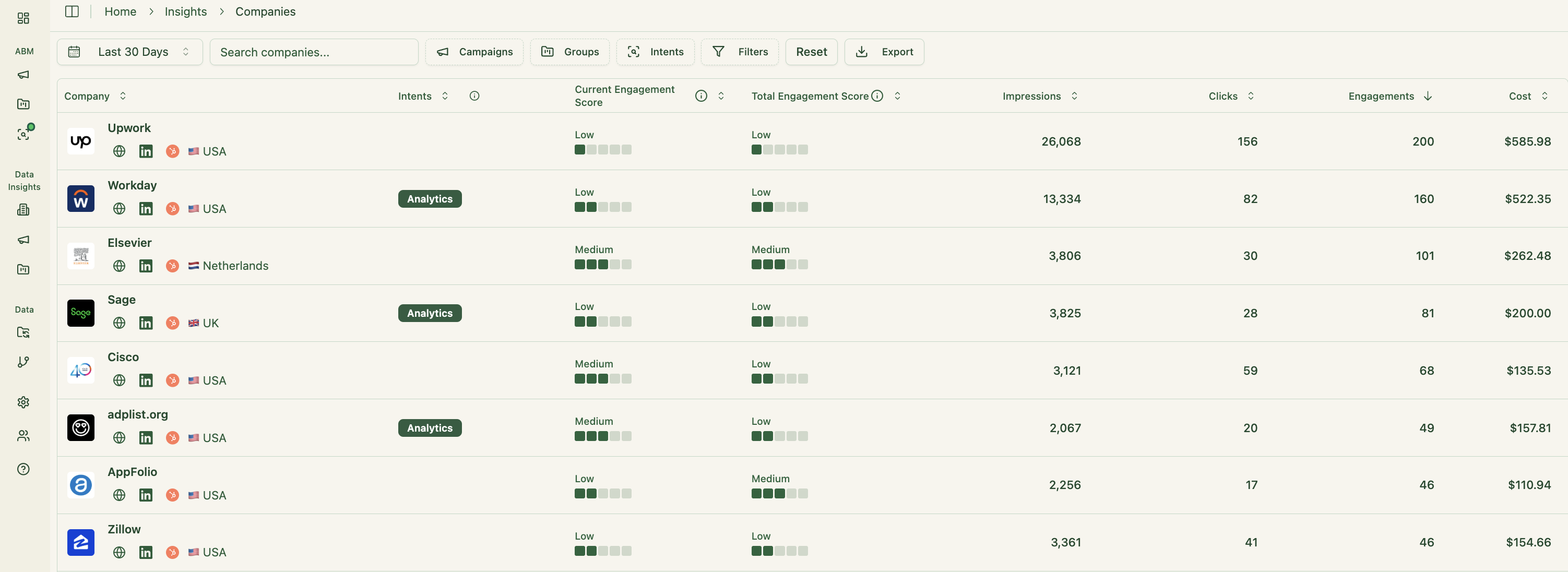

ZenABM connects to the official LinkedIn Ads API and captures account-level data for all LinkedIn campaigns.

You can see which companies see, click, and engage with your ads with account-level attribution.

Because this data is first-party from LinkedIn’s own environment, it is far more accurate than IP or cookie-based visitors.

A study by Syft found that IP-based visitor identification hits around 42 per cent accuracy.

ZenABM instead treats LinkedIn ad engagement itself as first-party intent. When multiple people from a company repeatedly interact with your ads, that is a clear buying signal without external intent feeds.

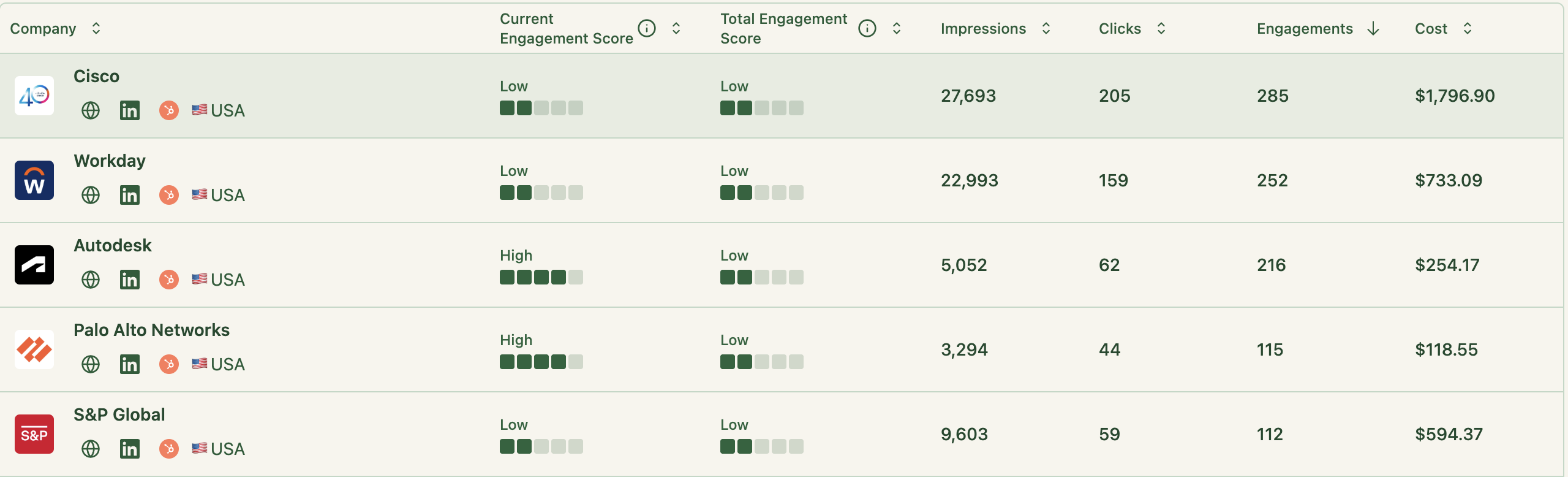

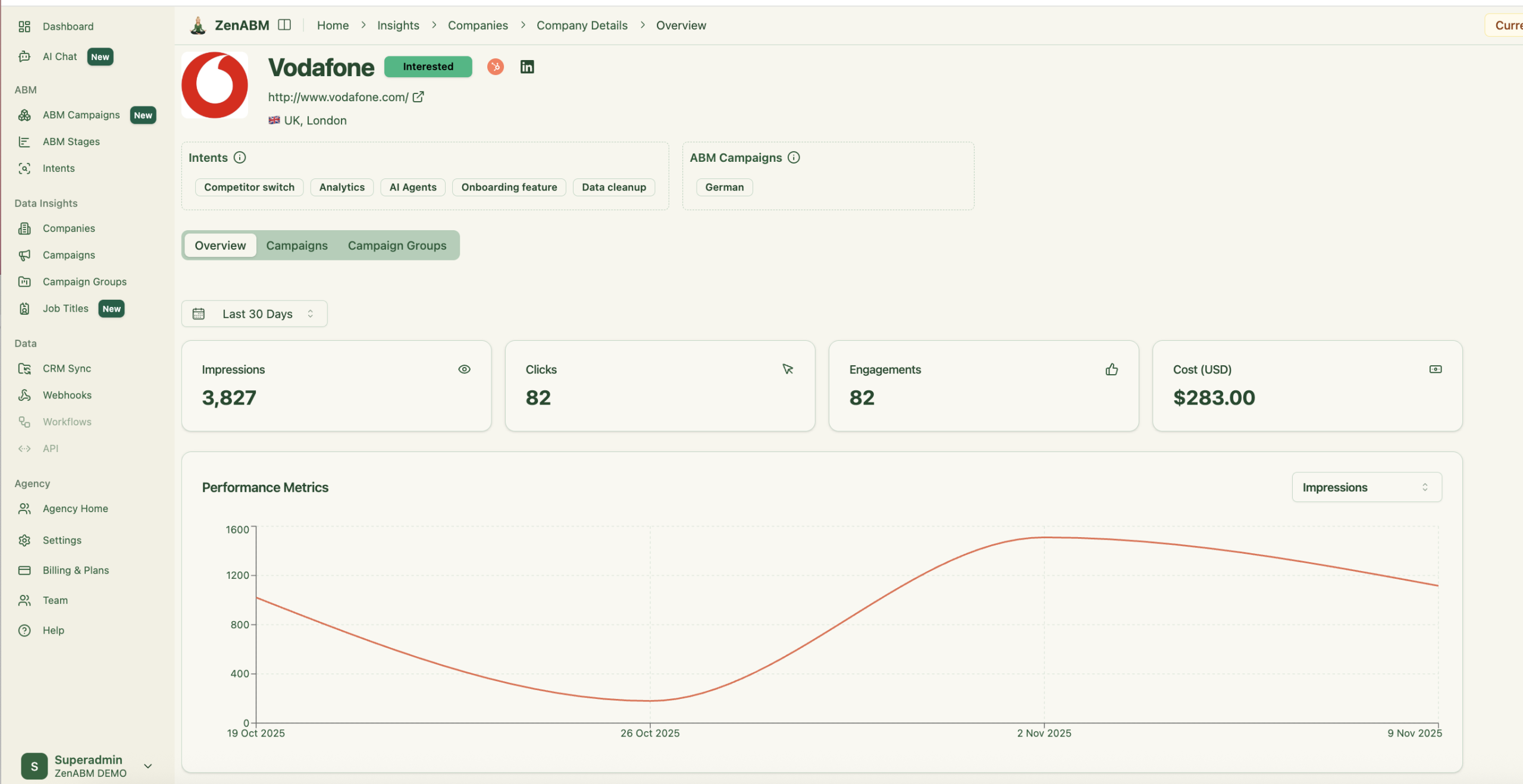

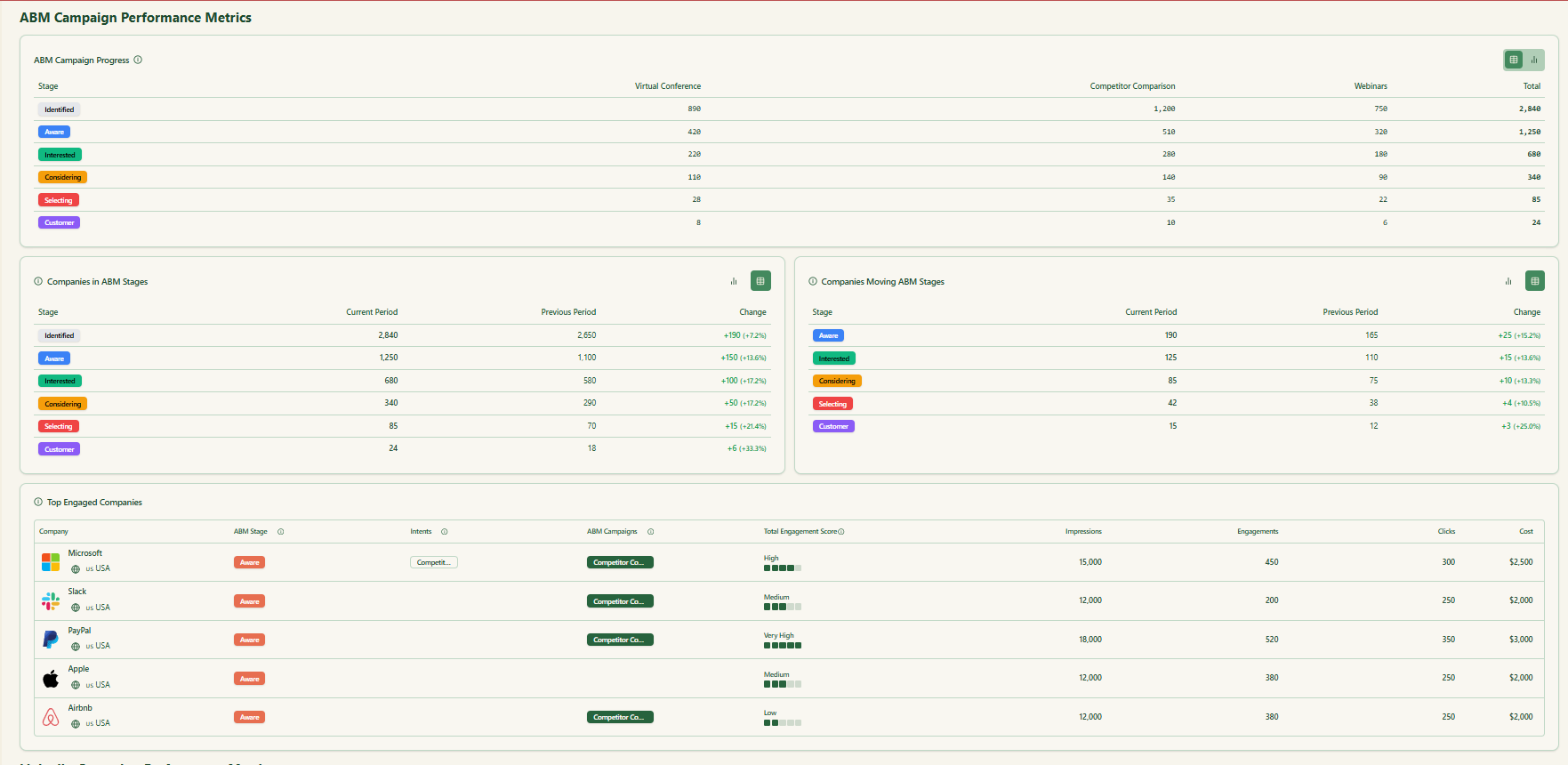

Real-Time Engagement Scoring + Full Touchpoint Timeline

ZenABM updates engagement scores as accounts interact with your ads across campaigns. You can analyze short windows, such as 7 days or longer periods, to see who is heating up.

These scores help marketing and sales prioritize accounts that are actively showing intent.

ZenABM also shows the full touchpoint timeline for each company:

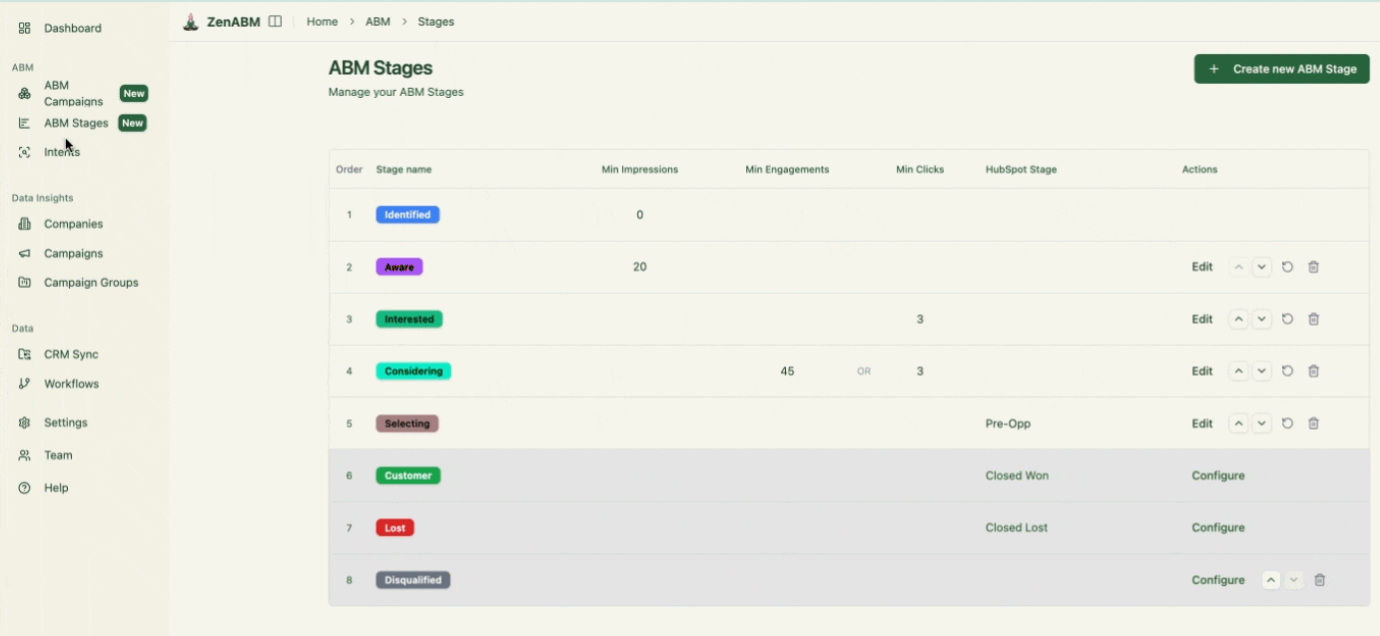

ABM Stage Tracking

ZenABM lets you define ABM stages such as Identified, Aware, Engaged, Interested, and Opportunity and then automatically places accounts in the right stage using scores and CRM data.

You control the thresholds and ZenABM tracks movement between stages.

This gives funnel visibility similar to large ABM suites but focused on LinkedIn data.

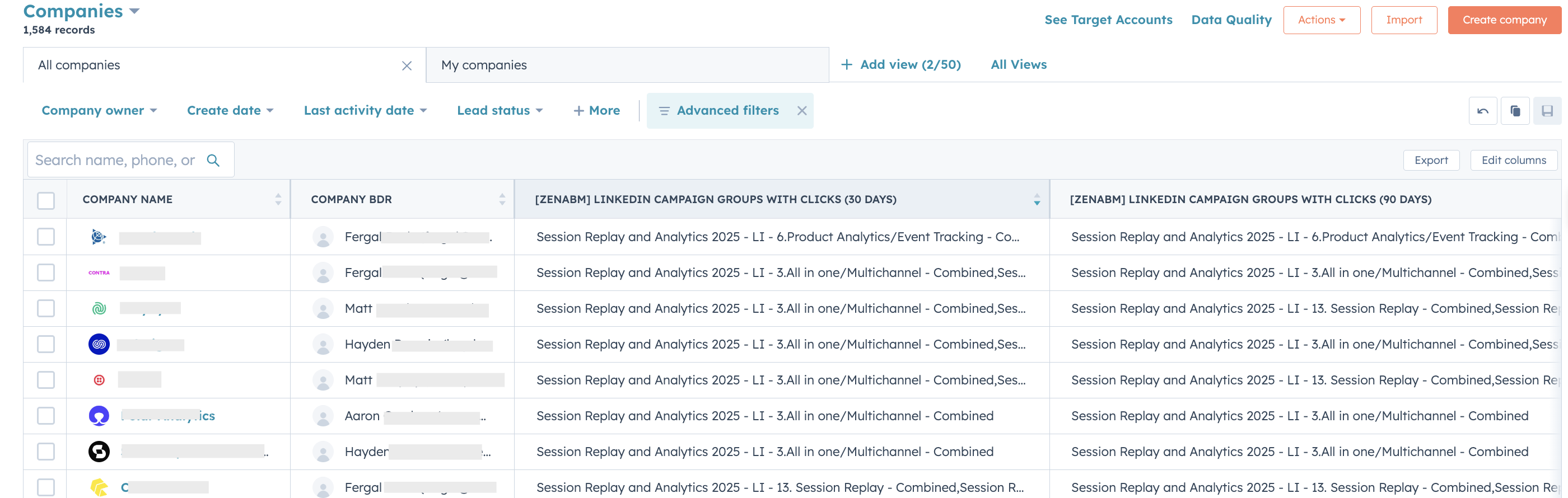

CRM Integration and Workflows

ZenABM integrates bi-directionally with CRMs like HubSpot and with Salesforce on higher tiers.

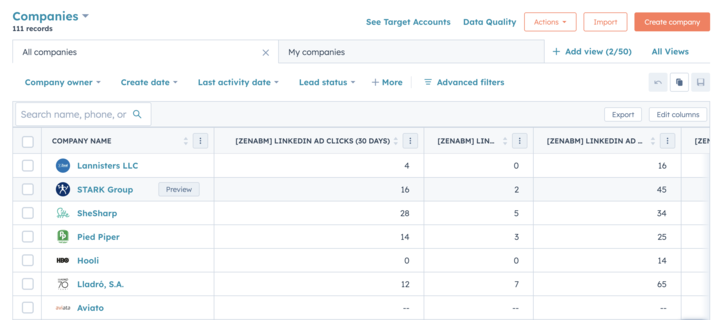

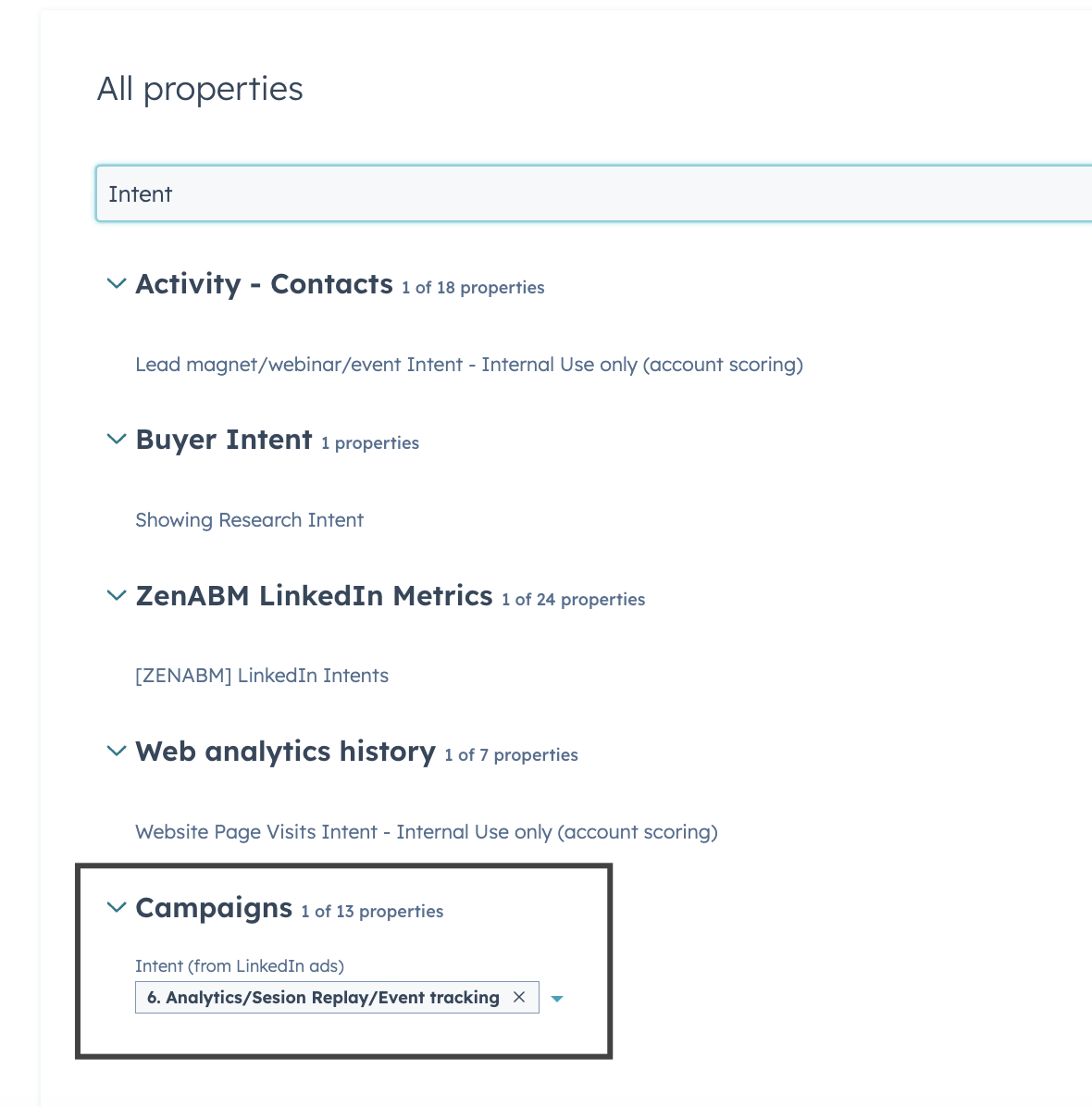

All LinkedIn engagement data can be written into the CRM as company level properties:

Once an account passes your score threshold, ZenABM updates its stage to Interested and auto assigns a BDR.

Intent Tagging from Ad Engagement

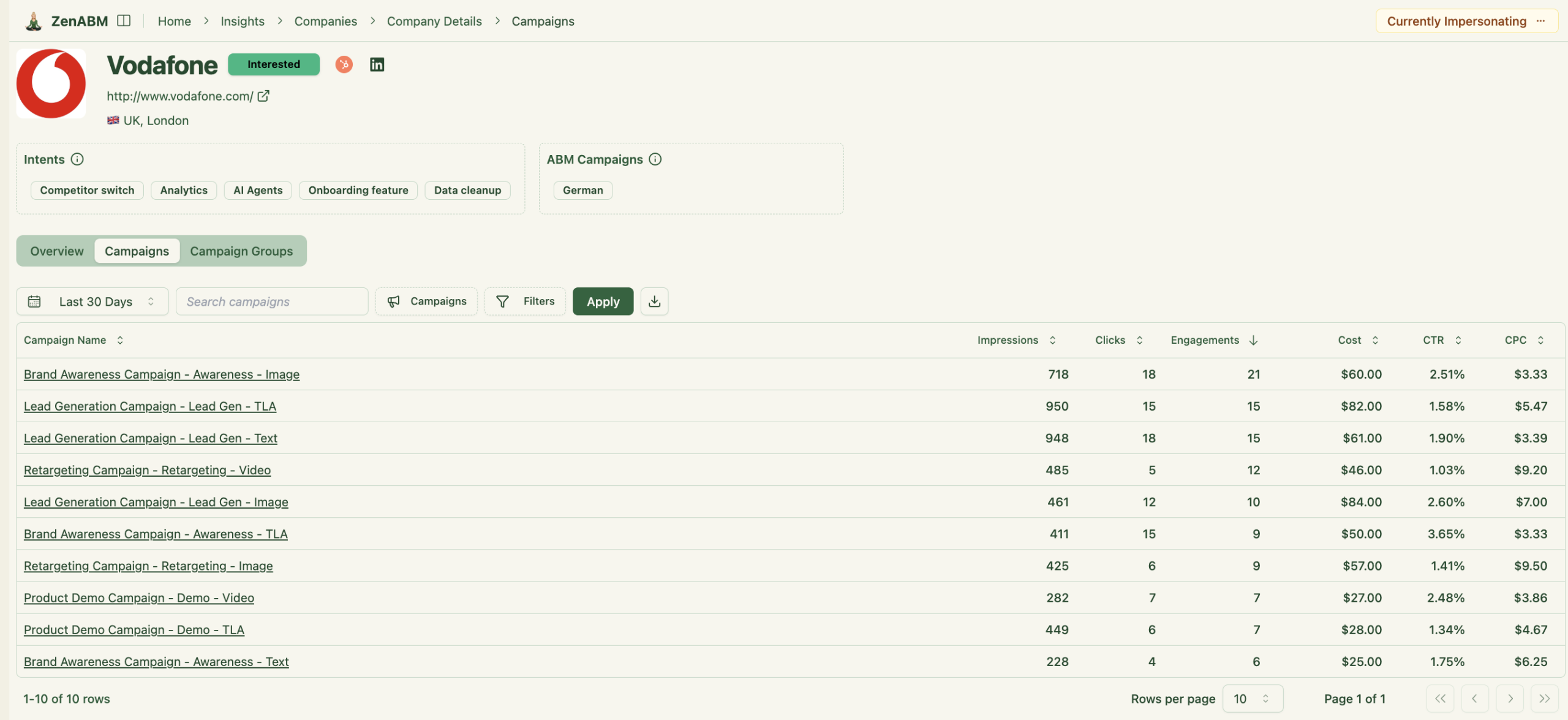

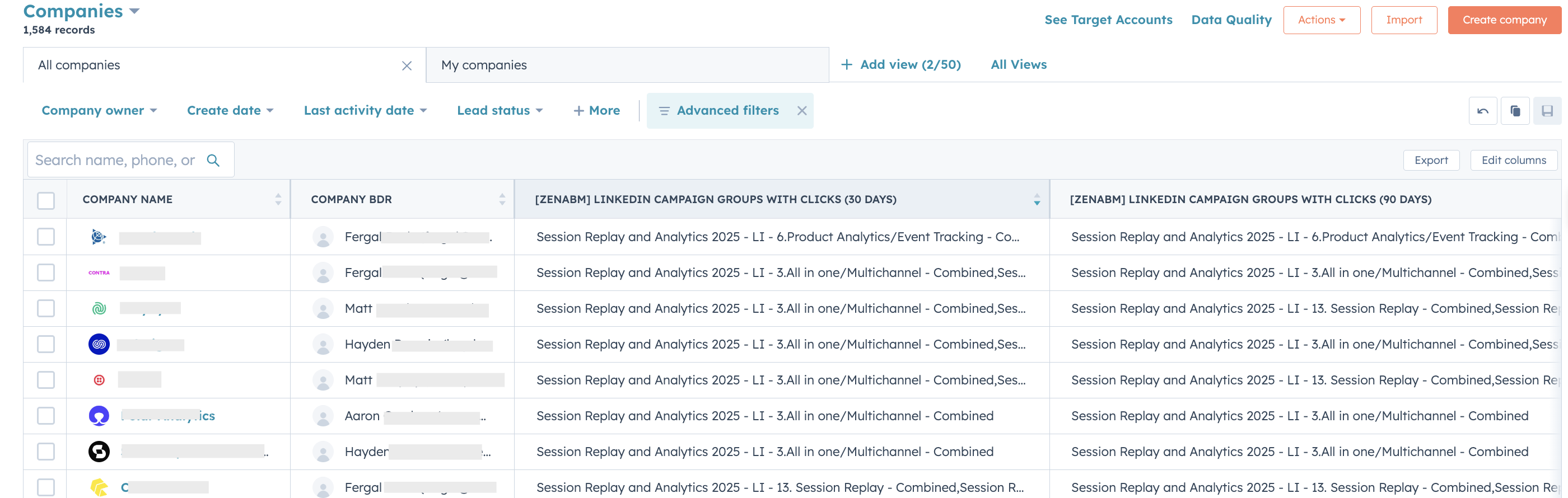

ZenABM lets you pull intent topics from your LinkedIn campaigns by tagging campaigns by feature, use case, or offer.

ZenABM then shows which accounts engage with which themes.

This is first party intent from owned interactions, not rented data.

You can push these topics into your CRM so sales and marketing can shape outreach around what each company has actually explored.

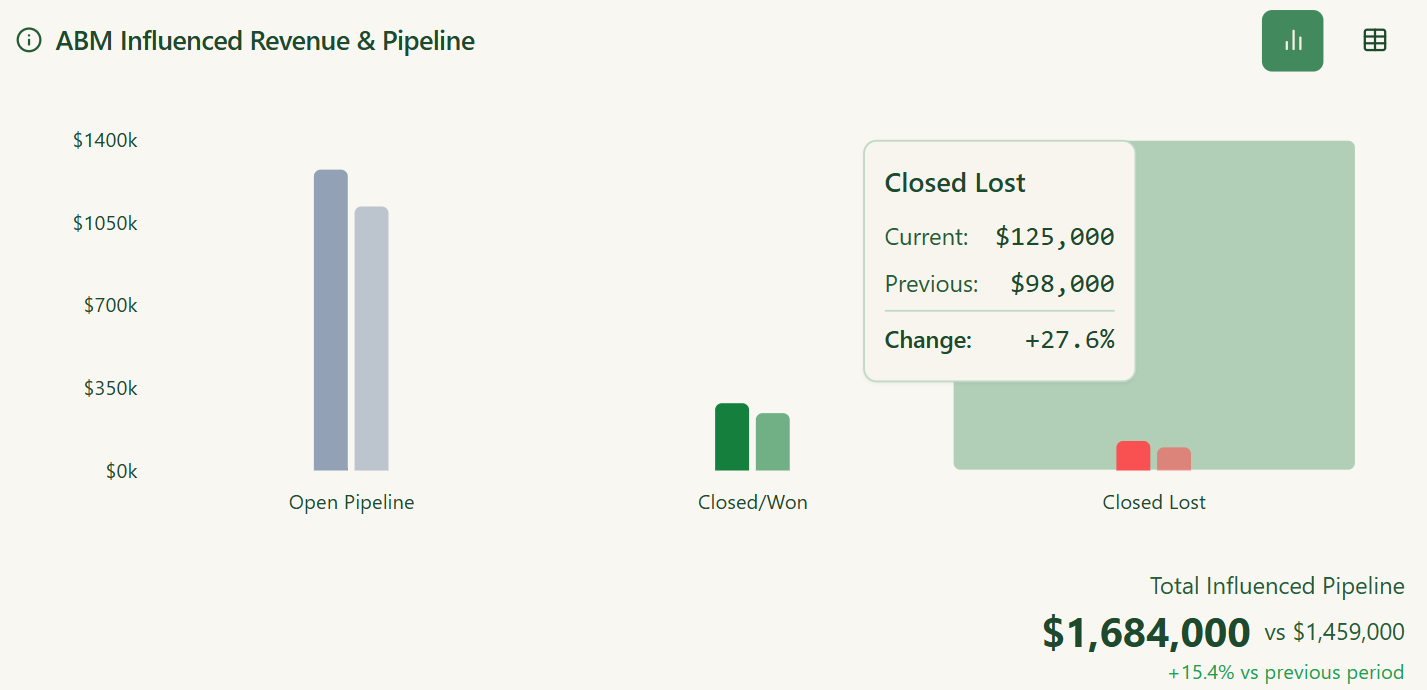

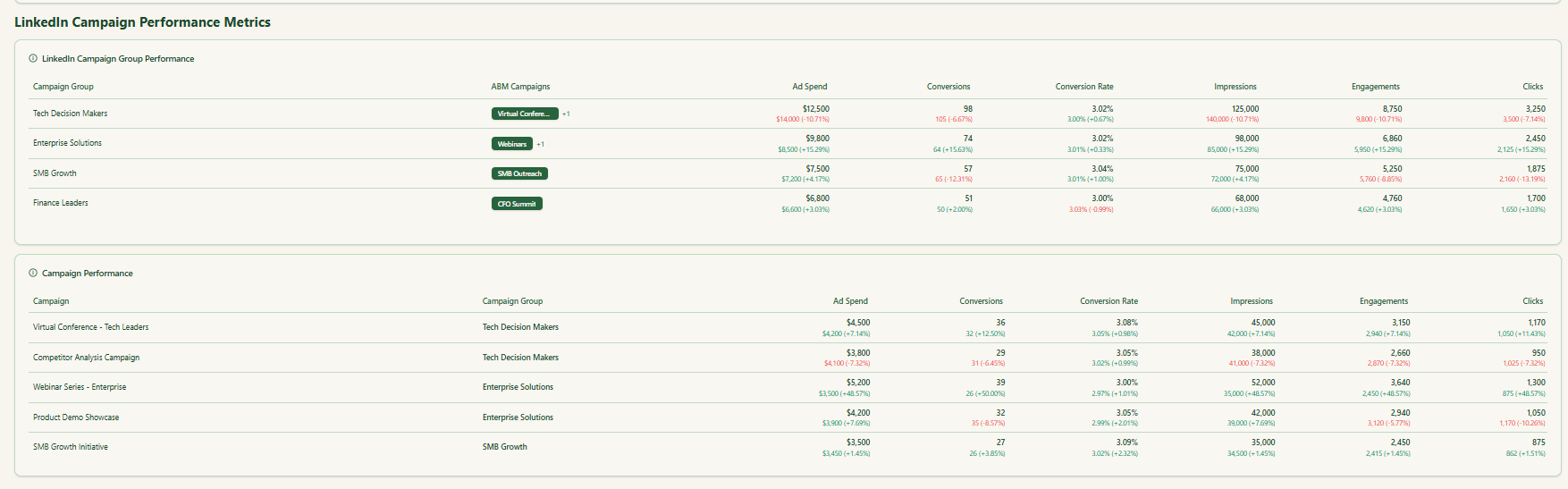

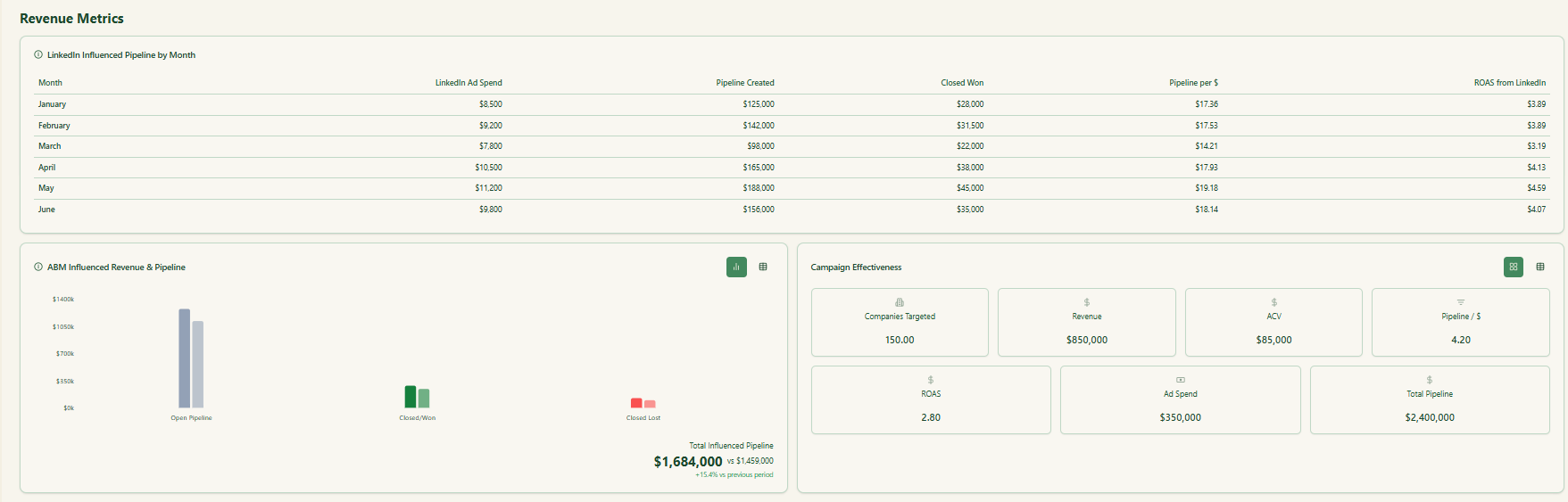

Built-in Dashboards and ABM Analytics

ZenABM ships with dashboards that tie LinkedIn ads to account engagement, stage movement, and revenue impact.

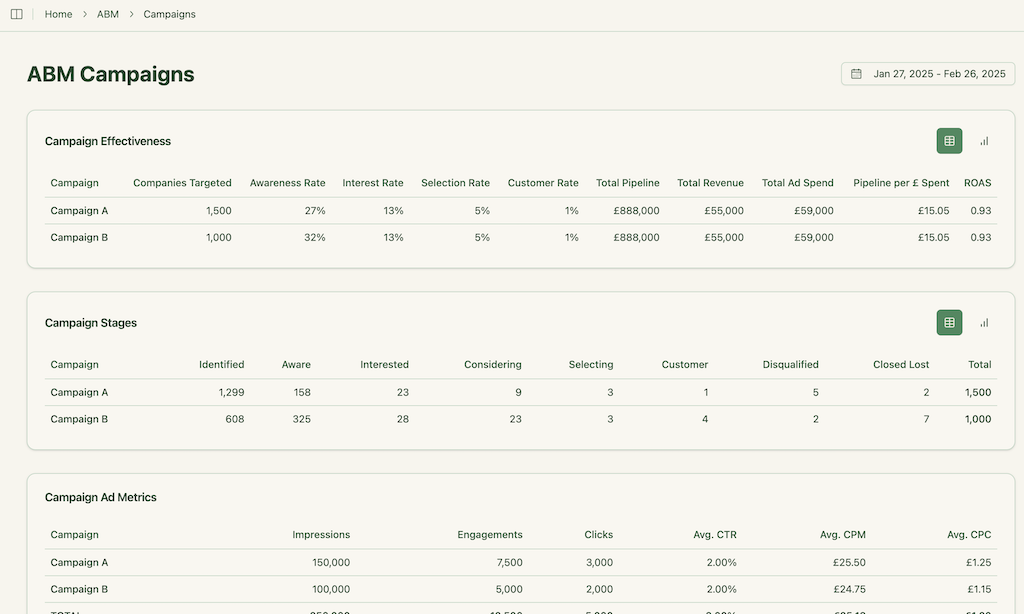

- You can monitor performance from high level ABM campaigns down to LinkedIn campaign groups and individual ads:

- Because ZenABM stores deal value and ad spend per company and campaign, it can calculate ROAS, pipeline per dollar, and other revenue linked metrics and visualize pipeline contribution.

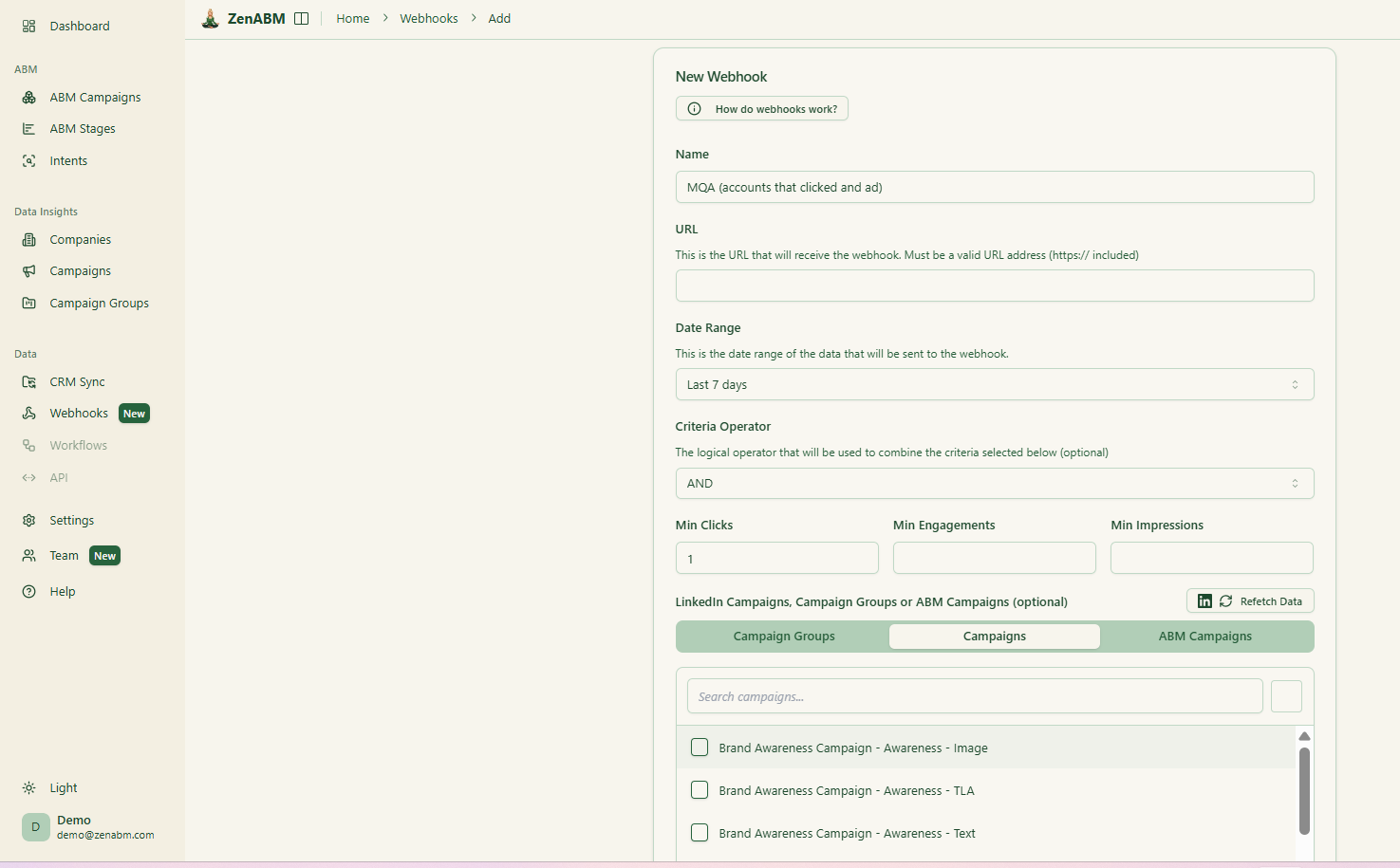

Custom Webhooks

ZenABM’s custom webhooks let you plug its events into your existing stack, such as Slack alerts, enrichment flows, or other ops logic.

Job-Title Analytics

ZenABM tells you which job titles actually interact with your creatives, along with dwell time and video funnel analytics.

ABM Campaign Objects for True Multi-Campaign Attribution

Most tools treat each LinkedIn campaign separately. ZenABM lets you group several into one ABM campaign object so you can see performance across markets, personas, or creative clusters at once.

Instead of juggling fragmented reports in Campaign Manager, you see spend, pipeline, account movement, and ROAS for the full initiative.

AI Chatbot to Analyze Your LinkedIn and ABM Data

ZenABM includes an AI chatbot on top of your LinkedIn API data and ABM model.

You can ask questions like “Which accounts moved from Interested to Selecting last month?” or “What is my pipeline per dollar on retargeting campaigns?” in plain language and get answers based on real data.

Multi Client Workspace for Agencies

For agencies, ZenABM offers a multi client workspace.

You can manage multiple ad accounts and clients in one environment, each with its own ABM strategy, dashboards, and reporting, without constantly switching accounts in Campaign Manager.

ZenABM Pricing

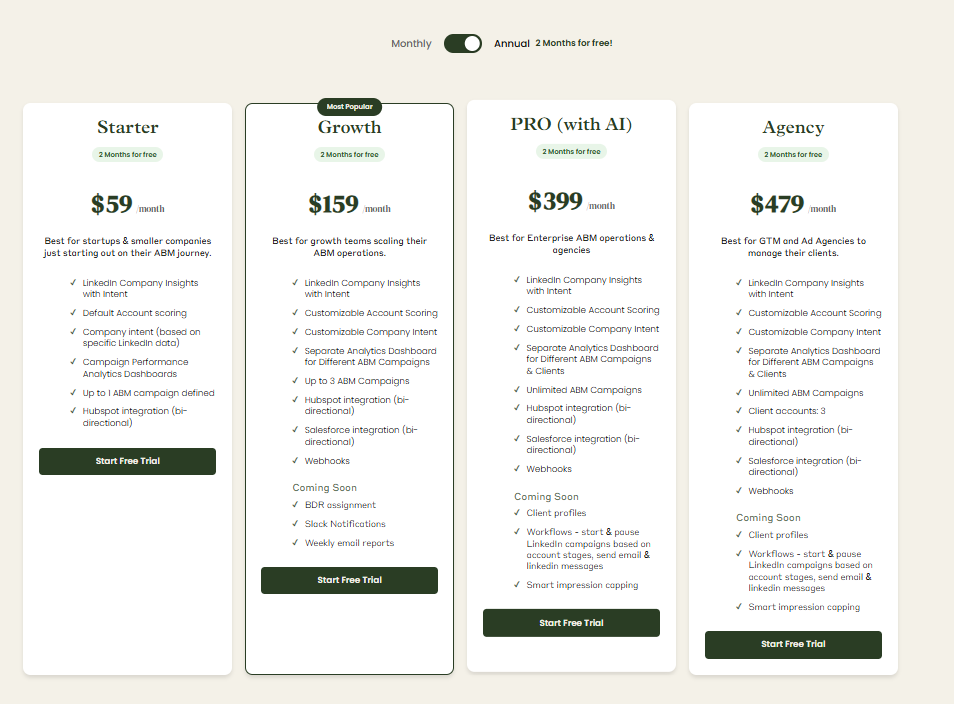

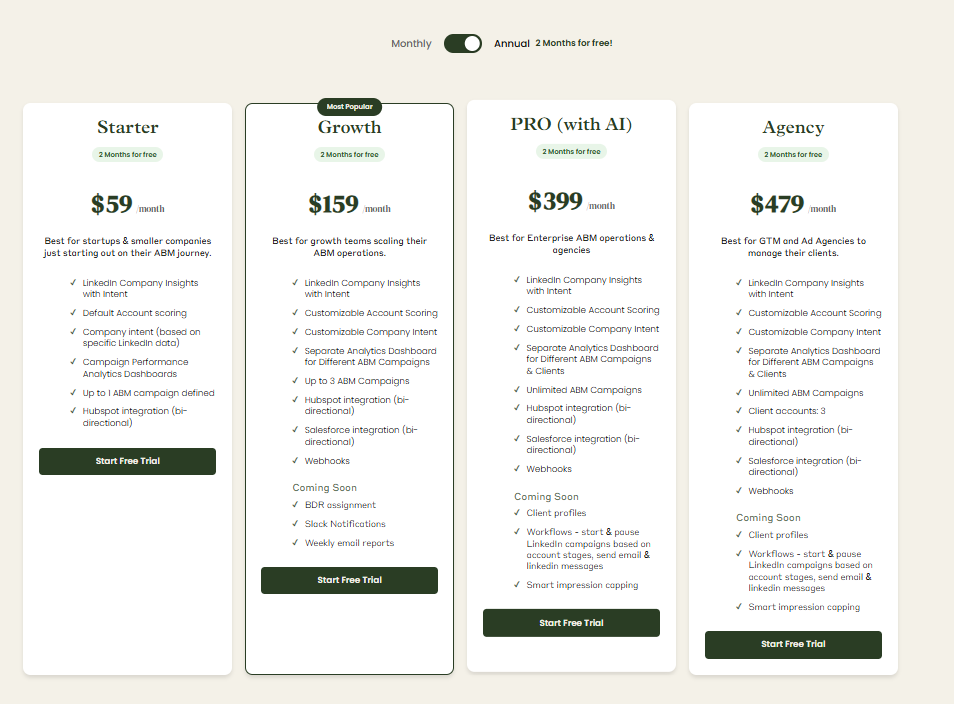

Plans start at $59/month for Starter, $159/month for Growth, $399/month for Pro (AI), and $479/month for Agency.

Even the agency plan stays under $6,000 per year.

All tiers include core LinkedIn ABM features. Higher tiers mainly increase limits and add Salesforce sync.

Plans are available on a monthly or annual billing, and every plan includes a 37-day free trial.

Conclusion

InsightSync and Madison Logic target different ABM needs.

InsightSync focuses on clarity and alignment, combining CI, target accounts, and engagement insights while campaigns run in your existing tools.

Madison Logic emphasizes large-scale execution, using third-party intent and multi-channel ads across display, LinkedIn, and CTV—powerful but complex and costly.

For visibility and prioritization, choose InsightSync. For enterprise reach, go with Madison Logic. For LinkedIn first, first-party ABM with pipeline attribution and CRM sync, ZenABM is the smarter, leaner option.

Try ZenABM now for free (37-day free trial) or book a demo to know more!