To run ABM with confidence, you need account-centric reporting that connects ad exposure at the impression level with engagement, pipeline creation, stage progression, and closed-won revenue. I mean, these features are the bare minimum.

And to help you choose your fit, I have discussed the 10 most effective ABM tools for B2B marketing, prioritizing view-through accuracy, tight CRM alignment, and board-ready reports that prove impact without guesswork.

Note: I do not recommend display ads or IP-based deanonymization for precise B2B ABM, so this comparison centers on a LinkedIn-first ABM strategy

Let’s go!

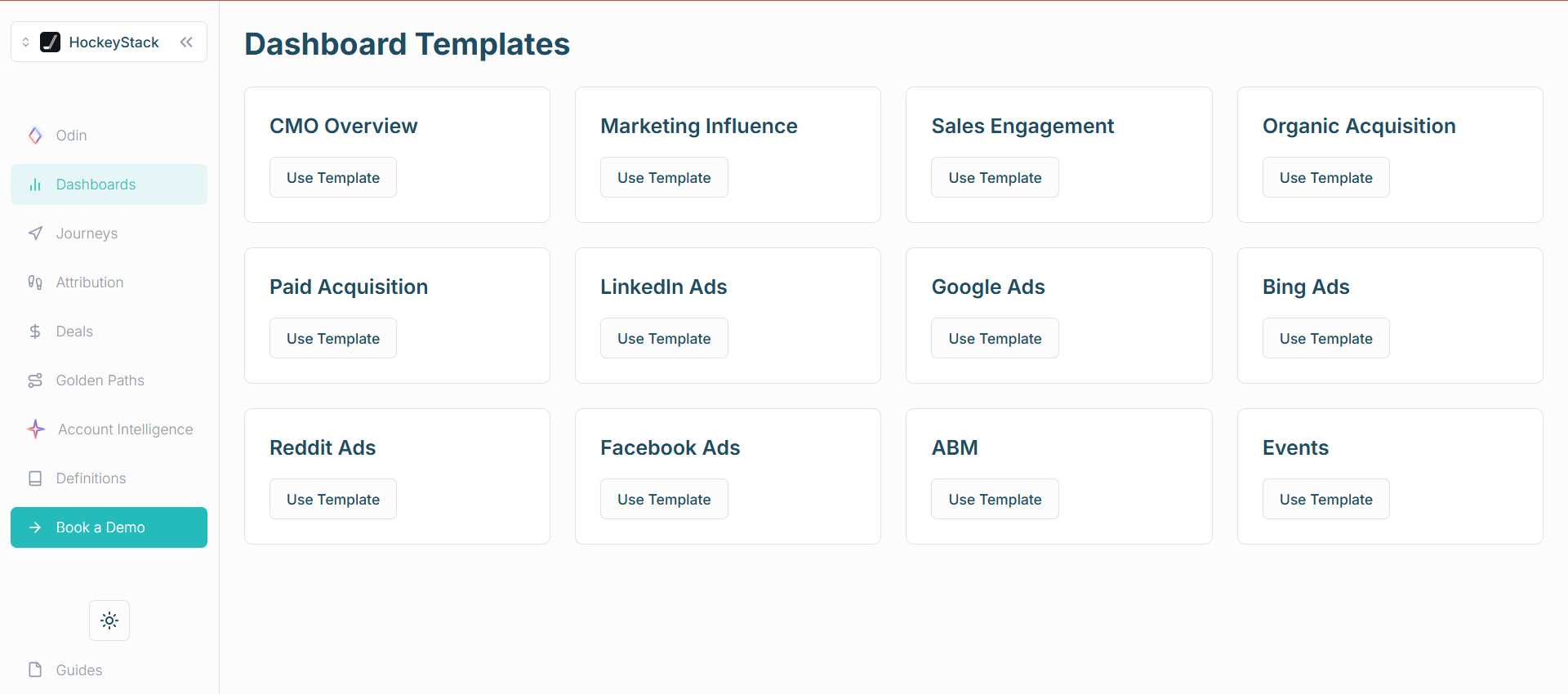

Effective ABM tools for B2B marketing: tabulated summary

| Tool | Company + Campaign-Level Impression Tracking | Two-Way CRM Integration | First-Party LinkedIn API Data | Pricing | Summary |

|---|---|---|---|---|---|

| ZenABM | ✅ | ✅ (native, bi-directional) | ✅ (via LinkedIn API) | $59–$119/mo | Built for a LinkedIn-first ABM motion. Clean campaign-by-company metrics, instant HubSpot sync, precise deal matching, and fast time to pipeline. A top pick among effective ABM tools for B2B marketing. |

| Factors.ai | ✅ | ❌ (pulls data, no native push) | ✅ (via LinkedIn API) | $399–Custom | Solid impression controls plus AdPilot. Lacks native property write-back for CRM-level pipeline reporting out of the box, so less ideal when you need effective ABM tooling inside the CRM. |

| Demandbase | ✅ | ✅ (multi-CRM, bi-directional) | ✅ (via LinkedIn API) | Custom | Enterprise ABM suite with deep controls and revenue reporting. Powerful and priced accordingly, still a frequent pick among effective ABM tools for B2B marketing. |

| Terminus | ⚠️ (only for Matched Audiences) | ✅ (bi-directional) | ✅ (limited to matched audiences) | Custom | Strong Salesforce fit and account views, although impression analytics are constrained to Matched Audiences. |

| HockeyStack | ✅ | ❌ (only pull; native workflow building needed) | ✅ (via LinkedIn API) | Custom | Rich journeys and account paths. One-way CRM sync means extra effort to make pipeline dashboards sing. |

| LeadsRx | ❌ (cookie-dependent) | ❌ (custom setup needed) | ❌ | Custom | Omni-channel attribution engine. No official LinkedIn account analytics for impressions, which limits ABM pipeline use cases. |

| 6Sense | ❌ | ✅ | ❌ | Custom | Excellent prediction and segmentation, but lacks impression-first, account-level LinkedIn reporting for pipeline proof. |

| HubSpot Attribution | ❌ | ✅ (internal) | ❌ | $800–$3600/mo | Great for click and contact attribution inside HubSpot. Not designed for impression-led ABM pipeline tracking. |

| CommonRoom | ❌ (tracks engagement only) | ✅ | ❌ (different LinkedIn API for contacts, not impressions) | $999–Custom | Community signals with LinkedIn engagement. Helpful context, but not a substitute for impression-level pipeline reporting. |

| Windsor.ai | ❌ | ❌ (manual account grouping) | ❌ | $19–$499+ | Excellent data hub and model playground. Not built for LinkedIn ABM impression or pipeline-by-account analytics, so not a core pick among effective ABM tools for B2B marketing. |

What should effective ABM tools for B2B marketing deliver in a LinkedIn-first strategy?

Flashy dashboards and long integration lists look impressive. For ABM pipeline math that stands up under scrutiny, three pillars matter. If one is missing, the numbers wobble.

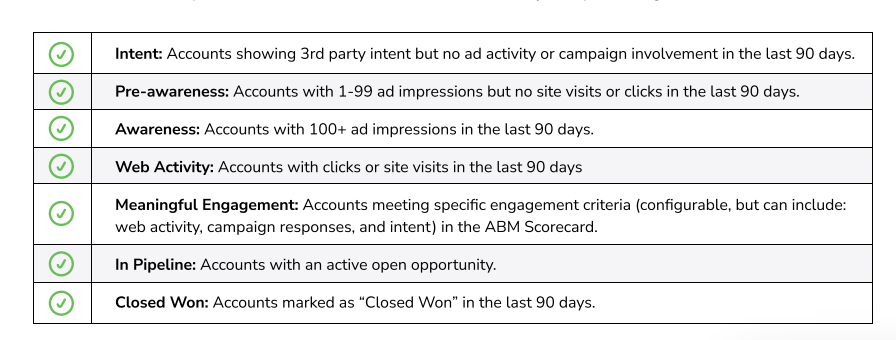

Company-level impression tracking per campaign

Most prospects never click. Sponsored Content CTR often sits around 0.44%. LinkedIn primes demand. Someone sees your ad on Monday, searches your brand on Thursday, and books a demo on Friday. That is not pure organic. You need impression logs at the company level by campaign and by campaign group to credit assists and connect exposure to pipeline movement.

Contact-level impression data is not available via the official API. Reverse IP guessing misses often. Treat those reads as directional only.

Two-way CRM integration

Your reporting must write back to the system of record and also pull live deal data forward for matching.

Push company-level ad data to your CRM

Sync impressions, clicks, and engagement into HubSpot or Salesforce as company properties. Remove CSV work. Make it filterable by lists, saved views, and reports that sales will actually use.

Match ad impact to your deals

Join CRM company records to LinkedIn campaign analytics. When Company X opens an opportunity and crosses your impression threshold, attribute influence to the right campaigns and refresh totals in near real time. This is ABM pipeline reporting.

First-party, official data

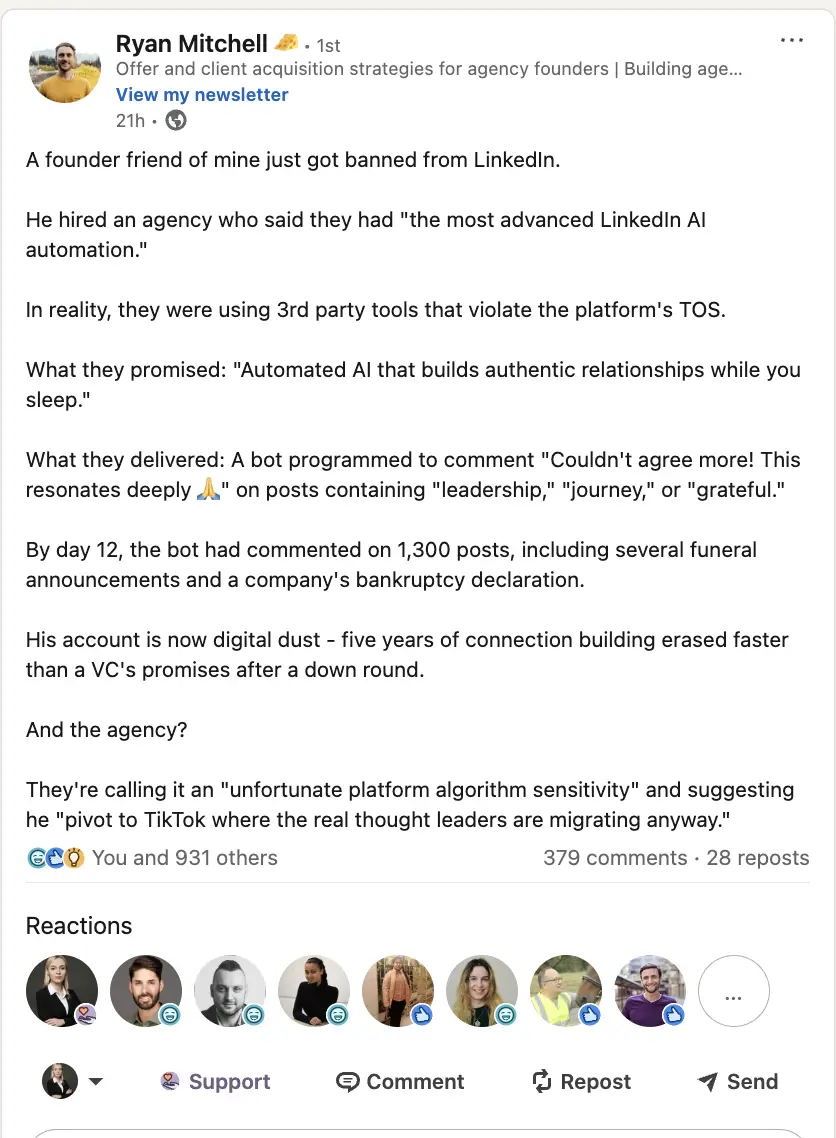

LinkedIn polices scraping and automation.

Deanonymization relies on cookies and IP ranges. That is fine for click paths, not for impressions, and it misclassifies regularly.

DANs add bot noise and false positives. The punchline is simple.

For ABM pipeline reporting, use first-party, account-level LinkedIn engagement via the official API.

Now, the top contenders and how they stack up.

Why not just rely on LinkedIn’s native stack for a LinkedIn-first ABM strategy?

If you are wondering why not run everything with LinkedIn’s native stack, here is the core issue.

LinkedIn’s Revenue Attribution Report is lead-centric, while ABM is account-centric. You can stitch the native pieces together to see revenue influence from leads, but you still miss critical account-level insight for the pipeline.

What the native stack covers today

First, here is how to set up the native reporting.

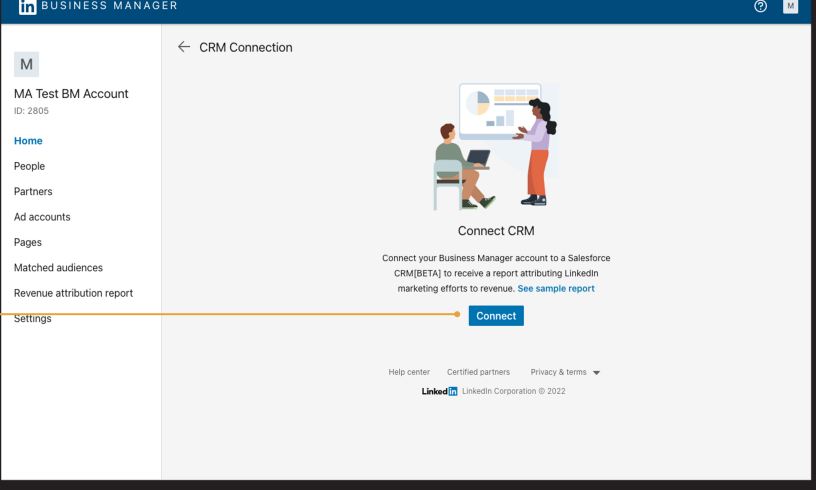

Connect your CRM to RAR:

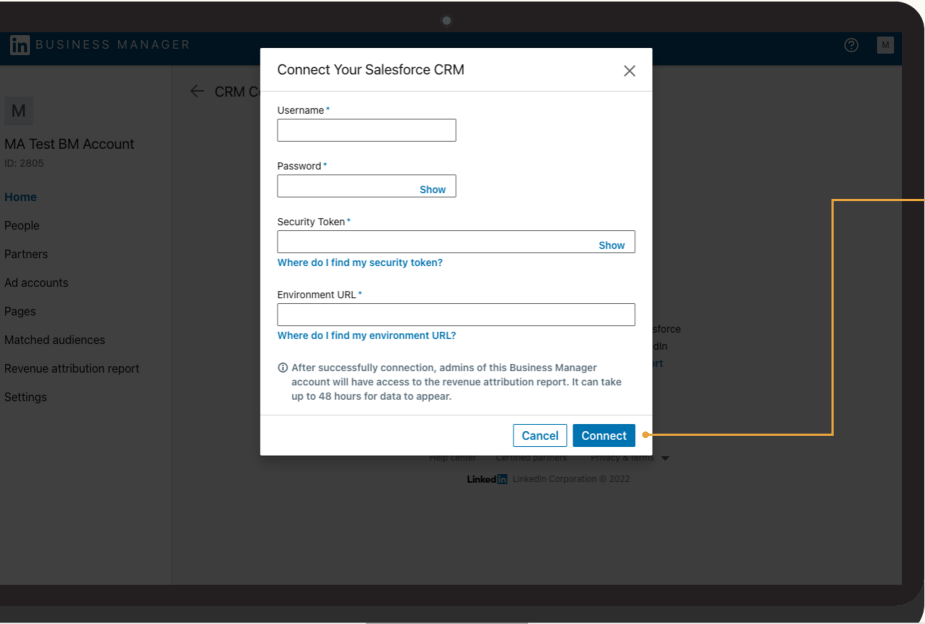

Provide the requested credentials, including Username, Password, Environment URL, and Security Token:

Data can take up to 72 hours to appear. Confirm the CRM opportunity field that RAR should treat as the revenue source of truth.

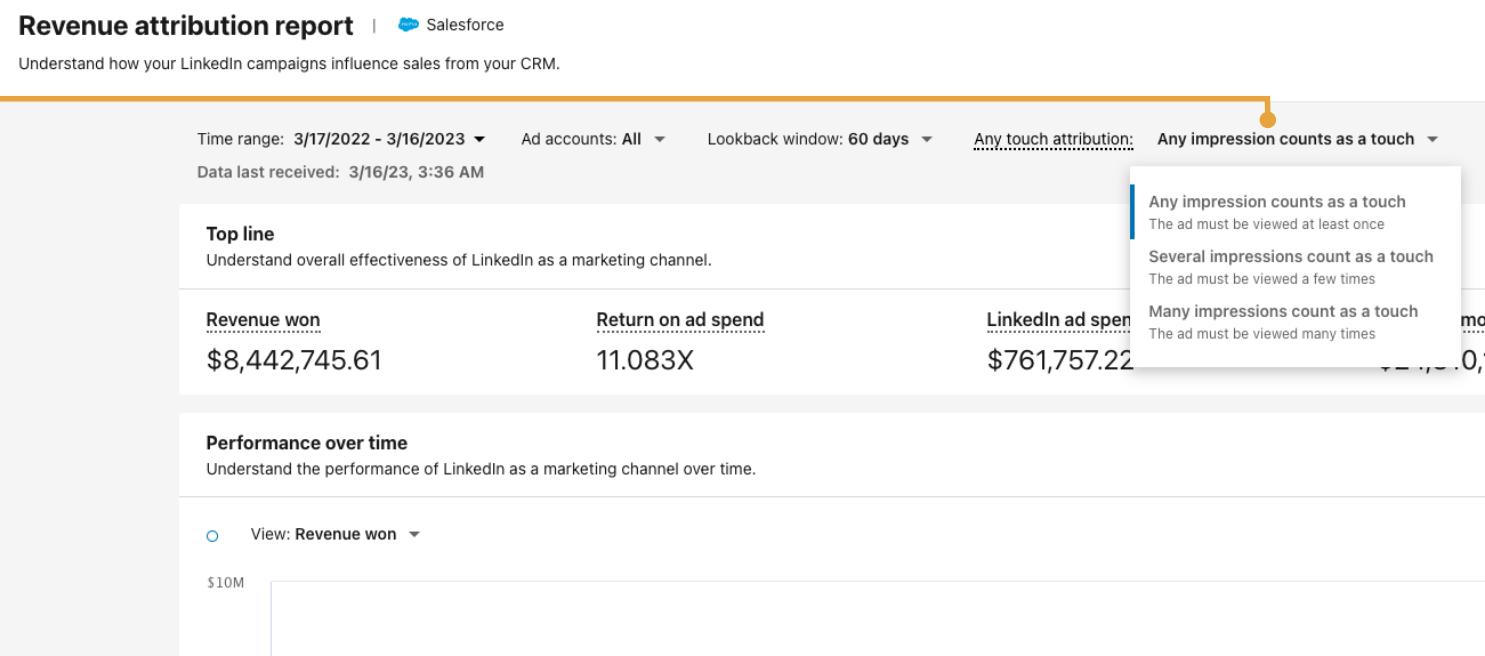

Set your minimum impression threshold for influence:

- Single impression counts as influence.

- A few impressions count as a touch.

- Many impressions raise the bar for influence.

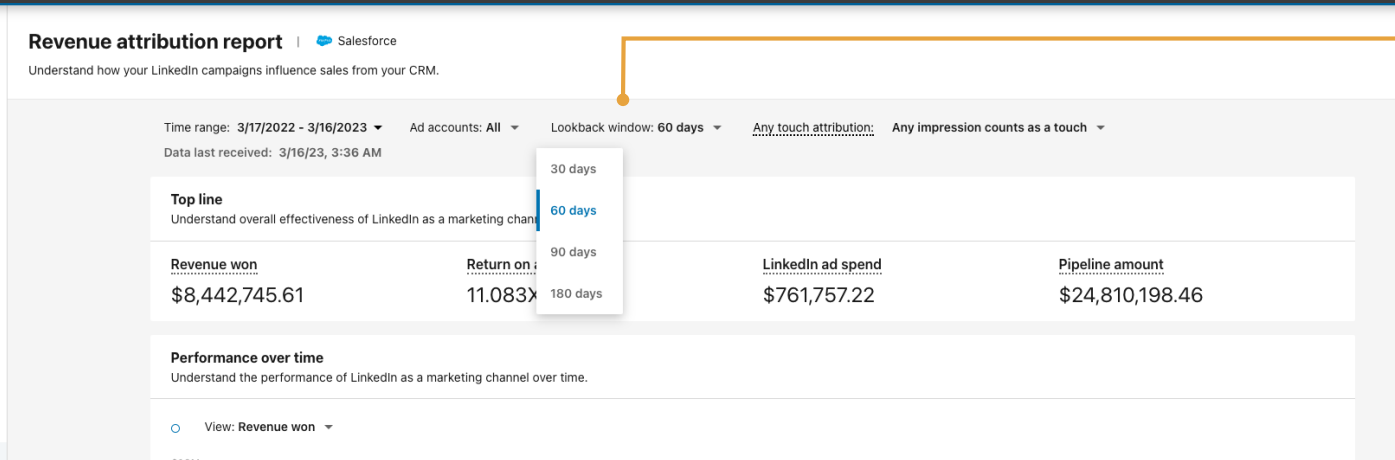

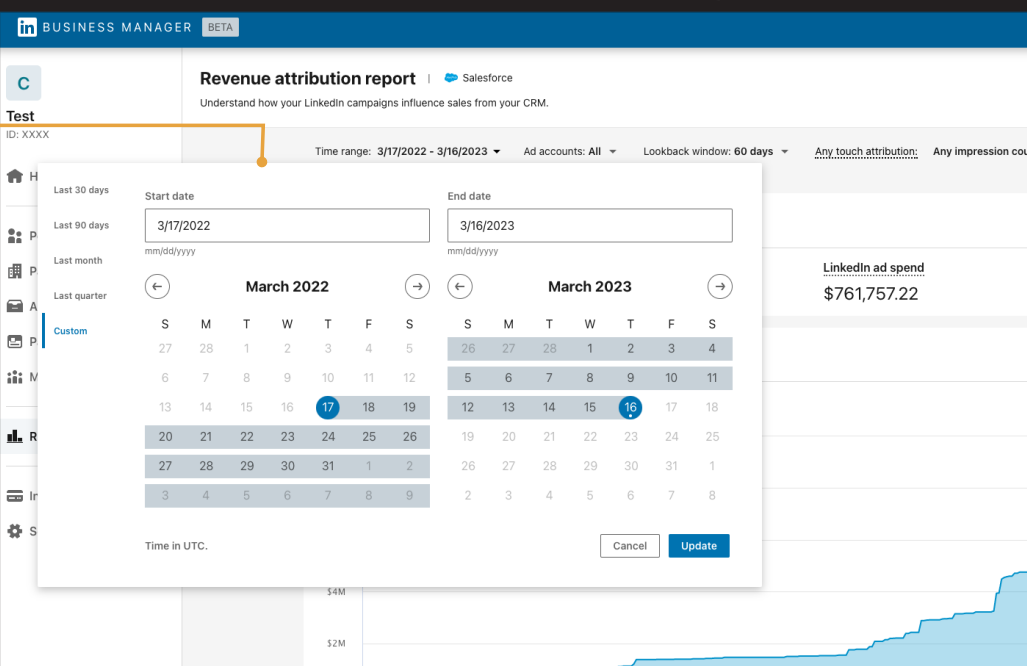

Choose a lookback window:

Then set the reporting time frame:

If you run multiple ad accounts, filter by the account or combine them as needed.

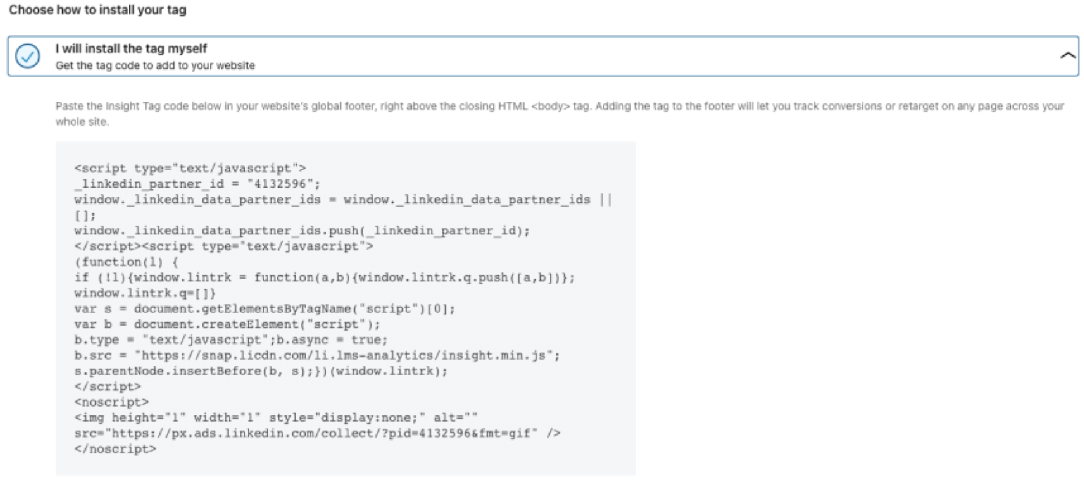

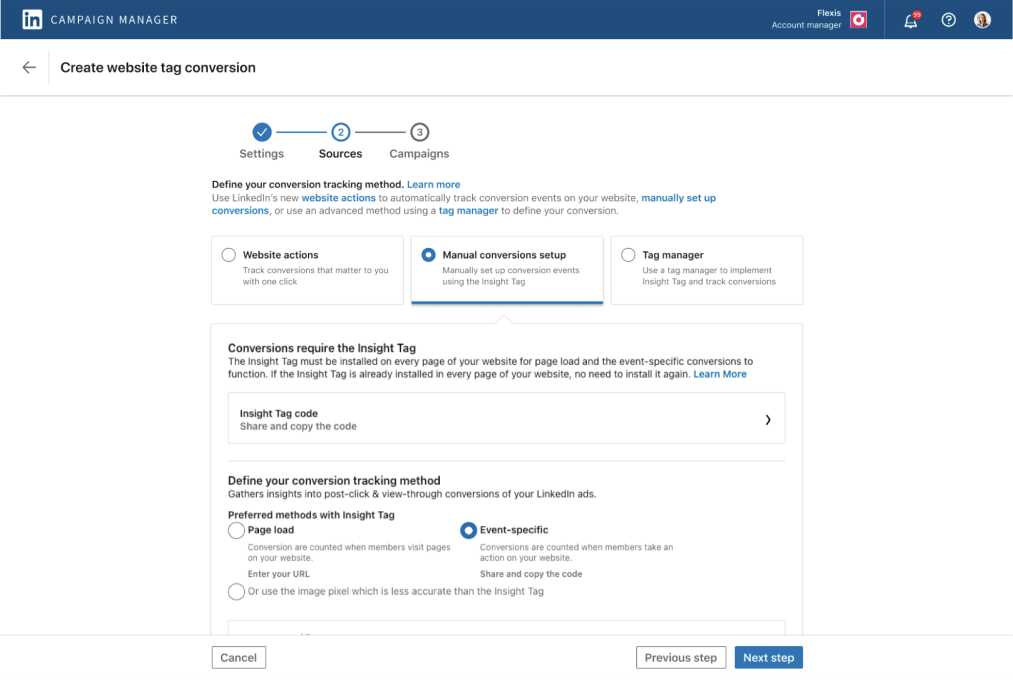

Install the Insight Tag across your site:

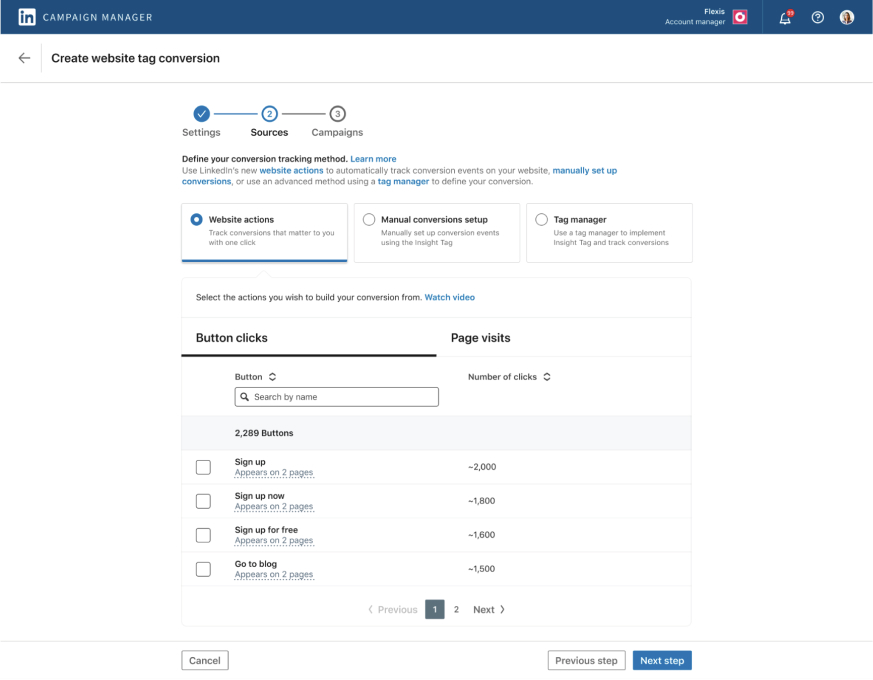

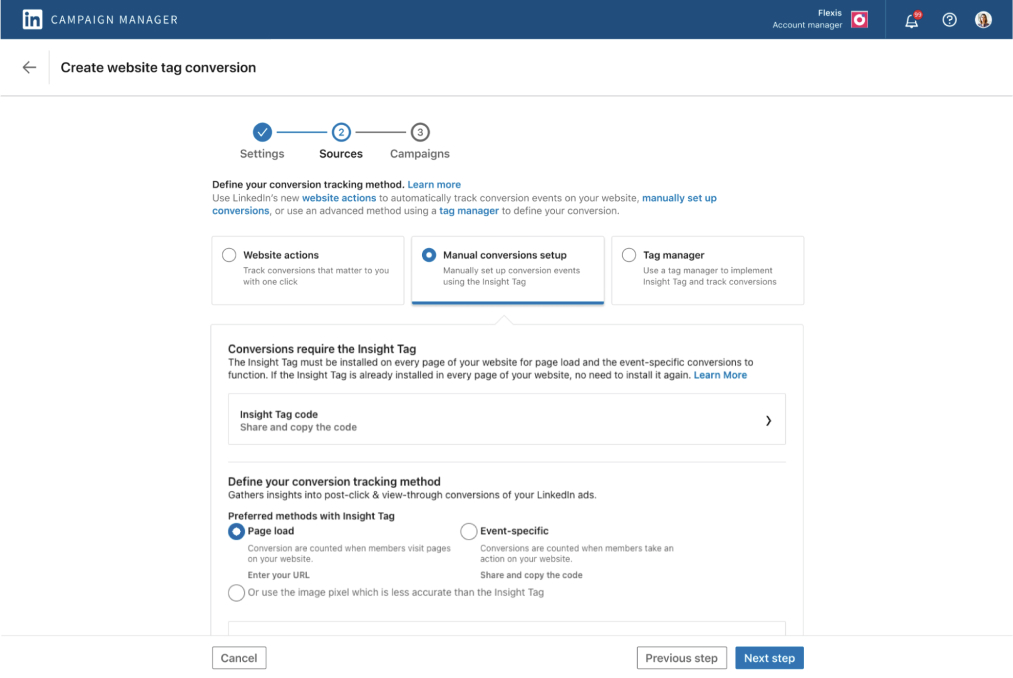

In Campaign Manager, configure conversions:

- Website Tag Conversions: submissions or link clicks that load a thank you page.

- URL or Page Conversions: visits to specific URLs after an ad click. Useful for deeper content like a blog post.

- Event Conversions: actions that do not change the URL, for example AJAX submits.

Set up CAPI as well:

- Mirror the same conversions in Campaign Manager.

- Post server-side events to

/conversionEventswith the rule URN, timestamp, value, and hashed identifiers.

With this setup, RAR can attribute most online conversions that preserve cookies and device continuity. To capture more, upload offline conversions from your CRM into Business Manager or stream them via CAPI with timestamps and hashed emails.

Where the native stack falls short for ABM pipeline proof

- Lead lens, not account lens. Buying groups involve many people. RAR ties influence to individuals and misses the company-level lift across contacts.

- View-through gaps. Cookie loss, browser privacy, cross-device jumps, and ad blockers hide exposure that still warms the account.

- Creative and campaign opacity. RAR does not reveal the exact ad or message that moved the account into the pipeline.

- Click bias. UTMs save clickers. They do nothing for silent viewers who still influenced the deal.

- Offline and lagged conversions. Manual files or CAPI streams are extra work. Mismatched timestamps or IDs reduce confidence.

- Person A views, Person B converts. Same company, different humans. Native reports require manual checks in Campaign Manager to infer influence.

- Arbitrary thresholds and windows. Impression minima and lookbacks change the narrative more than the marketing did.

- Slow refresh. Data can take up to 72 hours. Sales wants alerts in near real time when an account heats up.

- Multi-account fragmentation. Multiple ad accounts split truth unless you normalize everything outside LinkedIn.

- No account-level rollup across campaigns. You cannot see a single company’s cumulative impressions, clicks, and engagement against pipeline stages without external stitching.

If you must stay native, use these workarounds

- Mirror every critical conversion in both Insight Tag and CAPI, then reconcile against CRM opportunities.

- Automate offline uploads from CRM with strict timestamp and hashed email standards.

- Run a weekly company-level audit. List converting companies, then verify prior impressions, clicks, or engagement for those same firms in LinkedIn Campaign Manager before the conversion date.

For true pipeline reporting, you need company-level capture of impressions, clicks, and engagement per campaign group, plus a clean push into the CRM with account stages and intent. That is the gap the native stack does not fill on its own.

Now let’s look at top 10 effective ABM tools for B2B marketing that fully or partially provide a LinkedIn-first ABM strategy.

ZenABM

ZenABM is built for a LinkedIn-first ABM strategy. You get view-through coverage, native CRM write-back, plug-and-play ABM dashboards, and intent-based scoring.

Does ZenABM fulfil the prerequisites?

Yes. ZenABM leads with them.

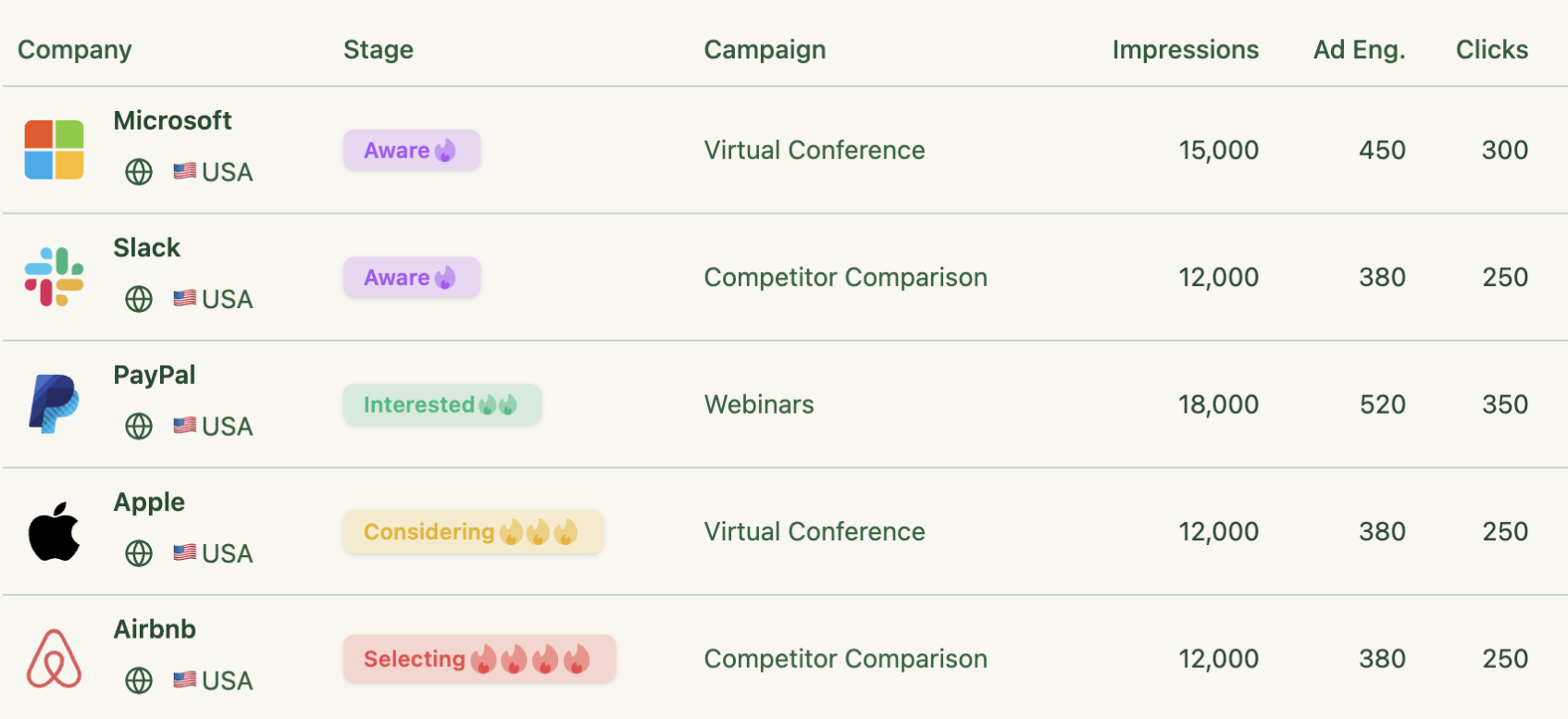

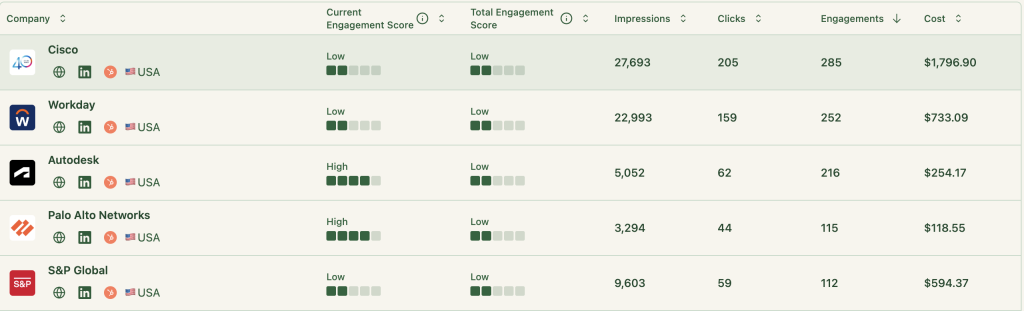

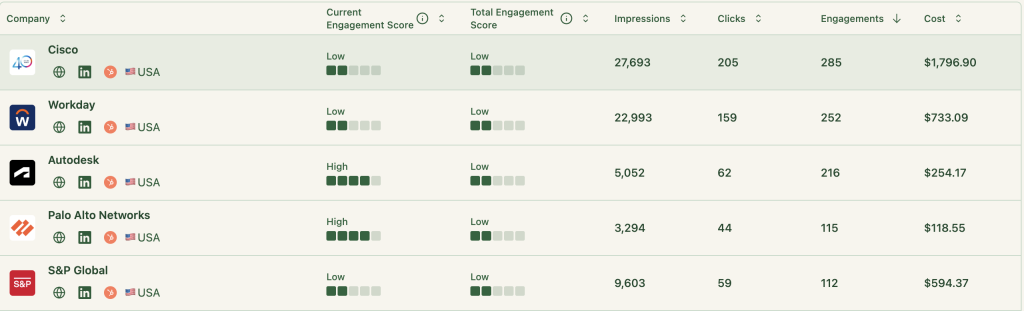

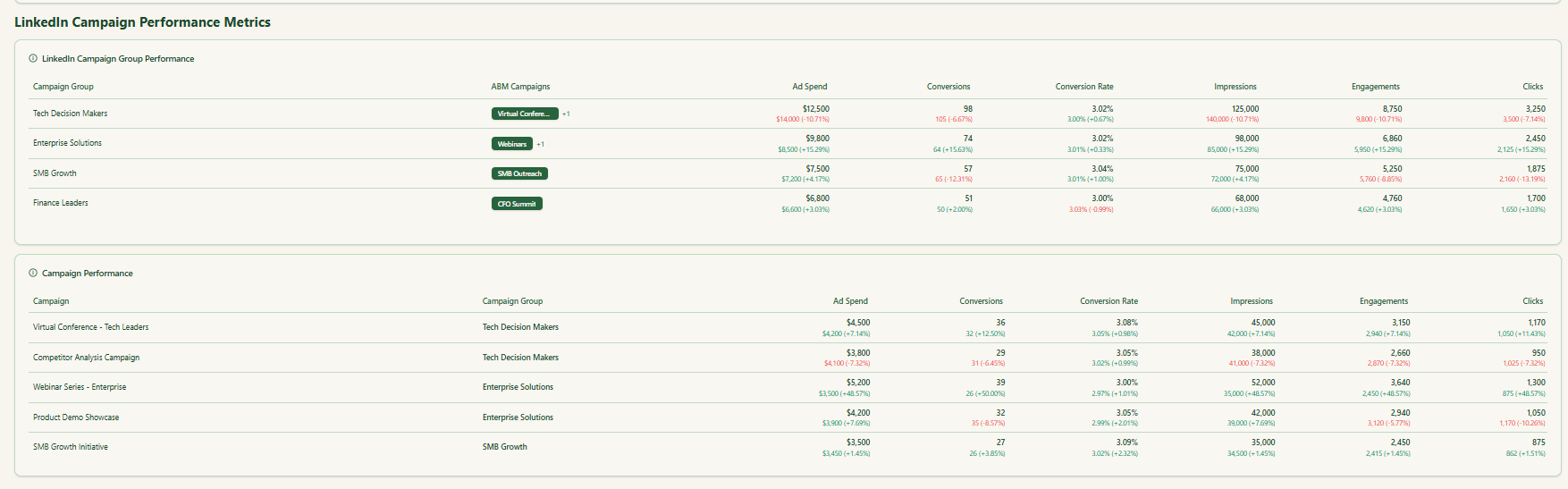

Company-level impression tracking per campaign

ZenABM records each account that:

- Was served an ad

- Reacted with a like, comment, or share

- Clicked

- Never visited your site, and still engaged later through view-through

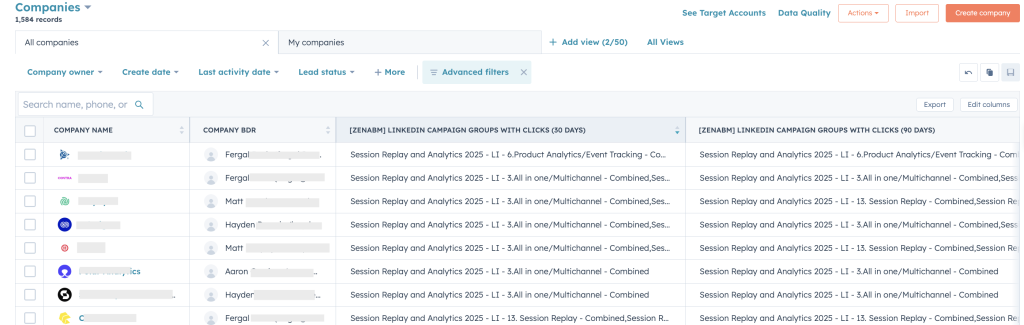

Example. Company X collects 50 impressions with zero clicks, then opens a 75k opportunity two weeks later. ZenABM shows which campaigns warmed the account and shares credit across all exposures. All of this is via the official LinkedIn API.

Two-way CRM integration

Native, no code, and bi-directional sync, so pipeline reporting for a LinkedIn-first ABM strategy is straightforward.

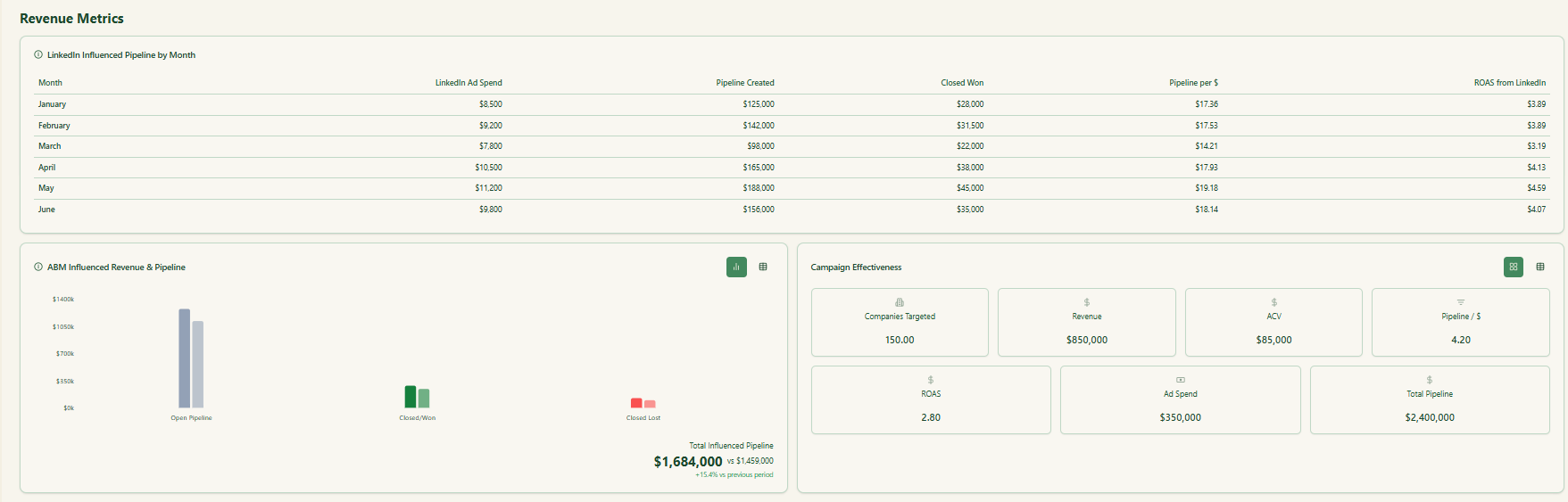

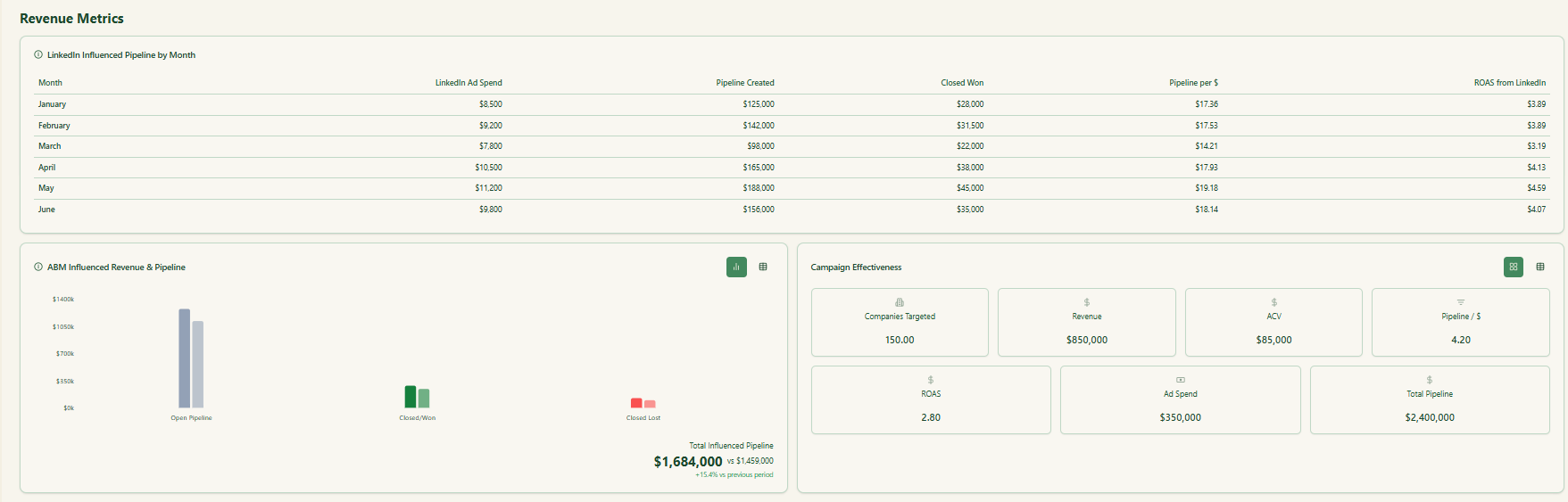

Connects LinkedIn Ads to real pipeline and revenue

ZenABM maps LinkedIn engagement to open opportunities and closed won inside your CRM.

You also see per-deal values tied to ad exposure.

So you can finally state:

- This campaign added 75k to the pipeline

- This campaign group touched 22 closed deals

- Quarterly LinkedIn ROAS ran 5.2 times

Pushes engagement data into HubSpot automatically as company properties

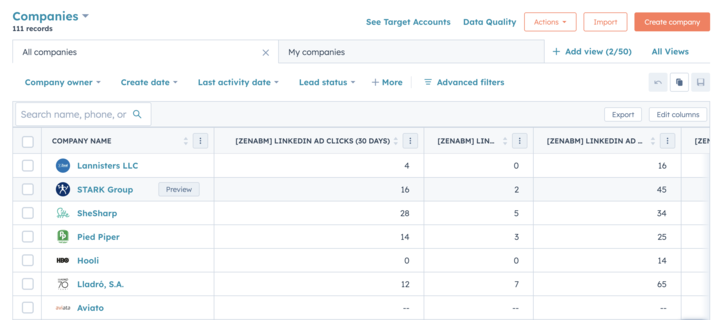

ZenABM writes LinkedIn engagement into HubSpot as properties such as “LinkedIn Ad Engagements – 7 days” and “LinkedIn Ad Clicks – 7 days.”

What else is strong about ZenABM?

Here is what stands out:

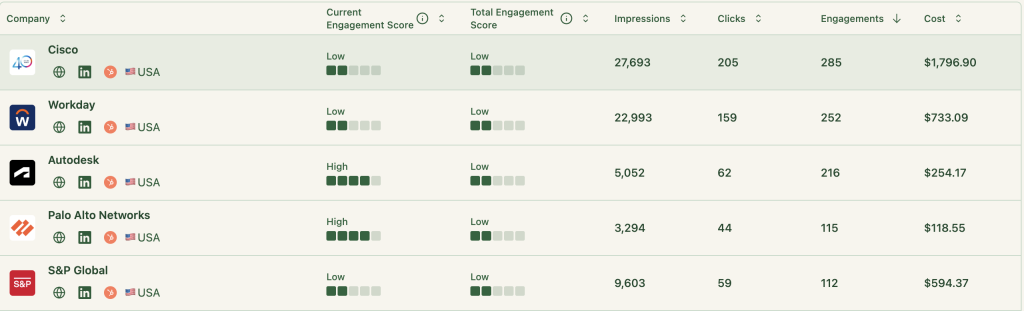

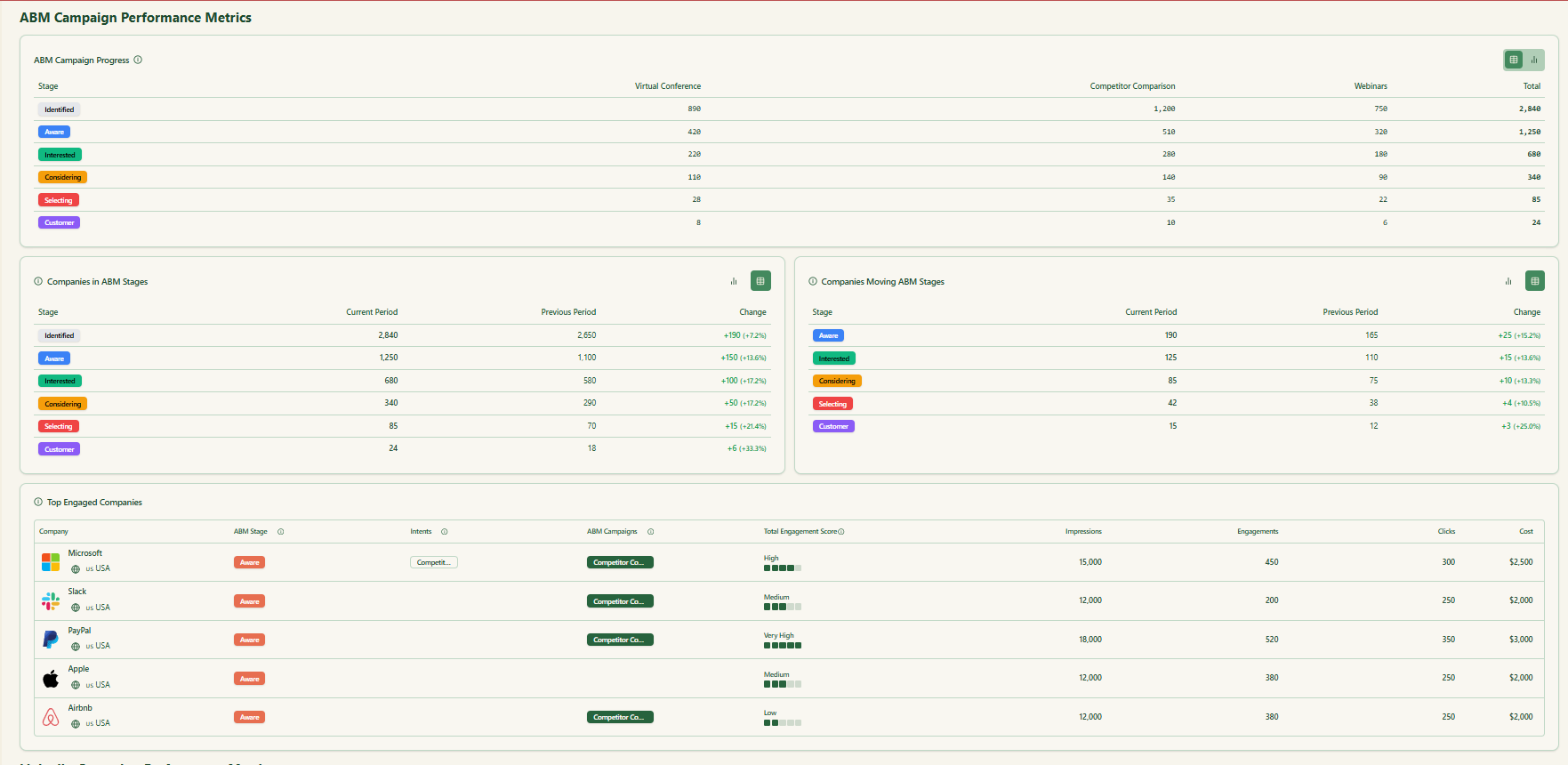

Automated scoring, BDR routing, and intent

ZenABM calculates a rolling Current Engagement Score using impressions, clicks, and freshness.

Qualified accounts are auto-assigned to reps in HubSpot.

Campaign tags feed buyer intent insights.

Built-in ABM dashboards

No Excel gymnastics or custom CRM builds. ZenABM ships dashboards that compute ROAS, lift, pipeline per dollar, and more.

In short, you get end-to-end view-through analytics and a single place to run ABM pipeline math.

Want to see it in action? Book a demo here.

Cons

ZenABM focuses on LinkedIn ABM, not visitor ID, broad intel, programmatic display, or list building.

Bottom line: A focused, accurate, and affordable option among the most effective ABM tools for B2B marketing on LinkedIn.

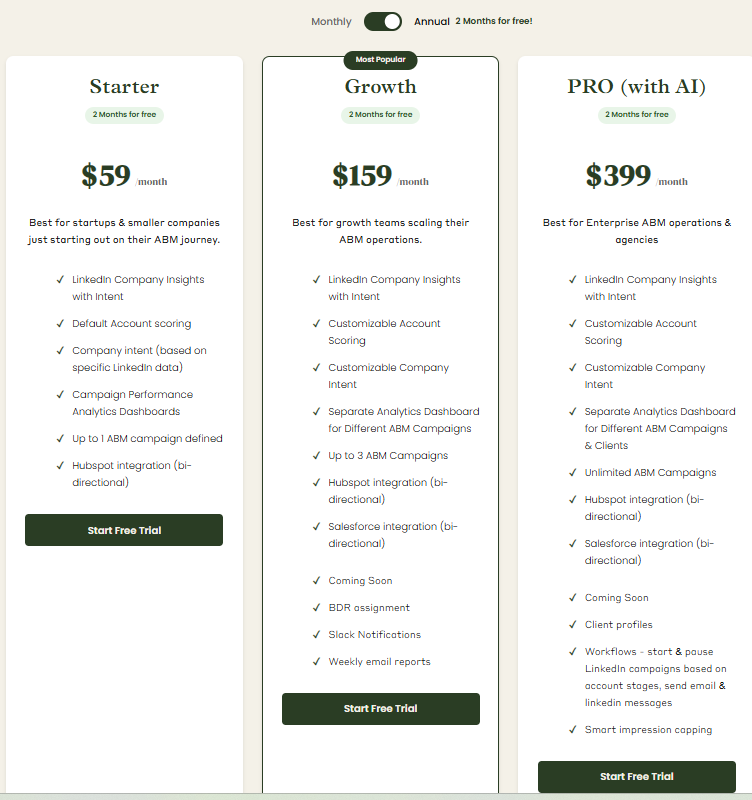

ZenABM pricing

Three plans with minimal decision friction.

Starter at 59 dollars per month annually for small teams. Company engagement insights, default scoring from CRM plus ad data, campaign-level intent, one ABM campaign, and native two-way HubSpot.

Growth at 75 dollars per month adds configurable scoring, dashboards for up to three campaigns, and queued upgrades like auto routing, Slack alerts, and weekly rollups.

Pro at 119 dollars per month fits larger teams and agencies. Unlimited campaigns, client-ready dashboards, and upcoming AI helpers for impression control and campaign ops.

Every plan has a free trial. See the pricing page.

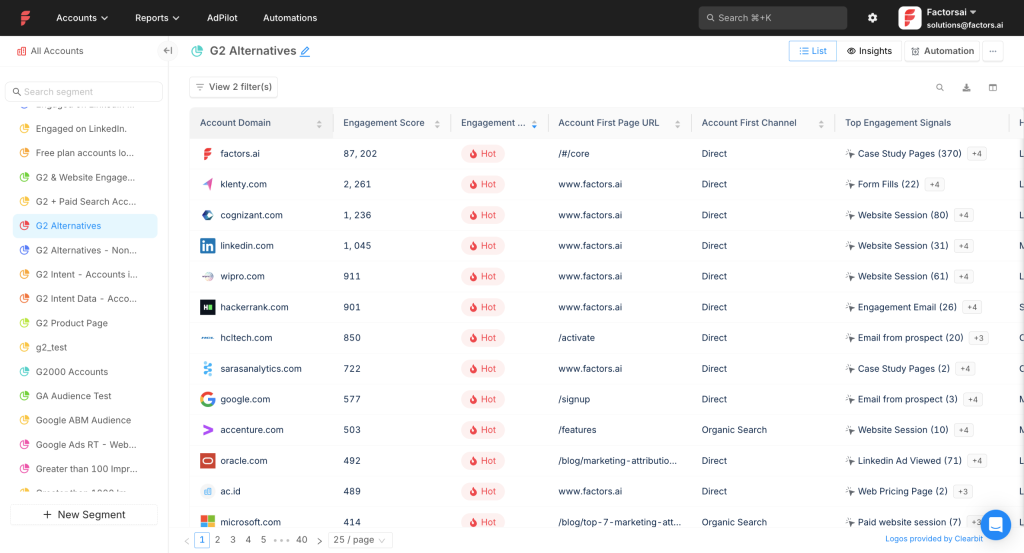

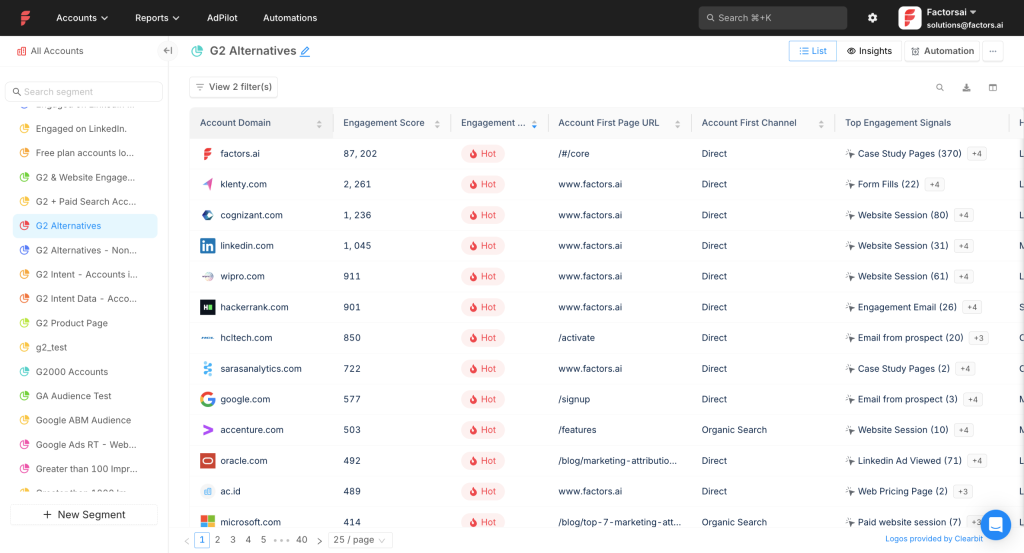

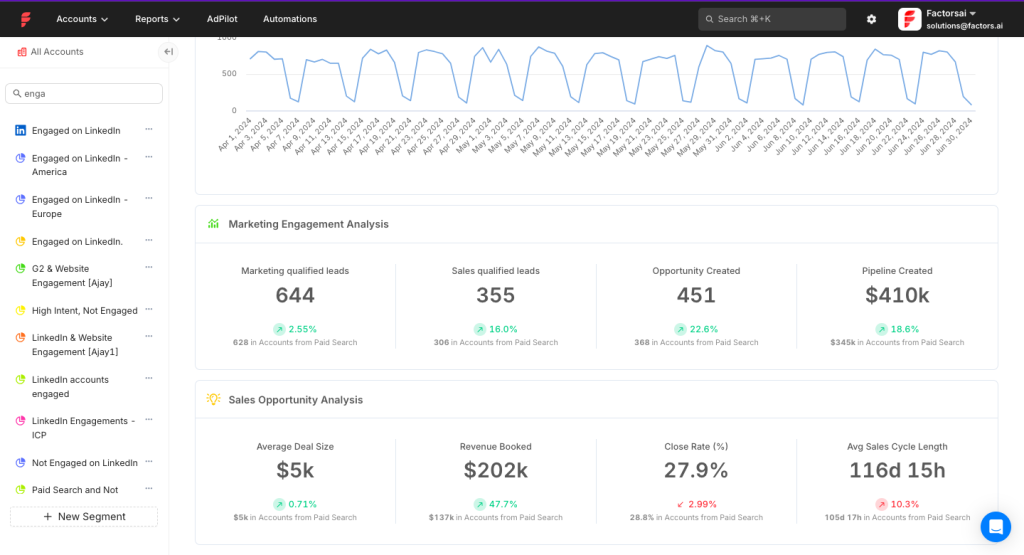

Factors.ai

Supports LinkedIn, Google, and Facebook. Adds automation, intent capture, deanonymization, scoring, and multi-touch reporting.

Does it fulfil the prerequisites?

For core data and pipeline mapping, mostly yes. CRM write-back is the main gap.

First-party company-level impression tracking per campaign

Pulls impressions, clicks, and spend via the LinkedIn API at the campaign group and campaign level, so you can tie exposure to pipeline movement.

Ties ad impact to pipeline and closed deals

HubSpot and Salesforce integrations bring opportunity and revenue views.

Note: No native company property write-back. You can create workflows to approximate it.

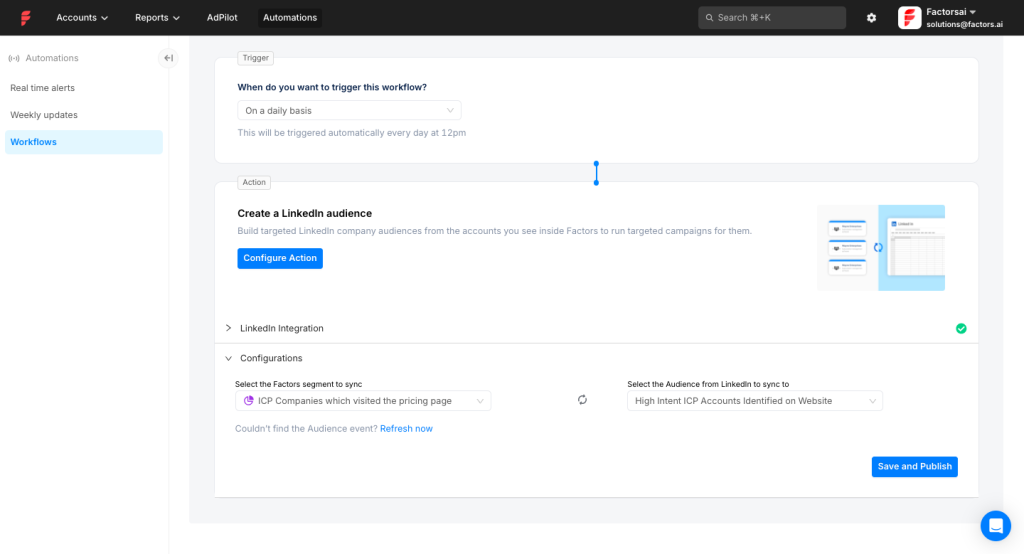

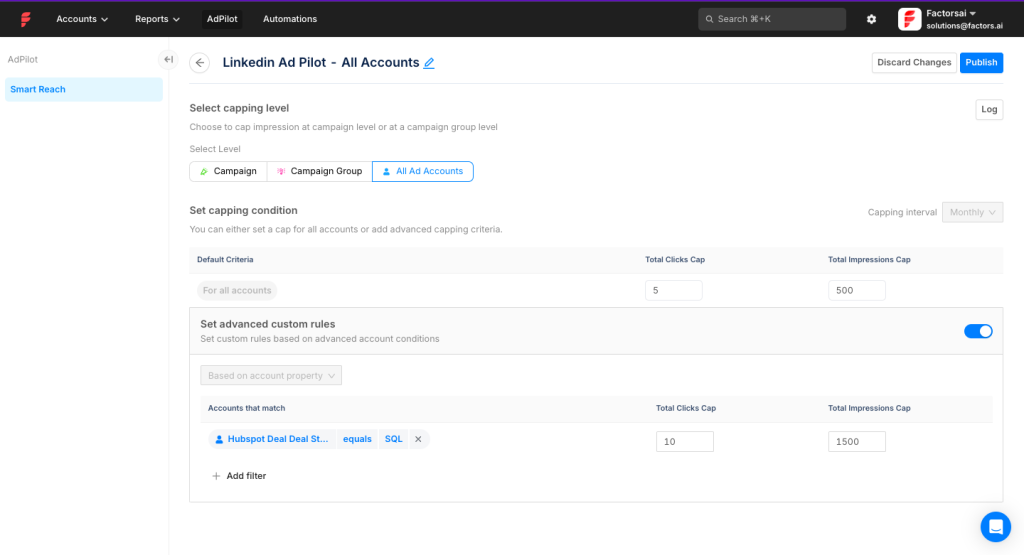

LinkedIn AdPilot

Audience builder

Impression capping

Additional features

Additional features of Factors.ai:

Workflow automation

MAP, CRM, and Slack hooks for operations teams.

Multi-touch and multi-channel attribution

Benchmark LinkedIn alongside other paid and owned channels.

Cons

- From 399 dollars per month. Weighted toward LinkedIn, which can be overkill if your budget is elsewhere.

- UI quirks and requests for deeper Salesforce event tracking (source).

Bottom line: Strong impression controls and account-level analytics.

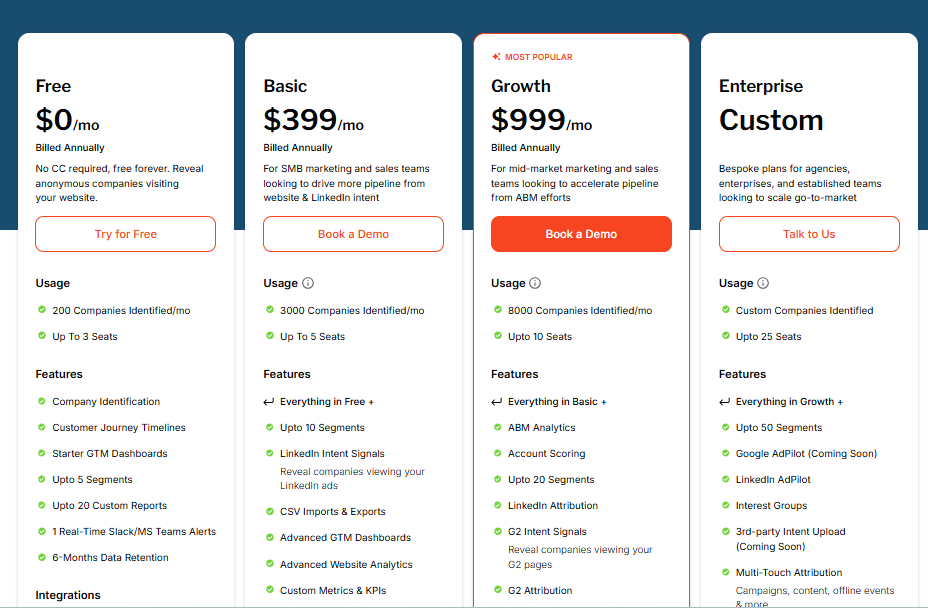

Factors.ai pricing

Free offers basic visitor intel for up to 200 identified companies. Basic at 399 dollars adds LinkedIn intent and core CRM links. Growth at 999 dollars adds ABM analytics, G2, and workflows. Enterprise is custom.

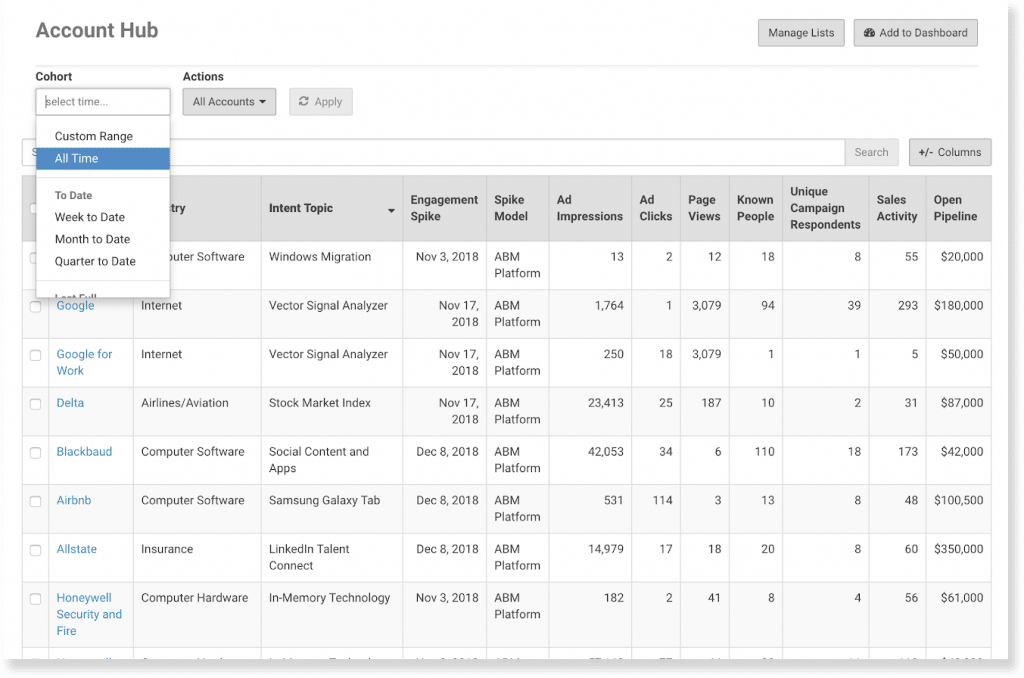

Demandbase One

Full-stack ABM with lists, delivery, analytics, and revenue reporting across channels. Demandbase is the brand, and Demandbase One is the platform.

Does Demandbase One fulfil the prerequisites?

Yes, across the board.

First-party company-level impression tracking

Certified LinkedIn partner with official API access. Account-level reporting is standard.

Two-way CRM integration

Bi-directional sync with HubSpot, Salesforce, Dynamics 365, Marketo, Pardot, and Eloqua. Measure pipeline and revenue, and write engagement into the CRM. A Capterra note. Sales teams often live in Salesforce, so plan change management.

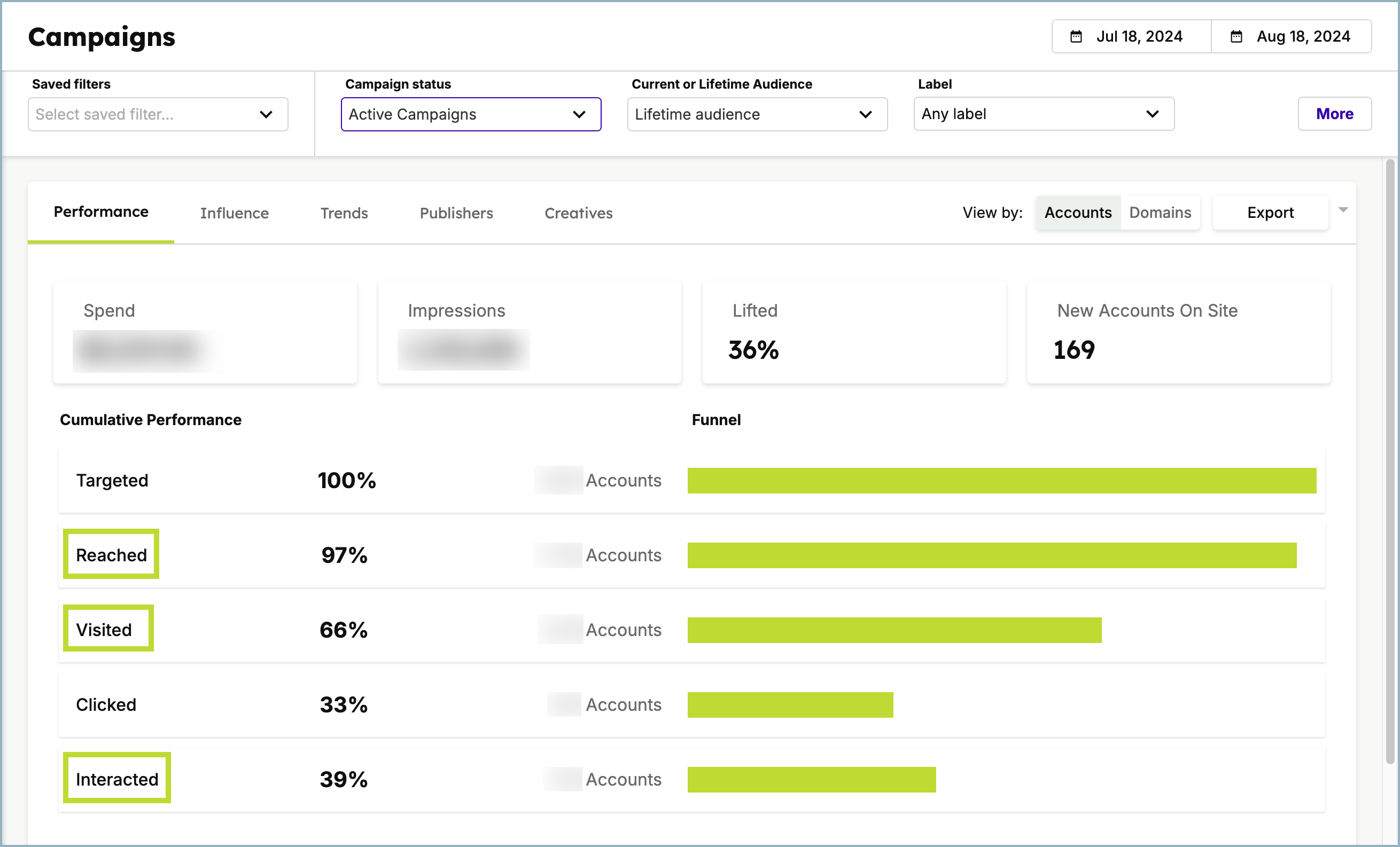

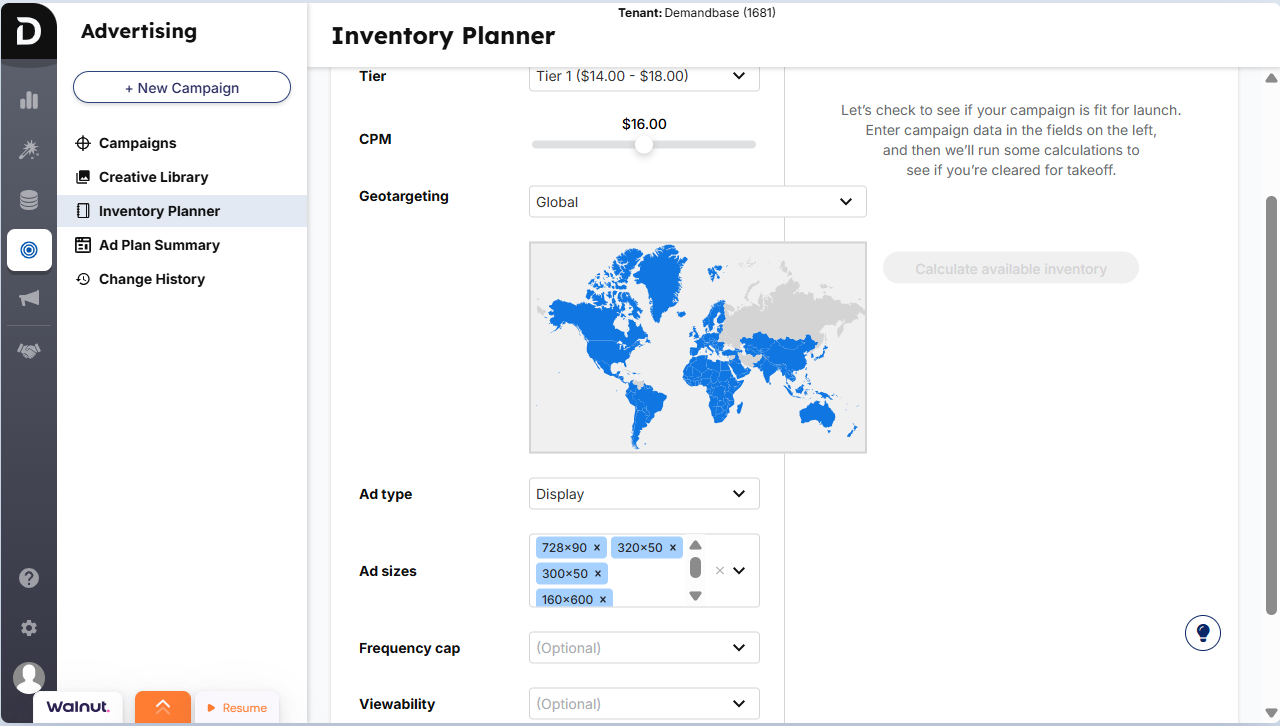

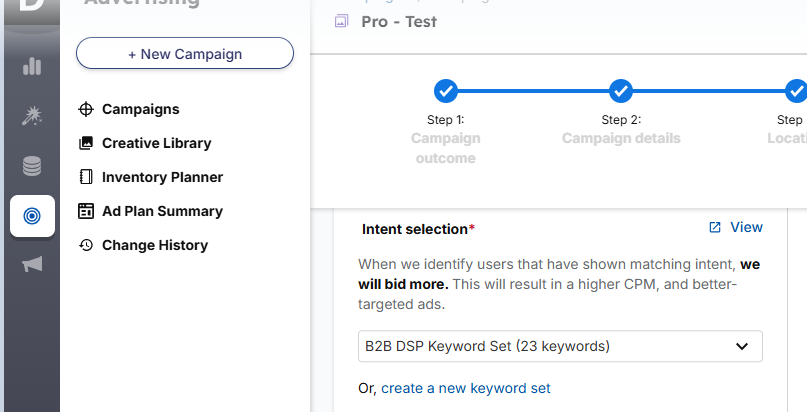

Additional features for LinkedIn

Demandbase’s additional features:

Frequency capping

Bid optimisation with intent

Prioritise spend toward in-market accounts using intent data.

Cons

Price and complexity. You will need time to land value.

Bottom line: Excellent if you run multi-channel ABM with a budget and want deep control.

Demandbase pricing

Not public. Book a demo.

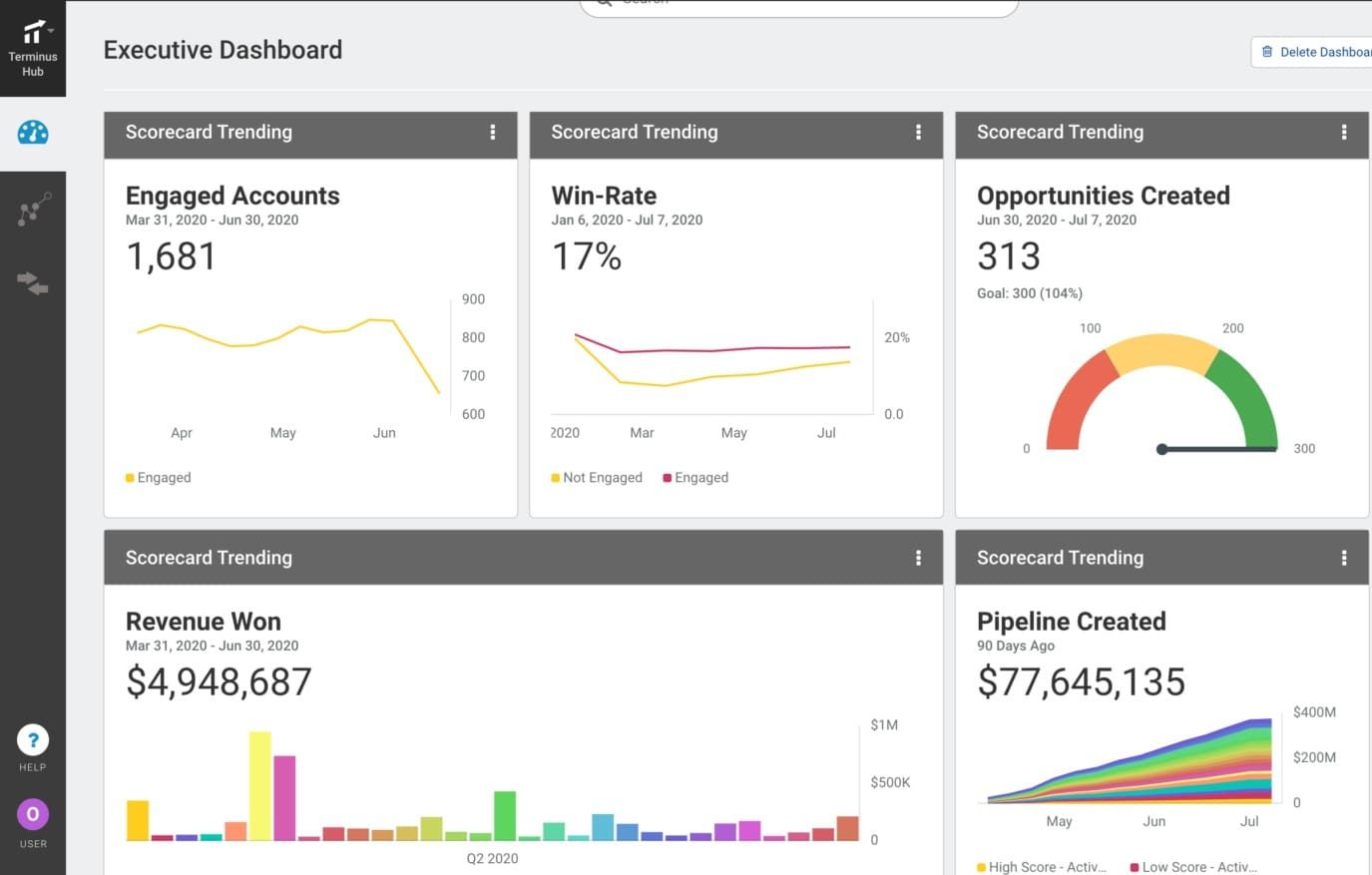

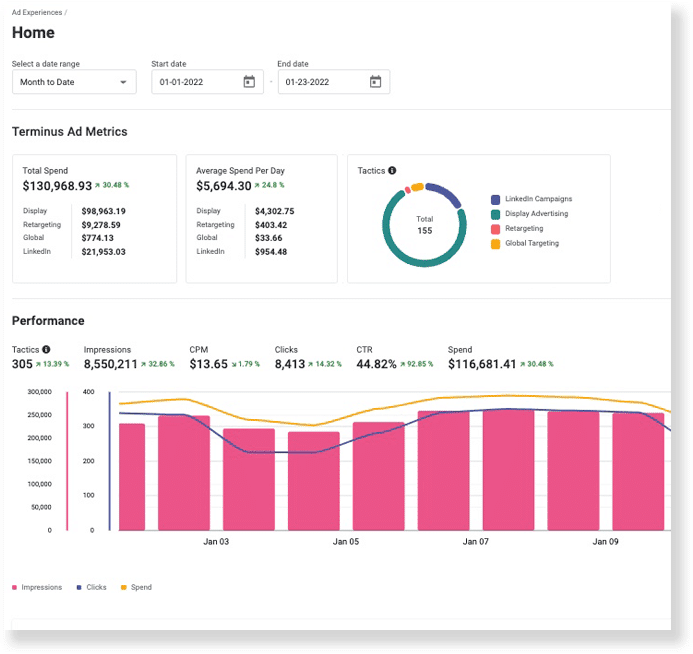

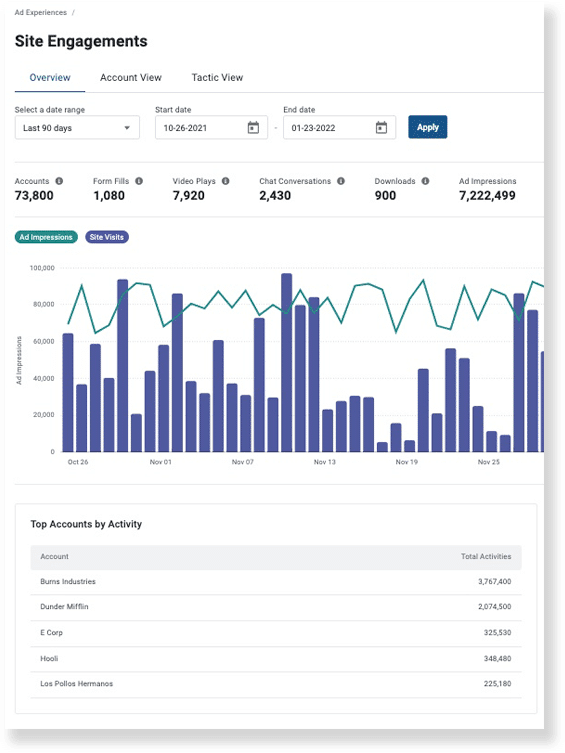

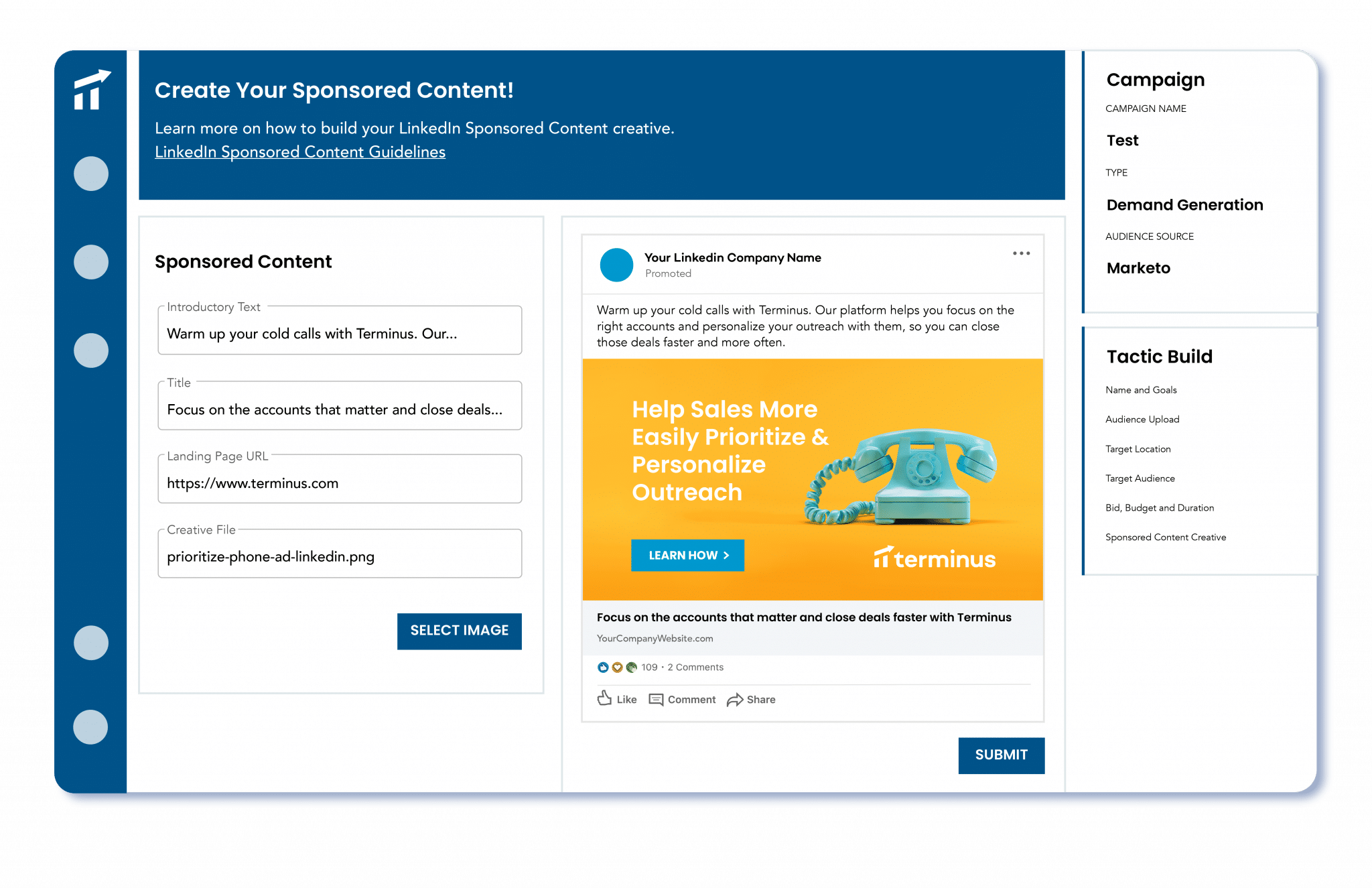

Terminus (by DemandScience)

Ad-first engagement platform. Its LinkedIn Marketing Solutions integration updates delivery and analytics quickly.

Does Terminus fulfil the prerequisites?

Partly.

Limited company-level impression tracking per campaign

Strong for uploaded or CRM Matched Audiences, but it will not cover every account outside those lists.

Two-way CRM integration

Salesforce-centric funnel views and executive dashboards.

Additional features

Additional features of Terminus:

Multi-channel, multi-touch attribution

Build and trigger LinkedIn campaigns inside Terminus

Triggers from Outreach, Salesloft, Uberflip, Bombora intent, and more.

Cons

- More ad-ops centric than a full ABM suite.

- Contract floors can pinch smaller teams.

Bottom line: Good LinkedIn analytics within curated lists. Pricing can be heavy if you advertise on LinkedIn only.

Terminus pricing

Now part of DemandScience. Contact sales.

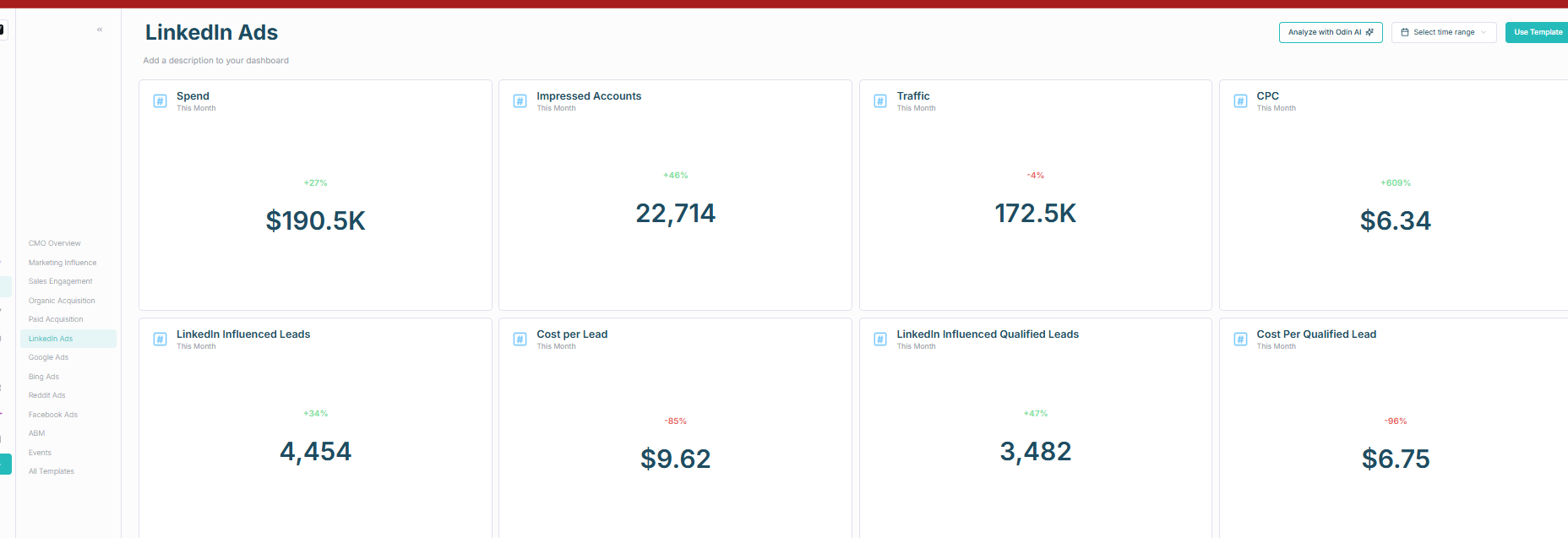

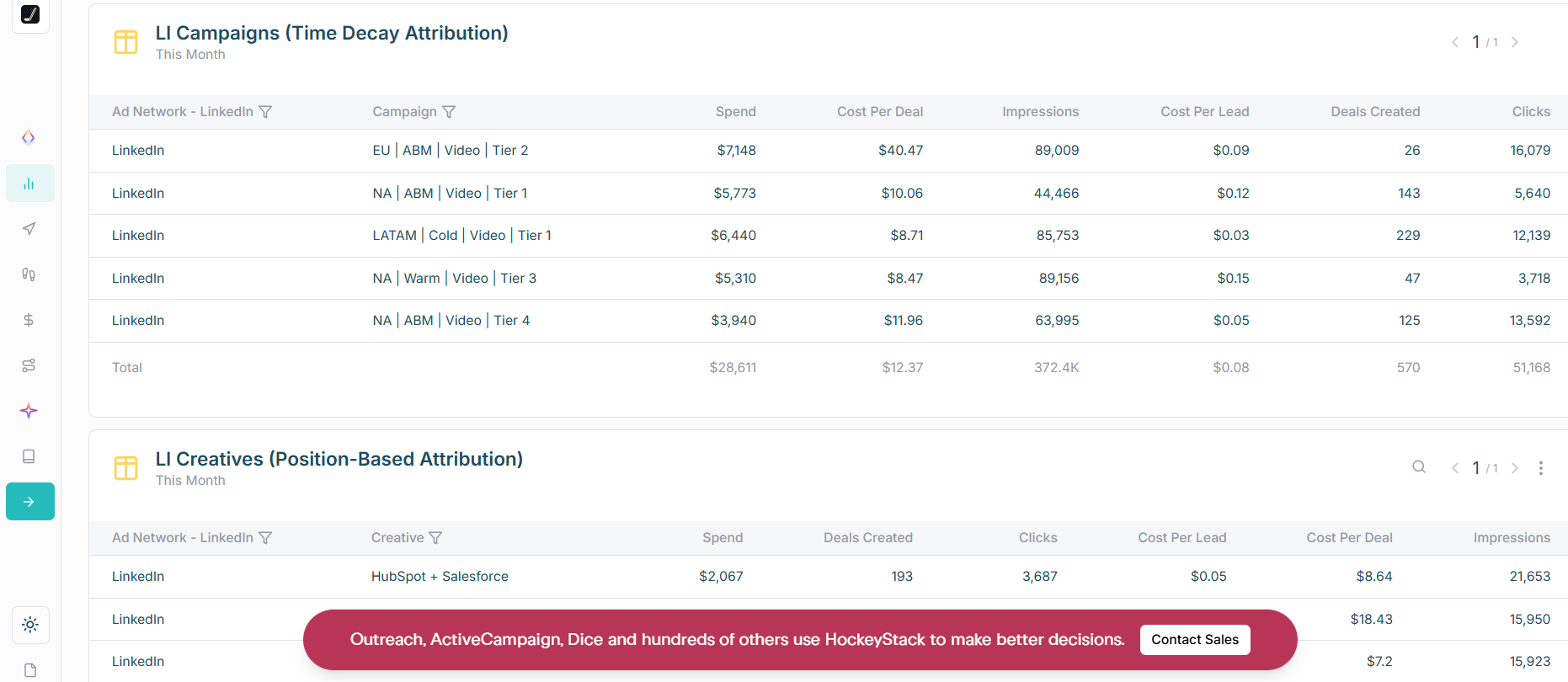

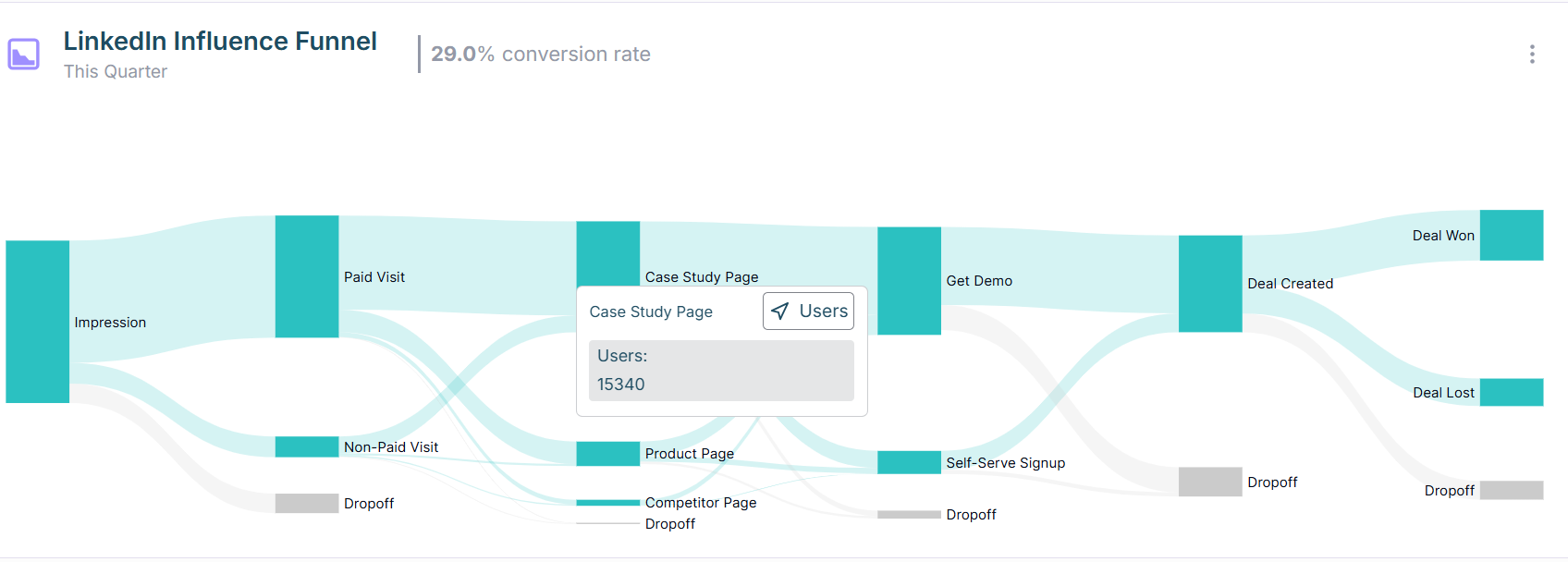

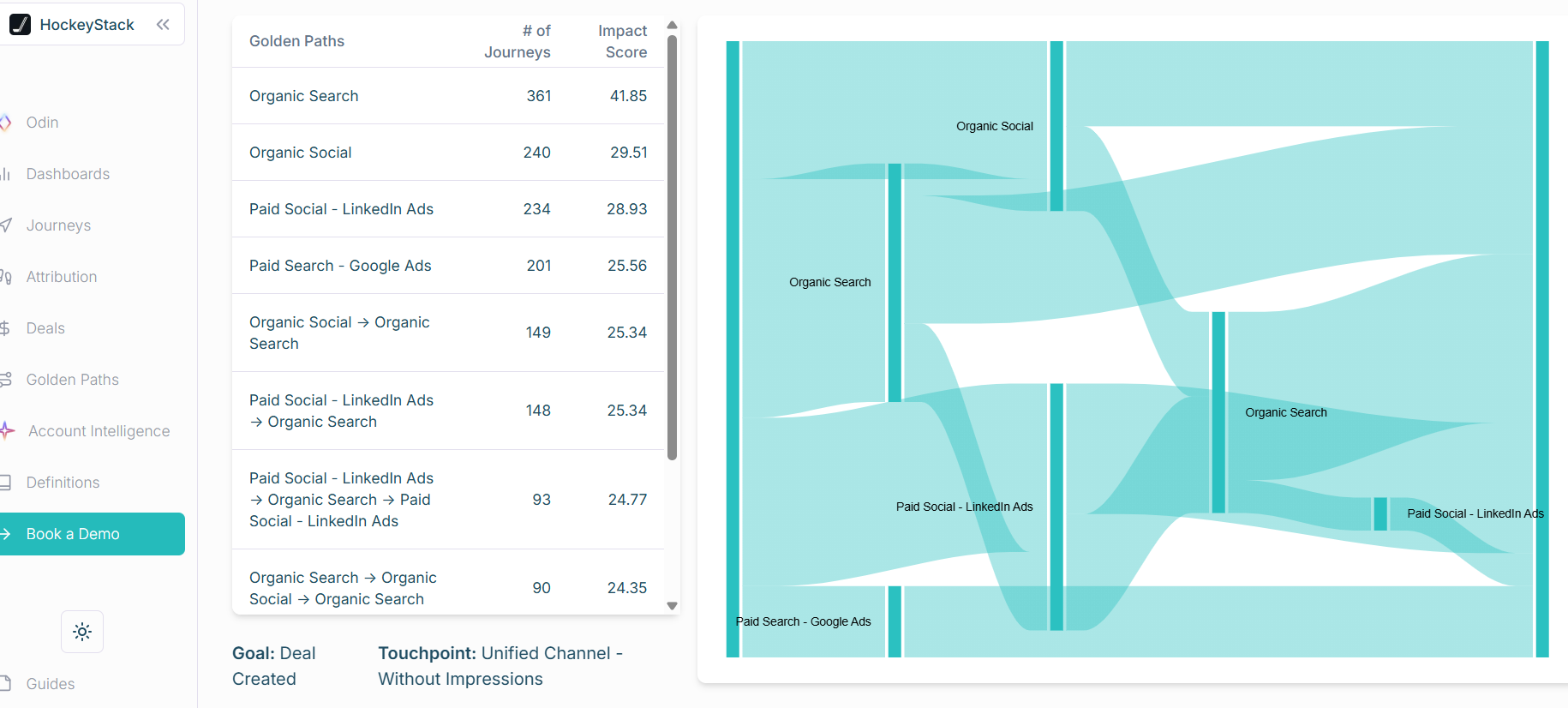

HockeyStack

B2B analytics platform that blends LinkedIn Ads, site analytics, and CRM touchpoints into account and person-level paths.

Does HockeyStack fulfil the prerequisites?

Almost.

First-party company-level impression tracking

CRM integration for pipeline and revenue

Note: One-way CRM sync. You will need workflows to push back into CRM properties.

Additional features

These are Hockeystack’s additional features:

Multi-channel, multi-touch attribution across 17 sources

Cons

One-way CRM sync, identity reliance on cookies and IP, and some UI depth gaps (see G2).

Bottom line: Strong cross-channel analytics with account-level LinkedIn impressions. Expect a learning curve and extra CRM work.

HockeyStack pricing

Sales-led. See the pricing page.

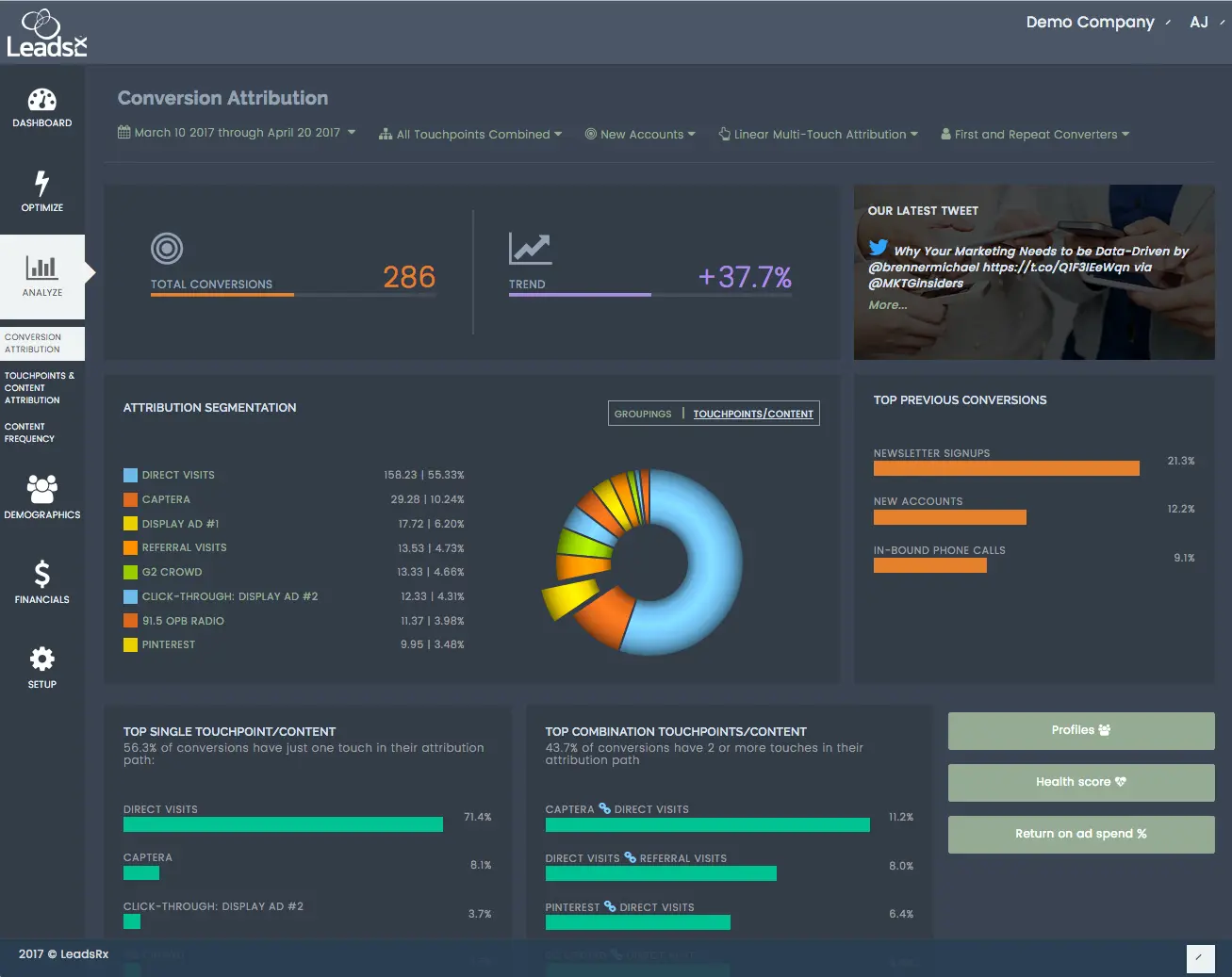

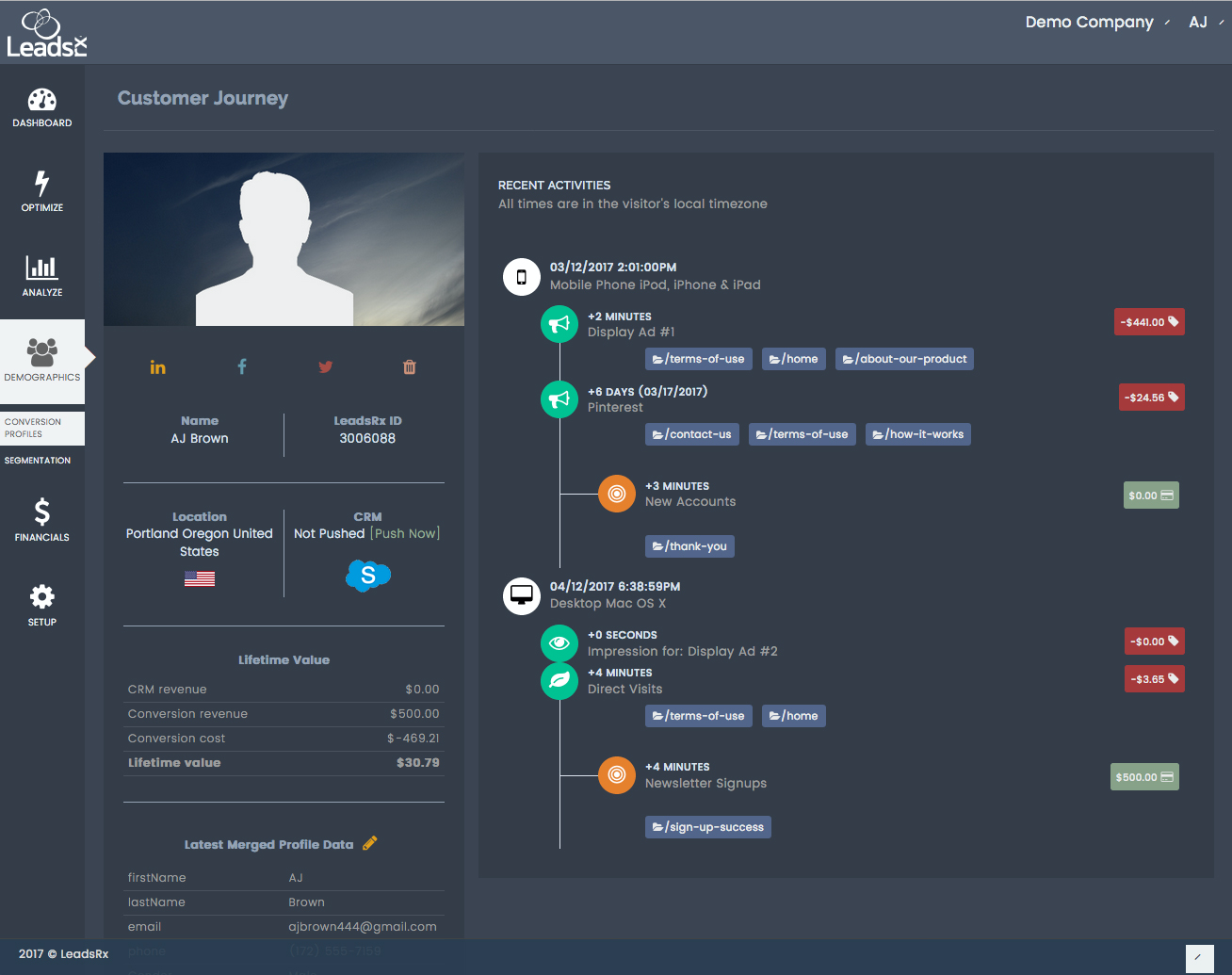

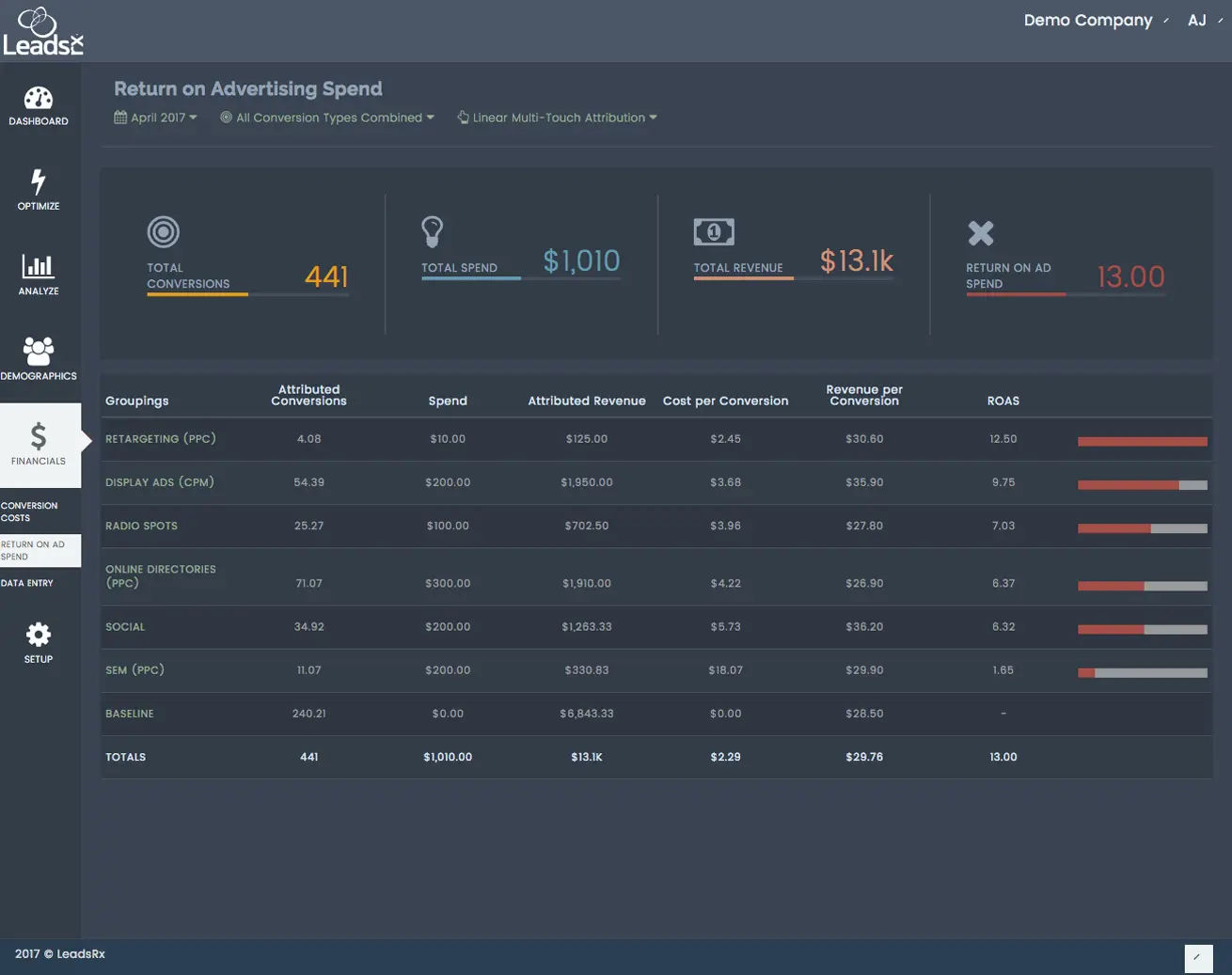

LeadsRx

Universal pixel plus offline ingestion for multi-touch attribution.

Does LeadsRx fulfil the prerequisites?

Partially. No LinkedIn API and cookie-centric. Company views depend on your CRM joins and forms. Lead Gen Forms need webhooks.

What is good about LeadsRx?

Excellent for mixed media such as radio, events, and podcasts alongside digital. Clean journey maps and ROAS views.

Bottom line: Great omnichannel lens. Weak for a view-through LinkedIn-first ABM strategy.

LeadsRx pricing

6Sense

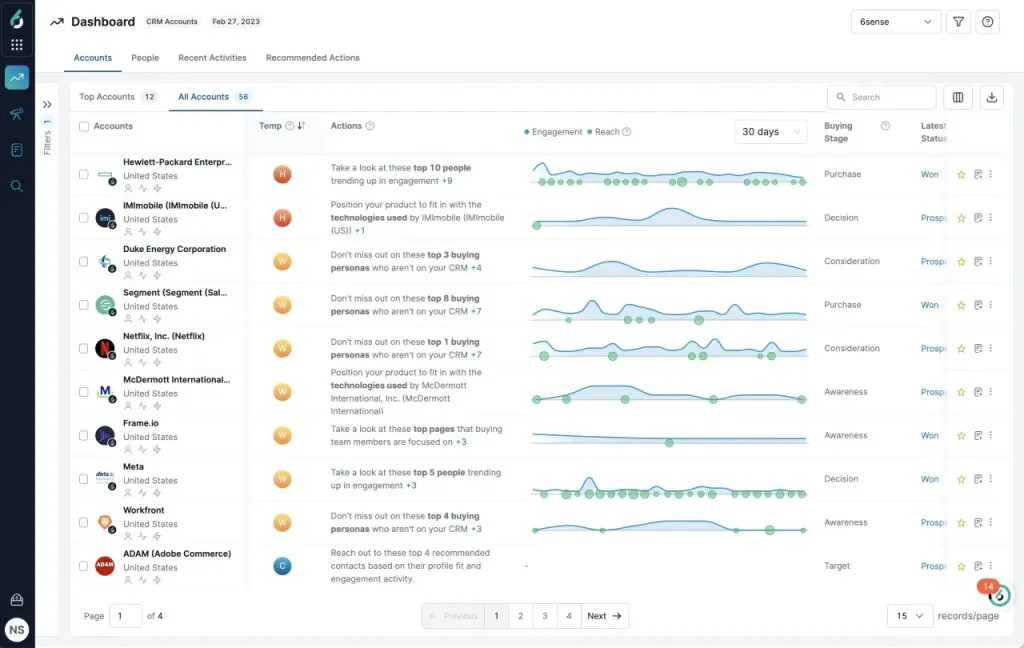

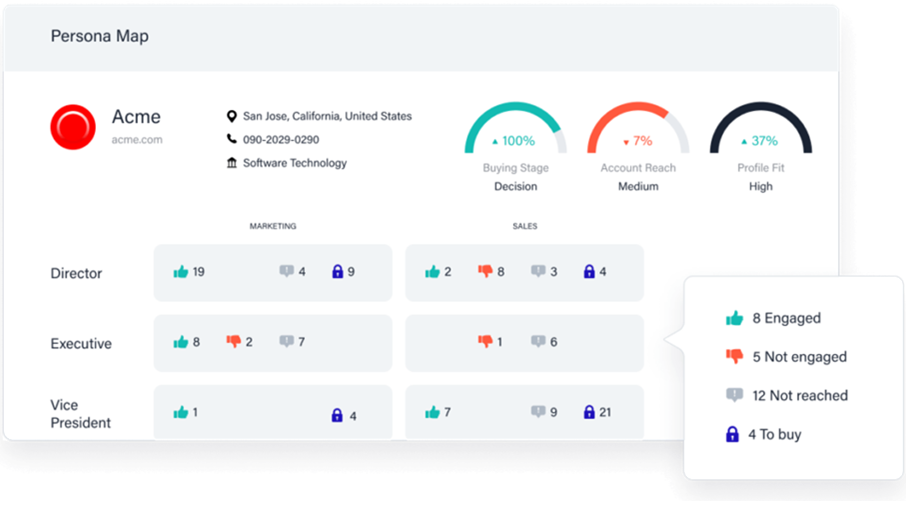

Known for account ID, intent, and predictive scoring, with a tighter LinkedIn connection since 2023.

Does 6Sense fulfil the prerequisites?

No. LinkedIn remains aggregate, and impression-by-account is not exposed. A click or visit is needed for attribution, which undercounts view-through influence on the pipeline.

What is good about 6Sense?

6sense’s highlights:

Advanced segments and targeting

Contextual ads

Persona coverage

Cons

- Complex onboarding and navigation.

- Total cost can stretch smaller teams.

Bottom line: Great for display and targeting, but can be an overkill for most SMBs.

6Sense pricing

Not public. Contact sales.

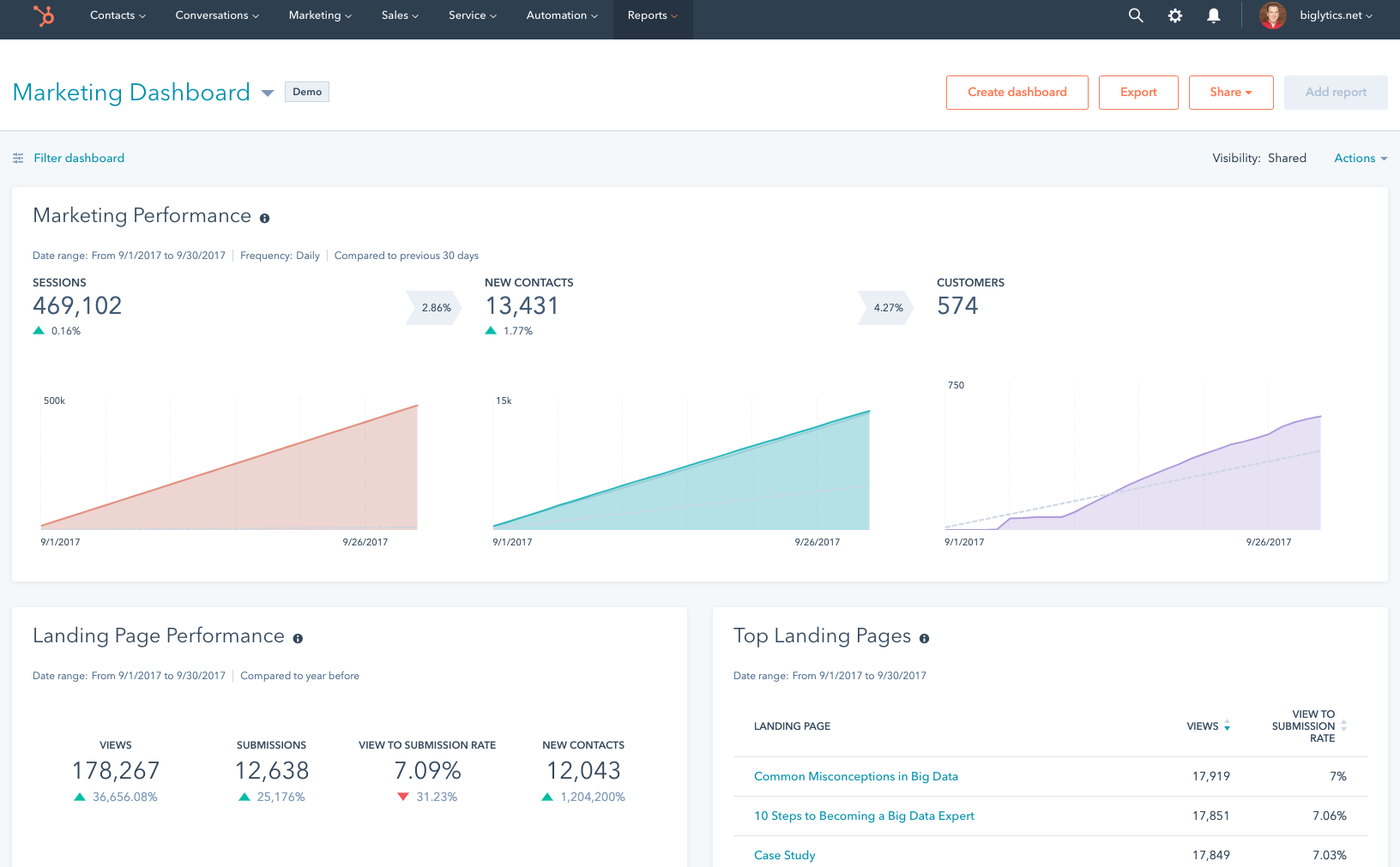

HubSpot Marketing Attribution

Native ads tool and attribution module. Pulls clicks and lead form data from LinkedIn into reports.

Does it fulfil the prerequisites?

- No impression-level account analytics.

- Contact and deal-centric attribution over company exposure.

- CRM strengths aside, the lack of impressions leaves pipeline reporting for a LinkedIn-first ABM strategy incomplete.

What is good about HubSpot Marketing Attribution?

For click-based contact attribution, it is straightforward. Connect clicks to contacts to revenue. Flip models such as First, Last, Linear, U or W, and Time Decay.

Cons

No custom weights and limited ad types via API. Practitioners note constraints, as many reviews indicate.

Bottom line: Excellent CRM and MAP. Not a strong pick among effective ABM tools for B2B marketing for impression-led LinkedIn reporting.

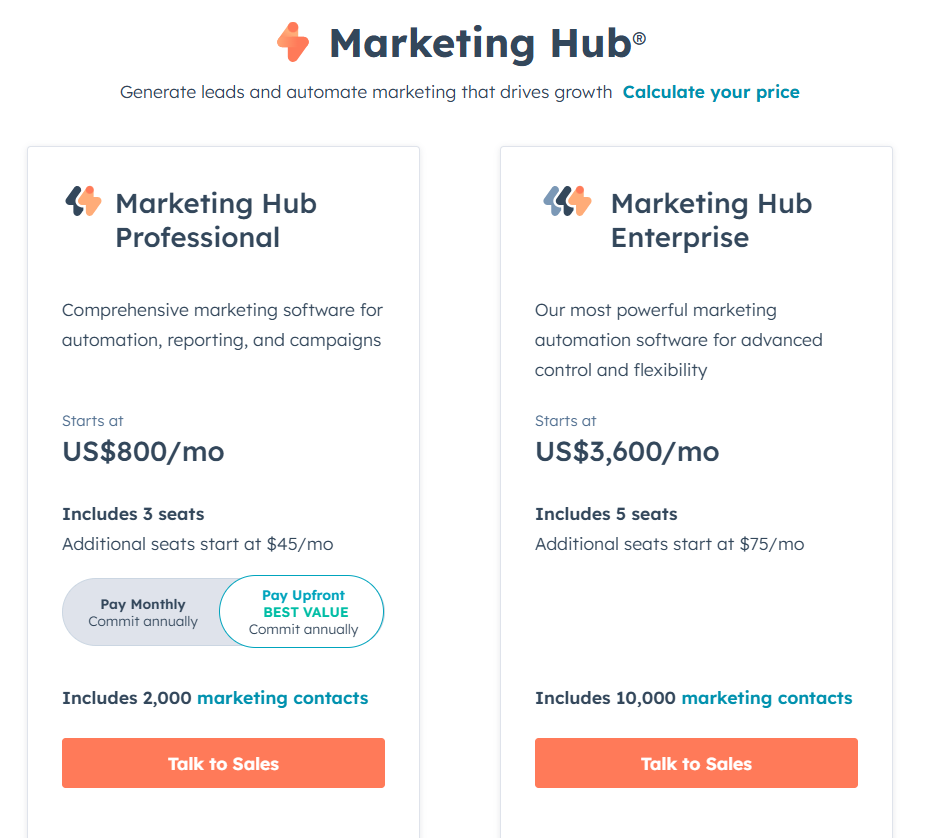

HubSpot Marketing Attribution pricing

- Marketing Professional from 800 dollars per month. Better ad management and custom reports. Not full revenue attribution.

- Marketing Enterprise from 3600 dollars per month. Multi-touch revenue attribution.

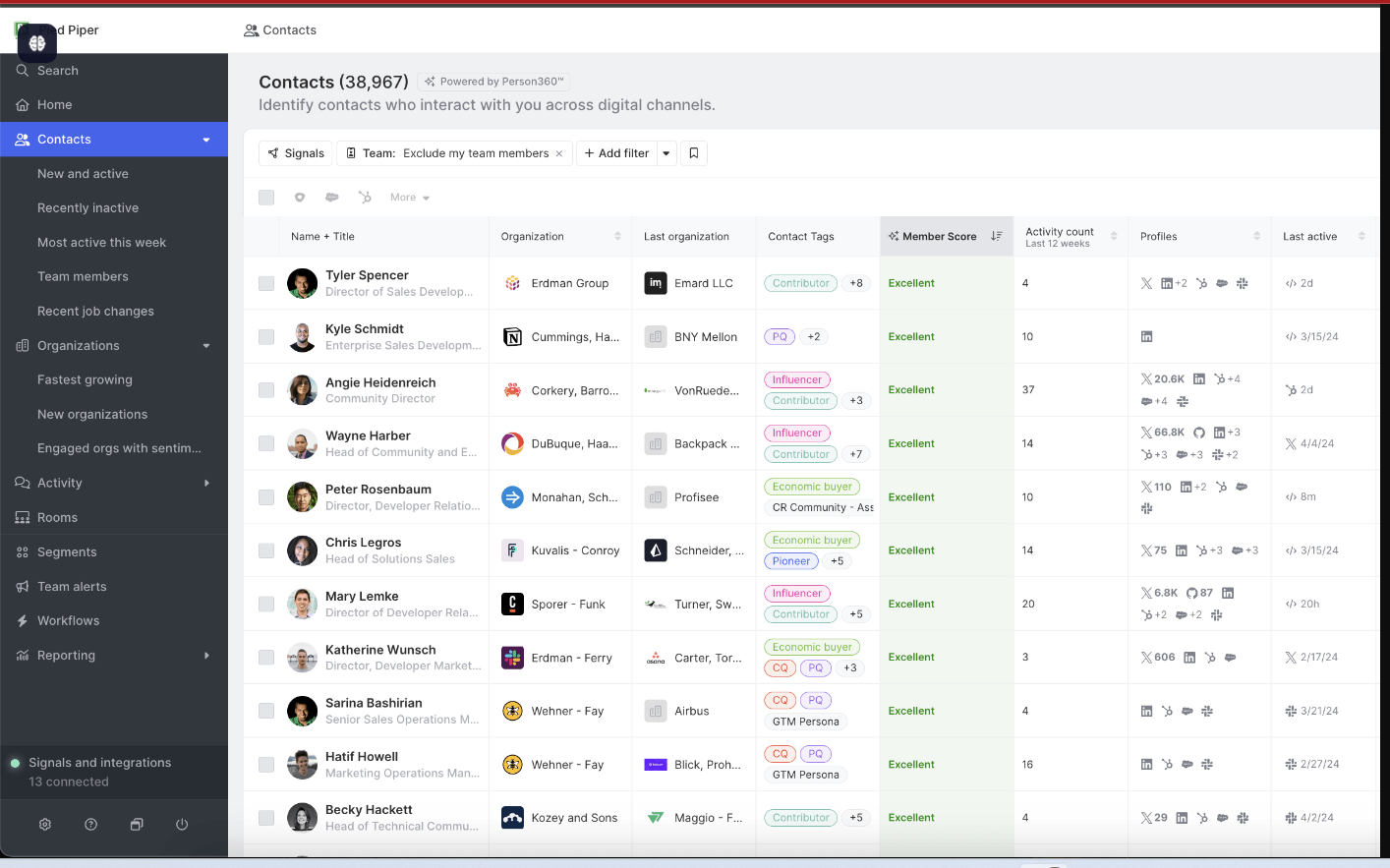

Common Room

Community intelligence that pulls LinkedIn engagement, Slack, social, and product signals to surface warm accounts.

Does it fulfil the prerequisites?

No. There is no account-level ad impression tracking, so the ABM pipeline read is incomplete compared to effective ABM tools for B2B marketing that use the LinkedIn API.

What is good about CommonRoom?

Great stuff in Common Room:

Community tracking and AI

Correlate community spikes with LinkedIn pushes and let RoomieAI surface patterns.

Firmographic enrichment

Turn raw signups into company profiles that map back to accounts.

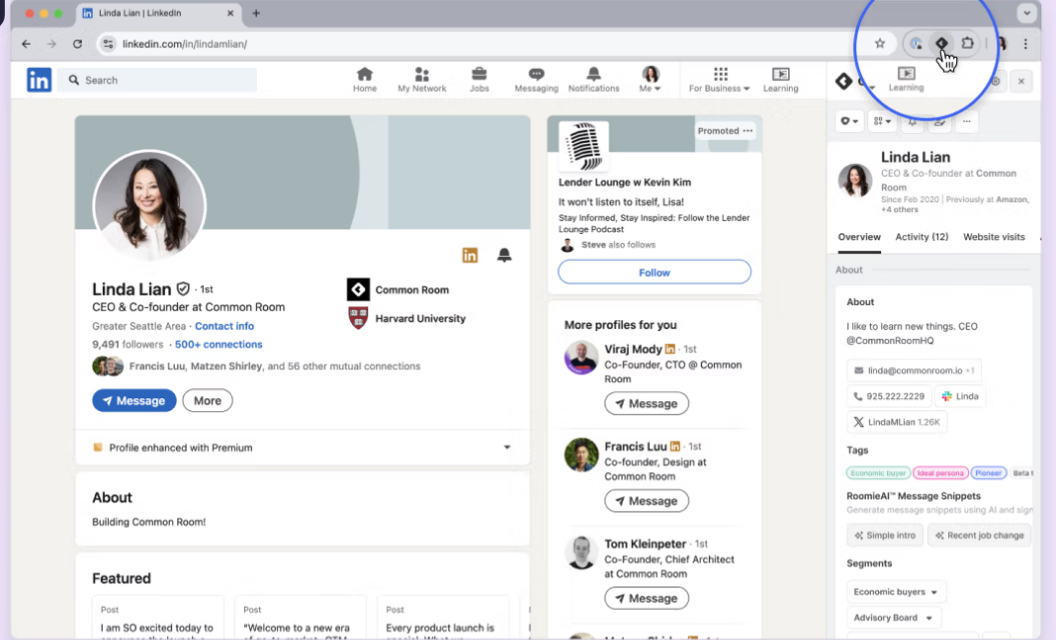

LinkedIn Chrome extension

Cons

- Seat tiers can feel rigid (G2).

- Users ask for steadier AI and more features.

Bottom line: Terrific for community-led growth. Not a substitute for ad pipeline reporting for a LinkedIn-first ABM strategy.

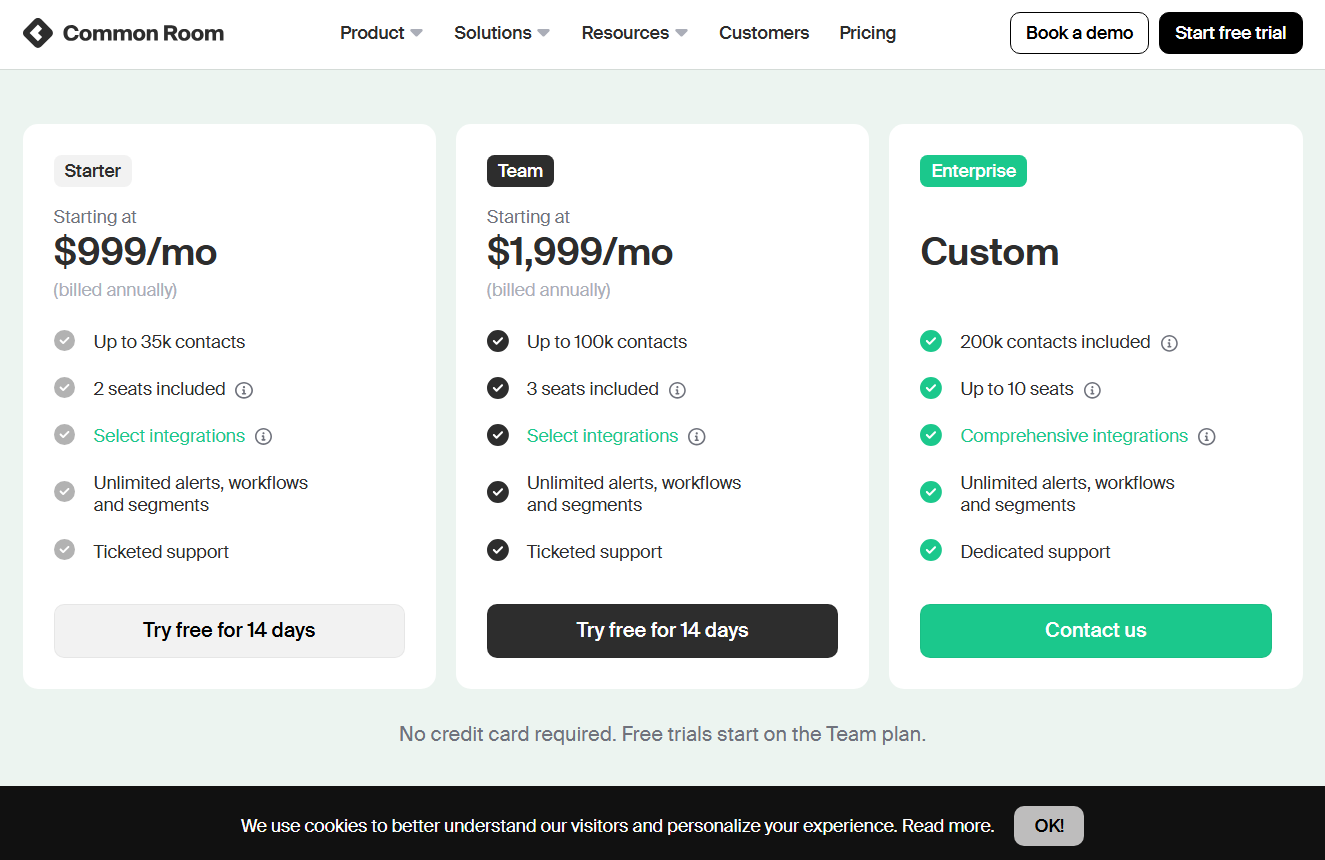

CommonRoom pricing

Starter from 999 dollars per month for 35k contacts and 2 seats. Team from 1999 dollars per month for 100k contacts and 3 seats. Enterprise is custom.

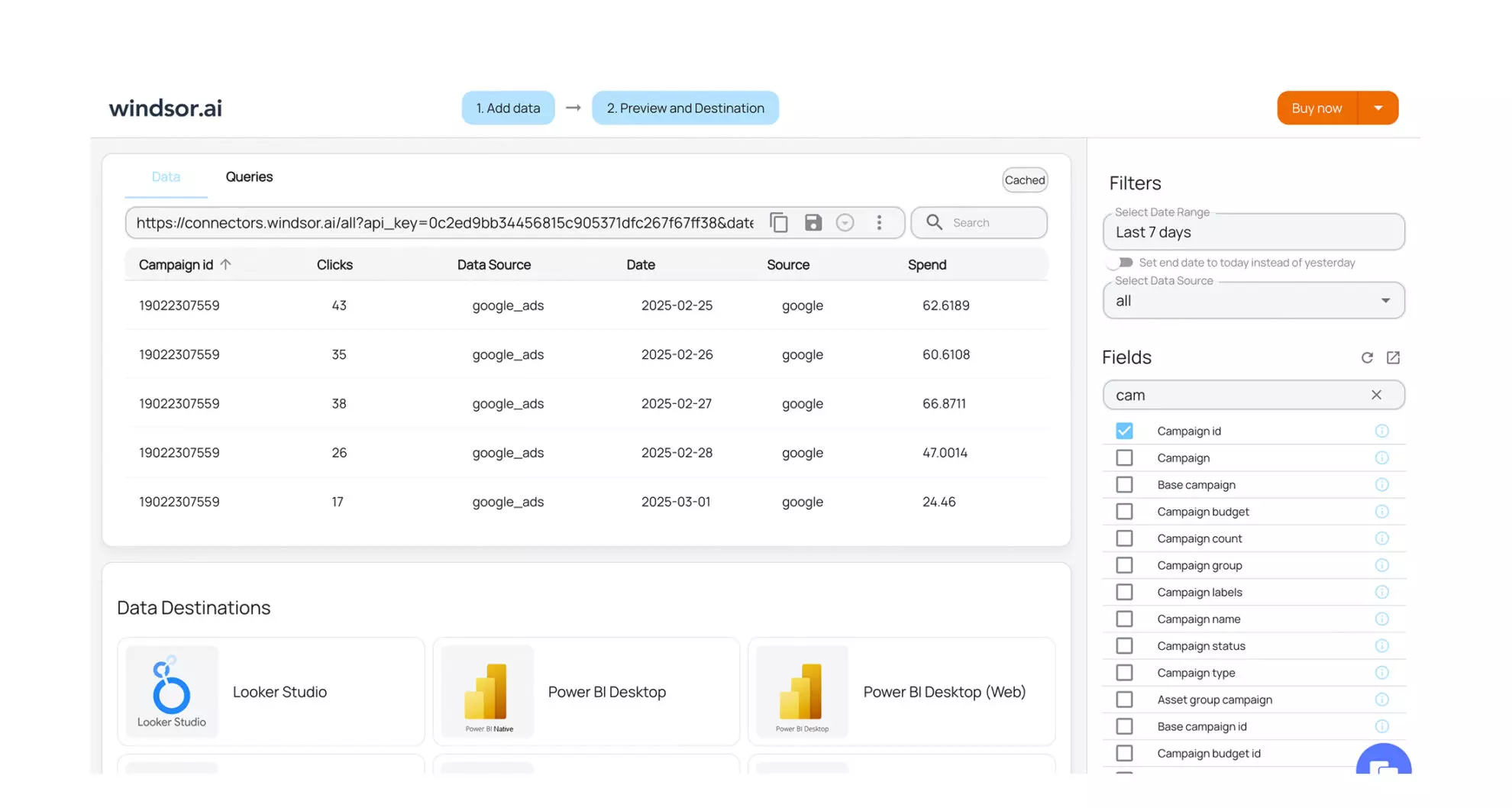

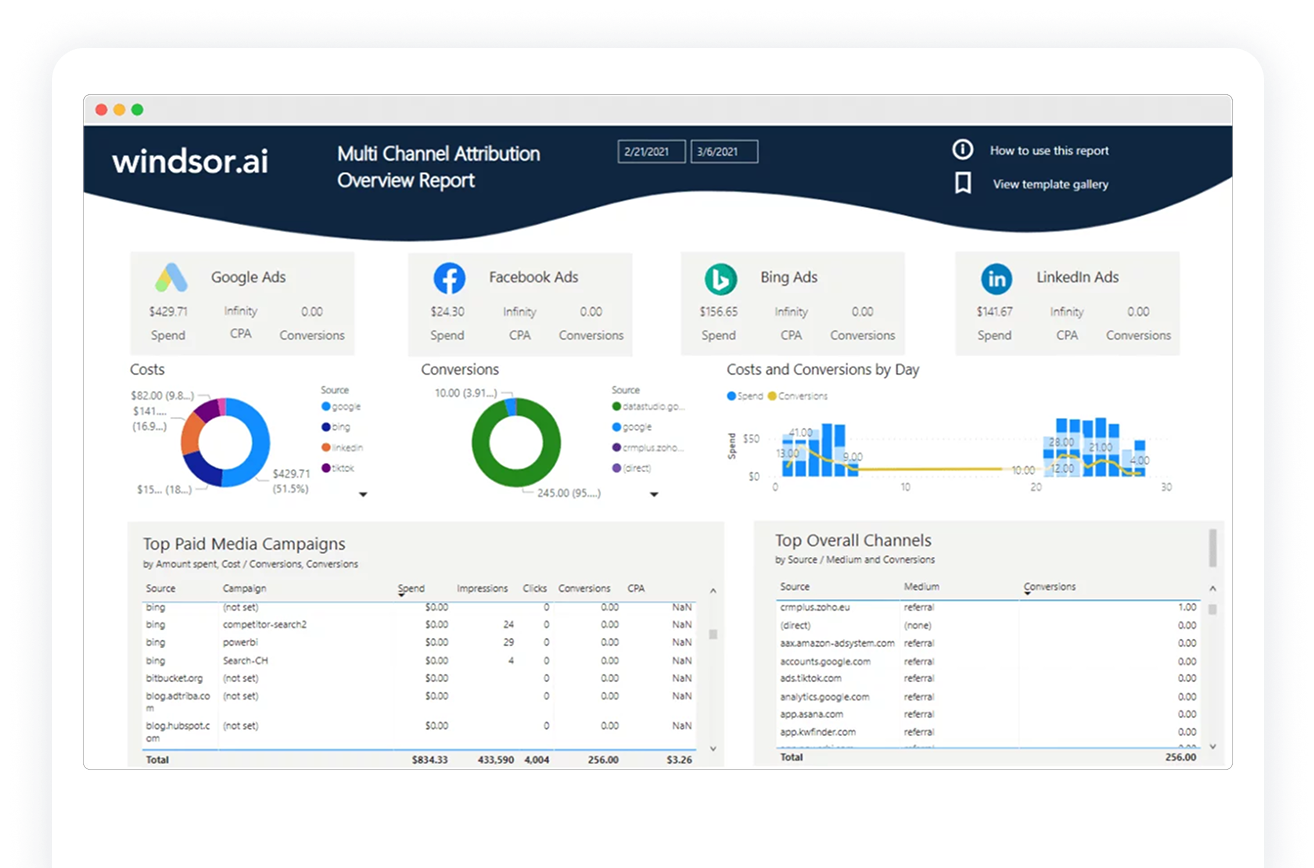

Windsor.ai

Data hub for attribution across more than 300 sources, with strong normalization and BI exports.

Does it fulfil the prerequisites?

No. It needs clicks or lead forms for LinkedIn credit and leans on reverse IP for grouping. No impression-by-account analytics and manual grouping for ABM.

What is good about Windsor.ai then?

- Multiple models, including algorithmic, with tunable weights.

- Exports that fit Python or R workflows.

Bottom line: Excellent model layer. Not a LinkedIn-first ABM reporting pick, so not a top choice among effective ABM tools for B2B marketing for this job.

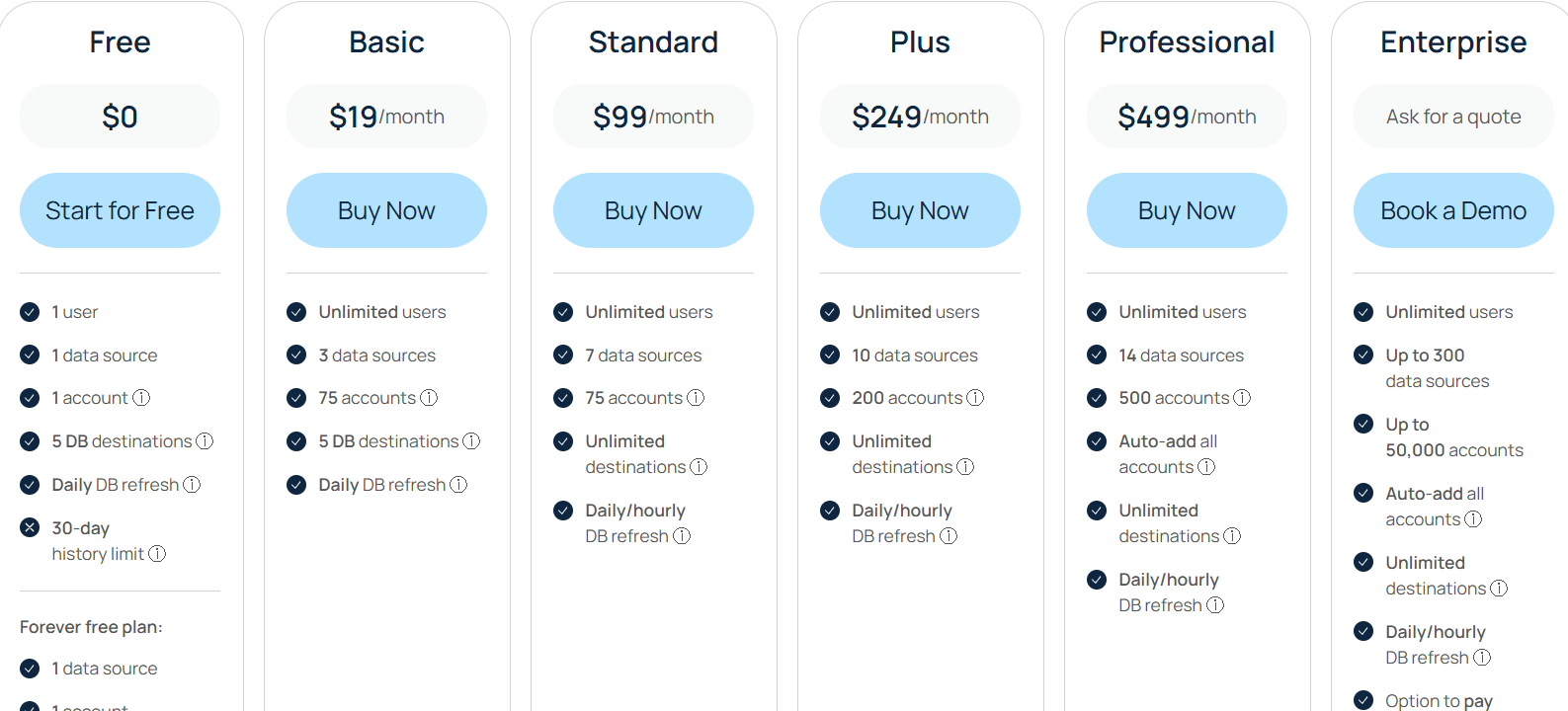

Windsor.ai pricing

Free includes 1 source and a 30-day history. Basic 19 dollars, Standard 99, Plus 249, Professional 499, and Enterprise custom.

Over to you

Demandbase, HockeyStack, Terminus, and Factors.ai are strong when you are running larger programs with multi-channel scope and deep controls. LeadsRx does not use the LinkedIn API and leans on cookies. HubSpot Attribution remains click and contact-centric. 6Sense focuses on targeting and visits more than impression-level reporting. CommonRoom surfaces community engagement, not impression logs. Windsor.ai is a stellar data layer, not an ABM first choice.

If you want a cost-conscious platform that still nails pipeline reporting and campaign orchestration for a LinkedIn-first ABM strategy, start with ZenABM. It tracks company-level impressions, maps them to CRM opportunities, writes properties into HubSpot, and shows which campaigns moved which deals, even when nobody clicked. That is the standard you want from effective ABM tools for B2B marketing. Book a ZenABM demo to see how the best tools operate in practice.