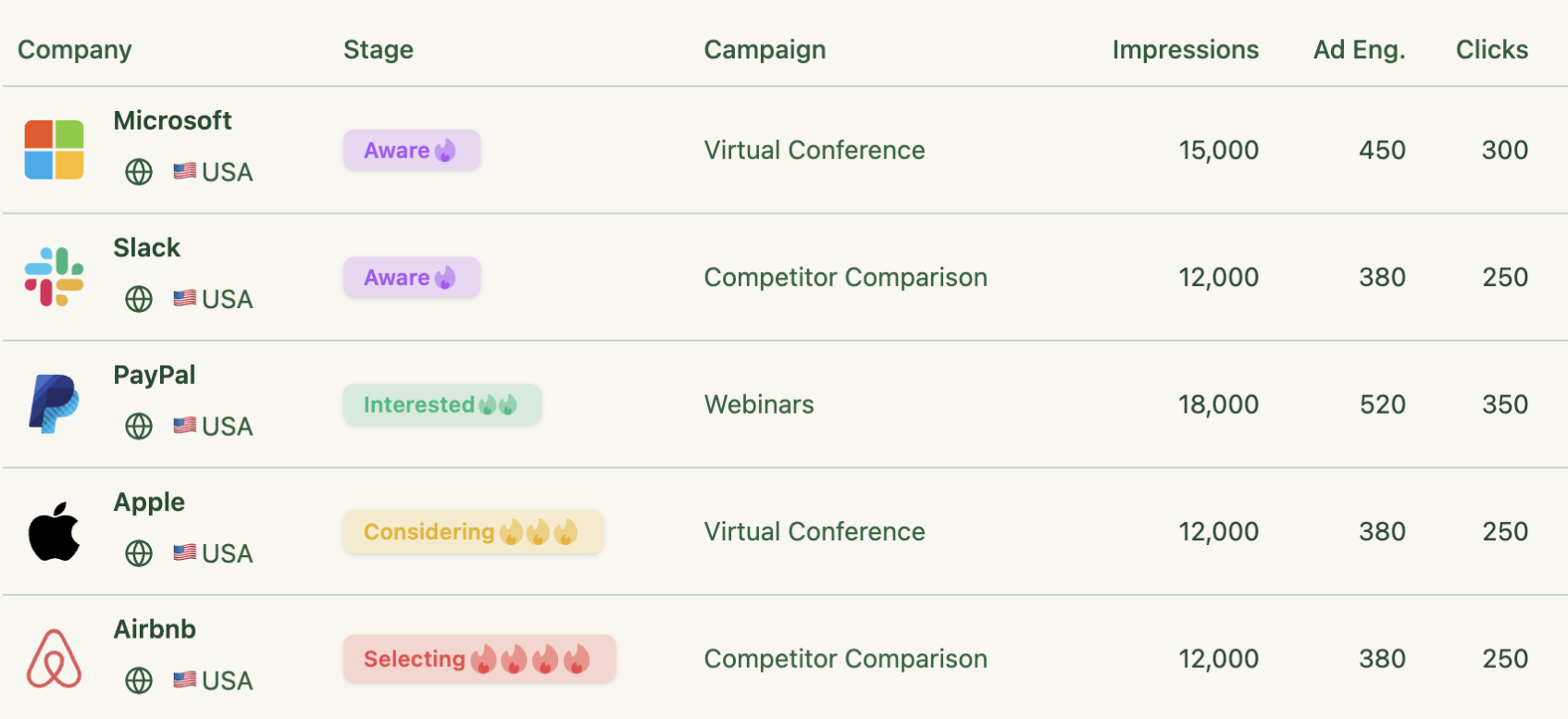

To run ABM with confidence, you need account-centric reporting that ties ad exposure (yes, down to impressions) and engagement to pipeline, movement across opportunity stages, and closed-won revenue.

If you want to defend budget and fine-tune delivery, you need a platform that is purpose-built for LinkedIn and ABM, not a generic analytics toy. This guide ranks the best LinkedIn ad reporting tools for ABM, with a clear bias toward view-through truth, tight CRM alignment, and board-ready reporting.

Let’s get to work.

10 Best LinkedIn ad reporting tools for ABM (2025): tabulated summary

| Tool | Company + Campaign-Level Impression Tracking | Two-Way CRM Integration | First-Party LinkedIn API Data | Pricing | Summary |

|---|---|---|---|---|---|

| ZenABM | ✅ | ✅ (native, bi-directional) | ✅ (via LinkedIn API) | $59–$119/mo | Built for LinkedIn ABM, with clean campaign-by-company metrics, instant HubSpot sync, clear deal matching, and very fast time to pipeline. |

| Factors.ai | ✅ | ❌ (pulls data, no native push) | ✅ (via LinkedIn API) | $399–Custom | Good impression controls plus AdPilot. Lacks native property write-back for CRM-level pipeline reporting out of the box. |

| Demandbase | ✅ | ✅ (multi-CRM, bi-directional) | ✅ (via LinkedIn API) | Custom | Enterprise ABM suite with deep controls and revenue reporting. Powerful, and priced accordingly. |

| Terminus | ⚠️ (only for Matched Audiences) | ✅ (bi-directional) | ✅ (limited to matched audiences) | Custom | Strong Salesforce fit and account views, though impression analytics are constrained to Matched Audiences. |

| HockeyStack | ✅ | ❌ (only pull; native workflow building needed) | ✅ (via LinkedIn API) | Custom | Rich journeys and account paths. One-way CRM sync means extra effort to make pipeline dashboards sing. |

| LeadsRx | ❌ (cookie-dependent) | ❌ (custom setup needed) | ❌ | Custom | Omni-channel attribution engine. No official LinkedIn account analytics for impressions, which makes it weak for ABM pipeline needs. |

| 6Sense | ❌ | ✅ | ❌ | Custom | Excellent prediction and segmentation, but it lacks impression-first, account-level LinkedIn reporting for pipeline proof. |

| HubSpot Attribution | ❌ | ✅ (internal) | ❌ | $800–$3600/mo | Great for click and contact attribution inside HubSpot. Not designed for impression-led ABM pipeline tracking. |

| CommonRoom | ❌ (tracks engagement only) | ✅ | ❌ (different LinkedIn API for contacts, not impressions) | $999–Custom | Community signals with LinkedIn engagement. Helpful context, but not a substitute for impression-level pipeline reporting. |

| Windsor.ai | ❌ | ❌ (manual account grouping) | ❌ | $19–$499+ | Excellent data hub and model playground. Not for LinkedIn ABM impression or pipeline-by-account analytics. |

What should an ABM-ready LinkedIn pipeline reporting tool deliver?

Slick dashboards and long integration lists may look fancy. For pipeline math that holds up, three pillars matter. Miss one and your numbers start to wobble.

Company-level impression tracking per campaign

Most prospects never click. Sponsored Content CTR often sits around 0.44%. LinkedIn primes demand. Someone sees your ad on Monday, searches your brand on Thursday, and requests a demo on Friday. That is not pure organic. You need impression logs at the company level by campaign and by campaign group to credit assists and connect exposure to pipeline movement.

Contact-level impression data is not available via the official API. Reverse IP guessing misses often. Treat those reads as directional only.

Two-way CRM integration

Your reporting should write back to the system of record and also pull live deal data forward for matching.

Push company-level ad data to your CRM

Sync impressions, clicks, and engagement into HubSpot or Salesforce as company properties. Kill CSVs. Make it filterable by lists, saved views, and reports that sales actually uses.

Match ad impact to your deals

Join CRM company records to LinkedIn campaign analytics. When Company X opens an opportunity and crosses your impression threshold, attribute influence to the right campaigns and refresh totals in near real time. That is pipeline reporting, not guesswork.

First-party, official data

LinkedIn polices scraping and automation.

Deanonymization relies on cookies and IP ranges. That can be fine for click paths, not for impressions, and it misclassifies regularly.

DANs add bot noise and false positives. The punchline is simple:

For ABM pipeline reporting, use first-party, account-level LinkedIn engagement via the official API.

Now, the top contenders and how they stack up.

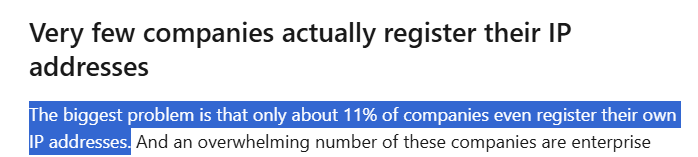

Wait, Why Not Use LinkedIn’s Own Stack for ABM Pipeline Reporting?

This article focuses on the tools you should use for ABM pipeline reporting. If you are wondering why not rely on LinkedIn’s native stack, here is the reason:

LinkedIn’s Revenue Attribution Report is lead centric, while ABM pipeline reporting is supposed to be account centric. You can stitch the native pieces together to see revenue influence from leads, but you will still miss critical account-level insights for the pipeline.

What the native stack covers today

First, here is how to set up the native reporting:

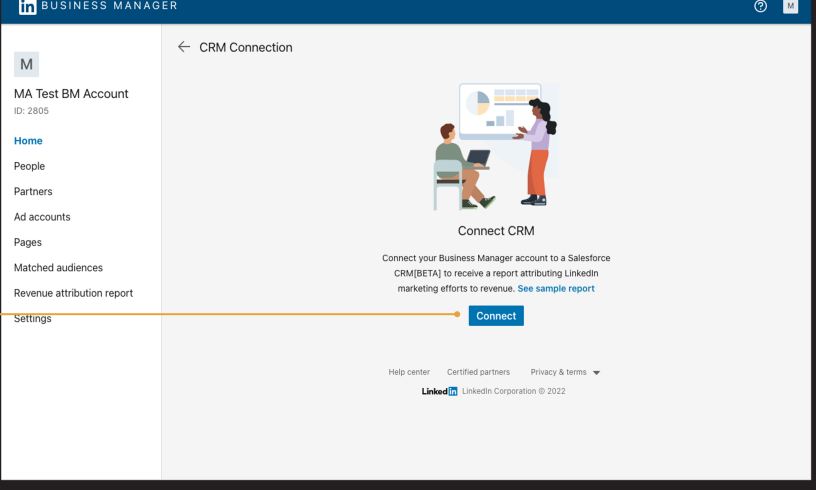

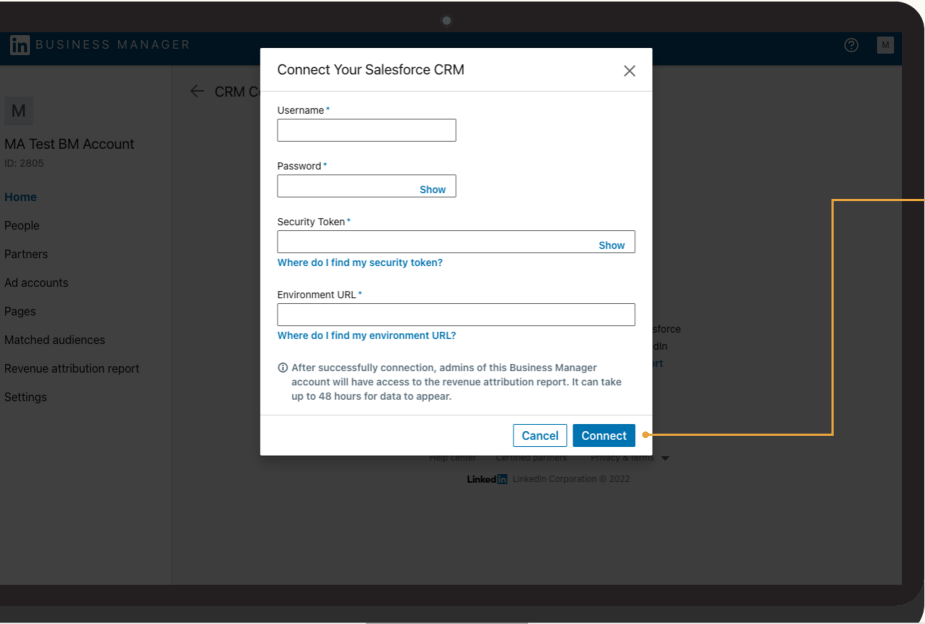

Connect your CRM to RAR:

Provide the requested credentials, including Username, Password, Environment URL, and Security Token:

Data can take up to 72 hours to appear. Confirm the CRM opportunity field that RAR should treat as the revenue source of truth.

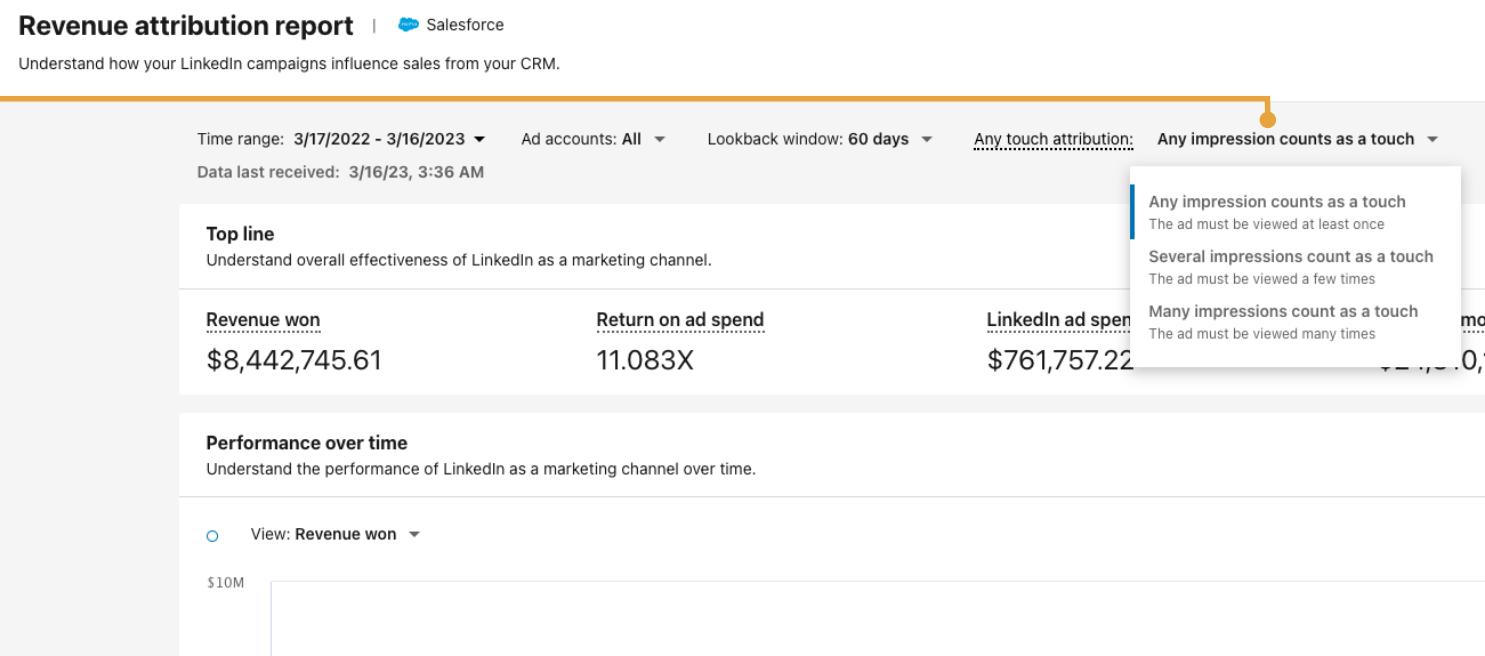

Set your minimum impression threshold for influence:

- Single impression counts as influence.

- A few impressions count as a touch.

- Many impressions raise the bar for influence.

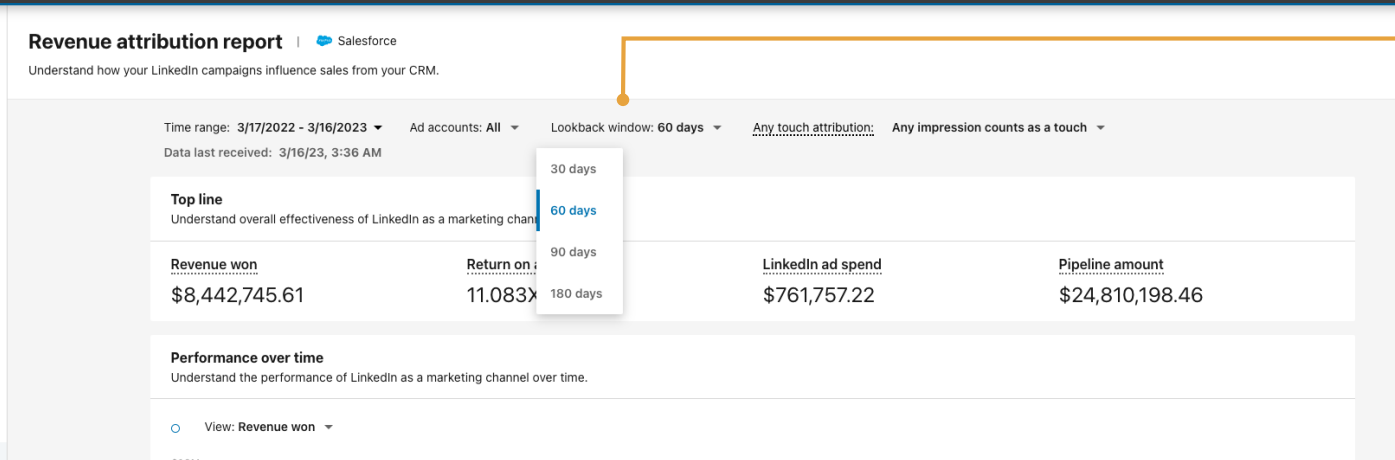

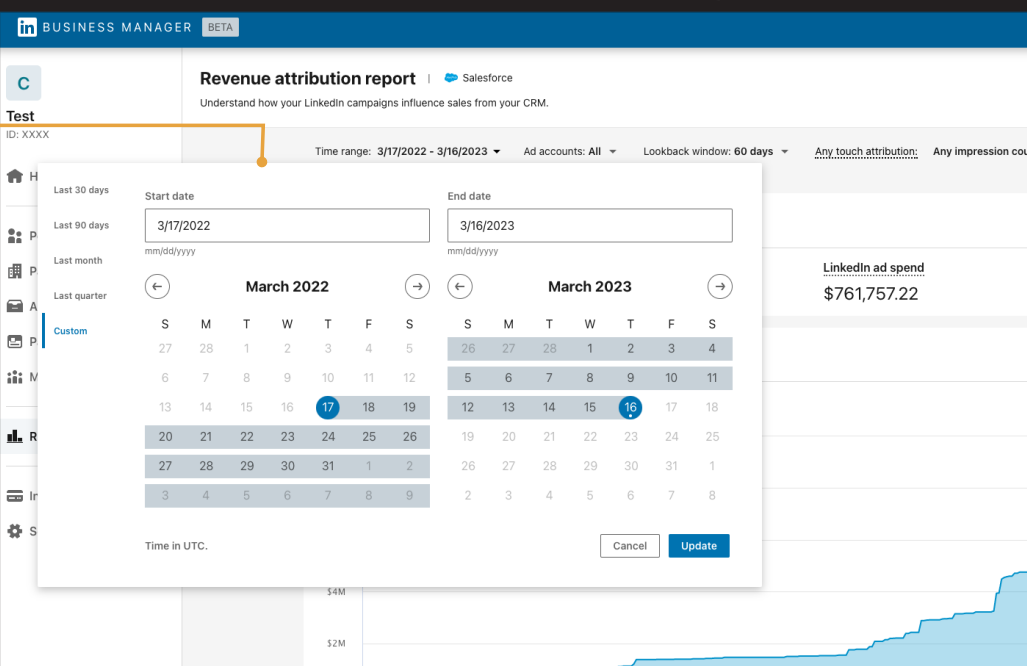

Choose a lookback window:

Then set the reporting time frame:

If you run multiple ad accounts, filter by the account or combine them as needed.

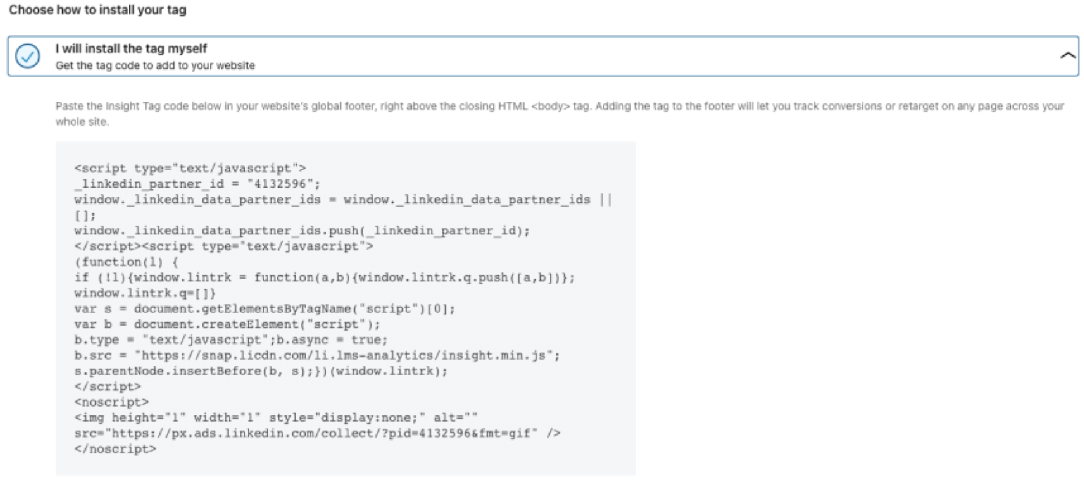

Install the Insight Tag across your site:

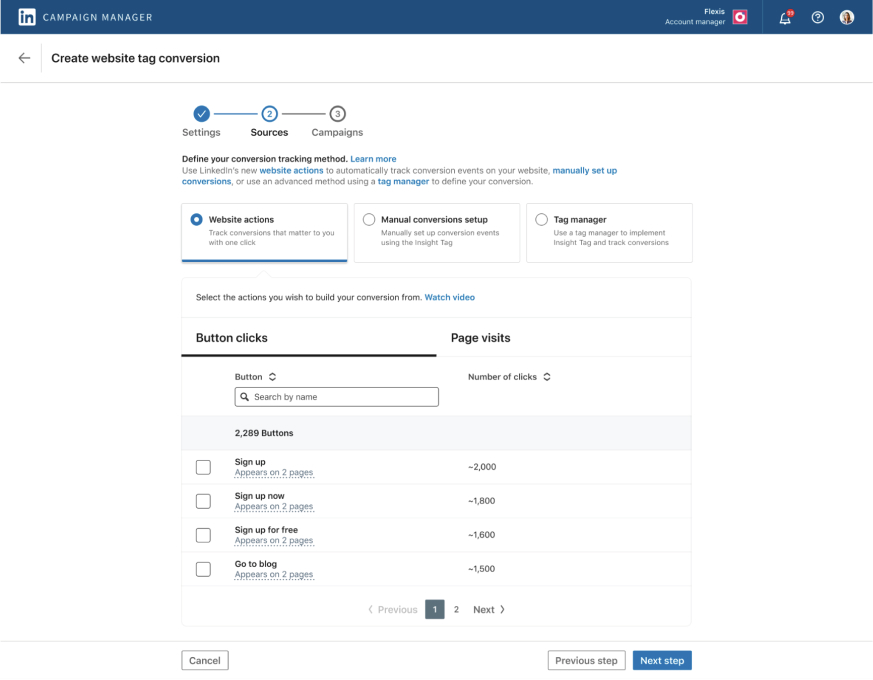

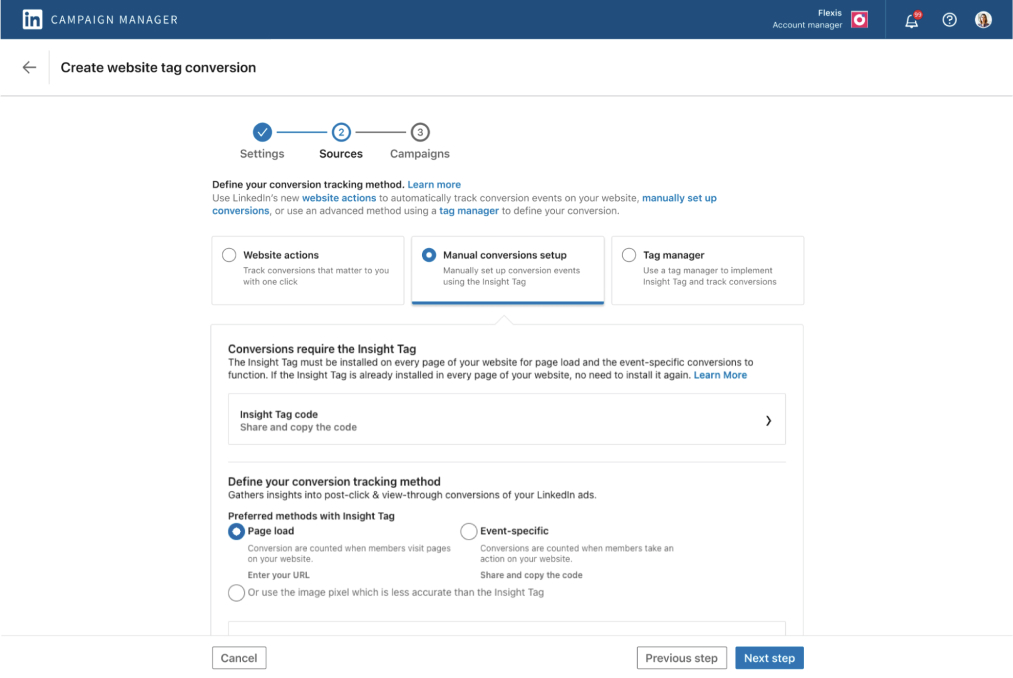

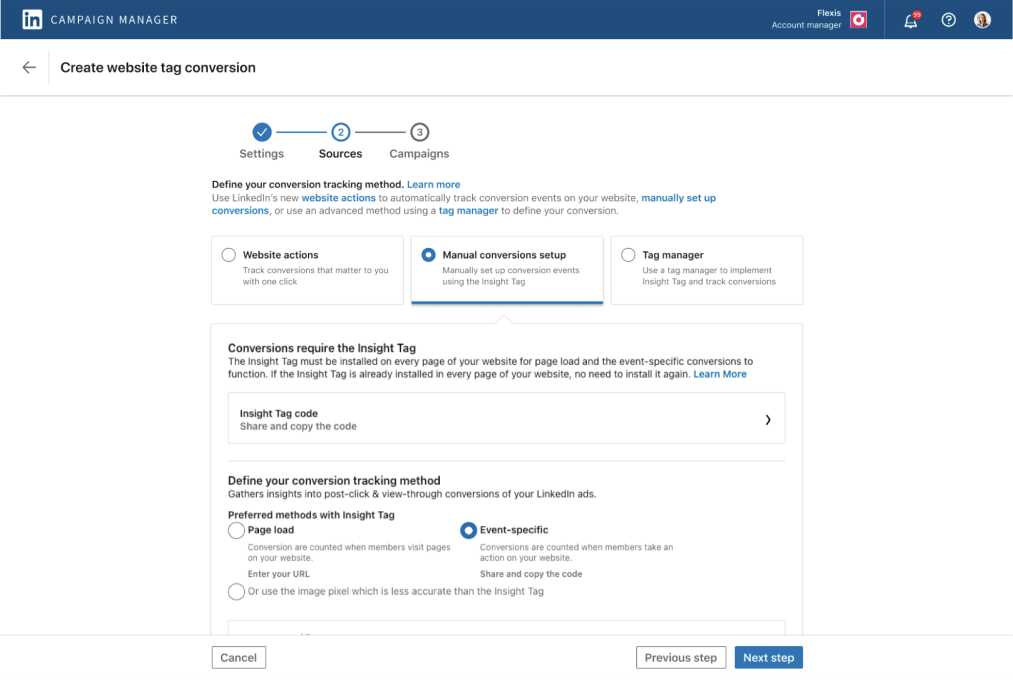

In Campaign Manager, configure conversions:

- Website Tag Conversions: submissions or link clicks that load a thank you page.

- URL or Page Conversions: visits to specific URLs after an ad click. Useful for deeper content like a blog post.

- Event Conversions: actions that do not change the URL, for example AJAX submits.

Set up CAPI as well:

- Mirror the same conversions in Campaign Manager.

- Post server-side events to

/conversionEventswith the rule URN, timestamp, value, and hashed identifiers.

Now, with this setup done, RAR can attribute most online conversions that preserve cookies and device continuity. To capture more, upload offline conversions from your CRM into Business Manager or stream them via CAPI with timestamps and hashed emails.

Where the native stack fails for ABM pipeline proof

- Lead lens, not account lens. Buying groups convert with many people. RAR ties influence to individuals and misses company-level lift across contacts.

- View-through gaps. Cookie loss, browser privacy, cross-device jumps, and ad blockers hide exposure that still warms the account.

- Creative and campaign opacity. RAR does not reveal the exact ad or message that moved the account into pipeline.

- Click bias. UTMs rescue clickers. They do nothing for silent viewers who still influenced the deal.

- Offline and lagged conversions. Manual files or CAPI streams are extra work. Mismatched timestamps or IDs dilute confidence.

- Person A views, Person B converts. Same company, different humans. Native reports require manual checks in Campaign Manager to infer influence.

- Arbitrary thresholds and windows. Impression minima and lookbacks change the story more than the marketing did.

- Slow refresh. Data can take up to 72 hours. Sales needs alerts in near real time when an account heats up.

- Multi-account fragmentation. Multiple ad accounts split truth unless you normalize everything outside LinkedIn.

- No account-level rollup across campaigns. You cannot see a single company’s cumulative impressions, clicks, and engagement against pipeline stages without external stitching.

If you must stay native, use these workarounds

- Mirror every critical conversion in both Insight Tag and CAPI, then reconcile against CRM opportunities.

- Automate offline uploads from CRM with strict timestamp and hashed email standards.

- Run a weekly company-level audit. List converting companies, then verify prior impressions, clicks, or engagement for those same firms in LinkedIn Campaign Manager before the conversion date.

For true ABM pipeline reporting, you need company-level capture of impressions, clicks, and engagement per campaign group, plus a clean push into the CRM with account stages and intent. That is the gap the native stack does not fill on its own.

Now let us look at tools that fully or partially provide ABM pipeline reporting.

ZenABM

ZenABM is built for LinkedIn ABM pipeline reporting. You get view-through coverage, native CRM write-back, plug-and-play ABM dashboards, and intent-based scoring. The roadmap moves quickly.

Does ZenABM fulfil the prerequisites?

These are not nice to have. They are table stakes, and ZenABM leads with them.

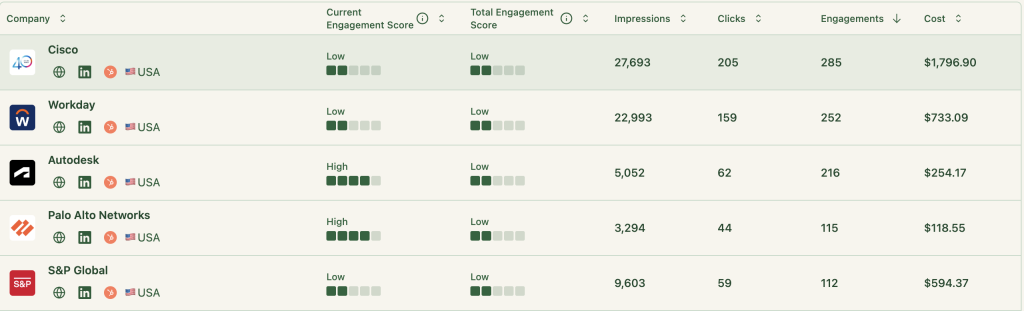

Company-level impression tracking per campaign

ZenABM records each account that:

- Was served an ad

- Reacted (like, comment, or share)

- Clicked

- Never visited your site (pure view-through)

Example. Company X collects 50 impressions with zero clicks, then opens a 75k opportunity two weeks later. ZenABM shows which campaigns warmed the account and shares credit across all exposures. All of this is via the official LinkedIn API.

Two-way CRM integration

Native, no code, and bi-directional sync, so pipeline reporting is not a science project.

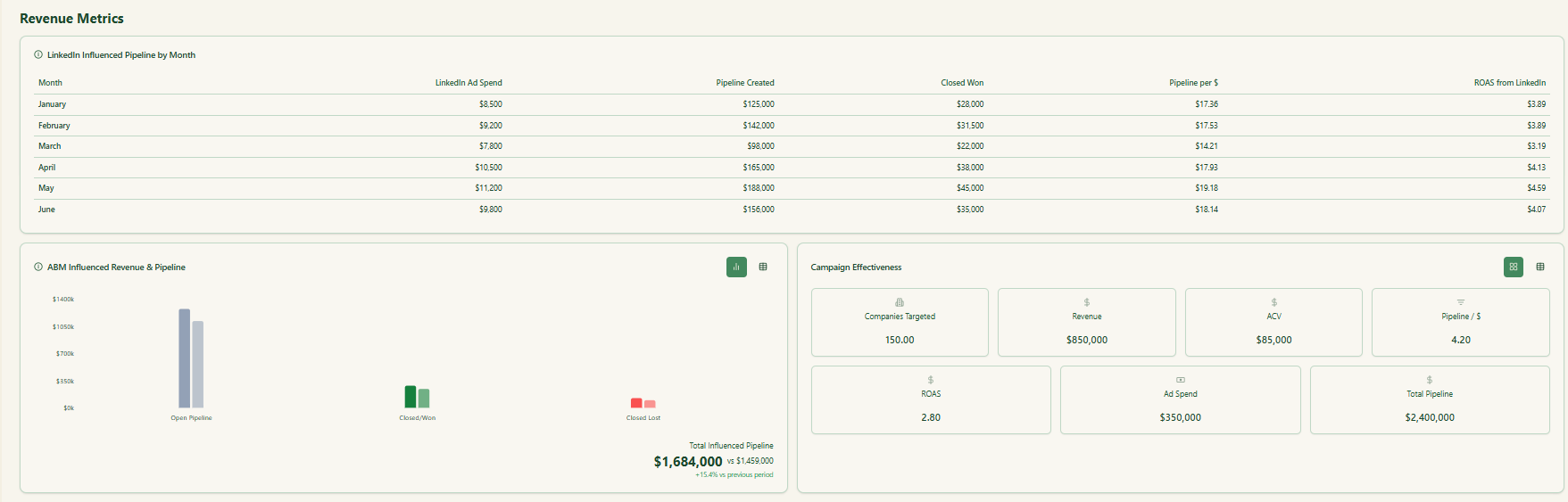

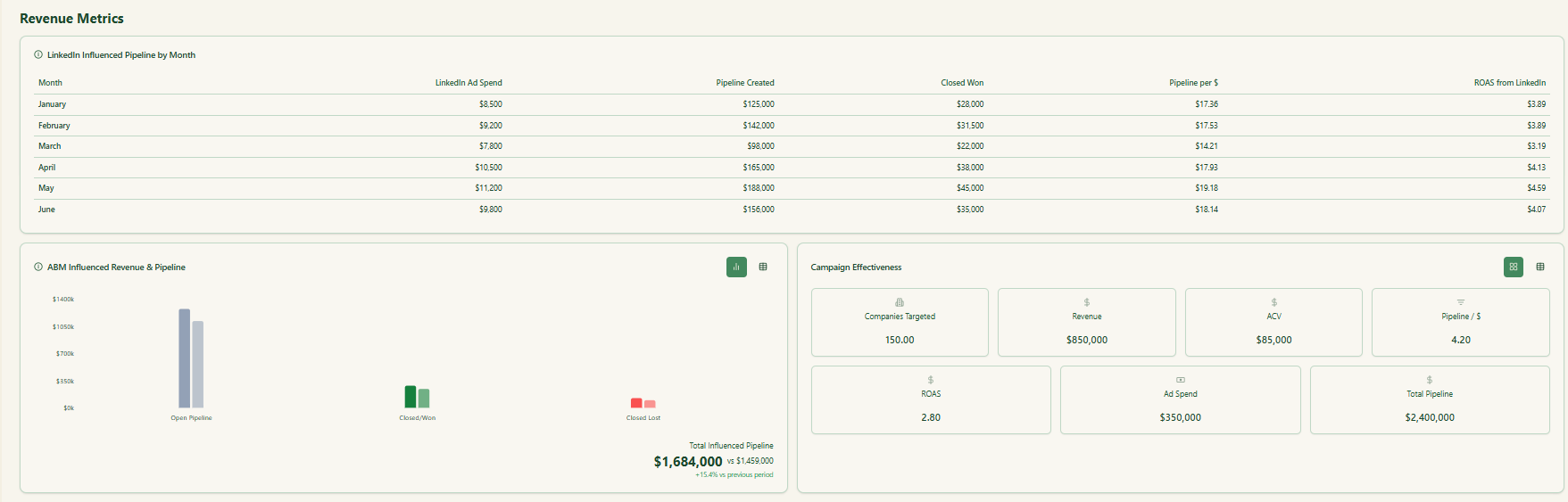

Connects LinkedIn Ads to real pipeline and revenue

ZenABM maps LinkedIn engagement to open opportunities and closed-won inside your CRM.

You also see per deal values tied to ad exposure.

So you can finally say:

- This campaign added 75k to the pipeline

- This campaign group touched 22 closed deals

- Quarterly LinkedIn ROAS ran 5.2 times

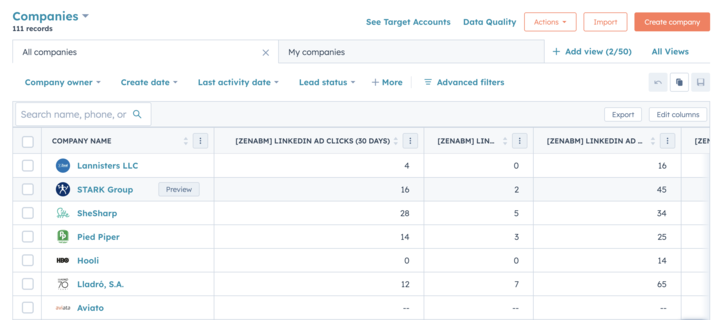

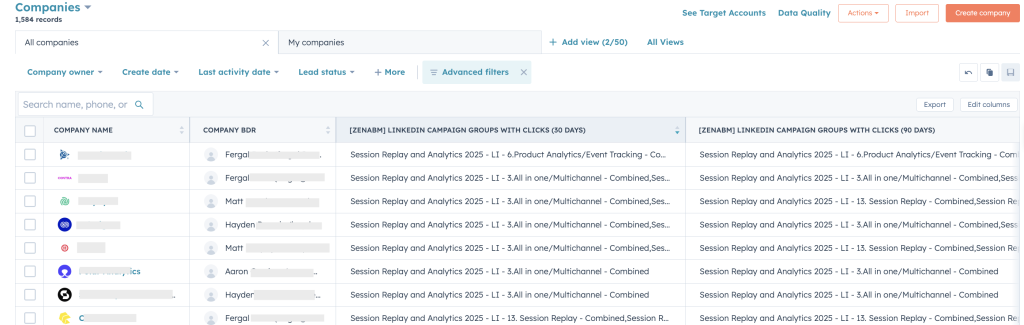

Pushes engagement data into HubSpot automatically as company properties

ZenABM writes LinkedIn engagement into HubSpot as properties like “LinkedIn Ad Engagements – 7 days” and “LinkedIn Ad Clicks – 7 days.”

What else is strong about ZenABM?

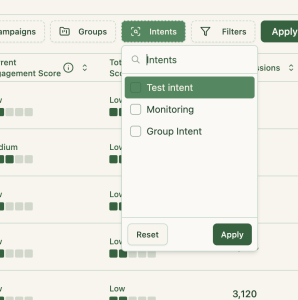

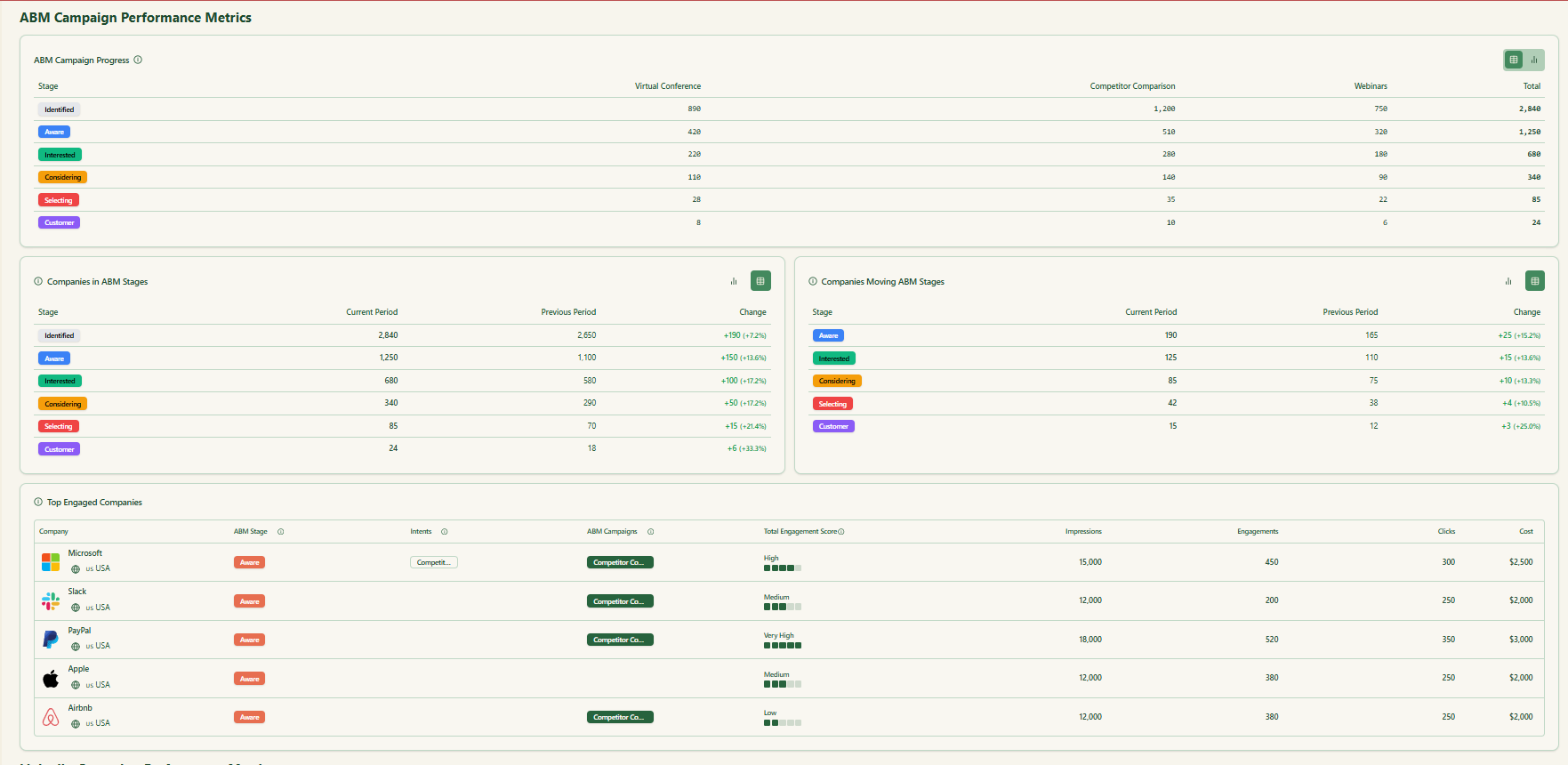

Automated scoring, BDR routing, and intent

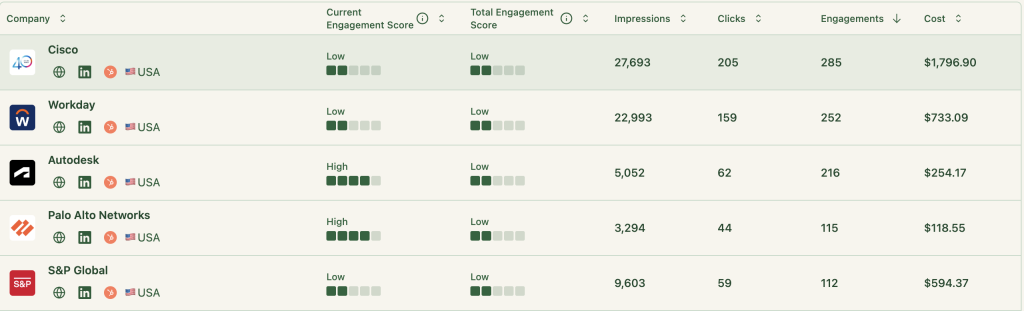

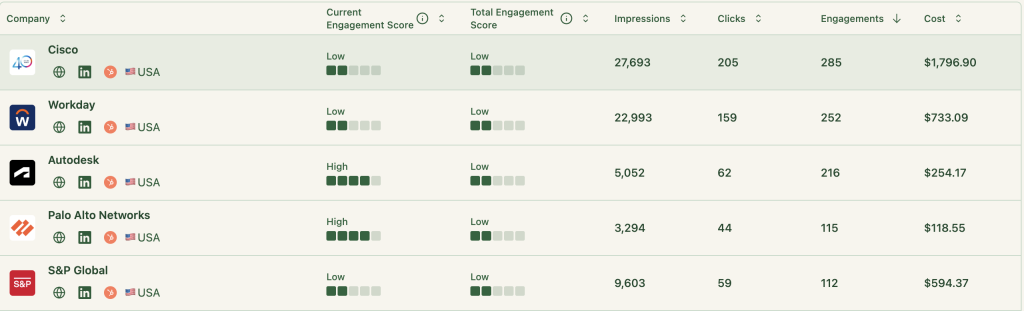

ZenABM calculates a rolling “Current Engagement Score” using impressions, clicks, and freshness.

Qualified accounts are auto-assigned to reps in HubSpot.

Campaign tags feed buyer-intent insights.

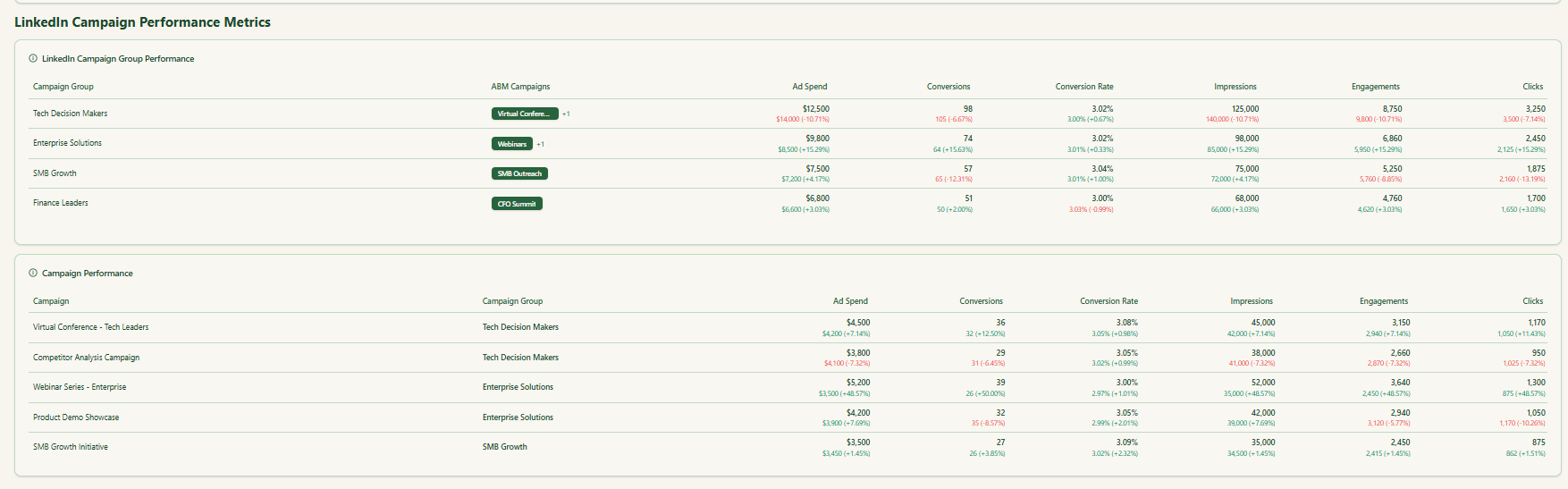

Built-in ABM dashboards

No Excel gymnastics or custom CRM builds. ZenABM ships dashboards that compute ROAS, lift, pipeline per dollar, and more.

In short, you get end-to-end view-through analytics and a single place to run ABM pipeline math.

Want to see it in action? Book a demo here.

Cons

ZenABM focuses on LinkedIn ABM, not visitor ID, broad intel, programmatic display, or list building.

Bottom line: A focused LinkedIn pipeline reporting and attribution tool that is lean, accurate, and affordable.

ZenABM pricing

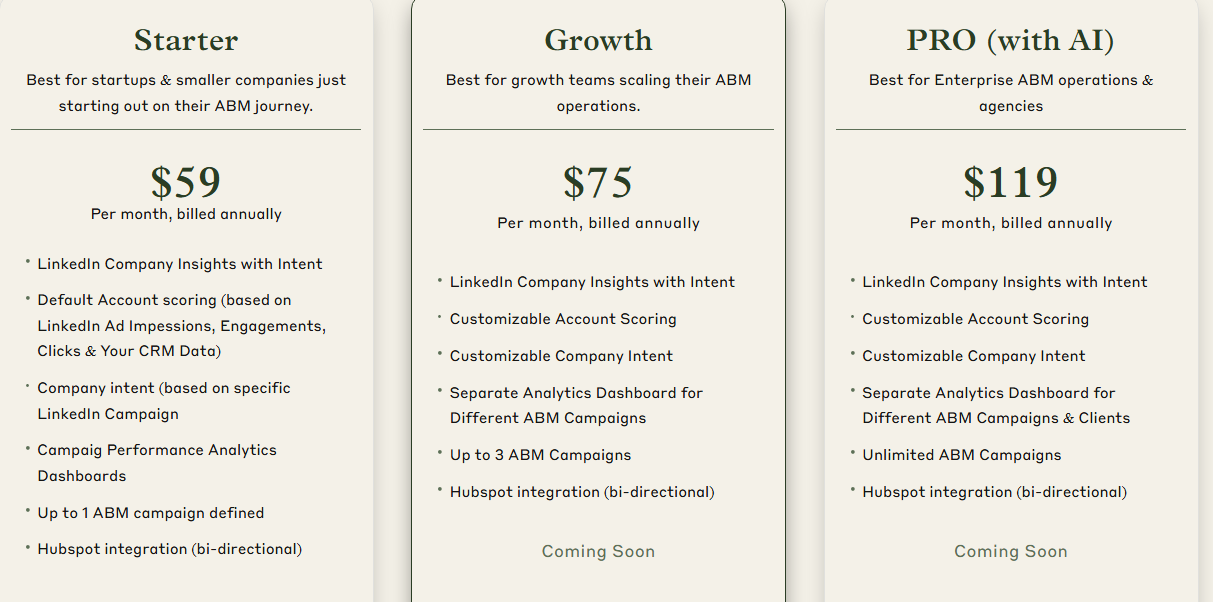

Three plans with minimal decision friction.

Starter at 59 dollars per month (annual) fits small teams. You get company engagement insights, default scoring from CRM plus ad data, campaign-level intent, one ABM campaign, and native two-way HubSpot.

Growth at 75 dollars per month adds configurable scoring, dashboards for up to three campaigns, and queued upgrades like auto routing, Slack alerts, and weekly rollups.

Pro at 119 dollars per month suits larger teams and agencies. It offers unlimited campaigns, client-ready dashboards, and upcoming AI helpers for impression control and campaign ops.

Every plan has a free trial. See the pricing page.

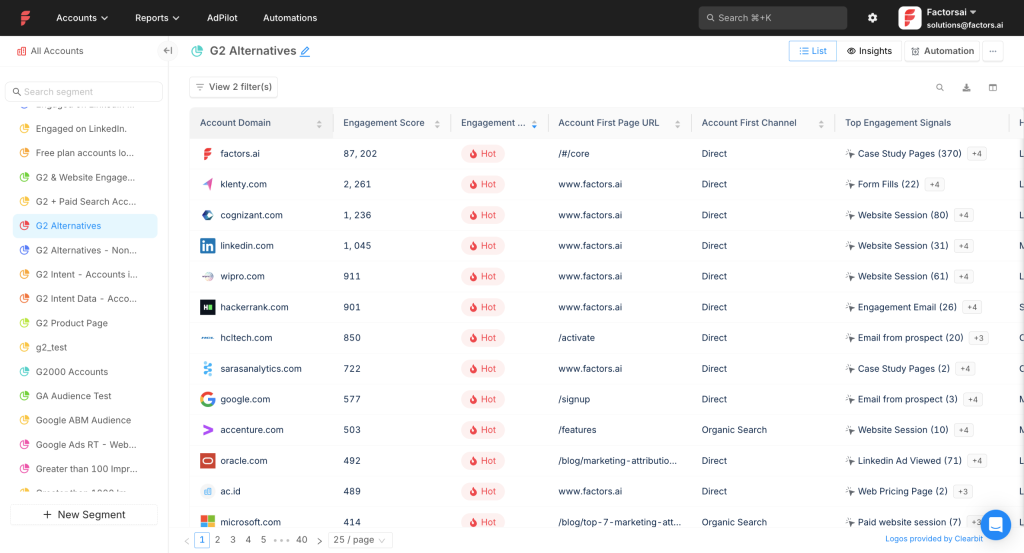

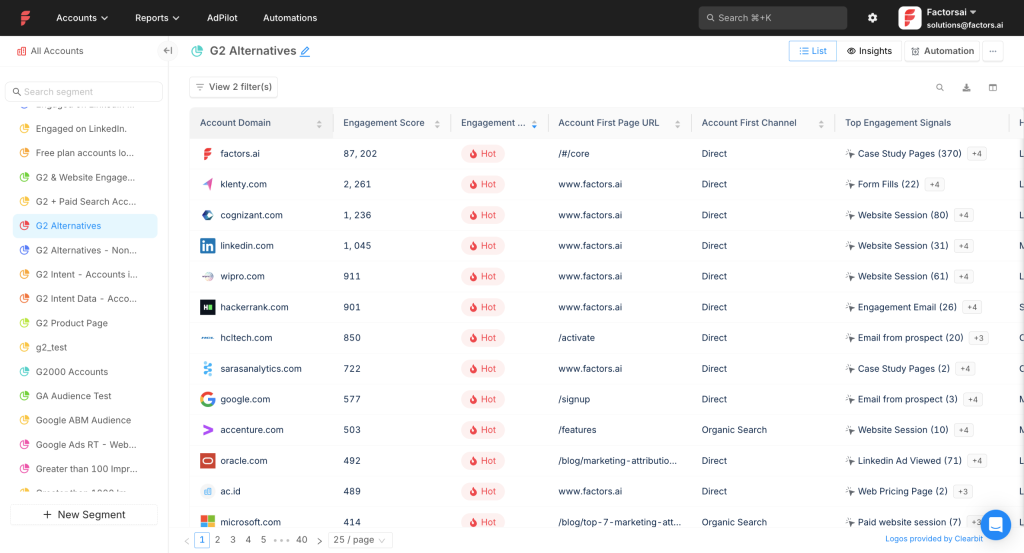

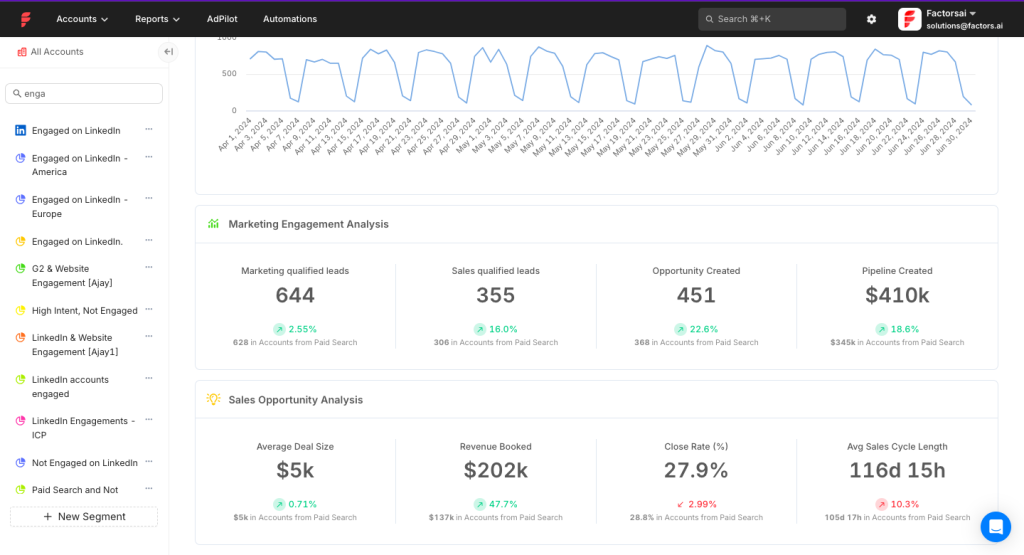

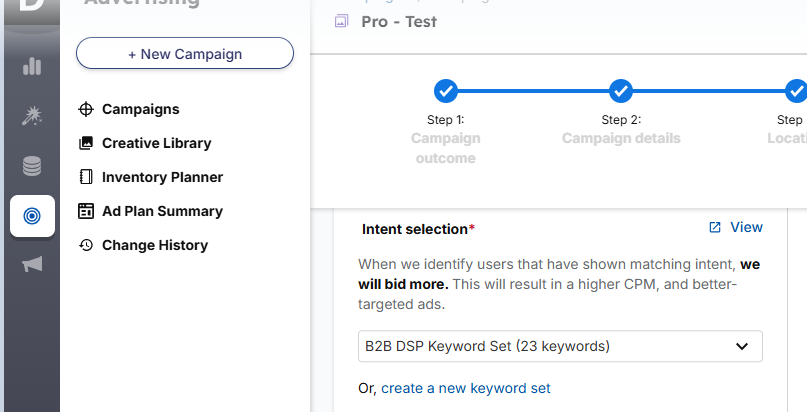

Factors.ai

Supports LinkedIn, Google, and Facebook. Adds automation, intent capture, deanonymization, scoring, and multi-touch reporting.

Does it fulfil the prerequisites?

For core data and pipeline mapping, mostly yes. CRM write-back is the main gap.

First-party company-level impression tracking per campaign

Pulls impressions, clicks, and spend via the LinkedIn API at campaign-group and campaign level, so you can tie exposure to pipeline movement.

Ties ad impact to pipeline and closed deals

HubSpot and Salesforce joins bring opportunity and revenue views.

Note: No native company-property write-back. You can create workflows to approximate it.

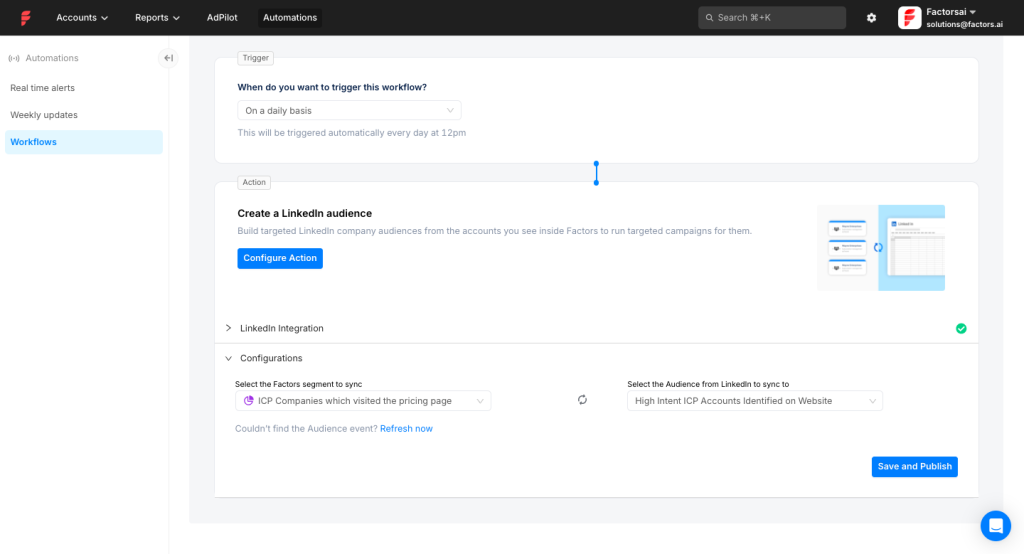

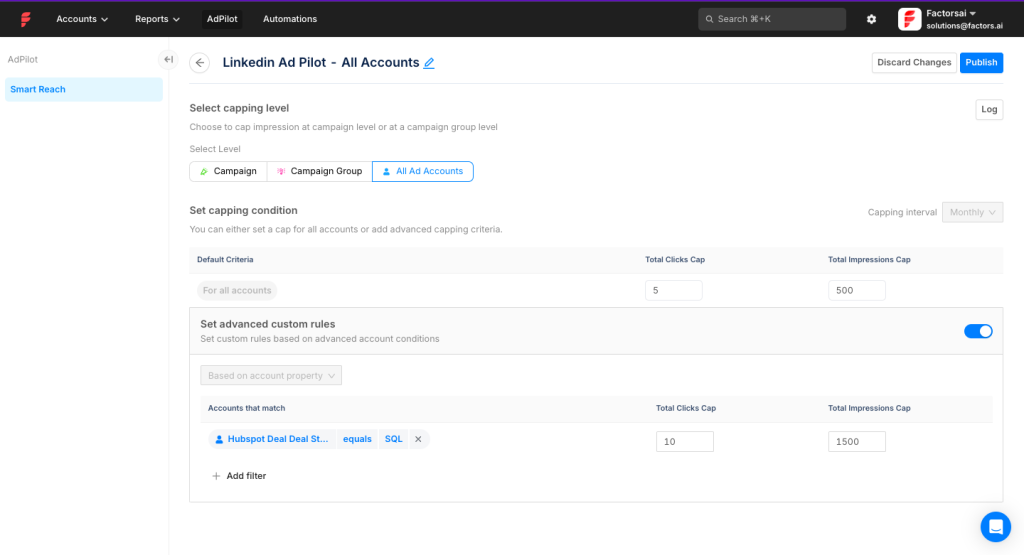

LinkedIn AdPilot

Audience builder

Impression capping

Additional features

Workflow automation

MAP, CRM, and Slack hooks for operations teams.

Multi-touch and multi-channel attribution

Benchmark LinkedIn alongside other paid and owned channels.

Cons

- From 399 dollars per month. Weighted toward LinkedIn, which can be overkill if your budget is elsewhere.

- UI quirks and requests for deeper Salesforce event tracking (source).

Bottom line: Strong impression controls and account-level analytics. Pipeline write-back to CRM requires some DIY.

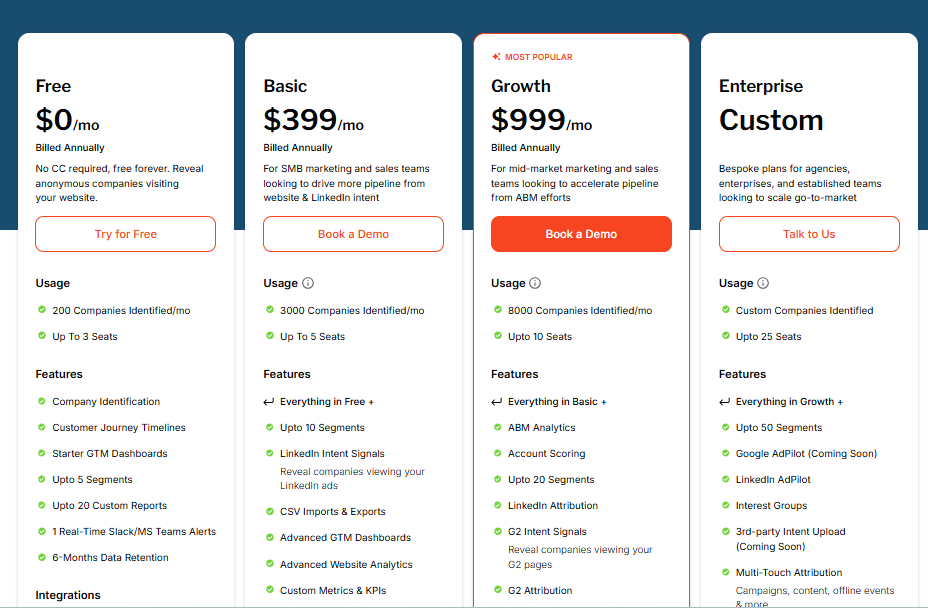

Factors.ai pricing

Free offers basic visitor intel for up to 200 identified companies. Basic at 399 dollars adds LinkedIn intent and core CRM links. Growth at 999 dollars adds ABM analytics, G2, and workflows. Enterprise is custom.

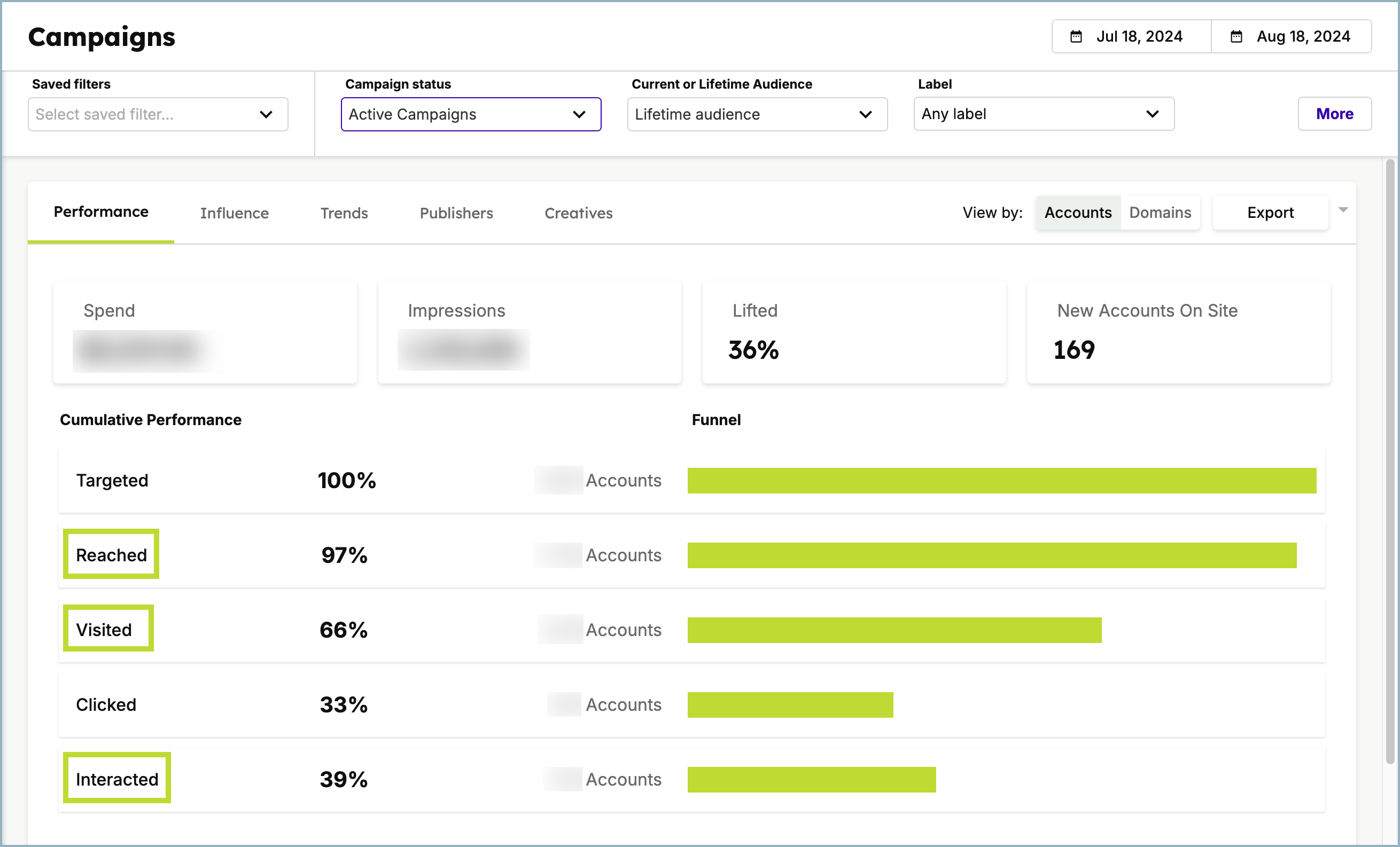

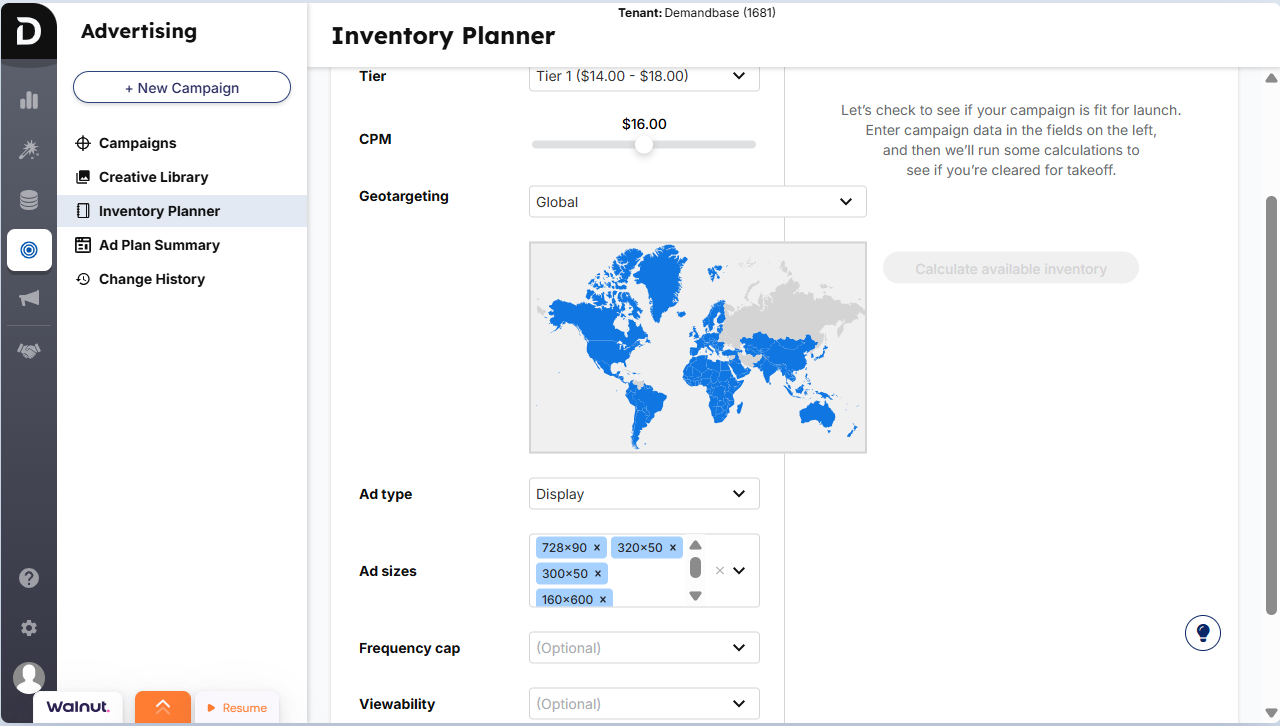

Demandbase One

Full-stack ABM with lists, delivery, analytics, and revenue reporting across channels. Demandbase is the brand, and Demandbase One is the platform.

Does Demandbase One fulfil the prerequisites?

Yes, across the board.

First-party company-level impression tracking

Certified LinkedIn partner with official API access. Account-level reporting is standard.

Two-way CRM integration

Bi-directional sync with HubSpot, Salesforce, Dynamics 365, Marketo, Pardot, and Eloqua. Measure pipeline and revenue, and write engagement into the CRM. A Capterra note. Sales teams often live in Salesforce, so plan change management.

Additional features for LinkedIn

Frequency capping

Bid optimisation with intent

Prioritise spend toward in-market accounts using intent data.

Cons

Price and complexity. You will need time to land value.

Bottom line: Excellent if you run multi-channel ABM with budget and want deep control.

Demandbase pricing

Not public. Book a demo.

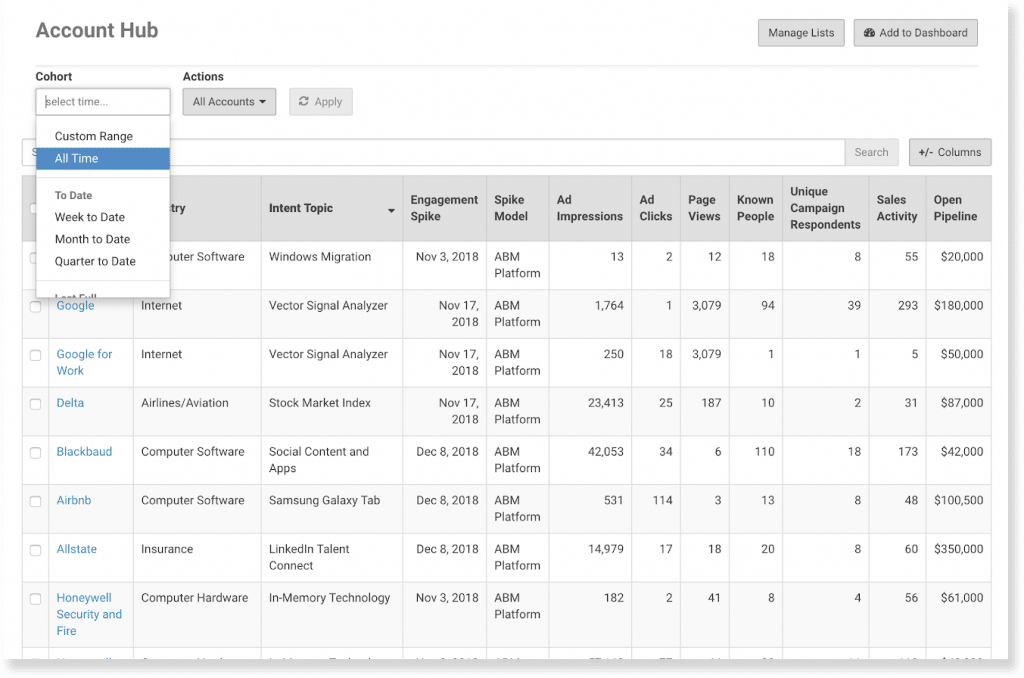

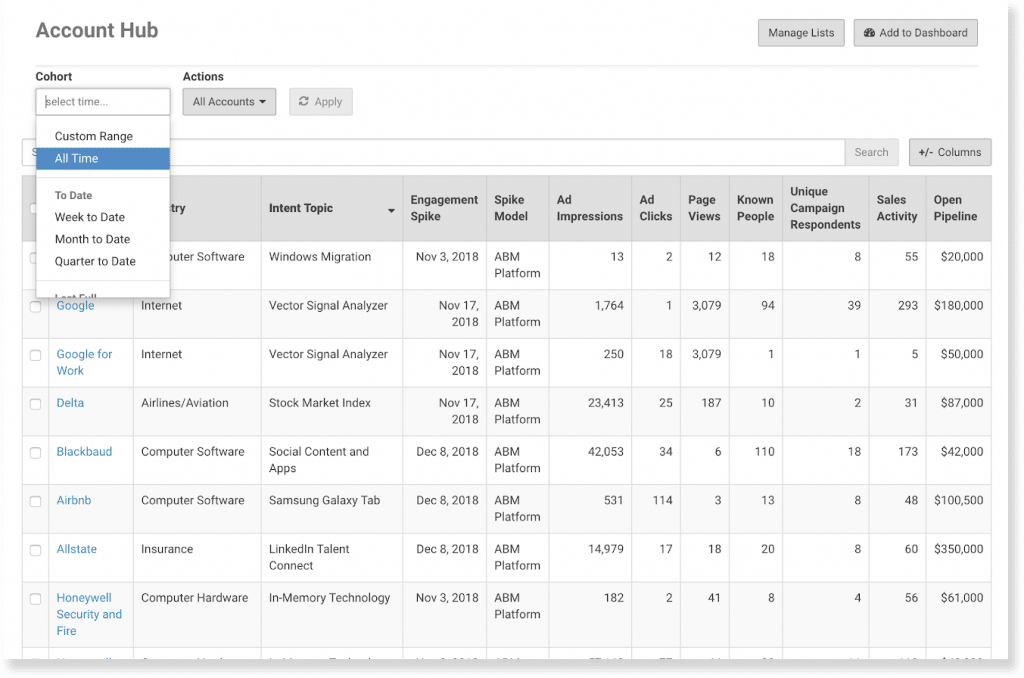

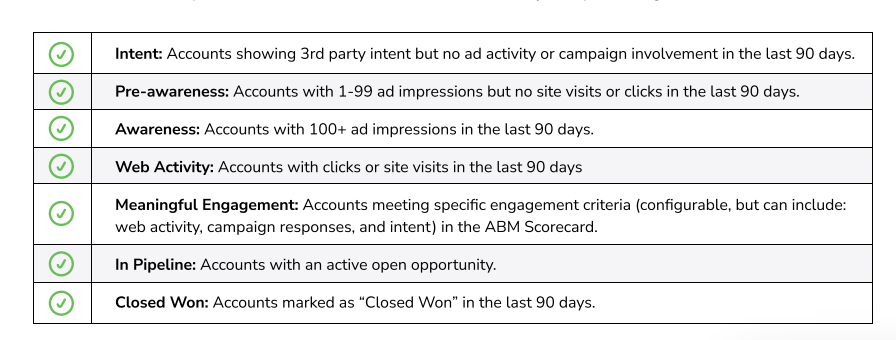

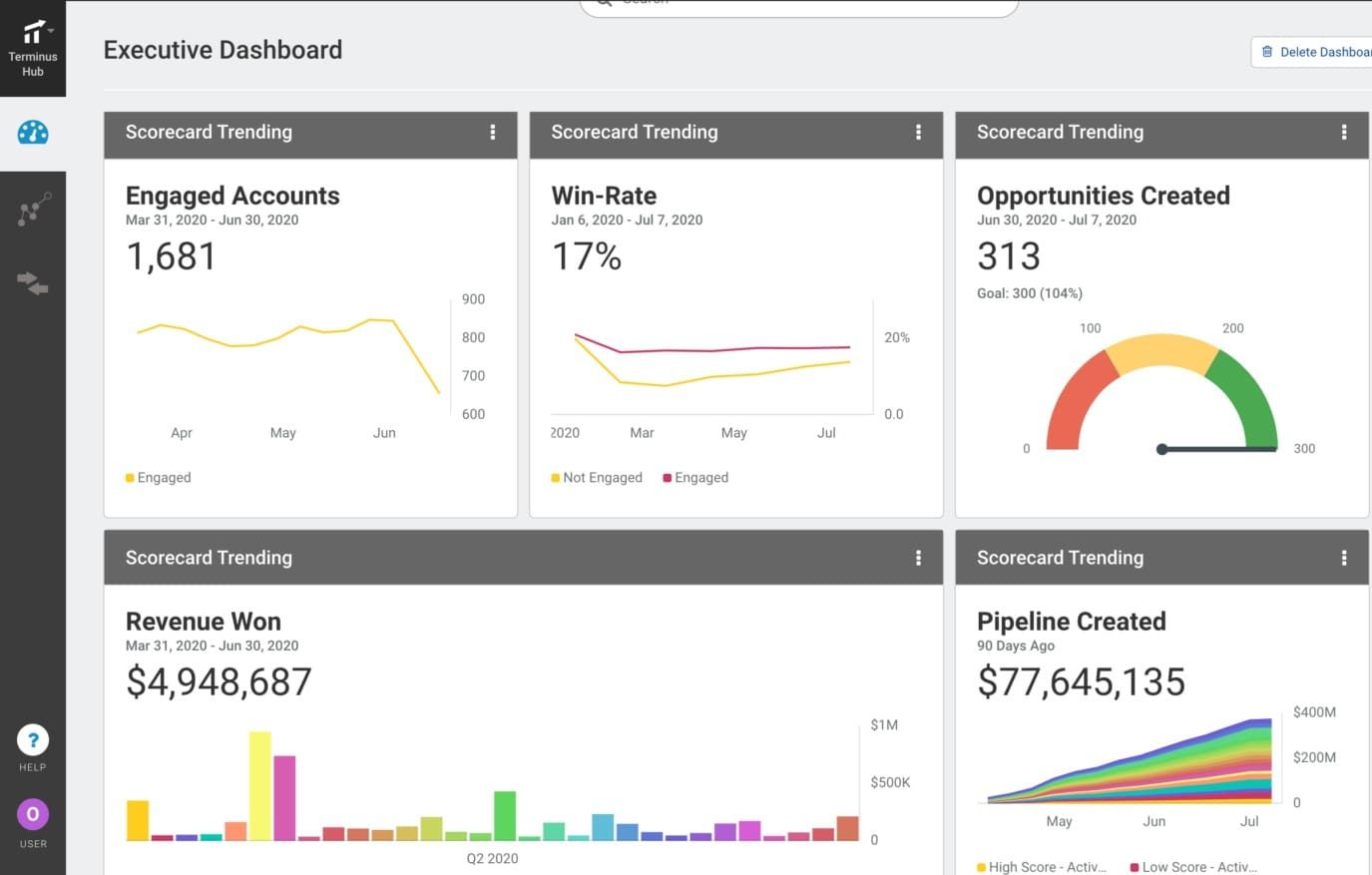

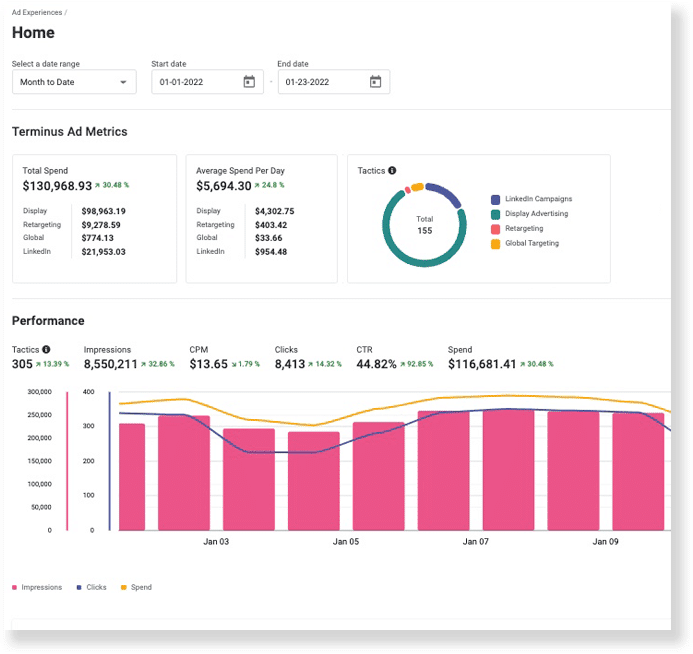

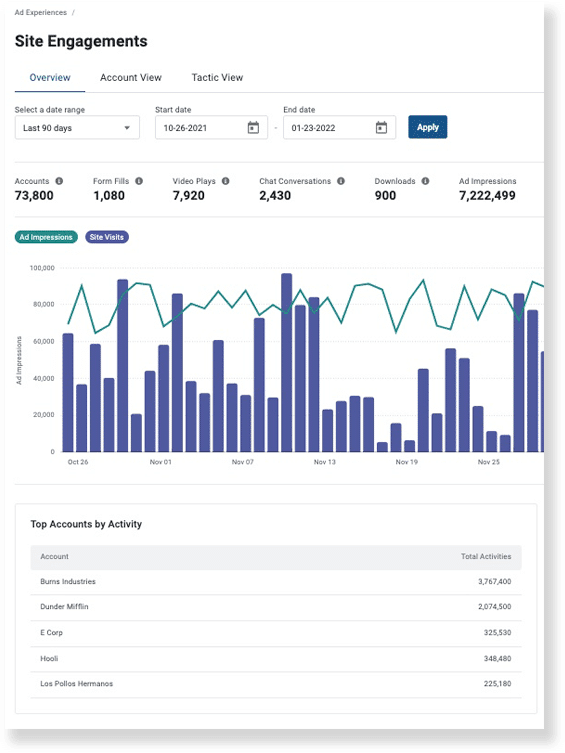

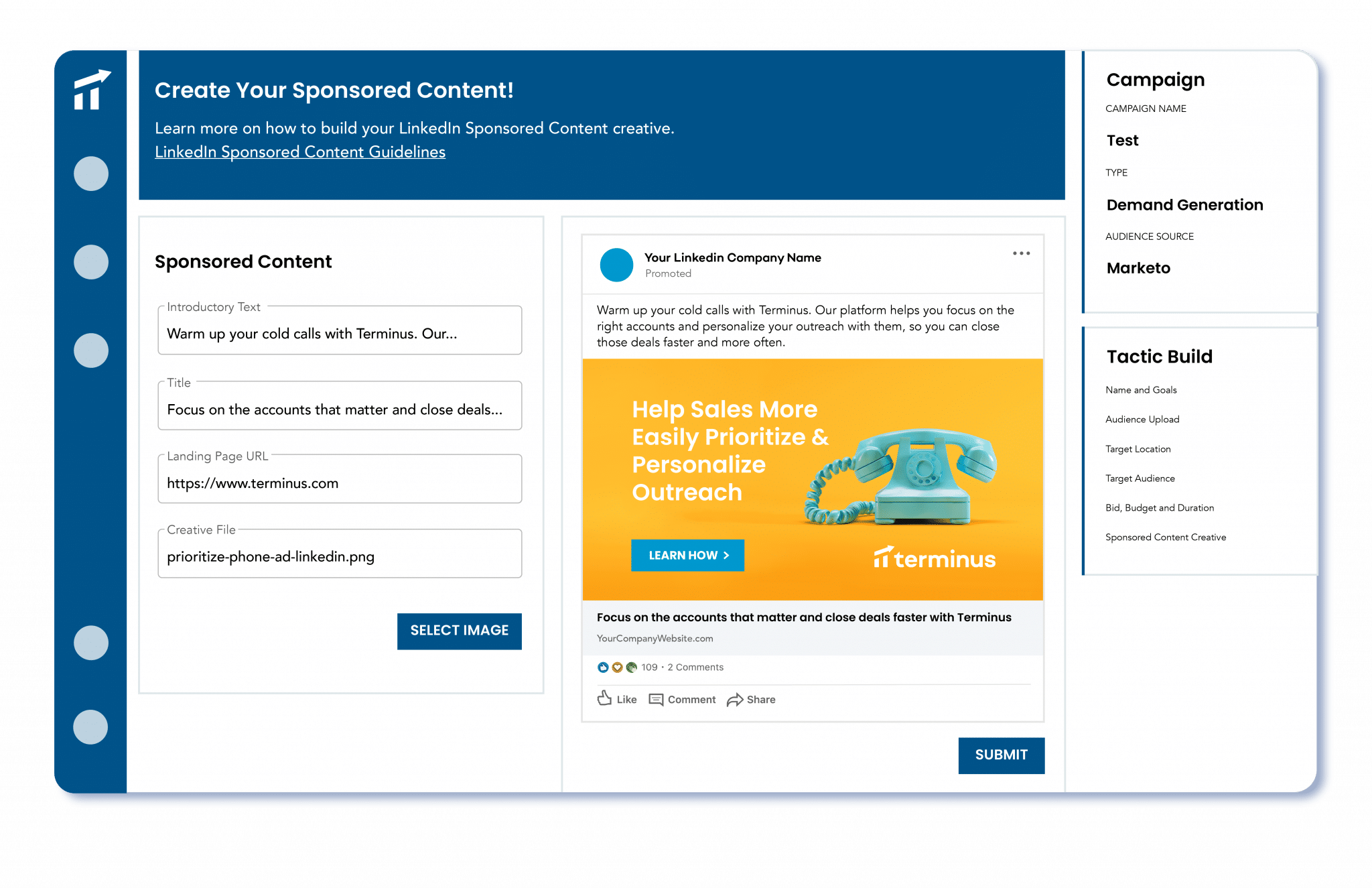

Terminus (by DemandScience)

Ad-first engagement platform. Its LinkedIn Marketing Solutions integration updates delivery and analytics quickly.

Does Terminus fulfil the prerequisites?

Partly.

Limited company-level impression tracking per campaign

Strong for uploaded or CRM Matched Audiences, but it will not cover every account outside those lists.

Two-way CRM integration

Salesforce-centric funnel views and executive dashboards.

Additional features

Multi-channel, multi-touch attribution

Build and trigger LinkedIn campaigns inside Terminus

Triggers from Outreach, Salesloft, Uberflip, Bombora intent, and more.

Cons

- More ad ops centric than a full ABM suite.

- Contract floors can pinch smaller teams.

Bottom line: Good LinkedIn analytics within curated lists. Not the cheapest if you are LinkedIn only.

Terminus pricing

Now part of DemandScience. Contact sales.

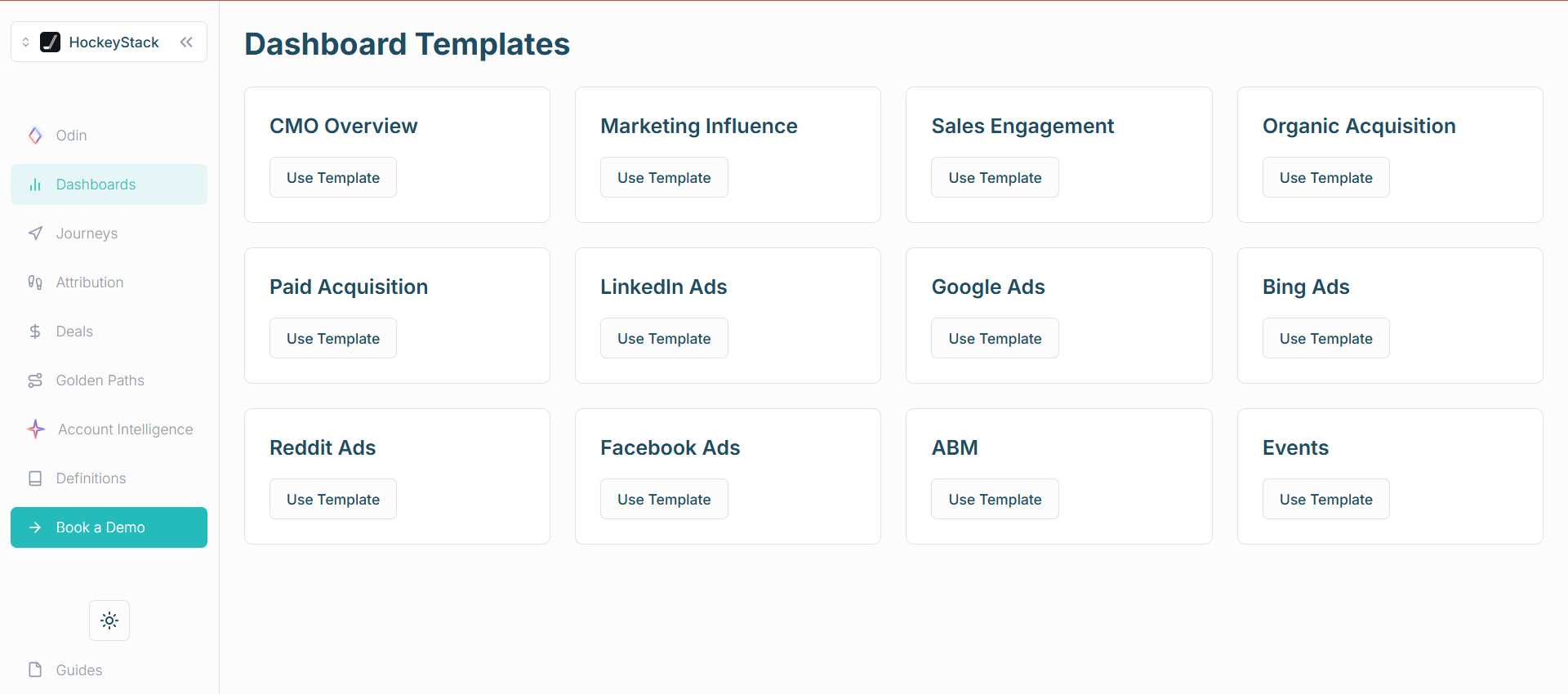

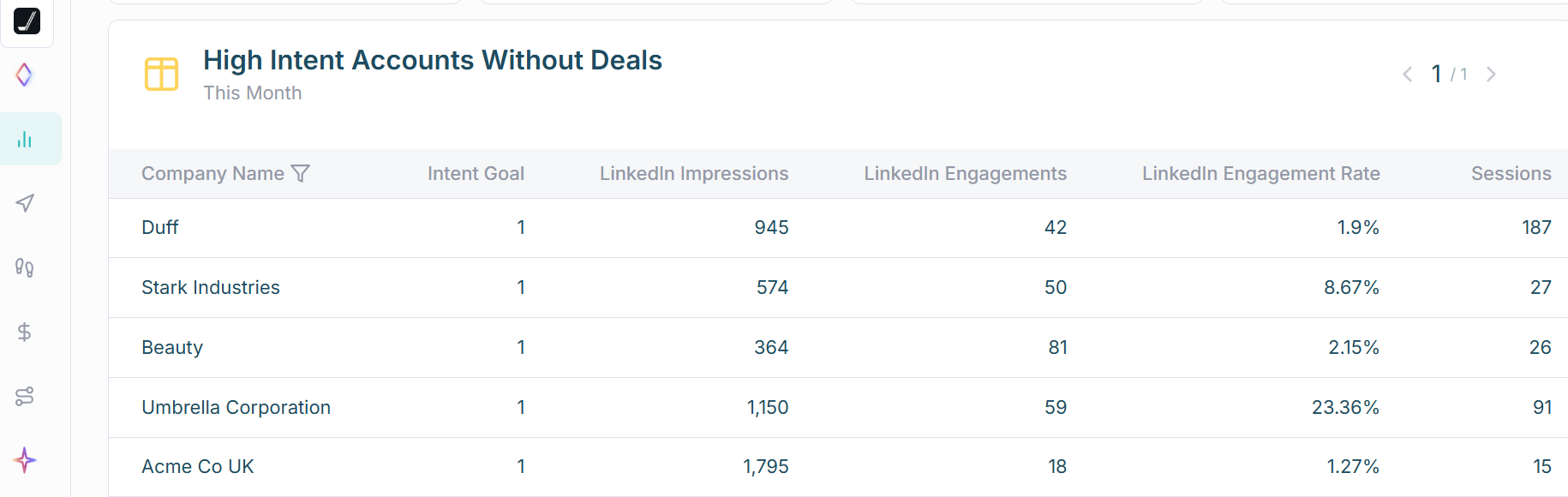

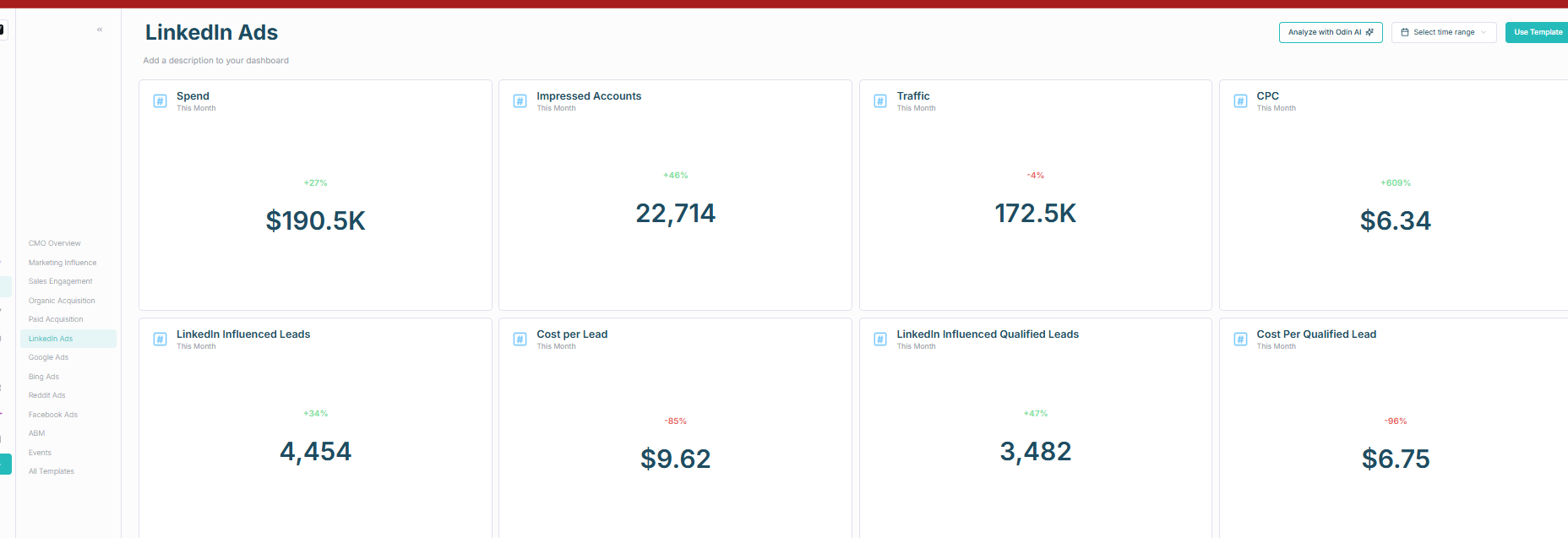

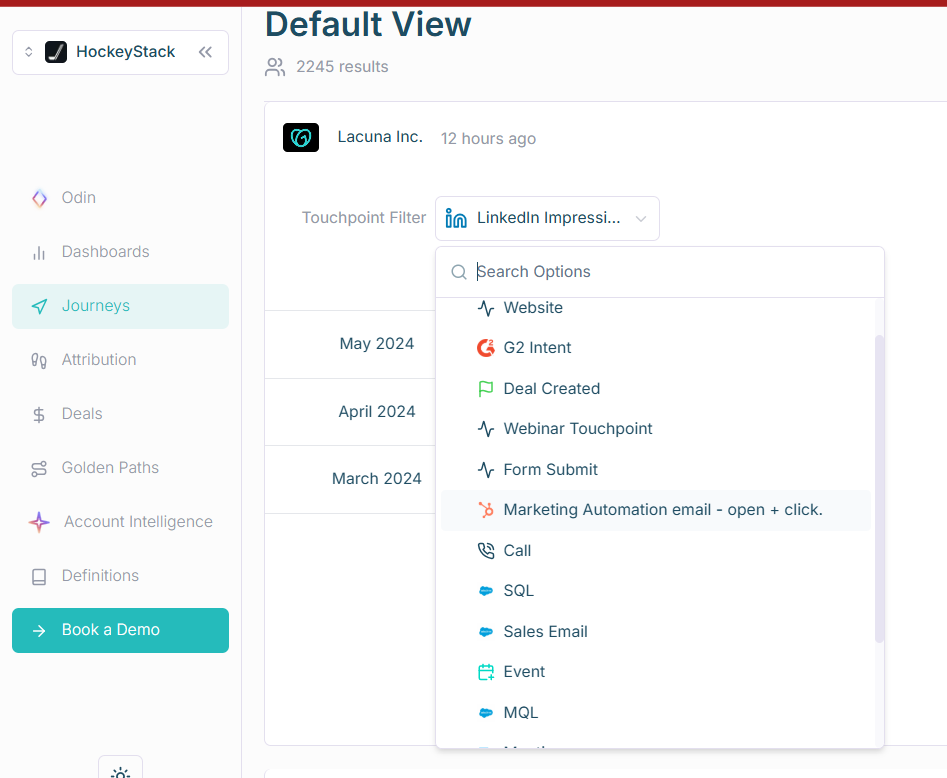

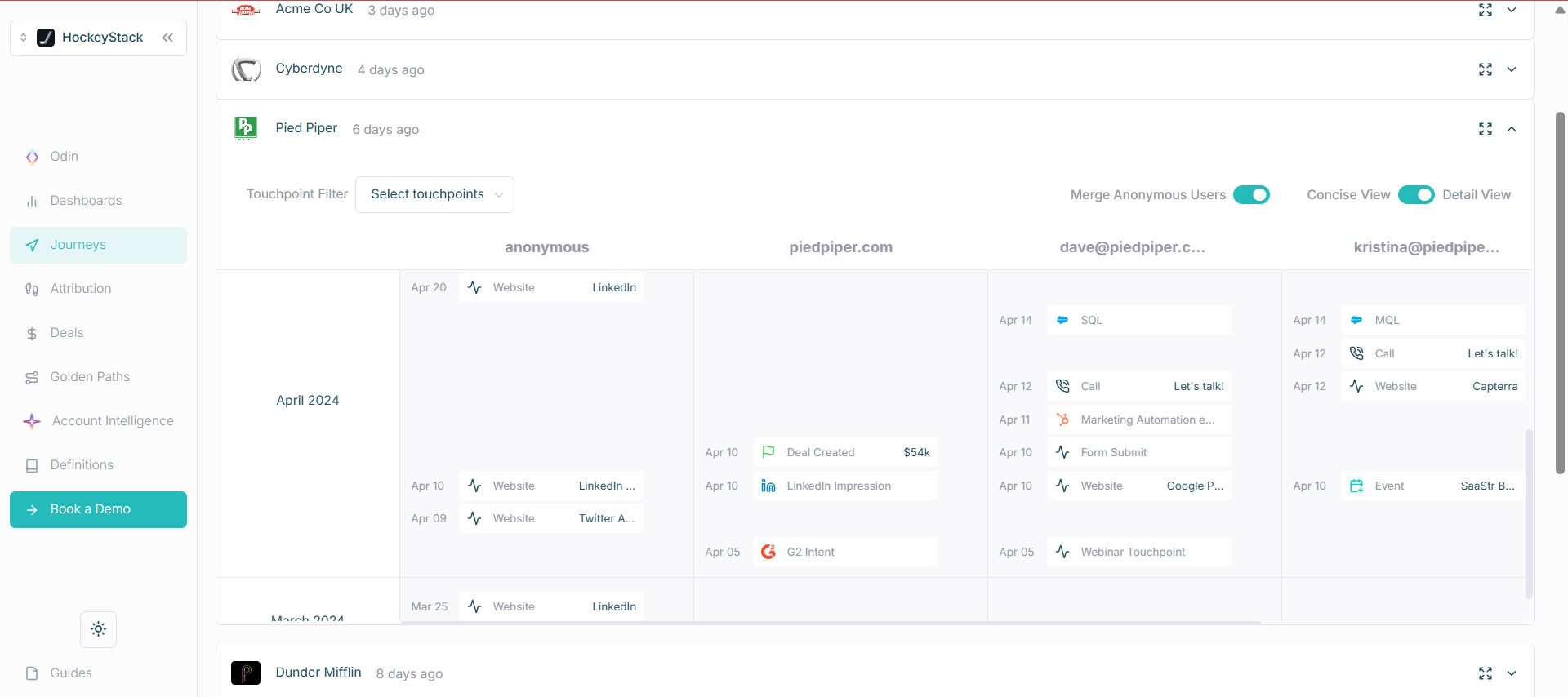

HockeyStack

B2B analytics platform that blends LinkedIn Ads, site analytics, and CRM touchpoints into account and person-level paths.

Does HockeyStack fulfil the prerequisites?

Almost.

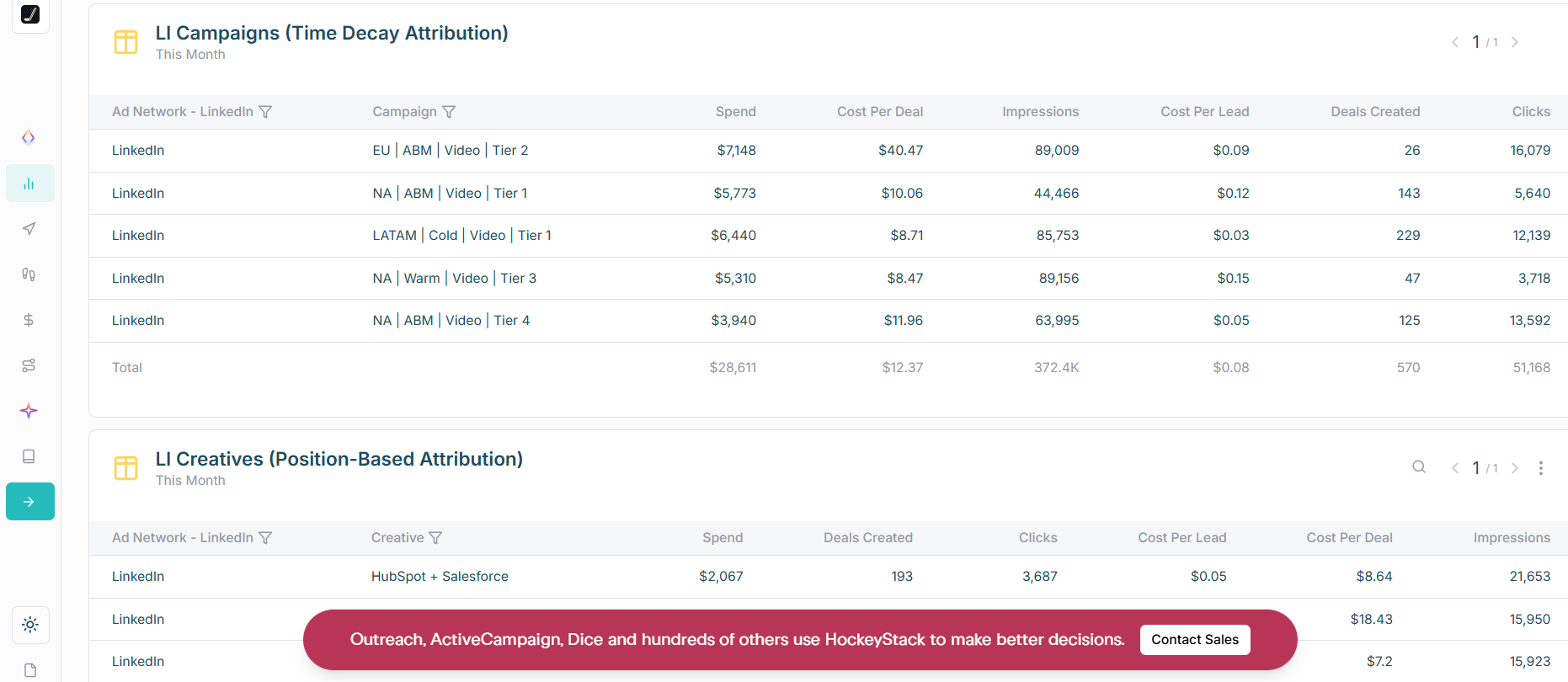

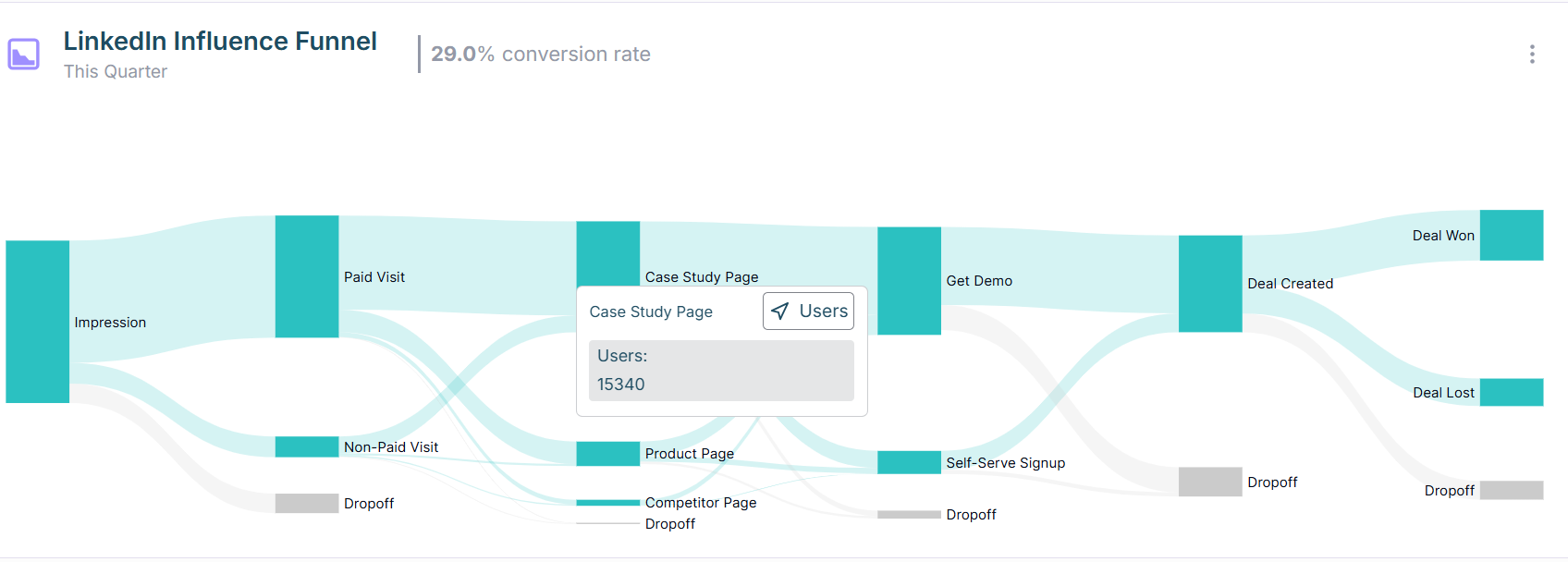

First-party company-level impression tracking

CRM integration for pipeline and revenue

Note: One-way CRM sync. You will need workflows to push back into CRM properties.

Additional features

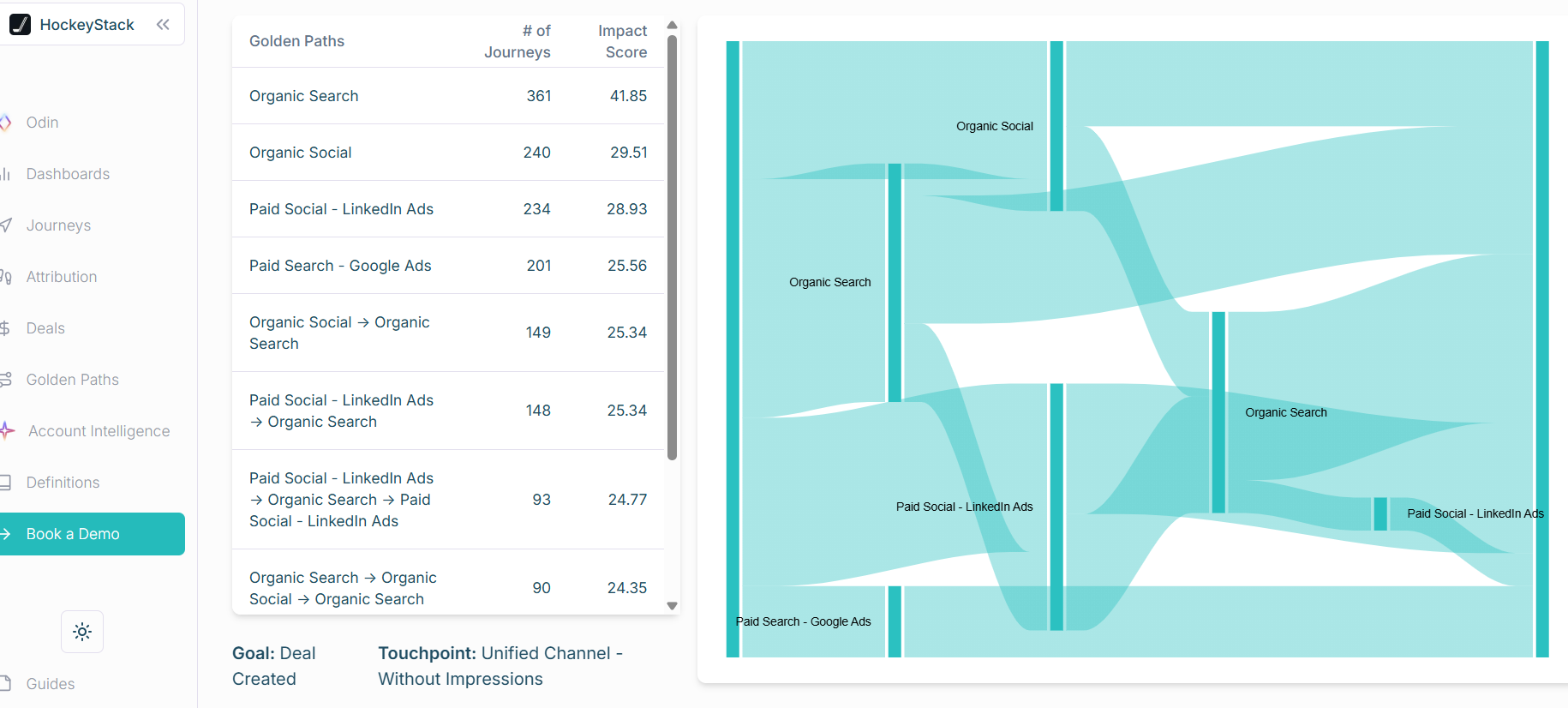

Multi-channel, multi-touch attribution across 17 sources

Person-level detail

Be cautious. Cookies and reverse IP affect identity fidelity. That is fine as supporting evidence.

Attribution models, funnels, and “Golden Paths”

Cons

One-way CRM sync, identity reliance on cookies and IP, and some UI depth gaps (see G2).

Bottom line: Strong cross-channel analytics with account-level LinkedIn impressions. Expect a learning curve and extra CRM work.

HockeyStack pricing

Sales led. See the pricing page.

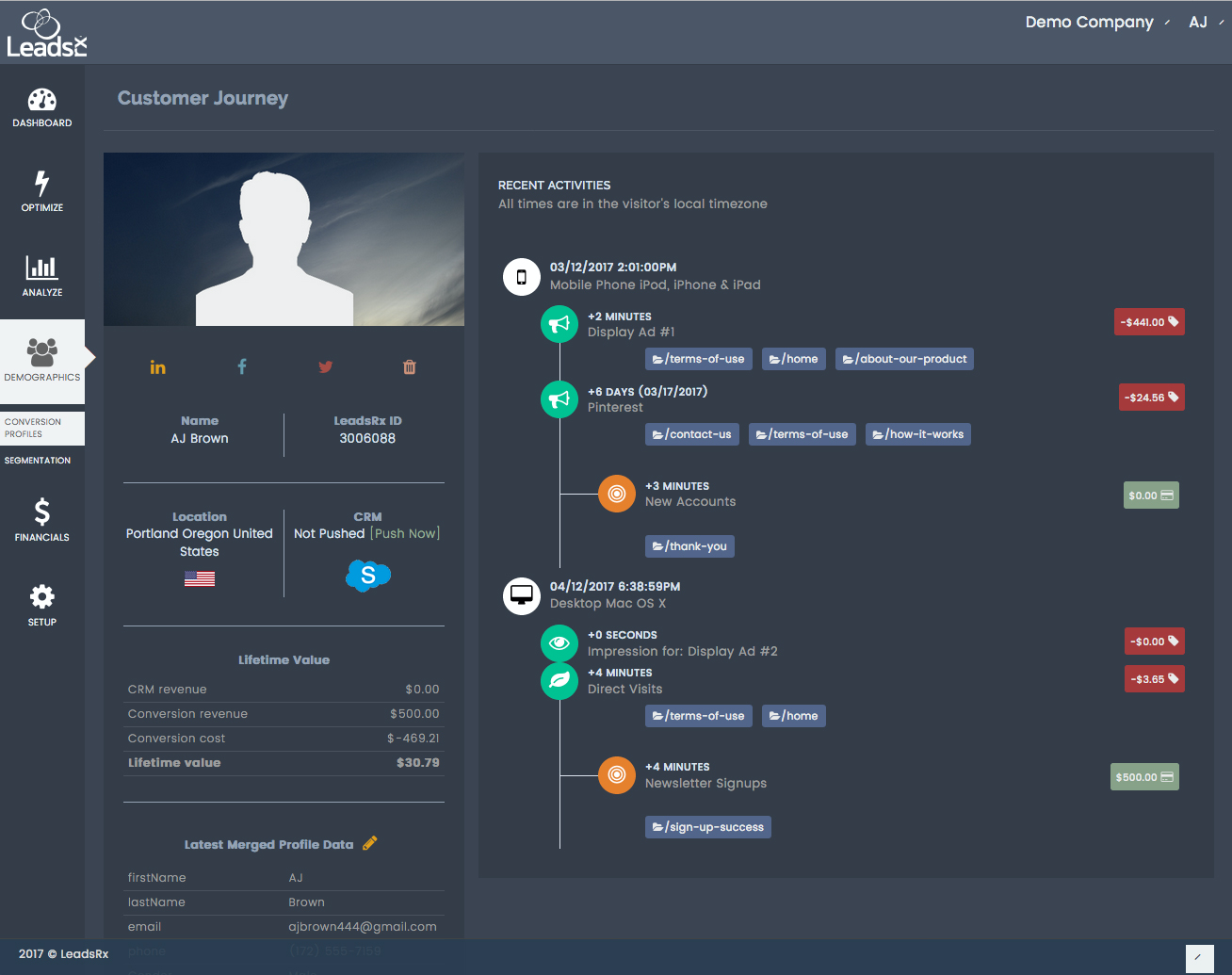

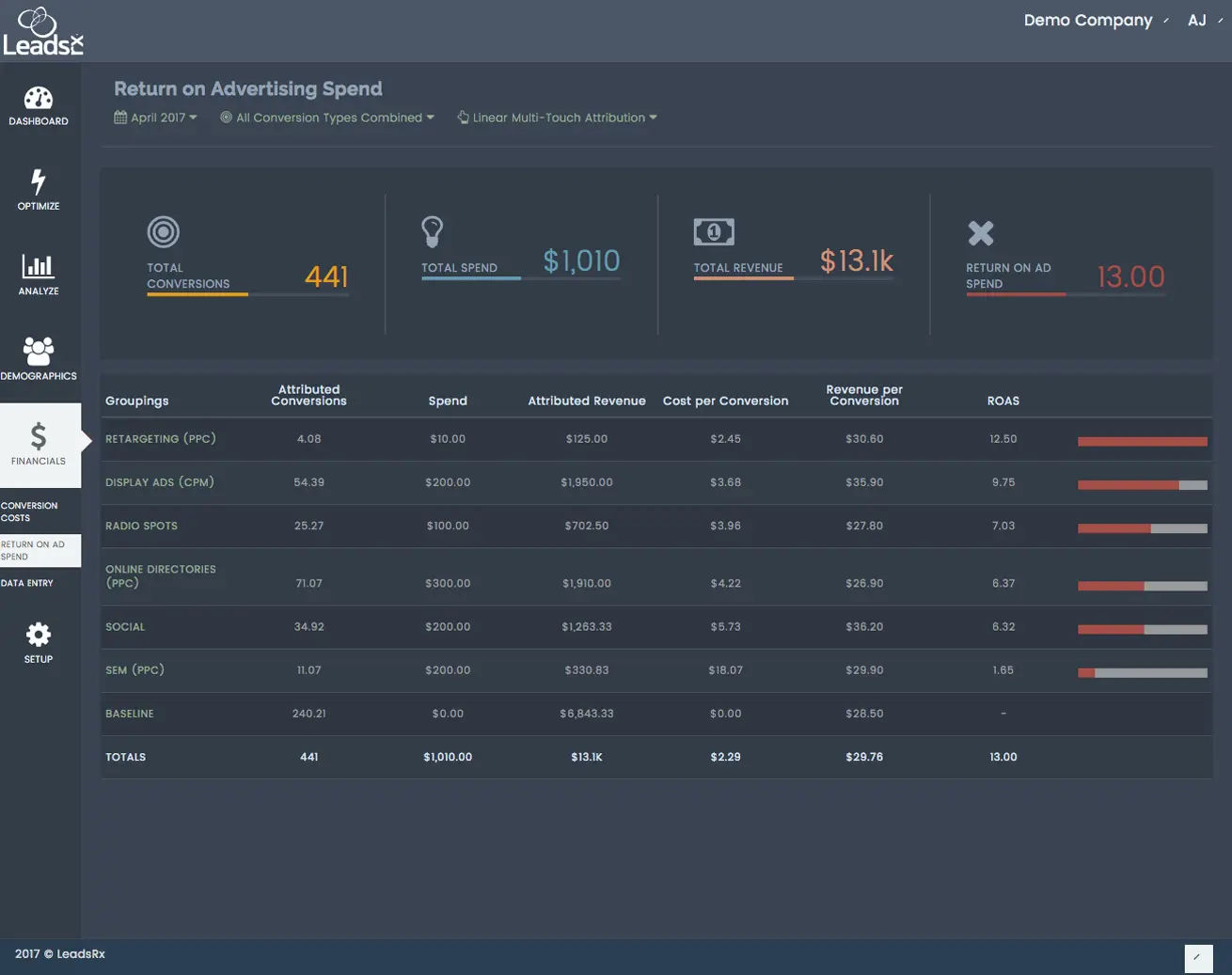

LeadsRx

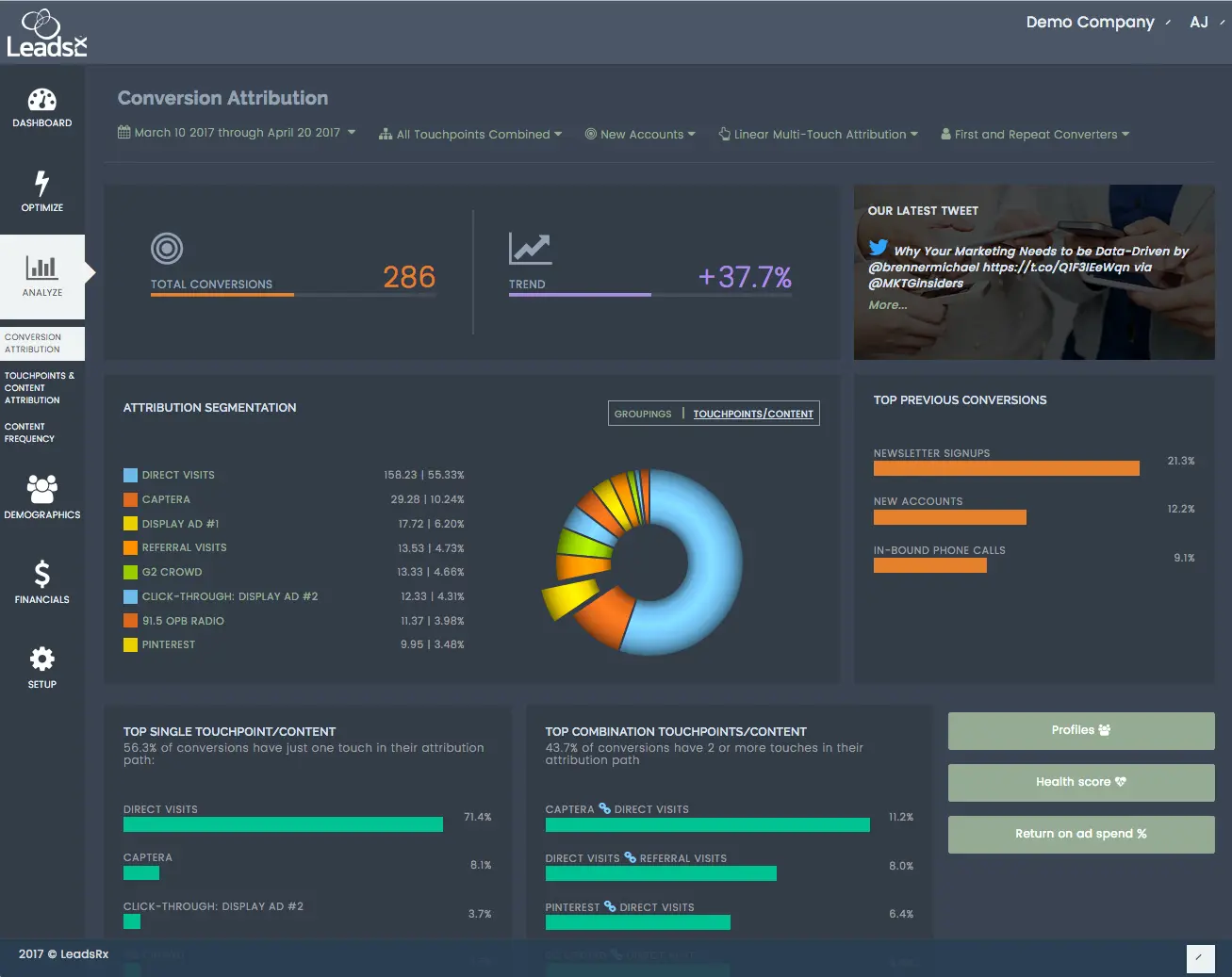

Universal pixel plus offline ingestion for multi-touch attribution.

Does LeadsRx fulfil the prerequisites?

Partially. No LinkedIn API and cookie centric. Company views depend on your CRM joins and forms. Lead Gen Forms need webhooks.

What’s good about LeadsRx?

Excellent for mixed media such as radio, events, and podcasts alongside digital. Clean journey maps and ROAS views.

Bottom line: Great omni-channel lens. Weak for impression-first LinkedIn ABM pipeline reporting.

LeadsRx pricing

6Sense

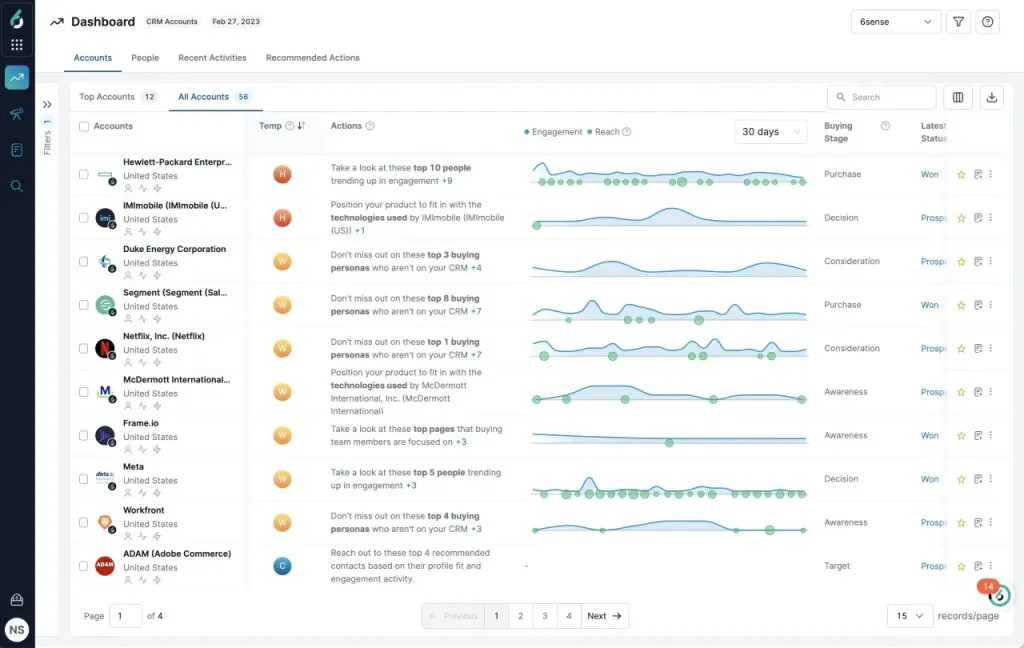

Known for account ID, intent, and predictive scoring, with a tighter LinkedIn connection since 2023.

Does 6Sense fulfil the prerequisites?

No. LinkedIn remains aggregate and impression by account is not exposed. Click or visit is needed for attribution, which under counts view-through influence on pipeline.

What’s good about 6Sense?

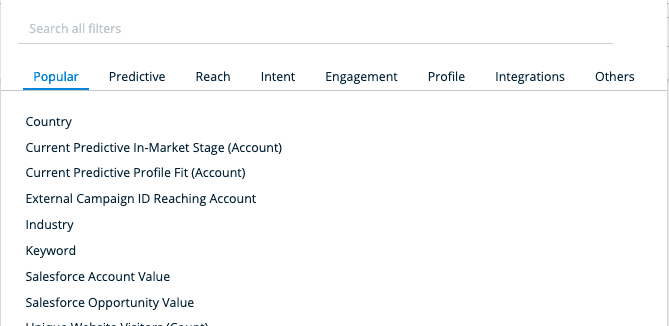

Advanced segments and targeting

Contextual ads

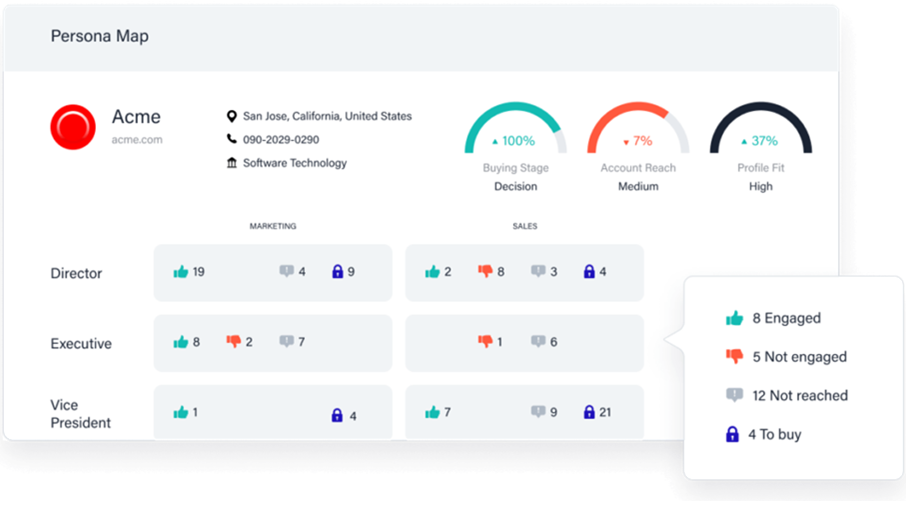

Persona coverage

Cons

- Complex onboarding and navigation.

- Total cost can stretch smaller teams.

Bottom line: Great for display and targeting. Not built for impression-led LinkedIn ABM pipeline reporting.

6Sense pricing

Not public. Contact sales.

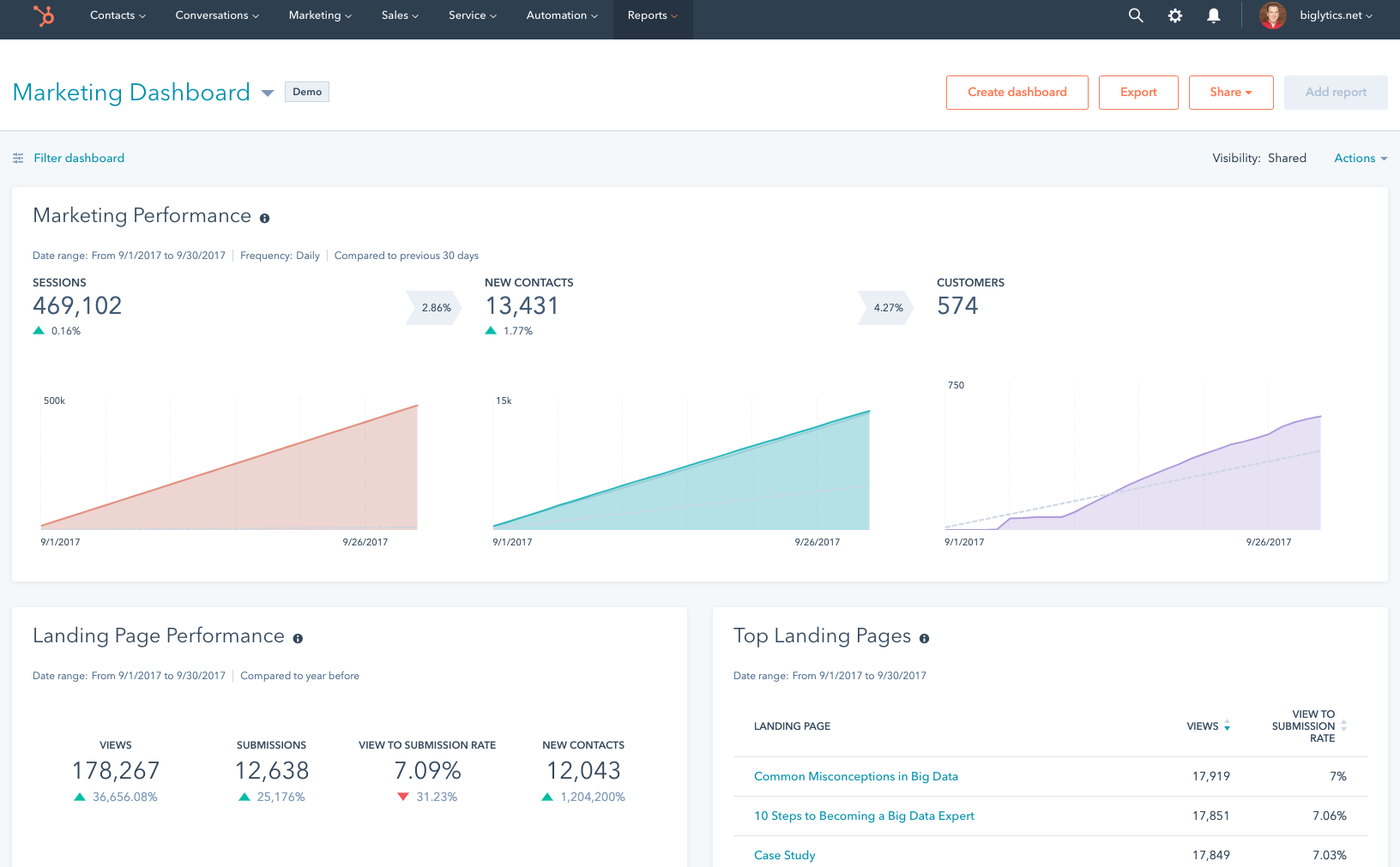

HubSpot Marketing Attribution

Native ads tool and attribution module. Pulls clicks and lead form data from LinkedIn into reports.

Does it fulfil the prerequisites?

- No impression-level account analytics.

- Contact and deal centric attribution over company exposure.

- CRM strengths aside, the lack of impressions leaves ABM pipeline reporting incomplete.

What’s good about HubSpot Marketing Attribution?

For click-based contact attribution, it is straightforward. Connect clicks to contacts to revenue. Flip models such as First, Last, Linear, U or W, and Time Decay.

Cons

No custom weights and limited ad types via API. Practitioners note constraints, as many reviews indicate.

Bottom line: Excellent CRM and MAP. Not a LinkedIn ABM pipeline reporter.

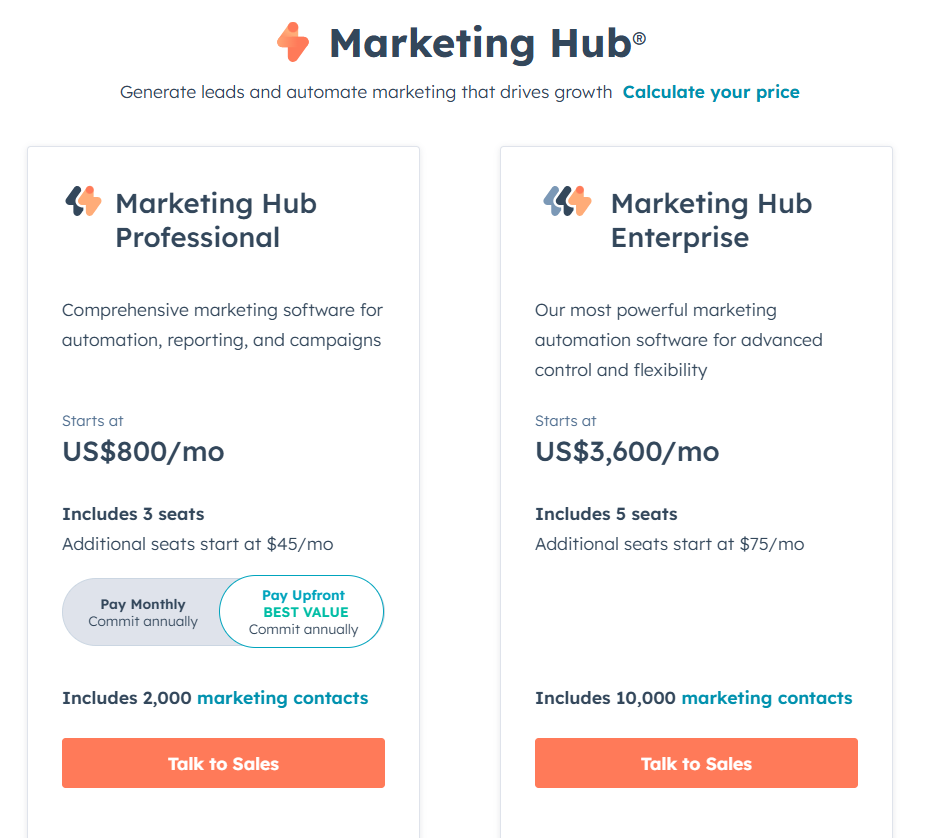

HubSpot Marketing Attribution pricing

- Marketing Professional from 800 dollars per month. Better ad management and custom reports. Not full revenue attribution.

- Marketing Enterprise from 3600 dollars per month. Multi-touch revenue attribution.

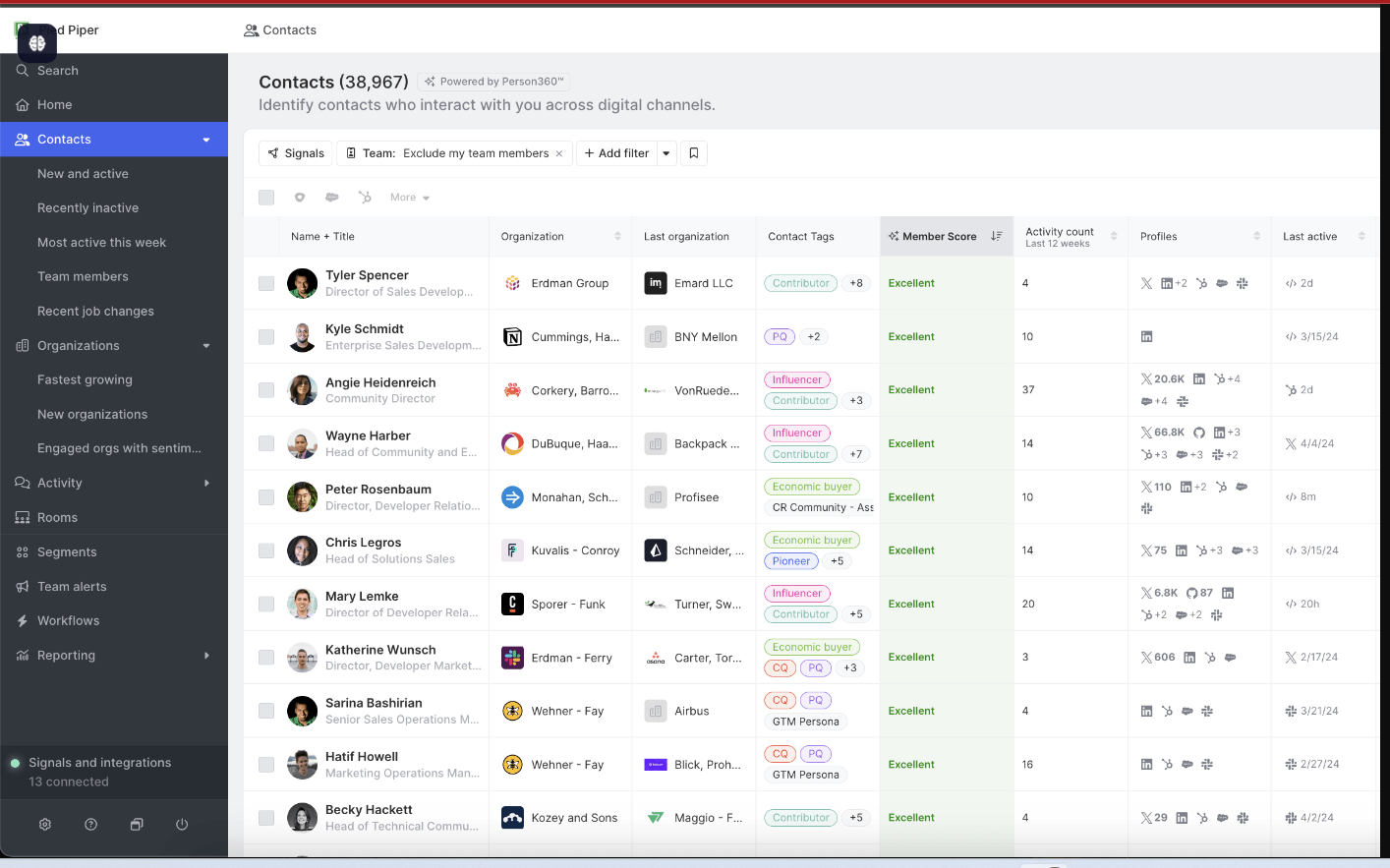

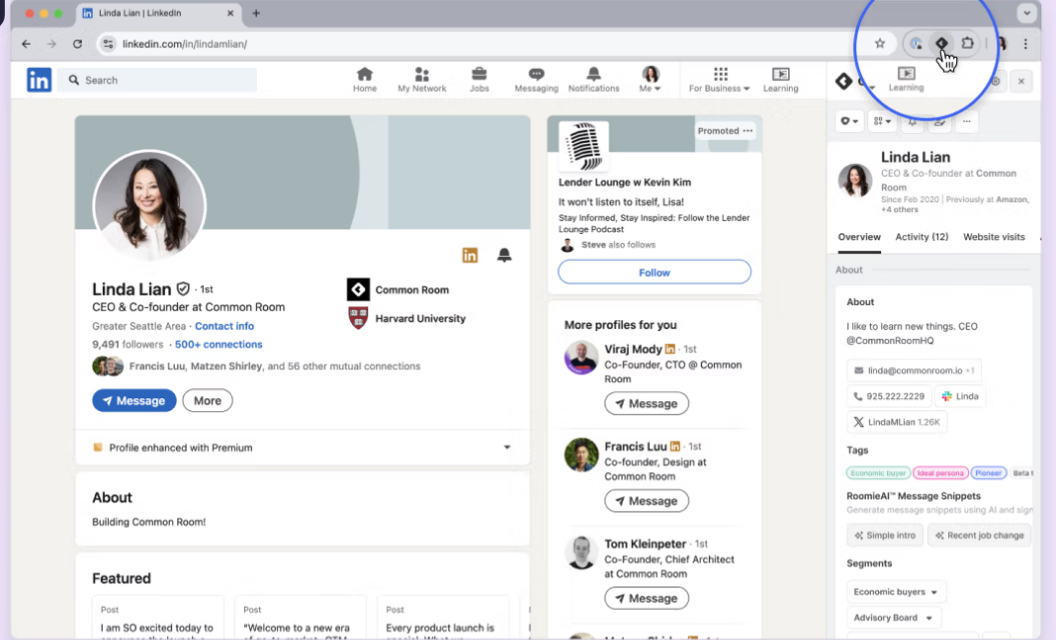

CommonRoom

Community intelligence that pulls LinkedIn engagement, Slack, social, and product signals to surface warm accounts.

Does it fulfil the prerequisites?

No. There is no account-level impression tracking, so the ABM pipeline read is incomplete.

What’s good about CommonRoom?

Community tracking and AI

Correlate community spikes with LinkedIn pushes and let RoomieAI surface patterns.

Firmographic enrichment

Turn raw signups into company profiles that map back to accounts.

LinkedIn Chrome extension

Cons

- Seat tiers can feel rigid (G2).

- Users ask for steadier AI and more features.

Bottom line: Terrific for community-led growth. Not a substitute for impression-level ABM pipeline reporting.

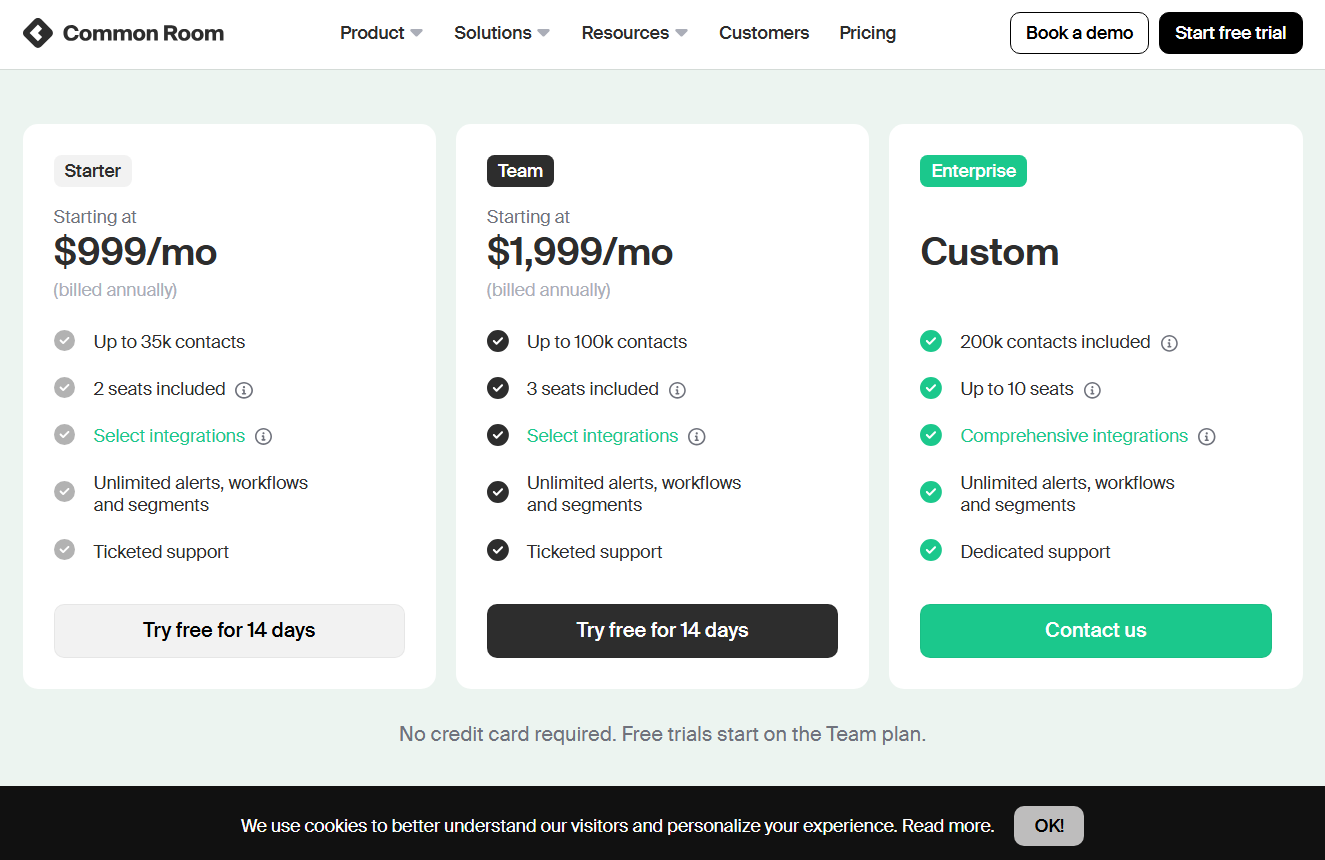

CommonRoom pricing

Starter from 999 dollars per month for 35k contacts and 2 seats. Team from 1999 dollars per month for 100k contacts and 3 seats. Enterprise is custom.

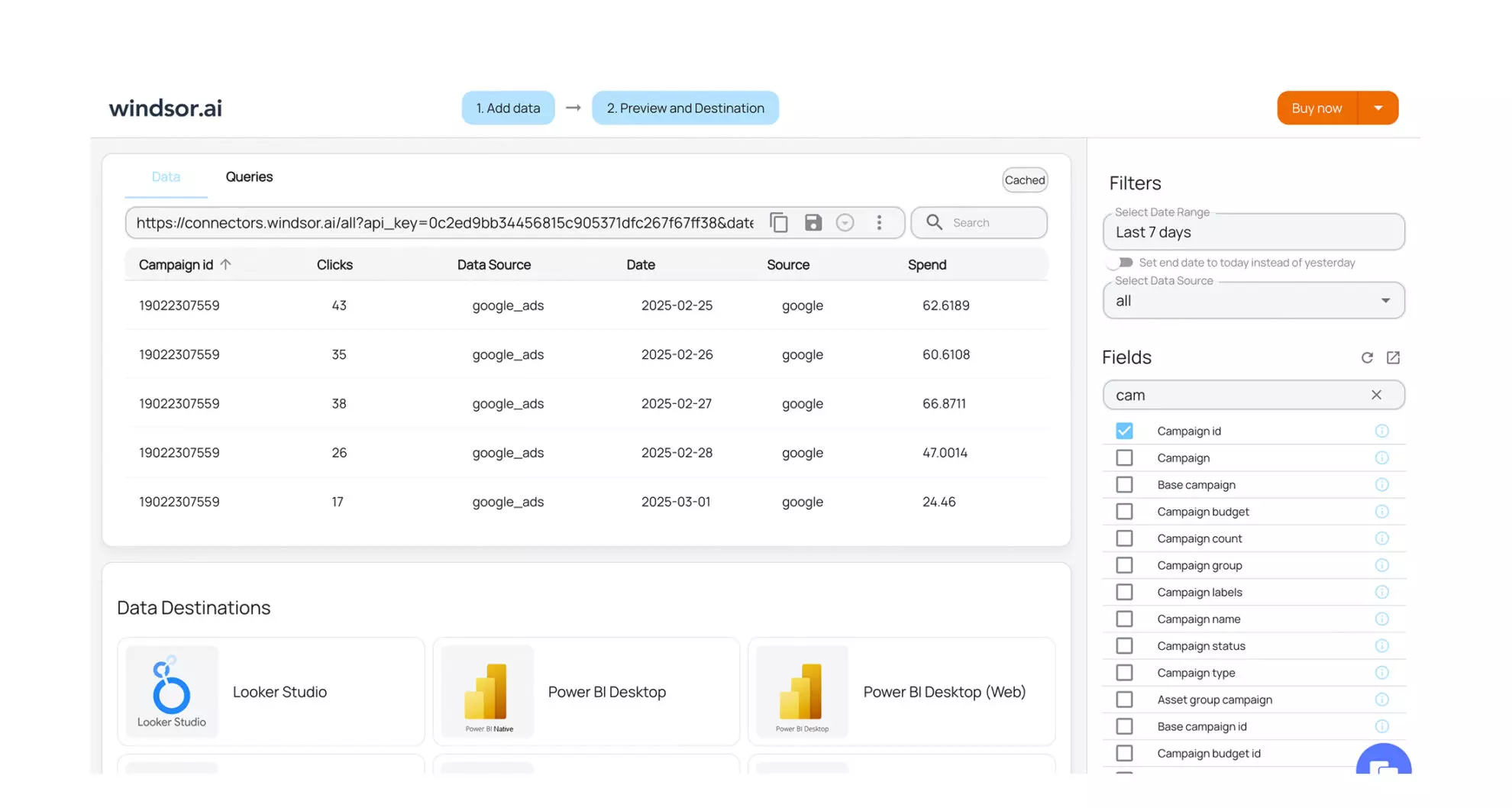

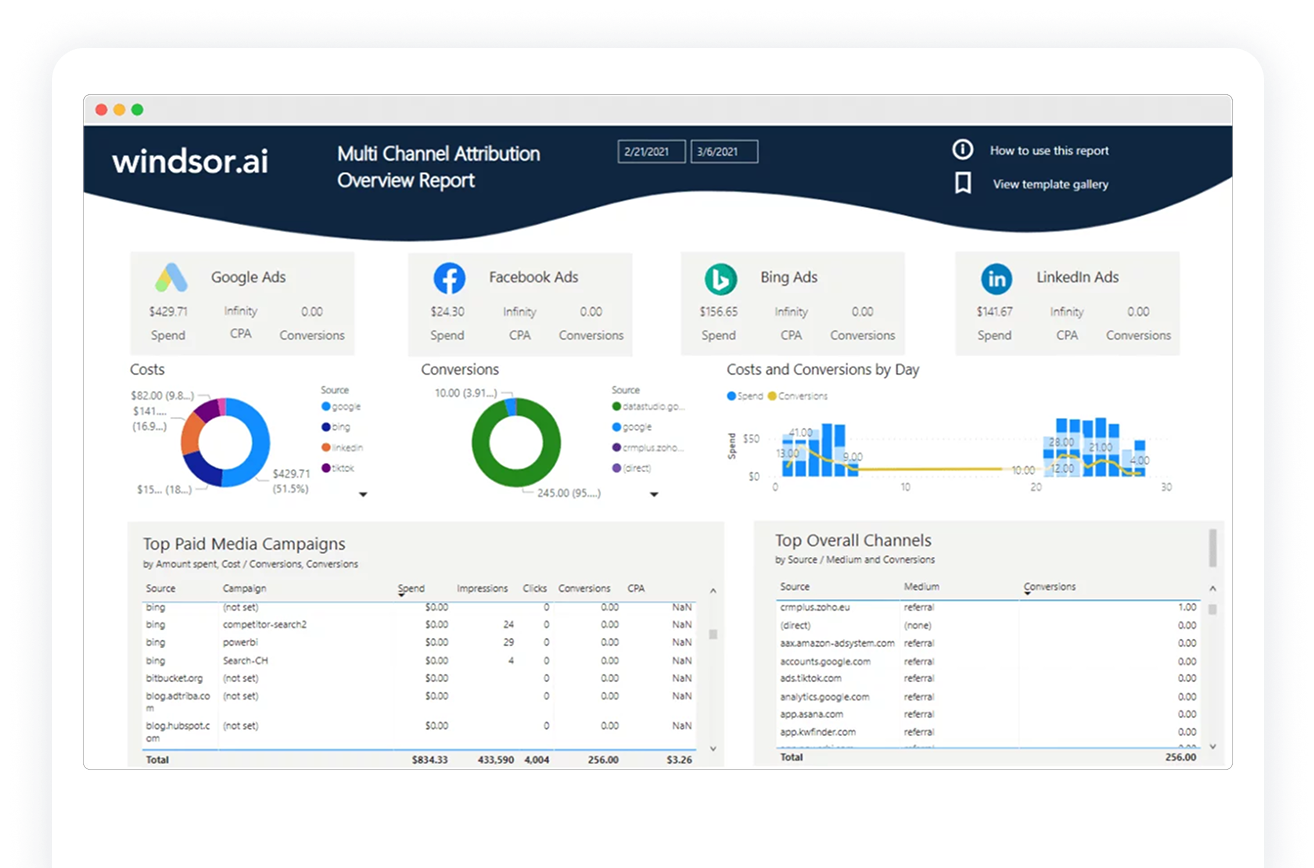

Windsor.ai

Data hub for attribution across more than 300 sources, with strong normalization and BI exports.

Does it fulfil the prerequisites?

No. It needs clicks or lead forms for LinkedIn credit and leans on reverse IP for grouping. No impression by account analytics and manual grouping for ABM.

What’s good about Windsor.ai then?

- Multiple models, including algorithmic, with tunable weights.

- Exports that fit Python or R workflows.

Bottom line: Excellent model layer. Not an ABM-first LinkedIn pipeline reporter.

Windsor.ai pricing

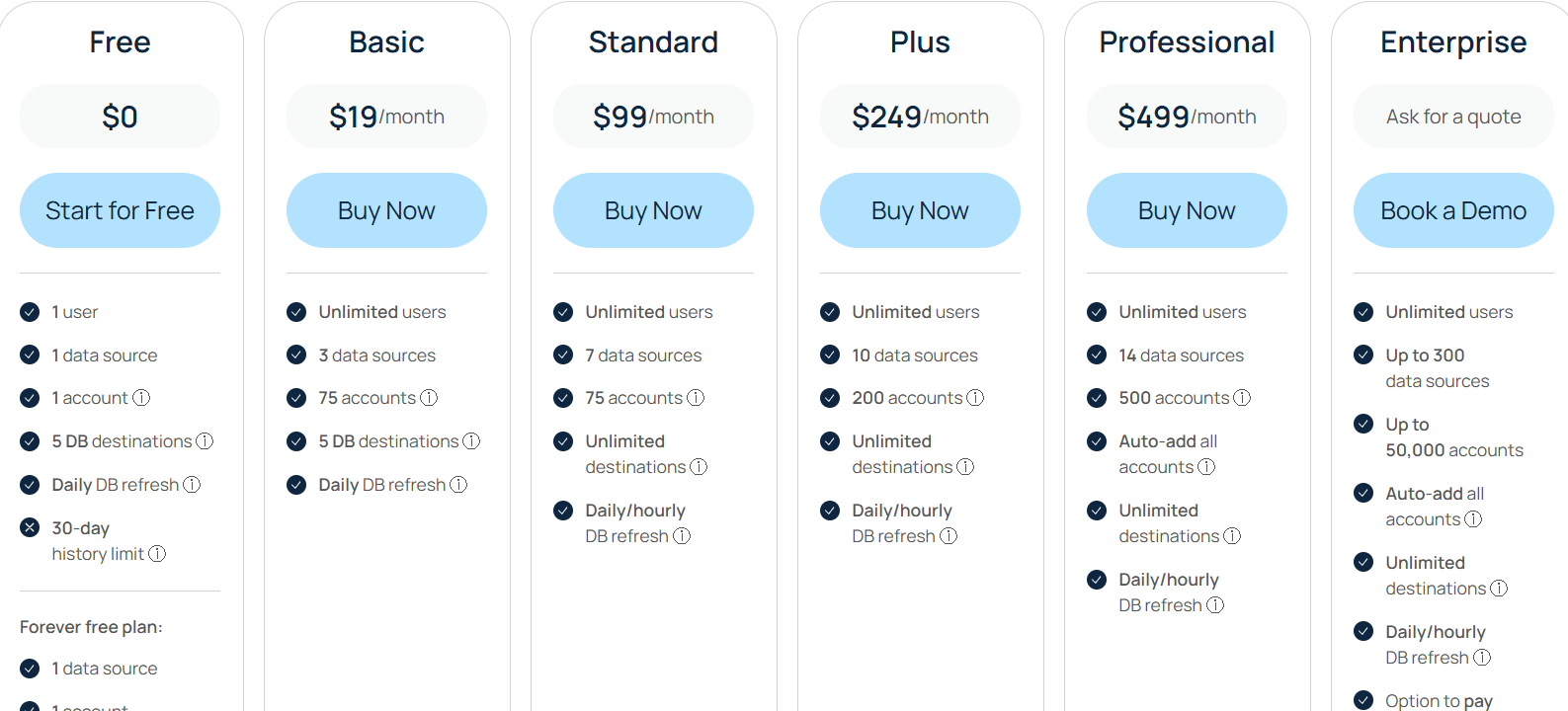

Free includes 1 source and 30 day history. Basic 19 dollars, Standard 99, Plus 249, Professional 499, Enterprise custom.

Over to you

Demandbase, HockeyStack, Terminus, and Factors.ai are strong when you are running larger programs with multi-channel scope and deep controls. LeadsRx does not use the LinkedIn API and leans on cookies. HubSpot Attribution remains click and contact centric. 6Sense focuses on targeting and visits more than impression-level reporting. CommonRoom surfaces community engagement, not impression logs. Windsor.ai is a stellar data layer, not an ABM-first choice.

If you want a cost conscious tool that still nails ABM pipeline reporting for LinkedIn, start with ZenABM. It tracks company-level impressions, maps them to CRM opportunities, writes properties into HubSpot, and shows which campaigns moved which deals, even when nobody clicked. Book a ZenABM demo to see how the best LinkedIn ad reporting tools for ABM should operate in practice.